Abstract

This study explored the complex interplay and potential risk of financial contagion across major financial indices, focusing on the Bucharest Exchange Trading Investment Funds Index (BET-FI), along with global indices like the S&P 500, Nasdaq Composite (IXIC), and Dow Jones Industrial Average (DJIA). Our analysis covered an extensive period from 2012 to 2023, with a particular emphasis on Romania’s financial market. We employed Autoregressive Distributed Lag (ARDL) modeling to examine the interrelations among these indices, treating the BET-FI index as our primary variable. Our research also integrated Exponential Curve Fitting (EXCF) and Generalized Supremum Augmented Dickey–Fuller (GSADF) models to identify and scrutinize potential price bubbles in these indices. We analyzed moments of high volatility and deviations from typical market trends, influenced by diverse factors like government policies, presidential elections, tech sector performance, the COVID-19 pandemic, and geopolitical tensions, specifically the Russia–Ukraine conflict. The ARDL model revealed a stable long-term relationship among the variables, indicating their interconnectedness. Our study also highlights the significance of short-term market shifts leading to long-term equilibrium, as shown in the Error Correction Model (ECM). This suggests the existence of contagion effects, where small, short-term incidents can trigger long-term, domino-like impacts on the financial markets. Furthermore, our variance decomposition examined the evolving contributions of different factors over time, shedding light on their changing interactions and impact. The Cholesky factors demonstrated the interdependence between indices, essential for understanding financial contagion effects. Our research thus uncovered the nuanced dynamics of financial contagion, offering insights into market variations, the effectiveness of our models, and strategies for detecting financial bubbles. This study contributes valuable knowledge to the academic field and offers practical insights for investors in turbulent financial environments.

1. Introduction

In the complex landscape of global financial markets, the phenomenon of financial contagion has emerged as a critical area of investigation, influencing and shaping the interconnectedness of major indices. This research endeavors to delve into the dynamic linkages and potential contagion effects among prominent financial indices, namely the BET-FI, S&P 500, DJIA, and IXIC, with a distinctive emphasis on the unique nuances of the Romanian market. Against the backdrop of the extended timeframe spanning from 2012 to 2023, this study employed sophisticated Autoregressive Distributed Lag (ARDL) modeling methodology to meticulously dissect the complex relationships among these indices. The focal point of examination lies in the BET index, strategically chosen as the dependent variable, offering a granular perspective on the Romanian financial landscape.

Furthermore, this study integrated the Exponential Curve Fitting (EXCF) and Generalized Supremum Augmented Dickey–Fuller (GSADF) models to investigate and detect potential price bubbles formed within the analyzed indices. The analysis of financial bubbles highlights moments of heightened volatility and potential deviations from normal market trends, influenced by various governmental policies, presidential elections, the performance growth of tech companies, the COVID-19 pandemic, and the armed conflict between Russia and Ukraine.

As financial markets continue to evolve in an era of heightened global connectivity, understanding the mechanisms of contagion becomes imperative for risk assessment and effective decision-making. By elucidating the nuanced interdependencies among indices, this research not only contributes to the broader discourse on global financial contagion but also holds particular significance for the Romanian market, providing tailored insights into its susceptibility to external financial shocks. The utilization of advanced modeling techniques such as EXCF and GSADF further enhances the study’s ability to uncover and comprehend unique dynamics, contributing to a comprehensive understanding of the complex financial landscape.

According to Ionescu et al. (2023), Gajurel and Dungey (2023), and Chiriță et al. (2023), financial contagion is a phenomenon wherein an occurrence or alteration in one financial market can trigger chain reactions and disseminate to other markets or economies. This can yield noteworthy ramifications for financial and economic stability. In other words, disruptions or changes in one part of the financial market or economy can have a significant and widespread impact on other markets or sectors, denoting the effect of financial contagion. It is a form of transmission of financial shocks, where events in one country, region, or sector spread rapidly and affect other markets, creating a domino effect.

Analysis of the Romanian stock market has been approached by several researchers with the aim of trying to correlate how certain financial disruptions in the market can create systemic risk events that may manifest as financial contagion. Additionally, the ways in which other stock markets can influence the Romanian market have been examined. For instance, in the research of Davidescu et al. (2023), the effect of financial contagion was analyzed using a Dynamic Conditional Correlation Model. The authors’ findings highlighted that the stock markets of the USA and Germany influence the emerging stock markets of Central and Eastern Europe. There is also a strong link between the dynamics of macroeconomic factors and the evolution of the stock market. For example, Balint and Derecichei (2023) analyzed how the Bucharest Stock Exchange evolves and how market capitalization is influenced by the dynamics of macroeconomic factors. Furthermore, the influence of external factors such as the COVID-19 pandemic has been studied. For example, in the study of Boldeanu et al. (2022), the impact of the pandemic on the Bucharest Stock Exchange was investigated.

The aim of this research was to shed light on the complex dynamics of financial markets and reveal potential connections and reciprocal influences among the analyzed indices. In this context, we formulated several research hypotheses to guide our investigation. We assumed that there are significant interdependencies between the BET-FI index and the S&P 500, IXIC, and DJIA indices, which could lead to financial contagion effects. Additionally, we hypothesized that a detailed analysis of price movements would allow for the identification of financial bubbles, aiding in the understanding of risks and behavioral changes in markets. The primary objective of this study was to assess potential financial contagion effects among these indices and identify causal relationships by detecting price bubbles. Thus, our hypotheses can be formulated as follows:

- RQ1: There is a reciprocal influence between the BET-FI index and the international indices S&P 500, IXIC, and DJIA.

- RQ2: Detecting potential financial contagion effects among these indices highlights how events in one domain can impact and induce changes in other markets.

- RQ3: Identifying and analyzing price bubbles in the movements of the indices helps us understand the factors contributing to market volatility and the potential associated risks.

By selecting the BET-FI as the dependent variable, this research focused on the Romanian financial market, providing a detailed perspective on the specific dynamics of this environment. This enabled an in-depth analysis of the influences and interactions between the BET-FI and the international indices S&P 500, IXIC, and DJIA within the specific context of the Romanian market. Moreover, choosing the BET-FI as the dependent variable brings significant benefits for investors, analysts, and decision-makers in Romania, offering insights into how international events and changes can impact the local financial market. It serves as a valuable tool for anticipating risks and making informed decisions regarding investment portfolios.

This research aligns with the specifics of the Romanian financial market and can contribute to the local literature, addressing elements and factors relevant to the local context. This approach has the potential to highlight the unique features and dynamics of the Romanian market compared to other international markets. Additionally, the methods used in analyzing stock indices can be applied to international markets as well. Therefore, selecting the BET-FI as the dependent variable in the context of financial contagion analysis brings significant advantages for understanding the interactions between the Romanian market and international markets, providing valuable contributions to both the local and international scholarly literature.

This research is structured as follows: Section 2 provides information on the current state of the research. Section 3 presents the methodologies of the EXCF, GSADF, and ARDL models used in the analysis of the selected indices. Section 4 is dedicated to empirical results. This section showcases the financial bubbles detected through the EXCF and GSADF models, as well as the results of the ARDL model. Section 5 is devoted to discussions, conclusions, limitations of the study, and potential directions for future research.

2. The Stage of Knowledge in the Field

2.1. Financial Bubbles in the Context of Economic Crisis

Among the economic systems that have sparked particular interest among complexity science specialists, the financial market holds a privileged position. Financial markets, especially capital markets, can be characterized as complex adaptive systems. They consist of a large number of interdependent and interconnected agents exhibiting emergent group behaviors. These behaviors result from aggregating the individual actions of agents (Nica and Chirita 2021; Scarlat and Chiriță 2019). By combining these individual behaviors, the system can act cohesively at critical points, where significant changes occur due to the accumulation of low-intensity stimuli. These stimuli, when triggered, can propagate in the form of an avalanche. The financial market comprises a variety of specialized markets that facilitate transactions involving various types of financial assets. These markets, such as the money market, capital market, and foreign exchange market, operate relatively autonomously with their own interdependencies within the national economy. Transactions with financial assets occur on these markets, and understanding their specific operating mechanisms is essential for comprehending the financial system as a whole.

Throughout time, there have been numerous economic crises generated by various factors, with many of them originating from financial disruptions or the formation of price bubbles. When not addressed promptly, these events have turned into systemic risk events that propagated like a domino effect throughout the entire global financial–economic network.

The connection between economic crises and financial bubbles is complex and interconnected. Typically, financial bubbles can form when asset prices rapidly increase, surpassing their fundamental values. This rise is often fueled by excessive optimism, speculation, easy access to credit, or a combination of these factors. Also, in the periods leading up to crises, there can be a general sentiment of economic euphoria and a tendency to overvalue assets. This can lead to excessive speculation and investment in certain sectors, contributing to the formation of bubbles. When a financial bubble bursts, asset prices drop sharply, which can lead to significant financial losses for investors and financial institutions. This can trigger a financial crisis, as the decline in asset values impacts the solvency of banks and other financial institutions, causing massive capital withdrawals and credit reductions. Analyses of historical crises with the purpose of understanding the formation of financial bubbles have been conducted in several studies (Hashimoto et al. 2020; Frehen et al. 2013; Michie 2022). Therefore, the following will present some significant economic crises with the aim of highlighting how understanding these historical crises can help us identify and better understand current patterns and trends in the formation of bubbles in emerging markets, such as the Romanian market.

Tulipmania represented a period of speculative frenzy that occurred in the Netherlands between 1636 and 1637 when the prices of tulip bulbs reached extremely high levels, followed by a rapid collapse (Garber 1989). This event unfolded during a period of economic growth in the Netherlands when trade and financial innovations were in full swing (McClure and Thomas 2017). Once introduced to the Netherlands, rare varieties of tulips quickly became highly popular and were regarded as a symbol of social status. Fueled by speculation and people’s desire to increase the prices of these bulbs, special exchanges emerged where individuals could buy and sell options for future tulip bulbs. In February 1637, prices began to decline rapidly, leaving many investors holding valuable assets that became nearly worthless (Garber 2001).

Another period of crisis was the Great Depression that took place between 1929 and 1933, primarily affecting the United States (Eigner and Umlauft 2015). At the heart of this crisis was the collapse of the 1929 stock market, a symbolic event of the collapse of a massive speculative bubble. This collapse generated a massive loss of wealth and triggered a general climate of economic uncertainty (Siklos 2003). However, the Great Depression cannot be reduced to a singular event; it was fueled by other profound factors as well. The fragile banking system, characterized by unit banking and the “too-big-to-fail” concept, contributed to the expansion of the crisis (Temin 2016). Additionally, an unsustainable real estate boom and heavy financial burdens on households and financial institutions further complicated the economic landscape. Accentuated economic disparities heightened social tensions and hindered a return to normalcy. Despite similarities with other crises, the political response to the Great Depression, especially in the United States, was initially marked by inaction and hesitation (Grossman and Meissner 2010; Eigner and Umlauft 2015).

According to Ashton (1996), another crisis named the Suez Crisis, which unfolded in 1956, revolved around the nationalization of the Suez Canal. A critical aspect of this crisis was its ability to create a division between the United States and Britain following their respective policy shifts in March 1956. The British viewed Nasser as a staunch enemy, believing that his plans needed to be thwarted to prevent the undermining of Britain’s position in the Middle East—a region crucial for national survival due to its oil supplies. On the other hand, the U.S. did not perceive Nasser as a threat to anything as vital. While acknowledging Nasser’s unfavorable influence in the region and his seemingly beneficial actions for the Soviet Union, the U.S. maintained a pragmatic approach to dealing with him (Moeller 2016; Ashton 1996).

The 1997 Asian Crisis was a period of severe economic instability that impacted several East Asian countries, including Indonesia, South Korea, Thailand, the Philippines, and Malaysia (Saqib 2001). Triggered by unsustainable financial practices, economic imbalances, and structural weaknesses, the crisis had a global impact, sparking fears of financial contagion. Key consequences included currency depreciation, stock market crashes, and a sudden increase in interest rates. In an attempt to manage the crisis, the International Monetary Fund (IMF) intervened with financial support, imposing stringent conditions for economic and financial reforms, including restructuring the financial sector and reducing budget deficits. The impact on the affected economies was significant, leading to painful repercussions for living standards and employment. The crisis prompted debates on the necessary reforms within the global financial system and the importance of rigorous oversight to prevent similar events in the future (Yin et al. 2023; IMF Staff 1998). The 1997 Asian Crisis represented a transformative period in the evolution of Asian economies, highlighting the need for appropriate measures to prevent and manage financial crises on a global scale.

Also, the East Asian crisis served as a crucial lesson in illustrating the effects of financial contagion (Park and Song 2001). The connection between the two primarily refers to how panic and sudden capital withdrawals in one country triggered the phenomenon in other countries in the region. In other words, financial contagion involves the rapid spread of financial and economic problems from one country to another through a chain of interconnected events. The belief that other East Asian countries could suffer from structural issues similar to those that led to the speculative attack on Thailand prompted a massive capital withdrawal. This phenomenon of the abrupt withdrawal of capital from one country and its impact on other regional economies is what we define as financial contagion in this context. Thus, the East Asian crisis illustrated how events in one country can set off chain reactions in other economies, emphasizing the complex interconnections within the global financial system.

Another significant crisis was the Russian Crisis of 1998, which marked a period of considerable economic turbulence in Russia (Akata 2023). Factors such as substantial external debt, the collapse of commodity prices, and pervasive corruption contributed to this crisis. The critical moment occurred with the abrupt devaluation of the Russian currency, the ruble, in August 1998, and the country’s inability to meet its external debts. The impact was devastating, affecting the banking sector and financial markets and resulting in a substantial increase in unemployment. The Russian government initially attempted austerity measures to stabilize the situation but later sought financial support from the International Monetary Fund, receiving international assistance to overcome the crisis. The Russian crisis brought to light economic vulnerabilities and emphasized the necessity for more robust financial management. Furthermore, it influenced Russia’s relations with the international community and prompted significant changes in the country’s economic policies. Also, the Russian Crisis is interconnected with the phenomenon of financial contagion (Dungey et al. 2006). The abrupt devaluation of the ruble was perceived as a signal of instability and uncertainty in international financial markets. This triggered concerns about the situation in other countries with emerging economies, fueling a sense of insecurity and leading to capital withdrawals from other markets. Additionally, the Russian Crisis exerted significant pressure on other currencies and emerging economies. Investors became more hesitant about exposure to markets deemed high-risk, prompting asset sales and currency depreciations in other countries. The crisis had a broader impact on global financial markets. Investors became more cautious, reevaluating their portfolios and reducing exposures to markets deemed vulnerable. This phenomenon of financial prudence spread to other regions, contributing to a climate of uncertainty globally.

A recent crisis of major significance is the Great Recession of 2007–2009, also known as the Global Financial Crisis. It was a challenging economic period primarily triggered by the U.S. housing crisis and risky financial practices. The global impact was substantial, marked by the collapse of financial markets, rising unemployment, and a decline in economic activity. Governments implemented fiscal stimulus policies, and central banks adopted monetary measures to mitigate the crisis. Long-term effects included financial reforms and extensive debates on risk management. The Great Recession stands out as one of the most impactful economic periods in recent history, shaping global economic policy (Aiyar 2012).

The study of price bubbles has long intrigued economists, leading to a wealth of literature and diverse viewpoints in this area. Wöckl’s (2019) research offers an insightful breakdown of the main research streams in bubble analysis. He first delved into theoretical models, categorizing them into rational and behavioral bubble frameworks. The second part of his study was dedicated to empirical methods for identifying rational bubbles, with a particular focus on innovative detection techniques like recursive unit root tests, fractional integration tests, and regime-switching tests. These approaches primarily utilize advanced methods in stationarity and cointegration, concentrating on asset price time series rather than fundamental factors. This strategy sidesteps the need to validate common hypotheses about rational bubbles or the accuracy of models for asset valuation. Notably, these methods can detect bubbles that collapse periodically. While there is no universal agreement on the optimal theoretical and empirical tools for studying bubbles, empirical research in this field has seen considerable advancements. Applying different bubble detection tests to the same data often yields overlapping results, yet many findings are still inconclusive, marking bubble analysis as a fertile ground for future exploration.

2.2. Current Approaches to Financial Bubbles and Financial Contagion

The stock market experiences influences from a range of factors, encompassing news data, political stability, macroeconomic elements, and unforeseen shocks (Raza et al. 2023). Studies have indicated that these diverse factors can exert a considerable impact on both stock price returns and overall market uncertainty (Nofsinger and Sias 1999). The news-based model posits that the introduction of fresh information, whether it carries a positive or negative connotation, has the potential to alter investors’ expectations, consequently influencing stock market returns.

A review of the relevant literature on financial contagion revealed two distinct approaches: one exploring the spread of financial crises and another focusing on the limitations of associated behaviors. Concepts such as viral marketing and buying decisions are integrated into the interpretation of these phenomena, and the approach specific to financial markets analyzes the impact of the spread of crises, shocks, and disruptions. In certain contexts, these cognitive perspectives can be complementary, providing a more comprehensive understanding of the phenomenon of financial contagion. The term “contagion” was introduced in 1797 by economist David Ricardo, who associated it with the sense of panic that led to the suspension of convertibility. This concept refers to the unfounded fears of the timid part of the community (Hansen 2021).

Kolb (2011), in his research, discussed the concept of financial contagion, which borrows a fundamental meaning from the field of epidemiology. The author recommended considering the significance of this concept in the very nature of the metaphor.

Another study conducted by Paskaleva and Stoykova (2021) focused on the impact of the global financial crisis of 2008 on the capital markets of ten European Union member states. The purpose of that research was to determine whether there is a contagion effect between the Bulgarian capital market and the other markets analyzed during the crisis period and whether these markets were efficient. The methods used included the Dickey–Fuller test for argumentation, the DCC-GARCH model, autoregressive (AR) models, the TGARCH model, and descriptive statistics (Paskaleva and Stoykova 2021).

Elsayed et al. (2023) employed the ARDL model to investigate dynamic co-movements and volatility spillovers between Islamic and conventional financial markets within a dual financial system. Liao and Li (2023), on the other hand, used ARDL to investigate the factors influencing systemic risks in the Chinese financial market and to explore the early identification of indicators for systemic risks.

Țilică (2021) also analyzed the financial contagion effects within distinct economic sectors of post-communist Eastern European markets, focusing on Poland, Romania, and Russia.

Also, Pascal (2020) conducted a study focusing on stability relations within Romania’s major financial markets, including capital, foreign exchange, and monetary markets. That research explored the intensity of connections among these markets, considering them as key indicators of the economy, seen as a complex, adaptive, and dynamic systems in constant flux. The analysis centered on deviations from equilibrium, identifying factors influencing these deviations. That study incorporated market evolution and estimated volatilities, revealing that currency and stock markets are most sensitive to financial shocks. These results were correlated with events, news, and market information to understand investor behavior and the impact of their decisions on markets. Due to instability in certain markets, investors shifted their finances to more reliable markets, causing imbalances.

Additionally, several studies analyzed the situation of financial markets during the 2007–2009 financial crisis, the COVID-19 pandemic, and the Russia–Ukraine War (Wang et al. 2021; Michie 2022; Boldeanu et al. 2022). For instance, Gherghina et al. (2021) conducted a study in which they analyzed the volatility of daily returns of the Romanian stock market based on the BET index, applying the GARCH model. The authors did not identify a causal link between COVID-19 variables and the BET index. A more detailed perspective was realized by Hatmanu and Cautisanu (2021). In their study, they analyzed the impact of COVID-19 on the BET index. The authors used the ARDL model to measure the impact of the pandemic on the Romanian stock market and concluded that there was a long-term negative impact on the BET index. In another study (Insaidoo et al. 2021), an assessment of the impact of the pandemic on the performance of the Ghanaian stock market was conducted using the EGARCH (Exponential Generalized Autoregressive Conditional Heteroscedasticity) model. The authors found that there was a negative relationship between the performance of Ghana’s stock returns and the pandemic that led to an increase in return volatility. Additionally, they highlighted the importance of practical interventions by the government in such contexts.

Regarding the exploration of the effects of the COVID-19 pandemic on stock market volatility, the specialized literature highlights the use of quantitative econometric methods such as the Vector Autoregressive model (Shahzad et al. 2021; Hoshikawa and Yoshimi 2021) and the GARCH model (Gherghina et al. 2021) and its variations like ECARCH, FIGARCH, and GARCH-MIDAS (Bai et al. 2021; Fakhfekh et al. 2023). Additionally, more advanced models have been employed to capture both short-term and long-term relationships and effects, such as the ARDL model (Adam et al. 2021; Javangwe and Takawira 2022; Qamruzzaman and Wei 2018; Nusair and Al-Khasawneh 2022). Among the findings of these analyses, it has been revealed that the pandemic increased the risk of a financial market crash (Z. Liu et al. 2021), unfavorable volatility spillover shocks outweighed favorable ones (Shahzad et al. 2021), there was a higher level of volatility spillover between the U.S. and Chinese equity markets during the pandemic compared to before it (Youssef et al. 2021), and government interventions led to an increase in volatility in stock markets worldwide (Zaremba et al. 2020). Another distinct approach (Contessi and De Pace 2021), considering the most commonly used models, was employed in a study that examined how market instability was propagated during the COVID-19 pandemic. The authors utilized the GSADF model, specifically designed for identifying price bubbles, and observed that in periods characterized by significant instability caused by the pandemic, it served as a means of disseminating and generating instability in stock markets (Contessi and De Pace 2021).

On the other hand, the armed conflict between Russia and Ukraine also influenced the financial market. For example, Yousaf et al. (2022) analyzed the impact of this conflict on the G20 capital markets and concluded that the stock markets in countries such as Hungary, Poland, and Slovakia recorded negative returns in the pre-event days, while countries such as France, Germany, and Romania were negatively affected in the post-invasion days. Another study (Ullah et al. 2023) highlighted the effects of the conflict between Russia and Ukraine on the Russian financial market. The authors used the TVP-VAR and Quantile VAR approaches and concluded that during the conflict period, the risk in this market increased significantly, affecting particularly the oil and gas sector, as well as financial services. Furthermore, the Russian invasion of Ukraine had global market implications. Izzeldin et al. (2023) applied the Markov-switching HAR model to volatility proxies and observed that wheat and nickel were the most affected commodities due to the prominent exporter status of the two countries. In another study (Das et al. 2023), from the perspective of the impact of this conflict, simple linear regression models were employed, and it was concluded that this conflict had a negative impact on stock returns in European markets.

Thus, we can assert that turbulence in financial markets can swiftly manifest as financial crises and even irregularly occurring catastrophes, unexpectedly surfacing about every generation. Nonlinear dynamics seek to demonstrate that these financial market phenomena are as natural as hurricanes, earthquakes, floods, revolutions, and other disturbances in nature and society. Therefore, the financial contagion phenomenon is most fittingly associated with these events in the form of a domino effect that can occur within the financial network. Financial markets, like any complex adaptive system, exhibit complex organization and nonlinear dynamics that generate instability and even chaos. These systems, with a large number of interdependent components and openness to the external environment, naturally tend to undergo change and reorganization, continually adapting their structure and internal dynamics to better withstand environmental disruptions.

Such a conception of complex adaptive systems and their turbulent behavior is gaining widespread recognition, drawing on concepts, theories, and ideas from various scientific disciplines. Our study emphasizes a novel approach that can contribute to the development of the existing literature by combining bubble detection models and utilizing the ARDL model to determine long- and short-term causality relationships, aiming to outline the dynamic landscape of the financial market surrounded by financial contagion effects.

3. Materials and Method

3.1. Methods and Techniques for Detecting Financial Bubbles

An economic bubble is characterized by a rapid increase in the market value of assets, especially their prices, followed by a sudden decrease or contraction, a phenomenon known as a bubble burst (Chiriță et al. 2023). The phenomenon of financial bubbles occurs when asset prices grow rapidly and become disproportionate to their real value. The emergence of these bubbles is often associated with abrupt changes in investor behavior, yet there is still no universally accepted explanation for the primary cause of this phenomenon (Shu et al. 2021).

According to Watanabe et al. (2007a), financial bubbles or crashes are subjects that are increasingly attracting researchers due to their dynamic behavior. Among the authors who have provided a mathematical description of financial bubbles are Johansen and Sornette (2001), who assumed that a crash occurs after the rapid growth of economic indicators, faster than an exponential function (Sornette and Andersen 2002; Johansen and Sornette 2001; Zhou and Sornette 2006). Nevertheless, it has been considered that this proposed method is useful for predicting the end of a bubble, not its beginning. Thus, (Watanabe et al. 2007b) introduced in their article a mathematical definition of bubbles and crashes based on exponential behaviors detected in systematic data analysis.

From a mathematical perspective (Sornette and Cauwels 2014), a financial bubble is defined as the positive difference between real prices and fundamental prices (reasonable values) of assets. The real price can be described by the following mathematical formula (Phillips et al. 2011):

In Equation (1), represents the stock price at a given time , represents the expected sum calculated based on valid information available at time , represents the dividends, and represents the discount rate. In Equation (1), the rate is considered constant throughout the period. Thus, the equilibrium price or fundamental value will be obtained. The random value of the bubble that satisfies this condition is determined by .

In Equation (2), the equilibrium price is described. According to this equation, as confirmed in the specialized literature, there is no concept of a negative bubble from a mathematical perspective. Nevertheless, in the context of this research, we will use the concept of a negative bubble when observing the effects of a sudden decline in the analyzed markets, and the concept of a positive bubble will be employed when the price unexpectedly rises rapidly.

From the perspective of rational expectations economics (Aoki and Nikolov 2012; Martin and Ventura 2018; Michau et al. 2023; Galí 2014), the theory of rational expectations specifies that the price of an asset can be determined through the discounted cash flows it generates. Market prices are formed based on the information available to market participants and economic models relevant to the situation. According to this theory, prices are expected to align with the intrinsic value of the asset, unless there is misinformation in the market that misleads investors. When individuals buy unprofitable stocks with the intention of selling them at a higher price and making a profit in the future, this behavior leads to an increased demand for those stocks, thereby driving up their prices. This phenomenon is known as a rational price bubble. Such bubbles continue to expand until they eventually burst, disrupting all planning and forecasting efforts.

In contrast, the theory of irrational bubbles (H. Liu et al. 2012; Seidens 2018; Baker and Wurgler 2007) posits that price bubbles can occur when irrational speculators, driven by the belief that the asset’s value will keep increasing based on its past performance, artificially drive up its price. In this scenario, the market consists of individuals with limited intellectual perspectives who fail to distinguish between market value and intrinsic value, thus contributing to the formation of a bubble. Within irrational price bubbles, people do not have rational expectations regarding the future benefits and prices of goods. Investment decisions in such situations are not based on information about risk and return, and the market operates on the basis of random and psychological reactions.

3.1.1. Exponential Curve Fitting (EXCF) Method

The Exponential Curve Fitting method is a mathematical technique used to model and analyze experimental data exhibiting exponential decay behavior. Essentially, this method aims to find an exponential function that best fits the observed dataset (Perl 1960; Foss 1970; Ma et al. 2021).

The primary application of this method lies in deducing and analyzing relevant parameters of the exponential function, such as the final equilibrium value, rate constants, or other specific characteristics of the studied phenomenon. This approach can be employed in various fields (Zuo et al. 2022; Zhang et al. 2018), including biological sciences, economics, physics, or any context where data evolution can be described by exponential decay processes.

However, the choice and application of the Exponential Curve Fitting method must be tailored to the specifics of the dataset and consider the underlying nature of the process. It is crucial to consider the complexity of the data and utilize methods that provide relevant, robust, and valid results within the context of the specific research or analysis.

The initial application of the EXCF method for identifying price bubbles in financial assets was proposed by (Watanabe et al. 2007a, 2007b). This approach relies on estimating the parameters and through the analysis of historical data , aiming to identify periods when prices exhibit divergence or convergence.

In Equation (3), the essential parameters are estimated, where denotes the financial asset’s price at time , and represents the error term. The expression indicates a scenario in which the price of the financial asset follows a random walk pattern. This means that the price does not exhibit a directional trend but undergoes random variations over time. In such a situation, the parameter has limited influence on the price evolution since it is mostly determined by random or unsystematic factors.

On the other hand, when , this signifies either a significant increase in the value of the financial asset (known as a “bubble”) or a substantial decrease that may lead to a price collapse. The value of the parameter in this context serves as a baseline or reference for exponential divergence. When , this indicates that the price of the financial asset converges toward the value of the parameter . This suggests that the price does not exhibit a significant upward or downward trend but tends to approach the baseline specified by . Consequently, the exponential divergence decreases, and the price converges toward the level determined by the same parameter.

Hence, the conditions , , serve as key indicators in the EXCF model, offering valuable insights into the trends and dynamics of financial asset prices based on exponential divergence and the estimated parameters and .

For identifying the most suitable time interval , an AR(p) model is initially estimated using the original data set:

After establishing the optimal time interval , a rolling estimation method is used to detect bubbles or periods of price crashes, following the method proposed by Fantazzini (2019).

The EXCF algorithm implementation and price bubble detection were carried out by Fantazzini (2019) using the “bubble” package in R. In this context, the parameter was assigned the first observation from the data sample for the interval . Additionally, Equation (4) was reformulated as an AR(p) equation without an intercept, as depicted in Equation (5).

The EXCF model and the bubble detection algorithm represent a valuable approach for identifying and analyzing price bubbles in financial assets. This method relies on estimating the parameters and using historical data and specific detection algorithms. It can contribute to understanding and assessing price trends in the context of financial markets.

3.1.2. Generalized Augmented Dickey–Fuller (GSADF) Test

Considerable attention has been given to studying rational bubbles, which are often associated with financial crises and economic recessions. A widely used theoretical framework for understanding a rapid rise in asset prices is the rational bubble model. This model is based on evaluating a rational bubble through the lens of present value theory, where the intrinsic value of the asset is determined by estimating the expected sum of future dividends discounted to their present value. A detailed approach to this model was presented by Phillips et al. (2011). Phillips et al. (2015a) proposed recursive tests that can detect evidence of explosive behavior in time series . The reason for using recursive tests is that price behavior is dominated by the bubble component. Therefore, we can directly test for the presence of bubbles in prices.

Equation (6) is a mathematical representation of the Augmented Dickey–Fuller (ADF) regression (Phillips et al. 2011).

In a study conducted by Phillips et al. (2015b), hereafter referred to as PSY, they developed a test statistic to address the presence of multiple bubbles in a time series. Specifically, they focused on the scenario where the drift term is greater than 0.5, as this is considered more significant in practical applications. The test they proposed is known as the Generalized Supremum ADF (GSADF) test. This test serves as a measure to determine the presence of explosive behavior in a time series.

The GSADF test is increasingly used for identifying price bubbles. For instance, Tan and Chan (2021) analyzed in their article how the GSADF test proposed by Phillips et al. (2015a) detected and timestamped real estate bubbles in ten major cities in China.

Phillips et al.’s (2015b) approach in their research highlights effective econometric mechanisms for identifying and dating financial bubbles in real time. Simulations conducted by the authors have shown that the GSADF test significantly improves discriminatory power and leads to distinct power gains when multiple bubbles occur. They tested the model on stock market data for the S&P 500 index.

3.2. ARDL Econometric Methodology

The Autoregressive Distributed Lag model is an econometric method used to analyze long-term relationships between variables. It is a cointegration technique that aims to identify the presence of a stable long-term relationship among the analyzed variables. The ARDL model is particularly useful when examining the links between variables that may evolve over time and affect each other in the long run. Although not developed specifically for detecting financial bubbles, it is often used in broader economic and financial analyses to examine how variables evolve in the long term and interact with each other (Nica et al. 2023a, 2023b). Detecting financial bubbles typically involves performing specific analyses, applying methods for testing the existence of bubbles, and assessing their impact on financial markets.

The ARDL model variant introduced by Pesaran and Shin (1998) and Pesaran et al. (2001) functions as a cointegration approach designed to assess the existence of a long-term relationship among variables. This advanced methodology presents various advantages compared to traditional cointegration tests, including those proposed by Engle and Granger (1987), Johansen (1988), Johansen (1991), and Johansen and Juselius (1990).

Philips (2018) notes that the ARDL method is particularly advantageous compared to other techniques because it enables the analysis of cointegration relationships among variables, even when some of them are integrated at order 0 (I(0)) and others at order 1 (I(1)). Pesaran et al. (2001) highlight the use of ARDL in scenarios of mixed integration orders. Additionally, the ARDL bounds test enables the construction of an unrestricted error correction model (ECM) through a linear transformation. According to Asteriou and Hall (2015), an ECM captures the dynamics of both long-term and short-term research variables. Remarkably, empirical evidence consistently attests to the superior performance of the ARDL model. Nkoro and Uko (2016) argue that the issue of endogeneity is less relevant within the ARDL framework due to the absence of residual correlations, indicating that all variables are endogenous. The ARDL model is as follows:

In Equation (7), the dependent variable is represented as a function of its previous values and the lagged variables of the dependent vector . The coefficients b and c denote short-term coefficients, while y and z refer to the lag numbers for and . The term represents the error term.

The ARDL process involves the following steps (Nica et al. 2023a; Androniceanu et al. 2023):

- (a)

- Verification of data stationarity.

- (b)

- Selection of the optimal lag length, which involves constructing the unrestricted Vector Autoregressive (VAR) model to identify the most suitable number of lags. An inaccurate choice of the lag length may introduce bias into the outcomes, rendering them inappropriate for forecasting and making inferences.

- (c)

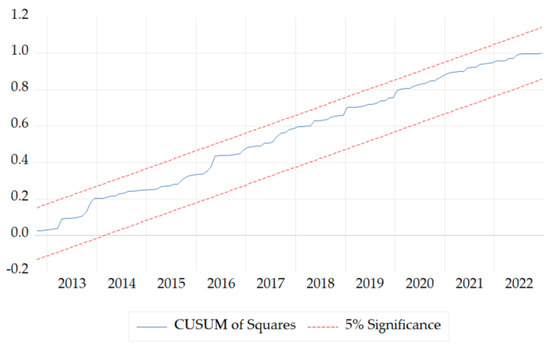

- Verification of cointegration and development of the Error Correction Model (ECM). The ARDL model was improved by incorporating the bounds test, which examines whether a combination of I(0) and I(1) variables exhibits a long-term relationship. The structure of the ARDL bounds test is delineated by Equation (8):where constitute the short-term terms and represent the long-term terms. According to Pesaran et al. (2001), if the calculated F-value is statistically significant, the subsequent step involves constructing an Error Correction Model (ECM) to analyze both long-term and short-term dynamics. The significance of the F-value is assessed in comparison to critical values established by (Pesaran et al. 2001). A dynamic ECM can be derived through a simple linear transformation of an ARDL model. This ECM integrates short-term dynamics with long-run equilibrium, preserving crucial long-term information. By doing so, it addresses issues like spurious relationships that may arise when dealing with non-stationary time series (Shrestha and Bhatta 2018). The lagged variables and from Equation (8) are replaced with the Error Correction Term (ECT) in Equation (9). The ECM is structured as follows, as outlined in Equation (9):

If falls within the interval [−1, 0] and holds statistical significance, this indicates that the variables are cointegrated.

- (d)

- Validation and conduction of stability tests.

According to (Nandy and Chattopadhyay 2019; Khalfaoui et al. 2023), a VAR model is a statistical method used to analyze and model the interdependencies among multiple time series variables. This model is commonly employed in econometrics and time series analysis, enabling researchers and analysts to assess how changes in one variable impact the other variables within the system. For instance, Ahelegbey et al. (2021) employed a Vector Autoregressive model in conjunction with a network approach to investigate the dynamics of financial contagion among countries.

The ARDL model emerges as a versatile and powerful econometric tool that proves instrumental in analyzing relationships between variables, especially in scenarios where integration orders vary. Its flexibility allows for the examination of both short-term and long-term dynamics, making it applicable to a wide range of economic and financial studies. ARDL’s utility extends to areas such as detecting cointegration, constructing error correction models, and exploring the interconnectedness of markets. Researchers leverage ARDL to unravel complex interactions, providing valuable insights into systemic risks, contagion effects, and volatility spillovers across diverse financial landscapes. The model’s adaptability and robustness make it a valuable asset in understanding and navigating the complex dynamics of economic and financial systems.

4. Results

In the dynamic world of financial markets, detecting and understanding the complex phenomenon of price bubbles poses a crucial challenge for investors, analysts, and decision-makers in the financial sector. In this context, the use of advanced models such as Exponential Curve Fitting and Generalized Supremum Augmented Dickey–Fuller becomes essential for assessing and anticipating the evolution of prices within benchmark indices like the BET-FI, DJIA, IXIC, and S&P 500. The significance of employing EXCF and GSADF in the analysis of financial indices like the BET-FI, DJIA, IXIC, and S&P 500 becomes evident amidst high volatility and rapid changes in global markets. Identifying price bubbles in these indices is vital for investors and decision-makers, providing them with the opportunity to adjust strategies and effectively manage risks.

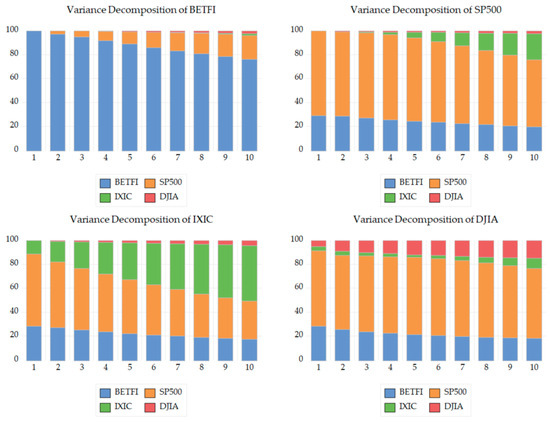

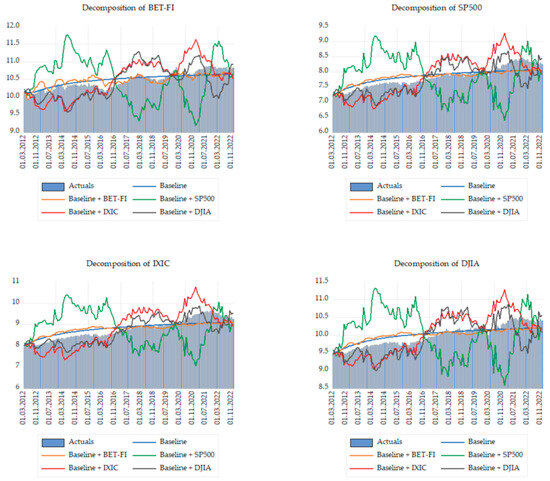

On the other hand, the analysis of price bubble detection is complemented by the use of the ARDL model, where the BET-FI serves as the dependent variable, while the S&P 500, DJIA, and IXIC act as independent variables. The ARDL model was employed to assess the relationships between variables, interdependencies, influences, and causality, as well as the effects of financial contagion. The BET-FI, as the dependent variable, represents the BET-FI Index, reflecting the overall performance of the financial market in Romania. Modeling this variable enables an understanding of its impact and interactions with other relevant variables. Thus, the ARDL model can unveil whether and how changes in the independent variables may influence the BET-FI, highlighting connections and interdependencies among financial markets. Additionally, the ARDL model provides the opportunity to analyze both short-term and long-term relationships, allowing the identification of immediate effects and adjustments in the dependent variable’s response to changes in the independent variables. The outcomes of the ARDL model can offer valuable insights for strategic decision-making, risk management, and the development of more effective strategies within financial markets.

The data source, analysis period, and their description are presented in Table 1.

Table 1.

Description of variables and sources.

The data presented in Table 1 were gathered over the period from 2012 to October 2023. Specifically, the dataset for the ARDL model covers the timespan from 2012 to 2022, while the data used for financial bubble detection extends until October 2023. For financial bubble detection, the data used were daily, preserving the actual observed values. For the ARDL model, the data were logarithmically transformed. Logarithmic transformation helps stabilize the variances across different levels of the data, according to Gustafsson and Stockhammar (2019) and Luetkepohl and Xu (2009), making the spread more consistent. This is particularly beneficial when dealing with financial time series data that may exhibit changing levels of volatility over time.

4.1. Detecting Financial Bubbles: EXCF and GSADF Models Unveiled

In the dynamic landscape of financial markets, identifying and managing risks associated with price bubbles is a critical challenge. The use of models such as Exponential Curve Fitting and Generalized Supremum Augmented Dickey–Fuller becomes paramount in understanding price movements and anticipating potential shifts in market behavior. These analytical tools are particularly relevant in the case of key financial indices such as the BET-FI, DJIA, IXIC, and S&P 500.

According to Watanabe et al. (2007a, 2007b) and Cabello Sánchez et al. (2021), EXCF makes a significant contribution to time series analysis, providing insights into market trends and volatility. By fitting exponential curves to price data, EXCF helps highlight significant patterns, facilitating the identification of potential price bubbles and the anticipation of directional changes. On the other hand, GSADF, with its robust approach, according to Peng et al. (2023) explores the phenomenon of price bubbles and contributes to validating the results obtained with EXCF. By integrating this model into our analysis, we had the opportunity to confirm and strengthen warning signals, adding an additional level of confidence to the process of identifying price bubbles. The importance of this analysis extends beyond the identification and quantification of price bubbles in isolation. As financial markets are interconnected, the phenomenon of financial contagion becomes a crucial component. Identifying a bubble in a major index, such as the S&P 500, can influence the behavior of other indices, such as the BET-FI, DJIA, and IXIC. By using EXCF and GSADF to examine these interdependencies, we gain a broader and more precise view of how changes in one index can propagate and affect the entire financial landscape. The EXCF model uses rolling estimates with the aim of providing information about the variation in volatility and significant changes in the dynamics of the analyzed time series. These estimates offer insight into how volatility changes over time and can help identify periods where it increases significantly, indicating potential points of interest for the analysis of financial bubbles. The interpretation of these estimates is performed in the context of the analyzed time series. When the rolling estimates present higher values, this suggests increased volatility during those periods, which may be associated with potentially significant changes in market prices. Generally, areas with high values of the rolling estimates can draw attention to periods where there is an increased probability of the formation of financial bubbles or significant events in the market.

Through this integrated analysis, we aimed to make a significant contribution to understanding the dynamics of financial markets, allowing investors and decision-makers to approach the risks associated with price bubbles with more confidence and develop more informed strategies in the face of global market challenges.

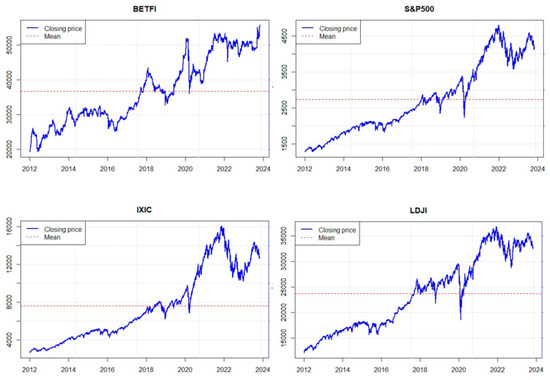

In Figure 1, the evolution of closing prices for the analyzed indices has been depicted for the period from 2012 to October 2023. The BET-FI reflects the performance of the most liquid companies listed on the Bucharest Stock Exchange, particularly those in the financial sector. The evolution of this index is influenced by the economic conditions in Romania and events specific to the local market. It is observed that throughout the analyzed period, the evolution of this index has been quite volatile, with many periods of growth or decline.

Figure 1.

The evolution of the daily closing prices of the BET-FI, S&P 500, IXIC, and DJIA indices.

The S&P 500 is one of the most closely monitored indices of the American stock exchange, representing the performance of 500 large companies listed on American exchanges. Its evolution is closely tied to the state of the American economy, government policies, and global trends in financial markets. The S&P 500 index showed relatively steady growth from 2012 until 2015, with a slight decline observed in 2016 followed by subsequent increases. Additionally, three distinct periods of decline with larger amplitudes can be observed in 2017, 2020, and the end of 2022.

The Nasdaq Composite (IXIC) comprises the stocks of a broad range of technology and other sector companies listed on the Nasdaq. The evolution of this index is influenced by technological innovations, the financial results of tech companies, and changes in investor preferences.

The DJIA represents the performance of 30 large and significant companies in the United States. This index is often considered a barometer of the health of the American economy, with an emphasis on industrial and consumer sectors.

Next, we used the EXCF test to detect financial bubbles. This model has a very short execution time compared to GSADF, which can take several hours. GSADF can be considered a more robust option, allowing comparisons between periods identified as the time of a price bubble’s emergence. We used RStudio (version 2023.09.1+494, developed by Posit, PBC) to implement these two methods.

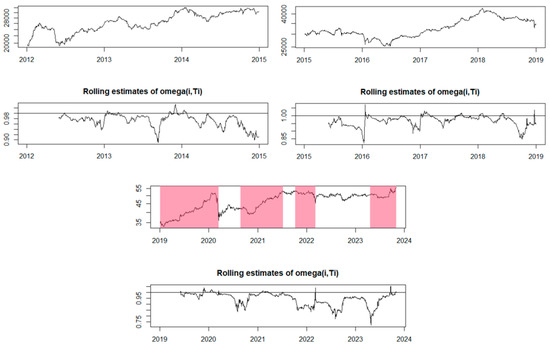

In Figure 2, we can observe that for the period from 2012 to 2018, the model did not identify any financial bubbles. However, during the period from 2019 to 2023, the model identified four potential price bubble formation periods (marked by pink bands). In 2019, a significant increase was noted, indicating the presence of a potential positive bubble, followed by a financial bubble forming at the end of 2020, extending for three quarters into 2021. A positive price bubble occurs when the prices of the analyzed indices rise rapidly and significantly. This can be caused by increased investor interest, speculation, or positive events that are relevant or impactful in the financial market. In a positive bubble, prices can exponentially rise and reach very high levels in a short period. On the other hand, a negative bubble refers to a period when cryptocurrency prices decline rapidly and significantly. This may result from a decrease in investor interest, negative external factors, or normal market corrections after a period of excessive price growth. In a negative bubble, prices can suddenly drop and reach much lower values than those recorded during the previous growth. The end of 2021 and the beginning of 2022 were marked by another period in which a potential price bubble could be identified, this time negative, as it was characterized by an unusual decline, according to the model. Additionally, it appeared that a fourth financial bubble was forming even in 2023.

Figure 2.

The EXCF method for the BET-FI Index.

The EXCF model has a limitation in its ability to accurately distinguish between genuine bubbles and artificial price fluctuations in a dataset. While it can identify apparent price increases, the EXCF test does not provide conclusive evidence to confirm the presence of a genuine positive price trend. To assess the precision of the models in detail and for a more comprehensive comparison, we also conducted the GSADF test. It is noted that the EXCF test has a relatively short processing time, typically requiring only a few seconds on a standard computer. In contrast, the GSADF test requires a longer processing time due to higher computational resource demands. It is essential to emphasize that, although the GSADF test provides more precise and advanced results, it does not offer the same cost efficiency as the EXCF test and requires more powerful equipment for long-term analyses.

Regarding the financial bubble identification test using the GSADF method, it was conducted as shown in Figure 3. We can observe that there are periods similar to those identified as price bubbles using the EXCF method, but it also brings to light additional periods. For instance, the GSADF model highlighted potential price bubbles during the period 2012–2018, which the EXCF model did not identify. Thus, during this period, 10 time intervals were identified where these financial bubbles occurred. Additionally, the GSADF test confirmed the bubbles from the recent years analyzed, 2019–2023, also identified by the EXCF model.

Figure 3.

The GSADF method for the BET-FI Index.

To understand how these price bubbles of the BET-FI Index formed, we sought various information to identify possible factors underlying the formation of financial bubbles.

At the end of 2009, according to Finance Newspaper (2009), the BET-FI Index, which monitors the performance of five financial investment companies on the Bucharest Stock Exchange, recorded a 6% decline in Wednesday’s session, marking the most significant downturn in the last four months, amid a 4% overall market decline. The BET Index, representing the top ten most liquid companies, depreciated by 3.29%. This development followed a recorded major decline, influenced by the negative trend in European markets.

According to information from Banking News in 2015, the Bucharest Stock Exchange experienced a significant decline, and analysts believed that, in the absence of a rapid recovery in the Chinese economy, a more severe crisis than the one in 2008 could follow. On 24 August 2015, all stock exchanges faced a price shock, driven by the crisis in the Chinese economy, according to specialists’ opinions. This day was dubbed “Black Monday.” Stock exchanges in several Asian countries opened lower due to the dramatic fall of the Shanghai Stock Exchange. Financial market panic began with the depreciation of the yuan, the Chinese national currency. Economists argued that everything was triggered by the decision of major investment funds to withdraw their capital under investor pressures. The Shanghai Stock Exchange closed down 8.5%, the most drastic decline in the last eight years, initiating a domino effect, meaning a financial contagion.

According to the Bucharest Stock Exchange (2023) for the BET-FI Index, 2019 was the year the index registered one of its best rentabilities since its apparition (1995), considering that all of the market indexes had also registered exponential rentability growth (up to 47%, if we consider the BET-TR Index). This immense increase in the rentability of the index was mainly a result of Hidroelectrica being listed in the market, considering its very high importance in the Romanian market. Between late 2020 and late 2021, it seems like the BET-FI Index registered a significant increase due to the fact that the dividends have paid off for investors, showing a 40% return on investment.

It seems like the armed war between Russia and Ukraine triggered a decrease in the financial markets. Russia’s late February invasion of Ukraine caused a global shock within the financial markets, BET-FI included, right in the next month. Yet, until 2022, the BET-FI Index managed to partially recover from this event, mainly due to how the other financial markets evolved, but also due to the dividend’s proposal. Even though the index registered small ups and downs throughout 2021, the beginning of 2022 registered a decrease in the index caused by a “solidarity tax” imposed by the local government, a tax that reduced the index by 3.7% (Bursa.ro 2022).

As for the abovementioned period, Hidroelectrica played a crucial role in how Romania’s financial market evolved during this year. The main reason for the increase that we can observe at the end of the year is the 170,000 investors in the Hidroelectrica company that directly impacted the direction of the local financial markets, the BET-FI included (Forbes.ro 2023).

This analysis indicates that the evolution of the BET-FI Index has been influenced by several key factors, leading to distinct periods of financial bubble formation. For example, in 2019, a significant growth period of the index was observed, marking a potential positive bubble. This was largely attributed to the listing of Hidroelectrica, which held significant importance in the Romanian financial market. Investors benefited from substantial dividends, contributing to the index’s rise. Between the end of 2020 and the end of 2021, the BET-FI Index experienced significant growth, primarily due to dividend payments to investors, yielding a 40% return. This contributed to the formation of a potential positive bubble. Furthermore, the beginning of 2022 was marked by a decline in the index following Russia’s invasion of Ukraine. This geopolitical instability triggered a global shock in financial markets, impacting the BET-FI as well. However, the index managed a partial recovery, reflecting the evolution of other financial markets. Additionally, in 2023, Hidroelectrica continued to play a crucial role in the financial market’s evolution, significantly influencing the BET-FI Index.

In summary, the multiple financial bubbles identified in the analyzed period can be attributed to a complex mix of events, listings of significant companies, geopolitical factors, and government decisions. Each period of growth or decline reflects the specific dynamics of the Romanian financial market and the factors that influenced it during those moments. Furthermore, each period of growth or decline in the BET-FI Index can be understood in the context of financial contagion, where external events and internal decisions have an amplified impact on financial markets, directly influencing the index’s evolution. Financial contagion manifests through the rapid transmission of shocks and instability from one area of financial markets to others.

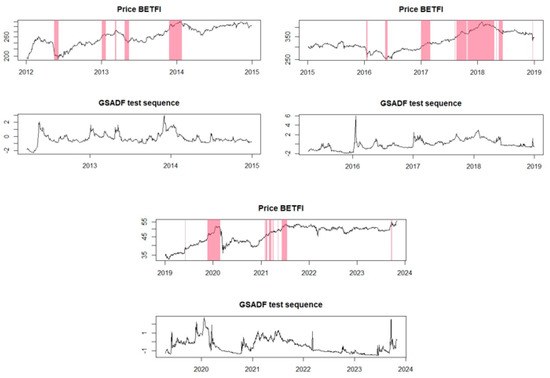

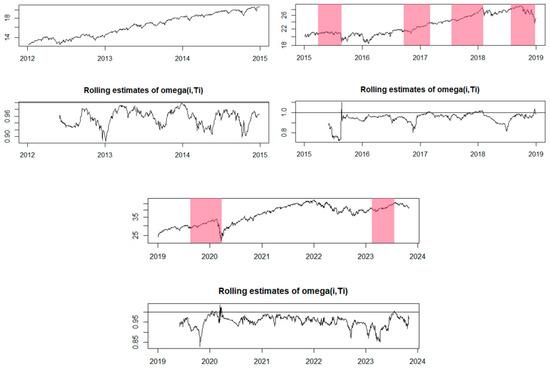

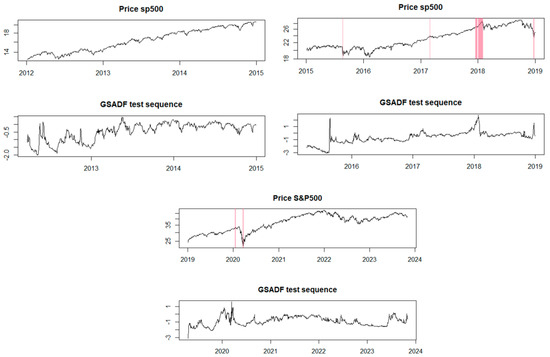

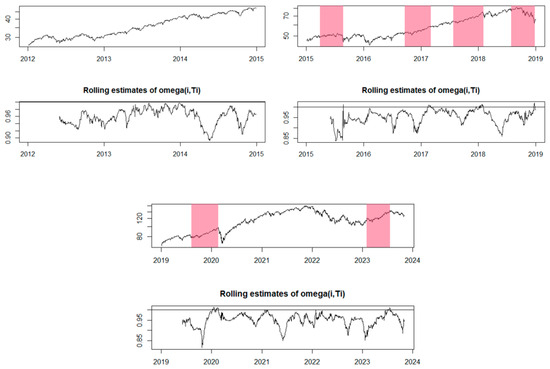

In Figure 4, the EXCF test was conducted to highlight financial bubbles for the S&P 500 index. In this case, the model identified six periods in which price bubbles formed, spanning from 2015 to 2023.

Figure 4.

The EXCF method for the S&P500 index.

In 2015, the S&P 500 index experienced varied performance throughout the year. Concerns arose about the global economic growth slowdown, particularly in China (CNBC.com 2015). Weak economic data and volatility in global financial markets raised worries about their impact on American companies and the potential for a recession. Additionally, oil prices significantly declined in 2015, impacting energy sector companies and causing concerns about the overall health of the global economy. This had a negative effect on the stocks of many S&P 500 companies, as a significant number of them are either directly related to or have ties with the energy sector (Yahoo Finance 2016; The Guardian.com 2015).

In 2016 and 2017, the S&P 500 index exhibited positive performance, with relatively limited periods of decline during those years. In the first part of 2016, concerns about the health of the Chinese economy and financial market volatility negatively impacted the S&P 500. However, the market later rebounded, partly due to global economic stimuli. The presidential elections in November 2016 were a significant moment for financial markets. Following the election of the president, the initial market reaction was negative, but a reversal occurred, and the market showed positive trends, fueled by optimism regarding pro-business policies announced by the presidential administration (CNBC.com 2017a).

The year 2017 witnessed a strong rally in financial markets, including the S&P 500, amid expectations of tax cuts, deregulation, and fiscal incentives under the presidential administration. In 2017, the U.S. economy continued to grow, and companies reported robust profits. These factors supported the positive performance of the S&P 500 (CNBC.com 2017b).

Trade tensions between the United States and China escalated in 2018, with the mutual imposition of customs tariffs. Investors were concerned about the potential impacts of these tensions on global economic growth and corporate profitability (International Monetary Fund 2019).

The GSADF model sequence in Figure 5 also illustrates periods during which price bubbles were identified, similar to the EXCF model, starting from the year 2015 but extending until the year 2021. Therefore, we can conclude that the financial bubbles identified for the S&P500 index between 2015 and 2023 were influenced by various factors such as global economic concerns, presidential elections, and economic and trade tensions. All of these events can create panic among investors, leading to immediate decisions that may cause disruptions in the financial market.

Figure 5.

The GSADF method for the S&P500 index.

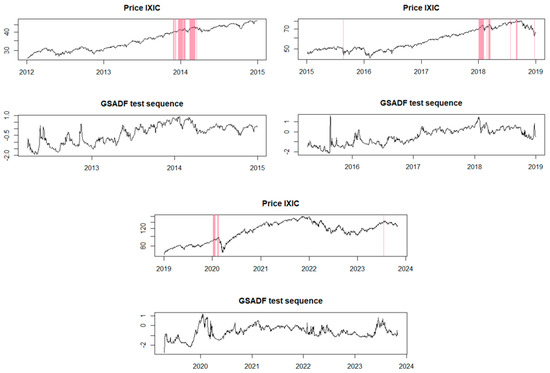

Regarding the IXIC index, the EXCF model was applied in Figure 6. It can be observed that the periods of identified financial bubbles are similar to those identified in the S&P 500 index.

Figure 6.

The EXCF method for the IXIC index.

In the first half of 2014, the IXIC index experienced robust growth, marked by significant increases and reaching new highs. The technology sector played a pivotal role in driving this growth, with companies such as Apple, Google, and Facebook delivering strong performances, contributing significantly to the index’s advancement. Additionally, the biotechnology sector saw significant growth during the same period, further adding to the rise of the IXIC. Smaller biotechnology companies recorded notable gains due to progress in drug development and positive results from clinical studies. All of these factors contributed to the formation of price bubbles (Techcrunch.com 2014).

Moreover, the other identified bubbles are justified by the same factors as those for the S&P 500, such as electoral elections, global concerns about economic growth, especially in China, but also factors like the performance growth of the tech sector (International Banker.com 2017). Additionally, the biotechnology and healthcare sectors were active contributors to the index’s volatility. The performance of smaller biotech firms and healthcare companies continued to impact the Nasdaq Composite’s movements.

Furthermore, the explosive growth of cryptocurrencies, especially Bitcoin, has captured the attention and interest of investors. While not directly linked to the IXIC index, this trend reflects an appetite for innovative assets with high growth potential among investors.

The GSADF test for the IXIC index can be identified in Figure 7. Unlike the EXCF model, this test identified fewer price bubbles for the analyzed index.

Figure 7.

The GSADF method for the IXIC index.

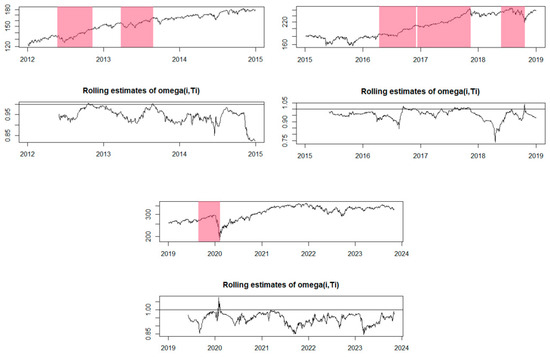

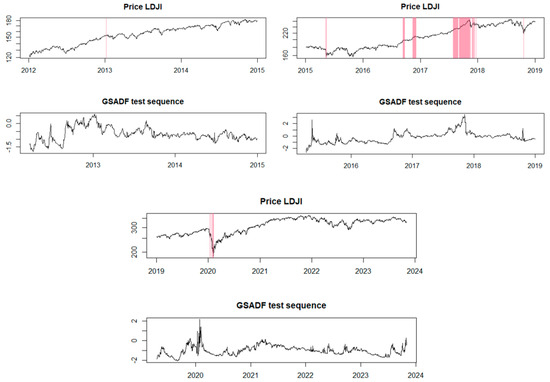

The EXCF model has been tested for the last index analyzed by us, the DJIA index. We observe in Figure 8 that six periods with financial bubbles have been identified. Both positive and negative bubbles are observed.

Figure 8.

The EXCF method for the DJIA index.

Additionally, the GSADF test also identified periods in which there were potential price bubbles for the DJIA index. In Figure 9, one can observe the periods marked for these price bubbles, which are relatively similar to the EXCF test but over shorter time frames.

Figure 9.

The GSADF method for the DJIA index.

All of these analyses highlight that political tensions, armed conflicts, and economic imbalances in major countries with systemic importance in the global economy, such as China, can generate contagion effects that affect the financial market. Investor panic and changes in investment behavior are also impacted and can contribute to the formation of price bubbles. Additionally, we observed for all of the analyzed indices that during the COVID-19 pandemic period, price bubbles were identified, emphasizing that the pandemic itself represented a factor in the formation of these bubbles.

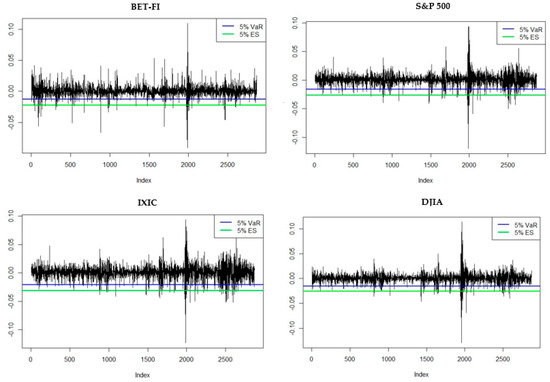

The analysis in this section concludes with the determination of the Value at Risk (VaR) and Expected Shortfall (ES). The VaR is a measure of the maximum expected loss at a certain confidence level, expressed in percentages. The ES (Expected Shortfall) represents the expected value of losses in case they exceed the specified VaR level. These values can provide investors with useful information about the level of risk associated with the analyzed stock indices.

The graphs in Figure 10 depict the VaR (Value at Risk) and ES (Expected Shortfall) levels for the analyzed indices: BET-FI, S&P 500, IXIC, and DJIA. The blue horizontal line represents the 5% VaR level, while the green horizontal line indicates the 5% ES level. The VaR represents the maximum expected loss in the worst 5% of scenarios, while the ES represents the expected value of losses in the worst 5% of scenarios. The graphs track moments when the returns of the four analyzed indices exceed the estimated risk levels. It is observed that most of the instances where the risk level was exceeded coincide with periods when the analyzed stock indices were in a negative or positive bubble. This may suggest that, despite the financial market being quite volatile, it is not advisable to invest during periods of identified financial bubbles.

Figure 10.

VaR (Value at Risk) and ES (Expected Shortfall) for .

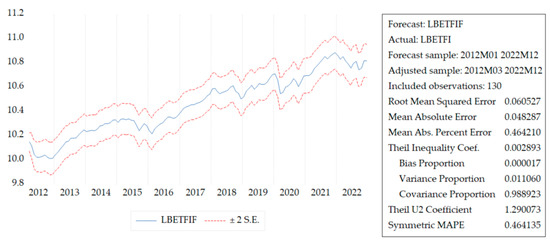

4.2. Exploring Stock Index Modeling with ARDL: Insights into Performance Metrics

This study delved into the complex world of financial indices, with a specific focus on the BET-FI as the dependent variable. Through advanced econometric techniques, we aimed to uncover hidden patterns, assess the impact of various factors, and provide valuable predictive insights into the performance of stock indices. According to Nica et al. (2023a), the ARDL model stands out as a flexible instrument for scrutinizing time series data and unraveling relationships among research variables. Its proficiency in addressing both short-term and long-term dynamics, as well as handling cointegration and ensuring robustness, renders it indispensable for empirical research. This section delves into the fundamental steps of applying the ARDL model to our dataset. Descriptive statistics play a crucial role in comprehending and priming the data before implementing the ARDL model.

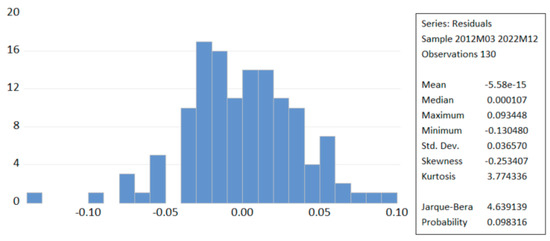

Table 2 provides a detailed overview of the basic statistical characteristics of the data distribution for the BET-FI, S&P 500, IXIC, and DJIA indices. Statistics such as mean, median, minimum and maximum values, standard deviation, skewness, kurtosis, and the Jarque–Bera test for normality of skewness and kurtosis are presented. According to the information in Table 2, all indices have median values close to the means, suggesting a relatively symmetric distribution around the central value. Additionally, small standard deviations indicate a relatively tight concentration of values around the mean. Skewness values close to zero indicate a relatively symmetric distribution for the analyzed stock indices, and the kurtosis values suggest that the peaks of the distributions are generally within the normal range, reflecting a moderate concentration around the mean. For all indices, the Jarque–Bera values are significant at a significance level of 0.10 or 0.08, suggesting a small deviation from a normal distribution.

Table 2.

Summary statistics.

In Table 3, the results of the Augmented Dickey–Fuller test are presented, indicating whether the time series of the analyzed variables has a unit root and providing information about the order of integration required to make these series stationary. At that level, the t-statistics coefficient is −1.28, with a probability (p-value) of 0.63. However, upon applying the first differencing, the t-statistics coefficient becomes significant at −10.95, with a probability of 0.00. This result suggests that the BET-FI variable requires differencing to become stationary, and the order of integration is I(1). Similarly, for the S&P 500, at that level, we have a t-statistics coefficient of −1.32 with a probability of 0.61, and through differencing the data once, the coefficient becomes significant at −13.28, with a probability of 0.00. This also indicates an order of integration of I(1). The same observations hold for the variables IXIC and DJIA. At that level, the t-statistics coefficients are not significant, but they become significant upon differencing the data once, and the order of integration is I(1). In the case of the ADF test, which includes both the intercept and trend, the results are similar. The t-statistics coefficients become significant at that level (with the intercept) and become even more significant upon differencing once. The order of integration for all variables is I(1). According to (Shrestha and Bhatta 2018), an Autoregressive Distributed Lag (ARDL) model represents a regression model based on Ordinary Least Squares (OLS) methodology. It is suitable for analyzing both non-stationary time series and time series with a mixed order of integration. The ARDL model incorporates an adequate number of lags to effectively capture the underlying data-generating process within a general-to-specific modeling framework.

Table 3.

(a) ADF Unit Root Test (intercept). (b) ADF Unit Root Test (trend and intercept).

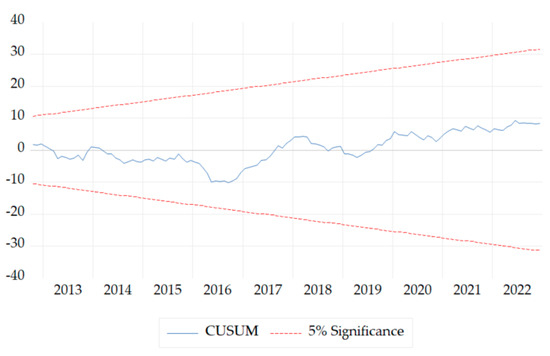

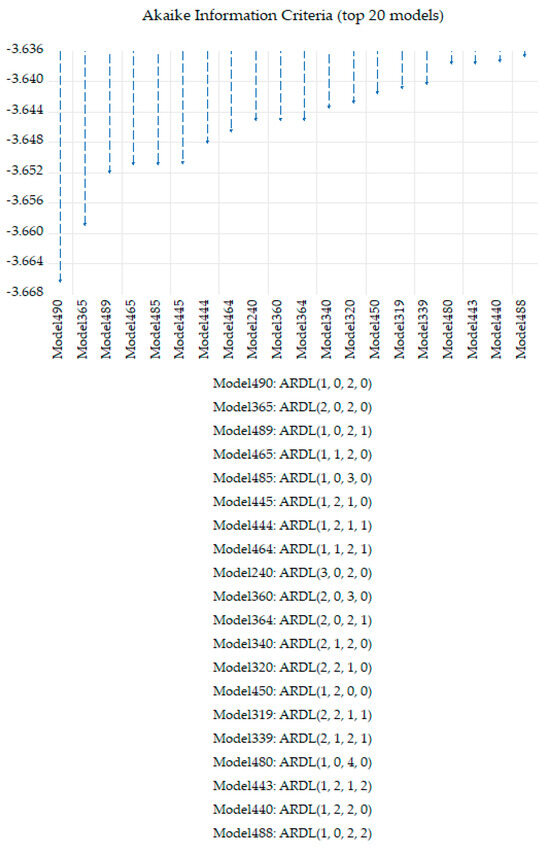

The subsequent step involves determining the suitable lag structure for the ARDL model, as outlined in Figure A1 from Appendix A.

Enders (2014) emphasized the importance of meticulously choosing the optimal lag length before implementing the ARDL model. This step is critical for several reasons, including ensuring the model’s proper alignment with the data. A lag length that is too short could lead to the model missing key dynamics, potentially causing an omitted variable bias.

Table 4 displays the outcomes of the cointegration bounds test, designed to explore the existence of long-term causality. The F-statistic, computed at 6.61, exceeds the critical upper bounds associated with I(1), signifying the presence of cointegration among the variables under scrutiny. In this instance, the chosen model is ARDL (1, 0, 2, 0).

Table 4.

The outcomes of the cointegration bounds test.

The results of the cointegration bounds test (ARDL) indicate that the F-statistic is relevant for analyzing the cointegration among the involved variables. The F-statistic values, along with critical bounds for different significance levels, are presented in Table 4. Since the F-statistic exceeds all critical values for a significance level of 1%, there is cointegration among the analyzed variables at a confidence level of 99%. This suggests a stable, long-term relationship between the respective variables.

The use of the Error Correction Model (ECM) equation is crucial for understanding short-term adjustments toward long-term equilibrium. In Table 5, it is observed that for each unit increase in the S&P 500, a corresponding increase of 1.31 units in the dependent variable BET-FI is expected in the long term. This result is significant at a 0.05 significance level. Regarding the IXIC index, for each unit increase, a corresponding decrease of 0.75 units in the dependent variable BET-FI is anticipated in the long term. This result is significant at a 0.05 significance level. The constant term, denoted as C, represents the expected value of the dependent variable BET-FI in the long term when all other regressors are zero. Although it is not significant at a 0.05 significance level, it contributes to the baseline level of the dependent variable. Also, in Equation (10), the mathematical form of the error correction term has been represented, indicating the short-term adjustments of the variable BET-FI toward the long-term equilibrium determined by the regressors included in the model.

Table 5.

The long-run estimated coefficients (restricted constant and no trend).