Abstract

This paper is devoted to the resolution of the problem of risk management in a high-risk market environment. The goal of this paper was to study the experience of and prospects for the use of responsible innovations as tools for managing the financial risks of high-tech companies’ projects for their sustainable development (using the example of companies in Russia’s IT sphere in 2022–2023). We used the SEM method to study the daily statistics of the Moscow Exchange in 2022–2023. As a result, we quantitatively measured the financial risks of Russian companies in the IT sphere in 2022–2023. The studied case experience of the IT sphere in 2022 confirmed that Russian high-tech companies actively implement responsible innovations based on ESG projects. Our main conclusion is that the financial risks of high-tech companies are reduced in the case of the implementation of responsible innovations. Therefore, it is advisable to implement responsible innovations for the sustainable development of high-tech companies in a high-risk market environment. The theoretical significance of our conclusions lies in the substantiation of the synergetic effect of financial risk management with the help of responsible innovations. The scientific novelty and contribution of this paper to the literature consist in its clarifying the sectorial (in the IT sphere) and market (in a high-risk market environment) specifics of managing the financial risks to companies. We also disclosed a poorly studied and largely unknown unique and leading experience of managing the financial risks of Russian high-tech companies in 2022–2023. The practical significance of our recommendations is that the compiled scenario can be used as a strategic benchmark for the most complete development of the potential of the sustainable development of Russian high-tech companies in 2024.

1. Introduction

An increased level of financial risk is one of the main features of the modern stage of economic systems’ development. The fight against risks and, in particular, financial risks is set in the basis of sustainable development, which was announced as a global priority in the Decade of Action. This determines the high relevance of the study of financial risks to companies and elaboration of the scientific and methodological and practical issues of reducing these risks.

As a scientific and economic category, risk—in a general sense—involves a negative event that deals damage to economic subjects and that takes place with a certain frequency (probability). In this aspect, financial risk manifests the volume of commercial loss and its probability. The experience of Russian companies in 2022–2023 is particularly useful for its applicability in scientific research on the positions of risk due to the following reasons. First, the business environment of the Russian economy is a high-risk environment in this period, i.e., is characterized by a high level of risk.

Second, Russian companies demonstrated good sustainability against financial risks, successfully stabilizing the financial indicators of their activities in late 2022 and 2023, compared to early 2022, when the aggravation of the international sanctions crisis caused a quick growth of the risk level in the Russian business environment (Stepnov et al. 2022).

That is why the study of the experience of Russian companies in the sphere of financial risk management is useful not only for economic theory—to specify the cause-and-effect relationships of risk management in a high-risk business environment—but also for economic practice. The experience of Russian companies can be used by companies in other countries, especially in developing countries, to raise their resilience to financial risks.

In addition to the above, Russia’s experience is notable for the fact that due to its successful adaptation to a high-risk market environment, Russia did not just avoid a deficit in the economy and preserve domestic production but achieved a rise in high-tech production, strengthening its technological sovereignty and the digital competitiveness of the economy. That is why, when studying the Russian experience of financial risk management, it is expedient to elaborate on the practice of high-tech companies.

International experience, which is reflected in the extant literature, in particular in the work by Khasanov et al. (2019), shows that responsible innovations help reduce financial risks to companies. These responsible innovations are implemented during the realization of investment and innovative projects under the condition of a high level of corporate responsibility. However, this experience was obtained in a market environment with a low or moderate risk level and cannot be extended to a high-risk market environment, which requires an independent study given its specifics.

Acknowledging the relevance of the scientific and practical problem of risk management in a high-risk market environment, this is aimed at studying the experience of and prospects for using responsible innovations as a tool for managing the financial risks of high-tech companies’ projects for their sustainable development (using the example of companies in Russia’s IT sphere in 2022–2023).

This paper strives to fill the literature gap, which is connected with the uncertainty of the role of responsible innovations for IT companies. This paper searches for answers to the following research question: RQ: How do responsible innovations influence the financial risks to high-tech companies? For this, we study the influence of responsible innovations on financial risks to IT companies in Russia. This paper focuses on the high-risk framework (peculiar to the IT sphere). Financial risks to projects are measured in this paper by measuring financial losses based on changes in market capitalization.

The originality of this paper is due to its rethinking the practice of management of the sustainable development of Russian high-tech companies from the perspective of financial risk. This paper’s scientific novelty and contribution to the literature are due to its clarifying the following: (1) sectorial (in the IT sphere) and (2) market (in a high-risk market environment) specifics of the management of financial risks to companies and disclosing the poorly studied and largely unknown unique and leading experience of managing the financial risks of Russian high-tech companies in 2022–2023.

Further on in this paper, a literature review (Section 2) is conducted, in which the essence of financial risks of high-tech companies and their connection with responsible innovations are explained, and the ways of achieving the sustainable development of high-tech companies in a high-risk market environment are determined. After this, the research design and methodology (Section 3) are explained.

After that, the results (Section 4) of an empirical study are given, which include the following: (1) determining the role of responsible innovations in the management of financial risks to the projects of high-tech companies (using the example of the IT sphere) in Russia in 2022–2023; (2) conducting a scenario analysis of the sustainable development of high-tech companies depending on financial risk management of projects; (3) studying the case experience of implementing ESG projects of responsible innovations in high-tech companies in Russia (using the example of the IT sphere in 2022). At the end of this paper, conclusions, their discussion, and significance are given (Section 5).

2. Literature Review

This paper continues the ongoing active discussion in the modern literature on the issues of the influence of responsible innovations on risks to companies (Beger et al. 2023; Memon and Ooi 2023). This paper focuses on the “responsible” side of the discussion, motivating the connection between responsible investment and risk taking (Luttikhuis and Wiebe 2023).

This paper differentiates between, on the one hand, “standard” investments in innovations—investments in simple innovations, the social implications of which may be anything and go beyond the area of responsibility of their companies (Liu et al. 2023; X. Qu et al. 2023)—and, on the other hand, investments in responsible innovations, investments in innovations, supplemented by investments in corporate social responsibility (Wicher and Frankus 2023; Zhang et al. 2023).

The main idea of this paper is to demonstrate the advantages of investments in responsible innovations from the perspective of their contribution to the reduction in financial risks to companies. Thus, this paper strives to strengthen the scientific arguments of preference for investments in responsible innovations, because making investment decisions is embedded in the profitability/risk ratio.

The theoretical basis of this research is the concept of financial risks to companies (Xu et al. 2023). The research object is the investment and innovative project, which is treated as investments in innovations within a specific project: measures to achieve the company’s goal with set limitations, such as budget, terms, and quality (Wang et al. 2023). Corporate responsibility is introduced as an additional limitation of the investment and innovative project.

Within this sphere, the research subject in this paper is the financial risks of high-tech companies during the implementation of investment and innovative projects (Turginbayeva et al. 2018). In this regard, the central scientific category of this paper is financial risk, which is treated as the risk of a reduction in market capitalization.

The logical substantiation of the given treatment is the fact that capitalization is one of the key financial indicators of a company’s activities in the market economy (Mlawu et al. 2023). According to this definition, financial risk in this research is measured by finding the product of companies’ factual loss (sum of a decrease in capitalization) and the probability of this risk event (number of cases of a decrease in capitalization) over a certain period (calendar year).

Investment and innovative projects for the implementation of responsible innovations involve a company’s manifesting of highly innovative activity in the spheres that conform to ESG, which include environmental responsibility (E), social responsibility (S), and responsible corporate governance (G) (Fu et al. 2023; Li et al. 2023).

While the practice of responsible innovations of modern companies based on investment and innovative projects was studied in detail in existing publications, their connection with financial risks to companies and, in particular, high-tech companies, was not studied sufficiently (Adomako and Nguyen 2023; Beger et al. 2023; Wiarda and Doorn 2023). This is a literature gap and leads to the following research question:

RQ:

How do responsible innovations influence the financial risks of high-tech companies?

The performed overview and content analysis of existing publications revealed that they share a popular opinion that responsible innovations based on investment and innovative projects increase the financial risks posed to high-tech companies, for they do the following: raise the general uncertainty and risk (Martins 2023); raise the investment burden on companies with limited opportunities to return investments (Toma et al. 2023); and require the flow of investments from more predictable innovative projects with larger opportunities to return investments (Veselovsky et al. 2018). However, the given arguments are not sufficiently supported by scientific facts and require cross-checking, and the RQ remains open.

The existing theoretical discussion on the topic of the sustainable development of companies is mainly focused on the experience of companies that function in the market environment with low and moderate risk (Silva et al. 2023). Here, the sustainable development of companies and their financial risks are differentiated. The sustainability of companies is measured from the perspective of the implementation of the SDGs, and financial risks are measured from the perspective of market capitalization (Trabelsi et al. 2023). Responsible innovations are treated as a means of achieving the SDGs and sustainable development of companies. But to increase the market capitalization of companies (reduce their financial risks), it is preferable to implement “standard” innovations (Nagarajah 2023).

In this case, the high-risk market environment is poorly studied and, thus, a promising research sphere. Differentiation of the market environment by the criterion of the level of its risk is performed in this paper based on C. Christensen’s theory of innovations (Christensen 2002). According to this theory, “standard” innovations, which are accompanied by slight changes and, therefore, low or moderate risk, and “disruptive” innovations, which lead to revolutionary changes and are, therefore, accompanied by high risk, are differentiated (Bertoluci et al. 2013; Birtchnell 2011; Butler and Martin 2016).

High-tech companies and, in particular, IT companies implement disruptive innovations and thus function in a high-risk market environment (Bednar and Spiekermann 2023; S. Qu et al. 2023; White 2023). In the conditions of the Fourth Industrial Revolution, the research on the experience of high-tech and, in particular, IT companies is especially relevant, for high-tech markets are developing dynamically and are dominating the structure of GDP, being a vector of economic growth (Du et al. 2020). Studying the experience of IT companies is important to understand the general specifics of the sustainable development of companies in a high-risk market environment, which is peculiar to all high-tech companies.

The sustainable development of companies is treated in this paper—based on the works of Khémiri et al. (2023) and Qin et al. (2023)—as stability of their financial position, i.e., their financial well-being. The sustainable development of companies is achieved via the management of their financial risks. In turn, the management of the financial risks to companies depends on the character of competition in the market. If the pricing competition dominates in the market, the management of financial risks to companies should be aimed at the reduction in the cost and price of the products sold.

If competition in the sphere of product quality dominates in the market, the management of financial risks to companies must be aimed at raising product quality—improving product technical qualities compared to rivals. If competition in the sphere of product novelty dominates in the market, which is typical for high-tech product markets, the management of financial risks to companies must be aimed at the issue of new (innovative) products which are in demand in the market.

If there is active competition in the market in the sphere of marketing, particularly in the sphere of corporate responsibility, the management of financial risks to companies must be aimed at raising the level of corporate responsibility. With the combination of the above types of competition in the market, the management of financial risks to companies must ensure complex positive effects that conform to these types of competition.

While the types of competition are listed in existing publications, the specifics of competition between high-tech companies in a high-risk market environment are not clear. The performed overview and content analysis of existing publications revealed that they contain alternative opinions. Thus, there are the following suggestions for ensuring the sustainable development of high-tech companies in a high-risk market environment: through the refusal of innovations as sources of additional risk (Osovtsev et al. 2018); through the refusal of corporate responsibility to reduce expenditures (Deng et al. 2023); and through the implementation of innovative projects with minimum risk and maximum profitability (Veselovsky et al. 2017). However, the given arguments are not sufficiently supported by scientific facts and require cross-checking.

Based on the existing literature, in which, according to the experience of companies of other spheres—European companies in the financial sector (Chabot and Bertrand 2023), Chinese financial agglomerates (Chen and Zhang 2023), and tourist companies (Chen 2023)—it is noted that responsible innovations help reduce the financial risks of companies, this paper offers hypothesis H, which states that the financial risks of high-tech companies are reduced in the case responsible innovations are implemented. So, it is advisable to implement responsible innovations for the sustainable development of high-tech companies in a high-risk market environment.

This paper strives to prove that responsible investments improve risk management more in a high-risk framework than in a moderate-risk framework, as the literature has shown. That is, this paper proves that the effect of responsible innovations for financial risks is non-linear: the higher the level of financial risk, the more responsible innovations facilitate the reduction in this risk. The logic therein is that in a high-risk market environment, the largest value in the financial measurement (from the perspective of the market capitalization of companies) is posed by corporate social responsibility as a source of stability, which is in high demand in this environment (Olasiuk et al. 2023; Oneshko 2023).

The focus on IT companies in this paper was motivated by the high-risk framework. Responsible innovations in this specific sphere are determined as the use of the high-tech capabilities of IT companies to implement socially important innovation projects (Diba 2023; Kokot 2023). Examples of responsible innovations of IT companies are the provision of expanded guarantees of the quality of high-tech services that are provided at electronic platforms by IT companies, the organization of remote employment for employees, and the organization of charity events that are promoted via their digital platforms (Błaszczyk et al. 2023; Cook et al. 2023; Peng et al. 2023). Analysis of IT companies can provide important ideas on the influence of corporate social responsibility on financial risk taking.

To search for an answer to the RQ posed and to check the proposed hypothesis, we conducted economic and mathematical modelling of the influence of responsible innovations on the financial risks of high-tech companies in Russia (using the example of the IT sphere in 2022–2023).

3. Research Design and Methodology

This research has the following design. In the first stage, the role of responsible innovations in the management of financial risks to the projects of high-tech companies (using the example of the IT sphere) in Russia in 2022–2023 is determined. For this, the method of regression analysis is used to find the interdependencies of control variables. Second, the method of structural equation modelling systemically presents the revealed interdependencies. The list of control variables is as follows: capitalization of companies on the Information Technology Index (IT) in rubles (MOEX 2023a); capitalization of companies according to the Moscow Exchange Innovations Index (MOEXINN) in rubles (MOEX 2023b); and capitalization of companies on the index “Responsibility and Transparency” (MRRT) in rubles (MOEX 2023c).

The period in which this research took place was 24 November 2022–24 November 2023 (daily statistics of the Moscow Exchange—MOEX). The number of observations is 256. The research sample is presented in Table A1, with not only the initial values of the indices by days but also the daily change (growth) of the values of the indices. Financial risk is measured for each index separately according to the following formula:

where FR—financial risk on the considered index;

FR = rp

- r—arithmetic mean of negative values of the change in indices as a risk event;

- p—share of negative values of the change in indices as a reflection of the probability of the risk event.

The following regression relationships are determined:

IT = aIT + bIT1MOEXINN + bIT2MRRT

MOEXINN = aMOEXINN + bMOEXINNMRRT

MRRT = aMRRT + bMRRTMOEXINN

Regression relationships (2)–(4) are unified in the SEM model. Indicator FR in Equation (1) is the measurement of financial losses. To measure risk, this indicator of financial losses is supplemented in the SEM model by the coefficient of variation as the indicator of index volatility. Due to this, a design that is based on SEM in Equations (1)–(4), compared to a design that is based on regressions of the change in the profitability of IT on the profitability of MRRT in connection with the profitability of the MOEXINN, allows for the most complete, precise, and correct measuring of the financial risk for companies, for in the SEM model, financial losses (profitability) are supplemented with the coefficient of variation (uncertainty).

In this paper, the analysis is based on the calculation of changes in the capitalization of indices. Higher indices have a positive effect on responsible innovations. A similar research design, SEM, in the sphere of risk management analysis is used in the works of Almaiah et al. (2023), Fujii et al. (2023), and Rehman et al. (2023).

When studying responsible innovations, compared to “standard” innovations, the roles of variables in the regression model (1) change, though the dependent variable remains unchanged (IT). Thus, according to the scenario of isolated innovations, the main regressor is MRRT, while the MOEXINN is an additional variable. According to the scenario of isolated corporate responsibility, the main regressor is the MOEXINN, and MRRT is an additional variable. According to the scenario of responsible innovations, both variables (MRRT and MOEXINN) are the main regressors.

This paper is focused on responsible innovations. Therefore, for the purpose of comparison, we empirically test “standard” innovations, i.e., innovative projects implemented without a targeted manifestation of corporate social responsibility, in isolation from this responsibility.

Hypothesis H is deemed proven if there are positive values of regression coefficients, b. In the second stage, scenario analysis of the sustainable development of high-tech companies depending on the financial risk management of projects is performed. Based on the sample (Table A1), we determine the annual growth rate (Δ) of capitalization for each index—the change in its value on 24 November 2023 compared to that on 24 November 2022. We find the following: ΔIT, ΔMOEXINN, and ΔMRRT.

From an economic perspective, the scenario analysis aims to determine whether we will observe stronger effects of the reduction in risks from responsible innovations. For this, we compiled a scenario of isolated innovations in which the innovative activity of IT companies grows but the level of their corporate social responsibility remains unchanged.

This paper is based on the assumption that with isolated innovations, the effect of the reduction in financial risks (growth of market capitalization) of IT companies will be lower than with responsible innovations (innovations that are supplemented by corporate social responsibility). Based on the compiled model SEM, we prepare four alternative scenarios of the change in IT in the studied period.

The scenario without innovations (“all else being equal”): to build this, we find the product of the value of IT on 24 November 2023 with ΔIT; the values of the MOEXINN and MRRT remain at the level of 24 November 2023.

The scenario of isolated innovations: to build this, we find the product of the value of the MOEXINN on 24 November 2023 with ΔMOEXINN; the value of MRRT remains at the level of 24 November 2023.

The scenario of isolated corporate responsibility: to build this, we find the product of the value of MRRT on 24 November 2023 with ΔMRRT; the value of the MOEXINN remains at the level of 24 November 2023.

The scenario of responsible innovations: to build this, we find the product of the value of the MOEXINN on 24 November 2023 with ΔMOEXINN, and the product of the value of MRRT on 24 November 2023 with ΔMRRT.

The method of trend analysis is used to assess the change in the values of the indicators in each scenario. We determine a scenario for which the annual growth of IT in 2024 will be the largest.

In the third stage, we study the case experience of implementing ESG projects on responsible innovations in high-tech companies in Russia (using the example of the IT sphere in 2022–2023). For this, the method of case study is used. We elaborate on the experience of the leading IT companies in Russia, which are listed in the Information Technology Index for 2022–2023. They include the following companies: (1) Vkontakte (in the MOEX, this company’s shares are quoted with the code VKCO; company’s official website: https://vk.com/, accessed on 24 November 2023) (2) Cian (in the MOEX, this company’s shares are quoted with the code CIAN; company’s official website: cian.ru, accessed on 24 November 2023); (3) Yandex (in the MOEX, this company’s shares are quoted with the code YNDX; company’s official website: ya.ru, accessed on 24 November 2023); (4) HeadHunter (in the MOEX, this company’s shares are quoted with the code HHRU; company’s official website: hh.ru, accessed on 24 November 2023); (5) Ozon (in the MOEX, this company’s shares are quoted with the code OZON; company’s official website: ozon.ru, accessed on 24 November 2023); (6) YouDo (company’s official website: youdo.com, accessed on 24 November 2023), Drom (company’s official website: drom.ru, accessed on 24 November 2023); and (7) Positive Technologies (in the MOEX, this company’s shares are quoted with the code POSI).

4. Results

4.1. The Role of Responsible Innovations in the Management of Financial Risks to the Projects of High-Tech Companies (using the Example of the IT Sphere) of Russia in 2022–2023

To identify the role of responsible innovations in the management of financial risks to the projects of high-tech companies, we found the interdependencies of the control variables using the example of the IT sphere of Russia in 2022–2023. Based on the sample from Table A1, we performed a statistical analysis of the sample and, according to Formula (1), assessed financial risks to companies in the IT sphere of Russia in 2022–2023. The results obtained are presented in Table 1.

Table 1.

Statistical analysis of the sample and assessment of financial risks.

According to Table 1, the capitalization of companies on the Information Technology Index (IT) was reduced 138 times. The arithmetic mean of negative values of the change in indices as a risk event was r = −2494.6731 billion in RUB. The share of negative values of the change in indices as a reflection of the probability of the risk event was p = 138/256 = 0.54. The financial risk on the Information Technology Index (IT) was FR = −2494.6731 × 0.54 = −1350.06 billion in RUB.

The capitalization of companies according to the Moscow Exchange Innovations Index (MOEXINN) was reduced by 112 times. The arithmetic mean of negative values of the change in indices as a risk event was r = −96.3201 billion in RUB. The share of negative values of the change in indices as a reflection of the probability of the risk event was p = 112/256 = 0.43. The financial risk according to the Moscow Exchange Innovations Index (MOEXINN) was FR = −96.3201 × 0.43 = −42.31 billion in RUB.

The capitalization of companies on the index “Responsibility and Transparency” (MRRT) was reduced 107 times. The arithmetic mean of negative values of the change in indices as a risk event was r = −22,423.3061 billion in RUB. The share of negative values of the change in indices as a reflection of the probability of the risk event was p = 107/256 = 0.42. The financial risk on the index “Responsibility and Transparency” (MRRT) was FR = −22,423.3061 × 0.42 = −9409.00 billion in RUB. Also, the following regression relationships were found. As is usually done in financial articles, regression equations are presented using the abstract notations in Equations (2)–(4) and estimated results/coefficients are presented in the tables below. For the convenience of visual perception and scientific treatment of the results of the regression analysis, the statistical data are presented in trillion RUB.

First: the regression relationship of the market capitalization of IT companies with their innovative activity and corporate social responsibility is determined (Table 2).

Table 2.

Regression statistics for Equation (2).

Based on the results from Table 2, we specified the values of coefficients in Equation (2).

The results in Table 2 were obtained based on the data for the period spanning from 24 November 2022 to 24 November 2023. The error of model (2) (standard error) is 0.0901, i.e., very small. The obtained value of the standard error means that observations in the sample deviate from the regression line by 0.0901. Model (2) indicates that with an increase in the MOEXINN by RUB 1, IT grows by RUB 5.6551. With an increase in the MRRT by RUB 1, IT grows by RUB 0.0564.

According to the results in Table 2, the change in IT by 95.31% is explained by the change in the MOEXINN and MRRT. The obtained value R2, which equals 0.9083, shows a close connection between the studied variables. The number of degrees of freedom is 255, which, at two factor variables, means that the sample is large enough to obtain reliable results. The F test and Student’s t-test, which were successfully passed at the highest level of significance of 0.01, demonstrate the high quality and reliability of Equation (2).

Second: the effect of the regression relationship of innovative activity on the corporate social responsibility of companies is shown (Table 3).

Table 3.

Regression statistics for Equation (3).

The results in Table 3 were obtained based on the data for the period spanning from 24 November 2022 to 24 November 2023. The error of model (3) (standard error) is 0.0120, i.e., very small. The obtained value of the standard error means that observations in the sample deviate from the regression line by 0.0120. Model (3) indicates that with the growth of the MRRT by RUB 1, the MOEXINN grows by RUB 0.0036.

According to the results in Table 3, 73.16% of the change in the MOEXINN is explained by the change in the MRRT. The F test and Student’s t-test, which were successfully passed at the highest level of significance of 0.01, demonstrate the high quality and reliability of Equation (3).

Third: the regression relationship of corporate social responsibility with the innovative activity of companies is shown (Table 4).

Table 4.

Regression statistics for Equation (4).

The results in Table 4 were obtained based on the data for the period spanning from 24 November 2022 to 24 November 2023. The error of model (4) (standard error) is 2.4377, i.e., very small. The obtained value of the standard error means that observations in the sample deviate from the regression line by 2.4377. Model (4) indicates that with an increase in the MOEXINN by RUB 1, the MRRT grows by RUB 148.2773.

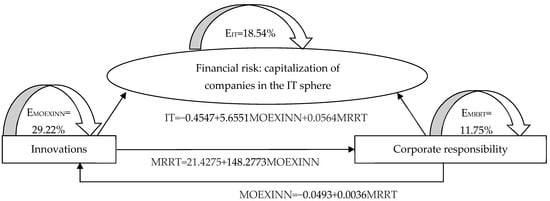

According to the results in Table 4, 73.16% of the change in the MRRT is explained by the change in the MOEXINN. The F test and Student’s t-test, which were successfully passed at the highest level of significance, demonstrate the high quality and reliability of Equation (4). Regression relationships (2)–(4) are unified in the SEM model (Figure 1).

Figure 1.

SEM model of the connection between the financial risks of high-tech companies and their responsible innovations. Source: authors.

Thus, all coefficients of regression b in regression Equations (2)–(4) took positive values. Therefore, the hypothesis H was proven. A scenario analysis was conducted to determine the prospects for the sustainable development of high-tech companies depending on financial risk management. Based on the sample (Table A1), we found the annual growth rate (Δ) of capitalization according to each index—the change in its value on 24 November 2023 compared to that on 24 November 2022:

- ΔIT = 1,983,738,500,417.60/1,319,593,124,490.40 = 1.50;

- ΔMOEXINN = 71,812,769,937.11/17,016,847,943.33 = 4.12;

- ΔMRRT = 34,599,151,372,166.40/28,586,141,537,287.80 = 1.21.

Based on the compiled SEM model, we prepared four alternative scenarios of the change in IT for the period under study (Table 5).

Table 5.

Scenarios of sustainable development of high-tech companies depending on financial risk management of projects.

As shown in Table 5, according to the scenario without innovations, i.e., “all else being equal”, the capitalization of companies on the Information Technology Index will grow by 24 November 2024 compared to 24 November 2023, i.e., by 50.33% over the calendar year. According to the scenario of isolated innovations, it will grow by 49.75%; according to the scenario of isolated corporate responsibility, it will grow by 13.25%.

In aggregate, isolated innovations and isolated corporate responsibility can ensure an increase in the capitalization of companies on the Information Technology Index by 62.99% (49.75 + 13.25). The scenario of responsible innovations, which involves a simultaneous increase in the corporate responsibility and innovative activity of companies, will raise their capitalization by 82.46%. That is, the synergetic effect of social innovations equals 19.47% (82.46–62.99).

Special attention should be paid to the comparison of the scenario of responsible innovations with the scenario of isolated innovations. As shown in Table 5, according to the scenario of isolated innovations (under which the innovative activity of IT companies grows but the level of their corporate social responsibility remains unchanged), the market capitalization of these companies grows by 49.75%. By contrast, according to the scenario of responsible innovations (innovations that are supplemented by corporate social responsibility), the market capitalization of IT companies grows by 82.46%.

This means that with isolated innovations, the effect of the reduction in financial risks (growth of market capitalization) of IT companies is lower than that seen with responsible innovations. Therefore, we observe a more significant reduction in the financial risks to IT companies from the implementation of responsible innovations than from the implementation of “standard” innovations.

4.2. Case Experience of Implementing ESG Projects on Responsible Innovations in High-Tech Companies of Russia (using the Example of the IT Sphere in 2022–2023)

To study the successful experience of implementing ESG projects on responsible innovations in high-tech companies in Russia, we performed a case overview of the practice of the leading IT companies in Russia that were included in the Information Technology Index in 2022–2023.

Regarding environmental responsibility (E), the experience of Vkontakte is notable. In the MOEX, shares of this company are quoted with the code VKCO, and the company’s official website is https://vk.com/ (accessed on 24 November 2023). In 2022, the company started the following projects of implementing responsible innovations in the sphere of environmental protection (VK 2023): (1) projects on the sorting of waste for its environmentally safe disposal; (2) a project on the transition to personnel electronic document turnover to save paper and protect forests; (3) a project on the popularization of zoo volunteering through the creation and mass dissemination of a mini-series about this; (4) projects on the start of a flash mob for the protection of endangered sea otters.

Regarding social responsibility (S), the experience of the following Russian companies in the IT sphere is interesting: Cian (in the MOEX, the company’s shares are quoted with the code CIAN; the company’s official website is cian.ru), Yandex (in the MOEX, the company’s shares are quoted with the code YNDX; the company’s official website is ya.ru), HeadHunter (in the MOEX, the company’s shares are quoted with the code HHRU; the company’s official website is hh.ru), Ozon (in the MOEX, the company’s shares are quoted with the code OZON; the company’s official website is ozon.ru), YouDo (the company’s official website is youdo.com), and Drom (the company’s official website is drom.ru).

These companies joined efforts and signed the “Charter of professional ethics of services for posting online advertisements (classifieds)” on the platform of the autonomous non-profit organization “Digital Economy”. This project of socially responsible innovations ensures an increase in the inclusiveness of services in the IT sphere, accessibility of these services for customers, transparency of their provision, and mutual respect and responsibility of all parties on the online platform of the supplier that signed the Charter (CIAN 2023).

Additionally, YouDo (2023) has implemented its project of socially responsible innovations, which is connected with the insurance of risks of the use of its online platform. Within this project, the company obligates the performer to accept material responsibility before the customer, who, in case of material damage, can receive compensation. That is, the idea behind the project is that YouDo is a conditional arbitrageur and guarantor of the high quality of services that are provided via its online platform.

Regarding responsible corporate governance (G), attention should be paid to the experience of Positive Technologies (in the MOEX, shares of this company are quoted with the code POSI). This company implements an investment project of responsible corporate governance. This project covers the following (Positive Technologies 2023): (1) active involvement of shareholders and investors in corporate management and the protection of their interests; (2) transparency and completeness of information support and financial reporting of corporate governance; (3) systemic accountability of the top management to shareholders and investors for the results of corporate governance.

Thus, high-tech Russian companies in the IT sphere actively practiced responsible innovations in 2022–2023, which ensured their high resilience to financial risks.

5. Conclusions and Their Discussion and Significance

This paper’s contribution to the literature consists in the development of the concept of financial risks posed to companies through substantiation (using the example of companies in Russia’s IT sphere in 2022–2023) of a significant contribution of responsible innovations to the reduction in the financial risks of high-tech companies and their sustainable development in a high-risk market environment. The results obtained in this paper are given in Table 6 in a comparison with the literature.

Table 6.

Obtained results in comparison with the literature.

As shown in Table 6, a new answer to the RQ was obtained. Unlike Martins (2023), Toma et al. (2023), and Veselovsky et al. (2018), we proved in this paper that responsible innovations do not raise but decrease financial risks because they increase the competitiveness of high-tech companies, simultaneously increasing their innovativeness and strengthening their business reputation as reliable suppliers, which is especially valuable in a high-risk market environment.

Also, we proved that the sustainable development of high-tech companies in a high-risk market environment is not facilitated either by refusal from innovations as sources of additional risk (unlike Osovtsev et al. 2018), refusal from corporate responsibility to reduce expenditures (unlike Deng et al. 2023), or the implementation of innovative projects with minimum risk and maximum profitability (unlike Veselovsky et al. 2017). It is facilitated by the active implementation of responsible innovations as sources of predictable and reliable additional income.

Therefore, this paper supports the ongoing scientific discussion by Beger et al. (2023), Liu et al. (2023), Luttikhuis and Wiebe (2023), Memon and Ooi (2023), X. Qu et al. (2023), Wicher and Frankus (2023), and Zhang et al. (2023) on the topic of the sustainable development of companies. Unlike the existing literature, which is focused on the experience of companies that function in a market environment with low and moderate risk, this paper disclosed the poorly studied experience of high-tech companies that function in a high-risk market environment. This paper expanded the scientific understanding of the essence of the innovative activity of these companies and proved that the sustainable development and reduction in financial risks (an increase in market capitalization) in their activities are not opposed (unlike Nagarajah 2023; Silva et al. 2023; Trabelsi et al. 2023) but associated with each other.

As the considered experience of IT companies showed, responsible innovations in their activities do not hinder the reduction in financial risks but ensure the reduction in these risks. Therefore, the specifics of responsible innovations in a high-risk market environment and, in particular, the activities of IT companies are that responsible innovations are universal management tools with increased effectiveness. Responsible innovations generate a dual (synergetic) effect, simultaneously increasing the sustainability and market capitalization of companies.

The main conclusion of the conducted research is that financial risks to high-tech companies are reduced in the case of the implementation of responsible innovations. Therefore, for the sustainable development of high-tech companies in a high-risk market environment, it is expedient to implement responsible innovations (hypothesis H was proven). The main results of the conducted empirical research are as follows:

1. We quantitatively measured the financial risks to Russian companies in the IT sphere in 2022–2023. The financial risk according to the index “Responsibility and Transparency” (MRRT) turned out to be the highest at RUB 9409.00 billion. The financial risk on the Information Technology Index (IT) equalled RUB 1350.06 billion. The financial risk according to the Moscow Exchange Innovations Index (MOEXINN) was assessed at RUB 42.31 billion.

2. We proved a large positive role of responsible innovations in the management of financial risks to the projects of high-tech companies (using the example of the IT sphere) in Russia in 2022–2023. The SEM model demonstrated not only the influence of responsible innovations on the reduction in financial risks but also the close connection between the innovative activity of Russian high-tech companies and their corporate responsibility. The studied case experience of the IT sphere in 2022 confirmed that Russian high-tech companies actively implement responsible innovations based on ESG projects.

3. The conducted scenario analysis revealed that the sustainable development of high-tech companies in Russia in 2024 must be based on responsible innovations, for they ensure the most effective management of projects’ financial risks.

The theoretical significance of the authors’ conclusions lies in the substantiation of the synergetic effect: responsible innovations ensure a contribution to the reduction in financial risks to companies in a high-risk market environment that is 19.47% higher than the contribution of innovations and corporate responsibility separately.

The authors’ conclusions ensure a better understanding of the general logic of innovations management in a high-risk market environment. They prove the significant positive contribution of responsible innovations simultaneously to sustainability and market capitalization, which is poorly expressed or absent in the market environment with low or moderate risk, according to the modern literature.

The practical significance of the authors’ recommendations is that the compiled scenario can be used as a strategic benchmark for the most complete development of the potential of the sustainable development of Russian high-tech companies in 2024. The experiences of Russian companies in financial risk management with the help of responsible innovations could be used by high-tech companies in other countries, in particular in countries of the Eurasian Economic Union (EAEU) and the expanding BRICS bloc, to raise the resilience of high-tech companies in a high-risk environment, e.g., a crisis market environment. The experiences of IT companies in financial risk management with the help of responsible innovations could be used by high-tech companies in other markets (e.g., in high-tech and exportation industries) to raise the sustainability of high-tech companies in a high-risk—for example, crisis—environment.

However, the analysis is based on indices and, therefore, does not explain firm specific channels that lead to this result. This showed, at the macroeconomic level, the very fact that responsible innovations ensure the sustainable development of IT companies, increasing their market capitalization. But the cause-and-effect links remain a “black box”, because, without specific measurements for companies, it is difficult to explain how and why exactly responsible innovations raise income or reduce uncertainty. This is a limitation of the performed research. It is expedient to open the discovered “black box” in future research based on the results of this paper. For this, future studies should embark on in-depth case research using specific companies as examples.

Author Contributions

Formal analysis, M.A.T.; Methodology, M.F.X.; Resources, E.S.P.; Writing—original draft, E.G.P.; Writing—review and editing, O.V.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Research sample.

Table A1.

Research sample.

| Date | Information Technology Index (IT), Rubles | Moscow Exchange Innovations Index (MOEXINN), Rubles | Index “Responsibility and Transparency” (MRRT), Rubles | |||

|---|---|---|---|---|---|---|

| Value | Daily Gain | Value | Daily Gain | Value | Daily Gain | |

| 24.11.2023 | 198,373,850,0417.60 | 16,558,888,566.00 | 71,812,769,937.11 | 384,970,094.21 | 34,599,151,372,166.40 | −93,507,875,109.70 |

| 23.11.2023 | 200,0297,388,983.60 | 9,122,873,962.80 | 71,427,799,842.90 | −1,426,477,090.77 | 34,692,659,247,276.10 | −132,452,554,324.30 |

| 22.11.2023 | 2,009,420,262,946.40 | −4,629,739,177.60 | 72,854,276,933.67 | 1,022,196,799.89 | 34,825,111,801,600.40 | 43,618,991,975.30 |

| 21.11.2023 | 2,004,790,523,768.80 | −36,396,628,064.20 | 71,832,080,133.79 | 262,673,700.61 | 34,781,492,809,625.10 | 62,388,259,062.40 |

| 20.11.2023 | 1,968,393,895,704.60 | −27,633,453,880.20 | 71,569,406,433.17 | −967,676,561.80 | 34,719,104,550,562.70 | −49,435,132,814.80 |

| 17.11.2023 | 1,940,760,441,824.40 | 3,840,132,267.20 | 72,537,082,994.97 | −803,365,555.31 | 34,768,539,683,377.50 | 86,870,232,992.50 |

| 16.11.2023 | 1,944,600,574,091.60 | −4,214,585,046.70 | 73,340,448,550.28 | 1,959,109,408.25 | 34,681,669,450,385.00 | −359,937,554,867.40 |

| 15.11.2023 | 1,940,385,989,044.90 | −186,002,128.50 | 71,381,339,142.03 | 2,398,791,329.19 | 35,041,607,005,252.40 | −127,540,255,235.10 |

| 14.11.2023 | 1,940,199,986,916.40 | −12,950,287,458.40 | 68,982,547,812.84 | −4,314,826,955.98 | 35,169,147,260,487.50 | −398,181,796,266.10 |

| 13.11.2023 | 1,927,249,699,458.00 | −410,999,268.40 | 73,297,374,768.82 | −3,508,192,345.47 | 35,567,329,056,753.60 | 51,351,139,966.40 |

| 10.11.2023 | 1,926,838,700,189.60 | 23,619,158,411.00 | 76,805,567,114.29 | −1,846,789,939.05 | 35,515,977,916,787.20 | 96,909,097,880.41 |

| 09.11.2023 | 1,950,457,858,600.60 | 11,976,022,438.70 | 78,652,357,053.34 | −1,200,089,456.46 | 35,419,068,818,906.80 | −62,664,178,146.91 |

| 08.11.2023 | 1,962,433,881,039.30 | 1,869,307,372.30 | 79,852,446,509.80 | −334,356,237.44 | 35,481,732,997,053.70 | −139,246,086,979.59 |

| 07.11.2023 | 1,964,303,188,411.60 | −3,909,712,225.80 | 80,186,802,747.24 | −605,464,406.95 | 35,620,979,084,033.30 | 52,662,036,026.09 |

| 06.11.2023 | 1,960,393,476,185.80 | −16,500,317,848.60 | 80,792,267,154.19 | 848,991,384.59 | 35,568,317,048,007.20 | 267,855,789,874.00 |

| 03.11.2023 | 1,943,893,158,337.20 | −10,325,591,733.90 | 79,943,275,769.60 | −127,388,798.37 | 35,300,461,258,133.20 | 75,330,823,446.20 |

| 02.11.2023 | 1,933,567,566,603.30 | 9,776,067,648.30 | 80,070,664,567.98 | −1,796,782,404.69 | 35,225,130,434,687.00 | −127,832,825,196.80 |

| 01.11.2023 | 1,943,343,634,251.60 | −12,308,256,795.90 | 81,867,446,972.67 | 2,148,089,738.64 | 35,352,963,259,883.80 | 83,133,383,979.00 |

| 31.10.2023 | 1,931,035,377,455.70 | 15,995,401,506.10 | 79,719,357,234.03 | −999,008,444.02 | 35,269,829,875,904.80 | −345,482,490,854.10 |

| 30.10.2023 | 1,947,030,778,961.80 | 21,288,908,327.80 | 80,718,365,678.05 | 126,447,739.76 | 35,615,312,366,758.90 | 2,612,968,686.90 |

| 27.10.2023 | 1,968,319,687,289.60 | 14,998,807,629.40 | 80,591,917,938.29 | −107,298,942.11 | 35,612,699,398,072.00 | 46,930,844,693.50 |

| 26.10.2023 | 1,983,318,494,919.00 | 29,862,703,289.30 | 80,699,216,880.40 | −2,255,814,811.86 | 35,565,768,553,378.50 | −321,365,756,200.10 |

| 25.10.2023 | 2,013,181,198,208.30 | −12,693,315,436.90 | 82,955,031,692.26 | 542,732,191.49 | 35,887,134,309,578.60 | −48,008,295,818.30 |

| 24.10.2023 | 2,000,487,882,771.40 | 3,403,216,072.20 | 82,412,299,500.77 | −269,230,109.14 | 35,935,142,605,396.90 | −143,825,964,831.60 |

| 23.10.2023 | 2,003,891,098,843.60 | 8,904,323,064.00 | 82,681,529,609.90 | −432,799,253.09 | 36,078,968,570,228.50 | −176,034,927,822.00 |

| 20.10.2023 | 2,012,795,421,907.60 | 5,670,548,059.20 | 83,114,328,862.99 | −819,184,188.92 | 36,255,003,498,050.50 | 325,143,707,824.20 |

| 19.10.2023 | 2,018,465,969,966.80 | −56,207,032,974.50 | 83,933,513,051.91 | 112,248,357.34 | 35,929,859,790,226.30 | 80,852,447,479.40 |

| 18.10.2023 | 1,962,258,936,992.30 | 1,107,945,505.70 | 83,821,264,694.57 | 176,815,472.77 | 35,849,007,342,746.90 | 165,441,322,805.80 |

| 17.10.2023 | 1,963,366,882,498.00 | 14,294,452,295.80 | 83,644,449,221.80 | −1,120,830,098.21 | 35,683,566,019,941.10 | 104,324,112,285.50 |

| 16.10.2023 | 1,977,661,334,793.80 | −10,787,661,128.90 | 84,765,279,320.01 | 8,303,938.56 | 35,579,241,907,655.60 | 483,431,964,159.40 |

| 13.10.2023 | 1,966,873,673,664.90 | −19,009,898,372.50 | 84,756,975,381.45 | 798,268,617.04 | 35,095,809,943,496.20 | 206,961,900,255.40 |

| 12.10.2023 | 1,947,863,775,292.40 | 15,408,832,903.60 | 83,958,706,764.42 | −732,276,630.97 | 34,888,848,043,240.80 | −235,860,052,424.90 |

| 11.10.2023 | 1,963,272,608,196.00 | −14,530,348,759.10 | 84,690,983,395.38 | −110,081,658.13 | 35,124,708,095,665.70 | 231,594,652,172.50 |

| 10.10.2023 | 1,948,742,259,436.90 | −13,198,039,357.30 | 84,801,065,053.51 | −582,560,466.94 | 34,893,113,443,493.20 | −94,609,542,627.10 |

| 09.10.2023 | 1,935,544,220,079.60 | −4,582,073,340.10 | 85,383,625,520.45 | 3,201,507,567.62 | 34,987,722,986,120.30 | 450,507,671,552.60 |

| 06.10.2023 | 1,930,962,146,739.50 | −15,803,677,819.00 | 82,182,117,952.83 | −1,504,512,834.66 | 34,537,215,314,567.70 | 119,402,663,407.80 |

| 05.10.2023 | 1,915,158,468,920.50 | −23,171,246,124.10 | 83,686,630,787.49 | −776,341,469.49 | 34,417,812,651,159.90 | −51,108,700,771.90 |

| 04.10.2023 | 1,891,987,222,796.40 | −3,096,563,199.60 | 84,462,972,256.97 | 406,887,290.37 | 34,468,921,351,931.80 | −42,870,836,504.40 |

| 03.10.2023 | 1,888,890,659,596.80 | −4,021,931,438.40 | 84,056,084,966.60 | −1,030,832,452.10 | 34,511,792,188,436.20 | 117,037,301,454.50 |

| 02.10.2023 | 1,884,868,728,158.40 | 6,697,874,233.10 | 85,086,917,418.71 | 614,764,320.23 | 34,394,754,886,981.70 | 21,407,980,734.30 |

| 29.09.2023 | 1,891,566,602,391.50 | 17,726,599,093.90 | 84,472,153,098.47 | −1,173,693,008.87 | 34,373,346,906,247.40 | 106,899,297,572.60 |

| 28.09.2023 | 1,909,293,201,485.40 | −17,234,312,355.30 | 85,645,846,107.34 | −92,500,344.88 | 34,266,447,608,674.80 | 450,454,510,588.70 |

| 27.09.2023 | 1,892,058,889,130.10 | −32,547,317,209.70 | 85,738,346,452.22 | 68,705,857.56 | 33,815,993,098,086.10 | 232,304,327,412.70 |

| 26.09.2023 | 1,859,511,571,920.40 | −1,770,778,842.60 | 85,669,640,594.66 | 571,955,790.07 | 33,583,688,770,673.40 | 43,290,394,036.50 |

| 25.09.2023 | 1,857,740,793,077.80 | −3,695,850,096.40 | 85,097,684,804.59 | 1,317,259,219.53 | 33,540,398,376,636.90 | 19,335,154,104.80 |

| 22.09.2023 | 1,854,044,942,981.40 | −5,081,218,324.00 | 83,780,425,585.06 | −1,331,809,816.30 | 33,521,063,222,532.10 | 293,207,453,369.00 |

| 21.09.2023 | 1,848,963,724,657.40 | 26,663,026,714.00 | 85,112,235,401.36 | 557,768,741.77 | 33,227,855,769,163.10 | −595,945,650,707.20 |

| 20.09.2023 | 1,875,626,751,371.40 | 38,354,864,337.80 | 84,554,466,659.59 | −2,539,648,324.27 | 33,823,801,419,870.30 | −233,149,372,003.50 |

| 19.09.2023 | 1,913,981,615,709.20 | 34,585,357,342.60 | 87,094,114,983.86 | −3,015,113,704.20 | 34,056,950,791,873.80 | −493,034,166,367.80 |

| 18.09.2023 | 1,948,566,973,051.80 | 38,717,316,174.80 | 90,109,228,688.06 | 309,746,684.64 | 34,549,984,958,241.60 | −239,489,262,527.50 |

| 15.09.2023 | 1,987,284,289,226.60 | −50,260,878,269.90 | 89,799,482,003.42 | 4,110,481,187.06 | 34,789,474,220,769.10 | 158,005,189,462.80 |

| 14.09.2023 | 1,937,023,410,956.70 | 19,229,628,715.90 | 85,689,000,816.35 | −6,153,513,921.14 | 34,631,469,031,306.30 | −56,583,848,868.20 |

| 13.09.2023 | 1,956,253,039,672.60 | 16,173,151,880.50 | 91,842,514,737.49 | −1,706,097,153.31 | 34,688,052,880,174.50 | −198,639,171,036.90 |

| 12.09.2023 | 1,972,426,191,553.10 | −45,326,003,901.10 | 93,548,611,890.80 | 2,246,706,845.88 | 34,886,692,051,211.40 | 392,766,005,335.80 |

| 11.09.2023 | 1,927,100,187,652.00 | 47,458,755,193.80 | 91,301,905,044.92 | −1,636,448,688.13 | 34,493,926,045,875.60 | −186,462,887,745.00 |

| 08.09.2023 | 1,974,558,942,845.80 | 16,830,980,118.40 | 92,938,353,733.05 | −222,162,132.68 | 34,680,388,933,620.60 | −322,287,632,337.30 |

| 07.09.2023 | 1,991,389,922,964.20 | 64,198,365,259.50 | 93,160,515,865.72 | −3,101,379,854.08 | 35,002,676,565,957.90 | −798,883,661,552.00 |

| 06.09.2023 | 2,055,588,288,223.70 | 45,747,265,674.10 | 96,261,895,719.80 | −2,340,583,586.45 | 35,801,560,227,509.90 | −142,541,738,383.60 |

| 05.09.2023 | 2,101,335,553,897.80 | −952,786,385.80 | 98,602,479,306.26 | 3,444,091,921.55 | 35,944,101,965,893.50 | 28,628,181,846.60 |

| 04.09.2023 | 2,100,382,767,512.00 | −34,810,847,922.00 | 95,158,387,384.71 | 4,183,037,841.95 | 35,915,473,784,046.90 | 402,836,397,994.60 |

| 01.09.2023 | 2,065,571,919,590.00 | −5,953,330,450.60 | 90,975,349,542.76 | 3,470,454,770.03 | 35,512,637,386,052.30 | 68,198,106,848.20 |

| 31.08.2023 | 2,059,618,589,139.40 | −2,315,401,023.40 | 87,504,894,772.73 | −2,116,857,186.49 | 35,444,439,279,204.10 | 174,932,559,621.10 |

| 30.08.2023 | 2,057,303,188,116.00 | 6,182,409,526.00 | 89,621,751,959.22 | −3,126,468,025.09 | 35,269,506,719,583.00 | 211,075,372,759.30 |

| 29.08.2023 | 2,063,485,597,642.00 | 9,342,540,266.00 | 92,748,219,984.31 | 9,700,520,958.96 | 35,058,431,346,823.70 | 36,808,284,021.20 |

| 28.08.2023 | 2,072,828,137,908.00 | −31,783,007,863.20 | 83,047,699,025.34 | 9,613,781,167.80 | 35,021,623,062,802.50 | 356,450,750,617.50 |

| 25.08.2023 | 2,041,045,130,044.80 | −11,643,914,759.60 | 73,433,917,857.54 | 1,774,473,143.29 | 34,665,172,312,185.00 | 206,407,266,856.90 |

| 24.08.2023 | 2,029,401,215,285.20 | 11,982,912,990.10 | 71,659,444,714.25 | −152,335,011.19 | 34,458,765,045,328.10 | −125,316,578,187.00 |

| 23.08.2023 | 2,041,384,128,275.30 | 4,492,955,802.50 | 71,811,779,725.44 | 1,060,097,844.23 | 34,584,081,623,515.10 | −180,549,930,282.70 |

| 22.08.2023 | 2,045,877,084,077.80 | −48,511,149,828.00 | 70,751,681,881.21 | 827,456,964.43 | 34,764,631,553,797.80 | 258,732,648,966.00 |

| 21.08.2023 | 1,997,365,934,249.80 | −41,051,483,380.20 | 69,924,224,916.78 | 1,116,093,491.85 | 34,505,898,904,831.80 | 254,364,894,449.80 |

| 18.08.2023 | 1,956,314,450,869.60 | −48,008,712,894.60 | 68,808,131,424.93 | 5,990,844,355.48 | 34,251,534,010,382.00 | 568,654,719,173.20 |

| 17.08.2023 | 1,908,305,737,975.00 | −9,356,354,607.60 | 62,817,287,069.45 | 702,778,357.75 | 33,682,879,291,208.80 | 164,357,842,252.70 |

| 16.08.2023 | 1,898,949,383,367.40 | 48,957,868,539.10 | 62,114,508,711.70 | −1,246,497,177.17 | 33,518,521,448,956.10 | −744,658,734,788.70 |

| 15.08.2023 | 1,947,907,251,906.50 | 14,781,585,861.90 | 63,361,005,888.87 | 834,351,562.17 | 34,263,180,183,744.80 | −181,855,141,191.40 |

| 14.08.2023 | 1,962,688,837,768.40 | 17,993,670,142.20 | 62,526,654,326.69 | −676,764,809.67 | 34,445,035,324,936.20 | −76,694,132,126.00 |

| 11.08.2023 | 1,980,682,507,910.60 | 9,073,974,028.50 | 63,203,419,136.37 | 1,430,816,341.64 | 34,521,729,457,062.20 | 129,371,434,957.30 |

| 10.08.2023 | 1,989,756,481,939.10 | −35,771,747,942.50 | 61,772,602,794.73 | 785,273,705.27 | 34,392,358,022,104.90 | 530,128,380,902.60 |

| 09.08.2023 | 1,953,984,733,996.60 | −1,655,919,221.60 | 60,987,329,089.45 | 538,788,943.76 | 33,862,229,641,202.30 | 213,307,729,520.00 |

| 08.08.2023 | 1,952,328,814,775.00 | −11,432,080,807.50 | 60,448,540,145.69 | −371,946,425.55 | 33,648,921,911,682.30 | −29,663,277,419.50 |

| 07.08.2023 | 1,940,896,733,967.50 | −12,624,207,097.60 | 60,820,486,571.25 | −161,014,703.03 | 33,678,585,189,101.80 | −70,541,212,938.20 |

| 04.08.2023 | 1,928,272,526,869.90 | 37,566,941,739.30 | 60,981,501,274.28 | −1,191,561,590.27 | 33,749,126,402,040.00 | −529,416,754,060.90 |

| 03.08.2023 | 1,965,839,468,609.20 | −72,439,922,624.50 | 62,173,062,864.55 | 755,501,122.02 | 34,278,543,156,100.90 | 540,841,371,929.50 |

| 02.08.2023 | 1,893,399,545,984.70 | −8,234,753,264.40 | 61,417,561,742.53 | −41,637,491.26 | 33,737,701,784,171.40 | 195,281,466,232.20 |

| 01.08.2023 | 1,885,164,792,720.30 | −16,717,441,791.40 | 61,459,199,233.78 | 694,670,402.68 | 33,542,420,317,939.20 | 94,843,287,075.20 |

| 31.07.2023 | 1,868,447,350,928.90 | −2,540,679,949.60 | 60,764,528,831.10 | 35,440,588.71 | 33,447,577,030,864.00 | 581,695,266,083.90 |

| 28.07.2023 | 1,865,906,670,979.30 | −6,105,652,479.20 | 60,729,088,242.39 | 27,334,255.55 | 32,865,881,764,780.10 | 204,107,882,761.30 |

| 27.07.2023 | 1,859,801,018,500.10 | −9,587,268,744.10 | 60,701,753,986.84 | 549,248,787.81 | 32,661,773,882,018.80 | 227,256,957,401.20 |

| 26.07.2023 | 1,850,213,749,756.00 | −17,226,083,699.10 | 60,152,505,199.03 | −1,162,181,548.42 | 32,434,516,924,617.60 | 2,688,777,028.40 |

| 25.07.2023 | 1,832,987,666,056.90 | −37,569,368,884.90 | 61,314,686,747.46 | 638,149,026.01 | 32,431,828,147,589.20 | 403,141,329,206.00 |

| 24.07.2023 | 1,795,418,297,172.00 | −66,128,890,201.20 | 60,676,537,721.45 | 656,812,528.29 | 32,028,686,818,383.20 | 84,392,818,083.00 |

| 21.07.2023 | 1,729,289,406,970.80 | −6,026,627,693.70 | 60,019,725,193.16 | 590,626,582.21 | 31,944,294,000,300.20 | 31,713,939,473.10 |

| 20.07.2023 | 1,723,262,779,277.10 | 24,248,531,444.40 | 59,429,098,610.96 | −690,359,949.70 | 31,912,580,060,827.10 | −294,227,381,606.10 |

| 19.07.2023 | 1,747,511,310,721.50 | 13,110,432,023.60 | 60,119,458,560.66 | 32,437,713.67 | 32,206,807,442,433.20 | −64,364,091,056.40 |

| 18.07.2023 | 1,760,621,742,745.10 | −21,835,997,933.70 | 60,087,020,846.99 | 238,559,140.93 | 32,271,171,533,489.60 | 448,898,278,413.70 |

| 17.07.2023 | 1,738,785,744,811.40 | −13,355,745,950.80 | 59,848,461,706.06 | 823,015,570.66 | 31,822,273,255,075.90 | 237,938,064,904.80 |

| 14.07.2023 | 1,725,429,998,860.60 | −47,286,846,297.60 | 59,025,446,135.40 | 669,596,439.38 | 31,584,335,190,171.10 | 225,122,170,215.00 |

| 13.07.2023 | 1,678,143,152,563.00 | 5,848,370,194.60 | 58,355,849,696.03 | −300,687,919.81 | 31,359,213,019,956.10 | −103,640,678,548.60 |

| 12.07.2023 | 1,683,991,522,757.60 | −29,772,176,601.40 | 58,656,537,615.84 | 381,068,641.32 | 31,462,853,698,504.70 | 498,506,523,887.10 |

| 11.07.2023 | 1,654,219,346,156.20 | −16,429,211,637.70 | 58,275,468,974.52 | 561,281,429.70 | 30,964,347,174,617.60 | 18,075,416,189.60 |

| 10.07.2023 | 1,637,790,134,518.50 | −22,077,492,605.90 | 57,714,187,544.82 | 567,698,406.46 | 30,946,271,758,428.00 | 142,293,580,378.80 |

| 07.07.2023 | 1,615,712,641,912.60 | 7,919,922,702.90 | 57,146,489,138.36 | 312,614,354.07 | 30,803,978,178,049.20 | 234,421,263,748.00 |

| 06.07.2023 | 1,623,632,564,615.50 | 1,928,236,662.60 | 56,833,874,784.29 | −668,288,435.28 | 30,569,556,914,301.20 | 270,651,549,883.90 |

| 05.07.2023 | 1,625,560,801,278.10 | −2,022,929,130.10 | 57,502,163,219.56 | −502,781,845.69 | 30,298,905,364,417.30 | −63,457,232,792.30 |

| 04.07.2023 | 1,623,537,872,148.00 | 5,784,242,962.90 | 58,004,945,065.25 | −447,985,540.16 | 30,362,362,597,209.60 | 201,772,671,456.50 |

| 03.07.2023 | 1,629,322,115,110.90 | 22,846,537,618.60 | 58,452,930,605.42 | −350,312,167.05 | 30,160,589,925,753.10 | −181,215,034,874.30 |

| 30.06.2023 | 1,652,168,652,729.50 | 12,802,956,846.10 | 58,803,242,772.47 | 421,989,680.75 | 30,341,804,960,627.40 | 30,788,009,553.50 |

| 29.06.2023 | 1,664,971,609,575.60 | −5,917,457,959.60 | 58,381,253,091.72 | −62,031,857.10 | 30,311,016,951,073.90 | 61,566,370,948.50 |

| 28.06.2023 | 1,659,054,151,616.00 | −6,582,672,629.60 | 58,443,284,948.81 | −168,330,766.47 | 30,249,450,580,125.40 | −16,857,467,366.40 |

| 27.06.2023 | 1,652,471,478,986.40 | −33,250,447,035.40 | 58,611,615,715.29 | 126,429,657.78 | 30,266,308,047,491.80 | 118,499,772,562.50 |

| 26.06.2023 | 1,619,221,031,951.00 | 46,329,349,807.00 | 58,485,186,057.51 | −862,018,910.52 | 30,147,808,274,929.30 | −410,678,977,495.30 |

| 23.06.2023 | 1,665,550,381,758.00 | 35,834,133,761.00 | 59,347,204,968.03 | −61,696,518.37 | 30,558,487,252,424.60 | −201,803,325,224.50 |

| 22.06.2023 | 1,701,384,515,519.00 | 1,584,302,775.90 | 59,408,901,486.40 | 448,212,903.71 | 30,760,290,577,649.10 | −52,540,279,695.10 |

| 21.06.2023 | 1,702,968,818,294.90 | −26,317,364,198.90 | 58,960,688,582.69 | 242,106,933.06 | 30,812,830,857,344.20 | 132,245,270,913.20 |

| 20.06.2023 | 1,676,651,454,096.00 | 4,991,056,842.00 | 58,718,581,649.63 | 606,015,096.89 | 30,680,585,586,431.00 | −182,164,276,581.00 |

| 19.06.2023 | 1,681,642,510,938.00 | 15,843,275,417.60 | 58,112,566,552.74 | −453,266,764.02 | 30,862,749,863,012.00 | 165,694,342,802.20 |

| 16.06.2023 | 1,697,485,786,355.60 | 55,492,610,802.20 | 58,565,833,316.76 | −7,406,495,887.52 | 30,697,055,520,209.80 | 63,804,995,241.30 |

| 15.06.2023 | 1,752,978,397,157.80 | 5,234,784,568.70 | 65,972,329,204.28 | −219,659,953.97 | 30,633,250,524,968.50 | 425,248,163,166.70 |

| 14.06.2023 | 1,758,213,181,726.50 | −29,451,080,593.40 | 66,191,989,158.25 | −210,570,412.43 | 30,208,002,361,801.80 | −32,317,950,656.30 |

| 13.06.2023 | 1,728,762,101,133.10 | −28,788,026,300.30 | 66,402,559,570.68 | −137,091,242.22 | 30,240,320,312,458.10 | 610,024,207,481.80 |

| 09.06.2023 | 1,699,974,074,832.80 | 9,634,053,998.20 | 66,539,650,812.89 | 1,206,162,849.16 | 29,630,296,104,976.30 | 21,713,045,562.90 |

| 08.06.2023 | 1,709,608,128,831.00 | −55,241,405,333.90 | 65,333,487,963.74 | 1,572,544,949.34 | 29,608,583,059,413.40 | 116,774,991,538.60 |

| 07.06.2023 | 1,654,366,723,497.10 | −61,946,913,604.30 | 63,760,943,014.39 | 1,585,758,685.85 | 29,491,808,067,874.80 | 136,638,478,681.80 |

| 06.06.2023 | 1,592,419,809,892.80 | −17,645,386,749.50 | 62,175,184,328.54 | −272,259,317.22 | 29,355,169,589,193.00 | −225,943,603,780.70 |

| 05.06.2023 | 1,574,774,423,143.30 | 11,008,098,801.30 | 62,447,443,645.76 | −171,148,002.83 | 29,581,113,192,973.70 | −84,365,717,686.40 |

| 02.06.2023 | 1,585,782,521,944.60 | −12,773,688,295.10 | 62,618,591,648.59 | 387,496,974.93 | 29,665,478,910,660.10 | 21,574,018,150.40 |

| 01.06.2023 | 1,573,008,833,649.50 | −3,749,781,534.50 | 62,231,094,673.67 | −60,370,843.62 | 29,643,904,892,509.70 | 164,138,127,235.00 |

| 31.05.2023 | 1,569,259,052,115.00 | −18,728,908,854.50 | 62,291,465,517.29 | 1,186,783,250.58 | 29,479,766,765,274.70 | 272,121,367,935.40 |

| 30.05.2023 | 1,550,530,143,260.50 | 39,203,906,834.70 | 61,104,682,266.71 | −774,831,344.70 | 29,207,645,397,339.30 | −174,895,577,251.70 |

| 29.05.2023 | 1,589,734,050,095.20 | −34,045,005,444.90 | 61,879,513,611.42 | 702,541,288.87 | 29,382,540,974,591.00 | 372,488,585,119.60 |

| 26.05.2023 | 1,555,689,044,650.30 | −21,878,862,887.70 | 61,176,972,322.54 | 390,632,052.18 | 29,010,052,389,471.40 | 255,789,928,453.50 |

| 25.05.2023 | 1,533,810,181,762.60 | −19,942,598,868.60 | 60,786,340,270.36 | 750,984,037.63 | 28,754,262,461,017.90 | −64,346,471,399.50 |

| 24.05.2023 | 1,513,867,582,894.00 | −9,077,567,791.00 | 60,035,356,232.73 | 1,084,555,472.22 | 28,818,608,932,417.40 | 29,912,793,978.10 |

| 23.05.2023 | 1,504,790,015,103.00 | −6,593,942,972.00 | 58,950,800,760.51 | 91,190,084.47 | 28,788,696,138,439.30 | 53,332,434,756.20 |

| 22.05.2023 | 1,498,196,072,131.00 | −16,864,641,642.80 | 58,859,610,676.04 | 103,044,034.56 | 28,735,363,703,683.10 | 109,120,579,929.50 |

| 19.05.2023 | 1,481,331,430,488.20 | −66,361,865,285.80 | 58,756,566,641.48 | −456,261,144.62 | 28,626,243,123,753.60 | −128,482,035,363.00 |

| 18.05.2023 | 1,414,969,565,202.40 | −2,102,129,623.80 | 59,212,827,786.11 | 43,549,778.81 | 28,754,725,159,116.60 | −1,366,238,547.10 |

| 17.05.2023 | 1,412,867,435,578.60 | −6,578,285,246.60 | 59,169,278,007.29 | 325,684,091.88 | 28,756,091,397,663.70 | −33,800,054,875.10 |

| 16.05.2023 | 1,406,289,150,332.00 | −6,905,404,209.00 | 58,843,593,915.41 | −286,086,840.37 | 28,789,891,452,538.80 | 275,418,002,628.20 |

| 15.05.2023 | 1,399,383,746,123.00 | −20,514,132,587.80 | 59,129,680,755.78 | 693,377,075.42 | 28,514,473,449,910.60 | 490,963,088,038.90 |

| 12.05.2023 | 1,378,869,613,535.20 | 17,936,045,500.00 | 58,436,303,680.36 | −874,993,482.63 | 28,023,510,361,871.70 | −243,915,306,414.20 |

| 11.05.2023 | 1,396,805,659,035.20 | −22,180,643,934.90 | 59,311,297,162.98 | 1241,597,156.57 | 28,267,425,668,285.90 | 294,538,864,466.30 |

| 10.05.2023 | 1,374,625,015,100.30 | −46,755,246,017.90 | 58,069,700,006.41 | 1,755,657,411.10 | 27,972,886,803,819.60 | 670,450,291,276.80 |

| 08.05.2023 | 1,327,869,769,082.40 | 20,294,346,246.30 | 56,314,042,595.31 | −432,478,417.59 | 27,302,436,512,542.80 | −111,718,626,030.30 |

| 05.05.2023 | 1,348,164,115,328.70 | −10,083,653,137.30 | 56,746,521,012.90 | 88,772,273.95 | 27,414,155,138,573.10 | 103,797,506,376.40 |

| 04.05.2023 | 1,338,080,462,191.40 | 9,521,292,481.80 | 56,657,748,738.96 | 761,401,921.32 | 27,310,357,632,196.70 | −67,995,473,336.50 |

| 03.05.2023 | 1,347,601,754,673.20 | 26,719,121,289.10 | 55,896,346,817.64 | −1,101,712,227.28 | 27,378,353,105,533.20 | −570,134,543,334.90 |

| 02.05.2023 | 1,374,320,875,962.30 | 44,780,070,313.20 | 56,998,059,044.92 | −2,479,218,403.33 | 27,948,487,648,868.10 | −725,019,473,104.90 |

| 28.04.2023 | 1,419,100,946,275.50 | 10,466,399,502.70 | 59,477,277,448.25 | 100,850,133.74 | 28,673,507,121,973.00 | −150,598,922,354.00 |

| 27.04.2023 | 1,429,567,345,778.20 | 729,266,317.80 | 59,376,427,314.51 | −264,869,777.20 | 28,824,106,044,327.00 | 193,696,621,988.90 |

| 26.04.2023 | 1,430,296,612,096.00 | −13,537,785,026.20 | 59,641,297,091.71 | −249,874,447.72 | 28,630,409,422,338.10 | −56,179,694,260.30 |

| 25.04.2023 | 1,416,758,827,069.80 | 4,464,041,773.80 | 59,891,171,539.43 | −68,177,418.56 | 28,686,589,116,598.40 | −145,726,262,256.60 |

| 24.04.2023 | 1,421,222,868,843.60 | 10,206,801,643.90 | 59,959,348,957.99 | 1,623,847,723.80 | 28,832,315,378,855.00 | −60,553,800,039.50 |

| 21.04.2023 | 1,431,429,670,487.50 | −14,631,381,327.20 | 58,335,501,234.19 | 575,502,308.79 | 28,892,869,178,894.50 | 14,942,950,065.80 |

| 20.04.2023 | 1,416,798,289,160.30 | −32,713,623,495.20 | 57,759,998,925.40 | −372,743,577.96 | 28,877,926,228,828.70 | 225,447,515,375.50 |

| 19.04.2023 | 1,384,084,665,665.10 | 2,249,893,850.80 | 58,132,742,503.36 | −220,837,253.34 | 28,652,478,713,453.20 | −144,435,226,480.10 |

| 18.04.2023 | 1,386,334,559,515.90 | −10,943,329,703.50 | 58,353,579,756.70 | 52,956,928.92 | 28,796,913,939,933.30 | 156,288,498,844.40 |

| 17.04.2023 | 1,375,391,229,812.40 | −19,172,224,709.20 | 58,300,622,827.77 | 653,528,503.80 | 28,640,625,441,088.90 | 415,835,293,761.60 |

| 14.04.2023 | 1,356,219,005,103.20 | 48,865,929.20 | 57,647,094,323.98 | 430,015,192.76 | 28,224,790,147,327.30 | 180,361,985,674.70 |

| 13.04.2023 | 1,356,267,871,032.40 | 10,748,917,208.40 | 57,217,079,131.21 | −928,110,859.78 | 28,044,428,161,652.60 | 123,165,198,943.00 |

| 12.04.2023 | 1,367,016,788,240.80 | 6,144,061,909.10 | 58,145,189,990.99 | 654,637,417.59 | 27,921,262,962,709.60 | 91,227,456,478.40 |

| 11.04.2023 | 1,373,160,850,149.90 | 23,737,239,546.20 | 57,490,552,573.40 | −373,199,386.88 | 27,830,035,506,231.20 | −161,668,926,489.80 |

| 10.04.2023 | 1,396,898,089,696.10 | −40,563,553,527.60 | 57,863,751,960.29 | 1875,482,114.72 | 27,991,704,432,721.00 | 347,699,091,017.70 |

| 07.04.2023 | 1,356,334,536,168.50 | 1,024,913,399.50 | 55,988,269,845.56 | 8,985,465.67 | 27,644,005,341,703.30 | 77,387,981,435.00 |

| 06.04.2023 | 1,357,359,449,568.00 | 7,241,139,065.30 | 55,979,284,379.89 | 577,446,600.70 | 27,566,617,360,268.30 | −18,314,159,831.70 |

| 05.04.2023 | 1,364,600,588,633.30 | −7,347,406,973.40 | 55,401,837,779.19 | −101,048,389.32 | 27,584,931,520,100.00 | 218,395,470,930.50 |

| 04.04.2023 | 1,357,253,181,659.90 | 19,586,118,832.10 | 55,502,886,168.52 | −18,945,140.69 | 27,366,536,049,169.50 | 116,127,363,783.70 |

| 03.04.2023 | 1,376,839,300,492.00 | −25,806,124,318.50 | 55,521,831,309.21 | 190,420,494.45 | 27,250,408,685,385.80 | 284,016,246,371.50 |

| 31.03.2023 | 1,351,033,176,173.50 | 10,422,151,387.50 | 55,331,410,814.76 | 297,509,019.87 | 26,966,392,439,014.30 | −146,592,783,855.40 |

| 30.03.2023 | 1,361,455,327,561.00 | −8,904,037,880.80 | 55,033,901,794.89 | 952,201,859.24 | 27,112,985,222,869.70 | 56,775,728,369.50 |

| 29.03.2023 | 1,352,551,289,680.20 | −2,446,496,518.70 | 54,081,699,935.65 | 214,645,624.66 | 27,056,209,494,500.20 | 139,580,460,357.80 |

| 28.03.2023 | 1,350,104,793,161.50 | −2,082,087,979.40 | 53,867,054,310.99 | −226,990,374.55 | 26,916,629,034,142.40 | −110,834,980,218.60 |

| 27.03.2023 | 1,348,022,705,182.10 | −30,150,973,341.50 | 54,094,044,685.54 | 813,879,246.70 | 27,027,464,014,361.00 | 470,311,999,792.30 |

| 24.03.2023 | 1,317,871,731,840.60 | 4,447,484,536.40 | 53,280,165,438.83 | 9,912,295.35 | 26,557,152,014,568.70 | 55,971,481,996.00 |

| 23.03.2023 | 1,322,319,216,377.00 | −8,226,772,603.80 | 53,270,253,143.48 | 383,050,340.02 | 26,501,180,532,572.70 | −72,695,528,196.60 |

| 22.03.2023 | 1,314,092,443,773.20 | 5,861,484,617.70 | 52,887,202,803.47 | 438,379,146.50 | 26,573,876,060,769.30 | 49,595,879,289.60 |

| 21.03.2023 | 1,319,953,928,390.90 | 8,330,563,255.70 | 52,448,823,656.97 | 298,255,819.48 | 26,524,280,181,479.70 | −72,394,287,551.40 |

| 20.03.2023 | 1,328,284,491,646.60 | −6,289,688,280.90 | 52,150,567,837.48 | 119,805,081.92 | 26,596,674,469,031.10 | 776,132,746,400.30 |

| 17.03.2023 | 1,321,994,803,365.70 | −25,409,679,942.00 | 52,030,762,755.56 | −323,292,862.22 | 25,820,541,722,630.80 | 419,319,102,998.00 |

| 16.03.2023 | 1,296,585,123,423.70 | 26,017,466,827.70 | 52,354,055,617.78 | −644,832,266.45 | 25,401,222,619,632.80 | −7,728,686,189.30 |

| 15.03.2023 | 1,322,602,590,251.40 | 19,559,568,983.60 | 52,998,887,884.23 | −360,752,978.63 | 25,408,951,305,822.10 | −362,118,477,256.40 |

| 14.03.2023 | 1,342,162,159,235.00 | −18,337,053,036.90 | 53,359,640,862.86 | 188,918,140.03 | 25,771,069,783,078.50 | 120,871,530,123.40 |

| 13.03.2023 | 1,323,825,106,198.10 | 5,486,544,933.10 | 53,170,722,722.83 | 264,070,804.81 | 25,650,198,252,955.10 | −91,563,142,897.40 |

| 10.03.2023 | 1,329,311,651,131.20 | 10,686,984,651.70 | 52,906,651,918.02 | −212,279,764.73 | 25,741,761,395,852.50 | −115,377,774,219.50 |

| 09.03.2023 | 1,339,998,635,782.90 | 7,364,017,183.80 | 53,118,931,682.75 | 181,777,305.05 | 25,857,139,170,072.00 | −46,310,155,208.70 |

| 07.03.2023 | 1,347,362,652,966.70 | 9,722,885,284.90 | 52,937,154,377.70 | −233,527,261.80 | 25,903,449,325,280.70 | −22,981,167,110.70 |

| 06.03.2023 | 1,357,085,538,251.60 | −10,088,910,645.20 | 53,170,681,639.50 | 670,785,032.81 | 25,926,430,492,391.40 | 245,467,723,977.40 |

| 03.03.2023 | 1,346,996,627,606.40 | −10,052,587,827.30 | 52,499,896,606.69 | 561,124,713.78 | 25,680,962,768,414.00 | 236,407,108,199.00 |

| 02.03.2023 | 1,336,944,039,779.10 | 27,445,568,737.90 | 51,938,771,892.90 | −885,793,606.87 | 25,444,555,660,215.00 | −296,366,968,717.40 |

| 01.03.2023 | 1,364,389,608,517.00 | −10,547,144,165.30 | 52,824,565,499.78 | 619,992,663.03 | 25,740,922,628,932.40 | 360,516,317,028.90 |

| 28.02.2023 | 1,353,842,464,351.70 | 1,139,018,820.60 | 52,204,572,836.74 | 271,326,436.12 | 25,380,406,311,903.50 | 105,488,633,225.90 |

| 27.02.2023 | 1,354,981,483,172.30 | −15,231,463,665.60 | 51,933,246,400.62 | 461,726,108.69 | 25,274,917,678,677.60 | 376,417,156,768.40 |

| 24.02.2023 | 1,339,750,019,506.70 | −7,721,971,513.50 | 51,471,520,291.93 | 296,296,174.84 | 24,898,500,521,909.20 | −152,131,622,318.40 |

| 22.02.2023 | 1,332,028,047,993.20 | −672,760,843.10 | 51,175,224,117.09 | 148,417,804.96 | 25,050,632,144,227.60 | 32,310,120,300.00 |

| 21.02.2023 | 1,331,355,287,150.10 | −33,150,230,875.60 | 51,026,806,312.13 | 1507,539,612.12 | 25,018,322,023,927.60 | 258,768,027,837.20 |

| 20.02.2023 | 1,298,205,056,274.50 | 4,038,484,269.00 | 49,519,266,700.01 | −253,952,789.63 | 24,759,553,996,090.40 | 189,656,736,384.90 |

| 17.02.2023 | 1,302,243,540,543.50 | 1,757,145,700.00 | 49,773,219,489.64 | −160,096,345.66 | 24,569,897,259,705.50 | 175,934,769,748.40 |

| 16.02.2023 | 1,304,000,686,243.50 | 578,405,741.30 | 49,933,315,835.30 | 1,413,119,571.59 | 24,393,962,489,957.10 | −134,648,379,443.20 |

| 15.02.2023 | 1,304,579,091,984.80 | 47,540,917,854.90 | 48,520,196,263.71 | −3,060,788,951.45 | 24,528,610,869,400.30 | −682,619,288,794.60 |

| 14.02.2023 | 1,352,120,009,839.70 | 20,427,152,480.50 | 51,580,985,215.15 | −999,764,218.08 | 25,211,230,158,194.90 | −355,181,472,669.70 |

| 13.02.2023 | 1,372,547,162,320.20 | −7,248,825,041.40 | 52,580,749,433.23 | 149,771,484.62 | 25,566,411,630,864.60 | 12,704,686,592.60 |

| 10.02.2023 | 1,365,298,337,278.80 | −1,396,858,611.70 | 52,430,977,948.61 | −449,025,722.73 | 25,553,706,944,272.00 | −5,928,827,945.10 |

| 09.02.2023 | 1,363,901,478,667.10 | 5,313,563,644.00 | 52,880,003,671.34 | 161,729,632.16 | 25,559,635,772,217.10 | 145,400,976,929.00 |

| 08.02.2023 | 1,369,215,042,311.10 | 18,753,978,710.90 | 52,718,274,039.18 | 979,017,339.29 | 25,414,234,795,288.10 | −185,136,253,836.30 |

| 07.02.2023 | 1,387,969,021,022.00 | 8,292,010,413.60 | 51,739,256,699.90 | 176,341,364.37 | 25,599,371,049,124.40 | 36,173,266,883.30 |

| 06.02.2023 | 1,396,261,031,435.60 | −17,665,371,896.60 | 51,562,915,335.53 | 1,110,000,538.49 | 25,563,197,782,241.10 | 224,963,940,181.30 |

| 03.02.2023 | 1,378,595,659,539.00 | 8,409,278,937.40 | 50,452,914,797.04 | −313,769,021.53 | 25,338,233,842,059.80 | 22,094,351,798.00 |

| 02.02.2023 | 1,387,004,938,476.40 | −15,640,715,994.60 | 50,766,683,818.57 | 89,761,690.69 | 25,316,139,490,261.80 | 78,970,973,816.30 |

| 01.02.2023 | 1,371,364,222,481.80 | 4,736,514,600.00 | 50,676,922,127.87 | −109,414,770.13 | 25,237,168,516,445.50 | 91,478,654,106.20 |

| 31.01.2023 | 1,376,100,737,081.80 | −38,381,711,415.20 | 50,786,336,898.00 | 1,140,257,022.12 | 25,145,689,862,339.30 | 140,056,445,894.40 |

| 30.01.2023 | 1,337,719,025,666.60 | −25,464,890,962.00 | 49,646,079,875.88 | 1,595,561,331.65 | 25,005,633,416,444.90 | 178,986,238,112.00 |

| 27.01.2023 | 1,312,254,134,704.60 | −16,006,509,298.00 | 48,050,518,544.23 | 300,496,183.12 | 24,826,647,178,332.90 | 245,533,670,475.10 |

| 26.01.2023 | 1,296,247,625,406.60 | 2,010,992,926.60 | 47,750,022,361.11 | 364,000,974.34 | 24,581,113,507,857.80 | −24,199,188,392.50 |

| 25.01.2023 | 1,298,258,618,333.20 | −899,577,004.60 | 47,386,021,386.77 | 419,964,462.71 | 24,605,312,696,250.30 | 4,861,177,132.60 |

| 24.01.2023 | 1,297,359,041,328.60 | 8,162,977,562.20 | 46,966,056,924.06 | 337,356,101.04 | 24,600,451,519,117.70 | −165,571,175,980.30 |

| 23.01.2023 | 1,305,522,018,890.80 | −34,267,298,643.20 | 46,628,700,823.02 | 842,467,999.64 | 24,766,022,695,098.00 | 104,969,218,556.70 |

| 20.01.2023 | 1,271,254,720,247.60 | −3,768,162,668.70 | 45,786,232,823.38 | 131,550,633.96 | 24,661,053,476,541.30 | −3,658,195,778,266.60 |

| 19.01.2023 | 1,267,486,557,578.90 | 9,017,259,462.60 | 45,654,682,189.41 | −803,879,851.43 | 28,319,249,254,807.90 | −387,444,921,281.70 |

| 18.01.2023 | 1,276,503,817,041.50 | −597,386,010.70 | 46,458,562,040.85 | 6,482,839.01 | 28,706,694,176,089.60 | −13,924,272,593.40 |

| 17.01.2023 | 1,275,906,431,030.80 | 23,322,647,074.70 | 46,452,079,201.84 | −798,294,440.40 | 28,720,618,448,683.00 | −319,220,094,412.00 |

| 16.01.2023 | 1,299,229,078,105.50 | −39,773,555,116.30 | 47,250,373,642.24 | 1,056,807,329.71 | 29,039,838,543,095.00 | 285,960,379,486.10 |

| 13.01.2023 | 1,259,455,522,989.20 | −6,599,926,057.00 | 46,193,566,312.53 | −36,666,864.09 | 28,753,878,163,608.90 | 134,197,441,421.20 |

| 12.01.2023 | 1,252,855,596,932.20 | −11,377,067,361.00 | 46,230,233,176.62 | 495,895,765.79 | 28,619,680,722,187.70 | −36,603,141,792.00 |

| 11.01.2023 | 1,241,478,529,571.20 | −34,763,335,623.20 | 45,734,337,410.83 | 1,256,436,855.29 | 28,656,283,863,979.70 | 124,313,269,296.10 |