1. Introduction

This paper aims to design a flexible dynamic program (DP) and efficiently evaluate two-dimensional financial derivatives. This methodology is highly flexible because it relies on known transition parameters of the underlying process and known payoff functions of financial derivatives. Moreover, it is efficient because it uses local polynomials to approximate the value functions at each step of the backward recursion. Our model assumes only a numerical (but not a statistical) error and a state (but not a time) discretization. As an illustration, we evaluate American options and exchangeable bonds.

DP and finite elements (local approximations) have been efficiently used for valuing one-dimensional financial derivatives. See

Ben-Ameur et al. (

2016) and

Ayadi et al. (

2016) for methods in valuing American-style options and corporate securities. Since this approach is not feasible in high-dimensional state spaces, DP is usually combined with the Monte Carlo simulation and spectral analysis (global approximations) to approximate the value functions at each step of the backward recursion. In this case, the numerical error is amplified by a statistical error underlying the Monte Carlo approach, which can be seen as an extra cost to overcome the curse of dimensionality.

The modeling process assumes a constant search for the best compromise between accuracy and computing time. Local approximations are much more accurate than global approximations, but they are more time-consuming. Parallel computing is used to speed up the model resolution at each step of the backward recursion and to enhance the overall efficiency of the numerical procedure. This paper supports the idea that DP combined with finite elements remains effective for valuing low-dimensional financial derivatives. Methods for model-dimensional reduction can help to reach this objective (

Reisinger and Wittum 2007).

American-style financial derivatives cannot be valued in closed form and must be approximated in some way. The literature reports three main backward pricing methodologies, namely, the lattice approach, finite differences, and dynamic programming. They all compete for valuing low-dimensional financial derivatives, but DP is the main methodology used in high-dimensional state spaces since it naturally combines with the Monte Carlo simulation.

The main challenge in valuing high-dimensional American options in continuous models, which combines dynamic programming and Monte Carlo simulation, is twofold. On the one hand, if the sole evaluation node is at inception, forward DP considers sub-optimal stopping policies, given that the true option exercise strategy is unknown (

Andersen and Broadie 2004;

Boyle et al. 1997;

Broadie and Detemple 1997;

Del Moral et al. 2012;

Ibáñez and Zapatero 2004;

Liu and Hong 2009). On the other hand, if the evaluation process is achieved along the random sample paths of the underlying asset vector, backward DP solves the model recursively from the option maturity down to the origin. At each step of the backward recursion and each evaluation node, a poor Monte Carlo simulation of size one is used to estimate the option (holding) value since the underlying trajectories never intersect. The literature reports several remedies. The bundling-based approach assumes that sample paths in the same neighborhood have the same evaluation root (

Barraquand and Martineau 1995;

Raymar and Zwecher 1997;

Bally and Pages 2003a,

2003b;

Bally and Printems 2005;

Jin et al. 2007,

2013). This approach goes back to

Tilley (

1993) and

Raymar and Zwecher (

1997) for valuing one-dimensional American options. The least squares-based approach adjusts the poor Monte Carlo estimates of size one at each step of the backward recursion via global approximations, such as linear, local, and robust regressions (

Carrière 1996;

Longstaff and Schwartz 2001;

Tompaidis and Yang 2014;

Tsitsiklis and Van Roy 1999) and neural networks (

Chen and Wan 2021;

Kohler et al. 2010). The simulated tree-based approach augments the number of simulated paths at each evaluation node (

Broadie and Glasserman 1997). Forward and backward DP create a dual approach for valuing multivariate American options (

Broadie and Glasserman 1997;

Haugh and Kogan 2004;

Rogers 2002). These methodologies inherit statistical errors from the generation of random paths and numerical errors from multiple approximations. Variance reduction techniques can be employed to enhance the overall efficiency of the numerical experiment (

Dang et al. 2015;

Giles 2015).

We propose a two-dimensional backward DP approach, which assumes only numerical (but not statistical) errors and state (but not time) discretization. Accurate local polynomials are employed to approximate the option value function at each step of the backward recursion, with parallel computing utilized to enhance the overall efficiency of the procedure.

The rest of this paper is organized as follows.

Section 2 presents our model for valuing two-dimensional American options,

Section 3 focuses on exchangeable bonds, and

Section 4 concludes the paper.

2. Designing and Valuing American Options

We consider a frictionless market in which two stocks,

and

, are traded continuously and move according to a bivariate lognormal process. The risk-free rate,

, is assumed to be constant. This market is known to be arbitrage-free and complete. Thus, there exists a unique risk-neutral probability measure

under which the state process

moves according to the following stochastic differential equation:

where

denotes the continuous dividend rate of stock

i,

denotes its log-return volatility, and

,

denotes a bivariate correlated Brownian motion with the following:

The analytical solution of (

1) is as follows:

An American option on

with maturity

T is defined by its cash-flow process,

, where

and

denote the levels of the underlying stocks at time

. This is the option exercise value

. Examples include the exchange option, as follows:

the call-on-max option, as follows:

and the put-on-min option, as follows:

where

K denotes the option strike price. The exchange option gives the option holder the right to exchange

for

; the call-on-max option gives its holder the right to purchase the higher-priced asset at the strike price

K; and the put-on-min gives the right to sell the lower-priced asset at the strike

K.

Stulz (

1982) and

Johnson (

1987) derived closed-form solutions for their European counterparts, characterized by the following:

We herein consider Bermudan options with

regular exercise opportunities, that is,

, where

. No-arbitrage pricing gives the following:

where

and

denote the option holding value and overall option value functions at

. We set

for all

and

.

The expectation in Equation (

3) cannot be computed in closed form and has to be approximated in some way. Valuing American options can be interpreted as an optimal Markov decision process (stochastic dynamic program) since the option value function is forward-looking and known at maturity.

Let be a set of grid points such that and , when p and . We set and . The rectangle is designated by .

Define the transition tables

, and

as follows:

For example,

represents the transition probability that the Markov process

moves from

at

and visits the rectangle

at

. The rest of the transition tables represent truncated first-order direct and cross-moments of the state process

at

given the current position

at

. The computation of these transition parameters, which are at the heart of our DP approach, can be treated as a fixed cost, provided that the Markov state process is homogeneous,

is a positive constant, and the grid points,

, are fixed over time. We derive them in closed form in

Appendix A.

Assume that an approximation of the option value function is available at a future decision date on , as indicated by , for and . This is not really a strong assumption since the option value function is known at maturity in closed form, that is, . DP acts as follows:

Equation (

7) splits the option holding value into two parts: The local coefficients are related to the option contract and the transition parameters to the dynamics of the state process. Overall, the option holding value is calculated by summing local future value components, each multiplied by their associated transition parameters, and then discounted back at the risk-free rate. The same equation shows that DP assumes a space discretization, but not time discretization, and does respect the true dynamics of the state process. Note that the time increment

does not need to be small as it is required by the lattice approach and by finite differences. Our numerical procedure can be designed to stop and evaluate option contracts only at decision dates since the transition parameters are derived in closed form for any positive time increment

. For a European option, set

at the option maturity and run DP in one step; for a Bermudan option, set

at the time interval between two decision dates and run DP in multiple steps. For example, we can fix

at the time interval between two coupon dates for options embedded in bonds that can be exercised only at payment dates. Finally, Equation (

5) shows that DP ends up with an interpolation

of

, for all

and

. Thus, the first and second derivatives of

become available at all

, among other sensitivity coefficients. For example, the approximated deltas at

are as follows:

given that

. Higher-order local approximations are more accurate but more time-consuming.

At each step

of the backward recursion, the computational effort underlying Equation (

7) can be conducted simultaneously for

and

. We used parallel computing to improve the overall efficiency of our DP procedure. The code lines are written in C and compiled with GCC. Parallel computing was performed using the MPI library. We used the supercomputer Briarée managed by Calcul Québec and Compute Canada.

1 Briarée has 8064 CPUs (cores), each running at the speed of 2.667 GHz. See

Appendix B for further details.

Our numerical experiment focuses on the put-on-min option contract.

Table 1 and

Table 2 compare DP to

Boyle (

1988), which uses a two-dimensional binomial tree for valuing European vs. American put-on-min options. The closed-form solution for the European contract is given in

Stulz (

1982). We set

,

,

,

,

,

(effective)

(continuously compounded), and

months

years.

As explained above, DP does not need time discretization. For comparison purposes, we run DP with the same number of time steps as

Boyle (

1988). When the number of time steps is low, DP performs almost perfectly, while the binomial tree method is less accurate. As expected, with a higher number of time steps, the binomial tree converges and achieves accuracy comparable to that of DP.

Boyle (

1988) does not report computing times. Each DP’s CPU time (in seconds) can be split into a fixed cost, associated with the transition parameters, and a linear cost, associated with the backward recursion. The fixed cost accounts for a sizable portion of the total CPU time. The relevant DP’s computing time is the linear CPU time since the transition parameters can be computed only once or twice a day, following the model estimation step.

Table 3 compares DP to alternative methodologies based on the Monte Carlo simulation in the context of the dual approach of

Rogers (

2002) and the bundling approach by

Jin et al. (

2007). Their random samples are of sizes

and

, respectively. We report their respective

confidence intervals.

Hartley (

2000) used finite differences. The parameters are

,

,

,

,

, and

. DP values, obtained with

, almost always belong to their associated

confidence intervals and compare extremely well with

Hartley’s (

2000) values, which were described by

Rogers (

2002) as extremely accurate.

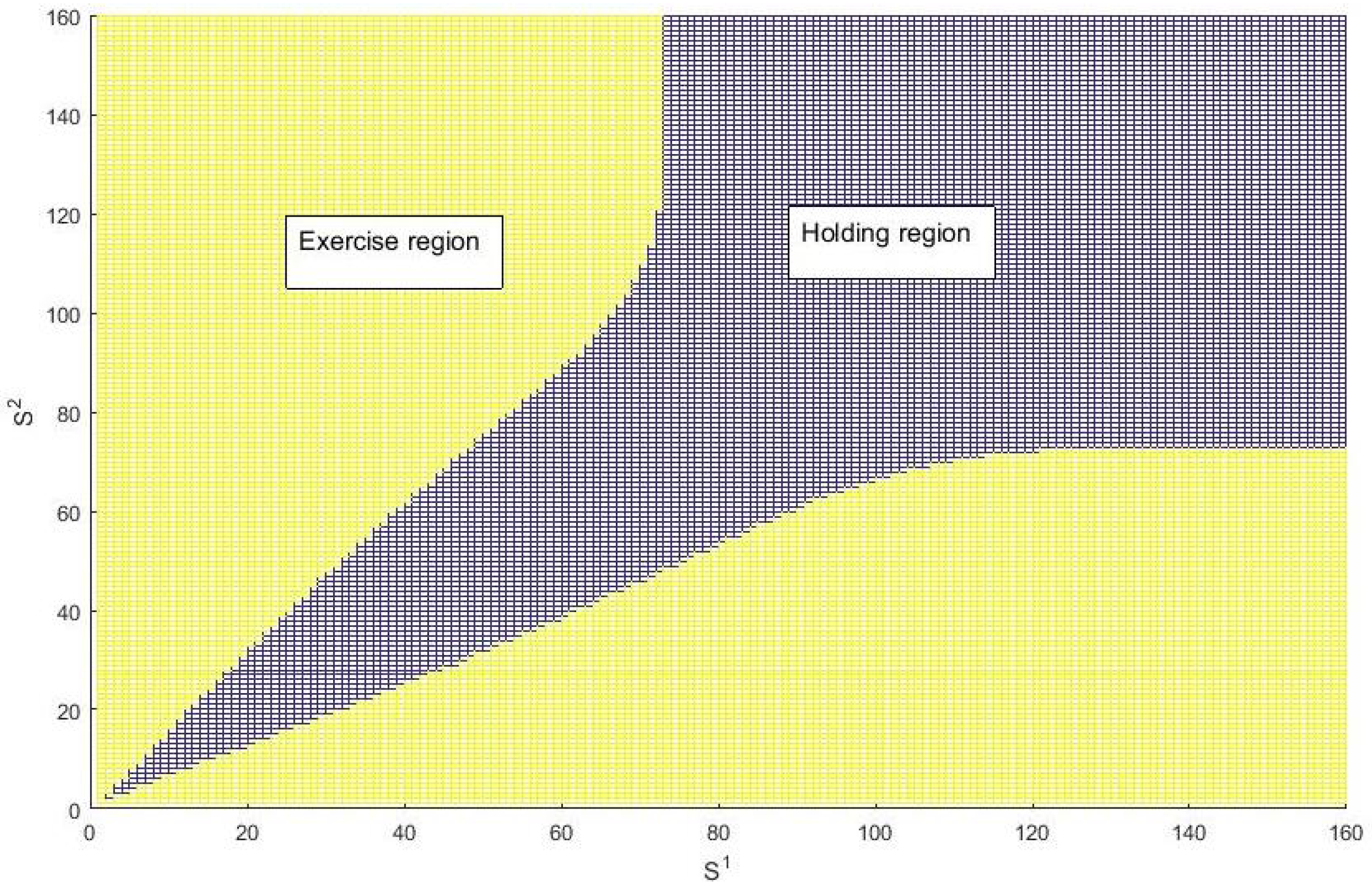

Figure 1 plots the exercise region of a put-on-min option at the fourth of ten decision dates, where

. For example, it is optimal to hold the option when

, even though exercising the option has value.

3. Designing and Valuing Exchangeable Bonds

An exchangeable bond allows bondholders the discretion to convert their holdings into shares of a company other than the issuer. This instrument is subject to both the credit risk of the issuing company and the market risk of the underlying stock.

Exchangeable bonds have been offered since the early 1970s. About 14% of convertible bonds were exchangeable in the US, according to

Grimwood and Hodges (

2002). The issuance of exchangeable bonds is mainly motivated in the literature as a tax-saving strategy (

Jones and Mason 1986) and/or a divesting policy (

Barber 1993).

We consider a public company with a debt portfolio made of a senior straight bond and a junior exchangeable bond. This (issuing) firm is assumed to hold the shares underlying the exchangeable bond, which are pledged to junior bondholders who have priority on the pledged shares under default.

The balance-sheet equality (BSE) of the issuing firm depends on whether the exchange option was already exercised or not, which results in the following:

where

denotes the value of the shares underlying the exchangeable bond,

denotes the value of the issuing firm’s assets;

if the exchange option was exercised before or at

, and 0 otherwise (held until

), with

. We assume that the evaluation date

belongs to the coupon/capital payment dates

. The couple

is modeled as a lognormal process, as described in Equation (

1). This two-dimensional structural setting builds on the work of

Ayadi et al. (

2016), who considered junior and senior debt portfolios without embedded options.

The value functions

and

represent the (net present) values of tax benefits, bankruptcy costs, the senior straight bond, the junior exchangeable bond, and equity of the issuing firm at

, respectively. In particular,

, for all

and

. Each value function is characterized by two components, namely, its current cash flows and future potentialities, as shown in

Table 4,

Table 5,

Table 6 and

Table 7.

The firm is committed to paying at to its creditors, where and denote the regular interest and principal payments to senior and junior bondholders, respectively. The current cash flow of is under survival at , where denotes the corporate tax rate. The current cash flow of is proportional to the remaining firm’s asset value , under default at , where w denotes the bankruptcy cost parameter.

DP starts the resolution at maturity, where the value functions of the corporate securities in Equation (

9) are known.

Table 4 presents these value functions under the condition of exercise before

(

), which is consistent with

Ayadi et al. (

2016). The junior debt and pledged shares vanish from the BSE at

.

Table 5 reports six events under the assumption that the exchange option was held until

(

), three of which happen under solvency, and the rest under financial stress. For example, event (3) reports the case of a solvent firm, where the junior bond is exchanged against the pledged shares, resulting in a default. The junior bondholders are paid

or

s, depending on whether the senior bondholders are fully or partially paid. It could happen that

, in which case junior bondholders are better off holding. For simplicity, we ignore this unlikely event. Event (5) reports the case of a stressed firm, where the exchange option is exercised, resulting in survival. Exercising the embedded option can lead a solvent company to default or a stressed company to survive.

Assuming the model has been solved backward in time from

to

, the potential future values of a generic value function

for corporate security are given by the following equations:

under the condition of exercising before

and, therefore, exercising before

,

when holding until

and exercising at

, and

when holding until

, where

denotes the risk-free discount factor over

. Thus,

is inferred from

Table 6 at

, while

is inferred from

Table 7 at

. It is important to note that

is a function of

only (

Ayadi et al. 2016). As explained in

Section 2, DP alternates between an interpolation step and an integration step to solve the model at time

.

Table 6 and

Table 7 exhibit the value functions of corporate securities at

. The rest comes by backward induction. It is important to note that

Table 4 and

Table 5 are consistent with

Table 6 and

Table 7, given that the future potentialities of

,

,

, and

are null, while

and

.

Section 3 shows that DP is a flexible alternative for designing and evaluating complex financial derivatives.