Research Trends in Going Concern Assessment and Financial Distress in Last Two Decades: A Bibliometric Analysis

Abstract

1. Introduction

2. Literature Review

3. Materials and Methodology

4. Results

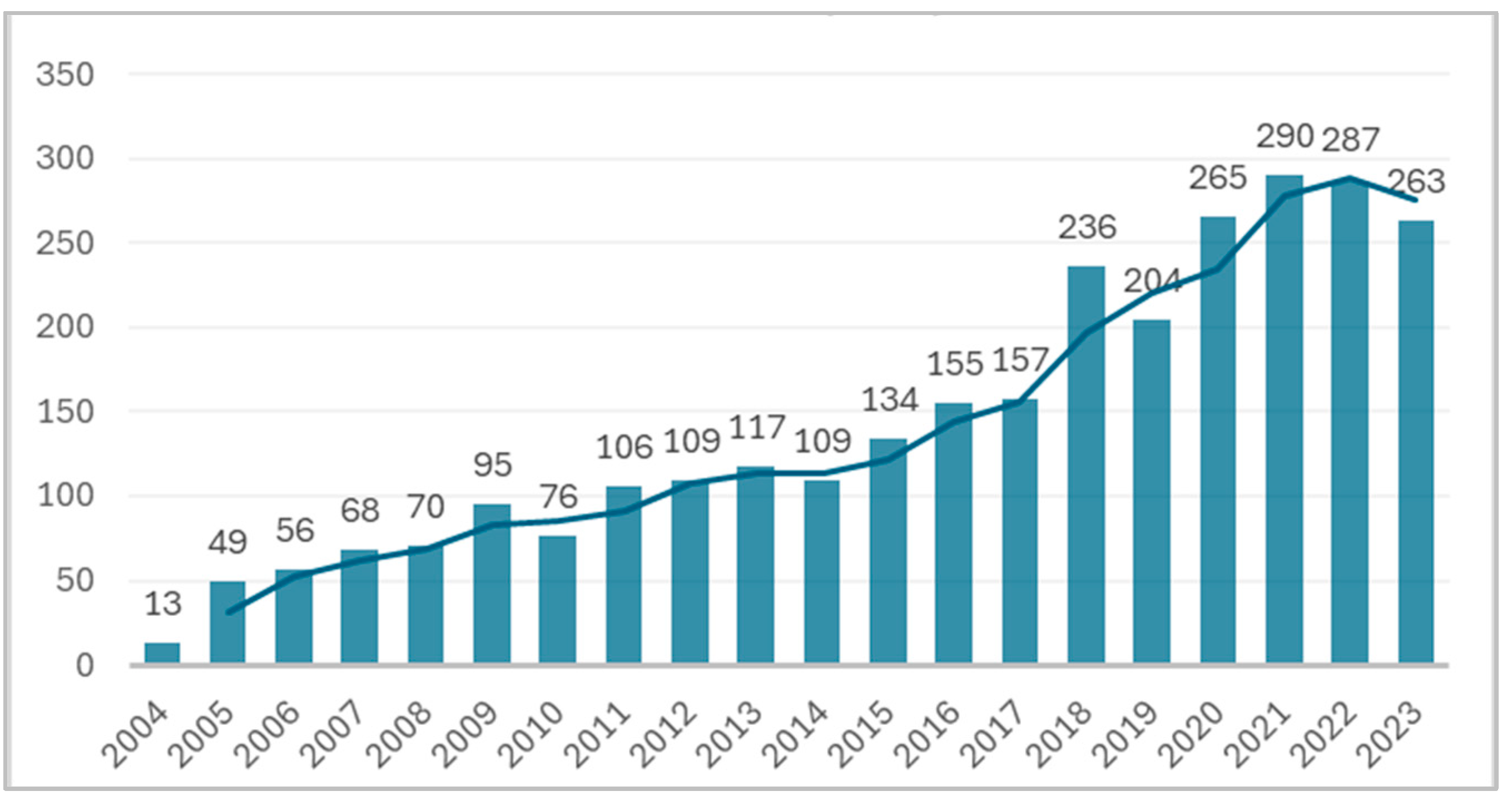

4.1. Performance Analysis

4.2. Science Mapping

4.3. Content Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ak, B. Korcan, Patricia M. Dechow, Yuan Sun, and Annika Yu Wang. 2013. The use of financial ratio models to help investors predict and interpret significant corporate events. Australian Journal of Management 38: 553–98. [Google Scholar] [CrossRef]

- Altman, Edward I., Małgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2017. Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-score model. Journal of International Financial Management & Accounting 28: 131–71. [Google Scholar] [CrossRef]

- Armstrong, Chris, Antonio Davila, and George Foste. 2006. Venture-backed private equity valuation and financial statement information. Review of Accounting Studies 11: 119–54. [Google Scholar] [CrossRef]

- Blay, Allen D., and Marshall A. Geiger. 2001. Market expectations for first-time going-concern recipients. Journal of Accounting, Auditing & Finance 16: 209–26. [Google Scholar]

- Blay, Allen D., Marshall A. Geiger, and David S. North. 2011. The auditor’s going-concern opinion as a communication of risk. Auditing: A Journal of Practice & Theory 30: 77–102. [Google Scholar]

- Bota-Avram, Cristina. 2023. Bibliometric analysis of sustainable business performance: Where are we going? A science map of the field. Economic Research-Ekonomska Istraživanja 36: 2137–76. [Google Scholar]

- Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2008. In search of distress risk. The Journal of Finance 63: 2899–939. [Google Scholar] [CrossRef]

- Campello, Murillo, and Janet Gao. 2017. Customer concentration and loan contract terms. Journal of Financial Economics 123: 108–36. [Google Scholar] [CrossRef]

- Carson, Elizabeth, Neil L. Fargher, Marshall A. Geiger, Clive S. Lennox, K. Raghunandan, and Marleen Willekens. 2013. Audit reporting for going-concern uncertainty: A research synthesis. Auditing: A Journal of Practice & Theory 32 Suppl. 1: 353–84. [Google Scholar]

- Chersan, Ionela-Corina, and Marilena Mironiuc. 2015. Incursiune în cercetarea de audit şi contabilitate pe orizontul unui deceniu. Audit Financiar 122: 52–64. [Google Scholar]

- Ciocan, Claudia Catalina, Carp Mihai, and Iuliana Georgescu. 2021. The Determinants of the Financial Reporting Quality: Empirical Evidence for Romania. Audit Financiar 19: 301. [Google Scholar] [CrossRef]

- De Jong, R. M., and D. Bus. 2023. VOSviewer: Putting research into context. In Research Software Community Leiden. Leiden: Leiden University. [Google Scholar] [CrossRef]

- DeFond, Mark, and Jieying Zhang. 2014. A review of archival auditing research. Journal of Accounting and Economics 58: 275–326. [Google Scholar] [CrossRef]

- DeFond, Mark L., and Clive S. Lennox. 2011. The effect of SOX on small auditor exits and audit quality. Journal of Accounting and Economics 52: 21–40. [Google Scholar] [CrossRef]

- Financial Accounting Standards Board. 2015. A Generally Accepted Accounting Principles (GAAP) 1 Presentation of Financial Statements, Washington, US. Available online: https://asc.fasb.org/205/40/showallinonepage (accessed on 28 August 2024).

- Ferreira, Fernando A. F. 2018. Mapping the field of arts-based management: Bibliographic coupling and co-citation analyses. Journal of Business Research 85: 348–57. [Google Scholar] [CrossRef]

- Foerster, Stephen R., and Stephen G. Sapp. 2005. The dividend discount model in the long-run: A clinical study. Journal of Applied 15. Available online: https://ssrn.com/abstract=869545 (accessed on 28 August 2024).

- Foster, Benjamin P., and Trim Shastri. 2016. Determinants of going concern opinions and audit fees for development stage enterprises. Advances in Accounting 33: 68–84. [Google Scholar] [CrossRef]

- Francis, Jere R. 2004. What do we know about audit quality? The British Accounting Review 36: 345–68. [Google Scholar] [CrossRef]

- Francis, Jere R., and Michael D. Yu. 2009. Big 4 office size and audit quality. The Accounting Review 84: 1521–52. [Google Scholar] [CrossRef]

- Girardi, Giulio, and A. Tolga Ergun. 2013. Systemic risk measurement: Multivariate GARCH estimation of CoVaR. Journal of Banking & Finance 37: 3169–80. [Google Scholar] [CrossRef]

- Gissel, Jodi L. 2010. Formation and consequences of going concern opinions: A review of the literature. Journal of Accounting Literature 29: 59–141. [Google Scholar]

- Hammond, Paul, and Mustapha Osman Opok. 2023. Bibliometric analysis of the relationship between going concern and investor confidence. International Journal of Business Management and Economic Review 6: 21–42. [Google Scholar] [CrossRef]

- Hammond, Paul, Mustapha Osman Opoku, and Paul Adjei Kwakwa. 2022. Identification of factors for developing going concern prediction models. Cogent Business & Management 9: 2152160. [Google Scholar] [CrossRef]

- Hardi, Hardi, Meilda Wiguna, Eka Hariyani, and Adhitya Agri Putra. 2020. Opinion shopping, prior opinion, audit quality, financial condition, and going concern opinion. The Journal of Asian Finance, Economics and Business 7: 169–76. [Google Scholar] [CrossRef]

- Hategan, Camelia-Daniela, Ruxandra-Ioana Pitorac, and Andreea Claudia Crucean. 2022. Impact of COVID-19 pandemic on auditors’ responsibility: Evidence from European listed companies on key audit matters. Managerial Auditing Journal 37: 886–907. [Google Scholar]

- International Federation of Accountants. 2015. International Standard on Auditing ISA 570, Going Concern, New York, US. Available online: https://www.ifac.org/_flysystem/azure-private/publications/files/ISA-570-(Revised).pdf (accessed on 30 August 2024).

- International Financial Reporting Standards. 2001. International Accounting Standard IAS 1, Presentation of Financial Statements, New York, US. Available online: https://www.ifrs.org/issued-standards/list-of-standards/ias-1-presentation-of-financial-statements/ (accessed on 30 August 2024).

- Jiang, Xiaoquan, and Bon-Soo Lee. 2005. An empirical test of the accounting-based residual income model and the traditional dividend discount model. The Journal of Business 78: 1465–504. [Google Scholar] [CrossRef]

- Jones, Frederick L. 1996. The information content of the auditor’s going concern evaluation. Journal of Accounting and Public Policy 15: 1–27. [Google Scholar] [CrossRef]

- Jones, Stewart. 2023. A literature survey of corporate failure prediction models. Journal of Accounting Literature 45: 364–405. [Google Scholar] [CrossRef]

- Kend, Michael, and Lan Anh Nguyen. 2022. Key audit risks and audit procedures during the initial year of the COVID-19 pandemic: An analysis of audit reports 2019–2020. Managerial Auditing Journal 37: 798–818. [Google Scholar] [CrossRef]

- Khwaja, Asim Ijaz, and Atif Mian. 2008. Tracing the impact of bank liquidity shocks: Evidence from an emerging market. American Economic Review 98: 1413–42. [Google Scholar] [CrossRef]

- Kothari, Sabino P., Susan Shu, and Peter D. Wysocki. 2009. Do managers withhold bad news? Journal of Accounting Research 47: 241–76. [Google Scholar] [CrossRef]

- McCloskey, Deirdre Nansen. 1983. The rhetoric of economics. Journal of economic literature 21: 481–517. [Google Scholar]

- Menon, Krishnagopal, and David D. Williams. 2010. Investor reaction to going concern audit reports. The Accounting Review 85: 2075–105. [Google Scholar] [CrossRef]

- Opler, Tim C., and Sheridan Titman. 1994. Financial distress and corporate performance. The Journal of Finance 49: 1015–40. [Google Scholar] [CrossRef]

- Pinto, María, Antonio Pulgarín, and M. Isabel Escalona. 2014. Viewing information literacy concepts: A comparison of two branches of knowledge. Scientometrics 98: 2311–29. [Google Scholar] [CrossRef]

- Rashid, Umra, Mohd Abdullah, Saleh F. A. Khatib, Fateh Mohd Khan, and Javaid Akhtera. 2024. Unravelling trends, patterns and intellectual structure of research on bankruptcy in SMEs: A bibliometric assessment and visualisation. Heliyon 10: e24254. [Google Scholar] [CrossRef]

- Reichelt, Kenneth J., and Dechun Wang. 2010. National and office-specific measures of auditor industry expertise and effects on audit quality. Journal of Accounting Research 48: 647–86. [Google Scholar] [CrossRef]

- Sa’diyah, Chalimatuz, Bambang Widagdo, and Erna Retna Rahadjeng. 2022. Financial distress: From bibliometric analysis to current research, future and trends research directions and content analysis. In Social and Political Issues on Sustainable Development in the Post COVID-19 Crisis. Abingdon: Taylor & Francis, pp. 131–38. [Google Scholar] [CrossRef]

- Serfling, Matthew. 2016. Firing costs and capital structure decisions. The Journal of Finance 71: 2239–86. [Google Scholar] [CrossRef]

- Shi, Yin, and Xiaoni Li. 2019. A bibliometric study on intelligent techniques of bankruptcy prediction for corporate firms. Heliyon 5: e02997. [Google Scholar] [CrossRef] [PubMed]

- Smolarski, Jan, Neil Wilner, and Weifang Yang. 2011. The use of financial information by private equity funds in evaluating new investments. Review of Accounting and Finance 10: 46–68. [Google Scholar] [CrossRef]

- Sun, Lili. 2007. A re-evaluation of auditors’ opinions versus statistical models in bankruptcy prediction. Review of Quantitative Finance and Accounting 28: 55–78. [Google Scholar] [CrossRef]

- Tahmasebi, Rasoul, Ali Asghar Anvary Rostamy, Abbas Khorshidi, and Seyyed Jalal Sadeghi Sharif. 2020. A data mining approach to predict companies’ financial distress. International Journal of Financial Engineering 7: 2050031. [Google Scholar] [CrossRef]

- Tomek, Jan. 1992. Marketingová Strategie Podniku. Prague: Management Press. [Google Scholar]

- Tudor, Liviu, Mădălina Ecaterina Popescu, and Marin Andreica. 2015. A decision support system to predict financial distress. The case of Romania. Romanian Journal of Economic Forecasting 18: 170–79. [Google Scholar]

- Van Eck, Nees Jan, and Ludo Waltman. 2014. Visualizing bibliometric networks. In Measuring Scholarly Impact: Methods and Practice. Cham: Springer International Publishing, pp. 285–320. [Google Scholar]

- Van Eck, Nees Jan, and Ludo Waltman. 2019. VOSviewer Manual. Available online: https://www.vosviewer.com/documentation/Manual_VOSviewer_1.6.20.pdf (accessed on 28 August 2024).

- Varian, Hal Ronald. 1995. Mikroekonomie: Moderní přístup. London: Victoria Publishing. [Google Scholar]

- Vassalou, Maria, and Yuhang Xing. 2004. Default risk in equity returns. The Journal of FINANCE 59: 831–68. [Google Scholar] [CrossRef]

- Velasco, Berta, Jose Mª Eiros, Jose Mª Pinilla, and Jose A. San Román. 2012. La utilización de los indicadores bibliométricos paraevaluar la actividad investigadora. Aula Abierta 40: 75–84. Available online: https://reunido.uniovi.es/index.php/AA/issue/view/1039/145 (accessed on 15 August 2024).

- Waltman, Ludo, and Nees Jan Van Eck. 2013. A smart local moving algorithm for large-scale modularity-based community detection. The European Physical Journal B 86: 1–14. [Google Scholar] [CrossRef]

- Waltman, Ludo, Nees Jan Van Eck, and Ed CM Noyons. 2010. A unified approach to mapping and clustering of bibliometric networks. Journal of Informetrics 4: 629–35. [Google Scholar] [CrossRef]

- Wójcik-Jurkiewicz, Magdalena, and Monika Karczewska. 2019. Assessment of the going concern value of a business entity by means of selected discriminative models. Scientific Journal of Bielsko-Biala School of Finance and Law 23: 53–60. [Google Scholar] [CrossRef]

| Classification | Examples |

|---|---|

| Financial factors |

|

| Operating factors |

|

| Non-financial factors |

|

| WoS Categories | Record Count | % of 2859 |

|---|---|---|

| Business Finance | 1547 | 54.11 |

| Economics | 1102 | 38.54 |

| Management | 450 | 15.74 |

| Business | 380 | 13.29 |

| Law | 167 | 5.84 |

| Operations Research Management Science | 63 | 2.20 |

| Cluster 1 (Red) | Doc. | Citations | Avg. Citations | Cluster 2 (Green) | Doc. | Citations | Avg. Citations |

|---|---|---|---|---|---|---|---|

| Campello, M | 5 | 474 | 94.80 | Zhang, J | 4 | 1275 | 318.75 |

| Li, C | 6 | 259 | 43.17 | Huang, X | 3 | 412 | 137.33 |

| Krishnan, J | 4 | 161 | 40.25 | Zhu, H | 3 | 412 | 137.33 |

| Gregoriou, A | 3 | 106 | 35.33 | Zhou, H | 4 | 476 | 119.00 |

| Tashjian, E | 3 | 105 | 35.00 | Al-Hadi, A | 3 | 171 | 57.00 |

| Singhal, R | 3 | 102 | 34.00 | Wang, C | 4 | 212 | 53.00 |

| Li, H | 8 | 249 | 31.13 | Hasan, I | 5 | 224 | 44.80 |

| Zhou, J | 4 | 117 | 29.25 | Krishnan, Gv | 4 | 176 | 44.00 |

| Eshleman, Jd | 4 | 114 | 28.50 | Cui, X | 3 | 124 | 41.33 |

| Gupta, J | 6 | 140 | 23.33 | Wang, K | 3 | 124 | 41.33 |

| Sun, J | 10 | 213 | 21.30 | Wang, H | 8 | 304 | 38.00 |

| Sun, Y | 3 | 60 | 20.00 | Richardson, G | 4 | 143 | 35.75 |

| Zhang, Y | 11 | 217 | 19.73 | Thorburn, Ks | 4 | 136 | 34.00 |

| Amin, K | 3 | 59 | 19.67 | Taylor, G | 7 | 228 | 32.57 |

| Zhu, Y | 5 | 87 | 17.40 | Eckbo, Be | 5 | 137 | 27.40 |

| Xing, Y | 3 | 884 | 294.67 | Francis, Jr | 5 | 807 | 161.40 |

| Strebulaev, Ia | 5 | 591 | 118.20 | Lim, Cy | 3 | 473 | 157.67 |

| Rodgers, Kj | 4 | 472 | 118.00 | Simnett, R | 4 | 591 | 147.75 |

| Li, Z | 7 | 412 | 58.86 | Tan, Ht | 3 | 360 | 120.00 |

| Wilson, N | 5 | 257 | 51.40 | Defond, Ml | 3 | 351 | 117.00 |

| Xu, J | 3 | 143 | 47.67 | Lennox, Cs | 5 | 492 | 98.40 |

| Ansell, J | 3 | 106 | 35.33 | Willenborg, M | 3 | 247 | 82.33 |

| Andreeva, G | 3 | 105 | 35.00 | Raghunandan, K | 5 | 387 | 77.40 |

| Zhao, L | 4 | 137 | 34.25 | Knechel, Wr | 5 | 368 | 73.60 |

| Wu, W | 3 | 91 | 30.33 | Bruynseels, L | 4 | 280 | 70.00 |

| Zhang, Z | 5 | 144 | 28.80 | Vanstraelen, A | 4 | 266 | 66.50 |

| White, Mj | 3 | 67 | 22.33 | Carson, E | 8 | 501 | 62.63 |

| Wang, M | 5 | 99 | 19.80 | Willekens, M | 6 | 343 | 57.17 |

| Chen, H | 5 | 83 | 16.60 | Blay, Ad | 4 | 200 | 50.00 |

| Li, W | 3 | 47 | 15.67 | Geiger, Ma | 11 | 549 | 49.91 |

| Publication Titles | Record Count | % of 2859 |

|---|---|---|

| Journal of Banking Finance | 73 | 2.55 |

| Journal of Corporate Finance | 62 | 2.16 |

| Auditing A Journal of Practice Theory | 49 | 1.71 |

| Journal of Financial Economics | 46 | 1.60 |

| International Review of Financial Analysis | 39 | 1.36 |

| Review of Financial Studies | 38 | 1.32 |

| Contemporary Accounting Research | 31 | 1.08 |

| International Review of Economics Finance | 31 | 1.08 |

| Managerial Auditing Journal | 31 | 1.08 |

| Review of Quantitative Finance and Accounting | 31 | 1.08 |

| Accounting and Finance | 30 | 1.04 |

| Managerial Finance | 30 | 1.04 |

| Other publications with less 30 papers | 2368 | 82.90 |

| Total | 2859 | 100 |

| Cluster 1 (Red) | No. | Cluster 2 (Green) | No. |

| Independence | 113 | Going concern (GC) | 117 |

| Audit fee | 96 | Bankruptcy | 76 |

| Non audit fees | 78 | Company | 70 |

| Audit quality | 66 | Financial distress | 64 |

| Earnings management | 62 | Performance | 52 |

| Corporate governance | 58 | Market | 47 |

| Earnings | 46 | Prediction | 43 |

| Litigation | 40 | Cost | 32 |

| Industry expertise | 39 | Management | 29 |

| Determinants | 31 | Debt | 22 |

| Cluster 3 (Blue) | No. | Cluster 4 (Yellow) | No. |

| Going concern opinion | 121 | Quality | 88 |

| Information | 70 | Impact | 55 |

| Audit report | 51 | Opinion | 48 |

| Decision | 47 | Litigation risk | 33 |

| Disclosure | 40 | Size | 22 |

| Risk | 38 | Business risk | 13 |

| Auditing | 27 | Reputation | 10 |

| Audit opinion | 22 | Services | 9 |

| Information-content | 22 | Investment | 8 |

| Conservatism | 21 | Lawsuits | 6 |

| Cluster 1 (Red) | No. | Cluster 2 (Green) | No. |

| Risk | 319 | Bankruptcy | 411 |

| Market | 205 | Company | 359 |

| Liquidity | 95 | Determinants | 283 |

| Equity | 92 | Capital structure | 246 |

| Crise | 85 | Investment | 222 |

| Default risk | 84 | Debt | 218 |

| Credit | 82 | Cost | 206 |

| Leverage | 81 | Agency costs | 115 |

| Return | 78 | Reorganization | 95 |

| Trade credit | 73 | Policy | 75 |

| Cluster 3 (Blue) | No. | Cluster 4 (Yellow) | No. |

| Financial distress | 1155 | Prediction | 388 |

| Performance | 394 | Ratios | 262 |

| Corporate governance | 316 | Model | 212 |

| Impact | 181 | Discriminant analysis | 128 |

| Information | 155 | Neural-networks | 95 |

| Ownership | 151 | Default | 87 |

| Management | 113 | Financial ratios | 82 |

| Earnings management | 97 | Credit risk | 79 |

| Ownership structure | 69 | Failure | 71 |

| Quality | 59 | Financial distress prediction | 55 |

| Cluster 1 (Red) | No. | Cluster 2 (Green) | No. |

| Financial distress | 1171 | Information | 210 |

| Bankruptcy | 469 | Earnings management | 150 |

| Company | 414 | Quality | 138 |

| Risk | 352 | Independence | 130 |

| Determinants | 311 | Going concern opinion | 121 |

| Capital structure | 249 | Going concern | 117 |

| Market | 245 | Audit fee | 113 |

| Debt | 236 | Earnings | 98 |

| Cost | 232 | Non audit fees | 88 |

| Investment | 229 | Decision | 86 |

| Cluster 3 (Blue) | No. | Cluster 4 (Yellow) | No. |

| Prediction | 412 | Performance | 439 |

| Ratios | 263 | Corporate governance | 368 |

| Model | 227 | Impact | 229 |

| Discriminant analysis | 134 | Ownership | 161 |

| Financial ratios | 101 | Management | 138 |

| Neural-networks | 100 | Agency costs | 119 |

| Default | 89 | Ownership structure | 70 |

| Credit risk | 79 | Incentives | 59 |

| Failure | 79 | Directors | 45 |

| Financial distress prediction | 55 | Corporate social responsibility | 44 |

| Title | Authors | Journal | IF | Year | Citations | Avg/Year |

|---|---|---|---|---|---|---|

| A review of archival auditing research | DeFond, M.; Zhang, J. | Journal of Accounting & Economics | 3.535 | 2014 | 1266 | 115.09 |

| Do Managers Withhold Bad News? | Kothari, S. P.; Shu, S.; Wysocki, P. D. | Journal of Accounting Research | 3.346 | 2009 | 941 | 58.81 |

| In Search of Distress Risk | Campbell, J. Y.; Hilscher, J.; Szilagyi, J. | Journal of Finance | 3.764 | 2008 | 937 | 55.12 |

| Default risk in equity returns | Vassalou, M; Xing, YH | Journal of Finance | 2.549 | 2004 | 810 | 38.57 |

| Financial Distress Prediction in an International Context: A Review and Empirical Analysis of Altman’s Z Score Model | Altman, E. I.; Iwanicz-Drozdowska, M.; Laitinen, E. K.; Suvas, A. | Journal of International Financial Management & Accounting | 1.478 | 2017 | 296 | 37 |

| National and Office-Specific Measures of Auditor Industry Expertise and Effects on Audit Quality | Reichelt, K. J.; Wang, D. | Journal of Accounting Research | 2.378 | 2010 | 543 | 36.2 |

| Big 4 Office Size and Audit Quality | Francis, J. R.; Yu, M. D. | Accounting Review | 2.488 | 2009 | 535 | 33.44 |

| Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market | Khwaja, A. I.; Mian, A. | American Economic Review | 2.531 | 2008 | 567 | 33.35 |

| Systemic risk measurement: Multivariate GARCH estimation of CoVaR | Girardi, G.; Erguen, A. Tolga | Journal of Banking & Finance | 1.299 | 2013 | 375 | 31.25 |

| Firing Costs and Capital Structure Decisions | Serfling, M. | Journal of Finance | 5.397 | 2016 | 229 | 25.44 |

| Topic | Article Title | Authors |

|---|---|---|

| Audit quality | A review of archival auditing research | DeFond, M.; Zhang, J. |

| National and Office-Specific Measures of Auditor Industry Expertise and Effects on Audit Quality | Reichelt, K. J.; Wang, D. | |

| Big 4 Office Size and Audit Quality | Francis, J. R.; Yu, M. D. | |

| Management and Corporate governance | Do Managers Withhold Bad News? | Kothari, S. P.; Shu, S.; Wysocki, P. D. |

| In Search of Distress Risk | Campbell, J. Y.; Hilscher, Je.; Szilagyi, J. | |

| Default risk in equity returns | Vassalou, M; Xing, YH | |

| Financial Distress Prediction in an International Context: A Review and Empirical Analysis of Altman’s Z Score Model | Altman, E.I.; Iwanicz-Drozdowska, M.; Laitinen, E. K.; Suvas, A. | |

| Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market | Khwaja, A. I.; Mian, A. | |

| Systemic risk measurement: Multivariate GARCH estimation of CoVaR | Girardi, G.; Erguen, A. Tolga | |

| Firing Costs and Capital Structure Decisions | Serfling, Matthew |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiosea, D.-B.-R.; Hategan, C.-D. Research Trends in Going Concern Assessment and Financial Distress in Last Two Decades: A Bibliometric Analysis. Risks 2024, 12, 184. https://doi.org/10.3390/risks12120184

Chiosea D-B-R, Hategan C-D. Research Trends in Going Concern Assessment and Financial Distress in Last Two Decades: A Bibliometric Analysis. Risks. 2024; 12(12):184. https://doi.org/10.3390/risks12120184

Chicago/Turabian StyleChiosea, Dorotheea-Beatrice-Ruxandra, and Camelia-Daniela Hategan. 2024. "Research Trends in Going Concern Assessment and Financial Distress in Last Two Decades: A Bibliometric Analysis" Risks 12, no. 12: 184. https://doi.org/10.3390/risks12120184

APA StyleChiosea, D.-B.-R., & Hategan, C.-D. (2024). Research Trends in Going Concern Assessment and Financial Distress in Last Two Decades: A Bibliometric Analysis. Risks, 12(12), 184. https://doi.org/10.3390/risks12120184