Cryptocurrency Portfolio Allocation under Credibilistic CVaR Criterion and Practical Constraints

Abstract

1. Introduction

2. Literature Review

2.1. Cryptocurrency Portfolio Optimization

2.2. Application of Credibility Theory in Portfolio Optimization Problems

2.3. Research Gap and Hypotheses Development

- The credibilistic CVaR framework with trapezoidal fuzzy variables will optimize cryptocurrency portfolios more effectively than traditional models;

- Practical constraints like cardinality and floor and ceiling constraints will create well-diversified portfolios with improved risk-adjusted returns;

- The proposed model will enhance risk management and decision-making for cryptocurrency investors.

3. Preliminaries

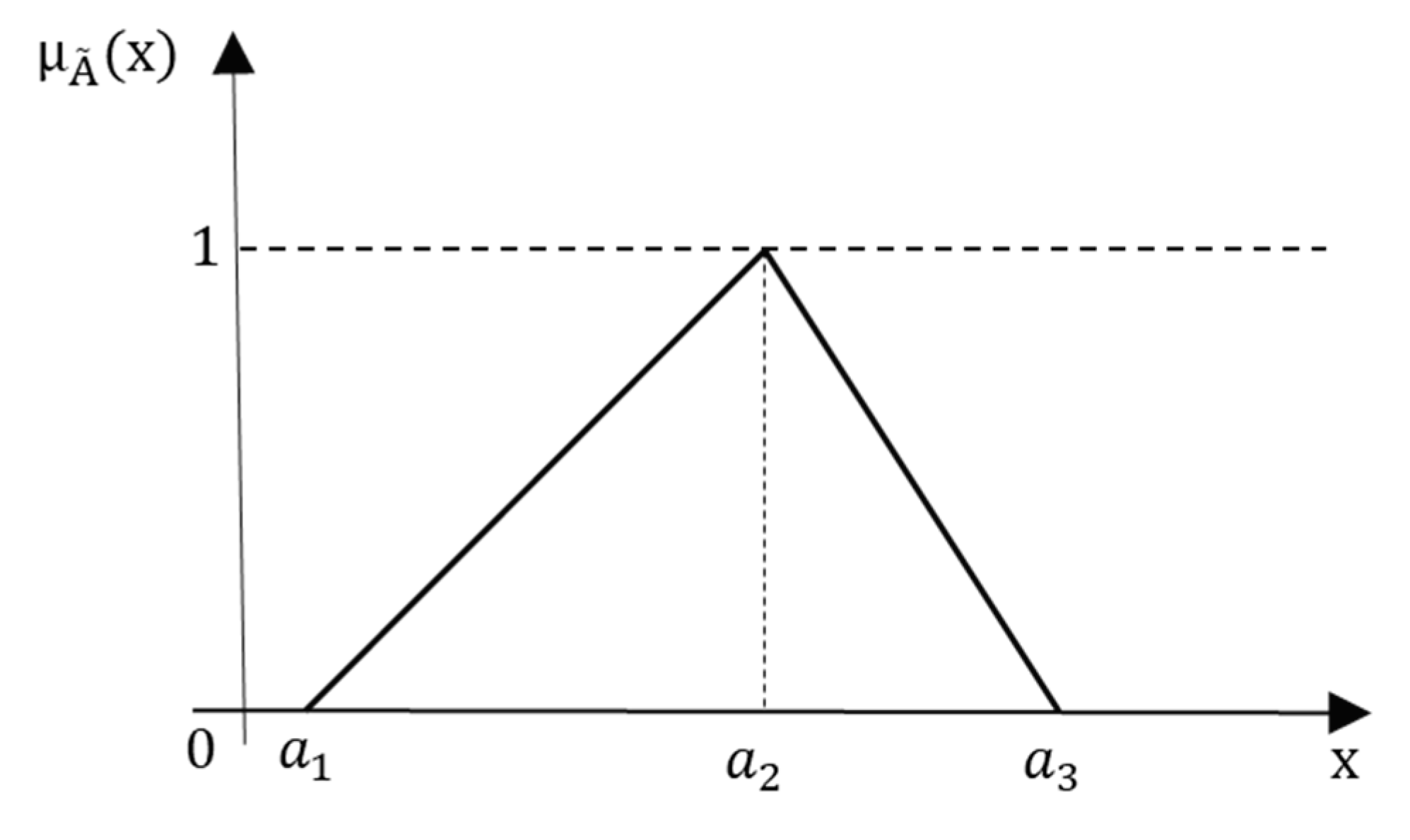

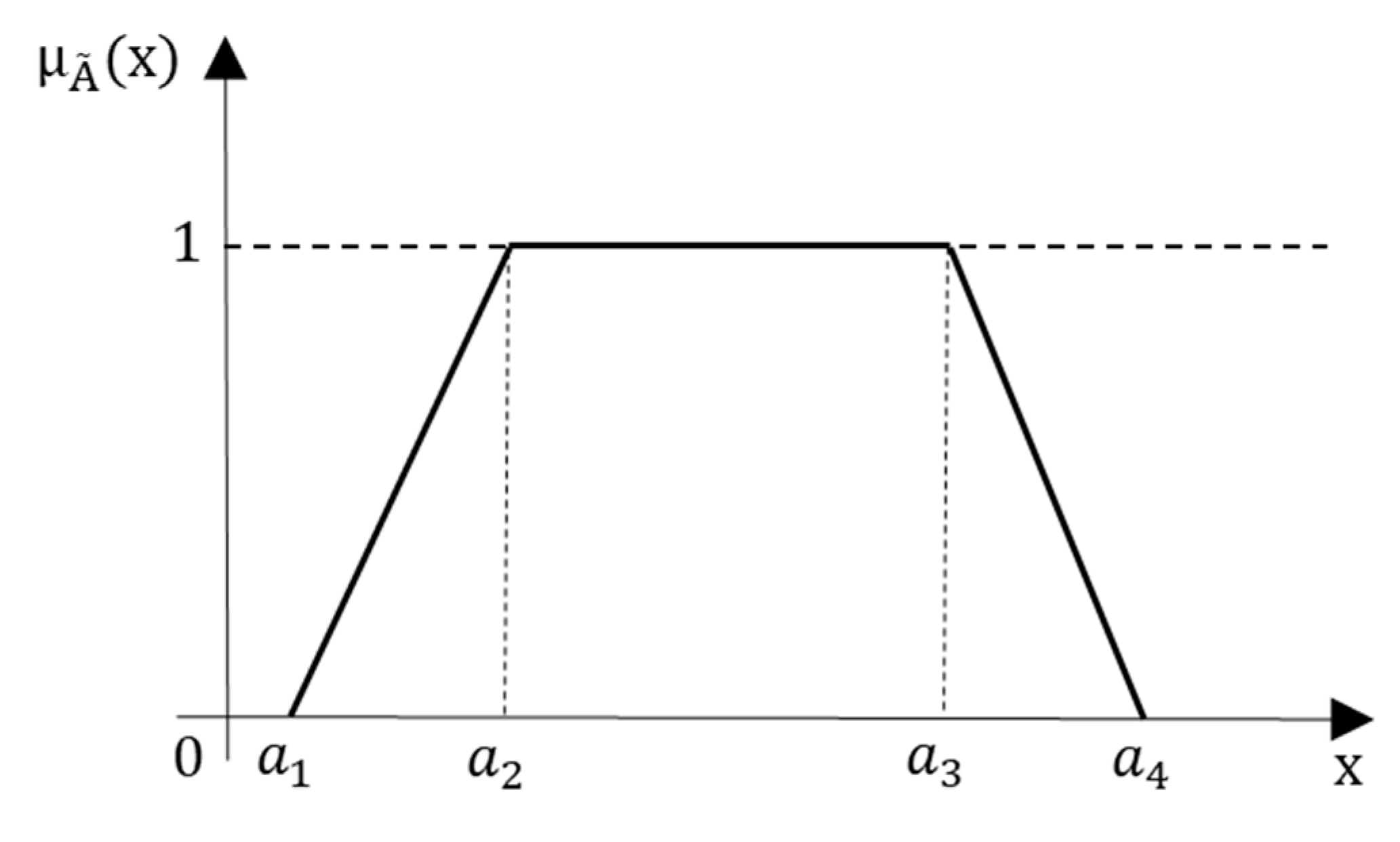

3.1. Fuzzy Set Theory

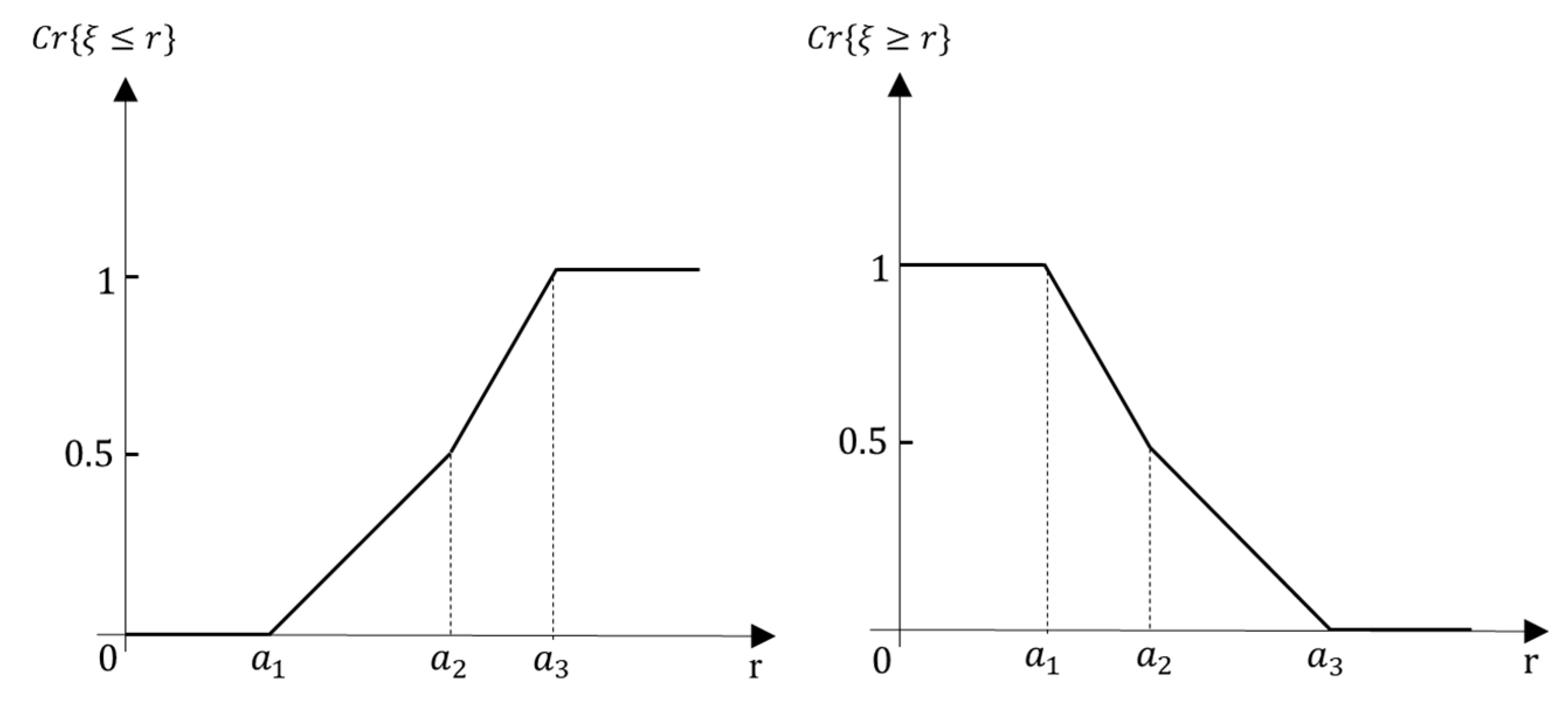

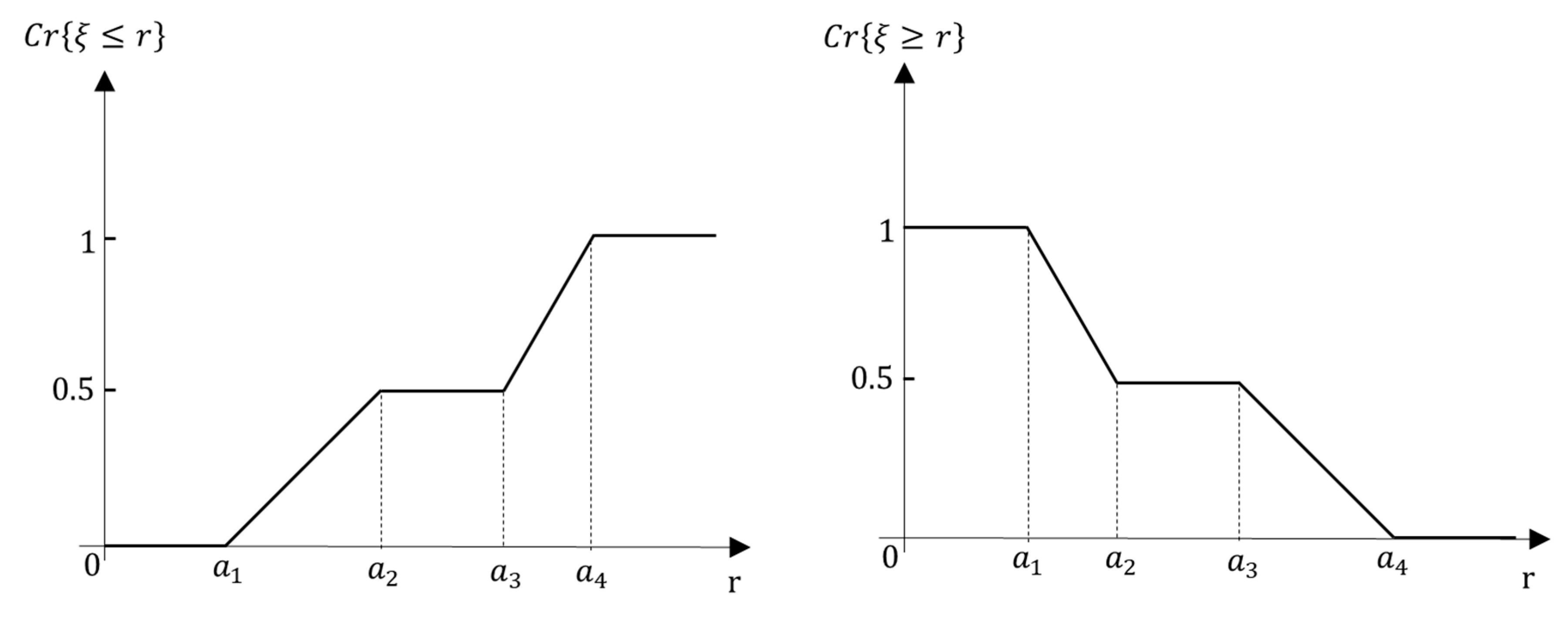

3.2. Credibility Theory

- Possibility Measure : This measure quantifies the maximum degree of membership within the fuzzy set , essentially reflecting the most plausible degree to which the event can occur. It is defined as:

- Necessity Measure : The necessity measure quantifies the degree to which the event is certain, calculated as the complement of the maximum degree of membership in the complement set . It is expressed as:

4. The Proposed Portfolio Optimization Model

4.1. Conditional Value at Risk (CVaR)

4.2. CVaR under Credibility Theory

4.3. Additional Practical Constraints

4.3.1. Cardinality Constraint

4.3.2. Floor and Ceiling Constraints

4.4. Proposed Portfolio Optimization Problem Formulation

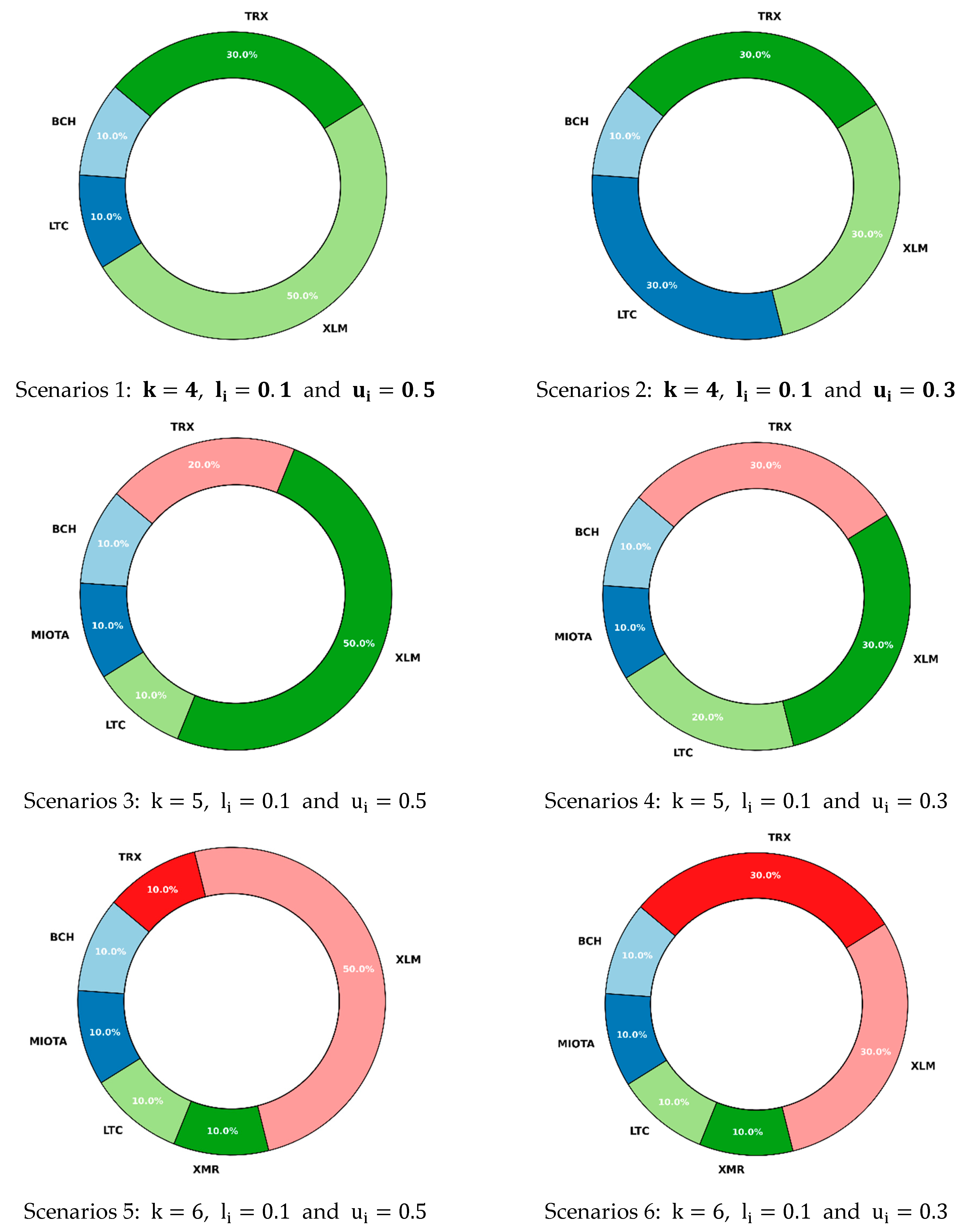

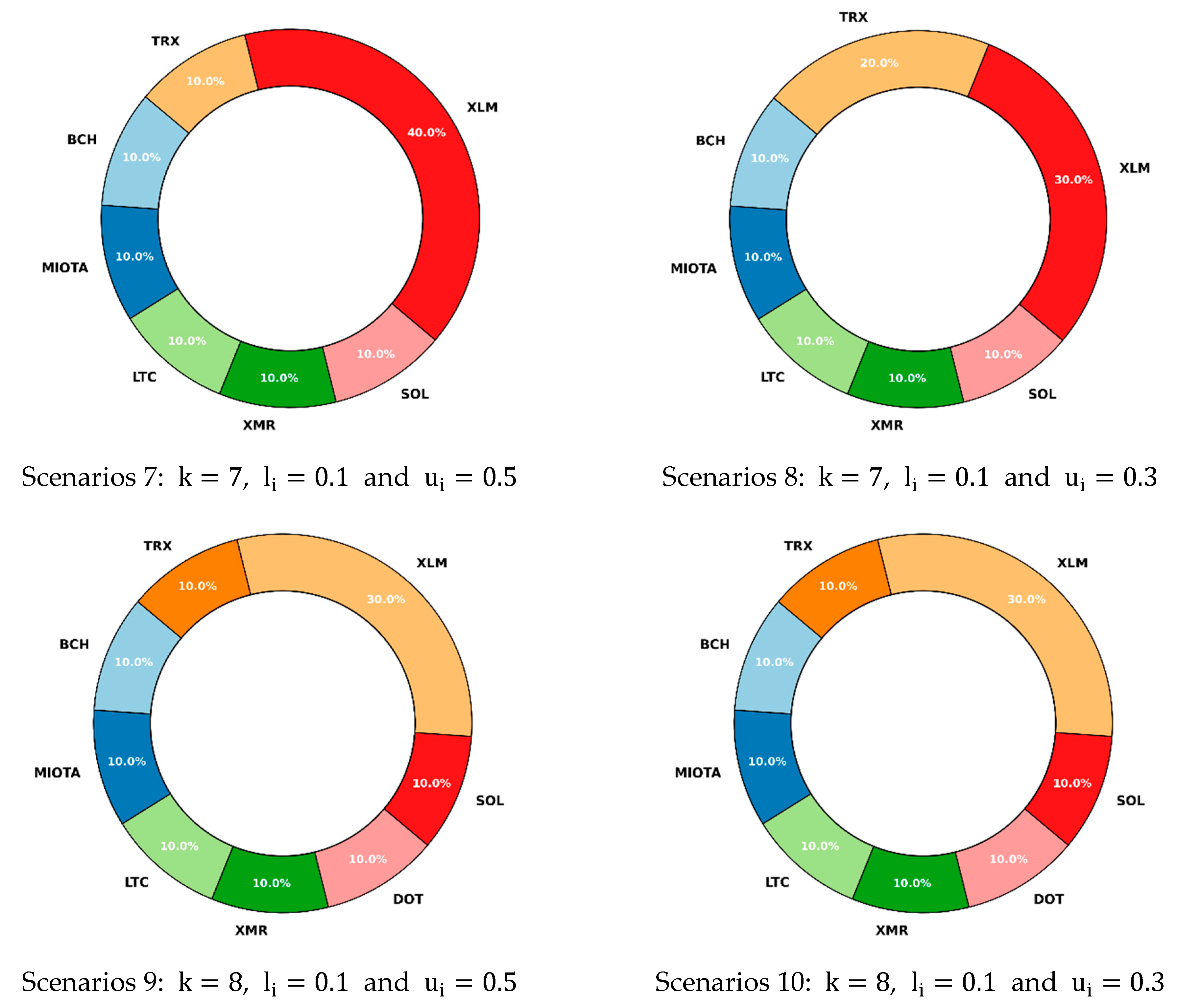

5. Numerical Experiments

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aljinović, Zdravka, Branka Marasović, and Tea Šestanović. 2021. Cryptocurrency portfolio selection—A multicriteria approach. Mathematics 9: 1677. [Google Scholar] [CrossRef]

- Almeida, Dora, Andreia Dionísio, Isabel Vieira, and Paulo Ferreira. 2022. Uncertainty and Risk in the Cryptocurrency Market. Journal of Risk and Financial Management 15: 532. [Google Scholar] [CrossRef]

- Babaioff, Moshe, Shahar Dobzinski, Sigal Oren, and Aviv Zohar. 2012. On bitcoin and red balloons. Paper presented at the 13th ACM Conference on Electronic Commerce, Valencia, Spain, June 4–8; pp. 56–73. [Google Scholar]

- Bouri, Elie, Syed Jawad Hussain Shahzad, and David Roubaud. 2019. Co-explosivity in the cryptocurrency market. Finance Research Letters 29: 178–83. [Google Scholar] [CrossRef]

- Bowala, Sulalitha, and Japjeet Singh. 2022. Optimizing Portfolio Risk of Cryptocurrencies Using Data-Driven Risk Measures. Journal of Risk and Financial Management 15: 427. [Google Scholar] [CrossRef]

- Brauneis, Alexander, and Roland Mestel. 2019. Cryptocurrency-portfolios in a mean-variance framework. Finance Research Letters 28: 259–64. [Google Scholar] [CrossRef]

- Canh, Nguyen Phuc, Udomsak Wongchoti, Su Dinh Thanh, and Nguyen Trung Thong. 2019. Systematic risk in cryptocurrency market: Evidence from DCC-MGARCH model. Finance Research Letters 29: 90–100. [Google Scholar] [CrossRef]

- Chen, Shuai. 2023. The Implementation of Modern Portfolio Theory on New Financial Assets: Evidence from Cryptocurrencies. Advances in Economics, Management and Political Sciences 56: 209–13. [Google Scholar] [CrossRef]

- Cryptocurrency Prices—Real Time Market Data—Investing.com. 2021. Available online: https://www.investing.com/crypto (accessed on 20 August 2021).

- Demircan, Murat Levent, and Tayfun Dirinda. 2023. Analysis of Various Portfolio Allocation Decision-Making Techniques in Crypto Assets Using Fuzzy Sets. In Intelligent and Fuzzy Systems. INFUS 2023. Lecture Notes in Networks and Systems. Edited by Cengiz Kahraman, Irem Ucal Sari, Basar Oztaysi, Selcuk Cebi, Sezi Cevik Onar and Çağrı Tolga. Cham: Springer, vol. 758, pp. 699–707. [Google Scholar] [CrossRef]

- Deng, Xue, Junfeng Zhao, and Zhongfei Li. 2018. Sensitivity Analysis of the Fuzzy Mean-Entropy Portfolio Model with Transaction Costs Based on Credibility Theory. International Journal of Fuzzy Systems 20: 209–18. [Google Scholar] [CrossRef]

- Elbahrawy, Abeer, Laura Alessandretti, Anne Kandler, Romualdo Pastor-Satorras, and Andrea Baronchelli. 2017. Evolutionary dynamics of the cryptocurrency market. Royal Society Open Science 4: 170623. [Google Scholar] [CrossRef]

- Eskorouchi, Amirhossein, Hossein Ghanbari, and Emran Mohammadi. 2024. Exploring the Evolution of Robust Portfolio Optimization: A Scientometric Analysis. Scientometric Analysis. Iranian Journal of Accounting, Auditing and Finance 8: 75–92. [Google Scholar] [CrossRef]

- García, Fernando, Jairo González-Bueno, Francisco Guijarro, Javier Oliver, and Rima Tamošiūnienė. 2020. Multiobjective approach to portfolio optimization in the light of the credibility theory. Technological and Economic Development of Economy 26: 1165–86. [Google Scholar] [CrossRef]

- García, Fernando, Jairo González-Bueno, Javier Oliver, and Rima Tamošiūnienė. 2019. A credibilistic mean-semivariance-PER portfolio selection model for Latin America. Journal of Business Economics and Management 20: 225–43. [Google Scholar] [CrossRef]

- Ghanbari, Hossein, Mojtaba Safari, Rouzbeh Ghousi, Emran Mohammadi, and Nawapon Nakharutai. 2023. Bibliometric analysis of risk measures for portfolio optimization. Accounting 9: 95–108. [Google Scholar] [CrossRef]

- Giunta, Nicolò, Giuseppe Orlando, Alessandra Carleo, and Jacopo Maria Ricci. 2024. Exploring Entropy-Based Portfolio Strategies: Empirical Analysis and Cryptocurrency Impact. Risks 12: 78. [Google Scholar] [CrossRef]

- Greenwood, Jeremy, Zvi Hercowitz, and Per Krusell. 2000. The role of investment-specific technological change in the business cycle. European Economic Review 44: 91–115. [Google Scholar] [CrossRef]

- Gupta, Pankaj, Mukesh Kumar Mehlawat, and Ahmad Zaman Khan. 2021. Multi-period portfolio optimization using coherent fuzzy numbers in a credibilistic environment. Expert Systems with Applications 167: 114135. [Google Scholar] [CrossRef]

- Hrytsiuk, Petro, Tetiana Babych, and Larysa Bachyshyna. 2019. Cryptocurrency Portfolio Optimization Using Value-at-Risk Measure. Amsterdam: Atlantis Press, pp. 385–89. Available online: https://www.atlantis-press.com/proceedings/smtesm-19/125917683 (accessed on 20 August 2021).

- James, Nick, and Max Menzies. 2023. Collective Dynamics, Diversification and Optimal Portfolio Construction for Cryptocurrencies. Entropy 25: 931. [Google Scholar] [CrossRef] [PubMed]

- Jeleskovic, Vahidin, Claudio Latini, Zahid Younas, and Mamdouh Al-Faryan. 2024. Cryptocurrency portfolio optimization: Utilizing a GARCH-copula model within the Markowitz framework. Journal of Corporate Accounting & Finance 35: 139–55. [Google Scholar] [CrossRef]

- Keller, Carmen, and Michael Siegrist. 2006. Investing in stocks: The influence of financial risk attitude and values-related money and stock market attitudes. Journal of Economic Psychology 27: 285–303. [Google Scholar] [CrossRef]

- Khosravi, Arman, Seyed Jafar Sadjadi, and Hossein Ghanbari. 2024. A bibliometric analysis and visualization of the scientific publications on multi-period portfolio optimization: From the current status to future directions. Accounting 10: 107–20. [Google Scholar] [CrossRef]

- Kim, Myungwan, Ye Jin Jeong, and Jaehong Jeong. 2024. Two Empirical Studies of Portfolio Optimization Using Cryptocurrency Allocation Ratios. IEEE Access 12: 63827–38. [Google Scholar] [CrossRef]

- Kolm, Petter, Reha Tütüncü, and Frank Fabozzi. 2014. 60 Years of portfolio optimization: Practical challenges and current trends. European Journal of Operational Research 234: 356–71. [Google Scholar] [CrossRef]

- Liu, Baoding. 2004. Credibility Theory. In Uncertainty Theory. Studies in Fuzziness and Soft Computing. Berlin/Heidelberg: Springer, vol. 154, pp. 79–135. [Google Scholar] [CrossRef]

- Liu, Baoding. 2007. Uncertainty Theory 4th Edition. Springer Uncertainty Research. Berlin/Heidelberg: Springer. [Google Scholar]

- Liu, Baoding, and Yian-Kui Liu. 2002. Expected value of fuzzy variable and fuzzy expected value models. IEEE Transactions on Fuzzy Systems 10: 445–50. [Google Scholar] [CrossRef]

- Liu, Naiqi, Yanju Chen, and Yankui Liu. 2018. Optimizing portfolio selection problems under credibilistic CVaR criterion. Journal of Intelligent & Fuzzy Systems 34: 335–47. [Google Scholar] [CrossRef]

- Liu, Yong-Jun, Wei-Guo Zhang, and Qun Zhang. 2016. Credibilistic multi-period portfolio optimization model with bankruptcy control and affine recourse. Applied Soft Computing 38: 890–906. [Google Scholar] [CrossRef]

- Longerstaey, Jacques, and Martin Spencer. 1996. Riskmetrics Technical Document. New York: Morgan Guaranty Trust Company of New York, vol. 51. [Google Scholar]

- Maghsoodi, Abtin Ijadi. 2023. Cryptocurrency portfolio allocation using a novel hybrid and predictive big data decision support system. Omega (Westport) 115: 102787. [Google Scholar] [CrossRef]

- Mansini, Renata, Wlodzimierz Ogryczak, and Maria Grazia Speranza. 2014. Twenty years of linear programming based portfolio optimization. European Journal of Operational Research 234: 518–35. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 1952. Portfolio selection. The Journal of Finance 7: 77–91. [Google Scholar] [CrossRef]

- Ma, Yechi, Ferhana Ahmad, Miao Liu, and Zilong Wang. 2020. Portfolio optimization in the era of digital financialization using cryptocurrencies. Technological Forecasting and Social Change 161: 120265. [Google Scholar] [CrossRef]

- Mba, Jules Clement, and Sutene Mwambi. 2020. A Markov-switching COGARCH approach to cryptocurrency portfolio selection and optimization. Financial Markets and Portfolio Management 34: 199–214. [Google Scholar] [CrossRef]

- Mba, Jules Clement, Edson Pindza, and Ur Koumba. 2018. A differential evolution copula-based approach for a multi-period cryptocurrency portfolio optimization. Financial Markets and Portfolio Management 32: 399–418. [Google Scholar] [CrossRef]

- Mehlawat, Mukesh K., Pankaj Gupta, and Ahmad Z. Khan. 2021. Multiobjective portfolio optimization using coherent fuzzy numbers in a credibilistic environment. International Journal of Intelligent Systems 36: 1560–94. [Google Scholar] [CrossRef]

- Mohebbi, Negin, and Amir Abbas Najafi. 2018. Credibilistic multi-period portfolio optimization based on scenario tree. Physica A: Statistical Mechanics and Its Applications 492: 1302–16. [Google Scholar] [CrossRef]

- Rockafellar, Tyrrell, and Stanislav Uryasev. 2000. Optimization of conditional value-at-risk. The Journal of Risk 2: 21–41. [Google Scholar] [CrossRef]

- Rockafellar, Tyrrell, and Stanislav Uryasev. 2002. Conditional value-at-risk for general loss distributions. Journal of Banking & Finance 26: 1443–71. [Google Scholar] [CrossRef]

- Sahu, Sonal, José Hugo Ochoa Vázquez, Alejandro Fonseca Ramírez, and Jong-Min Kim. 2024. Analyzing Portfolio Optimization in Cryptocurrency Markets: A Comparative Study of Short-Term Investment Strategies Using High-Frequency Data. Journal of Risk and Financial Management 17: 125. [Google Scholar] [CrossRef]

- Schmitz, Tim, and Ingo Hoffmann. 2020. Re-Evaluating Cryptocurrencies’ Contribution to Portfolio Diversification—A Portfolio Analysis with Special Focus on German Investors. Available online: https://arxiv.org/abs/2006.06237v2 (accessed on 27 September 2024).

- Shane, Scott. 2012. The Importance of Angel Investing in Financing the Growth of Entrepreneurial Ventures. The Quarterly Journal of Finance 2: 1250009. [Google Scholar] [CrossRef]

- Wątorek, Marcin, Stanisław Drożdż, Jarosław Kwapień, Ludovico Minati, Paweł Oświęcimka, and Marek Stanuszek. 2021. Multiscale characteristics of the emerging global cryptocurrency market. Physics Reports 901: 1–82. [Google Scholar] [CrossRef]

- Zadeh, Lotfi. 1965. Fuzzy sets. Information and Control 8: 338–53. [Google Scholar] [CrossRef]

| ID | Cryptocurrency | Ticker | ID | Cryptocurrency | Ticker |

|---|---|---|---|---|---|

| A1 | Aave | AAVE | A19 | FTX Token | FTT |

| A2 | Algorand | ALGO | A20 | IOTA | MIOTA |

| A3 | Avalanche | AVAX | A21 | Unus Sed Leo | LEO |

| A4 | Binance Coin | BNB | A22 | Litecoin | LTC |

| A5 | Bitcoin Cash | BCH | A23 | Maker | MKR |

| A6 | Bitcoin SV | BSV | A24 | Monero | XMR |

| A7 | BitTorrent | BTT | A25 | Neo | NEO |

| A8 | Cardano | ADA | A26 | Polkadot | DOT |

| A9 | Chainlink | LINK | A27 | Polygon | MATIC |

| A10 | Cosmos | ATOM | A28 | Solana | SOL |

| A11 | Crypto.com Coin | CRO | A29 | Stellar | XLM |

| A12 | Dai | DAI | A30 | Tether | USDT |

| A13 | Dash | DASH | A31 | Tezos | XTZ |

| A14 | Dogecoin | DOGE | A32 | THETA | THETA |

| A15 | EOS | EOS | A33 | Tron | TRX |

| A16 | Ethereum | ETH | A34 | USD Coin | USDC |

| A17 | Ethereum Classic | ETC | A35 | Waves | WAVES |

| A18 | Filecoin | FIL | A36 | Proton | XPR |

| ID | Ticker | Mean | Variance | SD | Max | Min |

|---|---|---|---|---|---|---|

| A1 | AAVE | −0.0442 | 0.1268 | 0.3561 | 1.0000 | −0.5000 |

| A2 | ALGO | −0.0217 | 0.0343 | 0.1851 | 0.3834 | −0.4161 |

| A3 | AVAX | 0.1749 | 0.4554 | 0.6748 | 2.2547 | −1.0000 |

| A4 | BNB | 0.1419 | 0.1620 | 0.4025 | 1.2642 | −0.4009 |

| A5 | BCH | 0.0723 | 0.2317 | 0.4814 | 1.6334 | −0.3865 |

| A6 | BSV | 0.0677 | 0.0774 | 0.2782 | 0.9346 | −0.4409 |

| A7 | BTTOLD | −0.0317 | 0.0217 | 0.1472 | 0.1955 | −0.4302 |

| A8 | ADA | −0.0602 | 0.0526 | 0.2293 | 0.7322 | −0.3360 |

| A9 | LINK | 0.0207 | 0.0447 | 0.2113 | 0.3810 | −0.3333 |

| A10 | ATOM | 0.0184 | 0.0284 | 0.1686 | 0.4864 | −0.2356 |

| A11 | CRO | 0.0070 | 0.0738 | 0.2717 | 0.8871 | −0.4334 |

| A12 | DAI | −0.0030 | 0.0001 | 0.0116 | 0.0146 | −0.0421 |

| A13 | DASH | 0.0689 | 0.0471 | 0.2170 | 0.7127 | −0.3962 |

| A14 | DOGE | 0.0923 | 0.1559 | 0.3948 | 1.1473 | −0.4494 |

| A15 | EOS | 0.0782 | 0.1580 | 0.3974 | 1.2145 | −0.4845 |

| A16 | ETH | 0.0190 | 0.0240 | 0.1551 | 0.4324 | −0.2106 |

| A17 | ETC | 0.0287 | 0.0419 | 0.2047 | 0.5893 | −0.2989 |

| A18 | FIL | 0.0279 | 0.0008 | 0.0286 | 0.1355 | 0.0026 |

| A19 | FTT | 0.0138 | 0.0061 | 0.0780 | 0.2226 | −0.1401 |

| A20 | MIOTA | 0.1199 | 0.2327 | 0.4824 | 1.7847 | −0.4594 |

| A21 | LEO | −0.0190 | 0.0039 | 0.0625 | 0.1577 | −0.2215 |

| A22 | LTC | 0.0660 | 0.0350 | 0.1871 | 0.8401 | −0.0762 |

| A23 | MKR | 0.0093 | 0.0390 | 0.1975 | 0.5126 | −0.2961 |

| A24 | XMR | 0.1292 | 0.2730 | 0.5225 | 2.2258 | −0.6400 |

| A25 | NEO | 0.0193 | 0.0477 | 0.2184 | 0.6457 | −0.4059 |

| A26 | DOT | 0.1102 | 0.0737 | 0.2715 | 0.9136 | −0.2534 |

| A27 | MATIC | 0.0231 | 0.0630 | 0.2511 | 0.9202 | −0.4954 |

| A28 | SOL | 0.1676 | 0.1492 | 0.3862 | 1.0682 | −0.2688 |

| A29 | XLM | 0.3260 | 1.6728 | 1.2934 | 6.4552 | −0.4303 |

| A30 | USDT | −0.0001 | 0.0004 | 0.0197 | 0.0300 | −0.0757 |

| A31 | XTZ | −0.0310 | 0.0209 | 0.1445 | 0.3020 | −0.3053 |

| A32 | THETA | 0.0040 | 0.0608 | 0.2466 | 0.5861 | −0.4348 |

| A33 | TRX | 0.3379 | 1.3487 | 1.1613 | 5.5693 | −0.3176 |

| A34 | USDC | 0.0001 | 0.0000 | 0.0012 | 0.0041 | −0.0021 |

| A35 | WAVES | −0.0256 | 0.0488 | 0.2210 | 0.5596 | −0.3933 |

| A36 | XPR | 0.0082 | 0.0983 | 0.3136 | 1.0554 | −0.4997 |

| ID | Trapezoidal Fuzzy Data | ID | Trapezoidal Fuzzy Data |

|---|---|---|---|

| A1 | (−0.5, −0.125, 0.625, 1) | A19 | (−0.140, −0.049, 0.131, 0.222) |

| A2 | (−0.416, −0.216, 0.183, 0.383) | A20 | (−0.459, 0.101, 1.223, 1.784) |

| A3 | (−1, −0.186, 1.441, 2.254) | A21 | (−0.221, −0.126, 0.062, 0.157) |

| A4 | (−0.400, 0.015, 0.847, 1.264) | A22 | (−0.076, 0.152, 0.611, 0.840) |

| A5 | (−0.386, 0.118, 1.128, 1.633) | A23 | (−0.296, −0.093, 0.310, 0.512) |

| A6 | (−0.440, −0.097, 0.590, 0.934) | A24 | (−0.64, 0.076, 1.509, 2.225) |

| A7 | (−0.430, −0.273, 0.039, 0.195) | A25 | (−0.405, −0.143, 0.382, 0.645) |

| A8 | (−0.336, −0.068, 0.465, 0.732) | A26 | (−0.253, 0.038, 0.621, 0.913) |

| A9 | (−0.333, −0.154, 0.202, 0.380) | A27 | (−0.495, −0.141, 0.566, 0.920) |

| A10 | (−0.235, −0.055, 0.305, 0.486) | A28 | (−0.268, 0.065, 0.733, 1.068) |

| A11 | (−0.433, −0.103, 0.556, 0.887) | A29 | (−0.430, 1.291, 4.733, 6.455) |

| A12 | (−0.042, −0.027, 0.000, 0.014) | A30 | (−0.075, −0.049, 0.003, 0.03) |

| A13 | (−0.396, −0.118, 0.435, 0.712) | A31 | (−0.305, −0.153, 0.150, 0.301) |

| A14 | (−0.449, −0.050, 0.748, 1.147) | A32 | (−0.434, −0.179, 0.330, 0.586) |

| A15 | (−0.484, −0.059, 0.789, 1.214) | A33 | (−0.317, 1.154, 4.097, 5.569) |

| A16 | (−0.210, −0.049, 0.271, 0.432) | A34 | (−0.002, 0.000, 0.002, 0.004) |

| A17 | (−0.298, −0.076, 0.367, 0.589) | A35 | (−0.393, −0.155, 0.321, 0.559) |

| A18 | (0.002, 0.035, 0.102, 0.135) | A36 | (−0.499, −0.110, 0.666, 1.055) |

| Objective Function | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.088 | - | - | - | - | |||||||

| 0.845 | - | - | - | - | |||||||

| 0.978 | - | - | - | ||||||||

| 0.842 | - | - | - | ||||||||

| 0.866 | - | - | |||||||||

| 0.836 | - | - | |||||||||

| 0.737 | - | ||||||||||

| 0.722 | - | ||||||||||

| 0.604 | |||||||||||

| 0.604 | |||||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ghanbari, H.; Mohammadi, E.; Fooeik, A.M.L.; Kumar, R.R.; Stauvermann, P.J.; Shabani, M. Cryptocurrency Portfolio Allocation under Credibilistic CVaR Criterion and Practical Constraints. Risks 2024, 12, 163. https://doi.org/10.3390/risks12100163

Ghanbari H, Mohammadi E, Fooeik AML, Kumar RR, Stauvermann PJ, Shabani M. Cryptocurrency Portfolio Allocation under Credibilistic CVaR Criterion and Practical Constraints. Risks. 2024; 12(10):163. https://doi.org/10.3390/risks12100163

Chicago/Turabian StyleGhanbari, Hossein, Emran Mohammadi, Amir Mohammad Larni Fooeik, Ronald Ravinesh Kumar, Peter Josef Stauvermann, and Mostafa Shabani. 2024. "Cryptocurrency Portfolio Allocation under Credibilistic CVaR Criterion and Practical Constraints" Risks 12, no. 10: 163. https://doi.org/10.3390/risks12100163

APA StyleGhanbari, H., Mohammadi, E., Fooeik, A. M. L., Kumar, R. R., Stauvermann, P. J., & Shabani, M. (2024). Cryptocurrency Portfolio Allocation under Credibilistic CVaR Criterion and Practical Constraints. Risks, 12(10), 163. https://doi.org/10.3390/risks12100163