Abstract

This article aims to contribute to the academic knowledge in the field of scientific production regarding decision support tools for investments in the capital market, specifically focusing on fundamental analysis, technical analysis, and Ichimoku dynamics. Bibliometric analysis, following the three main laws (Bradford’s Law, Lotka’s Law, and Zipf’s Law), was employed to evaluate scientific production, identify publication patterns, and uncover gaps and collaboration networks over the last thirty years. To achieve these objectives, 1710 relevant academic publications on the topic were analyzed and retrieved from the Web of Science (WOS) database, pertaining to the last 30 years, between 1990 and 22 May 2023. The significance of this article lies in the contributions of the findings, which advance scientific knowledge by identifying gaps in the knowledge and research, particularly in the limited literature on Ichimoku; our review reveals a growing trend of research in this area. Another notable conclusion is the emergence of new research topics and areas of interest, as well as the identification of collaboration networks among authors, institutions, and countries. Moreover, the article provides valuable insights for financial professionals and investors who are interested in applying these methodologies as methods for price forecasting. The highlighted results support investment decision making, trading strategies, and portfolio management.

1. Introduction

The endeavor to maximize profit inherently requires the ability to foresee shifts in prices, thus making it a subject that has attracted significant attention from academics, investors, and financial experts. Factors such as overarching economic circumstances, social influences, and political occurrences on the national and global scales introduce elements of uncertainty, which obstruct precise prognostications. Consequently, investment choices are frequently informed by one type of predictive modeling or another (Lin 2018; Almeida 2020).

Authors such as Brock et al. (1992), Ahmar (2017), and Lin (2018) have established that predicting market returns is a challenging task. Nonlinear and non-stationary market characteristics, coupled with factors including political events, news, financial reports, international influences, and trading behaviors, contribute to the complexity and risk associated with this type of investment.

To address this concern, investment decisions typically rely on two main approaches: technical analysis and fundamental analysis. Technical analysis employs graphical tools and mathematical methods based on historical price movements to predict market behavior patterns (Blume et al. 1994; Lo et al. 2000). Conversely, fundamental analysis evaluates the financial health of companies by analyzing financial indicators, calculating intrinsic asset values, and comparing them to market prices, thereby providing target prices for the assets (Mandelbrot 1963; Yu 2023).

Given the significance of these two methods of analysis, this study presents a bibliometric review (1993–2023) of the literature surrounding these methodologies as decision-making tools, with a particular focus on the Ichimoku dynamics approach as a complementary technique.

Ichimoku dynamics is a technique that aims to predict price movements through graphical analysis; it involves the analysis of five lines and the Kumo. This methodology encompasses a broader range of bullish/bearish signals, which can provide more accurate insights into market trends or price conditions (Deng et al. 2021).

The study has three main objectives. Firstly, it aims to characterize the literature on the subject by applying key bibliometric laws, including Lotka’s Law, which measures author productivity, Zipf’s Law, which assesses word frequency, and Bradford’s Law, which gauges journal productivity (Aria and Coccurullo 2017; Kushairi and Ahmi 2021). These analyses contribute to advancing scientific knowledge in this field.

Secondly, it contributes to the literature by analyzing the trends in and research status of Ichimoku dynamics, thereby enhancing the knowledge and dissemination of this approach and addressing a gap identified in the existing literature. Thirdly, it adds to the discussion on the effectiveness of these methodologies in evaluating and forecasting price movements.

This is the first study to adopt a bibliometric approach for fundamental analysis, technical analysis, and, notably, Ichimoku dynamics, thereby filling a gap in the existing literature. While there are studies focused on literature reviews, none have addressed Ichimoku dynamics; the same is true for fundamental and technical analysis from a bibliometric perspective, emphasising the novelty of our research. This unique approach may potentially lead to distinct discoveries, deepening our understanding of these topics and further stimulating academic debate.

Our study not only offers valuable insights for the academic community but also benefits practitioners, regulators, and policymakers. They can utilize our findings to inform their decisions and devise effective strategies in the field of asset management.

The paper is structured into five sections. The introduction provides an overview of the study. The second section presents a brief overview of the current state of the research. The third section outlines the research design and methodology. The fourth section presents and discusses the results. Finally, the fifth section concludes the research and offers suggestions for future studies.

2. State of the Art

Technical analysis is the study of market movements using chart analysis and technical indicators. It originates from the Greek word “technikos”, meaning art or wisdom, and is based on the Dow Theory. Wang et al. (2019) traced its roots back to 18th-century Japan, where candlestick charts were used in rice futures trading.

2.1. Technical Analysis

Authors such as Blume et al. (1994) and Almeida (2020) describe technical analysis as a methodology that uses historical price data, graphic tools, mathematical approaches, and econometric models to recognize price trends and predict market dynamics. It is based on three fundamental principles: the belief that market prices incorporate all existing information, the notion that prices follow certain trends, and the assumption that history tends to repeat itself (Murphy 1999).

Authors including Brown et al. (1998), Ahmar (2017), and Corbet et al. (2019) define technical analysis as the use of indicators based on historical data to predict financial market movements. Primarily through chart analysis, these indicators enable trend following and the anticipation of market movements, potentially increasing profitability.

Corbet et al. (2019) and Gerritsen et al. (2020) argue that technical analysis effectively extracts information from market prices. It identifies patterns or movements in asset prices based on support, resistance, and momentum. However, the subjective nature of technical analysis is acknowledged, as interpreting geometric shapes on charts poses challenges (Blume et al. 1994; Gerritsen et al. 2020).

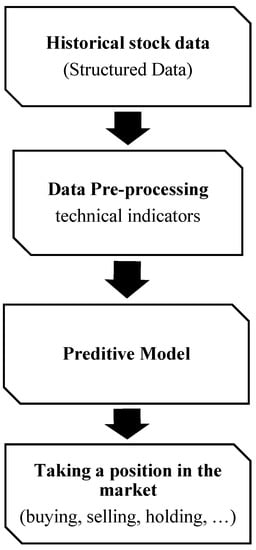

Overall, technical analysis aims to forecast market movements across various financial instruments, including stocks, forex, indices, commodities, derivatives, and options, by predicting and identifying price behavior patterns (Blume et al. 1994; Ahmar 2017; Gerritsen et al. 2020). Figure 1 illustrates the general format of a technical analysis approach for market forecasting.

Figure 1.

The technical analysis approach to the market.

Regarding the most prevalent technical indicators employed in the literature and commonly used by proponents of technical analysis, we present the four most cited indicators, according to some authors, such as Almeida (2022) and Goutte et al. (2023). The indicators are the Simple Moving Average (SMA), the Exponential Moving Average (EMA), the Moving Average Convergence/Divergence Rules (MACD), and the Relative Strength Index (RSI). Table 1 presents the calculation formulas.

Table 1.

The most common technical indicators and calculation formulas.

The first major academic study on technical analysis was conducted by Cowles (1933), who found that it yielded a lower average return of 3% compared to the market, contradicting the Dow theory.

Technical analysis gained interest in the 1970s due to advancements in information technology (Walkshäusl 2019; Wang et al. 2019). Cohen and Cabiri (2015) studied the RSI and MACD indicators across various indices. They discovered that RSI outperformed the Buy and Hold strategy for the Dow Jones index, while MACD yielded negative returns. Both RSI and MACD performed better than the Buy and Hold strategy for the FTSE100, but the strategy outperformed the indicators in the Israeli market.

Rosillo et al. (2013) examined the predictive capabilities of MACD and RSI in the Spanish stock exchange, finding that RSI performed well for companies listed on the IBEX 35 and those with higher market capitalization.

Nor and Wickremasinghe (2017), Ahmed and Safdar (2018), and Walkshäusl (2019) analyzed the predictive abilities of RSI and MACD in the Australian stock exchange, with MACD matching the Buy and Hold strategy and RSI outperforming both indicators.

According to Menkhoff (2010), a significant percentage of foreign exchange traders believe that technical analysis plays a role in determining short-term exchange rates. Hybrid approaches combining technical and fundamental analysis have gained prominence (Pätäri and Vilska 2014; Metghalchi et al. 2019).

Recent studies have integrated technical indicators with statistical models (Rubi et al. 2022; Tao et al. 2021) and machine learning techniques (Ghosh et al. 2022; Zhang et al. 2021), demonstrating strong predictive capabilities across various markets (Deb et al. 2022; Eugster and Uhl 2022; Bazán-Palomino and Svogun 2023; Gradojevic et al. 2023).

2.2. Fundamental Analysis

This methodology for asset analysis and valuation originates from the principles used in Graham and Dodd’s (1934) diligent financial evaluation; these researchers are considered the “fathers” of the buy-and-hold strategy. In a general sense, it evaluates the financial health of companies and projects’ future results by determining the price closest to the actual value of stocks, based on three pillars: (i) an analysis of the company or asset; (ii) an analysis of the industry and market; and (iii) an analysis of economic and financial indicators, considering the significant role of economic behavior, both in its micro- and macroeconomic aspects (Almeida 2022).

Authors such as Fama and French (1992), Walkshäusl (2019), and Wang et al. (2023) argue that fundamental analysis is a tool for analysis, reflection, and decision-making processes, as well as facilitating a macro view of long-term investment philosophies. Mandelbrot (1963) suggests that fundamental analysis implies buying an asset whenever it is a good company and waiting until a good return can be obtained. In summary, it calculates the intrinsic value of the assets and compares it to the market price, aiming at a target price.

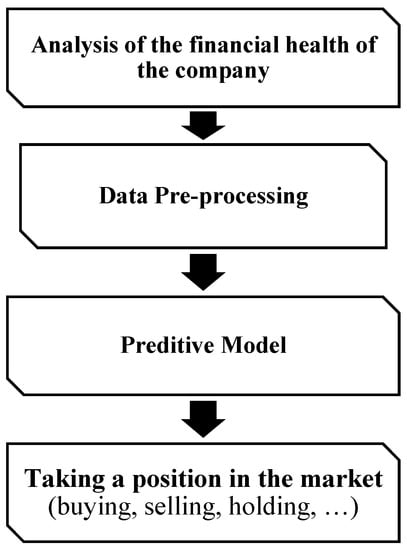

Figure 2 illustrates the general format of a fundamental analysis approach to the asset price.

Figure 2.

The fundamental analysis approach to the market.

Table 2 presents the most common indicators/ratios in fundamental analysis, according to Nti et al. (2020).

Table 2.

The most common indicators/ratios in technical analysis and their calculation formulae.

Fundamental analysis has been shown to be effective in predicting price movements (Mandelbrot 1963; Zhang et al. 2021; Yu 2023). Wang et al. (2023) found that, while some hedge and mutual fund managers trade against fundamental strategies due to accounting anomalies, others achieve higher returns using fundamentals. Hanauer et al. (2022) emphasized the importance of nonlinearities and interactions in fundamental analysis, employing linear regression and tree-based machine learning for European stocks.

Unlike professionals, academics often express skepticism towards technical analysis. This can likely be attributed to the adoption of the efficient market hypothesis (Fama 1970) and the unfavorable empirical outcomes derived from early research studies (Fama and Blume 1966; Van Horne and Parker 1967). On the other hand, fundamental analysis involves the computation of an asset’s inherent worth, its comparison with the market price, and the subsequent determination of whether the asset is overpriced, underpriced, or reasonably valued. This process assists investors in making informed decisions about the asset.

Studies by Fama and French (1992), Hou et al. (2015), Yan and Zheng (2017), and Walkshäusl (2019) have provided evidence of positive outcomes using fundamental analysis. In summary, fundamental analysis aims to assess the true value of an asset and provides insights into its market valuation, assisting investors in making informed decisions regarding buying, selling, or holding assets.

2.3. Ichimoku

Ichimoku is a trading system or methodology that uses chart analysis. It was originally developed by the Japanese journalist Goichi Hosada in the 1930s, before the Second World War. The author believed that the market was a direct reflection of human behavioral dynamics and that it could be described as having a constant cyclical movement, moving away from or towards a balance (Elliott 2007). It was in the early 21st century that Ichimoku started to be practiced in the West, with the publication of the book Ichimoku Charts by Elliott (2007), which is presumably the first book on this methodology in a language other than Japanese.

The author argues that, in 1996, the method was rediscovered and began to gain popularity through the publication of the book Ichimoku Kinko Studies by Hidenobu Sasaki. The author redefined the methodology to fit the current reality, popularizing the term Ichimoku Cloud or Ichimoku Kinko Hyo. In summary, Ichimoku is a trend-following system aimed at supporting decision-making. Compared to other technical indicators, Ichimoku Kinko Hyo includes more types of bullish/bearish signals that can more clearly reflect market trends or price conditions (Deng et al. 2021). Despite the significant influence and acceptance of Ichimoku among analysts and traders, there are very limited studies testing the predictive ability of trading strategies based on Ichimoku, unlike fundamental analysis or technical analysis (Almeida 2020; Deng et al. 2021).

Ichimoku Kinko Hyo, or simply Ichimoku, is a charting system composed of five lines calculated based on historical price data, specifically the high and low prices. Four of these lines are price averages, while one line is the lagging price. The five lines are Tenkan-sen, Kijun-sen, Chikou-span, Senkou-Span A, and Senkou-Span B. The latter two lines form the Kumo or cloud.

The main lines of the Ichimoku system are calculated similarly to moving averages, with the unique characteristic of incorporating daily maximum and minimum prices into their calculations. The Tenkan-Sen line, known as the conversion line, is one of the key components of the Ichimoku system. It is calculated by taking the average of the highest and lowest prices observed during the previous nine periods, including the current one. The Tenkan-Sen line provides insights into short-term price dynamics and helps traders identify potential trend reversals or entry points. Due to its rapid response to price changes, it is considered the fastest and most signal-producing indicator within the Ichimoku system. This line is calculated using the following formula:

The Kijun-Sen line, also known as the Base Line, complements the Tenkan-Sen line and represents the mid-point of prices over a longer span of twenty-six periods. Like the Tenkan-Sen line, the Kijun-Sen line helps traders to assess the overall market trend. However, it reacts more slowly to price fluctuations, making it a useful indicator for identifying medium-term trends. When the Tenkan-Sen line crosses above the Kijun-Sen line, it may signal an uptrend, while a cross below may indicate a downtrend. It is calculated as follows:

The Chikou Span, also known as the Lagging Span, provides a retrospective view of price action by plotting the closing price of the current period displaced twenty-six periods back on the chart. This lagging position allows traders to evaluate the historical strength of a signal generated by the Tenkan-Sen and Kijun-Sen lines. When the Chikou Span aligns with current prices and the Tenkan-Sen/Kijun-Sen lines, it confirms the validity of a trend or reversal.

Senkou Span A and Senkou Span B together form the Kumo or cloud, which provides valuable information about potential future market trends. Senkou Span A is calculated by taking the average of the Tenkan-Sen and Kijun-Sen lines over twenty-six periods. On the other hand, Senkou Span B represents the average of the highest and lowest prices over fifty-two periods. The area between Senkou Span A and Senkou Span B forms the cloud, which can act as a support or resistance level. A thicker cloud indicates higher volatility and potential stronger support/resistance levels, while a thinner cloud suggests lower volatility and weaker support/resistance areas.

By combining these lines and the cloud, the Ichimoku system offers traders a comprehensive and visual approach to analyzing market trends, potential entry/exit points, and the overall market health. It is a popular tool, especially in trend-following strategies.

The lines of the Ichimoku system are calculated similarly to moving averages in technical analysis; however, instead of resorting to closing prices like averages, the Ichimoku indicator uses daily highs and lows for average calculations. Alhashel et al. (2018) and Almeida (2020) argue that the Ichimoku methodology tests the predictive control of the model, to dynamically optimize a portfolio based on quotation forecasts, having already been tested in different markets, stocks, forex, and energy, for example.

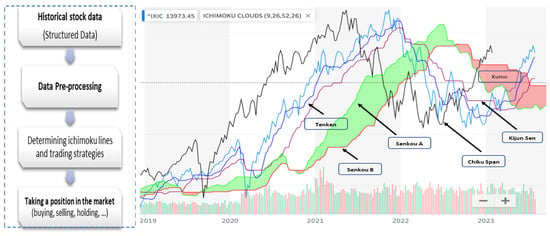

Figure 3 presents the general format of an analysis approach using Ichimoku dynamics, as well as the presentation of the five Ichimoku lines on the chart; the point when the lines cross is the moment when the investor should design his trading strategies.

Figure 3.

The Ichimoku strategy and a graphical representation of the lines and Kumo.

3. Research Background

This study employed bibliometric analysis as its research design. Bibliometric analysis has been recognized as an effective methodology for quantitatively studying scientific production (Kushairi and Ahmi 2021; Arslan et al. 2022). It allows for the analysis of large datasets and their evolution over time. The analysis was conducted based on key laws of bibliometrics. Bradford’s Law measures journal productivity by identifying core and dispersion areas in a specific subject. Lotka’s Law measures author productivity using a size–frequency distribution model. Zipf’s Law measures word frequency in articles (Aria and Coccurullo 2017; Kushairi and Ahmi 2021).

The analysis utilized the Bibliometrix package and the BiblioShiny platform in the RStudio software, as well as VosViewer (Aria and Coccurullo 2017; Bhattacharjee et al. 2023). Document selection was performed using the WOS database as of 22 May 2023.

Following the works of authors such as Donthu et al. (2021), Zhao and Li (2023), and Bansal et al. (2023) we utilized the Web of Science (WoS) database, which is a bibliographic digital database that supplies researchers with a diverse range of high-quality publications (Zhu and Liu 2020). Kemeç and Altınay (2023) posit that it is the most common and comprehensive data source. It allows for the monitoring of ideas from nearly 1.9 billion cited references across more than 171 million records, enabling the execution of high-quality research, the acquisition of insights, and the formulation of more informed decisions that shape the future of institutions and their research strategies (Zhu and Liu 2020).

Based on this context, the following research questions were formulated:

- Q.1—

- What is the research trend over the years?

- Q.2—

- What are the main sources of publication for research articles?

- Q.3—

- Which authors and articles that have exerted the most influence on this topic?

- Q.4—

- Which countries have contributed the most to the knowledge base of these methodologies?

- Q.5—

- What are the most relevant keywords used in research studies related to the topic?

To answer these questions, the following research strategy was followed.

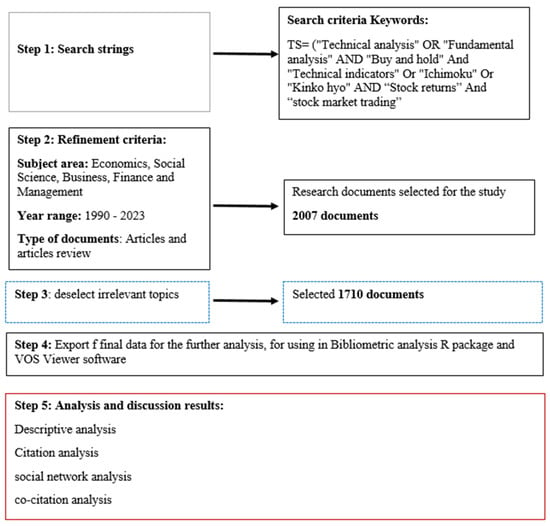

The main challenge of bibliometric analysis is formulating an appropriate query. In our study, we kept the query simple enough to gather the maximum number of publications. Our research design is presented in Figure 4.

Figure 4.

Research design.

After applying the selection criteria, the documents were saved in the BibTeX format. The final file was exported to Excel, and all records were analyzed, eliminating any incomplete ones. After this process, our final sample consisted of 1710 articles, for the period between 1990 and 2023.

4. Results

This section presents the research results in three subsections. The first subsection focuses on the quantification of studies, analyzing publication and citation trends. It presents the most cited works, impact, the relevance of journals, and authors in the field. The second subsection discusses the geographic distribution, while the third subsection analyzes the search map based on word frequency and co-citations.

4.1. Study Quantification

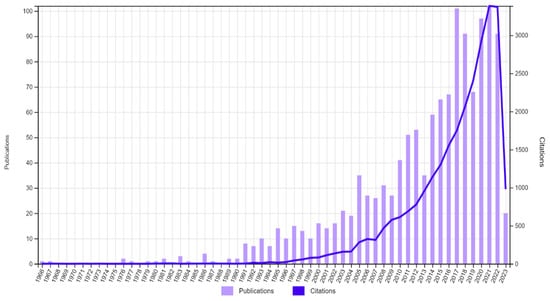

There is a general upward tendency in the number of papers produced each year. This publishing trend indicates a growing interest in research. Substantial growth can be observed, as shown in Figure 5, which shows the publication and citation trends for the sample period.

Figure 5.

Publication and citation trends.

It is evident that there is a growing trend in annual citations and publications. This trend highlights the topic’s significance and addresses the first research question. The historical analysis reveals an increase in scientific production, particularly from 2000 onwards. The peak year for publications was 2021, with 136 articles. Notably, within the first 4 months of 2023, 27 papers had already been published, representing approximately 20% of the publications from 2021 and almost twice as many publications as in 2000.

After presenting and analyzing the publication and citation trend, we constructed Table 3, which presents the 10 most cited works in WOS.

Table 3.

The 10 most cited articles in the databases.

The article by Brock et al. (1992) garnered the highest number of local citations (235), followed by Fama and French (1993), with 154 citations. On the other hand, the article of Neely et al. (1997) received 83 citations, with the other papers cited between 119 and 97 times.

Brock et al. (1992) examined the predictive power of technical indicators, particularly moving averages, for the Dow Jones Index over a 90-year period from 1897 to 1986. Their study utilized bootstrap techniques and concluded that trading based on technical indicators yielded higher returns. Fama and French (1993) identified five common risk factors in stock and bond returns, including market factors, the company size, net worth, maturity, and the default risk. They found that these factors explain average stock and bond returns, with the exception of low-grade companies.

Lo et al. (2000) evaluated the effectiveness of technical analysis on the NASDAQ, NYSE, and AMEX indices from 1962 to 1996. They employed smoothing techniques and non-parametric regression to support technical trading patterns, concluding that technical patterns provide incremental information and can generate superior profits.

Jegadeesh and Titman (1993) analyzed 16 momentum strategies from 1965 to 1989 and found evidence of significant abnormal gains in the North American stock market. Their findings were corroborated by subsequent studies, such as those conducted by Fama and French (1996) and Jegadeesh and Titman (2001).

Sullivan et al. (1999) examined the predictive capacity of 26 technical trading rules using the daily closing price of the DJIA from 1897 to 1986. They found evidence that trading based on technical indicators led to superior performance, agreeing with the conclusion of Brock et al. (1992). Carhart (1997) studied the performance of stock mutual funds using performance measurement models, finding evidence consistent with market efficiency assumptions, despite interpretations of the size, book-to-market, and momentum factors.

Taylor and Allen (1992) conducted a questionnaire survey among foreign exchange brokers in London, finding evidence that 90% of respondents placed weight on technical analysis. The authors concluded that brokers tended to rely on technical analysis over fundamental analysis for shorter horizons.

Fama and French (1992) conducted a seminal study on the performance of value-on-growth stocks in the US exchanges, identifying inefficiencies in the Capital Asset Pricing Model (CAPM) and proposing alternative risk factors. Park and Irwin (2007) reviewed the profitability of technical analysis and found evidence of its predictive capacity in the foreign exchange and futures markets but not in the equity markets. They analyzed 95 studies, with 56 indicating positive results, 20 showing negative results, and 19 reporting mixed results.

Neely et al. (1997) used genetic programming techniques and technical indicators to analyze exchange rates. They found strong evidence of excessive returns, particularly in the dollar/German mark, suggesting that trading rules can detect patterns not captured by statistical models.

In summary, the studies presented here demonstrate that there is no clear dominance of one investment methodology over the other, highlighting the importance of considering various approaches in financial analysis.

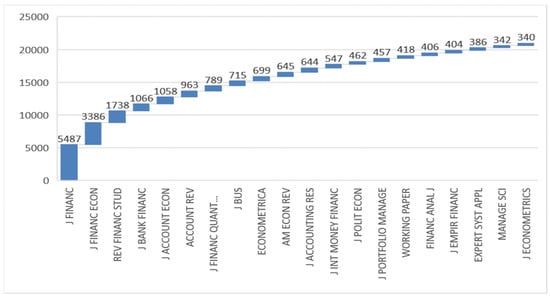

To analyze the relevance and importance of journals in this area, we present Figure 6, with an indication of the most-cited journals locally.

Figure 6.

Most locally cited sources.

As we can see, there are five journals with more than 1000 citations. The Journal of Finance is the most important publication in this area, followed by the Journal of Financial Economics.

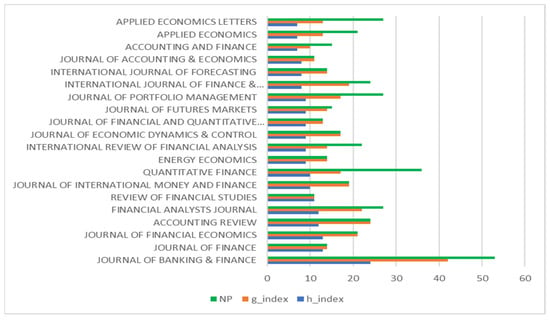

To analyze the performance of publications, Figure 7 presents the concentration of publications in specific journals, with their h-index and g-index as performance measures.

Figure 7.

The 20 journals with the most publications and performance.

Performance analysis involves several metrics to assess scholarly output. The primary indicators are the numbers of publications and citations. Publications reflect productivity, while citations measure impact and influence. Additional metrics include citations per publication and the h-index, which combine citations and publications to gauge performance. The h-index (h) represents the number of publications cited at least h times, reflecting influence. Conversely, the g-index (g) represents the number of publications that received at least g2 citations, indicating impact. These diverse measures offer valuable insights into a researcher’s academic contributions and research significance.

The Journal of Banking and Finance stands out, with 53 publications, with an h-index of 24 and a g-index of 42, proving to be the journal with the highest levels of contribution, influence, and impact. A total of 550 journals were involved in the selected articles, with the top 20 journals accounting for over 27% of the total publications. This concentration reflects the prominence of certain journals in the study area.

Several metrics exist for evaluating an author’s productivity and impact in their field. One of the most commonly used indicators of productivity is the number of publications an author has to their name, either per year or per research focus. Conversely, an author’s influence and reach can be gauged by the number of citations their work receives. Metrics such as citations per publication and the h-index amalgamate these elements, providing a comprehensive view of an author’s overall performance.

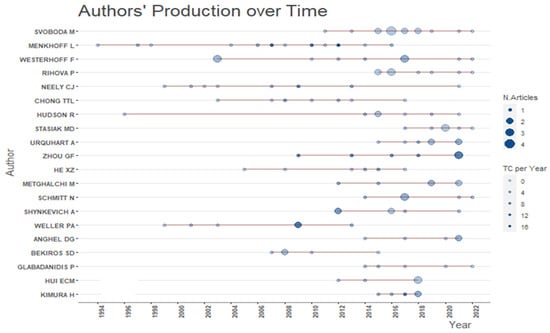

In Figure 8, we present the authors with the highest number of publications and their frequency over the time window under analysis.

Figure 8.

Authors’ productions over time.

According to Lotka’s Law or the Inverse Square Law, the top 20 authors with the highest number of publications in the field were identified. Svoboda leads, with 15 publications, followed by Menkhoff with 12. Four authors, namely Hudson, Menkhoff, Neely, and Westerhoff, have shown sustained interest in the field for over 20 years, as evident from their long publication records.

While productivity is one factor involved in assessing a researcher’s impact, it is crucial to consider factors such as usage and citations. The h-index, introduced by Hirsch (2005), measures a researcher’s academic quality and productivity by considering the balance between publications and citations. Another indicator, the g-index, proposed by Egghe (2006), accounts for the largest number of publications with a total citation count equal to or greater than g2. These indicators offer insights into researchers’ productivity and scholarly impact.

Table 4 provides a summary of the impact of the top 20 authors in the field.

Table 4.

The 20 most relevant authors.

It appears that the author with the greatest impact is Menkhoff, with an h-index of 7 and a g-index of 12, with 12 publications and a total of 744 citations on the WOS.

Of the authors in question, 11 have an h-index of 4, and the authors with the lowest impact have at least three papers published in this area and have a minimum of 3 citations each.

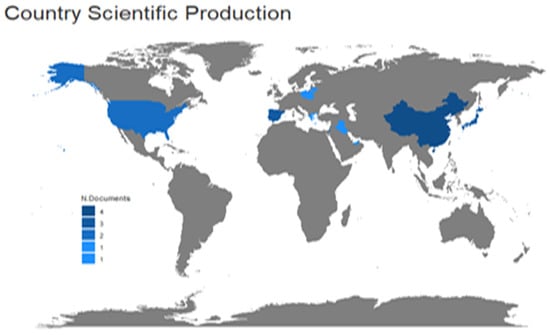

4.2. Geographic Distribution

At this point, the social and structural relationships between the different constituents of research, scientific production, countries, organizations, and the cooperation between them are presented and analyzed.

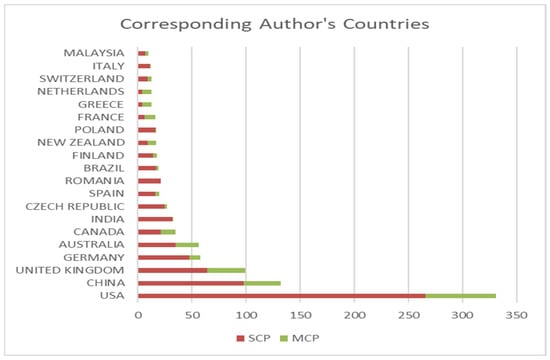

Figure 9 shows the 20 countries with the highest number of articles, with the country being identified according to the reference to the author’s affiliation.

Figure 9.

Countries with the most publications.

The country with the highest number of papers is the USA, followed at a distance by China. The publications are concentrated on North America (the United States and Canada), Europe (the United Kingdom, Germany, Czech Republic, Spain, Romania, Finland, Poland, France, Greece, Netherlands, Switzerland, and Italy), Asian countries (China, India, and Malaysia), followed by Oceania (Australia and New Zealand), and South America, with only Brazil featuring in the top 20 countries. This evidence shows that there is a scarcity of research in countries from Asia, South America, and Africa.

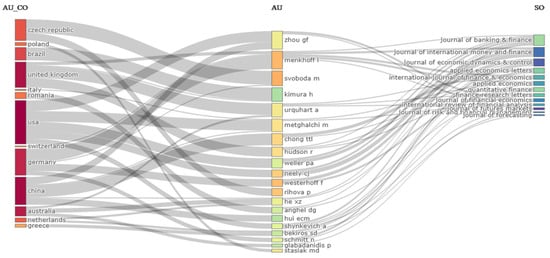

The three-field graph is a bibliometric analysis tool that provides a visual representation of the distribution of publication productivity, collaboration patterns, and publication impact in a specific field of study or scientific community (Koo 2021).

It allows for the identification of key actors in the scientific community and provides insights into the collaboration and publication behaviors of authors. The three-field graph illustrates the connections between influential authors, major countries, and high-impact journals, and is depicted in Figure 10.

Figure 10.

Three-field plots.

The data provided by this three-field graph can help scholars to identify key authors and their nationalities, manage research that can be used for collaboration, and target key journals.

The author from the Czech Republic who publishes the most is Svoboda, while the most prolific author from Brazil is Kimura, from the United Kingdom, it is Urquahart and Hudson, and, from the USA, it is Zou and Metghachi. The Chinese author with the most publications is Chong and the most prolific German author is Menkhoff. International research collaboration in original studies is shown in Figure 11.

Figure 11.

Countries with the most research and their collaborations.

The blue color represents the publication intensity of each country, reflecting their level of research output. Meanwhile, the thickness of the red line indicates the strength of collaborations based on frequency. Notably, the top 20 strongest collaborations were between the United States and several other countries, such as China (frequency = 36), the United Kingdom (frequency = 20), and Canada (frequency = 12). Additionally, collaborations between China and Australia (frequency = 12) and the United Kingdom (frequency = 11) were also prominent in the research landscape.

The strongest collaboration relationships found are between North America and Europe, followed by Asia. There is strong corporation between the countries of Oceania and Asia.

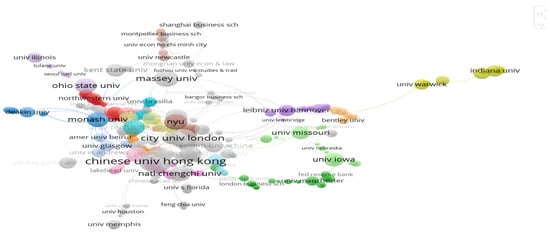

Regarding geographical distribution and the value of this study for bibliometric analysis, we present the relationships and collaboration between institutions, as represented in Figure 12.

Figure 12.

Relevance and collaboration between institutions.

There is a strong network of collaboration between authors from different institutions. The most relevant universities in research are the Chinese University of Hong Kong with 23 papers, Massey University, New Zealand, with 16 papers; for Europe, the most relevant is Erasmus University, Rotterdam, with 14 papers, while, for America, the most important are the Universities of Brasilia with 11 papers and Ohio State University and Texas University with 10 articles.

4.3. Scientific Mapping by Frequency

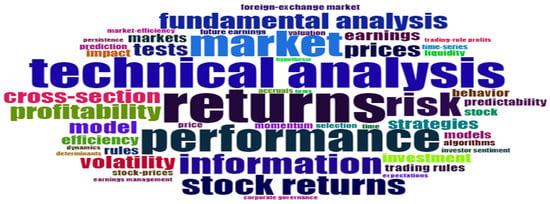

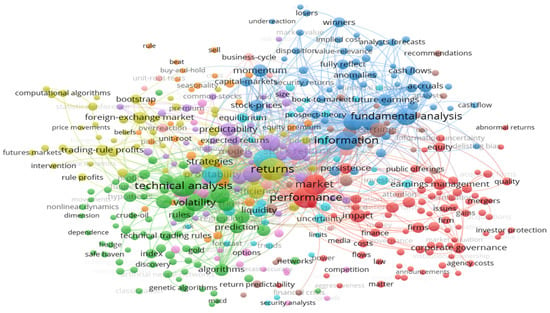

This study revolves around the examination of intellectual interactions and structural connections within the research area. Scientific mapping techniques, such as co-citation analysis, co-word analysis, and co-authorship analysis, are utilized for this purpose. Figure 13 visually presents the 50 most commonly used words, and Figure 14 presents their co-occurrences, with a frequency ≥ 5 co-occurrences, providing valuable insights into the research landscape (Zhu and Liu 2020; Zhao and Li 2023).

Figure 13.

Word cloud.

Figure 14.

Keyword co-occurrences.

The word cloud analysis provides an overview of the main research focuses, with the most prominent words being “return”, emerging as the most frequently used keyword, followed by “technical analysis”, “performance”, and “market”. Although technical and fundamental analyses are two popular techniques for predicting future asset prices, the expression “technical analysis” is more commonly used as a keyword than “fundamental analysis”. It is noteworthy that the word “Ichimoku” is not visible in the word cloud, indicating a gap in the literature regarding this term; therefore, this suggests a future avenue of research.

A co-occurrence network analysis was carried out using VOSviewer, analyzing the top 250 words plus keywords derived from the keywords extracted from 1710 documents and using Bradford’s law zones. The network analysis provides several clusters in the network, represented by distinct colors, with a frequency ≥ 5 in the keyword clustering. The size of the circular node on the map is proportional to the frequency of the Keyword Plus, and the distance and thickness of the lines between the words indicate the strength of their relationship, while the overall distance between the keywords reflects their correlation; generally, a smaller distance between two keywords implies a stronger relationship between them. The color of the node shows the cluster with which the keyword is associated. Each cluster belongs to a research theme represented by the keywords and their links.

The red cluster comprises frequently occurring terms such as technical analysis, profitability, and model. The green cluster revolves around terms such as technical analysis, volatility, technical trading rules, and prediction. In contrast, the blue cluster is associated with terms that are more strongly aligned with fundamental analysis. The remaining clusters consist of terms employed by authors utilizing various price forecasting methodologies.

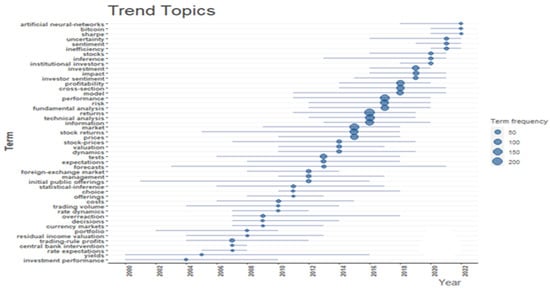

These analyses enable researchers to identify crucial concepts, observe trends, and uncover interconnections within the literature. Such insights support a comprehensive understanding of the main research themes and aid in defining future investigation directions. Figure 15 displays the evolution of the trends of terms over time.

Figure 15.

Trend topics.

From 2003 onwards, a critical mass of existing articles allowed for the identification of keywords with a minimum frequency. The prominence of specific keywords became evident in 2015, with terms such as “information” and “market” gaining significance. In 2016, the most frequently used keywords in the entire sample were “returns”, “technical analysis”, and “fundamental analysis”.

By 2020, keywords related to behavioral finance, such as “sentiment”, also became prevalent. In 2022, trending topics included terms such as “bitcoin” and “artificial neural networks”.

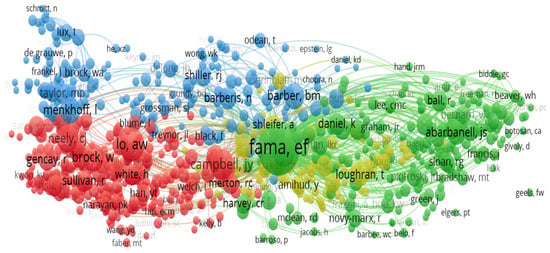

Co-citation analysis is a technique used to map the intellectual structure of a research field by identifying publications that are frequently cited together, indicating thematic similarity. By examining the co-occurrence of publications in the reference lists of other papers, co-citation analysis helps uncover underlying themes and provides insight into the research field. This analysis not only helps us to identify influential publications but also reveals topical groups within the field. Figure 16 illustrates the co-citation network.

Figure 16.

Co-citation network.

An analysis of the co-citation map allows for the identification of four clusters with a strong correlation with each other, using a frequency of m ≥ 3 for the construction of the clusters (Aria and Coccurullo 2017; Zhao and Li 2023). The red cluster, with 295 items, comprises the authors who investigate technical analysis, and the green cluster, with 202 items, shows the relationship between scholars of fundamentalist analysis. The blue cluster, on the other hand, shows the relationship between authors who, by various means, compare technical and fundamental analysis. The purple cluster represents the relationship between authors who defend the use of both methodologies as complementary.

4.4. Ichimoku Analysis

The papers were subsequently analyzed based on each of the clusters formed and on Ichimoku dynamics, which, due to the existing number of publications found in the WOS database (17 papers), did not show sufficient relevance for the formation of a cluster. Table 5 shows the works published by year, with 2022 being the year with the highest number of publications (6 papers).

Table 5.

Ichimoku papers in WOS.

Figure 17 shows that the countries with the most research are China, Japan, and some European countries, followed by the USA.

Figure 17.

Countries with the most Ichimoku-related papers.

The analysis of Figure 13 reveals that China, Japan, Portugal, and Spain have shown the highest research activity in the field of Ichimoku dynamics, followed by the United States. These regions have made significant contributions to advancing the understanding of Ichimoku dynamics on a global scale. In light of the limited research on Ichimoku dynamics, a comprehensive review of published works was conducted, yielding relevant conclusions.

5. Discussion

The growing trend in annual publications about technical analysis, fundamental analysis, and Ichimoku dynamics, especially from 2000, reflects the significance of these topics.

Focusing on the most commonly cited works, Brock et al. (1992) examined the predictive power of technical indicators, particularly moving averages, for the Dow Jones Index over a 90-year period from 1897 to 1986. Their study utilized bootstrap techniques and concluded that trading based on technical indicators yielded higher returns. Fama and French (1993) identified five common risk factors in stock and bond returns, including market factors, the company size, net worth, maturity, and the default risk. They found that these factors explain average stock and bond returns, with the exception of low-grade companies.

Lo et al. (2000) evaluated the effectiveness of technical analysis for the NASDAQ, NYSE, and AMEX indices from 1962 to 1996. They employed smoothing techniques and non-parametric regression to support technical trading patterns, concluding that technical patterns provide incremental information and can generate superior profits.

Jegadeesh and Titman (1993) analyzed 16 momentum strategies from 1965 to 1989 and found evidence of significant abnormal gains in the North American stock market. Their findings were corroborated by subsequent studies, such as those conducted by Fama and French (1996) and Jegadeesh and Titman (2001).

Sullivan et al. (1999) examined the predictive capacity of 26 technical trading rules using the daily closing price of the DJIA from 1897 to 1986. They found evidence that trading based on technical indicators led to superior performance, a conclusion in line with that of Brock et al. (1992). Carhart (1997) studied the performance of stock mutual funds using performance measurement models, finding evidence consistent with market efficiency assumptions, despite the interpretations of size, book-to-market, and momentum factors.

Taylor and Allen (1992) conducted a questionnaire survey among foreign exchange brokers in London, finding evidence that 90% of respondents placed weight on technical analysis. The authors concluded that brokers tended to rely on technical analysis over fundamental analysis for shorter horizons.

Fama and French (1992) conducted a seminal study on the performance of value-on-growth stocks in the US exchanges, identifying inefficiencies in the Capital Asset Pricing Model (CAPM) and proposing alternative risk factors. Park and Irwin (2007) reviewed the profitability of technical analysis and found evidence of its predictive capacity in the foreign exchange and futures markets but not in the equity markets. They analyzed 95 studies, with 56 indicating positive results, 20 showing negative results, and 19 reporting mixed results.

Neely et al. (1997) employed genetic programming techniques and technical indicators to analyze exchange rates. They found strong evidence of excessive returns, particularly in the dollar/German mark, suggesting that trading rules can detect patterns not captured by statistical models.

In summary, the studies presented here demonstrate that there is no clear dominance of one investment methodology over the other, highlighting the importance of considering various approaches in financial analysis.

Based on the countries with the most publications, there is evidence that the publications are concentrated in North America (the United States and Canada), Europe (the United Kingdom, Germany, Czech Republic, Spain, Romania, Finland, Poland, France, Greece, Netherlands, Switzerland, and Italy), and Asian countries (China, India, and Malaysia), followed by Oceania (Australia and New Zealand) and South America, with only Brazil featuring in the top 20 countries. This evidence shows that there is a lack of research in countries from Asia, South America, and Africa.

The evidence that the word “Ichimoku” is not visible in the word cloud analysis suggests that there is a gap in the literature regarding this subject, showing a future avenue for research.

Regarding the trends of the terms researched during the sample period, the prominence of keywords evolves from “information” and “market” in 2015 to “returns”, “technical analysis”, and “fundamental analysis” in 2016. In 2020, keywords related to behavioral finance, such as “sentiment”, became prevalent (Anamika et al. 2021; Jha et al. 2021; Feldman and Liu 2023; Almeida 2023), which shows a research interest in the way that human behavior affects the decision-making processes of investors. More recently, by 2022, trending topics included expressions such as “bitcoin”, (Dias et al. 2022; Wang et al. 2022; Wen et al. 2022; Liu et al. 2022; Benlagha and Hemrit 2023) and “artificial neural networks” (Şengüler and Mehmet 2022; Nametala et al. 2023), reflecting the trending research topics and suggesting potential areas for future investigation.

Among the three approaches analyzed in this bibliometric analysis, the most recent one is Ichimoku dynamics. Although there is limited research on this subject, we offer a comprehensive review of the relevant published works that yield relevant conclusions.

Deng and Sakurai (2014) conducted a comparison between the profitability of the Ichimoku method and the buy-and-hold strategy within the forex market. They discovered that, on average, trading strategies based on Ichimoku outperformed the buy-and-hold approach. Shawn et al. (2015) investigated the profitability of Ichimoku signals when applied to individual stocks in Japan and the US. They concluded that Ichimoku charts possessed predictive capabilities and generated profitable trade signals in these markets. In contrast, Bąk (2017) examined the Ichimoku technique’s predictive capacity for forecasting changes in GDP dynamics in Poland. The research did not find that the Ichimoku system had any substantial predictive capability in anticipating changes in the nation’s GDP dynamics.

Fafuła and Drelczuk (2015), in contrast, concluded that the Ichimoku methodology was ineffective for previously winning stocks in the Warsaw Stock Exchange. Other studies by Deng et al. (2023), Almeida (2020, 2022), Lutey and Rayome (2022), and Che-Ngoc et al. (2022) confirmed the predictive capabilities of Ichimoku in various financial markets, including Chinese crude oil futures, FAANG companies, and the stock market during the COVID-19 pandemic.

Gurrib et al. (2020) examined the predictive ability of Ichimoku regarding energy prices, and Deng et al. (2021) explored its use in the forex market, with both studies confirming its effectiveness, especially when combined with algorithmic trading. Overall, the reviewed studies support the notion that the Ichimoku trading technique possesses predictive capabilities in different financial markets.

However, its effectiveness may vary depending on market specificity, its combination with other approaches, and the specific assets being analyzed. These findings provide valuable insights for researchers and practitioners who are interested in utilizing the Ichimoku method for trading purposes.

6. Conclusions

This research applied a bibliometric evaluation to 1710 articles from 1990 to 2023 using the WOS database, focusing on technical and fundamental analysis, along with Ichimoku. The results, addressing the research queries, indicated a trend of publication growth. Rising interest in this domain was seen, with the Journal of Finance being pivotal among the 550 journals analyzed. The study of Brock et al. (1992) stood out with the most citations in the WOS database.

From 3320 identified authors, Svoboda and Menkhoff were prominent, particularly Menkhoff, showing extensive impact via the h-index and the g-index. These metrics underscore the significance of works within academia, guiding researchers and institutions in literature reviews and impact evaluations. The US and China led in publishing on the analyzed topics, highlighting significant cross-country collaborations. Keywords such as “feedback” and “technical analysis” were dominant, with increasing attention to terms including “bitcoin” and “artificial neural networks”.

Finally, the study used word cloud, co-occurrence, and word frequency analyses to provide an overview of key terms and trends. This aids in understanding the connections in the literature, helping to establish future research directions. Regarding Ichimoku, the study concluded that there is a limited number of investigations, and academic researchers have yet to show substantial interest in the topic. However, recent years have seen a modest growth trend. Authors who have studied Ichimoku have found compelling evidence of its applicability to stocks, forex, and commodities, yielding excellent results.

The research indicates that this field forms part of an expanding body of literature on the use of advanced computer-based methods and techniques in financial and accounting research. It also highlights the growing interest in and relevance of the areas of behavioral finance, specifically regarding investigations of market reactions triggered by investor sentiment (Jha et al. 2021; Feldman and Liu 2023). Furthermore, the research has extended into the fields of cryptocurrencies and artificial neural networks (Liu et al. 2022; Nametala et al. 2023; Benlagha and Hemrit 2023).

6.1. Limitations

This study has some limitations. First, the method used in this study, bibliometric analysis, can be seen as a heuristic method. Second, we only use the WOS as a bibliographic digital database to collect the sample of documents. Finally, we are concerned about the limited search results found for Ichimoku dynamics.

6.2. Suggestions for Future Research

For future research, we suggest that researchers include the Scopus database to explore new potential research trends and expand the field of knowledge. Based on the trend evolution of the relevant research, we think it will be important to include in this research the concepts of society 5.0 and artificial intelligence. The recent development of technology and artificial intelligence will have some influence on technical analysis, fundamental analysis, and Ichimoku dynamics.

Author Contributions

Conceptualization, L.A. and E.V.; Methodology, L.A. and E.V.; Writing—original draft, L.A. and E.V.; Writing—review & editing, L.A. and E.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that served as the basis for the investigation were taken from the WOS database and analyzed by the econometric program R and VOSviewer.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmar, Ansari Saleh. 2017. Sutte Indicator: A technical indicator in stock market. Journal of Economics and Financial 7: 223–26. [Google Scholar]

- Ahmed, Anwer S., and Irfan Safdar. 2018. Dissecting stock price momentum using financial statement analysis. Journal Accounting and Finance 58: 3–43. [Google Scholar] [CrossRef]

- Alhashel, Bader S., Fahad W. Almudhaf, and J. Andrew Hansz. 2018. Can technical analysis generate superior returns in securitized property markets? Evidence from East Asia markets. Pacific-Basin Finance Journal 47: 92–108. [Google Scholar] [CrossRef]

- Almeida, Luís A. 2020. Technical indicators for rational investing in the technology companies: The evidence of FAANG stocks. Jurnal Pengurusan 59: 75–87. [Google Scholar] [CrossRef]

- Almeida, Luís A. G. 2022. Será a dinâmica Ichimoku eficiente? Uma evidência nos mercados de ações. Innovar 32: 41–56. [Google Scholar] [CrossRef]

- Almeida, Luís A. G. 2023. Risk and Bankruptcy Research: Mapping the State of the Art. Journal of Risk and Financial Management 16: 361. [Google Scholar] [CrossRef]

- Anamika, Kulbhaskar K., Madhumita Chakraborty, and S. Sowmya Subramaniam. 2021. Does sentiment impact cryptocurrency? Journal of Behavioral Finance 24: 1950723. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Coccurullo. 2017. Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Arslan, Hafiz Muhammad, Ye Chengang, Bilal Muhammad Siddique, and Yusra Yahya. 2022. Influence of senior executives characteristics on Corporate Environmental Disclosures: A bibliometric analysis. Journal of Risk Financial Management 15: 136. [Google Scholar] [CrossRef]

- Bąk, Tomasz. 2017. Sygnały inwestycyjne na rynku polskich akcji generowane przez technikę Ichimoku na tle zmian PKB. Annales Universitatis Mariae Curie-Skłodowska, Sectio H–Oeconomia 51: 19. [Google Scholar] [CrossRef][Green Version]

- Bansal, Sanchita, Isha Garg, Mansi Jain, and Anshita Yadav. 2023. Improving the performance/competency of small and medium enterprises through intellectual capital. Journal of Intellectual Capital 24: 830–53. [Google Scholar] [CrossRef]

- Bazán-Palomino, Walter, and Daniel Svogun. 2023. On the drivers of technical analysis profits in cryptocurrency markets: A Distributed Lag approach. International Review of Financial Analysis 86: 102516. [Google Scholar] [CrossRef]

- Benlagha, Noureddine, and Wael Hemrit. 2023. Asymmetric determinants of Bitcoin’s wild price movements. Managerial Finance 49: 227–47. [Google Scholar] [CrossRef]

- Bhattacharjee, Subhradip, Amitava Panja, Moumita Panda, Subham Dutta, Susanta Dutta, Rakesh Kumar, Dinesh Kumar, Malu Ram Yadav, Tatiana Minkina, Valery P. Kalinitchenko, and et al. 2023. How Did Research on Conservation Agriculture Evolve over the Years? A Bibliometric Analysis. Sustainability 15: 2040. [Google Scholar] [CrossRef]

- Blume, Lawrence, David Easley, and Maureen O’Hara. 1994. Market statistics and technical analysis: The role of volume. Journal of Finance 49: 153–81. [Google Scholar] [CrossRef]

- Brock, William, Josef Lakonishok, and Blake LeBaron. 1992. Simple technical trading rules and the stochastic properties of stock returns. Journal Finance 47: 1731–64. [Google Scholar] [CrossRef]

- Brown, Stephen J., William N. Goetzmann, and Alok Kumar. 1998. The Dow theory: William Peter Hamilton’s track record reconsidered. Journal of Finance 53: 1311–33. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On persistence in mutual fund performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Che-Ngoc, Ha, Nga Do-Thi, and Thao Nguyen-Trang. 2022. Profitability of Ichimoku-based trading rule in Vietnam stock market in the context of the COVID-19 outbreak. Computational Economics, 1–19. [Google Scholar] [CrossRef]

- Cohen, Gil, and Elinor Cabiri. 2015. Can technical oscillators outperform the BandH strategy? Applied Economics 47: 3189–97. [Google Scholar] [CrossRef]

- Corbet, Shaen, Veysel Eraslan, Brian Lucey, and Ahmet Sensoy. 2019. The effectiveness of technical trading rules in cryptocurrency markets. Finance Research Letters 31: 32–37. [Google Scholar] [CrossRef]

- Cowles, Alfred. 1933. Can stock market forecasters forecast? Econometrica Journal of the Econometric Society 1: 309–24. [Google Scholar] [CrossRef]

- Deb, Pragyan, Davide Furceri, Jonathan D. Ostry, and Nour Tawk. 2022. The economic effects of COVID-19 containment measures. Open Economies Review 33: 1–32. [Google Scholar] [CrossRef]

- Deng, Shangkun, and Akito Sakurai. 2014. Short-term foreign exchange rate trading based on the support/resistance level of Ichimoku Kinkohyo. Paper presented at Information Science, Electronics and Electrical Engineering (ISEEE), Sapporo, Japan, April 26–28, vol. 1, pp. 337–40. [Google Scholar] [CrossRef]

- Deng, Shangkun, Chongyi Xiao, Yingke Zhu, Jingyuan Peng, Jie Li, and Zonghua Liu. 2023. High-frequency direction forecasting and simulation trading of the crude oil futures using Ichimoku KinkoHyo and Fuzzy Rough Set. Expert Systems with Applications 215: 119326. [Google Scholar] [CrossRef]

- Deng, Shangkun, Haoran Yu, Chenyang Wei, Tianxiang Yang, and Shimada Tatsuro. 2021. The profitability of Ichimoku Kinkohyo based trading rules in stock markets and FX markets. International Journal of Finance and Economics 26: 5321–36. [Google Scholar] [CrossRef]

- Dias, Ishanka K., Jayasuriya M. R. Fernando, and Narada D. Fernando. 2022. Does investor sentiment predict bitcoin return and volatility? A quantile regression approach. International Review of Financial Analysis 84: 102383. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Egghe, Leo. 2006. Theory and practice of the g-index. Scientometrics 69: 131–52. [Google Scholar] [CrossRef]

- Elliott, Nicole. 2007. Ichimoku Charts: An Introduction to Ichimoku Kinko Clouds. Hampshire: Harriman House Limited. [Google Scholar]

- Eugster, Patrick, and Mathias W. Uhl. 2022. Technical analysis: Novel insights on contrarian trading. European Financial Management, 1–31. [Google Scholar] [CrossRef]

- Fafuła, Aleksander, and Krzysztof Drelczuk. 2015. Buying stock market winners on Warsaw Stock Exchange-quantitative backtests of a short term trend following strategy. Paper presented at Computer Science and Information Systems, Lodz, Poland, September 13–16; pp. 1361–66. [Google Scholar]

- Fama, Eugene F. 1970. Efficient capital markets: A review of theory and empirical work. Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1992. The cross-section of expected stock returns. The Journal of Finance 47: 427–65. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Marshall E. Blume. 1966. Filter rules and stock-market trading. The Journal of Business 39: 226–41. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1996. Multifactor explanations of asset pricing anomalies. Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Feldman, Todd, and Shuming Liu. 2023. A new behavioral finance mean variance framework. Review of Behavioral Finance 15: 355–70. [Google Scholar] [CrossRef]

- Gerritsen, Dirk F., Elie Bouri, Ehsan Ramezanifar, and David Roubaud. 2020. The profitability of technical trading rules in the Bitcoin market. Finance Research Letters 34: 101263. [Google Scholar] [CrossRef]

- Ghosh, Pushpendu, Ariel Neufeld, and Jajati Keshari Sahoo. 2022. Forecasting directional movements of stock prices for intraday trading using LSTM and random forests. Finance Research Letters 46: 102280. [Google Scholar] [CrossRef]

- Goutte, Stéphane, Hoang-Viet Le, Fei Liu, and Hans-Jörg von Mettenheim. 2023. Deep learning and technical analysis in cryptocurrency market. Finance Research Letters 54: 103809. [Google Scholar] [CrossRef]

- Gradojevic, Nikola, Dragan Kukolj, Robert Adcock, and Vladimir Djakovic. 2023. Forecasting Bitcoin with technical analysis: A not-so-random forest? International Journal of Forecasting 39: 1–17. [Google Scholar] [CrossRef]

- Graham, Benjamin, and David Dodd. 1934. Security Analysis. New York: McGraw-Hill. [Google Scholar]

- Gurrib, Ikhlaas, Firuz Kamalov, and Elgilani E. Elshareif. 2020. Can the leading US energy stock prices be predicted using Ichimoku clouds? Gurrib I: 41–51. [Google Scholar] [CrossRef]

- Hanauer, Matthias X., Marina Kononova, and Marc Steffen Rapp. 2022. Boosting agnostic fundamental analysis: Using machine learning to identify mispricing in European stock markets. Finance Research Letters 48: 102856. [Google Scholar] [CrossRef]

- Hirsch, Jorge E. 2005. An index to quantify an individual’s scientific research output. Proceedings of the National Academy of Sciences USA 102: 16569–72. [Google Scholar] [CrossRef]

- Hou, Kewei, Chen Xue, and Lu Zhang. 2015. Digesting anomalies: An investment approach. The Review of Financial Studies 28: 650–705. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance 48: 65–91. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 2001. Profitability of momentum strategies: An evaluation of alternative explanations. Journal of Finance 56: 699–720. [Google Scholar] [CrossRef]

- Jha, Manish, Hongyi Liu, and Asaf Manela. 2021. Natural disaster effects on popular sentiment toward finance. Journal of Financial and Quantitative Analysis 56: 2584–604. [Google Scholar] [CrossRef]

- Koo, Malcolm. 2021. Systemic lupus erythematosus research: A bibliometric analysis over a 50-year period. International Journal of Environmental Research and Public Health 18: 7095. [Google Scholar] [CrossRef] [PubMed]

- Kemeç, Abidin, and Ayşenur T. Altınay. 2023. Sustainable Energy Research Trend: A Bibliometric Analysis Using VOSviewer, RStudio Bibliometrix, and CiteSpace Software Tools. Sustainability 15: 3618. [Google Scholar] [CrossRef]

- Kushairi, Norliza, and Aidi Ahmi. 2021. Flipped classroom in the second decade of the Millenia: A bibliometrics analysis with Lotka’s law. Education and Information Technologies 26: 4401–31. [Google Scholar] [CrossRef]

- Lin, Zhe. 2018. Modelling and forecasting the stock market volatility of SSE composite index using GARCH models. Future Generation Computer Systems 79: 960–72. [Google Scholar] [CrossRef]

- Liu, Tianquan, Yiming Wang, and Yu Yan. 2022. Underreaction and overreaction in Bitcoin market. Applied Economics Letters 30: 1685–91. [Google Scholar] [CrossRef]

- Lo, Andrew W., Harry Mamaysky, and Jiang Wang. 2000. Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. Journal of Finance 55: 1705–65. [Google Scholar] [CrossRef]

- Lutey, Matthew, and Dave Rayome. 2022. Ichimoku Cloud Forecasting Returns in the US. Global Business and Finance Review 27: 17. [Google Scholar] [CrossRef]

- Mandelbrot, Benoit. 1963. The variation of certain speculative prices. The Journal of Business 36: 394–419. [Google Scholar] [CrossRef]

- Menkhoff, Lukas. 2010. The use of technical analysis by fund managers: International evidence. Journal of Banking and Finance 34: 2573–86. [Google Scholar] [CrossRef]

- Metghalchi, Massoud, Massomeh Hajilee, and Linda A. Hayes. 2019. Return predictability and market efficiency: Evidence from the Bulgarian stock market. Eastern European Economics 57: 251–68. [Google Scholar] [CrossRef]

- Murphy, Kevin J. 1999. Executive compensation. Handbook of Labor Economics 3: 2485–563. [Google Scholar] [CrossRef]

- Nametala, Ciniro A. L., Jonas Villela de Souza, Alexandre Pimenta, and Eduardo Gontijo Carrano. 2023. Use of econometric predictors and artificial neural networks for the construction of stock market investment bots. Computational Economics 61: 743–73. [Google Scholar] [CrossRef]

- Neely, Christopher J., Paul A. Weller, and Robert D. Dittmar. 1997. Is technical analysis in the foreign exchange market profitable? A genetic programming approach. Journal of Financial and Quantitative Analysis 32: 405–26. [Google Scholar] [CrossRef]

- Nor, Safwan M., and Guneratne B. Wickremasinghe. 2017. Market efficiency and technical analysis uring different market phases: Further evidence from Malaysia. Investment Management and Financial Innovations 14: 359–66. [Google Scholar]

- Nti, Isaac K., Adebayo F. Adekoya, and Benjamin A. Weyori. 2020. A systematic review of fundamental and technical analysis of stock market predictions. Artificial Intelligence Review 53: 3007–57. [Google Scholar] [CrossRef]

- Park, Cheol-Ho, and Scott H. Irwin. 2007. What do we knowabout the profitability of technical analysis? Journal of Economic Surveys 21: 786–826. [Google Scholar] [CrossRef]

- Pätäri, Eero, and Mika Vilska. 2014. Performance of moving average trading strategies over varying stock market conditions: The Finnish evidence. Applied Economics 46: 2851–72. [Google Scholar] [CrossRef]

- Rosillo, Rafael, David De la Fuente, and José A. Lopez Brugos. 2013. Technical analysis and the Spanish stock exchange: Testing the RSI, MACD, momentum and stochastic rules using Spanish market companies. Applied Economics 45: 1541–50. [Google Scholar] [CrossRef]

- Rubi, Maksuda A., Shanjida Chowdhury, Abdul A. A. Rahman, Abdelrhman Meero, Nurul M. Zayed, and Anwarul Islam. 2022. Fitting Multi-Layer Feed Forward Neural Network and Autoregressive Integrated Moving Average for Dhaka Stock Exchange Price Predicting. Emerging Science Journal 6: 1046–61. [Google Scholar] [CrossRef]

- Şengüler, Hasan, and İnel Mehmet. 2022. Finansal Verilere Dayalı Marka Değeri Belirlemeye Yönelik Yapay Zekâ Temelli Ampirik Bir Çalışma. Sosyoekonomi 30: 395–424. [Google Scholar] [CrossRef]

- Shawn, Lim K. J., Selin Yanyali, and Joseph Savidge. 2015. Do Ichimoku Cloud Charts Work and Do They Work Better in Japan? International Federation of Technical Analysts Journal 16: 18–24. [Google Scholar]

- Sullivan, Ryan, Allan Timmermann, and Halbert White. 1999. Data snooping, technical trading rule performance, and the bootstrap. Journal of Finance 54: 1647–91. [Google Scholar] [CrossRef]

- Tao, Laifa, Tong Zhang, Di Peng, Jie Hao, Yuan Jia, Chen Lu, Yu Ding, and Liang Ma. 2021. Long-term degradation prediction and assessment with heteroscedasticity telemetry data based on GRU-GARCH and MD hybrid method: An application for satellite. Aerospace Science and Technology 115: 106826. [Google Scholar] [CrossRef]

- Taylor, Mark P., and Helen Allen. 1992. The use of technical analysis in the foreign exchange market. Journal of International Money and Finance 11: 304–14. [Google Scholar] [CrossRef]

- Van Horne, James C., and George G. C. Parker. 1967. The random walk theory: An empirical test. Financial Analyst Journal 23: 87–92. [Google Scholar] [CrossRef]

- Walkshäusl, Christian. 2019. The fundamentals of momentum investing: European evidence on understanding momentum through fundamentals. Accounting and Finance 59 Suppl. S1: 831–57. [Google Scholar] [CrossRef]

- Wang, Feifei, Xuemin Sterling Yan, and Lingling Zheng. 2023. Do sophisticated investors follow fundamental analysis strategies? Evidence from hedge funds and mutual funds. Review of Accounting Studies 2: 1–50. [Google Scholar] [CrossRef]

- Wang, Jying-Nan, Hung-Chun Liu, Jiangze Du, and Yuan-Teng Hsu. 2019. Economic benefits of technical analysis in portfolio management: Evidence from global stock markets. International Journal of Finance and Economics 24: 890–902. [Google Scholar] [CrossRef]

- Wang, Jiqian, Feng Ma, Elie Bouri, and Yangli Guo. 2022. Which factors drive Bitcoin volatility: Macroeconomic, technical, or both? Journal of Forecasting 42: 970–88. [Google Scholar] [CrossRef]

- Wen, Zhuzhu, Elie Bouri, Yahua Xu, and Yang Zhao. 2022. Intraday return predictability in the cryptocurrency markets: Momentum, reversal, or both. The North American Journal of Economics and Finance 62: 101733. [Google Scholar] [CrossRef]

- Yan, Xuemin, and Lingling Zheng. 2017. Fundamental analysis and the cross-section of stock returns: A data-mining approach. Review of Financial Studies 30: 1382–423. [Google Scholar] [CrossRef]

- Yu, Zhimin. 2023. Cross-Section of Returns, Predictors Credibility, and Method Issues. Journal of Risk and Financial Management 16: 34. [Google Scholar] [CrossRef]

- Zhang, Wengang, Chongzhi Wu, Haiyi Zhong, Yongqin Li, and Lin Wang. 2021. Prediction of undrained shear strength using extreme gradient boosting and random forest based on Bayesian optimization. Geoscience Frontiers 12: 469–77. [Google Scholar] [CrossRef]

- Zhao, Jing Yi, and Min Li. 2023. Worldwide trends in prediabetes from 1985 to 2022: A bibliometric analysis using bibliometrix R-tool. Frontiers in Public Health 11: 1072521. [Google Scholar] [CrossRef]

- Zhu, Junwen, and Weishu Liu. 2020. A tale of two databases: The use of Web of Science and Scopus in academic papers. Scientometrics 123: 321–35. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).