1. Introduction

Nonfungible Token (NFT) coins are a distinct category of cryptocurrencies that are integral to the NFT economy, governing initial coin offerings, transaction validations, and platform alterations, alongside facilitating NFT trade. The NFT coin MANA, for example, is used to conduct transactions in the Decentraland virtual world. There are multiple studies looking at the dynamic relationship between NFT coins and stocks, bonds, oil, and gold (

Corbet et al. 2018;

Aharon and Demir 2022;

Ko et al. 2022;

Umar et al. 2022a;

Yousaf and Yarovaya 2022a;

Urom et al. 2022), as well as the relationship between NFTs and other cryptocurrencies (

Dowling 2022;

Corbet et al. 2022;

Karim et al. 2022;

Maouchi et al. 2022;

Vidal-Tomás 2022;

Urom et al. 2022;

Yousaf and Yarovaya 2022b;

Qiao et al. 2023). These studies commonly reveal that NFT pricing dynamics vary across time, and that connectedness between NFTs and other assets increased during the COVID-19 pandemic. NFT coins enjoyed a marked price increase in 2021 due to their endorsement by celebrities and corporations (

Hawkins 2022). However, the initial fervor surrounding NFTs quickly faded, and by mid-2022, both NFT marketplaces and coin activity dwindled due to increased interest rates and the easing of COVID restrictions. This sell-off, paralleling a broader downturn in the crypto market, has been dubbed the “crypto winter” (

OECD 2022).

While there has been some research looking at the usefulness of NFT coins to diversify, hedge, or otherwise act as safe havens for other assets (

Ko and Lee 2023;

Zhang et al. 2022;

Umar et al. 2023), much less is known about how a holder of NFT coins can diversify or hedge their position. Key players in the NFT space, from content creators and traders to investors, venture capitalists, and governance actors, necessitate a comprehensive understanding of diversification strategies, hedging techniques, and safe havens for optimal risk management in this emergent asset class. Given the steep decline in the value of NFT coins witnessed in 2022, the study of these risk management strategies has become not only significant but also exceedingly timely and critical. This research addresses this vital knowledge gap, providing actionable insights for NFT coin holders navigating the rapidly evolving NFT economy.

The purpose of this research was to study the effectiveness of the major S&P 500 industry sectors in mitigating the risk associated with investments in NFT coins. Four NFT coins have been studied: Enjin coin (ENJ), MANA, Theta coin (THETA), and the Tezos coin (XTZ). These coins have a large market capitalization and are widely traded. ETFs representing the major S&P 500 sectors have been used in the analysis. The empirical methodology followed that of

Bouri et al. (

2017). Dynamic conditional correlation GARCH models were used to estimate the dynamic conditional correlations between the NFT coins and US industry sector ETFs. Then, a regression was used, in order to estimate the impact of NFT return quantiles on the DCC values. Several important findings have emerged from this research; in the pre-COVID period, seven out of eleven sectors offered diversification benefits. In the COVID period, all sectors provided diversification benefits. There was little evidence that S&P 500 sectors provided good hedges. In many cases, the sector indices were weak safe havens. A two-asset portfolio analysis indicated that, based on the Sharpe ratio, the optimal weighting of an NFT coin was between 10% and 30%.

The paper has been organized as follows:

Section 2 provides a brief review of the literature, shedding light on both existing knowledge and gaps in knowledge of NFT coins and risk management strategies;

Section 3 introduces the chosen methods, detailing the empirical approach, based on the framework of

Bouri et al. (

2017), as well as the utilization of dynamic conditional correlation GARCH models and regression models;

Section 4 provides an in-depth look at the data used, including specifics about the selected NFT coins and S&P 500 sector ETFs; results have been presented in

Section 5; a discussion of the results (as well as potential avenues for future research) is provided in

Section 6; we then conclude with key findings and implications.

2. Background Literature

In the literature, there is relatively little research looking at NFTs and diversification.

Aharon and Demir (

2022) found that NFTs generally had weak correlations with traditional asset classes, except for Ethereum, which had a slightly stronger correlation with NFTs, especially during the COVID-19 period. NFTs can provide diversification potential, as they have relatively low connectivity during normal times, but during turbulent periods like COVID-19, they act as net absorbers of systemic risk.

Dowling (

2022) found that NFT pricing seemed quite distinct from cryptocurrency pricing in terms of volatility transmission, suggesting that NFTs could be a low-correlation asset class. There was little spillover between NFT markets (unlike cryptocurrencies and stock markets, which tended to have high spillover effects among their individual markets).

Karim et al. (

2022) found that blockchain markets (and NFTs, in particular) offered considerable risk-mitigation avenues for investors and financial markets. There were significant risk spillovers between blockchain markets with strong disconnection of NFTs. Time-varying features characterized various uneven economic circumstances in blockchain markets.

NFTs revealed a higher diversification potential against Decentralized Finance (DeFi)—a financial system built on decentralized blockchain platforms—and Cryptocurrencies (Cryptos), pointing towards beneficial investing features in blockchain markets for policymakers, regulators, and risk-seeking investors.

Umar et al. (

2022b) investigated the pairwise time-frequency connectedness between nonfungible tokens (NFTs) and other major asset classes; namely, bitcoin, bonds, stocks, gold, and crude oil. The results indicated the existence of attractive diversification attributes and potential hedge benefits related to NFTs exposures. The coherence between NFTs and other major asset classes has been found to have been predominantly high for two-week-plus investments along the whole sample covering the prepandemic period and the ongoing pandemic. During the pre-Covid years, the NFTs lagged behind stocks and bitcoin, but led ahead of gold.

Umar et al. (

2022b) found that the interdependencies between new digital assets (NFT and DeFi) and other financial assets intensified due to the COVID-19 pandemic, as both the returns and volatility spillovers were significantly affected. Energy received the lowest shocks from other financial assets for both return and volatility spillovers during the pandemic period, likely due to the large shock within the energy industry caused by the decline in demand for crude oil owing to both the spread of COVID-19 and the Russia–Saudi Arabia oil price war.

Yousaf and Yarovaya (

2022a) found that NFTs and DeFi assets are risky assets that can offer higher returns for investors than other assets. The study also suggested that there were significant return and volatility spillovers between NFTs, DeFi assets, and other assets, such as gold, oil, bitcoin, and equity. The COVID-19 pandemic and the cryptocurrency market bubble of 2021 had a significant impact on the spillovers between these markets.

Zhang et al. (

2022) found that NFTs acted as hedges for equity and US dollar during the pre-COVID-19 period. NFTs can also act as hedges for gold.

Ko and Lee (

2023) found that NFTs have hedge and safe haven properties over particular asset markets, with varying degrees of effectiveness across the assets. NFTs can act as a protection against the loss of traditional asset markets, as well as providing an opportunity to diversify traditional asset investment and absorb the risk of unexpected shocks.

Umar et al. (

2023) used copula methods to study the diversification benefits of NFTs for conventional assets, such as equities, fixed income, and commodities. Their analysis revealed that NFTs had low correlations with traditional assets, and that there was no contagion effect between NFTs and conventional assets, which indicated the alternative new asset status of NFTs as a hedge and a safe haven. NFTs exhibited desirable investment and hedging attributes under all market conditions, and their desirability did not deteriorate, even during the Covid-19 pandemic. NFTs can complement the portfolios of conventional assets in the context of diversification and hedge benefits, and investors can develop trading strategies by considering the low tail dependencies between NFTs and conventional assets, such as equities, bonds, and commodities.

Overall, the main findings of this research showed that NFTs have few correlations with other assets, and this suggests that NFTs may offer diversification or hedging benefits, particularly during turbulent times. What is missing from the literature, however, is an understanding of how holders of NFT coins can hedge and diversify their investments in NFT coins.

3. Methods

The econometric methodology followed that of

Bouri et al. (

2017). A dynamic conditional correlation (DCC) GARCH model was used to estimate the dynamic conditional correlations between the assets. The DCC approach estimated univariate GARCH models for each variable, and then the standardized residuals from the univariate GARCH models were used to create a time-varying conditional correlation matrix (

Engle 2002). The DCC-GARCH model could easily handle a large number of variables, and was able to avoid the computational complexity of other multivariate GARCH models (

Engle 2002). Another advantage of DCC was that the dynamics of the correlation matrix could be described using a small number of parameters. Since asset returns exhibit volatility clustering, leverage, and fat tails, a GJR-GARCH(1,1) model (with Student’s t-distribution) was estimated for each variable. A one period lag of the dependent variable was included to account for any autocorrelation in the returns. The DCC model was estimated using maximum likelihood.

A DCC-GARCH model was used to model a system of 15 asset returns (four NFT coins and eleven S&P 500 sectors). The mean equation for the returns of asset

i (

ri) can be specified as:

where

ε is the error term. The asymmetric volatility of the NFT coins and the S&P 500 sectors was modeled using the GJR-GARCH(1,1) model (

Glosten et al. 1993).

The variable I is a dummy variable which models positive and negative shocks on the volatility.

The DCC specification included a positive definite conditional covariance matrix, Q, of the standardized residuals,

η, from (2).

The parameters

θ1 and

θ2 are non-negative parameters that sum to a value less than unity. The DCC matrix is:

The

qii,t is the (

i,

i) element of the matrix

Q. The pairwise dynamic conditional correlation between stock sector

i and NFT coin

j is:

The dynamic conditional correlations were then regressed on dummy variables,

D, representing the 1%, 5%, and 10% percentiles of the NFT return distribution.

The random error term in Equation (7) is ξ. A sector index was deemed to be a diversifier for an NFT coin if m was significantly positive. A sector was a weak hedge for an NFT coin if m was zero, or a strong hedge if m was negative. A sector was deemed to be a weak safe haven if the coefficients on the dummy variables were not significantly different from zero. A sector was a strong safe haven if the coefficients on the dummy variables were negative.

4. Data

The dataset consisted of the prices of four widely traded NFT coins (ENJ, MANA, THETA, and XTZ) and the major S&P 500 ETF sector indices. The coin ENJ is associated with the Enjin platform, which is one of the largest gaming platforms in the world. MANA is the coin used in the virtual world Decentraland. THETA coin is used for governance of the Theta Network, which is primarily a video and entertainment blockchain. The coin XTZ is associated with the Tezos blockchain network, which is used to conduct peer-to-peer transactions and smart contracts. The eleven S&P 500 sectors are (with ETF ticker symbol in parentheses): communication services (XLC), consumer discretionary (XLY), consumer staples (XLP), energy (XLE), financial services (XLF), health care (XLV), industrials (XLI), information technology (XLK), materials (XLB), real estate (XLRE), and utilities (XLU). The daily data covered the period 19 June 2018 to 31 December 2022, and were collected from Yahoo Finance. The start date was determined using the inception of XLC. The adjusted closing prices of the data were used in the analysis.

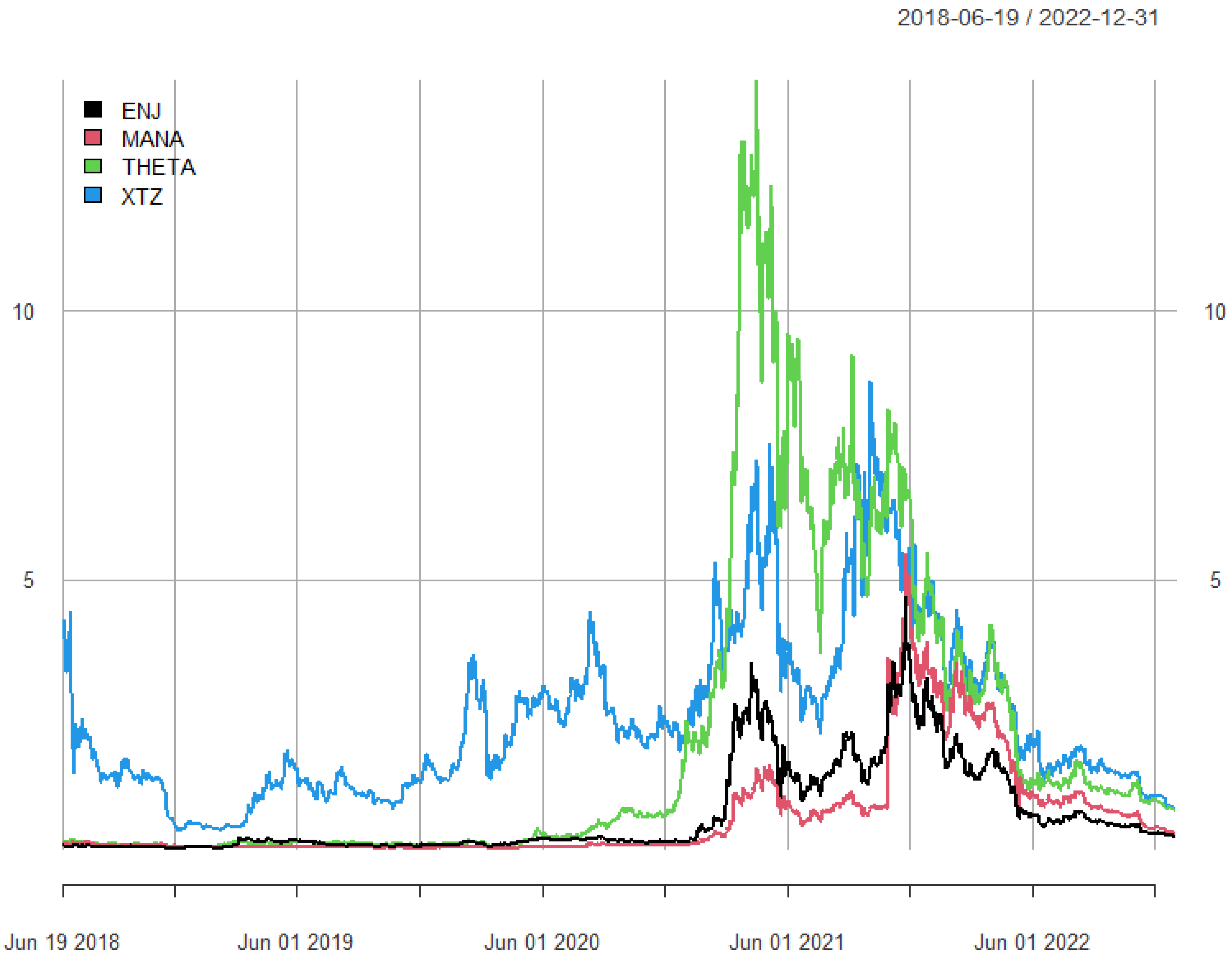

The time series plots of the NFT coins showed a pronounced increase around June of 2021 (

Figure 1). During 2021, the public’s attention was captivated by news about celebrities paying hundreds of thousands of dollars for NFTs to build up their collections and during this time period the Bored Ape Yacht Club collection featured prominently in discussions about NFTs (

Wang 2022). By June of 2022, however, much of the price appreciation had dissipated as the crypto-winter period took hold.

The descriptive statistics show that one of the NFT coins, XTZ, had a negative average return over the sample period (

Table 1). Of the coins with positive average returns, THETA had the least variation (as measured using the coefficient of variation) while MANA had the most variation. Among the sector ETFs with positive average returns, consumer staples (XLP) sector was the least variable, while consumer discretionary (XLY) was the most variable. All the returns displayed non-normal distributions, as evidenced by the W statistics.

Minimum spanning trees (MINSTs) were used to show the connectedness relationships between the data. A MINST was used to connect the vertices of the graph together without any cycles, and used the minimum possible edge weight (

Millington and Niranjan 2021). The MINST can be constructed using distance measures obtained from the correlation matrix of daily returns. The shorter the distance, the more highly connected the variables were. Looking first at a MINST plot for the full sample (

Figure 2), the NFT coins have been collected together on the right branch of the tree. The coins have been connected to the sector indices through consumer discretionary (XLY). The NFT coins were least connected to the energy (XLE) and real estate (XLRE) sectors.

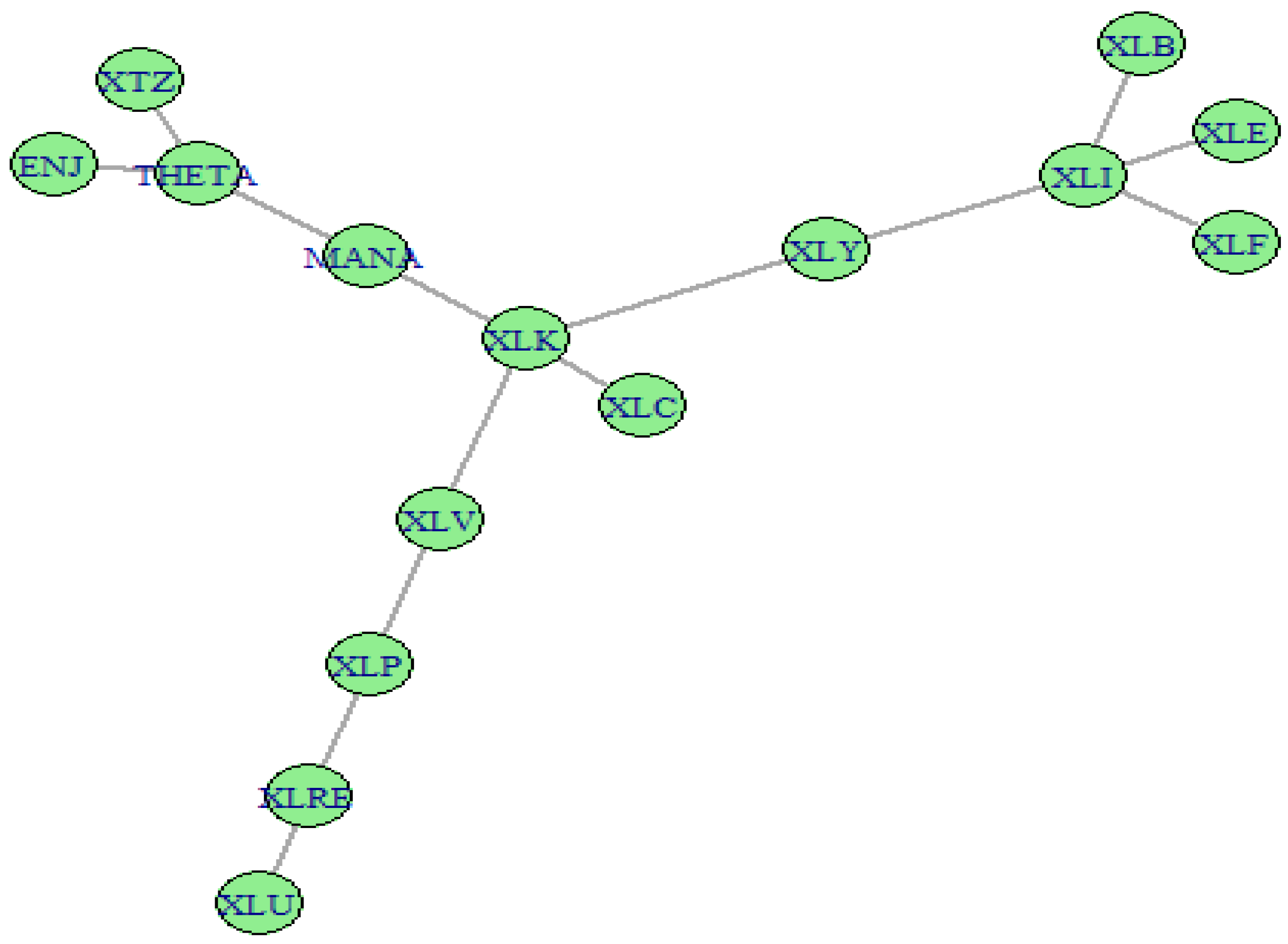

For the pre-COVID period (

Figure 3), the coins were connected to the sector indices through information technology (XLK). The coins were least connected to the materials (XLB), energy (XLE), financial services (XLF), and utility sectors (XLU).

For the COVID period (

Figure 4), the NFT coins were least connected to communication services (XLC), materials (XLB), energy (XLE), financial services (XLF), and health care (XLV). Comparing the pre-COVID period with the COVID period, the materials and energy sectors had low connectedness in both subperiods.

The MINST plots provided some idea what the connectedness between NFT coins and S&P 500 sectors looked like, based solely on distance measures constructed from correlations. To gain a deeper understanding of the usefulness of S&P 500 sectors in terms of diversification, hedging, and safe havens for NFT coins, a more formal analysis is required, which provides the subject of the subsequent section.

5. Results

This section reports the results from estimating Equation (1) for the full sample, as well as the pre-COVID and COVID subsamples. Additionally, a portfolio analysis has been undertaken to supplement the findings.

One of the first observations regarding

Table 2 was that the estimated coefficient on the intercept term (m) from Equation (1) was positive and statistically significant in each case. This was an important result and meant that each sector was a diversifier for each NFT. In the case of ENJ, the estimated coefficients on the dummy variables were statistically insignificant from zero (except for real estate—XLRE), providing evidence that industry sectors were weak safe havens. For MANA, there was evidence that all sectors except consumer staples (XLP) were safe havens. For THETA, all sectors except for communication services (XLC), health care (XLV), and utilities (XLU) were safe havens. For XTZ, most of the sectors were not safe havens. The energy (XLE), financial services (XLF), and real estate (XLRE) sectors were safe havens. The fewer number of safe haven sectors for XTZ may have been due to the fact that this coin was more closely aligned to peer-to-peer transactions and smart contracts, and less related to the NFT space.

For the pre-COVID period (

Table 3) communication services (XLC), consumer discretionary (XLY), financial services (XLF), health care (XLV), industrials (XLI), materials (XLB), and information technology (XLK) were diversifiers for ENJ. Consumer staples (XLP), real estate (XLRE), and utilities (XLU) were weak hedges, while energy (XLE) was a strong hedge for ENJ. Communication services (XLC), consumer discretionary (XLY), energy (XLE), materials (XLB), and information technology (XLK) were weak safe havens. For MANA, all of the sectors were diversifiers, except for utilities (XLU), which was a strong hedge. All of the sectors were weak safe havens. For THETA, communication services (XLC), consumer discretionary (XLY), financial services (XLF), health care (XLV), industrials (XLI), materials (XLB), real estate (XLRE), and information technology (XLK) were diversifiers, while consumer staples (XLP), energy (XLE), and utilities (XLU) were weak hedges. With the exception of real estate (XLRE), all sectors were weak safe havens. For XTZ, all the sectors were diversifiers, except for utilities (XLU), which was a strong hedge. All sectors were weak safe havens, except for communication services (XLC), consumer discretionary (XLY), consumer staples (XLP), health care (XLV), real estate (XLRE), and information technology (XLK).

For the COVID period (

Table 4), all sectors were diversifiers for each NFT coin. For ENJ, all sectors were weak safe havens, except for consumer discretionary (XLY), financial services (XLF), health care (XLV), industrials (XLI), and materials (XLB). For MANA, all sectors were weak safe havens, except for consumer staples (XLP), financial services (XLF), health care (XLV), and utilities (XLU). Except for health care (XLV) and utilities (XLU), all sectors were safe havens for THETA. Except for materials (XLB), all sectors were safe havens for XTZ.

In the pre-COVID period, communication services (XLC), consumer discretionary (XLY), financial services (XLF), health care (XLV), industrials (XLI), materials (XLB), and information technology (XLK) were diversifiers for each NFT coin, while in the COVID period all sectors were diversifiers for all NFT coins. There was little evidence to support the role of S&P 500 sectors as hedges for NFT coins. The safe haven properties of S&P 500 sectors varied across NFT coins and time periods.

Some additional insight on how useful S&P sector ETFs were for diversifying NFT coin risk was provided by comparing portfolios with different weights. For each NFT coin, two-asset portfolios were constructed for the coin, as well as for each S&P 500 sector ETF. The portfolio weights varied between unity (100% invested in the NFT coin) to zero (100% invested in the ETF). For ENJ, the optimal weight (as determined using the Sharpe ratio) was never greater than 30%, nor less than 10% (

Table 5). The benchmark rate for the Sharpe ratio calculations was set at 1% per year, which was the average yield on a three-month US T-bill over the sample period. For communication services (XLC), for example, the highest Sharpe ratio of 0.60 was observed for a portfolio that weighted ENJ as being 30% and XLC as being 70%. The highest Sharpe ratios were for combinations of 10% ENJ and 90% of either consumer staples (XLP) or health care (XLV). Notice also that the value-at-risk (VaR) diminished as the ENJ portfolio weight was reduced. This was expected, since NFT coins are more variable than the sector ETFs.

In a two-asset portfolio, the optimal weight of MANA varied between 30% and 10% (

Table 6). The highest Sharpe ratios were found for combinations of MANA and 10% of either consumer staples (XLP) or health care (XLV).

For THETA, the highest Sharpe ratios were found for weights between 40% and 20% (

Table 7). A 20% weight of THETA and an 80% weight of either consumer staples (XLP) or health care (XLV) produced the highest Sharpe ratios.

According to the Sharpe ratios, the optimal weight of XTZ varied between 20% and 0% (

Table 8). A 0% weight meant that higher-risk-adjusted returns could be obtained by not including XTZ in the portfolio.

One commonality across the results reported in

Table 5,

Table 6,

Table 7 and

Table 8 was that the portfolios with consumer staples (XLP) and health care (XLV) were associated with the highest Sharpe ratios. These sectors are essential to society, and had low sensitivity to business cycle conditions.

6. Discussion

The years 2020 and 2021 proved to be a challenging period for NFT coin holders. The prices of NFT coins experienced high volatility between July 2020 and July 2021. For owners of NFT coins seeking to mitigate market risk, this poses a major challenge. Owners of NFT coins include content creators, traders, investors, venture capitalists, and those involved in the governance of the NFT ecosystem. There has been, however, little research looking at how owners of NFT coins can protect their investment. The objective of this research was to examine how useful the S&P 500 sectors are for risk management of NFT coins.

This research has provided insights into the relationship between NFT coins and major S&P 500 industry sectors, addressing a significant gap in the literature on risk management strategies for NFT coin investors. It specifically studied four NFT coins, namely Enjin coin (ENJ), MANA, Theta coin (THETA), and Tezos coin (XTZ), and their interactions with the ETFs that represent the major S&P 500 sectors.

This study found that while the sector ETFs offered diversification benefits, they did not, however, appear to be effective hedges for NFT coin investments. To the best of our knowledge there has been no published literature on risk management for holders of NFT coins to which we can compare our results. There have been few studies on hedging Bitcoin with conventional assets.

Pal and Mitra (

2019) took the position of a Bitcoin investor who would want to hedge their Bitcoin with US stocks, gold, and wheat. Of the assets that they studied, gold provided the best hedge for Bitcoin.

Nekhili and Sultan (

2021) found that copper futures were the best for insample hedging for Bitcoin in a long-term horizon, whereas live cattle futures had the best out-of-sample performance.

Okorie (

2020) found that the S&P 500 could be used to hedge an investment in Bitcoin.

The optimal weighting of an NFT coin in a two-asset portfolio, based on the Sharpe ratio, lay between 10% and 30%. This suggested that, for investors seeking to maintain a diversified portfolio, maintaining a relatively small weighting of NFT coins can offer diversification benefits without introducing significant additional risk. This finding is crucial for portfolio managers and individual investors interested in gaining exposure to the NFT space.

This study contributed to the understanding of risk-management strategies for NFT coins by introducing a comprehensive approach based on the dynamic conditional correlation GARCH model. However, like any research, it comes with its limitations. First, it focused on four specific NFT coins with substantial market capitalization, which might not have entirely represented the entire NFT coin market. Second, the research considered only the S&P 500 sector ETFs, which represented only the U.S. market. Future research might explore the relationship between NFT coins and other international stock indices or commodities.

In summary, this study provided a practical guide to investors on diversification, hedging, and portfolio optimization strategies involving NFT coins and S&P 500 major sector indices. As the NFT market continues to evolve, so should the understanding of how this asset class interacts with traditional sectors. As such, future research should continue to explore risk management strategies in this rapidly evolving space.

7. Conclusions

Holders of NFT coins have had a difficult few years. NFT coin prices were mostly flat between 2018 and 2020. Then, in 2021, prices appreciated quickly, before rapidly falling. For holders of NFT coins, this type of pricing dynamics brings up an important question as to how to protect an investment in NFT coins. The research in this paper addressed this question.

Using data for four important NFT coins (ENJ, MANA, THETA, and XTX), analysis was conducted to see how useful S&P 500 sector indices were for diversifying, hedging, and providing safe havens for these coins. DCC-GARCH was used to estimate dynamic conditional correlations. The analysis revealed some important results.

In the pre-COVID period, communication services (XLC), consumer discretionary (XLY), financial services (XLF), health care (XLV), industrials (XLI), materials (XLB), and information technology (XLK) were diversifiers for each NFT coin; in the COVID period, by contrast, all sectors were diversifiers. There was little evidence to support the role of S&P 500 sectors as hedges for NFT coins. The safe haven properties of S&P 500 sectors varied across NFT coins and time periods. When considering two-asset portfolios comprising an NFT coin and one S&P 500 sector, the optimal weight for the NFT coin typically fell within the range of 10% to 30%. The term “optimal” in this context refers to the portfolio weight that maximizes the Sharpe ratio, a measure of risk-adjusted returns. Portfolios with consumer staples and health care (being sectors with low sensitivity to business cycle conditions) had the highest Sharpe ratios.

The results of this paper are of use to holders of NFT coins who want to protect their investments. As the NFT coin market continues to evolve, it will be interesting to observe whether the findings presented in this paper remain applicable and relevant in the future.