Simply put, volatility is financial uncertainty. If volatility can be quantified, then so can an investment’s risk profile. In 1952, Harry Markowitz explained volatility in statistical terms that allowed investors to better understand an investment portfolio’s return as a function of risk. About 20 years later, in 1973, Black and Scholes’ seminal paper ‘The Pricing of Options and Corporate Liabilities’ introduced a model to calculate implied, i.e., future, volatility from market prices of option contracts. Another 20 years later, in 1993, the CBOE launched the first version of the VIX, which computed the implied volatility of a basket of U.S. stocks with the help of the Black–Scholes–Merton model. In 2003, the CBOE changed the VIX’s calculation methodology to make it ‘model-free’. A couple of years later, derivatives on the VIX were rolled out and quickly picked up in popularity. Although the volatility market is relatively young (about 20 years), its rapid expansion provides an insight into how and why volatility derivatives became so popular with investors, ranging from retail to institutional.

2.1. Volatility as Risk

Any investment decision is based on two variables, risk and expected return. Risk is disliked (the less the better), and expected return is welcomed (the more the better). In practice, however, the investor is forced to make a trade-off between the two because an investment with higher expected return is usually accompanied with higher risk. So how is risk understood with respect to an expected return?

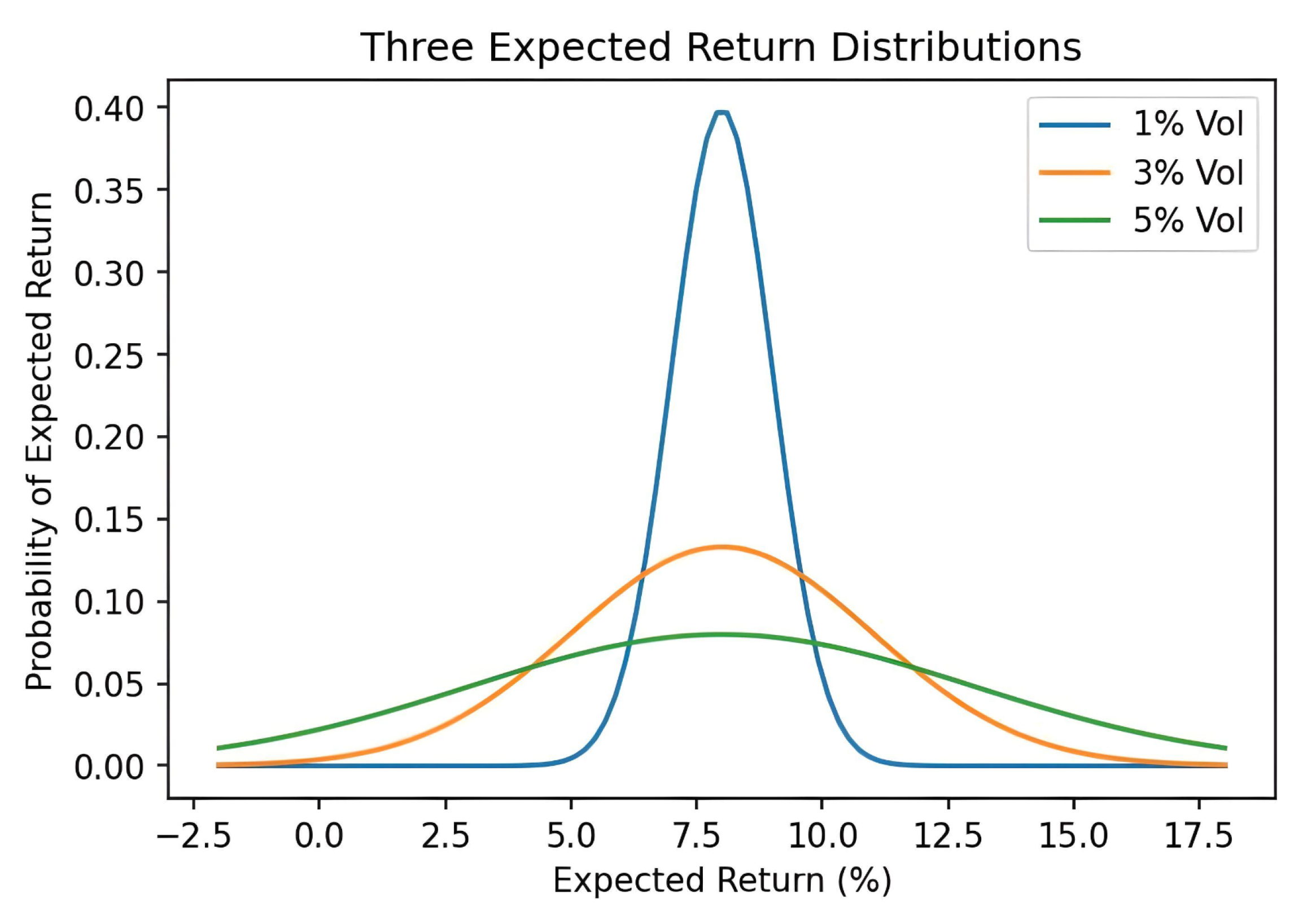

One way to measure risk is by the volatility of a financial asset’s return. Indeed, when the return is normally distributed, return and volatility fully describe this return profile. In less simple scenarios, the frequency of extreme events (thick tails), asymmetry (skewness), time-dependence (e.g., caused by the business cycle or crises), the unthinkable (non-anticipated changes, such as the occurrence of a ‘black swan’), and other dimensions, can also matter to the investor.

Figure 2 illustrates how volatility corresponds to the degree of dispersion of an asset’s return. In this example with a normal distribution, the expected return is 8% for each asset. The distribution of (future) returns is symmetric about this expected return which means, for example, a future return of 12% is as likely as a return 4%.

The bell-shaped curve posits that future returns closer to the expected return are more likely than those further toward the tail ends. As volatility increases, however, future returns away from the 8% mark increase in likelihood. Thus, the asset with 5% volatility is the riskiest of the three. In reality, however, one will find that the expected return increases with volatility.

There are subtleties in the semantics. An expected return is one you predict to see on average; a realized return is one you will observe in the future. There is a range of possible returns ex ante, but there will only be one return ex post. Risk, like expected return, is an ex ante concept because it is a feature of not-yet-realized returns. For example, consider an asset that promises you one of two returns,

or

, with equal likelihood. The expected return is

, but it will never be physically realized.

1One of the biggest challenges in quantitative finance is to come up with a fairly tenable distribution of an asset’s future return. Are you able to provide a detailed account of the possible returns and their respective likelihoods of, say, Apple’s stock price in one year’s time? A more informed alternative to daft speculation is the projection of historical data into the future. Nevertheless, how likely is Apple’s past performance a ‘guarantee of its future results’? It is difficult to say, but the use of historical data to quantify a future return is a widely used rule-of-thumb by financial practitioners.

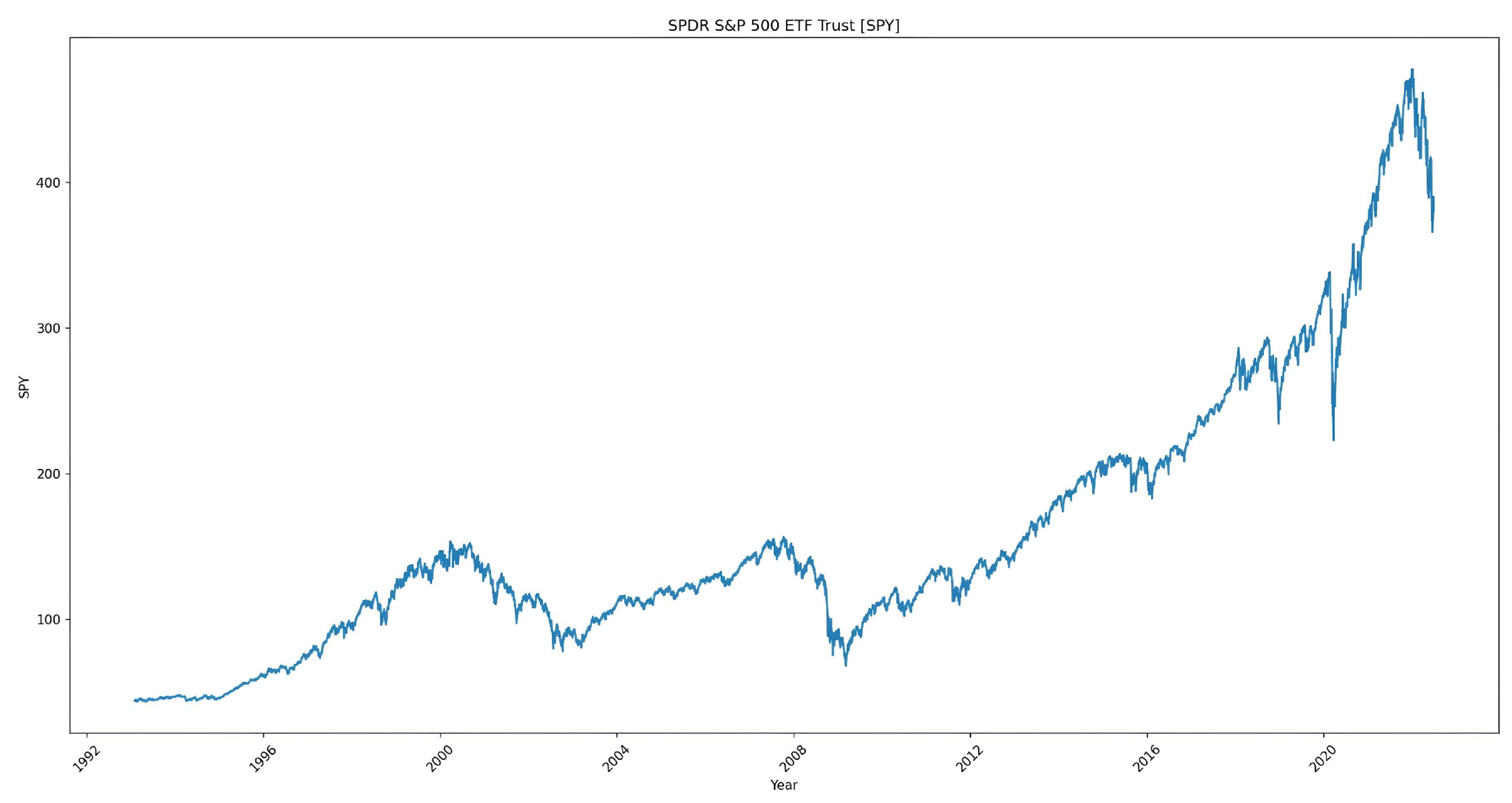

The S&P 500 index (SPX), which captures roughly 80% of the total U.S. stock market capitalization, is a measure of the near-term outlook of the United States’ economy. It might be more intuitive to think about the SPX as a financial barometer that indicates the expected weather of the general U.S. economy in the coming months.

Therefore, an investment in the index is an investment in the broad U.S. economy. The SPX is merely a tracker and not directly investable; its index ‘level’ is a number calculated from all 500 stocks and their respective market capitalizations. So one can invest in other instruments that either proxy the SPX or that expose you to risks associated with it. That sounds more complicated than it actually is.

One standard investment vehicle that tracks, and delivers, the returns of an underlying index is called the exchange-traded fund (ETF). In the case of the SPX, an issuer of the ETF pools together millions or billions of dollars to buy shares of businesses comprising the index in the right proportions. The issuer will then passively manage this ‘copy-of-SPX’ portfolio on behalf of the investor in exchange for a management fee.

Figure 3 depicts the past performance of the SPDR S&P 500 ETF Trust (SPY), a popular ETF on the S&P 500 index.

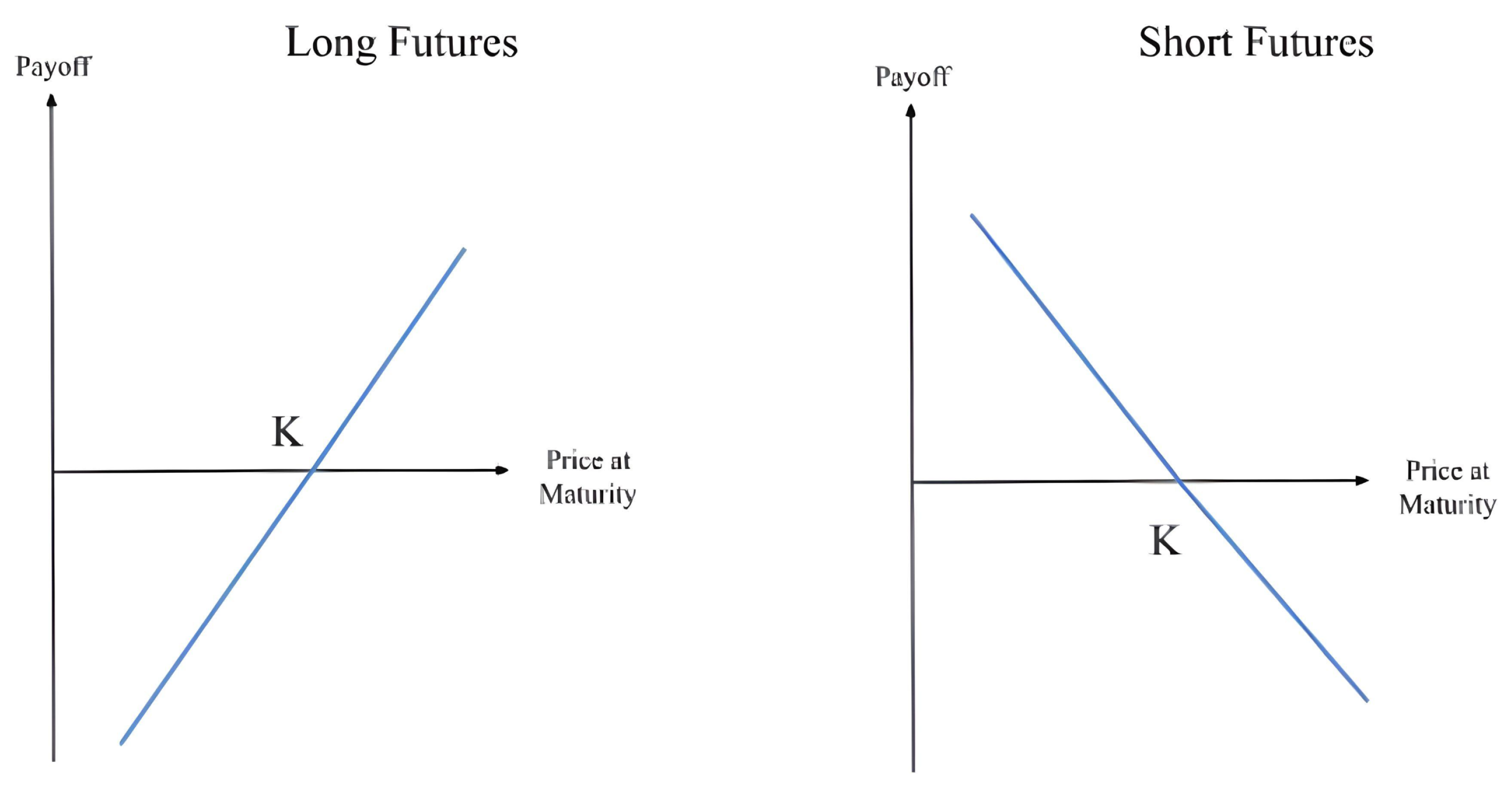

Two popular alternative investments are options and futures on the underlying SPX. Each one is a derivative contract with specifications on when to trade the underlying and for how much. A futures contract specifies a future date when the buyer purchases the underlying asset from the seller at the predetermined ‘future price’. Given the logistical challenges of delivering all 500 stocks associated with an SPX futures contract on the future date, the contract is instead settled on a cash basis. For example, if the SPX is higher than the predetermined future price on the future date, the buyer of the SPX futures receives the difference—in cash—from the seller.

A futures contract, unlike other derivatives, requires no payment upfront from the buyer to the seller.

2 Hence, the future price can be understood as the market’s expectation of where the SPX is going to be on the predetermined future date.

Figure 4 depicts a futures contract’s payoff, from the point of view of the buyer and the seller. When a futures contract is agreed upon by both parties, the directional risk (i.e., whether the SPX will move up or down on the way to the future date) is taken up equally by both sides because the transaction is obligated to take place on the future date.

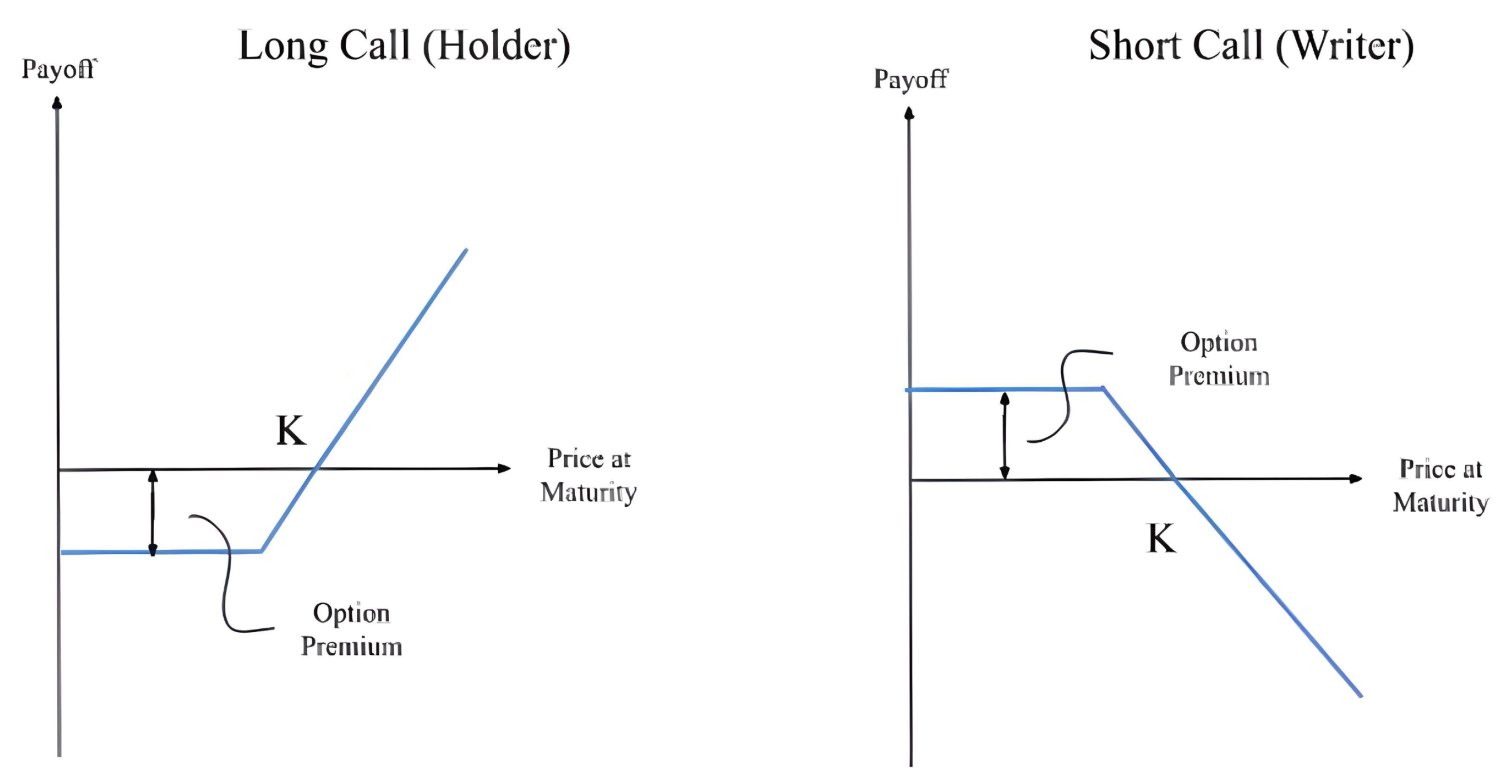

An option contract differs in this regard by requiring an upfront payment in exchange for the option or choice to conduct the transaction on the future date.

3 An option contract’s specifications are those of the futures’, a future price and a future date. However, market players refer to an option’s future price as its strike price and its future date as its expiration date. The option to transact from the buyer’s point of view, i.e., the right to buy on expiration date, is a call option. Likewise, the right to sell is a put option.

The buyer of a call option, therefore, gains if the SPX’s level is higher than the strike price on the expiration date. The seller of the option will have to pay to the buyer the difference between the SPX and the strike price, i.e., cash settlement on expiration. However, if the SPX’s level is below the strike price, no payment is made as the rational choice for the buyer would be to not exercise her right to purchase the SPX for a higher price. In options-speak, this call option expires out-of-the-money.

With put options, the payment on the expiration date is different. Since the buyer has the right to sell, the option is only exercised if the SPX is below the strike price. In that case, the put option seller pays the buyer the difference between the strike and the SPX. If the SPX is above the strike at the expiry date, the option is out-of-the-money and not exercised. To avoid confusion between the price of an option with the price of, say, the SPX, market players refer to the option price (aka the upfront payment) as option premium or simply premium.

A profit and loss (PL for short) is the price to hold the derivative starting now less the payoff at maturity. A long call’s payoff, as shown in

Figure 5, is only a neat approximation. In reality, its payoff is a convex function—i.e., a tilted smile of a curve above the approximation. For this reason, option contracts are a non-linear (i.e., convex) security. Likewise, futures contracts are a time-dependent linear derivative.

Pricing an options contract is no mean feat. For example, as a seller of a call option, how do you determine the fair value of your premium?

4 Too high and there will be no buyers; too low and you will lose your shirt. Just right, and you would have received a Nobel prize. In 1997, Robert C. Merton and Myron S. Scholes were awarded the ‘Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel’ for the Black–Merton–Scholes (BSM

5) option pricing formula.

The method is derived from an active trading strategy that is designed to perfectly replicate the payoff of an options contract using the underlying. The amount of cash required to mimic this payoff is simply the price of the option, i.e., the option premium, which is calculated for you by the formula. In technical terms, by dynamically trading with an amount equal to the option premium, one can fully hedge the option’s payoff.

The trading strategy is simple as it only depends on the sensitivity of the premium with respect to the change in the price of the underlying. For example, if the option premium went up (down) by USD 0.75 and the price of the underlying went up (down) by USD 1, then the trading strategy advises the investor to hold exactly 0.75 units of the underlying. In technical terms, the of an option provides the investor with an exact hedge. When a call option is hedged, the position in the underlying is positive (or, in finance terms, long) and money needs to be borrowed. When a put option is hedged, the position in the underlying is negative (short) and money is deposited.

In practical terms, the hedge makes the seller of an options contract ‘market-neutral’, i.e., it removes the directional risk associated with selling an option. The bet from the seller’s point of view is that the market goes down (up) and the call (put) option expires worthless.

Since hedging is of extreme importance to market participants, they have coined terms that express the underlying’s current price relative to the option’s strike price. An option is said to be ‘out of the money’ (OTM) if an expiration today will yield the contract worthless. Furthermore, an option is ‘in the money’ (ITM) if an expiration today will yield a positive payoff. Finally, an option is ‘at the money’ (ATM) if its strike price is the same as the current price of the underlying.

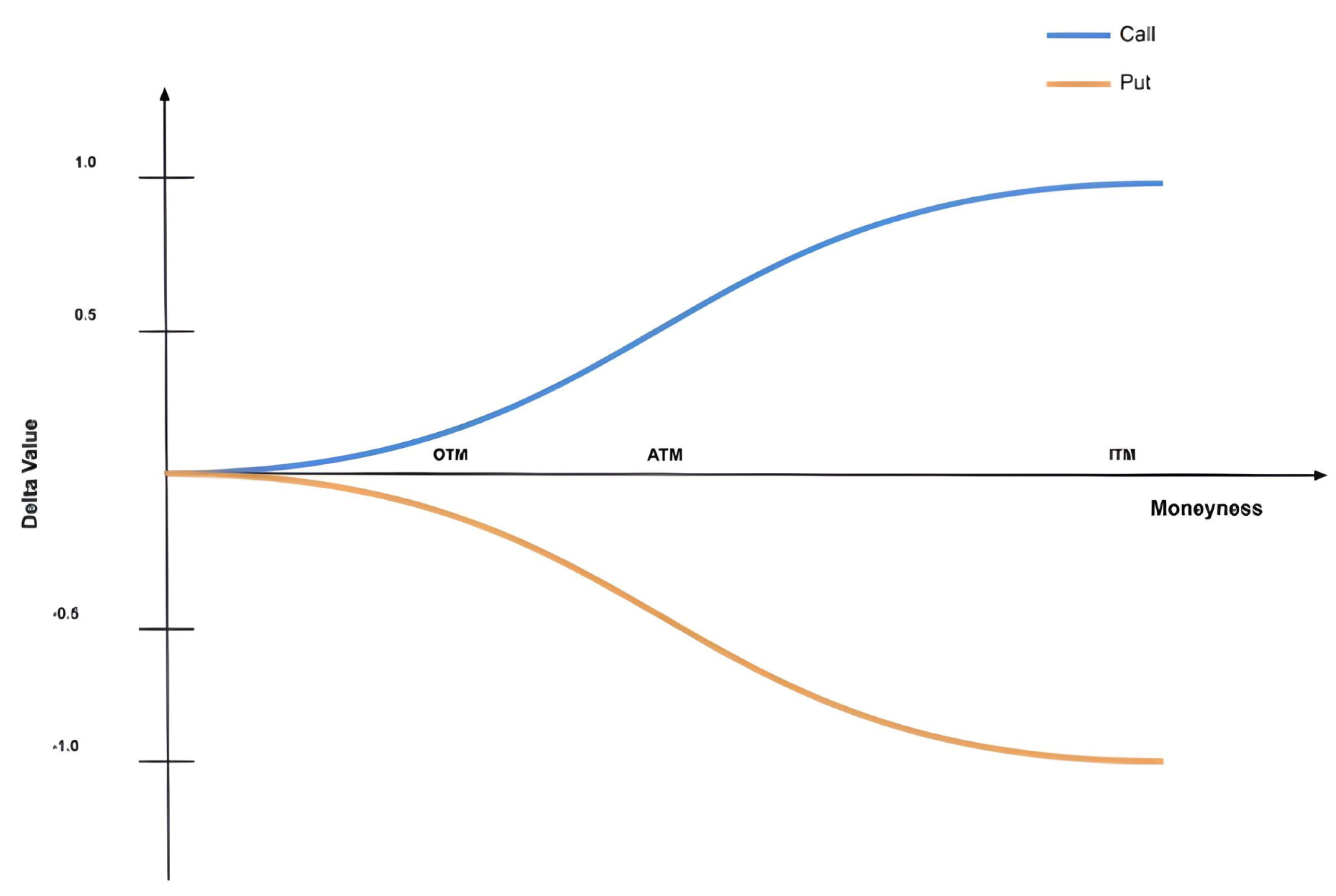

Figure 6 presents how the delta value (

) of a call or a put varies with the moneyness of an option with respect to its strike. All most all options are issued with a strike close to the current price of the underlying.

So who trades options and for what reasons? Well, there are a few market players whose intentions are clear. Retail investors would buy a call (put) if they are more (less) optimistic than the average investor about the future development of the underlying. They are classified as ‘speculators’, along with hedge funds, etc., because they make directional bets in the market. You will also find several investment banks who sell, or underwrite, options. Their aim is to collect the option premia and then hedge much less than what the BSM model prescribes. In fact, managing a large book of derivatives implies that many idiosyncratic risks offset each other, and so the investment bank only needs to manage the residual risk, i.e., what is leftover. Needless to say, computing this residual risk is not a walk in the park!

On the other hand, futures are often used by asset managers who want to hedge their investment. Suppose you manage a portfolio worth USD 100 billion in assets and whose risk-return profile closely resembles the S&P 500 index. If you are concerned about tomorrow’s release of U.S. labour market data (i.e., the non-farm payroll), you can completely hedge your portfolio with an appropriate short futures position on the SPX. No matter what the markets tell you tomorrow, any change in the value of the S&P 500 will be matched (or closed out) by an opposite change in the value of the futures. You are, once again, market-neutral.

2.2. The CBOE Volatility Index

In 1993, the first volatility index was introduced by the CBOE to measure the 30-day implied volatility of the S&P 100 index. The old VIX, now called the VXO, took the average of the BSM implied volatilities

6 from eight near-the-money (≈ATM) S&P 100 index options with the two nearest expirations. In 2003, the calculation methodology was changed to provide a ‘model-free’ measure of S&P 500 index’s 30-day expected volatility,

Carr and Wu (

2006). The methodology is in use to this day, and we aim to provide a sufficiently detailed discussion of it.

The VIX is quoted in volatility percentage points, when the VIX is at 15, it means that the (annualised) 30-day expected volatility of the S&P 500 is

. Rather counter-intuitively, it will make more sense to first understand how the VIX-squared works. The

is modelled after a variance swap, which is a forward contract on annualised variance expressed in variance percentage points, see

Diamond (

2012). A buyer and a seller of a variance swap agree on the variance swap rate

when exchanging contracts. On expiration day

T, the buyer pays the variance swap rate

and receives the realized variance

. The buyer makes a profit when the realized variance is higher than the swap rate, and a loss otherwise. In other words, the buyer locks in on the swap rate—which can be interpreted as the expected value of the variance.

Formally, the CBOE defines the VIX as

Here, the

is the variance swap rate of a variance swap on the S&P 500. The variance swap rate

in a variance swap is analogous to the predetermined future price in a futures contract; i.e., the variance swap rate

is the expectation of total realized variance

on expiration. Mathematically, this is written as

Rather remarkably, the fair value of

can be calculated directly from out-of-the-money put and call options on the S&P 500 index, see

Demeterfi et al. (

1999). This is formally expressed as

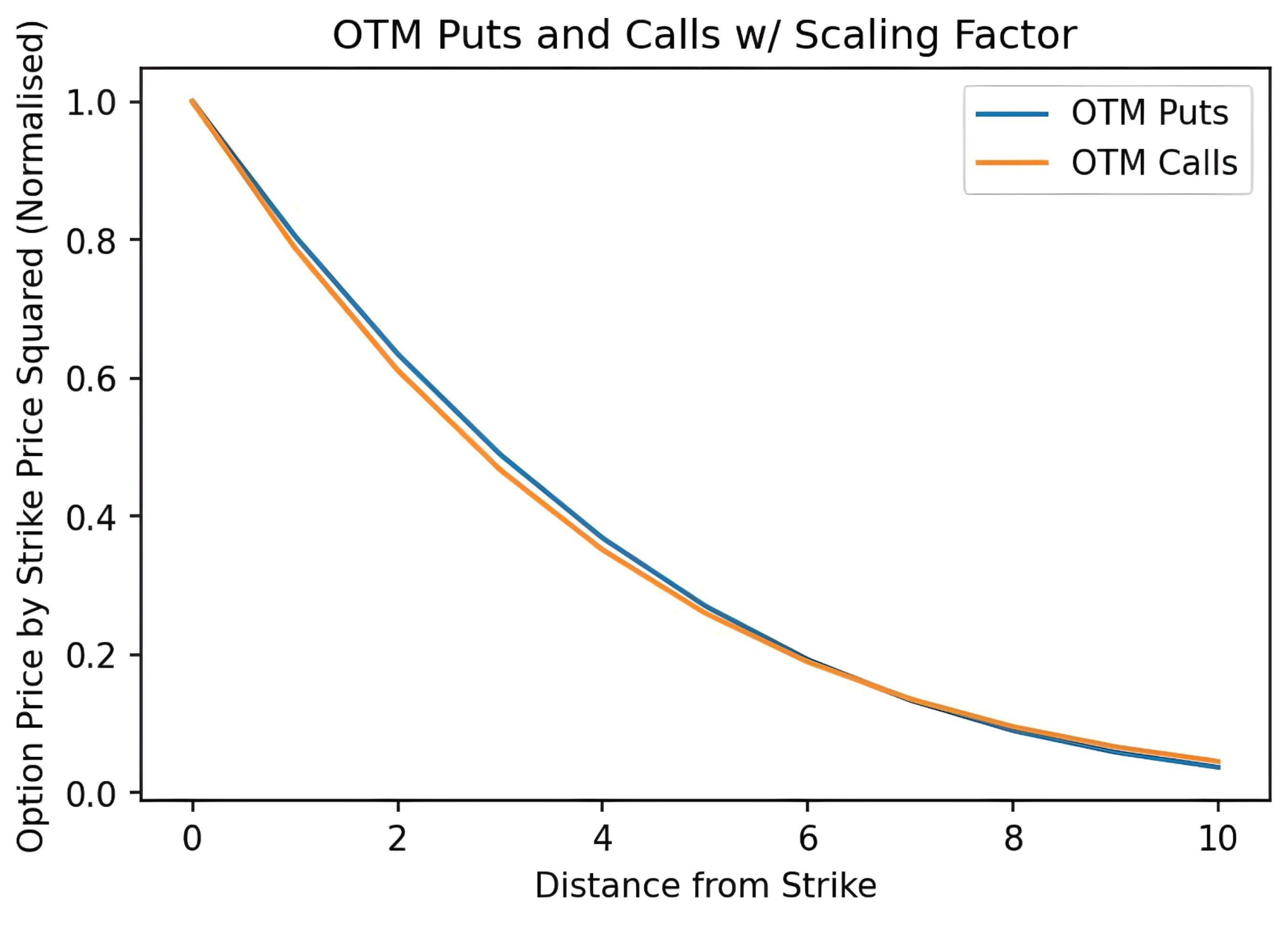

Here, is the forward price of the S&P 500 index at T days in the future, i.e., the market’s best guess where the S&P 500 will be at that time. The VIX uses all put options at strikes lower than and all call options at strikes higher than . All of these options are currently, at the present , out-of-the-money. The price of each option, whether a put or a call, is divided by its strike price squared, .

As the strike

K becomes further out-of-the-money for both options, the scaling factor

dampens the effect that these puts and calls have on the index’s final calculation (see

Figure 7). Likewise, as the prices of puts and calls clustered near the strike increase, the index weighs them approximately at their face value. It is important to note that it is extremely rare to have the VIX jump because of an increase in purchases of SPX calls near the strike

Wang (

2021). Instead, the VIX spikes when market players bid up the prices of SPX puts in anticipation that the underlying index will precipitously decline in value in the near future. It is for this reason that the Volatility Index is given the moniker ‘fear gauge’.

Since there are not infinitely many SPX options, the CBOE applies the following discrete approximation:

7Let us develop a qualitative feel for CBOE’s approximation. The integral over a continuum of options with strike prices

K changes into a sum of currently traded options with their respective strike price

. The sum adds up prices of all available out-of-the-money puts and calls. The price is the midpoint of its bid-ask spread—expressed as the function

. The

, a discrete modification to

, is the sum of half the spread between its closest, neighbouring strike prices. There is, however, one catch: at

, the first strike below the forward price

of the S&P 500 index, the call option is in-the-money. Indeed, the last term in (

4) represents the correction needed to convert this in-the-money call into an out-of-the-money put.

8Remember that the new Volatility Index is defined as the square-root of a one-month variance swap rate on the SPX; however, the CBOE only makes use of SPX options with Friday expirations in their calculation. Here, SPX options with more than 23 days and less than 37 days to the Friday SPX expiration are weighted to yield a constant, 30-day measure of the expected volatility of the S&P 500 index.

Since the VIX cannot be traded or replicated (in contrast to stocks and stock market indices which can be either traded or replicated), the standard futures pricing relationship based on ‘cash-and-carry’ arbitrage

9 does not hold. Hence, any fair-value calculation of a futures contract on the VIX will always be model-dependent.

However, there are upper and lower price bounds on VIX futures. The VIX is defined as the square-root of a one-month variance swap rate, i.e., the variance swap rate expressed in volatility units, on the SPX; it is not the one-month volatility swap rate on the SPX. The difference between the two is given by Jensen’s Inequality:

A futures contract on the VIX, at time

t with expiration

, is the expectation of square-root of expected total realized variance as shown below (

Carr and Wu 2006).

The mathematics here serves a symbolic purpose as it keeps the timeline in check. A typical volatility swap allows one to trade between realized and expected volatility. A forward volatility swap allows one to trade between future volatility percentages. While one fixes a volatility swap rate at the inception of a typical volatility swap, the fixing of a volatility swap rate on a forward volatility swap is set at some future time and the settlement day is on some time further in the future. A VIX futures contract is not your typical, over-the-counter volatility swap because it looks beyond the VIX, which itself is a forward-looking measure as it constantly gauges the expected square-root of variance of the SPX over the next 30 days. So then what is a VIX future?

By Jensen’s inequality, the price of a VIX futures is bounded below by a forward volatility swap rate. Likewise, the price of a VIX futures is bounded above by a forward variance swap rate, expressed in volatility percentage points. In practice, however, the VIX future price is set approximately to a forward volatility swap rate on the VIX. In volatility parlance, a VIX futures is simply referred to as a forward volatility swap.

10 For cases where this is violated, see

Van Tassel (

2020).

2.3. Volatility as an Asset Class

The quantification of volatility via an index allowed investors to track expected volatility of the broad U.S. stock market. Soon, it led investors to crave for directional exposure on the VIX—but this is the equivalent of trading the market’s expectation of future volatility. The initial VIX futures contracts were introduced in 2004, and VIX options followed after in 2006. Both volatility derivatives are settled in cash.

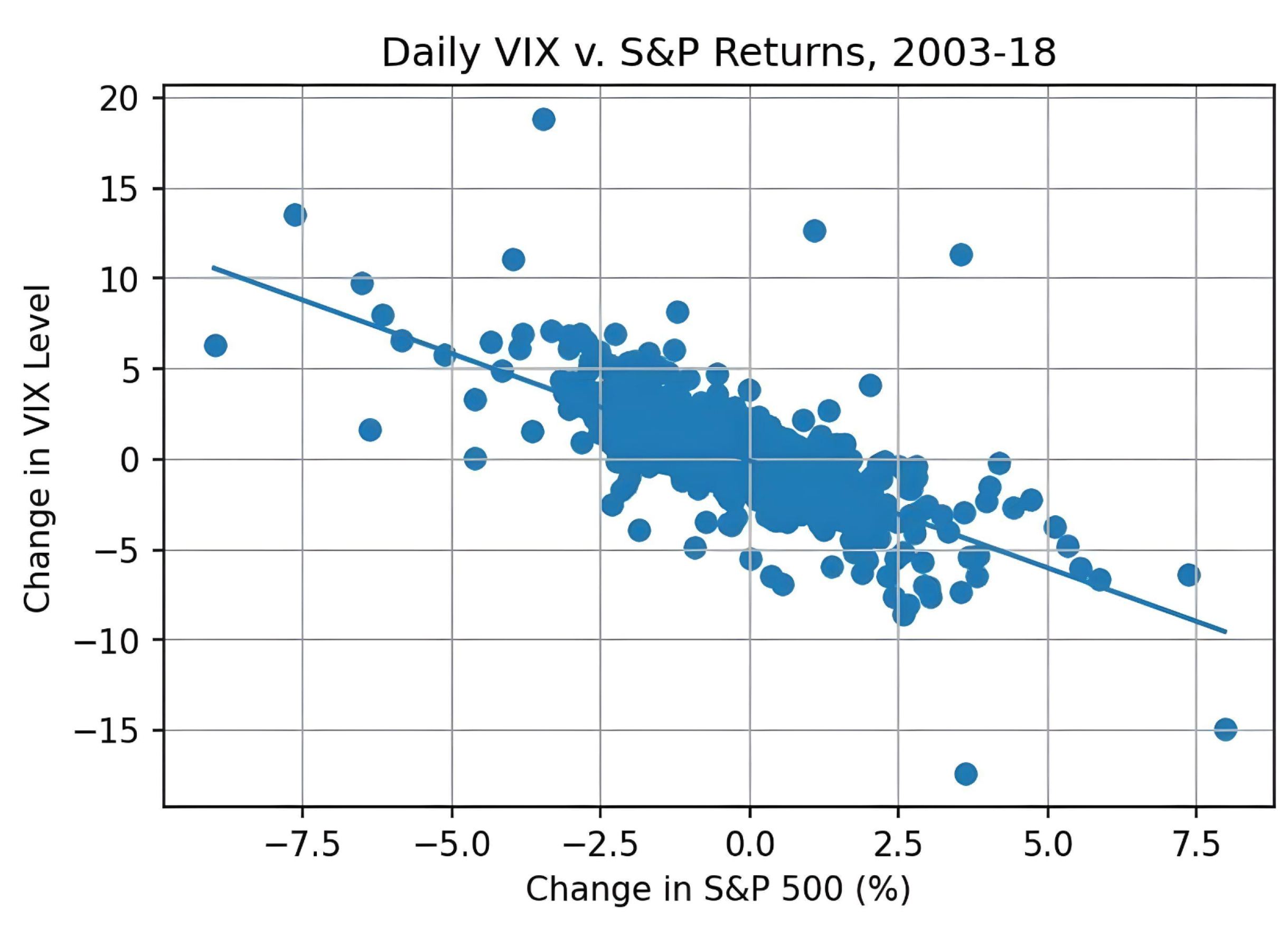

Historically, the correlation between daily returns of the S&P 500 index and daily changes in the VIX is around

, see

Macroption (

2022).

Figure 8 illustrates the negative relationship, leading up to and including Volmageddon.

Such a correlation exists for a valid reason. A VIX future, in terms of contract specifications, is just like any other futures contract. Namely, the buyer of a VIX future profits if the VIX at some date at or before expiry exceeds the future price, i.e., if the market’s expectation of volatility has increased since the buyer entered the contract. Sudden market drawdowns tend to increase the market’s expectation of volatility in the coming 30 days or so, therefore the price of near-term VIX futures shoots up. Likewise, the seller of a VIX futures profits if the market expects lower volatility in the short-term, which is usually associated with a rising market. Hence, the existence of the negative correlation between the VIX and SPX.

Of course correlation is not causality and there are several days where VIX and SPX move in opposite directions (all observations in the lower-left and upper-right quadrant in

Figure 8). We also observe several outliers; the most extreme are a VIX movement of +19 resp. −17 while the SPX moved by less than

. The former will be discussed in detail in the next section on Volmageddon.

A VIX option contract’s specifications adhere to those of any regular option on an underlying. Purchasing a call (put) means to speculate on an increase (decrease) in short-term volatility. Again, wanting limited downside risk as a buyer of an option would naturally entail the issuer demanding an upfront premium in return.

One drawback of entering a longer dated futures contract is that the exposure to changes in future volatility declines as the expiration date approaches. Implementing a futures trading strategy that maintains a defined exposure to the VIX can be challenging for the retail investor. For instance, it may be difficult to manage a portfolio of VIX futures that is supposed to provide a constant 30-day forward-looking exposure to the VIX. This sounds like a job for an index!

The index’s aim is clear: track a time-varying basket of VIX futures that maintains an average of 30 days to expiration. This is obtained by continuously adjusting the relative proportion of VIX futures; each day, the index adds exposure to the second month futures contract and reduces exposure to the first (or front) month futures contract, thus maintaining 30 days to maturity. The so-called S&P 500 VIX Short-Term Futures Index (VIX Futures Index) does just that and is maintained by the S&P Dow Jones Indices LLC

11. Like the S&P 500 index, this index cannot be directly invested in. Instead, VIX exchange-traded product (ETP) promises to track, and deliver, the returns of the VIX Futures Index.

Retail investors can buy ETPs from (and later sell them back to) their issuers, gaining access to an instrument that mimics changes in the 30-day VIX futures return. From the issuer’s point of view, keeping the index as an underlying allows the issuer to hedge by taking the opposite side of the trade. It would ensure that the issuer avoided all directional exposure to volatility, but it is not that simple.

The recipe to construct a VIX ETP involves choosing the type of product, and the direction and magnitude of the volatility trade. The two options permitted in each case are, respectively, an exchange-traded note (ETN) or exchange-traded fund (ETF); long or ‘inverse’; and leveraged or unleveraged.

For example, a 2X long leveraged VIX ETP with USD 100 million in assets would double the daily gains or losses for its investors by using a margin account to construct a USD 200 million notional position in VIX futures. Similarly, an unleveraged inverse VIX ETP would take short positions in VIX futures without any leverage.

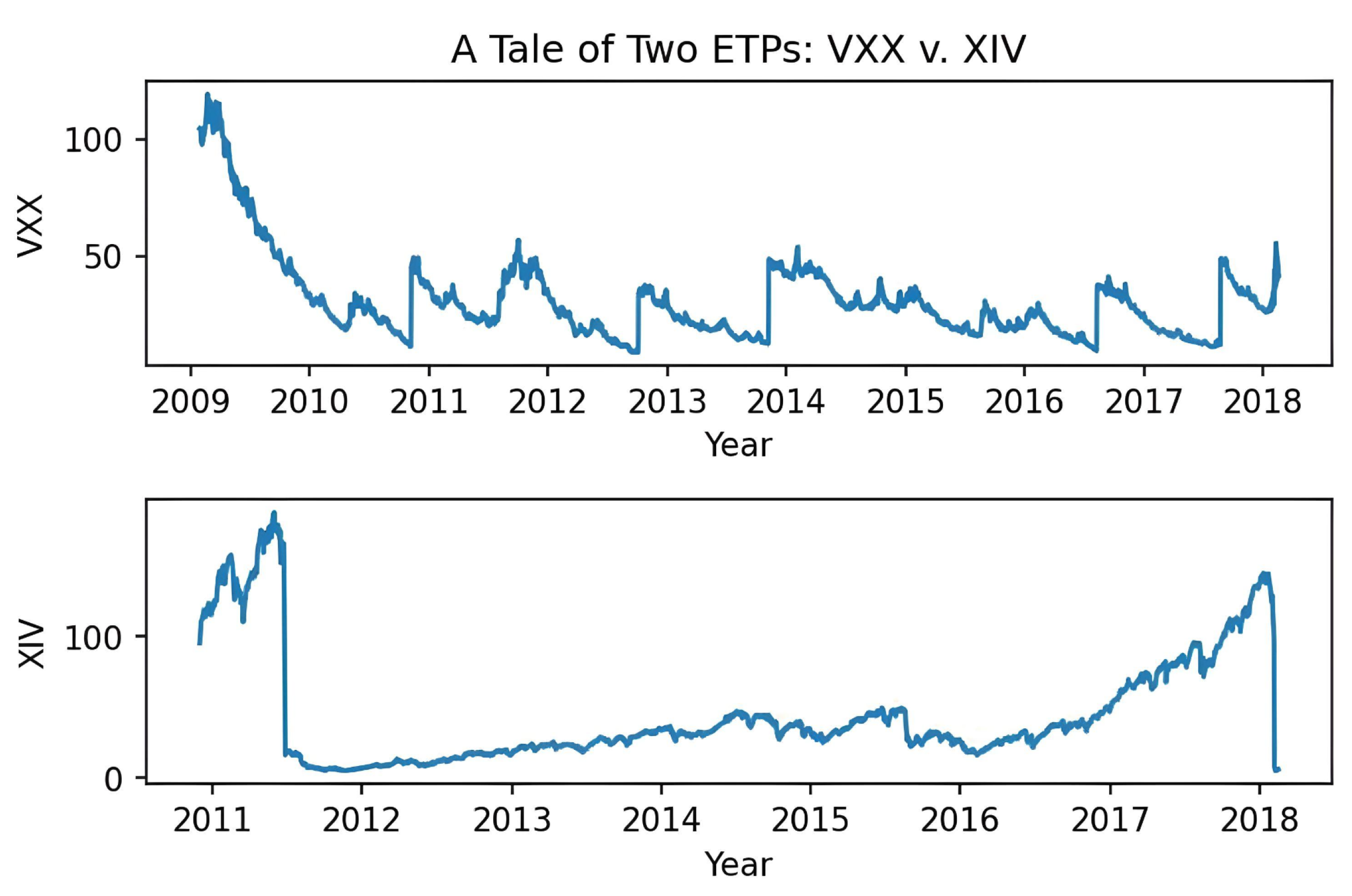

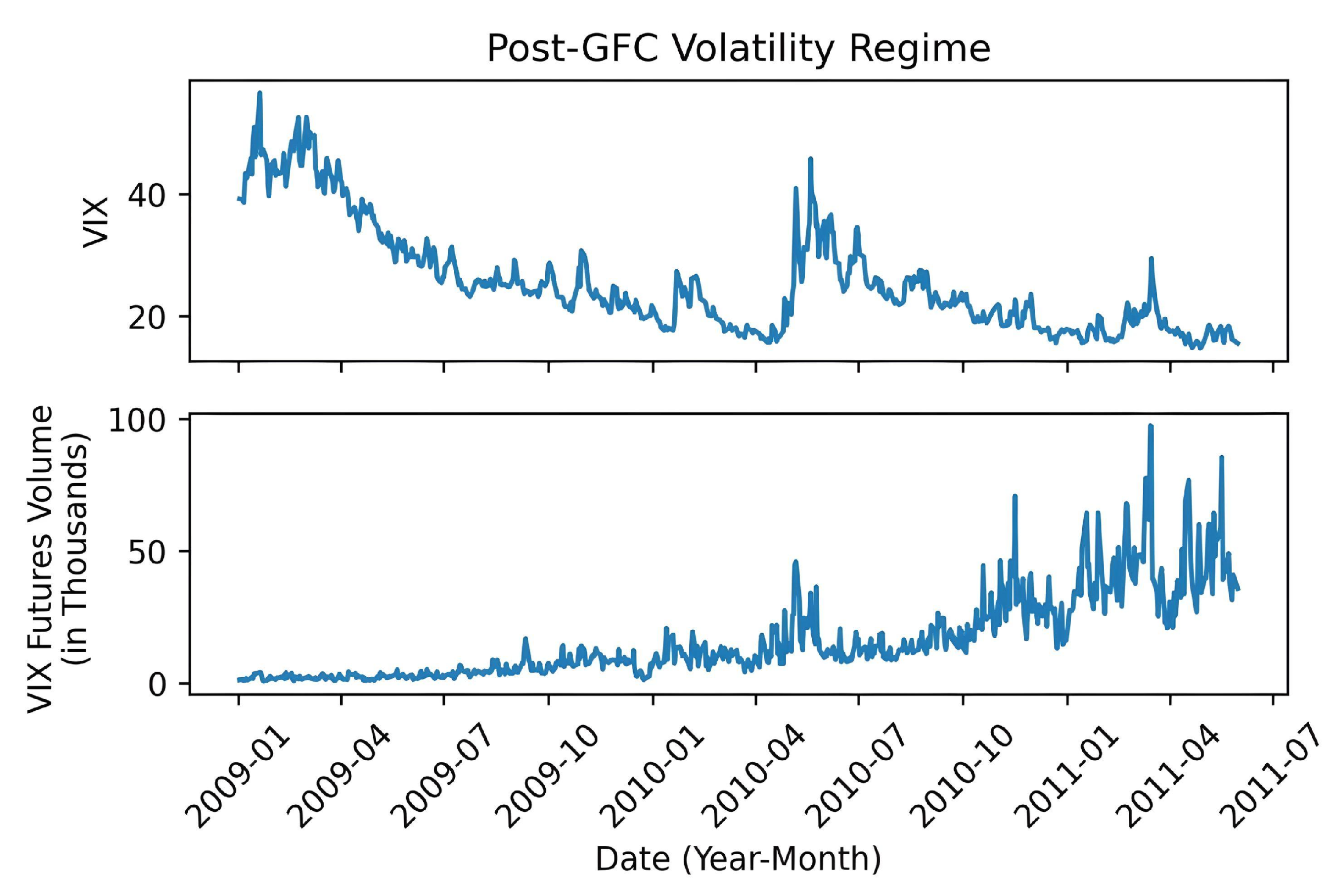

On 29 January 2009, Barclays LLC (Barclays) launched the first VIX ETP—the iPath S&P 500 VIX Short-Term Futures ETN (VXX)—that started trading on 30 January 2009. By 2016, the VXX ETP would be the fifth-most actively traded security in the US stock markets (

Wigglesworth 2017). An ETN is simply an unsecured debt obligation. The issuer promises to pay a 30-day VIX future price at a pre-specified maturity date. At the same time, Barclays also launched another ETN which gives exposure to a weighted average VIX futures maturity of 5 months (VXZ). Such ETNs are still actively traded at the time of this writing. On 19 January 2018, Barclays relaunched the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) after the previous series hit its maturity the same year. VXX’s new maturity is 23 January 2048 and has an annual management fee of 0.89%.

An ETN is different from an ETF. An ETF is secured by assets, e.g., an equity ETF, such as SPX, is backed by some proportion of the 500 stocks. When you own an ETF, you own a portfolio; when you own an ETN, you own a promise because an issuer can (in theory) invest the investors’ money in any asset. For the VXX, the investor is therefore exposed to credit risk, i.e., Barclays’ ability to keep its promise. However, there are two main reasons to own an ETN, a favourable tax treatment and—at least in theory—no tracking error, i.e., the value of the ETN follows the underlying index when traded in the secondary market due to arbitrageurs correcting mispricing. ETN issuers tend to also hedge some of the risk they are exposed to (

Damato 2009).

In 2011, inverse VIX ETPs, which provided investors with the opportunity to short volatility, followed suit. The most popular inverse VIX ETP at the time was issued by Credit Suisse Group AG (Credit Suisse) and was called the Velocity Shares Daily Inverse VIX Short-Term Futures ETN (XIV). A directional counterpart to the VXX, XIV promised to replicate the inverse one-day return of the VIX Futures Index. For example, if the VIX Futures Index dropped by

, XIV would post an end-of-the-day return of

to its investors (see

Figure 9). The XIV offered to harvest the ‘volatility risk premium’ by betting that near-term future, or expected, volatility will be lower than realized volatility. In practice, the XIV carried out its mandate by mechanically selling the same basket of near-term VIX futures that the VIX Futures Index tracks.