1. Introduction

This study investigates economic risks and impacts for countries included in the list of ‘jurisdictions under increased monitoring’, also known as the ‘grey list’, by the Financial Action Task Force (FATF), the global standard-setter for Anti-Money Laundering and Counter Financing of Terrorism and Proliferation (AML/CFT/CPF). Countries on the grey list have failed to adhere appropriately to the FATF standards but committed themselves to resolving the identified strategic deficiencies within agreed timeframes, during which they are subject to increased monitoring by the FATF. In the first quarter of 2023, 24 jurisdictions were listed on the FATF grey list, including Nigeria, South Africa, and Türkiye (

FATF 2023).

Studies have found that the FATF typically moved listed countries, predominantly developing economies, to higher levels of compliance with FATF standards within a reasonable period of time because governments responded with concern about the negative economic impact that listing might impose (

Sharman 2009;

Morse 2022;

FATF 2015). The studies are, however, divided on whether greylisting actually created negative economic consequences.

This study considers FATF’s greylisting impact from a market perspective, i.e., as it affects both private and public sector stakeholders. The study identifies different phases in market signalling engendered by the FATF’s greylisting process, develops a theoretical market impact model, and identifies indicators to be studied which may impact both banking operations and institutional decisions. It explores evidence of impact in each of the phases using indicators derived from the World Bank’s ‘World Development Indicators’ databank.

The study is novel in that it considers the whole time period over which the FATF has been operating; divides this period into phases during which the FATF’s signalling and processes varied; explores empirical evidence on the impact of listings across all countries for which usable data is available, and not just a sample of countries; seeks to identify the different impacts of listing, remediation, and delisting; and examines whether the impact occurs immediately or after a time lag. The approach is explicitly market-oriented, in that the theoretical model used for identifying variables which may be impacted seeks to reflect how stakeholders in financial and non-financial markets may typically respond to the signals sent out by the FATF.

Using a pooled cross-section and time series approach with fixed effects, based on a sample of 177 countries and 3540 country-years of data from 2000 to 2020, the study finds significant correlations between many financial variables and FATF listing events. This does not of itself prove causation, as it may be that the FATF listing and these variables are simply co-determined.

A major finding is that net official development assistance (ODA), International Bank for Reconstruction and Development (IBRD) loans, and International Development Association (IDA) credits seem to reduce during greylisting periods and this reduction endures after the country becomes delisted. This is of significant concern as such reduction may impact disproportionately on developing economies and their populations. The study finds evidence of improvements in the banking environment (non-performing loans, risk premiums) as well as some evidence of reductions in net foreign assets and increased indebtedness in the earlier listing phases. In Period III (2010–2015), which saw the most intense FATF activity, listing is correlated with a decline in market capitalisation, although remediation seems to reverse this, encouraging lenders and improving net financial flows and exchange rates. Negative correlation between net ODA, IBRD and IDA loans and credits and listings are evident in Periods III and IV (2016–2021), with the exception that net ODA is positively correlated in the remediation period in Period IV. There is also significant evidence of correlation between the remediation and delisting process and reduced GDP growth rates.

These findings are of concern from a development policy perspective and should inform further investigation of the use of greylisting along with a FATF review of its market signalling impact as well as the regulatory and market signalling responses of its members and other regulators. Measures resulting in economic hardship for countries when they are working with the FATF to improve their compliance levels require closer policy scrutiny.

The remainder of this paper is organised as follows. It contains a section that describes the background to the study, a literature review, a section that describes the materials and methods used, followed by the results, a discussion of the results, and the conclusions.

2. Background

The Financial Action Task Force (FATF), housed at the OECD in Paris, is the intergovernmental global standard-setter for anti-money laundering, and counter-terrorist and proliferation financing (AML/CTF/CPF). More than 200 jurisdictions are committed to ensuring technical compliance with the FATF standards, known as the ‘Forty Recommendations’, as well as effective implementation of compliant AML/CTF/CPF measures.

The FATF monitors progress on adoption and implementation of its standards. With FATF-style regional bodies (FSRBs), it assesses whether countries have the necessary legal and institutional frameworks in place and how effectively they are implementing them. This peer review process, known as Mutual Evaluation, applies an agreed methodology (

Kyriakos-Saad 2005;

FATF 2004b,

2013–2021).

The FATF has no formal powers of compulsion but its standards, especially Recommendations 10 (Customer due diligence) and 19 (Higher-risk countries), require countries to ensure that their financial institutions apply appropriate countermeasures where countries fail to meet the standards appropriately (

FATF 2012–2023). These measures include applying enhanced due diligence measures to business relationships and transactions relating to countries where this is called for by the FATF, and also where enhanced risk requires them to adopt such risk mitigation measures. Within this context, the FATF has been advising specific action against countries that fail to show adequate commitment to compliance (

Drezner 2008;

Nance 2015;

Morse 2017). In 2000 and 2001 the FATF listed 23 countries and territories publicly in its Non-Cooperative Countries or Territories (NCCT) program. According to the FATF, this process was highly successful as “all of the jurisdictions listed in 2000 and 2001 made significant progress and the last country was removed from the list in October 2006” (

FATF 2022a).

Since 2007, and with improved processes adopted in 2009, the FATF’s International Co-operation Review Group (ICRG) has identified, examined and worked with jurisdictions that were failing to adequately implement AML/CFT/CPF measures. A jurisdiction that enters the ICRG review process as a result of a disappointing mutual evaluation has 12 months to collaborate with the FATF or its FSRB to address the identified deficiencies and avoid possible public identification and formal review by the FATF. The FATF then prioritises the review of those countries with more significant financial sectors, e.g., USD 5 billion or more in financial sector assets. At this point, when the country has committed to addressing the identified deficiencies, the FATF may move to have it placed on its so-called greylist (

FATF 2022a).

2.1. Black and Greylisting

The FATF currently publishes two listing statements at the end of each of its three plenary meetings, in February, June, and October. The two statements reflect the different levels of risk posed at any given time by the deficiencies in the listed jurisdictions:

High-Risk Jurisdictions subject to a Call for Action (previously called “Public Statement”, more generally known as its blacklist): these high-risk jurisdictions have significant strategic deficiencies in their AML/CFT/CPF regimes and FATF calls on all jurisdictions to implement “counter-measures” against these countries to mitigate the risks they pose. These measures slow down and even prevent commercial engagements, reinforcing economic sanctions against the countries currently listed. For a number of years only two countries, Iran and North Korea, were ‘blacklisted’. Myanmar was added in October 2022 but in a special category where FATF calls for enhanced due diligence measures proportionate to the risks to be applied, rather than more drastic countermeasures. Myanmar was added due to unsatisfactory progress with its action plan to address its strategic deficiencies and this listing reflects elements of the dark-grey list that the FATF published in Period III, discussed below.

Jurisdictions under Increased Monitoring (previously called “Improving Global AML/CFT Compliance: On-going process”, more generally known as the greylist): these jurisdictions are actively working with the FATF to address the identified strategic deficiencies in their AML/CFT/CPF regimes. These countries have committed to swiftly resolving these within agreed timeframes. Other countries are advised to consider this information and, though the FATF explicitly states that it does not call for enhanced due diligence in relation to transactions and business linked to these countries, such risk mitigation measures are often triggered by a listing.

The neat division between these two lists was blurred for some time in the period 2011–2015 by the publication of a list of jurisdictions that had strategic deficiencies and that had not committed to an action plan to address them or had not made sufficient progress implementing that plan, the so-called dark-grey list. In these cases, FATF signalled that enhanced due diligence measures may be appropriate as it explicitly called on its members to consider the risks arising from the deficiencies associated with each jurisdiction.

To be removed from FATF monitoring, a jurisdiction must address all (or nearly all) the components of its action plan as confirmed by an on-site visit.

2.2. Phases in the FATF’s Greylisting Process

As explained above, the FATF currently publishes two lists, a so-called blacklist and a greylist (

Riccardi 2022;

Morse 2022). This study focuses on the greylist. Some authors refer to both grey- and blacklisting as “blacklisting” but, given the difference between the impact on blacklisted countries (e.g., on Iran and North Korea) and the impact on the large number of countries that are greylisted, the term “greylisting” is used here to distinguish the two lists and listing processes.

Since 2000 FATF’s communications and signals regarding greylisting have changed on several occasions. These communications are made in formal, public statements to inform risk mitigation measures to be taken by countries and financial institutions and changes in messaging could impact on market responses (

Ederington and Lee 1993;

Farka and Fleissig 2012). Previous impact studies differentiated mainly between the NCCT period and the post-NCCT period based on changes in the listing processes and have not specifically considered different messaging periods in the listing processes.

The authors distinguish four main periods. The first period commenced with the NCCT listings, which is classified as a greylisting process as it is more closely aligned in nature with the latter than with blacklisting and the accompanying countermeasures. With this as the starting point, and considering the FATF’s labelling, messaging, and market signalling in its statements, the following four periods are identified:

Period I—2000–2006: following discussions that began in 1998 (

FATF 2007a), the FATF in February 2000 agreed on 25 criteria to be applied to identify countries with “detrimental rules and practices which impair the effectiveness of their money-laundering prevention and detection systems, as well as the results of their judicial enquiries in this area” (

FATF 2000). The FATF published its first list of 15 “non-compliant countries or territories” (NCCTs) in June 2000 (

FATF 2000) and added another 8 jurisdictions in 2001 (

FATF 2001). The public naming and shaming of these countries put pressure on them to improve their compliance levels (

FATF 2003a,

2015;

Sharman 2009;

Morse 2022). No further countries were added but listed countries were delisted when they reached the desired compliance level. The last country on the list, Myanmar, was delisted in October 2006. A final formal NCCT report relating to the monitoring of Myanmar’s compliance was adopted in October 2007 (

FATF 2007a) but for practical impact purposes and to distinguish clearly between Periods I and II for this study, the year in which the last country was delisted is taken as the last year of Period I.

During this phase the FATF labelled the listed countries as “non-compliant”. Its communication of listing and delisting dates during this period had a measure of clarity that is not as evident in later periods.

The NCCT listing process did not follow a comprehensive compliance assessment of each country. The listings gave rise to political and economic development concerns. It was furthermore clear that the process could be strengthened technically. As a result, the IMF, World Bank and the FATF jointly adopted an agreed mutual evaluation methodology in October 2002. (

Kyriakos-Saad 2005). The methodology was revised in 2004 (

FATF 2004b) after FATF standards themselves were revised and expanded in 2003 (

FATF 2003b). This period also saw the adoption of financing of terrorism standards by the FATF (

FATF 2004a).

In October 2007 the FATF issued a public statement on Iran, expressing its concern that Iran’s deficient AML/CFT regime posed a significant vulnerability to the international financial system and announcing that FATF members were advising their financial institutions to consider the related risks for purposes of enhanced due diligence (

FATF 2007b). The FATF did not have a formal black- or greylist at this stage but the language used in the statement resembles those in greylisting statements, and was clearly intended to trigger risk management responses by the market. This was followed, from February 2008, by broader public statements on Iran, the northern part of Cyprus, Pakistan, São Tomé and Príncipe, Turkmenistan, and Uzbekistan, pointing to risks relating to the deficiencies in their AML/CFT systems (

FATF 2008a,

2008c). Later statements in this series recognised improvements by the northern part of Cyprus (

FATF 2008b) and Uzbekistan (

FATF 2009), although they were not formally or clearly “delisted”. In October 2009 Iran, Pakistan, São Tomé and Príncipe and Turkmenistan still appeared on the same series of public statements (

FATF 2009). The remaining countries were added to the new Period III statements that commenced in February 2010.

Period III—2010–2015: in June 2009 FATF adopted new review procedures providing a more important role for its ICRG regional review groups. Each reviewed jurisdiction also had an opportunity to engage the regional review group to discuss the results of the mutual evaluation report and to develop an action plan with the FATF to address the deficiencies of concern. The FATF now specifically requested high-level political commitment to implement these action plans (

FATF 2010a;

Morse 2017). The new procedures led to the publication of three lists, from June 2010 (

FATF 2010b,

2010c), following a February 2010 iteration that listed the remaining Period II countries separately (

FATF 2010a;

FATF Watch 2013):

- ○

Firstly, a list identifying “[j]urisdictions subject to a FATF call on its members and other jurisdictions to apply countermeasures to protect the international financial system from the ongoing and substantial money laundering and terrorist financing (ML/TF) risks emanating from the jurisdiction” (the so-called “blacklist”), where FATF called for jurisdictions to apply counter-measures;

- ○

Secondly, a list identifying “[j]urisdictions with strategic AML/CFT deficiencies that have not committed to an action plan developed with the FATF to address key deficiencies where the FATF called on its members to consider the risks arising from the deficiencies associated with each jurisdiction …”, as described in each statement (the so-called “dark-grey list”), where FATF called for countries to consider the risks arising from the identified deficiencies;

- ○

Thirdly, a list of jurisdictions with strategic AML/CFT deficiencies for which they have developed an action plan with the FATF (the so-called “light-grey list”). The FATF did not explicitly call for any measures to be taken in relation to these countries, though the listing would enliven normal FATF-related due diligence measures in the market to mitigate any jurisdictional risks. While the situations differ among jurisdictions, each jurisdiction has provided a written high-level political commitment to address the identified deficiencies.

From February 2011 the latter list was augmented by a list of “jurisdictions not making sufficient progress”, which identified those countries on the light-grey list that could be moved to the dark-grey list if they failed to take action expeditiously. From June 2011, the dark-grey list itself had added to it “countries with strategic AML/CFT deficiencies that have not made sufficient progress in addressing the deficiencies” (

FATF 2011).

The complexity of the signalling using black, dark-grey, light-grey and warning lists was enhanced when FSRBs began to issue their own lists and statements and some of these were published by the FATF on its website (

Nechaev 2014). The Caribbean Financial Action Task Force (CFATF), the FSRB for the Caribbean, for example, greylisted Belize and Guyana, but then blacklisted them in November 2013, with the CFATF calling on its members to consider implementing countermeasures to protect their financial systems (

CFATF 2013). In May 2014 Belize was removed from the CFATF blacklist, but Guyana was greylisted by the FATF in October 2014, delisted in October 2016 (

FATF 2016), and exited the CFATF processes in November 2016 (

CFATF 2016).

During this period the FATF published its current set of standards (

FATF 2012–2023) as well as its current mutual evaluation methodology (

FATF 2013–2021).

Period IV—2016–2021: from February 2016, the FATF’s greylist (now called “Improving Global AML/CFT Compliance: On-going Process”) was restricted to the jurisdictions previously listed on the light-grey list, i.e., “jurisdictions that have strategic AML/CFT deficiencies for which they have developed an action plan with the FATF.” Listing therefore held a more positive message than in the previous period where the dark-grey listing coloured the tone of greylisting.

Changes were made to the language of the statements too. In October 2019, for example, the FATF added explicitly that it “does not call for the application of enhanced due diligence measures to be applied to these jurisdictions”, but that it encourages its members “to take into account the information presented below in their risk analysis”.

The FATF’s messaging around the listed jurisdictions changed further in 2020 when the list heading changed to “Jurisdictions under Increased Monitoring” with the following new introductory text (

FATF 2020):

“Jurisdictions under increased monitoring are actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing. When the FATF places a jurisdiction under increased monitoring, it means the country has committed to resolve swiftly the identified strategic deficiencies within agreed timeframes and is subject to increased monitoring”.

In October 2022 it strengthened its statement that it is not calling for enhanced due diligence measures by adding that the FATF Standards “do not envisage de-risking, or cutting-off entire classes of customers, but call for the application of a risk-based approach (

FATF 2022b). The second paragraph of the statement now reads (

FATF 2023):

“The FATF and FATF-style regional bodies (FSRBs) continue to work with the jurisdictions below as they report on the progress achieved in addressing their strategic deficiencies. The FATF calls on these jurisdictions to complete their action plans expeditiously and within the agreed timeframes. The FATF welcomes their commitment and will closely monitor their progress. The FATF does not call for the application of enhanced due diligence measures to be applied to these jurisdictions. The FATF Standards do not envisage de-risking, or cutting-off entire classes of customers, but call for the application of a risk-based approach. Therefore, the FATF encourages its members and all jurisdictions to take into account the information presented below in their risk analysis.”

These language changes communicated a more positive message about the greylisted countries: they have strategic deficiencies but they are committed to fixing the problems and have implemented an action plan to do so reasonably expeditiously and subject to external monitoring. Furthermore, the FATF made it clear that, while the information in the statement may be relevant to a risk assessment, the mere listing of a country on this list does not amount to a call for the application of enhanced due diligence measures. The likelihood of a severe market reaction to such a listing would therefore tend to decline.

2.3. Other Lists

This study focuses on the FATF’s greylist and its economic impact on listed countries. It is however necessary to note that, while important, this is only one of a number of country risk lists published by nations or civil society that are likely to be taken into regard in a risk-based AML/CFT country risk assessment, for example the Financial Secrecy Index (

Tax Justice Network 2022); the US International Narcotics Control Strategy Report (

US Department of Justice 2022); the Corruption Perceptions Index (

Transparency International 2021) and the Basel AML Index (

Basel Institute on Governance 2022). In addition, lists of country risk indicators and country risk profiles are also available commercially to subscribers. These lists themselves are often informed, in part, by FATF country listings, and their weighting in the methodologies of those lists may not reflect the more constructive market signalling by the FATF in the current listing phase. The impacts of those lists are out of the scope of this study, but in principle they may modify or intensify the impacts of FATF listings. Clear messaging by the FATF can prevent or at least counteract such changes and hence the study focuses on the FATF and its messaging.

A particularly important development was the adoption of a European Union (EU) AML/CFT-related list of high-risk third countries in 2016, with listing rules revised in 2020 (

European Commission 2020,

2022). Countries that are greylisted by the FATF are usually added to the EU list, unless they are exempted. The EU can add any country to their list, but EU and European Economic Area members are exempted. This exemption owes more to

realpolitik than to principle. Least-developed countries, as identified by the UN, are also exempted unless such a country is identified as presenting a threat to the EU financial system or is designated as an offshore financial centre (

European Commission 2020).

While the EU professes to support the FATF’s processes, there are various points of tension between the two listing processes, e.g., the EU may add its own requirements to any FATF country action plan and a FATF delisting does not necessarily lead to an EU delisting of that country (

Dalip 2020). Importantly, the listing triggers an obligation of EU institutions to adopt enhanced due diligence measures in relation to a greylisted country, even though the FATF does not call for such measures (

Fourth EU AML Directive 2015):

Member States should at least provide for enhanced customer due diligence measures to be applied by the obliged entities when dealing with natural persons or legal entities established in high-risk third countries identified by the Commission. Reliance on third parties established in such high-risk third countries should also be prohibited. Countries not included in the list should not be automatically considered to have effective AML/CFT systems and natural persons or legal entities established in such countries should be assessed on a risk-sensitive basis.

Other countries, including the UK, also require enhanced due diligence measures in relation to greylisted countries. Their regulatory expectations are therefore not aligned with the FATF’s market signalling in the current period, although the FATF’s messaging may influence some of the enhanced measures that regulated institutions may choose to adopt.

The growing number of relevant country lists, and especially the operation of the EU high-risk third countries list, may blur the clear proportional attribution of any economic impact that the FATF greylist may have. Where a negative impact is identified, the market prominence and political weight of the FATF lists would support a strong argument for a significant share in such impact.

3. Literature Review

A number of studies have analysed economic data to determine whether greylisting impacted negatively on a jurisdiction, especially from an international political perspective. Given the questions pursued in this paper, the literature review focused on the key studies where an extensive analysis of economic data was undertaken.

Kudrle (

2008) studied changes in Bank for International Settlements data on financial flows to and from tax havens to determine whether there was evidence of a negative impact. The study focused on 46 jurisdictions and data in the quarters before and after FATF and OECD tax haven listing and delisting. The study considered total assets and liabilities, and the associated component non-bank assets and liabilities, as well as their counterparts for the loan and deposit data over the period for which the latter were available. The study produced mixed results and concluded that “no substantial and consistent impact of blacklisting on banking investment in and out of the tax havens was found across 38 jurisdictions.”

Balakina et al. (

2017) explored whether “blacklisting” had a measurable negative economic effect on a country, called the “stigma effect”. Drawing on the Global Financial Development Database they studied the relationship between international capital movements and FATF listing and delisting events in 126 countries from 1996 to 2014. Variables used for the analysis included total Foreign Claims (Bank Flow), size of financial institutions and markets, the degree to which individuals can and do use financial services, the efficiency of financial intermediaries and markets in intermediating resources and facilitating financial transactions, the stability of financial institutions and markets, and the level of macroeconomic stability. The authors concluded that the stigma effect did not exist.

A number of studies found more conclusive evidence of listing and economic impact correlations.

Farías and Almeida (

2014) analysed AML ratings, greylisting and corruption indicators in 36 Latin American and Caribbean countries between 1960 and 2010, and noted that poor FATF ratings and high levels of corruption can both have a downward impact on domestic and international investment. They also found evidence that illicit flows can increase the depth of financial markets, but that the impact varies depending on, for example, the strength of ties with main financial centres. In general, the authors are confident that their work demonstrates that FATF listings “have indeed penalized countries and territories that were target of the body’s critical reviews”.

Collin et al. (

2016) used SWIFT data to explore the impact of AML regulation on payment flows. They found that greylisted countries faced “up to a 10 percent decline in cross border payments received from other jurisdictions, but no change in the number sent”. Greylisted countries are also more likely to see a decline in payments from other countries with weak AML/CFT institutions. Their conclusions were based on monthly counts of cross-border payment messages recorded in the SWIFT system between January 2004 and August 2014 and listings by the FATF over the same period. In the period examined, the number of such messages rose from around 20 million/month to around 40 million/month, with substantial seasonal variation. Correlations were observed between such messages and exports, with an overall correlation of 0.33. They noted that the poorest countries were most likely to be greylisted: “countries with a GDP per capita under

$20,000 face greylisting rates as high as 40%”.

To identify the covariance of FATF greylisting against other ‘treatment’ measures, the authors also explored the impact of the US International Narcotics Control Strategy Report ratings and US, EU or UN sanctions. Control variables included GDP per capita (World Bank), a country’s democracy score (POLITY IV), the World Bank World Governance Indicators, a dummy variable indicating whether or not there is an ongoing conflict, and the country’s current exchange rate against the dollar. Tests were carried out for ‘leads’ and ‘lags’ in the responses.

The authors found that the impact is “more complex than recent narratives have suggested. There was no evidence that countries that have frequently been mentioned as sources of de-risking or sources of pressure to de-risk are the ones where there are substantial declines in payment flows to and from grey-listed countries”.

Morse (

2017) analysed the interaction between “reputation, market enforcement, and international cooperation”, focusing on the global campaign to combat terrorist financing. Her PhD thesis also provides some detail of specific countries and their experience with being put on non-complier lists, including Thailand, Turkey, Philippines, Guyana, and Panama.

Morse examined the effect of the FATF greylisting on cross-border bank-to-bank liabilities between February 2010 and December 2015 and concluded that cross-border bank flows decline and investors demand higher relative yields for sovereign debt when a jurisdiction is listed. The analysis focused on non-FATF member countries with comparable levels of compliance. A variety of methodologies were applied, including interviews with 15 finance industry professionals, fuzzy regression discontinuity, ‘non-instrumented analysis of sovereign spreads’, a Cox Proportional Hazards model, and a case study of Thailand. The latter provided a graphical presentation of trends in cross-border liabilities and in relation to listing and delisting. No particular pattern was found. Correlational evidence was cited that the non-complier list affected the risk premium for long-term debt.

Later,

Morse (

2019) analysed growth in cross-border liabilities for 39 countries, 10 of which were grey-listed, finding a large significant impact of c. 15–16%. Morse refined her analysis and found strong and statistically significant results ranging from an approximately 10.6 percent decrease to a 12.6% and 12.8% decrease in liabilities in certain specifications (

Morse 2022).

Case-Ruchala and Nance (

2020) replicated Morse’s 2019 model for a wider range of cases and found that the inclusion of more comprehensive data erased the effect. They argue that Morse’s findings were largely based on her (imbalanced) selection of cases, and that “[their] findings strongly suggest that being listed by FATF does not lead to a significant change in investment patterns”. They also examined the impact of listing on cross-border portfolio asset investments using the IMF Coordinated Portfolio Investment Survey 9 data in a similar series of regressions in relation to the wider range of cases and again found no effect of listing.

Jayasekara (

2021) analysed the short-term economic implications of AML/CFT policies. The study focused on seven economies selected from the FATF’s 2019 listings—Ethiopia, Sri Lanka, Tunisia, Serbia, Afghanistan, Lao PDR, and Guyana. It found that the domestic currency of monitored jurisdictions depreciated during the review period. The study also found evidence that limitations on fund transfers and correspondence banking relationships may have negative impacts on the capital markets of listed countries.

Kida and Paetzold (

2021), published as an IMF working paper, found that “gr[e]y-listing results in a large and statistically significant reduction in capital inflows”. The study used data from 89 emerging and developing countries in 2000–2017, and identified greylisting using FATF public statements. During the period, 78 of the countries were greylisted at least once, and the response to this event was explored using a machine-learning process known as lasso. They found statistically significant declines in capital inflows of 7.6%, in FDI inflows of 3.0%, in portfolio inflows of 2.9% and in other investment inflows of 3.6%.

The studies to date have therefore provided mixed results about the economic impact of greylisting by the FATF. The studies have however not identified the changes in the FATF’s listing-related market signalling over time or studied these to determine whether they may provide a clearer answer. Did the changes in language impact on market responses?

As discussed in

Section 2.2 above, the authors identify different signalling periods in the FATF’s greylisting processes. This study therefore set out to determine:

whether listing and delisting had significant correlations with economic indicators, either immediately or potentially over one and two years after listing and delisting; and

if any correlations were identified, whether there was evidence of any differences across the key periods of greylisting.

4. Materials and Methods

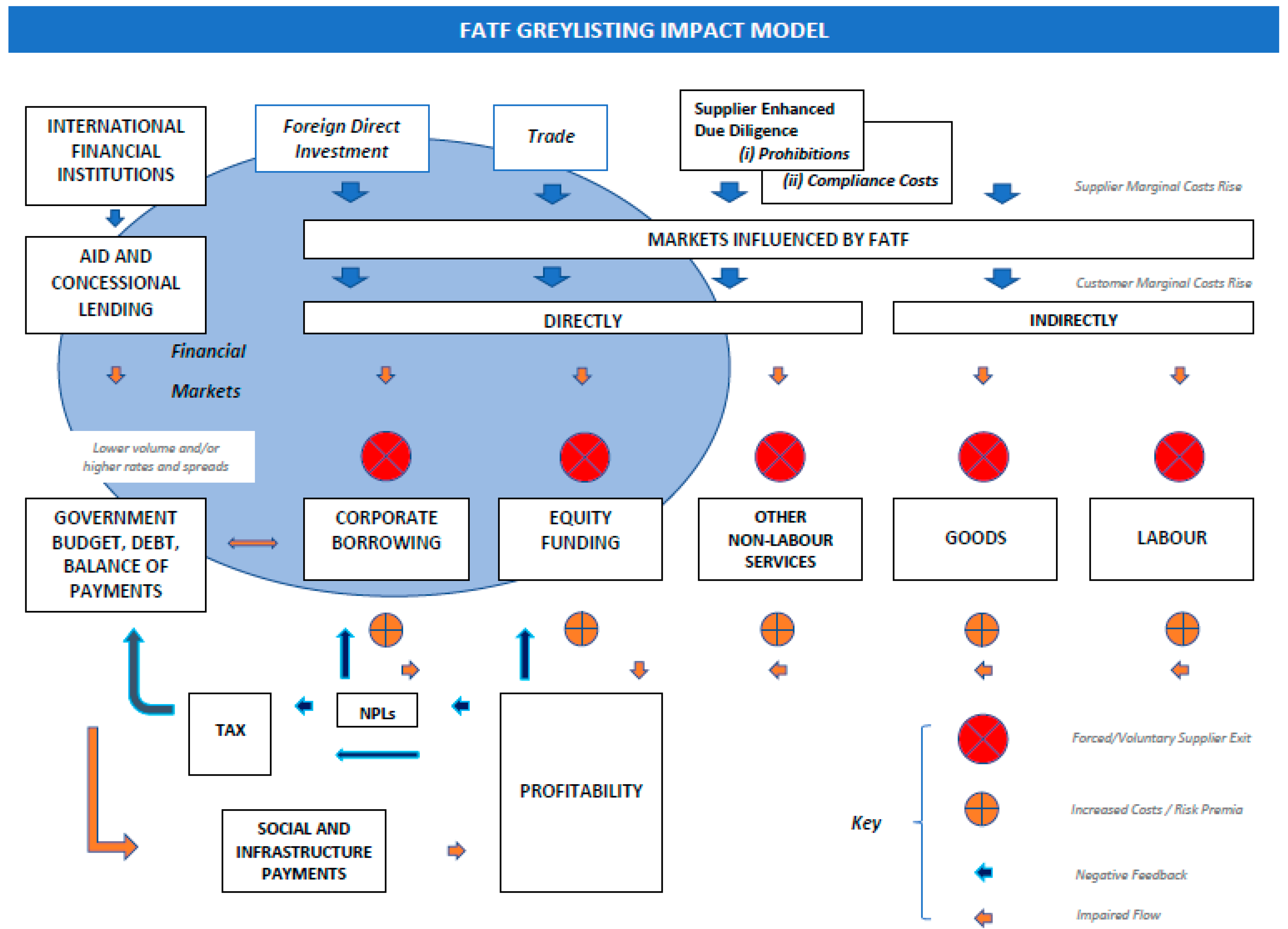

4.1. A FATF Greylisting Economic Impact Model

Previous studies selected relevant economic indicators without comprehensively explaining how they relate to greylisting, to the operation of the market, and to each other. It was therefore important to develop a theoretical impact model to inform the selection of indicators for the study and to assist in explaining any findings.

There is a well-developed literature on how signalling affects competitive behaviour dating back at least to the 1980s (

Heil and Robertson 1991). This literature provides some guidance on how firms, markets, and industries may react to particular signals, and in particular the importance of consistency, clarity, and aggressiveness of the signal (

Fiske and Taylor 1984). It also provides some evidence that (suitably designed) public policy signals can have a beneficial effect in integrated markets (

Avdjiev et al. 2012). Drawing on this literature, we have developed an impact model, summarized in

Figure 1.

The model tracks the broad high-level assumptions that underpin the FATF standards. These derive from a first-world and historical and generalised view of national financial systems and economies, albeit a view that is changing. However, the high-level basic market functions assumed by the model still exist. Importantly, there are standardised data on them to enable this analysis.

This model summarises the authors’ understanding of how FATF listing signals could affect the economy of a jurisdiction. FATF standards and statements are supposed to be reflected in the national regulations and policies of regulated businesses and professions. Non-regulated businesses and clients are indirectly affected if they depend on these sectors to function. Donor/lender governments and near-market international lending institutions also act in this space, as do market-based national and international investors.

Greylisting may decrease opportunities for, and increase the cost of, doing business:

Governments may tighten the regulation of trade with the listed country, or with connected entities, or even prohibit business

Firms in, or linked to, the listed country (e.g., by ownership or trade) may need to undertake more checks to comply, and be seen to be complying, with regulations

Resulting changes in aggregate volume, variety, quality and cost of goods and services may impact national profitability

Once trade is affected by listing signals there are likely to be first- and second-order effects. These are briefly outlined in

Section 5, together with indicators that could be considered to reflect and measure these effects.

4.2. First-Order Effects

4.2.1. Increased Supplier Costs

Firms may amend internal policies and operating practices to respond to greylisting risk signals.

At the margin, higher resulting regulatory risks may be unmanageable or inadequately compensated. Firms made inefficient and unprofitable (through inability to manage risk or pass on cost increases) may reduce the range of goods on offer or exit the market entirely.

4.2.2. Reduced Firm Profitability, Tax Payments and Debt Service Capacity

Reduced supply and increased cost of factor goods and services may reduce gross profit margins. This in turn would reduce firm headline tax liability and debt/equity service capacity.

- ○

Possible indicators: tax revenue totals, dividend levels

4.2.3. Reduced National Income and Expenditure

Direct aid to a listed country may fall as donors negotiate measures to address the new risk profile. The effect would add to national budgetary pressures. One way for government to relieve this might be to reduce ESI payments. This, however, would further lower firm profitability.

- ○

Possible indicators: net official development assistance and official aid received [current US$], IFC, private nonguaranteed [NFL, current US$] IBRD loans and IDA credits [DOD, current US$]. The focus here is on changes in access to capital given degrees of politicisation.

4.2.4. Reduced Access to Capital

International bond and loan markets are likely to see listing negatively, putting upwards pressure on both government borrowing levels and corporate spreads. Some creditors may no longer lend or may reduce investment levels. Governments and international lending organisations may react in a similar fashion, including by increasing the conditionality (and thus expense) of lending. There would be less liquidity. Of the liquidity that exists some would be needed to cover higher costs of indebtedness.

- ○

Possible indicators: risk premium on lending (lending rate minus treasury bill rate, %), Lending interest rate (%), Interest rate spread (lending rate minus deposit rate, %). Testing should show ballooning/tightening of both indicators on listing/delisting

4.3. Second-Order Effects

4.3.1. Downward Profitability Spiral

Higher reference rates and higher corporate spreads (linked to perceptions of lowered profitability and debt service capability) are a double shock to the debt markets, with knock-on effects in equity markets. This may produce further reductions in profitability, tax payment and debt service/equity raising capacity, plus an increase in non-performing loans.

- ○

Possible indicators: bank nonperforming loans to total gross loans (%)—important for showing incipient failures of companies, though also an indicator of reckless lending. Market capitalisation of listed domestic companies (current US$) would be expected to fall with MER and rise on delisting.

4.3.2. Reduced Government Income

The continuing drop in profitability may reduce government income, adding to pressure in sovereign debt and corporate capital markets. Knock-on effects on ESI payments, again impacting firm profitability, may cause the cycle to repeat in a negative feedback loop.

- ○

Possible indicators: private non-guaranteed loans, commercial, banks and other creditors (NFL, current US$).

4.4. Time Lags and Endurance

4.4.1. Time Lags

The effects described may not all impact at the same time. Market impacts may be immediate and slight but become significant as iterations of the negative cycle take cumulative effect. Impacts linked to structural factors (such as multilateral lending and aid) may be slow to show but significant.

- ○

Possible leading indicators: Exchange rates and monthly GDP (current LCU)/GDP(US$)) with both falling with listing and rising with delisting; Net financial flows, bilateral (NFL, current US$) with flows falling as commercial activity and FX values diminish (except for inflows from release of foreign holdings); foreign direct investment, net inflows (BoP, current US$) again, falling with listing, rising with delisting; foreign direct investment, net outflows (BoP, current US$)—rising with listing, falling with delisting.

- ○

Possible lagging indicators: net foreign assets (current LCU)—falling as assets are liquidated, possibly at a discount, to cover local trading losses and as a result of LC depreciation; external debt stocks, total (DOD, current US$) rising and falling as trade drops off; net acquisition of financial assets (% of GDP) (though it is important to exclude external buying on weakness); claims on central government, etc. (% GDP); claims on other sectors of the domestic economy (% of GDP).

4.4.2. Persistence

Negative impacts may endure and fluctuate whilst the causes of listing are uncorrected. They may return to normal when the FATF signals that its concerns have been addressed. However, they may also persist after successful correction and delisting, for example if private sector confidence and public sector surpluses are slow to return. Where firms have exited the market permanently, reduced supply of their own offerings and loss of demand for their factor goods may maintain pressure on the economy.

The model is therefore intended to help examine if removal of FATF grey listing acts in the same way as raising a blind—immediately readmitting sunlight—or whether it resembles removing a clothes iron—where outcomes depend on the fabric, the level of retained heat, and whether permanent damage has (already) occurred.

4.5. Empirical Testing

Using the model as a theoretical basis, a global FATF greylisting database was constructed for the period from 2001 to 2020. This brought together data on the financial and economic outcomes for all countries with data on when FATF and related events occurred, including publication dates for relevant listing statements. The focus was on NCCT listings, light- and dark-grey listings prior to 2016, and greylisting from 2016 onwards. For consistency, the handful of FSRB listings was added on the assumption that international market responses to FATF and FSRB greylisting would tend to be similar.

The principal source of economic and financial data was the World Bank’s ‘World Development Indicators’ databank, updated in 2022. Countries where the data were too sparse to be used were excluded from the analysis, so that the final analysis was based on 177 countries and 3540 country-years of data. For these remaining countries, some interpolation of missing data was also undertaken.

where:

Yti is the economic or financial variable which may be correlated with or affected by listing. This may either be the level of a variable or the year-on-year change in a variable.

Ai is the cross-section effects, a vector of dummy variables indicating cross-section I (fixed effects).

δt is a vector of dummy variables indicating time t (fixed effects).

Xkti are the k independent variables that vary over cross-section and time.

βk are the respective coefficients indicating the effect of Xk on Y.

εti are the stochastic errors that vary over both cross-section and time.

Many of the regulatory actions being explored coincide with the chaos caused by the Global Financial Crisis (GFC), so dummy variables for the two years of 2007 and 2008 have been included. Thus, the study uses a hybrid system of fixed effects with country variation and some limited time variation.

For each of the four FATF listing periods described above, dummy variables were established for the listings, remediation period, i.e., the period spent on the list, and delisting of listed countries, giving a total of twelve possible variables for each country. The magnitude and significance of the coefficients on these variables then provide an indication of the effect of FATF regulatory action in the period with respect to the financial or economic indicator chosen as the dependent variable.

The detailed econometric results are presented in Annex A, grouped into first-order and second-order effects reflecting the indicators selected for testing in the theoretical model. The tables presented there are colour-coded to denote significance at the 95% (dark blue), 90% (blue), and 80% (light blue) confidence levels and whether the effect is positive (green) or negative (pink). Those tables present results for all the possible indicators identified for testing above. The discussion below focuses on those economic and financial indicators that were found to be correlated in a significant way.

5. Results

5.1. Period I: 2000–2006

In the first FATF regulatory period, the econometric results, which are presented in more detail in

Appendix A, reflect correlations with risk-oriented indicators and external assets and debts. These are broadly consistent with the FATF greylisting economic impact model outlined in

Section 5. The more significant findings are provided in

Table 1 below.

Among the leading indicators identified in the theoretical model, there is strongly significant evidence that bank non-performing loans fell during the remediation periods and on delisting, and also some weakly significant evidence that risk premiums were reduced. Net foreign assets declined during the period in which countries were listed, and debts rose on listing, which provides some support for the findings of

Collin et al. (

2016), but there is some evidence of reduction in debt stocks after a time lag.

5.2. Period II: 2007–2009

As discussed above, the three-year period 2007–2009 has been identified as a transition period from the NCCT listing to the introduction of a more formal black- and greylist. Empirical findings from this period need to be treated with caution as they are based on a limited number of country-years of data and would be skewed by the nature of the handful of countries that were singled out.

Table 2 shows the beginnings of a more institutional response in this period, although weaker market-based effects, for example on exchange rates and growth, persist.

The impact on bank non-performing loans is more nuanced, with evidence of both positive and negative effects. Unlike other periods, this period does show some strongly significant effects on foreign direct investment, both inflows and outflows. There are also strongly significant negative impacts on IBRD loans and IDA credits, perhaps indicating that the same things that concern FATF also concern the officials who are deciding on the allocation of such loans and credits.

5.3. Period III: 2010–2015

The third period of FATF listings—a period characterised by higher levels of compliance with FATF listing signals by compliant countries and institutions—seems to have had more wide-ranging correlations, including with investment flows and with bank behaviour, as predicted by the theoretical model by

Collin et al. (

2016). This is also a period of more complex signalling, including the use of the dark-grey list that may have increased market responses to greylisting in general.

Table 3 summarises the more significant findings.

In this period FATF listing activity correlates with a decline in the market capitalisation of companies in the countries selected for listing, but this rebounds quite quickly, a trend reinforced during the remediation process. The remediation process also seems to encourage lenders, as does delisting. After an initial decline, remediation is also positive for exchange rates, although negative for GDP growth. The same pattern of improvement in financial situation is evident for net financial flows, and for net foreign assets, reinforcing the findings of

Balakina et al. (

2017). These findings also reinforce those of

Morse (

2017).

This period sees the emergence of a correlation between the remediation process plus delisting and a decline in net ODA, as well as, with a lag, the listing process itself. It is possible that this reflects FATF attention exacerbating institutional disquiet about a country (causation?), or that the same issues that FATF is concerned about also concern aid officials (correlation?). There is also more strongly significant evidence of a negative impact on IBRD loans and IDA credits throughout the remediation and delisting periods which persists after one- and two-year lags. Again, this may reflect greater caution in institutional policies and procedures following the listing.

5.4. Period IV: 2016 Onwards

From 2016, greylisting was restricted to those countries with an action plan, i.e., those countries that were actively working with the FATF to address strategic deficiencies in their AML/CFT/CPF regimes. This meant that the greylisting public statements may have been viewed as less alarming by the market, flagging these countries as jurisdictions with problems but also with political commitment and action plans to address the problems. At the same time that the FATF was stepping away from calling for enhanced due diligence measures in relation to greylisted countries, the EU and other countries were requiring their institutions to do precisely that.

Table 4 summarises the more significant results.

There is strongly significant evidence that listing coincided with a reduction in non-performing loans and (less significantly) an improvement in the willingness of lenders to grant loans, but that this reversed during the remediation period. Remediation seems to have coincided with an improvement in exchange rates, but also with a reduction in growth rates.

The negative correlation between net ODA and listings and delistings persists into this period, with more strongly significant coefficients. However, there are now important differences in that the impact during the remediation process seems to be positive and the negative impact on delisting lasts for longer. This may be because some ODA is in fact allocated to selected countries to help with the remediation process. This raises possible concern that the ODA contributed to assist with institutional reform may come at the expense of funding non-AML/CFT/CPF development activities (“crowding out”?) and may reduce future ODA. There is also significant evidence of correlation between the remediation and delisting process and reduced GDP growth rates, which may be related.

An empirical finding which stands out in all the periods is the correlation between FATF listings and reductions in ODA loans, IBRD loans and IDA credits. There are several possible explanations for this. One is that FATF listing creates a period of uncertainty, during which officials are hesitant to commit to loans in the relevant country. A second is that the same issues which cause FATF to list a country also cause officials to downgrade that country’s credit-worthiness. A third is that FATF scrutiny distracts government officials, and so delays other processes, including agreements on bilateral and multilateral loans. In Period IV, we also noted a positive correlation during the remediation and delisting phases, which may indicate a diversion of funds from other activities to those related to AML/CFT remediation. This is an area where more detailed investigation on a country-by-country basis, beyond the scope of this article, could well yield valuable insights.

6. Discussion

6.1. Linking the Findings and the Model

The key FATF compliance audiences are countries (government officials), markets (regulated institutions and investors), and society (civil society, commentators, etc). To secure the desired responses from these audiences, the FATF has to craft its standards, guidance, statements, and conduct to communicate information that would elicit the desired responses.

The model reflects how listing signals could reasonably affect trade and public finance, and thus the relevant economy. With respect to greylisting, these are:

A specific signal to the listed country expressing concern about the seriousness of the identified AML/CFT deficiencies, the risk they pose to the global AML/CFT, and the urgency with which the deficiencies have to be remedied. It is conveyed as a formal and objective finding based on agreed standards and made by trained evaluators and peers after a carefully managed process that includes dialogue and review.

A general signal to the rest of the AML/CFT/CPF audiences, drawing attention to the findings and how stakeholders may react to the risks posed by the identified deficiencies. This signal is less defined and more open to interpretation, depending on specific country knowledge and dealings as well as own risk exposure. Responses are also informed by expectations of appropriate behaviour by counterparts and national regulators.

It is important to note that the market response to the FATF signal has often reflected lags and delays. A negative impact may only eventuate a year or even two years after listing.

As greylisting conveys not one signal but two, maintaining the correct balance or blend is essential. Otherwise, action taken by target groups may lead to outcomes the FATF did not intend. Firms, the media, and even national regulators may, for example, overact or over-comply with the general signal. This is a common precautionary reaction to new information being received or new and old information being combined. Over-compliant stakeholders may be less responsive to positive news emanating from listed countries (

De Koker and Symington 2014). This would be expressed in the model as a delisted country still experiencing prohibitions and adverse terms of trade caused by enduring market sentiment or regulatory expectations. Disruption of the FATF’s general signalling could also be caused by interference from other macro signals such as market crises, political bargains and other competing review processes.

Over time, however, FATF stakeholders would be expected to become more familiar with the FATF process and to observe that unless greylistings become blacklistings (till now an event of global significance, and very rare) they apparently inevitably resolve over time. Stakeholders would also develop the ability to balance specific and general signals and note their individual relevance to greylisting outcomes.

In Period I the FATF’s general listing signal was new and, for the reasons described above, very strong. The specific signals were more focused. In terms of their effects, the correlation of foreign exchange rate falls on listing and delisting in this period are consistent with signals that combined to create/confirm high-level negative country opinions and thus hardened terms of credit and trade in markets influenced by FATF norms. At the same time, there may be disinvestment by criminal and marginal players put off by the increase in scrutiny and cooperation associated with listing and the improved AML/CFT measures signalled by delisting. The decrease in foreign holdings seen could also follow from lower firm/government purchasing power, due to currency depreciation, and sales of foreign assets to cover cash shortfalls or in response to regulatory pressure (especially host regulatory pressure on listed-country-owned firms). The increase in ODA after delisting would correspond to a country having met delisting conditionality criteria. The lags support the notion of a learning process on all sides.

In contrast, the signalling during Periods II and III was not as well-defined as that during Period I. The public statements during Period II were not particularly informative and the Period III messaging was complex with dark- and light-grey lists, warning lists and public statements, as well as lists issued by FSRBs and published by the FATF. Period III also coincided with IMF and G7/G20 attempts to limit the negative impacts of the Global Financial Crisis on the many smaller countries, now members of FSRBs. There were also internal adjustments between key FATF stakeholders, with rebalancing between especially IMF (Article IV) and FATF processes helping to rebalance FATF signalling towards the technical assistance and specifics (carrot) whilst maintaining the opportunity to name and shame generalities (stick). The increase in IBRD and IDA loans after delisting is again consistent with delisting signals being more readily discerned by markets and near-market multilateral actors with a corresponding positive impact on credit, goods and services.

Period IV saw a return to clearer signalling with the publication of only one FATF greylist, the former light-grey list, with countries that had deficiencies but were working on an agreed action plan to address them expeditiously. The language of the statements was also adjusted during this period to prevent unnecessarily negative market responses to these countries. In addition, the market would anticipate a fast resolution of the concerns followed by a delisting. As a result of all of these changes, negative market responses would tend to be limited. The more constructive approach by the FATF correlates with more positive outcomes in relation to positive aid and concessional lending correlations, possibly reflecting positive signals into credit markets, with knock-on effects in equity market confidence. Positive or neutral responses would however be limited as the EU and other national regulators continue to call for enhanced due diligence measures in relation to greylisted countries, even when the FATF explicitly stated the contrary.

Period IV therefore still reflects some concerns: net ODA, IBRD loans and IDA credits seem to be reduced on listing and delisting, GDP growth rates are impacted, and bank non-performing loans may be adversely affected. These findings are of concern from a development policy perspective. It is possible that risk managers and risk management processes in the ODA, IBRD loan, and IDA credit space are less responsive to the signalling changes in this phase than their corporate and commercial counterparts, or are less free to respond appropriately. These findings should be further investigated but they should prompt the FATF to review its listings market signalling and the regulatory requirements of its members to limit unintended negative economic consequences.

6.2. Limitations

The study and the research questions focus on correlations rather than causation. There is a likelihood that any improvements in a country’s AML/CFT/CPF system are the consequence of its listing (

Morse 2022) but this has to be determined at a country level as other drivers may also be relevant. Similarly, a negative economic impact may be discernible after a country was listed, and a positive impact after its delisting but, given the complexity of global, regional and national socio-political and economic factors, it cannot be stated with confidence that those impacts were indeed caused, or even significantly affected by, the listing and delisting.

Simply demonstrating a correlation between an improved AML/CFT regime and FATF actions does not prove that FATF actions cause such improvements. Collinearity between explanatory variables in a regression equation can cause bias to estimated coefficients, and also generate spurious measures of a particular variable’s significance. In addition, explanatory factors used in regression equations may themselves be endogenous, meaning that they may be co-determined with the variable they are supposed to be explaining.

For example, reductions in overseas investment and lending may be associated with FATF listing but in principle it could be that the same underlying concerns that drive the listing of a country also drive private sector concerns about inward investment and lending. Thus, a reduction in inward investment following a listing may not be caused by the listing. It is hard to tell without some model of causation. Listing considerations include information that is publicly available to the market, e.g., gaps in law and law enforcement. A plausible hypothesis is, however, that vulnerabilities that were suspected but could not be fully observed by honest private agents are verified or falsified by official action by an independent expert authority with some private information, such as the FATF. The unambiguous signal to the market from the FATF reduces information asymmetry from the perspective of the private agents and underpins a plausible hypothesis that listing itself makes a significant contribution to the relevant impact.

The existing empirical literature on the impact of FATF actions often does not address these questions adequately, despite there being a well-developed literature on causality and endogeneity as applied to other topics. It is for this reason that the empirical findings are described as correlations between listings and the economic and financial variables, rather than the effects of listings. This study is intended to inform further work that may help to shed more light on the issue by undertaking a more detailed micro- and meso-level investigation, taking into consideration the different periods in the FATF listing process.

Given the dataset used in the study, the econometric analysis focused on the relevant calendar years of listing, remediation, and delisting. This would obscure short-term impacts, e.g., short-lived spikes in foreign exchange rates, that do not impact on annual rates.

The full set of econometric results is attached as Attachment A.

7. Conclusions

This study identified four distinct periods in the FATF’s greylisting of countries that were not appropriately compliant with FATF standards, based on changes in its messaging and signalling in its processes and statements. The econometric analysis identified correlations between listing and delisting and a range of negative and positive economic indicators. The latter were identified using a FATF greylisting impact model that was developed to support the study. The study also provides an explanation of the potential causal drivers that may explain the correlations.

The study finds significant correlations with several of the economic and financial variables which are suggested as possible indicators by the economic and financial model, but not with all. One- or two-year lags are evident in a number of cases. Several of the findings reinforce those previously identified in the literature, but there are also some differences. Importantly, negative indicators are less visible in the dataset in Period IV (2016). This may be due to changes in the list itself as the FATF, from February 2016, only added countries with strategic deficiencies that committed themselves to a plan of action and a timeline to address the concerns. The signalling by the FATF was also more positive in relation to the listed countries. The market, on the other hand, had also come to expect a delisting to follow a listing. This combination of factors may result in more muted negative market responses. Net ODA, IBRD loans and IDA credits seem, however, to be reduced on listing and delisting, while GDP growth rates are impacted, and bank non-performing loans may be adversely affected. These findings are of concern from a development policy perspective.

Punitive economic consequences, especially in relation to development aid and funding, would seem to run counter to the spirit and objective of the Period IV listings. The listing informs the global community that a country with strategic deficiencies has given its commitment to the FATF to actively and speedily address them. While punitive action may be required to move a country towards a commitment to address such deficiencies, there seems to be little need for punitive measures once that commitment has been extracted and it is clear that the country has implemented an agreed plan to address remaining problems. Should a country fail to act on its commitment, the FATF still has the option to list the country on its blacklist. In October 2022 the FATF blacklisted Myanmar for its failure to implement its action plan as agreed. The FATF is therefore alive to this option. FATF listing processes that trigger negative economic consequences for countries that are committed to resolving deficiencies and are swiftly acting in terms of an agreed action plan to do so, should be subjected to close policy scrutiny by all FATF stakeholders. Improvements may avoid unintended and unwarranted negative consequences.

Despite the change in the FATF’s listing processes and language, the EU and other countries are requiring their institutions to adopt risk-based enhanced due diligence measures in relation to greylisted countries. Many of these countries are leading members of the FATF but adopt such measures even though the FATF is explicitly stating that it does not call for enhanced due diligence in relation to greylisted countries. The FATF operates by consensus and members who require their own institutions to implement enhanced due diligence measures therefore agree with the position taken by the FATF. The market signalling in this regard is confusing and should be clarified.

The push for enhanced due diligence measures in these cases is said to be based on the AML/CFT-related risks posed by these jurisdictions, including the need for a consistent response to those risks. Such risks however are generally at their highest when the country is assessed for FATF compliance. In many cases, countries then improve their assessed compliance levels in an unsuccessful attempt to avoid greylisting. The risks they pose, as assessed by FATF processes, therefore tend to be lower by the time they are listed, compared to the risk levels during the initial assessment period. If the EU and other countries were concerned about risk, calls for a risk-based response to the mutual evaluation report rather than to the later listing would be more appropriate.

The indications of a potential negative impact on development aid and funding in the current period are particularly concerning. Greylisting may cause economic and social harms that may not be fully appreciated by the FATF and its development stakeholders. The identified correlations should be further investigated but, even in the absence of further clarity, the FATF should consider its market signalling impact as well as the regulatory and market signalling responses of its members and other regulators to limit any unintended negative economic consequences for listed countries.

It should of course be noted that these findings are general and should not be interpreted as an absence or presence of negative responses or indicators for any particular country. Country profiles differ widely, and some may have been negatively affected, although on balance most other peers were not affected.

The findings and the model suggest least greylisting harm is likely when the FATF uses strong specific FATF signals that are to the point, combined with clear general signals which reinforce positive impacts and reassure unsettled markets. Positively framed and communicated greylisting need not have unintended and/or over-enduring effects on a national economy and may correct unfounded perceptions of risk that accompanied earlier periods in the FATF’s greylisting. These signals should, however, also be reflected by the FATF members’ own national regulations and regulators, and those of non-FATF members, to have their appropriate effect on the market.

Future decisions regarding greylisting should ideally be informed by data and research. In particular, it would be helpful to strengthen the understanding of causation. This study identified correlations and more work is required to deepen insights into causation. With the data available and the model that was developed it is possible to prospectively assess the likely economic impact of a listing on a country. An assessment of the likely impact (intended and unintended effects) would be a useful inclusion in future listing discussions of the FATF, especially coupled with planning for development assistance to address such impact and safeguards/mechanisms to check and correct unintended consequences.

Author Contributions

Conceptualisation, L.d.K., N.M., J.H.; methodology, L.d.K., N.M., J.H.; validation, N.M.; formal analysis, N.M.; investigation, L.d.K., N.M., J.H.; resources, L.d.K.; data curation, N.M., L.d.K.; writing—original draft preparation, L.d.K., N.M., J.H.; writing—review and editing, L.d.K., N.M., J.H.; visualisation, N.M., J.H. All authors have read and agreed to the published version of the manuscript.

Funding

This paper reflects work undertaken during a commission by the Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH (GiZ). Contract number: 81263810; Project processing number: 18.2126.3-009.00.

Data Availability Statement

Acknowledgments

This study was supported by an advisory panel consisting of Peter Andrews (regulatory economist), Sue Jaffer (regulatory economist) and Mike Levi (criminologist). The authors acknowledge with appreciation the valuable and constructive discussions with the advisory panel members, and the research assistance and support provided by Alette de Koker and Sue Jaffer. The paper however reflects the views of the authors and not necessarily those of individual advisory panel members. The authors further acknowledge support provided by the FATF secretariat who shared some data on listing dates, and constructive comments from Dr Julia Morse and other participants on an early draft presented at the Third Bahamas Empirical Anti-Money Laundering Conference, hosted in January 2022 by the Central Bank of The Bahamas. Louis de Koker acknowledges the support received from La Trobe University and from Wolfson College, Oxford, and CeFIM at SOAS who accommodated him as a visiting scholar and enabled the completion of this work.

Conflicts of Interest

The authors declare no conflict of interest. The funder framed the question but had no involvement in the design of the study or in the collection, analysis and interpretation of data, apart from making constructive comments on an early draft of the original report that included country studies. The funder had no role in the decision to publish the results.

Appendix A. Econometric Results

Table A1.

Summary of Pooled Cross-section Time Series regressions with Fixed Effects, First Order Correlations, Immediate, one- and two-year lags.

Table A1.

Summary of Pooled Cross-section Time Series regressions with Fixed Effects, First Order Correlations, Immediate, one- and two-year lags.

| | | T-stat 80% | 1.282 | T-stat 90% | 1.645 | T-stat 95% | 1.96 | https://www.stat.colostate.edu/inmem/gumina/st201/pdf/Utts-Heckard_t-Table.pdf (accessed on 5 February 2021) |

| Significant? | | | | | | | | http://uregina.ca/~gingrich/tt.pdf (accessed on 5 February 2021) | | | | | |

| Negative impact | | | | | | | | | | | | |

| Positive impact | | | | | | | | | | | | |

| | 2000–2006------------------------------------------------------------> | | 2007–2009------------------------------------------------------------> | | 2010–2015------------------------------------------------------------> | | 2016 onwards------------------------------------------------------------> | | | | Diagnostics |

| Dependent Variable | Initial Listing I | t-Stat | Remediation I | t-Stat | Delisting I | t-Stat | Initial Listing II | t-Stat | Remediation II | t-Stat | Delisting II | t-Stat | Initial Listing III | t-Stat | Remediation III | t-Stat | Delisting III | t-Stat | Initial Listing IV | t-Stat | Remediation IV | t-Stat | Delisting IV | t-Stat | GFC Dummy | t-Value | R-Square | F-Stat | Outliers |

| Net official development assistance and official aid received (current US$)/GDP | 0.0050 | 0.434 | −0.0005 | −0.04 | 0.0103 | 1.176 | 0.0191 | 0.896 | −0.01339 | −0.83 | 0.0072 | 0.286 | −0.001 | −0.15 | −0.0066 | −1.94 | −0.0098 | −1.75 | −0.035 | −2.56 | 0.0474 | 6.319 | −0.0376 | −3.66 | 0.0004 | 0.221 | 0.8235 | 74.0 | 51 |

| Net official development assistance and official aid received (current US$)/GDP t + 1 | 0.0116 | 1.001 | 0.0008 | 0.094 | 0.0133 | 1.517 | 0.0144 | 0.677 | −0.00945 | −0.58 | 0.0031 | 0.122 | −0.004 | −0.70 | −0.0047 | −1.38 | −0.0083 | −1.48 | −0.056 | −4.10 | 0.0580 | 7.718 | −0.0408 | −3.97 | 0.0041 | 2.057 | 0.8202 | 72.3 | 63 |

| Net official development assistance and official aid received (current US$)/GDP t + 2 | 0.0104 | 0.893 | 0.0018 | 0.215 | 0.0025 | 0.291 | −0.034 | −1.61 | 0.02859 | 1.756 | −0.0006 | −0.03 | −0.007 | −1.29 | −0.0021 | −0.61 | −0.0070 | −1.23 | −0.058 | −4.30 | 0.0604 | 8.027 | −0.0385 | −3.74 | 0.0034 | 1.713 | 0.8166 | 70.6 | 69 |

| IFC, private nonguaranteed (NFL, current US$)/GDP | 0.0000 | 0.136 | −0.0001 | −0.23 | −0.0002 | −0.48 | 0.0002 | 0.179 | 0.00002 | 0.024 | 0.0002 | 0.188 | 0.0001 | 0.515 | 0.0000 | 0.299 | 0.0001 | 0.476 | 0.0004 | 0.564 | −0.0001 | −0.41 | 0.0002 | 0.367 | −0.0002 | −1.701 | 0.0451 | 0.75 | 33 |

| IFC, private nonguaranteed (NFL, current US$)/GDP t + 1 | −0.0003 | −0.66 | 0.0001 | 0.128 | −0.0001 | −0.18 | −0.0001 | −0.07 | 0.00007 | 0.089 | 0.0002 | 0.208 | −0.0003 | −0.97 | 0.0002 | 0.966 | 0.0002 | 0.761 | 0.0004 | 0.639 | −0.0005 | −1.48 | −0.0006 | −1.28 | 0.0001 | 1.543 | 0.0478 | 0.80 | 34 |

| IFC, private nonguaranteed (NFL, current US$)/GDP t + 2 | −0.0004 | −0.75 | 0.0002 | 0.518 | −0.0002 | −0.46 | −0.0003 | −0.31 | 0.00009 | 0.114 | 0.0001 | 0.075 | 0.0001 | 0.308 | 0.0001 | 0.698 | −0.0002 | −0.59 | −0.0001 | −0.21 | −0.0001 | −0.41 | −0.0001 | −0.29 | 0.0004 | 3.845 | 0.0498 | 0.83 | 33 |

| IBRD loans and IDA credits (DOD, current US$)/GDP | −0.0033 | −0.15 | 0.0084 | 0.534 | −0.0013 | −0.08 | 0.0548 | 1.367 | −0.09248 | −3.03 | −0.0104 | −0.22 | 0.0045 | 0.413 | −0.0352 | −5.49 | −0.0352 | −3.33 | 0.0042 | 0.163 | −0.0250 | −1.77 | −0.0249 | −1.29 | −0.0129 | −3.440 | 0.6058 | 24.3 | 83 |

| IBRD loans and IDA credits (DOD, current US$)/GDP t + 1 | 0.0012 | 0.063 | 0.0045 | 0.304 | −0.0031 | −0.20 | 0.0506 | 1.354 | −0.07549 | −2.65 | −0.0082 | −0.18 | 0.0028 | 0.276 | −0.0307 | −5.15 | −0.0302 | −3.06 | 0.0060 | 0.254 | −0.0193 | −1.47 | −0.0193 | −1.07 | −0.0134 | −3.844 | 0.5967 | 23.4 | 93 |

| IBRD loans and IDA credits (DOD, current US$)/GDP t + 2 | 0.0032 | 0.174 | 0.0006 | 0.048 | −0.0047 | −0.34 | 0.0427 | 1.250 | −0.06014 | −2.31 | −0.0060 | −0.15 | 0.0025 | 0.274 | −0.0253 | −4.65 | −0.0235 | −2.60 | 0.0113 | 0.521 | −0.0125 | −1.04 | −0.0117 | −0.71 | −0.0118 | −3.697 | 0.5972 | 23.5 | 77 |

| Risk Premium y-on-y change | 0.13279 | 0.270 | −0.4811 | −1.355 | −0.3618 | −0.979 | −0.1212 | −0.134 | 0.0459 | 0.067 | 0.0133 | 0.012 | −0.0108 | −0.045 | −0.0429 | −0.298 | 0.0390 | 0.164 | 0.0480 | 0.084 | 0.0083 | 0.026 | −0.0757 | −0.174 | −0.0130 | −0.154 | 0.0484 | 0.81 | 10 |

| Risk Premium t + 1 y-on-y change | 0.20510 | 0.417 | −0.5222 | −1.470 | −0.2848 | −0.771 | 0.1350 | 0.150 | −0.0466 | −0.068 | −0.0008 | −0.001 | −0.0306 | −0.126 | −0.0165 | −0.114 | −0.0534 | −0.224 | −0.1740 | −0.303 | 0.0706 | 0.222 | −0.2060 | −0.474 | −0.0340 | −0.404 | 0.0484 | 0.81 | 10 |

| Risk Premium t + 2 y-on-y change | 0.16417 | 0.334 | −0.4923 | −1.390 | −0.3713 | −1.008 | 0.0013 | 0.001 | −0.0249 | −0.036 | −0.0163 | −0.015 | −0.0531 | −0.219 | −0.0152 | −0.106 | −0.0629 | −0.265 | 0.0980 | 0.171 | −0.0532 | −0.168 | −0.0494 | −0.114 | −0.0217 | −0.258 | 0.0480 | 0.80 | 10 |

| Spread y-on-y change | −0.05828 | −0.206 | 0.0594 | 0.291 | −0.0098 | −0.046 | −0.7295 | −1.406 | 0.0664 | 0.168 | −0.0362 | −0.059 | 0.0514 | 0.368 | −0.0273 | −0.329 | 0.0180 | 0.131 | −0.0497 | −0.151 | 0.0224 | 0.122 | −0.0205 | −0.082 | 0.0077 | 0.159 | 0.0136 | 0.22 | 13 |

| Spread t + 1 y-on-y change | 0.00711 | 0.025 | 0.0445 | 0.218 | −0.0211 | −0.099 | −0.0966 | −0.186 | 0.1055 | 0.267 | 0.0082 | 0.013 | −0.0168 | −0.120 | 0.0084 | 0.102 | 0.0179 | 0.131 | 0.0780 | 0.236 | 0.0133 | 0.073 | −0.0101 | −0.040 | 0.1319 | 2.728 | 0.0150 | 0.24 | 13 |

| Spread t + 2 y-on-y change | 0.07750 | 0.271 | −0.0231 | −0.112 | −0.0150 | −0.070 | 0.6489 | 1.239 | −0.6832 | −1.712 | 0.0084 | 0.013 | −0.0300 | −0.213 | 0.0294 | 0.351 | 0.1138 | 0.823 | −0.0769 | −0.231 | 0.0610 | 0.330 | 0.0429 | 0.170 | 0.1368 | 2.803 | 0.0161 | 0.26 | 12 |

Table A2.

Second-Order Correlations, Immediate, one- and two-year lags.

Table A2.

Second-Order Correlations, Immediate, one- and two-year lags.

| | 2000–2006------------------------------------------------------------> | | 2007–2009------------------------------------------------------------> | | 2010–2015------------------------------------------------------------> | | 2016 onwards------------------------------------------------------------> | | | Diagnostics |

|---|

| Dependent Variable | Initial Listing I | t-Stat | Remed-iation I | t-Stat | Delisting I | t-Stat | Initial Listing II | t-Stat | Remed-iation II | t-Stat | Delisting II | t-Stat | Initial Listing III | t-Stat | Remed-iation III | t-Stat | Delist-ing III | t-Stat | Initial Listing IV | t-Stat | Remed-iation IV | t-Stat | Delist- ing IV | t-Stat | GFC Dummy | t-Value | R-Square | F-Stat | Outliers |

|---|

| Bank nonperforming loans to total gross loans (%) y-on-y change | 0.01477 | 0.714 | −0.0628 | −4.207 | −0.0443 | −2.856 | −0.1900 | −5.012 | 0.35048 | 12.134 | −0.0452 | −1.005 | 0.0078 | 0.767 | −0.0045 | −0.748 | −0.0039 | −0.387 | −0.0522 | −2.163 | 0.0329 | 2.459 | 0.0198 | 1.083 | −0.0147 | −4.149 | 0.4683 | 13.96 | 51 |