Abstract

This study examines how airlines in the United States report risk at a difficult and uncertain time as a result of the COVID-19 pandemic. The fundamental differences between the years 2019 and 2020 are identified using Leximancer, which is used to locate the key ideas and themes addressed in the risk reporting sections. Following the pandemic, the themes that addressed generic and recurring hazards were afforded less weight than themes that highlighted risks particular to day-to-day business and the stock market. The findings also point to the need for corporations to disclose future-oriented risks more fully in post-COVID-19 reporting, with an emphasis on unpredictability, stock volatility, and operational disruption. This study adds to the body of knowledge on risk profiling, particularly as it relates to the airline business, and it offers stakeholders and investors a glimpse into the general concerns of airlines. The inherent information imbalance between management and investors is lessened and transparency is increased because of this improved understanding of the market.

1. Introduction

Financial transparency has gained importance in the increasingly cutthroat global economy, mostly due to one of its most obvious channels: risk reporting and management (Lobo et al. 2019). Corporate transparency is acknowledged by investors and stakeholders as one of the essential components of good governance, according to Kang and Gray (2019). Regulators throughout the world are attempting to push for higher levels of transparency because it can encourage higher levels of responsibility, lessen information asymmetry, and lower the cost of capital. This primarily occurs through financial reporting. This also has occurred in the wake of recent company scandals, which were mostly attributed to the murky, dangerous, and secretive business practices these firms engaged in (Vyychytilova et al. 2020).

Although there has been considerable recent research on the topic, Abraham and Shrives (2014) claimed that risk reporting is still in its “infancy”. To date, the majority of risk reporting is unhelpful and does not express true meaning, leading academics to conclude that the quality of risk is more important (Abraham and Shrives 2014). Recently, academics have shifted their attention to using a variety of approaches to measure quality as well as a mix of quality and quantity (Miihkinen 2012; Wang et al. 2019; Vyychytilova et al. 2020; Penela and Serrasqueiro 2019; Probohudono et al. 2014; Beretta and Bozzolan 2004).

Hassan (2009) highlighted a thorough distinction between industry- and country-specific risks and urged additional investigation into various sectors and nations. Due to “changing economic conditions, variable fuel price and variations in exchange rates, (…) cyclical demand, severe pricing rivalry, high capital costs of labor and equipment and regulatory barriers”, the airline business in particular is vulnerable to significant financial risk exposure (Yashodha et al. 2017). Therefore, controlling these risks is essential for the industry’s continued development. Despite this, there is a dearth of industry-specific risk-reporting research on the aviation industry. Probohudono et al. (2014) examined airlines with operations in APEC nations and investigated how they disclosed risk during the 2009–2011 financial crisis. Despite not actively determining the content of those reports, the researchers also examined the potential factors affecting the levels of risk reporting.

With roughly a billion passengers in 2019, the United States is one of the leading markets for commercial aviation, 40 percent higher than its nearest competitor, China (World Bank 2021). Following the market deregulation in 1978 and the consequent turbulence, the U.S. passenger airline industry has grown into its current state. Because of this, it has been characterized as having few competitors, copying, a strong dependence on routines, and little opportunity or motivation for innovation (Hannigan et al. 2015). Therefore, it was expected that a severe incident such as the COVID-19 pandemic would cause the industry enormous grief. As a result, the context of US airlines was chosen for this study. The pandemic has disrupted supply chains and decreased demand, especially for activities that increase the risk of contracting the virus, such means of transportation. The pandemic’s long-term consequences and effective length have been conservatively predicted by researchers (Tisdell 2020), creating a high level of uncertainty that, in the interest of transparency, should encourage greater levels of risk reporting (Akhigbe and Martin 2008).

With this in mind, this study aims to examine the risk factors faced by US airlines, comparing and contrasting the pre- and post-COVID-19 settings, as well as its implications for the risk reporting sections of airlines’ annual reports. By contrasting the key themes of risk reporting from the annual reports of US-based airline firms in 2019, which served as a baseline, with those of 2020, a year of extreme hardship, the current analysis seeks to answer the following research question: Did the COVID-19 pandemic have an influence on risk factor disclosures? It also attempts to highlight the primary strategies employed by airlines to mitigate new risks resulting from COVID-19. To determine whether and how changes in this practice occurred, it is important to identify variations in each year.

To improve the findings, this study makes use of an underutilized technology called Leximancer to help to create visual outputs that complement qualitative data (the risk reporting section of airlines’ annual reports) (Ong et al. 2020). We employ the Leximancer outputs and compare two different years in the manner of Penela and Serrasqueiro (2019).

According to this study, there are seven primary themes for each year, with new ideas emerging in 2020 and others losing significance. This allowed us to analyze fresh information regarding risk reporting issues and ways to deal with the pandemic’s longer-term hazards.

This study, which is a pioneer in the identification of risk themes in the airline industry, fills a gap in the literature where airlines’ risk reporting themes have not yet been properly studied, particularly in an unbiased manner. In this study, quantitative analysis and qualitative content analysis are combined using Leximancer (Indulska et al. 2012). In this study, the substance is more important than quantity or quality alone. It also helps to present a sneak preview of the potential countermeasures and some insight into the pandemic’s early effects.

The present paper is structured as follows: The first section is dedicated to the literature review on risk factors’ disclosures and risk disclosure specifically in the aviation industry. It is followed by the methodology section in which the sample and data collection techniques, and data analysis procedures are detailed. Then, the results are presented and discussed in two separate sections. Finally, the conclusions, contributions, and limitations and further research are detailed in three separate sections.

2. Literature Review

2.1. Risk Factors’ Disclosures

Companies publish annual reports after each fiscal year, which are crucial for stakeholders to assess the status of the corporation through its financial and operational performance, as well as to disclose the risks it confronts and the state of the firm overall (Bao and Datta 2014).

Risks are everywhere and always changing in a changing environment, including regulatory risks, political risks, and technological risks (Lajili and Zéghal 2009). On the other hand, Cabedo and Tirado (2004) created three different forms of risk: business risk, strategic risk, and market risk. These classic types of hazards include several others. The first is concerned with the possibility of losing one’s efficiency or competitive advantages, “with the resultant influence on the potential loss of corporate wealth in the future”. Strategic risk refers to a company’s sensitivity to potential changes in the socioeconomic and political environment in which it conducts business (i.e., inflation, GDP, and regulation changes). Anyone who can significantly impact a company’s net cash flow is subject to financial risk. Four categories of financial risks can be identified: liquidity risk, credit risk, operational risk (distress in established procedures and resulting legal ramifications), and market risk (exchange, interest, and price changes of commodities and financial assets) (failure to assume short-term payment obligations).

In contrast to conventional corporate disclosures, textual risk disclosures, according to Kravet and Muslu (2013), “direct users regarding the range of future performance rather than the level of future performance”. The risk disclosure part of an annual report “appears as a free-form textual segment, i.e., entirely unstructured language”, according to Bao and Datta (2014); hence, its empirical examination faces certain unique difficulties.

When “the reader is informed of any opportunity or prospect, or of any hazard, danger, harm, threat, or exposure, that has already affected the company or may impact the company in the future, or of the management of any such opportunity, prospect, hazard, harm, threat, or exposure”, the concept of risk disclosure is most commonly understood (Linsley and Shrives 2006). This concept could include both “good” risks and “bad” uncertainty. However, Linsley and Shrives (2006) also noted that it is difficult to conduct any risk disclosure study because, in defining risk, it is necessary to find risk disclosures. As a result, “risk” is defined as a set of outcomes resulting from a decision to which probabilities can be assigned, while “uncertainty” occurs when probabilities cannot be assigned to the set of possibilities. However, there is minimal agreement and coherence about many other crucial ideas in the study of risk reporting; hence, research has also urgesd convergence regarding those crucial concepts (Elshandidy et al. 2018).

The effects and applicability of the 2005 Securities and Exchange Commission (SEC) requirement to include a section in companies’ annual 10-K reports to discuss the “most significant factors that make the company speculative or risky” have recently received attention, according to Elshandidy et al. (2018) and primarily American-based research (SEC 2005). According to some studies, authorities should not require mandatory risk disclosure because it is frequently general, ambiguous, and formulaic.

Campbell et al. (2014) emphasized the significance of establishing whether risk disclosure information is indeed helpful to investors and other stakeholders in their research. Additionally, they discovered proof that the information in Section 1A of the Annual Report on Form 10-K is useful and helpful to investors and is not merely a boilerplate. It is also important to note that the tone used in risk disclosure is typically pessimistic, which might raise the cost of capital when deciding on potential investments. As well as lowering information asymmetry across stakeholders in the same company, improving market liquidity, and providing investors with better tools to allocate their capital more effectively, this disclosure also raises the market’s appraisal of a firm’s risk (Schuster and O’Connell 2006). In actuality, “businesses are likely to repeat a major amount of their risk disclosures throughout consecutive annual reports”, according to Kravet and Muslu (2013), although this is not inherently bad since it aids markets in evaluating systematic risk. The SEC routinely responds to these and other inquiries in its public requests for more precise, detailed, and insightful information. The ability to avoid private lawsuits under the Private Securities Litigation Reform Act of 1995, which may be void if the information turns out to be nonexistent, “cryptic”, or boilerplate, is one of the key benefits of risk reporting under the 10-K Form (Nelson and Pritchard 2007).

Research on risk disclosure has become increasingly popular over the past two decades, mostly as a result of the 2008–2011 global financial crisis and the effects of the aforementioned 2005 SEC regulation. Elshandidy et al. (2018) identified three key distinctions between risk reporting studies from the US and those from the EU/AUS: The former emphasizes the motivation or “why” firms disclose risk in the first place, while the latter emphasizes how markets respond to risk disclosure that is primarily provided through SEC requirements. Research in the US focuses on mandatory risk disclosure, while research in the EU/AUS examines voluntary, quasi-voluntary, or quasi-mandatory, and mandatory disclosure (generally one year).

2.2. Risk Disclosure in the Aviation Industry

Researchers recommend further industry-specific research utilizing the same methods (Penela and Serrasqueiro 2019), overall risk reporting and profiling (Linsley and Shrives 2006), or even country-specific aviation industry risk reporting (Probohudono et al. 2014). This occurs because it has been discovered that risk disclosure differs by industry and that the kinds of risks that a firm faces vary by industry (Hassan 2009; Elshandidy et al. 2018; Beretta and Bozzolan 2004). According to Probohudono et al. (2014), there was no risk-reporting study on the aviation industry before their research, which is the topic of the current study. For a variety of reasons, the aviation sector is especially odd. Due to its intense competition and extensive fare discounting, it has reduced profit margins (Berghöfer and Lucey 2014). It has been considered to be the most international of industries by Hanlon (1999), and as such, there are some unique characteristics, such as the increased vulnerability of airplanes to macroeconomic issues such as fluctuations in oil prices or exchange rates. Additionally, as they are frequently high-profile businesses, airlines typically reveal monthly traffic numbers, which adds to their transparency (Gong et al. 2006). Terrorist attacks, air disasters, and human and drug trafficking are other threats that affect airlines (Probohudono et al. 2014). Additionally, because airlines are seen as extremely risky investments, stakeholders are required to disclose more risk, which is one of the factors that attracted the attention of the current investigation. The COVID-19 outbreak, which started in China but had its epicenter in Europe, was deemed a global pandemic by the World Health Organization on 13 March 2020 (Callaway et al. 2020). Despite the paucity of published research on the subject, Gössling et al. (2021) noted that “most countries responded with various forms of nonpharmaceutical interventions (NPI), including lockdown (home isolation, voluntary/required quarantine), social distancing (vulnerable or entire populations), closure of schools/universities, and non-essential business”. The following travel restrictions were put into place: border closures, travel bans, and the introduction of required quarantine periods. The entire tourism system and value chain, including air travel, cruises, public transportation, lodging, cafes, restaurants, conventions, festivals, meetings, sporting events, laundry services, and catering, were significantly impacted. Following this, airlines filed for mass layoffs declared bankruptcy (such as FlyBe), and requested public aid (i.e., Virgin and Singapore Airlines).

The tourism industry has held up well in the face of external shocks. Only the SARS pandemic in 2003 and the global economic crisis in 2008/2009 reduced the number of foreign arrivals annually in the 21st century (−0.4 percent and −4 percent, respectively). The COVID-19 pandemic is expected to have unprecedented effects, and this is supported by the evidence. The epidemic has already had the greatest impact on the aviation business, as well as the rest of the travel and tourist industry, as customer-facing services are frequently curtailed or even discontinued (Suk and Kim 2021). As the world becomes increasingly interconnected and urbanized, pandemics have been a latent threat, but COVID-19 was initially not taken seriously. On the final day of 2019, there was a report of the first case; by the end of March, it had spread to the majority of nations. The World Trade Organization first expected a drop in foreign visitor arrivals in the range of 1–3 percent, but these predictions were amended to a decline in the range of 20–30 percent, three weeks later, on 26 March (Gössling et al. 2021). Per WTO (2020), by April 2020, all 217 locations had some sort of travel restriction in place. Of the 217 destinations, 45% had completely or partially closed their borders to visitors, and 30% had completely or partially ceased foreign flights.

At the start of 2020, the number of flights were more than cut in half, and some airlines had implemented rules about seating arrangements to create a more socially distant environment. The European market would be the most affected, according to IATA’s 2020 forecast, which called for a 48 percent fall in passenger revenue. After the WHO declared a pandemic and the President of the United States of America announced a travel ban for Europeans on March 11, airline stock returns had a large decline that was more severe than market stock returns, according to Maneenop and Kotcharin (2020). In addition, Sobieralski (2020) predicted a 7–13 percent decrease in airline employment in the United States, with big carriers suffering more consequences than low-cost and regional airlines.

Airlines experienced a general drop in traveler willingness as a result of health issues, orders to “remain at home”, and risk perceptions; this is likely a long-term impact of the epidemic (Hao et al. 2021). When determining whether and where to go, travelers take into account several criteria, including the current COVID-19 situation, national health and sanitary measures, healthcare services, transit options, and lodging options. Additionally, travelers must consider how reliable the information is (Teeroovengadum et al. 2021). Despite being a frequently mentioned factor in risk reporting, pandemics were not always taken seriously enough, according to Brown and Kline (2020). This led to the creation of a financial cushion that was insufficient to assist or mitigate the effects of the pandemic and that businesses were reluctant to expand, preferring to use it for stock buybacks and dividend distribution in the United States

3. Methodology

3.1. Sample and Data Collection

This study examined the risk factors faced by US airlines, comparing and contrasting the pre- and post-COVID-19 settings, as well as its implications for the risk reporting sections of airlines’ annual reports. These were taken from the EDGAR database, which is maintained by the SEC, using the standard 10-K format that is needed for all publicly traded companies in the United States of America. Millions of business and individual files are made available through EDGAR to increase the securities markets’ effectiveness, openness, and fairness (SEC 2021). According to Brown and Kline (2020) and the Occupational Safety and Health Administration (OSHA 2021), the Standard Industrial Classification (SIC) code 4512—Air Transportation, Scheduled—was used to identify airlines among the numerous businesses in the database. This code applies to either regional low-cost carriers or national hub and spoke carriers (such as Delta, American, and United) (i.e., Southwest, JetBlue, and Spirit).

The United States is one of the top markets for commercial aviation, with nearly one billion passengers in 2019—40% more than its closest rival, China (World Bank 2021). A total of 11 companies make up this sample (listed in Table 1). Only 13 US-based airlines, out of the 122 firms that have filled a report to SEC, were still in operation. A total of 2 of the 13 were removed since they belonged to the holding company of the title firm (United Airlines Holdings, Inc. and American Airlines Group Inc.). The years chosen were 2019, which served as the “standard” year, for direct comparison with 2020, which was heavily impacted by the COVID-19 pandemic. Reports of 2019 were primarily published in February and March 2020, with some documents already noting the new coronavirus as a distant concern in Eastern Asia. The MESA AIR GROUP INC company had a different reporting date, as this company’s fiscal year ends on 30 September of each year.

Table 1.

List of airlines included in this study.

3.2. Data Analysis

Due to the format of risk disclosure sections, content analysis is a suitable methodology to investigate the subject, whether it is manual or automated. Elshandidy et al. (2018) argued that Beretta and Bozzolan (2004) are a foundational paper for manual content analysis. They proposed a framework for the analysis of risk communication, mainly adequate for voluntary risk disclosure, based on four dimensions: quantity (number of risk-reporting related phrases adjusted to size and industry), density (the ratio between the number of sentences in which risk information is provided and the total number of sentences included in the Management Discussion and Analysis Section), depth (divided between two properties of the sign of economic impact (negative, positive, equal, or non-disclosed) and measurability of such impacts), and the outlook profile (approach to each risk by the managers). They argued that “the quantity of disclosure is not a satisfactory proxy for the quality of disclosure”, which was the main focal point of research until then.

Furthermore, Miihkinen (2012) further addressed manual content analysis with care for investigating quality as well as quantity. He addressed the impact of a new Finnish standard to risk reporting, concluding that both quantity (the number of words and sentences) and quality (the principal component of three proxies: quantity of disclosure, coverage of disclosure, and the semantic properties of the disclosure (contains two dimensions, depth and outlook)) increased after the new standard, more so in loss-making firms. He also found that quality was associated with size, profitability, listing status, risk, growth, and foreign ownership.

Wang et al. (2019) and Vyychytilova et al. (2020) analyzed two different industries (insurance and auto, respectively) through a content analysis methodology. The first used the Sent-LDA topic model to detect risk factor topics using a large data sample and their evolution throughout a troubled economic environment (2006–2018). The latter used a manual content analysis method to evaluate correlations between company size and company risk with the level of risk disclosure and its characteristics (type of risk, time orientation, and proportion of outlook).

Penela and Serrasqueiro (2019) used the software Leximancer for automated content analysis, which outputs concept maps, network clouds, and concept thesauruses. It does so through two main steps: word occurrence and co-occurrence to identify the main concepts and the combination of groups of concepts into themes based on how often they are used together. In their study, Penela and Serrasqueiro (2019) identified the main risk concepts and themes US lodging companies report in their annual 10-K filings in two different years, a financial crisis year in 2008 and a recovery year in 2016. They found that risk reporting became more specific and results-oriented versus a more macroeconomic perspective of risk.

Using a similar method, Martin and Rice (2007) conducted a Leximancer-based analysis on IBM, Hewlett Packard, and Dell risk reporting practices, also using their 10-K filing. Although the researchers used an early version of Leximancer, the researchers stated Leximancer’s usefulness, convenience, intuitiveness, and trustworthiness in using it as a risk profiling tool.

For this research, the risk factors covered in Item 1A of the 10-K form were used as data inputs for Leximancer (version 5.0). This tool, which Dr. Andrew Smith of the University of Queensland in Australia first developed in 2000, is a text-mining program that employs co-occurrence to perform an unsupervised semantic and relational analysis of textual data. This method was chosen to establish connections and related topics between each extracted annual report (Smith and Humphreys 2006). As a technique for qualitative analysis, it has recently earned greater acceptability, credibility, and reliability among scientists (Bae and Chi 2021; Lemon and Hayes 2020; Arasli et al. 2020; Kim and Kim 2017; Spry and Dwyer 2017; Wilk et al. 2021). Because Leximancer is a computer-assisted qualitative data analysis program (CAQDAS), its perceived objectivity has been deemed to be freer of researcher bias when compared to other content analysis techniques. It is also thought to be particularly effective in producing relevant maps and searches, as well as speedy automated analyses of massive volumes of data. According to Leximancer, “concepts” are just word clusters that are analyzed and merged to create “themes” (Wilk et al. 2019). Leximancer then generates a concept map based on word co-occurrence for each year that includes the key concepts found through word occurrence.

4. Findings

4.1. Main Concepts of the Years 2019 and 2020

Leximancer can generate concepts ranked according to the frequency of occurrence in the uploaded data after the risk report sections have been uploaded. Although there are only two proper nouns in 2019 (US and Company, as shown in Table 2), there are four in 2020 (COVID, Company, US, and DOT), according to Leximancer’s Web Portal, which begins with an upper-case letter. Concepts, on the other hand, can take the form of words that are lowercase and represent things such as objects and actions.

Table 2.

List of concepts for 2019.

For the year 2019, as seen in the previous table, there were 65 different concepts detected from the 11 Risk Factor sections. The most occurred concepts were results, operations, adverse, business, financial, and costs. With 1042 hits and 100% relevance (determined as a relation to the top concept), results is the top concept, followed closely by operations with 1035 hits. The other three aforementioned concepts have a relevance level of 76%, 74%, 72%, and 44%, respectively.

Regarding 2020, Leximancer detected 68 different concepts, as seen in Table 3. Likewise, the top five hit concepts were adverse (100% relevance and 1528 counts), operations (90%), business (69%), financial (68%), and including (34%).

Table 3.

List of concepts for 2020.

When comparing the two years side by side, it is interesting to see how the notion of COVID-19 emerged in 2020 with 327 counts and a relevance rate of 21% after being absent the year before. Additionally, the top concept of 2019 (results) drops from first to not even appearing on the list of concepts for 2020. Likewise, the remaining top four from 2019 are repeated in 2020 in a different order but with the same relevance (except for the operations jump from 76% to 90%) with the addition of including, which was 9th in 2019.

4.2. Main Themes of the Year 2019

Following the concept hit count, Leximancer creates a statistically built analysis in which concepts are combined based on concept co-occurrence and on how frequently concepts appear separately from one another, creating a network where concepts are shown connected to other concepts with which they most frequently co-occur, building a “Concept Map” (Wilk et al. 2019). Each notion is represented by a dot, the size of which varies depending on how significant it is. Each component of a network of concepts that are heat mapped (from red and orange to blue and purple) according to their importance is surrounded by a circle representing a theme. Tseng et al. (2015) contend that each theme becomes richer as additional notions are included within it.

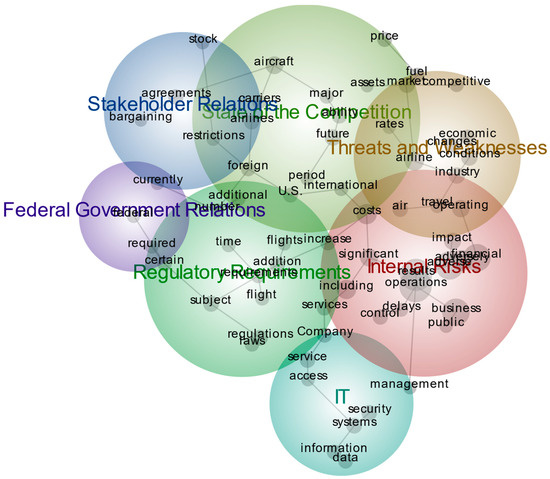

Initially, each theme derives its name from the most connected concept within that theme, but this can be altered, as shown in Figure 1, so they could reflect the concepts within each theme (Leximancer 2021). Thus, within this research, Leximancer detected seven main themes, which in order of importance were: “Internal Risks” (where the most important concept is operations), “State of the Competition” (aircraft), “Threats and Weaknesses” (airline), “Regulatory Requirements” (subject), “IT” (security), “Stakeholder Relations” (agreements), and “Federal Government Relations” (federal).

Figure 1.

Concept map with risk themes from 2019.

4.2.1. Internal Risks

The first and foremost theme is “Internal Risks” while also being the richest, counting 14 concepts within it: operations, results, adverse, financial, business, adversely, costs, including, significant, impact, control, increase, delays, and public. This theme is not surprising as it initially seems to portray a picture of any possible disturbance to day-to-day operations, as is shown in the excerpts below:

2019: “Extended interruptions or disruptions in service could have a material adverse impact on our operations. Our financial results may be adversely affected by factors outside our control, including, but not limited to, flight cancellations, significant delays in operations, and facility disruptions”.

2019: “If we are unable to hire, train and retain qualified employees at a reasonable cost, sustain employee engagement in our strategic vision, or if we are unsuccessful at implementing succession plans for our key staff, we may be unable to grow or sustain our business. Attrition beyond normal levels could negatively impact our operating results, increase our training and labor costs and our business prospects could be harmed”.

2019: “Annually, we perform activities that include reviewing, documenting, and testing our internal control over financial reporting. During the performance of these activities, we may encounter problems or delays in completing the implementation of any changes necessary to make a favorable assessment of our internal control over financial reporting”.

The risk of cancellations and delays, which may occur for causes beyond their control such as airport capacity or meteorological conditions, is demonstrated by these exact quotations from the sample. There are also hazards related to personnel, where they discuss potential challenges in finding and keeping suitable human resources (from management to pilots to flight attendants). Here, they also provided strategies for reducing this risk through the development of career plans or the design of alluring compensation schemes. The risks associated with being a large publicly traded corporation exposed to significant related costs were also mentioned by airlines, along with the high cost and risk associated with internal control over financial reporting and external audits.

4.2.2. State of the Competition

This theme contains 12 concepts, which are: aircraft, future, ability, airlines, price, U.S., foreign, carriers, international, major, period, and assets. Here are some citations, obtained from the sample:

2019: “These carriers have large numbers of international widebody aircraft on order and are increasing service to the U.S. from their hubs in the Middle East. The government support provided to these carriers has allowed them to grow quickly, reinvest in their product, invest in other airlines, and expand their global presence”.

2019: “Competition is increasing from foreign state-owned and state-affiliated airlines in the Gulf region, including Emirates, Etihad Airways, and Qatar Airways. These carriers have large numbers of international widebody aircraft in service and on order and are increasing service to the U.S. from locations both in and outside the Middle East”.

2019: “Through alliance and other marketing and codesharing agreements with foreign carriers, U.S. carriers have increased their ability to sell international transportation, such as services to and beyond traditional European and Asian gateway cities. Similarly, foreign carriers have obtained increased access to interior U.S. passenger traffic beyond traditional U.S. gateway cities through these relationships”.

This theme seems to be the concern of the main international competitors, mainly Middle Eastern Airlines, which threatened to take a large portion of the international flights market, mainly inward and outward United States flights. American Airlines outlined its state-owned nature as a competitive advantage, which allows this company to have large amounts of liquidity to invest in their products and expand quickly. Additionally, in this theme, companies also shared a strategy through which alliances (and other codesharing agreements) between international airlines are created to increase their ability to sell international transportation. These also come with the setback of creating other competitors when other alliances between national and international competitors are established, which allow for international carriers to operate certain internal routes.

The most important concept in this theme is aircraft, but this mainly happens because of a common reference to the typical fleet of these competitors (and orders set), which usually consists of widebody aircraft, allowing for long-range high-capacity flights, such as Boeing 777, Boeing 787, Airbus A350, and Airbus A330.

4.2.3. Threats and Weaknesses

The third theme was named “Threats and Weaknesses” due to its broadness with a significant focus on external risk factors and industry-specific risk factors. Its main concepts were the following 12: airline, operating, conditions, industry, market, air, changes, economic, fuel, travel, competitive, and rates. To understand this theme better, here are a few quotes relevant to it:

2019: “The airline industry is particularly sensitive to changes in economic conditions. Unfavorable U.S. economic conditions have historically driven changes in travel patterns and have resulted in reduced discretionary spending for leisure travel”.

2019: “Due to the competitive nature of the airline industry and unpredictability of the market for air travel, we can offer no assurance that we may be able to increase our fares, impose fuel surcharges or otherwise increase revenues or decrease other operating costs sufficiently to offset fuel price increases. Similarly, we cannot predict actions that may be taken by our competitors in response to changes in fuel prices”.

2019: “Due to greater demand for air travel during the spring and summer months, revenues in the airline industry in the second and third quarters of the year are generally stronger than revenues in the first and fourth quarters of the year, which are periods of lower travel demand. The Company’s operating results generally reflect this seasonality but have also been impacted by numerous other factors that are not necessarily seasonal, including, among others, extreme or severe weather, outbreaks of disease or pandemics, ATC congestion, geological events, political instability, terrorism, natural disasters, changes in the competitive environment due to industry consolidation, tax obligations, general economic conditions, and other factors”.

From the analysis of these quotes, we can conclude that companies tended to report commonplace (though relevant) external risks, such as the economic situation both in the United States and worldwide, fuel prices, leisure travel customer behavioral changes, ticket fare changes, seasonality, weather conditions, natural disasters, terrorism, tax obligations, air traffic, and airport congestion.

We should note the fact that we can, for the first time, find a reference to the risk of a disease outbreak or a pandemic, although mostly as a consequence of past pandemics, such as the SARS and MERS outbreaks, as well as with other viruses such as H1N1 and Ebola.

4.2.4. Regulatory Requirements

The second-most rich theme (13 concepts) is named “Regulatory Requirements”, named thusly since it deals with the heavy regulation airlines that are subject to national and international actors. Its main concepts are subject, regulations, addition, services, certain, additional, requirements, laws, time, flight, number, required, and flights. Below are a few quotations:

2019: “Airlines are subject to extensive regulatory and legal compliance requirements, both domestically and internationally, that involve significant costs. In the last several years, the FAA1 has issued several directives and other regulations relating to the maintenance and operation of aircraft that have required us to incur significant expenditures”.

2019: “We cannot assure that these and other laws or regulations enacted in the future will not harm our business. In addition, the TSA2 mandates the federalization of certain airport security procedures and imposes additional security requirements on airports and airlines, most of which are funded by a per ticket tax on passengers and a tax on airlines”.

2019: “Large numbers of pilots in the industry are approaching the FAA’s mandatory retirement age of 65. Our pilots and other employees are subject to rigorous certification standards, and our pilots and other crew members must adhere to flight time and rest requirements”.

Airlines showed concerns over the high costs of operating an international company obligated to comply with a wide-ranging array of directives, laws, and regulations over several of their business departments. When this changes or there is a need for an agreement to be settled, there is a severe risk of failing to comply effectively and promptly. Objectively, some of the agencies mentioned were the TSA, the DOT, and the FAA. For instance, the latter enforced a compulsory pilot retirement age, which may portray a future risk of high workforce turnover.

4.2.5. IT

A somewhat new risk has been widely reported in the past decade, following a 2011 and 2018 SEC Guidance, although it is sometimes referred to as boilerplate and cryptic (Gao et al. 2020). “IT” is the fifth most important theme and contains eight concepts: security, systems, service, Company, data, information, access, and management. According to Leximancer, some illustrative examples of this theme are:

2019: “The methods used to obtain unauthorized access, disable or degrade service or sabotage systems are constantly evolving, and may be difficult to anticipate or to detect for long periods of time. We may not be able to prevent all data security breaches or misuse of data”.

2019: “Unauthorized parties may attempt to gain access to our systems or information, or those of our service providers, including through fraud or other means of deception. Hardware or software we develop, acquire or use in connection with our systems may contain defects that could unexpectedly compromise information security”.

2019: “Additionally, the Company must manage evolving cybersecurity risks. Our network systems and storage applications, and those systems and storage and other business applications maintained by our third-party providers, may be subject to attempts to gain unauthorized access, breach, malfeasance or other system disruptions”.

Airlines worry about the constant evolution of IT threats from outside agents that can cause highly disruptive breaches in their systems, which then can cause poor stock performance (Hogan 2020) and negatively impact the company’s image. There is also a risk of cyber-attacks being hard to predict, prepare for, and even detect, as well as the chance for breaches to third-party providers that cannot be as calculated as insider threats.

4.2.6. Stakeholder Relations

This theme comprises relations with multiple stakeholders, such as shareholders, regulators, and unions. “Stakeholder Relations” includes the ensuing concepts: agreements, restrictions, stock, currently, and bargaining. To illustrate this theme, these are three quotes from the sample:

2019: “The restrictions imposed by federal law currently require no more than 25 percent of our stock be voted, directly or indirectly, by persons who are not U.S. citizens, and that our president and at least two-thirds of the members of our board of directors be U.S. citizens. Our bylaws provide no shares of our capital stock may be voted by or at the direction of non-U.S.”

2019: “We are currently in labor negotiations with our flight attendants’ union, AFA, whose contract became amendable on January 1 2017. If we are unable to reach an agreement with any unionized work group, we may be subject to future work interruptions and/or stoppages, which may hamper or halt operations. ”

2019: “As of 31 December 2019, approximately 85% of our employees were represented for collective bargaining purposes by labor unions”.

In the first quote, Allegiant referred to a law that limits shareholders’ diversity and can be an issue when looking for foreign investors. Additionally, from a company’s perspective, the existence of unions poses a risk as it can significantly increase labor costs with the increase in employee bargaining power. When collective bargaining agreements negotiations reach a deadlock, there is a chance for strikes to happen, which can disrupt day-to-day operations.

4.2.7. Federal Government Relations

The final and least rich theme from 2019 only contains one concept: federal. It indicates the major issues concerning the Federal Government, as can be seen from the following excerpts:

2019: “As of 31 December 2019, we had available NOL3 Carryforwards of approximately $9.1 billion for regular federal income tax purposes that will expire, if unused, beginning in 2023, and approximately $3.0 billion for state income tax purposes that will expire, if unused, between 2020 and 2039. Our NOL Carryforwards are subject to adjustment on audit by the Internal Revenue Service and the respective state taxing authorities”.

2019: “In the case of a CBA that is amendable under the RLA, if no agreement is reached during direct negotiations between the parties, either party may request that the NMB appoint a federal mediator. The RLA prescribes no timetable for the direct negotiation and mediation processes, and it is not unusual for those processes to last for many months or even several years”.

2019: “The general limitation rules for a debtor in a bankruptcy case are liberalized where the ownership change occurs upon emergence from bankruptcy. We elected to be covered by certain special rules for federal income tax purposes that permitted approximately $9.0 billion (with $7.3 billion of unlimited NOL still remaining at 31 December 2019) of our”.

As we can see, there are multiple references to NOL (Net Operating Losses) Carry forwards and how airlines plan to use them as well as other federal income taxes issues. The second and third quotes concern collective bargaining agreements negotiations and procedures in the event of a stand-off or bankruptcy situation.

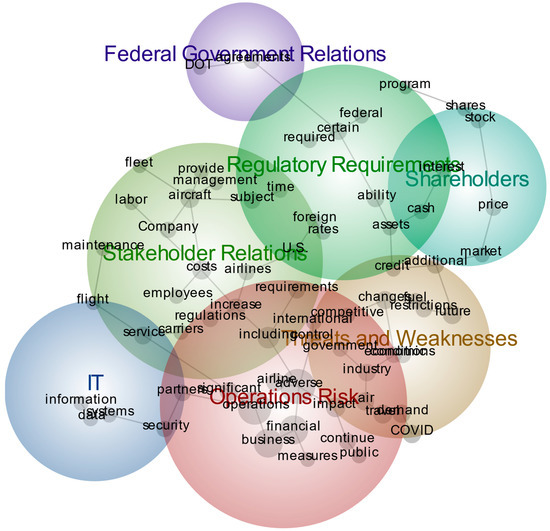

4.3. Main Themes of the Year 2020

Figure 2 highlights risk themes of 2020. When comparing the 2019 (Figure 1) and 2020 (Figure 2) themes, they are broadly similar, except for further references to the COVID-19 pandemic, its consequences, and future implications. It is interesting to understand (although not surprising) that large parts of the text are the same in both comparing years. The output extracted from Leximancer returned seven themes as well, which are, by order of importance: “Operations Risk”, “Stakeholder Relations”, “Threats and Weaknesses”, “Regulatory Requirements”, “Shareholders”, “Federal Government Relations”, and “IT”.

Figure 2.

Concept map with risk themes from 2020.

4.3.1. Operations Risk

The most important theme and the second with the most included concepts was named “Operations Risk” and includes 16 concepts: adverse, operations, business, financial, including, impact, travel, airline, significant, continue, security, partners, control, international, public, and measures. “Operations Risk” mostly relates to the “Internal Risks” theme from 2019 due to its broadness when referring to day-to-day business, but “Operations Risk” also has some vast references to the impact of and countermeasures to COVID-19. Below are a few examples:

2020: “The novel coronavirus (COVID-19) pandemic, together with the measures implemented or recommended by governmental authorities and private organizations in response to the pandemic, has had an adverse impact that has been material to the Company’s business, operating results, financial condition, and liquidity. Measures such as “shelter in place” or quarantine requirements, international and domestic travel restrictions or advisories, limitations on public gatherings, social distancing recommendations, remote work arrangements, and closures of tourist destinations and attractions, as well as consumer perceptions of the safety, ease, and predictability of air travel, have contributed to a precipitous decline in passenger demand and bookings for both business”.

2020: “Measures ranging from travel restrictions, “shelter in place” and quarantine orders, limitations on public gatherings to cancellation of public events have resulted in a precipitous decline in demand for both domestic and international business and leisure travel. In response to this material decrease in demand, our major airline partners, upon whom we depend to contract with us and to set our flight schedules, have drastically reduced their capacity in 2020 compared to 2019”.

2020: “Airlines are often affected by factors beyond their control, including: air traffic congestion at airports; air traffic control inefficiencies; major construction or improvements at airports; adverse weather conditions, such as hurricanes or blizzards; increased security measures; new travel related taxes or the outbreak of disease, any of which could harm our business, operating results, and financial condition”.

In 2020, the focus was largely on the effects of the pandemic, particularly on how it has upset the air travel industry through the cancellation of public events, such as conferences or music festivals, “stay at home” policies, and general travel restrictions. These caused an overall contraction of demand affecting most airlines.

4.3.2. Stakeholder Relations

“Stakeholder Relations” is the richest theme with 17 concepts included. These are costs, aircraft, increase, service, subject, Company, regulations, requirements, airlines, U.S., carriers, employees, provide, maintenance, labor, fleet, and management. Before further analysis, below are some excerpts that better illustrate this theme.

2020: “Airlines are subject to extensive regulatory and legal requirements, both domestically and internationally, that require substantial compliance costs. In the last several years, Congress has passed laws, and the U.S. DOT, the TSA, and the FAA have issued regulations that have required significant expenditures relating to maintenance of aircraft, operation of airlines, and broadening of consumer protections”.

2020: “In particular, we rely on AAR and Aviall4 to provide fixed-rate parts procurement and component overhaul services for our aircraft fleet and GE5 to provide engine support. Our agreements with AAR, and other service providers, are subject to termination after notice”.

2020: “We have incurred relatively low maintenance expenses on our E-175 aircraft because most of the parts are under multi-year warranties and a limited number of heavy airframe checks and engine overhauls have occurred. Our maintenance costs will increase significantly, both on an absolute basis and as a percentage of our operating expenses, as our fleet ages and the E-175 warranties expire”.

The main issue portrayed in this theme is maintenance costs and how they will change over time, mainly since contracts may be terminated or expire soon, increasing maintenance costs. Airlines in the United States expressed, once again, concern about the changing legal and regulatory environment.

4.3.3. Threats and Weaknesses

This is the most relevant theme to this research, where apprehensions over the pandemic are most explicit. This theme comprises 14 concepts, which are: future, COVID, air, demand, changes, industry, additional, restrictions, conditions, economic, fuel, government, competitive, and credit. Here we see, for the first time, the concept COVID highlighted for its effects on companies’ operations. Some illustrations of these statements are:

2020: “Due to the discretionary nature of business and leisure travel spending and the highly competitive nature of the airline industry, our revenues are heavily influenced by the condition of the U.S. economy and economies in other regions of the world. Unfavorable conditions in these broader economies have resulted, and may result in the future, in decreased passenger demand for air travel, changes in booking practices, and related reactions by our competitors, all of which in turn have had, and may have in the future, a strong negative effect on our business”.

2020: “The general worldwide economy has in the past experienced downturns due to the effects of the European debt crisis, unfavorable U.S. economic conditions, and slowing growth in certain Asian economies, including general credit market crises, collateral effects on the finance and banking industries, energy price volatility, concerns about inflation, slower economic activity, decreased consumer confidence, reduced corporate profits, and capital spending, adverse business conditions, geopolitical conflict, pandemic risks, government constraints on international trade and liquidity concerns. The airline industry is particularly sensitive to changes in economic conditions, which affect customer travel patterns and related revenues”.

2020: “The market price of our common stock may be volatile, which could cause the value of an investment in our stock to decline. The market price of our common stock may fluctuate substantially due to a variety of factors, many of which are beyond our control, including: the severity, extent and duration of the ongoing COVID-19 pandemic and its impact on our business, results of operations, financial condition and credit ratings, as well as on the travel industry and consumer spending more broadly, the actions taken to reduce the spread of the virus, the effectiveness of our cost reduction and liquidity preservation measures, and the speed and extent of the recovery across the broader travel industry; announcements concerning our competitors, the airline industry or the economy in general; strategic actions by us or our competitors, such as acquisitions or restructurings; increased price competition; media reports and publications about the safety of our aircraft or the aircraft type we operate; new regulatory pronouncements and changes in regulatory guidelines; changes in the price of aircraft fuel; announcements concerning the availability of the type of aircraft we use; general and industry-specific economic conditions; changes in financial estimates or recommendations by securities analysts or failure to meet analysts’ performance expectations; sales of our common stock or other actions by investors with significant shareholdings; trading strategies related to changes in fuel or oil prices; and general market, political and economic conditions, including as a result of the efficacy of, ability to administer and extent of adoption of any COVID-19 vaccines domestically and globally”.

There are some general concerns over external risks, such as the economic conditions of the national and international markets, stressing past events that affected the airline’s results. In the third excerpt, the company issued an alert to investors and shareholders about the predicted stock price volatility. Afterwards, the extent and severity of the pandemic were covered as an outside threat as it can affect in a variety of ways while also being solvable with mass vaccine administration.

4.3.4. Regulatory Requirements and Federal Government Relations

The sixth most important theme (“Federal Government Relations”) is only linked to, in the Concept Map, the fourth most important theme (“Regulatory Requirements”). Similar to 2019, they both relate to state and federal institutions in charge of regulating the industry. The regulatory environment is a risk for most airlines that perceive any changes as potentially harmful to their activities. Realistically, several actors regulate many activities within the airlines’ operation and companies make considerable efforts (and invest money) to deal with them. The concepts included in “Regulatory Requirements” are certain, ability, required, foreign, time, federal, assets, rates, and program. Then, in “Federal Government Relations”, the concepts involved are only agreements and DOT (making it the least rich theme in 2020). To better understand how these concepts fit the theme, here are some examples:

2020: “In general, a corporation that experiences an ownership change will be subject to an annual limitation on its pre-ownership change NOLs and certain other tax attribute carryforwards equal to the value of the corporation’s stock immediately before the ownership change, multiplied by the applicable long-term, tax-exempt rate posted by the IRS. Any unused annual limitation may, subject to certain limits, be carried over to later years, and the limitation may, under certain circumstances, be increased by built-in gains in the assets held by such corporation at the time of the ownership change”.

2020: “Alaska, Horizon, and McGee6 have to refrain from conducting involuntary furloughs or reducing employee rates of pay or benefits for non-officer employees through 31 March 2021”.

2020: “The commitments include growth commitments to ensure capacity expansion, slot divestitures at JFK and at DCA near Washington, D.C., and antitrust compliance measures. Beyond this agreement with the DOT, American and JetBlue will also be refraining from certain kinds of coordination on certain city pair markets”.

2020: “The Withdrawal Agreement provided for a transition period that ended on 31 December 2020. Prior to the end of the transition period, on 24 December 2020, EU and United Kingdom negotiators agreed to a new trade and cooperation agreement (the EU-UK Trade and Cooperation Agreement)”.

Logically, there are references to DOT, Treasury (the second quote refers to conditions to access a loan from the Treasury under COVID-19 Relief protocols), IRS, and international trade and cooperation agreements. It is interesting to notice the reference to Brexit as an uncertainty happening at the end of 2020, which shows that it also affects companies in the United States. Established relations with city and airport authorities have also proven to be crucial to companies’ success.

4.3.5. Shareholders

In 2020, stock prices gained a more prominent role in risk disclosure, possibly due to the high volatility they were subject to after March 2020. Hence, the theme “Shareholders” includes the concepts of price, stock, cash, market, shares, and interest. Here are a few quotes to better illustrate the theme:

2020: “Further, our repurchase of AAG7 common stock may fluctuate such that our cash flow may be insufficient to fully cover our share repurchases. Although our share repurchase programs are intended to enhance long-term stockholder value, there is no assurance that they will do so”.

2020: “Interested stockholders do not include stockholders whose acquisition of our securities is approved by the Board of Directors prior to the investment under Section 203. The issuance or sale of shares of our common stock, rights to acquire shares of our common stock, or warrants issued to Treasury under the CARES Act, the PSP Extension Law, PSP 1, PSP2, and in connection with the loan under the CARES Act, could depress the trading price of our common stock and the Convertible Notes”.

2020: “We currently do not intend to pay dividends on our common stock and, consequently, your only opportunity to achieve a return on your investment is if the price of our common stock appreciates. We have not historically paid dividends on shares of our common stock and do not expect to pay dividends on such shares in the foreseeable future”.

Risks and concerns are displayed with potential stock depreciation. American Airlines outlined its stock buyback strategies to minimize fluctuation and, in doing so, appeasing investors. On the other hand, the Mesa Air Group shared its intentions in 2020 and future dividend distribution.

4.3.6. IT

Lastly, IT and cybersecurity remain a concern, though a less prominent one. In this theme, Leximancer includes the concepts of systems, data, information, and flight. As it happened in 2019, general boilerplate concerns are outlined through the following examples:

2020: “Our website and reservation system must be able to accommodate a high volume of traffic and deliver necessary functionality to support our operations. Our automated systems cannot be completely protected against events that are beyond our control, such as natural disasters, telecommunications failures, malware, ransom ware, security breaches, or cyber-security attacks”.

2020: “Attacks may be targeted at us, our customers and suppliers, or others who have entrusted us with information. In addition, attacks not targeted at us, but targeted solely at suppliers, may cause disruption to our computer systems or a breach of the data that we maintain on customers, employees, suppliers, and others”.

2020: “When the Company learns of security incidents, we investigate the incident, which includes making reports to law enforcement, as appropriate. We also are aware that hackers may attempt to fraudulently induce crewmembers, customers, or others to disclose information or unwittingly provide access to systems or data”.

As expected, IT risks did not differ much from those disclosed in 2019. The concerns remained largely the same surrounding data breaches, attack detection, weak points in user capacity, and other potential liabilities.

5. Discussion

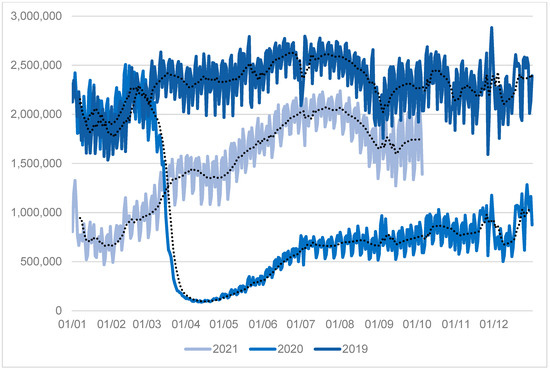

As seen in Figure 3, following the decline in demand brought on by the pandemic, the TSA recorded about 104 thousand people traveling through airport security at the height of the closure in the first part of April. In contrast, during the same period in 2019, it had 2.35 million passengers per day, a 95.6 percent decline. The pandemic’s consequences were still being seen because the number was 39.7% lower than 2019 levels in the same quarter of 2021 (TSA 2021). The graph below shows a sharp decline in airport passenger numbers, followed by a gradual recovery, with signs of improvement only appearing in the second half of 2021 to numbers comparable to those of 2019. A seven-day rolling average trendline was added for each year to improve data display and lessen the effects of weekly patterns.

Figure 3.

TSA daily passenger numbers. Source: Transportation Security Administration, 2021.

Airlines had to adjust immediately to the new situation to deal with this upheaval. Based on our findings, it is plausible to deduce that, even if they were aware that such events were possible, an event of this magnitude was neither expected nor even anticipated. In the United States, the government agreed to a USD 25 billion bailout plan that avoided industrial insolvency but did not stop declines in sales, profitability, and stock prices (Albers and Rundshagen 2020). According to Atems and Yimga (2021), Mesa, SkyWest, and Hawaiian only experienced minor shocks, while the heritage airlines in our sample—American, Delta, and United—were the ones most impacted by the stock market.

These results led to anticipation that new themes and ideas would emerge in the risk reporting sections, and these predictions were achieved. A novel concept (COVID) with marginal significance surfaced. As their two parts shrank, airlines expressed their concerns about a slow and unreliable recovery. On the one hand, its business division discovered ways to continue running its daily operations without the requirement for business travel through information and communications technologies. However, due to travel limitations and concerns over contamination, leisure travel decreased. In light of this, and considering the anticipated slow pace of the economy’s recovery (or the anticipated economic disaster), recovery to 2019 levels may take some time or not happen at all.

This study managed to identify the main concepts and themes for airlines’ 2019 and 2020 Section 1A of their annual 10-K forms. There were 65 and 68 concepts identified in 2019 and 2018, respectively. The most noticeable change was the surge in concept occurrence of adverse, future, increase, impact, service, changes, travel, and stock. Additionally, the concepts COVID, demand, continue, and partners appeared in the concept list only in 2020 and with substantial relevance. On the other hand, while being relevant concepts in 2019, results, market, systems, conditions, control, and regulations were significantly less relevant in 2020. From these data, we can infer a more future-oriented risk disclosure with more focus on unpredictability, service, and operations disturbance. We can also detect a preoccupation to warn stakeholders of stock volatility and low stock prices, which follows Atems and Yimga’s (2021) observation of large shocks in airline stock prices immediately after the pandemic hit, with consequences afterwards. Logically, all these worries are derived from the COVID-19 pandemic and the reduction in demand. The driving focus on these is accompanied by a relatively lower financial results orientation and the usually recurrent risks that are commonly boilerplate from one year to the next (i.e., regulators, IT, sector, and stock markets). This offsets Kravet and Muslu’s (2013) theory in which companies tend to repeat several portions of their risk reporting sections from year to year, which was to be expected given the situation. Oppositely, it supports Miihkinen’s (2012) theory that riskier environments offer a higher quality in risk disclosure.

In addition, businesses claimed that they implemented a variety of measures to lessen the effects of the pandemic, including capacity reductions (reduced number of flights), structural fleet changes (early aircraft retirement to achieve a more standardized and efficient fleet), cost reduction measures (cuts in marketing, maintenance, salaries, training, and fuel), and postponing the delivery of new aircrafts. This supports the findings of Budd et al.’s (2020) study on the responses of European airlines, which revealed similar techniques in both markets.

For each year, seven themes were identified by the current research. Of those, five were common themes (“State of the Competition”, “Threats and Weaknesses”, “Regulatory Requirements”, “IT”, and “Federal Government Relations”), which, although not exactly alike, share common ideas that are strong enough to be encompassed in a shared theme. Comparatively, “Stakeholder Relations” was the theme that gained more relative importance, as, on the other hand, “IT” decreased its relative importance. As explained before, this is complicit with a larger concern directed at easing investors (also with the advent of the new theme “Shareholders” in 2020) and other stakeholders while deriving attention from recurrent risks. Interestingly, the theme “State of the Competition” disappeared in 2020, from which we can presume a more considerable emphasis on internal threats in the risk reporting sections of airlines. For instance, Sobieralski’s (2020) prediction of a significant reduction in the workforce affecting an airline’s operations, and despite the CARES Act’s condition to retain jobs, is a major risk found in companies’ risk reporting sections.

This analysis, although it can be too soon to perform a more comprehensive analysis, supports Penela and Serrasqueiro’s (2019) study in which considerable changes in the environment lead to a more company-centric risk disclosure section instead of focusing on macroeconomic factors. In other words, the 2016 concept release aiming to improve regulations with regards risk disclosure, launched by SEC (SEC 2016), is an example of an enforcement effort to recognize not only the constantly changing risk profile of a public company, but also the need to address the risks companies face at a more company-centric level. The results of this study emphasize these efforts of companies, as it can be seen by the risk disclosure of 2020, with a more future-oriented focus on unpredictability, service, and operations disturbance. Finally, an interesting finding is the lower prominence of IT and cybersecurity risks on 2020 reporting, even though the regulatory body, SEC, has continuously demonstrated its pertinence and reinforced information on how to prepare disclosures concerning cybersecurity risks and events (SEC 2018).

6. Conclusions

Among the riskiest assets on the market are commercial airlines. To combat their low-profit margins and several other specialized risks, airlines frequently file for bankruptcy, and stock volatility is considerable. Therefore, it was crucial to profile the key risk concepts and topics presented in their annual reports. Before this study, there was little substantial research on this topic; instead, researchers were more interested in specialized risks such as fuel pricing and fleet management, as well as the degree of risk disclosure based on a predetermined risk checklist (Berghöfer and Lucey 2014; Probohudono et al. 2014).

Risk disclosure sections are vital tools to boost investor trust and reduce information asymmetry between management and other stakeholders since identifying risk factors is necessary for making informed investment decisions. The market, and especially the stock market, can function more effectively with more information. Thus, this study was able to evaluate commercial airlines, a well-known but understudied industry, in one of its most advanced markets, the United States of America. Investigating how a remarkable occurrence such as the COVID-19 pandemic affected one of the most affected large businesses (travel and tourism) is crucial.

This research was able to identify seven key themes for 2019 that clarified the primary issues that airlines in the United States face. These hazards were related to operations including labor disputes, potential flight delays, or flaws in internal financial control. In addition to highlighting fuel price sensitivity and seasonality difficulties, airlines also mentioned how well-aware they were of the strategies and innovations used by their rivals. Additionally, airline firms expressed concern over potential data breaches and their general interactions with politicians and authorities.

We can now answer the study question: Did the COVID-19 pandemic have an influence on risk factor disclosures? Despite certain repeated trends, it is plausible to infer that there was a change in the way operations were reported in the risk reporting sections in 2020. Stakeholders were generally informed of the pandemic’s potential long-term implications. The essential provisions, financial situation, fleet reduction, and labor relations, because of reduced flexibility and/or difficulty retaining, and luring talent, were all addressed. On the other hand, as businesses sought to increase transparency and appease investors, shareholders were also notified of potential future stock price volatility.

Our analysis supports the idea that airlines in the United States were not equipped to deal with this pandemic because they did not learn enough from prior pandemics. Airlines were therefore at risk and in need of federal assistance to have enough cash to deal with COVID-19.

7. Contributions

As one of the most prominent businesses in aviation, the U.S. airline industry frequently appears in our daily news, and it is projected to be worth close to USD 80 billion, with the global market reaching more than USD 330 billion (Global Industry Analysts 2021). Prior studies have demonstrated a beneficial relationship between corporate openness and firm competitiveness (Shivaani and Agarwal 2020). The investigation to comprehend the most prevalent risk themes reported in their risk reporting sections had a surprisingly large knowledge gap. This analysis provided some insight into how airlines communicate risk, freeing our methodologies from the a priori bias that Probohudono et al.’s (2014) study encountered. It drew attention to the risks that airlines are already aware of and added new ones. Therefore, this study serves as the foundation for further study in this area.

This research pioneered the identification of the risk themes in airlines in the United States of America in a reasonably ordinary year, while also identifying the changes corporations were susceptible to after the pandemic hit first. This was accomplished by identifying the themes of two different years. It laid the groundwork for greater levels of preparedness to deal with a potential future pandemic and is the first step to learn more about the COVID-19 occurrence and its repercussions on the larger travel sector. This study provided a look into future, more effective risk management techniques.

The current study strengthened Leximancer’s reputation as a competent content analysis tool in academia and business by demonstrating how well it can automatically identify common themes across massive volumes of textual data, in this case, risk profiling. Business decisions can be aided by the effective, practical, and time-saving tool known as Leximancer.

In actuality, defining the key themes provides stakeholders with an understanding of the overall issues faced by airlines. It lessens the natural information gap between management and investors by assisting them in gaining a clearer understanding of the market and improving risk assessment. The research’s findings will boost market confidence and enhance capital inflows because the pool of airlines is representative of the major commercial passenger carriers.

8. Limitations and Future Research

This investigation also has its limitations. Firstly, it had a time limitation, as it focused only on 2 years, separately. It is important to analyze a timespan to find what are the more recurrent themes over that span. The timing of this research also lacked the benefit of hindsight, and future research should focus on the longer-term effects of COVID-19 on the risk reporting practices in the aviation sector.

Second, this study’s sample size was limited, as we solely examined commercial passenger airlines operating in the United States of America. While other markets might not be subject to identical responsibilities, this market benefits from the standardization of reporting techniques under SEC standards, making information retrieval easier. For instance, Gulf airlines do not frequently include a section in their annual reports dedicated to reporting risks. To further grasp their realities, it is therefore required to conduct a study on the global market, other particular countries, or national clusters.

Third, it was methodologically limited, as the usefulness and quality of the information were not considered. Further research should consider these and look into the motivations for airlines to report risk. Other qualitative and quantitative methodologies could be used to increase the knowledge on risk reporting practices.

Lastly, the aviation business is among the most significant in terms of carbon footprint and the effects it has on global warming, which is crucial to remember. International laws and incentives for decarbonization are being implemented to lower greenhouse gas emissions from the aviation sector. The findings of this research indicate that this problem is not sufficiently disclosed among risk factors. Future research should be conducted to identify a precise list of concepts related to this topic, maybe utilizing another tool to verify the findings (robustness check).

Author Contributions

Conceptualization, D.P. and M.P.; Methodology, M.P.; Software, M.P.; Validation, M.P.; Formal analysis, D.P.; Investigation, M.P.; Resources, M.P.; Data curation, D.P.; Writing—original draft, M.P.; Writing—review & editing, D.P.; Visualization, M.P.; Supervision, D.P.; Project administration, D.P.; Funding acquisition, D.P. All authors have read and agreed to the published version of the manuscript.

Funding

We gratefully acknowledge financial support from FCT—Fundação para a Ciencia e Tecnologia (Portugal), national funding through research grant UIDB/04521/2020 and UIDB/00315/2020. The APC was funded by Academia Militar, Portugal.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | Federal Aviation Administration. |

| 2 | Transportation Security Administration. |

| 3 | Net Operating Losses. |

| 4 | AAR and Aviall are maintenance and other aviation services’ partners. |

| 5 | General Electric (engine supplier). |

| 6 | Alaska Air Group’s wholly owned subsidiaries. |

| 7 | American Airlines Group. |

References

- Abraham, Santhosh, and Philip J. Shrives. 2014. Improving the relevance of risk factor disclosure in corporate annual reports. The British Accounting Review 46: 91–107. [Google Scholar] [CrossRef]

- Akhigbe, Aigbe, and Anna D. Martin. 2008. Influence of disclosure and governance on the risk of US financial services firms following Sarbanes-Oxley. Journal of Banking & Finance 32: 2124–35. [Google Scholar] [CrossRef]

- Albers, Sascha, and Volker Rundshagen. 2020. European airlines′ strategic responses to the COVID-19 pandemic (January–May, 2020). Journal of Air Transport Management 87: 101863–101863. [Google Scholar] [CrossRef] [PubMed]

- Arasli, Huseyin, Mehmet Saydam, and Hasan Kilic. 2020. Cruise Travelers’ Service Perceptions: A Critical Content Analysis. Sustainability 12: 6702. [Google Scholar] [CrossRef]

- Atems, Bebonchu, and Jules Yimga. 2021. Quantifying the impact of the COVID-19 pandemic on US airline stock prices. Journal of Air Transport Management 97: 102141. [Google Scholar] [CrossRef]

- Bae, Wonmi, and Junwook Chi. 2021. Content Analysis of Passengers’ Perceptions of Airport Service Quality: The Case of Honolulu International Airport. Journal of Risk and Financial Management 15: 5. [Google Scholar] [CrossRef]

- Bao, Yang, and Anindya Datta. 2014. Simultaneously Discovering and Quantifying Risk Types from Textual Risk Disclosures. Management Science 60: 1371–91. [Google Scholar] [CrossRef]

- Beretta, Sergio, and Saverio Bozzolan. 2004. A framework for the analysis of firm risk communication. The International Journal of Accounting 39: 265–88. [Google Scholar] [CrossRef]

- Berghöfer, Britta, and Brian Lucey. 2014. Fuel hedging, operational hedging and risk exposure—Evidence from the global airline industry. International Review of Financial Analysis 34: 124–39. [Google Scholar] [CrossRef]

- Brown, Richard S., and William A. Kline. 2020. Exogenous shocks and managerial preparedness: A study of U.S. airlines’ environmental scanning before the onset of the COVID-19 pandemic. Journal of Air Transport Management 89: 101899. [Google Scholar] [CrossRef]

- Budd, Lucy, Stephen Ison, and Nena Adrienne. 2020. European airline response to the COVID-19 pandemic—Contraction, consolidation and future considerations for airline business and management. Research in Transportation Business & Management 37: 100578. [Google Scholar] [CrossRef]

- Cabedo, J.David, and José Miguel Tirado. 2004. The disclosure of risk in financial statements. Accounting Forum 28: 181–200. [Google Scholar] [CrossRef]

- Callaway, Ewen, David Cyranoski, Smriti Mallapaty, Emma Stoye, and Jeff Tollefson. 2020. Coronavirus by the Numbers. Nature 579: 482–83. Available online: https://www.nature.com/articles/d41586-020-00758-2 (accessed on 1 November 2022). [CrossRef] [PubMed]

- Campbell, John L., Hsinchun Chen, Dan S. Dhaliwal, Hsin-Min Lu, and Logan B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19: 396–455. [Google Scholar] [CrossRef]

- Elshandidy, Tamer, Philip J. Shrives, Matt Bamber, and Santhosh Abraham. 2018. Risk reporting: A review of the literature and implications for future research. Journal of Accounting Literature 40: 54–82. [Google Scholar] [CrossRef]

- Gao, Lei, Thomas G. Calderon, and Fengchun Tang. 2020. Public companies’ cybersecurity risk disclosures. International Journal of Accounting Information Systems 38: 100468. [Google Scholar] [CrossRef]

- Global Industry Analysts. 2021. Global Airlines Industry. ReportLinker. Available online: https://www.reportlinker.com/p05817569/Global-Airlines-Industry.html?utm_source=GNW (accessed on 1 November 2022).

- Gong, Stephen X. H., Michael Firth, and Kevin Cullinane. 2006. The information content of earnings releases by global airlines. Journal of Air Transport Management 12: 82–91. [Google Scholar] [CrossRef]

- Gössling, Stefan, Daniel Scott, and C. Michael Hall. 2021. Pandemics, tourism and global change: A rapid assessment of COVID-19. Journal of Sustainable Tourism 29: 1–20. [Google Scholar] [CrossRef]

- Hanlon, Pat. 1999. Global Airlines: Competition in a Transnational Industry. Oxford: Butterworth-Heinemann. [Google Scholar]

- Hannigan, Thomas J., Robert D. Hamilton III, and Ram Mudambi. 2015. Competition and competitiveness in the US airline industry. Competitiveness Review 25: 134–55. [Google Scholar] [CrossRef]

- Hao, Yu, Hanyu Bai, and Shiwei Sun. 2021. How does COVID-19 affect tourism in terms of people’s willingness to travel? Empirical evidence from China. Tourism Review 76: 892–909. [Google Scholar] [CrossRef]

- Hassan, Mostafa Kamal. 2009. UAE corporations-specific characteristics and level of risk disclosure. Managerial Auditing Journal 24: 668–87. [Google Scholar] [CrossRef]

- Hogan, Karen M. 2020. A global comparison of corporate value adjustments to news of cyber-attacks. Journal of Governance and Regulation 9: 34–44. [Google Scholar] [CrossRef]

- Indulska, Marta, Dirk S. Hovorka, and Jan Recker. 2012. Quantitative approaches to content analysis: Identifying conceptual drift across publication outlets. European Journal of Information Systems 21: 49–69. [Google Scholar] [CrossRef]