Enhancing Sustainable Finance through Green Hydrogen Equity Investments: A Multifaceted Risk-Return Analysis

Abstract

:1. Introduction

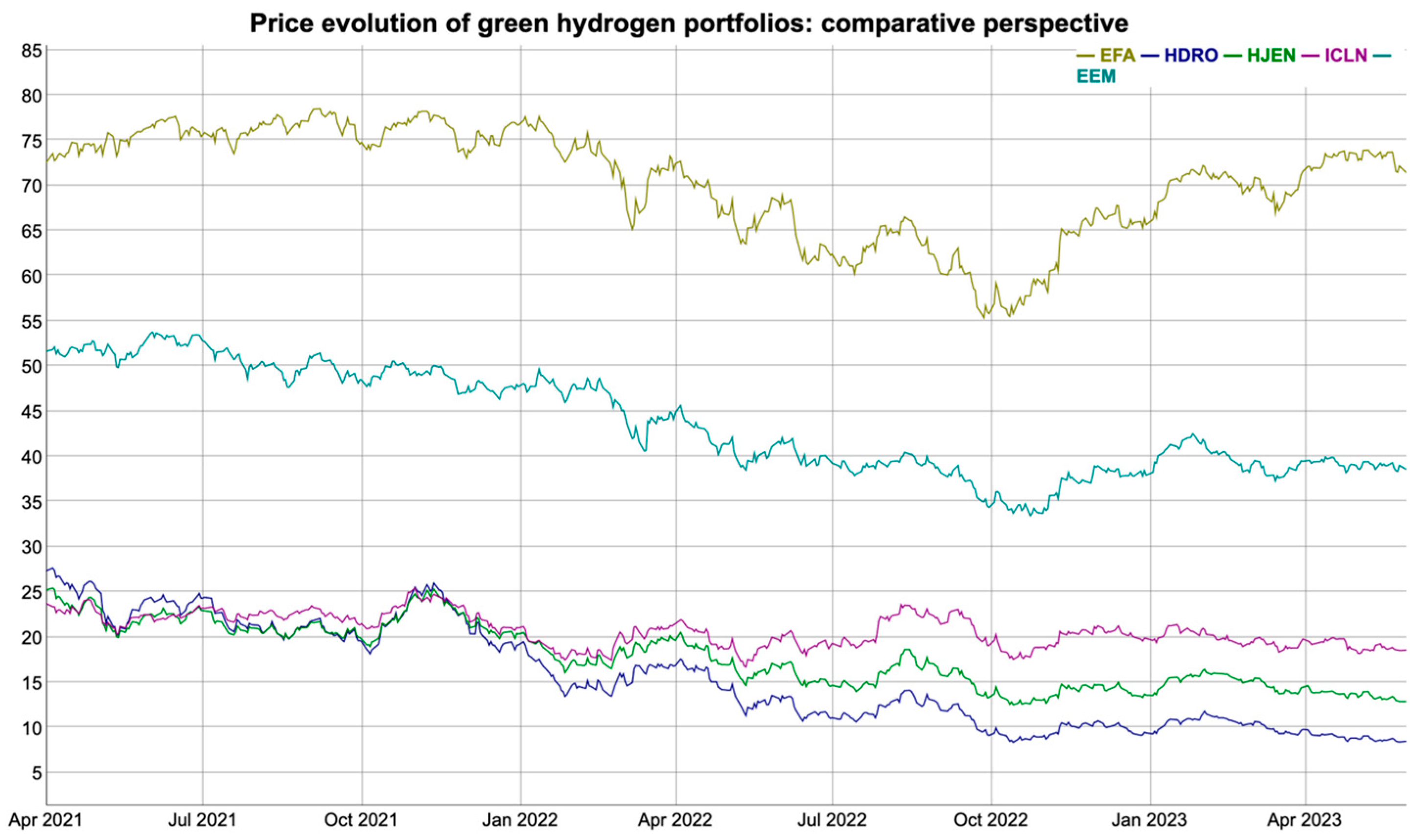

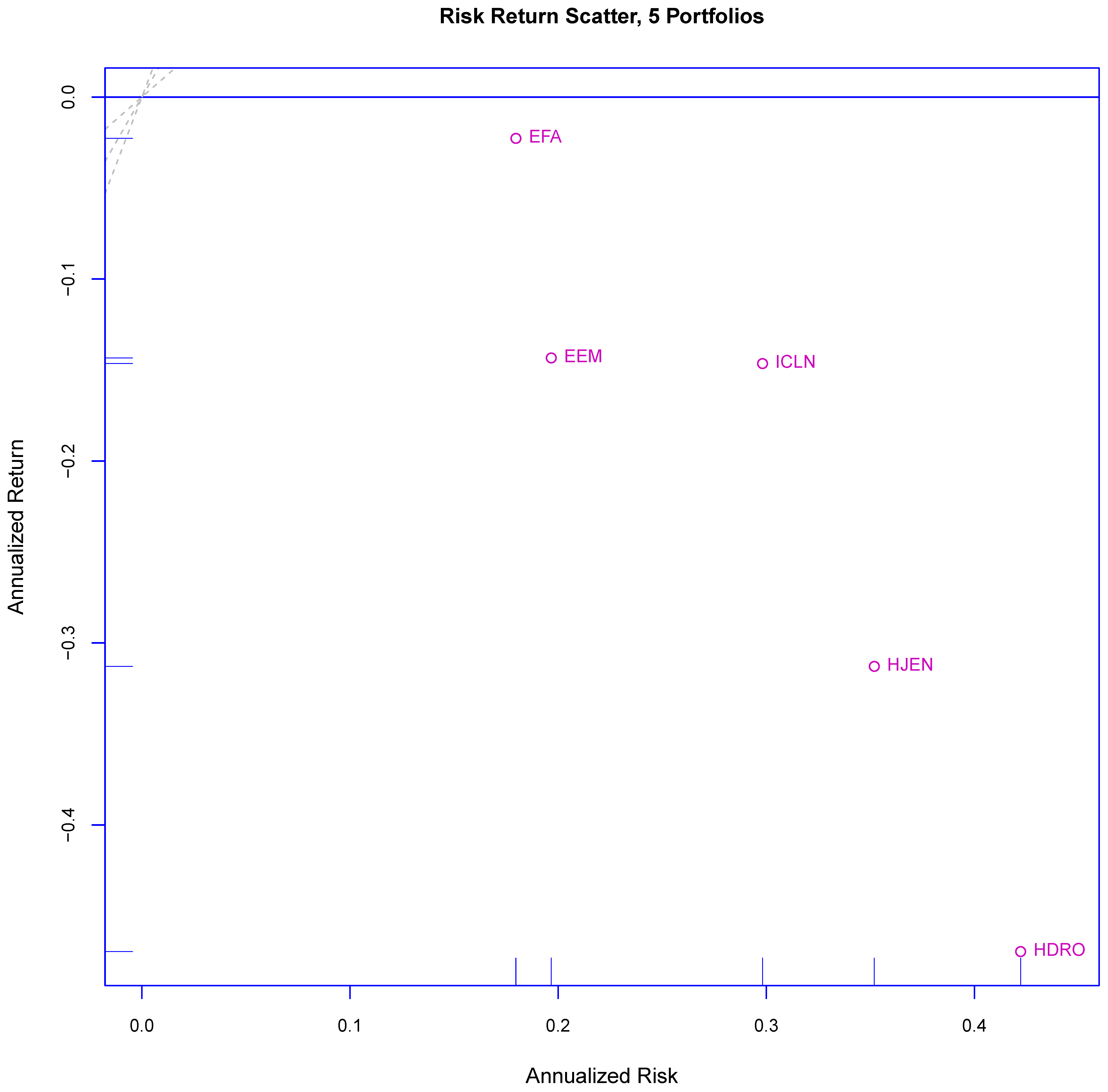

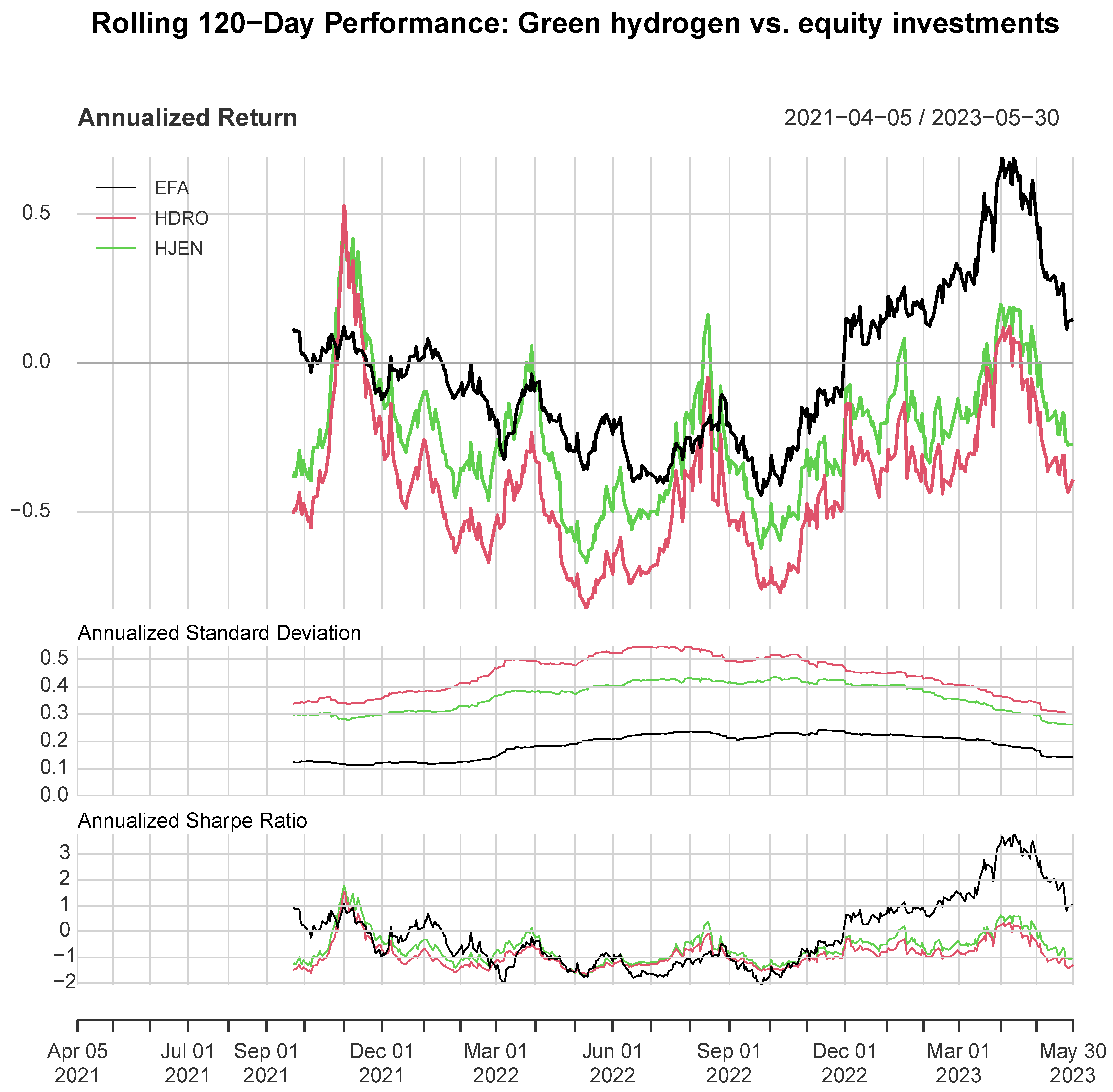

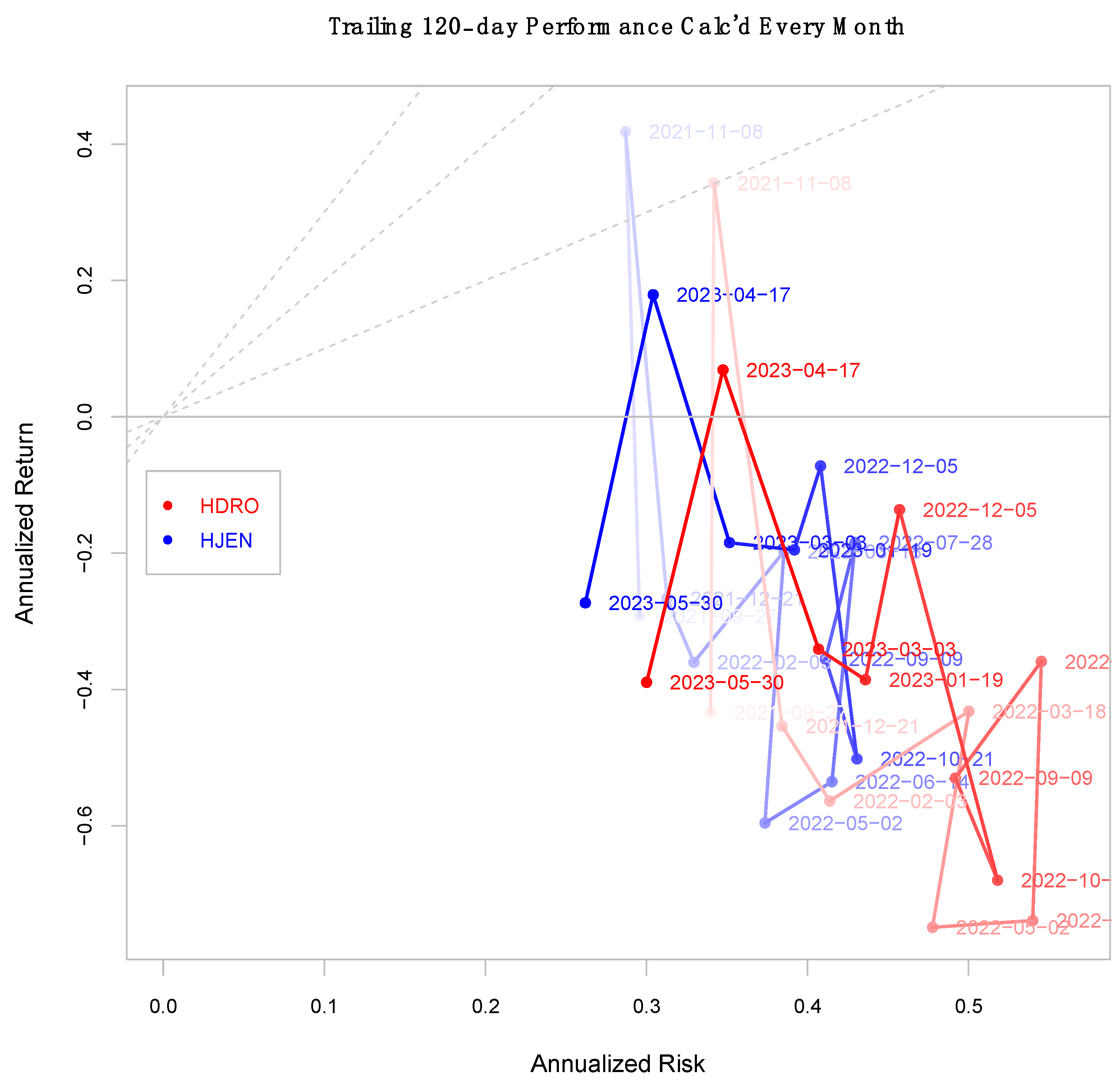

2. Results and Discussion

3. Material and Methods

3.1. Data

3.2. Visualization Techniques in R Software for Financial Data Analysis

- ▪

- Define Rolling Windows: Specify the length of rolling windows that slide through the dataset. In this research, a 120-day rolling window is used to match the longer MA length in the Dual Moving Average Crossover (DMAC) strategy implementation.

- ▪

- Calculate Performance Metrics: For each rolling window, calculate performance metrics such as returns, Sharpe ratios, or maximum drawdown.

- ▪

- Visualization in R: Use R’s {PerformanceAnalytics} package to generate line charts that display the performance metrics over the rolling windows with the charts.RollingPerformance() function. This helps identify trends and variations in performance throughout the historical data.

3.3. Risk-Adjusted Performance Metrics and Downside Risk Analysis

3.4. Single-Factor Models

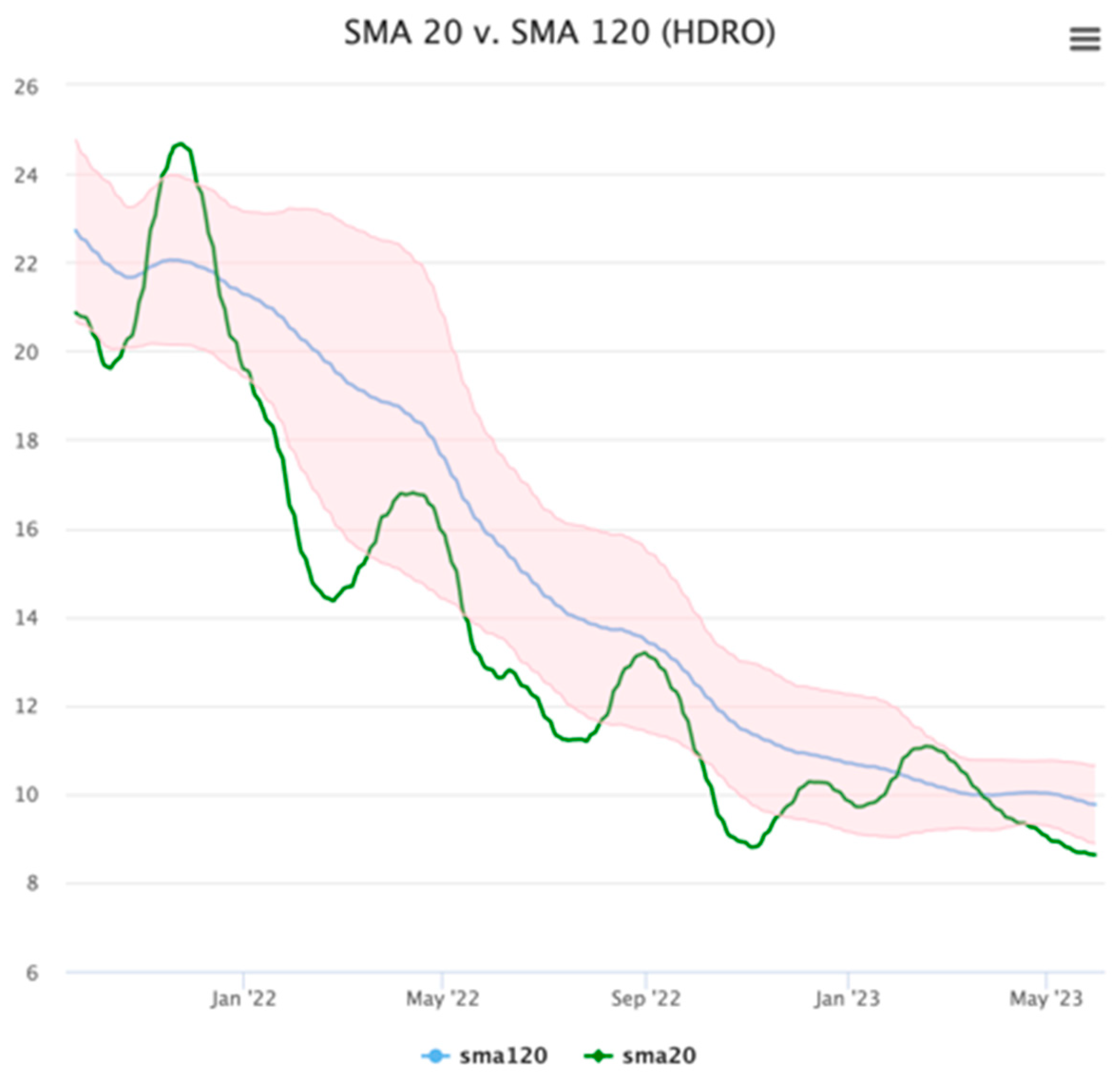

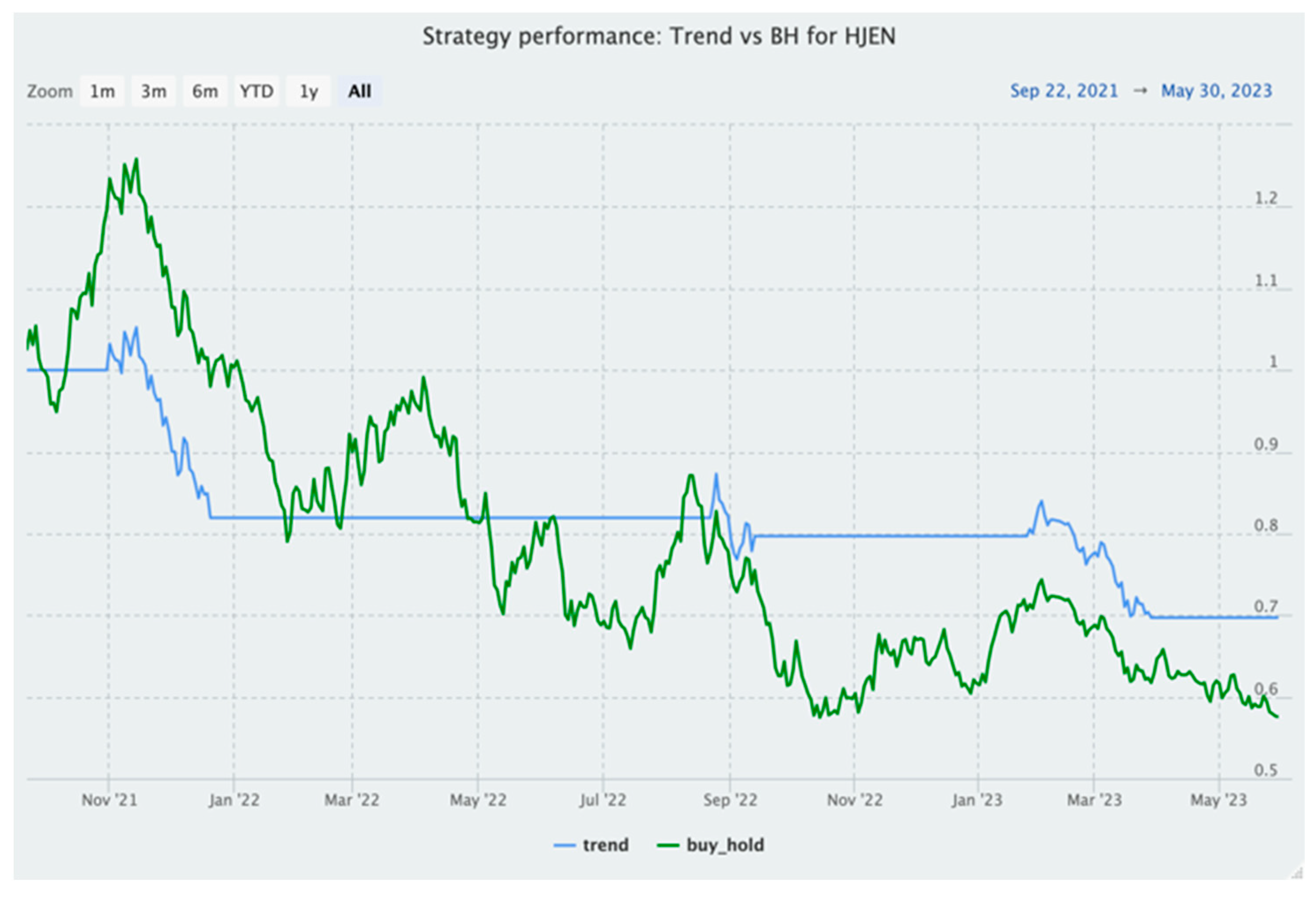

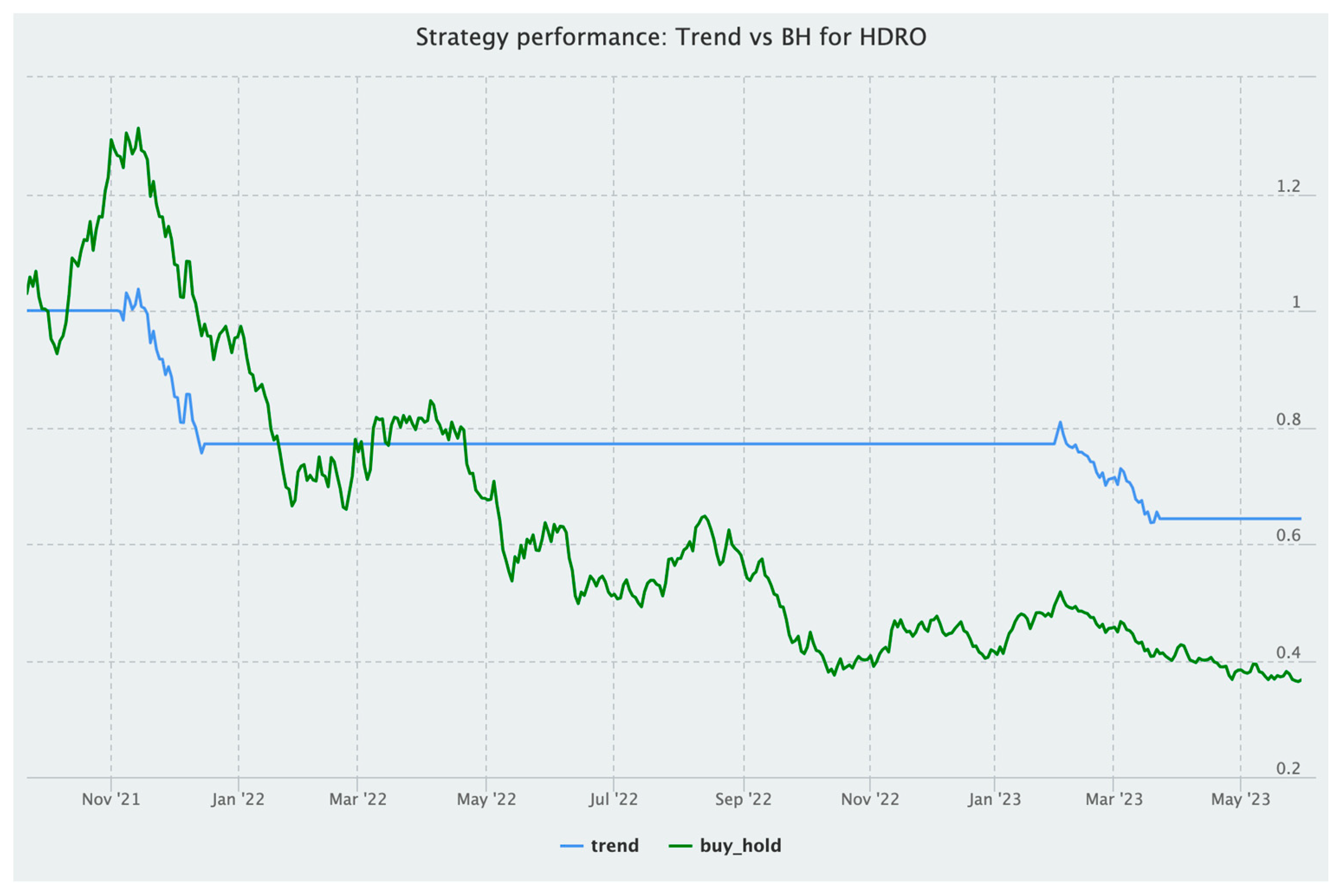

3.5. Trend Trading Strategy Implementation

- (1)

- rolling 20-day SMA

- (2)

- rolling 120-day SMA

- (3)

- “If_else” logic to create a buy or sell signal:

- ♦

- Buy when the Green hydrogen ETF (alternative HDRO and HJEN) 20-day SMA is above the 120-day SMA (a ‘golden cross’)

- ♦

- Sell when the 20-day SMA moves below the 120-day SMA (a ‘death cross’).

- (4)

- HDRO buy-and-hold (BH) returns/HJEN BH returns

- (5)

- Signal-based trading on each ETF

- (6)

- Visualizing strategy performance versus buy-and-hold (BH)

4. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Atilhan, Selma, Sunhwa Park, Mahmoud M El-Halwagi, Mert Atilhan, Margaux Moore, and Rasmus B Nielsen. 2021. Green hydrogen as an alternative fuel for the shipping industry. Current Opinion in Chemical Engineering 31: 100668. [Google Scholar] [CrossRef]

- Bacon, Carl R. 2023. Practical Portfolio Performance Measurement and Attribution. Hoboken: John Wiley & Sons. [Google Scholar]

- Biggins, Flora, Mohit Kataria, Diarmid Roberts, and Solomon Brown. 2022. Green hydrogen investments: Investigating the option to wait. Energy 241: 122842. [Google Scholar] [CrossRef]

- Boudt, Kris, Brian Peterson, and Christophe Croux. 2008. Estimation and decomposition of downside risk for portfolios with non-normal returns. The Journal of Risk 11: 79–103. [Google Scholar] [CrossRef]

- Brzeszczyński, Janusz, and Graham McIntosh. 2014. Performance of portfolios composed of British SRI stocks. Journal of Business Ethics 120: 335–62. [Google Scholar] [CrossRef]

- Camilleri, Mark Anthony. 2021. The market for socially responsible investing: A review of the developments. Social Responsibility Journal 17: 412–28. [Google Scholar] [CrossRef]

- Driessen, Marieke. 2021. Sustainable finance: An overview of ESG in the financial markets. In Sustainable Finance in Europe: Corporate Governance, Financial Stability and Financial Markets. Cham: Palgrave Macmillan, pp. 329–50. [Google Scholar]

- Dunis, Christian L., and Jia Miao. 2005. Optimal trading frequency for active asset management: Evidence from technical trading rules. Journal of Asset Management 5: 305–26. [Google Scholar] [CrossRef]

- Eroğlu, Hasan. 2021. Effects of COVID-19 outbreak on environment and renewable energy sector. Environment, Development and Sustainability 23: 4782–90. [Google Scholar] [CrossRef]

- Favre, Laurent, and José-Antonio Galeano. 2002. Mean-modified value-at-risk optimization with hedge funds. Journal of Alternative Investments 5: 21–25. [Google Scholar] [CrossRef]

- Hoang, Anh Tuan, Sandro Nižetić, Aykut I. Olcer, Hwai Chyuan Ong, Wei-Hsin Chen, Cheng Tung Chong, Sabu Thomas, Suhaib A. Bandh, and Xuan Phuong Nguyen. 2021. Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: Opportunities, challenges, and policy implications. Energy Policy 154: 112322. [Google Scholar] [CrossRef] [PubMed]

- Hood, Matthew, and Farooq Malik. 2018. Estimating downside risk in stock returns under structural breaks. International Review of Economics & Finance 58: 102–12. [Google Scholar]

- Ibn-Mohammed, Taofeeq, K. B. Mustapha, J. Godsell, Z. Adamu, K. A. Babatunde, D. D. Akintade, Adolf Acquaye, Hidemichi Fujii, M. M. Ndiaye, F. A. Yamoah, and et al. 2021. A critical analysis of the impacts of COVID-19 on the global economy and ecosystems and opportunities for circular economy strategies. Resources, Conservation and Recycling 164: 105169. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency (IEA). 2020. Global Energy Review 2020. Available online: https://www.iea.org/reports/global-energy-review-2020 (accessed on 10 October 2023).

- Ito, Yutaka, Shunsuke Managi, and Akimi Matsuda. 2013. Performances of socially responsible investment and environmentally friendly funds. Journal of the Operational Research Society 64: 1583–94. [Google Scholar] [CrossRef]

- Jiang, Peng, Yee Van Fan, and Jiri Jaromir Klemeš. 2021. Impacts of COVID-19 on energy demand and consumption: Challenges, lessons and emerging opportunities. Applied Energy 285: 116441. [Google Scholar] [CrossRef]

- Jones, Stewart, Sandra Van der Laan, Geoff Frost, and Janice Loftus. 2008. The investment performance of socially responsible investment funds in Australia. Journal of Business Ethics 80: 181–203. [Google Scholar] [CrossRef]

- Junkus, Joan C., and Thomas C. Berry. 2010. The demographic profile of socially responsible investors. Managerial Finance 36: 474–81. [Google Scholar] [CrossRef]

- Kempf, Alexander, and Peer Osthoff. 2007. The effect of socially responsible investing on portfolio performance. European Financial Management 13: 908–22. [Google Scholar] [CrossRef]

- Khan, Khalid, Chi-Wei Su, and Meng Nan Zhu. 2022. Examining the behaviour of energy prices to COVID-19 uncertainty: A quantile on quantile approach. Energy 239: 122430. [Google Scholar] [CrossRef]

- Kiani, Khurshid M. 2011. Relationship between portfolio diversification and value at risk: Empirical evidence. Emerging Markets Review 12: 443–59. [Google Scholar] [CrossRef]

- Kiesel, Florian, and Felix Lücke. 2019. ESG in credit ratings and the impact on financial markets. Financial Markets, Institutions & Instruments 28: 263–90. [Google Scholar]

- Kovač, Ankica, Matej Paranos, and Doria Marciuš. 2021. Hydrogen in energy transition: A review. International Journal of Hydrogen Energy 46: 10016–35. [Google Scholar] [CrossRef]

- Kumar, Shiva S., and Hankwon Lim. 2022. An overview of water electrolysis technologies for green hydrogen production. Energy Reports 8: 13793–813. [Google Scholar] [CrossRef]

- Lagioia, Giovanni, Maria Pia Spinelli, and Vera Amicarelli. 2023. Blue and green hydrogen energy to meet European Union decarbonisation objectives. An overview of perspectives and the current state of affairs. International Journal of Hydrogen Energy 48: 1304–22. [Google Scholar] [CrossRef]

- Le Quéré, Corinne, Robert B. Jackson, Matthew W. Jones, Adam J. P. Smith, Sam Abernethy, Robbie M. Andrew, Anthony J. De-Gol, David R. Willis, Yuli Shan, Josep G. Canadell, and et al. 2020. Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Nature Climate Change 10: 647–53. [Google Scholar] [CrossRef]

- Li, Chengzhe, Libo Zhang, Zihan Ou, and Jiayu Ma. 2022. Using system dynamics to evaluate the impact of subsidy policies on green hydrogen industry in China. Energy Policy 165: 112981. [Google Scholar] [CrossRef]

- Linsmeier, Thomas J., and Neil. D. Pearson. 2000. Value at risk. Financial Analysts Journal 56: 47–67. [Google Scholar] [CrossRef]

- Lintner, John. 1965. The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets. The Review of Economics and Statistics 47: 13–37. [Google Scholar] [CrossRef]

- Marti-Ballester, Carmen-Pilar. 2019. The role of mutual funds in the sustainable energy sector. Business Strategy and the Environment 28: 1107–20. [Google Scholar] [CrossRef]

- Nadarajah, Saralees, Bo Zhang, and Stephen Chan. 2014. Estimation methods for expected shortfall. Quantitative Finance 14: 271–91. [Google Scholar] [CrossRef]

- Olabi, Valentina, Tabbi Wilberforce, Khaled Elsaid, Enas Taha Sayed, and Mohammad Ali Abdelkareem. 2022. Impact of COVID-19 on the Renewable Energy Sector and Mitigation Strategies. Chemical Engineering & Technology 45: 558–71. [Google Scholar]

- Oliveira, Alexandra M., Rebecca R. Beswick, and Yushan Yan. 2021. A green hydrogen economy for a renewable energy society. Current Opinion in Chemical Engineering 33: 100701. [Google Scholar] [CrossRef]

- Osman, Ahmed I., Neha Mehta, Ahmed M. Elgarahy, Mahmoud Hefny, Amer Al-Hinai, Ala’a H. Al-Muhtaseb, and David W. Rooney. 2022. Hydrogen production, storage, utilisation and environmental impacts: A review. Environmental Chemistry Letters 20: 153–188. [Google Scholar] [CrossRef]

- Pätäri, Eero, and Mika Vilska. 2014. Performance of moving average trading strategies over varying stock market conditions: The Finnish evidence. Applied Economics 46: 2851–72. [Google Scholar] [CrossRef]

- Peterson, Brian G., Peter Carl, Kris Boudt, Ross Bennett, Joshua Ulrich, Eric Zivot, Dries Cornilly, Eric Hung, Matthieu Lestel, Kyle Balkissoon, and et al. 2020. PerformanceAnalytics: Econometric Tools for Performance and Risk Analysis. R Package Version 2.0.4. Available online: https://cran.r-project.org/web/packages/PerformanceAnalytics/PerformanceAnalytics.pdf (accessed on 1 October 2023).

- Pflug, Georg Ch. 2000. Some remarks on the value-at-risk and the conditional value-at-risk. Probabilistic constrained optimization: Methodology and applications. Kluwer Academic Publishers 38: 272–81. [Google Scholar]

- Pradhan, Sudeep, Dipanjan Ghose, and Shabbiruddin. 2020. Present and future impact of COVID-19 in the renewable energy sector: A case study on India. Energy Sources, Part A: Recovery, Utilization, and Environmental Effects, 1–11. [Google Scholar] [CrossRef]

- Renneboog, Luc, Jenke Ter Horst, and Chendi Zhang. 2008. Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking & Finance 32: 1723–42. [Google Scholar]

- Revelli, Christophe, and Jean-Laurent Viviani. 2015. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Business Ethics: A European Review 24: 158–85. [Google Scholar] [CrossRef]

- Ryan, Jeffrey A., Joshua M. Ulrich, Ethan Smith, Wouter Thielen, Paul Teetor, and Steve Bronder. 2023. Quantmod: Quantitative Financial Modelling Framework. R Package. Available online: https://cran.r-project.org/web/packages/quantmod/quantmod.pdf (accessed on 25 October 2023).

- Safari, Farid, and Ibrahim Dincer. 2020. A review and comparative evaluation of thermochemical water splitting cycles for hydrogen production. Energy Conversion and Management 205: 112182. [Google Scholar] [CrossRef]

- Shah, Syed Asim, Hassan Raza, and Aijaz Mustafa Hashmi. 2022. Downside risk-return volatilities during COVID 19 outbreak: A comparison across developed and emerging markets. Environmental Science and Pollution Research 29: 70179–91. [Google Scholar] [CrossRef]

- Sharma, Shubham, Mengyuan Zhang, Jingsi Gao, Hongliang Zhang, and Sri Harsha Kota. 2020. Effect of restricted emissions during COVID-19 on air quality in India. Science of the Total Environment 728: 138878. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Sharpe, William F. 1994. The Sharpe Ratio. Fall Journal of Portfolio Management 21: 49–58. [Google Scholar] [CrossRef]

- Sharpe, William F. 1998. The sharpe ratio. Streetwise–The Best of the Journal of Portfolio Management 3: 169–85. [Google Scholar] [CrossRef]

- Sortino, Frank A., and Lee N. Price. 1994. Performance measurement in a downside risk framework. The Journal of Investing 3: 59–64. [Google Scholar] [CrossRef]

- Sortino, Frank A., and Robert Van Der Meer. 1991. Downside risk. Journal of Portfolio Management 17: 27. [Google Scholar] [CrossRef]

- Squadrito, Gaetano, Gaetano Maggio, and Agatino Nicita. 2023. The green hydrogen revolution. Renewable Energy 216: 119041. [Google Scholar] [CrossRef]

- Stambaugh, Fred. 1996. Risk and value at risk. European Management Journal 14: 612–21. [Google Scholar] [CrossRef]

- Tasche, Dirk. 2002. Expected shortfall and beyond. Journal of Banking & Finance 26: 1519–33. [Google Scholar]

- Tripathi, Vanita, and Amanpreet Kaur. 2020. Socially responsible investing: Performance evaluation of BRICS nations. Journal of Advances in Management Research 17: 525–47. [Google Scholar] [CrossRef]

- Tudor, Cristiana. 2022a. Integrated framework to assess the extent of the pandemic impact on the size and structure of the e-commerce retail sales sector and forecast retail trade e-commerce. Electronics 11: 3194. [Google Scholar] [CrossRef]

- Tudor, Cristiana. 2022b. Ozone pollution in London and Edinburgh: Spatiotemporal characteristics, trends, transport and the impact of COVID-19 control measures. Heliyon 8: e11384. [Google Scholar] [CrossRef] [PubMed]

- Tudor, Cristiana. 2022c. The impact of the COVID-19 pandemic on the global web and video conferencing SaaS market. Electronics 11: 2633. [Google Scholar] [CrossRef]

- Vo, Nhi N. Y., Xuezhong He, Shaowu Liu, and Guandong Xu. 2019. Deep learning for decision making and the optimization of socially responsible investments and portfolio. Decision Support Systems 124: 113097. [Google Scholar] [CrossRef]

- Wu, Junjie, George Lodorfos, Aftab Dean, and Georgios Gioulmpaxiotis. 2017. The market performance of socially responsible investment during periods of the economic cycle–Illustrated using the case of FTSE. Managerial and Decision Economics 38: 238–51. [Google Scholar] [CrossRef]

- Zangari, Peter. 1996. A VaR methodology for portfolios that include options. RiskMetrics Monitor 1: 4–12. [Google Scholar]

- Zehir, Emre, and Asli Aybars. 2020. Is there any effect of ESG scores on portfolio performance? Evidence from Europe and Turkey. Journal of Capital Markets Studies 4: 129–43. [Google Scholar] [CrossRef]

- Zerta, Martin, Patrick R. Schmidt, Christoph Stiller, and Hubert Landinger. 2008. Alternative World Energy Outlook (AWEO) and the role of hydrogen in a changing energy landscape. International Journal of Hydrogen Energy 33: 3021–25. [Google Scholar] [CrossRef]

| EFA | HDRO | HJEN | ICLN | EEM | |

|---|---|---|---|---|---|

| StdDev Sharpe (Rf = 0%, p = 95%): | −0.002402 | −0.08127 | −0.05607 | −0.02409 | −0.04335 |

| VaR Sharpe (Rf = 0%, p = 95%): | −0.00154 | −0.05064 | −0.03436 | −0.01581 | −0.02877 |

| ES Sharpe (Rf = 0%, p = 95%): | −0.00115 | −0.04133 | −0.02754 | −0.01272 | −0.02293 |

| Sortino Ratio (MAR = 0%) | −0.003434 | −0.11296 | −0.07832 | −0.03511 | −0.0608 |

| Downside deviation | 0.0079 | 0.0191 | 0.0159 | 0.0129 | 0.0088 |

| Maximum drawdown | 0.3094 | 0.7501 | 0.5591 | 0.3652 | 0.3965 |

| Historical VaR | −0.0171 | −0.0416 | −0.0351 | −0.0291 | −0.0194 |

| Modified VaR | −0.0176 | −0.0427 | −0.0362 | −0.0286 | −0.0187 |

| Historical ES | −0.0247 | −0.0529 | −0.0446 | −0.0374 | −0.0262 |

| Modified ES | −0.0235 | −0.0523 | −0.0451 | −0.0356 | −0.0234 |

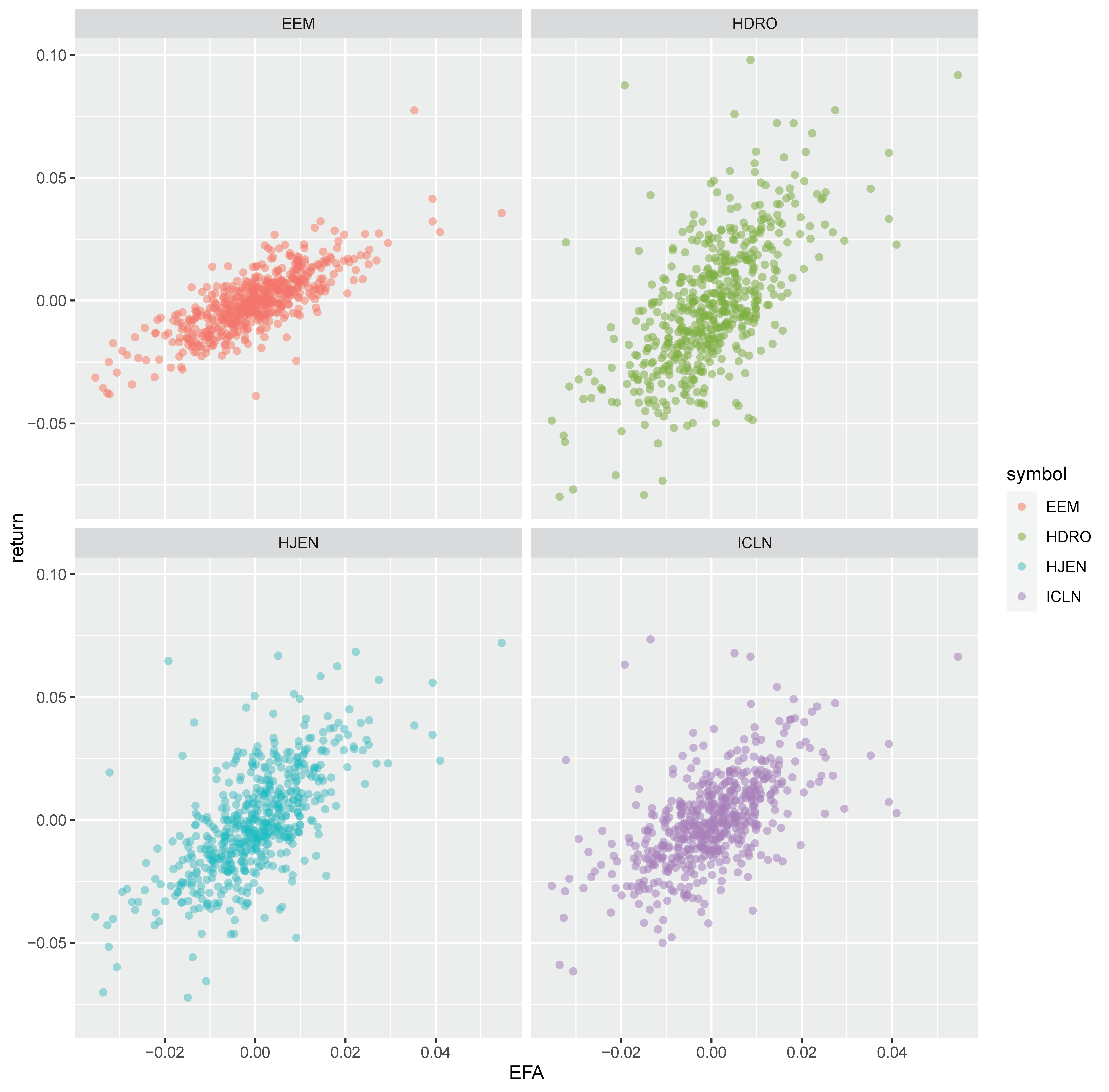

| HDRO to EFA | HJEN to EFA | ICLN to EFA | EEM to EFA | |

|---|---|---|---|---|

| Alpha | −0.0021 | −0.0012 | −0.0000 | −0.0000 |

| Beta | 1.5106 | 1.3021 | 0.9734 | 0.8553 |

| R-squared | 0.4137 | 0.4424 | 0.3443 | 0.6107 |

| Annualized Alpha | −0.4143 | −0.2625 | −0.1018 | −0.1215 |

| Correlation (p-value) | 0.6432 (0) | 0.6651 (0) | 0.5868 (0) | 0.7815 (0) |

| Active premium | −0.4469 | −0.2902 | −0.1237 | −0.1206 |

| Information ratio | −1.33 | −1.0814 | −0.5123 | −0.9614 |

| Treynor ratio | −0.3109 | −0.2403 | −0.1504 | −0.1676 |

| Ticker | Name | Exposure | Index Tracked | Source Location | Number of Observations |

|---|---|---|---|---|---|

| EFA | iShares MSCI EAFE ETF | large- and mid-capitalization developed market equities, excluding the U.S. and Canada, i.e., 900+ EAFE (Europe, Australia, Asia, and the Far East) companies | MSCI EAFE | https://finance.yahoo.com/quote/EFA/history?p=EFA, (accessed on 28 October 2023) | 543 |

| EEM | iShares MSCI Emerging Markets ETF | diversified large- and mid-capitalization emerging market equities (i.e., 800+ emerging market stocks) | MSCI Emerging Markets Index | https://finance.yahoo.com/quote/EEM/history?p=EEM, (accessed on 28 October 2023) | 543 |

| HJEN | Direxion Hydrogen ETF | 30 companies in the hydrogen industry, including hydrogen generation and storage, transportation and supply of hydrogen, fuel cells, and hydrogen fueling stations, with the US, UK, Japan, and France having the largest country weights | Hydrogen Economy Index (1H2ECO) | https://finance.yahoo.com/quote/HJEN/history?p=HJEN, (accessed on 28 October 2023) | 543 |

| HDRO | Defiance Next Gen H2 ETF | Globally listed companies that derive at least 50% of their revenue from hydrogen-based energy sources and fuel cell technologies (at least 25 constituents), with the US, south Korea, UK, and Canada having the largest country weights | BlueStar Hydrogen and NextGen Fuel Cell Index | https://finance.yahoo.com/quote/HDRO/history?p=HDRO, (accessed on 28 October 2023) | 543 |

| ICLN | iShares Global Clean Energy ETF | global equities in the clean energy sector, i.e., companies that produce energy from solar, wind, and other renewable sources | S&P Global Clean Energy Index | https://finance.yahoo.com/quote/ICLN/history?p=ICLN, (accessed on 28 October 2023) | 543 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tudor, C. Enhancing Sustainable Finance through Green Hydrogen Equity Investments: A Multifaceted Risk-Return Analysis. Risks 2023, 11, 212. https://doi.org/10.3390/risks11120212

Tudor C. Enhancing Sustainable Finance through Green Hydrogen Equity Investments: A Multifaceted Risk-Return Analysis. Risks. 2023; 11(12):212. https://doi.org/10.3390/risks11120212

Chicago/Turabian StyleTudor, Cristiana. 2023. "Enhancing Sustainable Finance through Green Hydrogen Equity Investments: A Multifaceted Risk-Return Analysis" Risks 11, no. 12: 212. https://doi.org/10.3390/risks11120212

APA StyleTudor, C. (2023). Enhancing Sustainable Finance through Green Hydrogen Equity Investments: A Multifaceted Risk-Return Analysis. Risks, 11(12), 212. https://doi.org/10.3390/risks11120212