1. Introduction

Throughout the past century, mortality rates have exhibited a consistent decline across all age groups in developed countries, a trend spanning over a hundred years (

Mitchell et al. 2013). This decline, often exceeding expectations, can be attributed to remarkable advancements in medical science, public health efforts, lifestyle transformations, technological innovations, increased healthcare access, and related factors. This phenomenon is commonly referred to as systematic longevity risk, introducing significant financial challenges for life insurers, pension plans, and social security systems.

In response to the increasing life expectancy and the financial risks associated with it, innovative longevity risk management tools and strategies have emerged. These tools offer individuals, institutions, and financial markets new ways to hedge against the challenges posed by extended lifespans. Notable among these tools are mortality-linked securities, longevity insurance, longevity bonds, and longevity swaps. Mortality models play a central role in various aspects of longevity risk management and longevity derivative pricing.

The Lee–Carter model (

Lee and Carter 1992) serves as a benchmark statistical methodology employed by the US Census Bureau to estimate the long-term forecast of US life expectancy (

Hollmann et al. 2000). Widely recognized for its structural simplicity and robustness, this model has found extensive application in demography, actuarial science, and public health. The Lee–Carter model is composed of two age-specific factors and a time-varying factor, often referred to as the mortality index or period effect, which captures the declining mortality trend.

Efforts to enhance the Lee–Carter model have resulted in various modified versions. For instance,

Renshaw and Haberman (

2003) expanded the model by introducing a cohort effect.

Mitchell et al. (

2013) proposed a transformation of the Lee–Carter model, focusing on modeling changes in mortality rates instead of mortality rates themselves to assess mortality improvements at different ages. These models retain the linear model as a core element, typically employing the random walk with drift (RWD) or an autoregressive moving integrated average (ARIMA) model to represent the period effect. Although the application of RWD and ARIMA models is widely accepted, the assumption of linearity regardless of the actual pattern may lead to bias in the forecast, as claimed by

Basellini et al. (

2023). They argue that systematic deviations from linearity may cause the drift term out of line with recent trends in the mortality index, inducing structural changes in the initial forecast year. More specifically, when these models are estimated over the entire dataset, the derived parameters are influenced by all past data points, including those that may no longer align with current mortality developments. Consequently, the resulting model may not accurately mirror the patterns observed in the latest data. This discrepancy means that the model, while fitting the historical data as a whole, may not be representative of the recent shifts in mortality, thus potentially skewing forecasts and introducing a structural change from the latest mortality experience to the forecasts.

To address these limitations, researchers have explored nonlinear models for the mortality index.

Milidonis et al. (

2011) applied regime-switching geometric Brownian motion to the US population mortality index. Regime-switching models allow mortality to transition between different states, each with distinct mean and variance, thereby capturing changes in both mean and volatility within the mortality index.

Hainaut (

2012) extended the

Renshaw and Haberman (

2003) model by applying a regime-switching model and demonstrated that it provides a significantly higher log-likelihood than the original model.

Li et al. (

2011) utilized a broken-trend stationary model on the Lee–Carter model and concluded that this approach, which incorporated a declining trend in the 1970s, explained the mortality index better than a random walk model.

Van Berkum et al. (

2016) considered random walk with a piece-wise constant drift on the Lee–Carter model with application to mortality in The Netherlands and Belgium, allowing for multiple changes in the mortality index. Their findings suggested that mortality projections based on structural change models were less sensitive to the calibration period and aligned better with observed trends compared to the ARIMA model.

Chen et al. (

2015),

Zhou (

2019), and

Zhou and Ji (

2021) have retained the ARIMA framework while incorporating the generalized autoregressive conditional heteroskedasticity (GARCH) approach to address the nonlinearity present in the variance. The GARCH model, introduced by

Bollerslev (

1986), was designed to describe volatility clustering commonly observed in financial time series, where periods of high or low volatility persist for some time. It models the conditional variance with a function of the average long-term volatility, previous forecast errors, and past volatility. By effectively capturing the volatility clustering, the GARCH model helps to make more accurate predictions about future market movements. The inclusion of GARCH effects in mortality studies has been shown to improve the goodness-of-fit significantly for the majority of mortality datasets examined. In addition,

Pascariu et al. (

2020) linked age-specific mortality rates to life expectancy, effectively accounting for the nonlinearity in mortality data. While other approaches incorporate more explicit and complex nonlinear structures, their study adopts a more parsimonious approach by utilizing life expectancy as a single aggregate indicator.

In this paper, we pioneer the application of the threshold autoregressive (TAR) model to mortality data as an experimental approach. The TAR model, originally introduced by

Tong (

1983) and further developed by

Hansen (

1997), is a widely used extension of the classic autoregressive model. Unlike the traditional AR model, which assumes linearity in time series, the TAR model embraces the notion of nonlinearity by introducing multiple regimes based on threshold variables. This allows the model to capture abrupt changes and diverse time-series dynamics. The threshold variable serves as a delineator, dictating which regime the series should belong to at any given point in time. This framework is particularly suited for time series that exhibit sudden jumps or breaks, making it a suitable choice for modeling nonlinearity in mortality data. Although the threshold vector autoregressive model has been explored for multi-population mortality modeling by

Li et al. (

2017), its univariate counterpart has not been applied to single-population mortality data.

We conduct a thorough comparison of five widely used time-series models: the autoregressive (AR) model, the Markov switching (MS) model, the threshold autoregressive (TAR) model, the structural change (SC) model, and the AR-GARCH model. We particularly focus on their goodness of fit and forecasting performance. While much of the existing literature tends to compare only a subset of these models, there is a noticeable gap in comprehensive studies that evaluate their forecasting capabilities together. Our research aims to bridge this gap by presenting these models collectively. Instead of advocating for a specific model, our goal is to provide an objective assessment of the suitability of established nonlinear time-series models for mortality modeling. To thoroughly evaluate these time-series models, we compare them based on both Lee–Carter and age–period–cohort (APC) mortality structures, using datasets from both England and Wales (EW) and Italy.

Furthermore, we illustrate the implications of nonlinearity in mortality modeling by evaluating its influence on longevity bond pricing. To obtain the longevity bond price, we employ the economic pricing framework put forth by

Zhou et al. (

2015). This framework uniquely captures the perspectives of both longevity risk hedgers and capital market investors. Through this analysis, we shed light on the potential consequences of overlooking nonlinearity, equipping market participants with insights for enhanced risk management.

The remainder of this paper is organized as follows:

Section 2 introduces the Lee–Carter mortality model and presents its parameter estimates based on data from England and Wales.

Section 3 describes the four nonlinear models and evaluates their performance in modeling the period effect and forecasting mortality.

Section 4 conducts further performance comparison based on the age–period–cohort (APC) mortality model and the Italian mortality data.

Section 5 applies an economic pricing approach to longevity bonds, demonstrating how the choice of different nonlinear models affects the pricing of these instruments. Finally,

Section 6 concludes the paper.

2. The Lee–Carter Model

In this paper, we use the Lee–Carter model to capture the dynamics of mortality rates. Widely recognized as a benchmark model in the literature, its simplicity allows us to focus on our main objectives. The Lee–Carter model has the following expression:

where

is the central death rate of an individual at age

x in year

t,

is the average age-specific pattern of mortality,

is age-specific response to the change in

, and

is the time-varying mortality index and often referred to as the period effect.

We use maximum-likelihood estimation to obtain parameter estimates for the Lee–Carter model, assuming a Poisson distribution for the number of deaths, following

Wilmoth (

1993). Let

denote the number of deaths at age

x in year

t, and

be the number of exposures to risk. We have

The log-likelihood function can then be expressed as follows:

We impose two parameter constraints for parameter uniqueness:

The maximum-likelihood estimation of the Lee–Carter model is performed using the

StMoMo package (

Villegas et al. 2018) in this paper.

We obtained the historical mortality data from the

Human Mortality Database (

2023). The mortality data consists of death counts and exposures to risk among the civilian population of England and Wales (EW) in the sample age range of 20–95 and the sample period of 1900–2019.

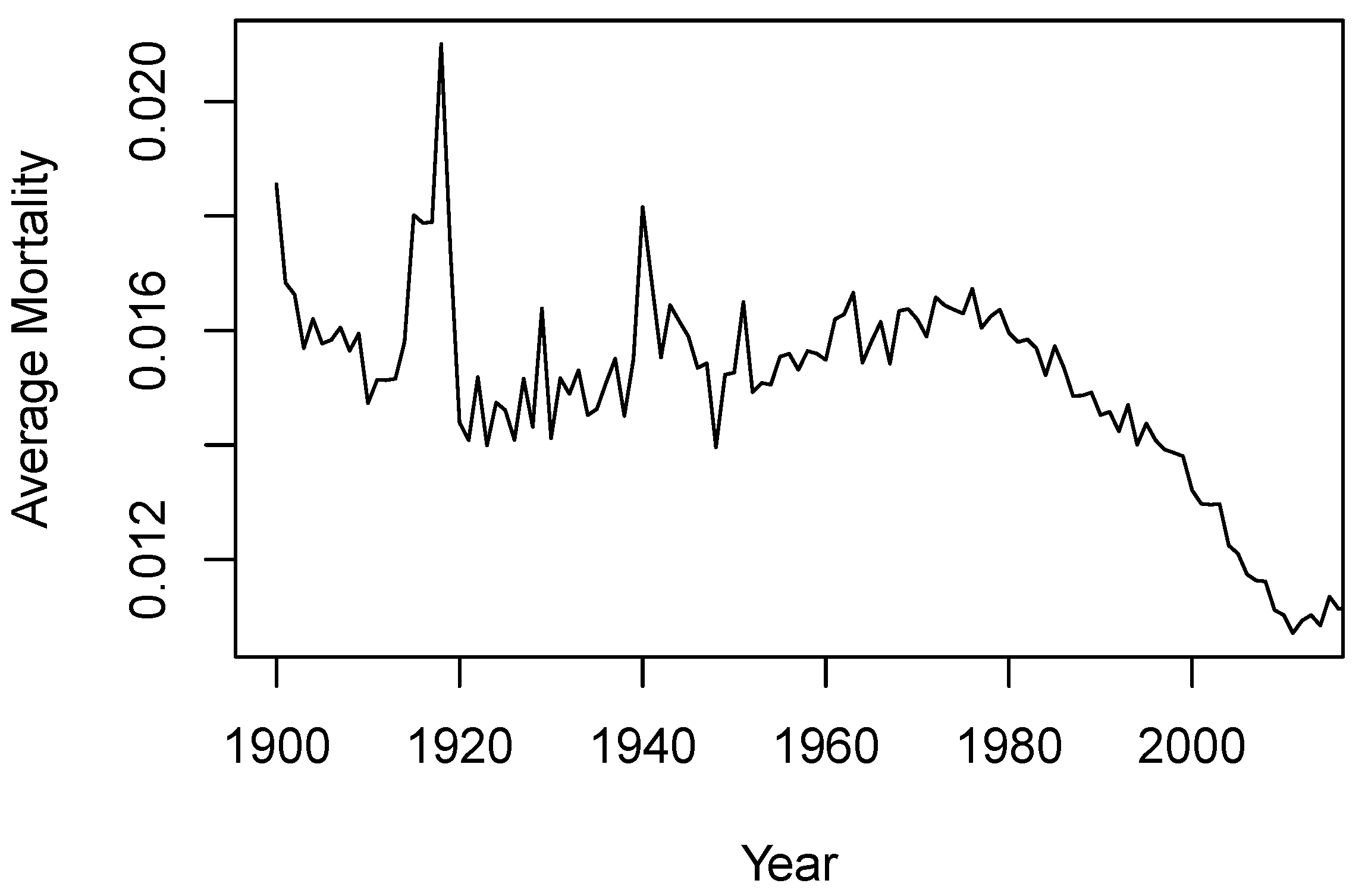

Figure 1 illustrates the average mortality rates across ages 20–95 for each year in the sample period. The average mortality rates exhibit an overall downward trend over the years. Before 1950, mortality rates were considerably volatile, while in recent years, they have become less erratic. In addition, mortality rates have been decreasing in a concave manner over the last few decades, suggesting an accelerating improvement in mortality. However, mortality stopped improving or even deteriorated slightly between 2015 and 2019, likely due to escalating drug-related deaths.

We fit the Lee–Carter model to the EW mortality data in the period of 1900–2011 and demonstrate the estimated parameters in

Figure 2.

represents the average age-specific mortality, reflecting the overall age pattern of human mortality. The decreasing

suggests a milder response to the time-varying mortality index

and thus diminishing mortality improvement at higher ages. The decreasing trend in the mortality index

indicates mortality improvement over time. Additionally,

appears to decrease faster post-1950 compared to pre-1950. The first difference in the mortality index, represented by

, was very volatile before 1950 and became relatively stable after 1950.

In

Lee and Carter (

1992), the mortality index

is further modeled as a random walk with a drift.

Antolin (

2010) considered linear AR(1) for the first difference in the mortality index,

. This is equivalent to modeling

with ARIMA(1,1,0). However, the plots of

and

suggest nonlinearity in the mean and the variance in the time series. Therefore, an ARIMA model may not be sufficient to capture the nonlinearity in the mortality index.

3. Linear and Nonlinear Time-Series Models for

3.1. Autoregressive (AR) Model

Since AR models are widely used for

in the existing literature, we use AR models as the baseline. We first select the number of AR lags based on the Bayesian information criterion (BIC). By penalizing extra parameters, the BIC addresses the potential overfitting problem in complex models. The formula for the BIC is

where

is the maximized value of the likelihood function,

k is the number of parameters to be estimated, and

n is the number of observations.

Table 1 summarizes the BIC values for models with different AR lag orders. We note that AR(0) is equivalent to modeling

as a random walk with drift. It is evident that the AR(1) model yields the lowest BIC. Therefore, we use AR(1) for

.

Employing the maximum-likelihood method, the estimated AR(1) model for

is shown as follows:

The long-term mean of is , indicating that the mortality index decreases at the rate of 1.0602 per year. The negative coefficient means that has a negative correlation with its immediate previous value , suggesting that after an above-average mortality improvement, the following year is likely to experience a below-average mortality improvement or even a mortality deterioration, and vice versa.

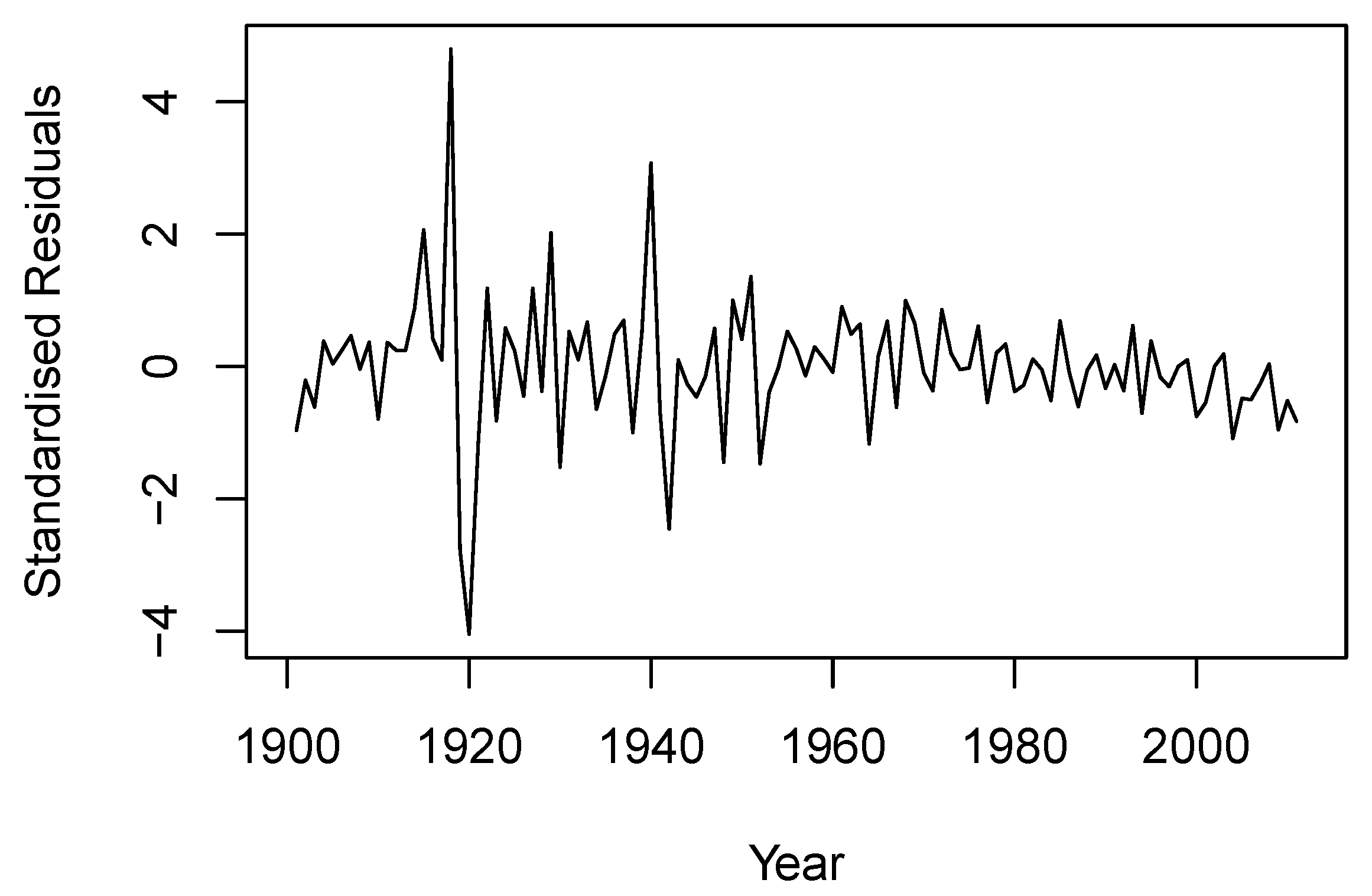

In

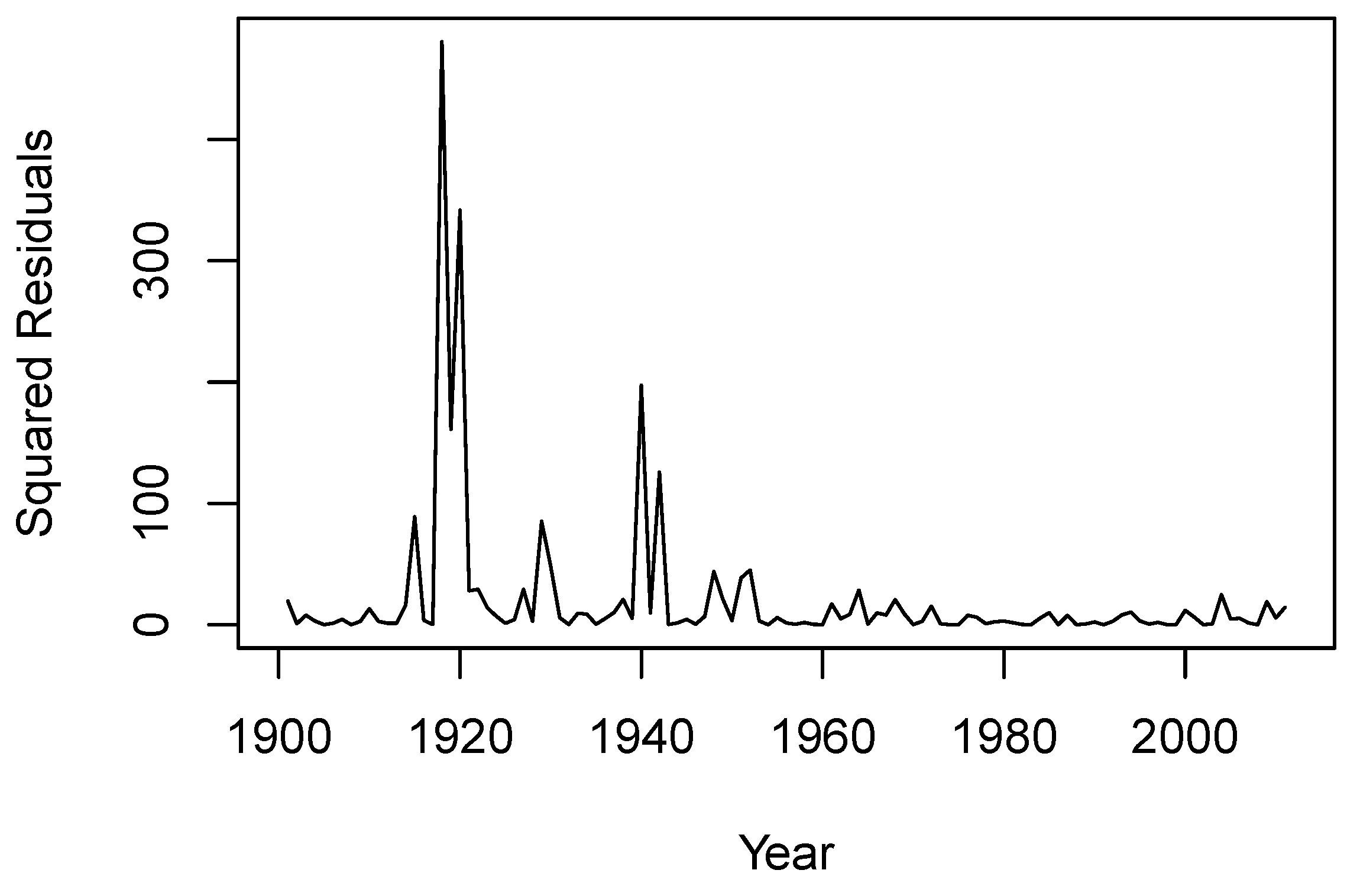

Figure 3, we depict the standardized residuals derived from the estimated linear AR(1) model for

. While the estimated model suggests a constant variance of 20.86 for the error term, the residuals in

Figure 3 reveal different volatility pre- and post-1950. The residuals also appear to have a slightly lower mean, which indicates a faster mortality improvement, in recent years. These observations suggest the presence of nonlinearity and heteroskedasticity in the residuals. To capture these features of the data, we consider four nonlinear time-series models: the TAR model, MS model, SC model, and AR-GARCH model for

in the remainder of this section.

3.2. Threshold Autoregressive (TAR) Model

The threshold autoregressive (TAR) model was initially introduced by

Tong (

1978) to describe nonlinear movements in stock prices within financial markets. Comprehensive discussion and extensions of the TAR model were made by

Tong and Lim (

1980) and

Tong (

1983). The TAR model employs piece-wise AR models to accommodate deviations from linearity. In this approach, AR models are estimated separately within each time-series segment or regime defined by threshold variables. A TAR model incorporating

m threshold variables for

can be expressed as follows:

where

is the

ith threshold value with

,

and

are the intercept and AR coefficient for the AR(1) model in regime

i, and

is the error term for regime

i, following a normal distribution with mean 0 and variance

. The threshold values classify the observations into

regimes.

switches between regimes based on the value of

. The TAR model allows the AR structure to change based on the threshold variables, thereby capturing complex nonlinearity dynamics.

To fit the TAR model, we use a two-step procedure. In the first step, we use the MLE method to estimate the TAR models with various numbers of threshold values. The threshold values are estimated together with the AR parameters using MLE. A minimum percentage of observations in each regime is set to 10%. In the second step, we compute the BIC for each estimated model and select the number of threshold values and its corresponding model to minimize the BIC.

Table 2 summarizes the BIC values for the AR(1) model and TAR models with two and three regimes. It is evident that the TAR model with two regimes yields the lowest BIC, indicating that the TAR model with one threshold value strikes a good balance between goodness of fit and model parsimony.

To further verify our choice of the number of threshold values, we conduct the test for threshold effects following

Hansen (

1999) using the bootstrap procedure. This test can be conducted in R with the

tsDyn package (

Stigler 2019;

Di Narzo et al. 2009). The test statistics and

p-values are presented in

Table 3. We note that one regime represents the original AR model with no threshold, hence linearity. The very low

p-values of the tests for one regime versus two regimes and one regime versus three regimes indicate that linearity is rejected at the 5% significance level for both tests. The

p-value of the test for two regimes versus three regimes is 0.146, suggesting that we cannot reject two regimes in favor of three regimes at the 5% significance level. Therefore, the three tests indicate that the model with two regimes, corresponding to one threshold, is the most suitable. This aligns with our model selection based on the BIC values.

The estimated TAR model with one threshold is expressed as follows:

where

and

. The threshold

divides

into two regimes, with 18.92% of the observations in the first regime, and 81.08% in the second regime.

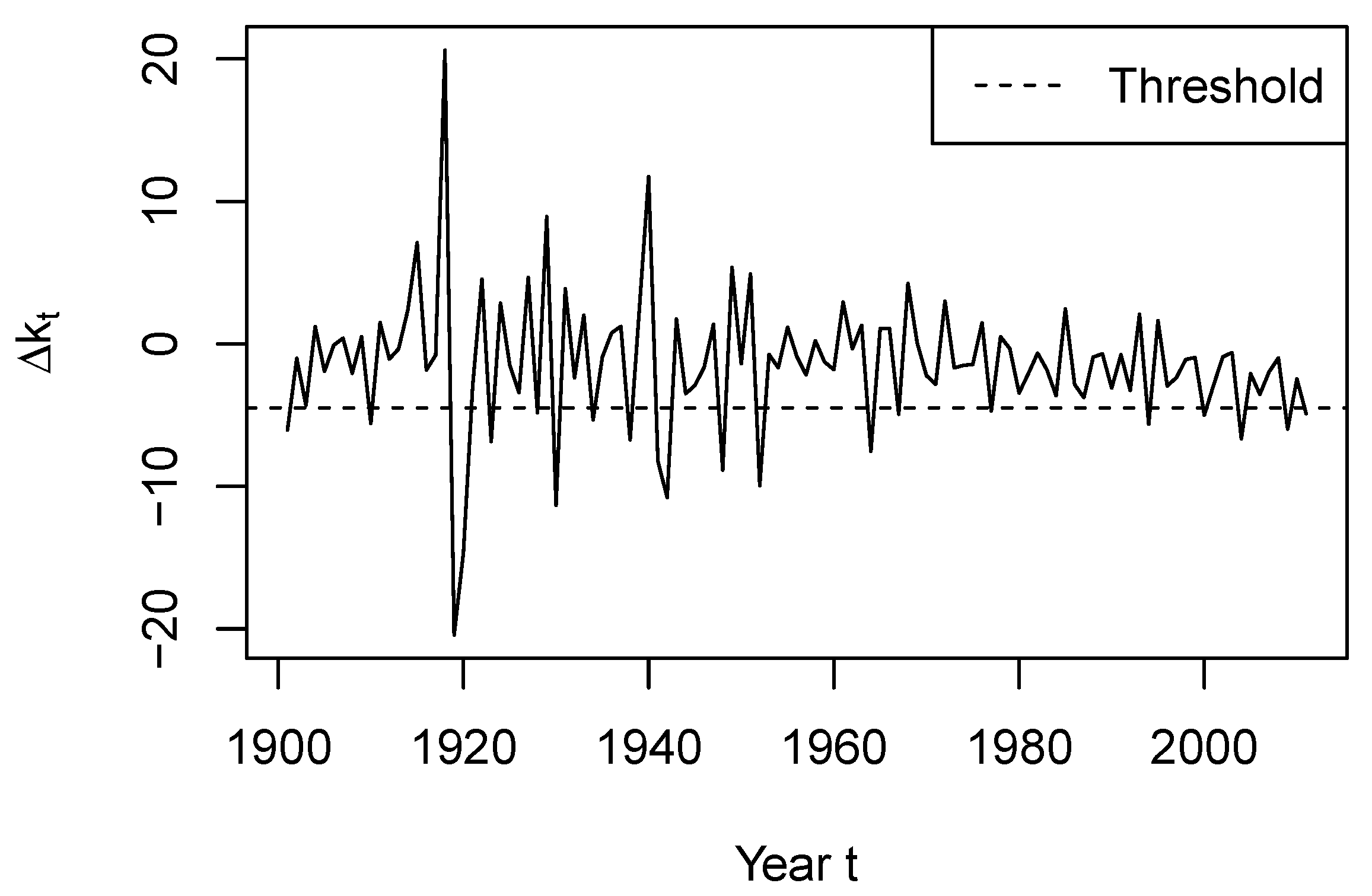

Figure 4 displays the values of

, with the estimated TAR threshold represented by the horizontal dashed line. We observe that

enters the first regime when

is very low, thus indicating a strong mortality improvement. Such substantial improvements likely happen in the recovery periods following catastrophe events such as pandemics or wars, which cause large mortality shocks. Therefore, the first regime occurs more often pre-1950. In addition, due to the rareness of these shocks, the first regime contains many fewer observations than the second regime.

The estimated TAR model with two regimes can be interpreted as follows. When , a higher-than-normal mortality improvement occurred at time . Such a large negative usually occurs when the population recovers from a mortality shock in previous years. Based on the estimated TAR model, is in the first regime. The extent of mortality improvement or deterioration in year t depends on the value of . If , we have , indicating further mortality improvement in year t. This can occur when the recovery from a large mortality shock lasts multiple years. If , we have , indicating a mild mortality deterioration in year t. For the second regime, the threshold constraint indicates that a mild mortality improvement or a mortality deterioration occurred in year . If , we obtain , which suggests a mortality deterioration in year t. If , a mortality improvement is expected in year t.

3.3. Markov Switching (MS) Model

The Markov switching (MS) model, introduced by

Hamilton (

1989), is designed to capture regime shifts in time-series data where different states or regimes have distinct statistical properties. Switching between these regimes is governed by a state variable that follows a first-order Markov chain.

Milidonis et al. (

2011) noted that the MS model is capable of identifying the time when a shock arrives at the underlying mortality variable, thereby reflecting different natures of mortality evolution and capturing both temporary mortality shocks and permanent mortality improvements.

Similar to the TAR model, we assume that each regime is described with its own AR model. An

n-state MS model can be expressed as follows:

where

is the state variable indicating the state level at time

t. The error term

follows a normal distribution with mean 0 and variance

. When

changes to a different value,

switches from one AR model to another.

is assumed to follow a time-homogeneous first-order Markov chain. Let

denote the transition probability from state

i at time

to state

j at time

t. The Markovian probability transition matrix

P that describes the random switching between different regimes can be written as

Let

represent the set of parameters in the MS model, and

denote the vector of

, where

and

are the first and last years in the sample period, respectively. The log-likelihood function of the MS model, based on observations of

, can be expressed as follows:

where

f is the probability density function. We maximize the log-likelihood to obtain parameter estimates. For the detailed estimation procedure, we refer the readers to

Milidonis et al. (

2011).

To determine the number of regimes, we estimate the MS model with both two and three regimes and select the model with a lower BIC.

Table 4 presents the BIC values for the AR(1) model and two MS models. The MS model with two regimes exhibits the lowest BIC and as a result we select it for our data. The estimated model is expressed as follows:

where

and

. The estimated transition matrix is

The two regimes have notably different parameter estimates. The variance for the AR model in the first regime is significantly higher than that in the second regime. Therefore, the first regime represents the more volatile period for mortality improvement, while the second regime represents the more stable period.

The transition probability of suggests that there is a very high probability of the state transiting from the volatile regime to the stable regime. However, when the state is in the stable regime, the transition probability of suggests that it is unlikely to transit to the volatile regime. Therefore, we expect that the state variable is equal to 2 most of the time.

The AR model for the first regime has an intercept of 6.1780 and an AR coefficient of 0.9444. When a mortality deterioration occurs at time , a significant deterioration is also expected at time t if the state at time t is 1. However, the probability of remaining in the first regime or switching to the first regime is low, 0.1733 and 0.0918, respectively. Therefore, following a mortality deterioration at time , it is more likely that the state at time t is 2. Due to the negative intercept and coefficient in the second regime, a mortality improvement is expected at time t given state 2 at time t.

The long-term mean of in the second regime can be calculated as . Since the state variable stays in regime 2 most of the time, we expect to fluctuate around over the long run and, thus, to continue to decrease in the future.

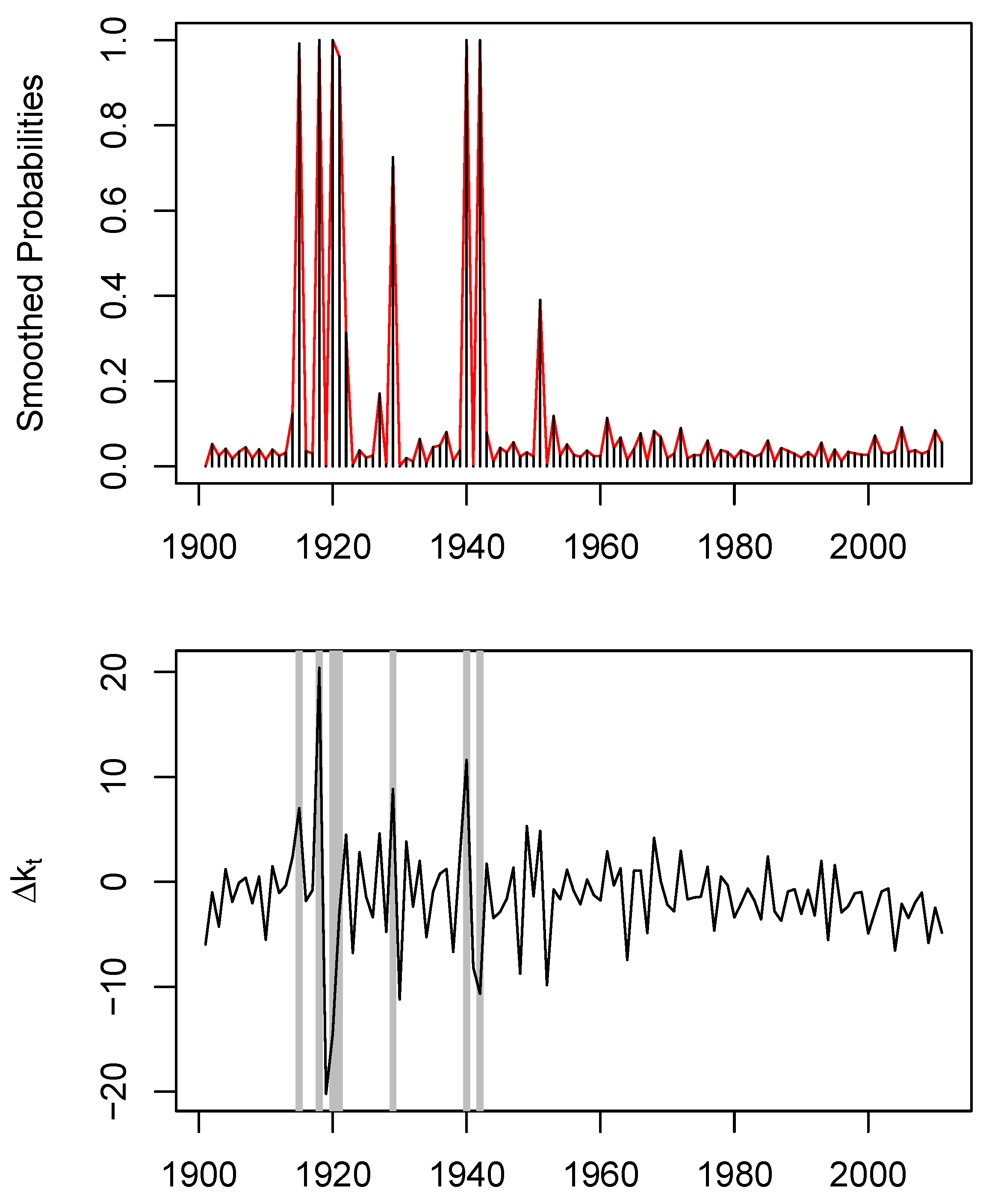

In

Figure 5, we provide a plot of the smoothed probability (top panel) of

being in the first regime given

alongside the values of

, with the periods of the first regime shaded in gray (bottom panel). We deem the state to be equal to 1 when the smoothed probability of being in the first regime is greater than that in the second regime. The two panels demonstrate that, given its observed value,

exhibits a higher probability of being in regime one when

is extremely high or low. Regime one predominantly occurs in the periods 1915–1920 and 1940–1950. These two decades coincide with periods of wars and severe flu outbreaks, characterized by high mortality variations.

3.4. Structural Change (SC) Model

The structural change (SC) model, initially introduced by

Lewis (

1955), originally aimed to illustrate the structural transformation from rural agriculture to urban industry due to economic growth. Recently, researchers such as

Sweeting (

2011) and

Van Berkum et al. (

2016) have explored its application in mortality modeling. Unlike the TAR and MS models, structural change is permanent. In other words, mortality improvement,

, follows a new model after each change point and never reverts to the previous model.

In an SC model, changes may manifest in various aspects, including the mean and variance. In this paper, we examine the changes in both mean and variance and assume that

follows a piece-wise AR(1) model. Such an SC model with

n change points can be written as follows:

where

is the time or location of the

jth detected change point and the error term

follows a normal distribution with mean 0 and variance

. This framework allows us to capture the varying patterns of the time series due to structural changes.

The n change points divide the time series into regimes. Given the number and location of the change points, we can estimate the AR model for each regime using the observations in the regime with MLE. Assuming that there is only one change point, we take the following procedures to determine the location of the change point:

For each value of in , estimate the SC model and compute the corresponding BIC value.

Select the value for that minimizes the BIC.

We consider the range of for to ensure a minimum of 10% observations in each regime. For two change points, the ranges for and are and , respectively. For each combination of and , we estimate the corresponding SC model and compute its BIC. We select the combination of and that minimizes the BIC.

Similar procedures are taken for three or more change points. The optimal number of change points is selected to minimize the BIC of the resulting SC model. In

Table 5, we provide the BIC values for the SC models with various numbers of change points. The model with one change point yields the lowest BIC. The optimal change point location for this model is 1952.

The selected SC model is expressed as follows:

where

and

.

In the fitted structural change model, the observations of are divided into two segments. The first regime comprises 46.85% of the observations, while the second regime accounts for 53.15% of the observations. It is interesting to note that the estimates of the intercept and AR coefficient for the two regimes are not as drastically different as we have seen in the TAR and MS models. However, the estimates of the variance are significantly different in the two regimes. Prior to 1952, was in the first regime, marked by significant volatility due to major mortality jumps in 1920 and 1940. From 1952 onward, is in the second regime with relative stability, as the Second World War had ended and no events that had a significant impact on mortality occurred in this period.

The long-term means for the two regimes are

and

, respectively, indicating that mortality improvement occurs in both segments, with higher improvement in regime two. Mortality improvement accelerates in the second regime due to medical advances and the strengthened health system. This aligns with our observations of accelerating mortality improvement in recent decades in

Figure 1.

3.5. AR-GARCH Model

To determine if an AR-GARCH model is an appropriate choice for our dataset, we first examine the squared residuals from the fitted AR(1) model, as illustrated in

Figure 6. We observe periods of spikes in volatility around the years 1918, 1929, 1940, and 1950, which suggest the potential existence of volatility clustering.

Further analysis is presented in the autocorrelation function (ACF) and partial autocorrelation function (PACF) plots for the squared residuals, as shown in

Figure 7. The significant values at the first and second lags in both ACF and PACF imply that there is a correlation in volatility over different lags. This supports the presence of volatility clustering and, thus, the use of a GARCH model for our data.

A GARCH

model for the conditional variance is expressed as follows:

where

is the error term from the AR model,

is the time-varying volatility,

follows a standard normal distribution,

p is the order of the GARCH terms, and

q is the order of the ARCH terms. To ensure that the model is statistically valid and that the volatility predictions are non-negative and stationary, the following parameter constraints are imposed:

,

for

,

for

, and

. We estimate the AR-GARCH model in one step by maximizing its log-likelihood using the

rugarch package (

Galanos 2023).

To determine the orders for the GARCH model, we use the BIC as the selection metric. Observations from the ACF and PACF plots of the squared residuals, which exhibit significant values at lags 1 and 2, suggest that the values of

p and

q do not exceed 2. The BIC values for various GARCH model specifications, with

and

, are presented in

Table 6. Note that the GARCH(0,0) variance is equivalent to an AR(1) model. The GARCH(2,1) model emerges as the best choice, indicated by the lowest BIC value among the considered models.

The selected AR-GARCH model is written as follows:

The positive ARCH and GARCH coefficients imply that a large shock in the previous two periods or high conditional variance in the previous period has a positive impact on the conditional variance in the current period.

3.6. Model Comparison

Table 7 compiles the BIC values obtained by fitting different time-series models to the EW mortality data. We observe that all four nonlinear models exhibit lower BIC values compared to the linear AR(1) model. This observation suggests that nonlinear models provide a significantly better fit than the AR(1) model and highlights the importance of properly modeling the nonlinear trend in mortality improvement.

Among all the models we fitted, the MS model with two regimes stands out as the best fit. MS models offer a transparent representation of structural changes in mortality. As pointed out by

Milidonis et al. (

2011), these models provide flexibility in choosing the switching time, duration, and parameter estimates through maximum-likelihood estimation. These properties collectively contribute to the excellent fit of the MS model to the mortality data.

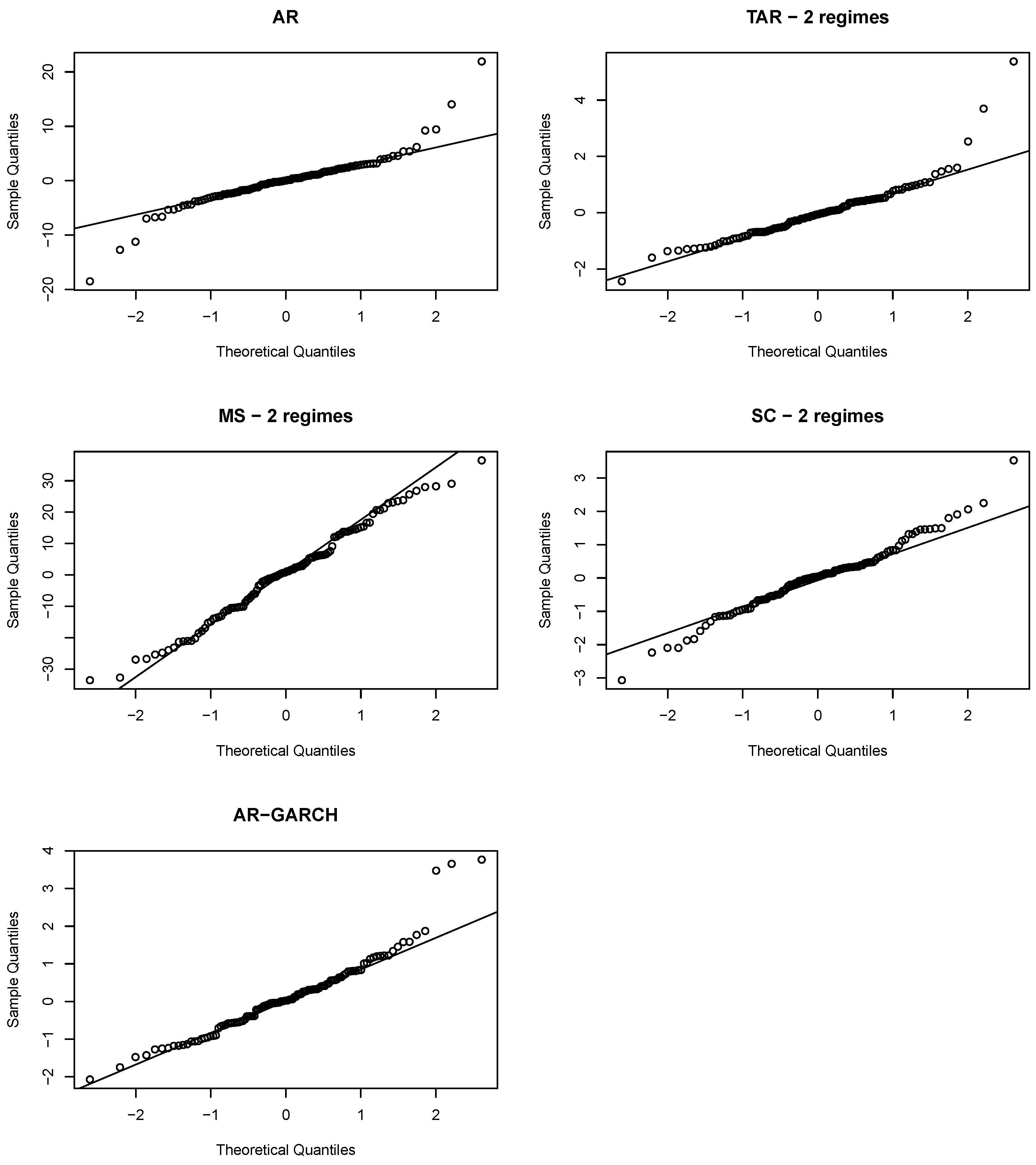

In

Figure 8, we present QQ plots of residuals to assess the normality assumptions for both linear and nonlinear models. The QQ plot for the AR(1) model deviates from the expected normality line, exhibiting heavier tails on both the left and right. In contrast, the QQ plots for the nonlinear models generally follow a more linear pattern, suggesting that their residuals are closer to normality than the residuals from the AR(1) model. While both TAR and AR-GARCH alleviate the heavy left tail, especially for extremely low values of

, they still display a pronounced heavy right tail. Both the MS and SC models, however, seem to effectively mitigate the heavy tails on both ends.

We further assess the performance of the five different models for an 8-year out-of-sample mortality forecast. We first simulate 5000 paths for the mortality index

, for

. The simulation procedures for

are presented in

Appendix A.

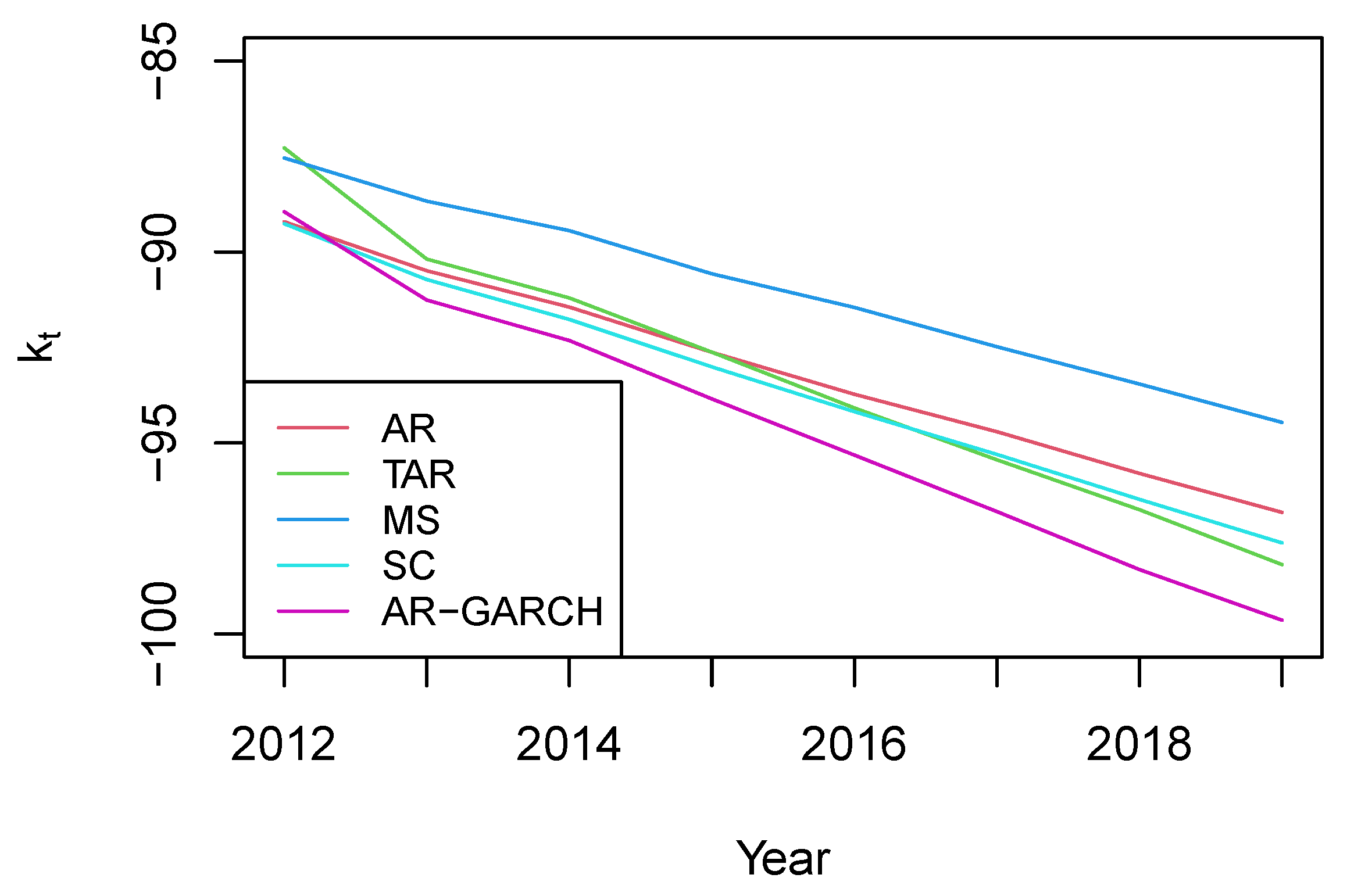

Figure 9 presents the mean forecasts of

from different models. The forecasts from the AR, TAR, and SC closely align, while the mean forecasts from the MS model are significantly higher. This discrepancy may be attributed to the inclusion of a small probability of transitioning into the first regime which has a large intercept and high volatility in the MS model. In addition, the AR-GARCH model yields the lowest mean forecasts.

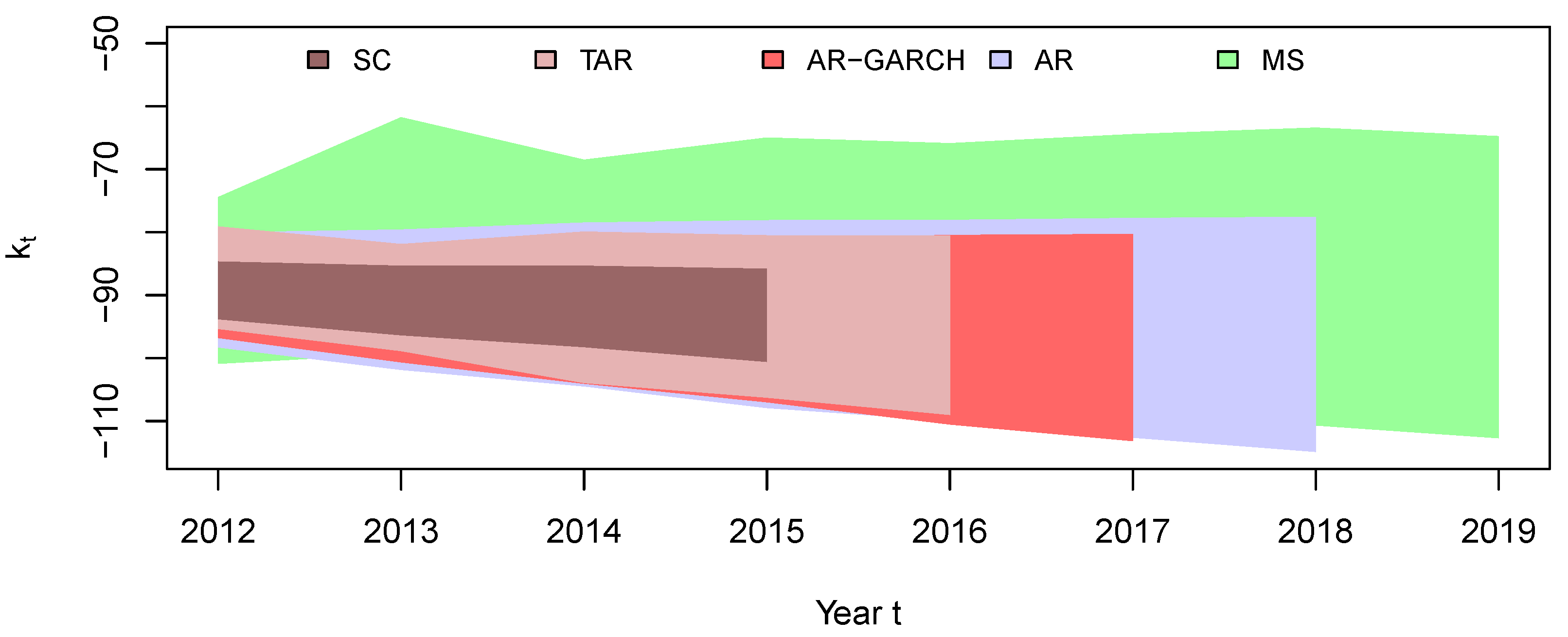

Figure 10 presents the 95% prediction interval of

using the four models. It is very interesting to see that the MS model results in the widest prediction interval, while the SC model yields the narrowest interval. This discrepancy can be explained by the SC model’s assumption that the process remains in the second regime post-1952 and follows the fitted AR(1) model from the second regime for future mortality predictions. Since the second regime primarily consists of periods with relatively low volatility, the simulated

experiences reduced volatility.

The simulated paths for future mortality rates are determined using the simulated paths for

and the estimated values for

and

.

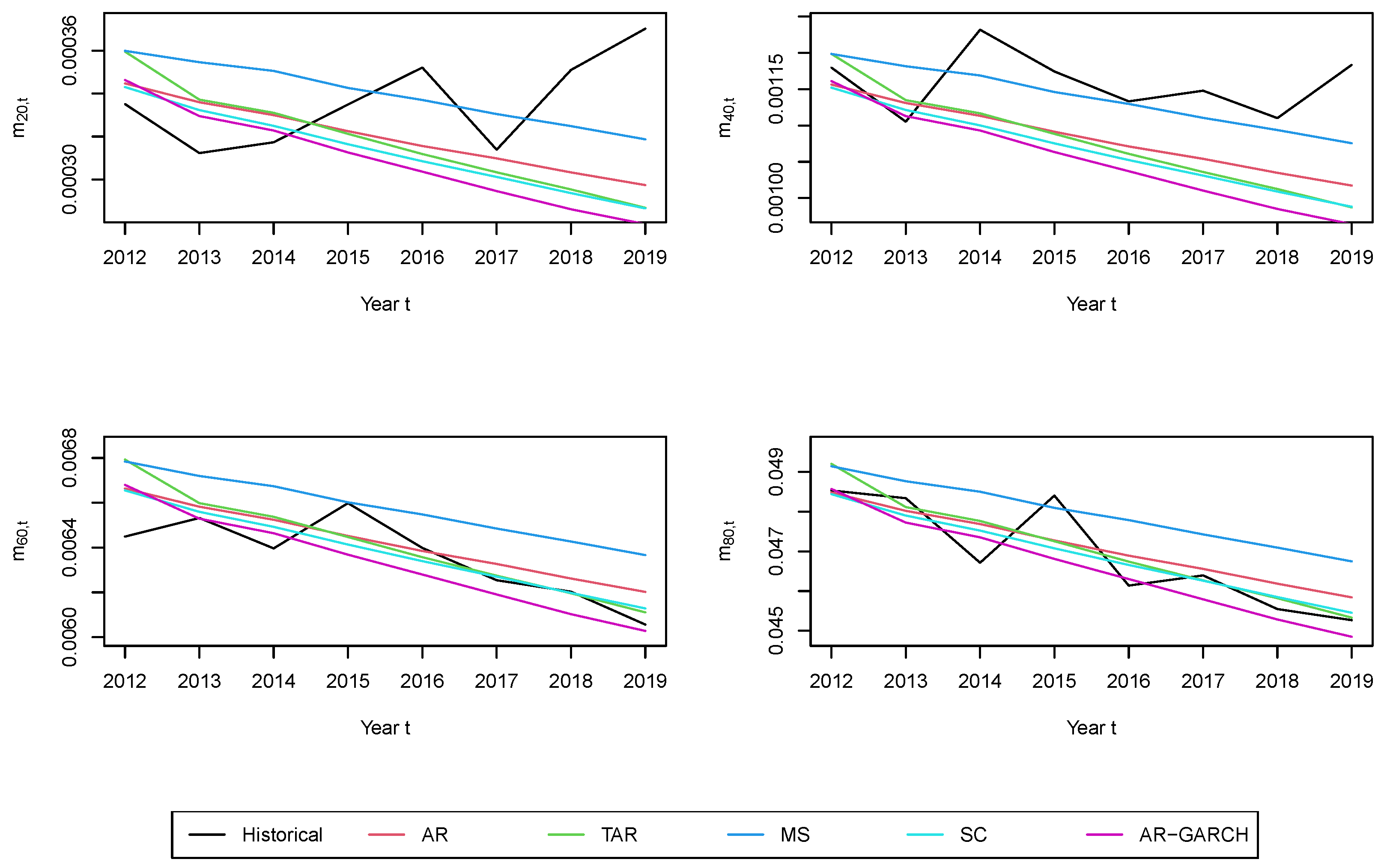

Figure 11 illustrates the mortality forecasts at four ages—20, 40, 60, and 80—and compares them with the observed rates. The MS model performs relatively better for ages 20 and 40, but worse for ages 60 and 80. The predicted mortality rates from the AR, TAR, and SC models are close to each other, while the predicted rates from the AR-GARCH model are consistently the lowest.

Furthermore, we quantify the mean squared error for a forecast period of

i across ages 20–95 as follows:

where

is the predicted mortality rate for an individual aged

x in year

.

Figure 12 plots the mean squared errors for

. The MS model outperforms the other three models for most of the forecast periods.

Finally, we average the mean squared errors across all forecast periods (1–8 years) as follows:

The MSEs using different models are presented in

Table 8. The MS model again yields the lowest overall mean squared error. Surprisingly, the AR(1) model, which does not consider any nonlinearity, performs the second best. The AR-GARCH model performs the worst among all five models and the SC model is the second worst. The existing literature often uses the SC approach implicitly by choosing a more recent starting year for the dataset and avoiding the periods with jumps and outliers. However, our out-of-sample results suggest that removing the observations in the early years may not necessarily lead to a good prediction for future mortality rates.

5. Longevity Bond Pricing

5.1. A Longevity Bond Trade

In this section, we study how the model choice for

may affect the price of a longevity bond. Suppose we have two counterparties involved in longevity bond trading: counterparty

A, with life contingent liabilities, and counterparty

B, an investor interested in the longevity bond for risk premiums. For simplicity, we assume that counterparty

A sponsors a pension plan that covers one pensioner aged 65 and one pensioner aged 66 at the beginning of the year 2012. This plan pays out

$1 at the end of the year if a pensioner is still alive, and the payments cease when the pensioner dies or reaches age 90. The pension payment made by counterparty

A at time

t is denoted by

and expressed as follows:

Counterparty B sells a T-year longevity bond to counterparty A to earn risk premiums. The bond payment at time t, which includes coupons and principal repayment, is for .

Let us assume that

Q represents the quantity of longevity bonds agreed upon by both counterparties

A and

B at the price of

P. In

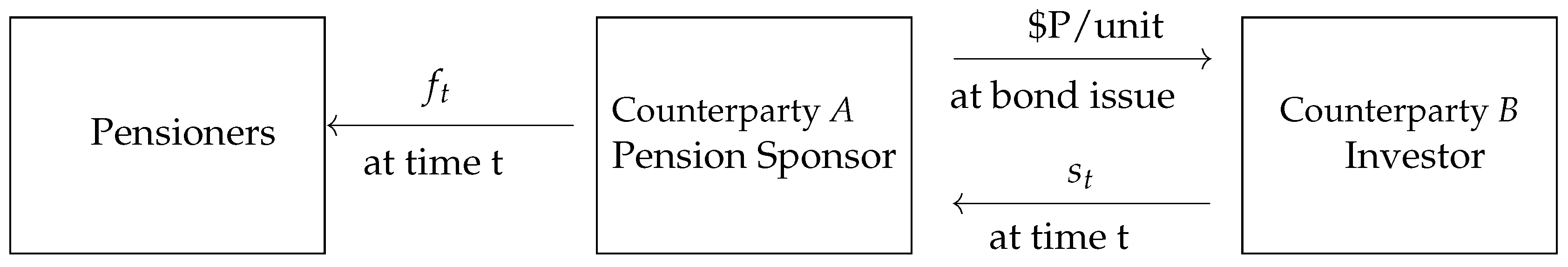

Figure 13, we depict the cash flow of this transaction. At the beginning of 2012, counterparty

A purchases

Q units of longevity bond and pays the price of

P for each unit. At time

t, counterparty

A pays out

to pensioners and receives the bond payment

from counterparty

B. When the mortality of the EW population improves, pensioners live longer. Consequently, counterparty

A has an extended obligation to pay pension benefits. The bond payment also increases, effectively offsetting the rise in pension liability payments for counterparty

A.

We can also allow counterparty A to issue a longevity bond. In such scenarios, the quantity Q will be negative. Such a bond should be designed to make decreasing payments with higher mortality improvement. In this section, we consider two bond payment structures to illustrate how the choice of nonlinear model may affect bond prices.

5.2. Economic Pricing

The economic pricing approach was first applied to mortality-linked securities by

Zhou et al. (

2015), who considered the pricing problem from fundamental economic concepts of supply and demand. It assumes that buyers and suppliers aim to maximize their expected terminal utility, and market equilibrium is reached when supply equals demand.

Let

and

be the initial wealth of counterparties

A and

B, and

and

be the wealth at the expiration of the bond.

Zhou et al. (

2015) assumed that the only alternative investment is to deposit in a bank that earns a continuously compounded annual risk-free interest rate of

r. Given the longevity bond price

P,

and

are quantities that counterparty

A is willing to purchase and counterparty

B has agreed to sell at the outset of the transaction. We have the following equations for the terminal wealth:

Denote

and

as the utility functions of counterparties

A and B, respectively. Assuming an exponential utility function, the terminal utility can be expressed as

where

and

are the absolute risk aversion parameters for

A and

B, respectively. Counterparty A purchases longevity bonds as a means to hedge its longevity risk, while counterparty

B accepts the longevity risk in pursuit of earning premiums. Consequently, it is reasonable to assume that counterparty

A is more risk-averse. We assume that

and

are 3 and 1, respectively.

Let

represent the accumulated pension benefit payment at time

T, and

represent the accumulated bond coupon payments at time

T. We then have

Given a price

P, counterparties

A and

B maximize their expected terminal utility. The maximization problem can be written as follows:

First, we maximize the expected terminal utility for

A. Recall that

. The conditions for maximizing the expected utility function of

A are

The first condition can be rewritten as

which implies

Next, we maximize the expected utility for counterparty

B. Recall that the terminal wealth of counterparty

B is

. The conditions for maximizing the expected utility of B are

The first condition can be rewritten as

which implies

The market equilibrium is achieved when

. Therefore,

P and

Q, the equilibrium trading price and quantity, should satisfy the following equality:

To calculate the expectations in Equation (

9), we first simulate 5000 mortality paths and determine the simulated values of the variables inside the expectation. The expectation is then obtained by taking the average of these simulated values.

5.3. Longevity Bond on Survival Probabilities

We first consider a longevity bond with payment associated with survival probabilities. The annual coupon payable at time

t is the approximate survival rate of a 65-year-old cohort. There is no principal repayment. The bond payment at time

t is expressed as follows:

Assume that the risk-free rate

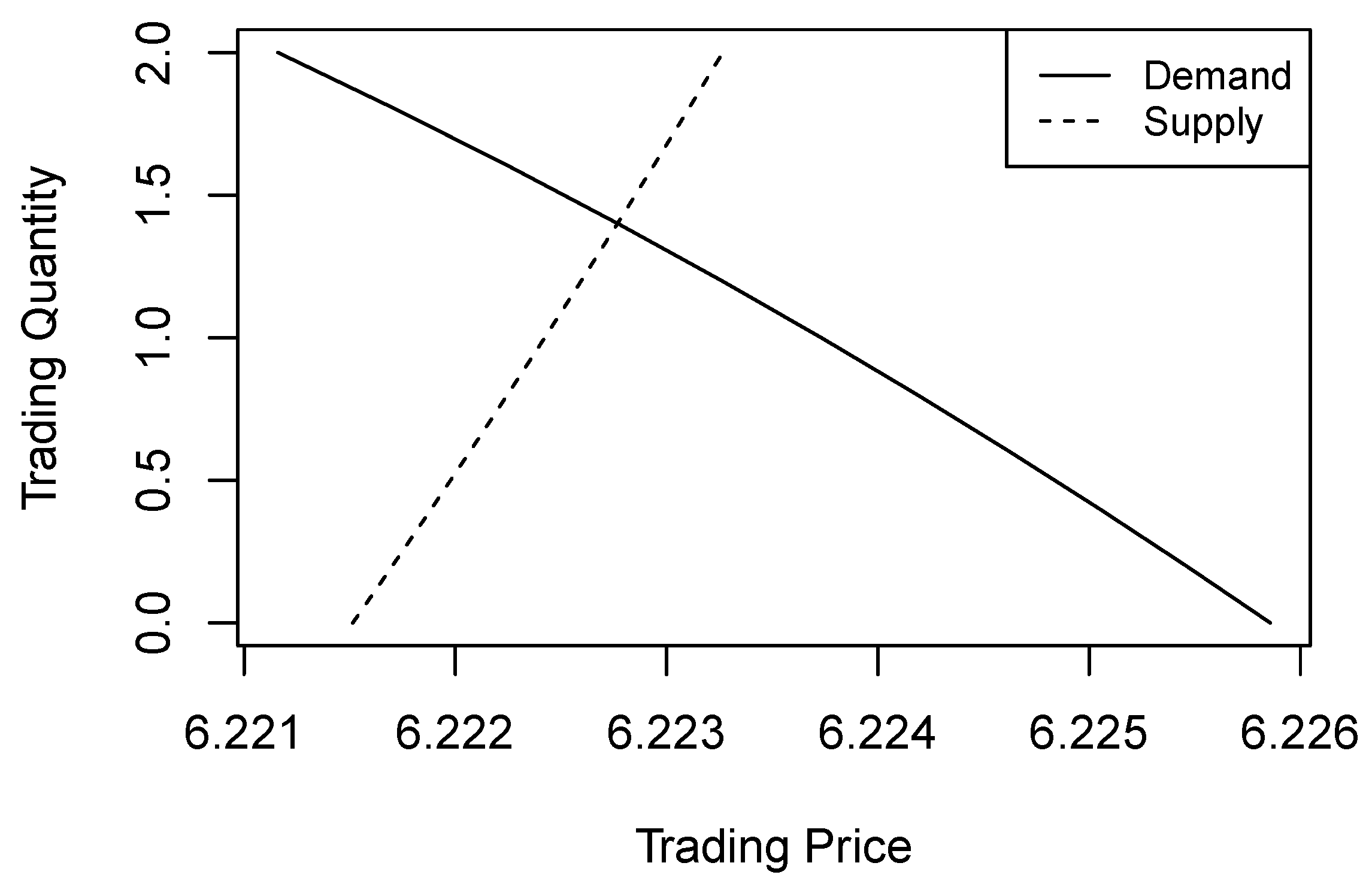

r is 4.5%. Taking the MS model with two regimes as an example, we plot the supply and demand curves for this bond in

Figure 14 where the intersection of the supply and demand curves represents the market equilibrium. Counterparty

A, being more risk-averse, demands fewer longevity bonds as the price increases. Conversely, counterparty

B, who is willing to take on more risk, is inclined to sell more bonds when the price rises.

Table 11 summarizes the trading price and quantity at market equilibrium and the expected present value (EPV) of future bond payments, which is expressed as

, based on the mortality forecasts using the five models.

The trading prices obtained from the AR, TAR, and SC models are remarkably close to each other and are higher than the prices derived from the MS model. This consistency in pricing can be attributed to the very close mean forecasts of the mortality index produced by these three models, as seen in

Figure 9. As we observed earlier, the mean mortality forecasts generated by the AR, TAR, and SC models are all significantly lower than those of the MS model. Consequently, this leads to a higher survival rate, increased longevity bond payments, and ultimately higher bond prices, compared to the MS model.

The price of the longevity bond obtained through the AR-GARCH model is the highest among the prices obtained from all models. The AR-GARCH model predicts a cohort survival rate that is substantially higher, leading to increased bond payments. The pension plan sponsor, facing a prolonged period of pension benefit payouts, is willing to pay a higher price to hedge against the heightened longevity risk.

Furthermore, when we examine the EPV of bond payments across different models, we observe that the MS model generates the lowest EPV, while the AR-GARCH model yields the highest EPV. This consistency in results reinforces the findings obtained through the economic pricing.

The variation in bond prices across different models is relatively minor, despite noticeable disparities in mortality rates across age groups. This observation can be attributed to the bond’s payment structure, which is based on the summation of approximate survival rates. For instance, a 5% uptick in a mortality rate of 0.02 translates to just around a 0.1% reduction in the corresponding approximate survival rate . Hence, employing a different bond payment structure might lead to more pronounced price differences.

5.4. Longevity Bond on Mortality Improvement Rates

We further consider a longevity bond with payments associated with mortality improvement rates. This bond is initially offered at a nominal issue price of unity, thus

. It makes an annual coupon payment of

, where

represents the yield spread, serving as compensation for the associated risk. The principal repayment of this bond is linked to a predefined mortality improvement index. This index, calculated as the average mortality improvement rate over the period 2012–2019 and the age range 65–89, is expressed as follows:

The principal repayment at expiration is defined as follows:

A full principal repayment of 1 is made when the average mortality improvement remains below 2%, termed the “attachment point”. Should the index exceeds 2%, the principal repayment is reduced proportionately with the increase in the index. The principal repayment drops to zero when the index exceeds the “detachment point” of 3%. To quantify the risk of principal reduction, we define the probability of first loss as follows:

The bond payment at time

t can be expressed as follows:

Since the issue price of the bond is already given, the pricing of this bond is equivalent to finding the spread .

Table 12 summarizes the pricing results for this bond. The negative values of

Q imply that counterparty

A is in the position of selling the bond. As the probability of the first loss, indicated by

, increases, the required spread

also increases. This is because a higher

suggests a lower expected principal repayment, prompting investors to demand a higher risk premium to compensate for the anticipated decrease in principal.

The spread

shows significant variation when priced under different nonlinear models. The variation in the spread is influenced by both the average predicted mortality improvements and their volatility. The AR-GARCH model generates the highest spread, aligning with the observations from

Figure 9 and

Figure 10 that the AR-GARCH model leads to the fastest average mortality improvement, with moderate volatility. The considerable increase in average mortality improvement leads to a greater chance of crossing the attachment point. On the other hand, the SC model predicts the lowest spread. Even though the SC model forecasts a mean mortality improvement similar to the TAR and AR models, as shown in

Figure 9, it has a very low variation in its predictions, as seen in

Figure 10. Consequently, the simulations mostly yield improvement rates tightly grouped around a narrow range of values, with only 0.92% of the simulated improvement rates exceeding the attachment point of 2.5%. The MS model, which predicts the slowest mortality improvement, leads to the second-lowest spread due to its slower improvement rate outweighing the effect of its higher variance.

6. Conclusions

In this paper, we conduct a thorough analysis of various nonlinear time-series models for the mortality index in the Lee–Carter and APC structures. We assess the goodness of fit of these models and examine how the choice of the nonlinear model affects mortality forecasts and subsequently longevity bond pricing. We focus on four specific nonlinear models: TAR, MS, SC, and GARCH, using mortality data from EW and Italy from 1900 to 2019.

All four nonlinear models demonstrated lower BIC values and more normally distributed residuals than the AR model. This signifies that nonlinear models offer significant improvements in fitting mortality data. Applying the Lee–Carter structure, the MS model with two regimes emerged as the best fit for both the EW and Italian mortality data. Under the APC structure, the SC model and the AR-GARCH model achieve the lowest BIC for EW and Italian mortality, respectively.

For an eight-year out-of-sample period, we obtain the mean squared errors and prediction intervals of mortality forecasts. Applying the Lee–Carter structure, the MS and SC models lead to the lowest MSE for EW and Italian mortality, respectively. The SC model yields the lowest out-of-sample MSEs for both datasets based on the APC structure. The prediction intervals under the Lee–Carter structure varied significantly among models, with the MS model producing the widest interval and the SC model yielding the narrowest. This is due to the SC model’s assumption of remaining in the second regime for future mortality predictions.

We further examine how the use of nonlinear time-series models may influence the prices of longevity bonds. Economic methods, based on fundamental concepts of supply and demand, were employed to price two types of longevity bonds, one written on the approximate survival rates and the other on the mortality improvement rates. Although the use of different nonlinear models leads to noticeable differences in mortality forecasts, it has a much lower impact on the survival rates and thus the price of the bond written on survival rates. In contrast, the price of the bond written on the improvement rates exhibits large variation with the choice of the model. The payment of this bond is reduced when the mortality improvement rate exceeds a certain threshold. Therefore, the bond price is affected not only by the mean but also by the tail distribution of the improvement rates. The large variation in longevity bond pricing underscored the significant impact of mortality modeling with nonlinearity on pricing outcomes.

In summary, our analysis reveals that no single model consistently outperforms others concerning both goodness-of-fit and forecasting accuracy. Our study highlights the critical role of nonlinear mortality models could play in mortality forecasting and longevity bond pricing. Practitioners are encouraged to consider the model that best aligns with their specific applications and expert judgment.

Several promising avenues for future research emerge from our study. Firstly, the robustness of the five models could be scrutinized using a rolling window analysis. The years 2015–2019 stand out, marked by a substantial rise in drug-related deaths and a consequent deceleration in mortality improvement. Therefore, it is necessary to examine how these models perform when using different periods of data.

Secondly, there is potential to examine the various extensions of the TAR model. While the TAR model is commonly known as the self-exciting TAR—where regime shifts are determined intrinsically by the time series—alternative models have been proposed by researchers like

Teräsvirta (

1994),

Tsay (

1989), and

Lundbergh and Teräsvirta (

2002). The smooth transition autoregressive (STAR) models enable gradual transitions between regimes, in contrast to the abrupt shifts typical of conventional TAR models. On the other hand, threshold autoregressive models with external variables (TARX) initiate regime transitions based on an external factor, rather than being solely influenced by the time series. Investigating the efficacy of these modified TAR models in predicting mortality data offers an intriguing prospect.

Finally, it is also important to explore the inclusion of mortality shocks, such as those caused by the recent COVID-19 pandemic or historical events like the 1981 influenza pandemic, into nonlinear models. Our analysis using QQ plots indicates that while the residuals mostly align with the expected 45-degree line, there are notable deviations at the tails. Introducing jump terms to these models, as inspired by the work of researchers like

Chen and Cox (

2009) who have modeled jumps in linear contexts, could potentially address these discrepancies. Adapting the mortality jumps to nonlinear models could enhance our understanding of mortality dynamics, especially in extreme conditions, and contribute valuable new insights to the existing literature.