An Analysis of Volatility and Risk-Adjusted Returns of ESG Indices in Developed and Emerging Economies

Abstract

:1. Introduction

2. Literature Review

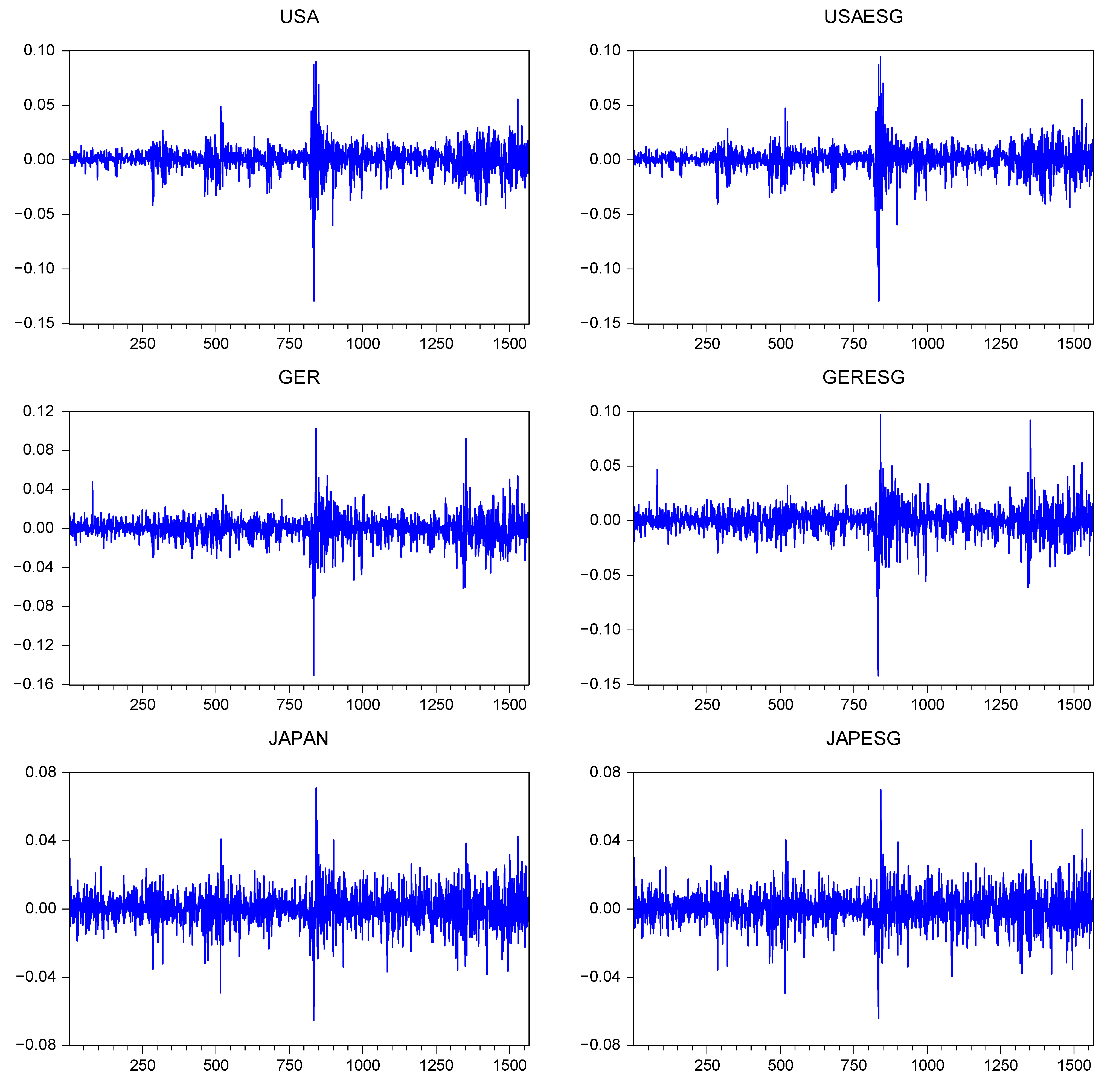

3. Data Analysis and Methodology

| Symbol | MSCI Indices Description |

|---|---|

| USA | USA Standard (Large and Mid Cap.) |

| USAESG | USA ESG Leaders Standard (Large and Mid Cap.) |

| GER | Germany Standard (Large and Mid Cap.) |

| GERESG | Germany ESG Leaders Standard (Large and Mid Cap.) |

| JAP | Japan Standard (Large and Mid Cap.) |

| JAPESG | Japan ESG Leaders Standard (Large and Mid Cap.) |

| IND | India Standard (Large and Mid Cap.) |

| INDESG | India ESG Leaders Standard (Large and Mid Cap.) |

| BRZ | Brazil Standard (Large and Mid Cap.) |

| BRZESG | Brazil ESG Leaders Standard (Large and Mid Cap.) |

| CHN | CHINA Standard (Large and Mid Cap.) |

| CHNESG | China ESG Leaders Standard (Large and Mid Cap.) |

3.1. Risk Return Analysis

3.2. Unit Root Test

3.3. Volatility Models

3.4. Modelling Asymmetric Volatility

4. Empirical Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abedifar, Pejman, Kais Bouslah, Christopher Neumann, and Amine Tarazi. 2023. Resilience of Environmental and Social Stocks under Stress: Lessons from the COVID-19 Pandemic. Financial Markets, Institutions & Instruments 32: 23–50. [Google Scholar] [CrossRef]

- Ahern, Kenneth R. 2009. Sample selection and event study estimation. Journal of Empirical Finance 16: 466–82. [Google Scholar] [CrossRef]

- Al Amosh, Hamzeh, and Saleh F. A. Khatib. 2023. ESG performance in the time of COVID-19 pandemic: Cross-country evidence. Environmental Science and Pollution Research 30: 39978–93. [Google Scholar] [CrossRef] [PubMed]

- Albuquerque, Rui, Yrjo Koskinen, Shuai Yang, and Chendi Zhang. 2020. Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies 9: 593–621. [Google Scholar] [CrossRef]

- Ashwin Kumar, N. C., Camille Smith, Leïla Badis, Nan Wang, Paz Ambrosy, and Rodrigo Tavares. 2016. ESG Factors and Risk-adjusted Performance: A New Quantitative Model. Journal of Sustainable Finance & Investment 6: 292–300. [Google Scholar] [CrossRef]

- Bannier, Christina E., Yannik Bofinger, and Björn Rock. 2023. The risk-return tradeoff: Are sustainable investors compensated adequately? Journal of Asset Management 24: 165–72. [Google Scholar] [CrossRef]

- Barberis, Nicholas C. 2013. Thirty years of prospect theory in economics: A review and assessment. Journal of Economic Perspectives 27: 173–96. [Google Scholar] [CrossRef]

- Baum, Christopher F. 2000. sts15: Tests for stationarity of a time series. Stata Technical Bulletin 57: 36–39. [Google Scholar]

- Baur, Dirk G. 2012. Asymmetric volatility in the gold market. The Journal of Alternative Investments 14: 26–38. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Brest, Paul, Ronald J. Gilson, and Mark A. Wolfson. 2018. Essay: How investors can (and can’t) create social value. The Journal of Corporation Law 44: 205. [Google Scholar]

- Broadstock, David C., Kalok Chan, Louis T. W. Cheng, and Xiaowei Wang. 2021. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Research Letters 38: 101716. [Google Scholar] [CrossRef] [PubMed]

- Campbell, John Y., and Ludger Hentschel. 1992. No news is good news: An asymmetric model of changing volatility in stock returns. Journal of Financial Economics 31: 281–318. [Google Scholar] [CrossRef]

- Dalal, Karishma K., and Nimit Thaker. 2019. ESG and corporate financial performance: A panel study of Indian companies. IUP Journal of Corporate Governance 18: 44–59. [Google Scholar]

- Edmans, Alex. 2023. The end of ESG. Financial Management 52: 3–17. [Google Scholar] [CrossRef]

- Endri, Endri, Widya Aipama, and Renil Septiano. 2021. Stock price volatility during the COVID-19 pandemic: The GARCH model. Investment Management and Financial Innovations 18: 12–20. [Google Scholar] [CrossRef]

- Engelhardt, Nils, Jens Ekkenga, and Peter Posch. 2021. ESG ratings and stock performance during the COVID-19 crisis. Sustainability 13: 7133. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar] [CrossRef]

- Estrada, Javier. 2002. Systematic risk in emerging markets: The D-CAPM. Emerging Markets Review 3: 365–79. [Google Scholar] [CrossRef]

- Folger-Laronde, Zachary, Sep Pashang, Leah Feor, and Amr ElAlfy. 2022. ESG ratings and financial performance of exchange-traded funds during the COVID-19 pandemic. Journal of Sustainable Finance & Investment 12: 490–96. [Google Scholar] [CrossRef]

- Fostel, Ana, and John Geanakoplos. 2012. Why does bad news increase volatility and decrease leverage? Journal of Economic Theory 147: 501–25. [Google Scholar] [CrossRef]

- Friede, Gunnar, Timo Busch, and Alexander Bassen. 2015. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment 5: 210–33. [Google Scholar]

- Górka, Joanna, and Katarzyna Kuziak. 2022. Volatility Modeling and Dependence Structure of ESG and Conventional Investments. Risks 10: 20. [Google Scholar] [CrossRef]

- Gupta, Hemendra. 2020. Stability of Beta in Various Sectors in Different Phases of Stock Market. Journal of Commerce & Accounting Research 9: 25–32. [Google Scholar]

- Gupta, Hemendra, and Rashmi Chaudhary. 2022. An Empirical Study of Volatility in Cryptocurrency Market. Journal of Risk and Financial Management 15: 513. [Google Scholar] [CrossRef]

- Gupta, Hemendra, Rashmi Chaudhary, Kajal Srivastava, and Suneel Gupta. 2022. Volatility modelling of asset classes: An empirical study during different phases of COVID-19. Academy of Accounting and Financial Studies Journal 26: 1–19. [Google Scholar]

- Hartzmark, Samuel M., and Abigail B. Sussman. 2019. Do investors value sustainability? A natural experiment examining ranking and fund flows. The Journal of Finance 74: 2789–837. [Google Scholar] [CrossRef]

- Jain, Mansi, Gagan Deep Sharma, and Mrinalini Srivastava. 2019. Can sustainable investment yield better financial returns: A comparative study of ESG indices and MSCI indices. Risks 7: 15. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1968. The performance of mutual funds in the period 1945–64. Journal of Finance 23: 389–416. [Google Scholar]

- Kahneman, Daniel, and Amos Tversky. 1979. On the interpretation of intuitive probability: A reply to Jonathan Cohen. Cognition 7: 409–11. [Google Scholar] [CrossRef]

- Kim, Sang, and Zhichuan Li. 2021. Understanding the impact of ESG practices in corporate finance. Sustainability 13: 3746. [Google Scholar] [CrossRef]

- Lashkaripour, Mohammadhossein. 2023. ESG tail risk: The COVID-19 market crash analysis. Finance Research Letters 53: 103598. [Google Scholar] [CrossRef]

- Lau, Chee Kwong. 2019. The economic consequences of business sustainability initiatives. Asia Pacific Journal of Management 36: 937–70. [Google Scholar] [CrossRef]

- Liu, Dayong, Kaiyuan Gu, and Wenhua Hu. 2023. ESG Performance and Stock Idiosyncratic Volatility. Finance Research Letters 58: 104393. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Thomas Conlon, and John Cotter. 2022. Green bonds and other assets: Evidence from extreme risk transmission. Journal of Environmental Management 305: 114358. [Google Scholar] [CrossRef]

- Nelson, Daniel B. 1991. Conditional heteroskedasticity in asset returns: A new approach. Econometrica: Journal of the Econometric Society 59: 347–70. [Google Scholar] [CrossRef]

- Nurhayati, Immas, Endri Endri, Renea Shinta Aminda, and Leny Muniroh. 2021. Impact of COVID-19 on Performance Evaluation Large Market Capitalization Stocks and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 56. [Google Scholar] [CrossRef]

- Ouchen, Abdessamad. 2022. Is the ESG portfolio less turbulent than a market benchmark portfolio? Risk Management 24: 1–33. [Google Scholar] [CrossRef]

- Park, So Ra, and Jae Young Jang. 2021. The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies 9: 48. [Google Scholar] [CrossRef]

- Rastogi, Shailesh. 2014. The financial crisis of 2008 and stock market volatility–analysis and impact on emerging economies pre and post crisis. Afro-Asian Journal of Finance and Accounting 4: 443–59. [Google Scholar] [CrossRef]

- Revelli, Christophe, and Jean-Laurent Viviani. 2015. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Business Ethics: A European Review 24: 158–85. [Google Scholar] [CrossRef]

- Ruggeri, Kai, Sonia Alí, Mari Louise Berge, Giulia Bertoldo, Ludvig D. Bjørndal, Anna Cortijos-Bernabeu, Clair Davison, Emir Demić, Celia Esteban-Serna, Maja Friedemann, and et al. 2020. Replicating patterns of prospect theory for decision under risk. Nature Human Behaviour 4: 622–33. [Google Scholar] [CrossRef] [PubMed]

- Sharpe, William F. 1966. Mutual Fund Performance. The Journal of Business 39: 119–38. [Google Scholar] [CrossRef]

- Singhania, Monica, and Neha Saini. 2023. Institutional framework of ESG disclosures: Comparative analysis of developed and developing countries. Journal of Sustainable Finance & Investment 13: 516–59. [Google Scholar] [CrossRef]

- Sortino, Frank A., and Robert Van Der Meer. 1991. Downside risk. Journal of Portfolio Management 17: 27. [Google Scholar] [CrossRef]

- Sudha, S. 2015. Risk-return and Volatility analysis of Sustainability Index in India. Environment, Development and Sustainability 17: 1329–42. [Google Scholar] [CrossRef]

- Suresha, B., V. R. Srinidhi, Dippi Verma, K. S. Manu, and T. A. Krishna. 2022. The impact of ESG inclusion on price, liquidity and financial performance of Indian stocks: Evidence from stocks listed in BSE and NSE ESG indices. Investment Management and Financial Innovations 19: 40–50. [Google Scholar] [CrossRef]

- Treynor, Jack. 1965. How to rate management of investment funds. Harvard Business Review 43: 63–75. [Google Scholar]

- Tversky, Amos, and Daniel Kahneman. 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5: 297–323. [Google Scholar] [CrossRef]

- Urom, Christian, Gideon Ndubuisi, and Jude Ozor. 2021. Economic activity, and financial and commodity markets’ shocks: An analysis of implied volatility indexes. International Economics 165: 51–66. [Google Scholar] [CrossRef]

- Van Duuren, Emiel, Auke Plantinga, and Bert Scholtens. 2016. ESG integration and the investment management process: Fundamental investing reinvented. Journal of Business Ethics 138: 525–33. [Google Scholar] [CrossRef]

- Wakker, Peter P. 2010. Prospect Theory: For Risk and Ambiguity. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Whieldon, Esther, and Robert Clark. 2021. ESG Funds Beat Out S&P 500 in 1st Year of COVID-19: How 1 Fund Shot to the Top. S&P Global Market Intelligence, April 6. [Google Scholar]

- Zhao, Changhong, Yu Guo, Jiahai Yuan, Mengya Wu, Daiyu Li, Yiou Zhou, and Jiangang Kang. 2018. ESG and corporate financial performance: Empirical evidence from China’s listed power generation companies. Sustainability 10: 2607. [Google Scholar] [CrossRef]

| USA | USAESG | GER | GERESG | JAP | JAPESG | IND | INDESG | BRZ | BRZESG | CHN | CHNESG | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 0.0004 | 0.0004 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0004 | 0.0005 | 0.0001 | −0.0001 | 0.0001 | 0.0001 |

| Median | 0.0005 | 0.0005 | 0.0005 | 0.0005 | 0.0003 | 0.0003 | 0.0007 | 0.0007 | 0.0004 | 0.0000 | 0.0002 | 0.0000 |

| Maximum | 0.0899 | 0.0946 | 0.1024 | 0.0969 | 0.0710 | 0.0698 | 0.0917 | 0.0979 | 0.1516 | 0.1317 | 0.1358 | 0.1565 |

| Minimum | −0.1292 | −0.1292 | −0.1509 | −0.1421 | −0.0652 | −0.0642 | −0.1550 | −0.1467 | −0.1942 | −0.1923 | −0.0853 | −0.0963 |

| Std. Dev. | 0.0126 | 0.0126 | 0.0136 | 0.0132 | 0.0106 | 0.0106 | 0.0127 | 0.0124 | 0.0218 | 0.0224 | 0.0151 | 0.0178 |

| Skewness | −0.8998 | −0.8257 | −0.7770 | −0.6678 | −0.0573 | −0.0492 | −1.6390 | −1.3557 | −1.2376 | −0.9264 | 0.2739 | 0.3308 |

| Kurtosis | 18.7801 | 19.1406 | 18.3359 | 17.0106 | 6.8516 | 6.6468 | 24.0091 | 22.9574 | 16.6722 | 12.7294 | 9.7472 | 9.4038 |

| No. of Days | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 | 1564 |

| USA | USA ESG | GER | GER ESG | JAP | JAP ESG | IND | IND ESG | BRZ | BRZ ESG | CHN | CHN ESG | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USA | 1.0000 | 0.9941 | 0.5629 | 0.5464 | 0.1635 | 0.1581 | 0.2930 | 0.2911 | 0.5139 | 0.4822 | 0.3229 | 0.2704 |

| USA ESG | 0.9941 | 1.0000 | 0.5626 | 0.5476 | 0.1594 | 0.1541 | 0.2910 | 0.2891 | 0.5070 | 0.4777 | 0.3107 | 0.2608 |

| GER | 0.5629 | 0.5626 | 1.0000 | 0.9906 | 0.3002 | 0.2932 | 0.4725 | 0.4708 | 0.4547 | 0.4230 | 0.3830 | 0.3418 |

| GER ESG | 0.5464 | 0.5476 | 0.9906 | 1.0000 | 0.2918 | 0.2849 | 0.4702 | 0.4696 | 0.4416 | 0.4111 | 0.3671 | 0.3272 |

| JAP | 0.1635 | 0.1594 | 0.3002 | 0.2918 | 1.0000 | 0.9921 | 0.3047 | 0.3139 | 0.1823 | 0.1660 | 0.3030 | 0.2855 |

| JAP ESG | 0.1581 | 0.1541 | 0.2932 | 0.2849 | 0.9921 | 1.0000 | 0.3044 | 0.3136 | 0.1768 | 0.1598 | 0.3054 | 0.2883 |

| IND | 0.2930 | 0.2910 | 0.4725 | 0.4702 | 0.3047 | 0.3044 | 1.0000 | 0.9803 | 0.3303 | 0.3102 | 0.3967 | 0.3672 |

| IND ESG | 0.2911 | 0.2891 | 0.4708 | 0.4696 | 0.3139 | 0.3136 | 0.9803 | 1.0000 | 0.3239 | 0.3049 | 0.3987 | 0.3682 |

| BRZ | 0.5139 | 0.5070 | 0.4547 | 0.4416 | 0.1823 | 0.1768 | 0.3303 | 0.3239 | 1.0000 | 0.9694 | 0.3068 | 0.2597 |

| BRZ ESG | 0.4822 | 0.4777 | 0.4230 | 0.4111 | 0.1660 | 0.1598 | 0.3102 | 0.3049 | 0.9694 | 1.0000 | 0.2692 | 0.2270 |

| CHN | 0.3229 | 0.3107 | 0.3830 | 0.3671 | 0.3030 | 0.3054 | 0.3967 | 0.3987 | 0.3068 | 0.2692 | 1.0000 | 0.9689 |

| CHN ESG | 0.2704 | 0.2608 | 0.3418 | 0.3272 | 0.2855 | 0.2883 | 0.3672 | 0.3682 | 0.2597 | 0.2270 | 0.9689 | 1.0000 |

| USA | USAESG | GER | GERESG | JAP | JAPESG | IND | INDESG | BRZ | BRZESG | CHN | CHNESG | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 0.1333 | 0.1369 | 0.0127 | 0.0189 | 0.0408 | 0.0411 | 0.1124 | 0.1304 | 0.0357 | −0.0253 | 0.0333 | 0.0548 |

| Median | 0.1364 | 0.1407 | 0.0177 | 0.0220 | 0.0485 | 0.0646 | 0.0635 | 0.1059 | 0.0270 | −0.0265 | −0.0192 | 0.0028 |

| Max | 0.8079 | 0.7681 | 0.8806 | 0.8467 | 0.6507 | 0.6034 | 1.0454 | 1.0573 | 0.7977 | 0.5944 | 0.6527 | 0.8002 |

| Min | −0.2166 | −0.2367 | −0.3864 | −0.3965 | −0.2987 | −0.3158 | −0.3937 | −0.3372 | −0.4874 | −0.4565 | −0.4832 | −0.5488 |

| St. Dev | 0.1669 | 0.1626 | 0.2157 | 0.2107 | 0.1607 | 0.1599 | 0.2278 | 0.2050 | 0.2287 | 0.2201 | 0.2720 | 0.3339 |

| Skew | 0.3575 | 0.2325 | 0.6138 | 0.5415 | 0.2785 | 0.0286 | 1.0004 | 0.9986 | 0.1221 | 0.3147 | 0.2062 | 0.2384 |

| Kurtosis | 0.5455 | 0.3781 | 0.7088 | 0.8859 | −0.0825 | −0.3221 | 0.8973 | 1.4110 | −0.3413 | −0.6439 | −1.0238 | −1.1492 |

| Count | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 | 1306 |

| C.L(95.0%) | 0.0091 | 0.0088 | 0.0117 | 0.0114 | 0.0087 | 0.0087 | 0.0124 | 0.0111 | 0.0124 | 0.0119 | 0.0148 | 0.0181 |

| Daily Returns | Rolling Annual Return | |||||

|---|---|---|---|---|---|---|

| Diff of Mean | T-Value | Prob | Diff of Mean | T-Value | Prob | |

| USAESG-USA | −0.0002 | 0.5553 | 0.5788 | 0.003546 * | 6.5427 | 0.000 |

| GERESG-GER | 0.0000 | −0.1675 | 0.8670 | 0.006199 * | 8.59408 | 0.000 |

| JAPESG-JAP | 0.0000 | −0.2031 | 0.8391 | 0.000301 *** | 1.9238 | 0.0546 |

| INDESG-IND | 0.0000 | 0.2442 | 0.8071 | 0.018006 * | 12.9403 | 0.000 |

| BRZESG-BRZ | 0.0001 | −0.8517 | 0.3945 | −0.06093 * | −28.11454 | 0.000 |

| CHNESG-CHN | −0.0002 | 1.5071 | 0.1320 | 0.021499 * | 10.5262 | 0.000 |

| (i). Performance of ESG Indices on Daily Returns | ||||||

| USAESG | GERESG | JAPESG | INDESG | BRZESG | CHNESG | |

| Sharpe Ratio | 0.0033 | 0.0276 | 0.0116 | −0.0082 | 0.0000 | 0.0026 |

| Treynor’s Ratio | 0.0001 | 0.0003 | 0.0002 | −0.0001 | 0.0000 | 0.0001 |

| Sortino’s Ratio | 0.0055 | 0.0419 | 0.0180 | −0.0136 | 0.0001 | 0.0041 |

| (ii). Performance of ESG Indices on Annual Rolling Returns | ||||||

| USAESG | GERESG | JAPESG | INDESG | BRZESG | CHNESG | |

| Sharpe Ratio | 0.5458 | −0.0645 | 0.2573 | 0.2955 | −0.7146 | 0.0988 |

| Treynor Ratio | 0.0871 | −0.0131 | 0.0387 | 0.0745 | −0.1467 | 0.0281 |

| Sortino Ratio | 1.8405 | −0.1262 | 0.5374 | 1.1756 | −1.2348 | 0.2193 |

| Alpha | T-Value | Beta | T Value | Adj. R2 | F-Value | |

|---|---|---|---|---|---|---|

| USAESG | 0.0001 | 0.1624 | 0.3861 | 13.3892 | 0.1024 | 179.2694 |

| GERESG | 0.0000 | 0.3447 | 0.9659 | 286.1195 | 0.9813 | 81,864.3412 |

| JAPESG | 0.0000 | −1.6001 | 1.0007 | 312.7198 | 0.9843 | 97,793.6859 |

| INDESG | 0.0001 | 1.1453 | 1.0007 | 195.9558 | 0.9609 | 38,398.6906 |

| BRZESG | −0.0002 | −1.6001 | 0.9967 | 156.0876 | 0.9397 | 24,363.3440 |

| CHNESG | 0.0000 | −0.1458 | 1.1437 | 154.7615 | 0.9397 | 23,951.1113 |

| Alpha | T-Val | Beta | T-Val | Adj. R2 | F-Value | |

|---|---|---|---|---|---|---|

| USAESG | 0.0012 * | 2.4881 | 1.0195 | 313.0370 | 0.9921 | 97,992.1872 |

| GERESG | 0.0098 * | 28.2001 | 1.0341 | 163.0579 | 0.9793 | 26,587.8813 |

| JAPESG | 0.0020 * | 6.0156 | 1.0644 | 192.3274 | 0.9793 | 36,989.8455 |

| INDIAESG | 0.0482 * | 61.0526 | 0.8129 | 112.4432 | 0.9417 | 12,643.4685 |

| BRAZESG | −0.0415 * | −33.1035 | 1.0717 | 56.7976 | 0.8046 | 3225.9622 |

| CHINAESG | 0.0149 * | 29.4931 | 1.1761 | 189.3385 | 0.9786 | 35,849.0637 |

| USA | GER | JAP | IND | BRZ | CHN |

| −34.16% | −46.56% | −35.42% | −43.14% | −57.08% | −62.54% |

| USAESG | GERESG | JAPESG | INDESG | BRZESG | CHNESG |

| −34.07% | −43.37% | −35.12% | −39.42% | −55.79% | −67.68% |

| Coefficients | T Statistics | p-Value | ||

|---|---|---|---|---|

| USAESG | Upside Beta | 0.3492 | 7.1413 | 0.0000 |

| Dummy | 0.0689 | 0.9345 | 0.3502 | |

| Downside Beta | 0.4181 | |||

| GERESG | Upside Beta | 1.0014 | 214.5653 | 0.0000 |

| Dummy | −0.0166 * | −2.3625 | 0.0183 | |

| Downside Beta | 0.9848 | |||

| JAPESG | Upside Beta | 0.9754 | 166.9043 | 0.0000 |

| Dummy | −0.0167 *** | −1.8523 | 0.0642 | |

| Downside Beta | 0.9588 | |||

| INDESG | Upside Beta | 1.0010 | 178.9532 | 0.0000 |

| Dummy | −0.0004 | −0.0485 | 0.9613 | |

| Downside Beta | 1.0005 | |||

| BRZESG | Upside Beta | 0.9900 | 109.5731 | 0.0000 |

| Dummy | −0.0454 * | −3.3879 | 0.0007 | |

| Downside Beta | 0.9446 | |||

| CHNESG | Upside Beta | 1.0270 | 88.6815 | 0.0000 |

| Dummy | −0.0519 * | −2.9265 | 0.0035 | |

| Downside Beta | 0.9750 |

| USA | USAESG | GER | GERESG | JAP | JAPESG | IND | INDESG | BRZ | BRZESG | CHN | CHNESG | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ADF | −11.9007 | −11.8307 | −25.5862 | −25.4116 | −40.9784 | −40.9756 | −16.1878 | −16.249 | −42.7107 | −42.029 | −36.0809 | −37.0997 |

| p Val | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| USA | USA ESG | GER | GER ESG | JAP | JAP ESG | IND | IND ESG | BRZ | BRZ ESG | CHN | CHN ESG | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F Stats | 233.66 | 227.48 | 9.50 | 13.72 | 72.59 | 62.28 | 44.87 | 64.82 | 228.65 | 185.86 | 58.46 | 84.37 |

| p-Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| USA | USA ESG | GER | GERESG | JAP | JAPESG | |||||||

| Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | |

| α | 0.2138 | 11.5218 | 0.2032 | 11.6048 | 0.0996 | 11.6513 | 0.0971 | 11.4961 | 0.1278 | 7.5722 | 0.1302 | 7.6498 |

| β | 0.7842 | 45.9354 | 0.7896 | 51.3306 | 0.8799 | 81.0020 | 0.8823 | 82.0020 | 0.8151 | 31.5392 | 0.8090 | 31.1521 |

| IND | INDESG | BRZ | BRZESG | CHN | CHNESG | |||||||

| Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | |

| α | 0.0949 | 8.4068 | 0.0908 | 8.4852 | 0.0901 | 10.7204 | 0.0926 | 8.9018 | 0.0894 | 10.0118 | 0.0852 | 10.0061 |

| β | 0.8748 | 55.8517 | 0.8860 | 61.8466 | 0.8567 | 70.0976 | 0.8552 | 66.2503 | 0.8936 | 74.6527 | 0.9051 | 89.3514 |

| USA | USA ESG | GER | GERESG | JAP | JAPESG | |||||||

| Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | |

| ω | −0.6435 | −10.3504 | −0.5595 | −10.5624 | −0.2918 | −6.8933 | −0.1408 | −5.6156 | −0.4488 | −5.9448 | −0.4397 | −6.1535 |

| α | 0.2887 | 13.9810 | 0.2864 | 14.0582 | 0.1146 | 7.4087 | 0.0655 | 5.2731 | 0.1504 | 7.6351 | 0.1480 | 7.8673 |

| λ | −0.1395 | −11.9187 | −0.1304 | −11.6487 | −0.1226 | −15.9075 | −0.1478 | −13.3448 | −0.0930 | −7.4241 | −0.0893 | −7.3271 |

| β | 0.9546 | 167.2299 | 0.9635 | 201.1148 | 0.9769 | 246.6733 | 0.9896 | 410.1815 | 0.9641 | 136.0620 | 0.9649 | 142.6274 |

| IND | INDESG | BRZ | BRZESG | CHN | CHNESG | |||||||

| Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | Coef. | z-Statistic | |

| ω | −0.2512 | −5.9149 | −0.2520 | −5.9053 | −0.6729 | −6.6409 | −0.6641 | −7.4643 | −0.3952 | −6.8627 | −0.3320 | −6.9612 |

| α | 0.0880 | 4.9953 | 0.1067 | 5.5289 | 0.1703 | 10.7506 | 0.1785 | 9.2771 | 0.1500 | 8.0830 | 0.1537 | 8.4181 |

| λ | −0.1301 | −13.2545 | −0.1119 | −11.6267 | −0.1099 | −6.8081 | −0.0973 | −6.0064 | −0.1029 | −7.7307 | −0.0885 | −7.7769 |

| β | 0.9795 | 262.8863 | 0.9812 | 267.1397 | 0.9312 | 76.6134 | 0.9323 | 89.2361 | 0.9676 | 166.9113 | 0.9742 | 195.2432 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gupta, H.; Chaudhary, R. An Analysis of Volatility and Risk-Adjusted Returns of ESG Indices in Developed and Emerging Economies. Risks 2023, 11, 182. https://doi.org/10.3390/risks11100182

Gupta H, Chaudhary R. An Analysis of Volatility and Risk-Adjusted Returns of ESG Indices in Developed and Emerging Economies. Risks. 2023; 11(10):182. https://doi.org/10.3390/risks11100182

Chicago/Turabian StyleGupta, Hemendra, and Rashmi Chaudhary. 2023. "An Analysis of Volatility and Risk-Adjusted Returns of ESG Indices in Developed and Emerging Economies" Risks 11, no. 10: 182. https://doi.org/10.3390/risks11100182

APA StyleGupta, H., & Chaudhary, R. (2023). An Analysis of Volatility and Risk-Adjusted Returns of ESG Indices in Developed and Emerging Economies. Risks, 11(10), 182. https://doi.org/10.3390/risks11100182