Abstract

During the COVID-19 pandemic, technology stocks, such as FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google), attracted the attention of global investors due to the vast use of technology in daily business. However, technology stocks are generally considered risky stocks; hence, efficient risk management is required to construct an optimal portfolio. In this study, we investigate the volatility spillovers and dynamic conditional correlations among the daily returns of FAANG company stocks, gold, and sharia-compliant equity to construct the optimal portfolio weights and hedge ratios during the COVID-19 pandemic period by utilizing a multivariate GARCH framework. The dynamic conditional correlations reveal that both gold and sharia-compliant equities exhibit lower correlations with FAANG stocks during the COVID-19 pandemic, implying opportunities for portfolio diversification. The findings indicate that gold and shariah-compliant equity are good candidates to hedge FAANG stocks. These findings are highly relevant for international investors, asset managers, hedgers, and portfolio managers.

1. Introduction

The aim of this paper is to document the hedging prospects of gold and shariah-compliant equities during the COVID-19 pandemic. We believe that it is particularly important to understand the hedging prospects of these assets during the COVID-19 pandemic because this period was characterized by one of the worst global recessions of the recent times (Shen et al. 2020). In addition to the impact on real markets, the COVID-19 pandemic also affected the stock markets (Al-Awadhi et al. 2020; Ashraf 2020; Baker et al. 2020; Ramelli and Wagner 2020; Zhang et al. 2020). Bossman et al. (2022) noted that conventional stocks were prone to more volatilities than Islamic stocks during market turbulence. This uncertainty in stock markets indicates a challenging situation, which calls for the deployment of effective and aggressive risk management strategies and the selection of asset classes with low or negative correlations during the pandemic period. Investors, hedgers, and asset managers, therefore, should be interested in identifying the asset classes that can reduce their exposure to risk.

The motivation behind understanding the hedging prospects of gold and shariah-compliant equities is based on the assumption that these assets possess a lower risk. A significant amount of the prior literature shows that gold is a good portfolio diversifier during uncertain times (Gürgün and Ünalmış 2014; Beckmann et al. 2015; Sherman 1982; Jaffe 1989; Baur and Lucey 2010; Ciner et al. 2013; Bekiros et al. 2017). AlKhazalia et al. (2021), for example, showed that a portfolio consisting of gold had lower risk than a portfolio that excluded gold. Likewise, Baur and McDermott (2016), among others, showed that gold acted as a strong candidate for optimal portfolio construction during 11 September 2001 and the Lehman insolvency in September 2008. This strand of the literature argues that the ability of gold to reduce portfolio risk depends on a number of factors. For instance, Baur and McDermott (2016) noted that behavioral biases linked with gold’s history as a currency or a store of value was the main reason behind safe haven properties of gold. Another important reason behind the ability of gold to reduce portfolio risk is based on the assumption that when other assets do not do well, investors turn to precious metals, such as gold, to safeguard themselves against adverse performance of other investments. As a result, the demand for gold increases, which has a positive impact on the prices of gold and leads to a lower variation of portfolios that include gold. These studies indicate that investors should include gold in their portfolios to maximize their expected returns, which is also supported by Yan and Garcia (2017) who studied the effectiveness of commodities in an optimal portfolio.

Similar to gold, shariah-compliant equities also possess characteristics that make them good candidates for acting as the safe havens during market downturns (Mirza et al. 2022; Saiti et al. 2014; Rizvi et al. 2015; Abbes and Trichilli 2015; Al-Zoubi and Maghyereh 2007; Milly and Sultan 2012). Ashraf et al. (2022), for example, reported that shariah-compliant equities outperformed their conventional counterparts in the first quarter of 2020, the peak of the COVID-19 pandemic. They documented that shariah-compliant equities provided hedging benefits during extreme market downfalls. Bossman et al. (2022) also documented the diversification opportunities between Islamic and conventional equities in the short- and mid-term periods of the COVID-19 pandemic. Ahmed and Farooq (2018) came to a similar conclusion, when they reported that the degree of shariah-compliance was a significant determinant of risk. They showed that the more compliant a portfolio was, the lower the risk of the portfolio was. Arif et al. (2021) also showed that shariah-compliant equities emerged as a robust safe-haven asset for the G7 stock markets during the pandemic crisis. Several arguments have been put forward for this relationship. Farooq and AbdelBari (2015), for example, argued that shariah-compliant equities had lower information asymmetries relative to noncompliant equities. Farooq and Ahmed (2022) documented lower information asymmetries of shariah-compliant equities due to their financial characteristics. They noted that lower levels of debt, cash, and account receivables associated with shariah-compliant equities resulted in a better information environment. The better information environment of shariah-compliant equities is also attributed to the increased scrutiny that these equities generate from investors and regulators. Haseeb et al. (2022) noted that managers in shariah-compliant equities pay close attention to not being caught in immoral actions. Therefore, they tend to manage their firms more ethically.

In this paper, we extend the literature on the safe haven properties of gold and sharia-compliant equities by documenting their impact on portfolios consisting of FAANG (Facebook, Amazon, Apple, Netflix, and Alphabet) stocks. These stocks traditionally generate lot of interest from stock market participants and constitute a large proportion of the S&P 500 index and NASDAQ index. The paper explores the diversification opportunities by constructing an optimal portfolio and offering a hedging strategy by computing the hedge ratios for risk management during the COVID-19 pandemic period. First, we investigate the return and volatility spillover effects among the daily closing prices of three asset classes, namely the FAANG stocks representing the technology sector and tracked by the NYSE FANG + TM Index, shariah-compliant equity measured by FTSE All-World Shariah Index, and gold spot prices using the VAR–GARCH BEKK representation proposed by Engle and Kroner (1995). More recently, several studies have utilized the Markov switching process to capture the volatility dynamics (Zheng and Zuo 2013; Balcilar et al. 2013) and to forecast volatility (D. Ardia et al. 2018); however, to examine the hedging and diversification opportunities, the Dynamic Conditional Correlation (DCC) framework proposed by Engle (2002) remains the standard methodology, which we utilize in this study. Our main findings indicate that the time-varying correlations are low compared to the static correlation; therefore, it is important to employ the DCC framework to calculate the time-varying correlations to avoid misleading conclusions. Moreover, we find that gold and shariah-compliant equity are both good candidates to hedge FAANG stocks. For example, a USD 1000 investment in FAANG stocks can be hedged with a short position in gold with USD 490 investment, whereas only USD 20 investment in shariah-compliant equity is necessary. The optimal weight for the FAANG/gold portfolio is 0.14, whereas the optimal weight for the FAANG/shariah-compliant portfolio is 0.23. Overall, these results imply that gold and shariah-compliant equity can provide portfolio diversification benefits. These findings are relevant for investors, hedgers, and portfolio managers.

We further contribute to the growing body of literature on the impact of COVID-19 on stock prices, specifically from the portfolio diversification viewpoint. As per the authors’ best knowledge, very few studies from the portfolio diversification viewpoint during the COVID-19 are available in the existing literature; the exceptions include, for example, Corbet et al. (2020). Our paper fills this gap by presenting new evidence on the optimal hedge and diversification opportunities for FAANG stocks investors with the well-known diversifiers, gold and shariah-compliant equity.

2. Data

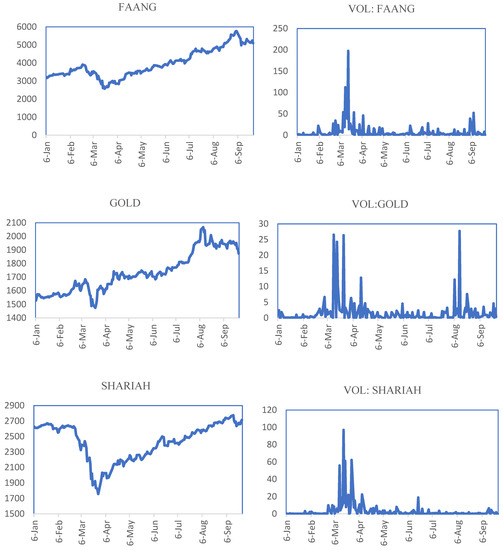

The data for this study were retrieved from the Thomson Reuters database, which comprises the daily closing prices of the NYSE FANG+TM Index (FAANG), the FTSE All-World Shariah Index (shariah-compliant equity) and gold spot prices (gold). The NYSE FANG+TM Index traces ten actively traded technology stocks. It is an equally weighted Index of Facebook, Amazon, Apple, Tesla, Netflix, NVidia, Twitter, Alibaba, Baidu, and Alphabet. The FTSE Sharia Global Equity index covers the stocks of all sharia-compliant companies in both developed and emerging markets. Our investigation period covered the ongoing COVID-19 pandemic, starting from 1 January 2020 and ending on 25 September 2020, comprising 186 daily observations. As a first step, we calculated the compounded daily returns , by using the closing prices (pt) of all assets under investigation. The descriptive statistics for the return series of FAANG, gold, and shariah-compliant equity are reported in Table 1. For each asset class, the mean and median values were positive. For each asset class, the standard deviation was larger than the mean value. For each asset class, Student’s t test showed that the mean was statistically insignificant from zero. Each asset class showed a small amount of negative skewness and a moderate amount of kurtosis, and the returns were not normally distributed. In addition, the summary statistics for unconditional correlations revealed that there was a moderate positive correlation between FAANG, gold, and shariah-compliant equity; however, it was less than 0.50, which provides a large amount of room for diversification. It is clearly evident from the time series graphs, Figure 1, of the squared daily returns of the FAANG stocks, gold, and shariah-compliant equity that the volatility has changed across time. All asset classes showed volatility clustering between March 2020 and April 2020. Moreover, the FAANG stocks exhibited some large jumps in volatility in March 2020. The information presented in Figure 1 shows volatility clustering and the development of the three asset classes under investigation.

Table 1.

Summary statistics for daily returns.

Figure 1.

Time-varying hedge ratios computed from the DCC model.

3. Empirical Framework

The Autogressive Conditional Heteroscedasticity (ARCH) process presented by Engle (1982) and the generalized ARCH (GARCH) process introduced by Bollerslev (1986) are considered the standard methods to model the volatility of stock returns in a univariate setting. However, to investigate the volatility spillovers among different classes of assets, a multivariate GARCH procedure is preferred. As a first attempt, Bollerslev et al. (1988), among others, proposed a diagonal VECH method to study the conditional covariances in the bond and stock market in the USA; however, the model failed to ensure the positive definiteness of the conditional variance matrix, which is one of the requirements to construct a multivariate model. Moreover, the diagonal VECH model was not able to capture the cross-equation effects. A substantial amount of literature has been published around multivariate GARCH models over the last couple of decades. Engle and Kroner (1995) proposed multivariate GARCH–BEKK (Baba, Engle, Kraft, and Kroner) parameterization, which overcame most of the problems inherited in the early models. However, the BEKK model only satisfied the hypothesis of constant correlation instead of the dynamic conditional correlations among different asset classes. Engle (2002) proposed a dynamic conditional correlation coefficient (DCC) model to overcome the BEKK limitations. In this study, we utilized both the GARCH–BEKK and GARCH–DCC model to investigate the volatility spillovers and conditional correlations among FAANG stocks, gold, and sharia-compliant equity.

3.1. VAR–GARCH–BEKK Model

To compute the return and volatility spillovers among FAANG stocks, gold, and shariah-compliant equity, we utilized a bivariate VAR–GARCH–BEKK model. The VAR model can accommodate each asset’s returns and one period lagged returns of the other assets. Equation (1) represents the model.

The above bivariate construction enables the measurement of the effects of the mean series returns of one asset on its own lagged returns and those of the lagged returns of other assets. Here, rt represents the daily returns at time t for each asset. μt represents the error term for each asset at time t, with its corresponding conditional variance–covariance matrix Ht. Ωt−1 represents the information set available at time t − 1. The parameter α represents the constant. The own mean spillovers and cross-mean spillovers are measured by the estimates of the matrix β elements, the parameters of the vector autoregressive term.

Further, by adopting a multivariate GARCH–BEKK specification and following Engle and Kroner (1995), the conditional covariance matrix can be stated as:

where the parameters for the variance equation are defined as and to capture the short-term volatility persistence and long-term volatility persistence, respectively, whereas the parameters and measure the cross-asset shock and volatility spillovers, respectively.

3.2. DCC–GARCH Model

To investigate the nature of the conditional correlations across the three series, we utilized a dynamic conditional correlation (DCC) model, proposed by Engle (2002) and Engle and Sheppard (2001). The DCC model may be expressed as follows:

where Ht represents the conditional covariance matrix representing the DCC specification with Dt as the conditional volatility of the returns on each asset under investigation, defined as , while Rt measures the conditional correlations among the three assets, defined as , where represents a symmetric positive definite matrix with , while, refers to the unconditional variance matrix of μt, and α and β are nonnegative scalar parameters satisfying . Finally, the conditional correlation coefficient ρij between two assets i and j can be expressed by the following equation:

As per Engle and Sheppard (2001) and Engle (2002), this model can be estimated with the quasi-maximum likelihood method (QMLE).

4. Empirical Results

4.1. Volatility Spillovers

Table 2 shows the volatility spillovers between the three assets, both in terms of short-term persistence (ARCH effect), represented by ɣii, and long-term persistence (GARCH effect), represented by δii. Consistent with a typical GARCH framework, the results showed that for each asset, the estimated ɣii values were smaller than their respective estimated δii values, which revealed that each asset was influenced by its own volatility in the long run rather than in the short run; however, only the estimated coefficients of the sharia-compliant equity, δ33, were statistically significant (p-value < 1%), indicating that the conditional volatility of sharia-compliant equity was predictable in the long run. Moreover, the findings from the BEKK model showed several cross-asset volatility spillover effects. For short-term volatility persistence, the findings indicated that a significant bidirectional relationship existed between FAANG and gold (ɣ12, ɣ21), as well as between FAANG and sharia-compliant equity (ɣ13, ɣ31). However, for long-term volatility persistence, we found no bidirectional relationship between FAANG and gold (δ12, δ21), as well as between FAANG and sharia-compliant equity (δ13, δ31). These results are important for portfolio managers and FAANG stocks investors to forecast the short-term volatility spillovers among FAANG stocks, gold, and sharia-compliant equity. Moreover, the findings of no long-term volatility persistence among FAANG stocks, gold, and sharia-compliant equity indicated the diversification opportunities. The diagnostic tests provided no evidence of serial correlation in both the standardized residuals and squared standardized residuals at the 1% significance level in the BEKK model.

Table 2.

GARCH–BEKK parameter estimates of volatility spillovers among FAANG stocks, gold, and sharia-compliant equity.

4.2. Dynamic Conditional Correlations

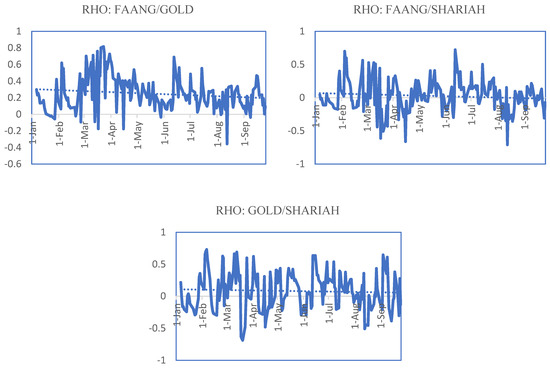

The DCC model was utilized to construct the portfolio weights, hedge ratios, and dynamic conditional correlations among the three assets. The findings from the application of the DCC model showed that the dynamic conditional correlations (ρ12 = 0.248, ρ13 = 0.026, and ρ23 = 0.082) were significantly lower than the constant conditional correlations (ρ12 = 0.37, ρ13 = 0.26, and ρ23 = 0.20) as outlined in Table 3 and Figure 2. These findings emphasized the need to estimate the dynamic correlations to generate deeper and higher quality inferences. Estimation of the dynamic correlations showed that after December 2019, when the news of the pandemic spread, there was an upward trend in the dynamic correlations between the FAANG stocks and gold, which peaked at 80% by the last week of March. This specifies that there was a very narrow opportunity for portfolio diversification among these two assets in the early stage of pandemic. However, the dynamic conditional correlation started to decline after March 2020 and saw some episodes of negative correlations until August 2020, indicating the protentional of diversification benefits between the two classes of assets.

Table 3.

Static and dynamic conditional correlations.

Figure 2.

Time-varying conditional correlations.

Similar trends were observed in the dynamic correlations between the FAANG stocks and sharia-compliant equity with a peak correlation happening in June 2020 at 72% followed by a significant negative correlation (−70%) in August 2020, indicating the strong protentional of diversification benefits between the two assets. Likewise, the time-varying conditional correlations between gold and shariah-compliant equity showed a similar pattern of negative correlation during the pandemic period. The time series plots generated by the dynamic conditional correlation model in Figure 2 gives further detailed information that supports the hypothesis that the overall correlations between the assets were lowest during the COVID-19 period, emphasizing, the superiority of the DCC model over a constant conditional correlation model.

The optimal portfolio weights, calculated by utilizing the DCC model, are presented in Table 4. As per our results, the optimal weight for the FAANG/gold portfolio was 0.14, signifying that in a USD 1 portfolio, comprised of FAANG stocks and gold, USD 0.86 should be invested in FAANG stocks and USD 0.14 in gold. Likewise, the optimal weight for the FAANG/shariah-compliant equity portfolio specified that USD 0.77 should be invested in FAANG and USD 0.23 in shariah-compliant equity. The optimal weight for the shariah-compliant equity/gold portfolio showed that USD 0.56 should be invested in shariah-compliant equity and USD 0.44 in gold to realize the diversification benefits.

Table 4.

Summary statistics of the hedge ratios (long/short) and portfolio weights.

4.3. Hedge Ratios

Theoretically, taking a long position in one asset (say FAANG stocks) can be hedged by talking a short position in a second asset (say gold). Following Kroner and Sultan (1993) and utilizing the conditional variances retrieved from the DCC procedure, we constructed the hedge ratios as follows:

The mean values of the hedge ratio between the three assets are reported in Table 4. The mean value of the hedge ratio among FAANG and gold was 0.49 whereas the mean value of the hedge ratio amongst FAANG and shariah-compliant equity was 0.02, while the mean value of the hedge ratio between shariah-compliant equity and gold is 0.12. The implications of these results are vital to construct an optimal portfolio from a risk management perspective. For instance, as per our results, a USD 1 long position in FAANG can be hedged for USD 0.49, with a short position in the gold market, whereas a USD 1 long position in FAANG can be hedged for just USD 0.02, with a short position in the shariah-compliant equity; in contrast, a USD 1 long position in shariah-compliant equity can be hedged for USD 0.12 with a short position in gold. The most expensive hedge is long FAANG and short gold, while the least expensive hedge is long FAANG and short shariah-compliant equity.

5. Summary and Conclusions

The purpose of this paper was to investigate the volatility spillovers and conditional correlations among the daily returns of FAANG company stocks, gold, and shariah-compliant equities. We also constructed the optimal portfolio weights and hedge ratios during the COVID-19 pandemic period. We used the VAR–GARCH framework to estimate the volatility spillovers. The DCC framework was adopted to analyze the time-varying correlations among the three asset classes, which was instrumental in finding the optimal portfolios and hedge ratios among the three indices. The findings indicated the significance of the DCC model while estimating the time-varying correlations as opposed to using static correlations. Using the findings from the DCC model, it emerged that FAANG stocks, gold, and sharia-compliant equities exhibited lower correlations during times of market volatility brought about by recession fears. Therefore, the findings suggest that gold and sharia-compliant stocks can hedge stocks during periods of market downturn. These findings are highly relevant for international investors, asset managers, hedgers, and portfolio managers. The scope of the current study was limited to only three classes of assets; however, the study can be further extended by adding more classes of assets, and instead of a global investor prospect, a future study may explore regional diversification opportunities.

Author Contributions

Conceptualization, K.S.; Methodology, K S. and O.F.; Formal analysis, K.S. and H.K.; Data curation, O.A.; Writing—original draft, K.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abbes, Mouna Boujelbène, and Yousra Trichilli. 2015. Islamic stock markets and potential diversification benefits. Borsa İstanbul Review 15: 93–105. [Google Scholar] [CrossRef]

- Ahmed, Neveen, and Omar Farooq. 2018. Does the Degree of Shari’ah Compliance Affect the Volatility? Evidence from the MENA Region. Research in International Business and Finance 45: 150–57. [Google Scholar] [CrossRef]

- Al-Awadhi, Abdullah M., Khaled Alsaifi, Ahmad Al-Awadhi, and Salah Alhammadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef] [PubMed]

- AlKhazalia, Osamah M., Hooi Hooi Lean, Ali Mirzaei, and Taisier Zoubi. 2021. A comparison of the gold-oil portfolio and oil portfolio: A stochastic dominance approach. Finance Research Letters 40: 101670. [Google Scholar] [CrossRef]

- Al-Zoubi, Haitham, and Aktham Issa Maghyereh. 2007. The relative risk performance of Islamic finance: A new guide to less risky investments. International Journal of Theoretical Applied Finance 10: 235–49. [Google Scholar] [CrossRef]

- Ardia, David, Keven Bluteau, Kris Boudt, and Leopoldo Catania. 2018. Forecasting risk with Markov-switching GARCH models:A large-scale performance study. International Journal of Forecasting 34: 733–47. [Google Scholar] [CrossRef]

- Arif, Muhammad, Muhammad Abubakr Naeem, Mudassar Hasan, Suha M. Alawi, and Farhad Taghizadeh-Hesary. 2021. Pandemic crisis versus global financial crisis: Are Islamic stocks a safe-haven for G7 markets? Economic Research-Ekonomska Istraživanja 35: 1–21. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2020. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance 54: 101249. [Google Scholar] [CrossRef]

- Ashraf, Dawood, Muhammad Suhail Rizwan, and Ghufran Ahmad. 2022. Islamic equity investments and the COVID-19 pandemic. Pacific-Basin Finance Journal 73: 101765. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Reaction to COVID-19: Covid Economics. The Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rıza Demirer, and Shawkat Hammoudeh. 2013. Investor herds and regime-switching: Evidence from Gulf Arab stock markets. Journal of International Financial Markets, Institutions and Money 23: 295–321. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. The Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas K.J. McDermott. 2016. Why is gold a safe-haven? Journal of Behavioral and Experimental Finance 10: 63–71. [Google Scholar] [CrossRef]

- Beckmann, Joscha, Theo Berger, and Rober Czudaj. 2015. Does gold act as a hedge or a safe-haven for stocks? A smooth transition approach. Economic Modelling 48: 16–24. [Google Scholar] [CrossRef]

- Bekiros, Stelios, Sabri Boubaker, Duc KhuongNguyen, and Gazi SalahUddin. 2017. Black swan events and safe havens: The role of gold in globally integrated. Journal of International Money and Finance Emerging Market 73: 317–34. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Robert F. Engle, and Jeffrey M. Wooldridge. 1988. A capital asset pricing model with time-varying covariances. Journal of Political Economy 96: 116–31. [Google Scholar] [CrossRef]

- Bossman, Ahmed, Peterson Owusu Junior, and Aviral Kumar Tiwari. 2022. Dynamic connectedness and spillovers between Islamic and conventional stock markets: Time- and frequency-domain approach in COVID-19 era. Heliyon 8: e09215. [Google Scholar] [CrossRef]

- Ciner, Cetin, Constantin Gurdgıev, and Brian M. Lucey. 2013. Hedges and Safe Havens: An Examination of Stocks, Bonds, Gold, Oil and Exchange Rates. International Review of Financial Analysis 29: 202–11. [Google Scholar] [CrossRef]

- Corbet, Shaen, Charles Larkin, and Brian Lucey. 2020. The contagion effects of the Covid-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters 35: 101554. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business and Economic Statistics 20: 339–50. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kevin Sheppard. 2001. Theoretical and Empirical Properties of Dynamic Conditional Correlation Multivariate GARCH. Working Paper. San Diego: UCSD. [Google Scholar]

- Farooq, Omar, and Allaa AbdelBari. 2015. Earnings Management Behaviour of Shariah-compliant Firms and Non-shariah-compliant Firms: Evidence from the MENA Region. Journal of Islamic Accounting and Business Research 6: 173–88. [Google Scholar] [CrossRef]

- Farooq, Omar, and Neveen Ahmed. 2022. Shariah Compliance and Stock Price Synchronicity: Evidence from India. 2022. International Journal of Emerging Markets. [Google Scholar] [CrossRef]

- Gürgün, Gözde, and İbrahim Ünalmış. 2014. Is gold a safe haven against equity market investment in emerging and developing countries? Finance Research Letters 11: 341–48. [Google Scholar] [CrossRef]

- Haseeb, Muhammad, Nurul Shahnaz Mahdzan, and Wan Marhaini Wan Ahmad. 2022. Are Shariah-compliant firms less prone to stock price crash risk? Evidence from Malaysia. International Journal of Islamic and Middle Eastern Finance and Management. [Google Scholar] [CrossRef]

- Jaffe, Jeffrey F. 1989. Gold and gold stocks as investments for institutional portfolios. Financial Analysts Journal 45: 53–59. [Google Scholar] [CrossRef]

- Kroner, Kenneth F., and Jahangir Sultan. 1993. Time-varying distributions and dynamic hedging with foreign currency futures. Journal of Financial and Quantitative Analysis 28: 535–51. [Google Scholar] [CrossRef]

- Milly, Maher, and Jahangir Sultan. 2012. Portfolio diversification during financial crisis: Analysis of faith-based investment strategies. In Building Bridges across the Financial Communities: The Global Financial Crisis, Social Responsibility, and Faith-based Finance. Edited by S. Nazim Ali. Cambridge: Harvard Law School, Islamic Finance Project, pp. 334–52. [Google Scholar]

- Mirza, Nawazish, Syed Kumail Abbas Rizvi, Irum Saba, Bushra Naqvi, and Larisa Yarovaya. 2022. The resilience of Islamic equity funds during COVID-19: Evidence from risk adjusted performance, investment styles and volatility timing. International Review of Economics & Finance 77: 276–95. [Google Scholar]

- Ramelli, Stefano, and Alexander F. Wagner. 2020. Feverish stock price reactions to COVID-19. The Review of Corporate Finance Studies 9: 622–55. [Google Scholar] [CrossRef]

- Rizvi, Syed Aun R., Shaista Arshad, and Nafis Alam. 2015. Crises and contagion in Asia pacific—Islamic v/s conventional markets. Pacific-Basin Finance Journal 34: 315–26. [Google Scholar] [CrossRef]

- Saiti, Buerhan, Obiyathulla I. Bacha, and Mansur Masih. 2014. The diversification benefits from Islamic investment during the financial turmoil: The case for the US-based equity investors. Borsa İstanbul Review 14: 196–211. [Google Scholar] [CrossRef]

- Shen, Huayu, Mengyao Fu, Hongyu Pan, Zhongfu Yu, and Yongquan Chen. 2020. The Impact of the COVID-19 Pandemic on Firm Performance. Emerging Markets Finance and Trade 56: 2213–30. [Google Scholar] [CrossRef]

- Sherman, E. J. 1982. Gold: A conservative, prudent diversifier. Journal of Portfolio Management 8: 21–27. [Google Scholar] [CrossRef]

- Yan, Lei, and Philip Garcia. 2017. Portfolio investment: Are commodities useful? Journal of Commodity Markets 8: 43–55. [Google Scholar] [CrossRef]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial market under the global pandemic of COVID-19. Finance Research Letter 36: 101528. [Google Scholar] [CrossRef]

- Zheng, Tingguo, and Haomiao Zuo. 2013. Reexamining the time-varying volatility spillover effects: A Markov switching causality approach. The North American Journal of Economics and Finance 26: 643–62. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).