A Systematic Literature Review of Volatility and Risk Management on Cryptocurrency Investment: A Methodological Point of View

Abstract

:1. Introduction

2. Methodology

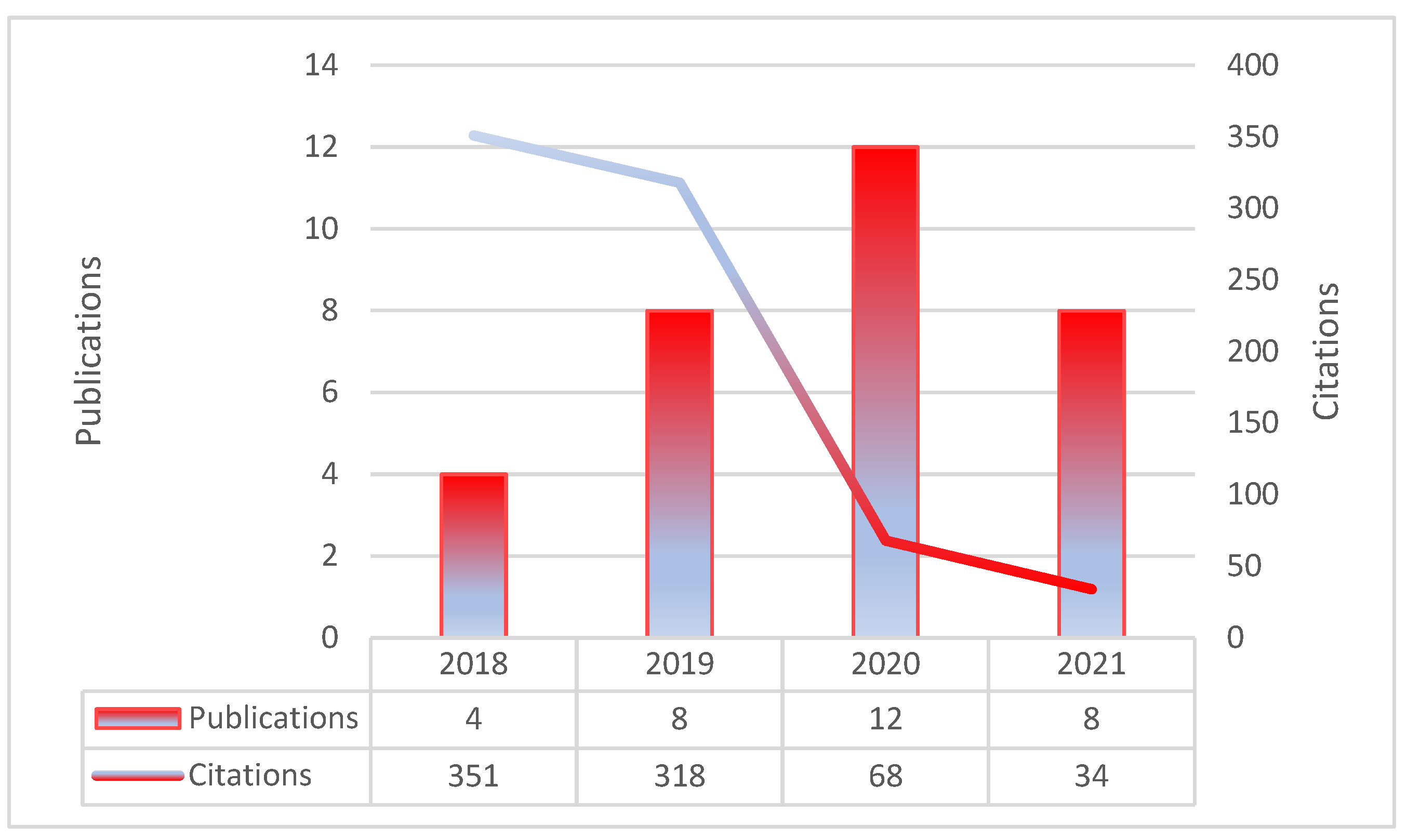

3. Bibliometric Analysis

3.1. Top Articles

3.2. Countries

3.3. Journals

3.4. Authors

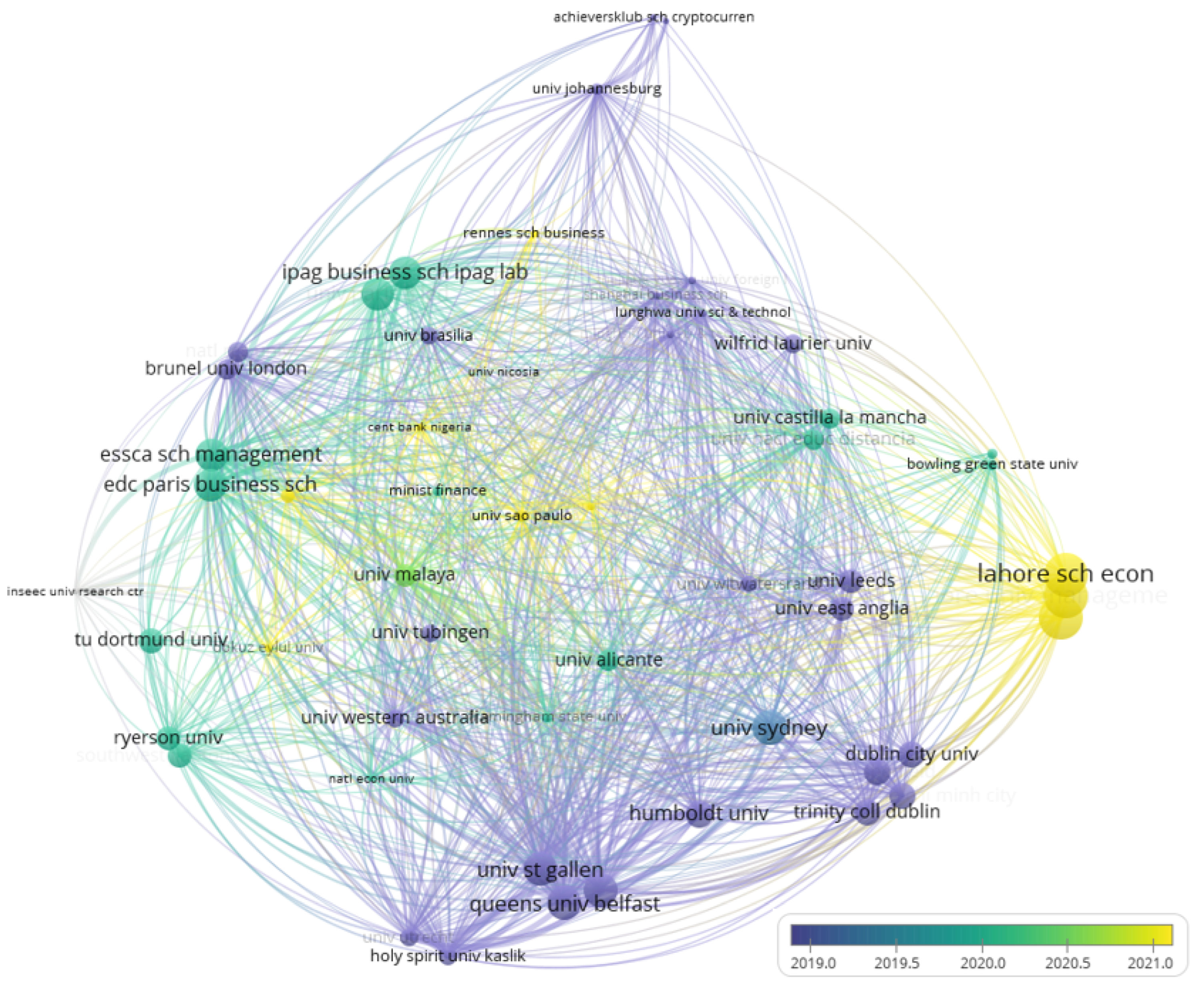

3.5. Institutions

4. Literature Analysis

4.1. Methodological Findings

4.2. Discussion of Main Findings

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Acereda, Beatriz, Angel Leon, and Juan Mora. 2020. Estimating the expected shortfall of cryptocurrencies: An evaluation based on backtesting. Finance Research Letters 33: 101181. [Google Scholar] [CrossRef]

- Angerer, Martin, Christian Hugo Hoffmann, Florian Neitzert, and Sascha Kraus. 2020. Objective and subjective risks of investing into cryptocurrencies. Finance Research Letters 40: 101737. [Google Scholar] [CrossRef]

- Aras, Serkan. 2021. Stacking hybrid GARCH models for forecasting Bitcoin volatility. Expert Systems with Applications 174: 114747. [Google Scholar] [CrossRef]

- Aysan, Ahmet Faruk, Hüseyin Bedir Demirtaş, and Mustafa Saraç. 2021. The Ascent of Bitcoin: Bibliometric Analysis of Bitcoin Research. Journal of Risk and Financial Management 14: 427. [Google Scholar] [CrossRef]

- Bariviera, Aurelio F., and Ignasi Merediz-Solà. 2021. Where Do We Stand in Cryptocurrencies Economic Research? A Survey Based on Hybrid Analysis. Journal of Economic Surveys 35: 377–407. [Google Scholar] [CrossRef]

- Bartolacci, Francesca, Andrea Caputo, and Michela Soverchia. 2020. Sustainability and financial performance of small and medium sized enterprises: A bibliometric and systematic literature review. Business Strategy and the Environment 29: 1297–309. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas Dimpfl. 2018. Asymmetric volatility in cryptocurrencies. Economics Letters 173: 148–51. [Google Scholar] [CrossRef]

- Baur, Dirk G., Thomas Dimpfl, and Konstantin Kuck. 2018. Bitcoin, gold and the US dollar—A replication and extension. Finance Research Letters 25: 103–10. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, and Timur Zekokh. 2019. Modelling volatility of cryptocurrencies using Markov-Switching GARCH models. Research in International Business and Finance 48: 143–55. [Google Scholar] [CrossRef]

- Caputo, Andrea, Giacomo Marzi, Jane Maley, and Mario Silic. 2019. Ten years of conflict management research 2007–17: An update on themes, concepts and relationships. International Journal of Conflict Management 30: 87–110. [Google Scholar] [CrossRef]

- Chan, Wing Hong, Minh Le, and Yan Wendy Wu. 2019. Holding Bitcoin longer: The dynamic hedging abilities of Bitcoin. Quarterly Review of Economics and Finance 71: 107–13. [Google Scholar] [CrossRef]

- Cheikh, Nidhaleddine Ben, Younes Ben Zaied, and Julien Chevallier. 2020. Asymmetric volatility in cryptocurrency markets: New evidence from smooth transition GARCH models. Finance Research Letters 35: 101293. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and d’Artis Kancs. 2017. Virtual relationships: Short- and long-run evidence from BitCoin and altcoin markets. Journal of International Financial Markets, Institutions and Money 52: 173–95. [Google Scholar] [CrossRef]

- Corbet, Shaen, Brian Lucey, Andrew Urquhart, and Larisa Yarovaya. 2019. Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis 62: 182–99. [Google Scholar] [CrossRef] [Green Version]

- Ding, Ying, Ronald Rousseau, and Dietmar Wolfram. 2014. Measuring Scholarly Impact. Cham: Springer. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef] [Green Version]

- Fang, Fan, Waichung Chung, Carmine Ventre, Michail Basios, Leslie Kanthan, Lingbo Li, and Fan Wu. 2021. Ascertaining price formation in cryptocurrency markets with machine learning. European Journal of Finance, 1–23. [Google Scholar] [CrossRef]

- Flori, Andrea. 2019. Cryptocurrencies in finance: Review and applications. International Journal of Theoretical and Applied Finance 22: 1950020. [Google Scholar] [CrossRef]

- Ftiti, Zied, Wael Louhichi, and Hachmi Ben Ameur. 2021. Cryptocurrency volatility forecasting: What can we learn from the first wave of the COVID-19 outbreak? Annals of Operations Research, 0123456789. [Google Scholar] [CrossRef]

- Galvao, Anderson, Carla Mascarenhas, Carla Marques, João Ferreira, and Vanessa Ratten. 2019. Triple helix and its evolution: A systematic literature review. Journal of Science and Technology Policy Management 10: 812–33. [Google Scholar] [CrossRef]

- García-Corral, Francisco Javier, José Antonio Cordero-Garcí, Jaime de Pablo-Valenciano, and Juan Uribe-Toril. 2022. A bibliometric review of cryptocurrencies: How have they grown? Financial Innovation 8: 1–31. [Google Scholar] [CrossRef]

- Garcia-Jorcano, Laura, and Sonia Benito. 2020. Studying the properties of the Bitcoin as a diversifying and hedging asset through a copula analysis: Constant and time-varying. Research in International Business and Finance 54: 101300. [Google Scholar] [CrossRef] [PubMed]

- Gil-Alana, Luis Alberiko, Emmanuel Joel Aikins Abakah, and María Fátima Romero Rojo. 2020. Cryptocurrencies and stock market indices. Are they related? Research in International Business and Finance 51: 101063. [Google Scholar] [CrossRef]

- Haq, Inzamam Ul, Apichit Maneengam, Supat Chupradit, Wanich Suksatan, and Chunhui Huo. 2021. Economic policy uncertainty and cryptocurrency market as a risk management avenue: A systematic review. Risks 9: 163. [Google Scholar] [CrossRef]

- Hattori, Takahiro. 2020. A forecast comparison of volatility models using realized volatility: Evidence from the Bitcoin market. Applied Economics Letters 27: 591–95. [Google Scholar] [CrossRef]

- Hoang, Lai T., and Dirk G. Baur. 2020. Forecasting bitcoin volatility: Evidence from the options market. Journal of Futures Markets 40: 1584–602. [Google Scholar] [CrossRef]

- Jalal, Raja Nabeel-Ud-Din, Ilan Alon, and Andrea Paltrinieri. 2021. A bibliometric review of cryptocurrencies as a financial asset. Technology Analysis and Strategic Management, 1–16. [Google Scholar] [CrossRef]

- Jalan, Akanksha, Roman Matkovskyy, and Saqib Aziz. 2021. The Bitcoin options market: A first look at pricing and risk. Applied Economics 53: 2026–41. [Google Scholar] [CrossRef]

- Jiang, Shangrong, Xuerong Li, and Shouyang Wang. 2021. Exploring evolution trends in cryptocurrency study: From underlying technology to economic applications. Finance Research Letters 38: 101532. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019. Volatility spillover effects in leading cryptocurrencies: A BEKK-MGARCH analysis. Finance Research Letters 29: 68–74. [Google Scholar] [CrossRef] [Green Version]

- Klein, Tony, Hien Pham Thu, and Thomas Walther. 2018. Bitcoin is not the New Gold—A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis 59: 105–16. [Google Scholar] [CrossRef]

- Köchling, Gerrit, Philipp Schmidtke, and Peter N. Posch. 2020. Volatility forecasting accuracy for Bitcoin. Economics Letters 191: 108836. [Google Scholar] [CrossRef]

- Kyriazis, Nikolaos, Stephanos Papadamou, and Shaen Corbet. 2020. A systematic review of the bubble dynamics of cryptocurrency prices. Research in International Business and Finance 54: 101254. [Google Scholar] [CrossRef]

- Lansky, Jan. 2018. Possible State Approaches to Cryptocurrencies. Journal of Systems Integration 9: 19–31. [Google Scholar] [CrossRef]

- Li, Rong, Sufang Li, Di Yuan, and Huiming Zhu. 2021. Investor attention and cryptocurrency: Evidence from wavelet-based quantile Granger causality analysis. Research in International Business and Finance 56: 101389. [Google Scholar] [CrossRef]

- Liang, Xiaobei, Yibo Yang, and Jiani Wang. 2016. Internet finance: A systematic literature review and bibliometric analysis. Paper presented at the International Conference on Electronic Business (ICEB), Xiamen, China, December 4–8; pp. 386–98. [Google Scholar]

- Linnenluecke, Martina K., Mauricio Marrone, and Abhay K. Singh. 2020. Conducting systematic literature reviews and bibliometric analyses. Australian Journal of Management 45: 175–94. [Google Scholar] [CrossRef]

- Ma, Feng, Chao Liang, Yuanhui Ma, and Mohamed Ismail Mohamed Wahab. 2020. Cryptocurrency volatility forecasting: A Markov regime-switching MIDAS approach. Journal of Forecasting 39: 1277–90. [Google Scholar] [CrossRef]

- Maciel, Leandro. 2021. Cryptocurrencies value-at-risk and expected shortfall: Do regime-switching volatility models improve forecasting? International Journal of Finance and Economics 26: 4840–55. [Google Scholar] [CrossRef]

- Mba, Jules Clement, and Sutene Mwambi. 2020. A Markov-switching COGARCH approach to cryptocurrency portfolio selection and optimization. Financial Markets and Portfolio Management 34: 199–214. [Google Scholar] [CrossRef]

- Mba, Jules Clement, Edson Pindza, and Ur Koumba. 2018. A differential evolution copula-based approach for a multi-period cryptocurrency portfolio optimization. Financial Markets and Portfolio Management 32: 399–418. [Google Scholar] [CrossRef]

- Miglietti, Cynthia, Zdenka Kubosova, and Nicole Skulanova. 2020. Bitcoin, Litecoin, and the Euro: An annualized volatility analysis. Studies in Economics and Finance 37: 229–42. [Google Scholar] [CrossRef]

- Omane-Adjepong, Maurice, and Imhotep Paul Alagidede. 2019. Multiresolution analysis and spillovers of major cryptocurrency markets. Research in International Business and Finance 49: 191–206. [Google Scholar] [CrossRef]

- Peng, Yaohao, Pedro Henrique Melo Albuquerque, Jader Martins Camboim de Sá, Ana Julia Akaishi Padula, and Mariana Rosa Montenegro. 2018. The best of two worlds: Forecasting high frequency volatility for cryptocurrencies and traditional currencies with Support Vector Regression. Expert Systems with Applications 97: 177–92. [Google Scholar] [CrossRef]

- Phillip, Andrew, Jennifer Chan, and Shelton Peiris. 2019. On long memory effects in the volatility measure of Cryptocurrencies. Finance Research Letters 28: 95–100. [Google Scholar] [CrossRef]

- Rialti, Riccardo, Giacomo Marzi, Cristiano Ciappei, and Donatella Busso. 2019. Big data and dynamic capabilities: A bibliometric analysis and systematic literature review. Management Decision 57: 2052–68. [Google Scholar] [CrossRef]

- Sabah, Nasim. 2020. Cryptocurrency accepting venues, investor attention, and volatility. Finance Research Letters 36: 101339. [Google Scholar] [CrossRef]

- Sadeghi Moghadam, Mohammad Reza, Hossein Safari, and Narjes Yousefi. 2021. Clustering quality management models and methods: Systematic literature review and text-mining analysis approach. Total Quality Management and Business Excellence 32: 241–64. [Google Scholar] [CrossRef]

- Sapuric, Svetlana, Angelika Kokkinaki, and Ifigenia Georgiou. 2020. The relationship between Bitcoin returns, volatility and volume: Asymmetric GARCH modeling. Journal of Enterprise Information Management. [Google Scholar] [CrossRef]

- Siu, Tak Kuen. 2021. The risks of cryptocurrencies with long memory in volatility, non-normality and behavioural insights. Applied Economics 53: 1991–2014. [Google Scholar] [CrossRef]

- Symitsi, Efthymia, and Konstantinos J. Chalvatzis. 2019. The economic value of Bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance 48: 97–110. [Google Scholar] [CrossRef] [Green Version]

- Tan, Chia-Yen Tan, You-Beng Koh, Kok-Haur Ng, and Kooi-Huat Ng. 2021. Dynamic volatility modelling of Bitcoin using time-varying transition probability Markov-switching GARCH model. North American Journal of Economics and Finance 56: 101377. [Google Scholar] [CrossRef]

- Tan, Shay-Kee, Jennifer So-Kuen Chan, and Kok-Haur Ng. 2020. On the speculative nature of cryptocurrencies: A study on Garman and Klass volatility measure. Finance Research Letters 32: 101075. [Google Scholar] [CrossRef]

- Umar, Muhammad, Syed Kumail Abbas Rizvi, and Bushra Naqvi. 2021. Dance with the devil? The nexus of fourth industrial revolution, technological financial products and volatility spillovers in global financial system. Technological Forecasting and Social Change 163: 120450. [Google Scholar] [CrossRef]

- Uzonwanne, Godfrey. 2021. Volatility and return spillovers between stock markets and cryptocurrencies. Quarterly Review of Economics and Finance 82: 30–36. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2017. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 111: 1053–70. [Google Scholar] [CrossRef] [Green Version]

- Vidal-Tomás, David, and Ana Ibañez Ibañez. 2018. Semi-strong efficiency of Bitcoin. Finance Research Letters 27: 259–65. [Google Scholar] [CrossRef]

- Walther, Thomas, Tony Klein, and Elie Bouri Bouri. 2019. Exogenous drivers of Bitcoin and Cryptocurrency volatility—A mixed data sampling approach to forecasting. Journal of International Financial Markets, Institutions and Money 63: 101133. [Google Scholar] [CrossRef]

- Wang, Jying-Nan, Hung-Chun Liu, Shu-Mei Chiang, and Yuan-Teng Hsu. 2019. On the predictive power of ARJI volatility forecasts for Bitcoin. Applied Economics 51: 4849–55. [Google Scholar] [CrossRef]

- Wang, Junpeng, Yubo Xue, and Minghao Liu. 2016. An Analysis of Bitcoin Price Based on VEC Model. In International Conference on Economics and Management Innovations (ICEMI 2016). Beijing: Atlantis Press, pp. 146–52. [Google Scholar] [CrossRef] [Green Version]

- Yue, Yao, Xuerong Li, Dingxuan Zhang, and Shouyang Wang. 2021. How cryptocurrency affects economy? A network analysis using bibliometric methods. International Review of Financial Analysis 77: 101869. [Google Scholar] [CrossRef]

| Rank | Article | Citations |

|---|---|---|

| 1 | Klein et al. (2018) | 192 |

| 2 | Baur and Dimpfl (2018) | 81 |

| 3 | Peng et al. (2018) | 75 |

| 4 | Katsiampa et al. (2019) | 74 |

| 5 | Symitsi and Chalvatzis (2019) | 61 |

| 6 | Caporale and Zekokh (2019) | 46 |

| 7 | Chan et al. (2019) | 36 |

| 8 | Walther et al. (2019) | 34 |

| 9 | Omane-Adjepong and Alagidede (2019) | 31 |

| 10 | Phillip et al. (2019) | 29 |

| Rank | Country | Publications | Citations | Citations per Publications |

|---|---|---|---|---|

| 1 | Germany | 4 | 318 | 79.5 |

| 2 | North Ireland | 2 | 226 | 113 |

| 3 | Switzerland | 2 | 226 | 113 |

| 4 | Australia | 6 | 190 | 31.67 |

| 5 | England | 3 | 181 | 60.33 |

| 6 | Brazil | 2 | 77 | 38.5 |

| 7 | Ireland | 1 | 74 | 74 |

| 8 | Vietnam | 2 | 74 | 37 |

| 9 | Canada | 2 | 46 | 23 |

| 10 | Russia | 1 | 46 | 46 |

| Rank | Journal | Publications | Citations | Citations per Publications |

|---|---|---|---|---|

| 1 | International review of financial analysis | 1 | 192 | 192 |

| 2 | Research in international business and finance | 4 | 145 | 36.25 |

| 3 | Finance research letters | 6 | 135 | 22.5 |

| 4 | Economics letters | 2 | 92 | 46 |

| 5 | Expert systems with applications | 2 | 76 | 38 |

| 6 | Quarterly review of economics and finance | 2 | 36 | 18 |

| 7 | Journal of international financial markets institutions and money | 1 | 34 | 34 |

| 8 | Technological forecasting and social change | 1 | 26 | 26 |

| 9 | Journal of forecasting | 1 | 10 | 10 |

| 10 | Applied economics | 3 | 9 | 3 |

| Rank | Author | Publications | Citations | Citations per Publications |

|---|---|---|---|---|

| 1 | Klein, Tony | 2 | 226 | 113 |

| 2 | Walther, Thomas | 2 | 226 | 113 |

| 3 | Hien Pham Thu | 1 | 192 | 192 |

| 4 | Baur, Dirk G. | 2 | 81 | 40.5 |

| 5 | Dimpfl, Thomas | 1 | 81 | 81 |

| 6 | Akaishi Padula, Ana Julia | 1 | 75 | 75 |

| 7 | Camboim De Sa, Jader Martins | 1 | 75 | 75 |

| 8 | Melo Albuquerque, Pedro Henrique | 1 | 75 | 75 |

| 9 | Montenegro, Mariana Rosa | 1 | 75 | 75 |

| 10 | Peng, Yaohao | 1 | 75 | 75 |

| Rank | Institution | Publications | Citations | Citations per Publications |

|---|---|---|---|---|

| 1 | Queens University Belfast | 2 | 226 | 113 |

| 2 | Technical University of Dresden | 2 | 226 | 113 |

| 3 | University of St Gallen | 2 | 226 | 113 |

| 4 | Humboldt University | 1 | 192 | 192 |

| 5 | Sydney University | 3 | 108 | 36 |

| 6 | Tubingen University | 1 | 81 | 81 |

| 7 | University of Western Australia | 2 | 81 | 40.5 |

| 8 | University Brasilia | 1 | 75 | 75 |

| 9 | Dublin City University | 1 | 74 | 74 |

| 10 | Trinity College Dublin | 1 | 74 | 74 |

| Paper | Time Horizon | Models Used | Best Model |

|---|---|---|---|

| Acereda et al. (2020) | 2010–2018 | GARCH/ NGARCH/CGARCH/TGARCH | NGARCH/CGARCH |

| Aras (2021) | 2013–2020 | ANN/SVM/KNN/GARCH (2,2)/LASSO | SVM/LASSO |

| Baur and Dimpfl (2018) | 2013–2018 | T-GARCH | |

| Caporale and Zekokh (2019) | 2010–2018 | MS-GRACH/SGARCH/EGARCH/GJR-GARCH/TGARCH | MS-GRACH |

| Chan et al. (2019) | 2010–2017 | GARCH/CCC/Frequency dependence model | GARCH/CCC/Frequency dependence model |

| Cheikh et al. (2020) | 2013–2018 | ST-GARCH/GARCH/EGARCH/GJR-GARCH/ZARCH | ST-GARCH |

| Ftiti et al. (2021) | 2018–2020 | HAR-RV/HAR-CV-J/HAR-SRV/HAR-RV-ΔJ2 /HAR-RV- ΔJ2+-ΔJ2- | HAR-SRV |

| Garcia-Jorcano and Benito (2020) | 2011–2019 | Copula models such as Gaussian, Student-t, Clayton, Gumbel, and Frank. | Copula Student-t |

| Hattori (2020) | 2016–2018 | GARCH/GJR-GARCH/EGARCH/APARCH/IGARCH | EGARCH/APARCH |

| Hoang and Baur (2020) | 2015–2020 | Black–Scholes–IV/GARCH/TGARCH/HARQ-F-J/ARMA/AFIRMA | Black–Scholes–IV/ARMA/GARCH |

| Jalan et al. (2021) | 2018–2020 | Black–Scholes–Merton/two-regime Heston–Nandi GARCH | Heston–Nandi model |

| Katsiampa et al. (2019) | 2015–2018 | Unrestricted BEKK-MGRACH | |

| Klein et al. (2018) | 2011–2017 | APARCH/FIAPARCH/BEKK-GARCH | FIAPARCH |

| Köchling et al. (2020) | 2015–2018 | ARCH/IGARCH(1,2) | ARCH |

| Ma et al. (2020) | 2013–2018 | MIDAS-RV/MIDAS-CJ MRS-MIDAS/MIDAS-CJL/HAR-CJ/FTP-MRS-MIDAS-RV/FTP-MRS-MIDAS-CJL/TVTP-MRS-MIDAS-CJL | FTP-MRS-MIDAS-CJL/TVTP-MRS-MIDAS-CJL |

| Maciel (2021) | 2013–2018 | MS-GARCH/GARCH/EGARCH/TGARCH | MS-GARCH |

| Mba and Mwambi (2020) | 2017–2019 | MS-COGARCH/COGARCH | MS-COGARCH |

| Mba et al. (2018) | 2014–2018 | GARCH-DE/DE/GARCH-DE-t-copula | GARCH-DE-t-copula |

| Miglietti et al. (2020) | 2014–2017 | GARCH/ARCH | |

| Omane-Adjepong and Alagidede (2019) | 2014–2018 | WMCC/VAR/GJR-GARCH/GARCH | GJR-GARCH/GARCH |

| Peng et al. (2018) | 2016–2017 | GARCH/EGARCH/GJR-GARCH/SVR-GARCH | SVR-GARCH |

| Phillip et al. (2019) | Varry-2017 | JBAR-SV-GLR | |

| Sabah (2020) | 2013–2018 | VAR | |

| Sapuric et al. (2020) | 2010–2017 | EGARCH | |

| Siu (2021) | 2013–2019 | GRACH/FIGARCH/AR-GARCH/AR-FIGARCH/MS-GRACH/EVT | EVT/MS-GRACH |

| Symitsi and Chalvatzis (2019) | 2011–2017 | EW/GMV/CGMV/CGMV-DDC | EW/GMV |

| Tan et al. (2021) | 2010–2018 | GARCH/GJR-GARCH/TGARCH/MS-GARCH/TV-MS-GARCH | TV-MS-GARCH |

| Tan et al. (2020) | 2013–2018 | ABL-CARR | |

| Umar et al. (2021) | 2018–2020 | VAR/BEKK-GARCH | |

| Uzonwanne (2021) | 2013–2018 | VARMA-AGARCH | |

| Walther et al. (2019) | Varry-2019 | GARCH/GARCH-MIDAS | GARCH-MIDAS |

| Wang et al. (2019) | 2013–2018 | ARJI/GARCH/EGARCH/CGARCH | ARJI |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almeida, J.; Gonçalves, T.C. A Systematic Literature Review of Volatility and Risk Management on Cryptocurrency Investment: A Methodological Point of View. Risks 2022, 10, 107. https://doi.org/10.3390/risks10050107

Almeida J, Gonçalves TC. A Systematic Literature Review of Volatility and Risk Management on Cryptocurrency Investment: A Methodological Point of View. Risks. 2022; 10(5):107. https://doi.org/10.3390/risks10050107

Chicago/Turabian StyleAlmeida, José, and Tiago Cruz Gonçalves. 2022. "A Systematic Literature Review of Volatility and Risk Management on Cryptocurrency Investment: A Methodological Point of View" Risks 10, no. 5: 107. https://doi.org/10.3390/risks10050107

APA StyleAlmeida, J., & Gonçalves, T. C. (2022). A Systematic Literature Review of Volatility and Risk Management on Cryptocurrency Investment: A Methodological Point of View. Risks, 10(5), 107. https://doi.org/10.3390/risks10050107