Financial Planning for Retirement: The Mediating Role of Culture

Abstract

:1. Introduction

2. The CWO Model

3. Theoretical Background and Hypotheses Development

3.1. Intentional Change Theory (ICT)

3.2. Financial Literacy (FL)

3.3. Financial Risk Tolerance (FRT)

3.4. Mediating Role of Culture

4. Methodology

4.1. Research and Sampling Design

4.2. Instruments

4.3. Participants

4.4. Procedure

5. Results and Findings

5.1. Preliminary Data Analysis

5.2. Descriptive Statistic Result

5.3. Confirmatory Tetrad Analysis (CTA)

5.4. Assessing Formative Measurement Model

5.5. Assessment of Structural Model

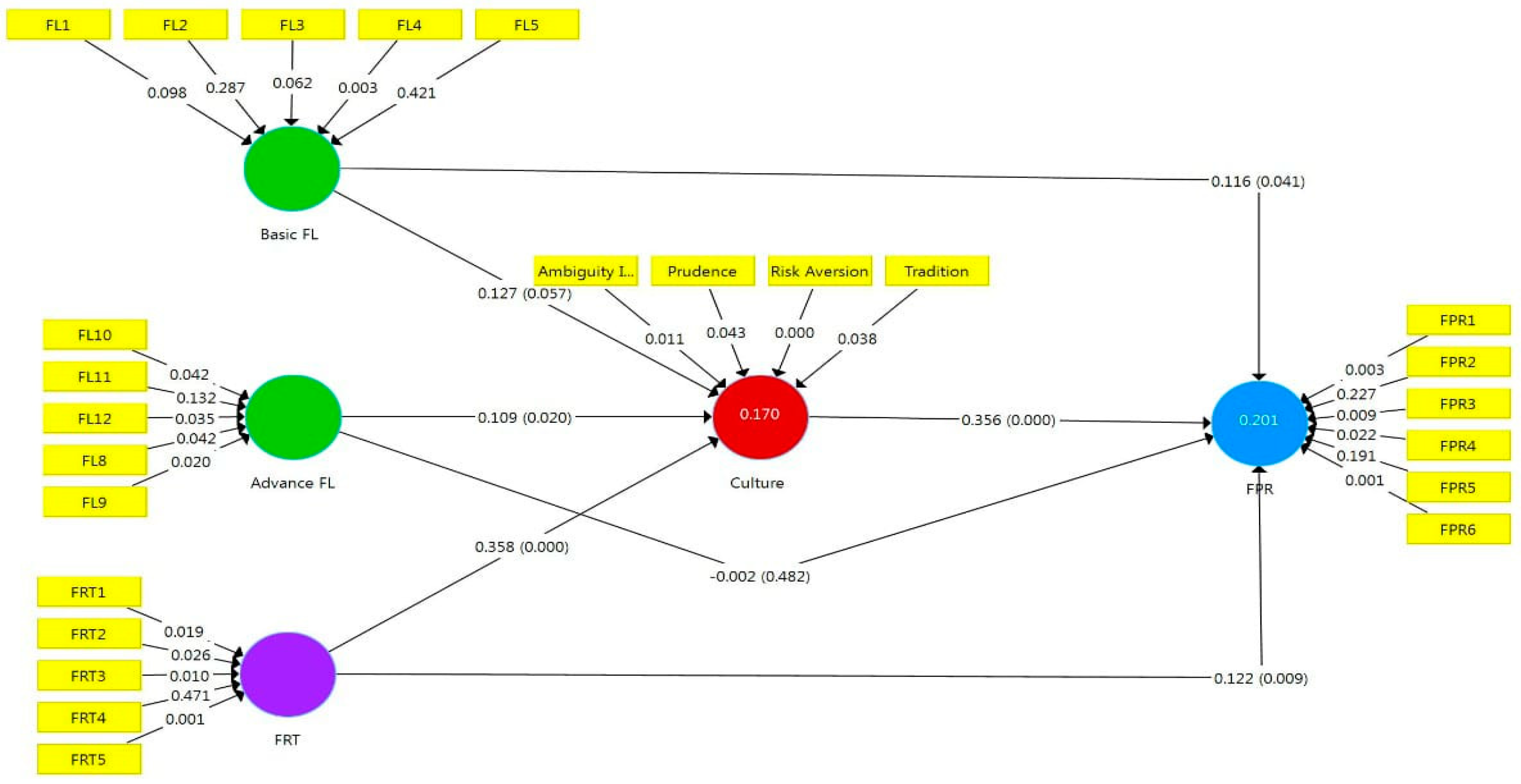

5.6. Multigroup Analysis (PLS-MGA)

6. Discussion

6.1. Consideration of Direct Effects

6.2. Consideration of Indirect Effects

7. Implication for Intervention

8. Recommendations and Limitations

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Not literate (0–1.5); Less literate (1.5–2.5), sufficient literatre (2.5–3.5); Well literate (3.5–4). |

References

- Al-Ghabri, Asmaa. 2013. A Non-Descriptive Curriculum Teaches Elementary School Students the Culture of Saving. Available online: https://aawsat.com/home/article/14004 (accessed on 4 October 2017).

- Alghamdi, Amani K. Hamdan, Sue L. T. McGregor, and Wai Si El-Hassan. 2021. Financial Literacy, Stability, and Security as Understood by Male Saudi University Students. International Journal of Economics and Finance 13: 7. [Google Scholar] [CrossRef]

- Alkhawaja, Sara Osama, and Mohamed Albaity. 2020. Retirement Saving Behavior: Evidence From UAE. Journal of Islamic Marketing 13: 265–86. [Google Scholar] [CrossRef]

- Almenberg, Johan, and Jenny Save-Soderbergh. 2011. Financial Literacy and Retirement Planning in Sweden. Journal of Pension Economics and Finance 10: 585–98. [Google Scholar] [CrossRef]

- Alyahya, Rema Yousef. 2017. Financial Literacy among College Students in Saudi Arabia. Master’s dissertation, The University of Queensland, Brisbane, Australia. Available online: https://espace.library.uq.edu.au/view/UQ:677345 (accessed on 10 May 2020).

- AXA. 2007. Retirement in the World: Culture Shock. Available online: https://axa-prod.s3.amazonaws.com/www-axa-com%2F9b3527fa-b868-4976-8007-229b0addf568_axa_pr_20070322.pdf (accessed on 6 August 2019).

- Bacova, Viera, and Lenka Kostovicova. 2018. Too Far Away to Care about? Predicting Psychological Preparedness for Retirement Financial Planning among Young Employed Adults 1. Ekonomický Časopis 66: 43–63. [Google Scholar]

- Baker, H. Kent, Sweta Tomar, Satish Kumar, and Deepak Verma. 2020. Are Indian Professional Women Financially Literate and Prepared for Retirement? Journal of Consumer Affairs 55: Joca.12332. [Google Scholar] [CrossRef]

- World Bank. 2022. Life Expectancy at Birth. Available online: https://data.worldbank.org/indicator/SP.DYN.LE00.IN (accessed on 13 February 2022).

- Bayar, Yılmaz, H. Funda Sezgin, Ömer Faruk Öztürk, and Mahmut Ünsal Şaşmaz. 2020. Financial Literacy and Financial Risk Tolerance of Individual Investors: Multinomial Logistic Regression Approach. SAGE Open 10: 215824402094571. [Google Scholar] [CrossRef]

- Blumberg, Melvin, and Charles D. Pringle. 1982. The Missing Opportunity in Organizational Research: Some Implications for a Theory of Work Performance. Academy of Management Review 7: 560–69. [Google Scholar] [CrossRef]

- Boisclair, David, Annamaria Lusardi, and Pierre-Carl Michaud. 2017. Financial Literacy and Retirement Planning in Canada. Journal of Pension Economics and Finance 16: 277–96. [Google Scholar] [CrossRef] [Green Version]

- Bongaarts, John. 2004. Population Aging and the Rising Cost of Public Pensions. Population and Development Review 30: 1–23. [Google Scholar] [CrossRef]

- Boyatzis, Richard E. 2006. An Overview of Intentional Change From a Complexity Perspective. Journal of Management Development 25: 607–23. [Google Scholar] [CrossRef]

- Boyatzis, Richard E. 2019. Professional Coaching Principles and Practice. New York: Springer Publishing Company. [Google Scholar]

- Brahmana, Rayenda, Chin-Hong Puah, Daw Tin Hla, and Suci Lestari. 2016. Financial Literacy and Retirement Planning: Evidence from Malaysia. pp. 1–19. Available online: http://docplayer.net/11733890-Financial-literacy-and-retirement-planning-evidence-from-malaysia.html (accessed on 2 December 2019).

- Chahal, Saravjit S., and Surabhi Savita. 2014. Knowledge Sharing among University Teaching Staff: A Case Study. Rohtak: Maharshi Dayanand University, pp. 1–8. [Google Scholar]

- Cohen, Jacob. 1988. Statistical Power Analysis for the Behavioral Sciences, 2nd ed. New York and London: Academic Press Ltd. [Google Scholar]

- Cooper, William W., Angela T. Kingyens, and Joseph C. Paradi. 2014. Two-Stage Financial Risk Tolerance Assessment Using Data Envelopment Analysis. European Journal of Operational Research 233: 273–80. [Google Scholar] [CrossRef]

- Crossan, Diana, David Feslier, and Roger Hurnard. 2011. Financial literacy and retirement planning in New Zealand. Journal of Pension Economics and Finance 10: 619–35. [Google Scholar] [CrossRef]

- Croy, Gerry, Paul Gerrans, and Craig Speelman. 2010. The Role and Relevance of Domain Knowledge, Perceptions of Planning Importance, and Risk Tolerance in Predicting Savings Intentions. Journal of Economic Psychology 31: 860–71. [Google Scholar] [CrossRef] [Green Version]

- Diaw, Alassane. 2017. Retirement Preparedness in Saudi Arabia. International Journal of Economics and Financial Issues 7: 78–86. Available online: http://dergipark.gov.tr/download/article-file/364145 (accessed on 15 July 2019).

- Sue Farrar, Jonathan Moizer, Jonathan Lean, and Mark Hyde. 2019. Gender, Financial Literacy, and Preretirement Planning in the UK. Journal of Women & Aging 31: 319–39. [Google Scholar] [CrossRef]

- Fornero, Elsa, and Chiara Monticone. 2011. Financial literacy and pension plan participation in Italy. Journal of Pension Economics and Finance 10: 547–64. [Google Scholar] [CrossRef]

- França, Lucia H. F., and Douglas A. Hershey. 2018. Financial Preparation for Retirement in Brazil: A Cross-Cultural Test of the Interdisciplinary Financial Planning Model. Journal of Cross-Cultural Gerontology 33: 43–64. [Google Scholar] [CrossRef] [PubMed]

- Gallego-Losada, Rocío, Antonio Montero-Navarro, José-Luis Rodríguez-Sánchez, and Thais González-Torres. 2022. Retirement Planning and Financial Literacy, at the Crossroads. A Bibliometric Analysis. Finance Research Letters 44: 102109. [Google Scholar] [CrossRef]

- Garson, G. David. 2016. Partial Least Squares: Regression & Structural Equation Models. New York: Statistical Associates Publishers. [Google Scholar]

- Ghadwan, Ahmad, Wan Ahmad Wan Marhaini, and Mohamed Hisham Hanifa. 2022. Financial Planning for Retirement Models: An Integrative Systematic Review. Pertanika Journal of Social Sciences and Humanities 30. [Google Scholar]

- Grable, John E. 1999. Financial Risk Tolerance Revisited: The Development of a Risk Assessment Instrument. Financial Services Review 8: 163–81. [Google Scholar] [CrossRef]

- Grable, John E. 2000. Financial Risk Tolerance and Additional Factors that Affect Risk Taking in Everyday Money Matters. Journal of Business and Psychology 14: 625–30. [Google Scholar] [CrossRef]

- Hair, Joseph F., G. Tomas M. Hult, Christian M. Ringle, and Marko Sarstedt. 2017a. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed. Los Angeles: SAGE Publications Inc. [Google Scholar]

- Hair, Joseph F., G. Tomas M. Hult, Christian M. Ringle, Marko Sarstedt, and Kai Oliver Thiele. 2017b. Mirror, Mirror on the Wall: A Comparative Evaluation of Composite-based Structural Equation Modeling Methods. Journal of the Academy of Marketing Science 45: 616–32. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to Use and How to Report the Results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hassan Al-Tamimi, Hussein A., and Al Anood Bin Kalli. 2009. Financial Literacy and Investment Decisions of UAE Investors. The Journal of Risk Finance 10: 500–16. [Google Scholar] [CrossRef] [Green Version]

- Henkens, Kène. 2022. Forge Healthy Pathways to Retirement with Employer Practices: A Multilevel Perspective. Work, Aging and Retirement 8: 1–6. [Google Scholar] [CrossRef]

- Hershey, Douglas A., Kène Henkens, and Hendrik P. Van Dalen. 2007. Mapping the Minds of Retirement Planners: A Cross-Cultural Perspective. Journal of Cross-Cultural Psychology 38: 361–82. [Google Scholar] [CrossRef] [Green Version]

- Hershey, Douglas A., Joy M. Jacobs-Lawson, and James T. Austin. 2012. Effective Financial Planning for Retirement. In The Oxford Handbook of Retirement. Edited by Mo Wang. New York: Oxford University Press. [Google Scholar] [CrossRef]

- Hershey, Douglas A., Hendrik P. van Dalen, Wieteke Conen, and Kène Henkens. 2017. Are “Voluntary” Self-Employed Better Prepared for Retirement Than “Forced” Self-Employed? Work, Aging and Retirement 3: 243–56. [Google Scholar] [CrossRef] [Green Version]

- Highhouse, Scott, and Jennifer Z. Gillespie. 2010. Do Samples Really Matter That Much? In Statistical and Methodological Myths and Urban Legends, 1st ed. Edited by Charles E. Lance, Charles E. Lance and Robert J. Vandenberg. London: Routledge, p. 20. [Google Scholar] [CrossRef]

- Hutabarat, Agung Satria Setyawan, and Chandra Wijaya. 2020. Analysis the Effect of Financial Literacy on Financial Planning for Retirement (Case Study Lecturers and Administrative Staffs in Universitas Indonesia. International Journal of Management 11: 741–50. [Google Scholar] [CrossRef]

- Imamoglu, E. Olcay, Rikard Küller, Vacit Imamoglu, and Marianne Küller. 1993. The Social Psychological Worlds of Swedes and Turks in and Around Retirement. Journal of Cross-Cultural Psychology 24: 26–41. [Google Scholar] [CrossRef]

- Jaafar, Roslan, Kevin James Daly, and Anil V. Mishra. 2019. Challenges Facing Malaysia Pension Scheme in an era of Ageing Population. Finance Research Letters 30: 334–40. [Google Scholar] [CrossRef]

- Jacobs-Lawson, Joy M., and Douglas A. Hershey. 2005. Influence of Future Time Perspective, Financial Knowledge, and Financial Risk Tolerance on Retirement Saving Behaviors. Financial Services Review 14: 331–44. [Google Scholar]

- Kerry, Matthew J., and Susan E. Embretson. 2018. An experimental evaluation of competing age-predictions of future time perspective between workplace and retirement domains. Frontiers in Psychology 8: 2316. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Khan, Rida Zahra, and Tahar Tayachi. 2021. Financial Literacy and Saudi Youth. PalArch’s Journal of Archaeology of Egypt/Egyptology 18: 595–603. [Google Scholar]

- Klapper, Leora, and Annamaria Lusardi. 2020. Financial Literacy and Financial Resilience: Evidence from Around the World. Financial Management 49: 589–614. [Google Scholar] [CrossRef]

- Koposko, Janet L., Helen Kiso, Douglas A. Hershey, and Paul Gerrans. 2015. Perceptions of Retirement Savings Relative to Peers. Work, Aging and Retirement 2: wav019. [Google Scholar] [CrossRef] [Green Version]

- Koposko, Janet L., Douglas A. Hershey, Martha Isabel Bojórquez, and Antonio Emmanuel Pérez. 2016. College Student Attitudes toward Retirement Planning: The Case of Mexico and the United States. Journal of Personal Finance 15: 52–67. [Google Scholar]

- Krejcie, Robert V., and Daryle W. Morgan. 1970. Determining Sample Size for Research Activities. Educational and Psychological Measurement 30: 607–10. [Google Scholar] [CrossRef]

- Larisa, Linda Evelina, Anastasia Njo, and Serli Wijaya. 2020. Female Workers’ Readiness for Retirement Planning: An Evidence from Indonesia. Review of Behavioral Finance 13: 1–24. [Google Scholar] [CrossRef]

- Larson, Lindsay R. L., Jacqueline K. Eastman, and Dora E. Bock. 2016. A Multi-Method Exploration of the Relationship between Knowledge and Risk: The Impact on Millennials’ Retirement Investment Decisions. Journal of Marketing Theory and Practice 24: 72–90. [Google Scholar] [CrossRef]

- Liu, Chang, Xue Bai, and Martin Knapp. 2021. Multidimensional Retirement Planning Behaviors, Retirement Confidence, and Post-Retirement Health and Well-Being Among Chinese Older Adults in Hong Kong. Applied Research in Quality of Life 17: 833–49. [Google Scholar] [CrossRef]

- Lusardi, Annamaria. 2000. Saving for Retirement: The Importance of Planning. Research Dialogue 66: 1–12. Available online: http://www.tiaa-crefinstitute.org/ucm/groups/content/@ap_ucm_p_tcp_docs/documents/document/tiaa02029411.pdf (accessed on 18 October 2019).

- Lusardi, Annamaria. 2008. Financial Literacy: An Essential Tool for Informed Consumer Choice? (NBER No. 14084). Available online: http://hdl.handle.net/10419/25554 (accessed on 25 March 2020).

- Lusardi, Annamaria, and Olivia S. Mitchell. 2008. Planning and Financial Literacy: How Do Women Fare? American Economic Review 98: 413–17. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011a. Financial Literacy and Planning: Implications for Retirement WELLBEING (NBER WORKING PAPER SERIES No. 17078). Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011b. Financial Literacy Around the World: An Overview. Journal of Pension Economics and Finance 10: 497–508. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, Annamaria. 2019. Financial Literacy and the Need for Financial Education: Evidence and Implications. Swiss Journal of Economics and Statistics 155: 1. [Google Scholar] [CrossRef] [Green Version]

- Mardia, Kanti V. 1970. Measures of Multivariate Skewness and Kurtosis with Applications. Biometrika 57: 519–30. [Google Scholar] [CrossRef]

- Mian, Tariq Saeed. 2014. Examining the Level of Financial Literacy Among Saudi Investors and its Impact on Financial Decisions. International Journal of Accounting and Financial Reporting 4: 312–28. [Google Scholar] [CrossRef]

- Moure, Natalia Garabato. 2016. Financial Literacy and Retirement Planning in Chile. Journal of Pension Economics & Finance 15: 203–23. [Google Scholar] [CrossRef]

- The Department of Economic and Social Affairs of the United Nations. 2017. World Population Prospects: The 2017 Revision, Key Findings and Advance Tables. Available online: https://esa.un.org/unpd/wpp/Publications/%0AFiles/WPP2017_KeyFindings.pdf (accessed on 3 March 2020).

- OECD (Organization for Economic Co-Operation and Development). 2017. G20/OECD INFE Report on Adult Financial Literacy in G20 Countries. Available online: www.oecd.org/daf/fin/financial-education/G20-OECD-INFE-report-adult-financial-literacy-in-G20-countries.pdf (accessed on 3 April 2020).

- Palací, Francisco, Irene Jiménez, and Gabriela Topa. 2017. Economic Cognitions Among Older Adults: Parental Socialization Predicts Financial Planning for Retirement. Frontiers in Aging Neuroscience 9: 376. [Google Scholar] [CrossRef] [Green Version]

- Palací, Francisco, Irene Jiménez, and Gabriela Topa. 2018. Too Soon to Worry? Longitudinal Examination of Financial Planning for Retirement Among Spanish Aged Workers. PLoS ONE 13: e0209434. [Google Scholar] [CrossRef]

- Palekar, S. A. 2012. Development Administration. New Delhi: PHI Learning Pvt. Ltd. [Google Scholar]

- Parker, Andrew M., Wändi Bruine De Bruin, Joanne Yoong, and Robert Willis. 2012. Inappropriate Confidence and Retirement Planning: Four Studies with a National Sample. Journal of Behavioral Decision Making 25: 382–89. [Google Scholar] [CrossRef]

- Ramayah, T. J. F. H., Jacky Cheah, Francis Chuah, Hiram Ting, and Mumtaz Ali Memon. 2018. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using SmartPLS 3.0: An Updated and Practical Guide to Statistical Analysis. Singapore: Pearson Education. [Google Scholar]

- Ricci, Ornella, and Massimo Caratelli. 2017. Financial Literacy, Trust and Retirement Planning. Journal of Pension Economics and Finance 16: 43–64. [Google Scholar] [CrossRef]

- Van Rooij, Maarten, Annamaria Lusardi, and Rob Alessie. 2011a. Financial Literacy and Retirement Planning in The Netherlands. Journal of Economic Psychology 32: 593–608. [Google Scholar] [CrossRef]

- Van Rooij, Maarten, Annamaria Lusardi, and Rob Alessie. 2011b. Financial Literacy and Stock Market Participation. Journal of Financial Economics 101: 449–72. [Google Scholar] [CrossRef] [Green Version]

- Van Rooij, Maarten, Annamaria Lusardi, and Rob J. M. Alessie. 2012. Financial Literacy, Retirement Planning and Household Wealth. The Economic Journal 122: 449–78. [Google Scholar] [CrossRef]

- Rudi, Jessie H., Joyce Serido, and Soyeon Shim. 2020. Unidirectional and Bidirectional Relationships Between Financial Parenting and Financial Self-Efficacy: Does Student Loan Status Matter? Journal of Family Psychology 34: 949–59. [Google Scholar] [CrossRef] [PubMed]

- Rudzinska-Wojciechowska, Joanna. 2017. If You Want to Save, Focus on the Forest Rather than on Trees. The Effects of Shifts in Levels of Construal on Saving Decisions. PLoS ONE 12: e0178283. [Google Scholar] [CrossRef] [Green Version]

- Safari, Meysam, Shaheen Mansori, and Stephen Sesaiah. 2016. Personal Financial Planning Industry in Malaysia: A Market Survey. The Journal of Wealth Management 18: 29–35. [Google Scholar] [CrossRef]

- Salleh, Pg Md Hasnol Alwee Pg, and Roslee Baha. 2020. Retirement Concerns and Financial Literacy in Brunei. International Journal of Sociology and Social Policy 40: 342–65. [Google Scholar] [CrossRef]

- SAMA. 2019. Annual Statistics. Riyadh: SAMA. [Google Scholar]

- Sarigul, Haşmet. 2014. A Survey of Financial Literacy Among University Students. The Journal of Accounting and Finance 64: 207–24. 64, pp. 207–24. Available online: http://www.journal.mufad.org.tr/attachments/article/767/11.pdf (accessed on 20 January 2020).

- Scharn, Micky, Ranu Sewdas, Cécile RL Boot, Martijn Huisman, Maarten Lindeboom, and Allard J. Van Der Beek. 2018. Domains and Determinants of Retirement Timing: A Systematic Review of Longitudinal Studies. BMC Public Health 18: 1083. [Google Scholar] [CrossRef]

- Sekita, Shizuka. 2011. Financial Literacy and Retirement Planning in Japan. Journal of Pension Economics and Finance 10: 637–56. [Google Scholar] [CrossRef] [Green Version]

- Selamat, Zarehan, Nahariah Jaffar, Hamsatulazura Hamzah, and Izyan Syazana Awaludin. 2020. Financial Literacy of the Younger Generation in Malaysia. In Understanding Digital Industry: Proceedings of the Conference on Managing. Edited by Siska Noviaristanti, Hasni Mohd Hanafi and Donny Trihanondo. London: Routledge, p. 387. [Google Scholar]

- Sharma, Piyush. 2010. Measuring Personal Cultural Orientations: Scale Development and Validation. Journal of the Academy of Marketing Science 38: 787–806. [Google Scholar] [CrossRef]

- Shreevastava, Richa, and Mamta Brahmbhatt. 2020. Impact of Demographic Variable of Retirement planning Behavior of Gen Y. Palarch’s Journal of Archaeology of Egypt/Egyptology 17: 9452–60. Available online: https://www.archives.palarch.nl/index.php/jae/article/view/2485 (accessed on 18 December 2021).

- Swiecka, Beata, Eser Yeşildağ, Ercan Özen, and Simon Grima. 2020. Financial Literacy: The Case of Poland. Sustainability 12: 700. [Google Scholar] [CrossRef] [Green Version]

- Tan, Shirley, and Kuppusamy Singaravelloo. 2020. Financial Literacy and Retirement Planning among Government Officers in Malaysia. International Journal of Public Administration 43: 486–98. [Google Scholar] [CrossRef]

- Tharenou, Phyllis, Ross Donohue, and Brian Cooper. 2007. Management Research Methods. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Tomar, Sweta, H. Kent Baker, Satish Kumar, and Arvid O. I. Hoffmann. 2021. Psychological Determinants of Retirement Financial Planning Behavior. Journal of Business Research 133: 432–49. [Google Scholar] [CrossRef]

- Topa, Gabriela, and Encarnación Valero. 2017. Preparing for Retirement: How Self-Efficacy and Resource Threats Contribute to Retirees’ Satisfaction, Depression, and Losses. European Journal of Work and Organizational Psychology 26: 811–27. [Google Scholar] [CrossRef]

- Topa, Gabriela, Gregg Lunceford, and Richard E. Boyatzis. 2018a. Financial Planning for Retirement: A Psychosocial Perspective. Frontiers in Psychology 8: 2338. [Google Scholar] [CrossRef]

- Topa, Gabriela, Adrián Segura, and Sergio Pérez. 2018b. Gender Differences in Retirement Planning: A longitudinal Study Among Spanish Registered Nurses. Journal of Nursing Management 26: 587–96. [Google Scholar] [CrossRef]

- Warmath, Dee, and David Zimmerman. 2019. Financial Literacy as More than Knowledge: The Development of a Formative Scale through the Lens of Bloom’s Domains of Knowledge. Journal of Consumer Affairs 53: 1602–29. [Google Scholar] [CrossRef]

- Weisfeld-Spolter, Suri, Fiona Sussan, Cindy Rippé, and Stephen Gould. 2018. Integrating Affect, Cognition, and Culture in Hispanic Financial Planning. International Journal of Bank Marketing 36: 726–43. [Google Scholar] [CrossRef] [Green Version]

- Yeung, Wei-Jun Jean, and Yeonjin Lee. 2022. Aging in East Asia: New Findings on Retirement, Health, and Well-Being. The Journals of Gerontology: Series B 77: 589–91. [Google Scholar] [CrossRef] [PubMed]

| Life Expectancy | Life Expectancy | ||||

|---|---|---|---|---|---|

| Industrialized Countries | 1960 | 2019 | Emerging Countries | 1960 | 2019 |

| Australia | 70.82 | 82.90 | Argentina | 65.00 | 76.67 |

| Canada | 71.13 | 82.05 | Brazil | 54.14 | 75.88 |

| Germany | 69.31 | 80.94 | China | 43.73 | 76.91 |

| Denmark | 72.18 | 81.20 | Algeria | 46.14 | 76.88 |

| Spain | 69.11 | 83.49 | Mexico | 57.08 | 75.05 |

| United States | 69.77 | 78.79 | Malaysia | 59.99 | 76.16 |

| Italy | 69.12 | 83.20 | Saudi Arabia | 45.64 | 75.13 |

| Financial Planning for Retirement Questions with Likert Scale (1 = “strongly Disagree”, 7 = “Strongly Agree”) Cronbach’s Alpha = 0.86 |

| 1. I have put aside some money for my retirement. |

| 2. I am expecting benefits that can be utilized for my retirement planning. |

| 3. I will receive fixed payments as my pensions when I retire. |

| 4. I will have enough money to maintain my desired standard of living when I retire. |

| 5. I am expecting that I will have enough savings to pay for my expenditures during my retirement. |

| 6. I am expecting some earnings, which I can utilize during my retirement. |

| Financial Literacy coded as 1 for the correct answer and 0 for the incorrect answer |

| 1. Suppose you had SR 100 in an investing account, and the profit rate was 2% per year. After five years, how much do you think you would have in the account if you left the money to grow? 2. Imagine that the profit rate on your investing account was 1% per year and inflation was 2% per year. After one year, how much would you be able to buy with the money in this account? 3. Suppose you had SR 100 in an investing account and the profit rate is 20% per year, and you never withdraw money or profit payments. After five years, how much would you have on this account in total? 4. Suppose that in the year 2017, your income has doubled, and the prices of all goods have doubled too. In 2017, how much will you be able to buy with your income? 5. Assume my friend inherits SR 10,000 today, and his sibling inherits SR 10,000 3 years from now. Who is richer because of the inheritance? 6. What happens if somebody buys the stock from Firm B in the stock market? 7. What happens if somebody buys a bond of Firm B? 8. Considering a long time period (for example, 10 or 20 years), which asset typically gives the highest return? 9. When an investor spreads his/her money among different assets, the risk shall __________. 10. Which of the following statements describes the main function of the stock market? |

| Financial Risk Tolerance Questions with a Likert scale (1 = “strongly disagree”, 7 = “strongly agree”) Cronbach’s alpha is 0.87 |

| 1. I am willing to risk financial losses. 2. I prefer investments that have higher returns, even though they are riskier. 3. The overall growth potential of retirement investment is more important than the level of risk of the investment. 4. I am very willing to make risky investments to ensure financial stability in retirement. 5. I would never choose the safest investment when planning for retirement. |

| Cultural items with a Likert scale (1 = “strongly disagree”, 7 = “strongly agree”) Cronbach’s alpha is 0.79 |

| 1. I tend to avoid talking to strangers, especially about my financial matter. 2. I prefer a routine way of life to an unpredictable one full of change. 3. I would not describe myself as a risk-taker. 4. I do not like taking too many chances to avoid making a mistake. 5. I find it difficult to function without clear directions and instructions. 6. I prefer specific instructions to broad guidelines. 7. I tend to get anxious quickly when I do not know the outcome. 8. I feel stressed when I cannot predict the consequences. 9. I am proud of my culture. 10. Respect for tradition is important to me. 11. I value a strong link to my past. 12. Traditional values are important to me. 13. I believe in planning for the long-term. 14. I will work hard for success in the future. 15. I am willing to give up today’s fun for success in the future. 16. I do not give up easily, even if I do not succeed in my first attempt. |

| Demographic Variables | Valid Percent |

|---|---|

| Gender | |

| Male | 344 (66%) |

| Female | 181 (34%) |

| Marital Status | |

| Single | 73 (14%) |

| Married | 429 (82%) |

| Divorced | 23 (4%) |

| Age | |

| 26–30 | 74 (14%) |

| 31–35 | 151 (29%) |

| 36–40 | 129 (25%) |

| 41–45 | 60 (11%) |

| 46–50 | 55 (10%) |

| 51–55 | 32 (6%) |

| 56–60 | 16 (3%) |

| Above 60 | 8 (2%) |

| Employment Sector | |

| Academic | 330 (63%) |

| Administrator | 195 (37%) |

| Education | |

| Secondary | 12 (2%) |

| Diploma | 15 (3%) |

| Bachelor | 161 (31%) |

| Master | 185 (35%) |

| Doctoral | 152 (29%) |

| Variable | Tetrad | Original Sample | T Statistics | CI Low Adj. | CI Up Adj. |

|---|---|---|---|---|---|

| Financial Planning for Retirement (FPR) | FPR1, FPR2, FPR3, FPR4 | 0.022 | 0.061 | −0.893 | 0.943 |

| FPR1, FPR2, FPR4, FPR3 | 0.052 | 0.139 | −0.908 | 1.014 | |

| FPR1, FPR2, FPR3, FPR5 | −0.128 | 0.395 | −0.945 | 0.701 | |

| FPR1, FPR3, FPR5, FPR2 | −0.247 | 0.671 | −1.187 | 0.682 | |

| FPR1, FPR2, FPR3, FPR6 | −0.323 | 1.080 | −1.082 | 0.437 | |

| FPR1, FPR2, FPR4, FPR5 | 1.613 | 3.917 | 0.578 | 2.671 | |

| FPR1, FPR2, FPR5, FPR6 | 0.803 | 2.082 | −0.172 | 1.787 | |

| FPR1, FPR3, FPR4, FPR6 | 1.033 | 2.837 | 0.114 | 1.963 | |

| FPR1, FPR3, FPR6, FPR5 | 1.259 | 3.167 | 0.252 | 2.272 | |

| Basic Financial Literacy (BFL) | FL1, FL2, FL3, FL4 | −0.002 | 2.442 | −0.005 | −0.000 |

| FL1, FL2, FL4, FL3 | 0.000 | 0.466 | −0.001 | 0.002 | |

| FL1, FL2, FL3, FL5 | −0.001 | 1.646 | −0.003 | 0.001 | |

| FL1, FL3, FL5, FL2 | 0.001 | 1.498 | −0.001 | 0.003 | |

| FL1, FL3, FL4, FL5 | 0.001 | 1.592 | −0.001 | 0.004 | |

| Advanced Financial Literacy (AFL) | FL8, FL9, FL10, FL6 | 0.000 | 0.083 | −0.002 | 0.002 |

| FL8, FL9, FL6, FL10 | 0.000 | 0.051 | −0.002 | 0.002 | |

| FL8, FL9, FL10, FL7 | 0.000 | 0.312 | −0.002 | 0.002 | |

| FL8, FL10, FL7, FL9 | −0.001 | 0.780 | −0.003 | −0.001 | |

| FL8, FL10, FL6, FL7 | 0.001 | 1.489 | −0.001 | 0.003 | |

| Financial Risk Tolerance (FRT) | FRT1, FRT2, FRT3, FRT4 | 0.510 | 2.097 | −0.041 | 1.094 |

| FRT1, FRT2, FRT4, FRT3 | 0.451 | 1.871 | −0.109 | 1.017 | |

| FRT1, FRT2, FRT3, FRT5 | 0.694 | 3.133 | 0.183 | 1.218 | |

| FRT1, FRT3, FRT5, FRT2 | −0.156 | 0.889 | −0.568 | 0.249 | |

| FRT1, FRT3, FRT4, FRT5 | −0.244 | 1.194 | −0.726 | 0.228 | |

| Culture | Ambiguity Intolerance, Prudence, Risk Aversion, Tradition | −0.129 | 4.196 | −0.188 | −0.071 |

| Ambiguity Intolerance, Prudence, Tradition, Risk Aversion | −0.020 | 1.026 | −0.059 | 0.018 |

| Construct | Items | Outer Weights | T-Value | Outer Loading | T-Value | VIF | Result | Decision |

|---|---|---|---|---|---|---|---|---|

| Financial Planning for Retirement (FPR) | FPR1 | 0.323 | 3.126 | 0.671 | 8.329 | 1.259 | Significant | Kept |

| FPR2 | 0.071 | 0.642 | 0.534 | 5.902 | 1.320 | Significant | Kept | |

| FPR3 | 0.246 | 2.220 | 0.617 | 7.451 | 1.283 | Significant | Kept | |

| FPR4 | 0.283 | 2.530 | 0.766 | 12.605 | 1.927 | Significant | Kept | |

| FPR5 | 0.245 | 1.907 | 0.779 | 12.398 | 2.107 | Significant | Kept | |

| FPR6 | 0.262 | 2.323 | 0.707 | 9.266 | 1.492 | Significant | Kept | |

| Basic FL (BFL) | FL1 | 0.388 | 1.646 | 0.486 | 2.208 | 1.149 | Significant | Kept |

| FL2 | −0.306 | 1.182 | 0.002 | 0.009 | 1.122 | Non-Significant | Kept | |

| FL3 | −0.346 | 1.476 | −0.105 | 0.448 | 1.091 | Non-Significant | Kept | |

| FL4 | 0.859 | 4.571 | 0.837 | 5.379 | 1.179 | Significant | Kept | |

| FL5 | 0.159 | 0.689 | 0.355 | 1.639 | 1.137 | Non-Significant | Kept | |

| Advanced FL (AFL) | FL6 | 0.403 | 1.350 | 0.632 | 2.476 | 1.254 | Significant | Kept |

| FL7 | −0.182 | 0.567 | 0.327 | 1.325 | 1.312 | Non-Significant | Kept | |

| FL8 | 0.376 | 1.275 | 0.553 | 2.052 | 1.084 | Significant | Kept | |

| FL9 | 0.331 | 1.114 | 0.592 | 2.284 | 1.162 | Significant | Kept | |

| FL10 | 0.527 | 1.698 | 0.762 | 2.909 | 1.227 | Significant | Kept | |

| Financial Risk Tolerance (FRT) | FRT1 | 0.289 | 2.080 | 0.726 | 8.258 | 1.536 | Significant | Kept |

| FRT2 | 0.297 | 2.008 | 0.766 | 9.931 | 1.757 | Significant | Kept | |

| FRT3 | 0.274 | 2.305 | 0.688 | 8.283 | 1.398 | Significant | Kept | |

| FRT4 | 0.011 | 0.072 | 0.682 | 7.433 | 1.861 | Significant | Kept | |

| FRT5 | 0.448 | 3.547 | 0.818 | 12.098 | 1.534 | Significant | Kept | |

| Culture | Ambiguity Intolerance | 0.238 | 2.694 | 0.717 | 12.104 | 1.496 | Significant | Kept |

| Prudence | 0.346 | 3.774 | 0.812 | 18.052 | 1.736 | Significant | Kept | |

| Risk Aversion | 0.343 | 4.031 | 0.746 | 13.655 | 1.427 | Significant | Kept | |

| Tradition | 0.360 | 3.599 | 0.814 | 16.791 | 1.738 | Significant | Kept |

| Hypothesis | Relationship | Std Beta | Std. Dev. | t-Value | p-Value | VIF | Decision | F2 |

|---|---|---|---|---|---|---|---|---|

| H1 | Basic FL -> FPR | 0.116 | 0.063 | 1.843 | 0.033 | 1.025 | Supported | 0.017 |

| H2 | Advanced FL -> FPR | −0.002 | 0.054 | 0.046 | 0.482 | 1.034 | Non-Supported | 0.000 |

| H3 | FRT -> FPR | 0.122 | 0.050 | 2.412 | 0.008 | 1.170 | Supported | 0.132 |

| H4a | Culture -> FPR | 0.356 | 0.047 | 7.645 | 0.000 | 1.205 | Supported | 0.016 |

| H4b | Basic FL -> Culture -> FPR | 0.045 | 0.028 | 1.601 | 0.055 | - | Non-Supported | - |

| H4c | Advance FL -> Culture -> FPR | 0.039 | 0.020 | 1.922 | 0.028 | - | Supported | - |

| H4d | FRT -> Culture -> FPR | 0.128 | 0.023 | 5.507 | 0.000 | - | Supported | - |

| Hypothesis | Path | Academic (330) | Administrators (195) | Parametric Test | PLS-MGA | ||||

|---|---|---|---|---|---|---|---|---|---|

| Std. Beta | p-Value | Std. Beta | p-Value | Std. Beta | p-Value | Std. Beta | p-Value | ||

| H1 | Basic FL -> FPR | −0.080 | 0.266 | 0.196 | 0.100 | −0.276 | 0.087 | −0.276 | 0.082 |

| H2 | Advance FL -> FPR | 0.092 | 0.206 | 0.037 | 0.411 | 0.055 | 0.388 | 0.055 | 0.391 |

| H3 | FRT -> FPR | 0.176 | 0.001 | −0.087 | 0.317 | 0.263 | 0.049 | 0.263 | 0.095 |

| H4 | Culture -> FPR | 0.406 | 0.000 | 0.313 | 0.056 | 0.093 | 0.292 | 0.093 | 0.362 |

| Hypothesis | Path | Men (344) | Women (181) | Parametric Test | PLS-MGA | ||||

|---|---|---|---|---|---|---|---|---|---|

| Std. Beta | p-Value | Std. Beta | p-Value | Std. Beta | p-Value | Std. Beta | p-Value | ||

| H1 | Basic FL -> FPR | 0.097 | 0.102 | 0.182 | 0.186 | −0.085 | 0.319 | −0.085 | 0.279 |

| H2 | Advance FL -> FPR | −0.076 | 0.252 | 0.197 | 0.146 | −0.273 | 0.093 | −0.273 | 0.127 |

| H3 | FRT -> FPR | 0.106 | 0.051 | 0.117 | 0.238 | −0.011 | 0.470 | −0.011 | 0.439 |

| H4 | Culture -> FPR | 0.449 | 0.000 | 0.245 | 0.069 | 0.204 | 0.076 | 0.204 | 0.103 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ghadwan, A.; Wan Ahmad, W.M.; Hanifa, M.H. Financial Planning for Retirement: The Mediating Role of Culture. Risks 2022, 10, 104. https://doi.org/10.3390/risks10050104

Ghadwan A, Wan Ahmad WM, Hanifa MH. Financial Planning for Retirement: The Mediating Role of Culture. Risks. 2022; 10(5):104. https://doi.org/10.3390/risks10050104

Chicago/Turabian StyleGhadwan, Ahmad, Wan Marhaini Wan Ahmad, and Mohamed Hisham Hanifa. 2022. "Financial Planning for Retirement: The Mediating Role of Culture" Risks 10, no. 5: 104. https://doi.org/10.3390/risks10050104

APA StyleGhadwan, A., Wan Ahmad, W. M., & Hanifa, M. H. (2022). Financial Planning for Retirement: The Mediating Role of Culture. Risks, 10(5), 104. https://doi.org/10.3390/risks10050104