Ecologically Responsible Entrepreneurship and Its Contribution to the Green Economy’s Sustainable Development: Financial Risk Management Prospects

Abstract

:1. Introduction

2. Theory

3. Method

- Unification of the statistics on the green economy for 2020 (as a result of the year) of Global Green Economic Institute (2021b) and the statistics of sustainable development for 2021 (as of the beginning of the year) of the UN (2021) in one table, with the same list and order of countries (sheet 2 of the Excel file in the Supplementary Materials);

- Calculation of weight coefficients (w). For this, the authors calculate coefficients of correlation (R2) between the indicators of the green economy—green investment, green trade, green employment and green innovation (Global Green Economic Institute 2021b) and the Sustainable Development Index (in isolation for each region). The sum of all positive coefficients of correlation (∑R2) is calculated. After this, the ratio of each coefficient of correlation to their total sum is calculated: w = R2/∑R2;

- Norming of indicators (nm). Calculation of arithmetic means of the indicators of the green economy for the world on the whole (Gmid). Determination of ratios of arithmetic means for each region (Rmid) to world average values (bringing all indicators to one denominator for ensuring their compatibility): nm = Rmid/Gmid;

- Calculation of weighted sums (WS): products of standardized indicators and weights (in isolation for each region): WS = nm * w;

- Hierarchy synthesis (IS): finding the sum of all weighted sums for the region: IS = ∑WS.

- -

- Below 1: The lower the green economy’s sustainability (for IS) or its manifestation (for WS);

- -

- 1–1.5: The more moderate the green economy’s sustainability (for IS) or its manifestation (for WS);

- -

- above 1.5: The higher the green economy’s sustainability (for IS) or its manifestation (for WS).

- -

- Indicators of the green economy: green trade (GT), green employment (GE), green innovation (GI) and green investment (Rfin);

- -

- Green economy sustainability (IS) and its variations among regions of the world (ISvar).

4. Results

4.1. Evaluation of the Green Economy’s Sustainability, Analysis of Its Differences among Regions of the World and Prospects of Their Overcoming

4.2. Analysis of the Impact of the COVID-19 Pandemic and Financial and Economic Crisis on Financial Risks of the Green Economy

- -

- Indicators of the green economy (the overall growth of their sum—from 139.96 to 142.83, i.e., Rfin2020-Rfin2019 > 0, is observed):

- ➢

- Green trade (GT) decreases insignificantly—from 66.54 to 65.82;

- ➢

- Green employment (GE) reduced from 21.32 to 13.85;

- ➢

- Green innovation (GI) grew from 33.82 to 36.29;

- ➢

- Green investment (Rfin) grew from 18.28 to 26.87.

- -

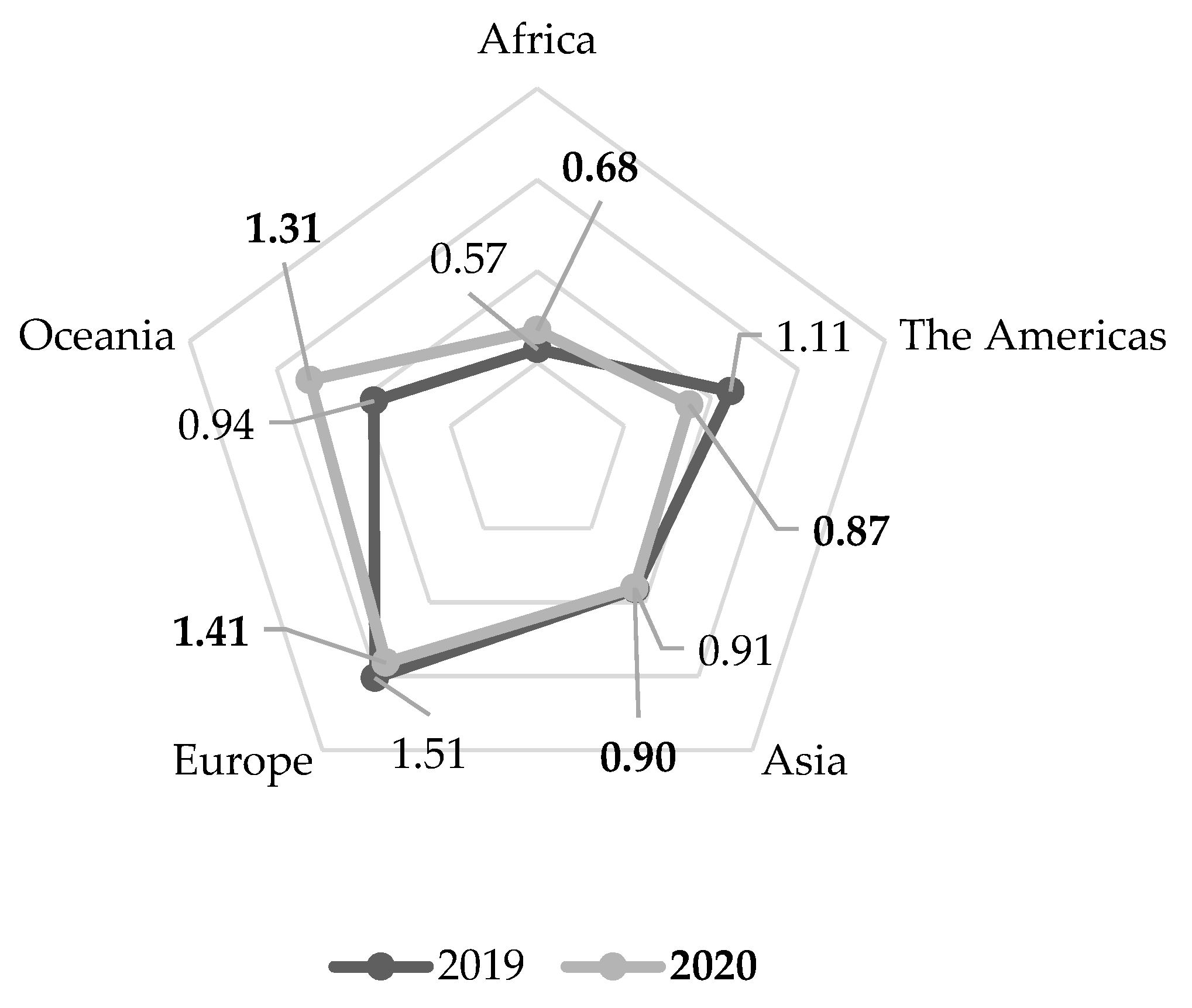

- The green economy’s sustainability (IS): from 1.01 to 1.04, i.e., IS2020-IS2019 > 0;

- -

- Variation in green economy sustainability among regions of the world (ISvar): from 33.84% to 30.04% (homogeneity grew, but insignificantly; variation remained high), i.e., ISvar2019-ISvas2020 > 0.

4.3. Determining the Impact of Financial Risks on the Development of the Green Economy through the Prism of Green Investments

- -

- In Africa, an increase in green investment from 50.79 points (in 2020) to 100 points (+96.88%) leads to an increase in green employment from 10.91 points to 19.96 points (+82.86%);

- -

- In America, due to the discovered negative impact of green investments on green trade, the optimisation of green investments is inaccessible (inexpedient);

- -

- In Asia, an increase in green investment from 57.43 points (in 2020) to 100 points (+74.13%) leads to an increase in green trade from 10.85 points to 38.58 points (+55.58%) and an increase in green employment from 30.76 points to 100 points (+90.45%);

- -

- Europe has the highest level of green trade (29.30 points) and green employment (47.53 points). That is why, in order not to increase the disproportion of the green economy and its sustainability in regions of the world and Europe, the special (artificial) increase in green investments is not recommended;

- -

- In Oceania, insufficient reliability of the models makes the optimisation of green investments inaccessible (its consequences for financial risks of the green economy are unpredictable).

- -

- Africa: from factual 0.68 in 2020 to 0.70;

- -

- Asia: from factual 0.90 in 2020 to 1.66;

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Abid, Nabila, Muhammad Ikram, Jianzu Wu, and Marcos Ferasso. 2021. Towards environmental sustainability: Exploring the nexus among ISO 14001, governance indicators and green economy in Pakistan. Sustainable Production and Consumption 27: 653–66. [Google Scholar] [CrossRef]

- Afonso, Whitney. 2021. Planning for the Unknown: Local Government Strategies from the Fiscal Year 2021 Budget Season in Response to the COVID-19 Pandemic. State and Local Government Review 53: 159–71. [Google Scholar] [CrossRef]

- Arcese, Gabriella, Marco Valeri, Stefano Poponi, and Grazia Chiara Elmo. 2020. Innovative drivers for Family business models in tourism. Journal of Family Business Management 11: 402–22. [Google Scholar] [CrossRef]

- Asongu, Simplice, and Joseph Nnanna. 2021. Globalization, Governance, and the Green Economy in Sub-Saharan Africa: Policy Thresholds. World Affairs 184: 176–212. [Google Scholar] [CrossRef]

- Baggio, Rodolfo, and Marco Valeri. 2020. Network science and sustainable performance of family businesses in tourism. Journal of Family Business Management. [Google Scholar] [CrossRef]

- Blazovich, Janell, Katherine Taken Smith, and Laqrence Murphy Smith. 2013. An examination of financial performance and risk of environmentally friendly ‘green’ companies. Journal of Legal, Ethical and Regulatory Issues 16: 121–34. [Google Scholar]

- Bouri, Elie, Riza Demirer, Rangan Gupta, and Jacobus Nel. 2021. COVID-19 pandemic and investor herding in international stock markets. Risks 9: 168. [Google Scholar] [CrossRef]

- Černìnko, Tomáš, Erika Neubauerová, and Alena Zubal’ová. 2021. Impact of the COVID-19 pandemic on the budget of Slovak local governments: Much cry and little wool? Scientific Papers of the University of Pardubice, Series D: Faculty of Economics and Administration 29: 1249. [Google Scholar] [CrossRef]

- Chen, Yujin, and Jerry Zhao. 2021. The rise of green bonds for sustainable finance: Global standards and issues with the expanding Chinese market. Current Opinion in Environmental Sustainability 52: 54–57. [Google Scholar] [CrossRef]

- Chiang, Thomas. 2021. Geopolitical risk, economic policy uncertainty and asset returns in Chinese financial markets. China Finance Review International 11: 474–501. [Google Scholar] [CrossRef]

- da Silva, Cátia, Ana Paula Barbosa-Póvoa, and Ana Carvalho. 2019. Green Supply Chain: Integrating Financial Risk Measures while Monetizing Environmental Impacts. Computer Aided Chemical Engineering 46: 1549–54. [Google Scholar] [CrossRef]

- D’Orazio, Paola, and Lilit Popoyan. 2019. Fostering green investments and tackling climate-related financial risks: Which role for macroprudential policies? Ecological Economics 160: 25–37. [Google Scholar] [CrossRef] [Green Version]

- Dzau, Victoe, and Celynne Balatbat. 2020. Strategy, coordinated implementation, and sustainable financing needed for COVID-19 innovations. The Lancet 396: 1469–71. [Google Scholar] [CrossRef]

- Elmo, Grazia Chiara, Gabriella Arcese, Marco Valeri, Stefano Poponi, and Francesco Pacchera. 2020. Sustainability in tourism as innovation driver: An analysis of family business reality. Sustainability 12: 6149. [Google Scholar] [CrossRef]

- Essaber, Fatima Ezzahra, Rachid Benmoussa, Roland De Guio, and Sébastien Dubois. 2021. A hybrid supply chain risk management approach for lean green performance based on AHP, RCA and TRIZ: A case study. Sustainability 13: 8492. [Google Scholar] [CrossRef]

- Gao, Yang, Yangyang Li, and Yaojun Wang. 2021. Risk spillover and network connectedness analysis of China’s green bond and financial markets: Evidence from financial events of 2015–2020. North American Journal of Economics and Finance 57: 101386. [Google Scholar] [CrossRef]

- Global Green Economic Institute. 2021a. GGGI Technical Report No. 5 “Green Growth Index Concept, Methods and Applications”. October. Available online: https://greengrowthindex.gggi.org/wp-content/uploads/2019/12/Green-Growth-Index-Technical-Report_20191213.pdf (accessed on 17 November 2021).

- Global Green Economic Institute. 2021b. GGGI Technical Report No. 16 “Green Growth Index 2020. Measuring Performance in Achieving SDG Targets”. December. Available online: https://greengrowthindex.gggi.org/wp-content/uploads/2021/01/2020-Green-Growth-Index.pdf (accessed on 17 November 2021).

- Goenka, Aditya, Lin Liu, and Manh-Hung Nguyen. 2021. COVID-19 and a Green Recovery? Economic Modelling 104: 105639. [Google Scholar] [CrossRef] [PubMed]

- Govinda Rao, Marapalli. 2021. A Budget for Pandemic Times—Implementation Questions. Economic and Political Weekly 56: 16–20. [Google Scholar]

- Gün, Musa, and Melih Kutlu. 2021. A New Approach of Energy Financing: The Yields of Green Bonds in Emerging Economies. Contributions to Management Science. Cham: Springer, pp. 89–102. [Google Scholar] [CrossRef]

- Hagspiel, Verena, Cláudia Nunes, Carlos Oliveira, and Manuel Portela. 2021. Green investment under time-dependent subsidy retraction risk. Journal of Economic Dynamics and Control 126: 103936. [Google Scholar] [CrossRef]

- He, Junqian, and Hyosun Kim. 2021. The effect of socially responsible HRM on organizational citizenship behavior for the environment: A proactive motivation model. Sustainability 13: 7958. [Google Scholar] [CrossRef]

- Jinru, Long, Changbiao Zhong, Bilal Ahmad, Muhammad Irfan, and Rabia Nazir. 2021. How do green financing and green logistics affect the circular economy in the pandemic situation: Key mediating role of sustainable production. Economic Research-Ekonomska Istrazivanja, 1–21. [Google Scholar] [CrossRef]

- Jones, Jennifer, and Xiang Bi. 2020. Fundraising for regional environmental issues: Public perceptions of who is financially responsible for the local environment. International Journal of Nonprofit and Voluntary Sector Marketing 26: e1699. [Google Scholar] [CrossRef]

- Jonsdottir, Erla Gudrun, Throstur Olaf Sigurjonsson, Ahmad Rahnema Alavi, and Jordan Mitchell. 2021. Applying responsible ownership to advance SDGs and the ESG framework, resulting in the issuance of green bonds. Sustainability 13: 7331. [Google Scholar] [CrossRef]

- King, Jonathan, David Goldenberg, Gary Goldstein, William Hartung, Catherine Royer, Eric Sundberg Cornelia van der Ziel, Michael Van Elzakker, and Richard Roberts. 2021. Congressional budget responses to the pandemic: Fund health care, not warfare. American Journal of Public Health 111: 200–1. [Google Scholar] [CrossRef]

- Kwon, Soonman, and Eunkyoung Kim. 2021. Sustainable Health Financing for COVID-19 Preparedness and Response in Asia and the Pacific. Asian Economic Policy Review 17: 140–56. [Google Scholar] [CrossRef]

- Lalvani, Mala, and Ajit Karni. 2021. Budget 2021–22 Any lessons learnt from the pandemic? Economic and Political Weekly 56: 15–20. [Google Scholar]

- Lapo, Andrei. 2001. Vladimir Vernadsky (1863–1945), founder of the biosphere concept. International Microbiology 4: 47–49. [Google Scholar] [CrossRef]

- Lăzăroiu, George, Luminuta Ionescu, Cristian Uţă, Iulian Hurloiu, Mihail Andronie, and Irina Dijmarescu. 2020. Environmentally responsible behavior and sustainability policy adoption in green public procurement. Sustainability 12: 2110. [Google Scholar] [CrossRef] [Green Version]

- Lin, Brenda, Monika Egerer, Jonathan Kingsley, Pauline Marsh, Lucy Diekmann, and Alessandro Ossola. 2021. COVID-19 gardening could herald a greener, healthier future. Frontiers in Ecology and the Environment 19: 491–93. [Google Scholar] [CrossRef]

- Liu, Yanhong, Jia Lei, and Yihua Zhang. 2021. A study on the sustainable relationship among the green finance, environment regulation and green-total-factor productivity in China. Sustainability 13: 11926. [Google Scholar] [CrossRef]

- Mach, Łukasz, Karina Bedrunka, Anna Kuczuk, and Marzena Szewczuk-Stępień. 2021. Effect of structural funds on housing market sustainability development—Correlation, regression and wavelet coherence analysis. Risks 9: 182. [Google Scholar] [CrossRef]

- Mensi, Walid, Muhammad Abubakr Naeem, Xuan Vinh Vo, and Sang Hoon Kang. 2022. Dynamic and frequency spillovers between green bonds, oil and G7 stock markets: Implications for risk management. Economic Analysis and Policy 73: 331–44. [Google Scholar] [CrossRef]

- Mezghani, Taicir, Mouna Boujelbène, and Mariam Elbayar. 2021. Impact of COVID-19 pandemic on risk transmission between googling investor’s sentiment, the Chinese stock and bond markets. China Finance Review International 11: 322–48. [Google Scholar] [CrossRef]

- Miralles-Quirós, Maria Mar, and Jose Luis Miralles-Quirós. 2021. Sustainable finance and the 2030 agenda: Investing to transform the world. Sustainability 13: 10505. [Google Scholar] [CrossRef]

- Morelli, Giacomo, and Lea Petrella. 2021. Option pricing, zero lower bound, and COVID-19. Risks 9: 167. [Google Scholar] [CrossRef]

- Nadanyiova, Margareta, Lubica Gajanova, and Lana Majerova. 2020. Green marketing as a part of the socially responsible brand’s communication from the aspect of generational stratification. Sustainability 12: 7118. [Google Scholar] [CrossRef]

- Nagy, Roel, Verena Hagspiel, and Peter Kort. 2021. Green capacity investment under subsidy withdrawal risk. Energy Economics 98: 105259. [Google Scholar] [CrossRef]

- Ngo, Quang-Thanh, Hoa Anh Tran, and Hai Thi Thanh Tran. 2021. The impact of green finance and COVID-19 on economic development: Capital formation and educational expenditure of ASEAN economies. China Finance Review International. [Google Scholar] [CrossRef]

- Pyka, Irena, and Aleksandra Nocoń. 2021. Responsible lending policy of green investments in the energy sector in Poland. Energies 14: 7298. [Google Scholar] [CrossRef]

- Rogulenko, Tatyana, Evgeniy V. Orlov, Oleg A. Smolyakov, Anna V. Bodiako, and Svetlana V. Ponomareva. 2021. Analytical Methods to Assess Financial Capacity in Face of Innovation Projects Risks. Risks 9: 171. [Google Scholar] [CrossRef]

- Ruiz, Juan Rafael. 2020. Green investments in the post COVID-19 world and debt sustainability: The cases of France, Italy and Spain. Revista de Economia Mundial 2020: 1–24. [Google Scholar] [CrossRef]

- Ruiz, Juan Rafael, and Patricia Stupariu. 2021. A green new deal and debt sustainability for the post COVID-19 world. International Review of Applied Economics 35: 288–307. [Google Scholar] [CrossRef]

- Shoshitaishvili, Boris. 2021. From Anthropocene to Noosphere: The Great Acceleration. Earth’s Future 9: e2020EF001917. [Google Scholar] [CrossRef]

- Sriyono, Sarwendah Biduri, and Bayu Proyogi. 2021. Acceleration of performance recovery and competitiveness through non-banking financing in SMEs based on green economy: Impact of COVID-19 pandemic. Journal of Innovation and Entrepreneurship 10: 27. [Google Scholar] [CrossRef] [PubMed]

- Streimikiene, Dalia, and Vitaliy Kaftan. 2021. Green finance and the economic threats during COVID-19 pandemic. Terra Economicus 19: 105–13. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, Fahrad, Naoyuki Yoshino, and Han Phoumin. 2021. Analyzing the characteristics of green bond markets to facilitate green finance in the post-COVID-19 world. Sustainability 13: 5719. [Google Scholar] [CrossRef]

- Tan, Luc Phan, Muhammad Sadiq, Talla Aldeehani, Syed Ehsanullah, Putri Mutira, and Hieu Minh Vu. 2021. How COVID-19 induced panic on stock price and green finance markets: Global economic recovery nexus from volatility dynamics. Environmental Science and Pollution Research, 1–14. [Google Scholar] [CrossRef]

- Trippel, Elia. 2020. How green is green enough? The changing landscape of financing a sustainable European economy. ERA Forum 21: 155–70. [Google Scholar] [CrossRef]

- Tsani, Stella, Elena Riza, Panagiota Tsiamagka, and Margarita Nassi. 2021. Public financing and management for a sustainable healthcare sector: Some lessons from the COVID-19 pandemic. World Sustainability Series, 233–54. [Google Scholar] [CrossRef]

- Tsao, Yu-Chung, Vo-Van Thanh, Yi-Ying Chang, and Hsi-Hsien Wei. 2021. COVID-19: Government subsidy models for sustainable energy supply with disruption risks. Renewable and Sustainable Energy Reviews 150: 111425. [Google Scholar] [CrossRef]

- Tu, Qiang, Jianlei Mo, Zhuoran Liu, Chunxu Gong, and Ying Fan. 2021. Using green finance to counteract the adverse effects of COVID-19 pandemic on renewable energy investment-The case of offshore wind power in China. Energy Policy 158: 112542. [Google Scholar] [CrossRef] [PubMed]

- UN. 2021. Sustainable Development Report 2021. Available online: https://dashboards.sdgindex.org/downloads (accessed on 17 November 2021).

- Valeri, Marco. 2021. Organizational Studies. Implications for the Strategic Management. Cham: Springer. [Google Scholar]

- Wang, Xiaoxia, Jiaoya Huang, Ziman Xiang, and Jialiang Huang. 2021. Nexus Between Green Finance, Energy Efficiency, and Carbon Emission: COVID-19 Implications From BRICS Countries. Frontiers in Energy Research 9: 786659. [Google Scholar] [CrossRef]

- Wang, Xinue, and Qing Wang. 2021. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resources Policy 74: 102436. [Google Scholar] [CrossRef]

- Yang, Wenke, Qianting Ma, Jianmin He, Shuai Lu, and Xi Chen. 2021. Can green innovation subsidies reduce the systemic risk of green innovative enterprises? A simulation study. Technology Analysis and Strategic Management, 1–17. [Google Scholar] [CrossRef]

- Zhao, Yang, Jin-Ping Lee, and Min-Teh Yu. 2021. Catastrophe risk, reinsurance and securitized risk-transfer solutions: A review. China Finance Review International 11: 449–73. [Google Scholar] [CrossRef]

| Research Question | Hypothesis | Research Task | Research Method | Control Indicator |

|---|---|---|---|---|

| RQ1: How is the green economy’s sustainability understood, how is it measured, and what is it at present? | H1: Sustainability of the green economy differs depending on regions of the world (varIS2020 > 10%) | Finding the current level of the green economy’s sustainability | Proprietary methodology | Worldwide mean IS2020 (indicator of the green economy’s sustainability) |

| Finding the differences in the green economy’s sustainability among regions of the world | Analysis of variance | varIS2020 | ||

| RQ2: What was the impact of the COVID-19 pandemic and financial and economic crisis on the green economy’s sustainability? | H2: The pandemic reduced the green economy’s sustainability (GT2020−GT2019 < 0 and/or GE2020−GE2019 < 0 and/or GI2020−GI2019 < 0) | Finding the change in the green economy’s sustainability in 2020 compared to 2019 | Horizontal analysis | Green trade GT); green employment (GE); green innovation (GI) |

| RQ3: How to reduce the negative impact of the COVID-19 pandemic and financial and economic crisis through financial risk management of the green economy’s sustainability? | H3: Growth of green investments allows reducing the financial risks of the green economy, raising its sustainability and reducing its differences among regions of the world (ISoptim-IS2020 > 0; varISoptim-varIS2020 < 0) | Finding the role of (private) green investments in financial risk management of the green economy | Regression analysis | Research model (1) |

| Discovering the potential of green economy sustainability and the reduction of its differences among regions of the world with the help of green investments | Least square method | ISoptim; varISoptim |

| Region of the World | Indicator | Green Investment | Green Trade | Green Employment | Green Innovation | ∑R2 |

|---|---|---|---|---|---|---|

| Africa | Correlation with the Sustainable Development Index, R2 | 0.33 | 0.33 | 0.31 | 0.32 | 1.29 |

| Weight coefficient, w | 0.25 | 0.25 | 0.24 | 0.25 | - | |

| Asia | Correlation with the Sustainable Development Index, R2 | 0.45 | 0.26 | 0.32 | 0.13 | 1.16 |

| Weight coefficient, w | 0.39 | 0.22 | 0.28 | 0.11 | - | |

| Europe | Correlation with the Sustainable Development Index, R2 | 0.59 | 0.10 | 0.63 | 0.54 | 1.85 |

| Weight coefficient, w | 0.32 | 0.05 | 0.34 | 0.29 | - | |

| The Americas | Correlation with the Sustainable Development Index, R2 | 0.71 | −0.11 | 0.47 | 0.52 | 1.71 |

| Weight coefficient, w | 0.42 | 0 | 0.28 | 0.31 | - | |

| Oceania | Correlation with the Sustainable Development Index, R2 | 0.73 | −0.23 | 0.67 | 0.54 | 1.95 |

| Weight coefficient, w | 0.38 | 0 | 0.35 | 0.28 | - |

| Region of the World | Arithmetic Means, Rmid | Standardized Values, nm | Weighted Sums, WS | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Green Innovation | Green Investment | Green Trade | Green Employment | Green Innovation | Green Investment | Green Trade | Green Employment | Green Innovation | Green Investment | Green Trade | Green Employment | |

| - | 2019 | |||||||||||

| Africa | 51.93 | 51.93 | 7.48 | 21.45 | 0.78 | 0.35 | 0.63 | 0.53 | 0.20 | 0.09 | 0.16 | 0.13 |

| The Americas | 68.01 | 68.01 | 18.90 | 36.76 | 1.02 | 0.89 | 1.09 | 1.22 | 0.43 | 0.00 | 0.30 | 0.38 |

| Asia | 71.13 | 71.13 | 16.05 | 32.07 | 1.07 | 0.75 | 0.95 | 0.59 | 0.42 | 0.17 | 0.27 | 0.06 |

| Europe | 69.83 | 69.83 | 35.06 | 54.16 | 1.05 | 1.64 | 1.60 | 1.90 | 0.34 | 0.08 | 0.54 | 0.55 |

| Oceania | 71.79 | 71.79 | 29.14 | 24.66 | 1.08 | 1.37 | 0.73 | 0.77 | 0.41 | 0.00 | 0.28 | 0.25 |

| Average, Gmid | 66.54 | 66.54 | 21.32 | 33.82 | - | - | - | - | - | - | - | - |

| - | 2020 | |||||||||||

| Africa | 56.31 | 56.31 | 6.37 | 23.19 | 0.86 | 0.46 | 0.64 | 0.76 | 0.21 | 0.12 | 0.16 | 0.19 |

| The Americas | 64.82 | 64.82 | 14.34 | 29.79 | 0.98 | 1.04 | 0.82 | 0.75 | 0.41 | 0.00 | 0.23 | 0.23 |

| Asia | 68.91 | 68.91 | 11.84 | 32.82 | 1.05 | 0.85 | 0.90 | 0.50 | 0.41 | 0.19 | 0.25 | 0.05 |

| Europe | 67.84 | 67.84 | 30.76 | 51.18 | 1.03 | 2.22 | 1.41 | 1.69 | 0.33 | 0.11 | 0.48 | 0.49 |

| Oceania | 71.23 | 71.23 | 5.92 | 44.48 | 1.08 | 0.43 | 1.23 | 1.32 | 0.41 | 0.00 | 0.48 | 0.42 |

| Average, Gmid | 65.82 | 65.82 | 13.85 | 36.29 | - | - | - | - | - | - | - | - |

| Regression Model | Regression Statistics | Africa | The Americas | Asia | Europe | Oceania |

|---|---|---|---|---|---|---|

| Model for Green trade | Correlation, % | 10.31 | 26.64 | 32.31 | 41.84 | 7.43 |

| Constant | 3.92 | 24.61 | 4.32 | 12.29 | 13.25 | |

| Coefficient of regression | 0.03 | −0.19 (Negative impact) | 0.14 | 0.32 | 0.06 | |

| Significance F | 0.3098 (Not reliable) | 0.0218 | 0.0012 | 7.5 × 10−0.5 | 0.7423 (not reliable) | |

| Model for Green employment | Correlation, % | 24.71 | 30.71 | 24.33 | 51.75 | 34.77 |

| Constant | 1.53 | 4.22 | 18.01 | 14.41 | 6.93 | |

| Coefficient of regression | 0.18 | 0.24 | 0.19 | 0.57 | 0.25 | |

| Significance F | 0.0137 | 0.0080 | 0.0163 | 4.6 × 10−0.7 | 0.1128 (not reliable) |

| Region of the World | Arithmetic Means, Rmid | Standardized Values, nm | Weighted Sums, WS | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Green Innovation | Green Investment | Green Trade | Green Employment | Green Innovation | Green Investment | Green Trade | Green Employment | Green Innovation | Green Trade | Green Employment | Green Innovation | |

| - | 2020 | |||||||||||

| Africa | 56.31 | 7.01 | 19.96 | 100.00 | 0.86 | 0.42 | 0.58 | 1.09 | 0.21 | 0.10 | 0.15 | 0.26 |

| The Americas | 64.82 | 20.15 | 24.61 | 100.00 | 0.98 | 1.20 | 0.72 | 1.09 | 0.41 | 0.47 | 0.16 | 0.31 |

| Asia | 68.91 | 14.62 | 41.49 | 100.00 | 1.05 | 0.87 | 1.21 | 1.09 | 0.41 | 0.28 | 0.06 | 0.37 |

| Europe | 67.84 | 29.30 | 47.53 | 58.15 | 1.03 | 1.75 | 1.39 | 0.63 | 0.33 | 0.74 | 0.00 | 0.18 |

| Oceania | 71.23 | 12.59 | 37.85 | 100.00 | 1.08 | 0.75 | 1.10 | 1.09 | 0.41 | 0.29 | 0.00 | 0.38 |

| On average, Gmid | 65.82 | 16.73 | 34.29 | 91.63 | - | - | - | - | - | - | - | - |

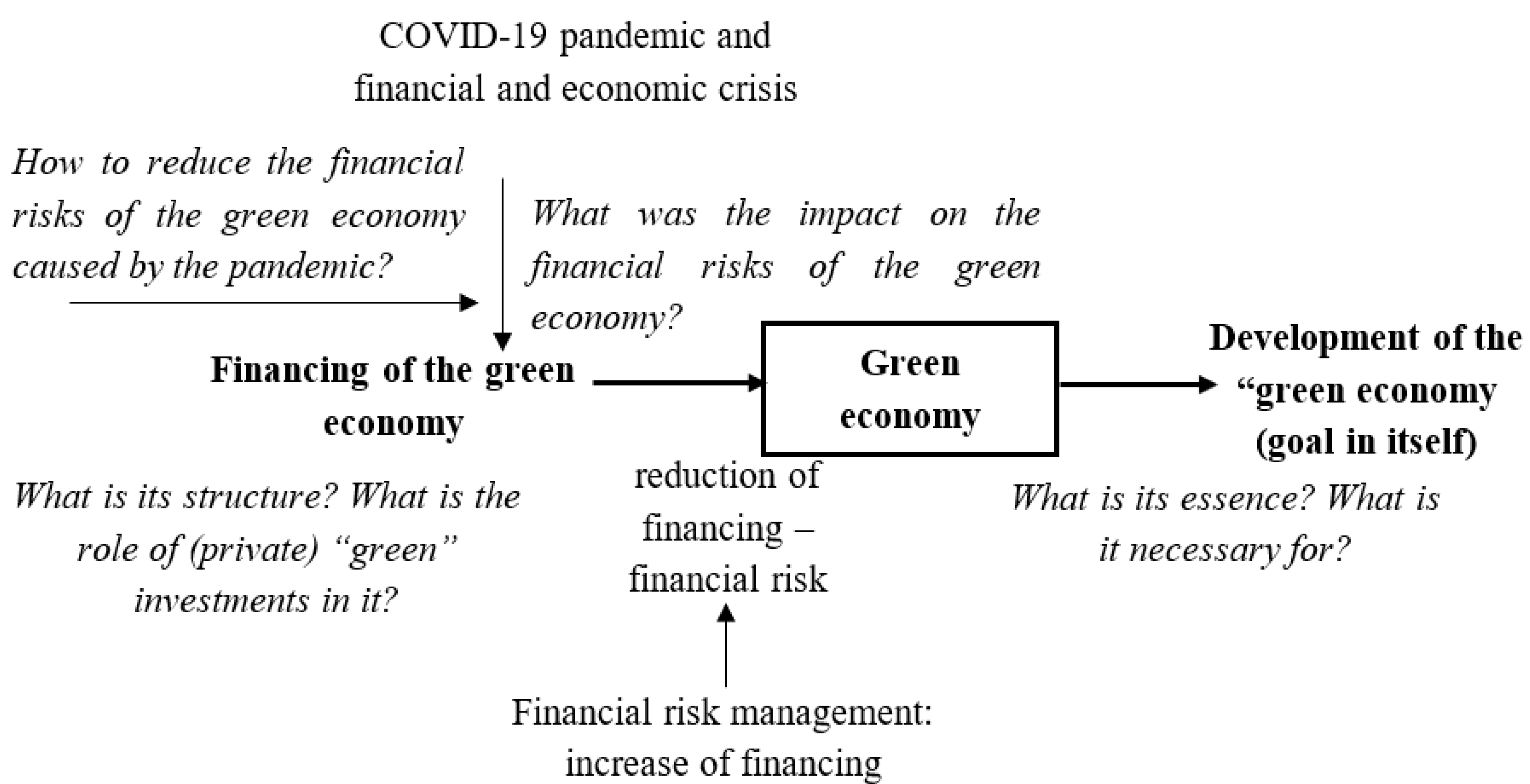

| The Paper’s Research Question | Gap in the Existing Literature (Figure 1) | The Result That Is Received in This Paper and Answers the Research Question and Fills the Gap in the Literature |

|---|---|---|

| What is the sustainability of the green economy? How can it be measured? What is its current level? | What does the development of the green economy consist in? What is it necessary for? | The development of the green economy is necessary for supporting sustainable development; it is treated as a contribution to sustainable development. A proprietary methodology is proposed for measuring the green economy’s sustainability. At present, the green economy’s sustainability is moderate at the global scale, but rather differentiated among regions of the world. |

| What was the impact of the COVID-19 pandemic and financial and economic crisis on the financial risks of the green economy’s sustainability? | What is the structure of financing of the green economy? What is the role of (private) green investments in it? | In the structure of the green economy financing, it is expedient to distinguish and differentiate government financing and (private) green investments which have the key role. |

| What was the impact of the COVID-19 pandemic and financial and economic crisis on the financial risks of the green economy? | The COVID-19 pandemic and financial and economic crisis has a contradictory impact on the financial risks of the green economy. On the one hand, there was a decline in government financing, which is noted in the literature. On the other hand, green investments did not reduce but grew, which allowed preserving green innovation at the pre-crisis level and even increasing it. | |

| How to reduce the negative impact of the COVID-19 pandemic and financial and economic crisis on the financial risks of the green economy’s sustainability? | How to reduce the financial risks of the green economy that are caused by the pandemic? | The financial risks to the green economy is the reduction of its contribution to sustainable development under the influence of the decrease in financing. The COVID-19 pandemic and crisis led to the reduction of green trade and green employment—as a result of the decrease in government financing (noted in the literature). Financial risk management of the green economy (amid the pandemic and crisis) is allowed by green investments, the increase in which could ensure also the increase in the global green economy’s sustainability and the reduction of its disproportions among regions of the world. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Osipov, V.S.; Krupnov, Y.A.; Semenova, G.N.; Tkacheva, M.V. Ecologically Responsible Entrepreneurship and Its Contribution to the Green Economy’s Sustainable Development: Financial Risk Management Prospects. Risks 2022, 10, 44. https://doi.org/10.3390/risks10020044

Osipov VS, Krupnov YA, Semenova GN, Tkacheva MV. Ecologically Responsible Entrepreneurship and Its Contribution to the Green Economy’s Sustainable Development: Financial Risk Management Prospects. Risks. 2022; 10(2):44. https://doi.org/10.3390/risks10020044

Chicago/Turabian StyleOsipov, Vladimir S., Yuriy A. Krupnov, Galina N. Semenova, and Maria V. Tkacheva. 2022. "Ecologically Responsible Entrepreneurship and Its Contribution to the Green Economy’s Sustainable Development: Financial Risk Management Prospects" Risks 10, no. 2: 44. https://doi.org/10.3390/risks10020044

APA StyleOsipov, V. S., Krupnov, Y. A., Semenova, G. N., & Tkacheva, M. V. (2022). Ecologically Responsible Entrepreneurship and Its Contribution to the Green Economy’s Sustainable Development: Financial Risk Management Prospects. Risks, 10(2), 44. https://doi.org/10.3390/risks10020044