From the Great Recession to the COVID-19 Pandemic: The Risk of Expansionary Monetary Policies

Abstract

:1. Introduction

2. Materials and Methods

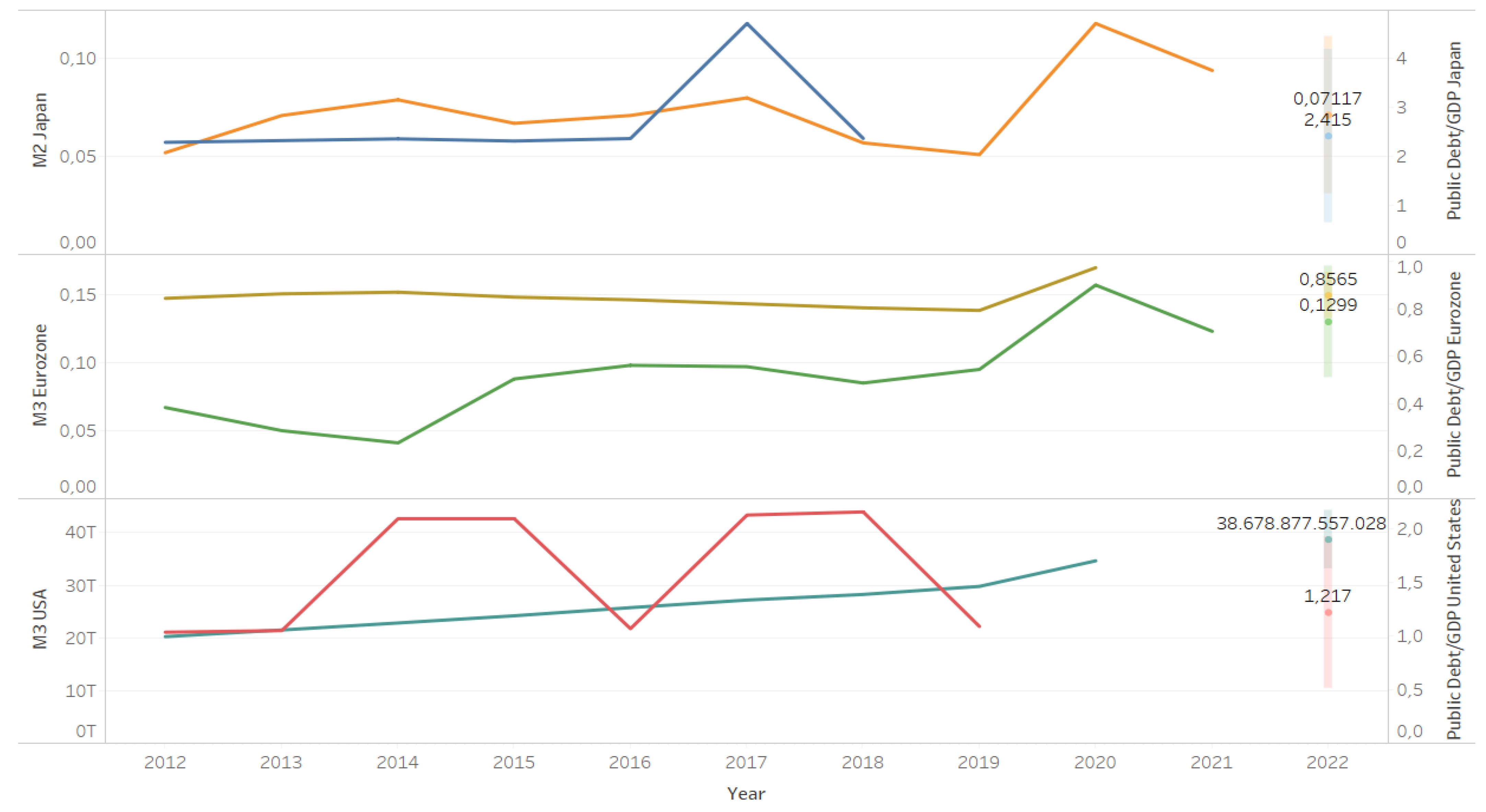

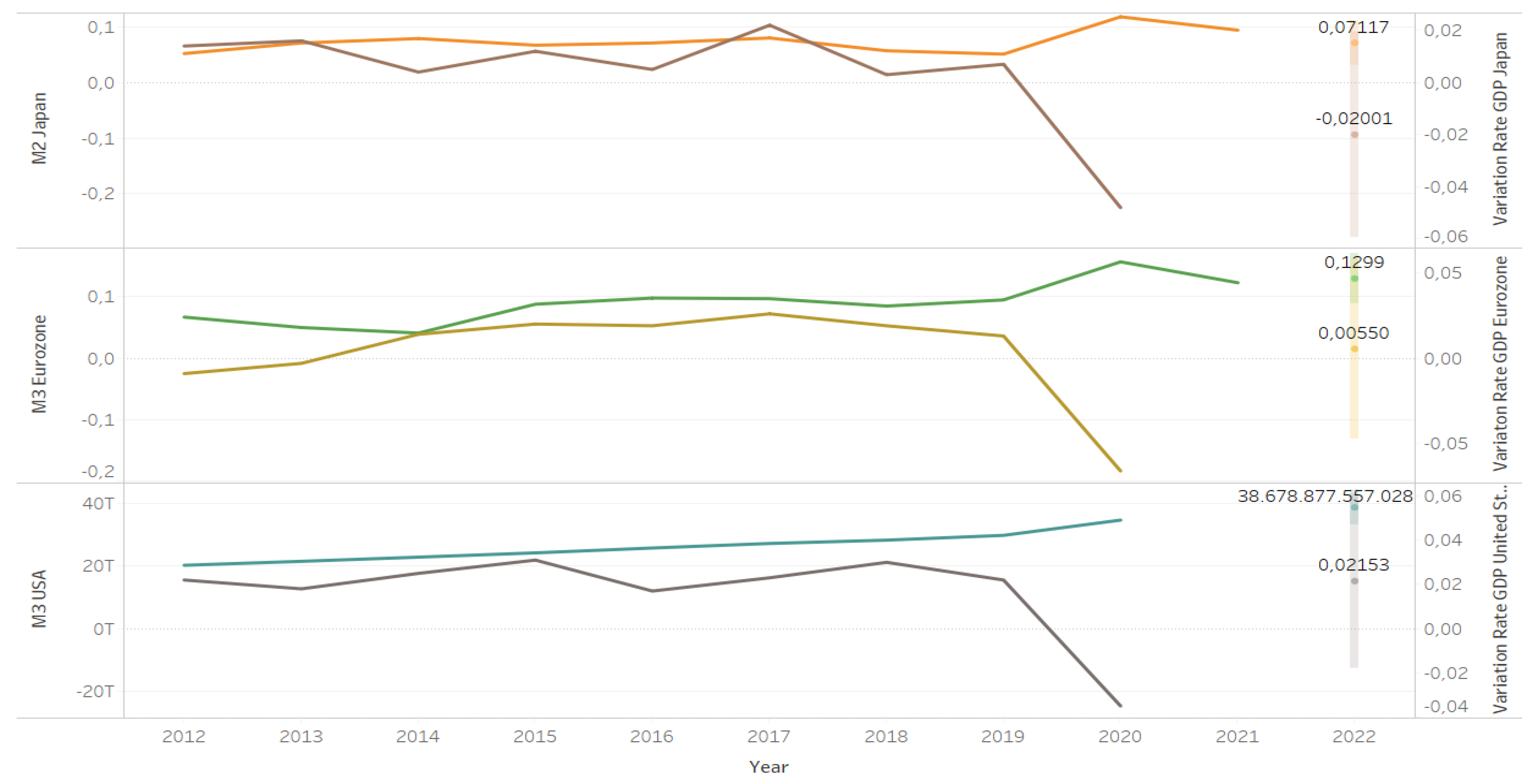

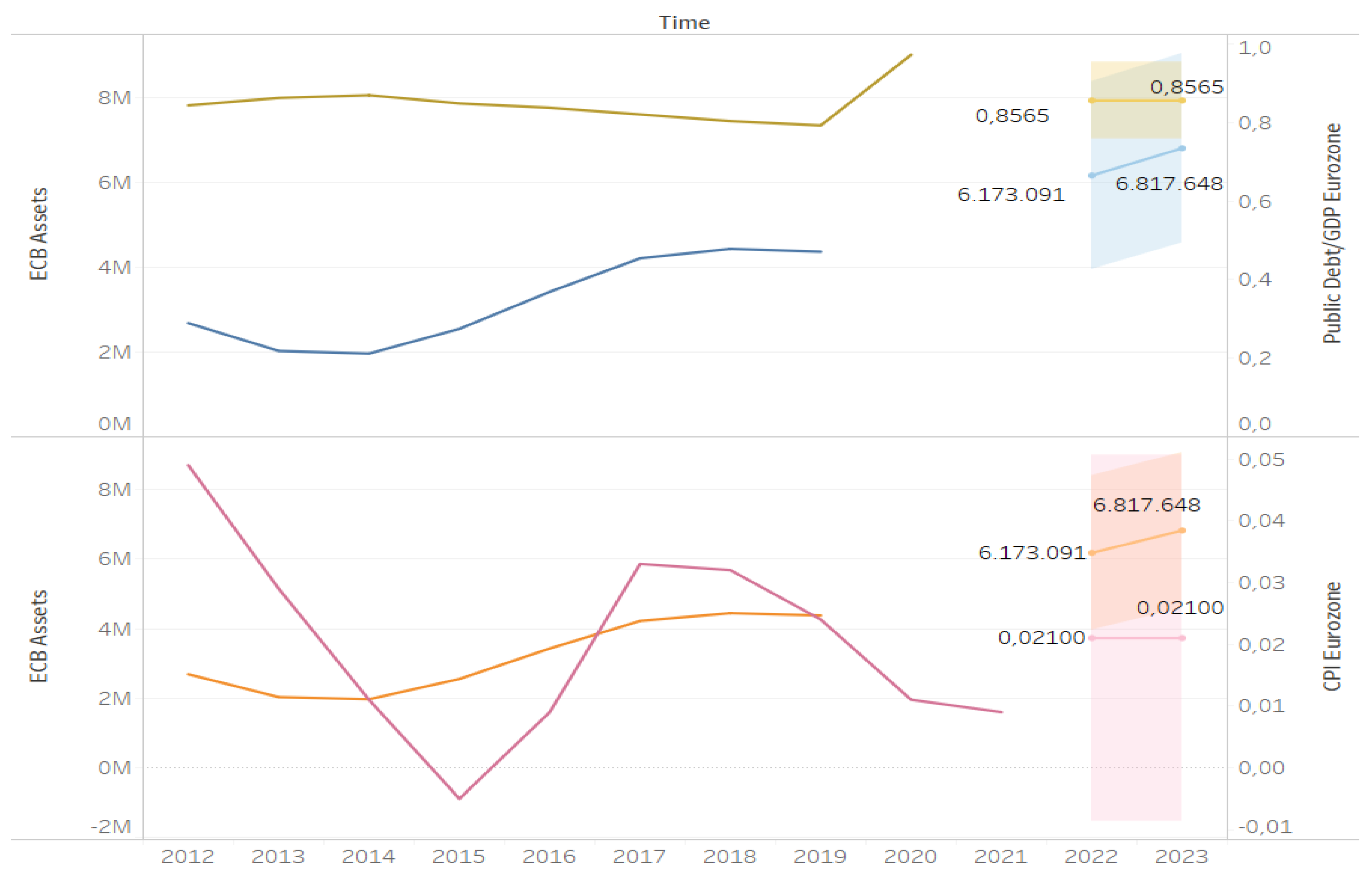

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Afonso, Antonio, and Jorge Silva. 2019. Efectos de la política monetaria de la zona del euro en los sectores institucionales: El caso de Portugal. Cuadernos De Economía 42: 120. [Google Scholar] [CrossRef]

- Ahmed, Haydory Akbar. 2019. Monetary base and federal government debt in the long-run: A non-linear analysis. Bulletin of Economic Research 72: 167–84. [Google Scholar] [CrossRef]

- Alonso Neira, Miguel Ángel, Philipp Bagus, and Juan Ramón Rallo Julián. 2010. La crisis subprime a la luz de la teoría austríaca del ciclo económico: Expansión crediticia, decision errors and moral hazard. Revista de Economía Mundial 28: 145–74. [Google Scholar]

- Alonso-Rivera, Angélica. 2019. Impact of monetary policy on financial markets efficiency under speculative bubbles: A non-normal and non-linear entropy-based approach. Análisis Económico 34: 157–78. [Google Scholar] [CrossRef]

- Ammous, Saifedean. 2018. The Bitcoin Standard: The Decentralized Alternative to Central Banking. Hoboken: John Wiley & Sons. [Google Scholar]

- Bagus, Philipp, and David Howden. 2009. The federal reserve and eurosystem’s balance sheet policies during the subprime crisis: A comparative analysis. Romanian Economic and Business Review 3: 165–85. [Google Scholar]

- Bagus, Philipp, and David Howden. 2015. Central bank insolvency: Causes, effects, and remedies. Journal of Social, Political and Economics Studies 39: 3–23. [Google Scholar]

- Bagus, Philipp, and Markus Schiml. 2010. A cardiograph of the dollar’s quality: Qualitative easing and the federal reserve balance sheet during the subprime crisis. Prague Economic Papers 19: 195–217. [Google Scholar] [CrossRef] [Green Version]

- Baranovskyi, O. I., M. O. Kuzheliev, D. M. Zherlitsyn, O. S. Sokyrko, and A. V. Nechyporenko. 2019. Econometric models of monetary policy effectiveness in Ukraine. Financial and Credit Activity: Problems of Theory and Practice 3: 226–35. [Google Scholar] [CrossRef] [Green Version]

- Barrdear, John, and Michael Kumhof. 2016. The Macroeconomics of Central Bank Issued Digital Currencies. SSRN Electronic Journal, 104148, in press. [Google Scholar] [CrossRef]

- Cachanosky, Nicolás. 2019. Does Bitcoin Have the Right Monetary Rule? SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Cai, Yue. 2019. Expansionary monetary policy and credit misallocation: Evidence from China. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Chen, Wei, Huilin Xu, Lifen Jia, and Ying Gao. 2021. Machine learning model for Bitcoin exchange rate prediction using economic and technology determinants. International Journal of Forecasting 37: 28–43. [Google Scholar] [CrossRef]

- Chevallier, Julien, Stéphane Goutte, David Guerreiro, Sophie Saglio, and Bilel Sanhaji, eds. 2019. Financial Mathematics, Volatility and Covariance Modelling: Volume 2. Milton Park: Routledge. [Google Scholar]

- Chohan, Usman. 2018. Cryptocurrencies as asset-backed instruments: The venezuelan petro. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- De Soto, Jesús Huerta. 2012. Money, Bank Credit, and Economic Cycles. Auburn: Ludwig von Mises Institute. [Google Scholar]

- ECB (European Central Bank). 2020. Report on a Digital Euro. Frankfurt: European Central Bank. [Google Scholar]

- Echarte Fernández, Miguel Ángel, Sergio Luis Náñez Alonso, Javier Jorge-Vázquez, and Ricardo Francisco Reier Forradellas. 2021. Central banks’ monetary policy in the face of the COVID-19 economic crisis: Monetary stimulus and the emergence of CBDCs. Sustainability 13: 4242. [Google Scholar] [CrossRef]

- Espinosa, Victor, Miguel Ángel. Alonso Neira, and Jesús Huerta de Soto. 2021. Principles of sustainable economic growth and development: A call to action in a post-COVID-19 world. Sustainability 13: 13126. [Google Scholar] [CrossRef]

- Fabris, Nikola. 2019. Cashless Society—The Future of Money or a Utopia? Journal of Central Banking Theory and Practice 8: 53–66. [Google Scholar] [CrossRef] [Green Version]

- Fidrmuc, Jarko, and Iikka Korhonen. 2016. Meta-Analysis of Chinese Business Cycle Correlation. Pacific Economic Review 23: 385–410. [Google Scholar] [CrossRef]

- Franses, Philip Hans. 2016. A note on the Mean Absolute Scaled Error. International Journal of Forecasting 32: 20–22. [Google Scholar] [CrossRef] [Green Version]

- Fukuda, Shin-Ichi. 2018. Impacts of Japan’s negative interest rate policy on Asian financial markets. Pacific Economic Review 23: 67–79. [Google Scholar] [CrossRef] [Green Version]

- Gokmenoglu, Korhan, and Abobaker Al Al Hadood. 2020. Impact of US unconventional monetary policy on dynamic stock-bond correlations: Portfolio rebalancing and signalling channel effects. Finance Research Letters 33: 101185. [Google Scholar] [CrossRef]

- Granger, Clive, and Paul Newbold. 2014. Forecasting Economic Time Series. Cambridge: Academic Press. [Google Scholar]

- Griffoli, Tommaso Mancini, Maria Soledad Martinez Peria, Itai Agur, Anil Ari, John Kiff, Adina Popescu, and Celine Rochon. 2018. Casting Light on Central Bank Digital Currencies. Washington, DC: International Monetary Fund. [Google Scholar]

- Guerello, Chiara. 2018. Conventional and unconventional monetary policy vs. households income distribution: An empirical analysis for the Euro Area. Journal of International Money and Finance 85: 187–214. [Google Scholar] [CrossRef]

- Guerini, Mattia, Francesco Lamperti, and Andrea Mazzocchetti. 2018. Unconventional Monetary Policy: Between the Past and Future of Monetary Economics. SSRN Electronic Journal 15: 122–31. [Google Scholar] [CrossRef] [Green Version]

- Hegerty, Scott. 2016. Inflation volatility, monetary policy, and exchange-rate regimes in central and eastern europe: Evidence from parametric and nonparametric analyses. Eastern European Economics 55: 70–90. [Google Scholar] [CrossRef]

- Hetzel, R. L. 2020. COVID-19 and the fed’s monetary policy. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Hossain, Akhand Akhtar. 2017. Monetary policy for maintaining low, stable inflation in Malaysia. The Journal of Developing Areas 51: 381–404. [Google Scholar] [CrossRef]

- Ito, Takatoshi, Kazumasa Iwata, Colin McKenzie, and Shujiro Urata. 2018. Did abenomics succeed?: Editors’ overview. Asian Economic Policy Review 13: 1–22. [Google Scholar] [CrossRef]

- Kaczmarek, Jaroslaw, Alonso Sergio Luis Náñez, Sokołowski Andrzej, Fijorek Kamil, and Denkowska Sabina. 2021. Financial threat profiles of industrial enterprises in Poland. Oeconomia Copernicana 12: 463–98. [Google Scholar] [CrossRef]

- Kawai, Masahiro, and Peter Morgan. 2013. Banking crises and “Japanization”: Origins and implications. SSRN Electronic Journal. [Google Scholar] [CrossRef] [Green Version]

- Keller, Gerald. 2014. Statistics for Management and Economics. Boston: Cengage Learning. [Google Scholar]

- Kenourgios, Dimitris, Emmanouela Drakonaki, and Dimitrios Dimitriou. 2019. ECB’s unconventional monetary policy and cross-financial-market correlation dynamics. The North American Journal of Economics and Finance 50: 101045. [Google Scholar] [CrossRef]

- Kim, Gi. 2020. Why is China going to issue CBDC (Central Bank Digital Currency)? The Journal of Internet Electronic Commerce Resarch 20: 161–77. [Google Scholar] [CrossRef]

- Lacalle, Daniel. 2020. Monetary and fiscal policies in the COVID-19 crisis. Will they work? Journal of Business Accounting and Finance Perspectives 2: 1. [Google Scholar] [CrossRef]

- Lakdawala, Ali Muhammad. 2016. The War is on “Currency War”: Its Impact on Commodities in 2016. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Lepetit, Antoine, and Cristina Fuentes-Albero. 2020. The limited power of monetary policy in a pandemic. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Liu, Yongxin, Hok Sum Fok, Robert Tenzer, Qiang Chen, and Xiuwan Chen. 2019. Akaike’s bayesian information criterion for the joint inversion of terrestrial water storage using GPS vertical displacements, GRACE and GLDAS in southwest china. Entropy 21: 664. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lopez, Luciano, and Sylvain Weber. 2017. Testing for granger causality in panel data. The Stata Journal: Promoting Communications on Statistics and Stata 17: 972–84. [Google Scholar] [CrossRef] [Green Version]

- Mayer, Thomas. 2019. A Digital Euro to Compete With Libra. The Economists’ Voice 16. [Google Scholar] [CrossRef]

- Momirovic, Dragan. 2014. Non-standard monetary policy of the ECB: Macroeconomic effects and exit strategy. Bankarstvo 43: 58–85. [Google Scholar] [CrossRef] [Green Version]

- Murota, Ryu-ichiro. 2019. Negative interest rate policy in a permanent liquidity trap. SSRN Electronic Journal. [Google Scholar] [CrossRef] [Green Version]

- Náñez Alonso, Sergio Luis. 2019. Activities and operations with cryptocurrencies and their taxation implications: The spanish case. Laws 8: 16. [Google Scholar] [CrossRef] [Green Version]

- Náñez Alonso, Sergio Luis, Miguel Ángel Echarte Fernández, David Sanz Bas, and Jarosław Kaczmarek. 2020a. Reasons Fostering or Discouraging the Implementation of Central Bank-Backed Digital Currency: A Review. Economies 8: 41. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vazquez, and Ricardo Francisco Reier Forradellas. 2020b. Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain). Sustainability 12: 7480. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vázquez, Miguel Ángel Echarte Fernández, and Ricardo Francisco Reier Forradellas. 2021a. Cryptocurrency mining from an economic and environmental perspective. Analysis of the most and least sustainable countries. Energies 14: 4254. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vazquez, and Ricardo Francisco Reier Forradellas. 2021b. Central banks digital currency: Detection of optimal countries for the implementation of a CBDC and the implication for payment industry open innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 72. [Google Scholar] [CrossRef]

- Nidhiprabha, Bhanupong. 2016. Impacts of quantitative monetary easing policy in the united states and japan on the thai economy. The Developing Economies 54: 80–102. [Google Scholar] [CrossRef]

- Nosratabadi, Saeed, Amirhosein Mosavi, Puhong Duan, Pedram Ghamisi, Ferdinand Filip, Shahab S. Band, Uwe Reuter, Joao Gama, and Amir H. Gandomi. 2020. Data science in economics: Comprehensive review of advanced machine learning and deep learning methods. Mathematics 8: 1799. [Google Scholar] [CrossRef]

- Obinabo, Chinyere Rose. 2017. Cashless economic policy: An analysis of financial intermediation in the pre and post cashless policy periods. Journal of Policy and Development Studies 11: 1–12. [Google Scholar] [CrossRef]

- Ojo D Delaney, M. 2020. Monetary and economic policy impacts of the COVID-19 pandemic in the United Kingdom. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Okano, Eiji, and Masataka Eguchi. 2020. The importance of default risk awareness in conducting monetary and fiscal policies. Eurasian Economic Review 10: 361–92. [Google Scholar] [CrossRef]

- Ortiz Zarco, Ruth, and Ignacio Perrotini Hernández. 2019. Asimetría y convergencia en política monetaria entre Canadá, Estados Unidos y México. Economía: Teoría Y Práctica, 105–33. [Google Scholar] [CrossRef]

- Parella, Jordi Franch. 2018. Unconventional expansionary monetary policies. An economic analysis of quantitative easing. Journal of Business & Economic Policy 5: 22–28. [Google Scholar] [CrossRef]

- Parra Barrios, Alberto. 2019. Impacto de las decisiones de política monetaria de la FED en indicadores de la economía colombiana durante el período de 2007 a 2015. Revista Finanzas Y Política Económica 11: 149–82. [Google Scholar] [CrossRef]

- Perović, Malesevic Lena. 2015. Investigating croatian inflation through the cointegration with structural break approach. Journal of Economic and Social Studies 5: 221–34. [Google Scholar] [CrossRef] [Green Version]

- Reier Forradellas, Ricardo Francisco, Sergio Luis Náñez Alonso, Javier Jorge-Vazquez, and Marcela Laura Rodriguez. 2021. Applied machine learning in Social Sciences: Neural network and crime prediction. Social Sciences 10: 4. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 2017. Monetary policy in a low interest rate world. Journal of Policy Modeling 39: 673–79. [Google Scholar] [CrossRef]

- Rutter, Harry, Miranda Wolpert, and Trisha Greenhalgh. 2020. Managing uncertainty in the COVID-19 era. BMJ 2020: m3349. [Google Scholar] [CrossRef]

- Sambira, Jocelyne. 2014. Hunting for eurobonds. Africa Renewal 28: 30–32. [Google Scholar] [CrossRef]

- Sampieri, Roberto Hernández. 2018. Metodología de la Investigación: Las Rutas Cuantitativa, Cualitativa Y Mixta. New York: McGraw Hill. [Google Scholar]

- Sanz Bas, David. 2020. Hayek and the cryptocurrency revolution. Iberian Journal of the History of Economic Thought 7: 15–28. [Google Scholar] [CrossRef]

- Sanz Bas, David, Carlos del Rosal, Sergio Luis Náñez Alonso, and Miguel Ángel Echarte Fernández. 2021. Cryptocurrencies and fraudulent transactions: Risks, practices, and legislation for their prevention in Europe and Spain. Laws 10: 57. [Google Scholar] [CrossRef]

- Solís, Mireya, and Shujiro Urata. 2018. Abenomics and japan’s trade policy in a new era. Asian Economic Policy Review 13: 106–23. [Google Scholar] [CrossRef]

- Suárez, Ibujés, and Mario Orlando. 2011. Coeficiente De Correlación De Karl Pearson. December 9. From Repositorio Digital Universidad Técnica del Norte Website. Available online: http://repositorio.utn.edu.ec/handle/123456789/766 (accessed on 24 January 2021).

- Suárez, Ibujés, and Mario Orlando. 2018. Probabilidades Y Estadística Empleando Las TIC. June 13. From Repositorio Digital Universidad Técnica del Norte Website. Available online: http://repositorio.utn.edu.ec/handle/123456789/8698 (accessed on 24 January 2021).

- Switzer, Lorne Nelson, and Alan Picard. 2016. Stock market liquidity and economic cycles: A non-linear approach. Economic Modelling 57: 106–19. [Google Scholar] [CrossRef]

- Tercero-Lucas, David. 2021. Nonstandard monetary policies and bank profitability: The case of Spain. International Journal of Finance & Economics. [Google Scholar] [CrossRef]

- Wang, Olivier. 2018. Banks, low interest rates, and monetary policy transmission. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Wang, William, and Antonio Vegas García. 2020. Business cycle and stability of China’s financial and monetary system. Revista Procesos de Mercado 14: 123–71. [Google Scholar] [CrossRef]

- Wang, William Hongsong, Vicente Moreno-Casas, and Jesús Huerta de Soto. 2021. A free-market environmentalist transition toward renewable energy: The cases of Germany, Denmark, and the United Kingdom. Energies 14: 4659. [Google Scholar] [CrossRef]

- Xing, Yuqing. 2020. Japan’s Practice of Modern Monetary Theory amid the Pandemic Recession. East Asian Policy 12: 47–56. [Google Scholar] [CrossRef]

| N | Minimum | Maximum | Average | Deviation | Asymmetry | Kurtosis | |||

|---|---|---|---|---|---|---|---|---|---|

| Statistician | Statistician | Statistician | Statistician | Statistician | Statistician | Dev. Error | Statistician | Dev. Error | |

| Time | 19 | 01-FEB-12 | 01-FEB-21 | 28-SEP-16 | 1029 13:09:42,187 | −0.020 | 0.524 | −1.188 | 1.014 |

| M3 Eurozone (%) | 19 | 1.00% | 12.30% | 4.7421% | 2.66215% | 1.712 | 0.524 | 3.684 | 1.014 |

| M3 Fed USD (billion USD) | 18 | 97731 | 19188 | 13014 | 2296 | 0.994 | 0.536 | 1.668 | 1.038 |

| M2 Japan | 19 | 0.021 | 0.094 | 0.03895 | 0.020024 | 2.231 | 0.524 | 4.546 | 1.014 |

| Public Debt/GDP US | 12 | 1.0332 | 1.0868 | 1.058450 | 0.0171112 | 0.519 | 0.637 | −0.678 | 1.232 |

| Public Debt/GDP Japan | 8 | 2.2868 | 2.3657 | 2.340050 | 0.0294747 | −0.910 | 0.752 | −0.388 | 1.481 |

| Public Debt/GDP Eurozone | 9 | 0.7930 | 0.9730 | 0.850556 | 0.0525383 | 1.690 | 0.717 | 3.915 | 1.400 |

| CPI Eurozone (%) | 19 | −0.60% | 2.70% | 1.0632% | 0.87000% | −0.114 | 0.524 | −0.435 | 1.014 |

| CPI US (%) | 19 | −0.70% | 0.40% | 0.0474% | 0.26113% | −1.379 | 0.524 | 2.459 | 1.014 |

| CPI Japan (%) | 19 | −1.20% | 2.40% | 0.5421% | 0.96108% | 0.178 | 0.524 | −0.114 | 1.014 |

| M.C Dow Jones | 19 | 181,327 | 3,152,275 | 1,787,339.26 | 894,812.076 | −0.448 | 0.524 | −0.316 | 1.014 |

| M. C Nikkei 225 | 19 | 9723.24 | 28,966.01 | 18,936.6037 | 5156.12085 | −0.036 | 0.524 | −0.046 | 1.014 |

| M. C Eurostoxx50 | 19 | 2523.69 | 3800.00 | 3227.8389 | 377.86144 | −0.340 | 0.524 | −0.592 | 1.014 |

| Annual GDP Variation Rate US | 9 | −3.50% | 3.10% | 1.7000% | 2.00624% | −2.681 | 0.717 | 7.639 | 1.400 |

| Annual GDP Variation Rate Japan | 9 | −4.80% | 2.20% | 0.3889% | 2.04539% | −2.449 | 0.717 | 6.743 | 1.400 |

| Annual GDP Variation Rate Eurozone | 9 | −0.06600 | 0.02600 | 0.0036667 | 0.02847806 | −2.198 | 0.717 | 5.216 | 1.400 |

| Correlation M2-M3 with Public Debt | |||||||

|---|---|---|---|---|---|---|---|

| Correl. Pearson | Public Debt/GDP US | Public Debt/GDP Eurozone | Public Debt/GDP Japan | Rho Spearman | Public Debt/GDP US | Public Debt/GDP Eurozone | Public Debt/GDP Japan |

| M3 Eurozone | 0.691 | M3 Eurozone | −0.100 | ||||

| M3 Fed USD | 0.915 | M3 Fed USD | 0.887 | ||||

| M2 Japan | 0.345 | M2 Japan | 0.211 | ||||

| Correlation M2-M3 with CPI | |||||||

| Correl. Pearson | CPI US | CPI Eurozone | CPI Japan | Rho Spearman | CPI US | CPI Eurozone | CPI Japan |

| M3 Eurozone | −0.271 | M3 Eurozone | −0.219 | ||||

| M3 Fed USD | 0.314 | M3 Fed USD | 0.358 | ||||

| M2 Japan | −0.42 | M2 Japan | 0.101 | ||||

| Correlation M2-M3 with Variation Rate GDP | |||||||

| Correl. Pearson | V. R GDP US | V.R GDP Eurozone | V.R GDPJapan | Rho Spearman | V. R GDP US | V.R GDP Eurozone | V.R GDP Japan |

| M3 Eurozone | −0.675 | M3 Eurozone | 0.021 | ||||

| M3 Fed USD | −0.754 | M3 Fed USD | −0.176 | ||||

| M2 Japan | −0.84 | M2 Japan | 0 | ||||

| Correlation M2-M3 with Selected Stock Index | |||||||

| Correl. Pearson | Dow Jones | Nikkei 225 | Eurostoxx50 | Rho Spearman | Dow Jones | Nikkei 225 | Eurostoxx50 |

| M3 Eurozone | 0.486 | M3 Eurozone | 0.652 | ||||

| M3 Fed USD | 0.552 | M3 Fed USD | 0.688 | ||||

| M2 Japan | 0.622 | M2 Japan | 0.28 | ||||

| Correl. Pearson | Public Debt/GDP US | Public Debt/GDP Eurozone | CPI Eurozone | CPI US |

|---|---|---|---|---|

| Fed Assets | 0.799 | 0.31 | ||

| ECB Assets | −0.948 | 0.453 | ||

| Rho Spearman | Public Debt/GDP US | Public Debt/GDP Eurozone | CPI Eurozone | CPI US |

| Fed Assets | 0.337 | −0.06 | ||

| ECB Assets | −0.970 | 0.595 |

| Sum of Public Debt/GDP Eurozone | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.360 | 0.293 | 1.23 | 19.2% | −4 |

| Sum of Public Debt/GDP US | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | Additive | 0.36 | 0.293 | 1.23 | 19.20% | −4 |

| Sum of Public Debt/GDP Japan | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.903 | 0.367 | 0.45 | 8.30% | 5 |

| Sum of M2 Japan | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.02052 | 0.01524 | 0.8 | 19.50% | −72 |

| Sum of M3 Eurozone | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | Additive | None | 0.0209 | 0.0149 | 0.66 | 22.00% | −67 |

| Sum of M3 Fed USD | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Multiplicative | Multiplicative | None | 1.817.147.305.476 | 1.289.046.256.037 | 0.72 | 5.20% | 518 |

| Sum of CPI US | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.00449 | 0.00343 | 0.84 | 72.90% | −102 |

| Sum of CP Eurozone | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.01512 | 0.0132 | 1.02 | 113.60% | −78 |

| Sum of CPI Japan | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.01503 | 0.01319 | 0.97 | 341.20% | −78 |

| Sum of V. R GDP Eurozone | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.02691 | 0.01917 | 1.19 | 107.2% | −59 |

| Sum of V. R. GDP US | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.02015 | 0.01016 | 0.75 | 34.80% | −64 |

| Sum of V.R. GDP Japan | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 0.02012 | 0.01206 | 0.78 | 115.40% | −64 |

| Sum of M. C Euro Stoxx 50 | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 1.024 | 818 | 0.93 | 15.4% | 145 |

| Sum of M. C Dow Jones | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 10.675 | 9.348 | 1.05 | 28.50% | 192 |

| Sum of M. C Nikkei 225 | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 7.855 | 6.754 | 1.14 | 21.10% | 185 |

| Sum of ECB Assets | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Multiplicative | Multiplicative | None | 553.443 | 472.974 | 1.02 | 18.40% | 222 |

| Sum of Fed Assets | |||||||

| Model | Quality Metrics | ||||||

| Level | Trend | Season | RMSE | MAE | MASE | MAPE | AIC |

| Additive | None | None | 1.210.185 | 796.204 | 1.09 | 16.20% | 230 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Echarte Fernández, M.Á.; Náñez Alonso, S.L.; Reier Forradellas, R.; Jorge-Vázquez, J. From the Great Recession to the COVID-19 Pandemic: The Risk of Expansionary Monetary Policies. Risks 2022, 10, 23. https://doi.org/10.3390/risks10020023

Echarte Fernández MÁ, Náñez Alonso SL, Reier Forradellas R, Jorge-Vázquez J. From the Great Recession to the COVID-19 Pandemic: The Risk of Expansionary Monetary Policies. Risks. 2022; 10(2):23. https://doi.org/10.3390/risks10020023

Chicago/Turabian StyleEcharte Fernández, Miguel Ángel, Sergio Luis Náñez Alonso, Ricardo Reier Forradellas, and Javier Jorge-Vázquez. 2022. "From the Great Recession to the COVID-19 Pandemic: The Risk of Expansionary Monetary Policies" Risks 10, no. 2: 23. https://doi.org/10.3390/risks10020023

APA StyleEcharte Fernández, M. Á., Náñez Alonso, S. L., Reier Forradellas, R., & Jorge-Vázquez, J. (2022). From the Great Recession to the COVID-19 Pandemic: The Risk of Expansionary Monetary Policies. Risks, 10(2), 23. https://doi.org/10.3390/risks10020023