Abstract

Fintech allows investors to explore previously unavailable investment opportunities; it provides new return opportunities while also introducing new risks. The aim of this study is to investigate the relationship between risk and return in the fintech industry in the Indian stock market. This article is based on market-based research that focuses on demonstrating the volatility in the fintech market’s prices and demystifying the opportunities. Secondary data were collected from the Bombay Stock Exchange’s official fintech industry website from January 2017 to July 2022 to determine whether there is any dynamic link between risk and return in the Indian fintech market. The variance-based Mean-GARCH (GARCH-M) model was used to determine whether there is a dynamic link between risk and return in the Indian fintech market. The findings emphasize the importance of taking the risk of investing in India’s fintech industry. The implications for stock investors’ and fund managers’ portfolio composition and holding periods of equities or market exposure are significant. Finally, depending on their investment horizons, the Indian fintech industry may yield significant profits for risk-taking individuals.

1. Introduction

Globally, India is acknowledged as a strong fintech hub, and as the Indian entrepreneurial landscape develops further, more businesses driven by fintech use cases will be created and supported by more investors (EY 2022). India has the highest rate of adoption of financial technologies (David et al. 2022). The skyrocketing Indian fintech market is appealing to investors, but is the risk worth it? Fintech unicorns went public around the world in 2020–2021, with high returns; a similar process is taking place in India. However, the recent drop in the value of the fintech stock market makes investors nervous. This article formulates intuition regarding volatility in the Indian fintech market, and the conclusion drawn from the analysis will be useful for both individual and institutional investors. The adoption of financial technology, or fintech, is increasing in developing nations (Hinson et al. 2019). Numerous new platforms have emerged (Lee et al. 2015), and there has been a rise in investment activity (Arslanian and Fischer 2019). The fast expansion of the fintech business has prompted a flurry of activity on the part of governments and regulators worldwide as they attempt to catch up by creating supportive ecosystems for the sector (Wonglimpiyarat 2018). Looking at this swiftness of adoption and popularization of the fintech industry, this sector is seizing the attention of investors (Chishti and Barberis 2016).

Fintech is a new and rapidly evolving phenomenon with only partially settled regulation. Moreover, the pandemic has also triggered the application of fintech in economic transactions (Al Nawayseh 2020). How should investors approach the market? Can it be analyzed using traditional investment theories, or does it require a new one? Until recently, the majority of fintech capital was private, but that is changing as more fintechs go public. This means that fintechs will be accessible to a broader range of investors.

The aim of the study is to investigate the relationship between risk and return in the fintech industry in the Indian stock market. To the best of our knowledge, this is the first attempt to determine whether investing with high risk in the stock market’s fintech sector increases the likelihood of a high return.

This article is based on market-based research that focuses on demonstrating the volatility in the fintech market’s prices and demystifying the opportunities. Secondary data were collected from the Bombay Stock Exchange’s official website from January 2017 to July 2022 to determine whether there is any dynamic link between risk and return in the Indian fintech market. The database of Bombay stock is reliable to use to draw conclusions as many researchers frame their data framework through its official records (e.g., Khan et al. 2022; Singh et al. 2021; Al-Homaidi et al. 2021; Elangovan et al. 2021; Kumar and Robiyanto 2021). The variance-based Mean-GARCH (GARCH-M) model was used to determine whether there is a dynamic link between risk and return in the Indian fintech market.

2. Literature Review

The origins of financial technology may be traced back to the nineteenth century and earlier. PENTELEGRAPH was invented in 1860 as a signature verification instrument for financial institutions. The first verifiable instances of financial technology are dated to 1866. In this year, the transatlantic cables were installed, ushering in a new era of global network construction and connectivity. The automatic teller machine (ATM) created by Barclay’s in 1967 is widely regarded as the starting point for the modern era of financial technology. In 1967, Telex took over from Telegraph as the de facto international information transmission method, ushering in a new age of seamless global communication and business dealings. The advent of Bitcoin, the first cryptocurrency, in 2009 and peer-to-peer (P2P) payment systems in 2011 were two such landmark developments. Since then, the Western world has produced hundreds of new “unicorns,” or groundbreaking innovations. Numerous industries, including BaaS, RegTech, Digital Lending, InsurTech, Wallets, and many more, are expanding and innovating every day. China and India, two of the world’s most populous nations, have seen rapid and erratic growth in the financial technology sector since 2014 (Agrawal 2021).

Nayer, interested in how conventional financial technology like the chit fund may coexist with newer forms of FinTech like blockchain, wrote the first article to be published on the subject (Nayer 1986). Publications on FinTech have not developed significantly, and for a while, none existed until the term’s meteoric rise to prominence in 2015. From that point on, the annual rate of publishing skyrocketed (Ahmi et al. 2020).

Since the 2008 worldwide economic and financial crisis, the fintech business has expanded rapidly (Morales et al. 2022). Fintech can serve today’s evolving smart cities by catering to the increasing financial needs of the urban population (Popova 2021). Global health crises, including the spread of COVID-19, have had far-reaching effects on the global economy, hastening the development of fintech (Vasenska et al. 2021).

The fast progress of IT has far-reaching implications for the modern corporate environment (Varma et al. 2022). As a result of technological advancements, the financial sector has incorporated information and financial technology into financial technology (fintech) (Rupeika-Apoga and Thalassinos 2020). Changes in the financial services industry are slower than those in fintech (Alam et al. 2022). Fintech offers innovative viewpoints on financial services and examples of its use. The use of fintech will enable companies to stay competitive because of the advantages it offers in terms of speed and adaptability (Rupeika-Apoga and Wendt 2022). So many other companies are now offering similar financial technology services, and competition has heated up (Feyen et al. 2021). Many fintech startups are being pushed to excel at customer service. People will use the fintech company’s services more if the company pays attention to and analyzes people’s actions and attitudes (Zalan and Toufaily 2017). Customers need to feel safe and confident in the companies they interact with (Kaur et al. 2021). Researchers are interested in this because they believe it is critical to know if the company’s fintech services are being used for other reasons. Using the Theory of Technology Acceptance Model (TAM), the researcher investigates how trust and perceived risk influence users’ actions (Al-Emadi et al. 2021).

One of fintech’s extrinsic incentives is the need for ease of use, because of the industry’s emphasis on mobility and instantaneous availability (Laidroo et al. 2021; Ionescu 2020). The biggest reason why people prefer using online and mobile services is that they are more convenient in terms of time and location (Laidroo et al. 2021). Mobile devices allow users to achieve previously unattainable ease and efficacy in managing their finances, all without having to physically visit a bank (Tanda and Schena 2019).

Research shows that when compared to MSGARCHst and GARCHst, MSGARCH-MLPst provides superior prediction performance across the board. Because of this, COVID-19 had a large impact on the returns of precious metals and oil prices, and the two sets of returns exhibited both co-movement and contagion behavior (Bildirici 2022). Additionally, a study presented a novel pre-processing to SDICA using multiwavelet based on multivariate GARCH modeling (M-GARCH) with time-varying temporal structure of sub-bands of mixed sources with restricted independence of sub-bands. Through this approach, researchers are able to get rid of the temporal structural impacts of sources. The suggested approach is compared to a single sub-band ICA technique through the M-GARCH model (Fouladi and Amindavar 2012). A study conducted in Malaysia through the GARCH model strongly suggests that opportunities for effective portfolio diversification between the sample markets exist primarily for short holding periods; for investment horizons where investor stock holding periods exceed one year, the markets appear to be mostly highly correlated, yielding minimal portfolio diversification benefits. Overall, the findings provide essential insight into the importance of variability in investment perspectives and have substantial implications for portfolio diversification approaches (Najeeb et al. 2015).

Numerous studies have been conducted on the dynamics of asset covariance, with the majority focusing on univariate volatilities rather than covariances or correlations (Wei et al. 2022; Panda and Nanda 2018; Bollerslev and Engle 1993; Engle 2002). A large number of parameters is a significant issue in the multivariate GARCH (MGARCH) literature (Wei et al. 2022; Panda and Nanda 2018). The tricky situation can be simplified by maintaining steady correlations and proposing a model based on continuous conditional correlations (CCC). According to Bollerslev and Engle (1993), this is the way to go about it. Afterwards, Engle (2002) suggested a new set of models that let the correlations fluctuate over time while retaining the simplicity of estimation of Bollerslev’s constant correlation model. A GARCH-like structure, which Engle incorporates into the CCC model, allows for a more constrained correlation dynamic. All the dynamics, however, are confined to being uniform across all the correlations (Aielli 2013).

Both established and developing economies are prone to exhibit correlated short-term behavior (Cardenas and Carpenter 2008). Using vector autoregression (VAR) models, Janakiramanan and Lamba (1998) and Cha and Cheung (1998) investigated the connections between equity markets in Asia and the United States and found that the latter had a considerable impact on the markets studied. In order to investigate the extent of financial integration across North American stock markets, Beaulieu, Gagnon, and Khalaf used an arbitrage pricing theory framework to analyze data from 1984–2003. The research found that domestic portfolios and inter-listed equities are only moderately integrated rather than strongly integrated (Beaulieu et al. 2009). Using a global diversification framework Srivastava et al. (2015) examined the interplay between the United States’ developed market and Asia’s developing stock markets before and after the global financial crisis. The research shows that Indian stock markets are highly integrated over the long run but not with global markets over the short term. There is substantial evidence that markets show consistent tendencies over the long run concerning the mean and volatility spillover. Many researchers have tried to find evidence of a long-run equilibrium state, e.g., (Chen and Kim 2006; Sotiropoulou et al. 2009; Chen et al. 2002). Chen et al. (2002) studied stock markets in Latin America and looked at the dynamic interconnectedness of those markets. Sotiropoulou et al. (2009) conducted a similar study, but this time for four Latin American stock markets over a period of several years. This study employed cointegration analysis and the error correction vector autoregressive model; the findings indicate that investing across Latin American markets is unlikely to provide significant risk diversification.

The analyses of Berdjane and Pergamenshchikov (2016), Cheng (2020), Chen and Kim (2006), Da Fonseca and Xu (2019) ignore the relationship in terms of volatility across markets. It has been proposed that if two markets are interconnected, a sudden and unexpected event in one market will affect the returns and variation in the other markets. Volatility analysis may be useful because it offers a different perspective on asset risk. Scheicher (2001) applied a multivariate GARCH model with a constant conditional correlation to the returns and volatility of national stock indexes. He concluded that developing stock markets are connected with the global market. However, the assumption of a fixed conditional correlation is impractical. It has been established via several investigations that the associations shift throughout time.

3. Methodology

3.1. Sample

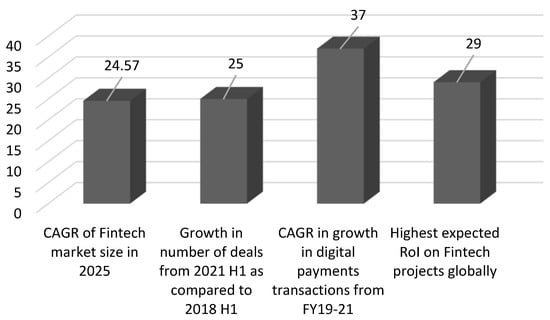

According to Invest India, India’s FinTech ecosystem will be one of the largest and most dynamic in the world by 2022, with 6636 FinTech startups. The Indian FinTech sector is expected to be worth $50 billion by 2021, rising to nearly $150 billion by 2025 (Invest India 2022). During the last decade, digital payments in India’s payment environment have grown rapidly in terms of both volume, with a compound annual growth rate (CAGR) of 50%, and value, with a CAGR of 6% (Invest India 2022). The total value of all Fintech transactions is expected to rise from $66 billion in 2019 to $138 billion in 2023, a 20% compound annual growth rate (CAGR) (Invest India 2022). The Indian Fintech sector ecosystem is divided into several subsegments. These subsegments include payments, lending, Wealth Technology (WealthTech), Personal Financial Management, Insurance Technology (InsurTech), Regulation Technology (RegTech), and other services (Kaur et al. 2021). The Indian fintech sector captured 14% of global investment and ranked second in deal volume during the study period (January 2017–July 2022), covering 2084 transactions and $29 billion (Invest India 2022). To draw a reliable conclusion using the GARCH model, a minimum of 1000 observations are required (Ng and Lam 2006), which is why we included the most recent available data for 2022 and the previous 5 years. The Indian financial technology industry received $8.53 billion in investment in FY22, spread across 278 separate agreements (Statista 2022). As of July 2022, 23 Fintech companies in India have achieved “Unicorn Status”, which means they are worth more than $1 billion (Statista 2022). Over $130 billion in monthly transactions were processed through India’s Unified Payments Interface (UPI), which is supported by 338 different banks, as of July 2022 (Invest India 2022). Since its inception in July 2016, UPI has set a new monthly record with approximately 6.28 billion transactions processed in July 2022 (Invest India 2022) (see Figure 1).

Figure 1.

Statistics that explain India’s position as a global fintech market (Invest India 2022).

The companies that are listed on the BSE (Bombay Stock Exchange) are chosen to obtain data on fintech return volatility. As of the 8 February 2022, there are 5246 companies listed on the Bombay Stock Exchange (BSE 2022). The term “fintech” appears in the names of four companies: Algoquant Fintech Ltd., Policy Bazaar (PB) Fintech Ltd., Niyogin Fintech Ltd., and Polo Queen Industrial and Fintech Ltd.

Algoquant Fintech Ltd. is a new-age, tech-driven company that focuses on generating maximum return through complex algorithms and sophisticated technology, allowing clients to invest for their future financial security (Algoquant Fintech Limited n.d.). The company specializes in assessing each client’s unique needs and developing a personalized investment plan and strategy that meets their needs and assists them in achieving secure and low-risk returns. Since 2 July 2001, the company has been listed on the BSE (BSE 2022). The asset value of the company in March 2022 was 5.2 million USD (BSE 2022).

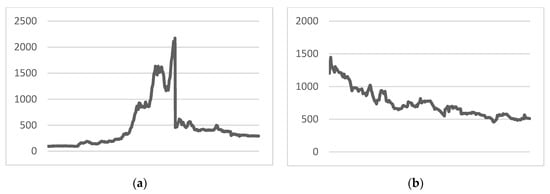

PB Fintech Ltd. is an online platform for insurance and lending products. The company provides easy access to insurance, credit, and other financial products and aims to raise awareness in India about the financial impact of death, disease, and damage. The company generates all of its revenue in India. The company was founded in 2008, and its assets were valued at $780 million USD in March 2022 (BSE 2022). In 2022, the company had over 11,000 employees (PitchBook 2022a). The company went public on 15 November 2021. Figure 2 depicts Algoquant Fintech Ltd. and PB Fintech Ltd. share price fluctuations from January 2017 to July 2022.

Figure 2.

(a) Algoquant Fintech Ltd. share price fluctuations from January 2017 to July 2022; (b) PB Fintech Ltd. share price fluctuations from November 2021 to July 2022 (BSE 2022).

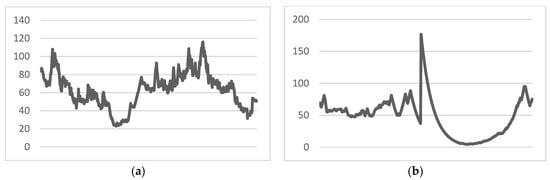

Niyogin Fintech Ltd. is an Indian non-banking finance company. It provides small businesses with a cost-effective holistic support system through innovative technology and a dedicated network of partners (Niyogin Fintech Ltd. 2022). The company is engaged in providing lending facilities and credit services to small and medium business. Geographically, it operates only in India. The company generates its revenue in the form of interest income, processing fees, bounce charges, and other finance charges. The company was founded in 1988 and had 78 employees in 2022. The company went public on the BSE on 17 November 2014. The asset value of the company in March 2022 was 47.8 million USD (BSE 2022).

Polo Queen Industrial and Fintech Ltd. is in the non-banking financial activity and trading business, with significant revenue coming from the trading segment. The company was founded in 1967 and had 20 employees in 2022 (PitchBook 2022b). In March 2022, the company’s assets were valued at $28.5 million USD (BSE 2022). The company went public on the BSE on 28 September 2017 (BSE 2022). Figure 3 depicts Niyogin Fintech Ltd. and Polo Queen Industrial and Fintech Ltd. share price fluctuations from January 2017 to July 2022.

Figure 3.

(a) Niyogin Fintech Ltd. share price fluctuations from January 2017 to July 2022; (b) Polo Queen Industrial and Fintech Ltd. share price fluctuations from January 2017 to July 2022 (BSE 2022).

The final sample of 906 observations was composed of share prices collected from four companies from January 2017 to July 2022.

3.2. Model

The GARCH model was developed by Tim Bollerslev (Bollerslev 1986). Black and Scholes’s (1973) foundational work established continuous time models as a valuable tool in theoretical financial economics (Black and Scholes 1973). The theory of pricing assets in general and the idea of pricing options specifically employ them. The emphasis of this article is on GARCH(1,1) processes since it allows for explicit computations. The theoretical foundation of GARCH-behaving continuous-time processes is straightforward to generalize. However, unlike the GARCH(1,1) instance, parameter limits and explicit formulae in this more generic situation need numerical processes and cannot be stated in a closed form. For the rest of the study, we will use the Mean-GARCH model on the included data, focusing only on GARCH-M(1,1). The first article published on the Mean-GARCH model was by Kroner in 1993, which investigated the impact of exchange rate volatility on international trade (Kroner and Lastrapes 1993).

Time-varying volatility is more common than constant volatility in economic and financial data, and accurate modeling of time-varying volatility is critical in financial engineering (Panda and Nanda 2018). MGARCH allows the conditional-on-past-history covariance matrix of the dependent variables to follow a flexible dynamic structure (De Almeida et al. 2018).

To determine whether there is any dynamic link between risk and return in the Indian fintech market, the GARCH-M model is applied to the average returns of listed fintech companies in India based on their closing stock prices. The dependent variable is the log of return from India’s fintech market, and the variance is used to calculate the relationship between risk and return.

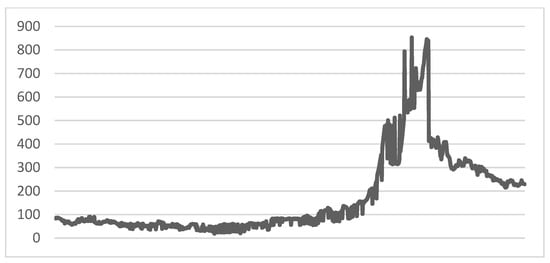

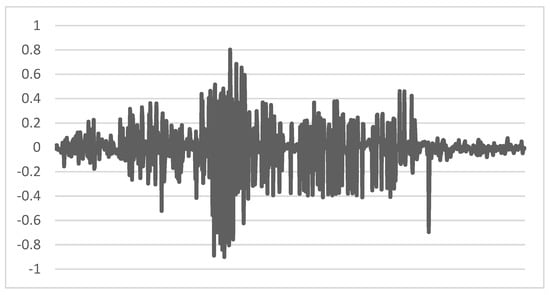

To conclude the result, first the ARMA model is applied to the average return with 906 observations consisting of fluctuations (see Figure 4).

Figure 4.

Fluctuations in the average closing prices of Indian fintech companies (authors calculation based on BSE stock prices).

Following that, the heteroskedasticity test is applied to the framed data set to ensure that the conditions for applying the GARCH model (with two lags) are met. When no ARCH effect or volatility clustering is found, the GARCH model is used with the student’s T-distribution on the log values of returns (residuals). The GARCH model is based on the following equation:

where is the conditional volatility, and are squired unexpected returns for the previous period. The β coefficient shows the persistence of the volatility, i.e., how long the volatility would take to revert back to long-run volatility.

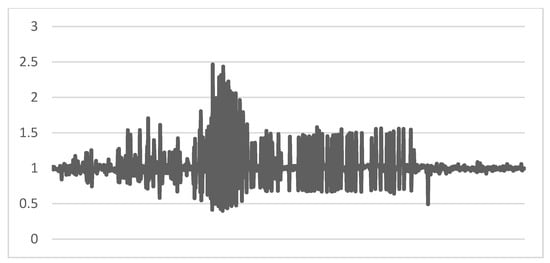

Figure 5 shows the residuals of the log returns.

Figure 5.

LOG (RETURN) residuals (authors calculation based on BSE stock prices).

The GARCH-M model with variance equation is used in the Indian fintech industry to answer the question of whether or not there is a relationship between returns and volatility. The GARCH-M model is based on the equation:

Figure 6 shows the average returns of Indian fintech companies as a dependent variable.

Figure 6.

Average returns of Indian fintech companies (authors calculation based on BSE stock prices).

4. Results

The application of the augmented Dickey–Fuller test to the data of the average return of the fintech industry in India is shown in Table 1.

Table 1.

Augmented Dickey–Fuller test for unit root.

The p and t values in the table show statistically significant results at 1%, 5%, and 10% significance levels. As a result, the return data is stationary at the level.

Table 2 shows the calculations for the Augmented Dickey–Fuller test equation. The average return in India’s fintech market is used as a dependent variable in this test, and the method of least squares has been applied to 896 observations after adjustment. According to the test, the value of r square is 0.762, and the value of adjusted r square is 0.759. Because the R-square values are within the acceptable limit for time series data, these values indicate that the model used in the equation is a good fit.

Table 2.

Augmented Dickey-Fuller test equation.

After drawing the correlogram of return, the value of Autocorrelation and Partial Correlation gave values of p and q as “1”. Hence in the next table, AR(1) and MA(1) with dependent Variable of LOG(RETURN) with 906 observation is shown.

Table 3 shows the results of the regression analysis using the autoregressive moving average model. The r square and adjusted r square values are 0.7603 and 0.759, respectively, which indicate that the model is a good fit. As a result, the average values of return in India’s fintech industry can be used to make future predictions. However, since the primary aim of the study is to investigate the relationship between risk and return in the Indian fintech industry, the following section of the study focuses on testing heteroskedasticity. To determine whether the ARCH effect exists in the data set’s frame, heteroskedasticity will be examined.

Table 3.

ARMA Model of Average Returns in FINTECH market of India.

The heteroskedasticity test of the ARCH model is shown in Table 4, which runs the test equation of the dependent variable of the square of residuals of the log of the average rate of return. The table calculations are based on the least squares method, which includes 904 observations after adjustments. The table calculations are best based on the null hypothesis in that there is no ARCH effect or volatility clustering. However, based on the numerical values of the various parameters shown in the table, the null hypothesis is rejected because Prob. F(2,901) and Prob. Chi-Square(2) are less than 0.05. As a result, the GARCH-Model is then applied in the following sections of the research.

Table 4.

Heteroskedasticity test: ARCH.

Table 5 shows the GARCH model calculations using the log of the average return of the Indian fintech industry. The method used in Table 5 is MGARCH–Student’s t distribution, which was applied to 905 observations after adjustment. The calculation consists of failure to improve likelihood (non-zero gradients) after 19 iterations. The equation can be written using the values in the table as follows:

Table 5.

GARCH Model.

Hence the value of and . Therefore,

Since the summation of coefficients is less than 1, there is decaying volatility in the returns of the Fintech market of India with the decaying rate of 0.25. Moreover, this means the reason for the volatility is persistence.

Table 6 displays the values associated with the application of the GARCH-M model with the log of return from India’s fintech market as the dependent variable. The model is used by taking 905 observations after adjustments and computing the coefficient of covariance using the outer product of gradients. The relationship between risk and return is calculated using variance. The table’s values assist in determining the relationship between risk and return on investment in India’s fintech market. The analysis will determine whether or not taking a high risk in the given market will result in a high return. Because the probability of the GARCH value is 0.027, which is less than 0.05, there is a significant relationship between risk and return.

Table 6.

GARCH-M Model for risk-return analysis.

5. Discussion

Fintech’s rapid evolution means it can improve our financial lives and threaten them. Fintech had a peak year in 2021 with a record amount of private market funding, mergers and acquisitions (M&A) deals, and successfully completed initial public offers (IPOs) and special purpose acquisition companies (SPACs). Private investment in private fintechs reached an estimated $135 billion, a 206% increase from 2020 (Fintech Insights 2022). The years 2020–2021 were record years for IPOs, with 54 fintechs going public, including some of the biggest names like Coinbase, Robinhood, and SoFi (Fintech Insights 2022). However, huge success in the beginning was reversed in November 2021, when fintech share prices began to fall (Investor’s Business Daily 2022). As a result, the public fintech market’s performance over the last two years has been volatile.

With over 2000 FinTech startups and reported investments totaling more than $20 billion in 2021, India was one of the leaders in the development of the fintech industry (Invest India 2022). The rapid expansion of startups in the sector has been facilitated by a large talent pool, a supportive regulatory environment, a growing customer base, access to funding, and a foundation of free public digital infrastructure (Invest India 2022). In spite of a slowdown in economic activity brought on by the pandemic in 2020, the fintech sector continued to show growth on a number of fronts and is anticipated to report accelerated growth in funding, users, and revenues in the following year. Many investors have been drawn to the growing fintech market, but how risky is it? Fintech is a relatively new market for advanced economies with stable financial markets and systems, but it still has a number of unresolved regulatory issues (Rupeika-Apoga and Wendt 2022). Fintech puts extra strain on already-overburdened authorities in developing and emerging countries, who often have fewer resources at their disposal to deal with technological advancements (Wu et al. 2020). Fintech’s potential effects on financial stability are difficult to gauge since so little data exists on the topic (Xu and Zou 2022).

As a result, in this article, the first attempt (to the best of our knowledge) was made to empirically study the relationship between risk and return in the fintech industry in the Indian equity market. The sampling of the Indian fintech market is conducted by choosing four fintech firms listed on the BSE. In this article, it was attempted to determine whether or not investing with high risk in the fintech sector of the equity market increases the likelihood of obtaining a high return on investment.

The earlier academic and empirical literature provides different discernment concerning asset portfolio investment opportunities (Oehler et al. 2021; Mubarak and Petraite 2020; Chang 2019). At the same time, an emerging dimension in the literature accentuates the significance and emergence of the fintech industry around the globe (Li et al. 2017; David et al. 2022; Feyen et al. 2021; Horn et al. 2020). Present research considers the volatilities and assesses the return dynamics of the fintech market in India. This dimension has received little attention, with only a few empirical studies (Asmarani and Wijaya 2020; Bildirici 2022). As a result, in this article, an attempt has been made to empirically investigate the returns of Fintech investment horizons in the Indian landscape using recent data and recent empirical techniques.

The articulated data set fulfilled the condition of stationarity at the level. With the application of the augmented Dickey–Fuller test, the results were significant, and the regression coefficient values made the model acceptable. This average return on the investment in the fintech market of India can be considered for further calculations. Figure 2 and Figure 3 show the volatility in the prices of significant fintech companies listed on the Bombay Stock Exchange of India. Whether the riskiness arising out of this volatility also helps the investor earn a high return or not, the GARCH-M model was applied in the research (De Almeida et al. 2018).

While heteroskedasticity testing is important, the major aim of this study was to examine the link between risk and return in India’s fintech business. Heteroskedasticity was analyzed to see whether the ARCH effect can be found in the given dataset. Using the test equation of the square of residuals of the log of the average rate of returns, the heteroskedasticity test of the ARCH model was performed, as shown in Table 4. In the end, 904 observations were used to compile the data in the table using the least squares approach. To obtain the most accurate results from the table, it is preferable to work with the assumption that neither the ARCH effect nor volatility clustering is present. However, the values of the table’s parameters indicate that the null hypothesis cannot be accepted, since the probability of both F(2,901) and Chi(2) is less than 0.05. The GARCH Model may thus be used in the subsequent analyses. In Table 5, the results of applying the GARCH model to the log of the average return in India’s fintech business, can be observed. The returns of the Indian Fintech market exhibit fading volatility with a decaying rate of 0.25 since the total is less than 1. Moreover, this implies that the persistent nature of the underlying cause of the volatility is to blame. Results from using the GARCH-M model with the log of return from the Indian fintech industry as the dependent variable are shown in Table 6. In order to apply the model, 905 post-adjusted data were used and the coefficient of covariance using the outer product of gradients calculated. The correlation between risk and return may be determined by examining the variance. The risk and return of an investment in India’s fintech sector may be calculated using the figures in the table. If the study finds that high risk in this market yields a high return, then high risk should be taken. There is a substantial connection between risk and return since the likelihood of a GARCH value of 0.0271 is less than 0.05.

6. Concluding Remarks

In conclusion, the findings emphasize the importance of accepting the risks associated with investing in India’s Fintech sector. This has significant implications for the portfolio composition decisions made by stock investors and fund managers, as well as the length of time they hold stocks or are exposed to a particular market. Finally, depending on an investor’s investment horizons, the Indian fintech market can generate high returns for risk-averse individuals.

Our study is not without limitations. First of all, while the Indian fintech market’s risk–return relationship is statistically significant according to our GARCH-M model, the companies that were studied only make up a small portion of the entire sector. Second, the inclusion of fintech companies from other countries would benefit the discussion and future research on investments in the Indian fintech industry.

Even though the results of our study and those of other researchers have allowed some conclusions to be drawn, the fintech industry’s rapid development necessitates ongoing research to keep up with the high levels of innovation. Furthermore, regulators’ responses and/or supporting activities may have a significant impact on the fintech investment market.

Present research focuses on the GARCH-M application of the return in the Fintech Industry of India. To cover other aspects, various volatility models can also be applied to the framed data set in the same sample, such as seasonality in volatility, E-GARCH, volatility spillover, dynamic condition correlation, BEKK, BECH Model, etc.

Our research, despite its limitations, can assist institutional and individual investors in developing investment strategies.

Author Contributions

Conceptualization, M.B., E.Ö., S.T., S.G. and R.R.-A.; methodology, M.B., E.Ö., S.T. and S.G.; formal analysis, M.B., E.Ö., S.T. and S.G.; investigation, M.B., E.Ö., S.T. and S.G.; data curation, M.B., E.Ö., S.T. and S.G.; writing—original draft preparation, M.B., E.Ö., S.T., S.G. and R.R.-A.; writing—review and editing, R.R.-A. and S.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data is publicly available on the Bombay Stock Exchange.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agrawal, Vivek. 2021. “History of Fintech”. FINTICA. August 28. Available online: https://www.fintica.com/history-of-fintech/ (accessed on 12 September 2022).

- Ahmi, Aidi, Afiruddin Tapa, and Ahmad Husni Hamzah. 2020. Mapping of Financial Technology (FinTech) Research: A Bibliometric Analysis. International Journal of Advanced Science and Technology 29: 379–92. [Google Scholar]

- Aielli, Gian Piero. 2013. Dynamic Conditional Correlation: On Properties and Estimation. Journal of Business & Economic Statistics 31: 282–99. [Google Scholar] [CrossRef]

- Al Nawayseh, Mohammad K. 2020. Fintech in COVID-19 and beyond: What Factors Are Affecting Customers’ Choice of Fintech Applications? Journal of Open Innovation: Technology, Market, and Complexity 6: 1–15. [Google Scholar] [CrossRef]

- Alam, Azhar, Ririn Tri Ratnasari, Chabibatul Mua’awanah, and Raisa Aribatul Hamidah. 2022. Generation Z Perceptions in Paying Zakat, Infaq, and Sadaqah Using Fintech: A Comparative Study of Indonesia and Malaysia. Investment Management and Financial Innovations 19: 320–30. [Google Scholar] [CrossRef]

- Al-Emadi, Khalid Ahmed, Zorah Abu Kassim, and Anjum Razzaque. 2021. User Friendly and User Satisfaction Model Aligned With FinTech. In Advances in Finance, Accounting, and Economics. Edited by Yousif Abdullatif Albastaki, Anjum Razzaque and Adel M. Sarea. Bahrain: IGI Global, pp. 291–301. [Google Scholar] [CrossRef]

- Algoquant Fintech Limited. n.d. Available online: https://www.algoquantfintech.com/ (accessed on 6 October 2022).

- Al-Homaidi, Eissa A., Ebrahim Mohammed Al-Matari, Mosab I. Tabash, Amgad S. D. Khaled, and Nabil Ahmed M. Senan. 2021. The Influence of Corporate Governance Characteristics on Profitability of Indian Firms: An Empirical Investigation of Firms Listed on Bombay Stock Exchange. Investment Management and Financial Innovations 18: 114–25. [Google Scholar] [CrossRef]

- Arslanian, Henri, and Fabrice Fischer. 2019. The Rise of Fintech. In The Future of Finance. Cham: Palgrave Macmillan, pp. 25–56. [Google Scholar] [CrossRef]

- Asmarani, Saraya Cita, and Chandra Wijaya. 2020. Effects of Fintech on Stock Return: Evidence from Retail Banks Listed in Indonesia Stock Exchange. The Journal of Asian Finance, Economics and Business 7: 95–104. [Google Scholar] [CrossRef]

- Beaulieu, Marie-Claude, Marie-Hélène Gagnon, and Lynda Khalaf. 2009. A Cross-section Analysis of Financial Market Integration in North America Using a Four Factor Model. International Journal of Managerial Finance 5: 248–67. [Google Scholar] [CrossRef]

- Berdjane, Belkacem, and Serguei Pergamenshchikov. 2016. Sequential δ-Optimal Consumption and Investment for Stochastic Volatility Markets with Unknown Parameters. Theory of Probability & Its Applications 60: 533–60. [Google Scholar] [CrossRef]

- Bildirici, Melike E. 2022. Chaos Structure and Contagion Behavior between COVID-19, and the Returns of Prices of Precious Metals and Oil: MS-GARCH-MLP Copula. Nonlinear Dynamics, Psychology, and Life Sciences 26: 209–30. [Google Scholar]

- Black, Fischer, and Myron Scholes. 1973. The Pricing of Options and Corporate Liabilities. Journal of Political Economy 81: 637–57. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim, and Robert F. Engle. 1993. Common Persistence in Conditional Variances. Econometrica 61: 167. [Google Scholar] [CrossRef]

- BSE. 2022. India Stock Exchange. Available online: https://www.bseindia.com/ (accessed on 15 September 2022).

- Cardenas, Juan Camilo, and Jeffrey Carpenter. 2008. Behavioural Development Economics: Lessons from Field Labs in the Developing World. The Journal of Development Studies 44: 311–38. [Google Scholar] [CrossRef]

- Cha, Baekin, and Yan-leung Cheung. 1998. The Impact of the U.S. and the Japanese Equity Markets on the Emerging Asia-Pacific Equity Markets. Asia-Pacific Financial Markets 5: 191–209. [Google Scholar] [CrossRef]

- Chang, Kuo-Ping. 2019. Behavioral Economics Versus Traditional Economics: Are They Very Different? SSRN Scholarly Paper ID 3350088. Rochester: Social Science Research Network. [Google Scholar] [CrossRef]

- Chen, Gong-meng, Michael Firth, and Oliver Meng Rui. 2002. Stock Market Linkages: Evidence from Latin America. Journal of Banking & Finance 26: 1113–41. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang, and Woo Gon Kim. 2006. The Long-Run Equilibrium Relationship Between Economic Activity and Hospitality Stock Prices. The Journal of Hospitality Financial Management 14: 1–15. [Google Scholar] [CrossRef]

- Cheng, Ing-Haw. 2020. Volatility Markets Underreacted to the Early Stages of the COVID-19 Pandemic. Edited by Jeffrey Pontiff. The Review of Asset Pricing Studies 10: 635–68. [Google Scholar] [CrossRef]

- Chishti, Susanne, and Janos Barberis. 2016. The Fin Tech Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries. Hoboken: Wiley. [Google Scholar]

- Da Fonseca, José, and Yahua Xu. 2019. Variance and Skew Risk Premiums for the Volatility Market: The VIX Evidence. Journal of Futures Markets 39: 302–21. [Google Scholar] [CrossRef]

- David, Dharish, Miyana Yoshino, and Joseph Pablo Varun. 2022. Developing FinTech Ecosystems for Voluntary Carbon Markets Through Nature-Based Solutions: Opportunities and Barriers in ASEAN. In Green Digital Finance and Sustainable Development Goals. Edited by Farhad Taghizadeh-Hesary and Suk Hyun. Economics, Law, and Institutions in Asia Pacific. Singapore: Springer Nature, pp. 111–42. [Google Scholar] [CrossRef]

- De Almeida, Daniel, Luiz K. Hotta, and Esther Ruiz. 2018. MGARCH Models: Trade-off between Feasibility and Flexibility. International Journal of Forecasting 34: 45–63. [Google Scholar] [CrossRef]

- Elangovan, Rajesh, Francis Gnanasekar Irudayasamy, and Satyanarayana Parayitam. 2021. Testing the Market Efficiency in Indian Stock Market: Evidencefrom Bombay Stock Exchangebroad Market Indices. Journal of Economics, Finance and Administrative Science. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- EY. 2022. How Is the Fintech Sector in India Poised for Exponential Growth? Available online: https://www.ey.com/en_in/financial-services/how-is-the-fintech-sector-in-india-poised-for-exponential-growth (accessed on 9 September 2022).

- Feyen, Erik, Jon Frost, Leonardo Gambacorta, Harish Natarajan, and Matthew Saal. 2021. Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS and World Bank Group. Available online: https://www.bis.org/publ/bppdf/bispap117.pdf (accessed on 27 August 2022).

- Fintech Insights. 2022. Performance of Public FinTechs Raises an Alarm: Is the FinTech Story Still Intact? Available online: https://www.rblt.com/fintech-insights/public-market-fintech-performance-raises-an-alarm-is-the-fintech-story-still-intact (accessed on 30 September 2022).

- Fouladi, Seyyed Hamed, and Hamidreza Amindavar. 2012. Blind Separation of Dependent Sources Using Multiwavelet Based on M-GARCH Model. Paper presented at IEEE 2012 11th International Conference on Information Science, Signal Processing and Their Applications (ISSPA), Montreal, QC, Canada, July 2–5; pp. 49–53. [Google Scholar] [CrossRef]

- Hinson, Robert, Robert Lensink, and Annika Mueller. 2019. Transforming Agribusiness in Developing Countries: SDGs and the Role of FinTech. Current Opinion in Environmental Sustainability 41: 1–9. [Google Scholar] [CrossRef]

- Horn, Matthias, Andreas Oehler, and Stefan Wendt. 2020. FinTech for Consumers and Retail Investors: Opportunities and Risks of Digital Payment and Investment Services. In Ecological, Societal, and Technological Risks and the Financial Sector. Edited by Thomas Walker, Dieter Gramlich, Mohammad Bitar and Pedram Fardnia. Palgrave Studies in Sustainable Business in Association with Future Earth. Cham: Springer International Publishing, pp. 309–27. [Google Scholar] [CrossRef]

- Invest India. 2022. Financial Services Sector in India|Fintech Industry in India. Available online: https://www.investindia.gov.in/sector/bfsi-fintech-financial-services (accessed on 27 September 2022).

- Investor’s Business Daily. 2022. Fintech Stocks to Buy: Acquirers Weather Market Rotation. Investor’s Business Daily. October 3. Available online: https://www.investors.com/news/technology/fintech-companies-to-buy-and-watch/ (accessed on 1 September 2022).

- Ionescu, Luminita. 2020. Digital Data Aggregation, Analysis, and Infrastructures in FinTech Operations. Review of Contemporary Philosophy 19: 92–98. [Google Scholar] [CrossRef]

- Janakiramanan, Sundaram, and Asjeet S. Lamba. 1998. An Empirical Examination of Linkages between Pacific-Basin Stock Markets. Journal of International Financial Markets, Institutions and Money 8: 155–73. [Google Scholar] [CrossRef]

- Kaur, Balijinder, Sood Kiran, Simon Grima, and Ramona Rupeika-Apoga. 2021. Digital Banking in Northern India: The Risks on Customer Satisfaction. Risks 9: 209. [Google Scholar] [CrossRef]

- Khan, Shahebaz Sarfaraz, Meer Mazhar Ali, and M. A. Imran Khan. 2022. Analyzing the Factors That Influence Capital Investment Decisions: A Case Study o f SME’s Listed on Bombay Stock Exchange. International Journal of Science and Research 11: 44–48. [Google Scholar] [CrossRef]

- Kroner, Kenneth F., and William D. Lastrapes. 1993. The Impact of Exchange Rate Volatility on International Trade: Reduced Form Estimates Using the GARCH-in-Mean Model. Journal of International Money and Finance 12: 298–318. [Google Scholar] [CrossRef]

- Kumar, Joseph John Allwyn, and Robiyanto Robiyanto. 2021. The Impact of Gold Price and Us Dollar Index: The Volatile Case of Shanghai Stock Exchange and Bombay Stock Exchange During the Crisis of COVID-19. Jurnal Keuangan Dan Perbankan 25: 508–31. [Google Scholar] [CrossRef]

- Laidroo, Laivi, Ekaterina Koroleva, Agata Kliber, Ramona Rupeika-Apoga, and Zana Grigaliuniene. 2021. Business Models of FinTechs—Difference in Similarity? Electronic Commerce Research and Applications 46: 101034. [Google Scholar] [CrossRef]

- Lee, David Kuo Chuen, and Ernie G. S. Teo. 2015. Emergence of Fintech and the Lasic Principles. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Li, Guozhong, Jian Sheng Dai, Eun-Mi Park, and Seong-Taek Park. 2017. A Study on the Service and Trend of Fintech Security Based on Text-Mining: Focused on the Data of Korean Online News. Journal of Computer Virology and Hacking Techniques 13: 249–55. [Google Scholar] [CrossRef]

- Morales, Lucía, Geraldine Gray, and Daniel Rajmil. 2022. Emerging Risks in the FinTech Industry—Insights from Data Science and Financial Econometrics Analysis. Economics, Management, and Financial Markets 17: 9. [Google Scholar] [CrossRef]

- Mubarak, Muhammad Faraz, and Monika Petraite. 2020. Industry 4.0 Technologies, Digital Trust and Technological Orientation: What Matters in Open Innovation? Technological Forecasting and Social Change 161: 120332. [Google Scholar] [CrossRef]

- Najeeb, Syed Faiq, Obiyathulla Bacha, and Mansur Masih. 2015. Does Heterogeneity in Investment Horizons Affect Portfolio Diversification? Some Insights Using M-GARCH-DCC and Wavelet Correlation Analysis. Emerging Markets Finance and Trade 51: 188–208. [Google Scholar] [CrossRef]

- Nayer, C. P. S. 1986. Can a traditional financial technology co-exist with modern financial technologies? Savings and Development 10: 31–58. [Google Scholar]

- Ng, Hs Raymond, and Kai-Pui Lam. 2006. How Does the Sample Size Affect GARCH Model? Paper presented at 9th Joint Conference on Information Sciences (JCIS 2006), Kaohsiung, Taiwan, October 8–11; pp. 3–6. [Google Scholar] [CrossRef]

- Niyogin Fintech Ltd. 2022. Available online: https://www.niyogin.com/ (accessed on 25 August 2022).

- Oehler, Andreas, Matthias Horn, and Stefan Wendt. 2021. Investor Characteristics and Their Impact on the Decision to Use a Robo-Advisor. Journal of Financial Services Research 62: 91–125. [Google Scholar] [CrossRef]

- Panda, Ajaya Kumar, and Swagatika Nanda. 2018. A GARCH Modelling of Volatility and M-GARCH Approach of Stock Market Linkages of North America. Global Business Review 19: 1538–53. [Google Scholar] [CrossRef]

- PitchBook. 2022a. PolicyBazaar Company Profile. Available online: https://pitchbook.com/profiles/company/54757-00 (accessed on 27 October 2022).

- PitchBook. 2022b. Polo Queen Industrial Company Profile. Available online: https://pitchbook.com/profiles/company/187485-67 (accessed on 27 October 2022).

- Popova, Yelena. 2021. Economic Basis of Digital Banking Services Produced by FinTech Company in Smart City. Journal of Tourism and Services 12: 86–104. [Google Scholar] [CrossRef]

- Rupeika-Apoga, Ramona, and Eleftherios I. Thalassinos. 2020. Ideas for a Regulatory Definition of FinTech. International Journal of Economics and Business Administration VIII: 136–54. [Google Scholar] [CrossRef]

- Rupeika-Apoga, Ramona, and Stefan Wendt. 2022. FinTech Development and Regulatory Scrutiny: A Contradiction? The Case of Latvia. Risks 10: 167. [Google Scholar] [CrossRef]

- Scheicher, Martin. 2001. The Comovements of Stock Markets in Hungary, Poland and the Czech Republic. International Journal of Finance & Economics 6: 27–39. [Google Scholar] [CrossRef]

- Singh, Manvendra Pratap, Arpita Chakraborty, Mousumi Roy, and Avinash Tripathi. 2021. Developing SME Sustainability Disclosure Index for Bombay Stock Exchange (BSE) Listed Manufacturing SMEs in India. Environment, Development and Sustainability 23: 399–422. [Google Scholar] [CrossRef]

- Sotiropoulou, Georgia, Georgios Pampalakis, and Eleftherios P. Diamandis. 2009. Functional Roles of Human Kallikrein-Related Peptidases. Journal of Biological Chemistry 284: 32989–94. [Google Scholar] [CrossRef] [PubMed]

- Srivastava, Aman, Shikha Bhatia, and Prashant Gupta. 2015. Financial Crisis and Stock Market Integration: An Analysis of Select Economies. Global Business Review 16: 1127–42. [Google Scholar] [CrossRef]

- Statista. 2022. Fintech in India. Statista. Available online: https://www.statista.com/topics/5666/fintech-in-india/ (accessed on 15 August 2022).

- Tanda, Alessandra, and Cristiana-Maria Schena. 2019. FinTech, BigTech and Banks: Digitalisation and Its Impact on Banking Business Models. Palgrave Macmillan Studies in Banking and Financial Institutions. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Varma, Parminder, Shivinder Nijjer, Kiran Sood, Simon Grima, and Ramona Rupeika-Apoga. 2022. Thematic Analysis of Financial Technology (Fintech) Influence on the Banking Industry. Risks 10: 186. [Google Scholar] [CrossRef]

- Vasenska, Ivanka, Preslav Dimitrov, Blagovesta Koyundzhiyska-Davidkova, Vladislav Krastev, Pavol Durana, and Ioulia Poulaki. 2021. Financial Transactions Using Fintech during the COVID-19 Crisis in Bulgaria. Risks 9: 48. [Google Scholar] [CrossRef]

- Wei, Shaobo, Dabao Xu, and Hua Liu. 2022. The Effects of Information Technology Capability and Knowledge Base on Digital Innovation: The Moderating Role of Institutional Environments. European Journal of Innovation Management 25: 720–40. [Google Scholar] [CrossRef]

- Wonglimpiyarat, Jarunee. 2018. Challenges and Dynamics of FinTech Crowd Funding: An Innovation System Approach. The Journal of High Technology Management Research 29: 98–108. [Google Scholar] [CrossRef]

- Wu, Wuqing, Dongliang Xu, Yue Zhao, and Xinhai Liu. 2020. Do Consumer Internet Behaviours Provide Incremental Information to Predict Credit Default Risk? Economic and Political Studies 8: 482–99. [Google Scholar] [CrossRef]

- Xu, Zhong, and Chuanwei Zou. 2022. Fintech: Frontier and Beyond, 1st ed. London: Routledge. [Google Scholar] [CrossRef]

- Zalan, Tatiana, and Elissar Toufaily. 2017. The Promise of Fintech in Emerging Markets: Not as Disruptive. Contemporary Economics 11: 415–430. Available online: https://papers.ssrn.com/abstract=3200954 (accessed on 18 September 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).