Factors Driving Duration to Cross-Selling in Non-Life Insurance: New Empirical Evidence from Switzerland

Abstract

1. Introduction

2. Insurance Portfolio Data and Cross-Selling Statistics

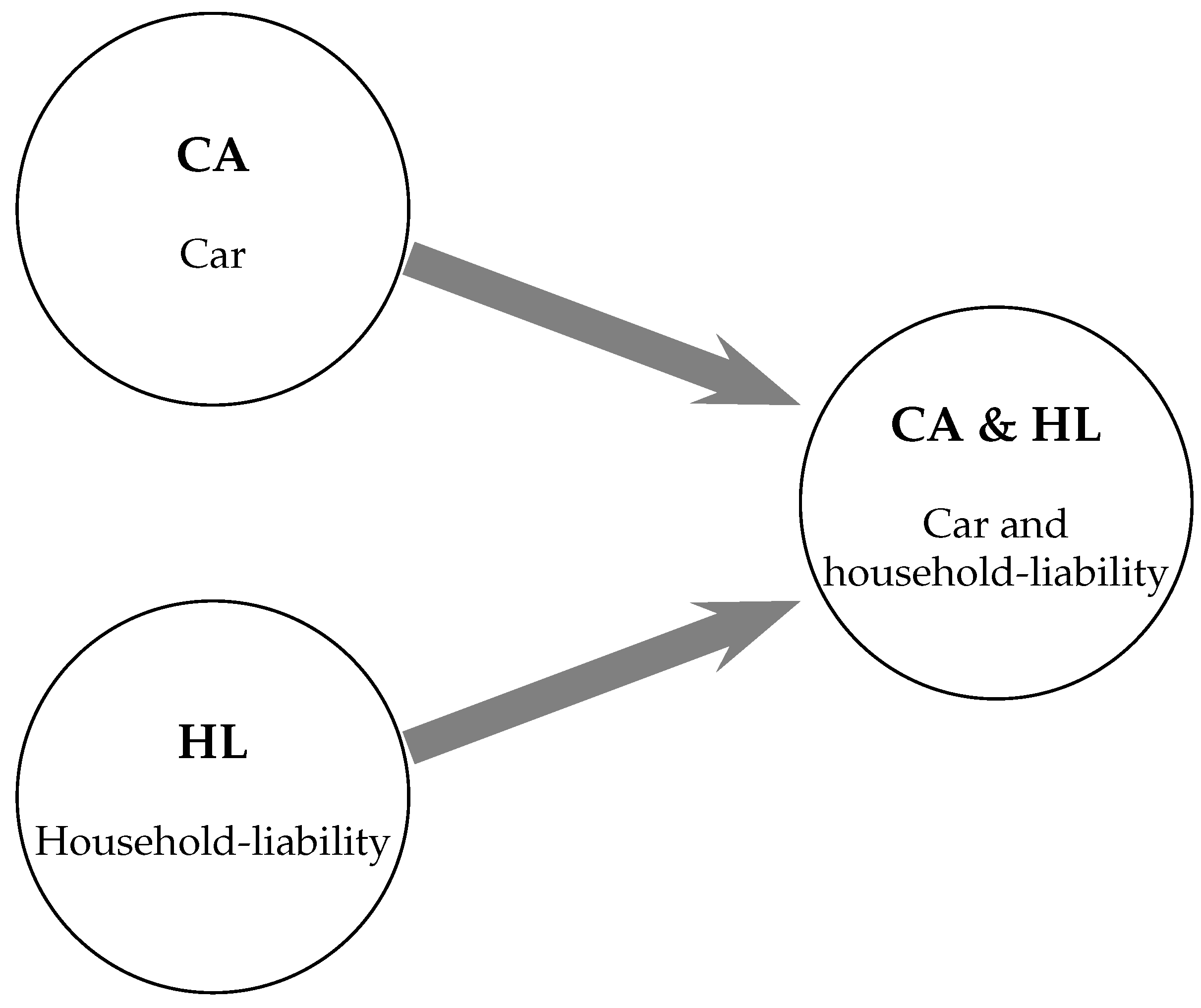

2.1. Time to Cross-Selling

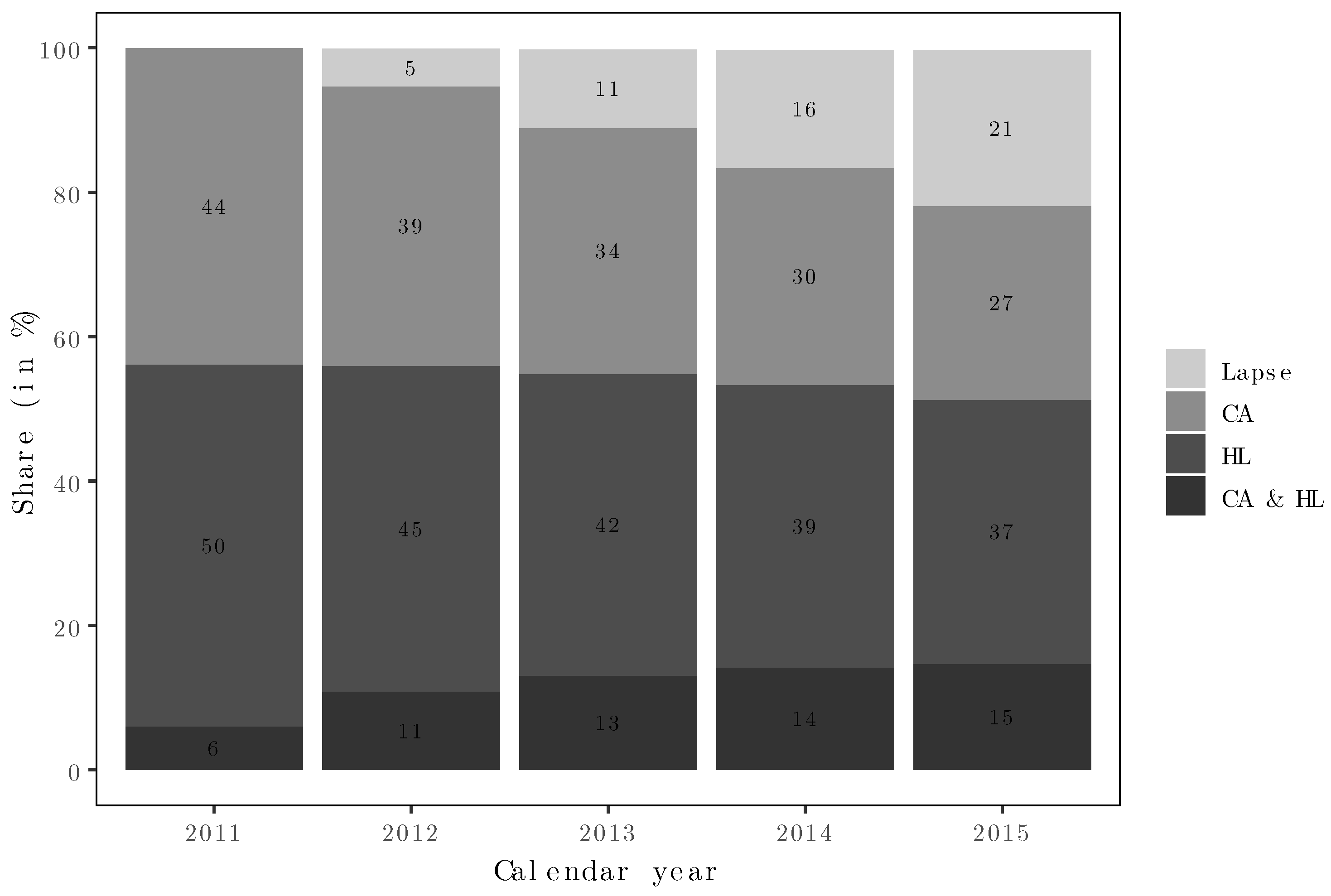

2.1.1. Portfolio Development

2.1.2. Duration to Cross-Selling and Right-Censoring

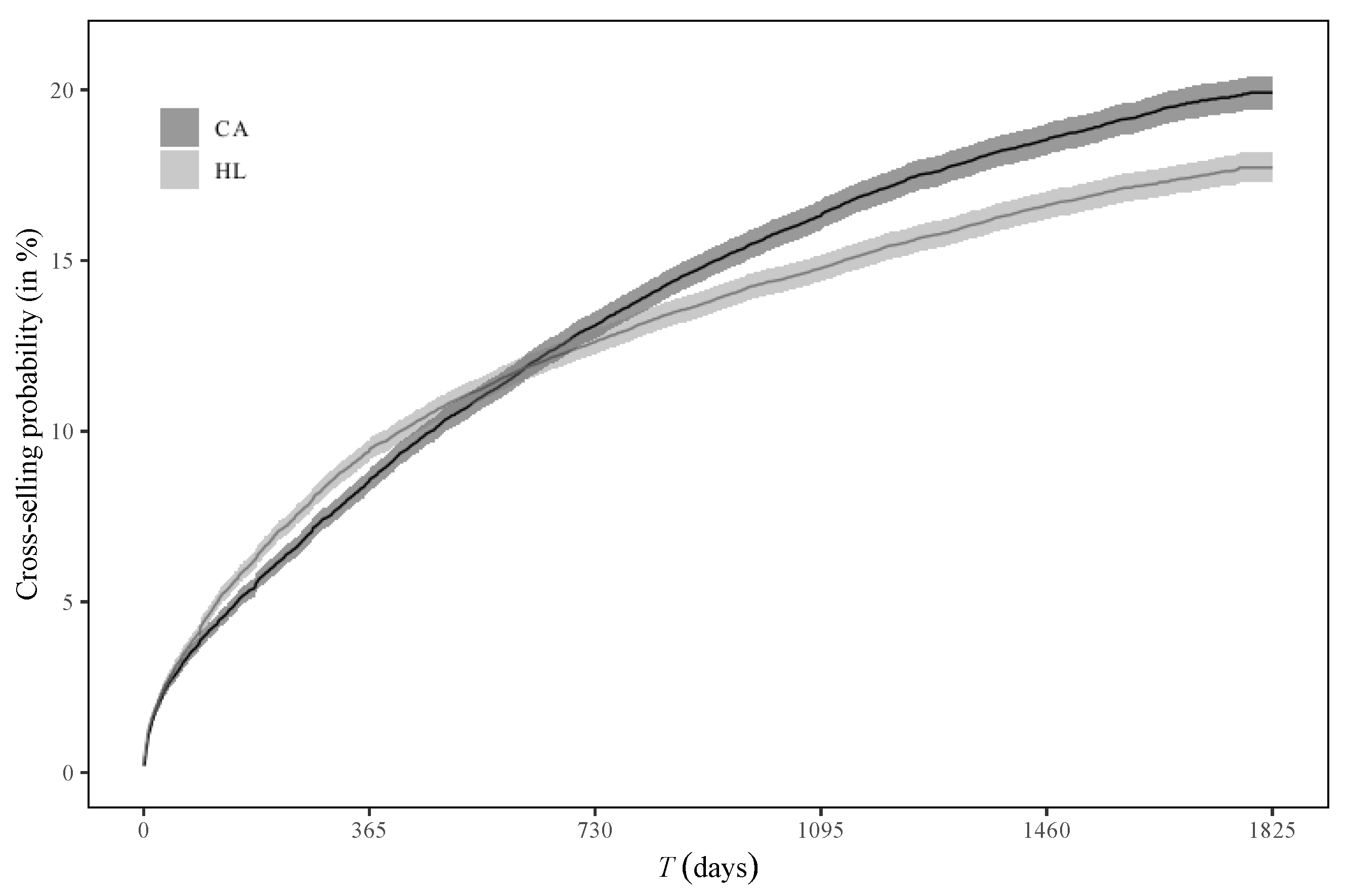

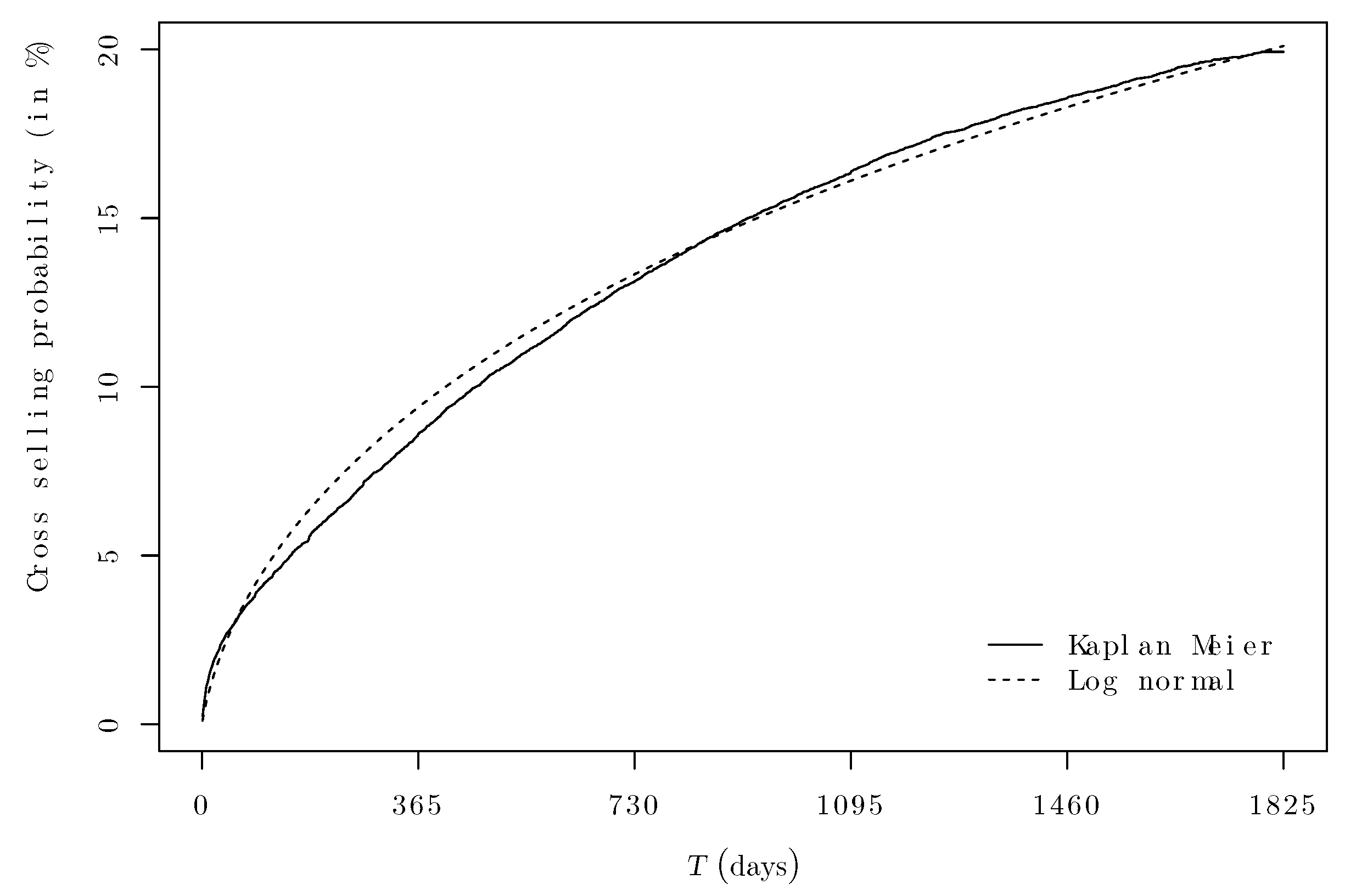

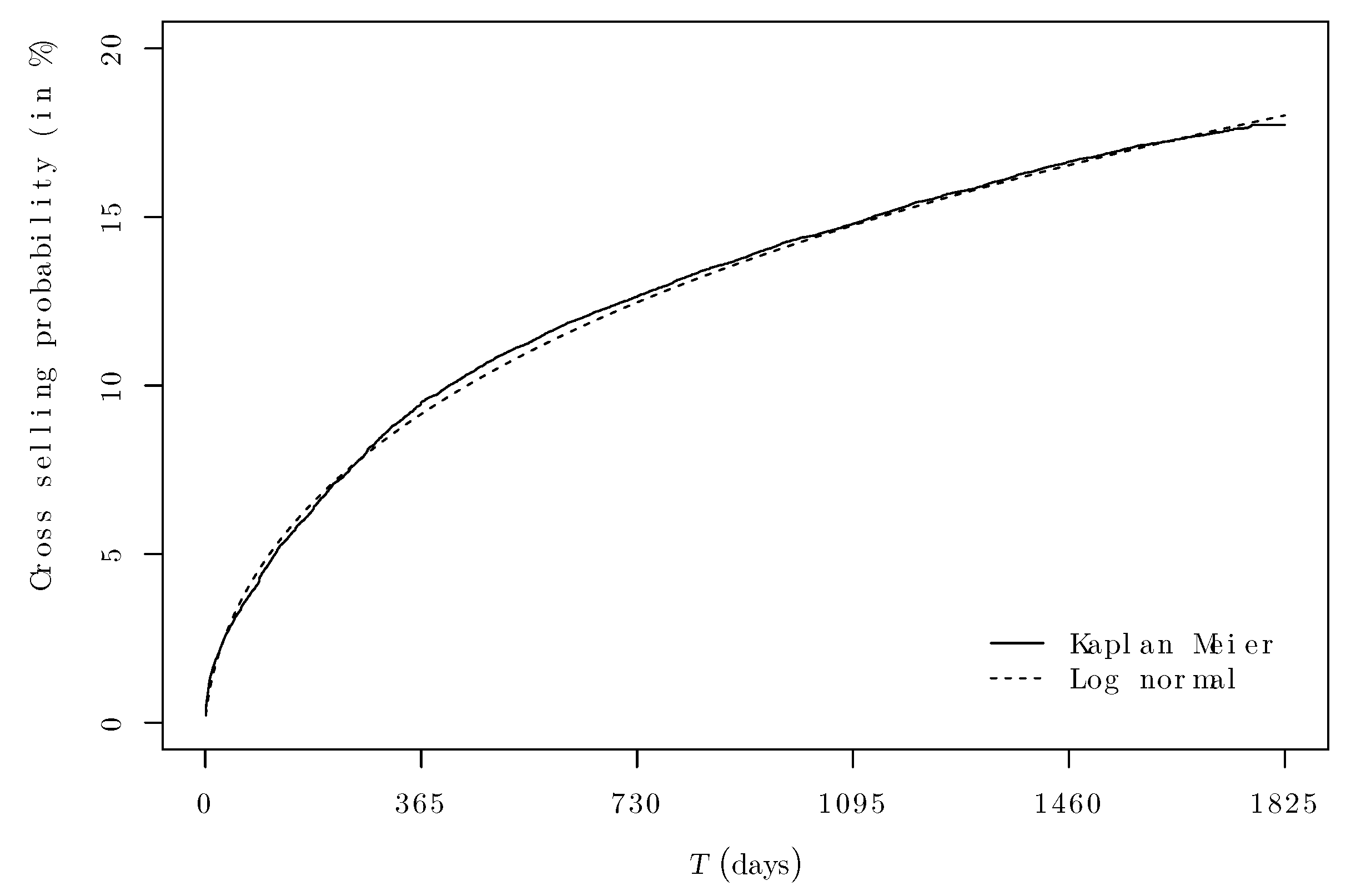

2.1.3. Kaplan–Meier Estimates for the Cross-Selling Probability

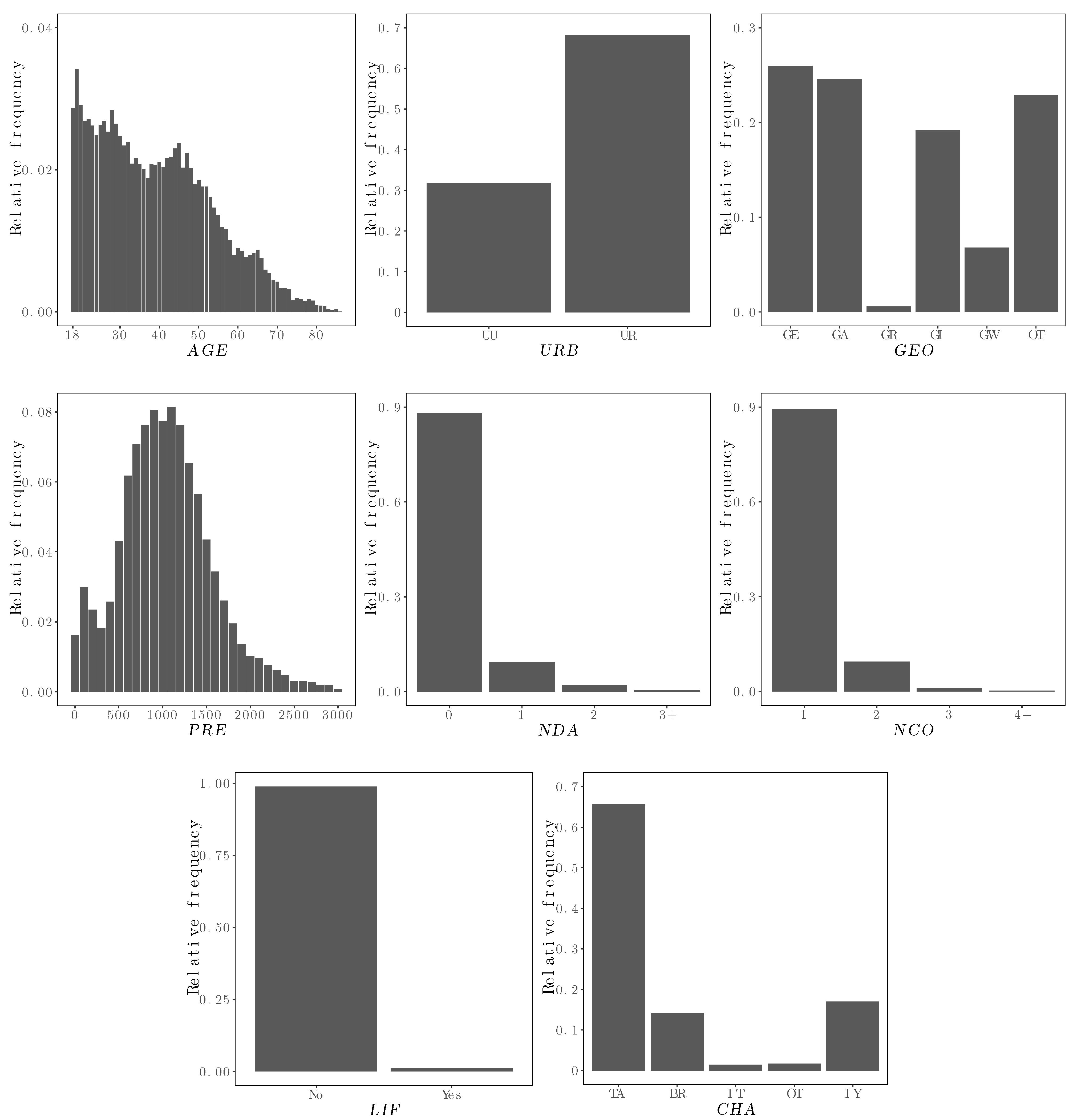

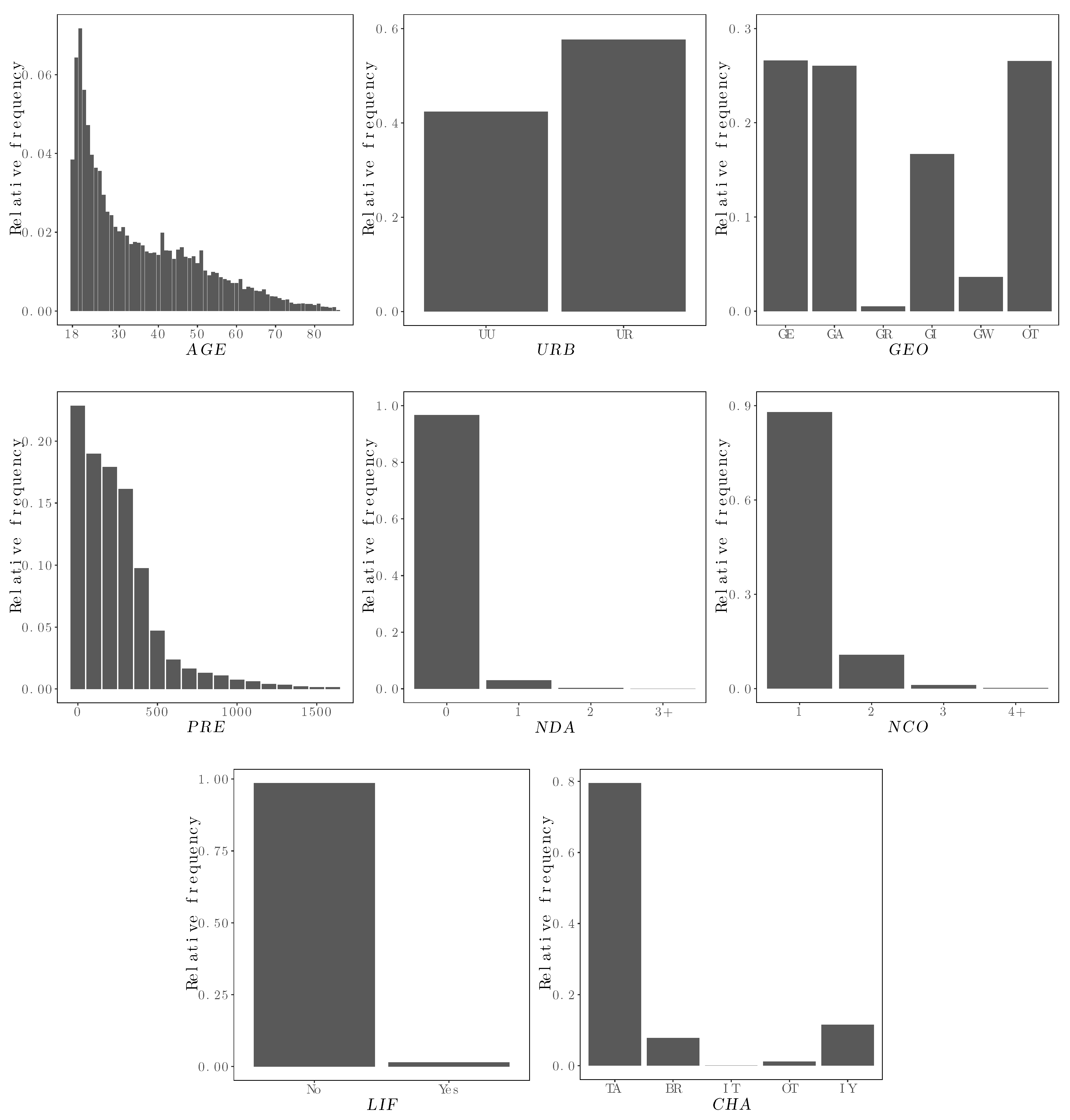

2.2. Covariates and Descriptive Statistics

3. Duration to Cross-Selling Analysis

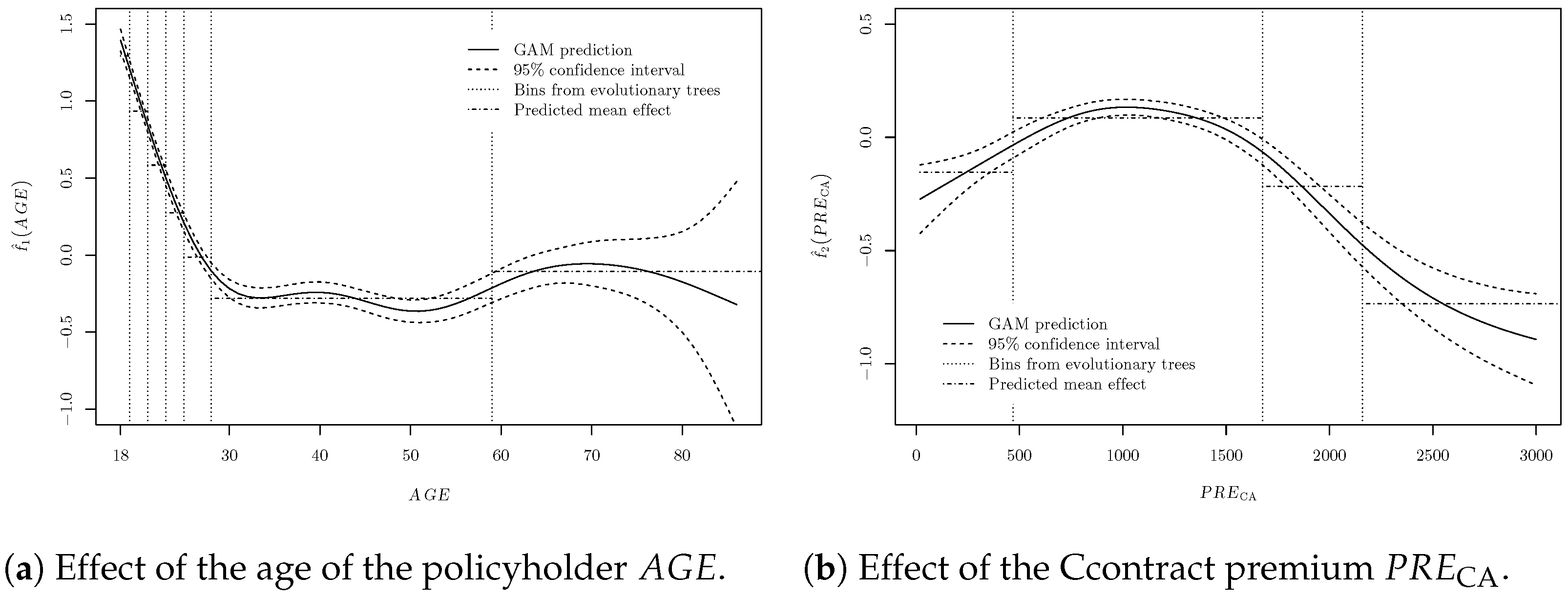

3.1. Model for the CA Cohort

3.1.1. Cox Model

3.1.2. Model Development

3.1.3. Binning of Continuous Variables

3.1.4. Accelerated Failure Time Model

3.1.5. Numerical Results and Discussion

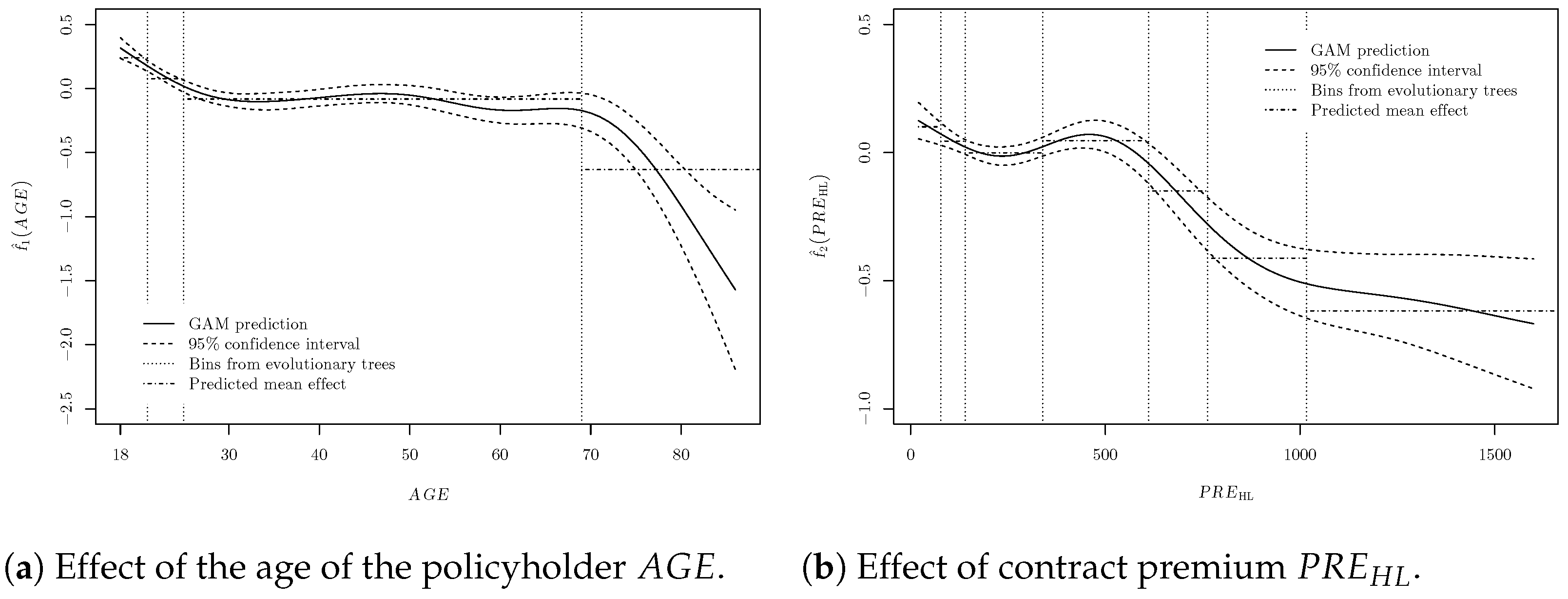

3.2. Model for the HL Cohort

3.2.1. Model Development

3.2.2. Numerical Results and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | GE includes major cities like Zurich and Winterthur, GW includes Berne and Basel, GA includes St. Gallen, Chur and Lucerne, GR includes Geneva, Lausanne and Sion, and GI includes Lugano and Locarno. We denote categorical variables in bold face and, e.g., the vector GEO has the form (GE, GW, GA, GR, GI, OT). |

| 2 | We use subscripts CA and HL on to distinguish the premium in both products. |

| 3 | As we use rounded quartile values as boundaries for the classes, we find shares not exactly equal to 25%. |

References

- Aalen, Odd O., Ørnulf Borgan, and Håkon K. Gjessing. 2008. Survival and Event History Analysis. Statistics for Biology and Health. New York: Springer. [Google Scholar] [CrossRef]

- Ansell, Jake, Tina Harrison, and Tom Archibald. 2007. Identifying Cross-selling Opportunities, Using Lifestyle Segmentation and Survival Analysis. Marketing Intelligence and Planning 25: 394–410. [Google Scholar] [CrossRef]

- Bieck, Christian, Boderas Mareike, Peter Maas, and Tobias Schlager. 2010. Powerful Interaction Points: Saying Goodbye to the Channel. Somers: IBM Institute for Business Value and University of St. Gallen. [Google Scholar]

- Denuit, Michel, and Stefan Lang. 2004. Non-life Rate-making with Bayesian GAMs. Insurance: Mathematics and Economics 35: 627–47. [Google Scholar] [CrossRef]

- Dougherty, James, Ron Kohavi, and Mehran Sahami. 1995. Supervised and Unsupervised Discretization of Continuous Features. Machine Learning 12: 194–202. [Google Scholar] [CrossRef]

- Dutang, Christophe. 2012. Etude des Marchés D’assurance Non-Vie à L’aide D’équilibre de Nash et de Modèle de Risques Avec Dépendance. Doctoral thesis, Université Claude Bernard—Lyon I, Villeurbanne, France. [Google Scholar]

- Eling, Martin, and Dieter Kiesenbauer. 2014. What Policy Features determine Life Insurance Lapse? An Analysis of the German Market. The Journal of Risk and Insurance 81: 241–69. [Google Scholar] [CrossRef]

- Fornell, Claes, and Birger Wernerfelt. 1987. Defensive Marketing Strategy by Customer Complaint Management: A Theoretical Analysis. Journal of Marketing Research 24: 337–46. [Google Scholar] [CrossRef]

- Frees, Edward W. 2015. Analytics of Insurance Markets. Annual Review of Financial Economics 7: 253–77. [Google Scholar] [CrossRef]

- Frees, Edward W., Richard A. Derrig, and Glenn Meyers. 2016. Predictive Modeling Applications in Actuarial Science Volume 1: Predictive Modeling Techniques. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Fuino, Michel, and Joël Wagner. 2020. Duration of Long-Term Care: Socio-Economic Drivers, Evolution and Type of Care Interactions. Insurance: Mathematics and Economics 90: 151–168. [Google Scholar] [CrossRef]

- Grewal, Rajdeep, Raj Mehta, and Frank R. Kardes. 2004. The Timing of Repeat Purchases of Consumer Durable Goods: The Role of Functional Bases of Consumer Attitudes. Journal of Marketing Research 41: 101–15. [Google Scholar] [CrossRef]

- Grubinger, Thomas, Achim Zeileis, and Karl-Peter Pfeiffer. 2014. Evtree: Evolutionary Learning of Globally Optimal Classification and Regression Trees in R. Journal of Statistical Software 61: 1–29. [Google Scholar] [CrossRef]

- Guillen, Montserrat, Jens Perch Nielsen, and Ana M. Pérez-Marín. 2008. The Need to Monitor Customer Loyalty and Business Risk in the European Insurance Industry. The Geneva Papers on Risk and Insurance—Issues and Practice 33: 207–18. [Google Scholar] [CrossRef]

- Gupta, Sunil, Dominique Hanssens, Bruce Hardie, William Kahn, V. Kumar, Nathaniel Lin, Nalini Ravishanker, S. Sriram, Dominique Hanssens, and W. Kahn. 2006. Modeling Customer Lifetime Value. Journal of Service Research 9: 139–55. [Google Scholar] [CrossRef]

- Henckaerts, Roel, Katrien Antonio, Maxime Clijsters, and Roel Verbelen. 2018. A Data Driven Binning Strategy for the Construction of Insurance Tariff Classes. Scandinavian Actuarial Journal 2018: 681–705. [Google Scholar] [CrossRef]

- Jackson, Christopher. 2016. flexsurv: A Platform for Parametric Survival Modeling in R. Journal of Statistical Software 70: 1–33. [Google Scholar] [CrossRef] [PubMed]

- Jain, Dipak C., and Naufel J. Vilcassim. 1991. Investigating Household Purchase Timing Decisions: A Conditional Hazard Function Approach. Marketing Science 10: 1–23. [Google Scholar] [CrossRef]

- James, Gareth, Daniela Witten, Trevor Hastie, and Robert Tibshirani. 2013. An Introduction to Statistical Learning with Applications in R. New York: Springer. [Google Scholar] [CrossRef]

- Janssen, Jacques, and Raimondo Manca. 2006. Applied Semi-Markov Processes. New York: Springer. [Google Scholar]

- Kalbfleisch, John D., and Ross L. Prentice. 2002. The Statistical Analysis of Failure Time Data. Wiley Series in Probability and Statistics; Hoboken: John Wiley & Sons, Inc. [Google Scholar] [CrossRef]

- Kamakura, Wagner A. 2007. Cross-Selling: Offering the Right Product to the Right Customer at the Right Time. Journal of Relationship Marketing 6: 41–58. [Google Scholar] [CrossRef]

- Kamakura, Wagner A., Michel Wedel, Fernando de Rosa, and Jose Afonso Mazzon. 2003. Cross-Selling through Database Marketing: A Mixed Data Factor Analyzer for Data Augmentation and Prediction. International Journal of Research in Marketing 20: 45–65. [Google Scholar] [CrossRef]

- Klein, Nadja, Michel Denuit, Stefan Lang, and Thomas Kneib. 2014. Nonlife Ratemaking and Risk Management with Bayesian Generalized Additive Models for Location, Scale, and Shape. Insurance: Mathematics and Economics 55: 225–49. [Google Scholar] [CrossRef]

- Knott, Aaron, Andrew Hayes, and Scott A. Neslin. 2002. Next-Product-to-Buy Models for Cross-Selling Applications. Journal of Interactive Marketing 16: 59–75. [Google Scholar] [CrossRef]

- Kumar, Vikas, Morris George, and Joseph Pancras. 2008. Cross-Buying in Retailing: Drivers and Consequences. Journal of Retailing 84: 15–27. [Google Scholar] [CrossRef]

- Laas, Daniela, Hato Schmeiser, and Joël Wagner. 2016. Empirical Findings on Motor Insurance Pricing in Germany, Austria and Switzerland. The Geneva Papers on Risk and Insurance—Issues and Practice 41: 398–431. [Google Scholar] [CrossRef]

- Lüdi, Georges, and Iwar Werlen. 2005. Sprachenlandschaft in der Schweiz. Neuchâtel: Swiss Federal Statistical Office. [Google Scholar]

- Maas, Peter, Albert Graf, and Christian Bieck. 2008. Trust, Transparency and Technology. Somers: IBM Institute for Business Value and University of St. Gallen. [Google Scholar]

- Mau, Stefan, Irena Pletikosa Cvijikj, and Joël Wagner. 2015. From Research to Purchase: An Empirical Analysis of Research-shopping Behaviour in the Insurance Sector. Zeitschrift für die Gesamte Versicherungswissenschaft 104: 573–93. [Google Scholar] [CrossRef]

- Mau, Stefan, Irena Pletikosa Cvijikj, and Joël Wagner. 2017. Insurance Consumption and Customer Portfolio Characteristics in Multichannel Distribution: New Empirical Evidence. Working Paper. Lausanne: University of Lausanne. [Google Scholar]

- Mau, Stefan, Irena Pletikosa Cvijikj, and Joël Wagner. 2018. Forecasting the Next Likely Purchase Events of Insurance Customers. International Journal of Bank Marketing 36: 1125–44. [Google Scholar] [CrossRef]

- Moore, Dirk F. 2016. Applied Survival Analysis Using R Use R! Cham: Springer International Publishing. [Google Scholar] [CrossRef]

- Ngobo, Paul Valentin. 2004. Drivers of Customers’ Cross-Buying Intentions. European Journal of Marketing 38: 1129–57. [Google Scholar] [CrossRef]

- Ohlsson, Esbjörn, and Björn Johansson. 2010. Non-Life Insurance Pricing with Generalized Linear Models. EAA SERIES. Berlin/Heidelberg: Springer. [Google Scholar] [CrossRef]

- Prinzie, Anita, and Dirk Van den Poel. 2006. Investigating Purchasing-Sequence Patterns for Financial Services using Markov, MTD and MTDg Models. European Journal of Operational Research 170: 710–34. [Google Scholar] [CrossRef]

- Prinzie, Anita, and Dirk Van den Poel. 2007. Predicting Home-appliance Acquisition Sequences: Markov/Markov for Discrimination and Survival Analysis for Modeling Sequential Information in NPTB models. Decision Support Systems 44: 28–45. [Google Scholar] [CrossRef]

- Schwarz, Gideon. 1978. Estimating the Dimension of a Model. The Annals of Statistics 6: 461–64. [Google Scholar] [CrossRef]

- Staudt, Yves, and Joël Wagner. 2018. What Policyholder and Contract Features Determine the Evolution of Non-life Insurance Customer Relationships? A Case Study Analysis. International Journal of Bank Marketing 36: 1098–124. [Google Scholar] [CrossRef]

- Staudt, Yves, and Joël Wagner. 2019. Comparison of Machine Learning and Traditional Severity-Frequency Regression Models for Car Insurance Pricing. Working Paper. Lausanne: University of Lausanne. [Google Scholar]

- Verhoef, Peter C., and Bas Donkers. 2005. The Effect of Acquisition Channels on Customer Loyalty and Cross-Buying. Journal of Interactive Marketing 19: 31–43. [Google Scholar] [CrossRef]

- Verhoef, Peter C., Philip Hans Franses, and Janny C. Hoekstra. 2001. The Impact of Satisfaction and Payment Equity on Cross-Buying: A Dynamic Model for a Multi-Service Provider. Journal of Retailing 77: 359–78. [Google Scholar] [CrossRef]

- Whitehead, John. 1980. Fitting Cox’s Regression Model to Survival Data using GLIM. Applied Statistics 29: 268. [Google Scholar] [CrossRef]

- Wood, Simon N. 2017. Generalized Additive Models: An Introduction with R, 2nd ed. Boca Raton: CRC Press. [Google Scholar]

| Variable | Description |

|---|---|

| Customer attributes | |

| Age of the policyholder | |

| Urbanicity of the residence: urban (UU) or rural (UR) | |

| Geographic region of the residence: | |

| – East Swiss Plateau (GE) | |

| – West Swiss Plateau (GW) | |

| – Alps and Prealps (GA) | |

| – Romandy (GR) | |

| – Italian-speaking area of Switzerland (GI) | |

| – Outside of Switzerland (OT) | |

| Products attributes | |

| CA or HL contract premium paid (in CHF) | |

| Number of damages declared (0, 1, 2, 3+) | |

| Number of contracts underwritten (1, 2, 3, 4+) | |

| Life insurance underwritten (yes or no) | |

| Buying channel attribute | |

| Access channel used by the policyholder: | |

| – Tied agent (TA) | |

| – Independent intermediary (IY) | |

| – Broker (BR) | |

| – Internet/insurer’s website (IT) | |

| – Other (OT) | |

| CA Cohort | HL Cohort | |||||||

|---|---|---|---|---|---|---|---|---|

| Share | Share | |||||||

| Age (AGE, in years) | ||||||||

| 18–25 | 40 | 189 | 349 | 122 | 412 | 919 | ||

| 26–40 | 221 | 762 | 1683 | 111 | 423 | 1348 | ||

| 41–65 | 250 | 781 | n.a | 112 | 365 | 1226 | ||

| 66+ | 25 | 703 | 1231 | 179 | 853 | n.a. | ||

| Urbanicity (URB) | ||||||||

| Urban (UU) | 190 | 616 | 1218 | 205 | 849 | n.a. | ||

| Rural (UR) | 137 | 416 | 819 | 89 | 289 | 719 | ||

| Geographic region () | ||||||||

| East Swiss Plateau (GE) | 159 | 509 | 1001 | 122 | 451 | 1168 | ||

| West Swiss Plateau (GW) | 118 | 380 | 710 | 126 | 416 | 1156 | ||

| Alps and Prealps (GA) | 108 | 365 | 720 | 96 | 325 | 822 | ||

| Romandy (GR) | 214 | 609 | 1370 | 153 | 589 | 1641 | ||

| Italian-speaking area (GI) | 396 | 1223 | n.a. | 122 | 550 | 1382 | ||

| Outside Switzerland (OT) | 179 | 481 | 759 | 34 | 96 | 216 | ||

| CA contract premium (PRE, in CHF) | ||||||||

| 0–747 | 212 | 654 | 1380 | |||||

| 748–1068 | 137 | 441 | 869 | |||||

| 1069–1405 | 128 | 404 | 762 | |||||

| 147 | 418 | 853 | ||||||

| HL contract premium (PRE, in CHF) | ||||||||

| 0–109 | 117 | 397 | 901 | |||||

| 110–252 | 201 | 868 | n.a. | |||||

| 253–391 | 112 | 409 | 1233 | |||||

| 92 | 275 | 699 | ||||||

| Number of damages () | ||||||||

| 0 | 158 | 478 | 955 | 118 | 413 | 1137 | ||

| 1 | 95 | 365 | 758 | 112 | 349 | 792 | ||

| 2 | 113 | 365 | 763 | 456 | 820 | n.a. | ||

| 85 | 314 | 478 | 884 | 1264 | 1264 | |||

| Number of contracts () | ||||||||

| 1 | 479 | 931 | 1774 | 475 | 1207 | n.a. | ||

| 2 | 3 | 7 | 15 | 3 | 7 | 17 | ||

| 3 | 6 | 12 | 19 | 4 | 11 | 17 | ||

| 2 | 7 | 31 | 6 | 8 | 37 | |||

| Life insurance underwritten (LIF) | ||||||||

| No | 152 | 470 | 933 | 120 | 427 | 1161 | ||

| Yes | 40 | 189 | 522 | 92 | 165 | 253 | ||

| Access channel () | ||||||||

| Tied agent (TA) | 114 | 365 | 708 | 109 | 372 | 977 | ||

| Independent intermediary (IY) | 162 | 617 | 1214 | 148 | 462 | 1720 | ||

| Broker (BR) | 524 | 1676 | n.a. | 264 | 1343 | n.a. | ||

| Internet/insurer’s website (IT) | 144 | 438 | 704 | n.a. | n.a. | n.a. | ||

| Other (OT) | 475 | n.a. | n.a. | 112 | 932 | n.a. | ||

| Distribution | Exponential | Weibull | Gamma | Log-Normal |

|---|---|---|---|---|

| CA cohort | 108,385 | 106,309 | 106,332 | 106,306 |

| Cox Model (4) | AFT Model (6) | |||||||

|---|---|---|---|---|---|---|---|---|

| exp(coeff.) | exp(s.e.) | exp(−coeff.) | coeff. | s.e. | exp(coeff.) | |||

| Geographic region () | ||||||||

| East Swiss Plateau (GE) | Baseline | Baseline | ||||||

| West Swiss Plateau (GW) | 0.881 | |||||||

| Alps and Prealps (GA) | 0.870 | |||||||

| Romandy (GR) | . | 1.082 | ||||||

| Italian-speaking area (GI) | 1.345 | |||||||

| Outside Switzerland (OT) | 0.851 | . | ||||||

| Number of contracts () | ||||||||

| 1 | Baseline | |||||||

| 2 | 0.111 | |||||||

| 3 | 0.074 | |||||||

| 0.063 | ||||||||

| Access channel () | ||||||||

| Tied agent (TA) | Baseline | Baseline | ||||||

| Independent intermediary (IY) | 1.080 | |||||||

| Broker (BR) | 1.765 | |||||||

| Internet/insurer’s website (IT) | 1.029 | |||||||

| Other (OT) | 3.040 | |||||||

| Age (, in years) | ||||||||

| 18–19 | 0.209 | |||||||

| 20–21 | 0.280 | |||||||

| 22–23 | 0.388 | |||||||

| 24–25 | 0.624 | |||||||

| 26–28 | 0.872 | |||||||

| 29–59 | Baseline | Baseline | ||||||

| 0.847 | ||||||||

| CA contract premium (, in CHF) | ||||||||

| 18–473 | 1.327 | |||||||

| 474–1676 | Baseline | Baseline | ||||||

| 1677–2161 | 1.413 | |||||||

| 2.327 | ||||||||

| Distribution | Exponential | Weibull | Gamma | Log-Normal |

|---|---|---|---|---|

| CA cohort | 108,385 | 106,309 | 106,332 | 106,306 |

| HL cohort | 111,327 | 107,822 | 107,867 | 107,652 |

| Cox Model (8) | AFT Model (9) | |||||||

|---|---|---|---|---|---|---|---|---|

| exp(coeff.) | exp(s.e.) | exp(−coeff.) | coeff. | s.e. | exp(coeff.) | |||

| Urbanicity () | ||||||||

| Urban (UU) | Baseline | Baseline | ||||||

| Rural (UR) | ||||||||

| Number of contracts () | ||||||||

| 1 | Baseline | |||||||

| 2 | ||||||||

| 3 | ||||||||

| Access channel () | ||||||||

| Tied agent (TA) | Baseline | Baseline | ||||||

| Independent intermediary (IY) | ||||||||

| Broker (BR) | ||||||||

| Internet/insurer’s website (IT) | ||||||||

| Other (OT) | ||||||||

| Age (, in years) | ||||||||

| 18–21 | ||||||||

| 22–25 | ||||||||

| 26–69 | Baseline | Baseline | ||||||

| HL contract premium (, in CHF) | ||||||||

| 20–80 | ||||||||

| 81–148 | ||||||||

| 149–359 | Baseline | Baseline | ||||||

| 360–578 | ||||||||

| 579–698 | ||||||||

| 699–910 | ||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Staudt, Y.; Wagner, J. Factors Driving Duration to Cross-Selling in Non-Life Insurance: New Empirical Evidence from Switzerland. Risks 2022, 10, 187. https://doi.org/10.3390/risks10100187

Staudt Y, Wagner J. Factors Driving Duration to Cross-Selling in Non-Life Insurance: New Empirical Evidence from Switzerland. Risks. 2022; 10(10):187. https://doi.org/10.3390/risks10100187

Chicago/Turabian StyleStaudt, Yves, and Joël Wagner. 2022. "Factors Driving Duration to Cross-Selling in Non-Life Insurance: New Empirical Evidence from Switzerland" Risks 10, no. 10: 187. https://doi.org/10.3390/risks10100187

APA StyleStaudt, Y., & Wagner, J. (2022). Factors Driving Duration to Cross-Selling in Non-Life Insurance: New Empirical Evidence from Switzerland. Risks, 10(10), 187. https://doi.org/10.3390/risks10100187