1. Introduction

From the 1980s to current years, many interest rate models were proposed in the literature. Their common aim is to explain changes in bond or swap quotes and to replicate risks within the interest rates market. Three dominating frameworks coexist: short-term rate, forward rate and the Libor market models. In this last approach proposed by

Brace et al. (

1997), interest rates are driven by geometric processes. In the forward rate model pioneered by

Heath et al. (

1992), the term structure of rates is specified through instantaneous forward rates.

Mercurio and Moraleda (

2000) and

Falini (

2010) proposed a forward model with a humped structure of volatilities.

Li et al. (

2020) developed a forward rate model unifying most existing Gaussian models for interest rates. Short-term rate models such as those promoted by

Hull and White (

1990) specify a mean reverting dynamic for the instantaneous risk-free rate. The framework developed in this article belongs to this third category.

The family of short-term rate models gathers multiple frameworks and we refer the reader, e.g., to

Boero and Torricelli (

1996) or to

Schmidt (

2011) for a review. On the other hand, various processes were proposed to explain the interest rate risk. The literature is too vast to be exhaustive. We restrict our attention to contributions related to this work and do not attempt at providing a general overview, referring instead to

Brigo and Mercurio (

2006) for detailed accounts on the topic. For instance,

Eberlein and Raible (

1999) were among the first to propose a short-term rate model driven by Lévy processes. In their setting, the short-term rate is ruled by Ornstein–Uhlenbeck processes reverting in an exponential manner to a mean level. Within this framework,

Eberlein and Kluge (

2005) derived analytical formulae for the prices of caps and floors using bilateral Laplace transforms. In a similar setting,

Hainaut and MacGilchrist (

2010) proposed a pentanomial tree for pricing derivatives.

Hainaut (

2013) studied the properties of a Gaussian short-term rate with a Markov Switching Multifractal volatility.

Moreno and Platania (

2015) proposed a square-root model replicating economic cycles in the dynamics of interest rates.

Hainaut (

2016) and

Njike and Hainaut (

2020) developed unicurve and multicurve models in which the short-term rate is exposed to self-excitating jumps.

Fontana et al. (

2020) studied a modelling framework exploiting the the self-exciting behavior of continuous-state branching processes with immigration (CBI).

A wide majority of short-term rate models are driven by Markov mean reverting processes. In this setting, the interest rate depends on its path through the integral of past occurrences weighted by an exponential decaying function, called the memory kernel. In this framework, the influence of previous variations of interest rates decreases exponentially over time. In this article, we consider an alternative that consists in replacing this memory kernel by a Mittag–Leffler decaying function. This function is sub-exponential and may be seen as a generalization of the exponential. In this setting, the interest rate remembers its previous occurrences for a longer period than in the exponential framework. The motivations for studying such a model are multiple. Firstly, the features replicate the persistence empirically observed in short term rates, as illustrated in

Section 3, or in nominal yields and inflation, as shown by

Golinski and Zaffaroni (

2016). Secondly, the proposed model has a sufficient level of analytical tractability for most of financial applications such as option pricing. Finally, it also offers a novel alternative to existing approaches based on the fractional Brownian motion for introducing long memory, as for instances studied in

Cheridito et al. (

2003) or

Maejima and Yamamoto (

2003).

A consequence of this change of memory kernel is that the interest rate process is not Markovian anymore. Bond prices depend then on the sample path of past rates. Nevertheless, we take advantage of the representation of the memory kernel as a Laplace Stieltjes integral to rewrite the short-term rate as an infinite dimensional Markov process. The last part of the article studies the properties of the model under a forward measure and proposes a pricing method for bond options.

2. A Lévy Model with a Mittag Leffler Kernel

We consider that the short-term rate is driven by

independent Lévy processes, denoted by

for

. These processes are defined on a probability space

endowed with the natural filtration

and a risk neutral measure,

. Each process

has independent and stationary increments. It is fully described by a triplet

where

,

and

is a Lévy measure. The moment generating function (mgf) is denoted by

for

and is equal to the following:

where

. Notice that if the Lévy measure,

, has no singurality at

, we can set

to zero. The function

is the characteristic exponent of this Lévy process that is always defined for pure imaginary numbers. Without loss of generality, we assume that

. According to the Lévy Itô decomposition, each

is the sum of three components: a deterministic drift

, a Brownian motion with variance

and a jump process,

, of intensity

well defined on

. This Lévy measure is such that the probability of observing

k jumps between

of a size included in a set

is given by the following:

for

. If

for

, are independent Brownian motions on

,

may be split as the sum of a drift, a Brownian motion and a jump process:

where the following is the case.

Without loss of generality, we assume that

. This constraint implies that the drift compensates jumps larger than

in absolute value:

This can be proved by approaching

with a stepwise function and by using the property of independence of increments. This property will be useful in later developments. We postulate that the risk-free rate,

, is the sum of a deterministic function

and of

d processes:

:

where

is such that the following is the case.

The function

is continuously decreasing with an initial value

. As

determines the influence of past realizations of

on the current value of the process, we call it “memory kernel” or “kernel function” in the remainder of this article. When the function

decreases exponentially, the processes

are Markov and mean-reverting as recalled in

Appendix A. Such a model was, e.g., developed in

Hainaut and MacGilchrist (

2010) for pricing interest rate derivatives and will serve as benchmark in numerical illustrations. However,

and

are in general not Markov for any other non-exponential kernels. This feature makes difficult the evaluation of bond prices at a given time

as their value depends on the entire sample path of interest rates up to

t. Nevertheless, for a few kernel functions that admit a representation as a Laplace–Stieltjes integral, we will show that the interest rate may be represented as an infinite dimensional Markov process. In particular, we consider two types of kernel functions, both based on the Mittag–Leffler function, denoted by

where

.

In order to understand the motivation for working with such functions, we need to review the main properties of the Mittag–Leffler function. The Mittag–Leffler function of order

plays a fundamental role in the fractional calculus and can be considered as an extension of the exponential function. It is defined as an infinite sum.

In this article, we assume that

. For this range of values,

is an intermediary between the power and the exponential decreasing functions.

We refer the reader to the book of

Gorenflo et al. (

2020) for a detailed presentation of this function. For a complete presentation of fractional calculus, we recommend the book of

Baleanu et al. (

2012) and the book of

Kochubei and Luchko (

2019). Let us recall that a function

is called completely monotonic if it possesses derivatives

of any order

and the derivatives are alternating in sign.

The above property is equivalent to the existence of a representation of the function

f in the form of a Laplace–Stieltjes integral with non-decreasing density and non-negative measure

such that the following is the case.

The Mittag–Leffler function of negative argument

is completely monotonic for all

and

. A proof of this result is available in

Gorenflo et al. (

2020) on page 47. The authors show the following:

where the derivative of

is equal to the following.

Given that

, we have

and

is then a measure of probability on

. In the remainder of this article,

is called the decreasing Mittag–Leffler (ML) kernel. The DML behaves at short-term as follows:

when

. From

Haubold et al. (

2011), we known that when

, DML converges to the following.

The function

interpolates for intermediate times

t between the decreasing exponential and the inverse power law. The exponential models fast decay for small time

t, whereas the asymptotic inverse power law entails a slow decrease at long term. This point is illustrated in the left plot of

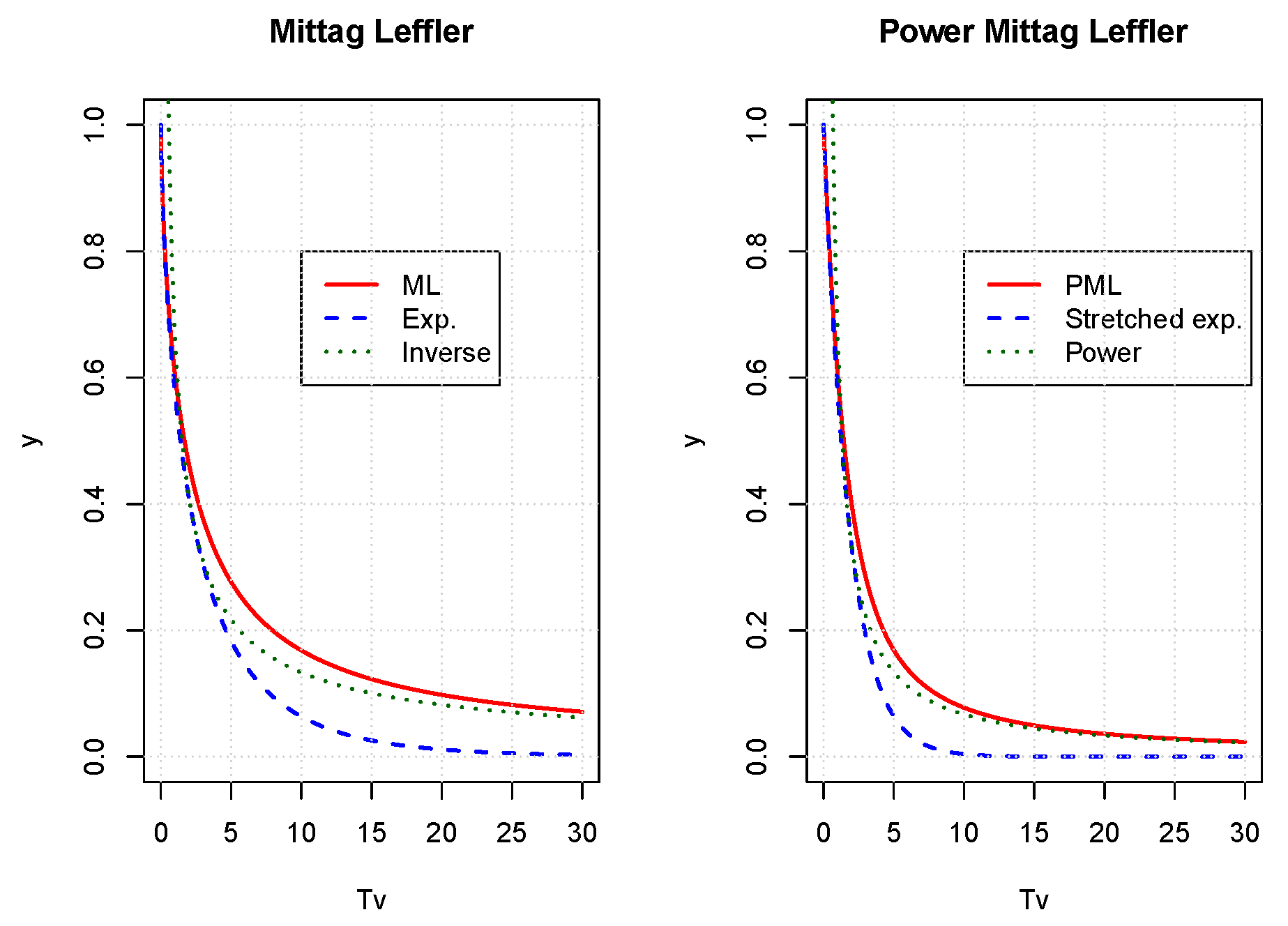

Figure 1, which compares the ML kernel to the exponential and inverse power functions.

The Mittag–Leffler function is also related to the fractional calculus. In order to explain this link, we recall that Caputo’s fractional derivative of order

for a function

:

,

with respect to

t is defined by the following.

When

, this derivative corresponds to the first order derivative. The solution of the fractional differential equation of the following:

with the initial condition

is

. We abusively call this function the power decreasing Mittag–Leffler kernel (PML). The Laplace transform of

is given by

where

. By inverting this transform, we can prove as in

Gorenflo and Mainardi (

1997) that the PML is the Laplace transform of the following:

where the derivative of

is given by the following.

Since

, we have

and

is a measure of probability on

. As underlined by

Mainardi (

2020), the PML behaves at short-term as follows:

when

. From

Erdélyi et al. (

1955), we known that when

, PML converges to the following.

As a consequence, the function

interpolates for intermediate times

t between the stretched exponential and the negative power law. The stretched exponential models the very fast decay at short-term whereas the asymptotic power law is due to the very slow decay for large time

t. The right plot of

Figure 1 illustrates this convergence.

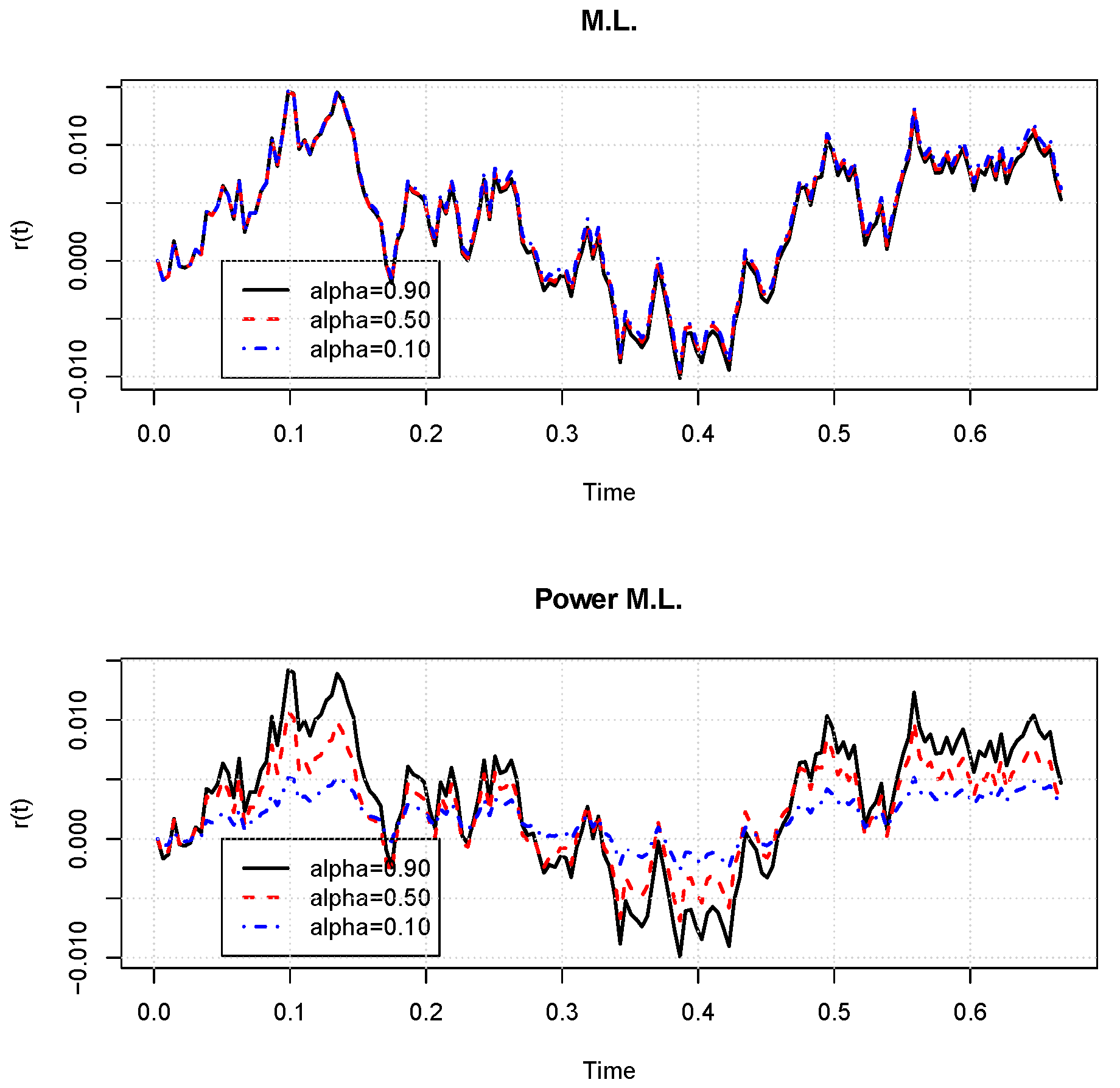

Figure 2 presents simulated sample paths of the short-term rate with a one dimensional (

) model ruled by a Brownian motion. These paths are computed for various

with the same random occurrences in order to make a comparison feasible. For the ML kernel, the trajectories are nearly similar. An analysis of figures reveals that the sample path is smoother for

than for

. This trend becomes visible if we choose the highest value for

. For PML sample paths, the difference is clearly visible. Decreasing

reduces the volatility of rates and smooths the sample path.

To conclude this section, we present the first two moments of the short-term rate and its autocovariance function. The ML and PML kernels defined in Equation (

7) are continuously decreasing and integrable functions on any bounded interval of

. From Equation (

4), the mgf of

for

is then equal to the following.

Deriving mgf allows us to find the first moments of

conditionally to the initial information. On the other hand, from the following representation:

of

, we infer that the conditional expectation of the short-term rate is given by the following.

On the other hand, the conditional variance of

is equal to the sum of variances of Lévy processes times the integral of the squared kernels.

Unfortunately the integral of

does not admit a closed form expression for the ML and PML kernels. Nevertheless, they can be numerically estimated. A direct calculation allows us to infer that autocovariance between

and

for

is given by:

Contrary to the exponential case, this covariance function between and does not admit any closed form expression when .

3. Empirical Motivation

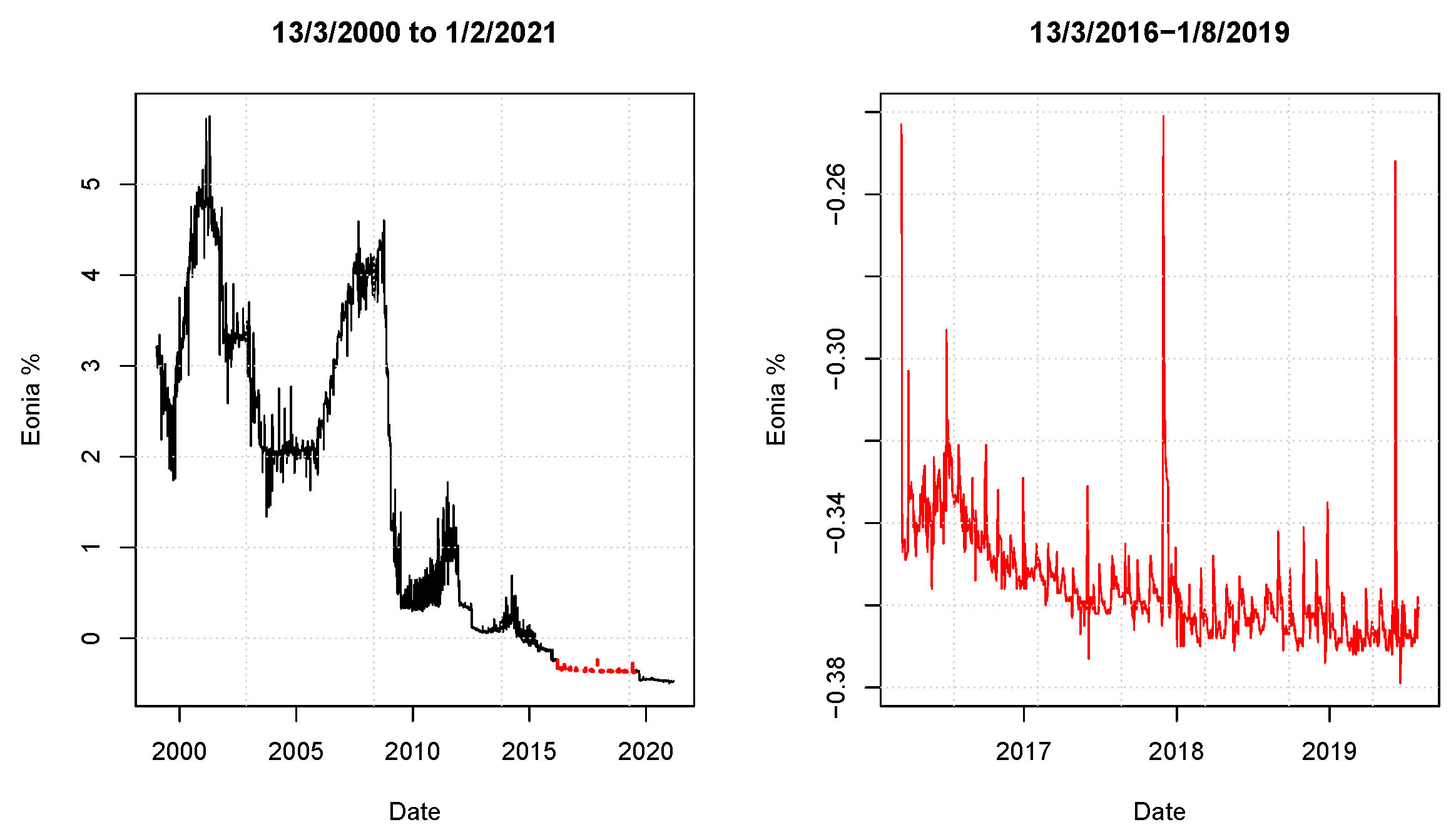

This short section provides some empirical arguments motivating the developments performed in this article, particularly the choice of a ML or PML memory kernel. We fit univariate Gaussian models (

) with exponential ML and PML kernels to the Eonia time series from 13 March 2016 to 1 August 2019. The dataset counts

866 daily observations. We select this time window mainly because Eonia was relatively stable during this period, as illustrated in the right plot of

Figure 3. This allows us to assume that the trend function,

, is constant. Considering a larger dataset would raise the question of modelling a non-linear trend in view of the left plot of

Figure 3.

The dates of observations are denoted by

, whereas the step of time between two successive observations is

. We first consider a one dimensional exponential kernel model as detailed in

Appendix A. Under the assumption that

and

, we find the following:

for

. Under the assumption that

is a Brownian motion without drift and of variance

, parameters are estimated by log-likelihood maximization. We next consider models with ML and PML kernel functions. In this cases, the variations of the underlying Lévy process are approached by the following:

for

where

) is either the ML or the PML function. Under the assumption of normality, parameters are estimated by log-likelihood maximization whereas the goodness of fit is measured with the Akaike Information Criterion (AIC). The results of this procedure are reported in

Table 1. In terms of log-likelihood, exponential and ML models achieve the same goodness of fit but the exponential model is more parsimonious and preferred. They share the same estimated volatilities but the parameters of reversion

and

slightly differ. The best fit, based on the AIC, is obtained with a power Mittag–Leffler kernel. The parameter

that drives the decay of the memory is small. This means that the process has a longer-term memory than the exponential model. On the other hand, the mean reversion speed is significantly higher than the ones of other models. We recall to the reader that estimated parameters reflect the dynamic of

under the real measure

and not the risk neutral one.

4. Alternative Formulation

If the memory is not exponential decaying, the interest rate process

is not Markovian. This feature makes difficult the evaluation of bond prices or interest rate derivatives because their values depend on the entire history of the rate process. Nevertheless, if the memory kernel admits a representation as a Laplace–Stieltjes integral, we can convert the short-term rate into an infinite dimensional Markov process. Approximating this process allows us to infer the dynamic of bond prices. As developments are similar in both cases, we denote by

the measures

or

of

and

. Let us recall that the function

. Using the Fubini’s theorem, the processes

are then rewritten as follows:

for

. The

are Ornstein–Uhlenbeck processes for

and for all

. Their initial values are

, and they obey to the following stochastic differential equation (SDE).

As this SDE admits the following solution:

the short-term rate is then a sum of integrals of

.

Given that

and

are probability measures, the differential of

is, on the other hand, equal to the following.

Combining Equations (

18) and (

19) allows us to rewrite the short-term rate as the following sum:

which does not depend anymore upon information prior to

s. This relation emphasizes that

and

form well an infinite dimensional Markov process. If we remember that

, we infer an equivalent representation of Equation (

14) for the conditional expectation of

in terms of

.

We will explain in the next section how to approximate the infinity of processes by discretizing measures . However, we evaluate zero coupon bonds and instantaneous forward rates in this setting first.

5. Bond Prices and Forward Rates

A zero-coupon bond of maturity t delivers a unit cash-flow at expiry. Its price at time s prior to t is denoted by and in absence of arbitrage, and it is the expected discount factor under the risk neutral measure, . The next proposition presents a semi-closed form expression for this price.

Proposition 1. Let us, respectively, define functions and as follows:for and . The zero coupon bond price is equal. to Proof. From Equation (

13), we infer, after a change of the integration order, the following.

A direct calculation allows us to rewrite the integrals of

in this last expression as follows.

The zero-coupon bond price becomes the following.

Finally, the expectation in this last expression is calculated with Equation (

4). □

Remark that

and that

. Furthermore, the function

admits a single maximum

such that

for a’l

. Therefore, the integral

is bounded by

and is well defined. Equation (

23) emphasizes the dependence of the bond price to the history of Levy processes. A more convenient formulation in terms of

for

is presented in the next proposition. In this alternative valuation formula, the bond price is exclusively calculated with information available at the time of valuation.

Proposition 2. The value at time of a zero coupon bond price expiring at is also equal to the following:where and for are defined by Equations (21) and (22). Proof. Starting from Equation (

23), we rewrite the last terms as follows.

We conclude that the bond price is well given by Equation (

24). □

The integrals in the bond price formula do not admit closed form expressions. Nevertheless, the integrals can be numerically computed without any particular difficulty whereas is approached by a discretization scheme developed in the following section.

Let us recall that the initial values of processes

are null, that is

, for all

and

. Therefore, Equation (

24) provides us a method to estimate the function

such that the model perfectly matches the initial term structure of bond prices. More precisely, the integral of

is the following.

Deriving this last expression results in the following function.

The dynamic of interest rates can also be reformulated in terms of instantaneous forward rates. Let us recall that the instantaneous forward rate, denoted by

, is such that

and is, therefore, equal to the following.

The next proposition states that the forward rate is the sum of the expected interest rate under the risk neutral measure and of an adjustment that directly depends upon the memory kernel.

Proposition 3. The instantaneous forward rate at time s and of maturity t is given by the following:where the following is the case. Its dynamic is independent from processes and is equal to the following. Proof. From Equation (

24) and

, we have the following.

If we remember expression (

24) of the characteristic exponent, we immediately infer the following.

As

, we obtain Equation (

26). The differential of

is obtained by applying the Itô’s lemma for Lévy processes. □

This last proposition emphasizes that our short-term rate model can be reformulated as a forward rate model in which the forward rate dynamic is independent from processes for .

6. Discretization Scheme

Instead of considering an infinity of processes

, we approach the model with a finite number of equivalent processes. This presents several advantages. Firstly, this makes the implementation of our model. Secondly, we can rely on Itô’s calculus in most developments. This allows us to deduce the dynamic of bond prices both in the approximated and original models. The key step consists in approximating

by discrete measures with a finite numbers of atoms. For this purpose we consider a partition of the following:

. On each interval

, we define the barycenter of

:

and the mass of corresponding atoms is defined as the measure of intervals of the following partition:

for

In practice, we choose

and set

to a percentile of the density

(e.g., 95%). The discrete measure for a partition of size

n is defined as follows:

where

is the Dirac measure located at point

. We consider that the following assumption holds for the partition

In this case, for any function integrable with respect to , we have .

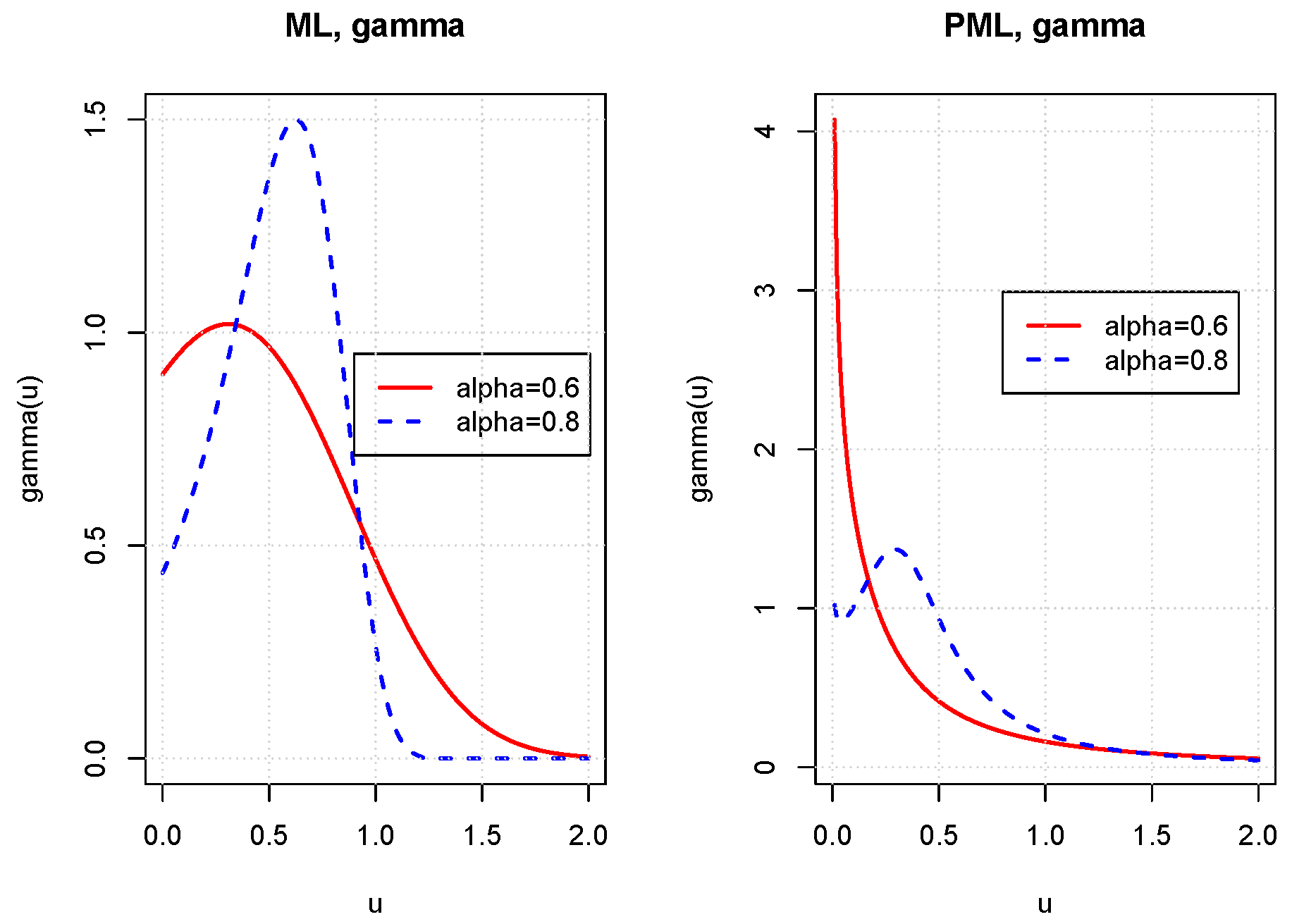

Figure 4 shows the differential of measures

of the ML and PML kernels. For the ML kernels (left plot), decreasing

clearly makes the right tail of

larger. The right plot also reveals that the construction of the partition requires a particular care for the PML kernel as we have to integrate numerically measure

that is not defined for

. The two next propositions, respectively, present the expressions of integrals needed for calculating the discrete equivalent distributions of

in the ML and PML cases.

Proposition 4. For the ML kernel, the discrete probability mass of atoms is given by the following:whereas the numerator in the expression of barycenters (27) is the following. This result is a direct consequence of the definition of the ML function. To the best of our knowledge, these expressions does not admit any other representations. In the PML case, barycenters have a closed-form expression.

Proposition 5. For the PML kernel, the discrete probability mass of atoms is given by the following. The numerator in the expression of barycenters (27) does not admit a closed form expression but may be approached by the following. Proof. The expression of the probability mass

comes from the following relation.

The second result is obtained with an integration by parts in which the integral is approached with the trapezoidal method. □

To lighten further developments, we adopt the following notations

for

and

. Let us first recall that

and therefore

is an integral from zero to

s with respect to the

Lévy process.

Replacing the continuous measures

by their discrete equivalents results in approximation

of the short-term rate

.

We adopt the following notation

for

and

. The bond price in the discretized model with partitions of size

n is denoted by

and is equal to the following:

where

is the discretized version of

.

As the number of processes in the discretized model is finite, we can apply Itô’s lemma in order to establish the dynamic of .

Proposition 6. The zero coupon bond price is a geometric Lévy processes solution of the SDE: with the terminal condition .

Proof. If we remember that

, the Itô’s lemma provides us with the following differential for

.

The first and second order partial derivatives of

are equal to the following.

On the other hand, its partial derivative with respect to time is given by the following:

where the characteristic exponent is developed as the following sum.

Combining Equations (

39)–(

43) allows us to rewrite the dynamic of bond prices as follows.

We infer the result if we remember Equation (

35) and notice that the following is the case.

□

As by construction

, we immediately infer the dynamic of the bond price in the non-discretized model by considering the limit of Equation (

38).

Corollary 1. If the short-term rate is driven by Equation (19), the bond price is solution of the following SDE:where and with the terminal condition . In order to understand the role played by the memory kernel in the evolution of the term structure of interest rates, we analyze the expectation and variance of bond yields. The bond yield of a zero-coupon bond in the discretized model is defined as follows.

From Equation (

36), we infer that this yield is proportional to a weighted sum of mean reverting processes

. Since

by construction, the expected yield conditionally to the initial filtration is equal to the following.

The variance of the yield is the sum of

d variances of a linear combination of processes

. If we remember that the covariance

and

is equal to the following:

the variance of the yield, conditionally to

, is the following triple sum.

To illustrate these results, we consider an univariate jump-diffusion model (

) in which a single Lévy process is ruled by the following SDE.

is a Poisson process with constant intensity

. The characteristic exponent is in this case equal to the following:

whereas the Lévy measure is

where

is the Dirac measure located at

. The instantaneous variance of

is equal to the following.

Of course, we can consider other types of Lévy processes such as the variance gamma and the Normal inverse gaussian, but this does not fundamentally modify the conclusions drawn in this section. We first fit the curve

to the term structure of zero-coupon bond yields, bootstrapped from the ICE swap rates on the 26/2/21 at noon. Since this function is proportional to instantaneous forward rates, we have to interpolate bond yields. For this purpose, we use a Nelson–Siegel (NS) model.

Appendix B recalls this model and reports the swap rates curve on the 26/2/21 and parameter estimates. There exist more advanced interpolation methods such as, e.g., splines or kriging techniques as detailed in

Cousin et al. (

2016) but the NS model is sufficiently accurate for our purposes to understand the dynamic of yields over time.

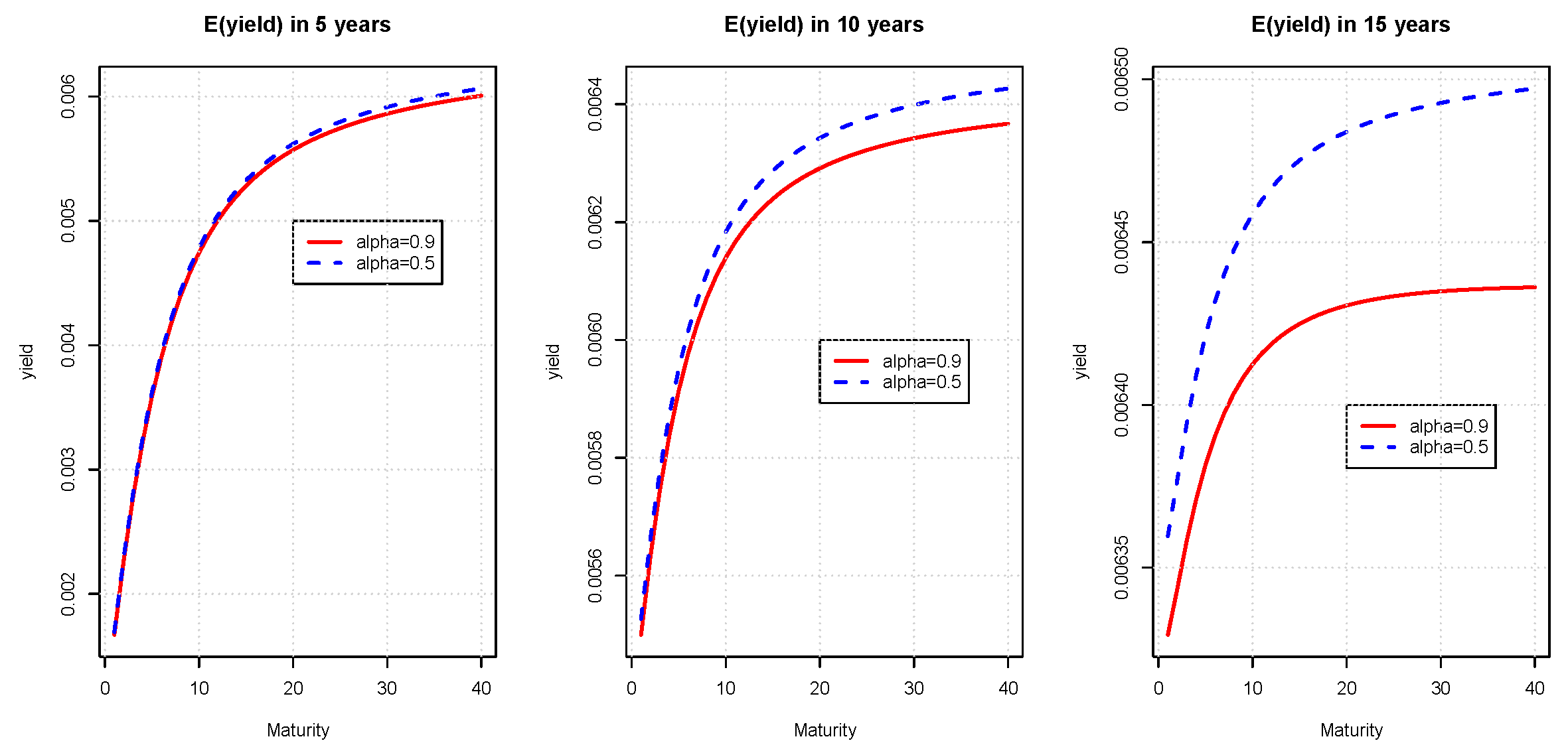

We calculate the term structure of expected yields in 5, 10 and 15 years with

40 atoms. Increasing

n does not significantly modify the results. A sensitivity analysis with respect to the number of atoms is proposed in

Section 7. For the parameters, we set

,

,

and

, which are possible realistic values in view of results from

Section 3. We remind the reader that

is the parameter tuning the memory of the model. If

, the memory kernel is exponential and the model forgets in an exponential manner past fluctuations of interest rates. On the other hand, for lower values of

, the model forgets these variations according to a power decaying function.

Figure 5 and

Figure 6 show expected yields computed with the ML and PML models for

and

. We use a discretization scheme with 40 atoms that cover ML and PML density up to their 90% percentiles. For both models, the range between short and long-term yields is narrowing with the time horizon. In the ML model, the lower

is, the longer the memory and the quicker the convergence to a bumped (but nearly flat) yield curve. In the PML model, expected yield curves with a low

dominate those with a high

and have a more pronounced curvature.

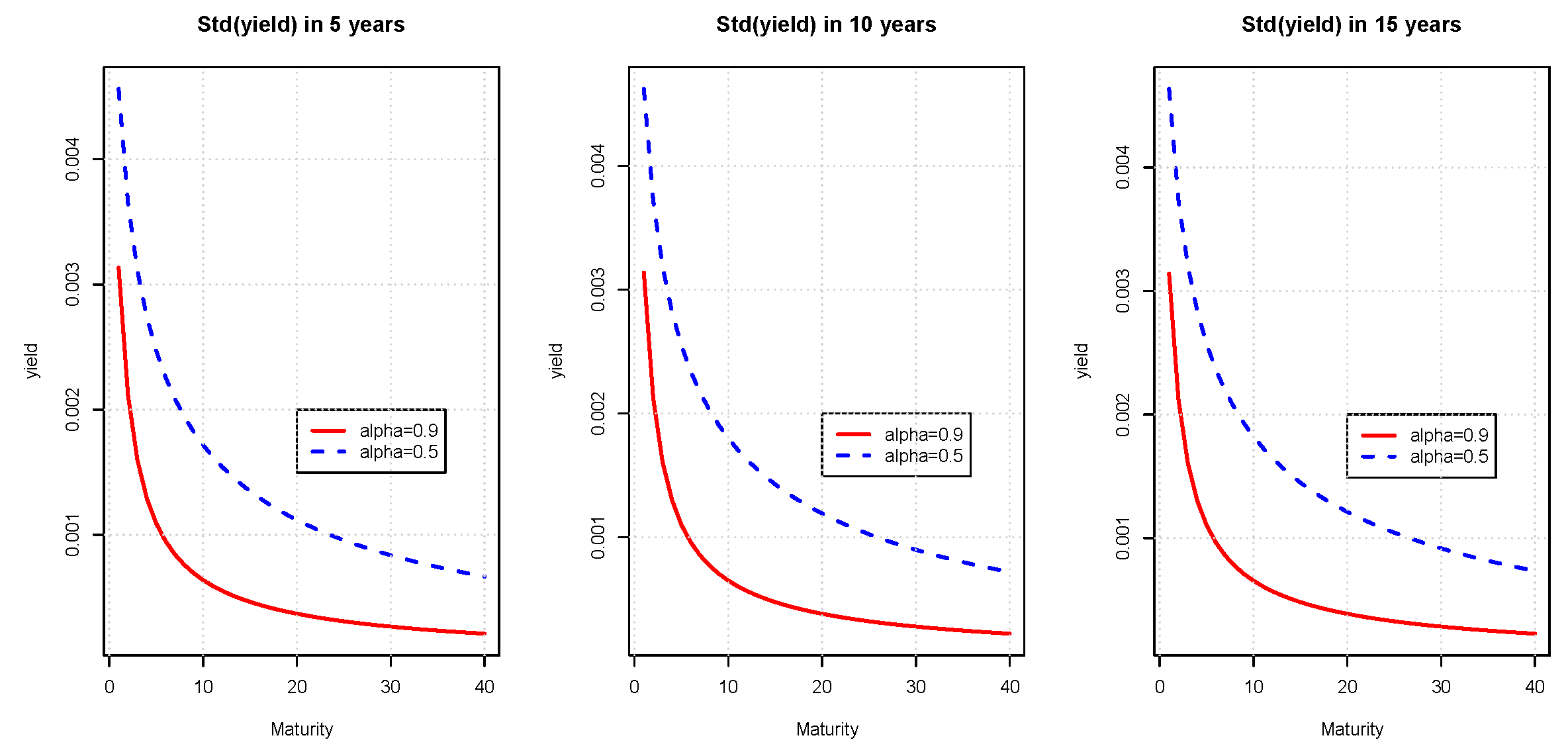

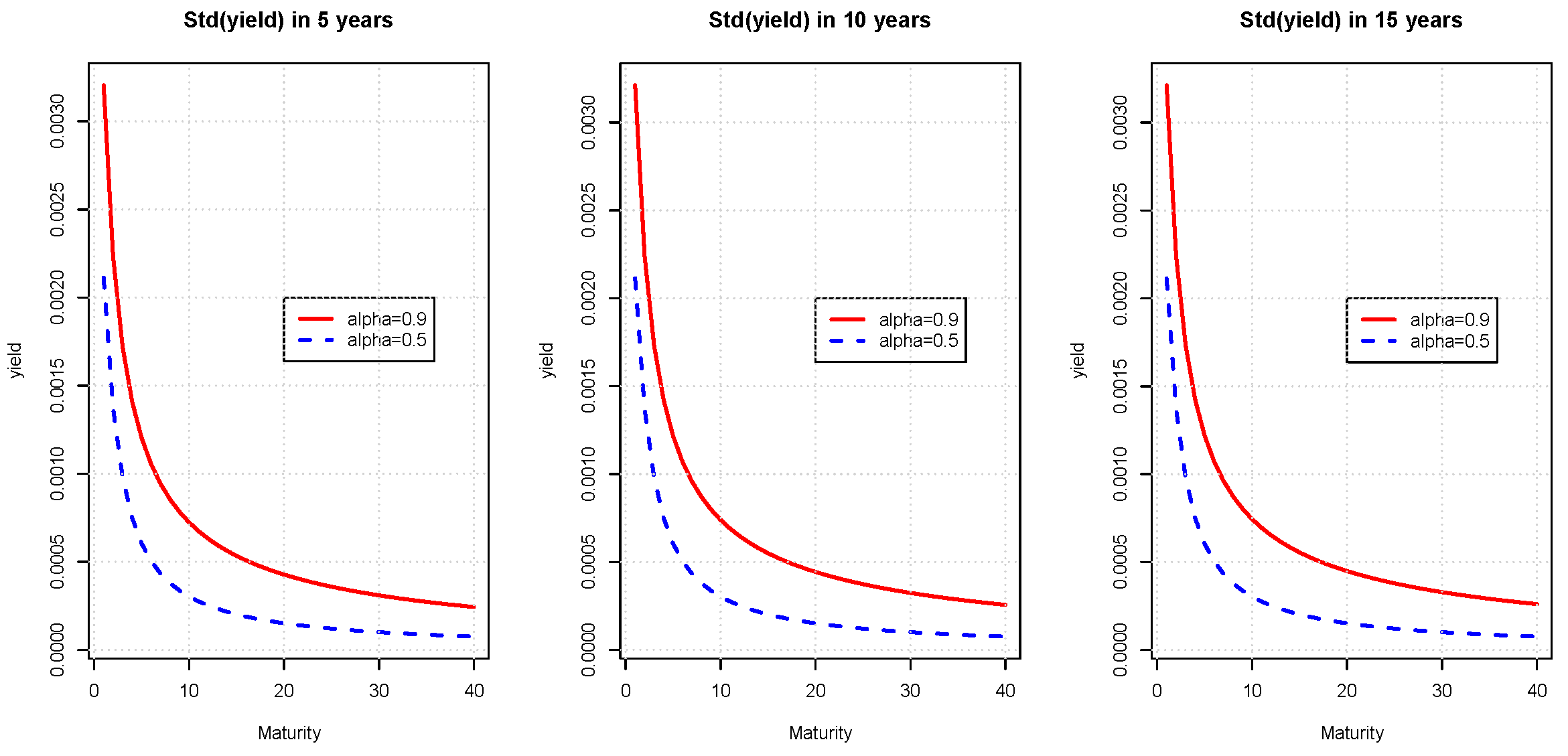

Figure 7 and

Figure 8 report the expected standard deviations of future yields calculated with ML and PML models. In both cases, the term structures of expected standard deviations do not significantly evolve with the time horizon and are decreasing functions of the maturity. We also notice that standard deviations are, respectively, inversely and directly proportional to

in ML and PML models.

7. Pricing of Bond Options

The purpose of this section is to illustrate how long-term memory models can be used for the pricing of derivatives. We investigate this for European options written on a zero coupon bond. Our choice is motivated by the fact that these are the building blocks of many structured products. The underlying bond has a maturity noted

while the option expires at time

with a strike price

K. Without loss of generality we focus on a call option but all developments remain valid for any other type of European options. The value at time

of the call option is denoted by

and is equal to the expected discounted payoff under the risk neutral measure

.

This price does not admit any closed form expression. Nevertheless, we can apply the standard technique of changes of numeraire combined with a discrete Fourier’s transform (DFT) to evaluate this call option. The first stage consists to define a forward measure, denoted by

that has

as numeraire, i.e., every assets discounted by

is a martingale. If

is the cash account (numeraire of

), the Radon–Nykodym derivative defining this change of measure is

. Using standard arguments, the call price is equal to the product of a discount bond and of the expected payoff under this forward measure.

The next proposition details the dynamics of underlying Lévy processes under the forward measure.

Proposition 7. Under the forward measure with as numeraire, the process is the following:for is a Brownian motion. Furthermore, the random measure is the following:for defines a jump process under with the time-varying measure . Proof. From

Applebaum (

2004, chap. 5, secs. 2 and 4), the forward change of the following measure:

is a martingale under the measure

, which defines an equivalent measure

under which

and

for

are, respectively, Brownian motions and random jump measures satisfying Equations (

51) and (

52). □

Combining Corollary 1 and Proposition 7 allows us to infer that a zero-coupon bond of maturity

is ruled under the forward measure by the SDE.

This equation emphasizes that the average bond return under the forward measure is the risk-free rate plus a positive time varying premium that converges toward zero when . The next proposition reveals that the processes do not revert anymore toward zero under .

Proposition 8. Let us define the following function. Under the forward measure , is a process reverting to at a speed ξ such that the following is the case: for all and .

Proof. By definition of

and from Corollary 1, we immediately infer its dynamic under the forward measure.

Since we impose that

for

in order to ensure that

, we deduce that

reverts to

:

and the solution of this SDE is Equation (

56). □

Equations (

53) and (

57) are useful for simulating sample paths of interest rates and bond prices under the forward measure, e.g., for pricing exotic options. One solution to price a call option on a zero-coupon bond consists in numerically inverting the Fourier’s transform of the density of its bond log-return under the forward measure. This step is performed with a standard discrete Fourier’s transform algorithm (DFT) that approximates the probability density function of the log-return under the forward measure

. The expectation of the payoff under the forward measure is next computed with this distribution. The moment generating function of the bond log-return, presented in the next proposition, admits a closed form formula and is a key result to implementing the DFT procedure.

Proposition 9. The moment generating function (mgf) of under measure , conditionally to the filtration , is given by the following. Proof. The mgf can be rewritten as an expectation under the risk neutral measure using Bayes’ rule:

where

is detailed in Equation (

53). From Equation (

24) and due to the independence between the processes

and

for

, expectation (

59) becomes the following.

From Equation (

18) and after a change of integration order, the integral of processes

is the following.

This allows us to rewrite

as follows,

By definition of

, we have the following:

wherein the integrand is equal to the following.

Combining these three last equations leads to the result. □

The expression (

58) of the mgf involves integrals of

with respect to

. These integrals do not admit analytical formulas and are in practice approached with the discretization scheme introduced in

Section 6. Let

n be the number of atoms of the discrete approximation of

for

. To lighten future developments, we adopt the following notation:

for

. The discretized version of the mgf of the bond log-return under the forward measure is as follows:

where

, the discretized version of

is detailed in Equation (

37). The integrals with respect to times are numerically computed, e.g., with a Simpson’s rule. Let us denote by

the probability density of

conditionally to

and the following.

The above is its Fourier’s transform. The probability density function can, therefore, be expressed as the real part of the inverse Fourier’s transform:

and is numerically computed with the algorithm detailed in the next proposition.

Proposition 10. Let M be the number of steps used in the Discrete Fourier Transform (DFT) and be this step of discretization. Let us denote and the following:for . The values of and the pdf of at points are approached by the following sum:where . The proof of this result is based on the trapezoidal approximation of the integral in Equation (

60).

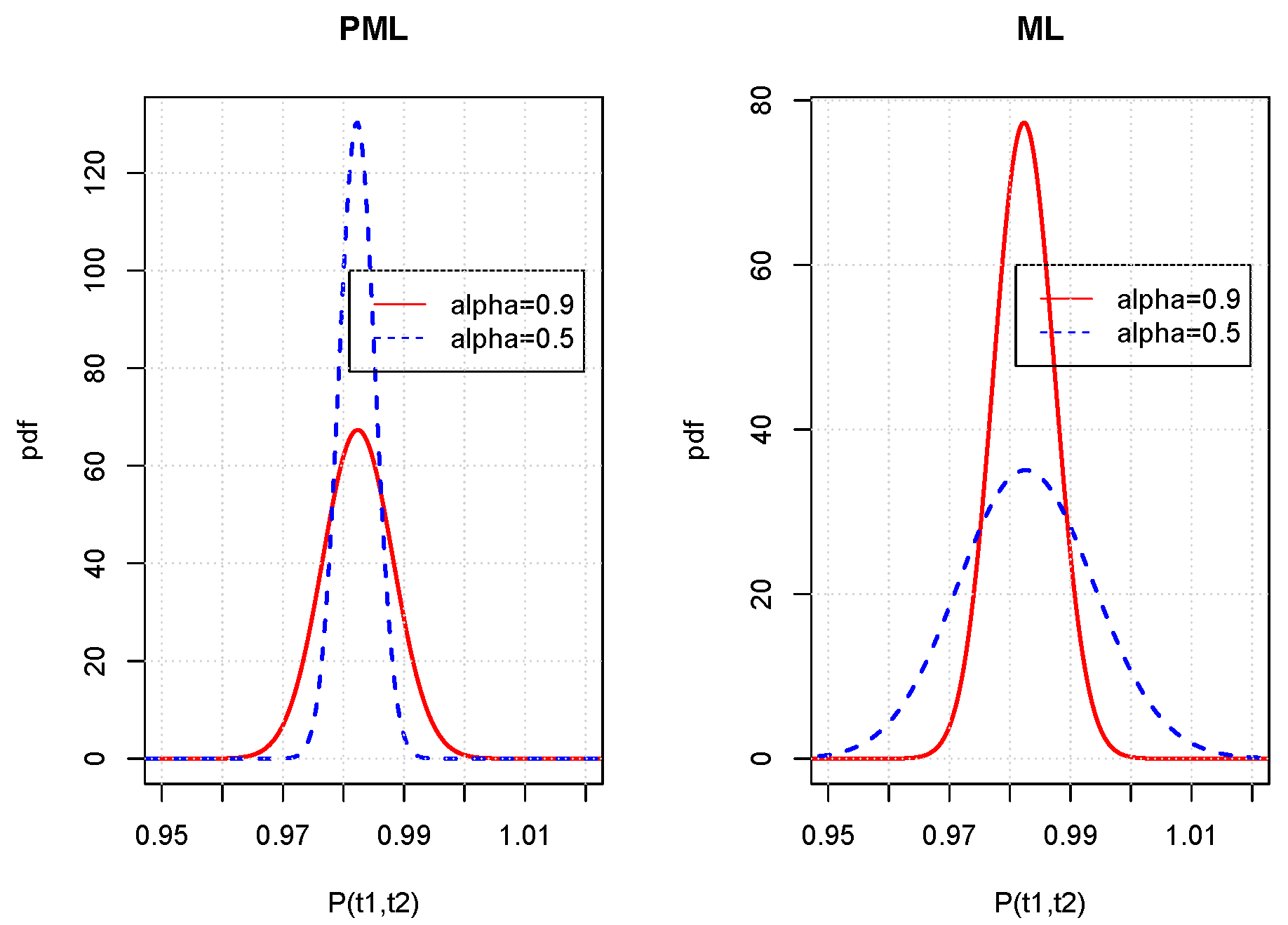

Figure 9 shows the probability density functions of

under the forward measure of numeraire

. We consider for this illustration a one factor Lévy model (

) in which the driving process is a jump-diffusion such as presented in Equation (

48), with the same parameters as those of

Section 6. The DFT parameters are

and

. The plots reveals that variances under

of bond prices display the same sensitivity to memory parameter

as under the risk of neutral measures. PML and ML bond variances are, respectively, directly and inversely proportional to

.

After computation of the log-bond density, the call price is calculated by the following sum:

where

is an indicator variable equal to one on

and zero otherwise.

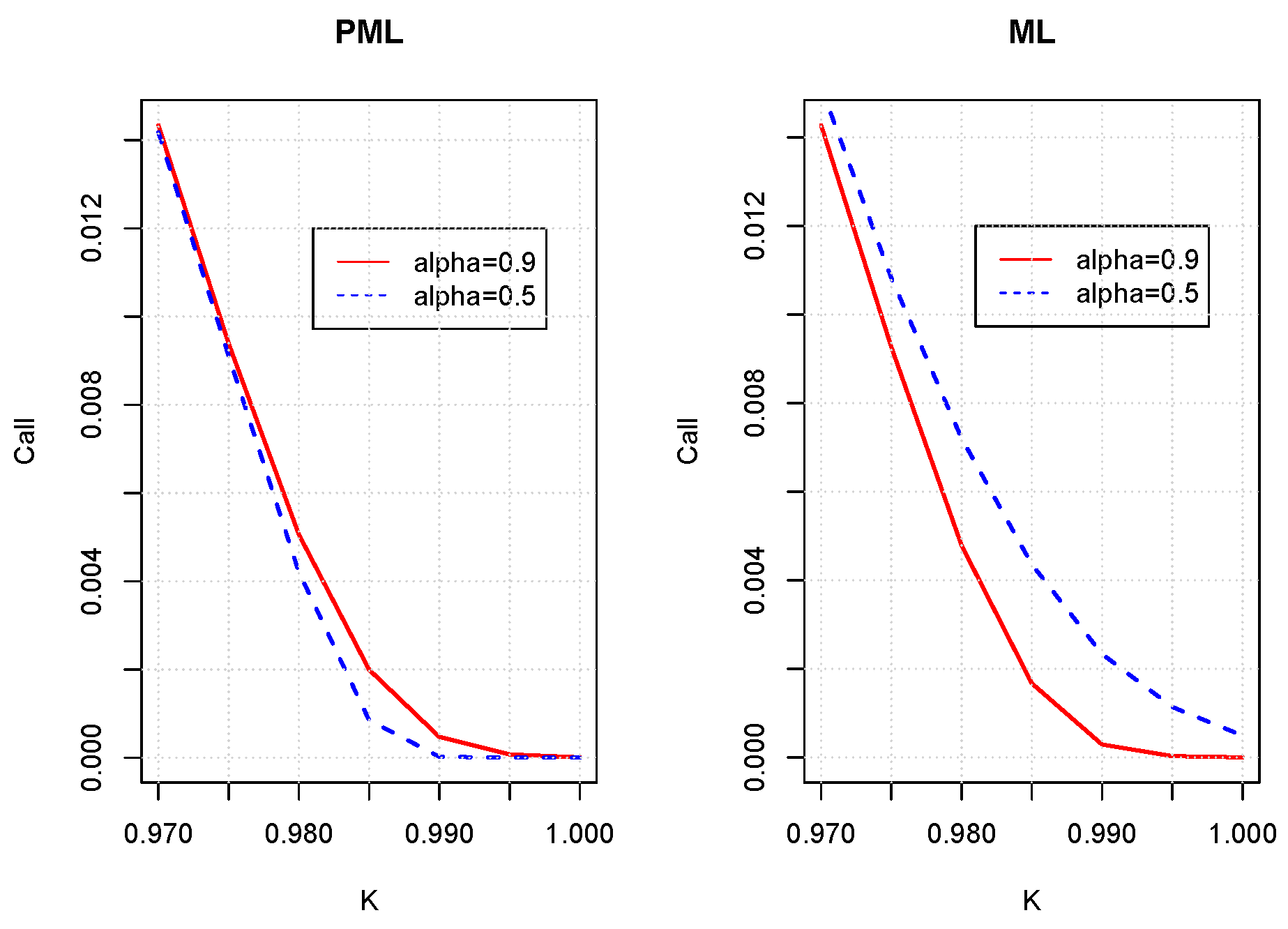

Figure 10 shows call prices on

for various strike prices in ML and PML kernels. In the PML model, increasing the memory parameter

drives up the option values with respect to whatever the strike price is. For the ML kernel, we observed the opposite trend. This is relevant with our previous conclusions about the variance that is the main driving factor of option prices.

Figure 11 allows us to confirm the convergence of the call option when the number,

n, of atoms in the discretization scheme grows. We recall that the partition ranges from

up to

that is a percentile of

. Here, percentiles 90%, 95% and 97% are considered. For the ML kernel (right plot), the convergence is quick and the difference between prices computed with the 90% and 97% is negligible (around 2.6

). For the PML model (left plot), prices are higher (and then conservative) with a 90% percentile and converge with less atoms than with a partition covering 97% of

.