Jump-Diffusion Models for Valuing the Future: Discounting under Extreme Situations

Abstract

1. Introduction

2. Materials and Methods

2.1. Main Definitions

2.2. Diffusion Process in the Presence of Random Jumps

The Ornstein–Uhlenbeck Process and Poissonian Jumps

3. Results

3.1. Asymptotic Discount Function

Bounded and Symmetric Jump Density

3.2. Some Specific Jump Distributions

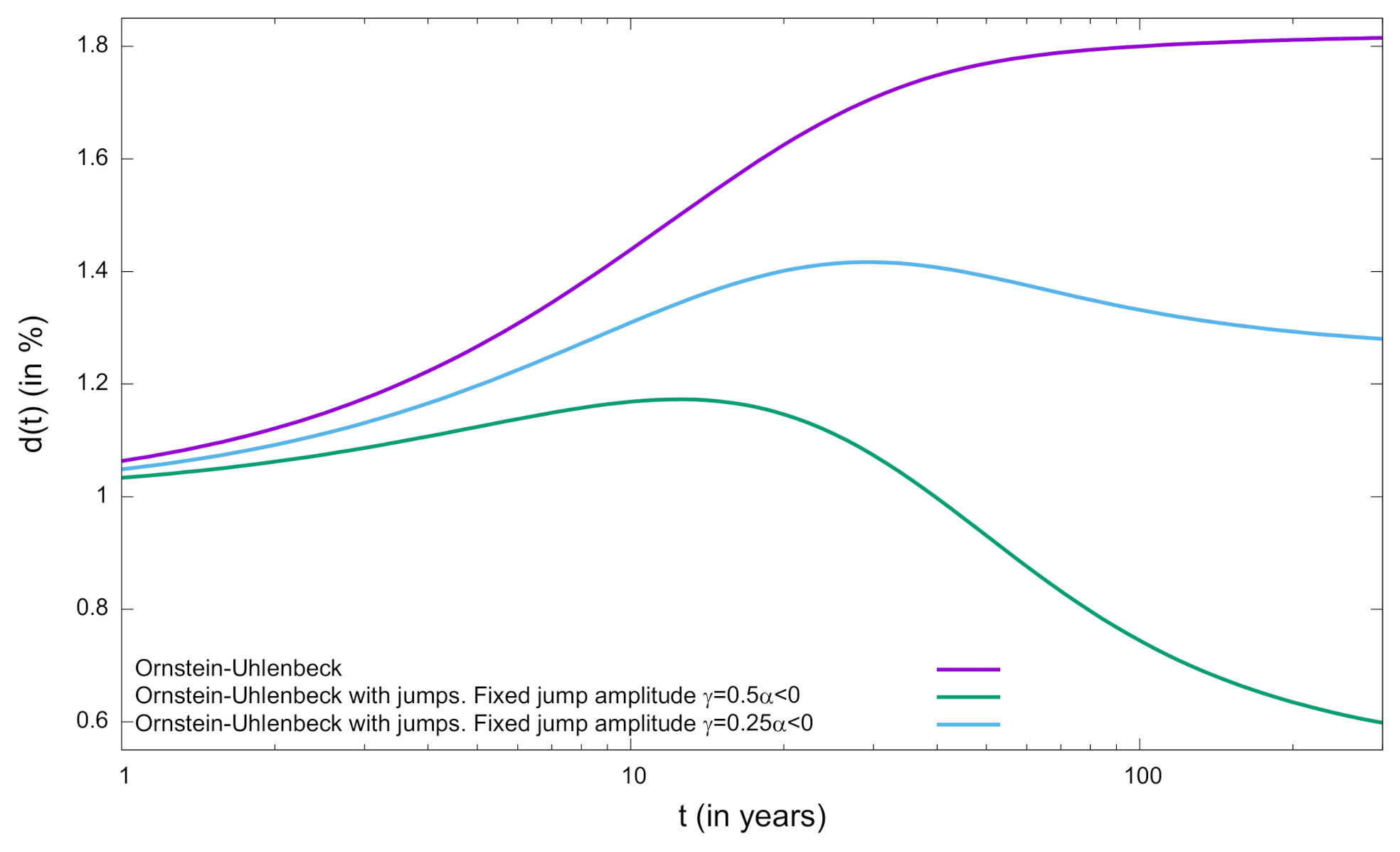

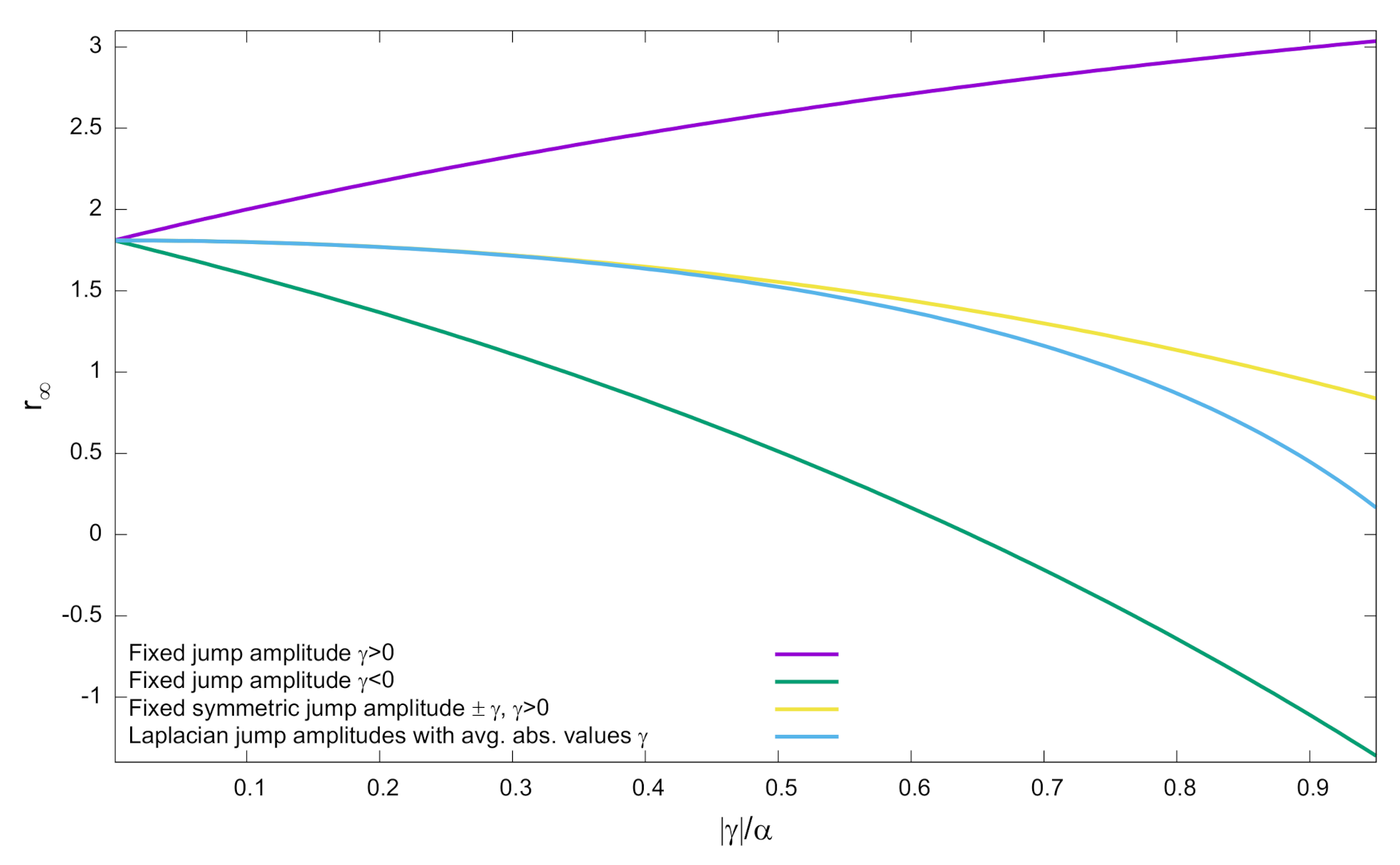

3.2.1. Fixed Jump Amplitudes

3.2.2. Laplacian Jump Amplitudes

- 1.

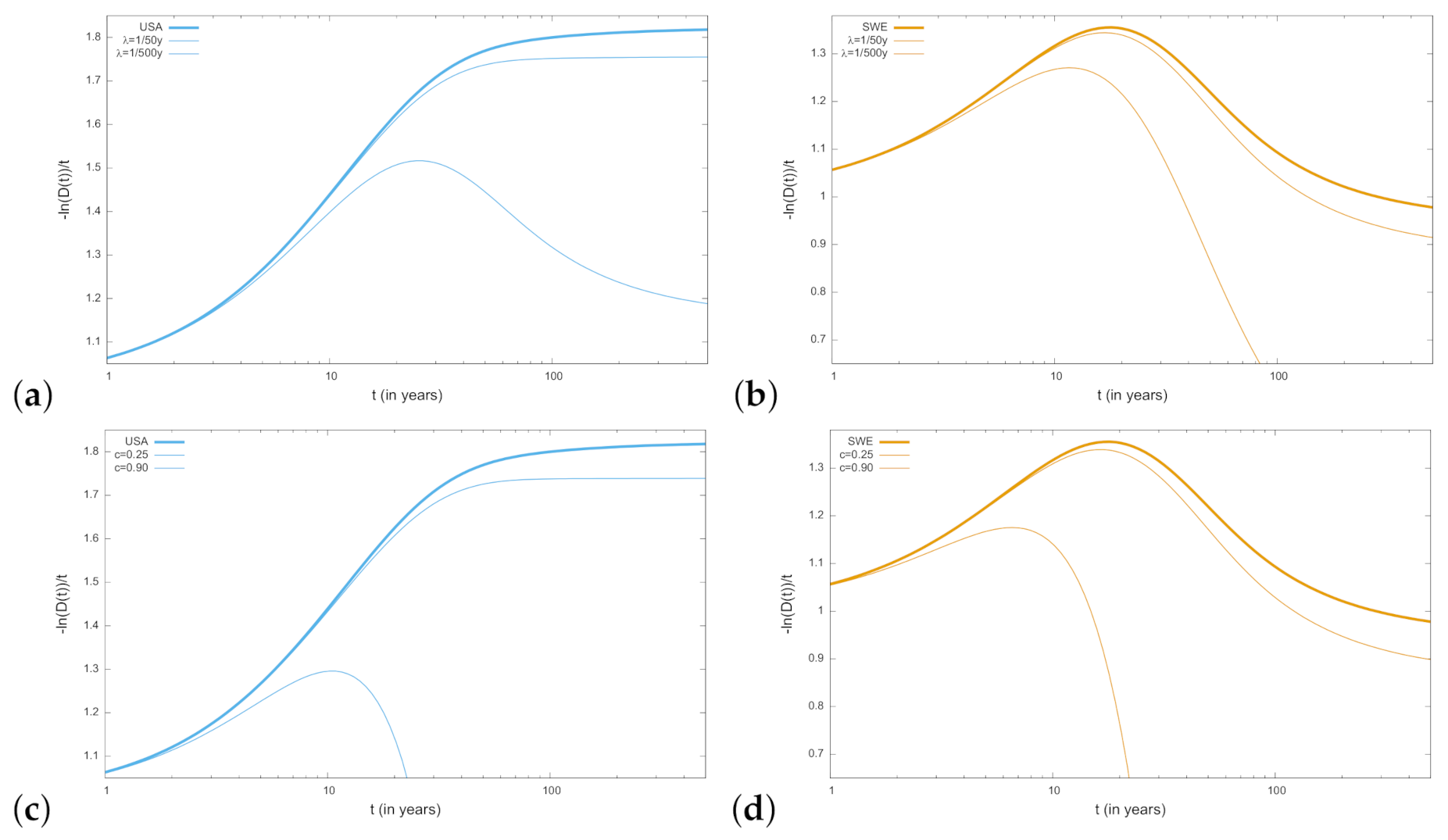

- When (i.e., ) we prove in the Appendix C that the function is given byIn this case, the discount function is finite and follows from Equation (65) after substituting Equation (66). Figure 3 illustrate this result considering the OU parameters estimated in Ref. [17] while considering different jumps frequencies and different jumps amplitudes in terms of c. For large values of t, we haveSince as (cf. Equations (36) and (43)), we finally obtainand the expression for the long-run rate readswith given in Equation (43). In this model, discontinuities reduce the long-run discount rate if , which implies that is finite. That is, when and the average of the absolute value of discontinuities is smaller than the strength of the reversion to the mean represented by . The behavior of the long-run discount rate for Laplacian jumps can be compared to the fixed and bounded jumps amplitude case provided in Section 3.2.1. As shown in Figure 2, the behavior is qualitatively similar to the case of two symmetric jumps. The differences among both examples become relevant when , being the curve consistent with the critical behavior described in Equation (63).

- 2.

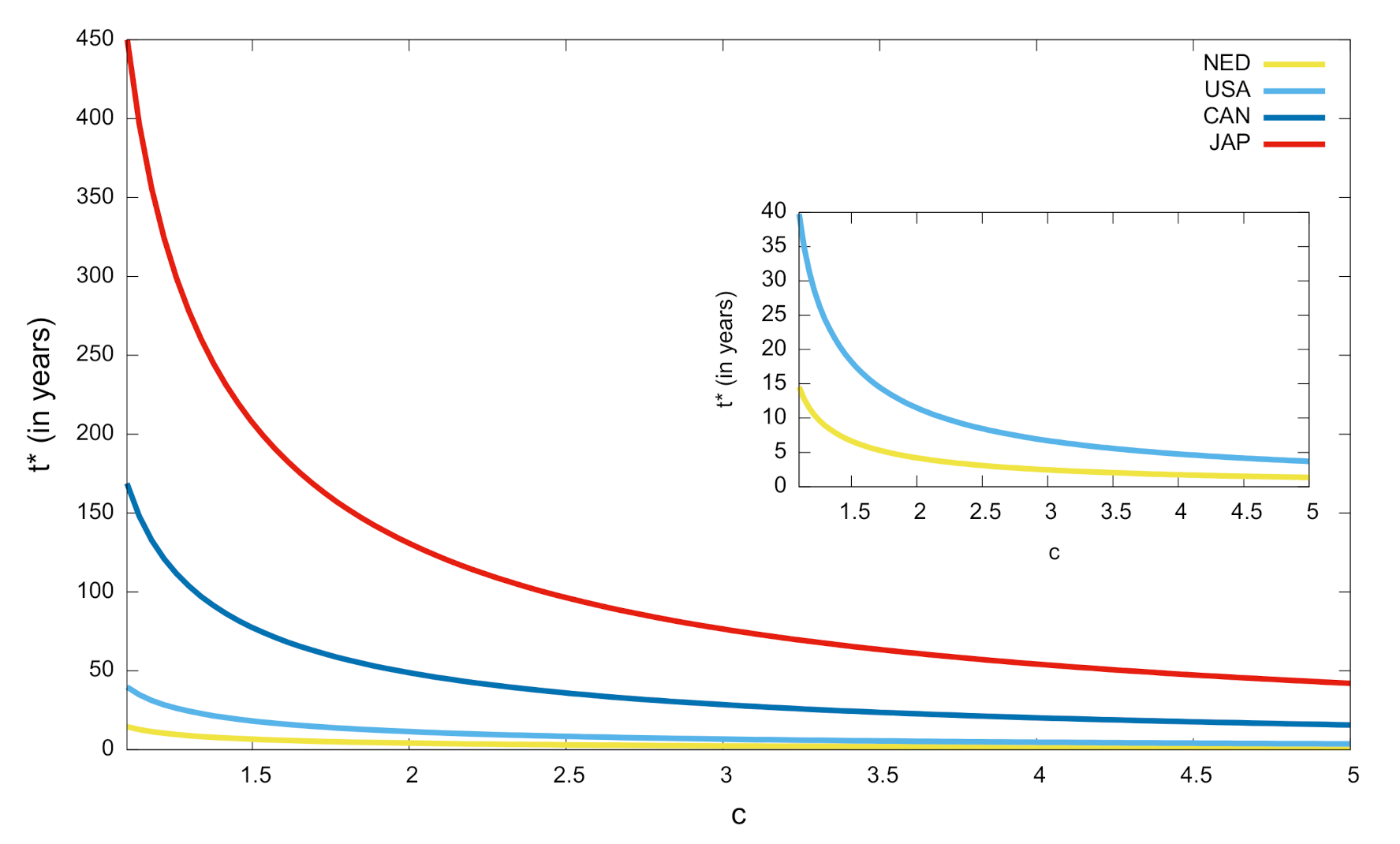

- When (i.e., ), we prove in the Appendix C that the discount becomes infinite for times greater than a critical time,wherewhile for the discount function is given as in case (i) above (even though now it has no sense asking for the asymptotic behavior of discount as ). Figure 4 shows the sensitivity of the critical time with respect to jumps amplitude. We there show that critical time can become shorter than a year or be strongly reduced as c increases.

- 3.

- For the threshold case (i.e., ), the discount function grows exponentially. Thus, in the Appendix C we show thatNote that this behavior is not contradictory with our previous results since, as andbecomes negative, and discount turns into an increasing function for t large enough.

3.3. Discount in the Continuous Time Random Walk Formalism

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. The Method of Characteristics

Appendix B. Long-Run Discount Rate for Asymmetric Jump Distributions

Appendix C. Discount Function for Laplacian Jumps

References

- Stern, N. The Economics of Climate Change: The Stern Review; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar]

- Nordhaus, W.D. The Stern Review on the economics of climate change. J. Econ. Lit. 2007, 45, 687–702. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Critical assumptions in the Stern Review on Climate Change. Science 2007, 317, 201–202. [Google Scholar] [CrossRef] [PubMed]

- Stern, N. Ethics, Equity and the Economics of Climate Change. Paper 1: Science and Philosophy. Econ. Philos. 2014, 30, 397–444. [Google Scholar] [CrossRef]

- Stern, N. Ethics, Equity and the Economics of Climate Change. Paper 2: Economics and Politics. Econ. Philos. 2014, 30, 445–501. [Google Scholar] [CrossRef]

- Heal, G.M.; Millner, A. Agreeing to disagree on climate policy. Proc. Natl. Acad. Sci. USA 2014, 111, 3695–3698. [Google Scholar] [CrossRef]

- Ramsey, F.P. A mathematical theory of saving. Econ. J. 1928, 38, 543–559. [Google Scholar] [CrossRef]

- Arrow, K.J.; Cropper, M.L.; Gollier, C.; Groom, B.; Heal, G.M.; Newell, R.G.; Nordhaus, W.D.; Pindyck, R.S.; Pizer, W.A.; Portney, P.R.; et al. Determining Benefits and Costs for Future Generations. Science 2013, 341, 349–350. [Google Scholar] [CrossRef]

- Heath, D.; Jarrow, R.; Morton, A. Bond pricing and the term structure of interest rates: A new methodology for contingent claims valuation. Econom. J. Econom. Soc. 1992, 60, 77–105. [Google Scholar] [CrossRef]

- Vasicek, O. An equilibrium characterization of the terms structure. J. Financ. Econ. 1977, 5, 177–188. [Google Scholar] [CrossRef]

- Cox, J.C.; Ingersoll, J.E.; Ross, S.A. A theory of the term structure of interest rates. Econometrica 1985, 53, 385–407. [Google Scholar] [CrossRef]

- Dothan, L.U. On the term structure of interest rates. J. Financ. Econ. 1978, 6, 59–69. [Google Scholar] [CrossRef]

- Ahn, C.M.; Thompson, H.E. Jump-diffusion processes and the term structure of interest rates. J. Finance 1988, 43, 155–174. [Google Scholar] [CrossRef]

- Brigo, D.; Mercurio, F. Interest Rate Models—Theory and Practice; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Farmer, J.D.; Geanakoplos, J.; Masoliver, J.; Montero, M.; Perelló, J. Discounting the Distant Future; Cowles Foundation Discussion Paper no. 1951; University of Yale: New Haven, CT, USA, 2014. [Google Scholar]

- Farmer, J.D.; Geanakoplos, J.; Masoliver, J.; Montero, M.; Perelló, J.; Richiardi, M.G. Discounting the distant future: What do historical bond prices imply about the long term discount rate? J. Math. Econ. 2020, submitted. [Google Scholar]

- Perelló, J.; Montero, M.; Masoliver, J.; Farmer, J.D.; Geanakoplos, J. Statistical analysis and stochastic interest rate modeling for valuing the future with implications in climate change mitigation. J. Stat. Mech. 2020, 2020, 0432110. [Google Scholar] [CrossRef]

- Weitzman, M.L. Why the far-distant future should be discounted at its lowest possible rate? J. Environ. Econ. Manag. 1998, 36, 201–208. [Google Scholar] [CrossRef]

- Gollier, C.; Koundouri, P.; Pantelidis, T. Declining discount rates: Economic justifications and implications for the long-run policy. Econ. Policy 2008, 23, 757–795. [Google Scholar] [CrossRef]

- Newell, R.; Pizer, N. Discounting the Distant Future: How much do uncertain rates increase valuations? J. Environ. Econ. Manag. 2003, 46, 52–71. [Google Scholar] [CrossRef]

- Farmer, J.D.; Geanakoplos, J. Hyperbolic Discounting Is Rational: Valuing the Far Future with Uncertain Discount Rates; Cowles Foundation Discussion Paper no. 1719; University of Yale: New Haven, CT, USA, 2009. [Google Scholar] [CrossRef][Green Version]

- Geanakoplos, J.; Sudderth, W.; Zeitouini, O. Asymptotic behavior of stochastic discount rate. Indian J. Stat. 2014, 76A, 150–157. [Google Scholar] [CrossRef]

- Cox, C.; Ingersoll, J.E.; Ross, S.A. A re-examination of the traditional hypothesis about the term structure of interest rates. J. Finance 1981, 35, 769–799. [Google Scholar] [CrossRef]

- Gilles, C.; Leroy, S.F. A note on the local expectation hypothesis. J. Finance 1986, 41, 975–979. [Google Scholar] [CrossRef]

- Piazzesi, M. Affine term structure models. In The Handbook of Financial Econometrics; Sahala, Y.A., Hansen, M.P., Eds.; Elsevier: Amsterdam, The Netherlands, 2009; pp. 691–766. [Google Scholar]

- Farmer, J.D.; Geanakplos, J.; Masoliver, J.; Montero, M.; Perelló, J. Value of the future: Discounting in random environments. Phys. Rev. E 2015, 91, 052816. [Google Scholar] [CrossRef]

- Uhlenbeck, G.E.; Ornstein, L.S. On the theory of Brownian Motion. Phys. Rev. 1930, 36, 823–841. [Google Scholar] [CrossRef]

- Feller, W. Two singular diffusion processes. Ann. Math. 1951, 54, 173–182. [Google Scholar] [CrossRef]

- Osborne, M.F.M. Brownian motion in the stock market. Oper. Res. 1959, 7, 145–173. [Google Scholar] [CrossRef]

- Masoliver, J. The value of the distant future: The process of discount in random environments. Estud. Econ. Aplicada 2019, 37. [Google Scholar] [CrossRef]

- Gardiner, C.W. Handbook of Stochastic Methods; Springer: Berlin/Heidelberg, Germany, 1985. [Google Scholar]

- Merton, R.C. Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 1976, 3, 125–144. [Google Scholar] [CrossRef]

- Kou, S.G. A jump-diffusion model for option pricing. Manag. Sci. 2002, 48, 1086–1101. [Google Scholar] [CrossRef]

- Weitzman, M.L. On modeling and interpreting the economics of catastrophic climate change. Rev. Econ. Stat. 2009, 91, 1–19. [Google Scholar] [CrossRef]

- Weitzman, M.L. Fat-tailed uncertainty in the economics of catastrophic climate change. Rev. Environ. Econ. Policy 2011, 5, 275–292. [Google Scholar] [CrossRef]

- Posner, R.A. Catastrophe: Risk and Response; Oxford University Press: Oxford, UK, 2004. [Google Scholar]

- Susnstein, C.R. Worst-Case Scenarios; Harvard University Press: Cambridge, MA, USA, 2007. [Google Scholar]

- Masoliver, J.; Weiss, G.H. Some first passage time problems for shot noise processes. J. Stat. Phys. 1988, 50, 377–382. [Google Scholar] [CrossRef]

- Masoliver, J.; Weiss, G.H. First passage time statistics for some stochastic processes with superimposed shot noise. Phys. A Stat. Mech. Appl. 1988, 149, 395–405. [Google Scholar] [CrossRef]

- Masoliver, J. Random Processes, First-Passage and Escape; World Scientific: Singapore, 2018. [Google Scholar]

- Courant, R.; Hilbert, D. Methods of Mathematical Physics; Wiley: New York, NY, USA, 1989. [Google Scholar]

- Gradshteyn, I.S.; Ryzhik, I.M. Table of Integrals, Series and Products; Academic Press: San Diego, CA, USA, 2007. [Google Scholar]

- Kutner, R.; Masoliver, J. The continuous time random walk, still trendy: Fifty-year history, state of art and outlook. Eur. Phys. J. B 2017, 90, 50. [Google Scholar] [CrossRef]

- Masoliver, J.; Montero, M.; Perelló, J.; Weiss, G.H. The continuous time random walk formalism in financial markets. J. Econ. Behav. Organ. 2006, 61, 577–598. [Google Scholar] [CrossRef]

- Madan, D.B.; Seneta, E. The Variance Gamma (V.G.) model for share market returns. J. Bus. 1990, 63, 511–524. [Google Scholar] [CrossRef]

- Eberlein, E.; Keller, U. Hyperbolic distributions in finance. Bernoulli 1995, 1, 281–299. [Google Scholar] [CrossRef]

| Model | Discount |

|---|---|

| Main definitions | Discount function: |

| Discount rate: | |

| Long-run discount rate: | |

| Ornstein–Uhlenbeck (OU) | |

| OU and Poissonian jumps | |

| Jumps size PDF | |

| Poissonian time interval PDF | |

| If is finite | |

| If is finite and | |

| If is finite and jumps are symmetric | |

| If jumps have two fixed amplitudes | |

| Laplacian jumps with absolute jump average | |

| If | |

| If | Not defined |

| Critical explosive time | |

| If jumps have one-fixed increasing amplitude | |

| If jumps have one-fixed decreasing amplitude | |

| If jumps have two-fixed amplitudes | |

| Continuous Time Random Walk | |

| Laplacian jumps with absolute jump average | Not defined |

| Critical explosive time |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Masoliver, J.; Montero, M.; Perelló, J. Jump-Diffusion Models for Valuing the Future: Discounting under Extreme Situations. Mathematics 2021, 9, 1589. https://doi.org/10.3390/math9141589

Masoliver J, Montero M, Perelló J. Jump-Diffusion Models for Valuing the Future: Discounting under Extreme Situations. Mathematics. 2021; 9(14):1589. https://doi.org/10.3390/math9141589

Chicago/Turabian StyleMasoliver, Jaume, Miquel Montero, and Josep Perelló. 2021. "Jump-Diffusion Models for Valuing the Future: Discounting under Extreme Situations" Mathematics 9, no. 14: 1589. https://doi.org/10.3390/math9141589

APA StyleMasoliver, J., Montero, M., & Perelló, J. (2021). Jump-Diffusion Models for Valuing the Future: Discounting under Extreme Situations. Mathematics, 9(14), 1589. https://doi.org/10.3390/math9141589