4.1. Simulation Study

We want to generate multi-stage simulated multivariate dataset so that a current stage process is affected by the previous stage process and multivariate data have high correlations among variables, we employed the copula dependence method which can express the multi-stage dependence and can make a high correlation structure among variables in each stage. With this simulated dataset, we want to verify our conditional multi-stage CPD scheme by the copula conditional distribution. We generate three stage simulated datasets . We name as stage 1, as stage 2, and as stage 3.

For the dataset , we simulate the highly correlated multivariate data by using the ‘copula’ R package with the ‘normalCopula’ function for the five variables, and each variable has sample size 400 with the correlation parameters (0.9, 0.8, 0.8, 0.8, 0.7, 0.7, 0.7, 0.6, 0.5, 0.4), specifying that the type of the symmetric positive definite matrix characterizing the elliptical copula is unstructured. For each marginal distribution for the five variables in , we use three gamma distributions ( follows gamma distribution with shape parameter (set to 5) and scale parameter (set to 1), follows gamma distribution with shape parameter (set to 5) and scale parameter (set to 2), and follows gamma distribution with shape parameter (set to 5) and scale parameter (set to 3)) and two exponential distributions ( follows exponential distribution with parameter (set to 5) and follows exponential distribution with parameter (set to 2)).

For the dataset , we simulate the highly correlated multivariate data by using ‘copula’ R package with the ‘normalCopula’ function for the five variables, and each variable has sample size 400 with the correlation parameters (0.4, 0.5, 0.6, 0.7, 0.7, 0.7, 0.7, 0.6, 0.5, 0.4), specifying that the type of the symmetric positive definite matrix characterizing the elliptical copula is unstructured. For each marginal distribution for the five variables in , we use three gamma distributions ( follows gamma distribution with shape parameter (set to 2) and scale parameter (set to 1), follows gamma distribution with shape parameter (set to 2) and scale parameter (set to 2), and follows gamma distribution with shape parameter (set to 2) and scale parameter (set to 3)) and two exponential distributions ( follows exponential distribution with parameter (set to 2), and follows exponential distribution with parameter (set to 5)).

For the dataset , we simulate the highly correlated multivariate data by using ‘copula’ R package with ‘normalCopula’ function for the 5 variables and each variable has sample size 400 with the correlation parameters (0.5, 0.5, 0.5, 0.5, 0.5, 0.5, 0.5, 0.5, 0.5, 0.5) to specify the symmetric positive definite matrix characterizing that the elliptical copula is unstructured. For each marginal distribution for five variables in , we use three gamma distributions ( follows gamma distribution with shape parameter (set to 3) and scale parameter (set to 1), follows gamma distribution with shape parameter (set to 3) and scale parameter (set to 2), and follows gamma distribution with shape parameter (set to 3) and scale parameter (set to 3)) and two exponential distributions ( follows exponential distribution with parameter (set to 4), and follows exponential distribution with parameter (set to 3)).

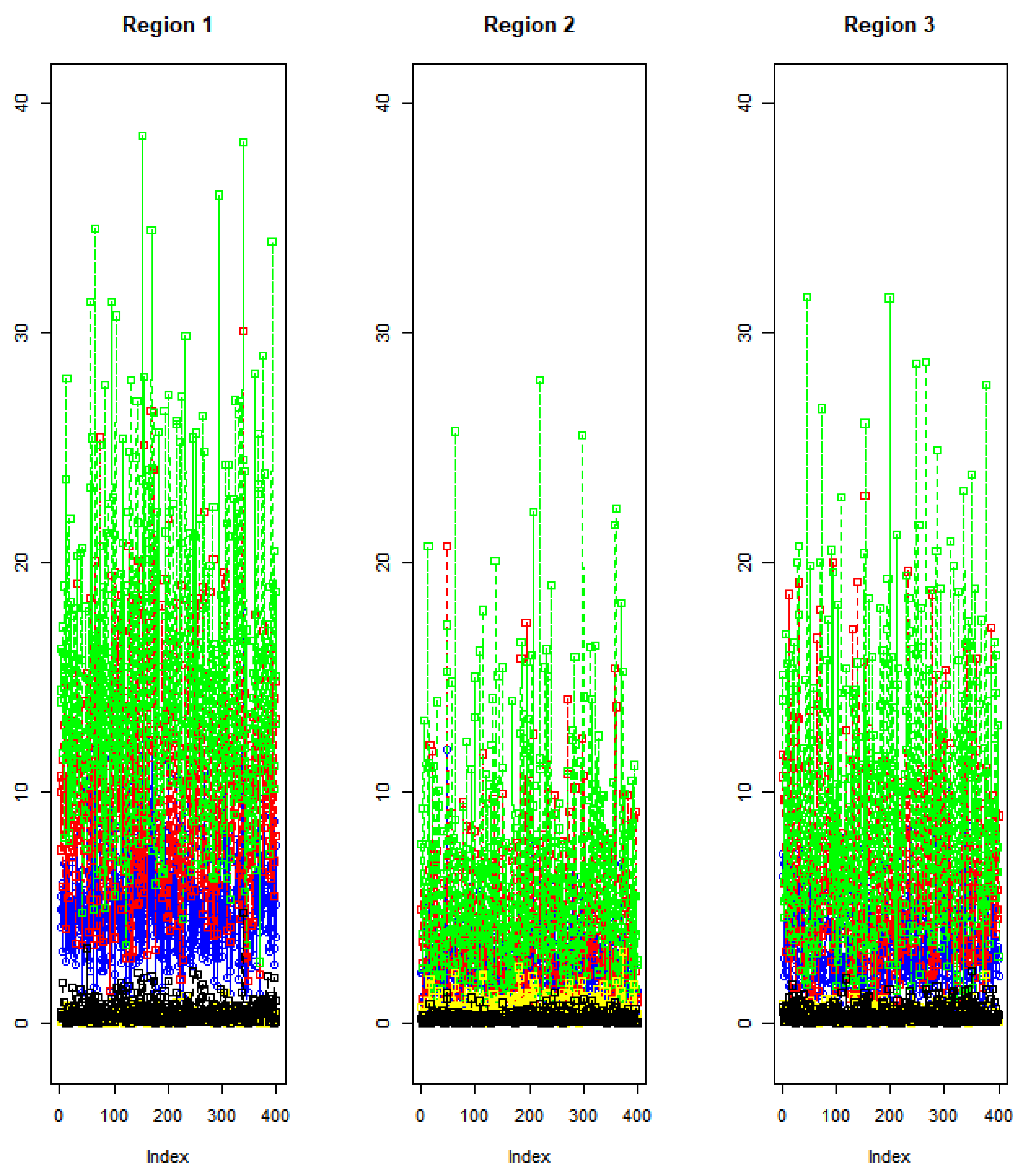

Figure 1 shows the data plots of the three stages

. In

Figure 1, stage 1 shows bigger spread than stage 2 and stage 3, stage 2 shows smaller spread than stage 1 and stage 3, and stage 3 has bigger spread than stage 2. The correlation matrix with the simulated multivariate data in

Table 2 shows high correlations exist among the five variables in

,

, and

.

To perform the change point detection for the conditional multi-stage multivariate highly correlated simulated dataset, we apply PCA or FPCA to the simulated data

and then generate PCA or FPCA scores to the uniform distribution transformed data

by the empirical CDF approach. For FPCA, we employ Fourier basis functions for constructing functional eigenfunctions with

and

introduced in

Section 2.2, and three eigenfunctions by the FPCA are transformed to the uniform distributed data

by the empirical CDF approach. We apply the copula conditional distribution for transforming three-stage multivariate data

to two conditional datasets

and

and then apply multivariate CPD methods (ETCC and NPMVCP) to each

,

and

to detect change points for each stage

,

and

.

Table 3 shows the PCA variance proportions for

,

and

.

Table 4 shows the PCA variance proportions with copula conditional distributions of t-copula, Gaussian copula and Frank copula,

and

.

Table 5 shows the change points by both ETCC and NPMVCP with the whole simulated data case and PCA components of the simulated multivariate data. We compare our proposed method with recent methods on multi-stage change point detection of multivariate data. We chose a nonparametric multiple change point analysis of multivariate data developed by Reference [

9,

10] with ‘ecp’ R package.

Table 6 shows change point detections with nonparametric multiple change point analysis of simulated multivariate data with using the command ‘ks.cp3o_delta’ for the change points estimation by pruned objective via the Kolmogorov–Smirnov statistic, and the window size between segments is 30 in the ‘ecp’ R package. Compared with the results of ETCC and NPMVCP in

Table 5, James, Zhang, and Matteson (2019) detected more change points with simulated multivariate data for each stage (stage 1, stage 2, stage 3).

Table 7 shows the change point detections by both ETCC and NPMVCP with FPCA components of simulated multivariate data. The ETCC and NPMVCP with FPCA components of simulated multivariate data in

Table 7 detected more change points with simulated multivariate data for each stage (stage 1, stage 2, stage 3) than the James, Zhang, and Matteson (2019) nonparametric multiple change point method.

For considering the conditional multivariate data, the change point detections by both ETCC and NPMVCP with a copula conditional distribution of the t-copula, Gaussian copula, and Frank copula with PCA components are proposed in this paper. We notice that the performance of our copula-based method depends on the choice of the copula function. But, as we mentioned in

Section 2.3, it is difficult to apply many copula functions to SPC because the range of the association parameter,

, in the Clayton copula, FGM copula, and Gumbel copula functions in

Table 1 is restricted so that we had computation difficulty to apply the Clayton copula, FGM copula, and Gumbel copula functions to SPC. Since the range of the association parameter,

, from the Gaussian copula and the t-copula is

, and the Frank copula is

, we can compare these copula functions to simulated multivariate data to choose the copula function properly, which is the critical issue about a copula-based CPD method.

Table 8 shows the change point detections by both ETCC and NPMVCP with copula conditional distribution of the t-copula, Gaussian copula, and Frank copula with PCA components. From

Table 8, we can notice that the change point detections by the three copula functions (Gaussian copula, t-copula, and Frank copula) are slightly different.

Through the empirical trial and error learning based on the certain manufacturing circumstance, we recommend that industry practitioners compare these copula-based CPD methods and choose a copula function properly.

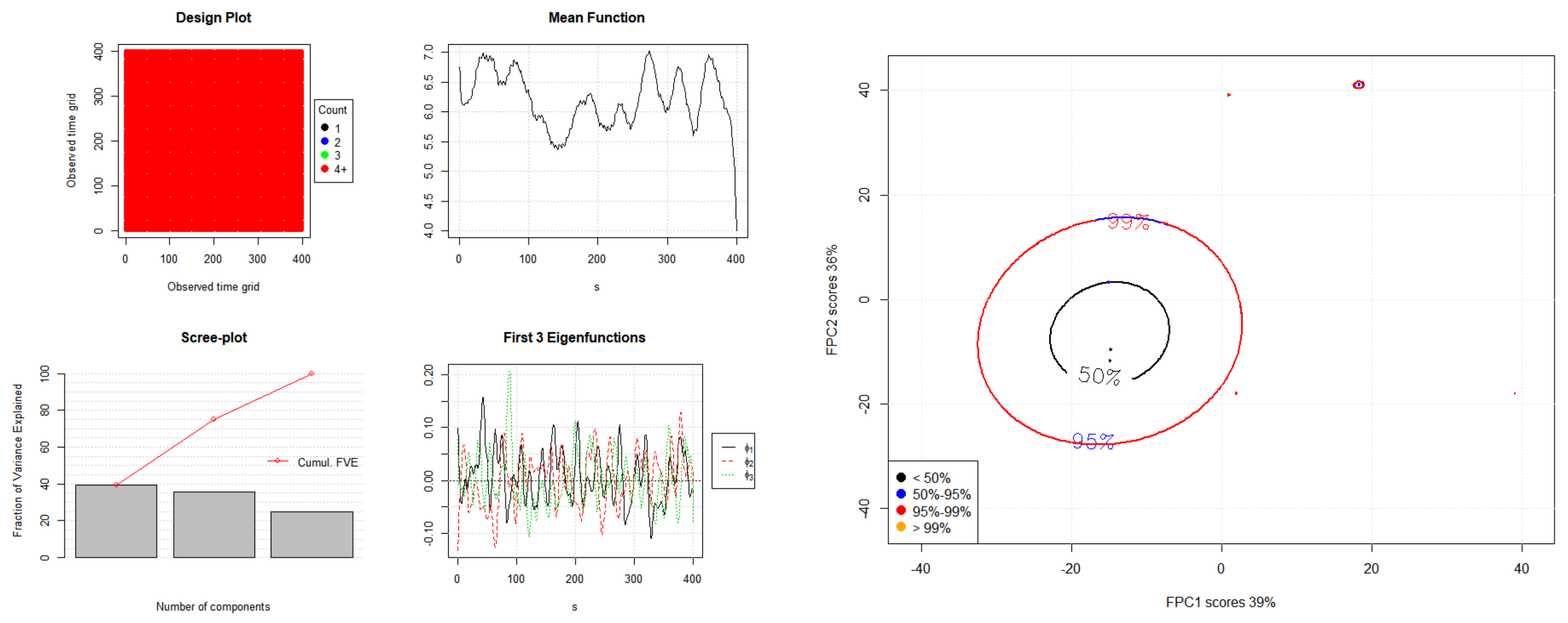

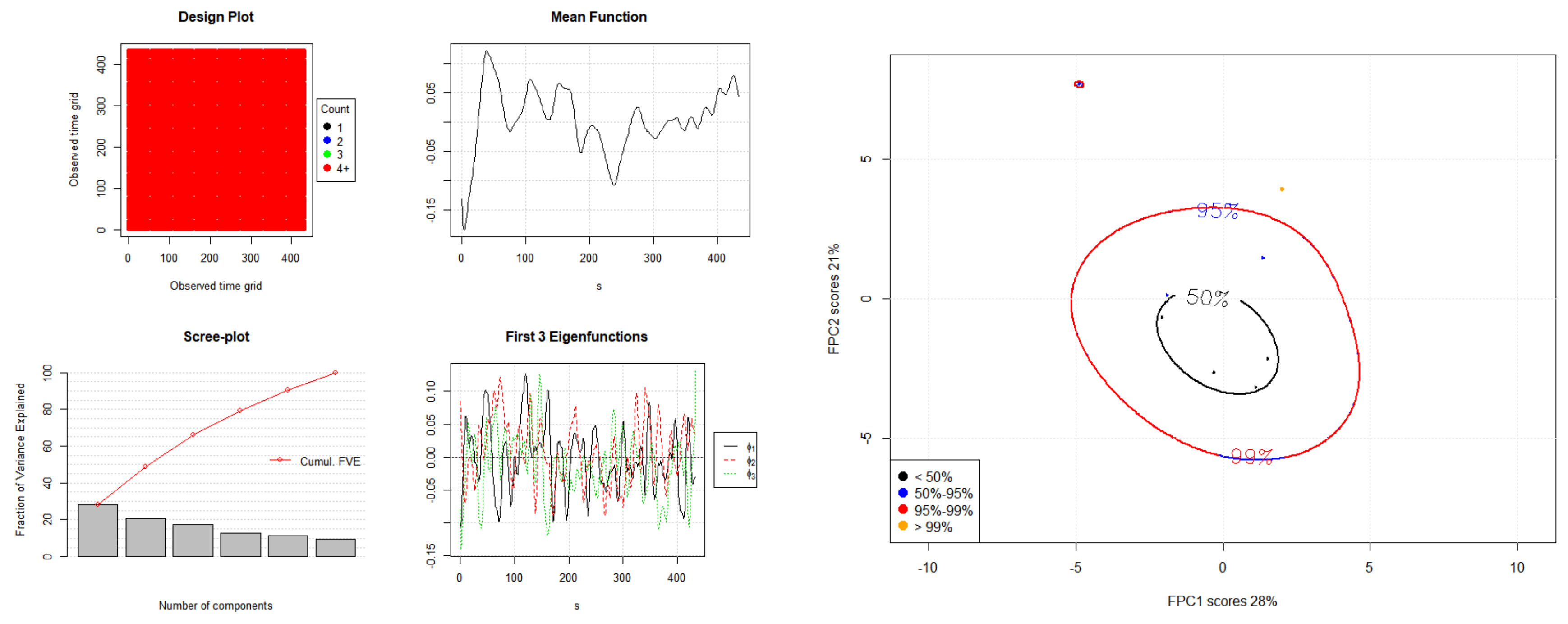

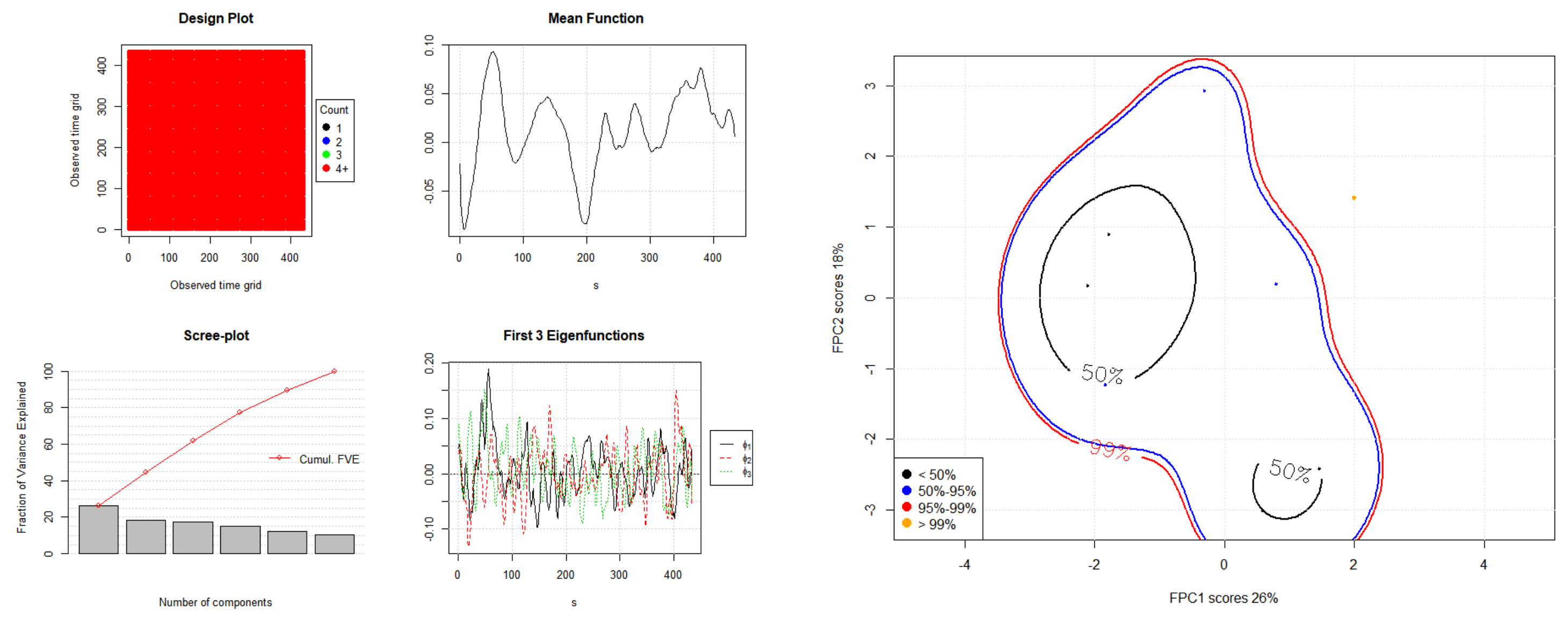

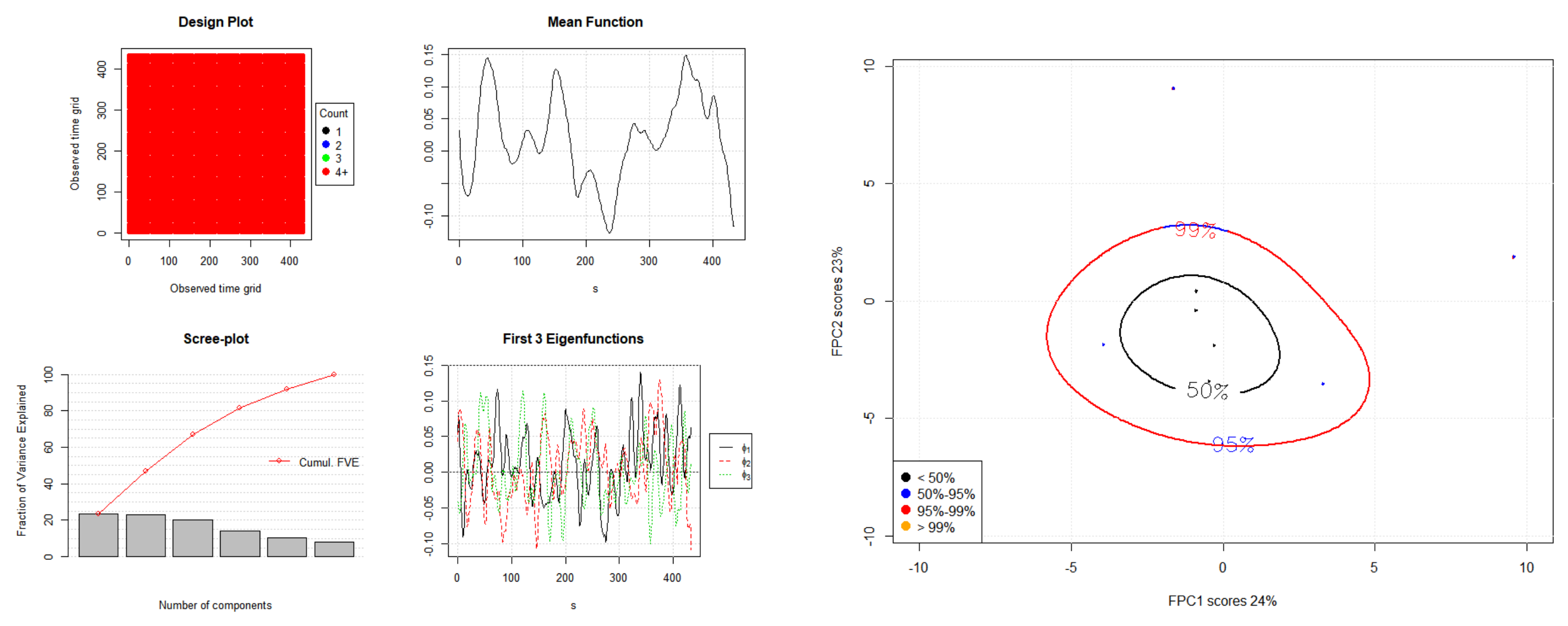

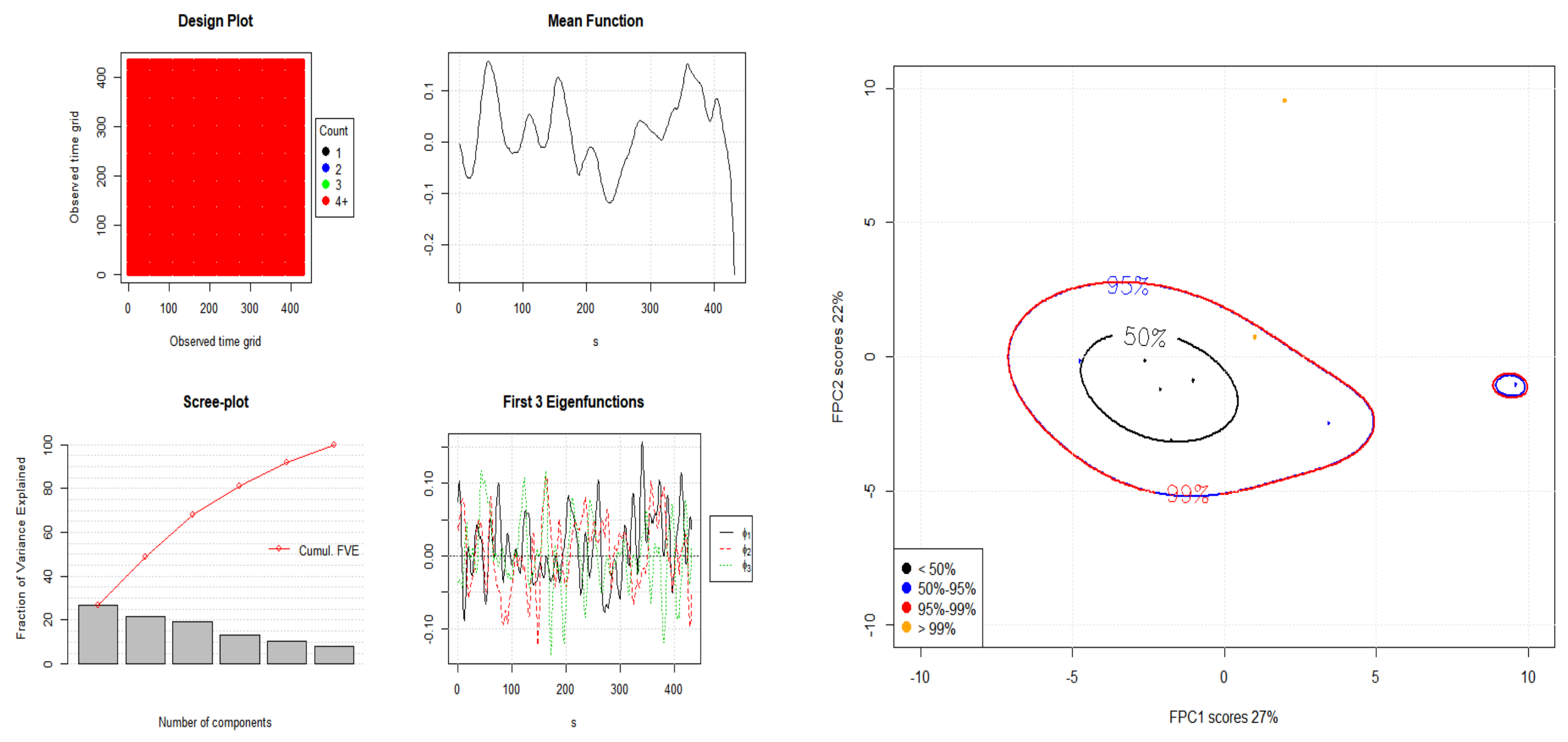

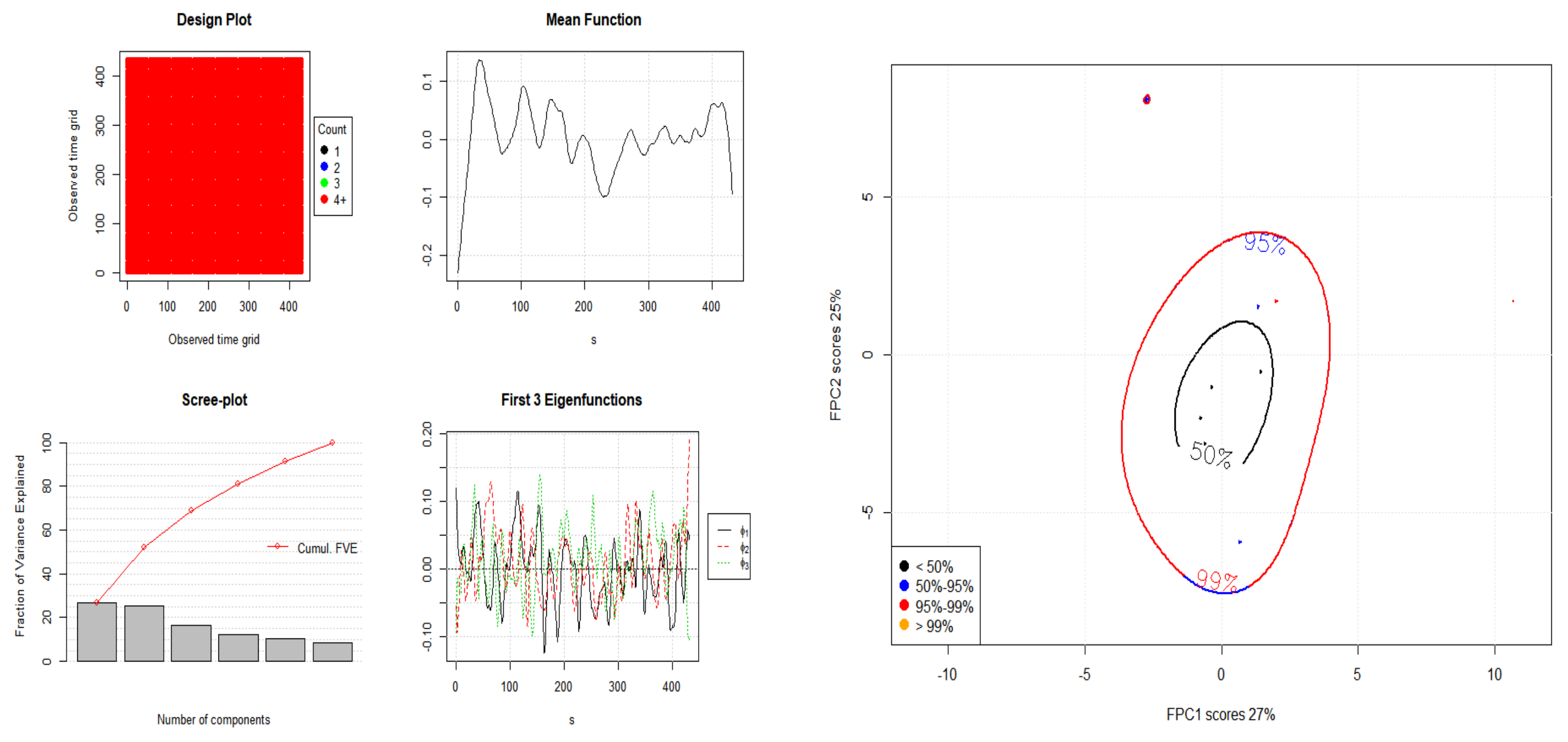

Figure 2,

Figure 3 and

Figure 4 show the eigenvalues and eigenfunctions of the FPCA plots of

,

, and

.

Table 9 shows the change point detections by both ETCC and NPMVCP with a copula conditional distribution of the t-copula, Gaussian copula, and Frank copula with FPCA components. With the simulated multivariate data, we found that the FPCA-based conditional multi-stage multivariate CPD method detected more change points for each stage case rather than the PCA-based conditional multi-stage multivariate CPD method. From

Table 9, the FPCA-based conditional multi-stage multivariate CPD method is a promising research area for detecting change points if we can implement the proper copula function empirically.

4.2. Real Data

To apply multi-stage multivariate real dataset to our proposed CPD method, we chose daily foreign exchange rates in each continental region which each continental region is financially and economically influenced by another continental region by the time zone difference. Our data set contains daily foreign exchange rates for the twenty four most traded currencies (8 countries in Asia, 8 countries in Europe, and 8 countries in America) against the euro from January 3, 2013 (1/3/2013) to October 6, 2014 (10/6/2014). The data set was retrieved from the currency database retrieval system provided by Professor Werner Antweiler’s website at UBC (University of British Columbia)’s Sauder School of Business,

http://fx.sauder.ubc.ca/data.html. We denote

to be an observed daily foreign exchange rate process in discrete time,

, and

to be the rates of return of the exchange rates at time

t. In particular, we select highest Gross Domestic Product (GDP) to lowest GDP order in each continent so that, in Asia, we select Japan, South Korea, Taiwan, China, Philippines, Thailand, India, and Vietnam; in Europe, we select Norway, Switzerland, Denmark, Sweden, United Kingdom, Poland, Hungary, and Russia; and, in America, we select USA, Canada, Chile, Uruguay, Brazil, Mexico, Columbia, and Peru in

Table 10.

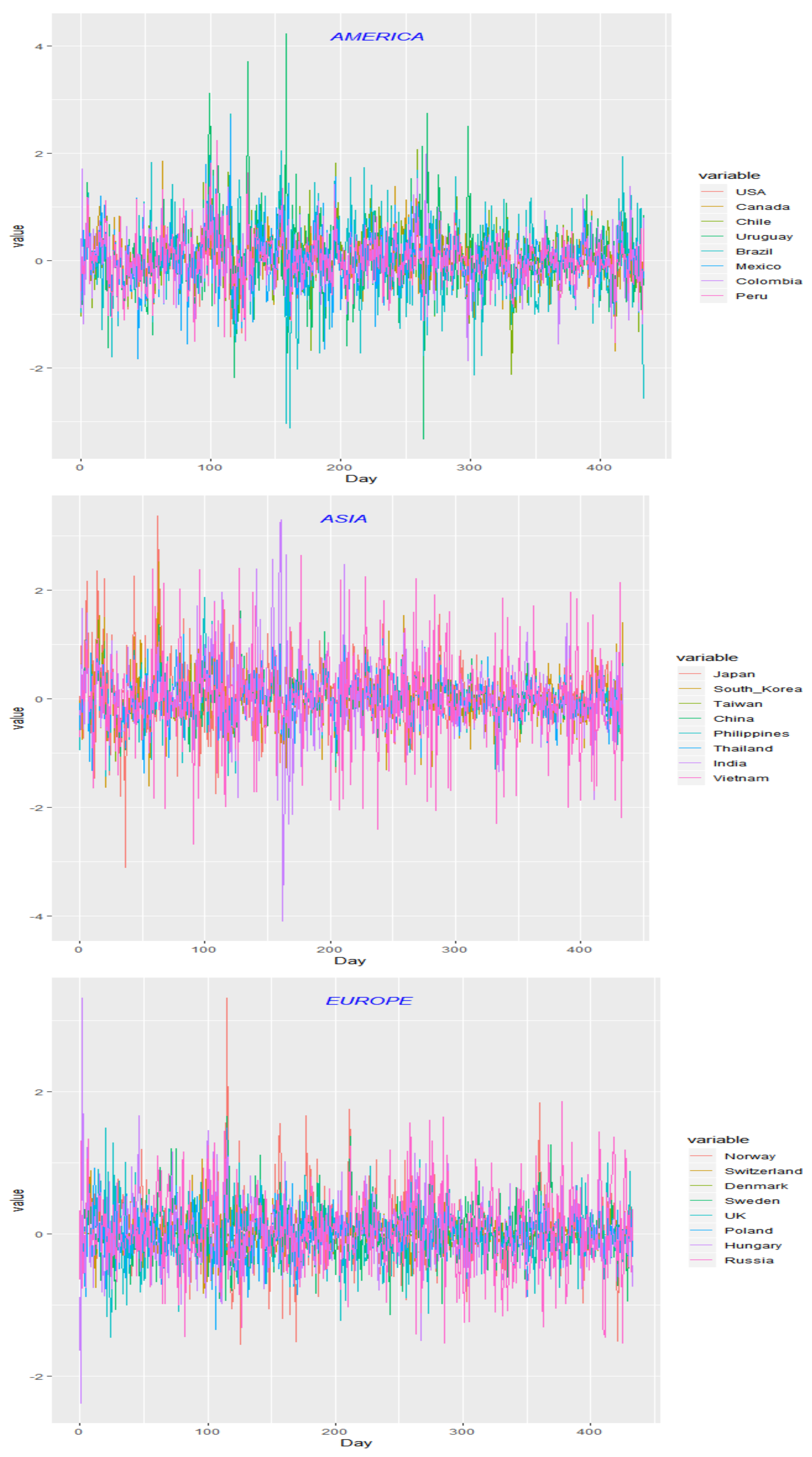

Figure 5 shows the time plots of the twenty-four currencies in America, Europe, and Asia.

Table 11 shows the correlation matrix with the twenty-four currencies in the period (1/3/2013 to 10/6/2014). We can find that there are high correlations among currencies in Asia and America but not high correlations among currencies in Europe.

Table 12 shows the results of PCA variance proportions with real exchange currency data in the period. The result in

Table 12 shows that America and Asia have similar PCA component variance proportions but Europe is different from America and Asia in terms of PCA component variance proportions.

Table 13 shows PCA variance proportions with copula conditional distributions with t-copula, Gaussian copula, and Frank copula for

F(Europe | Asia) and

F(America | (Europe, Asia)) of real data.

Table 14 shows the change point detection by ETCC and NPMVCP with real exchange currency data and PCA components.

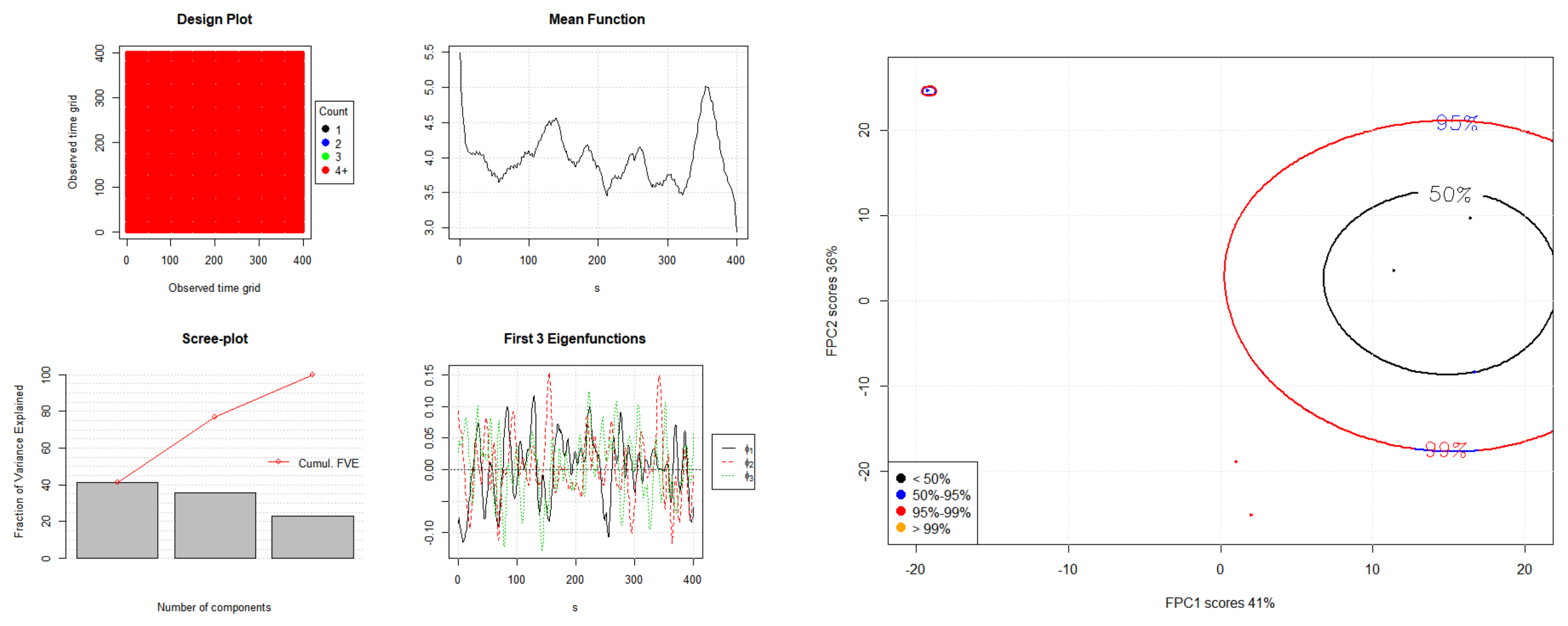

Figure 6,

Figure 7 and

Figure 8 show the eigenvalues and eigenfunctions of FPCA plots of Asia, Europe, and America.

Table 15 shows the change points with real exchange currency data by the [

9,

10] nonparametric multiple change point analysis with the ‘ecp’ R package. Compared with the results of ETCC and NPMVCP in

Table 14, Reference [

10] detected more change points with real exchange currency data with America, Asia, and Europe (1/3/2013 to 10/6/2014).

Table 16 shows change point detections of FPCA components of real exchange currency data with America, Asia, and Europe (1/3/2013 to 10/6/2014). The ETCC and NPMVCP with FPCA components of real data in

Table 16 detected more change points with real exchange currency data with America, Asia, and Europe (1/3/2013 to 10/6/2014) than Reference [

10] nonparametric multiple change point method. To consider the conditional multivariate real data, the change point detections by ETCC and NPMVCP with copula function of PCA components are shown in

Table 17.

Table 18 shows change point detection by ETCC and NPMVCP with copula function of FPCA components for real exchange currency data with America, Asia, and Europe (1/3/2013 to 10/6/2014).

For the second real data application, we consider real exchange currency data with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014) because of the time zone difference between America and Asia.

Table 19 shows change point detection by ETCC and NPMVCP with real exchange currency data with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014) and the PCA components of the data.

Table 20 shows the change point detection with real exchange currency data with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014) by Reference [

9,

10] nonparametric multiple change point analysis. Compared with the results of ETCC and NPMVCP in

Table 19, Reference [

10] detected more change points with real exchange currency data with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014).

Table 21 shows change point detection by ETCC and NPMVCP with FPCA components of real exchange currency data with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014). The ETCC and NPMVCP with FPCA components of real data in

Table 21 detected more change points with real exchange currency data with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014) than [

10] nonparametric multiple change point method. We also considered the conditional real data, Asia given America, in terms of time zone difference with America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014).

Table 22 shows change point detection by ETCC and NPMVCP of the copula conditional distribution and PCA with real exchange currency data of America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014).

Figure 9 and

Figure 10 show the eigenvalues and eigenfunctions of FPCA plots of America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014).

Table 23 shows change point detection by ETCC and NPMVCP of the copula conditional distribution and FPCA with real exchange currency data of America (1/3/2013 to 10/3/2014) and Asia (1/4/2013 to 10/6/2014). From these two real data examples, we can conclude that the FPCA-based conditional multi-stage multivariate CPD method detected more change points for each stage case rather than the PCA-based conditional multi-stage multivariate CPD method because FPCA is nonlinear PCA, which can be flexible to the real data.