Analyzing the Causality and Dependence between Gold Shocks and Asian Emerging Stock Markets: A Smooth Transition Copula Approach

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data

3.2. Methodology

3.2.1. Generalized Autoregressive Conditional Heteroscedasticity (GARCH) Model

3.2.2. Granger Causality Test Method

3.2.3. Copulas Approaches

3.2.4. Smooth Transition Dynamic Copula Model

4. Empirical Results and Discussion

4.1. GARCH-skew-t Model Results

4.2. Estimates of Causality Using Granger Causality Test

4.3. Estimates of Causality Using the Rolling Window Granger Causality Test

4.4. Measurement of Static Dependence Between Stock Volatilities and Gold Shocks

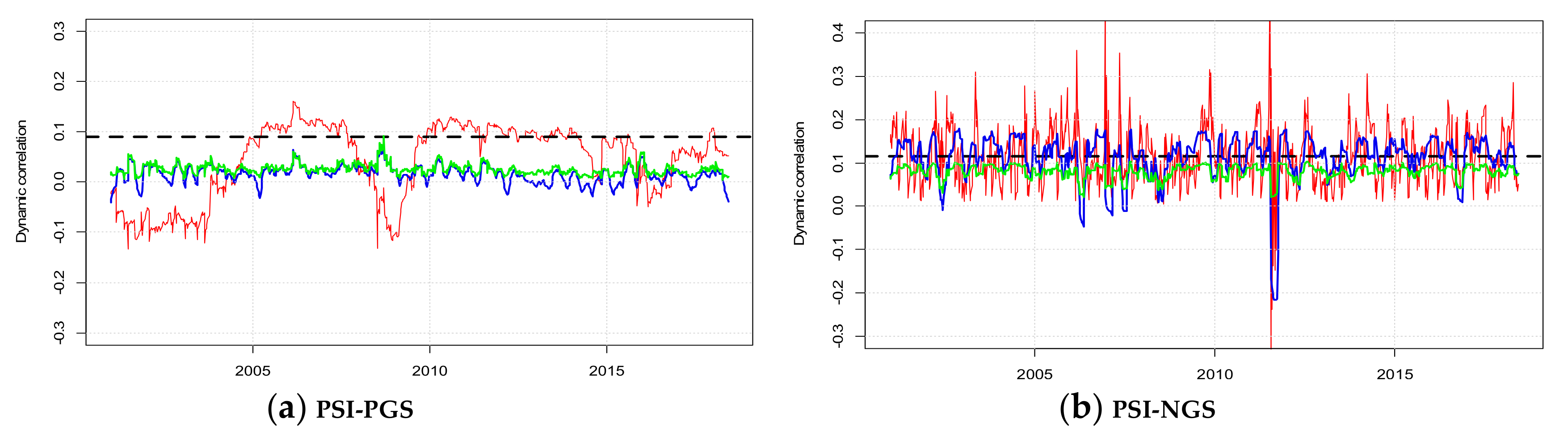

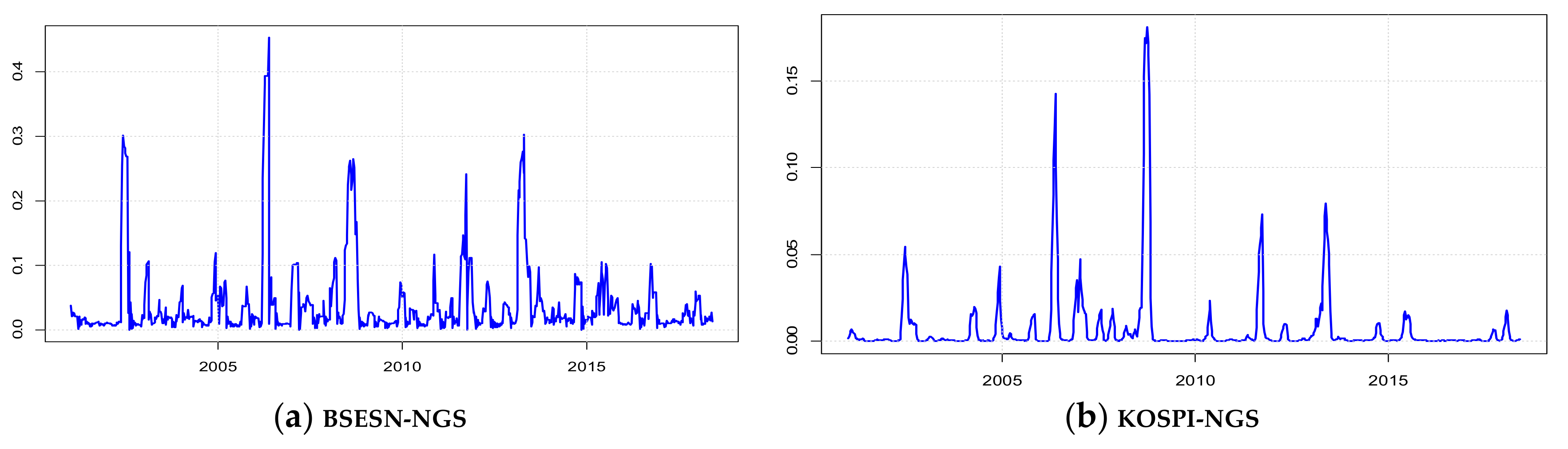

4.5. Measurement of Time-Varying Dependence Between Stock Volatilities and Gold Shocks

4.6. The out-of-Sample Forecasting Performance

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. The Markov Switching Copula Model

References

- Wen, X.; Cheng, H. Which is the safe haven for emerging stock markets, gold or the US dollar? Emerg. Mark. Rev. 2018, 35, 69–90. [Google Scholar] [CrossRef]

- Nguyen, C.; Bhatti, M.I.; Komorníková, M.; Komorník, J. Gold price and stock markets nexus under mixed-Copulas. Econ. Model. 2016, 58, 283–292. [Google Scholar] [CrossRef]

- Pastpipatkul, P.; Yamaka, W.; Sriboonchitta, S. Portfolio selection with stock, gold and bond in Thailand under vine Copulas functions. In International Econometric Conference of Vietnam; Springer: Cham, Switzerland, 2018; pp. 698–711. [Google Scholar]

- Do, G.; McAleer, M.; Sriboonchitta, S. Effects of international gold market on stock exchange volatility: Evidence from Asean emerging stock markets. Econ. Bull. 2009, 29, 599–610. [Google Scholar]

- Chen, K.; Wang, M. Does Gold Act as a Hedge and a Safe Haven for China’s Stock Market? Int. J. Financ. Stud. 2017, 5, 18. [Google Scholar] [CrossRef]

- Liao, J.; Qian, Q.; Xu, X. Whether the fluctuation of China’s financial markets have impact on global commodity prices? Phys. A Stat. Mech. Its Appl. 2018, 503, 1030–1040. [Google Scholar] [CrossRef]

- Gulzar, S.; Mujtaba Kayani, G.; Xiaofeng, H.; Ayub, U.; Rafique, A. Financial cointegration and spillover effect of global financial crisis: A study of emerging Asian financial markets. Econ. Res. Ekon. Istraživanja 2019, 32, 187–218. [Google Scholar] [CrossRef]

- Xu, G.; Gao, W. Financial Risk Contagion in Stock Markets: Causality and Measurement Aspects. Sustainability 2019, 11, 1402. [Google Scholar] [CrossRef]

- Beckmann, J.; Berger, T.; Czudaj, R. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Econ. Model. 2015, 48, 16–24. [Google Scholar] [CrossRef]

- Baur, D.G.; Lucey, B.M. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. SSRN Electron. J. 2009, 40. [Google Scholar] [CrossRef]

- Markowitz, H.M. Portfolio Selection: Efficient Diversification of Investments; John Wiley & Sons: New York, NY, USA, 1959. [Google Scholar]

- Tiwari, A.K.; Adewuyi, A.O.; Roubaud, D. Dependence between the global gold market and emerging stock markets (E7+ 1): Evidence from Granger causality using quantile and quantile-on-quantile regression methods. World Econ. 2019, 42, 2172–2214. [Google Scholar] [CrossRef]

- Mishra, P.K.; Das, J.R.; Mishra, S.K. Gold price volatility and stock market returns in India. Am. J. Sci. Res. 2010, 9, 47–55. [Google Scholar]

- Bhunia, A.; Das, A. Association between gold price and stock market returns: Empirical evidence from NSE. J. Exclus. Manag. Sci. 2012, 1, 1–7. [Google Scholar]

- Hussin, M.Y.M.; Muhammad, F.; Razak, A.A.; Tha, G.P.; Marwan, N. The link between gold price, oil price and Islamic stock market: Experience from Malaysia. J. Stud. Soc. Sci. 2013, 4, 161–182. [Google Scholar]

- Choudhry, T.; Hassan, S.S.; Shabi, S. Relationship between gold and stock markets during the global financial crisis: Evidence from nonlinear causality tests. Int. Rev. Financ. Anal. 2015, 41, 247–256. [Google Scholar] [CrossRef]

- Mensi, W.; Beljid, M.; Boubaker, A.; Managi, S. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Econ. Model. 2013, 32, 15–22. [Google Scholar] [CrossRef]

- Hood, M.; Malik, F. Is gold the best hedge and a safe haven under changing stock market volatility? Rev. Financ. Econ. 2013, 22, 47–52. [Google Scholar] [CrossRef]

- Pearson, K., VII. Note on regression and inheritance in the case of two parents. Proc. R. Soc. Lond. 1895, 58, 240–242. [Google Scholar]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Econ. 2016, 54, 235–247. [Google Scholar] [CrossRef]

- Sklar, M. Fonctions de repartition an dimensions et leurs marges. Publ. Inst. Statist. Univ. Paris 1959, 8, 229–231. [Google Scholar]

- Joe, H. Multivariate Models and Multivariate Dependence Concepts; CRC Press: London, UK, 1997. [Google Scholar]

- Nelsen, R.B. An Introduction to Copulas. In Springer Series in Statistics, 2nd ed.; Springer: New York, NY, USA, 2006. [Google Scholar]

- Pastpipatkul, P.; Yamaka, W.; Sriboonchitta, S. Co-Movement and Dependency between New York Stock Exchange, London Stock Exchange, Tokyo Stock Exchange, Oil Price, and Gold Price. In International Symposium on Integrated Uncertainty in Knowledge Modelling and Decision Making; Huynh, V.N., Inuiguchi, M., Demoeux, T., Eds.; Springer: Cham, Switzerland, 2015; Volume 9376. [Google Scholar]

- Pastpipatkul, P.; Yamaka, W.; Sriboonchitta, S. Analyzing Financial Risk and Co-Movement of Gold Market, and Indonesian, Philippine, and Thailand Stock Markets: Dynamic Copula with Markov-Switching. In Causal Inference in Econometrics; Huynh, V.N., Kreinovich, V., Sriboonchitta, S., Eds.; Springer: Cham, Switzerland, 2016; Volume 622. [Google Scholar]

- Beckmann, J.; Berger, T.; Czudaj, R. Tail dependence between gold and sectorial stocks in China: Perspectives for portfolio diversification. Empir. Econ. 2019, 56, 1117–1144. [Google Scholar] [CrossRef]

- Patton, A.J. Modelling asymmetric exchange rate dependence. Int. Econ. Rev. 2006, 47, 527–556. [Google Scholar] [CrossRef]

- Da Silva Filho, O.C.; Ziegelmann, F.A.; Dueker, M.J. Modeling dependence dynamics through Copulas with regime switching. Insur. Math. Econ. 2012, 50, 346–356. [Google Scholar] [CrossRef]

- Fei, F.; Fuertes, A.M.; Kalotychou, E. Dependence in credit default swap and equity markets: Dynamic Copula with Markov-switching. Int. J. Forecast. 2017, 33, 662–678. [Google Scholar] [CrossRef]

- Hamilton, J.D. A new approach to the economic analysis of nonstationary time series and the business cycle. Econom. J. Econom. Soc. 1989, 57, 357–384. [Google Scholar] [CrossRef]

- Maneejuk, P.; Yamaka, W.; Leeahtam, P. Modeling Nonlinear Dependence Structure Using Logistic Smooth Transition Copula Model. Available online: http://thaijmath.in.cmu.ac.th/index.php/thaijmath/article/view/3910 (accessed on 2 October 2019).

- Silvennoinen, A.; Teräsvirta, T. Modeling multivariate autoregressive conditional heteroskedasticity with the double smooth transition conditional correlation GARCH model. J. Financ. Econom. 2009, 7, 373–411. [Google Scholar] [CrossRef]

- Dornbusch, R.; Park, Y.C.; Claessens, S. Contagion: Understanding how it spreads. World Bank Res. Obs. 2000, 15, 177–197. (In English) [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Oh, D.H.; Patton, A.J. Time-varying systemic risk: Evidence from a dynamic Copula model of cds spreads. J. Bus. Econ. Stat. 2018, 36, 181–195. [Google Scholar] [CrossRef]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S.; Ratti, R.A. Oil shocks and the macroeconomy: The role of price variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef]

- Shi, G.; Liu, X.; Zhang, X. Time-varying causality between stock and housing markets in China. Financ. Res. Lett. 2017, 22, 227–232. [Google Scholar] [CrossRef]

- Andrews, D.W.; Ploberger, W. Optimal tests when a nuisance parameter is present only under the alternative. Econom. J. Econom. Soc. 1994, 62, 1383–1414. [Google Scholar] [CrossRef]

- Nyakabawo, W.; Miller, S.M.; Balcilar, M.; Das, S.; Gupta, R. Temporal causality between house prices and output in the US: A bootstrap rolling-window approach. N. Am. J. Econ. Financ. 2015, 33, 55–73. [Google Scholar] [CrossRef]

- Maneejuk, P.; Yamaka, W. Predicting Contagion from the US Financial Crisis to International Stock Markets Using Dynamic Copula with Google Trends. Mathematics 2019, 7, 1032. [Google Scholar] [CrossRef]

- Song, Q.; Liu, J.; Sriboonchitta, S. Risk Measurement of Stock Markets in BRICS, G7, and G20: Vine Copulas versus Factor Copulas. Mathematics 2019, 7, 274. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Chan, K.F.; Treepongkaruna, S.; Brooks, R.; Gray, S. Asset market linkages: Evidence from financial, commodity and real estate assets. J. Bank. Financ. 2011, 35, 1415–1426. [Google Scholar] [CrossRef]

- Hansen, P.R.; Lunde, A.; Nason, J.M. The model confidence set. Econometrica 2011, 79, 453–497. [Google Scholar] [CrossRef]

- Liu, G.D.; Su, C.W. The dynamic causality between gold and silver prices in China market: A rolling window bootstrap approach. Financ. Res. Lett. 2019, 28, 101–106. [Google Scholar] [CrossRef]

- Maneejuk, P.; Yamaka, W.; Sriboonchitta, S. Does the Kuznets curve exist in Thailand? A two decades’ perspective (1993–2015). Ann. Oper. Res. 2019, 1–32. [Google Scholar] [CrossRef]

| SERIES | MEAN | STD | SKEWNESS | KURTOSIS | ADF |

|---|---|---|---|---|---|

| GOLD | 0.0033 | 0.2470 | −0.1998 | 4.5683 | −31.1167 *** |

| SSEC | 0.0008 | 0.0335 | −0.0423 | 5.6511 | −27.9771 *** |

| BSESN | 0.0028 | 0.0298 | −0.2767 | 6.0163 | −18.6378 *** |

| JKSE | 0.0033 | 0.0296 | −0.6408 | 7.6383 | −31.6757 *** |

| KOSPI | 0.0019 | 0.0301 | −0.3639 | 8.2530 | −32.9096 *** |

| HIS | 0.0010 | 0.0294 | −0.0679 | 5.5274 | −30.4016 *** |

| PSE | 0.0022 | 0.0278 | −0.1281 | 7.7969 | −31.8466 *** |

| TASI | 0.0019 | 0.0339 | −0.9987 | 9.1291 | −28.9613 *** |

| QE | 0.0028 | 0.0333 | −0.1224 | 8.3156 | −28.4976 *** |

| SET | 0.0023 | 0.0273 | −0.9961 | 10.6266 | −12.6105 *** |

| VNI | 0.0023 | 0.0398 | −0.0702 | 6.8271 | −17.4981 *** |

| Copula | Function | Parameter | Kendall’s Tau | Tail Dependence |

|---|---|---|---|---|

| Normal | No tail dependence | |||

| Student-t | ||||

| Gumbel | , | |||

| Clayton | , | |||

| Frank | No tail dependence |

| Parameter Estimation | Log-likelihood | Q(10) | ARCH(1)-LM | ||||||

|---|---|---|---|---|---|---|---|---|---|

| SSEC | 0.0003 * (0.0001) | <0.0001 * (<0.0001) | 0.1231 * (0.0279) | 0.8604 * (0.0284) | 5.3588 * (1.3354) | 0.9413 * (0.0248) | 1903.939 | 0.2280 | 0.8993 |

| BSESN | 0.0033 * (0.0004) | <0.0001 (<0.0001) | 0.0987 * (0.0231) | 0.8895 * (0.0262) | 13.5783 * (5.058) | 0.8665 * (0.0429) | 2022.767 | 0.4269 | 0.6320 |

| JKSE | 0.0034 * (0.0008) | <0.0001 (<0.0001) | 0.1243 * (0.0326) | 0.8481 * (0.0429) | 4.3589 * (0.9547) | 0.9322 * (0.0427) | 2003.342 | 0.0792 | 0.9815 |

| KOSPI | 0.0016 * (0.0007) | <0.0001 * (<0.0001) | 0.1286 * (0.0295) | 0.8567 * (0.0344) | 7.8885 * (2.0185) | 0.7866 * (0.0368) | 2044.873 | 0.5249 | 0.6271 |

| HIS | 0.0019 * (0.0008) | <0.0001 * (<0.0001) | 0.0855 * (0.0205) | 0.8927 * (0.0248) | 12.8507 * (4.3224) | 0.9041 * (0.0469) | 2013.785 | 0.7588 | 0.8403 |

| PSE | 0.0028 * (0.0008) | <0.0001 (<0.0001) | 0.1081 * (0.0344) | 0.8568 * (0.0488) | 6.7247 * (1.2758) | 0.9536 * (0.047) | 2033.291 | 0.4216 | 0.6623 |

| TASI | 0.0029 * (0.0007) | <0.0001 * (<0.0001) | 0.3271 * (0.0490) | 0.6348 * (0.0409) | 4.5519 * (0.6832) | 0.8688 * (0.0433) | 1972.510 | 0.0060 | 0.9464 |

| QE | 0.0024 * (0.0008) | <0.0001 * (<0.0001) | 0.2589 * (0.0578) | 0.6832 * (0.0670) | 3.9941 * (0.6088) | 1.0567 * (0.0461) | 1960.371 | 0.1001 | 0.2883 |

| SET | 0.0019 * (0.0007) | <0.0001 (<0.0001) | 0.0803 * (0.0192) | 0.9145 * (0.0199) | 6.3371 * (1.2102) | 0.8455 * (0.0401) | 2070.848 | 0.5220 | 0.3001 |

| VNI | 0.0002 * (0.0001) | <0.0001 * (<0.0001) | 0.3461 * (0.0634) | 0.6741 * (0.0517) | 5.6696 * (0.9806) | 0.9692 * 0.0486) | 1861.425 | 0.4001 | 0.4539 |

| GOLD | 0.0025 * (0.0001) | <0.0001 * (<0.0001) | 0.0487 * (0.0300) | 0.9110 * (0.0749) | 11.9145 * (4.3710) | 0.8505 * (0.0412) | 1598.22 | 0.2368 | 0.5981 |

| Stock→PGS | PGS→Stock | Stock→NGS | NGS→Stock | |||||

|---|---|---|---|---|---|---|---|---|

| p-Value | Causality | p-Value | Causality | p-Value | Causality | p-Value | Causality | |

| SSEC | 0.2894 | No | 0.4818 | No | 0.1989 | No | 0.1282 | No |

| BSESN | 0.6213 | No | 0.3218 | No | 0.0197 | Yes | 0.6562 | No |

| JKSE | 0.7206 | No | 0.1132 | No | 0.028 | Yes | 0.1158 | No |

| KOSPI | 0.8298 | No | 0.4675 | No | 0.0212 | Yes | 0.9489 | No |

| HIS | 0.2820 | No | 0.4307 | No | 0.0297 | Yes | 0.2071 | No |

| PSE | 0.6704 | No | 0.2625 | No | 0.4443 | No | 0.3753 | No |

| TASI | 0.4239 | No | 0.6444 | No | 0.2021 | No | 0.6505 | No |

| QE | 0.8411 | No | 0.3134 | No | 0.3490 | No | 0.4286 | No |

| SET | 0.9868 | No | 0.6758 | No | 0.0485 | Yes | 0.0275 | Yes |

| VNI | 0.3177 | No | 0.6069 | No | 0.0973 | Yes | 0.4132 | No |

| Stock→PGS Eq. | Stock→PGS Eq. | Stock→NGS Eq. | NGS→Stock Eq. | |||||

|---|---|---|---|---|---|---|---|---|

| Sup-F | p-Value | Sup-F | p-Value | Sup-F | p-Value | Sup-F | p-Value | |

| SSEC | 18.994 | 0.000 | 20.378 | 0.000 | 23.661 | 0.000 | 24.643 | 0.000 |

| BSESN | 34.778 | 0.000 | 36.311 | 0.000 | 36.325 | 0.000 | 38.197 | 0.000 |

| JKSE | 45.109 | 0.000 | 43.318 | 0.000 | 47.315 | 0.000 | 45.987 | 0.000 |

| KOSPI | 13.125 | 0.000 | 12.998 | 0.000 | 13.987 | 0.000 | 13.547 | 0.000 |

| HIS | 34.477 | 0.000 | 32.364 | 0.000 | 36.897 | 0.000 | 34.211 | 0.000 |

| PSE | 13.288 | 0.000 | 11.559 | 0.000 | 15.368 | 0.000 | 12.331 | 0.000 |

| TASI | 10.548 | 0.000 | 9.374 | 0.000 | 10.314 | 0.000 | 12.887 | 0.000 |

| QE | 8.677 | 0.000 | 9.665 | 0.000 | 11.556 | 0.000 | 13.984 | 0.000 |

| SET | 20.668 | 0.000 | 22.365 | 0.000 | 24.357 | 0.000 | 26.779 | 0.000 |

| VNI | 31.156 | 0.000 | 35.664 | 0.000 | 33.971 | 0.000 | 36.341 | 0.000 |

| Period | Findings |

|---|---|

| Pre-crisis | Seven out of the ten Asian emerging stock markets’ volatilities had the contagion effect on the gold market |

| During crisis | The bidirectional causality between stock volatility and negative gold shock in India, Korea, China, and Vietnam is detected, indicating that gold may not serve as a safe haven for Indian, Korean, Chinese stock markets in some years during the global financial crisis period |

| Post-crisis | There is significant causality running from all stock volatilities to gold shocks in some years. However, when we consider the Granger causality running from gold price shocks to stock volatilities, the results display weak evidence supporting the Granger causality as the p-values (blue dashed line) tend to increase |

| SSEC | BSESN | JKSE | KOSPI | HSI | PSI | TASI | QE | SET | VNI | |

|---|---|---|---|---|---|---|---|---|---|---|

| STOCK-PGS | ||||||||||

| NORMAL | −2.593 | 1.932 | −1.402 | 1.901 | 1.954 | 0.865 | 1.352 | 1.851 | −1.699 | 0.130 |

| STUDENT-T | 8.299 | 10.066 | 6.772 | 16.687 | 12.512 | 16.011 | 11.774 | 12.124 | 4.0416 | 24.174 |

| CLAYTON | 19.860 | 17.892 | 17.763 | 2.807 | 27.667 | 22.155 | 2.741 | 2.044 | 19.100 | 3.504 |

| GUMBEL | −8.752 | −3.766 | −9.223 | 1.577 | 4.153 | −1.578 | 0.749 | 1.915 | −12.297 | 0.913 |

| FRANK | −12.388 | −3.413 | −12.378 | 0.988 | −2.863 | −8.381 | 0.074 | 1.495 | 14.036 | −1.350 |

| STOCK-NGS | ||||||||||

| NORMAL | −2.117 | −9.013 | −10.597 | −1.817 | −15.767 | −11.397 | 1.994 | 2.588 | −4.911 | 2.615 |

| STUDENT-T | 9.879 | −1.809 | −7.092 | 5.951 | −10.253 | −3.842 | 10.704 | 15.218 | 0.100 | 23.601 |

| CLAYTON | 15.885 | −11.474 | −8.442 | −8.850 | −11.609 | −8.453 | 21.158 | 3.375 | −0.829 | 3.972 |

| GUMBEL | −2.300 | −4.839 | −8.122 | −0.251 | −10.030 | −7.253 | 21.152 | 1.811 | −3.467 | 2.703 |

| FRANK | −2.836 | −0.640 | −0.082 | 2.387 | −6.567 | −3.135 | 1.722 | 1.519 | 1.228 | 3.097 |

| Market | Selected Copula | Dependence Parameter | Kendall’s Tau | Upper Tail | Lower Tail |

|---|---|---|---|---|---|

| STOCK-PGS | |||||

| SSEC | Frank | 0.743 * (0.151) | 0.08 | ||

| BSESN | Gumbel | 1.053 * (0.021) | 0.05 | 0.06 | |

| JKSE | Frank | 0.631 * (0.161) | 0.07 | ||

| KOSPI | Frank | 0.042 (0.163) | 0.01 | ||

| HIS | Frank | 0.543 * (0.160) | 0.06 | ||

| PSE | Frank | 0.623 * (0.144) | 0.07 | ||

| TASI | Frank | 0.069 (0.161) | 0.01 | ||

| QE | Frank | 0.036 (0.150) | 0.01 | ||

| SET | Gumbel | 1.096 * (0.033) | 0.09 | 0.11 | |

| VNI | Frank | 0.031 * (0.072) | 0.02 | ||

| STOCK-NGS | |||||

| SSEC | Frank | 0.845 * (0.401) | 0.09 | ||

| BSESN | Clayton | 0.153 (0.100) | 0.07 | 0.01 | |

| JKSE | Normal | 0.149 * (0.073) | 0.09 | ||

| KOSPI | Clayton | 0.169 (0.093) | 0.07 | 0.01 | |

| HIS | Normal | 0.253 (0.171) | 0.16 | ||

| PSE | Normal | 0.146 * (0.073) | 0.09 | ||

| TASI | Frank | −0.035 (0.423) | −0.01 | ||

| QE | Frank | 0.123 (0.445) | 0.01 | ||

| SET | Normal | 0.115 * (0.044) | 0.11 | ||

| VNI | Normal | 0.039 (0.075) | 0.02 | ||

| SSEC | BSESN | JKSE | KOSPI | HSI | PSI | TASI | QE | SET | VNI | |

|---|---|---|---|---|---|---|---|---|---|---|

| STOCK-PGS | ||||||||||

| Dynamic Copula | ||||||||||

| NORMAL | −3.158 | −4.788 | −3.010 | −3.148 | −4.789 | −4.680 | −2.414 | −4.679 | −3.279 | −2.505 |

| STUDENT-T | −1.225 | −1.301 | −2.315 | −0.335 | −0.566 | −1.332 | −0.115 | −0.326 | −2.543 | −0.351 |

| CLAYTON | −0.241 | −0.541 | −0.331 | −0.758 | −0.158 | −0.9521 | −1.354 | −1.665 | −0.554 | −1.351 |

| GUMBEL | −9.554 | −4.215 | −10.354 | −3.012 | −2.158 | −6.654 | −3.215 | −4.941 | −15.115 | −2.005 |

| FRANK | −13.845 | −5.356 | −15.214 | −4.112 | −5.331 | −9.356 | −4.558 | −5.321 | −1.358 | −3.358 |

| Markov Switching Dynamic Copula | ||||||||||

| NORMAL | −4.525 | −11.311 | −5.542 | −6.112 | −5.348 | −7.982 | −3.090 | −5.958 | −8.213 | −8.3457 |

| STUDENT-T | −2.334 | −1.566 | −3.214 | −0.585 | −0.986 | −2.912 | −0.965 | −0.535 | −3.335 | −1.661 |

| CLAYTON | −0.456 | −0.964 | −0.559 | −0.987 | −0.542 | −1.720 | −2.503 | −1.965 | −0.983 | −1.699 |

| GUMBEL | −10.134 | −13.215 | −11.897 | −3.985 | −3.159 | −7.025 | −4.299 | −6.001 | −25.013 | −6.035 |

| FRANK | −18.812 | −6.758 | −15.214 | −5.329 | −8.883 | −13.206 | −8.210 | −7.321 | −2.118 | −11.358 |

| Smooth Transition Dynamic Copula | ||||||||||

| NORMAL | −4.617 | −10.687 | −6.708 | −9.114 | −5.511 | −7.681 | −6.359 | −9.329 | −4.713 | −6.612 |

| STUDENT-T | −2.218 | −1.516 | −3.310 | −0.656 | −0.916 | −2.609 | −0.644 | −0.443 | −3.431 | −1.203 |

| CLAYTON | −0.994 | −0.904 | −0.601 | −0.631 | −0.593 | −1.441 | −2.309 | −2.110 | −1.022 | −1.887 |

| GUMBEL | −12.499 | −12.250 | −11.229 | −3.914 | −3.221 | −7.321 | −7.299 | −6.591 | −30.911 | −5.319 |

| FRANK | −14.114 | −6.801 | −18.240 | −10.323 | −10.305 | −12.213 | −8.537 | −9.551 | −2.389 | −10.397 |

| STOCK-NGS | ||||||||||

| Static Copula | ||||||||||

| NORMAL | −2.117 | −9.013 | −10.597 | −1.817 | −15.767 | −11.397 | 1.994 | 2.588 | −4.911 | 2.615 |

| STUDENT-T | 9.879 | −1.809 | −7.092 | 5.951 | −10.253 | −3.842 | 10.704 | 15.218 | 0.100 | 23.601 |

| CLAYTON | 15.885 | −11.474 | −8.442 | −8.850 | −11.609 | −8.453 | 21.158 | 3.375 | −0.829 | 3.972 |

| GUMBEL | −2.300 | −4.839 | −8.122 | −0.251 | −10.030 | −7.253 | 21.152 | 1.811 | −3.467 | 2.703 |

| FRANK | −2.836 | −0.640 | −0.082 | 2.387 | −6.567 | −3.135 | 1.722 | 1.519 | 1.228 | 3.097 |

| Dynamic Copula | ||||||||||

| NORMAL | −7.294 | −6.504 | −12.430 | −0.149 | −12.343 | −16.094 | −3.431 | −3.896 | −7.392 | −6.346 |

| STUDENT-T | −0.597 | −2.115 | −10.315 | −1.059 | −11.681 | −5.361 | −0.597 | −0.631 | −2.397 | −0.398 |

| CLAYTON | −0.158 | −13.641 | −10.967 | −9.541 | −13.189 | −9.559 | −0.115 | −2.369 | −1.117 | −1.135 |

| GUMBEL | −7.561 | −4.351 | −10.321 | −3.987 | −12.136 | −8.129 | −0.361 | −1.336 | −6.358 | −1.268 |

| FRANK | −8.054 | −1.397 | −1.114 | −2.115 | −8.669 | −4.331 | −5.311 | −5.324 | −0.554 | −1.111 |

| Markov Switching Dynamic Copula | ||||||||||

| NORMAL | −7.285 | −7.894 | −13.341 | −6.6413 | −15.588 | −14.532 | −6.687 | −12.300 | −6.954 | −9.551 |

| STUDENT-T | −0.619 | −1.995 | −10.551 | −1.364 | −12.598 | −5.368 | −0.169 | −0.129 | −2.147 | −0.188 |

| CLAYTON | −0.264 | −14.991 | −11.321 | −15.123 | −17.597 | −10.109 | −0.035 | −3.997 | −1.006 | −1.987 |

| GUMBEL | −8.239 | −5.229 | −11.991 | −3.558 | −13.516 | −9.035 | −0.416 | −2.691 | −6.597 | −1.691 |

| FRANK | −10.065 | −2.116 | −1.138 | −3.313 | −7.024 | −4.697 | −7.967 | −15.324 | −0.597 | −1.268 |

| Smooth Transition Dynamic Copula | ||||||||||

| GAUSSIAN | −7.783 | −7.740 | −14.071 | −8.082 | −18.358 | −13.079 | −6.791 | −9.135 | −6.076 | −13.018 |

| STUDENT-T | −0.930 | −2.139 | −10.202 | −1.297 | −14.881 | −5.978 | −0.221 | −0.291 | −2.396 | −0.291 |

| CLAYTON | −0.661 | −15.169 | −11.109 | −15.361 | −17.564 | −9.119 | −0.149 | −3.339 | −1.697 | −2.068 |

| GUMBEL | −8.321 | −5.997 | −12.871 | −4.100 | −14.336 | −9.543 | −0.669 | −2.497 | −6.570 | −1.198 |

| FRANK | −10.765 | −3.156 | −2.698 | −3.014 | −8.213 | −4.793 | −8.071 | −15.997 | −0.471 | −1.303 |

| SSEC | BSESN | JKSE | KOSPI | HSI | PSI | TASI | QE | SET | VNI | |

|---|---|---|---|---|---|---|---|---|---|---|

| Stock-PGS | ||||||||||

| MSDC-F | MSDC-N | STDC-F | STDC-F | STDC-F | MSDC-F | STDC-F | STDC-F | STDC-N | MSDC-F | |

| 4.041 * (1.488) | 2.021 * (1.001) | −0.046 * (0.001) | −0.147 * (0.056) | 0.011 * (0.006) | 0.388 * (0.117) | 0.054 * (0.002) | −0.042 * (0.001) | −0.109 * (0.056) | 3.386 * (1.506) | |

| −1.475 (1.040) | −0.697 * (0.125) | 2.411 * (0.382) | 5.230 * (0.549) | 0.762 (0.890) | 0.013 * (0.051) | 1.589 * (0.537) | 1.445 * (0.215) | −0.771 * (0.188) | 2.825 * (1.184) | |

| −4.040 * (1.872) | −1.714 (1.419) | −0.304 * (0.009) | −4.888 (4.303) | −1.041 * (0.280) | 0.107 (0.568) | 1.439 (0.353) | −2.603 (1.568) | 0.595 (1.125) | −0.663 * (0.391) | |

| −0.161 * (0.048) | −0.387 * (0.124) | −0.012 * (0.001) | −0.311 * (0.125) | −0.011 * (0.003 | −0.465 * (0.143) | −0.154 * (0.213) | −0.154 (0.148) | 0.201 * (0.021) | −0.230 0.283) | |

| 1.268 * (0.496) | 1.230 * (0.464) | 0.140 (0.299) | −1.239 (2.287) | 2.189 * (0.722) | 0.082 (0.779) | −0.652 * (0.309) | −0.254 * (0.127) | 0.936 * (0.331) | −0.891 * (0.031) | |

| 0.308 (0.211) | 0.757 (0.406) | 1.333 * (0.685) | 2.233 * (0.100) | 2.322 * (0.302) | 0.244 * (0.334) | −0.315 (0.651) | 0.300 * (0.125) | −0.409 * (0.180) | 0.857 (0.830) | |

| 0.867 * (0.073) | 0.940 * (0.032) | 0.995 * (0.004) | 0.321 * (0.151) | |||||||

| 0.974 * (0.017) | 0.975 * (0.022) | 0.989 * (0.007) | 0.969 * (0.015) | |||||||

| 1.873 * (0.110) | 2.151 * (0.067) | 1.820 * (0.496) | 3.114 * (1.135) | 0.953 * (0.001) | 0.230 (0.561) | |||||

| 0.427 * (0.061) | −0.525 * (0.108) | 0.445 * (0.016) | 0.430 * (0.074) | −0.163 * (0.035) | −0.099 * (0.001) | |||||

| Stock-NGS | ||||||||||

| STDC-F | STDC-C | STDC-N | STDC-C | STDC-C | STDC-N | STDC-F | STDC-F | MSDC-N | STDC-N | |

| 0.338 * (0.168) | 0.528 * (0.204) | 0.365 * (0.100) | 0.037 * (0.010) | 0.964 * (0.154) | 0.324 * (0.125) | −0.009 * (0.004) | −0.194 (0.174) | 0.573 * (0.085) | −0.051 * (0.025) | |

| −2.337 * (0.102) | −1.672 * (0.189) | −0.918 (0.994) | −0.937 * (0.554) | −2.091 * (0.100) | 4.006 (4.044) | 2.029 * (0.562) | 1.257 * (0.328) | 1.878 * (0.974) | −0.821 * (0.280) | |

| −7.677 * (0.547) | −4.515 * (2.302) | −1.941 (2.002) | −4.281 * (0.557) | −0.468 * (0.014) | 0.481 (0.455) | −0.194 (1.581) | −0.310 * (0.180) | −0.490 (0.629) | −1.465 (0.861) | |

| −0.214 * (0.101) | −0.484 * (0.211) | 1.090 * (0.510) | 0.011 * (0.001 | −0.125 * (0.054) | 0.101 * (0.013) | 0.103 * (0.015) | 0.115 * (0.035) | −0.015 * (0.001) | 0.256 * (0.100) | |

| −0.474 * (0.125) | −2.129 * (0.914) | 1.001 * (0.438) | 3.090 * (0.245) | −0.681 * (0.157) | −0.447 * (0.043) | 1.952 (0.602) | −0.985 * (0.531) | −0.110 * (0.15) | 1.361 * (0.258) | |

| 2.112 * (0.554) | 3.099 * (1.113) | 2.994 * (1.088) | 4.163 * (0.547) | −0.681 (0.611) | −2.344 * (0.103) | 0.268 (1.461) | 0.987 (0.540) | 0.036 (0.516) | 1.543 (0.683) | |

| 0.716 * (0.150) | ||||||||||

| 0.938 * (0.042) | ||||||||||

| 0.148 * (0.003) | 2.812 * (0.225) | 1.786 * (0.539) | 0.232 * (0.018) | 0.115 (0.321) | 1.006 * (0.017) | 0.071 (0.280) | 5.125 * (2.115) | 0.086 * (0.031) | ||

| 0.559 * (0.046) | −0.076 * (0.031) | 0.402 (0.105) | −0.265 * (0.105) | 0.493 * (0.117) | 0.795 * (0.123) | 0.499 * (0.125) | 0.514 * (0.039) | 0.349 * (0.097) | ||

| Period | Findings |

|---|---|

| Pre-crisis | The correlations of all pairs (except VNI-NGS, VNI-PGS, BSESN-PGS, and SSEC-PGS) are quite low and close to zero. This indicates a weak dependence between stock volatilities and gold shocks. |

| During crisis | The magnitude of the correlations of all pairs (except SET-PGS, JKSE-NGS, HSI-PGS, and HSI NGS) is larger during the financial crisis period (2007–2009), compared to pre-crisis and post-crisis. This indicates the presence of the financial contagion effects. |

| Post-crisis | The correlation between stock volatility and gold shock dropped in many markets. However, it is obvious that the dependence increased again in 2015, but the magnitude is smaller compared to the financial crisis period. |

| SSEC | BSESN | JKSE | KOSPI | HSI | PSI | TASI | QE | SET | VNI | |

|---|---|---|---|---|---|---|---|---|---|---|

| STOCK-PGS | ||||||||||

| Dynamic Copula | ||||||||||

| GAUSSIAN | 0.125 | 0.119 | 0.113 | 0.101 | 0.159 | 0.159 | 0.141 | 0.114 | 0.115 | 0.106 |

| STUDENT-T | 0.015 | 0.151 | 0.115 | 0.000 | 0.000 | 0.293 | 0.000 | 0.000 | 0.266 | 0.000 |

| CLAYTON | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| GUMBEL | 0.123 | 0.151 | 0.135 | 0.169 | 0.221 | 0.111 | 0.109 | 0.309 | 0.133 | 0.159 |

| FRANK | 0.214 | 0.231 | 0.193 | 0.148 | 0.203 | 0.213 | 0.158 | 0.155 | 0.148 | 0.169 |

| Markov Switching Dynamic Copula | ||||||||||

| GAUSSIAN | 0.536 | 0.529 | 0.413 | 0.401 | 0.297 | 0.359 | 0.341 | 0.368 | 0.201 | 0.321 |

| STUDENT-T | 0.501 | 0.573 | 0.215 | 0.000 | 0.000 | 0.383 | 0.000 | 0.000 | 0.239 | 0.000 |

| CLAYTON | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| GUMBEL | 0.524 | 1.000 | 0.335 | 0.269 | 0.357 | 0.329 | 0.329 | 0.448 | 0.359 | 0.233 |

| FRANK | 1.000 | 0.521 | 0.593 | 0.448 | 0.403 | 1.000 | 0.905 | 0.401 | 0.254 | 1.000 |

| Smooth transition Dynamic Copula | ||||||||||

| GAUSSIAN | 0.310 | 0.520 | 0.435 | 0.529 | 0.301 | 0.268 | 0.498 | 0.509 | 0.366 | 0.468 |

| STUDENT-T | 0.398 | 0.561 | 0.663 | 0.000 | 0.000 | 0.000 | 0.401 | 0.495 | 0.498 | 0.000 |

| CLAYTON | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| GUMBEL | 0.418 | 0.997 | 0.544 | 0.331 | 0.359 | 0.297 | 0.551 | 0.697 | 1.000 | 0.559 |

| FRANK | 0.999 | 0.498 | 1.000 | 1.000 | 1.000 | 0.951 | 1.000 | 1.000 | 0.158 | 0.801 |

| SSEC | BSESN | JKSE | KOSPI | HSI | PSI | TASI | QE | SET | VNI | |

|---|---|---|---|---|---|---|---|---|---|---|

| STOCK-NGS | ||||||||||

| Dynamic Copula | ||||||||||

| GAUSSIAN | 0.114 | 0.204 | 0.367 | 0.000 | 0.432 | 0.554 | 0.158 | 0.411 | 0.211 | 0.259 |

| STUDENT-T | 0.000 | 0.000 | 0.248 | 0.000 | 0.299 | 0.319 | 0.000 | 0.000 | 0.165 | 0.000 |

| CLAYTON | 0.000 | 0.594 | 0.298 | 0.413 | 0.331 | 0.334 | 0.000 | 0.059 | 0.035 | 0.321 |

| GUMBEL | 0.239 | 0.336 | 0.309 | 0.211 | 0.305 | 0.398 | 0.000 | 0.023 | 0.298 | 0.001 |

| FRANK | 0.331 | 0.307 | 0.059 | 0.198 | 0.106 | 0.301 | 0.254 | 0.498 | 0.000 | 0.002 |

| Markov Switching Dynamic Copula | ||||||||||

| GAUSSIAN | 0.201 | 0.112 | 0.342 | 0.000 | 0.551 | 0.665 | 0.136 | 0.561 | 1.000 | 0.296 |

| STUDENT-T | 0.000 | 0.000 | 0.350 | 0.000 | 0.301 | 0.561 | 0.000 | 0.000 | 0.158 | 0.000 |

| CLAYTON | 0.000 | 0.631 | 0.348 | 0.539 | 0.359 | 0.595 | 0.000 | 0.000 | 0.005 | 0.447 |

| GUMBEL | 0.319 | 0.441 | 0.409 | 0.358 | 0.399 | 0.543 | 0.000 | 0.000 | 0.301 | 0.000 |

| FRANK | 0.564 | 0.403 | 0.010 | 0.201 | 0.111 | 0.299 | 0.413 | 0.579 | 0.000 | 0.000 |

| Smooth transition Dynamic Copula | ||||||||||

| GAUSSIAN | 0.259 | 0.315 | 1.000 | 0.000 | 1.000 | 1.000 | 0.200 | 0.871 | 0.597 | 1.000 |

| STUDENT-T | 0.000 | 0.000 | 0.431 | 0.000 | 0.396 | 0.633 | 0.000 | 0.000 | 0.231 | 0.000 |

| CLAYTON | 0.000 | 1.000 | 0.514 | 1.000 | 0.637 | 0.648 | 0.000 | 0.000 | 0.118 | 0.588 |

| GUMBEL | 0.423 | 0.551 | 0.342 | 0.649 | 0.403 | 0.559 | 0.000 | 0.000 | 0.403 | 0.000 |

| FRANK | 1.000 | 0.498 | 0.058 | 0.587 | 0.200 | 0.290 | 1.000 | 1.000 | 0.000 | 0.000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yamaka, W.; Maneejuk, P. Analyzing the Causality and Dependence between Gold Shocks and Asian Emerging Stock Markets: A Smooth Transition Copula Approach. Mathematics 2020, 8, 120. https://doi.org/10.3390/math8010120

Yamaka W, Maneejuk P. Analyzing the Causality and Dependence between Gold Shocks and Asian Emerging Stock Markets: A Smooth Transition Copula Approach. Mathematics. 2020; 8(1):120. https://doi.org/10.3390/math8010120

Chicago/Turabian StyleYamaka, Woraphon, and Paravee Maneejuk. 2020. "Analyzing the Causality and Dependence between Gold Shocks and Asian Emerging Stock Markets: A Smooth Transition Copula Approach" Mathematics 8, no. 1: 120. https://doi.org/10.3390/math8010120

APA StyleYamaka, W., & Maneejuk, P. (2020). Analyzing the Causality and Dependence between Gold Shocks and Asian Emerging Stock Markets: A Smooth Transition Copula Approach. Mathematics, 8(1), 120. https://doi.org/10.3390/math8010120