1. Introduction

Any production system may produce both perfect and imperfect products. During the long-run production process of a smart production system, there may be a chance of machine failure, due to machine breakdown, unskilled laborers, or interrupted energy suppliers, and so on. Due to these reasons, a defective product may be produced in two ways: at a constant rate or at a random rate. For a constant defect rate, the total number of defective items is constant and, for a random defect rate, the total number of defective products is a random variable. Many studies based on constant defect rates in single-item production systems have been carried out (see, for instance, [

1]); however, very little research based on random defect rates (see, for instance, [

2]) is available. Sarkar [

3] proposed a model for a multi-item production system with a random defect rate and budget and space constraints. There has been no research, to our knowledge, on multi-item smart production systems with the optimum consumption of energy and a random defect rate for smart products, with advertisement, price-dependent demand patterns, and reduced failure rates. Therefore, this proposed model gives a new direction for production systems with budget and space constraints under the effect of energy.

For this type of (perfect and imperfect) production system, rework has a vital role in smart production, where the production system becomes out-of-control (from an in-control state) within a random time interval. It provides a reliable system by reworking the defective items. Some studies of imperfect production systems with deterioration are already available in the literature, such as Rossenblat and Lee [

4], who discussed imperfect production systems; which was extended by Kim and Hog [

5] by considering the deterioration of products in a production system to find the optimal production length. They indicated three types of deterioration methods—constant deterioration, linearly increasing deterioration, and exponentially increasing deterioration—for system moving from an in-control to an out-of-control state. Giri and Dohi [

6] proposed a model which highlights random machine failure rates for single-item production systems, where the machine breakdown is stochastic and the preventive maintenance time for machine failure is also a random variable.

Sana et al. [

7] gave an idea for a research model of an imperfect production system, by considering defective products with reduced prices, although this type of idea is now common in the market. Chiu et al. [

8] proposed a model which assumes a rework policy of the defective products, using extra costs for the reworking of imperfect products. In the literature, there are few models based on energy in an imperfect smart production system. No study, to our knowledge, has considered the optimum energy consumption and its profit for a smart production system, under advertising- and price-dependent demands. Egea et al. [

9] expressed, in a model, how to measure energy during the loading of a smart machine. González et al. [

10] proposed a model for turbo-machinery components, using a total energy consideration.

Sarkar [

11] considered an inventory model involving stock-dependent demand with delayed payments. This model indicated the replenishment policy for an imperfect production system with a finite replenish rate. A production-inventory model with deterioration and a finite replenishment rate was developed by Sarkar [

12]. In this model, to maximize the profit, several discount offers for customers, to attract a large order size, were considered. Generally, imperfect product production depends on the production system reliability. Sarkar [

13] developed an economic manufacturing quantity (EMQ) model with an investment in the production system for the development of a high system reliability with lower imperfect production. This model first considered an advertisement policy, where the demand depends on the price of products. An imperfect production model was considered by Chakraborty and Giri [

14] with some imperfect products produced in an out-of-control system during preventive maintenance. An inspection was considered in this model to detect the defective items for the reworking process, although some defective products cannot be repaired.

Sarkar [

15] investigated an economic production quantity (EPQ) model with imperfect products, where a back-ordering policy was included in the model, along with a reworking policy. To calculate the rate of defective items, three different distribution functions were used and the results are compared in this model. Sarkar and Saren [

16] introduced a production model in an imperfect production system with an inspection policy. In their model, the production system becomes out-of-control in a random time interval. This model considered a quality inspector for choosing falsely an imperfect product and making a decision about quality, and vice versa. Over a fixed time period, the warranty policy also makes this model more realistic.

Pasandideh et al. [

17] extended a production model for multiple products in a single-machine imperfect production system, where the imperfect products were classified by their nature, to consider whether to rework or scrap them. To make this model more realistic, they considered fully backlogging all shortages. An inventory model for a system with a non-stationary stochastic demand with a detailed analysis of the lot-size problem was developed by Purohit et al. [

18]; a carbon-emissions mechanism was included with this model to make it a more generalized study. This model discussed labor issues with the training required involving work related to the machine. Sana [

19] considered an EPQ lot-size model for imperfect production with defective items when the system becomes out-of-control. An optimal inventory for a repair model was initiated by Cárdenas-Barrón et al. [

20]. Another two research models, based on deterioration and partial backlogging, were developed by Tiwari et al. [

21,

22].

Storage capacity for an inventory system plays an important role in any production house. Limited storage makes increasing production problematic. Due to this reason, shortages may occur. Huang et al. [

23] developed an inventory model in which a rental warehouse was considered, with an associated cost, for fulfilling the required capacity in addition to the available warehouse. This inventory model investigated optimal retailer lot-size policies with delayed payments and space constraints. An inventory model for multiple products with limited space was proposed by Pasandideh and Niaki [

24]. This model contained a non-linear integer programming problem and found an optimal solution for the available warehouse by adding space constraints. Through a genetic algorithm with a non-linear cost function and space constraint, a multi-stage inventory model was discussed by Hafshejani et al. [

25]. An inventory model considering demand and limited space availability, where reliability depends on the unit production costs, was introduced by Mahapatra et al. [

26].

In a production model, the budget for a production system is initially required for the manufacturer. Instead of a periodic budget, a limited budget is preferable. There is some on-going research into budget constraints, such as Taleizadeh et al. [

27], who proposed a model, in a multi-item production system, for a reworking of defective items policy. They found the global minimum of the total cost by considering a service level and a budget constraint. Minimizing the total annual cost with a limited capital budget and calculating the optimal lot size and capital investment in a setup-costs model was explained by Hou and Lin [

28]. Mohan et al. [

29] introduced an inventory model, considering delayed payments, budget constraints, and permissible partial payment (with penalty) for a multi-item production system with a replenishment policy. Todde et al. [

30] and Du et al. [

31] published the basic energy models, based on energy consumption and energy analysis. Cárdenas-Barrón et al. [

32] proposed an inventory model with an improved heuristic algorithm solving method for a just-in-time (JIT) system with the maximum available budget. Xu et al. [

33] presented a bio-fuel model for the pyrolysis products of plants. Tomi

and Schneider [

34] discussed a method for recovering energy from waste using a closed-loop supply chain. Haraldsson and Johansson [

35] developed an energy model, based on different energy efficiencies during production. Similarly, Dey et al. [

36] and Sarkar et al. [

37,

38,

39] developed their models based on energies, but did not consider advertising for smart products, reducing the sale price of products, or reducing the failure rate of a production system. Yao et al. [

40] and Gola [

41] put forth the valuable idea of formulating a model considering the reliability of a manufacturing system.

The world becomes smarter every day. Several researchers have discussed imperfect production processes, such as Tayyab et al. [

42], Sarkar [

43], Kim et al. [

44], and Sarkar et al. [

45], but the effect of a smart manufacturing system in any production model has not been discussed. The effects of energy and failure rate in a multi-item smart production system was first discussed by Sarkar et al. [

3]. In reality, the demand for a particular product depends on various key factors, with advertisement of a particular product being one of them. Ideally, advertisement of a particular product increases the demand for that product. Thus, the total profit can be optimized when the demand depends on the advertisement of products. The relationship between product quality and advertising, in an analytical model, was developed by Chenavaz and Jasimuddin [

46]; they also explained the positive and negative advertising–quality relationships. A two-level supply chain model was developed by Giri and Sharma [

47], where the demand depends on the advertising cost. In this model, they considered a single-manufacturer, two-retailer system, where the retailers compete. In the same direction, Xiao et al. [

48] formulated a two-echelon supply chain model for a single manufacturer and multiple retailers. In this model, they studied co-operative issues in advertising. Recently, Noh et al. [

49] developed a two-echelon supply chain model, where the demand depends on the advertisement. They used the Stackelberge game policy to solve this model. Sale price, also, has a great impact on the demand for a product. The demand for a product gradually increases if the sale price is less, and vice versa. Constant demand is a business service that helps customers to find new consumers and penetrate new markets, which can optimize the inside-sales and marketing activities to achieve high-quality sales. Variable demand can predict and quantify changes that are caused by transportation conditions on the demand. As a high price negatively affects how likely clients are to buy products or services, assuming the demand to be price-dependent is more realistic. Karaoz et al. [

50] considered an inventory model with price- and time-dependent demand, under the influence of complementary and substitute product sale prices. The finite replenishment inventory model was developed by considering the demand to be sensitive to changes in time and sale price. Sana [

51] introduced the price-sensitive demand for perishable items in an inventory model. The demand for any inventory system is not always constant and may depend on time, sale price, and inventory. Pal et al. [

52] developed a multi-item inventory model where the demand was sensitive to the sale price and price-break. Sarkar et al. [

53] developed an EMQ model with price- and time-dependent demand, under the effects of reliability and inflation. Sarkar and Sarkar [

54] established an inventory model, where the demand was inventory-dependent, and an algorithm was developed to maximize the profit. To maximize the vendor profit, the optimal ordering quantity and sale price were optimized by an analytical procedure. An integrated model, with development lead time and production rate, was discussed by Azadeh and Paknafs [

55]. Several researchers have developed many models where the demand depends on the sale price of the products or advertising-dependent demand; however, price- and advertising-dependent demand in a smart production system has still not been considered, to our knowledge. Thus, this new direction is considered in this research.

Table 1 shows the contribution of previous author(s).

3. Model Formulation

The model studies about a smart production system for multi-item. During the time

= 0 to

, the production continues with upward direction graph and for the time [

, there is no production, thus, the holding inventories positions are downstream direction with demand

D. The production system becomes out-of-control from in-control in random time interval

. See

Figure 2 for the description of the production system. The governing differential equation of the inventory is

with initial condition

and

with initial condition

.

Solving the above differential equations, one can obtain

Considering the following costs in a multi-item smart production system, we must optimize for those which have a low failure rate and maximum profit.

Setup Cost (SC)

In this model, setup cost for product

i is

per setup and per setup energy consumption cost be

. Then, the average setup cost per cycle is

Holding Cost (HC)

For this production system, to calculate the holding cost it is necessary to find the total inventory by summation from

to

; further, to get the average inventory, the total inventory can be divided by cycle length. Thus, the total inventory can be calculated as

Hence, the total holding cost, with sufficient consumption of energy, can be calculated, as follows:

Development Cost (DC)

The system becomes more reliable based on development costs. A high investment in the production system, in terms of development costs, makes for a low failure rate, and vice versa. The labor cost and energy resources cost are included in the development cost. Thus, the total development cost per unit time is

Inspection Cost (IC)

A multi-item smart production system is considered to be a long-run process, where the process is imperfect. Thus, an inspection cost plays an important role in detecting defective items, such that the defective products can be reworked easily. Thus, the inspection cost per unit cycle, under energy consumption, is

Rework Cost (RC)

For reworking the defective products, at first, inspection is needed for all defective products. To find the RC, it is important to know how many defective products there are, and how much the RC is for defective items. The rate of defective items is considered (see, for instance, [

3]) to be

, where

and

. Hence, the number of imperfect items produced by the machine is

For reworking the defective products to perfect state, a RC is needed, along with a consumption of energy cost. The rework cost (RC) per cycle can, thus, be calculated as

Unit Production Cost (UPC)

The production cost depends on the raw material costs, the development cost, and the tool/die cost. It is proportional to the cost of the previous indicated costs. The quality of the raw materials affects the reliability of the products. In this model, the unit production cost is considered to be as follows:

Advertisement Cost (AC)

The multi-item production system based on advertisement, and demand gradually increased due to huge amount investment on advertisement.This model consider advertisement cost to make popular of the smart products.

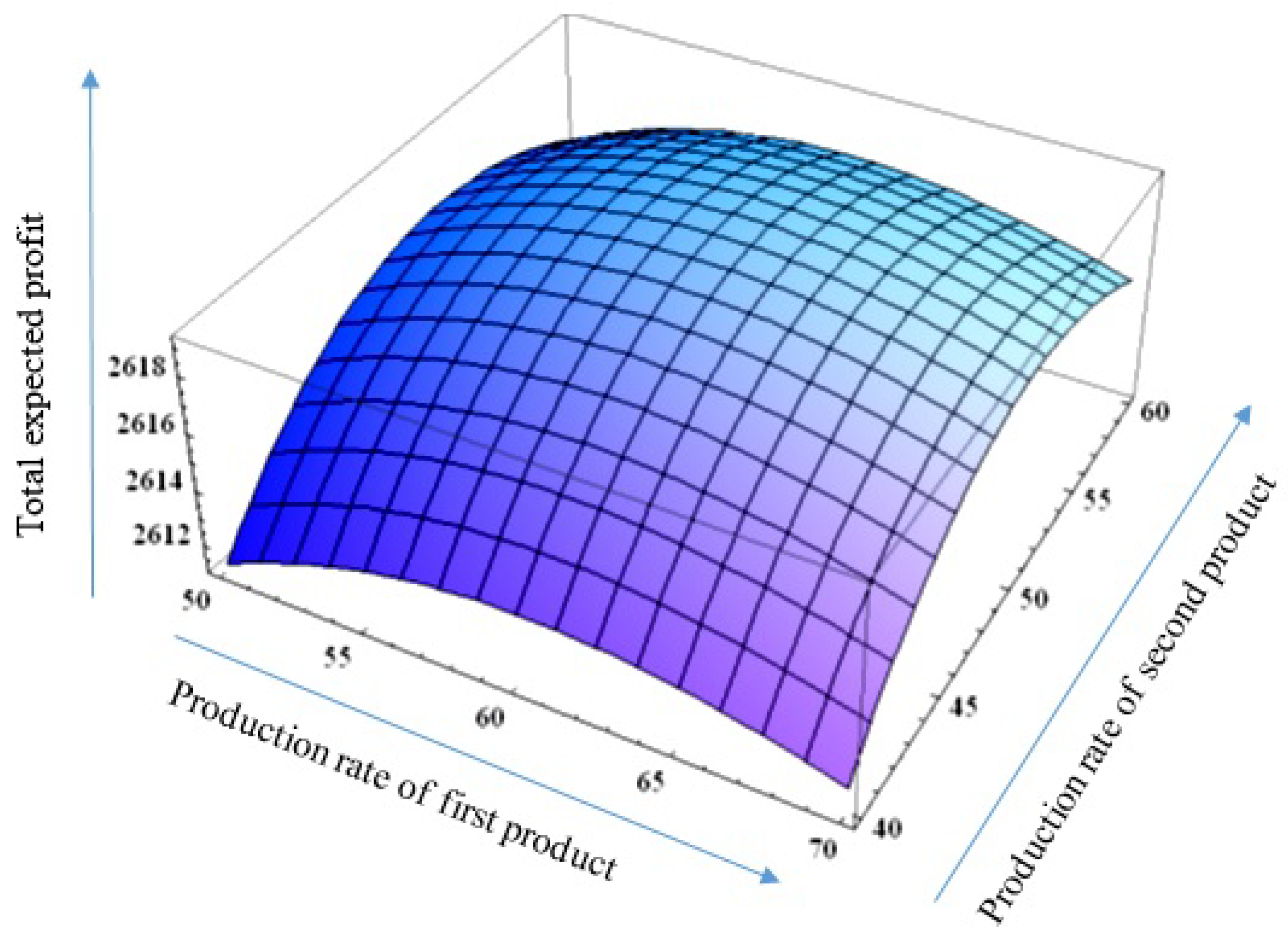

Total Expected Profit (TEP)

The TEP per cycle is

where

and

Constraints

Capital investment in a smart production system plays an important role, although the amount is limited. A sufficient amount of investment gives an opportunity to choose good-quality raw materials within a required time. Although in this model, defective items are produced and a rework facility is available, this may differ in other situations, with different investment budgets. This model considers a budget constraint and, to separate the imperfect products, managers define a specific quality level, which may or may not be chosen for reworking. Considering

A for maximum space available for storing in square feet and

B for maximum budget available. Sufficient spaces are allotted for storing good-quality products and for reworking imperfect products. Therefore, the profit function, including budget and space constraints, becomes

, and

.

The model cannot be solved analytically. Thus, this model is solved through a numerical tool. The global maximum values of the decision variables are proved numerically.

5. Sensitivity Analysis

A sensitivity analysis of the cost and scaling parameters was conducted, and the major changes are summarized in

Table 9 and

Figure 10.

Table 9 shows how changes by certain percentages (

) in the cost and scaling parameters affect the total profit. Here NF indicates that the numerical result is not feasible. We can conclude the following from the sensitivity analysis.

1. That changes in energy cost due to inspection and energy cost per setup has low effects on the total optimal profit as, in a smart production system, there is an optimum consumption of energy for different purposes. Some industries do not consider inspection on the final product, due to the value-added process. Due to an increase of inspection, the reworking cost and other costs also increase, which has a large impact on the total optimal profit. On the other hand, inspection maintains the quality and correctness of the products produced in a smart production system.

2. Changes in holding cost had little impact on the total profit of the smart production system. This result can be justified, as the products are not held for a long time. Similarly, variation of the setup cost also has a lesser, but significant, effect on the total optimal profit. Increasing the value of the cost parameters decreases the total optimal profit, which is clearly shown in the sensitivity analysis table and agrees with reality.

3. On the other hand, the material costs in a multi-item smart production system has a great impact on the total profit. With an increase in material costs, all other production costs will increase and, thus, the profit decreases.

4. The value of the scaling parameters for advertising and the tool/die cost function also had effects on the total profit. These parameters behave similarly to other cost parameters for controlling the total optimal profit.

5. The effect of advertisement has a sensitive impact on the total profit. The advertisement of a product is very much important for generating a high popularity and increasing the market demand for the product. Due to increases in sales, the total optimal profit gradually increases. As in

Table 9, it is found that eventually, an increasing value of advertising will reduce the total profit.

6. Managerial Insights

Some recommendations for the industry are as follows:

1. The industry manager must concentrate on the matter of advertisement. This paper clearly shows the impact of advertisement on the total profit. To increase the popularity of products and, in turn, the demand for products, the industry manager should invest some costs into advertisement. In the competitive modern market, this matter plays a significant role for a smart production system. However, no research has considered the advertisement concept, until now, in the field of smart production system. Thus, the result of this study will help the industry manager to increase their profits.

2. Another support that industry managers of smart production systems can use are the strategies, obtained by this research, regarding energy consumption. If a smart production system uses a machine, instead of labor, energy consumption will be present and there will, subsequently, be energy costs to bear. Thus, this model will help the industry to maximize the profit.

3. This model considers random machine breakdowns. Using this idea, the industry manager can pay attention to the previous data of machine failures. This way, the failure rate can be reduced by using smart machines with optimum energy consumptions, and by optimizing development-cost investments.