Evaluation of the Impact of Strategic Offers on the Financial and Strategic Health of the Company—A Soft System Dynamics Approach

Abstract

1. Introduction

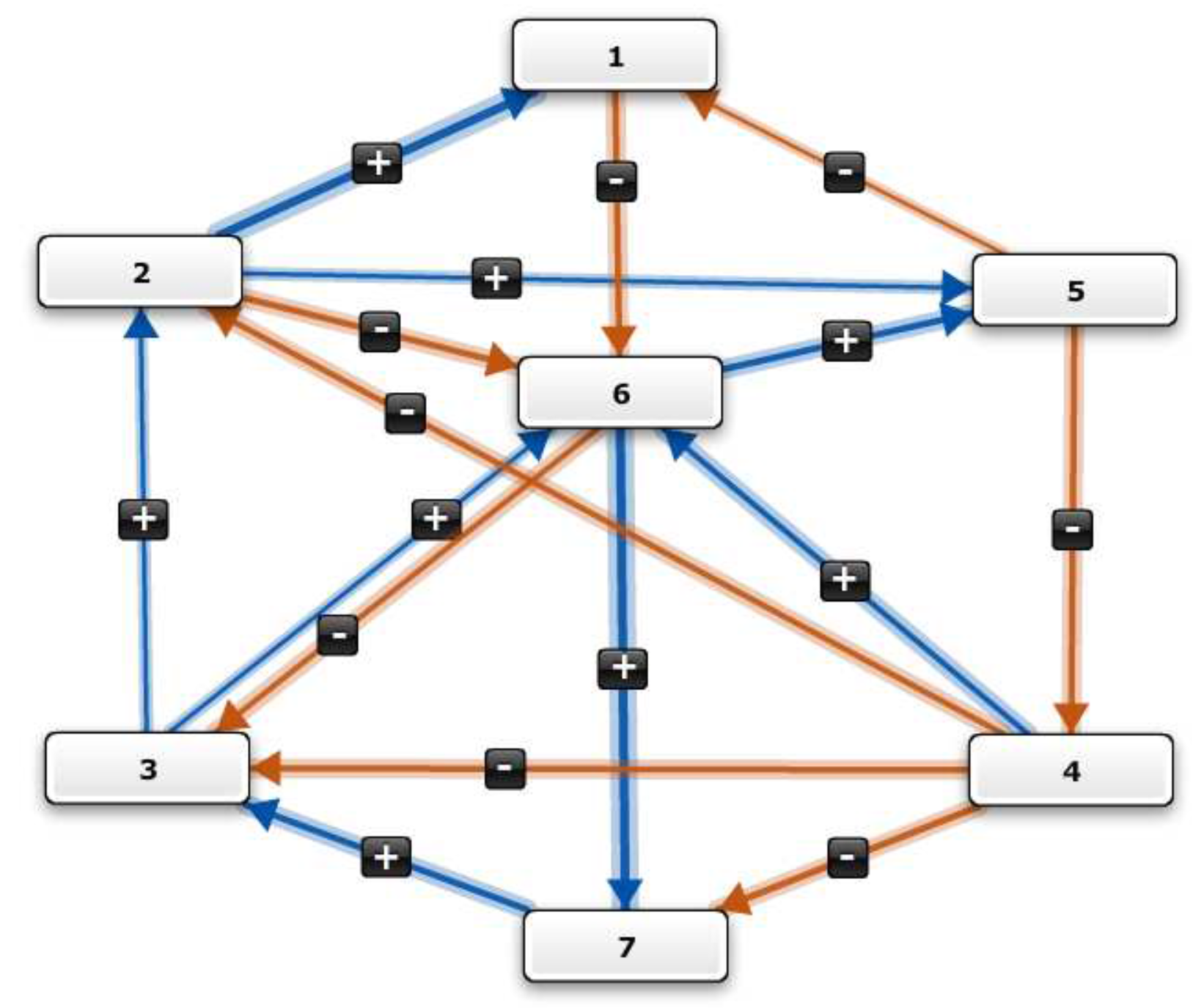

2. Fuzzy Cognitive Map

The FCM Procedure

- FCM is a cognitive description of a system that represents the model in the form of a weighted directed graph;

- Concepts (nodes) are the important system components; their values are given by vector , where n is the number of components in the system;

- is a transition matrix, describing the relations between the components;

- The change of the system in consecutive iterations is given by the formula:where is the system state vector at the iteration u, is the transition matrix, f is threshold function, k is the iteration number, and is the vector of the initial state of the system;

- Among many threshold functions used in (1), the following two are commonly used in modeling social systems [13]:

- −

- linear:

- −

- sigmoidal:where z is the slope, and h is the offset;

- Depending on the slope and offset values, the output function may return distorted or even unstable results [13], for example, if is small enough, then there is a unique value ; if is large enough, there can be multiple (distinct) values;

3. WINGS

3.1. Assumptions of the WINGS Method

- Two basic features of the system components are responsible for the interrelations: internal strength and influence;

- The objective mechanism of interactions should include direct and also all possible indirect relations between components which are a result of the transitivity of interactions;

- The more complex interactions, involving more than two components, can be characterized with enough approximation by two-component interactions;

- The strength of indirect interaction between two components decreases with the length of the path between the components (the length of the path is measured by the number of intermediate components on the path, or equivalently, by the number of path segments);

- Time in which a model reaches its stable final state is short enough to allow a reasonable inference about the final state of a real-world system;

- Although an objective measurement is not possible, the experienced specialist can make rational assessments (also expressed in numbers) of the strength (importance) of the components and influences between them.

3.2. WINGS Procedure—Dynamic Variant

3.2.1. Qualitative Analysis

3.2.2. Quantitative Evaluation

3.2.3. Technical Stage—Calculation of Output

- All numbers are inserted into the direct strength-influence matrix , which is an matrix with elements (n is the number of components in the system).

- Values representing strengths of components are inserted into the main diagonal, i.e., = strength of component i;

- Values representing influences are inserted so that for , = influence of component i on component j.

- The matrix is scaled according to the following formula:where is the scaled strength-influence matrix and the scaling factor is defined as the sum of absolute values of all elements of , i.e.,

- The total strength-influence matrix is calculated from the following formula (with the scaling defined in Equation (4), the series below converges, and thus is well-defined; the proof is given in Appendix A).Matrix represents the sum of influences along all possible paths in the WINGS digraph. If strength has non-zero values, self-loops of arbitrary length occur in the digraph, even if it does not contain loops. However, it should be noted that as a result of scaling, the contribution becomes lower with the path length.

- For each element in the system, the row sum and the column sum of are calculated:

- For each element in the system, the row sum and the column sum of are calculated:

- —relative total impact represents the net (algebraic sum of positive and negative items) influence of component i on all other components in the system,

- —relative total receptivity represents the net influence of all other components in the system on component i,

- —relative total involvement represents the sum of all net influences exerted on and received by component i,

- indicates the net role (position) of component i in the system; if it is positive, component i belongs to the net influencing (cause) group; if it is negative, component i belongs to the net influenced (result) group.

- —absolute total impact represents the absolute influence of component i on all other components in the system,

- —absolute total receptivity represents the absolute influence of all other components in the system on component i,

- —absolute total involvement represents the sum of all absolute influences exerted on and received by component i,

- —absolute role (position); if it is positive, component i belongs to the absolute influencing (cause) group; if it is negative, component i belongs to the absolute influenced (result) group.

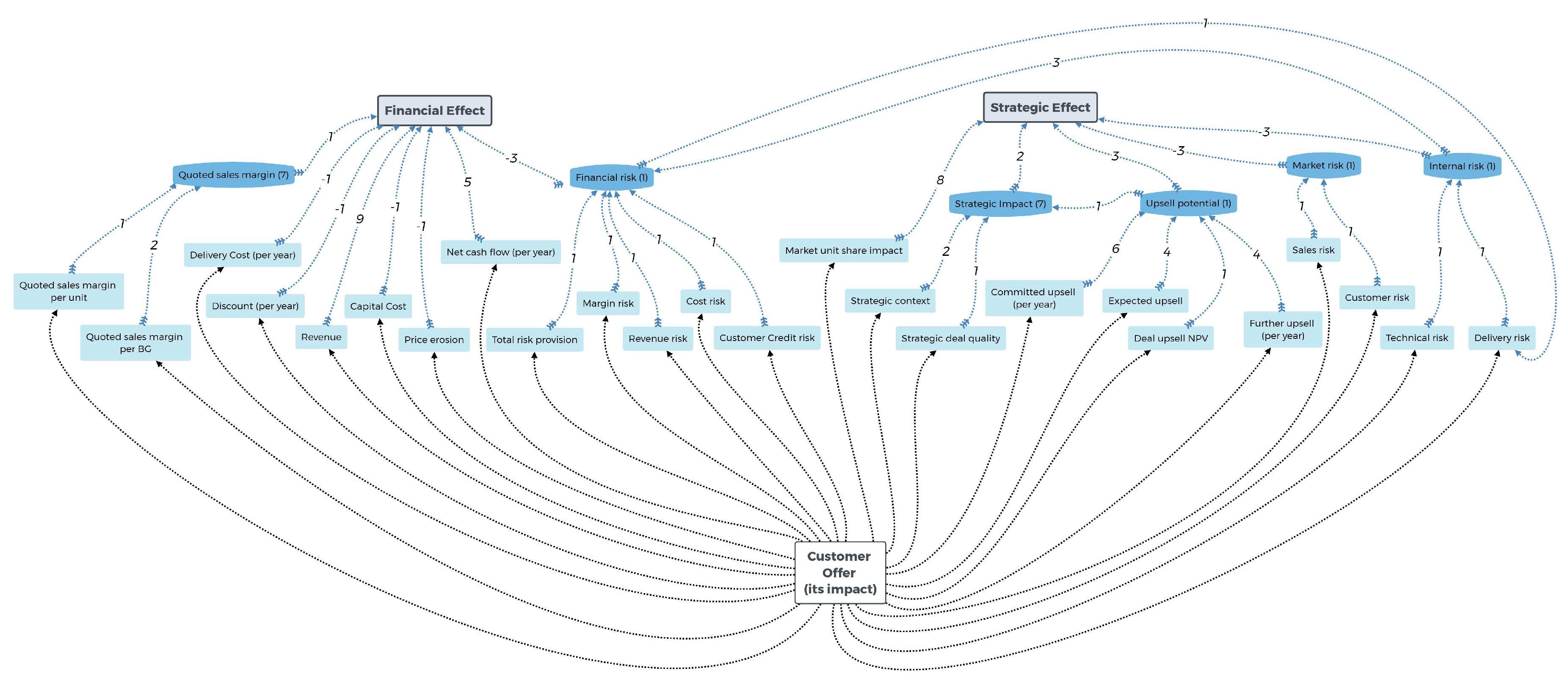

4. Case Study

- Current status of the firm/business line (these values are given in parentheses);

- Offers A, B, C—these columns contain impacts of the offers on the current status of the firm.

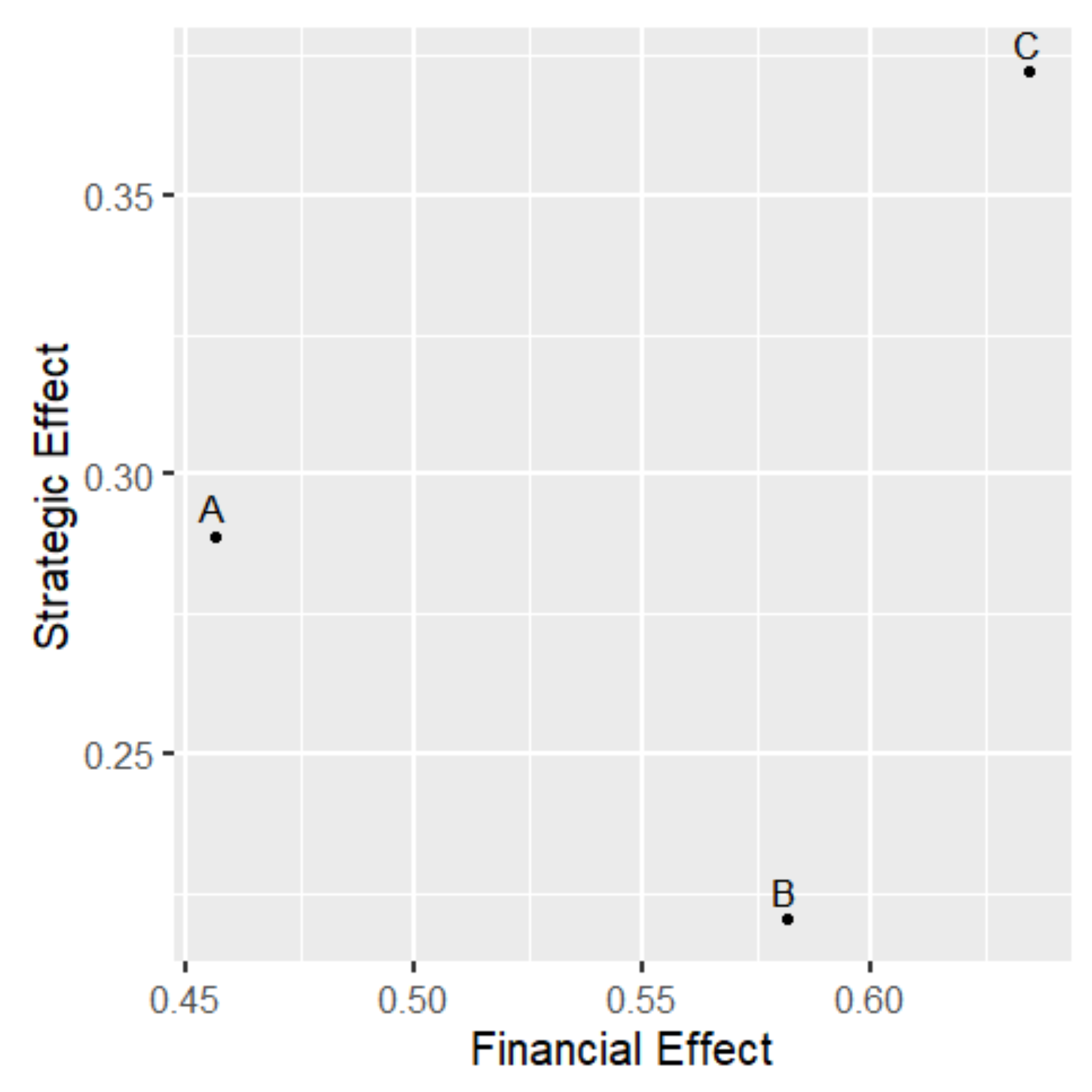

5. Results

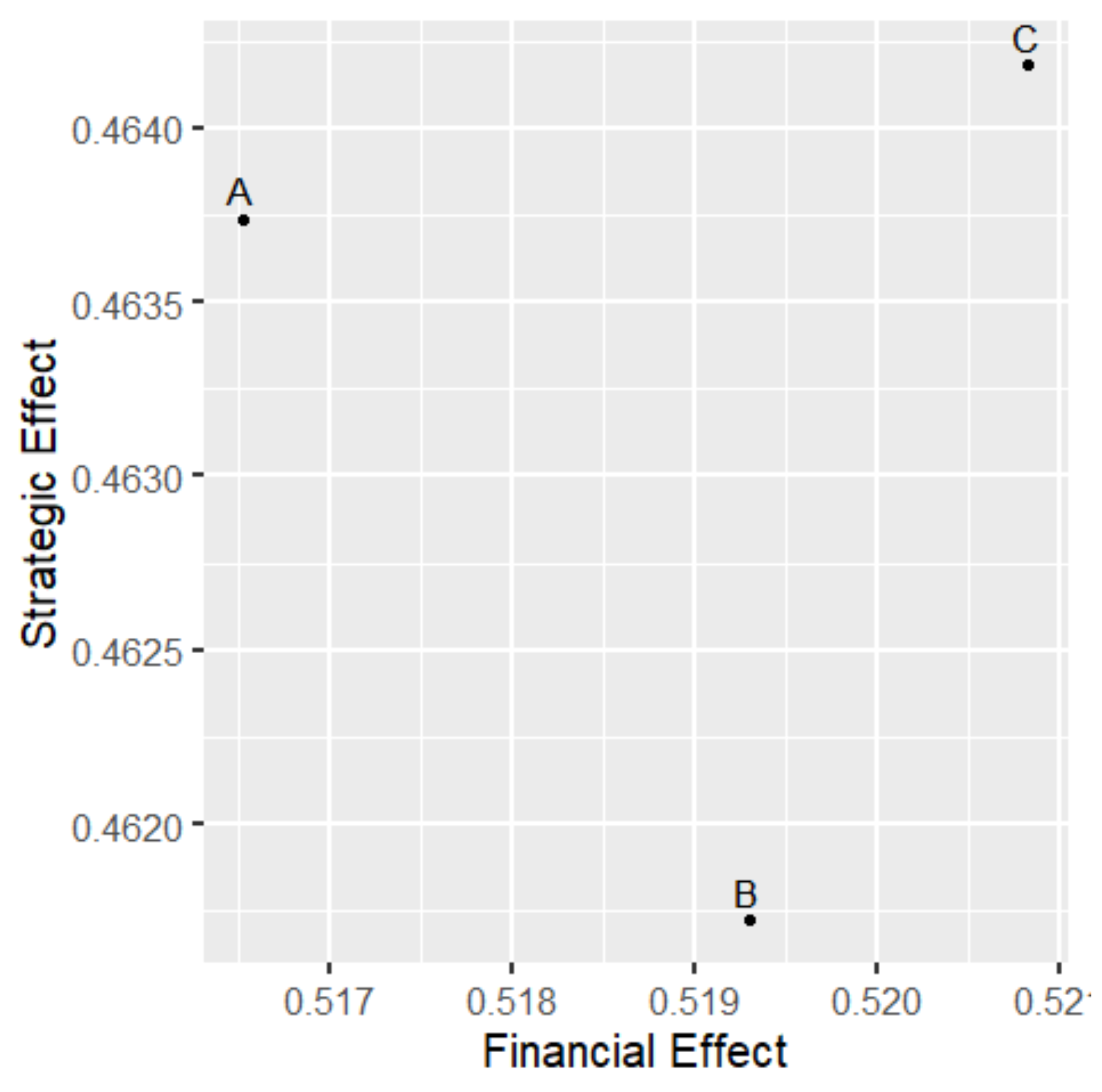

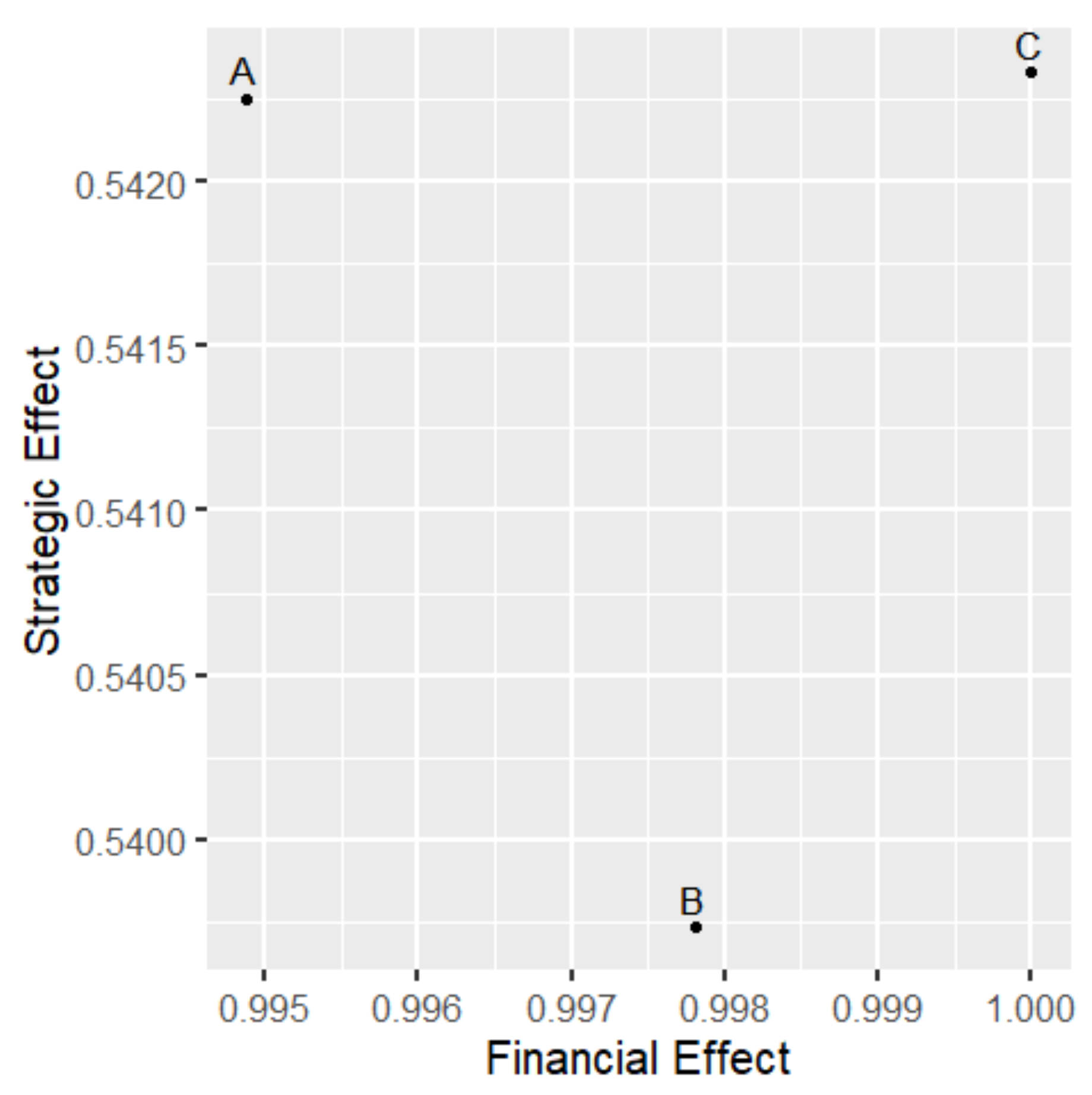

5.1. Results of the FCM Procedure

5.2. Results of the WINGS Procedure

5.3. Comparison of the FCM and WINGS Results

- Financial Effect: WINGS and both FCM rankings are the same: Offer C—rank 1, Offer B—rank 2, Offer A—rank 3;

- Strategic Effect: WINGS and both FCM rankings are the same: Offer C—rank 1, Offer A—rank 2, Offer B—rank 3.

6. Discussion

7. Conclusions and Directions of Future Studies

- Both methods appear theoretically applicable to study the impact of strategic decisions on the financial and strategic aspects of the company;

- FCM has proven its practical applicability in a very large number of cases, especially in participatory modeling. Some technical problems arise from the need to implement an auxiliary threshold function. Not only is it chosen arbitrarily, but it is also difficult to understand and interpret by practitioners;

- The main drawback of FCM comes from the fact that the threshold function has a strong influence on the results, but it has no direct interpretation in the system modeled;

- WINGS uses simple matrix algebra and does not need any additional functions or parameters for calculations;

- An important novelty of WINGS comes from its unique mechanism used for calculating influences between system concepts. The final impact on the concept is an effect of the combined action of two measures: the internal strength and the influence.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Proof of the Convergence of Matrix S

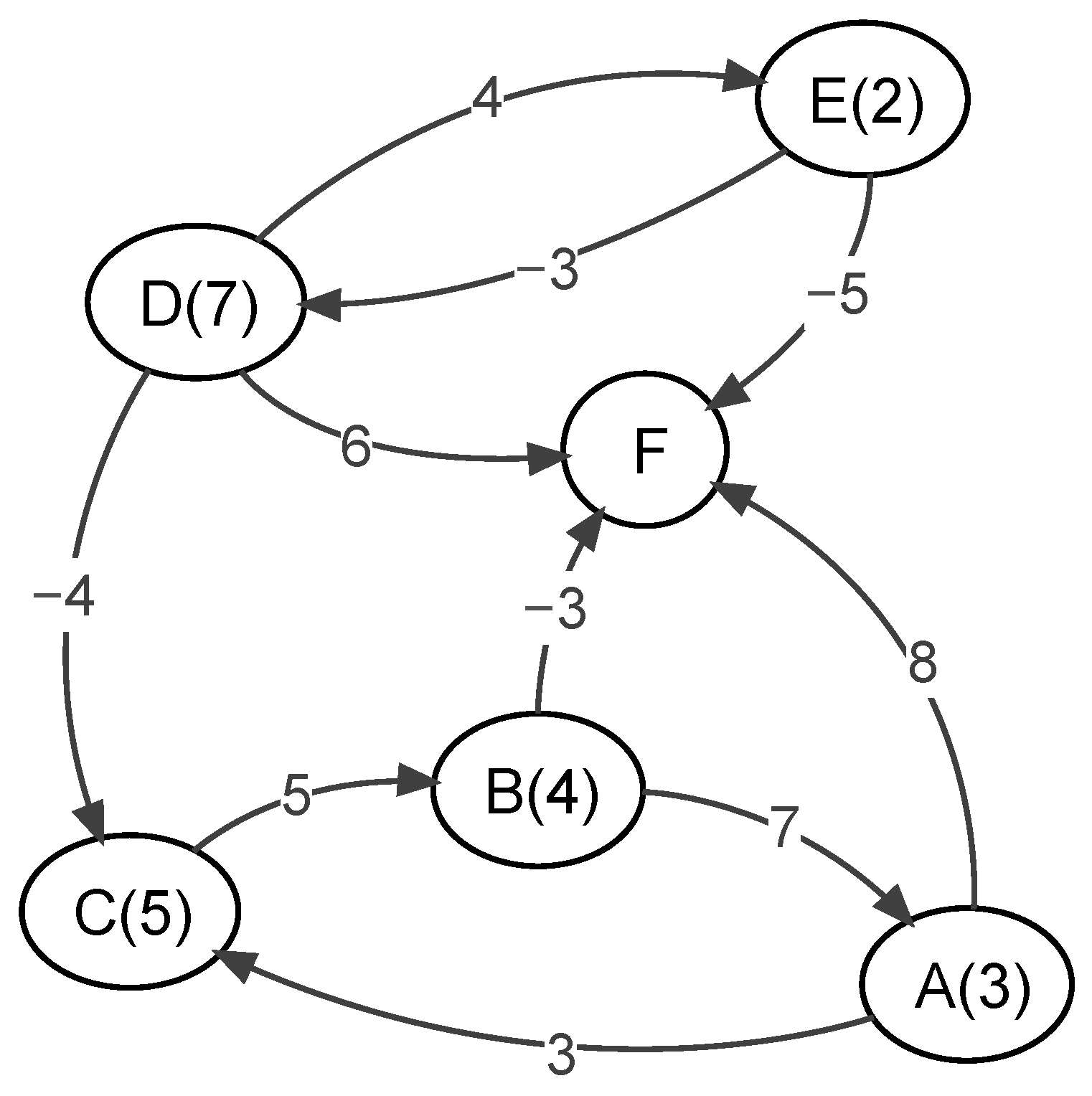

Appendix B. Illustrative Example of the Extended WINGS Procedure

| Impact | Receptivity | Involvement | Role | |

|---|---|---|---|---|

| A | 1.0000 | 0.2065 | 1.2065 | 0.7935 |

| B | 0.0700 | 0.6539 | 0.7239 | |

| C | 0.7185 | 0.2767 | 0.9952 | 0.4418 |

| D | 0.8747 | 0.2722 | 1.1469 | 0.6026 |

| E | 0.4242 | 0.8739 | 0.0256 | |

| F | 0.0000 | 0.3801 | 0.3801 |

| Impact | Receptivity | Involvement | Role | |

|---|---|---|---|---|

| A | 0.6369 | 0.1315 | 0.7684 | 0.5054 |

| B | 0.3121 | 0.4516 | 0.7638 | |

| C | 0.4811 | 0.5839 | 1.0650 | |

| D | 1.0000 | 0.4638 | 1.4638 | 0.5362 |

| E | 0.4617 | 0.2702 | 0.7318 | 0.1915 |

| F | 0.0000 | 0.9908 | 0.9908 |

References

- Michnik, J. Weighted Influence Non-linear Gauge System (WINGS)–An analysis method for the systems of interrelated components. Eur. J. Oper. Res. 2013, 228, 536–544. [Google Scholar] [CrossRef]

- Kosko, B. Fuzzy cognitive maps. Int. J. Man-Mach. Stud. 1986, 24, 65–75. [Google Scholar] [CrossRef]

- Jetter, A. Fuzzy Cognitive Maps for Engineering and Technology Management: What Works in Practice? In Proceedings of the 2006 Technology Management for the Global Future-PICMET 2006 Conferen, Istanbul, Turkey, 8–13 July 2006; pp. 498–512. [Google Scholar] [CrossRef]

- Kok, K. The potential of Fuzzy Cognitive Maps for semi-quantitative scenario development, with an example from Brazil. Glob. Environ. Chang. 2009, 19, 122–133. [Google Scholar] [CrossRef]

- Soler, L.S.; Kok, K.; Camara, G.; Veldkamp, A. Using fuzzy cognitive maps to describe current system dynamics and develop land cover scenarios: A case study in the Brazilian Amazon. J. Land Use Sci. 2012, 7, 149–175. [Google Scholar] [CrossRef]

- Sapp, C. Solution Path for Implementing a Comprehensive Architecture for Data and Analytics Strategies, Gartner 2018, ID G00351281. Available online: https://www.gartner.com/document/3880568 (accessed on 22 February 2019).

- Buytendijk, F.; Laney, D. Information 2020: Beyond Big Data, Gartner 2017 (refreshed), ID G00261907. Available online: https://www.gartner.com/document/2681316 (accessed on 22 February 2019).

- Forrester, J.W. Industrial Dynamics; Martino Fine Books: Eastford, CT, USA, 2013. [Google Scholar]

- Mendoza, G.A.; Prabhu, R. Participatory modeling and analysis for sustainable forest management: Overview of soft system dynamics models and applications. For. Policy Econ. 2006, 9, 179–196. [Google Scholar] [CrossRef]

- Lane, D.C.; Oliva, R. The greater whole: Towards a synthesis of system dynamics and soft systems methodology. Eur. J. Oper. Res. 1998, 107, 214–235. [Google Scholar] [CrossRef]

- Felix, G.; Nápoles, G.; Falcon, R.; Froelich, W.; Vanhoof, K.; Bello, R. A review on methods and software for fuzzy cognitive maps. Artif. Intell. Rev. 2017. [Google Scholar] [CrossRef]

- Papageorgiou, E.I. Review study on fuzzy cognitive maps and their applications during the last decade. In Proceedings of the 2011 IEEE International Conference on Fuzzy Systems (FUZZ-IEEE 2011), Taipei, Taiwan, 27–30 June 2011; pp. 828–835. [Google Scholar] [CrossRef]

- Knight, C.J.K.; Lloyd, D.J.B.; Penn, A.S. Linear and sigmoidal fuzzy cognitive maps: An analysis of fixed points. Appl. Soft Comput. 2014, 15, 193–202. [Google Scholar] [CrossRef]

- Penn, A.S.; Knight, C.J.K.; Lloyd, D.J.B.; Avitabile, D.; Kok, K.; Schiller, F.; Woodward, A.; Druckman, A.; Basson, L. Participatory Development and Analysis of a Fuzzy Cognitive Map of the Establishment of a Bio-Based Economy in the Humber Region. PLoS ONE 2013, 8, e78319. [Google Scholar] [CrossRef] [PubMed]

- Adamus-Matuszyńska, A.; Michnik, J.; Polok, G. City Image Building—Soft System Dynamics Approach. 2019; submission. [Google Scholar]

- Gabus, A.; Fontela, E. Perceptions of the World Problematic: Communication Procedure, Communicating with Those Bearing Collective Responsibility; DEMATEL 1; Battelle Geneva Research Centre: Geneva, Switzerland, 1973. [Google Scholar]

- Fontela, E.; Gabus, A. The DEMATEL Observer; DEMATEL 1976; Battelle Geneva Research Centre: Geneva, Switzerland, 1976. [Google Scholar]

- Kashi, K.; Franek, J. Application of Multiple Attribute Decision Making Methods in Human Resources. In Proceedings of the 7th International Scientific Conference Managing and Modeling of Financial Risks, Ostrava, Czech Republic, 8–9 September 2014. [Google Scholar]

- Michnik, J.; Adamus-Matuszyńska, A. Structural analysis of problems in public relations. Mult. Criteria Decis. Mak. 2015, 10, 105–123. [Google Scholar]

- Michnik, J. The WINGS method with multiple networks and its application to innovation projects selection. Int. J. Appl. Manag. Sci. 2018, 10, 105–126. [Google Scholar] [CrossRef]

- Pechová, H.; Staňková, Š. Application of WINGS method in CRM performance measurement. In Proceedings of the IDIMT 2015: Information Technology and Society-Interaction and Interdependence-23rd Interdisciplinary Information Management Talks, Poděbrady, Czech Republic, 9–11 September 2015; pp. 391–398. [Google Scholar]

- Radziszewska-Zielina, E.; Śladowski, G. Assessment of the Conditions that Determine the Reclaiming of Stone Materials and their Use in the Revalorisation of Historical Buildings. In Proceedings of the Assessment of the Conditions that Determine the Reclaiming of Stone Materials and their Use in the Revalorisation of Historical Buildings, Warsaw, Poland, 21–25 August 2017. [Google Scholar]

- Radziszewska-Zielina, E.; Śladowski, G. Supporting the selection of a variant of the adaptation of a historical building with the use of fuzzy modeling and structural analysis. J. Cult. Herit. 2017, 26, 53–63. [Google Scholar] [CrossRef]

- Rego Mello, B.B. Industry Risk Assessment in Brazil Based on Weighted Influence Non-Linear Gauge System and Analytic Hierarchy Process Methods. In Proceedings of the Industry Risk Assessment in Brazil Based on Weighted Influence Non-Linear Gauge System and Analytic Hierarchy Process Methods, Hamburg, Germany, 2–7 August 2015. [Google Scholar]

- Eden, C. Analyzing cognitive maps to help structure issues or problems. Eur. J. Oper. Res. 2004, 159, 673–686. [Google Scholar] [CrossRef]

- Mingers, J.; Rosenhead, J. Problem structuring methods in action. Eur. J. Oper. Res. 2004, 152, 530–554. [Google Scholar] [CrossRef]

- Eden, C.; Ackermann, F. Knowledge Based Management Support Systems; Halsted Press: New York, NY, USA, 1989; pp. 198–207. [Google Scholar]

- Checkland, P. Systems Thinking, Systems Practice; J. Wiley: Chichester, UK, 1981. [Google Scholar]

- Checkland, P. Soft systems methodology: A thirty year retrospective. Syst. Res. Behav. Sci. 2000, 17, S11–S58. [Google Scholar] [CrossRef]

- Bouyssou, D.; Marchant, T.; Pirlot, M.; Tsoukias, A.; Vincke, P. Evaluation and Decision Models with Multiple Criteria: Stepping Stones for the Analyst; International Series in Operations Research & Management Science; Springer: New York, NY, USA, 2006. [Google Scholar]

- Marr, B. Does Synthetic Data Hold The Secret To Artificial Intelligence? Available online: https://www.forbes.com/sites/bernardmarr/2018/11/05/does-synthetic-data-hold-the-secret-to-artificial-intelligence/40d0ca5f42f8 (accessed on 22 February 2019).

- Miley, W. Project Portfolio Management Software Tools. Available online: https://www.prioritysystem.com/tools.htmltools (accessed on 22 February 2019).

- Gray, S. Mental Modeler-Fuzzy Logic Cognitive Mapping. Available online: http://www.mentalmodeler.org/ (accessed on 22 February 2019).

- Grinstead, C.; Snell, L. Introduction to Probability; American Mathematical Society: Providence, RI, USA, 2006. [Google Scholar]

- Trench, W. Introduction to Real Analysis. Faculty Authored Books. Book 7. 2013. Available online: http://digitalcommons.trinity.edu/mono/7 (accessed on 22 February 2019).

| Current Status in the Firm (Values in Parenthesis) | Offer A | Offer B | Offer C |

|---|---|---|---|

| Net cash flow (per year) (4) | 2 | 1 | 3 |

| Revenue (6) | 3 | 5 | 4 |

| Quoted sales margin per BG (business group) (2) | 1 | 0 | 0 |

| Quoted sales margin per unit (4) | 2 | 2 | 2 |

| Capital Cost (1) | 0 | 0 | 0 |

| Delivery costs (per year) (9) | 2 | 5 | 5 |

| Further upsell (per year) (9) | 6 | 2 | 4 |

| Expected upsell (9) | 4 | 8 | 2 |

| Deal upsell NPV (Net Present Value) (7) | 1 | 2 | 3 |

| Strategic deal quality (6) | 4 | 1 | 4 |

| Strategic context (3) | 1 | 0 | 1 |

| Committed upsell (per year) (9) | 1 | 2 | 6 |

| Market unit share impact (1) | 1 | 0 | 1 |

| Price erosion (0) | 0 | 0 | 0 |

| Revenue risk (2) | 1 | 0 | 2 |

| Sales risk (2) | 1 | 1 | 0 |

| Discount (per year) (2) | 1 | 1 | 0 |

| Cost risk (1) | 0 | 2 | 2 |

| Technical risk (3) | 2 | 0 | 1 |

| Customer Credit risk (1) | 0 | 0 | 1 |

| Margin risk (2) | 1 | 0 | 1 |

| Customer risk (1) | 1 | 2 | 1 |

| Delivery risk (3) | 3 | 1 | 2 |

| Total risk provision (4) | 3 | 2 | 3 |

| Financial Impact | Offer A | Offer B | Offer C | |

|---|---|---|---|---|

| Net cash flow (per year) (5) | 2 | 1 | 3 | |

| Revenue | 3 | 5 | 4 | |

| Quoted sales margin per BG (2) | 1 | 0 | 0 | |

| Quoted sales margin per unit (1) | 2 | 2 | 2 | |

| Capital Cost | 0 | 0 | 0 | |

| Delivery costs (per year) | 2 | 5 | 5 | |

| Price erosion (1) | 0 | 0 | 0 | |

| Revenue risk | 1 | 0 | 2 | |

| Discount (per year) | 1 | 1 | 0 | |

| Cost risk | 0 | 2 | 2 | |

| Customer Credit risk | 0 | 0 | 1 | |

| Margin risk | 1 | 0 | 1 | |

| Total risk provision | 3 | 2 | 3 | |

| WINGS rank | 3 | 2 | 1 | |

| FCM (linear) rank | 3 | 2 | 1 | |

| FCM (sigmoid) rank | 3 | 2 | 1 |

| Strategic Impact | Offer A | Offer B | Offer C | |

|---|---|---|---|---|

| Further upsell (per year) (4) | 6 | 2 | 4 | |

| Expected upsell (4) | 4 | 8 | 2 | |

| Deal upsell NPV | 1 | 2 | 3 | |

| Strategic deal quality (1) | 4 | 1 | 4 | |

| Strategic context | 1 | 0 | 1 | |

| Committed upsell (per year) (6) | 1 | 2 | 6 | |

| Market unit share impact | 1 | 0 | 1 | |

| Sales risk | 1 | 1 | 0 | |

| Technical risk | 2 | 0 | 1 | |

| Customer risk | 1 | 2 | 1 | |

| Delivery risk | 3 | 1 | 2 | |

| WINGS rank | 2 | 3 | 1 | |

| FCM (linear) rank | 2 | 3 | 1 | |

| FCM (sigmoid) rank | 2 | 3 | 1 |

| Basic Data | ||||||

|---|---|---|---|---|---|---|

| FCM-linear | FCM-sigmoid | WINGS | ||||

| Value | Rank | Value | Rank | Value | Rank | |

| Offer A | 0.45606 | 3 | 0.51652 | 3 | 0.99488 | 3 |

| Offer B | 0.58160 | 2 | 0.51930 | 2 | 0.99781 | 2 |

| Offer C | 0.63471 | 1 | 0.52082 | 1 | 1.00000 | 1 |

| Net Cash Flow Impact: 5 → 9; Quoted Sales Margin per BG: 2 → 6 | ||||||

| FCM-linear | FCM-sigmoid | WINGS | ||||

| Value | Rank | Value | Rank | Value | Rank | |

| Offer A | 0.62620 | 3 | 0.62225 | 3 | 0.99744 | 2 |

| Offer B | 0.63000 | 2 | 0.62231 | 2 | 0.99728 | 3 |

| Offer C | 0.77991 | 1 | 0.62580 | 1 | 1.00000 | 1 |

| Basic Data | ||||||

|---|---|---|---|---|---|---|

| FCM-linear | FCM-sigmoid | WINGS | ||||

| Value | Rank | Value | Rank | Value | Rank | |

| Offer A | 0.28898 | 2 | 0.46374 | 2 | 0.54225 | 2 |

| Offer B | 0.22025 | 3 | 0.46172 | 3 | 0.53973 | 3 |

| Offer C | 0.37213 | 1 | 0.46418 | 1 | 0.54233 | 1 |

| Expected Upsell: 4 → 8; Upsell Potential: 3 → 6 | ||||||

| FCM-linear | FCM-sigmoid | WINGS | ||||

| Value | Rank | Value | Rank | Value | Rank | |

| Offer A | 0.61875 | 2 | 0.51722 | 2 | 0.78763 | 2 |

| Offer B | 0.71846 | 3 | 0.51612 | 3 | 0.78528 | 3 |

| Offer C | 0.70148 | 1 | 0.51767 | 1 | 0.78771 | 1 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Banaś, D.; Michnik, J. Evaluation of the Impact of Strategic Offers on the Financial and Strategic Health of the Company—A Soft System Dynamics Approach. Mathematics 2019, 7, 208. https://doi.org/10.3390/math7020208

Banaś D, Michnik J. Evaluation of the Impact of Strategic Offers on the Financial and Strategic Health of the Company—A Soft System Dynamics Approach. Mathematics. 2019; 7(2):208. https://doi.org/10.3390/math7020208

Chicago/Turabian StyleBanaś, Dariusz, and Jerzy Michnik. 2019. "Evaluation of the Impact of Strategic Offers on the Financial and Strategic Health of the Company—A Soft System Dynamics Approach" Mathematics 7, no. 2: 208. https://doi.org/10.3390/math7020208

APA StyleBanaś, D., & Michnik, J. (2019). Evaluation of the Impact of Strategic Offers on the Financial and Strategic Health of the Company—A Soft System Dynamics Approach. Mathematics, 7(2), 208. https://doi.org/10.3390/math7020208