On the Pricing of Vulnerable Foreign Equity Options with Stochastic Volatility in an Intensity-Based Model

Abstract

1. Introduction

2. Model

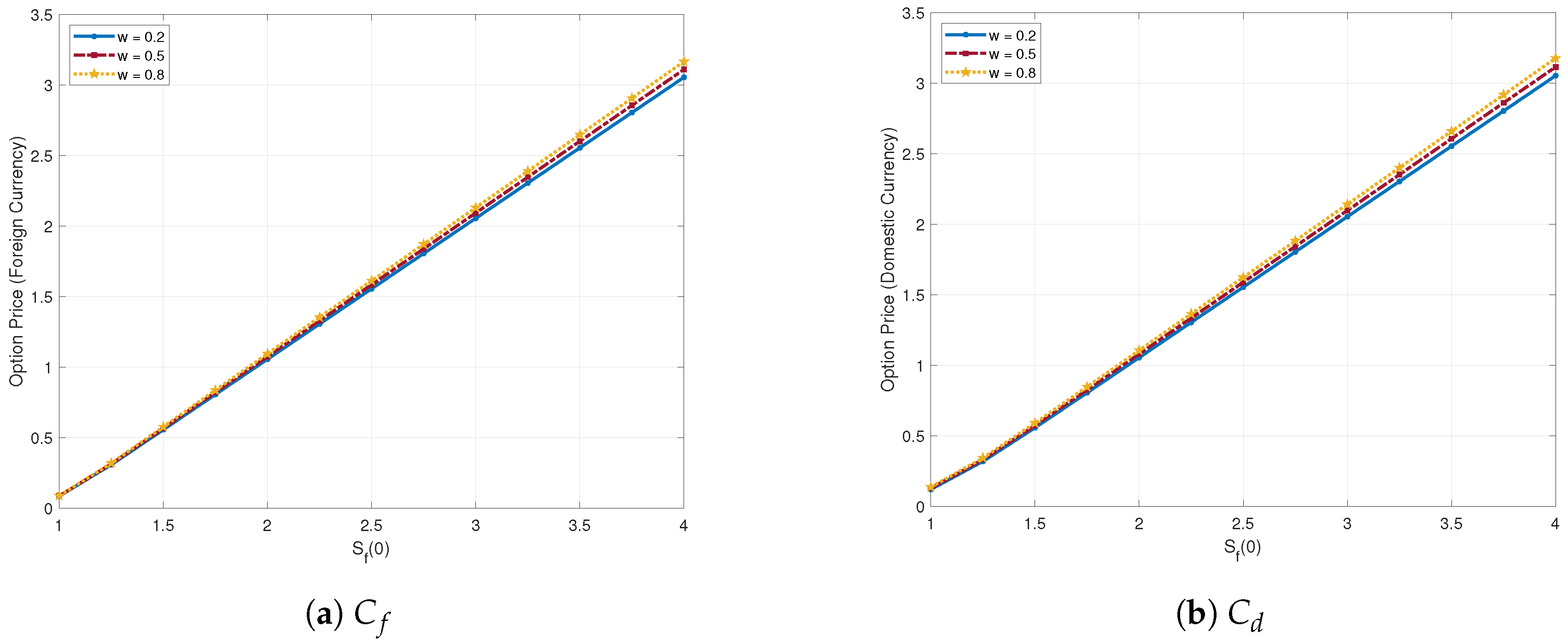

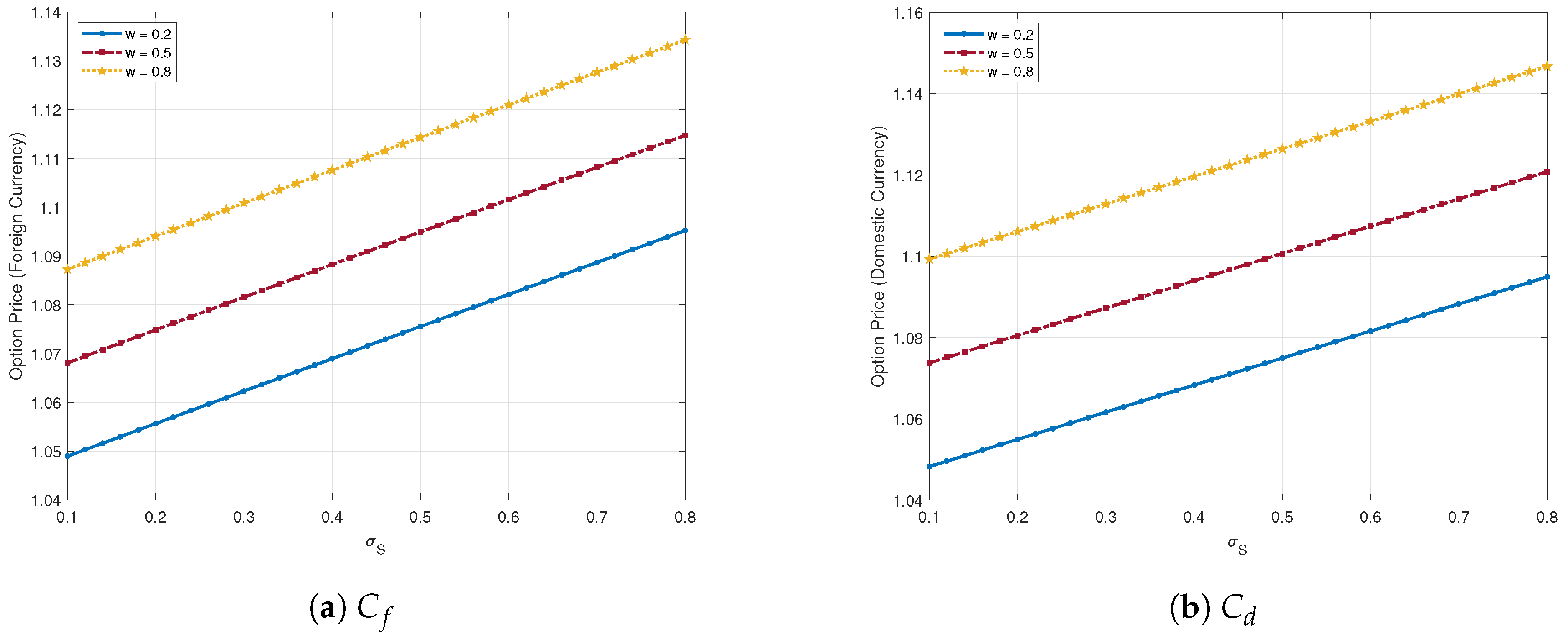

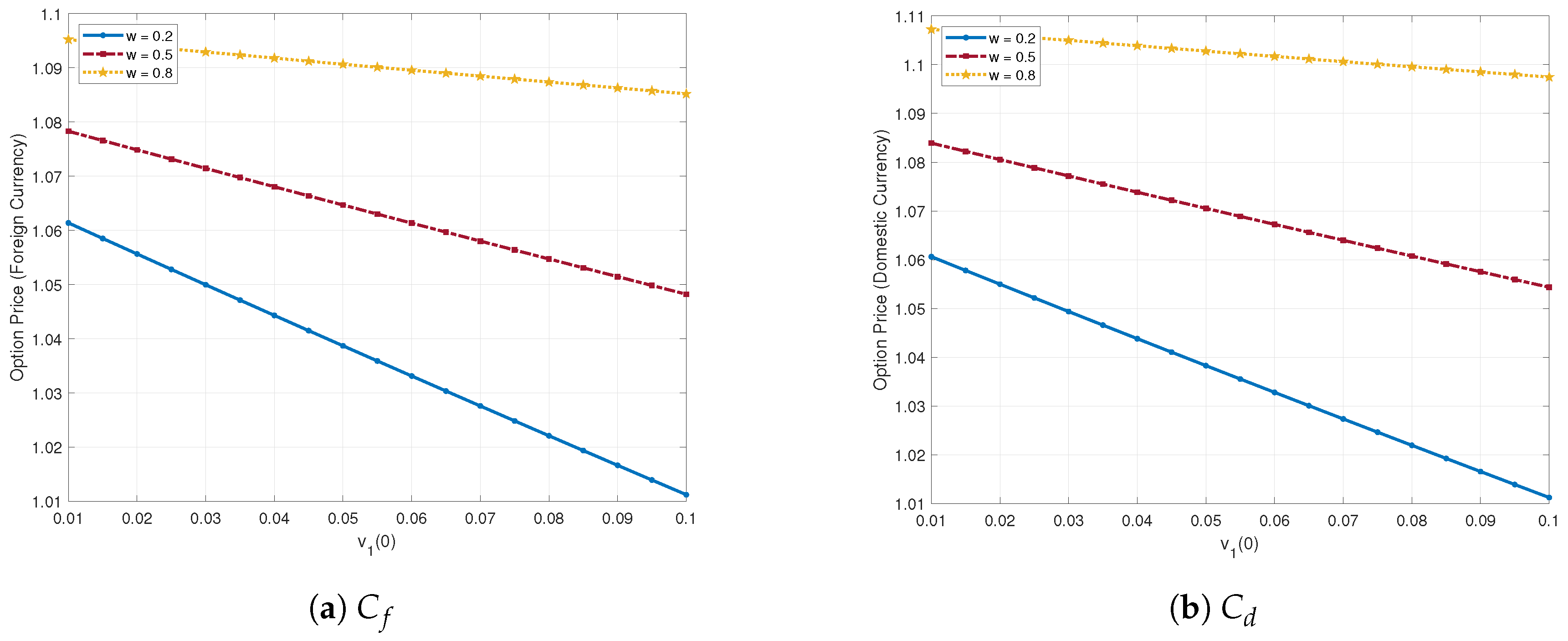

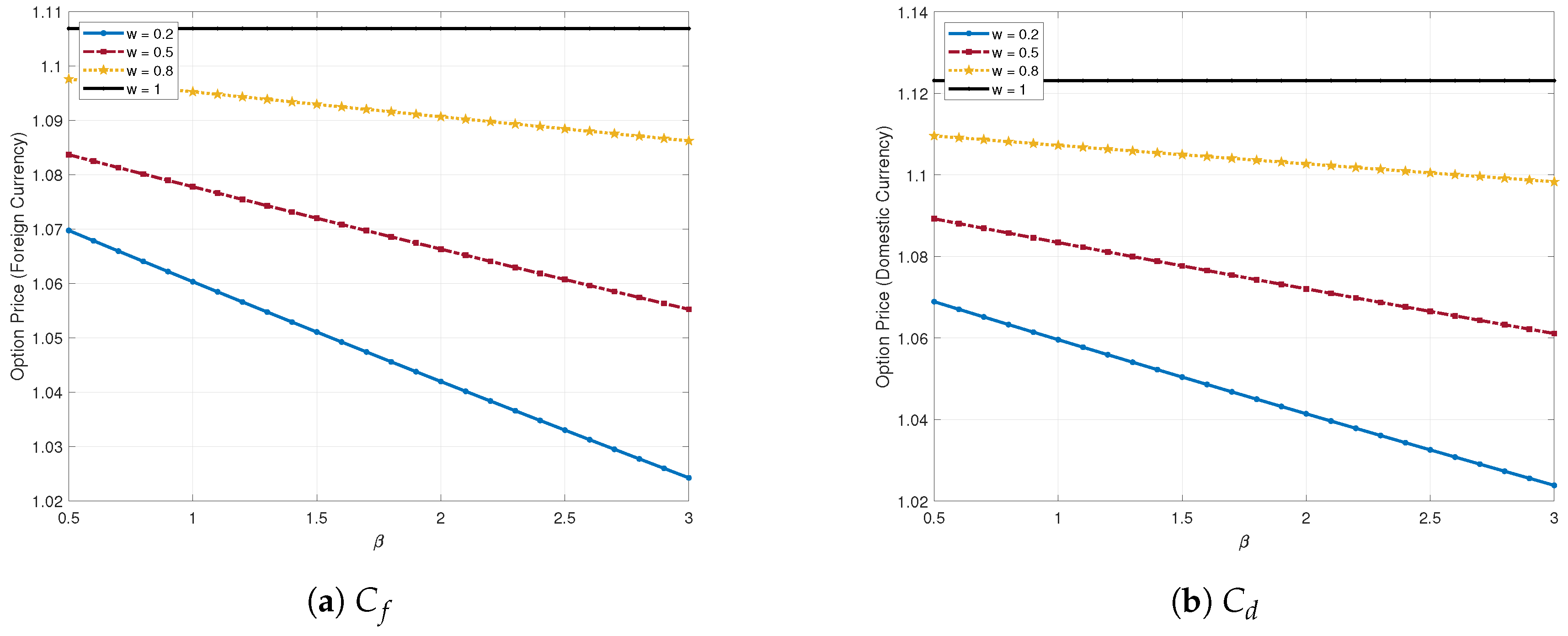

- (1)

- The payoff of foreign equity call struck in foreign currency:

- (2)

- The payoff of foreign equity call struck in domestic currency:

3. The Valuation of Vulnerable Foreign Equity Options

4. Numerical Examples

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Johnson, H.; Stulz, R. The pricing of options with default risk. J. Financ. 1987, 42, 267–280. [Google Scholar] [CrossRef]

- Klein, P. Pricing Black-Scholes options with correlated credit risk. J. Bank. Financ. 1996, 20, 1211–1229. [Google Scholar] [CrossRef]

- Jarrow, R.; Turnbull, S. Pricing options on financial securities subject to default risk. J. Financ. 1995, 50, 53–86. [Google Scholar] [CrossRef]

- Lando, D. On Cox processes and credit risky securities. Rev. Deriv. Res. 1998, 2, 99–120. [Google Scholar] [CrossRef]

- Kwok, Y.K.; Wong, H.Y. Currency-translated foreign equity options with path dependent features and their multi-asset extensions. Int. J. Theor. Appl. Financ. 2000, 3, 257–278. [Google Scholar] [CrossRef]

- Huang, S.C.; Hung, M.W. Pricing foreign equity options under Lévy processes. J. Futur. Mark. Futur. Options Other Deriv. Prod. 2005, 25, 917–944. [Google Scholar] [CrossRef]

- Ma, J. Pricing Foreign Equity Options with Stochastic Correlation and Volatility. Ann. Econ. Financ. 2009, 10, 303–327. [Google Scholar]

- Sun, Q.; Xu, W. Pricing foreign equity option with stochastic volatility. Phys. A Stat. Mech. Its Appl. 2015, 437, 89–100. [Google Scholar] [CrossRef]

- Fan, K.; Shen, Y.; Siu, T.K.; Wang, R. Pricing foreign equity options with regime-switching. Econ. Model. 2014, 37, 296–305. [Google Scholar] [CrossRef]

- Xu, W.; Wu, C.; Li, H. Foreign equity option pricing under stochastic volatility model with double jumps. Econ. Model. 2011, 28, 1857–1863. [Google Scholar] [CrossRef]

- Ma, Y.; Pan, D.; Shrestha, K.; Xu, W. Pricing and hedging foreign equity options under Hawkes jump–diffusion processes. Phys. A Stat. Mech. Its Appl. 2020, 537, 122645. [Google Scholar] [CrossRef]

- Kim, D.; Yoon, J.H.; Kim, G. Closed-form pricing formula for foreign equity option with credit risk. Adv. Differ. Equ. 2021, 2021, 332. [Google Scholar] [CrossRef]

- Kim, G. A Simplified Approach to the Pricing of Vulnerable Options with Two Underlying Assets in an Intensity-Based Model. Axioms 2023, 12, 1105. [Google Scholar] [CrossRef]

- Fard, F.A. Analytical pricing of vulnerable options under a generalized jump–diffusion model. Insur. Math. Econ. 2015, 60, 19–28. [Google Scholar] [CrossRef]

- Wang, X. Analytical valuation of vulnerable European and Asian options in intensity-based models. J. Comput. Appl. Math. 2021, 393, 113412. [Google Scholar] [CrossRef]

- Shephard, N.G. From characteristic function to distribution function: A simple framework for the theory. Econom. Theory 1991, 7, 519–529. [Google Scholar] [CrossRef]

- Jeon, J.; Kim, G. Analytically Pricing a Vulnerable Option under a Stochastic Liquidity Risk Model with Stochastic Volatility. Mathematics 2024, 12, 2642. [Google Scholar] [CrossRef]

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| T | 1 | 0.06 | |

| 2 | 0.05 | ||

| 1 | −0.5 | ||

| 0.2 | 0.02 | ||

| 0 | 0.03 | ||

| 0.03 | 0.06 | ||

| 1.1 | 0.3 | ||

| 0.02 | 0.2 | ||

| 2 | 0.2 | ||

| 0.02 | 0.06 | ||

| 2 | 0.01 | ||

| a | 0.02 | 1.25 | |

| b | 2 | w | 0.4 |

| 1 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeon, J.; Kim, G. On the Pricing of Vulnerable Foreign Equity Options with Stochastic Volatility in an Intensity-Based Model. Mathematics 2025, 13, 400. https://doi.org/10.3390/math13030400

Jeon J, Kim G. On the Pricing of Vulnerable Foreign Equity Options with Stochastic Volatility in an Intensity-Based Model. Mathematics. 2025; 13(3):400. https://doi.org/10.3390/math13030400

Chicago/Turabian StyleJeon, Junkee, and Geonwoo Kim. 2025. "On the Pricing of Vulnerable Foreign Equity Options with Stochastic Volatility in an Intensity-Based Model" Mathematics 13, no. 3: 400. https://doi.org/10.3390/math13030400

APA StyleJeon, J., & Kim, G. (2025). On the Pricing of Vulnerable Foreign Equity Options with Stochastic Volatility in an Intensity-Based Model. Mathematics, 13(3), 400. https://doi.org/10.3390/math13030400