Dynamic Decisions of Quality and Goodwill in a Two-Echelon Supply Chain with Delay Effect

Abstract

:1. Introduction

- (1)

- How do the manufacturer and the retailer implement quality improvement decisions and marketing decisions when delay effects occur? What are the effects of delays in manufacturer quality improvement on product quality and goodwill? How do the levels of quality and goodwill change in comparison to the immediate effect?

- (2)

- What are the differences in investments and profits of the manufacturer and the retailer under decentralized and centralized models? In the relative profit decision model, what effect does the manufacturer’s concern degree have on the revenue of the retailer and the supply chain?

- (3)

- Is the supply chain profit under the centralized decision model necessarily better than those under the decentralized decision model? Which decision structure is more favorable to the economic efficiency of the supply chain and its members under the delay effect?

2. Literature Review

2.1. Product Quality in Supply Chain

2.2. Goodwill in Supply Chain

2.3. Product Quality and Goodwill in Supply Chain

2.4. Supply Chain with Delay Effect

2.5. Supply Chain Decision-Making

2.6. Research Gap

3. Problem Description and Relevant Assumptions

4. Model Framework

4.1. Decentralized Decision Model: Based on the Own Profit Decision Scenario (Model D)

4.2. Decentralized Decision Model: Based on the Relative Profit Decision Scenario (Model θ)

4.3. Centralized Decision Model (Model C)

5. Numerical Analysis

5.1. The Impact of the Delay Effect on the Efforts of the Manufacture and the Retailer

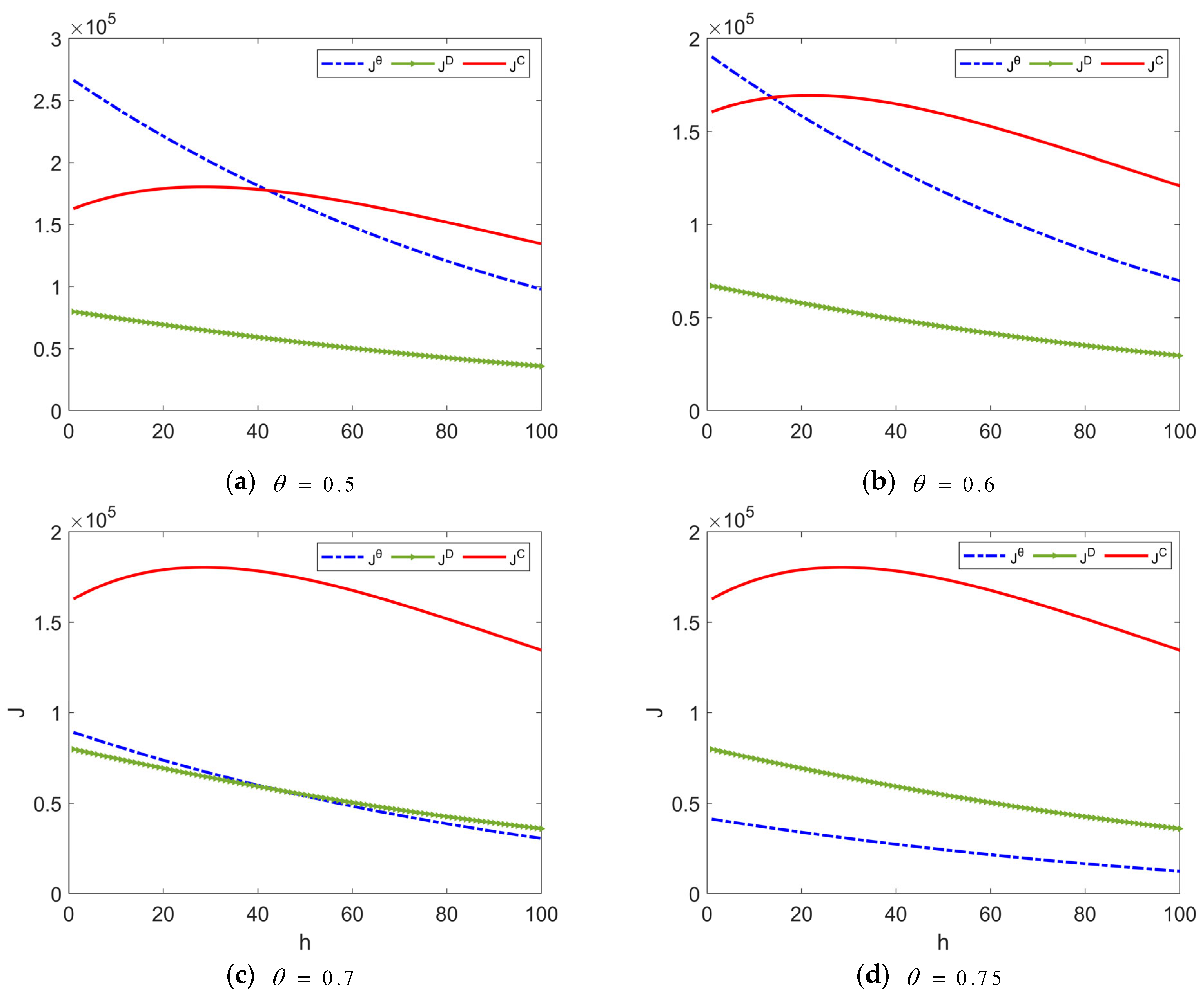

5.2. The Impact of the Delay Effect on Profits of the Manufacture and the Retailer

5.3. The Impact of the Delay Effect on the Profit of the Supply Chain in Different Decision Models

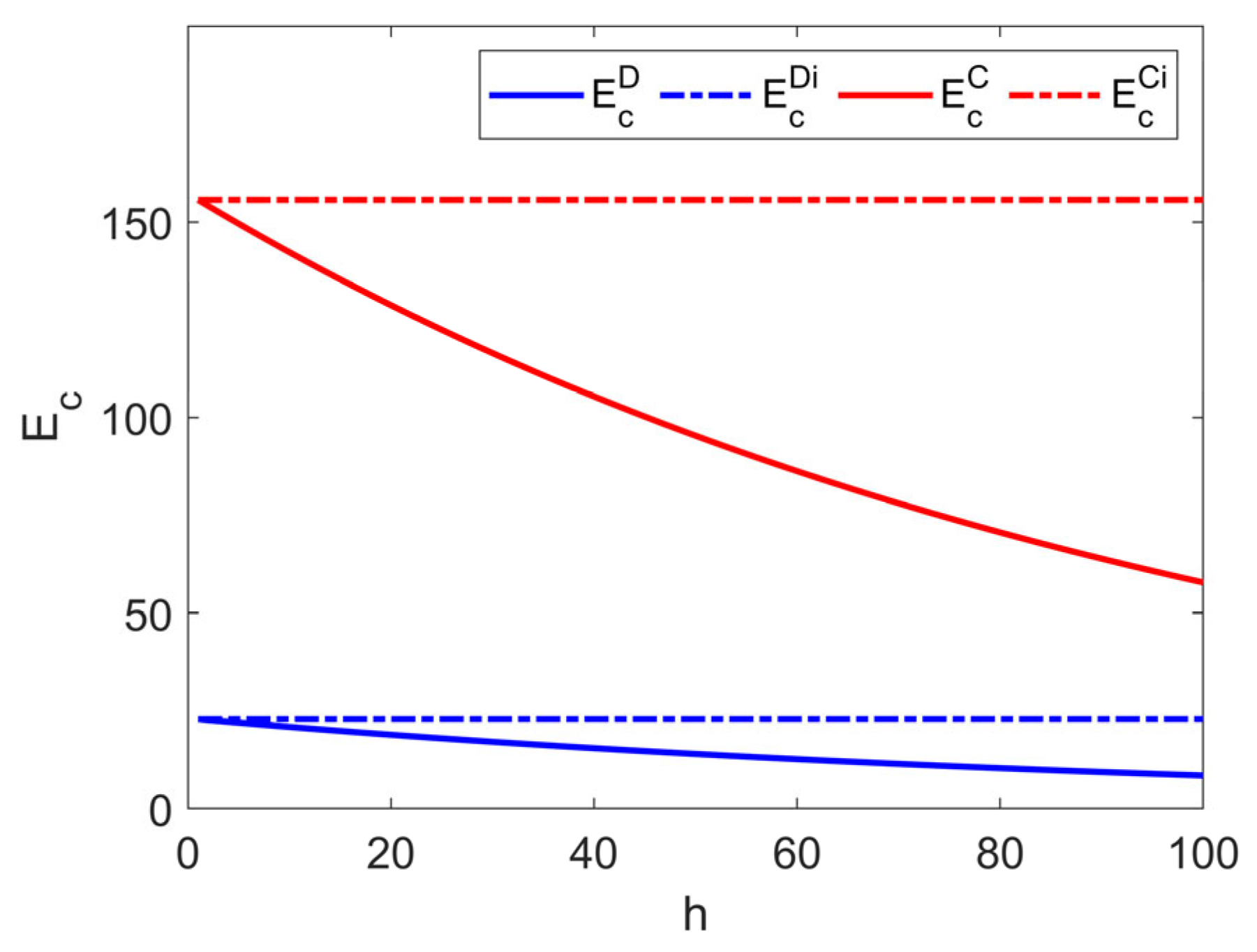

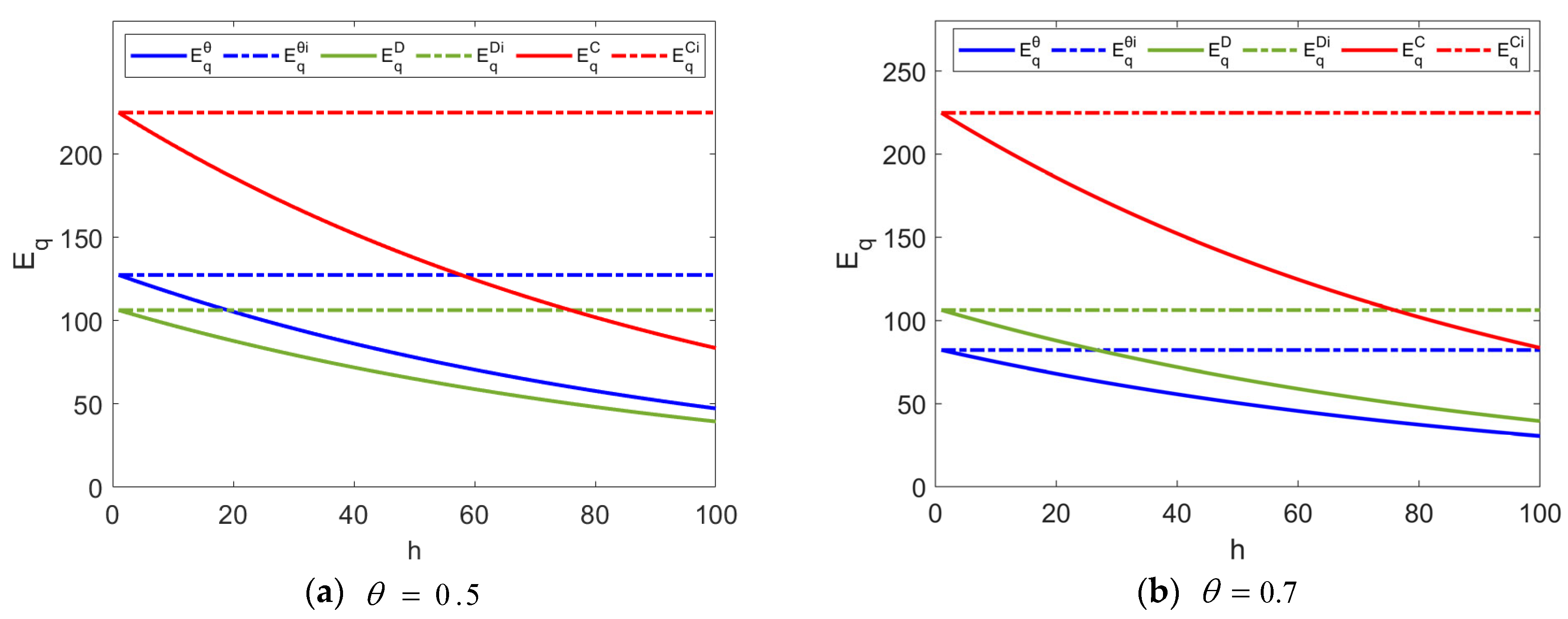

5.4. The Impact of the Delay Effect on Product Quality and Goodwill

6. Discussions

6.1. Results Analysis

- (1)

- Both quality improvement efforts and marketing efforts are decreasing functions of delay time, and the length of delay time directly affects the motivation of decision-makers in strategy investment. In contrast to the decentralized model, the manufacturer and the retailer increase their strategic inputs under the centralized model. Centralization is more conducive to product quality and goodwill improvement.

- (2)

- In Model θ, the higher the manufacturer’s attention is to the retailer, the lower its level of quality improvement investment. The manufacturer maintains the downstream retail channel by reducing part of the quality improvement inputs.

- (3)

- The established Rubinstein bargaining model can ensure that the profits of the manufacturer and the retailer are not lower than the profits under decentralized decisions, and effectively motivate the supply chain members to participate in the cooperation.

- (4)

- When goes from 0.5 to 0.6, although the profit of the supply chain under Model θ begins to decrease, it is still higher than the profit of the supply chain under Model C for a relatively short delay time. As the delay time increases, the advantage of the centralized decision is prominent and the profit increases.

- (5)

- The longer the delay time, the lower the quality level and goodwill level. Compared with the delay effect, the levels of quality and goodwill are highest under the immediate effect, and when , the level of product quality under the steady state in Model θ is always higher than that under Model C. However, the level of goodwill under Model θ is only higher than that under Model C within a certain time range.

- (6)

- Regardless of whether the delay effect occurs, the levels of quality and goodwill under Model D and Model C show an increase and tend to stabilize. On the contrary, the levels of quality and goodwill in Model θ show a decrease and tend to stabilize. Therefore, the dual effect of the delay effect and attention degree exacerbates the negative impact on product quality and goodwill.

6.2. Managerial Insights

- (1)

- The delay time is an important basis for the manufacturer’s decision. When the delay time , the revenue of the supply chain under the relative profit decision is higher than that under the centralized decision. The manufacturer can make the supply chain more profitable with lower quality improvement inputs. When , the supply chain revenue is optimal under the centralized decision. It can be seen that the length of the delay time determines in which way the manufacturer makes quality improvement inputs. Manufacturers can categorize product quality into long-term and short-term updates according to the short delay time to avoid excessive investment in the quality improvement process.

- (2)

- Maintaining channel stability is good for the long-term development of enterprises. The profit of the retailer under the relative profit decision is significantly increased. The manufacturer’s attention degree brings a positive externality to the retailer, which can stabilize the downstream retail channels to a certain extent. Therefore, when quality improvement takes a long time, the manufacturer’s marketing subsidy to downstream retailers can be divided into two parts. On the one hand, it can alleviate the delay loss caused by product updates; on the other hand, it can carry out advance marketing, promote and warm up for the launch of the new products, and increase the popularity and attention.

- (3)

- The bargaining approach to revenue distribution is more flexible. The optimal distribution interval of revenue between the manufacturer and the retailer under centralized decision is and . In the face of the uncertainty of product quality replacement, the widening of the revenue distribution interval promotes the cooperation and mutual assistance between the manufacturer and the retailer, provides more choices for the cooperative alliance and finally realizes the Pareto improvement of both members. This also requires manufacturers not to focus on short-term revenue loss, but to establish long-term stable cooperative relationships with retailers to maximize profits.

- (4)

- The rational utilization of the concern degree and delay time are the keys to improving enterprise efficiency. When and the delay time is short, the manufacturer can obtain the product quality second only to the centralized decision with the lowest quality improvement input, while when the delay time is long, the manufacturer can obtain a quality level exceeding that of the Model C with the quality input of the Model θ. Therefore, a reasonable grasp of the relationship between the concern degree and the delay time could not only promote the close cooperation of the supply chain members, but also improve the operation efficiency of the entire supply chain system and reduce operating costs to create greater value for enterprises.

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Zhang, S.C.; Wei, L.C.; Zhang, J.X. Demand forecast sharing for a dominant retailer with supplier encroachment and quality decisions. Eur. J. Oper. Res. 2022, 301, 39–50. [Google Scholar] [CrossRef]

- Luo, L.L.; Liu, X.Y.; Zhao, X.D.; Flynn Barbara, B. The impact of supply chain quality leadership on supply chain quality integration and quality performance. Supply Chain Manag. Int. J. 2023, 28, 508–521. [Google Scholar] [CrossRef]

- Weichai Power Co., Ltd. Available online: https://www.weichai.com/cpyfw/wmdpp/wcdl (accessed on 25 March 2024).

- Gozzi, F.; Marinelli, C.; Savin, S. On controlled linear diffusions with delay in a model of optimal advertising under uncertainty with memory effects. J. Optim. Theory Appl. 2009, 142, 291–321. [Google Scholar] [CrossRef]

- Gozzi, F.; Marinelli, C. Stochastic optimal control of delay equations arising in advertising models. In Stochastic Partial Differential Equations and Applications—VII; Da Prato, G., Tubaro, L., Eds.; Chapman & Hall/CRC Press: Boca Raton, FL, USA, 2005; Volume 245, pp. 133–148. [Google Scholar]

- The Origin and Rise and Fall of Smartisan Mobile Phone. Available online: https://baijiahao.baidu.com/s?id=1764761535238665037 (accessed on 2 May 2023).

- Toktas-Palut, P. An integrated contract for coordinating a three-stage green forward and reverse supply chain under fairness concerns. J. Clean. Prod. 2021, 279, 123735. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.M.; Govindan, K.; Nematollahi, M.; Jokar, A. An adjustable bi-level wholesale price contract for coordinating a supply chain under scenario- based stochastic demand. Int. J. Prod. Econ. 2019, 214, 175–195. [Google Scholar] [CrossRef]

- Li, Y.; Liu, L.; Li, W.; Li, W. Stability analysis of supply chain members time delay decisions considering corporate social responsibility. Int. J. Gen. Syst. 2024, 53, 805–830. [Google Scholar] [CrossRef]

- Li, Y.; Liu, L.Z.; Li, W.X. Quality control strategies of the supply chain based on stochastic differential game. Evol. Intell. 2024, 17, 177–188. [Google Scholar] [CrossRef]

- Xu, B.; Zhang, Z.; Li, X. Research on the coordination of quality behavior of supply chain of e-commerce platform under C2B model of high-grade e-commerce based on differential game. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1409–1430. [Google Scholar] [CrossRef]

- Ren, H.; Luo, Z. Decisions and Coordination of E-Commerce Supply Chain Considering Product Quality and Marketing Efforts under Different Power Structures. Sustainability 2024, 16, 5536. [Google Scholar] [CrossRef]

- Hardie, B.G.S.; Johnson, E.J.; Fader, P.S. Modeling loss aversion and reference dependence effects on brand choice. Mark. Sci. 1993, 12, 378–394. [Google Scholar] [CrossRef]

- Zhou, X.D.; Xu, B.; Xie, F.; Li, Y. Research on quality decisions and coordination with reference effect in dual-channel supply chain. Sustainability 2020, 12, 2296. [Google Scholar] [CrossRef]

- Xu, Y.; Tian, Y.; Pang, C.; Tang, H. Manufacturer vs. Retailer: A Comparative Analysis of Different Government Subsidy Strategies in a Dual-Channel Supply Chain Considering Green Quality and Channel Preferences. Mathematics 2024, 12, 1433. [Google Scholar] [CrossRef]

- Chenavaz, R. Dynamic quality policies with reference quality effects. Appl. Econ. 2017, 49, 3156–3162. [Google Scholar] [CrossRef]

- Liu, G.W.; Sethi, S.P.; Zhang, J.X. Myopic vs. far-sighted behavious in a revenue-sharing supply chain with reference quality effects. Int. J. Prod. Res. 2016, 54, 1334–1357. [Google Scholar] [CrossRef]

- Nerlover, M.; Arrow, K.J. Optimal advertising policy under dynamic conditions. Economica 1962, 29, 129–142. [Google Scholar] [CrossRef]

- Aust, G.; Buscher, U. Cooperative advertising models in supply chain management: A review. Eur. J. Oper. Res. 2014, 234, 1–14. [Google Scholar] [CrossRef]

- Gou, Q.L.; Zhang, J.; Liang, L.; Huang, Z.M.; Ashley, A. Horizontal cooperative programmes and cooperative advertising. Int. J. Prod. Res. 2014, 52, 691–712. [Google Scholar] [CrossRef]

- Dai, R.; Zhang, J.X.; Tang, W.S. Cartelization or cost-sharing? Comparison of cooperation modes in a green supply chain. J. Clean. Prod. 2017, 156, 159–173. [Google Scholar] [CrossRef]

- Yu, L.L.; He, X.L.; Zhang, J.; Xu, C.Y. Horizontal cooperative advertising with advertising threshold effects. Omega 2019, 1, 102104. [Google Scholar] [CrossRef]

- Taboubi, S. Incentive mechanisms for price and advertising coordination in dynamic marketing channels. Int. Trans. Oper. Res. 2019, 26, 2281–2304. [Google Scholar] [CrossRef]

- He, Y.; Zhang, J.; Gou, Q.L.; Bi, G.B. Supply chain decisions with reference quality effect under the O2O environment. Ann. Oper. Res. 2018, 268, 273–292. [Google Scholar] [CrossRef]

- Giovanni, P.D. Quality improvement vs. advertising support: Which strategy works better for a manufacturer. Eur. J. Oper. Res. 2011, 208, 119–130. [Google Scholar] [CrossRef]

- Xu, Q.; Xu, B.; He, Y. Channel coordination through quality improvement with brand halo effect. Rairo Oper. Res. 2019, 53, 1407–1425. [Google Scholar] [CrossRef]

- Ni, J.; Li, S. When better quality or higher goodwill can result in lower product price: A dynamic analysis. J. Oper. Res. Soc. 2019, 70, 726–736. [Google Scholar] [CrossRef]

- Reddy, P.V.; Wrzaczek, S.; Zaccour, G. Quality effects in different advertising models—An impulse control approach. Eur. J. Oper. Res. 2016, 255, 984–995. [Google Scholar] [CrossRef]

- Liu, H.Y.; Liu, S.L. Research on advertising and quality of paid apps, considering the effects of reference price and goodwill. Mathematics 2020, 8, 733. [Google Scholar] [CrossRef]

- Chen, J.J.; Xu, Z.H.; Huang, D.B.; Wang, X.X.; Fang, C.J.; Zhang, J.C. Automotive supply chain networks equilibrium model under uncertain payment delay and objective weights. Comput. Ind. Eng. 2020, 150, 106866. [Google Scholar] [CrossRef]

- Sun, L.C.; Cao, X.X.; Alharthi, M.; Zhang, J.; Taghizadeh-Hesary, F.; Mohsin, M. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 2020, 264, 121664. [Google Scholar] [CrossRef]

- Bloomfield, R.J.; Kulp, S.L. Durability, transit lags, and optimality of inventory management decisions. Prod. Oper. Manag. 2013, 22, 826–842. [Google Scholar] [CrossRef]

- Pauwels, W. Optimal dynamic advertising policies in the presence of continuously distributed time lags. J. Optim. Theory Appl. 1977, 22, 79–89. [Google Scholar] [CrossRef]

- Aravindakshan, A.; Naik, P.A. Understanding the memory effects in pulsing advertising. Oper. Res. 2015, 63, 35–47. [Google Scholar] [CrossRef]

- Cheng, H.J.; Ding, H. Incentive decision for supply chain with corporate social responsibility and lag effect. Sustainability 2020, 12, 2608. [Google Scholar] [CrossRef]

- Yu, H.; Yang, W.; Xu, N.; Du, Y. Advertising strategy and contract coordination for a supply chain system: Immediate and delayed effects. Kybernetes 2023, 53, 235–261. [Google Scholar] [CrossRef]

- Yu, H.; Bai, S.Z.; Chen, D.Y.; Dong, C.Q.; Feng, X.Y. Application of optimal control to the dynamic advertising decisions for supply chain with multiple delays. Syst. Sci. Control Eng. 2020, 8, 141–152. [Google Scholar] [CrossRef]

- Wu, Z.H.; Liu, G.P.; Chen, D.Y. Advertising strategies and coordination for supply chain based on consignment platform with delayed effect. Syst. Sci. Control Eng. 2020, 8, 162–174. [Google Scholar] [CrossRef]

- Zhou, X.; Zhan, L.; Shu, H.; Peng, Y. Dynamic decision modeling of production and marketing in low-carbon supply chains considering delay effects. Sci. Prog. 2023, 106, 1–33. [Google Scholar] [CrossRef]

- Zhan, L.Z.; Shu, H.; Zhou, X.D.; Lin, X.W. A quality decision model considering the delay effects in a dual-channel supply chain. Sustainability 2022, 14, 6240. [Google Scholar] [CrossRef]

- Peng, Y.; Ning, L. Study on quality decision in supply chain considering the lagged time and retailers competition. Discret. Dyn. Nat. Soc. 2020, 1, 7482967. [Google Scholar] [CrossRef]

- Zheng, X.X.; Li, D.F.; Liu, Z.; Sheu, J.B. Coordinating a closed-loop supply chain with fairness concerns through variable-weighted shapley values. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 227–253. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, W.; Boros, E. Optimal pricing and greening decisions in a supply chain when considering market segmentation. Ann. Oper. Res. 2023, 324, 93–130. [Google Scholar] [CrossRef]

- Fiala, P. Profits allocation games in supply chains. Cent. Eur. J. Oper. Res. 2016, 24, 267–281. [Google Scholar] [CrossRef]

- Gao, J.H.; Han, H.S.; Hou, L.T.; Wang, H.Y. Pricing and effort decisions in a closed-loop supply chain under different channel power structures. J. Clean. Prod. 2016, 112, 2043–2057. [Google Scholar] [CrossRef]

- Li, Y. Research on supply chain CSR management based on differential game. J. Clean. Prod. 2020, 268, 122171. [Google Scholar] [CrossRef]

- Tanka, Y. Irrelevance of the choice of strategic variables in duopoly under relative profit maximization. Econ. Bus. Lett. 2023, 2, 75–83. [Google Scholar] [CrossRef]

- Elsadany, A.A. Dynamics of a cournot duopoly game with bounded rationality based on relative profit maximization. Appl. Math. Comput. 2017, 294, 253–263. [Google Scholar] [CrossRef]

- Hattori, M.; Tanaka, Y. Incentive for adoption of new technology in duopoly under absolute and relative profit maximization. Econ. Bull. 2014, 34, 2051–2059. [Google Scholar]

- Li, T.; Ma, J.H. Complexity analysis of dual-channel game model with different managers’ business objectives. Commun. Nonlinear Sci. Numer. Simul. 2015, 20, 199–208. [Google Scholar] [CrossRef]

- Yang, M.G.; Yang, Z.; Li, Y.; Liang, X.Z. Research on corporate social responsibility coordination of three-tier supply chain based on stochastic differential game. Front. Psychol. 2022, 13, 783998. [Google Scholar] [CrossRef]

- Chen, T.Q.; Zhang, J.; Luo, J. Differential game evolution of food quality safety based on market supply and demand. Food Sci. Nutr. 2021, 9, 2414–2435. [Google Scholar] [CrossRef]

- Satoh, A.; Tanaka, Y. Equivalence of cournot and Bertrand equilibria in duopoly under relative profit maximization: A general analysis. J. Econ. Political Econ. 2016, 3, 513–523. [Google Scholar]

- Miller, N.; Pazgal, A. Relative performance as a strategic commitment mechanism. Manag. Decis. Econ. 2020, 23, 51–68. [Google Scholar] [CrossRef]

| Authors | Product Quality | Goodwill | Differential Game | Delay Effect | Decision Structure |

|---|---|---|---|---|---|

| Xu et al. [26] | × | √ | √ | × | Decentralized and integrated model, bilateral participation contract |

| Yang et al. [51] | √ | × | √ | × | Decentralized and overall alliance model |

| Taboubi [23] | × | √ | √ | × | Decentralized and coordination model, incentive mechanism |

| Ni et al. [27] | √ | √ | √ | × | Price-quality and price-goodwill model |

| Li et al. [10] | √ | × | √ | × | Nash, Stackelberg and cooperation model |

| Zhan et al. [40] | √ | × | √ | √ | Decentralized and centralized model |

| Yu et al. [36] | × | √ | √ | √ | Non-cooperation, incomplete and complete cooperation model |

| Li [46] | × | × | √ | × | Nash non-cooperative and Stackelberg model |

| Chen et al. [52] | √ | × | √ | × | Decentralized and centralized model |

| Li et al. [50] | × | × | × | × | Own profit and relative profit model |

| This paper | √ | √ | √ | √ | Decentralized and centralized model, bargaining model |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Liu, L.; Li, W. Dynamic Decisions of Quality and Goodwill in a Two-Echelon Supply Chain with Delay Effect. Mathematics 2024, 12, 3838. https://doi.org/10.3390/math12233838

Li Y, Liu L, Li W. Dynamic Decisions of Quality and Goodwill in a Two-Echelon Supply Chain with Delay Effect. Mathematics. 2024; 12(23):3838. https://doi.org/10.3390/math12233838

Chicago/Turabian StyleLi, Yu, Linzhong Liu, and Wen Li. 2024. "Dynamic Decisions of Quality and Goodwill in a Two-Echelon Supply Chain with Delay Effect" Mathematics 12, no. 23: 3838. https://doi.org/10.3390/math12233838

APA StyleLi, Y., Liu, L., & Li, W. (2024). Dynamic Decisions of Quality and Goodwill in a Two-Echelon Supply Chain with Delay Effect. Mathematics, 12(23), 3838. https://doi.org/10.3390/math12233838