1. Introduction

Copula models are useful tools for the analysis of multivariate data, since by using the well-known Sklar’s theorem, any multivariate joint distribution can be decomposed into its univariate marginal distributions and a copula function, which allows capturing of the arbitrary dependence structure between several random variables. As a result, copulas have been widely used in the fields of finance, insurance, system reliability, etc., among many other application areas. See, e.g., Jaworski et al. [

1], Joe [

2] and Nelsen [

3] for more details about copulas and their applications.

Given a random vector

with joint cumulative distribution function (CDF)

F and continuous marginal CDFs

, by Sklar’s theorem (Sklar [

4]), the CDF

F can be expressed uniquely as

, where

denotes the copula function. A copula is itself the joint CDF of a random vector

having its marginals as uniform distributions on

, henceforth denoted by

. It is to be noted that the original results in Sklar [

4] are also applicable to discrete-valued random variables; however, the focus of this paper is modeling continuous-valued multivariate random vectors. Thus, for the rest of the paper, we assume that the marginal CDFs

are absolutely continuous.

As a copula plays an important role in capturing the general dependence structure between multiple variables, it is critical to estimate copulas in an accurate way, especially in higher dimensions where the dependence structure becomes much more complicated, is often illusive, and may even be supported on a lower-dimensional manifold. One of the primary goals of this paper is to estimate a smooth copula function C from a random sample of n independent identically distributed (iid) observations for .

Many parametric families have been proposed for modeling multivariate copulas, and there has been previous work addressing the corresponding parametric estimation methods. For detailed discussions, see, e.g., Joe [

5], Joe [

2], McNeil et al. [

6], Nelsen [

3], Smith [

7] and Žežula [

8], etc. However, regardless of how sophisticated and flexible the parametric models are that we may use, they might still lead to biased copula estimates when the parametric model is misspecified and thus may not be able to capture complex dependence structures required in practice. Compared to standard multivariate copulas, vine copula models allow for more flexibility in capturing complex dependency structures using appropriate vine tree structures by choosing bivariate copula families for each node of pair copulas from a vast array of parametric bivariate copulas. But it is often challenging to obtain estimates of multivariate dependence measures that involve high-dimensional integrals which are often algebraically intractable by using vine copulas.

Thus, recognizing some of the abovementioned limitations of parametric copula models, a variety of nonparametric estimators have been proposed for multivariate copula estimation. Most of the available nonparametric estimators rely on the empirical methods, e.g., the empirical copula and its multilinear extension, the empirical multilinear copula (Deheuvels [

9]; Fermanian et al. [

10]; Genest et al. [

11]), or kernel-based methods such as local linear estimator (Chen and Huang [

12]), mirror reflection estimator (Gijbels and Mielniczuk [

13]), and improvements of these two estimators (Omelka et al. [

14]). See alsoRémillard and Scaillet [

15] and Scaillet and Fermanian [

16] for other nonparametric copula estimators. However, except for the empirical multilinear copula, most of these estimators are valid copulas only asymptotically, meaning that they are not necessarily genuine copulas for finite samples. Moreover, multivariate dependent measures (e.g., Spearman’s rho, Kendall’s tau, etc.) based on such estimated copulas could take values outside of their natural range, thus making them unattractive in practice. On the other hand, there has been recent work on Bayesian nonparametric methods for estimating general d-dimensional copulas and, among many others, a noteworthy Bayesian nonparametric model is based on an infinite mixture of multivariate Gaussian or the skew-normal copulas proposed by Wu et al. [

17]. The infinite mixture models provide a lot of flexibility in modeling various dependence structures, but those typically lack simple (analytic) expressions of dependence measures making them harder to compute in practice.

The primary focus of this paper is the nonparametric estimation of multivariate copulas for any arbitrary dimensions that are genuine copulas for any finite sample size and are uniformly consistent as the sample size becomes large. We consider an extension of the Bernstein copula (Sancetta and Satchell [

18]), which is a family of copulas defined in terms of multivariate Bernstein polynomials. One of the primary advantages of the Bernstein copula is that it provides a class of nested models that are able to uniformly approximate any multivariate copula with minimal regularity conditions. A simple case of the Bernstein copula is the empirical Bernstein copula, which is a nonparametric copula estimator proposed by Sancetta and Satchell [

18]. The asymptotic properties of the empirical Bernstein copula are well studied in Janssen et al. [

19], and its application in testing independence is described in Belalia et al. [

20]. The application of the Bernstein copula to the modeling of dependence structures of non-life-insurance risks is provided in Diers et al. [

21], among many other applications.

However, the empirical Bernstein copula has two main drawbacks that could prevent us from obtaining accurate copula estimation for small samples: (i) the empirical Bernstein copula is not necessarily a valid copula itself, which is a common disadvantage for most nonparametric copula estimators; and (ii) the degrees of Bernstein polynomials are often set to be equal to an integer across different dimensions, which limits the flexibility of the Bernstein copula and thus might not be appropriate for large dimensions.

In order to address the above-described problem (i), Segers et al. [

22] showed that the empirical Bernstein copula is a genuine copula if and only if all the polynomial degrees are divisors of the sample size, and further proposed a new copula estimator called the empirical beta copula, which can be seen as a special case of the empirical Bernstein copula when the degrees of Bernstein polynomials are all set equal to the sample size. The empirical beta copula is a valid copula itself and has been shown to outperform some classical copula estimators in terms of bias and variance, but it always has a larger variance compared to the empirical Bernstein copula with smaller polynomial degrees. It is surprising that much less attention has been given to the problem (ii), and even for equally set degrees, there has been limited work on the data-dependent choice of degrees in the literature. Janssen et al. [

19] recommended an optimal choice of the equal degrees in the bivariate case by minimizing the asymptotic mean squared error. Nevertheless, such a choice requires the knowledge of the first- and second-order partial derivatives, which might not be easy to estimate in practice. Burda and Prokhorov [

23] put priors on the polynomial degrees; however, their priors did not rely on data or sample size, and they used multivariate Bernstein density instead of Bernstein copula density. The Dirichlet process assigned as the prior for the copula does not guarantee the copula estimate to be a valid copula itself. In addition, the number of weights grows exponentially as the dimension increases, leading to computational inefficiency of MCMC methods for larger dimensions. To the best of our knowledge, Lu and Ghosh [

24] first developed a data-dependent grid search algorithm for the selection of polynomial degrees, which has shown superior empirical estimation properties for small- to moderate-sized samples, but the methodology is limited to bivariate cases, and extension to larger dimensions remains challenging.

For the purpose of addressing the two problems described above, we introduce a new nonparametric smooth estimator for multivariate copula that we call the empirical checkerboard Bernstein copula (ECBC), which is constructed by extending the Bernstein copula, allowing for varying degrees of the polynomials. It is shown to be a genuine smooth copula for any number of degrees and any finite sample size. Furthermore, we develop an empirical Bayesian method that takes the data into account to automatically choose the degrees of the proposed estimator using its posterior distribution, thereby accounting for the uncertainty of such tuning parameter selection. As shown in Segers et al. [

22], larger degrees of the Bernstein copula lead to a larger variance of the estimation, so a choice of degrees that is relatively small compared to the sample size but sufficient for a good copula estimation is desirable. The degrees are allowed to be dimension-varying within the Bayesian model, which provides much more flexibility and accuracy, especially in higher dimensions.

It is especially noteworthy that while the focus of the paper is to estimate the copula function, it is straightforward to obtain a closed-form estimate of the corresponding copula density by taking derivatives of the ECBC. However, direct estimation of a closed-form copula function has many advantages compared to first estimating a copula density, e.g., it is often easier to differentiate than to integrate for higher dimensions. In addition, for those copulas which are not absolutely continuous, such as Marshall–Olkin copulas (Embrechts et al. [

25]) having support on a possibly lower-dimensional manifold, the direct estimation of the copula density could be difficult. Owing to the closed form of the estimated copula function and its density, it can be shown that the proposed ECBC allows for straightforward estimation of various dependence measures.

The rest of the paper is organized as follows: in

Section 2, we present an empirical Bayes nonparametric copula model. In

Section 2.1, we derive the closed-form expression of estimates of popular multivariate dependence measures based on the novel methodology of multivariate copula estimation. We then illustrate the performance of the proposed methodology in

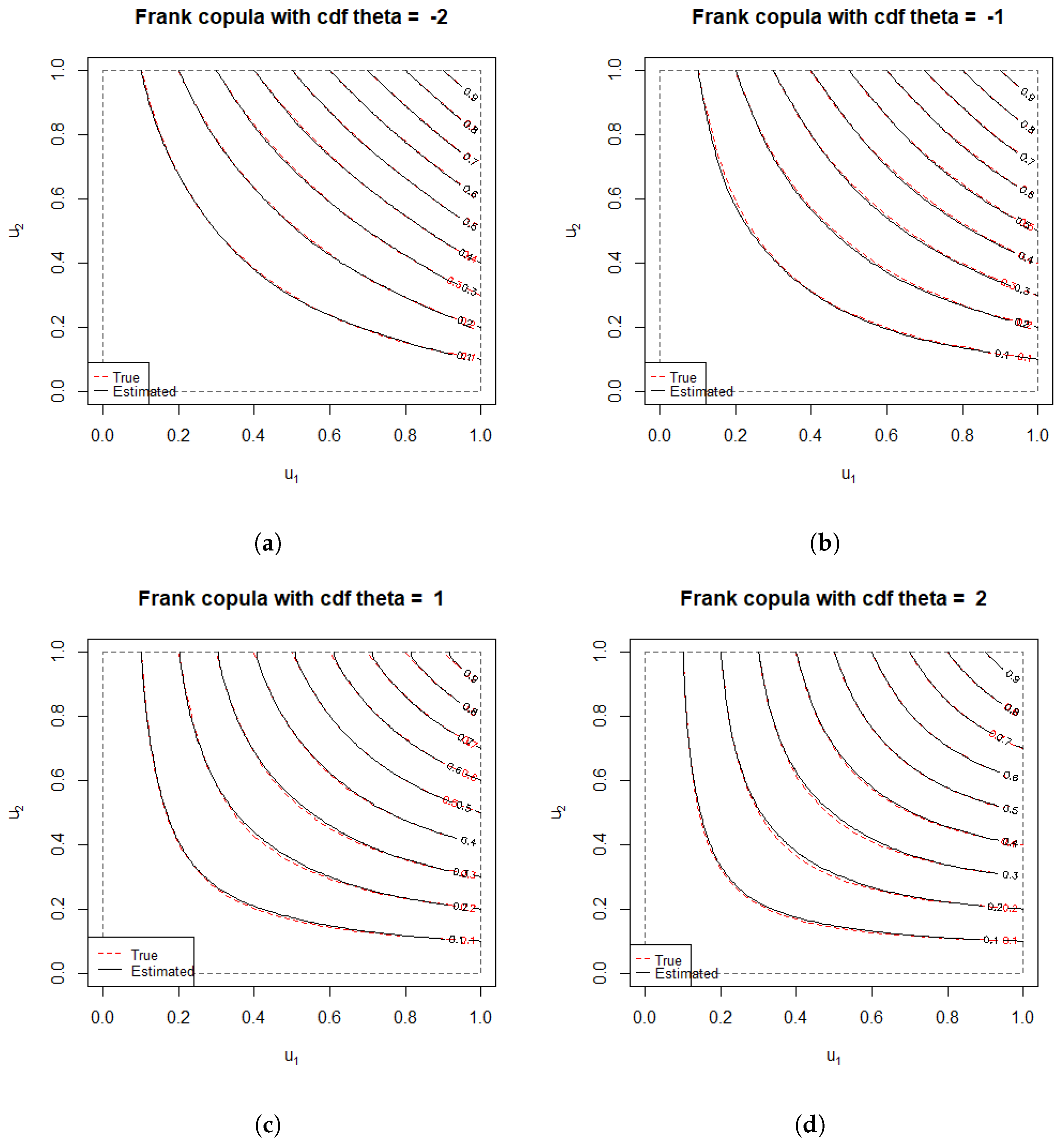

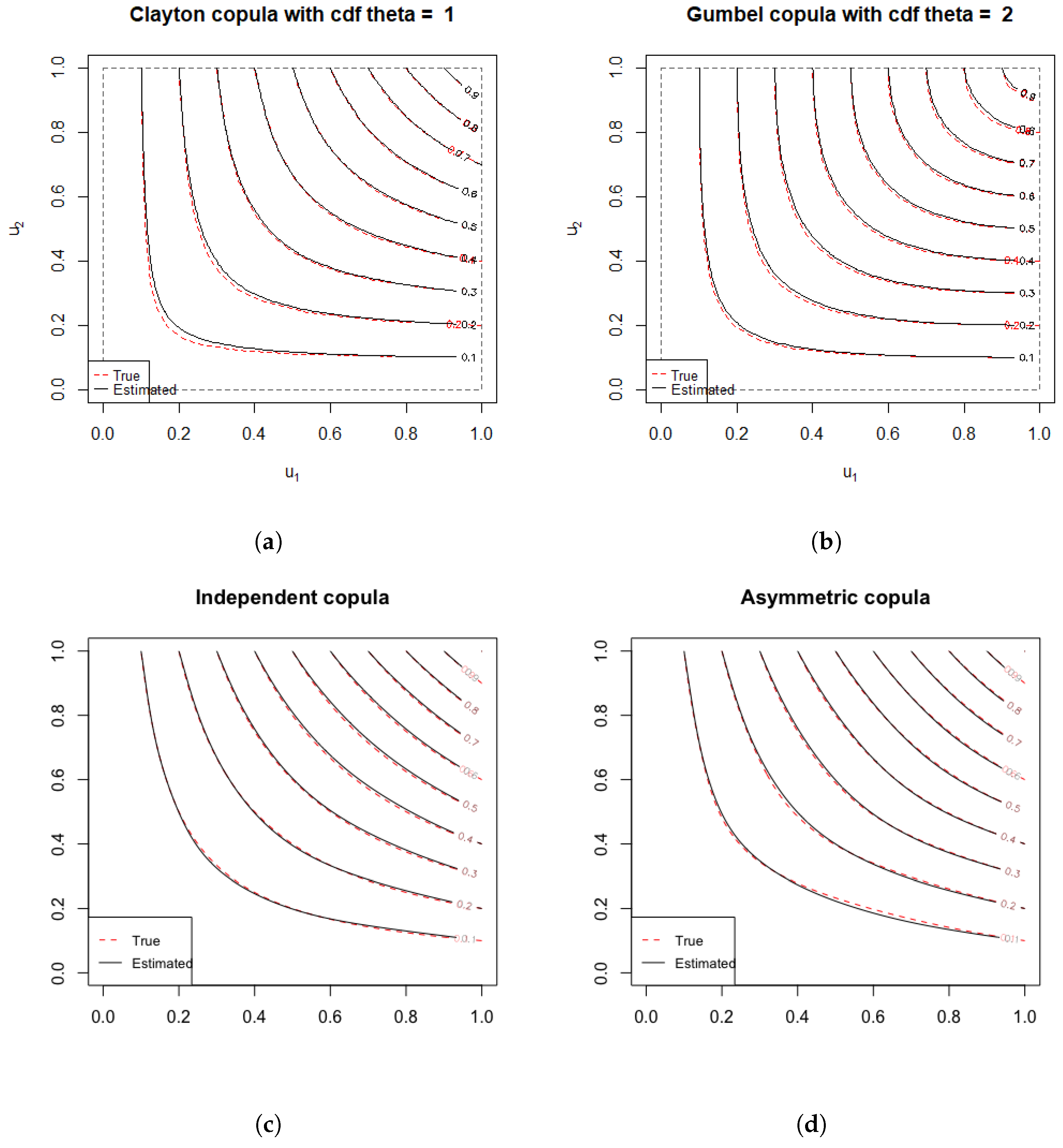

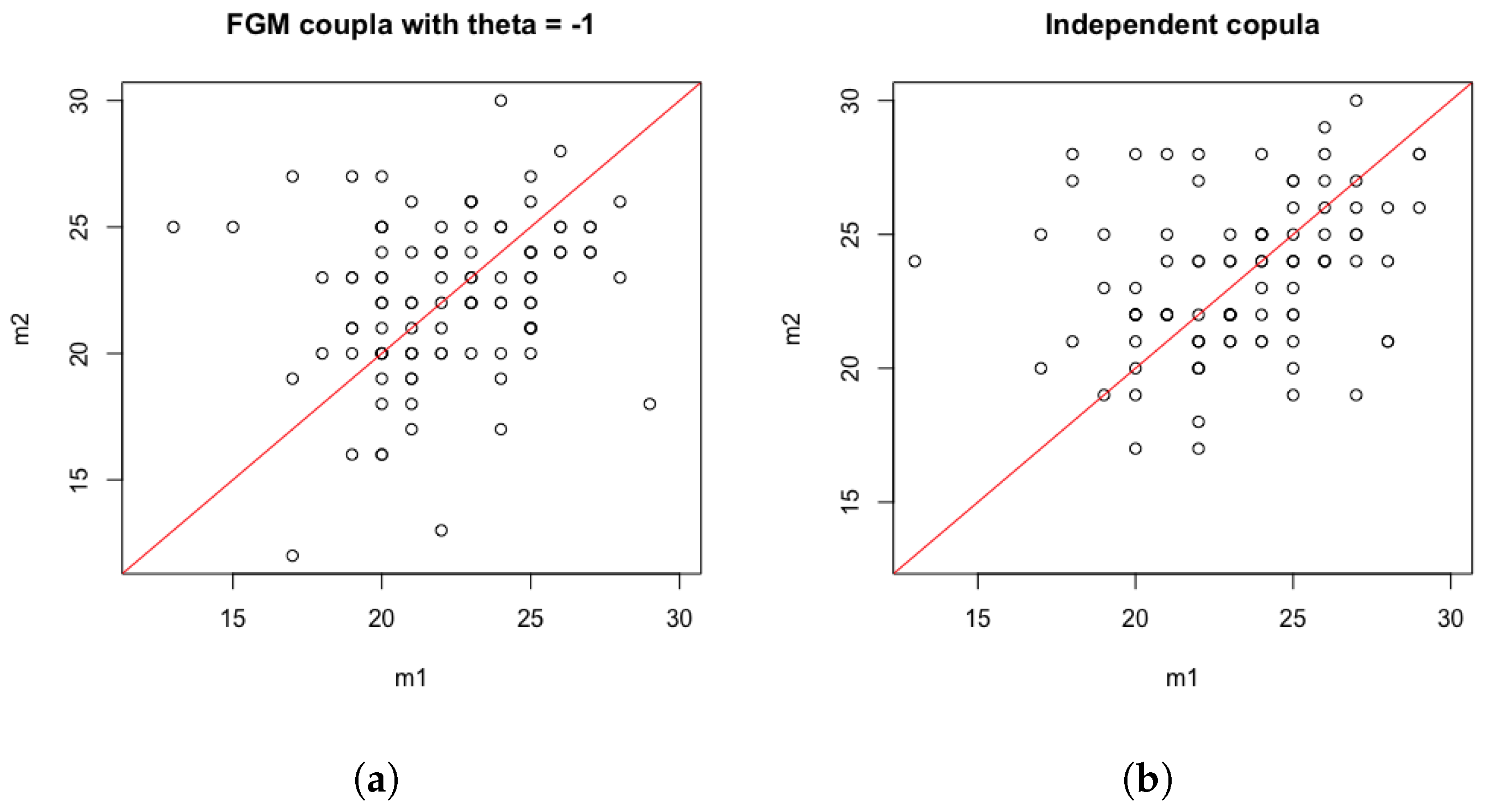

Section 3.

Section 3.1 shows the finite-sample performance for bivariate cases. The accuracy of the estimation of multivariate dependence measures is investigated in

Section 3.2.

Section 3.3 illustrates the estimation of tuning parameters of the proposed ECBC copula estimator, and the comparison with the empirical Bernstein copulas is provided in

Section 3.4.

Section 4 provides an application to portfolio risk management. Finally, we make some general comments in

Section 5.

2. An Empirical Bayes Nonparametric Copula Model

Suppose we have i.i.d. samples

, where

F is a cumulative distribution function and

is the absolutely continuous marginal CDF of the

j-th component. By Sklar ’s theorem (Sklar [

4]), there exists a unique copula

such that

and

The Bernstein copula is a family of copulas defined in terms of Bernstein polynomials, and it was first introduced by Sancetta and Satchell [

18]. It is a flexible model that can be used to uniformly approximate any copula. The Bernstein polynomial with degrees

of a function

is defined as

and

is called the Bernstein copula when

C is a copula.

A general estimation for the Bernstein copula of an unknown copula hl

C is the empirical Bernstein copula (Sancetta and Satchell [

18])

, where

is the rank-based empirical copula. We denote the empirical Bernstein copula as

where

where

denotes indicator function, and slightly modified empirical marginal distribution functions are defined as

where the modification

instead of

modifies the standard empirical marginal distribution to be away from 1 in order to reduce potential problems at boundaries.

However, the empirical Bernstein copula

is not guaranteed to be a valid copula for finite samples as the empirical copula

is not necessarily a genuine copula. Segers et al. [

22] showed that the empirical Bernstein copula

is a copula if and only if all the degrees

are divisors of

n. In order to obtain a valid copula estimation for any degrees, we replace the empirical copula

with the empirical checkerboard copula

, which is a simple multilinear extension of the empirical copula defined as

where

is the rank of

among

; see, e.g., Carley and Taylor [

26] and Li et al. [

27] for more details. Notice that the main difference between the empirical copula

and the empirical checkerboard copula

is that

is a genuine copula, so we can obtain a valid copula estimation

taking the form

where

and we call the proposed

empirical checkerboard Bernstein copula (ECBC).

Unlike the empirical Bernstein copula, the ECBC is a genuine copula for any degrees , and any fixed sample size n. It is known that Bernstein polynomials with smaller values of degrees s may lead to biased estimates while unnecessary larger degrees of Bernstein polynomials will necessarily lead to larger variances. Therefore, it is critical to choose the proper degrees of the ECBC based on a given sample. In order to do that, we develop an empirical Bayes method for choosing ‘optimal’ degrees , where s are allowed to be different for different and also depend on the random sample of observations.

As illustrated in Sancetta and Satchell [

18], using partial derivatives of (

2) with respect to each

and rearranging, we can obtain the density corresponding to ECBC as follows:

where

Clearly, the Bernstein copula is a mixture of independent Beta distributions leading to a tensor product form. For notational convenience, let us denote

Following the work by Gijbels et al. [

28], the pseudo-observations

can be treated as samples from

. We then use this approximation to build an empirical Bayesian hierarchical model:

where

is the ‘floor’ function denoting the largest integer not exceeding the value

a, and

i.e.,

are samples from the empirical checkerboard copula

. It then follows that

Based on the proposition 1 in Genest et al. [

11],

can be drawn using the following hierarchical scheme:

where

and

denotes the discrete uniform distribution, i.e.,

for

. Assuming that there are no ties in the pseudo samples

(owing to absolute continuity of marginal distributions or breaking it by random assignment in practice), we can equivalently represent the

’s more conveniently as

Next, to account for the uncertainty in the estimation of the degrees

s, we propose to introduce a sample-size-dependent empirical prior distribution on the degrees

and obtain posterior estimates by Markov chain Monte Carlo (MCMC) methods. This would not only allow for the almost automatic adaptive estimation of the degrees (based on the observed data) but would also allow for quantifying the uncertainty of this crucial tuning parameter vector. Notice that the idea of putting priors on the polynomial degrees was also adopted by Burda and Prokhorov [

23]. However, their priors did not rely on data or sample size and they used multivariate Bernstein density instead of Bernstein copula density, i.e., the weights belonged to a simplex without any more constraints. A Dirichlet process with a baseline of uniform distribution on

was assigned as the prior for the copula

C in (

1), which did not guarantee

C to be a valid copula. In order to avoid the construction of priors under constraints, we use the empirical estimates for the coefficients of the Bernstein copula instead of assigning priors to them.

Motivated by the asymptotic theory of the empirical Bernstein estimator, e.g., as in Janssen et al. [

29], we propose the hierarchical shifted Poisson distributions as the prior distribution for

:

and

The following theorem provides the large-sample consistency of the ECBC using the same set of assumptions as required for the large-sample consistency of the empirical checkerboard copula.

Theorem 1. Given the empirical priors distribution of as in (6) and (7), and assuming the regularity conditions for the consistency of the empirical checkerboard copula, the proposed ECBC is consistent in the following sense:where the expectation is taken with respect to the empirical prior distribution. Proof. We denote the ECBC as

for simplicity. Also, the empirical Bernstein copula and the Bernstein copula are denoted as

and

, respectively. Let

denote the supremum norm of a function

defined on d-dimensional square

. Using the familiar triangle inequality, we have

First, under the assumption that the marginal CDFs are continuous, it follows from Remark 2 in Genest et al. [

11] that

Next, notice that

In the above, the second inequality follows from the fact that since

are binomial probabilities,

for any

and for any

.

Next, by using Lemma 1 in Janssen et al. [

19] and Equation (3) in Kiriliouk et al. [

30], we obtain

Hence, it now follows that

Also, by using Lemma 3.2 in Segers et al. [

22], we have

Thus, combining the above inequalities that are satisfied almost surely (a.s.) for every fixed

s, we obtain

Next, we consider the proposed empirical priors on the degrees

to be

□

We make use of the following simple lemma:

Lemma 1. Suppose , then .

Proof of Lemma 1. By Jensen’s inequality for the square-root function, it follows that

Notice that as

,

and conditioning on

, we then have, by the above lemma,

as

. Thus, taking expectation with respect to the prior distribution, it follows that

□

Notice that in the above result, the a.s. convergence is with respect to the empirical marginal distribution of the data integrating out the conditional empirical distribution of data (given the

s) weighted by the empirical prior distribution of the tuning parameters

s. This is not the usual notion of posterior consistency, but, rather, the notion can be viewed as using an integrated likelihood approach (Berger et al. [

31]) with respect to the empirical marginal distribution obtained by integrating the priors given by Equations (

6) and (

7).

It is to be noted that the joint posterior distribution of (

) may not necessarily preserve an exchangeable structure as the above prior. Using the empirical Bayes hierarchical structure of the above-proposed model, it can be shown that efficient MCMC methods can be utilized to draw approximate samples from the path of a geometrically ergodic Markov Chain with posterior distribution as its stationary distribution. By generating a sufficiently large number of MCMC samples, we can estimate the marginal posterior mode of the discrete-valued parameter

s as final estimates. Let

denote

K MCMC samples of

and for each

j, let

denote the distinct values among these MCMC samples. Then, the (marginal) posterior mode of

is estimated by

The final estimate of the smooth copula based on the proposed ECBC is then given by

where

It is to be noted that other posterior estimates (e.g., posterior mean when it exists or coordinate-wise posterior median or some version of multivariate posterior median) can also be used, but for simplicity (and the requirement that these posterior estimates of s be necessarily integer-valued) we chose to use posterior mode based on the marginal posterior distributions of s. Through many numerical illustrations, we show the easy applicability of this choice in various examples.

2.1. Multivariate Dependence Estimation

In higher dimensions, it is often of interest to evaluate the strength of dependence among variables. This is often performed using copulas since most dependence measures can be expressed as a function of copulas. Spearman’s rank correlation coefficient (Spearman’s rho) is one of the most widely used dependence measures. For a bivariate copula

C, Spearman’s rho can be written as

A multivariate extension of Spearman’s rho given in Nelsen [

32] takes the form

Compared to vine copulas that rely on pair copulas and complex tree structures, one of the advantages of our copula estimator is that it is straightforward to obtain an estimate of multivariate Spearman’s rho as

where

B is the beta function.

It can be shown that the multivariate Spearman’s rho is bounded by

where the lower bound approaches to zero as dimension increases. Since our copula estimator is a genuine copula, the estimate of multivariate d-dimensional Spearman’s rho

can avoid taking values out of the parameter space, which might be an issue for estimates built on other nonparametric copula estimators, e.g., the empirical copula (see Pérez and Prieto-Alaiz [

33]).

Similar to Spearman’s rho, Kendall’s tau is another common dependence measure and has its multivariate version as well, which is given by Nelsen [

32] as

By applying (

4) and (

5), it is also easy to obtain an estimate of multivariate Kendall’s tau based on our copula estimator as

Thus, using our proposed ECBC copula, not only are we able to obtain a fully nonparametric estimate of any copula function in closed form (once the tuning parameters are estimated by their posterior modes), but we are also able to derive the closed-form expression of estimates of the popular multivariate measures of dependence for any arbitrary dimension .

Moreover, although we only illustrate the use of multivariate extensions of Kendall’s tau and Spearman’s rho as possible measures of multivariate dependence, any other multivariate notion of dependence measures that are suitable functionals of the underlying copula can also be computed using our closed-form expression of the ECBC estimator. This is particularly advantageous compared to even some of the flexible yet complicated parametric copula family (e.g., Archimedian, multivariate Gaussian, t, etc.) for which it may require high-dimensional numerical integration to compute multivariate versions of Spearman’s rho as given in (

8) and/or Kendall’s tau given in (

10). For vine copulas, it is particularly challenging to obtain estimates of these multivariate measures of dependence as such high-dimensional integrals are often algebraically and even numerically intractable, say for dimension

, whereas for ECBC, even when a new measure of dependence is created as a functional of the copula that may be more complicated than those defined in Equations (

8) and (

10), we can easily obtain a large number of Monte Carlo (MC) samples from the ECBC and use MC-based approximation to estimate such new measures of multivariate dependence (we illustrate such a case in our real case study involving portfolio risk optimization in

Section 4).

4. Application to Portfolio Risk Management

Copulas have been widely used in portfolio optimization and risk measurement as they are powerful tools to model the dependence among different assets in a portfolio. The proposed ECBC is capable of estimating multivariate copula and it is straightforward to sample from the estimated copula, so it can be applied to find optimal weights and estimate risk measures for a portfolio with a variety of assets.

We now illustrate the use of ECBC for portfolio risk allocation using real data consisting of a

d asset values. Value at risk (VaR) and conditional value at risk (CVaR) (also called expected shortfall (ES)) are common measures of risk in the field of risk management (see, e.g., Jorion [

35] and Uryasev [

36]). Assume that

X is the return of a portfolio or asset (daily log-return of a portfolio of stocks or individual stocks, with positive indicating profit and negative values representing loss) with distribution function

. The VaR of

X at the level of

is defined as

while the CVaR (ES) of

X is defined as

Notice that, if we consider the corresponding loss of the same portfolio represented by , then we have and .

Mean-CVaR portfolio optimization is a popular portfolio optimization technique introduced by Rockafellar et al. [

37]. The advantage of mean-CVaR portfolio optimization is that it calculates VaR and minimizes CVaR simultaneously, where the optimization can be formulated as a linear programming problem.

Let

denote a realized return value of

d assets in a portfolio, and

denote the portfolio weights to be determined within the d-dimensional simplex

. The key to the approach in Rockafellar et al. [

37] is the auxiliary function for CVaR taking the form of

where

is a linear loss function and

is the joint distribution function of daily (random) return vector

, which we will estimate using our proposed ECBC-based empirical Bayes method. It was shown in Theorem 1 of Rockafellar et al. [

37] that for any weights

,

is convex as a function of

and is equal to

at the minimum point. Moreover,

would be the left endpoint of

. Moreover, minimizing

with respect to

is equivalent to minimizing

with respect to

(e.g., see Theorem 2 of Rockafellar et al. [

37] for details). To numerically approximate the integral in (

15), it is often good enough to generate

M samples from

or its estimate, which can be performed by using the proposed empirical Bayes method based on the ECBC. However, a relatively less-answered question in finance is how large we should choose

M for accurate estimation, as the integral in (

15) depends on sampling the tail part of

or its estimate. The empirical estimate of

based on generating

or

can be written as

where

.

Proposition 1. In order to achieve an accuracy of for the MC approximation, it is sufficient to generate M MC samples such thatwhere and is the largest eigenvalue of Σ. Proof. By the law of the iterated logarithm (see, e.g., Balsubramani [

38]), the deviation of MC approximation from the mean is almost surely bounded by

Let

and

be the largest eigenvalue of

, then we have

for any

, because

. Thus, for an accuracy of

for the MC approximation, it is sufficient to generate

M MC samples such that

□

Notice that

, and hence

, can be easily estimated from the observed return values without any modeling assumption as long as

; however, sparse methods are necessary for large-sized portfolios when

. Next, it is shown that minimizing (

16) is equivalent to minimizing

Thus, along with the linear constraints on the weights

, it can be formulated as a linear programming problem and can be solved using standard convex optimization methods. Conveniently,

function

within the package

can be used for this purpose. Following the algorithm in Semenov and Smagulov [

39], simulated return values can be obtained using estimated ECBC for portfolio optimization. The complete algorithm is summarized below:

Step 1. Transform assets’ historical data

to pseudo-observations

and estimate copula using our proposed method.

Step 2. Generate a sample of pseudo-observations

from the estimated ECBC using empirical Bayes method and transform simulated pseudo-observations to univariate quantiles.

Step 3. Calculate optimal weights

using simulated data

,

, and the corresponding VaR and CVaR, which are byproducts of the portfolio optimization, by solving the linear programming problem given in (

18).

Our copula estimator is useful to find optimal weights and estimate risk measures as sampling from the estimated copula is straightforward. Considering the Bernstein copula density given in (

4) and (

5), we can obtain samples

as follows:

As an example with moderately large dimension, we investigate the time series of daily closing stock prices of the 10 top Nasdaq companies: AMZN, FB, GOOGL, AAPL, MSFT, INTC, CSCO, NFLX, CMCSA, and ADBE for the time period from 1 January 2018 to 31 December 2019. This dataset consists of 502 observations and can be obtained using package .

Suppose we want to find an optimal portfolio of stocks above that minimizes the expected shortfall of the portfolio. First, we convert the price series

to log-returns

resulting in

log-return values for

assets. Then we follow Steps 1–3 as above to obtain the optimal portfolio weights and the corresponding VaR and CVaR. Similar to Semenov and Smagulov [

39], we set the minimum weight to be limited by

to avoid corner portfolio cases.

In Step 1, the posterior mode estimators of the degrees of the proposed ECBC are

. The largest eigenvalue of the covariance matrix is

, so we are able to find the value of

M that is sufficient for a given accuracy

from the relationship in (

17).

We set

(adequate for an accuracy

) and repeat Steps 2–3

times to quantify estimation uncertainty. For each replicate we conduct portfolio optimization at the level of

as popularly used. As a result, we are able to obtain the distribution of optimal weights (

Figure 5) and risk measures (

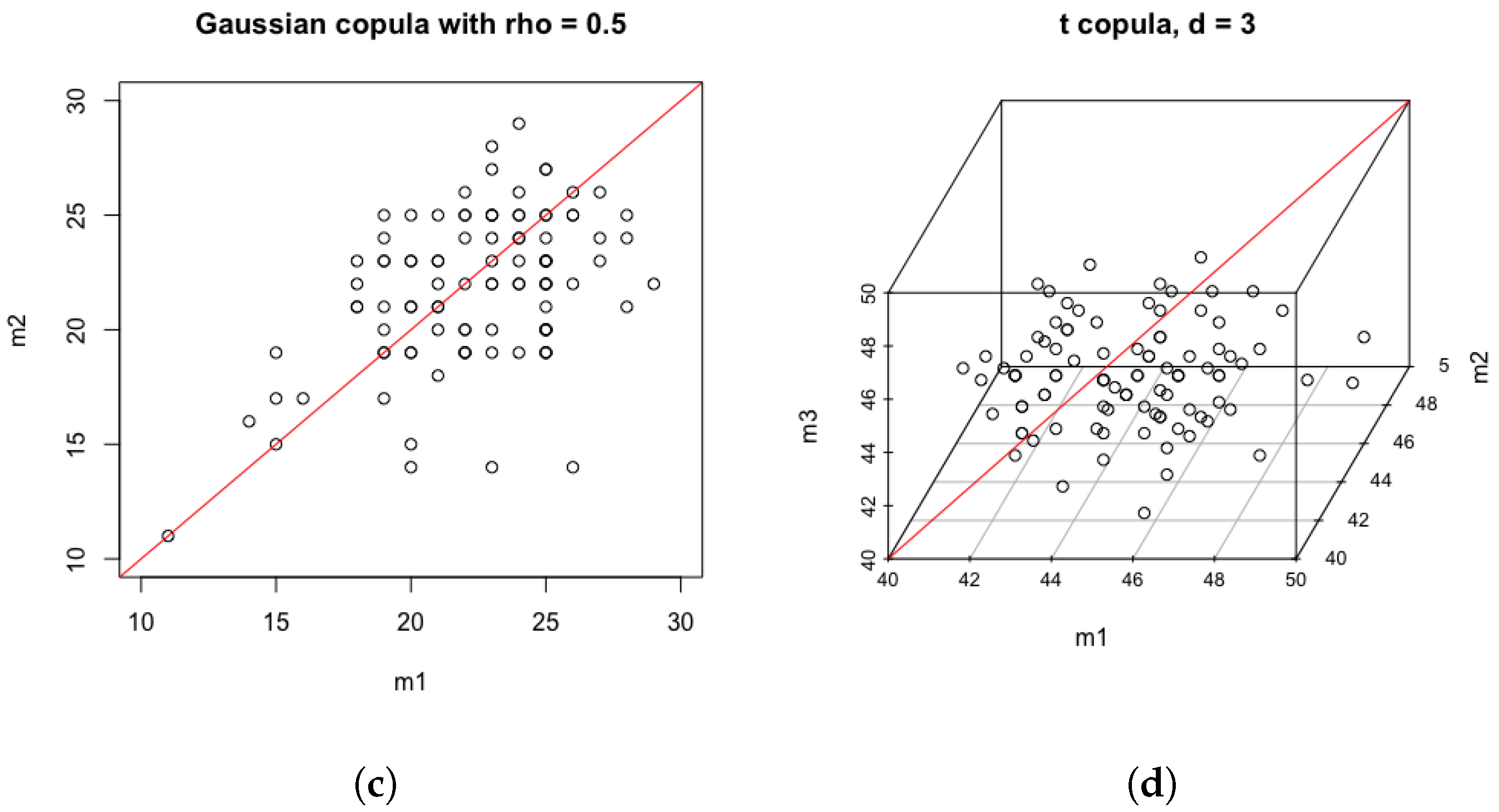

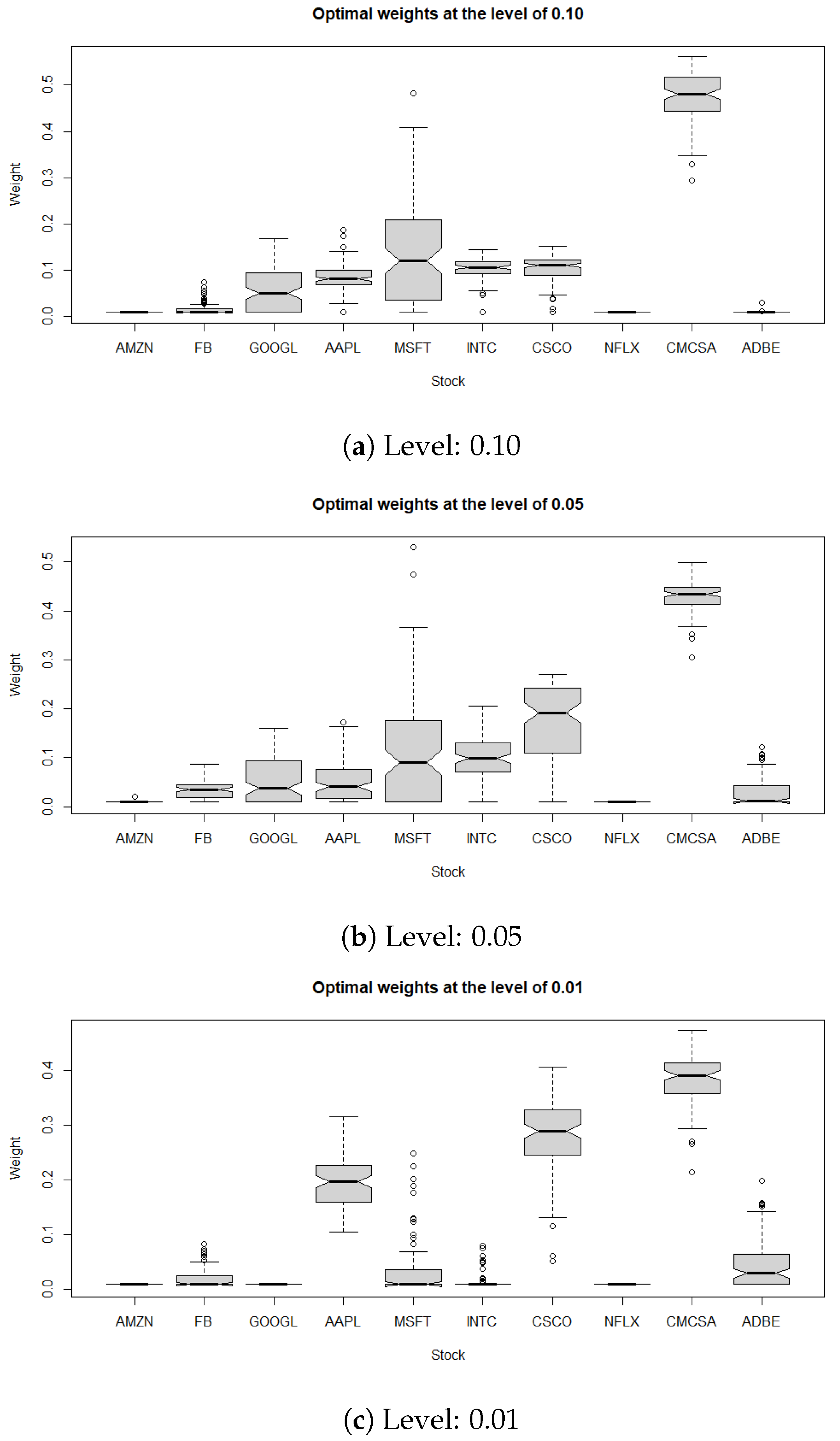

Figure 6) using simulated data from the estimated copula.

From the boxplots of optimal weights in

Figure 5 we can see that CMCSA has a much higher weight than the other stocks in the mean-CVaR optimal portfolio across different levels. Also, by applying mean-CVaR portfolio optimization to the historical log-return data

, we can obtain estimates of optimal weights and risk measures as well. In

Figure 6, the dashed lines indicate empirical estimates of risk measures using historical data.

We can see from the plots in

Figure 6 that the estimated risk measures from two different methods seem to be fairly close. However, we are able to quantify the uncertainty for all the estimates by repeatedly sampling from the estimated copula. Semenov and Smagulov [

39] conducted a similar stability study to report the means and SDs of VaR and CVaR, but they used predetermined weights based on historical data and did not report the distribution of optimal weights obtained from simulated data. Our copula estimator shows good performance for relatively small samples, and operationally, we can generate as many samples as we want from the estimated copula; thus, the copula-based method would be more reliable when there are not sufficient historical data. In addition, compared to the empirical estimates, it is possible to estimate VaR and CVaR for much smaller values of levels using the copula-based method.