1. Introduction

Unexpected changes in market demand are becoming more common than ever before with the deepening of economic integration and globalization [

1]. The markets for different products are often changed by some unexpected events, such as machine breakdown, financial crisis, raw material shortage, new tax or tariff policy, earthquake, terrorism, epidemic, labor strikes, and so on [

2]. Unexpected incidents may lead to changes in the market demand for products and then affect the sales plan and original production [

3]. Moreover, the demand uncertainty may have a significant impact on the performance of the dual-channel supply chain system of a and the dual-channel supply chain cannot be coordinated any more [

3,

4]. Thus, it is becoming increasingly important to handle the demand uncertainty in an effective way in order to ensure the success of dual-channel supply chain management [

5].

The existing research on the coordination of the dual-channel supply chain has mainly focused on designing contracts under uncertain demand. The uncertain demand for products in existing research is mainly characterized by a random variable or fuzzy set [

6,

7,

8]. However, when adopting a random variable for uncertain demand, its probability distribution is assumed to be known. In fact, the amounts of information available for uncertain demand are often insufficient to accurately define a probability distribution, and even a small deviation from the real probability distribution may also result in large errors in reliability analysis [

9]. For another case in which the uncertain demand for a product is depicted by a fuzzy set, the corresponding membership function has to be considered known. In practice, it is a challenge to specify an appropriate membership function, since it is always decided depending on limited sample information. Thus, the uncertain demand for a product characterized by a random variable or fuzzy set may cause large errors in practical applications [

10].

In contrast to many traditional studies on the design of a dual-channel supply chain coordination scheme under an uncertain environment [

11], this paper characterizes the uncertain demand for products as an interval and only knows the bounds of uncertain demand. To our knowledge, this paper considers such a case for the first time. Compared to an accurate probability distribution or a membership function adopted by the most existing studies, it is very easy to obtain knowledge of bounds of uncertain demand in practice, which only needs to exploit some simple information in an uncertain environment. We would like to point out that the uncertainty characterized by an interval is becoming popular and has been applied in various fields. An example of the need for spacing was the SARS outbreak, which led to a sudden surge in demand for respirators and sterilizers. Similarly, mad cow disease has had a significant impact on beef demand. However, few researchers have examined the coordination of a competitive dual-channel supply chain under interval demand, which motivates the investigation of the following primary research questions: How do the bounds of interval demand affect the prices and profits of partners, and the performances of the whole dual-channel supply chain in a competitive situation? What could be the optimal contract parameters of a revenue sharing to coordinate the competitive dual-channel supply chain under interval demand?

This paper considers a dual-channel supply chain consisting of a manufacturer and a retailer. Moreover, the retailer only knows the information of bounds of uncertain demand. The manufacturer distributes its products through an online direct channel and a traditional retail channel. Because customers may have different perceptions of the product, the two channels sell the same product at different prices. The particular purposes of this paper are to explore the impacts of interval uncertainty on the performances of partners and the supply chain system and analyze the effects of interval uncertainty on the coordination of the dual-channel supply chain with a revenue sharing between the manufacturer and retailer. More importantly, two effective methods, i.e., the satisfaction degree of interval and the order relation of interval number, are proposed to deal with uncertain structures of the dual-channel supply chain under interval demand in this paper. In detail, we adopt the satisfaction degree of interval to compare the constraint interval caused by the uncertainty with an allowable value and then transform uncertain constraints into deterministic ones using a satisfaction degree level. Meanwhile, by adjusting the corresponding satisfaction degree level, the feasible field of design vector can be changed [

12]. Moreover, we use the order relation of interval number to convert an uncertain single-objective problem into a deterministic two-objective problem [

13]. Then, the two-objective problem is further integrated into a deterministic single-objective problem by using a linear combination method.

The contributions of this paper mainly include three aspects. First, we model the optimal strategies of partners in a competitive dual-channel supply chain under interval demand. Second, we propose the satisfaction degree of interval and the order relation of interval number to analyze the performances of partners and the dual-channel supply chain system facing interval uncertainty. Third, an improved revenue sharing contract is proposed to coordinate the dual-channel supply chain under interval demand. Furthermore, we also make some interesting observations in this paper. First, facing interval demand and channel competition, the optimal price strategies of partners are examined in a centralized decision system and a wholesale price contract model, respectively. Meanwhile, the optimal price strategies are illustrated to be closely related with the bounds of uncertain demand. Second, we find that the optimal online selling prices for a manufacturer in a centralized decision system and a wholesale price contract model are equivalent; the optimal retail price for a retailer in a centralized decision system is equal to the optimal wholesale price for a manufacturer in a wholesale price contract model. Finally, a revenue sharing contract is illustrated to coordinate the competitive dual-channel supply chain under interval demand.

The following sequence of events is adopted in this paper. First, the partners make the quantity and pricing decisions in a centralized decision system under interval demand. Then, the competitive dual-channel supply chain under interval demand is no longer coordinated by the wholesale price contract. The pricing and production plan is adjusted by the partners to respond to the uncertain demand. Finally, a revenue sharing contract is presented by the partners to coordinate the competitive dual-channel supply chain under interval demand. We organized the rest of this paper as follows. Some closely related literature is reviewed in

Section 2.

Section 3 gives the assumption and problem formation.

Section 4 analyzes a competitive dual-channel supply chain in a centralized decision system and a wholesale price contract model under interval demand. In

Section 5, we illustrate that a revenue sharing contract coordinates the dual-channel supply chain facing interval demand and channel competition. Numerical analyses are provided in

Section 6. Finally,

Section 7 concludes this paper.

2. Literature Review

This paper mainly investigates the optimal strategies of partners in a dual-channel supply chain under interval demand and provides a revenue sharing contract to coordinate the dual-channel supply chain. Thus, there are two groups of literature related to our work. The first group mainly studies the operational decisions of a dual-channel supply chain under an uncertain environment. The second group primarily pays close attention to the coordination of a dual-channel supply chain with uncertainty.

The first group of literature explores the management problems of a dual-channel supply chain under uncertain demand. Over the past few decades, an increasing number of studies have analyzed the operational strategies of supply chains. At first, [

14,

15] pointed out the important economic reasons for different channels serving different customer segments. Subsequently, [

16] found that the dual channels not only help companies to extend their market coverage but also increase the awareness of customers and their product loyalty. [

17] summarized the correlation analysis models of the dual-channel supply chain. [

18] considered the competition between a traditional retail channel and an online channel, in which a game theory model was used to analyze the optimal price strategy. Then, [

19] examined the price decision-making problem in a dual-channel supply chain by considering the delivery lead time. [

20] developed a new inventory control strategy in a two-echelon dual-channel supply chain and set up the production and delivery. [

21] investigated production and pricing strategies in a centralized and decentralized dual-channel supply chain system, respectively. [

22] analyzed the impacts of dual-channel adoption on the performances of a two-echelon supply chain. Recently, [

23] analyzed a stochastic dual-channel supply chain under the low carbon preferences of consumers and cap-and-trade regulation. [

24] explored the network equilibrium decision of a dual-channel environmental hotel supply chain under altruism preference and demand uncertainty. [

25] used a distribution-free approach to examine the order fulfillment, ordering, and joint pricing decisions for a dual-channel supply chain under demand uncertainties. [

26] analyzed the influence of manufacturers’ or retailers’ risk aversion preference on their late payment decisions and effectiveness when adopting dual-channel structure. [

27] provided an adaptive robust optimization model for a two-channel closed-loop supply chain that considers cost and demand uncertainties. [

28] developed a novel distributionally robust optimization modeling framework for the capital-constrained dual-channel supply chain. Other related literature can be found in [

8,

19,

29].

In most of the existing literature mentioned above, the uncertain demand for a product is mainly characterized by a random variable or fuzzy set. However, to the best of our knowledge, scant literature has focused on the optimal strategies of a dual-channel supply chain under interval demand; that is to say, the uncertain demand is described as an interval. In practice, it is easy to obtain the knowledge of bounds of uncertain demand, and this only needs to exploit some simple information in an uncertain environment. Thus, this paper analyzes the optimal strategies of a dual-channel supply chain when the demand of both traditional retail and online direct sale channels is characterized as an interval.

The second group of literature focuses on the coordination of a dual-channel supply chain. It is noted that an effective coordination mechanism can not only improve the competitiveness of a dual-channel supply chain but can also achieve a Pareto improvement in profits. Hence, in recent decades, some contract mechanisms have been proposed to coordinate a dual-channel supply chain [

30]. Under some conditions, [

31] determined that a wholesale quantity discount policy can coordinate a supply chain, so that the maximum potential profit is realized. [

32] investigated a revenue sharing contract in a general model, where the revenue is determined by the quantity and price that each retailer pays. [

33] considered a competitive inventory and coordination mechanism in a dual-channel distribution system. [

34] analyzed the impacts of channel structure and channel coordination on the performances of a dual-channel supply chain system. In recent years, [

35] investigated a linear quantity discount contract to coordinate a supply chain and offered some managerial insights. [

36] applied a revenue sharing contract to coordinate a decentralized supply chain. [

37] used a price discount contract to coordinate a supply chain with a carbon emission capacity regulation. [

38] examined the pricing and coordination strategies of a dual-channel supply chain when considering the green quality and sales effort. [

39] analyzed the pricing strategy and channel coordination in a two-echelon supply chain under stochastic demand. [

40] analyzed the coordination mechanism of a dual-channel supply chain with conditional value-at-risk under demand uncertainty. [

41] studied the selection and coordination of recycling channels in a closed-loop supply chain with dual sales channels. [

42] analyzed the competition and coordination in a dual-channel green supply chain with an eco-label policy. More related literature can be found in [

43,

44,

45,

46,

47]. None of these studies considered the coordination of a dual-channel supply chain under interval uncertainty. This paper discusses not only the pricing strategies but also the coordination in a dual-channel supply chain under interval demand.

This paper contributes to the literature in several ways. First, the uncertain demand in the literature is always assumed to be stochastic or fuzzy, which requires an accurate probability distribution or appropriate membership function. Compared to the existing literature, this paper only needs to know the knowledge of bounds of uncertain demand for products. In fact, the bounds of uncertain demand are easily obtained by using limited information in an uncertain environment. Second, when the market demands of the retail and direct sale are described as intervals, this paper analyzes the optimal pricing decisions in a centralized and decentralized dual-channel supply chain and discusses the impacts of interval demand on the performances of partners and the whole system. Third, this paper proposes the satisfaction degree of interval and the order relation of interval number to investigate the interval optimization problem and shows that the revenue sharing contract can coordinate the dual-channel supply chain under interval demand.

In the end, to illustrate the actual novelty of this study in brief, we present

Table 1 to show the related publications from the updated literature study.

3. Problem Formation

We considered a competitive dual-channel supply chain system that consists of a manufacturer and a retailer under interval demand, where the manufacturer is a leader and the retailer is a follower. The manufacturer distributes its products through both a traditional retail channel and an online channel. Moreover, the manufacturer and retailer are denoted by and in the subscript, respectively. In this context, for a manufacturer, is for the unit production cost, is for the unit wholesale price, and is for the unit selling price of the online channel. It is noted that the constraint is required; otherwise, the retailer may choose an online channel to gain products. Let and be the market demand and ordering quantity in an online channel. For a retailer, denote by the selling price of a traditional channel, in which ; otherwise, the retailer cannot obtain any profit. The market demand and ordering quantity in a traditional retail channel are denoted by and , respectively.

We considered that the market demand is negatively correlated with the price of its own channel and is positively correlated with the price of other channel. Thus, the market demands for products faced by the manufacturer and retailer under an interval uncertain environment are given by

and

where

is uncertain and represents the potential market size, in which

where the superscript

denotes an interval, the superscript

indicates the lower bound of interval, and the superscript

implies the upper bound of interval. Particularly, if

, the interval is degenerated into a real number. The parameters

and

indicate the market shares of the online channel (manufacturer) and traditional retail channel (retailer), respectively.

and

denote the price sensitivity and cross-price sensitivity, respectively. Generally speaking, this means that

, which demonstrates that the sensitivity of demand to its own price is higher than that to the cross-price. Moreover, we first introduce Assumption 1 before providing the main results.

Assumption 1. - (a)

; ; .

- (b)

, where .

- (c)

, where .

Assumption 1(a) implies that the participating channels are profitable. Assumptions 1(b) and 1(c) show the market demands for products in an online channel and a retailer channel, respectively. Based on the above analysis, the profit of the retailer under interval demand is given by

The profit of the manufacturer under interval demand is defined as

Hence, we obtain the profit of the whole dual-channel supply chain system under interval demand, which is given by

4. Dual-Channel Supply Chain under Interval Demand

This section first investigates the optimal price strategies for the manufacturer and retailer in a centralized dual-channel supply chain and then analyzes the competitive dual-channel supply chain with a wholesale price contract under interval demand.

4.1. A Centralized Dual-Channel Supply Chain

The manufacturer and retailer are regarded as a whole integration in the centralized decision system, aiming at maximizing the total profit of the dual-channel supply chain system. Then, we explore the optimal pricing decisions of the retail channel and online channel. The centralized decision problem under interval demand is given by

The market size is an interval so that Problem (3) is called an interval programming problem. In a similar analysis of a stochastic or fuzzy program, the interval programming Problem (3) needs to be transformed into a deterministic one. For this purpose, we propose the satisfaction degree of interval and the order relation of interval number to deal with the interval programming Problem (3).

Using the satisfaction degree of interval [

12], the interval uncertain constraints of Problem (3) are reformulated into deterministic inequality constraints, which are given by

where

are predetermined possibility degree levels. It is noted that

and

can be adjusted to control the feasible field. When

and

are larger, the inequality constraints are more strictly restricted, and thus the feasible fields become smaller. Furthermore, we have

and

Consequently, based on the order relation of interval number [

10], the interval uncertain objective function of Problem (3) is converted into a deterministic multi-objective function, which is given by

where

and

for any

and

are separately defined as

and

Then, using a linear combination method [

13], the deterministic multi-objective function is integrated into a deterministic single-objective function, which is defined as

where

is a multi-objective evaluation function, and

is a weighting factor of two objective functions. Hence, based on the satisfaction degree of interval and the order relation of interval number, the centralized decision Problem (3) under interval demand is transformed into a deterministic optimization problem, which is given by

Proposition 1. For a centralized dual-channel supply chain under interval demand, if

, and , then there exist the optimal price strategies .

Proof. Since Problem (4) is a strict concave function, from the KKT condition, we have

and

Combining Equations (5) and (6), we obtain the optimal prices

and

immediately, which are given by

and

Furthermore, we deduce the optimal ordering quantities in the centralized decision system, i.e.,

Consequently, we obtain the optimal profit of a centralized dual-channel supply chain system under interval demand, which is defined as

□

Proposition 1 shows that, for a centralized dual-channel supply chain system under interval demand, the optimal strategies of the retailer and manufacturer not only depend on the market share of the online channel, price sensitivity, cross-price sensitivity, and unit production cost, but also rely on the upper and lower bounds of market size. Thus, the size of an interval plays a vital role in the optimal pricing decisions.

4.2. The Wholesale Price Contract Model

In the wholesale price contract model, the manufacturer first decides the wholesale price

and online selling price

. Then, the retailer decides the retail price

. For the wholesale price contract model under interval demand, the profit-maximizing problem of the manufacturer is

The profit-maximizing problem of the retailer is

Then, using the satisfaction degree of interval and the order relation of interval number [

13], we convert the interval programming Problem (7) for the manufacturer into a deterministic optimization problem, which is given by

Similarly, the interval programming Problem (8) for the retailer is also transformed into a deterministic optimization problem, which is defined as

Proposition 2. For the dual-channel supply chain with a wholesale price contract under interval demand, if

, , , and , then there exist the optimal price strategies .

Proof. According to the backward induction, we first focus on the retailer profit function πr, which is a strict concave function, and then applying the KKT condition, we have

Substituting

into function

, and using the KKT condition, we have

and

Immediately, we obtain the optimal price decisions

,

and

, which are given by

Furthermore, the optimal ordering quantities in the wholesale price contract model are also obtained and are given by

Consequently, the optimal profit of the retailer under interval demand is

The optimal profit of the manufacturer under interval demand is

The total profit of a dual-channel supply chain under interval demand is

□

Proposition 2 illustrates that the bounds of market size play significant roles in the optimal price strategies. Moreover, by comparing the optimal prices and profits in the centralized decision system and the wholesale price contract model, respectively, we gain another important result.

Proposition 3. In a dual-channel supply chain under interval demand,

, and .

Proof. It is easy to determine from Propositions 1 and 2 that

Then, we have

□

Proposition 3 demonstrates that, under interval demand, the manufacturer’s optimal online selling price in a wholesale price contract model is the same as that in a centralized decision system; the manufacturer’s optimal wholesale price in a wholesale price contract model is equal to the retailer’s optimal price in a centralized decision system. In addition, the total profit in a wholesale price contract model is strictly less than that in a centralized decision system. Hence, under interval demand, designing a contract to coordinate the competitive dual-channel supply chain becomes a challenging task in this paper.

5. Coordination Mechanism under Interval Demand

As discussed previously, it can be easily inferred that the wholesale price contract fails to coordinate a competitive dual-channel supply chain under interval demand. A coordination mechanism means that partners make the optimal decisions for the whole supply chain system, so that the total profit of a supply chain is equal to that of a centralized decision system as far as possible. The common contracts mainly include the revenue sharing contract, the price discount contract, the quantity discount contract, and so on [

30]. In this paper, a revenue sharing contract is proposed to realize the coordination of a dual-channel supply chain under interval demand. The revenue sharing contract is a way of coordination, in which the partners in a dual-channel supply chain distribute the sales revenue reasonably, share the market risk, and enhance the performance of the dual-channel supply chain at the end of sales cycle. The revenue sharing contract contains parameters

,

and

, among which

is the wholesale price for per-unit product paid by the retailer,

is the proportion of sales revenue from the retail channel achieved by the manufacturer, and

is the proportion of sales revenue from the online channel obtained by the retailer. Thus, the profit-maximizing problem of the manufacturer with a revenue sharing contract is given by

The profit-maximizing problem of the retailer with a revenue sharing contract is defined as

Furthermore, using the satisfaction degree of interval and the order relation of interval number [

10], we transform the manufacturer’s optimal decision Problem (9) under interval demand into a deterministic one, which is given by

The retailer’s optimal decision Problem (10) is also converted into a deterministic one, which is defined as

Based on the backward induction, the first-order optimal condition on the retail price is obtained as

In a revenue sharing contract model, in order to achieve the performance in a centralized decision system, the optimal prices in a revenue sharing contract model should be equal to the counterparts in a centralized decision system; that is,

and

. Consequently, in this case, Equation (11) satisfies

Then, we obtain the optimal wholesale price in the revenue sharing contract model immediately, which is given by

Let

,

and

, and Equation (11) is rewritten as

Substituting Equation (12) into function

and applying the first-order optimal condition on the online selling price

, then an important equation is obtained, i.e.,

Thus, the optimal decisions

in the revenue sharing contract satisfy Equation (13). Moreover, we know from Equation (13) that

Consequently, when the decision-making environment remains unchanged, i.e., other exogenous parameters remain unchanged, there is a direct correspondence between

and

; thus, a reasonable distribution of the total profit of a dual-channel supply chain system between the manufacturer and retailer is achieved by changing the value of

or

. Based on the above analysis, the profit of the retailer with a revenue sharing contract is

The profit of the manufacturer with a revenue sharing contract is

The total profit of a competitive dual-channel supply chain system with a revenue sharing contract is

Proposition 4. For the dual-channel supply chain system with a revenue sharing contract under interval demand, if

, , , and , then the optimal decisions are .

Proposition 4 shows that the proposed revenue sharing contract is related to not only the unit production cost, the market share of the online channel, the price sensitivity, and the cross-price sensitivity, but also the upper and lower bounds of interval demand. Thus, the bounds of uncertain demand play significant roles in the establishment of a revenue sharing contract proposed by this paper. In addition, to realize the coordination under a revenue sharing contract, the profits of both the manufacturer and retailer should be Pareto improvements. In other words, the profits of the partners must be higher than those in a wholesale price contract model. For this purpose, we have

Proposition 5. Under interval demand, the parameters of a revenue sharing contract satisfyand To enable the partners to experience a win–win situation, Proposition 5 presents the conditions that parameters of a revenue sharing contract have to satisfy. In an interval uncertain environment, the parameters of a revenue sharing contract are affected by the bounds of interval demand. Additionally, these parameters have also direct impacts on the optimal whole price . Moreover, it is easy to verify from Proposition 5 that the values of depend on the bargaining power of the partners. Consequently, the coordination mechanism under interval demand is realized by adjusting parameters .

6. Numerical Analysis

Some numerical examples are presented to illustrate the theoretical results obtained in the previous sections. Especially, we are interested in the impacts of a revenue sharing contract on the price decisions and profits of the partners. Then, the sensitivity analyses of a few important parameters are also illustrated by some numerical examples. Without loss of generality, we considered and analyzed the following example with parameters. Some basic parameters were defined as: the price sensitivity

, the cross-price sensitivity

, the lower bound of market size

, the upper bound of market size

, the market share of the online channel

, the unit production cost

, and the multi-objective weight coefficient

. Thus, according to Propositions 1 and 2, in a centralized decision system, the optimal price strategies were calculated as

and

; the optimal ordering quantities were

,

,

and

; the optimal profit of the supply chain system was

. In a wholesale price contract model, the optimal price strategies were

and

; the optimal wholesale price for the manufacturer was

; the optimal ordering quantities were

,

,

and

; the optimal profits of the partners were

and

. These results are summarized in

Table 2.

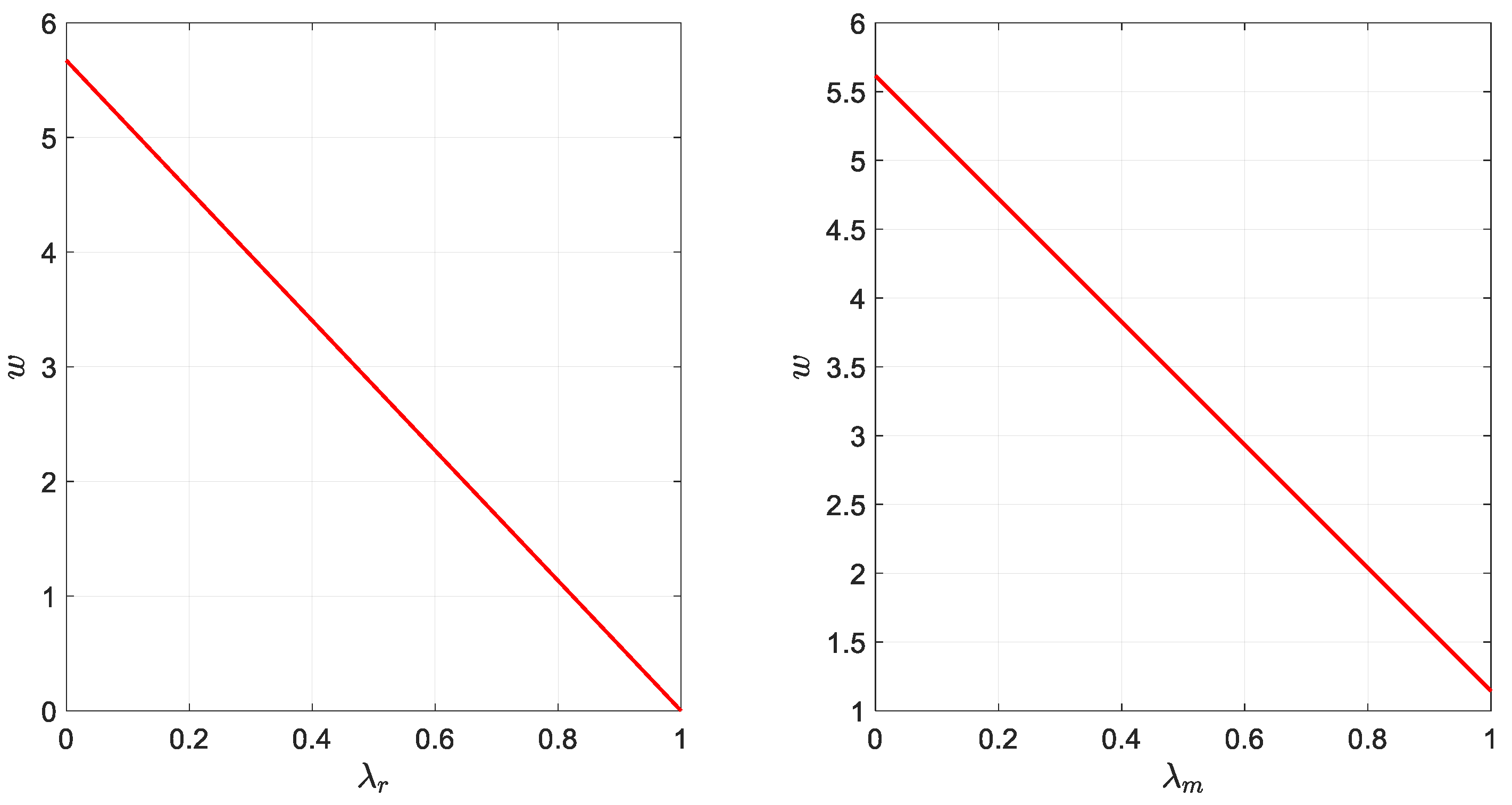

6.1. Discussion of a Revenue Sharing Contract

In this subsection, we first pay attention to the revenue sharing ratios

and

contained in the revenue sharing contract and discuss the impacts of parameters

and

on the wholesale price

. These results are shown in

Figure 1.

Figure 1 illustrates that the wholesale price

was negatively correlated with the revenue sharing ratios

and

. In other words, the wholesale price

decreased as the revenue sharing ratios

and

increased. It was concluded that the manufacturer can adjust the revenue sharing ratios of both retail channel and online channel by changing the wholesale price. For example, if the manufacturer chooses to increase the wholesale price, it will lead to a decrease in the revenue sharing ratio of the retail channel, which further reduces the retailer’s revenue sharing ratio of the online channel, and vice versa. Similarly, the optimal wholesale price of the manufacturer is also affected by changing the revenue sharing ratios. For instance, if the manufacturer and retailer increase the revenue sharing ratios of the dual-channel system, it will bring a reduction in the manufacturer’s optimal wholesale price, and vice versa.

Moreover, we focused on the impacts of revenue sharing ratios

and

on the performances of the manufacturer, retailer, and supply chain system in a revenue sharing contract model.

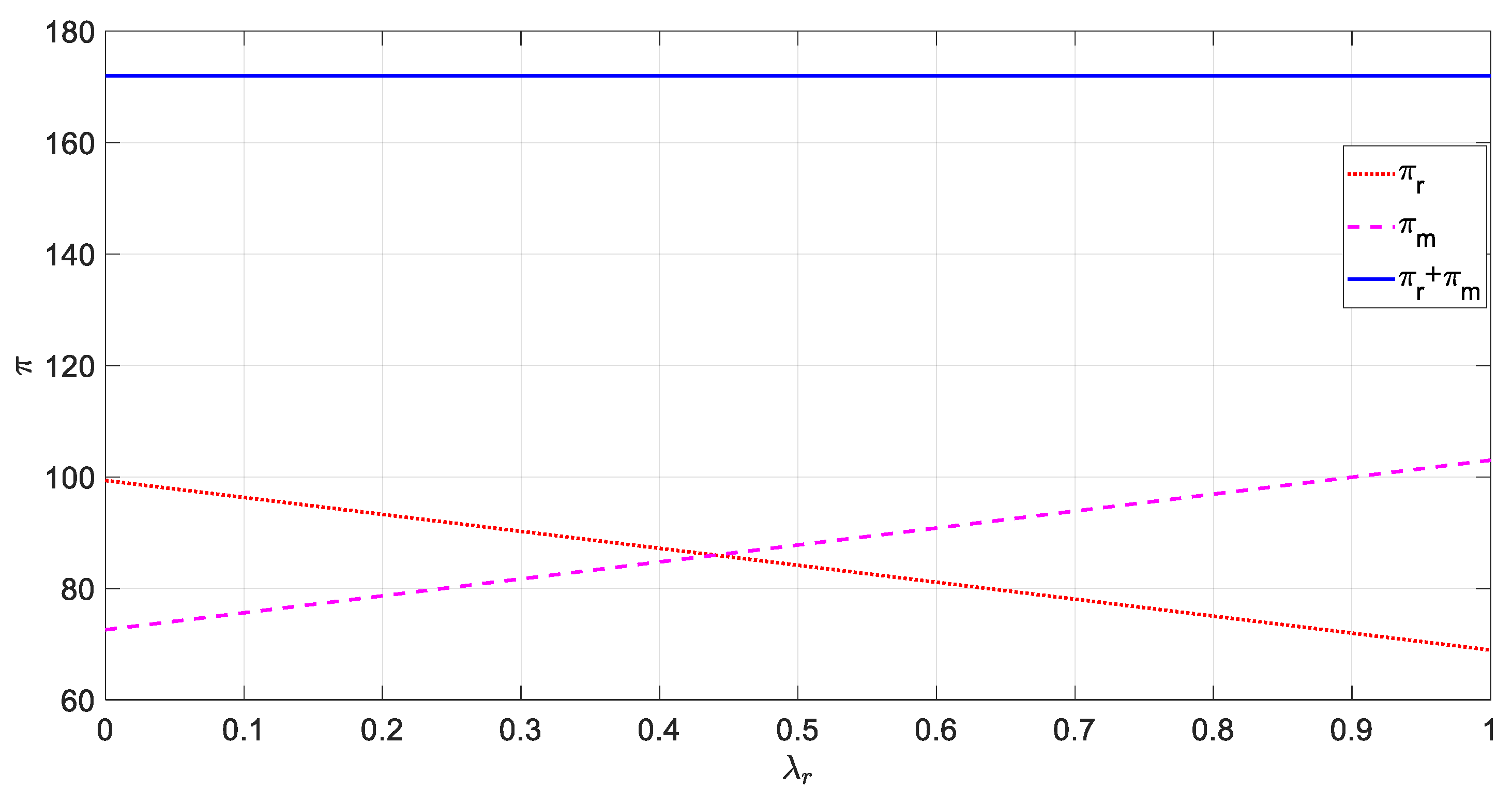

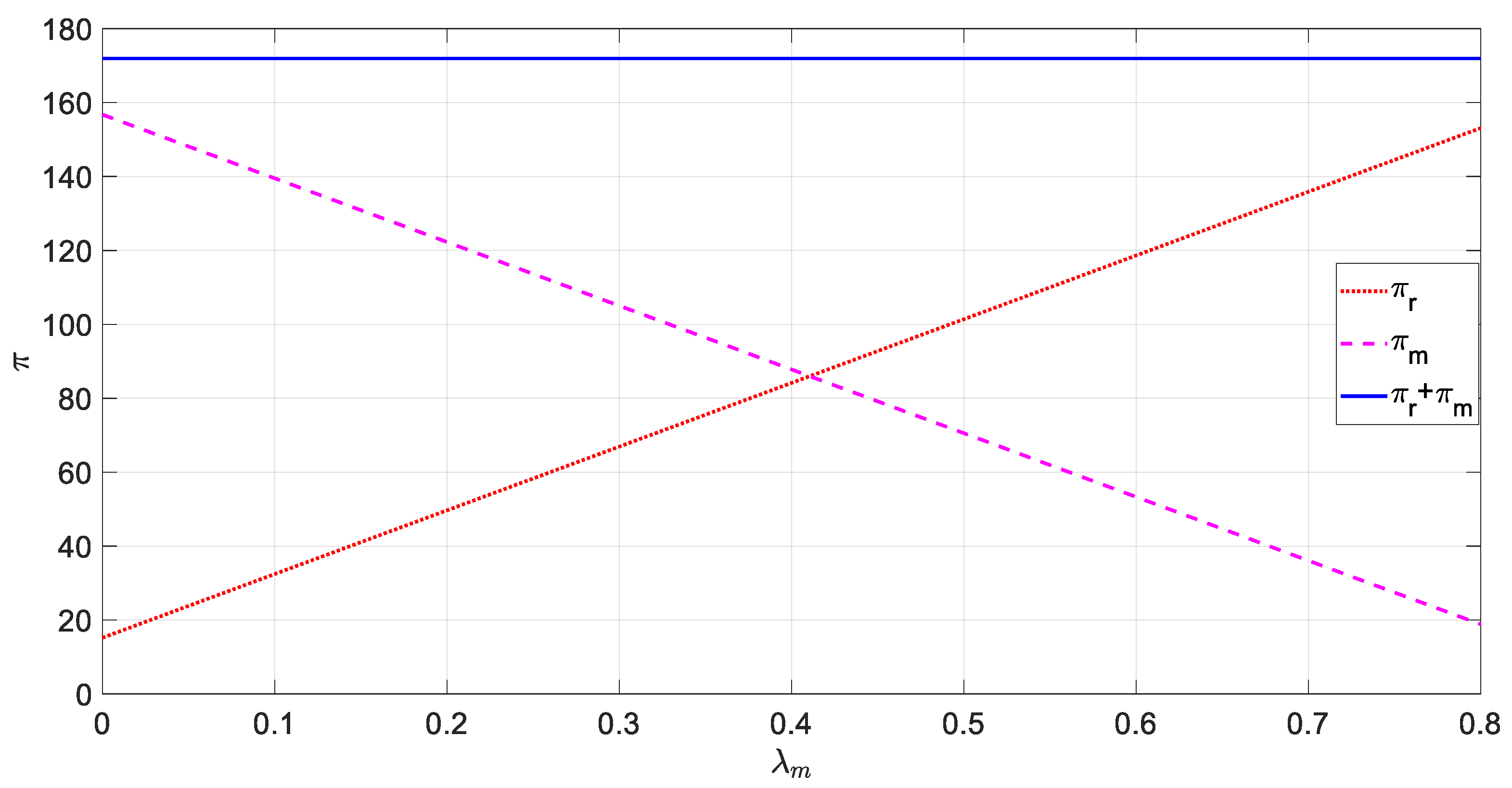

Figure 2 and

Figure 3 provide these results.

It is easy to see from

Figure 2 and

Figure 3 that the total profit of the supply chain system in a revenue sharing contract model reaches that of a centralized decision system. This result demonstrated that the proposed revenue sharing contract in this paper not only coordinated the dual-channel supply chain under interval demand, but also realized the maximum profit of the supply chain system. In addition, in

Figure 2, we observed that the profit of the retailer decreased with the increase in the revenue sharing ratio

of the retail channel, but the profit of the manufacturer increased with the change in

in a revenue sharing contract model. Namely, the revenue sharing ratio

was negatively correlated with the profit of the retailer and positively correlated with the profit of the manufacturer. In the meantime, it is also seen from

Figure 3 that the profit of the manufacturer decreased with the change in revenue sharing ratio

of the online channel, but the profit of the retailer increased as

changed. That is to say, the revenue sharing ratios

and

had different impacts on the profits of the manufacturer and retailer. Thus, under interval uncertainty,

Figure 2 and

Figure 3 imply that the proposed revenue sharing contract can reasonably distribute the total profit between the manufacturer and retailer.

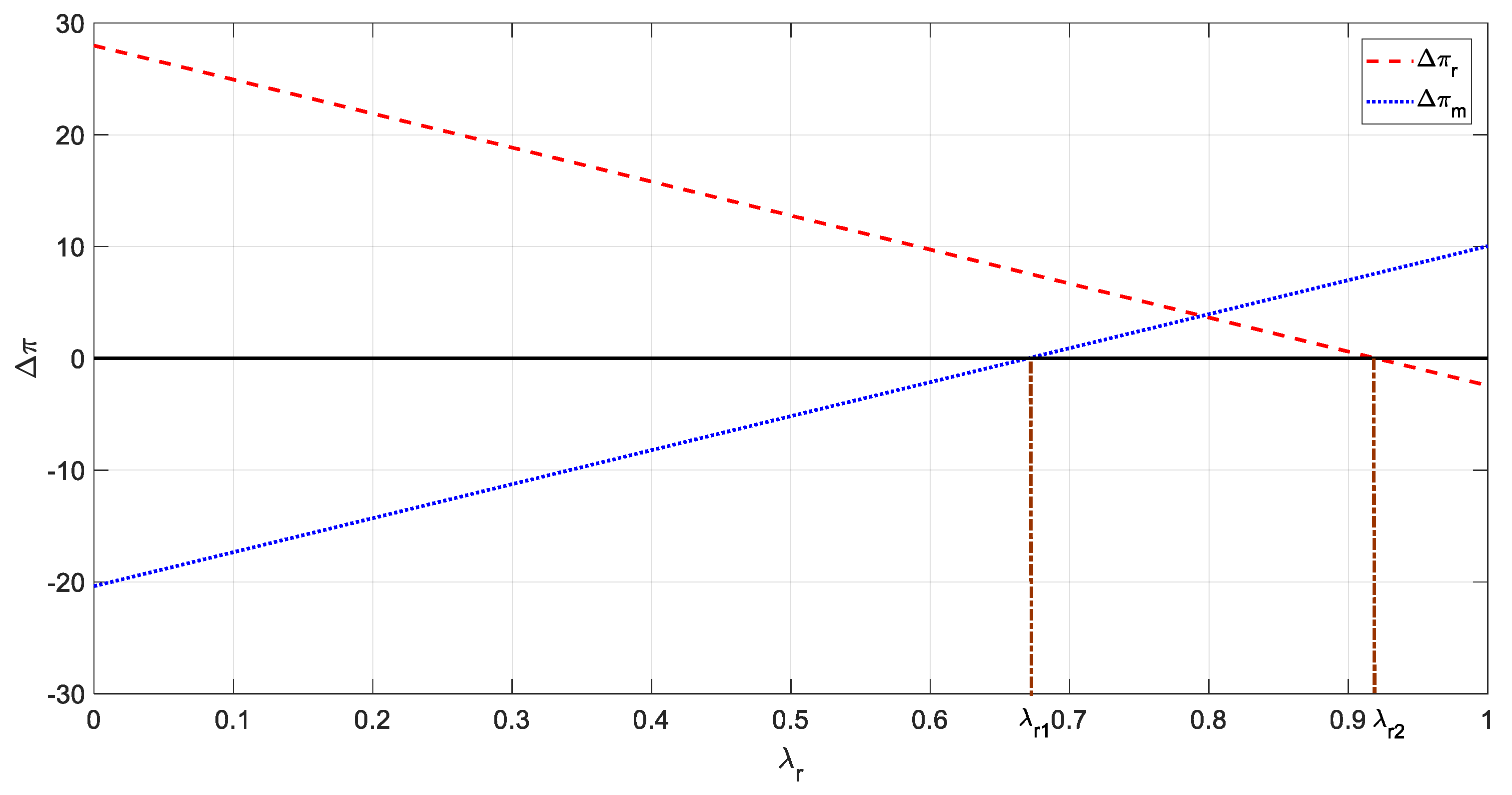

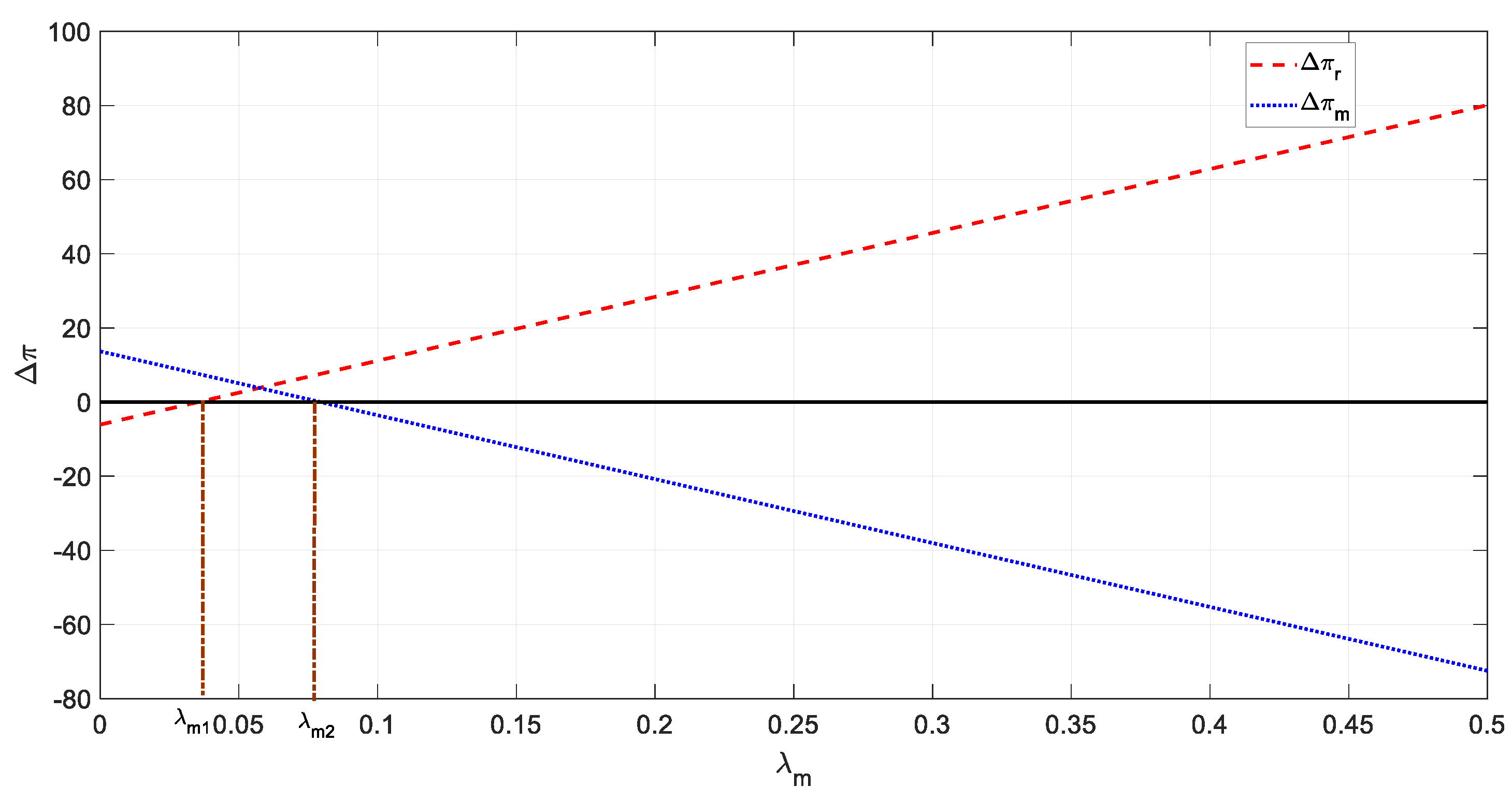

Finally, we denoted the partners’ profit changes by

and

after the supply chain coordination. The impacts of revenue sharing ratios

and

on

and

are analyzed by

Figure 4 and

Figure 5, respectively.

Figure 4 and

Figure 5 verify the participation constraints satisfied by the coordination mechanism. Namely, the profits of the manufacturer and retailer in a revenue sharing contract model were not lower than those in a wholesale price contract model. In particular,

Figure 4 indicates that the profit change of the retailer

and the revenue sharing ratio

were negatively correlated, but the profit change of the manufacturer

was positively correlated with the revenue sharing ratio

. Moreover, we observed that when

, the profits of the manufacturer and retailer in a revenue sharing contract model were not less than those in a wholesale price contract model, which proved that the proposed revenue sharing contract realized the coordination of a dual-channel supply chain under interval demand. However, it is obvious from

Figure 5 that the profit change of the retailer

and the revenue sharing ratio

were positively correlated, but the profit change of the manufacturer

was negatively correlated with the revenue sharing ratio

. Meanwhile,

Figure 5 demonstrates that when

, then

and

. This result meant that the proposed revenue sharing contract can coordinate the dual-channel supply chain under interval demand.

6.2. Sensitivity Analysis

This subsection examines the impacts of interval bounds, price sensitivities, and market shares on the optimal strategies of a dual-channel supply chain with a centralized decision, a wholesale price contract, and a revenue sharing contract, respectively. First, we focused on the impacts of different intervals

on the price strategies of the partners. These results are illustrated by

Table 3,

Table 4 and

Table 5, respectively.

When the lower bound of interval remained unchanged,

Table 3 shows the impacts of the changes in the upper bound of interval on the price strategies of the retailer and manufacturer under a centralized decision, a wholesale price contract, and a revenue sharing contract. Moreover,

Table 4 demonstrates the impacts of changes of the lower bound of interval on the price strategies when the upper bound of interval remained unchanged. Then,

Table 5 lists the impacts of changes of both upper and lower bounds of interval simultaneously on the price strategies. We obtained some results from

Table 3,

Table 4 and

Table 5, which are summarized as follows.

- (1)

The optimal price decisions under a centralized decision, a wholesale price contract, and a revenue sharing contract were positively correlated with the upper and lower bounds of interval, which are presented in

Table 3 and

Table 4, respectively. Furthermore,

Table 5 demonstrates that the optimal price decisions of the manufacturer and retailer were closely related to the upper and lower bounds of interval.

- (2)

Under the same interval demand, the optimal price of the retailer in a centralized decision system was equivalent to the optimal wholesale price of the manufacturer in a wholesale price contract model. Meanwhile, the optimal online price of the manufacturer in a centralized decision system was equal to that in a wholesale price contract model.

Then, we paid attention to the impact of interval

on the profit of a centralized supply chain

, the profits of the retailer, manufacturer, and supply chain system

in a wholesale price contract model, and the profits

in a revenue sharing contract model. These result are listed in

Table 6,

Table 7 and

Table 8.

It is obvious from

Table 6 that all the optimal profits

,

and

were positively correlated with the upper bound of interval when the lower bound

remained unchanged. Similarly, when the upper bound

was unchanged, the optimal profits

,

and

increased as the lower bound of interval changed, as seen in

Table 7.

Table 8 indicates that the changes in both upper and lower bounds of interval were closely related to the optimal profits. Moreover,

Table 6,

Table 7 and

Table 8 show that, under the same interval demand, the optimal profits of the partners and supply chain system in a revenue sharing contract model were higher than those in a wholesale price contract model. More importantly, the profit of a dual-channel supply chain in a revenue sharing contract model was equal to that in a centralized decision system, which demonstrated that the proposed revenue sharing contract realized the coordination and Pareto improvement to profits of the partners under interval demand.

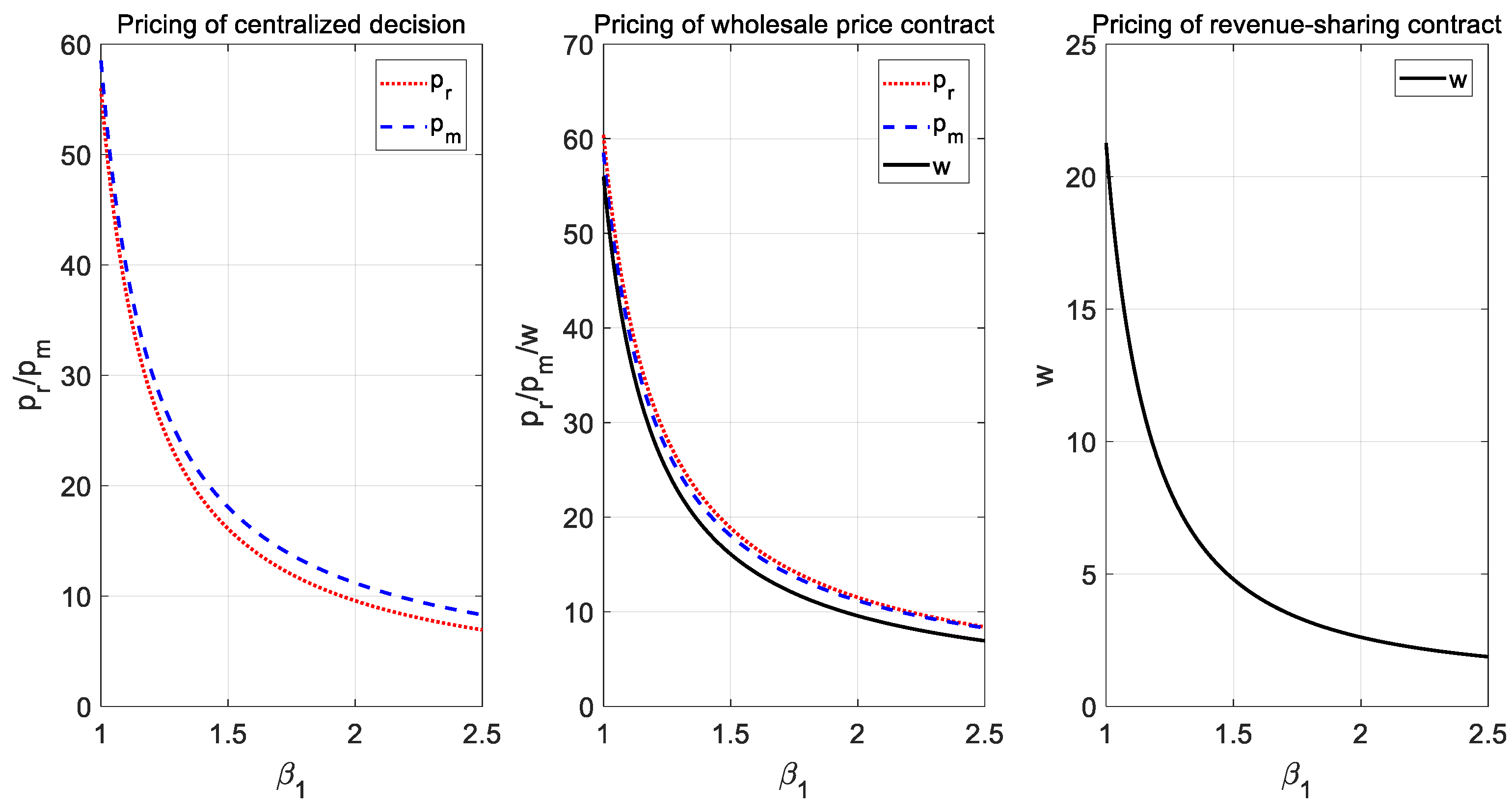

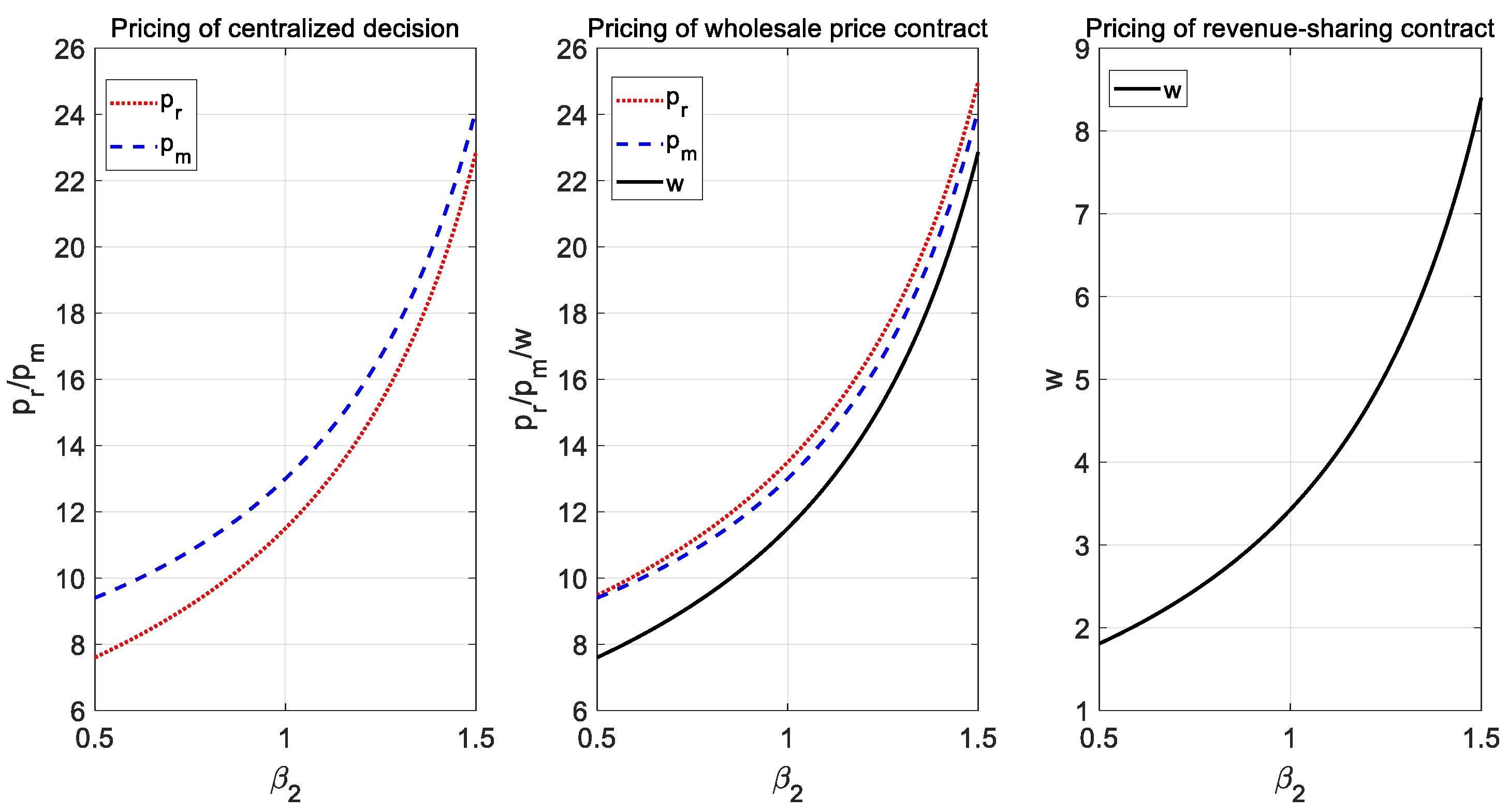

Furthermore, we analyzed the impacts of price sensitivity

and cross-price sensitivity

on the price strategies in a centralized decision, a wholesale price contract, and a revenue sharing contract.

Figure 6 and

Figure 7 show these results.

Figure 6 and

Figure 7 separately show the impacts of price sensitivity

and cross-price sensitivity

on the price strategies of the retailer and manufacturer with different decision models. Moreover,

Figure 6 implies that the optimal prices in a centralized decision, wholesale price contract, and revenue sharing contract were negatively correlated with the price sensitivity

. This was because when the price sensitivity

increased, the market demands faced by the manufacturer and retailer decreased, which led to the decline in optimal prices. On the contrary,

Figure 7 demonstrates that the optimal prices with different decision models were positively correlated with the cross-price sensitivity

. The reason for this was that the market demands faced by the manufacturer and retailer increased as the cross-price sensitivity

changed, which brought an increase in the optimal prices.

Finally, we investigated the impact of the market share of the online channel

on the price strategies in a centralized decision system and a wholesale price contract model, which is shown in

Figure 8.

Figure 8 implies that the retail price of the retailer decreased as the market share of online channel

changed in a centralized decision system. However, the online price of the manufacturer and the market share of the online channel

were positively correlated. Similar results were also observed in the wholesale price contract model from

Figure 8. Moreover, it was apparent from

Figure 8 that the wholesale price of the manufacturer decreased as the market share

increased. The reasons for these results were that when the market share of the online channel

increased, the market share of the retail channel decreased, which resulted in a lower wholesale and retail price but a higher online selling price.

7. Managerial Implications

There is widespread uncertainty in some practical engineering problems. It is of great significance to study the theory and method of uncertainty optimization for the reliability design of industrial products and systems. As is well known, stochastic programming and fuzzy programming are two traditional uncertain optimization methods, which require a large amount of sampling information about uncertainty to construct accurate probability distributions or fuzzy membership functions. Unfortunately, getting enough uncertain information often seems very difficult and sometimes costly, so both types of approaches may encounter some limitations in terms of applicability. Interval number optimization is a newly developed uncertain optimization method that uses interval to model the uncertainty of variables. Therefore, only the change boundary of uncertain variables is needed and can be obtained through a small amount of uncertain information. In recent years, the problem of interval number optimization has received more and more attention. It is expected to become the third largest uncertain optimization method after stochastic programming and fuzzy programming. More importantly, interval number optimization has shown greater potential for application than the other two methods in many practical engineering problems.

In fact, dual channels are used to sell products to consumers by many industries (such as Dell, Sony, Hewlett Packard, and Nike) with the rapid development of e-commerce. At the same time, interval uncertainty in demand is more prevalent than ever and can have a more significant impact on the performance of dual-channel supply chains. Because of the difficulty of recovering from interval demand in a short period of time in a dual-channel supply chain, adopting effective pricing and coordination strategies to improve performance under interval demand has important management significance. Partners in a dual-channel supply chain should be aware of the impact of interval demand on pricing and order quantities, as well as the impact on coordination contracts, especially when demand uncertainty leads to certain deviant costs. Revenue sharing contracts have been widely used in many industries, especially in online markets such as Amazon, Alibaba, and eBay. In the dual-channel supply chain with interval demand, the manufacturer sells at a wholesale price lower than the marginal cost, but its contribution to the retailer’s income exceeds the loss of sales. The revenue sharing contract effectively increases the profits of partners and improves the performance of the dual-channel supply chain under interval demand.

8. Conclusions

This paper explored the coordination problem of a dual-channel supply chain when the demand is characterized as an interval and reveals how interval demand affects the optimal ordering quantity and pricing, as well as the coordination contract in a dual-channel supply chain with a competition environment. First, facing an interval uncertain environment, we established the interval optimization problems of a dual-channel supply chain in a centralized decision model and a wholesale price contract model. Meanwhile, the satisfaction degree of interval and the order relation of interval number were proposed to convert the interval uncertain problems into deterministic optimization problems. Second, we showed that the upper and lower bounds of uncertain demand play an important role in the optimal decisions in both a centralized decision system and a wholesale price contract model. Moreover, we found that the optimal online selling prices of the manufacturer remained unchanged in different cases, and the manufacturer’s optimal wholesale price in a wholesale price contract model was equal to the optimal retail price of the retailer in a centralized decision system. Third, we illustrated that a wholesale price contract failed to coordinate a dual-channel supply chain under interval demand. Thus, a revenue sharing contract was proposed to realize the coordination of a competitive dual-channel supply chain and enable the partners to experience a win–win situation under interval demand. Consequently, our findings provide a reference for decision makers and managers to make scientific decisions in an interval uncertain environment.

Several extensions of this work can be considered for future research. It will be meaningful to propose other contracts to coordinate the dual-channel supply chain in the context of interval demand and channel competition. Another interesting aspect for future research will be to consider the interval management problem of a dual-channel supply chain under asymmetric information or multiple competing retailers or competing manufacturers. Finally, it will also be interesting to consider the optimal strategy and coordination mechanism of an omni-channel supply chain under an interval uncertain environment.