1. Introduction

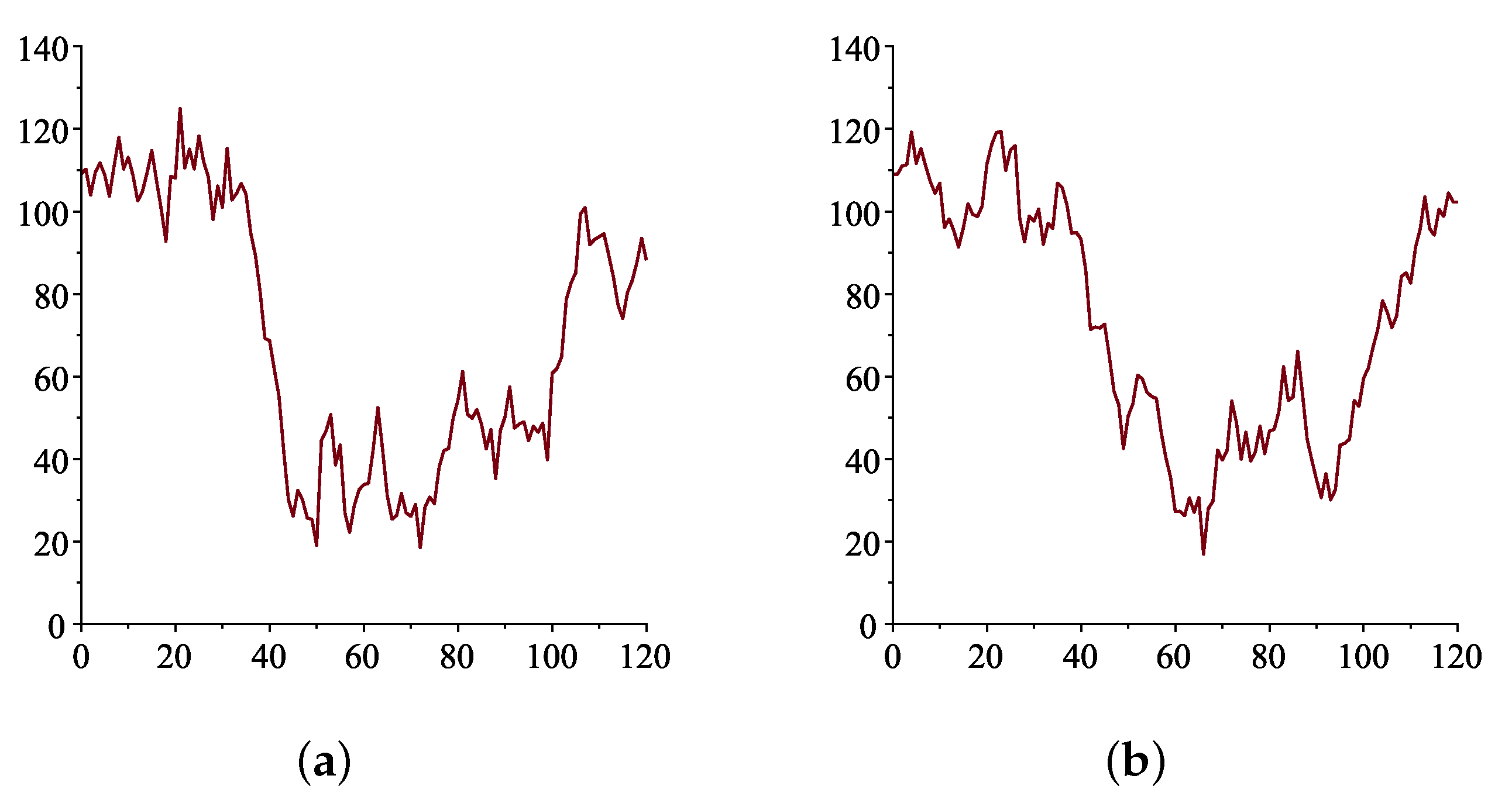

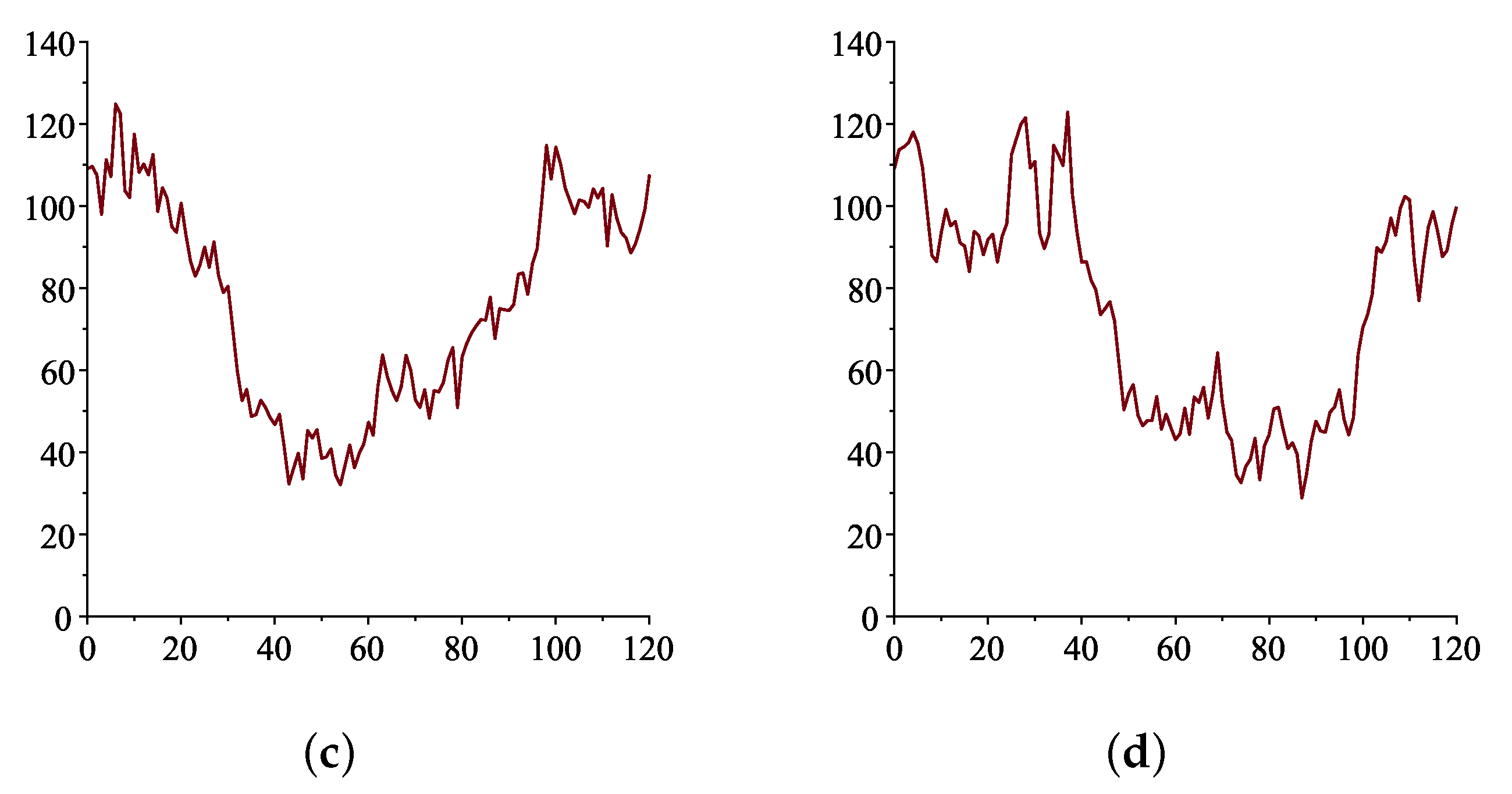

Crude oil is one of the world’s most important commodities, not just for consumption but also as a financial asset. Futures contracts on oil are traded by financial institutions and investors for investment and risk management purposes. Successful hedging and risk management techniques, though, depend upon the accurate pricing of the contracts. In order to value financial contracts on oil, one needs to understand and develop a stochastic process that describes oil price dynamics. There are many complex factors affecting oil prices, including net demand in the market, geopolitical events, interest rates, the weather, the cost of extracting and producing oil and even market sentiment. In recent years, the corona virus pandemic saw many governments restricting travel, and businesses were forced to shut down. This led to the fall in demand for oil. In the first three months of 2020, oil consumption was down 5.6 million barrels per day to 94.4 million barrels per day. This in turn led to a drop in oil prices. In April 2020, the price for a barrel of oil fell to −USD 37.68 in the US for West Texas Intermediate (WTI) and USD 9 per barrel worldwide for Brent oil. When Russia attacked Ukraine on 24 February 2022, investors saw the potential for sanctions on Russian oil exports, which saw oil prices rocket. Large price changes over short periods are not new—they are an inherent part of the oil market. Observing the data set of oil prices over the last 10 years, it is obvious that the data are bimodal in nature (other commodities such as natural gas and food grains may also exhibit the same price pattern over this period). There is a strong tendency for prices to stay around one range of high prices and then a range of low prices before going back to the high prices and so on.

In this paper, we model the bimodal nature of oil with a nonlinear one-factor stochastic model. One-factor models are of the form , where is the price of oil at time t, is the drift term, is the diffusion term, and where here and in the rest of this paper, is an increment in a Wiener process Z under a real probability measure. The main advantages of using one-factor models are simplicity and tractability—i.e., they can lead to closed formulae for futures prices.

An early model used to define the behaviour of commodity prices was the GBM model—i.e., Geometric Brownian Motion, in which

and

, where

and

are constant. Using this model, Brennan and Schwartz [

1] identified a relationship between spot and futures prices that included known constant convenience yields and interest rates. Using a GBM model, Gabillon [

2] established a closed-form solution for futures prices of oil that depended only on the spot price of oil and a constant cost of carry of physical oil. He did, however, observe that with this formula, the term structure in backwardation could not be explained. So Gabillon extended his formula to include convenience yield. This formula could now describe both backwardation and contango states. Unfortunately, however, the formula implies a discontinuity when changing between the backwardation and contango states. Gabillon noted that use of the GBM model to value oil futures could lead to unreasonable over- or under-valuations.

Other authors suggested including mean reversion in the oil price model to capture the effect of net demand of the commodity. Using this property, Bjerksund and Ekern [

3] derived the price of a European call option when the spot price follows the Ornstein–Uhlenbeck process:

. This process can, however, generate negative prices, which, although can happen with oil prices, is very rare. In a well-known paper on futures pricing of oil, Schwartz [

4] derived an analytic solution for futures prices under the mean-reverting model:

. Pindyck [

5] also added a mean-reversion term to a deterministic linear trend model. AbaOud and Goard [

6] proposed two one-factor models for oil prices with

and empirically showed they outperformed some well-known models in capturing the behaviour of oil prices. They also derived futures prices based on their mean-reverting models.

A number of extensions have been proposed to the one-factor model for oil prices. These include two- and three-factor models. In the two-factor models, the convenience yield and long-run mean seem to be the popular choices for the second factor. Gibson and Schwartz [

7] assumed that the underlying oil price follows the GBM process and the short convenience yield follows the Ornstein–Uhlenbeck (OU) process. This was later modified by Schwartz [

4], who modelled the spot price using the Geometric Ornstein–Uhlenbeck process. Some authors who considered the long-term price as a second state variable include Gabillon [

2], Pilipovic [

8] and Schwartz and Smith [

9].

The addition of factors to the model can add complexity to the model. However, Schwartz [

4] derived a futures prices under a three-factor model for oil that included the spot price, convenience yield and interest rate. In this model, the spot price follows the GBM, and the convenience yield and interest rate follow OU processes. Hilliard and Reis [

10] also used the three-factor model proposed by Schwartz [

2] but added jumps into the spot price process. Cortazar and Schwartz [

11] proposed a three-factor model that includes spot price, convenience yield and long-term spot price return. Abadie and Chamorro [

12] use mean-reverting spot price and volatility and a long-term equilibrium price that follows a GBM.

Various other modifications to the one-factor model can be found in the literature. This includes the paper by Cortazar and Naranjo [

13], who used n-factor Gaussian models, and Ogbogbo [

14], who considers a Levy market and uses a Levy process to model oil prices.

Examination of oil price data sets over a span of 10 years, and even just the past 5 years, shows that they are bimodal in character, showing a strong inclination to aggregate around one range of high prices and one range of low prices. No system of affine equations could lead to a finite number of non-unique fixed point solutions. Therefore, to model bimodal oil price data, we require a nonlinear model. In order to achieve this, we require only a single nonlinear equation with two stable fixed points at high and low values of oil prices, respectively. Obviously, we also need the additional external stochastic driving force, representing the unpredictable effect of many neglected influences that will enable transitions to occur between the two basins of attraction. The simplest such single-factor model is

with

,

the stable low fixed point,

the stable high fixed point and

an unstable intermediate fixed point. In the neighbourhood of

, oil prices revert to

as

with time scale

. Similarly, in the neighbourhood of

, oil prices revert to

exponentially with a time scale

.

For an initial value

strictly between

and

, the full solution to the nonlinear deterministic model (i.e., (1) with

) is

where

Similar solutions can be found for other initial conditions simply by separation of variables and integration by partial fractions.

The occasional switching between the zone of low oil price, with interval of attraction , and the zone of high oil price, with interval of attraction , occurs because of the random excursion . This simple device for modelling bimodal oil price dynamics is to be compared with the device of deterministic chaos, which requires at least three coupled autonomous differential equations, two coupled non-autonomous equations or two coupled difference equations.

The goal of this paper is two-fold:

To model oil prices, we want to demonstrate the significance of the cubic term in Equation (1) with

(which we call our unrestricted model). To do this, in

Section 2, we compare the ability to capture oil price behaviour of several existing one-factor stochastic models for oil prices that are subsets of the unrestricted model. The estimation technique that we use to compare these models is the statistical method of the Generalized Method of Moments (GMM). This method combines the observed data with the information in population moment conditions to generate estimates of the unknown parameters in the given model. Using 10 years of data, we empirically test the nested models and explain the results.

Having justified the need for a cubic drift term, in

Section 3, we formulate analytic approximate solutions to futures prices under (1) with

and

.

3. Analytic Futures Prices under Model (3)

Given that the real process for

is of the form

then allowing for the possibility of a nonzero market price of risk,

, associated with oil prices, the risk-neutral process will be

where

is a Wiener process under an equivalent risk-neutral probability measure under which

p becomes a martingale. One way

can be found is by implying it from market futures prices, i.e., choosing a

that minimises the error between market and model prices. This usually involves assuming a form for the market price of risk (see, e.g., Egloff et al. [

24]). Here, like many other authors (e.g., Stein and Stein [

25] and Grünbichler and Longstaff [

26]), we assume that the market price of risk

is such that the forms of the real and risk-neutral processes are alike. This means that when

, then

, and when

, then

, where

are constants. Without loss of generality, for convenience we will still use the same notation for the constants.

The partial differential equation (PDE) that governs futures prices under the risk-neutral process

is given by (see [

27])

where

. From the GMM analysis of

Section 2.3, we choose to consider only the cases

and

. We start by non-dimensionalising the problem. This ensures that the relative sizes of different variables are obvious and signifies the important variables and constants in the equation. Hence, we let

and

. This reduces the problem to

and

,

to be solved subject to

. Hence, once

is calculated, we then have

However, to the best of the authors’ knowledge, PDE (9) has no analytic solution, and so we look for a good analytic approximation.

Given that

is large and we are considering

, then

is assumed small

. Hence, we seek a perturbation solution of the form

where

for

. Substituting (10) into (9) and collecting the coefficients of

, we get that

needs to satisfy

subject to

. Note, this equation is independent of

.

Solving (11) by the method of characteristics gives

where we need

when

. This is hard to solve for the function

for arbitrary

. However, we recall from the GMM analysis that if we let

, then we can well approximate

by

or

. Hence, we will study these two cases and will get solutions for futures prices of the form

where

with

1. when (a) and (b) and

2. when (a) and (b)

As explained further in the paper, if higher-order approximations are needed, then they can be found in a similar way to .

3.1. Case

Here we assume , so we have and . We now approximate z under this assumption by finding and as in (10).

3.1.1. The O(1) Term

With

, without loss of generality, from (12) we may write

for some function

so that

.

By letting

at

, we need to find

so that

We let

and solve for

Y (and hence

y) in terms of

. This gives us

Hence,

. However, to satisfy the initial condition, we must use the positive sign when

, and when

we must use the negative sign. This then leads to the solution for all

y:

[Note that in terms of the original variables we get

, and, hence,

We also note that we can simplify .]

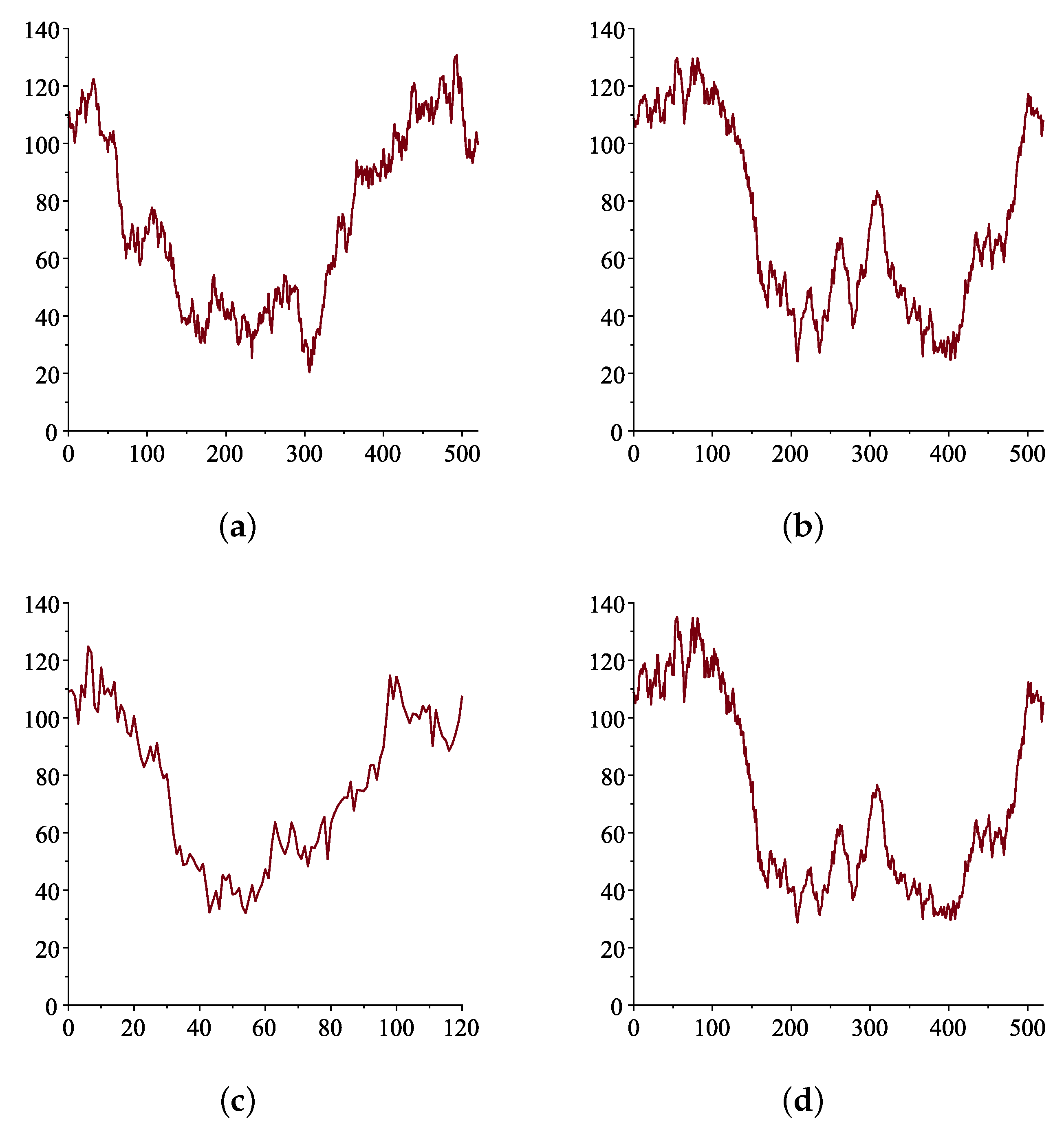

Figure 2 illustrates the solution

, in which

and

are approximately 1.52 and 2.04, respectively. We see that when

, the solution increases with

(contango). When

, the solution decreases with

(backwardation), and then, when

, the solution again increases with

. This is to be expected, as

and

are the stable fixed points.

3.1.2. The Term

We now consider two cases for the approximation : when = 0, so , and when , so , in (9).

Subcase in (9)

Substituting (10) into (9) and collecting the coefficients of

, we get that with

,

needs to satisfy

subject to

Solving (16) by the method of characteristics (see [

28]), we get

, where

, and

where

with

replaced by

with

A constant.

After integration, we then replace A with

This gives

where

. To find

, we use the initial condition at

that

, so we need

Hence, to find

, we need to first write

Q as a function of

when

. This can be done easily by using (14) and considering the cases

,

separately. This gives

. Replacing

by

, we get

.

After much simplification, we get

in terms of

y and

for all

y as:

Then . The above reasoning serves to prove the following proposition:

Proposition 1. An analytic approximation of (9) with and is , where is given in (15) and is given by using (17) and (18). Then the futures price is given by .

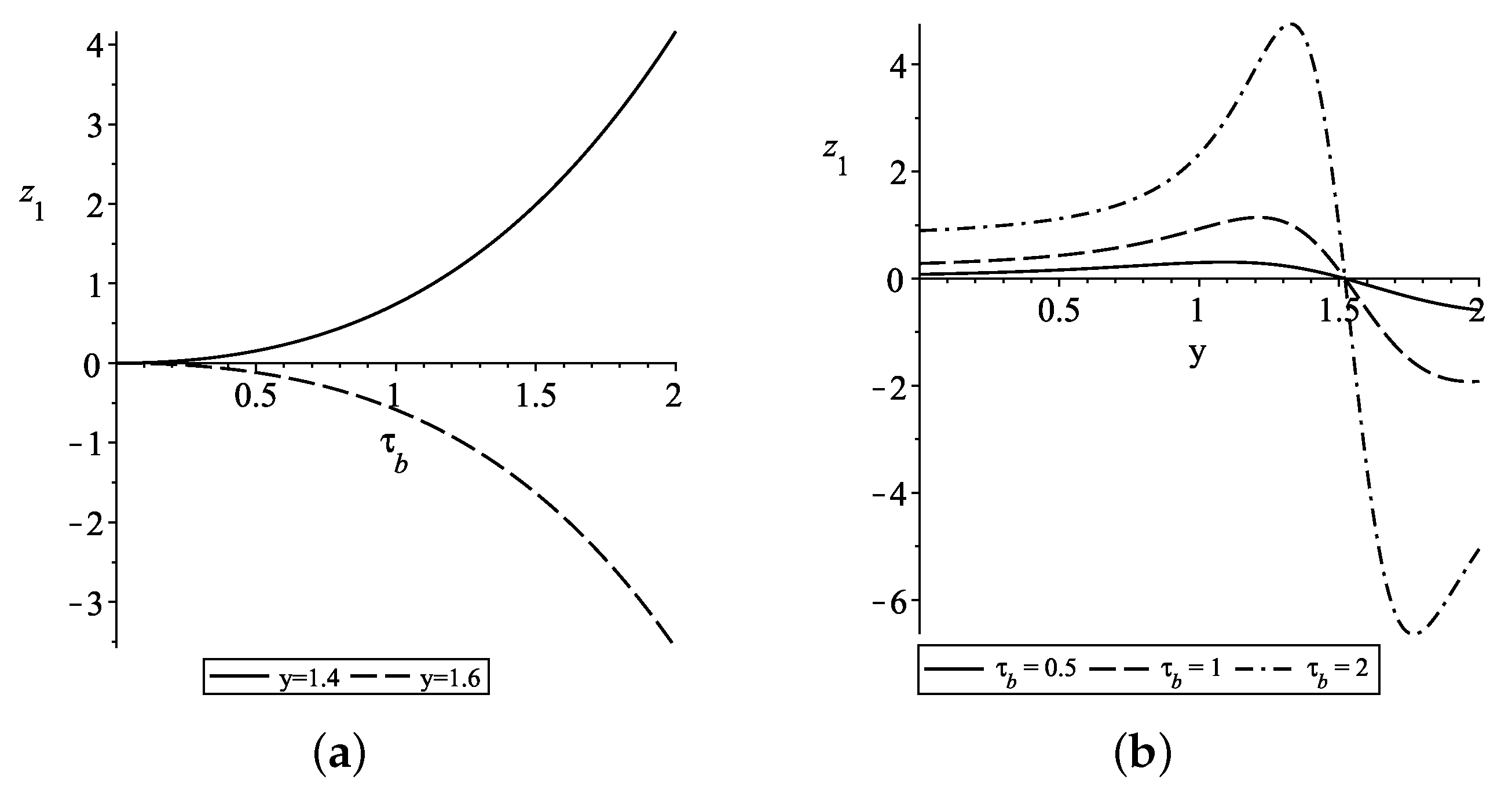

The

term

when

is plotted in

Figure 3. When

is increasing in

, and it is decreasing in

when

. This is the opposite behaviour to that of

when

. The difference between the curves in

are also larger than those for

.

In

Table 4 we compare the approximate

and

results for

and

with those obtained numerically using an implicit finite difference (FD) scheme in Maple [

29] with increments of

y and

, respectively, of

and

. We use the numerical results as the proxy for the true solution. The table also lists the root mean square error (RMSE)

and the mean absolute error (MAE)

, where

are the FD values,

are our estimated values and

N is the number of data points.

The tables clearly show the excellent results from using and as compared to the numerical FD method. The results are displayed to four decimal places in terms of the dimensionless parameters and . The first-order approximation results on their own yield relatively good results. However, it is obvious that the results from using are an improvement on the alone. We have excellent results, especially for smaller values of and , with the RMSE ranging from 0 (when ) to 0.0034 (when is almost one). Similarly, the MAEs are of comparable order.

If higher degrees of accuracy are ever needed, then the next approximation can be found using the same technique we used here to find .

Subcase in (9)

We now look to approximate

when

and

. The PDE in this case is

to be solved subject to

and where

. Solving (19) by the method of characteristics, we get

, where

, and

where

with

replaced by

with

K constant.

After integration, we then replace K with

To find

, we use the initial condition at

, i.e.,

. Hence, we need

So to find

, we need to first write

Q as a function of

when

. This gives

. Replacing

by

, we get

.

After much simplification, we get:

Then

The work in the current section and in

Section 3.1.1 provides the proof for the following proposition:

Proposition 2. An analytic approximation of (9) with and is , where is given in (15) and is given by using (20) and (21a)–(21c). Then the futures price is given by

In

Figure 4, we plot

when

. Compared with

Figure 5 when

, we see that although the figures have the same shape, the magnitudes of the values with

tend to be larger, especially as

increases.

In

Table 5 we list the values obtained for

and those obtained using an implicit finite difference method in Maple [

29], with the dimensionless parameters as given in the table. We see that the

solutions

are by themselves fairly accurate, but the

approximations

are clearly better, with RMSE ranging from

and five-significant-figure accuracy (with

) to RMSE of 0.00169 and three-significant-figure accuracy (with

).

3.2. Case

We now assume so that and . We approximate z under this assumption by finding and as in Equation (10).

3.2.1. The O(1) Term

The PDE for

is given in (11), but we now have

as well as

. By the method of characteristics, the solution to this is

To find the function , we use the initial condition .

Letting

, we need to solve the cubic equation

where

i.e.,

when

.

We let and consider three cases:

- (a)

;

- (b)

;

- (c)

.

In Cases (a) and (b), (23) has only one real solution for

Y, namely

Hence, for

Case (a) , we can find

where

For Case (b)

where

, we find

where

However, upon simplification, this leads to the same solution for as in (27).

For Case (c)

Equation (23) has three real solutions, which we can write as

where

From this, we get in the intervals and .

Putting all the solutions together, we have

where

Note that the solutions match at the endpoints of their intervals, and we have that when ; when ; and when .

The solution is plotted in

Figure 5. Compared with

Figure 2 where

, the shapes of the figures are very similar. However, the magnitudes of the values here when

are larger, especially when

3.2.2. The Term

We now find the approximation for two cases: when and when

Subcase:

We now approximate when and

By substituting (10) into (9) and collecting the coefficients of

, we get

Solving (37) by the method of characteristics, we have

where

A is constant. Further, we have

where

with

replaced by

, and where

.

First, we simplify the integrand in (38) before integrating, and then after the integration we replace A with We write the solution to (38) as .

For , we use in Equation (29).

To find

, we use the initial condition

. So at

(i.e.,

), we write

Hence,

So we write

as a function of

using Equation (38) to get

. Then

. The above reasoning serves to prove the following proposition:

Proposition 3. An analytic approximation of (9) with and is , where is given in (29) and is given by as explained above in this section. Then the futures price is given by

Unfortunately, the integral

Q cannot be obtained explicitly. However, excellent approximations of the integral can be found using series representations of the integrand. Here, we obtain results using Maple [

29] for the most relevant interval, namely

We first split the integral into two, namely

- (a)

where ;

- (b)

where

In (a), we write the integrand as a series in

. In (b), we write the integrand for

as a series in

and otherwise as a series in

. The results obtained are listed in

Table 6.

As in the previous section, we tabulate in

Table 6 the values obtained for

and

and those obtained using an implicit finite difference method in Maple [

29] using the dimensionless parameters as stated in the table. Again, the

solutions

are relatively accurate, but the

approximations

are certainly an improvement, with RMSE ranging from

and mostly five-significant-figure accuracy (with

) to RMSE of

and mostly three-significant-figure accuracy (with

).

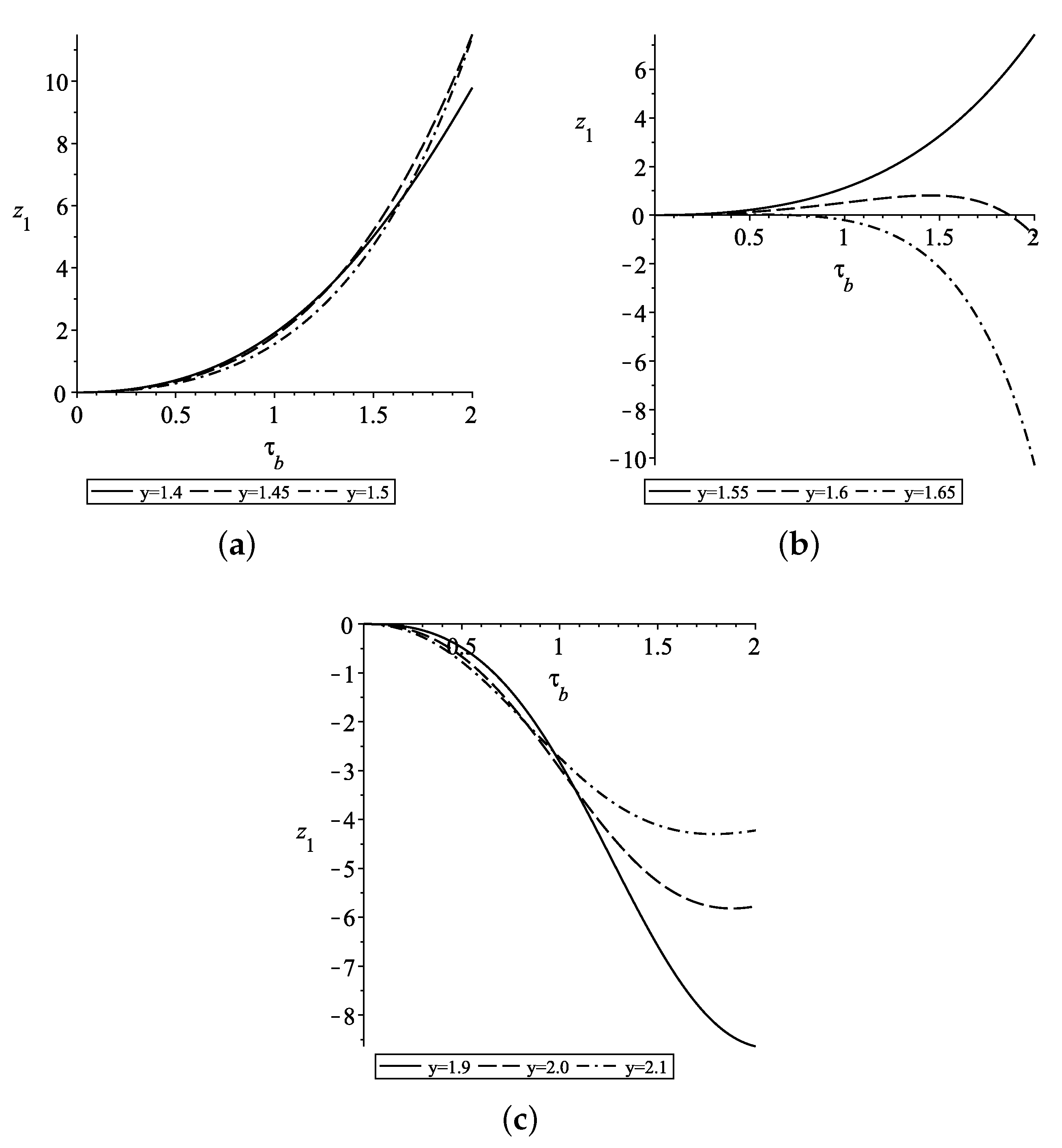

In

Figure 6,

is plotted as a function of

in [0,2] for various values of

y with

. We see that when

,

increases as a function of

; when

initially slowly increases before turning to decrease; then, for

when

decreases before turning. The larger

y is in this last range, the smaller the magnitude of the turning point. Compared with

when

and

,

generally increases/decreases more quickly but mostly maintains the same shape.

Subcase

For

when

and

, we solve

where

and

.

Hence,

where

with

replaced by

(after

has been determined). The solution process is then the same as in the previous section. Hence, the above work provides the proof for the following proposition:

Proposition 4. An analytic approximation of (9) with and is , where is given in (29) and is as given above. Then the futures price is given by

In

Figure 7,

when

is plotted as a function of

in [0,2] for various values of

y with

. Compared to the case when

,

displays the same behaviour but the magnitude of the values is greater.

In

Table 7 we present the results obtained for

and

and those obtained using an implicit finite difference method in Maple [

29]. The dimensionless parameters used are given in the table. The results are very similar to those of

Table 4,

Table 5 and

Table 6, with the

approximations

outperforming the

solutions

. The RMSE from the

approximations ranges from

with mostly five-significant-figure accuracy (with

) to RMSE of

and mostly three-significant-figure accuracy with (

).