Versatile Stochastic Two-Sided Platform Models

Abstract

1. Introduction

2. Stochastic Modelling for Two-Sided Platform

2.1. Stochastic Pseudo-Game

2.2. Open Two-Sided Platform Model

2.3. Memoryless Two-Sided Platform

3. Stochastic Optimizations for Two-Sided Platform

3.1. Two-Sided Platform Payoff Function Design

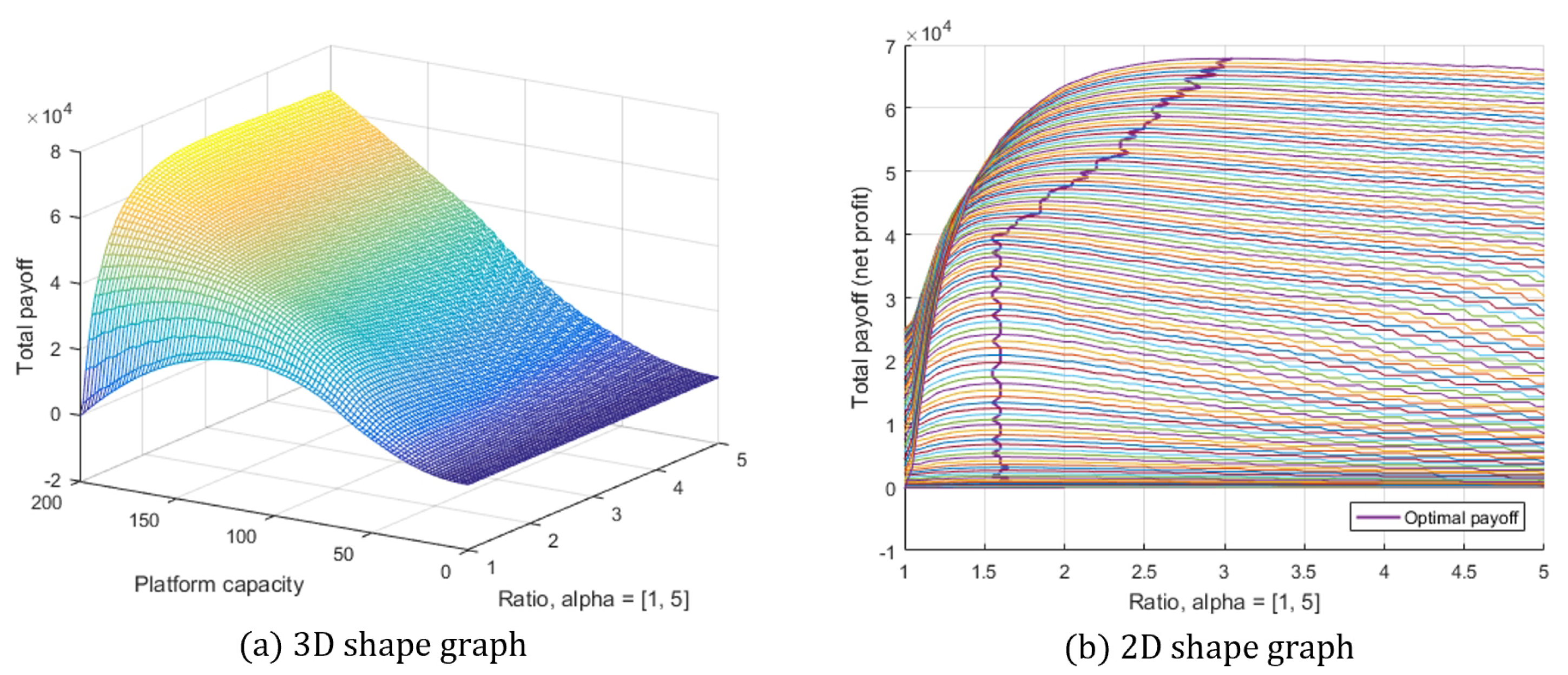

3.2. Two-Sided Platform Optimization Setup and Visualization

3.3. Properties of Open Two-Sided Platforms

4. Applications Cases

4.1. Khaos Nightclub

- Based on the data during the soft launch (see Table 1 for details), the club is operating good enough for the grand opening?

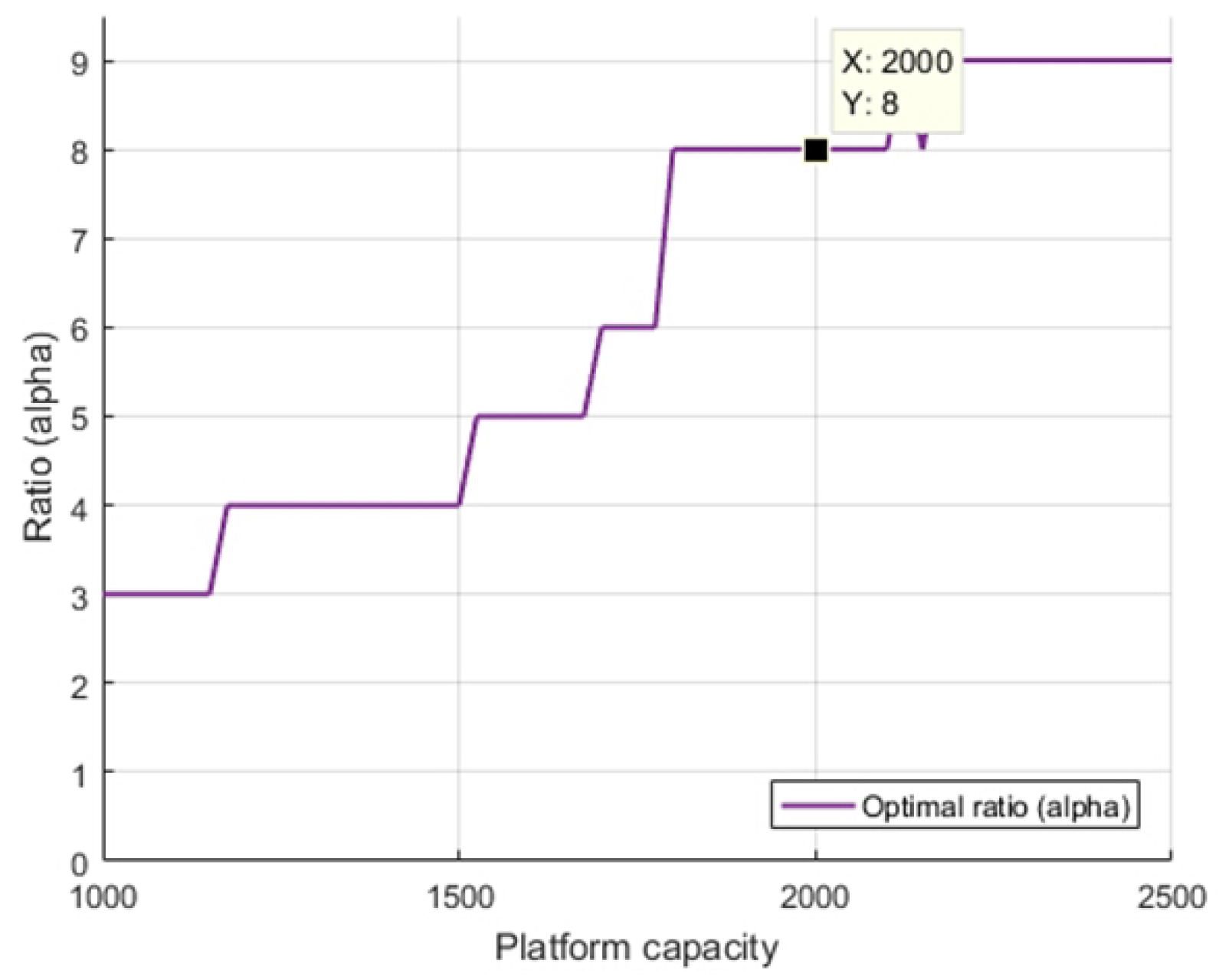

- How many ladies should be needed to maximize the profit with same number of clubers (2000 clubers)?

- What will be the proper managerial actions to improve the operation of the nightclub?

- The information (or data) for this nightclub case is reliable enough for making proper decision?

4.2. Omnia AppStore

- What is a proper threshold for optimizing this application store?

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Muzellec, L.; Ronteau, S.; Lambkin, M. Two-sided Internet platforms: A business model lifecycle perspective. Ind. Mark. Manag. 2015, 45, 139–150. [Google Scholar] [CrossRef]

- Eisenmann, T.; Parker, G.; Van Alstyne, M.W. Strategies for two-sided markets. Harv. Bus. Rev. 2006, 84, 92–101. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Smith, A. Business Model Generation; Wiley & Sons: Hoboken, NJ, USA, 2010; p. 288. [Google Scholar]

- Hagiu, A. Strategic Decisions for Multi-sided Platforms. MIT Sloan Manag. Rev. 2014, 55, 4–13. [Google Scholar]

- Evans, D.S.; Schmalensee, R.; Noel, M.D.; Chang, H.H.; Garcia-Swartz, D.D. Platform Economics: Essays on Multi-Sided Businesses. 2011. Available online: https://ssrn.com/abstract=1974020 (accessed on 31 August 2022).

- Rochet, J.-C.; Tirole, J. Platform Competition in Two-Sided Markets. J. Eur. Econ. ASSN 2003, 1, 990–1029. [Google Scholar] [CrossRef]

- Trabucchi, D.; Buganza, T. Landlords with no lands: A systematic literature review on hybrid multi-sided platforms and platform thinking. Eur. J. Innov. Manag. 2022, 25, 64–96. [Google Scholar] [CrossRef]

- Evans, D.S. Some empirical aspects of multi-sided platform industries. Rev. Netw. Econ. 2003, 2, 19. [Google Scholar] [CrossRef]

- Parker, G.G.; Van Alstyne, M.W. Two-sided network effects: A theory of information product design. Manag. Sci. 2005, 51, 1494–1504. [Google Scholar] [CrossRef]

- Rysman, M. The economics of two-sided markets. J. Econ. Perspect. 2009, 23, 125–143. [Google Scholar] [CrossRef]

- Jocevski, M.; Ghezzi, A.; Arvidsson, N. Exploring the growth challenge of mobile payment platforms: A business model perspective. Electron. Commer. Res. Appl. 2020, 40, 100908. [Google Scholar] [CrossRef]

- Staykova, K.S.; Damsgaard, J. The race to dominate the mobile payments platform: Entry and expansion strategies. Electron. Commer. Res. Appl. 2015, 14, 319–330. [Google Scholar] [CrossRef]

- Gawer, A. Platforms, Markets and Innovation; Edward Elgar Publishing: Cheltenham, UK, 2009. [Google Scholar]

- Sinha, K.; Colombo, E.F.; Shougarian, N.R.; de Weck, O.L. A Simplified Mathematical Model for Two-Sided Market Systems With an Intervening Engineered Platform. In Proceedings of the 41st Design Automation Conference, Boston, MA, USA, 2–5 August 2015. [Google Scholar]

- Kirpalani, R.; Philippon, T. Data Sharing and Market Power with Two-Sided Platforms; National Bureau of Economic Research Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2020; p. 28023. [Google Scholar]

- Choi, J.P.; Jeon, D.-S. Two-Sided Platforms and Biases in Technology Adoption; CESifo Working Paper; Munich Society for the Promotion of Economic Research: Munich, Germany, 2020; p. 8559. [Google Scholar]

- Armstrong, M. Competition in Two-Sided Markets. RAND J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef]

- Gale, D.; Lloyd, S.S. College admissions and the stability of marriage. Am. Math. Mon. 1962, 69, 9–15. [Google Scholar] [CrossRef]

- Gusfield, D. Three fast algorithms for four problems in stable marriage. SIAM J. Comput. 1987, 16, 111–128. [Google Scholar] [CrossRef]

- Kelso, A.S., Jr.; Crawford, V.P. Job matching, coalition formation, and gross substitutes. Econom. J. Econom. Soc. 1982, 50, 1483–1504. [Google Scholar] [CrossRef]

- Irving, R.W.; Leather, P. The complexity of counting stable marriages. SIAM J. Comput. 1986, 15, 655–667. [Google Scholar] [CrossRef]

- Xu, J. A Two-Sided Market Model of Optimal Price Structure for Instant Messenger. J. Appl. Math. 2013, 2013, 768168. [Google Scholar] [CrossRef]

- Kojima, F. School choice: Impossibilities for affirmative action. Games Econ. Behav. 2012, 75, 685–693. [Google Scholar] [CrossRef]

- Dshalalow, J.H.; Ke, H.-J. Layers of noncooperative games. Nonlinear Anal. 2009, 71, e283–e291. [Google Scholar] [CrossRef]

- Kim, S.-K. Blockchain Governance Game. Comp. Indust. Eng. 2019, 136, 373–380. [Google Scholar] [CrossRef]

- Kim, S.-K. Strategic Alliance for Blockchain Governance Game. Probab. Eng. Inf. Sci. 2022, 36, 184–200. [Google Scholar] [CrossRef]

- Kim, S.-K. Enhanced IoV Security Network by Using Blockchain Governance Game. Mathematics 2021, 9, 109. [Google Scholar] [CrossRef]

- Kim, S.-K. A Versatile Stochastic Duel Game. Mathematics 2020, 8, 678. [Google Scholar] [CrossRef]

- Kim, S.-K. Antagonistic One-To-N Stochastic Duel Game. Mathematics 2020, 8, 1114. [Google Scholar] [CrossRef]

- Kim, S.-K. Robust Pairwise n-Person Stochastic Duel Game. Mathematics 2021, 9, 825. [Google Scholar] [CrossRef]

- Kim, S.-K. Shifted Brownian Fluctuation Game. Mathematics 2022, 10, 1735. [Google Scholar] [CrossRef]

- Dshalalow, J.H.; Ke, H.-J. Multilayers in a modulated stochastic game. J. Math. Anal. Appl. 2009, 353, 553–565. [Google Scholar] [CrossRef]

- White, R.T.; Dshalalow, J.H. On Reliability of Stochastic Networks. Neural Parallel Sci. Comp. 2013, 21, 141–160. [Google Scholar]

- White, R.T.; Dshalalow, J.H. Characterizations of random walks on random lattices and their ramifications. Stoch. Anal. Appl. 2020, 38, 307–342. [Google Scholar] [CrossRef]

- Dshalalow, J.H. First excess levels of vector processes. J. Appl. Math. Stoch. Anal. 1994, 7, 457–464. [Google Scholar] [CrossRef][Green Version]

- Dshalalow, J.H. First excess level process. In Advances in Queueing; CRC Press: Boca Raton, FL, USA, 1995; pp. 244–261. [Google Scholar]

- Kim, S.-K. Advanced Mathematical Business Strategy Formulation Design. Mathematics 2020, 8, 1642. [Google Scholar] [CrossRef]

| Name | Formula | Description |

|---|---|---|

| M | – | Platform capacity |

| (17) | Termination index (i.e., first exceed level) | |

| – | Ratio between both sides of the platform | |

| (16) | The revised input rate of the men based on the dominant | |

| (101) | Payoff function |

| Name | Value | Description |

|---|---|---|

| 100 [USD/person] | Entry fee for men (i.e., a customer side) | |

| 1 [USD/person] | Reward for women’s entry | |

| 4 [h] | Monitoring duration before the nightclub operation | |

| 1 [h] | Monitoring duration during the nightclub operation | |

| 8 [person/h] | The base input rate of men during the operation | |

| 10 [person/h] | The input rate of men before starting (waiting on the queue) | |

| 6 [person/h] | The base input rate of women during the operation | |

| 1 [person/h] | The input rate of women before starting (waiting on the queue) |

| Name | Value | Description |

|---|---|---|

| B | [K app] | The number of contents (i.e., dominant side) |

| 0.345 [USD/app] | Download price | |

| 1.945 [USD/app] | Reword for app developers | |

| 1 [day] | Observation duration of the AppStore platform | |

| 7.67 [M app/day] | The download rate per day during the operation | |

| 2.67 [M app/day] | The download rate per day during the maintenance | |

| 2.33 [K app/day] | The upload rate by app developers |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, S.-K. Versatile Stochastic Two-Sided Platform Models. Mathematics 2023, 11, 131. https://doi.org/10.3390/math11010131

Kim S-K. Versatile Stochastic Two-Sided Platform Models. Mathematics. 2023; 11(1):131. https://doi.org/10.3390/math11010131

Chicago/Turabian StyleKim, Song-Kyoo (Amang). 2023. "Versatile Stochastic Two-Sided Platform Models" Mathematics 11, no. 1: 131. https://doi.org/10.3390/math11010131

APA StyleKim, S.-K. (2023). Versatile Stochastic Two-Sided Platform Models. Mathematics, 11(1), 131. https://doi.org/10.3390/math11010131