A Profit Maximization Inventory Model: Stock-Linked Demand Considering Salvage Value with Tolerable Deferred Payments

Abstract

1. Introduction

2. Literature Review

3. Assumptions, Notations, Decision Variables, Mathematical Model Formulation and Calculation of the Optimal Cycle Time

3.1. Assumptions

- Considers only single product in the inventory system.

- There is no lead time and an endless replenishment rate.

- Shortages are not tolerated.

- The demand function is high in value as display stock raises at the display area (super mall or shop) also low according to the selling price of the goods. It is defined as , where a positive constant demand is large enough that , displayed goods, depends on the change in demand rate and constant mark-up .

- The retailer has a variety of options for how to use the sales revenue, including expansion, the creation of new products, the upgrading of gear and software, and others. For the sake of simplicity, let us imagine that retailers pay out the money for something other than paying down the debt. Sales revenue is generated and placed in an interest generating account while an account is not resolved. At the end of this period, the retailer starts paying interest on the goods in stock, pays for all sold goods, maintains the balance for future use and then starts paying for all units purchased. The retailer begins to build up profit in the meantime, which will be used for the other activities. Here, the manufacturer offers an N-days-deferred period to the retailer. The produced revenue is put into the retailer’s account during the deferred period. When the deferred period finishes, the retailer pays off for all sold units, keeping the rest for daily expenses as well as for spending on the unsold goods for which retailer starts paying the interest charges.

- () Assuming that the deterioration rate is constant, it begins as soon as the objects are added to the inventory. Additionally, damaged things cannot be repaired or replaced for the duration of the cycle.

- Salvage cost is connected to deteriorated components throughout the purchase period.

3.2. Notations

3.3. Decision Variables

3.4. Mathematical Model Fomulation

- The total income, which is determined by the retailer’s demand rate throughout the course of the period, yields the overall revenue.

- 2.

- Ordering cost per cycle:

- 3.

- Holding charge:

- 4.

- Deterioration cost:

- 5.

- Salvage value:

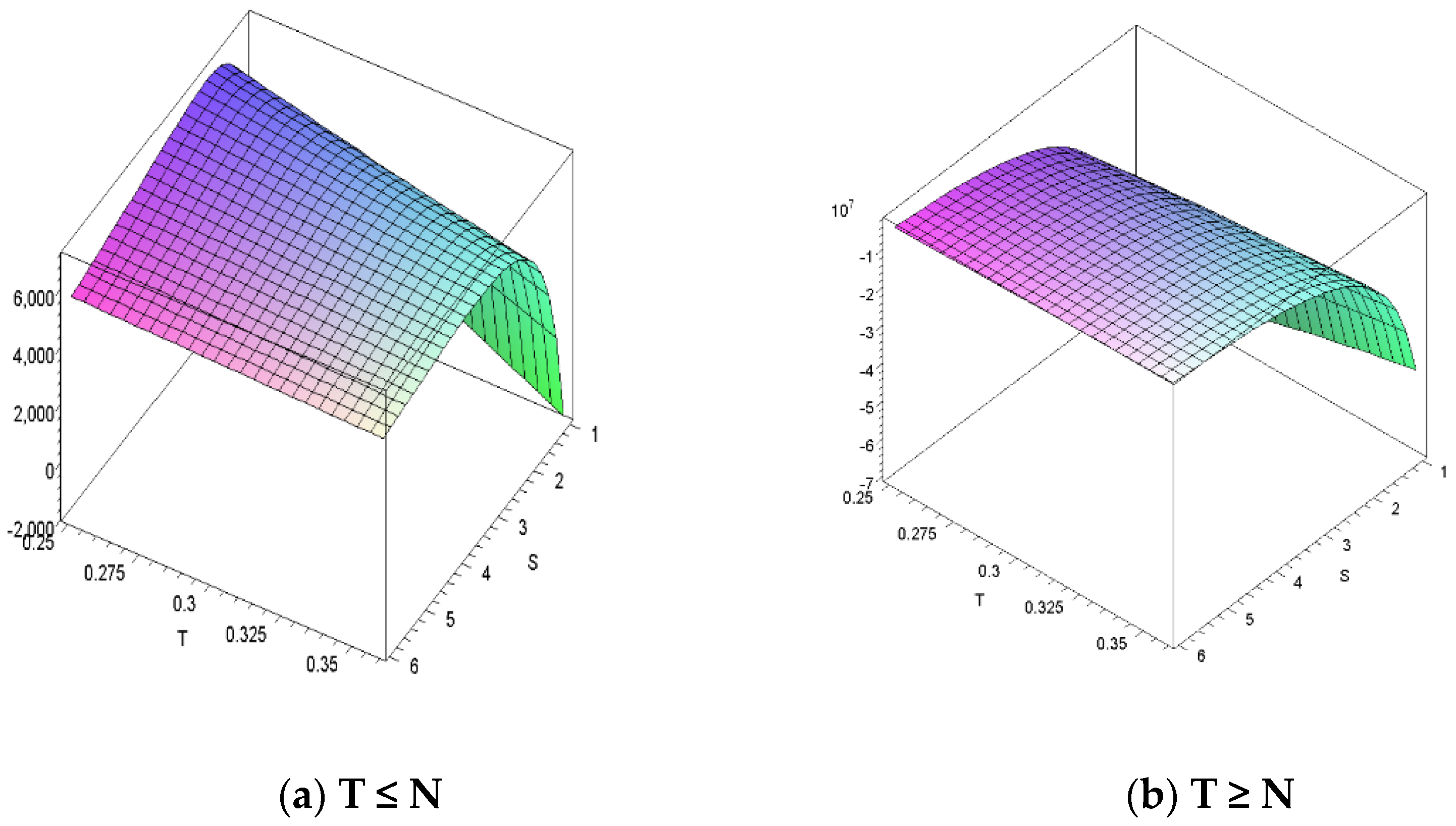

3.5. Calculation of the Optimal Cycle Time

3.6. Solution Method

- 1.

- Ifthen optimal cycle time is

- 2.

- Ifthen optimal cycle time is

- 3.

- Ifthen optimal cycle time is N

4. Computational Algorithm

- Determine by solving the Equation (31).

- Calculate by taking . If there exist such that and satisfies both the first-order derivative according to the Equation (18) and the second-order derivative for concavity according to the Equation (20), then we determine by Equation (22) and by Equation (15). Otherwise, we set .

- Calculate by taking . If there exist such that and satisfies both the first-order derivative according to the Equation (19) and the second-order derivative for concavity according to the Equation (21), then we determine by Equation (26) and by Equation (16). Otherwise, we set .

- If then is an optimal net annual profit so stop. Otherwise, an optimal net annual profit is , and stop.

- Calculate related cycle time as well as net profit per cycle.

5. Numerical Investigation

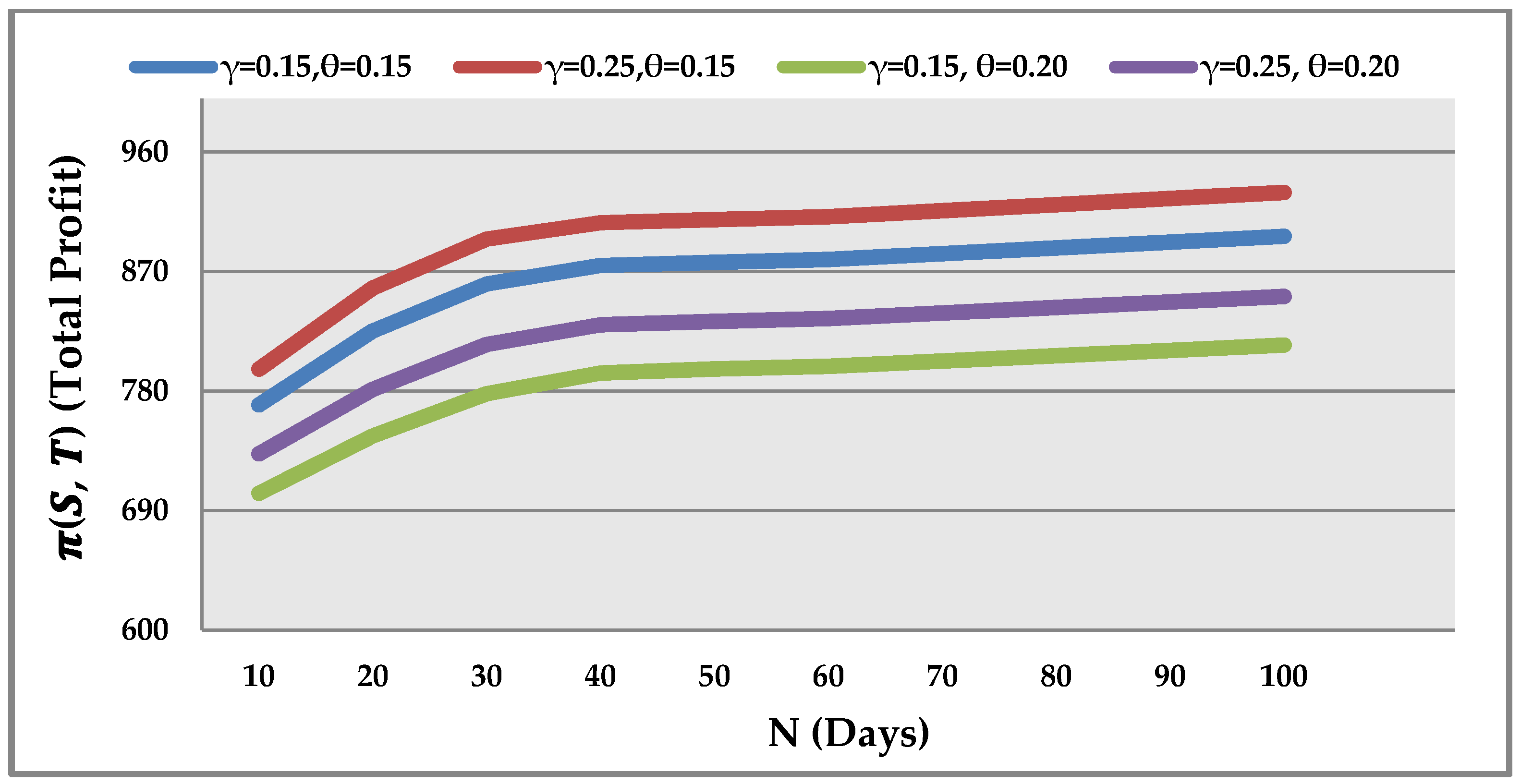

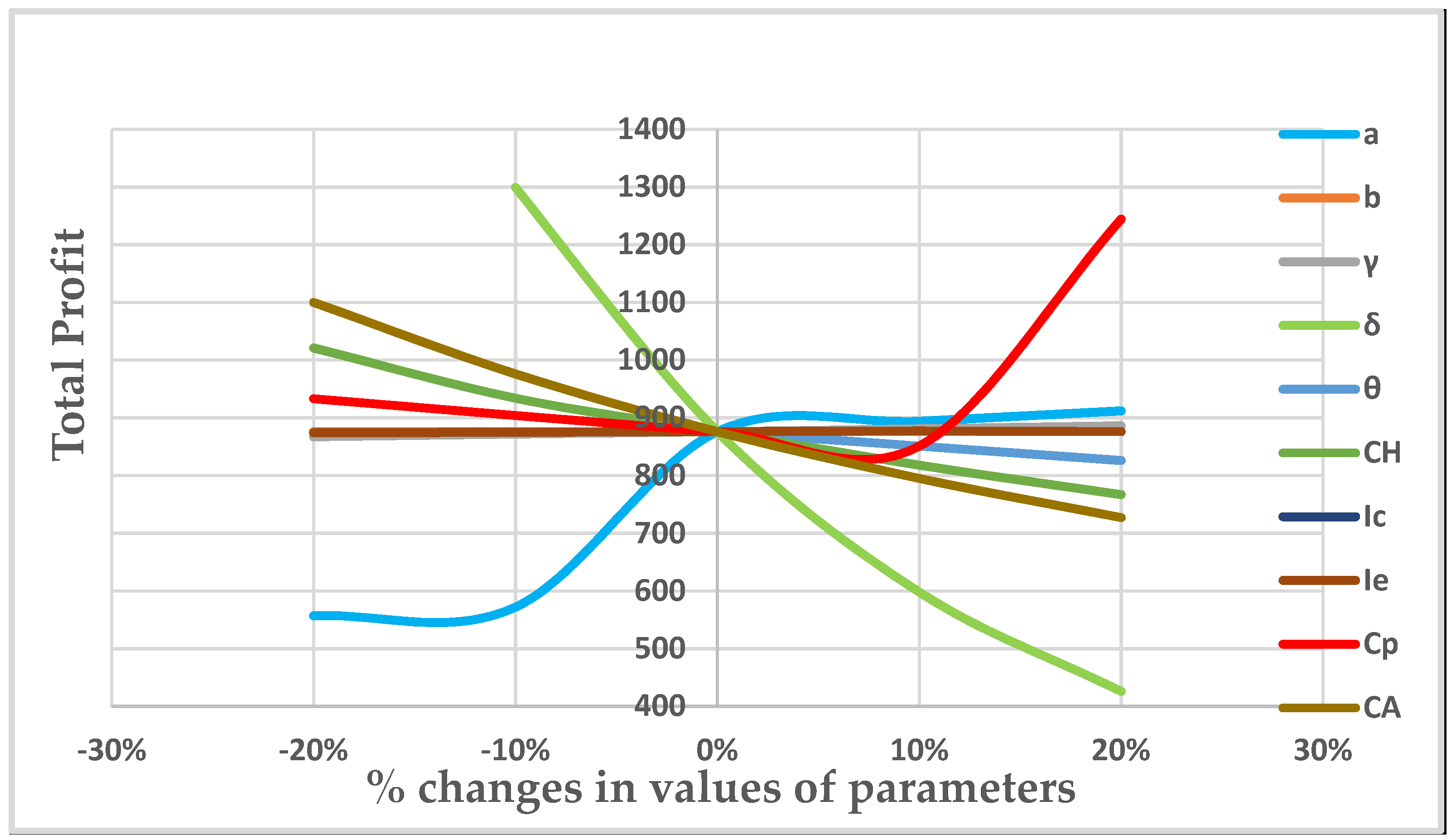

5.1. Sensitivity Analysis

5.2. Observations and Managerial Insights

- For higher value of fix display parameter, salvage value and degradation component during the deferred payment period increases the net profit per cycle but decreases cycle length and optimal selling price.

- When (optimal), there is a decrease in optimum lot size and an increase in the deferred payment period N.

- If , then there were increases in optimum order quantity as higher value in the deferred payment period N.

- Higher value in display parameter and degradation component as well as lower in salvage value decrease the overall income per cycle and order size. This happens due to more degradation and less salvage value in inventory system. Moreover, higher value in stock-linked parameter raises selling price.

- The rise in order size is evident when the stock-dependent parameter is increased. With rising stock levels, the profit function rises. Therefore, increasing b is recommended.

- One of the main elements in the inventory model that has a direct impact on both the cycle time and the overall profit function is holding cost. Increased cycle times brought on by higher holding costs result in a decline in profit margin.

- It is not advisable to raise the interest rate because doing so will directly reduce the retailer’s profit when the selling price rises.

- A higher interest rate is advised since it will immediately optimize the retailer’s profit while lowering the selling price and cycle time.

- Increased rates of deterioration cause objects to lose their usefulness. The profit function will suffer as a result of the increased unit deterioration.

6. Discussions

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dave, U. “Economic order quantity under conditions of permissible delay in payments” by Goyal. J. Oper. Res. Soc. 1985, 36, 10–69. [Google Scholar] [CrossRef]

- Goyal, S.K. Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 1985, 36, 335–338. [Google Scholar] [CrossRef]

- Aggarwal, S.P.; Jaggi, C.K. Ordering policies of deteriorating items under permissible delay in payments. J. Oper. Res. Soc. 1995, 46, 658–662. [Google Scholar] [CrossRef]

- Jamal, A.M.M.; Sarker, B.R.; Wang, S. Ordering policies for deteriorating items with allowable shortage and permissible delay in payments. J. Oper. Res. Soc. 1997, 48, 826–833. [Google Scholar] [CrossRef]

- Hwang, H.; Shinn, S.W. Retailer’s pricing and lot sizing policy for exponentially permissible delay in payments. Comput. Oper. Res. 1997, 24, 539–547. [Google Scholar] [CrossRef]

- Liao, H.C.; Tsai, C.H.; Su, C.T. An inventory model with deteriorating items under inflation when a delayin payment is permissible. Int. J. Prod. Econ. 2000, 63, 207–214. [Google Scholar] [CrossRef]

- Jamal, A.M.M.; Sarker, B.R.; Wang, S. Optimal payment time for a retailer under permitted delay of payment by the wholesaler. Int. J. Prod. Econ. 2000, 66, 59–66. [Google Scholar] [CrossRef]

- Sarker, B.R.; Jamal, A.M.M.; Wang, S. Optimal payment time under permissible delay for products with deterioration. Prod. Plan. Control 2000, 11, 380–390. [Google Scholar] [CrossRef]

- Chang, H.J.; Dye, C.Y. An inventory model for deteriorating items with partial backlogging and permissible delay in payments. Int. J. Syst. Sci. 2001, 32, 345–352. [Google Scholar] [CrossRef]

- Chang, H.J.; Dye, C.Y.; Chung, B.R. An inventory model for deteriorating items under the condition of permissible delay in payments. Yugosl. J. Oper. Res. 2002, 12, 73–84. [Google Scholar] [CrossRef]

- Teng, J.T. On the economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 2002, 53, 915–918. [Google Scholar] [CrossRef]

- Chang, C.T.; Ouyang, L.Y.; Teng, J.T. An EOQ model for deteriorating items under manufacturer credits linked to ordering quantity. Appl. Math. Model. 2003, 27, 983–996. [Google Scholar] [CrossRef]

- Teng, J.T.; Chang, C.T.; Goyal, S.K. Optimal pricing and ordering policy under permissible delay in payments. Int. J. Prod. Econ. 2005, 97, 121–129. [Google Scholar] [CrossRef]

- Huang, Y.F. An inventory model under two-level of trade-credit and limited storage space derived without derivatives. Appl. Math. Model. 2006, 30, 418–436. [Google Scholar] [CrossRef]

- Shah, N.H.; Patel, A.R. Optimal pricing and ordering policy for stock-dependent demand under delay in payments. Aust. Soc. Oper. Res. Inc. 2009, 28, 2–9. [Google Scholar]

- Chung, K.J. The simplified solution procedures for the optimal replenishment decisions under two-level of trade-credit policy depending on the order quantity in a supply chain system. Exp. Syst. Appl. 2011, 38, 13482–13486. [Google Scholar] [CrossRef]

- Venkateswarlu, R.; Mohan, R. An inventory model for time varying deterioration and price dependent quadratic demand with salvage value. J. Comput. Appl. Math. 2013, 1, 21–27. [Google Scholar]

- Chen, S.C.; Cárdenas-Barrón, L.E.; Teng, J.T. Retailers economic order quantity when the supplier offers conditionally permissible delay in payments link to order quantity. Int. J. Prod. Econ. 2014, 155, 284–291. [Google Scholar] [CrossRef]

- Bhunia, A.K.; Shaikh, A.A.; Sahoo, S. A two-warehouse inventory model for deteriorating item under permissible delay in payment via particle swarm optimization. Int. J. Logist. Syst. Manag. 2016, 24, 45–69. [Google Scholar]

- Bardhan, S.; Pal, H.; Giri, B.C. Optimal replenishment-policy and preservation-technology investment for a non instantaneous deteriorating item with stock dependent demand. Oper. Res. 2017, 19, 347–368. [Google Scholar] [CrossRef]

- Pervin, M.; Roy, S.K.; Weber, G.W. A two echelon inventory model with stock-dependent demand and variable holding-cost for deteriorating items. Numer. Algebra Control Optim. 2017, 7, 21. [Google Scholar] [CrossRef]

- Sen, N.; Saha, S. An inventory model for deteriorating items with time dependent holding cost and shortages under permissible delay in payment. Int. J. Procure. Manag. 2018, 11, 518–531. [Google Scholar]

- Tripathi, R.P.; Tomar, S.S. Establishment of EOQ Model with Quadratic Time Sensitive Demand and Parabolic Time Linked Holding-cost with Salvage-value. Int. J. Oper. Res. 2018, 15, 135–144. [Google Scholar]

- Kumar, P. An inventory planning problem for time varying linear demand and parabolic holding-cost with salvage-value. Croat. Oper. Res. Rev. 2019, 10, 187–199. [Google Scholar] [CrossRef]

- Chen, L.; Chen, X.; Keblis, M.F.; Li, G. Optimal pricing and replenishment policy for deteriorating inventory under stock level dependent, time varying and price sensitive demand. Comput. Ind. Eng. 2019, 135, 1294–1299. [Google Scholar] [CrossRef]

- Lu, C.J.; Lee, T.S.; Gu, M.; Yang, C.T. A Multistage Sustainable Production–Inventory Model with Carbon Emission Reduction and Price-Dependent Demand under Stackelberg Game. Appl. Sci. 2020, 10, 4878. [Google Scholar] [CrossRef]

- Saren, S.; Sarkar, B.; Bachar, R.K. Application of Various Price-Discount Policy for Deteriorated Products and Delay-in-Payments in an Advanced Inventory Model. Inventions 2020, 5, 50. [Google Scholar] [CrossRef]

- Tripathi, R.P.; Tomar, S.S. Innovative study of economic order quantity model for quadratic time dependent demand under tolerable delay in payments with inconsistent holding cost and associated salvage-value. Int. J. Comput. Syst. Eng. 2020, 6, 52–62. [Google Scholar] [CrossRef]

- Khanna, A.; Jaggi, C.K. An inventory model under price and stock-dependent demand for controllable deterioration rate with shortages and preservation technology investment: Revisited. Opsearch 2021, 58, 181–202. [Google Scholar]

- Miah, M.S.; Islam, M.M.; Hasan, M.; Mashud, A.H.M.; Roy, D.; Sana, S.S. A Discount Technique-Based Inventory Management on Electronics Products Supply Chain. J. Risk Financ. Manag. 2021, 14, 398. [Google Scholar] [CrossRef]

- Pando, V.; San-José, L.A.; Sicilia, J. An Inventory Model with Stock-Dependent Demand Rate and Maximization of the Return on Investment. Mathematics 2021, 9, 844. [Google Scholar] [CrossRef]

- Pando, V.; San-José, L.A.; Sicilia, J.; Alcaide-López-de-Pablo, D. Profitability Index Maximization in an Inventory Model with a Price- and Stock-Dependent Demand Rate in a Power-Form. Mathematics 2021, 9, 1157. [Google Scholar] [CrossRef]

- Mondal, R.; Shaikh, A.A.; Bhunia, A.K.; Hezam, I.M.; Chakrabortty, R.K. Impact of trapezoidal demand and deteriorating preventing technology in an inventory model in interval uncertainty under backlogging situation. Mathematics 2022, 10, 78. [Google Scholar] [CrossRef]

| Authors | Stock-, Price- Dependent Demand | Deterioration | Trade Credit | Salvage Value |

|---|---|---|---|---|

| Liao et al. (2000) | √ | √ | ||

| Sarker et al. (2000) | √ | |||

| Chang et al. (2003) | √ | √ | ||

| Teng et al. (2005) | √ | √ | ||

| Shah and Patel (2009) | √ | √ | ||

| Chen et al. (2014) | √ | |||

| Pervin et al. (2017) | √ | √ | ||

| Sen and Saha (2018) | √ | √ | ||

| Chen et al. (2019) | √ | √ | √ | |

| Tripathi and Tomar (2020) | √ | √ | √ | |

| Khanna and Jaggi (2021) | √ | √ | ||

| Our Paper | √ | √ | √ | √ |

| N—Days | T | K(T) | ||||

|---|---|---|---|---|---|---|

| 10 | 0.15 | 0.5444 | = 4.0606 | = 0.1130 | 188 | 769 |

| 0.20 | 0.2300 | = 4.9804 | = 0.1264 | 138 | 703 | |

| 20 | 0.15 | 1.3740 | = 3.2908 | = 0.0986 | 253 | 825 |

| 0.20 | 1.4635 | = 4.1028 | = 0.1110 | 179 | 746 | |

| 30 | 0.15 | 2.3636 | = 3.2571 | = 0.1000 | 277 | 860 |

| 0.20 | 2.5174 | = 3.9221 | = 0.1101 | 197 | 778 | |

| 40 | 0.15 | 3.4758 | = 3.5468 | = 0.1109 | 256 | 874 |

| 0.20 | 3.7018 | = 4.1419 | = 0.1177 | 192 | 793 | |

| 45 | 0.15 | 4.0714 | = 3.5696 | = 0.1117 | 255 | 876 |

| 0.20 | 4.3359 | = 4.3119 | = 0.1227 | 186 | 796 | |

| 50 | 0.15 | 4.6908 | = 3.5581 | = 0.1115 | 256 | 879 |

| 0.2. | 4.9954 | = 4.2979 | = 0.1224 | 187 | 798 | |

| 60 | 0.15 | 5.9961 | = 3.5351 | = 0.1109 | 258 | 883 |

| 0.20 | 6.3850 | = 4.2702 | = 0.1218 | 189 | 802 | |

| 70 | 0.15 | 7.3831 | = 3.5123 | = 0.1104 | 260 | 887 |

| 0.20 | 7.8613 | = 4.2427 | = 0.1213 | 190 | 806 | |

| 80 | 0.15 | 8.8456 | = 3.4897 | = 0.1099 | 262 | 892 |

| 0.20 | 9.4177 | = 4.2154 | = 0.1207 | 192 | 810 | |

| 90 | 0.15 | 10.3787 | = 3.4673 | = 0.1093 | 264 | 896 |

| 0.20 | 11.0490 | = 4.1884 | = 0.1201 | 193 | 814 |

| N—Days | T | K(T) | ||||

|---|---|---|---|---|---|---|

| 10 | 0.15 | 0.5316 | = 3.7539 | = 0.1081 | 213 | 796 |

| 0.20 | 0.5633 | = 4.5382 | = 0.1201 | 159 | 732 | |

| 20 | 0.15 | 1.3417 | = 3.0302 | = 0.0944 | 290 | 857 |

| 0.20 | 1.4217 | = 3.7075 | = 0.1051 | 209 | 781 | |

| 30 | 0.15 | 2.3081 | = 3.0466 | = 0.0981 | 305 | 894 |

| 0.20 | 2.4456 | = 3.5963 | = 0.1057 | 228 | 815 | |

| 40 | 0.15 | 3.3943 | = 3.3351 | = 0.1081 | 287 | 906 |

| 0.20 | 3.5964 | = 3.8519 | = 0.1144 | 219 | 829 | |

| 45 | 0.15 | 59 | = 3.3243 | = 0.1078 | 287 | 909 |

| 0.20 | 4.2125 | = 3.9539 | = 0.1176 | 215 | 832 | |

| 50 | 0.15 | 4.5809 | = 3.3135 | = 0.1076 | 288 | 911 |

| 0.20 | 4.8533 | . = 3.9411 | = 0.1173 | 216 | 834 | |

| 60 | 0.15 | 5.8558 | . = 3.2921 | = 0.1071 | 291 | 915 |

| 0.20 | 6.2035 | = 3.9157 | = 0.1167 | 218 | 838 | |

| 70 | 0.15 | 7.2106 | = 3.2709 | = 0.1066 | 293 | 920 |

| 0.20 | 7.6382 | = 3.8905 | = 0.1161 | 219 | 842 | |

| 80 | 0.15 | 8.6391 | = 3.2498 | = 0.1060 | 296 | 924 |

| 0.20 | 9.1507 | 221 | 847 | |||

| 90 | 0.15 | 10.1368 | = 3.2290 | = 0.1055 | 298 | 929 |

| 0.20 | 10.7362 | = 3.8406 | = 0.1150 | 223 | 851 |

| Parameter | % Changes | T | K(T) | ||

|---|---|---|---|---|---|

| A | −20% | 5.557 | 0.1737 | 124 | 557 |

| −10% | 5.422 | 0.1695 | 128 | 572 | |

| 10% | 3.499 | 0.1096 | 263 | 894 | |

| 20% | 3.432 | 0.107 | 273 | 912 | |

| b | −20% | 3.569 | 0.112 | 220 | 876 |

| −10% | 3.569 | 0.112 | 238 | 878 | |

| 10% | 3.569 | 0.112 | 272 | 880 | |

| 20% | 3.569 | 0.112 | 289 | 883 | |

| −20% | 3.645 | 0.113 | 246 | 867 | |

| −10% | 3.670 | 0.112 | 250 | 872 | |

| 10% | 3.532 | 0.111 | 259 | 881 | |

| 20% | 3.495 | 0.110 | 264 | 886 | |

| −20% | Infeasible | ||||

| −10% | 5.728 | 0.139 | 175 | 1299 | |

| 10% | 2.384 | 0.088 | 383 | 598 | |

| 20% | 1.375 | 0.057 | 819 | 426 | |

| −20% | 3.157 | 0.105 | 313 | 933 | |

| −10% | 3.360 | 0.108 | 282 | 904 | |

| 10% | 3.785 | 0.115 | 231 | 851 | |

| 20% | 4.006 | 0.1183 | 210 | 826 | |

| −20% | 2.640 | 0.096 | 427 | 1021 | |

| −10% | 3.087 | 0.104 | 326 | 934 | |

| 10% | 4.086 | 0.119 | 203 | 818 | |

| 20% | 4.637 | 0.126 | 164 | 767 | |

| −20% | 3.157 | 0.105 | 314 | 933 | |

| −10% | 3.360 | 0.108 | 282 | 904 | |

| 10% | 3.785 | 0.115 | 231 | 851 | |

| 20% | 4.006 | 0.094 | 145 | 1244 | |

| −20% | 2.289 | 0.071 | 372 | 1100 | |

| −10% | 2.895 | 0.090 | 304 | 976 | |

| 10% | 4.313 | 0.135 | 217 | 795 | |

| 20% | 5.126 | 0.160 | 189 | 727 | |

| −20% | 3.595 | 0.113 | 253 | 874 | |

| −10% | 3.582 | 0.112 | 254 | 875 | |

| 10% | 3.556 | 0.111 | 256 | 877 | |

| 20% | 3.544 | 0.110 | 257 | 876 | |

| −20% | 2.289 | 0.071 | 372 | 1100 | |

| −10% | 2.895 | 0.090 | 304 | 976 | |

| 10% | 4.313 | 0.135 | 217 | 795 | |

| 20% | 5.126 | 0.160 | 189 | 727 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Patel, A.; Talati, I.; Oza, A.D.; Burduhos-Nergis, D.D.; Burduhos-Nergis, D.P. A Profit Maximization Inventory Model: Stock-Linked Demand Considering Salvage Value with Tolerable Deferred Payments. Mathematics 2022, 10, 3830. https://doi.org/10.3390/math10203830

Patel A, Talati I, Oza AD, Burduhos-Nergis DD, Burduhos-Nergis DP. A Profit Maximization Inventory Model: Stock-Linked Demand Considering Salvage Value with Tolerable Deferred Payments. Mathematics. 2022; 10(20):3830. https://doi.org/10.3390/math10203830

Chicago/Turabian StylePatel, Amisha, Isha Talati, Ankit D. Oza, Dumitru Doru Burduhos-Nergis, and Diana Petronela Burduhos-Nergis. 2022. "A Profit Maximization Inventory Model: Stock-Linked Demand Considering Salvage Value with Tolerable Deferred Payments" Mathematics 10, no. 20: 3830. https://doi.org/10.3390/math10203830

APA StylePatel, A., Talati, I., Oza, A. D., Burduhos-Nergis, D. D., & Burduhos-Nergis, D. P. (2022). A Profit Maximization Inventory Model: Stock-Linked Demand Considering Salvage Value with Tolerable Deferred Payments. Mathematics, 10(20), 3830. https://doi.org/10.3390/math10203830