1. Introduction

The supply of energy in South Korea is mainly reliant on imports, and any shifts in the energy supply would have a significant influence on the Korean economy. A good illustration of this is the fact that the global energy supply has been severely disrupted as a result of the combined effects of the war between Ukraine and Russia and the COVID-19 pandemic, which has also placed a significant strain on the Korean economy. Raw material price information was obtained from the Ministry of Industry, Trade, and Resources of the Republic of Korea on June 1. As of that date, the import price of liquefied natural gas in Korea rose 68.4% (USD 534.9 per ton), while the price of coal used for power generation increased 125.5% (USD 206.3 per ton) year on year. In the meantime, a report from the Korean Institute of Contemporary Economics suggested that South Korea was already suffering from a lack of available resources. In addition, Korea’s economy, which was mostly based on the heavy chemical industry, was heavily reliant on the world’s supply of raw materials and its economic interactions with the world. As a result, it is possible that it will be impacted more severely than other countries.

Given the significance of energy to the progress of Korea’s economy, a significant number of academics have focused their emphasis on this specific feature. Oh and Lee [

1] investigated this subject using the vector error correction model. They came to the conclusion that the use of energy was a significant factor that promoted economic development. Cunado et al. [

2] investigated the macroeconomic effects of oil price fluctuations in Korea. For empirical analysis, they employed the structural vector autoregression approach. They discovered that an oil price shock had a substantial impact on the gross domestic product, the consumer price index, the exchange rate, and the interest rate. Masih et al. [

3] assessed the volatility in Korea. Using a linear error correction model and an asymmetric two-period Markov switching model for empirical analysis, they discovered that variations in gross domestic product, interest rate, and stock returns were induced by the oil price. Moreover, Lee and Cho [

4], Hsieh [

5], and Hoffmaister and Roldós [

6] explored this issue using various methodologies. Likewise, they arrived at the same conclusions.

The research background that was discussed before serves as the point of departure for the work that will be done in this paper. As a result of this, we make use of a stochastic general dynamic equilibrium model to study how the energy price shock affects the Korean macroeconomy. Based on the findings of an investigation that made use of the impulse response function, an energy price shock leads to a drop in output, labor supply, capital stock, and energy consumption, as well as a rise in consumption, wages, goods price level, inflation, and deposit interest rate. In the meantime, results from variance decomposition suggest that the energy price shock has a higher influence on the macroeconomy of Korea than other shocks. Additionally, these new findings, which were obtained by using international data, modifying the inflation response coefficient and the output response coefficient, and adjusting the degree of staggered pricing for re-simulation, are supported by the conclusions that were derived beforehand.

The following are some of the contributions that this study makes in comparison to the great majority of the Korean studies that have been conducted in the past: to begin, it has come to light that past investigations into this topic that were carried out in Korea made use of the vector autoregressive technique, the structural vector autoregressive approach, and the vector error correction approach. These techniques, on the other hand, are not supported by any economic evidence. As a result of this rationale, the dynamic stochastic general equilibrium model was used in this study to investigate the effects that a shock in the price of energy might have on the Korean macroeconomy. The model has microeconomic foundations in three sectors: households, firms, and central banks. Furthermore, since Korea is an energy importer, changes in the price of energy are very sensitive to Korean macroeconomic variables’ fluctuations. As a result, looking at this topic from the perspective of Korea is the most representative way to approach it.

The remainder of this work is structured as follows:

Section 2 provides the previous literature on this topic.

Section 3 presents the model.

Section 4 shows the findings and discussion.

Section 5 draws the conclusions.

2. Literature Review

The effects of energy prices on the macroeconomy have been studied by a significant number of economists. In this section, we establish the theoretical foundation for this article by conducting a literature review of research techniques, research goals, and research results from previous studies.

Using the recursive vector autoregressive model and the vector error correction model, Ran and Voon [

7] investigated whether oil price shocks had a substantial impact on the Korean economy. Regardless of the model’s assumptions, they found no significant impact on real gross domestic product. However, after three period lags, they discovered substantial positive impacts on unemployment. Park et al. [

8] employed a structural vector autoregressive model to examine the impact of oil price variations on provincial macroeconomic indicators. They divided Korea into four main areas (Central, Honam, Gyeongsang, and Capital) based on the number of metropolitan cities and provinces in Korea. Then, they investigated how changes in the price of oil affected the economies of these areas. They discovered a negative reaction to industrial output and prices. Meanwhile, oil price variations had less of an impact on the capital area than on the other three provincial areas. Alom et al. [

9] used a structural vector autoregressive model to assess the macroeconomic effects of an oil price shock on the Korean economy. They observed that the oil price shock had a substantial influence on the economic operations of resource-scarce countries such as Korea, which was recognized for its proficiency in heavy manufacturing sectors. Ioannidis and Ka [

10] conducted research on the effects of oil price shocks on the South Korean economy using a structural vector autoregressive framework. They discovered that interruptions in oil supply had a short-term negative influence on interest rates. In addition, the results of Akay and Uyar [

11], Jin and Kim [

12], and Ran and Baek [

13] were in line with the findings presented above.

Using a global vector autoregressive model, Park and Shin [

14] conducted an empirical investigation to study how oil prices affected the Korean economy. According to what they discovered, the influence of oil prices became quite significant in the case of real output, equity prices, and real exports. Greenwood-Nimmo et al. [

15] also used a global vector autoregressive model to study this topic in Korea. Despite the fact that this factor has a minor effect on inflation, they found that the financial markets and the real economy are extremely sensitive to fluctuations in the price of oil. This was a surprising finding given that inflation is mostly influenced by other factors. Nusair and Olson [

16] explored the asymmetric impact of oil prices on the Korean economy using a nonlinear autoregressive distributed lag technique. They found that an increase in oil prices had an asymmetrically higher impact on output than a decrease in oil prices did. In addition, they used nonlinear causality tests to demonstrate the causal relationship between oil price and output in Korea. Baek [

17] also used a nonlinear autoregressive distributed lag technique to examine the economic effects of oil prices. They made the discovery that there was evidence suggesting that fluctuations in oil prices seemed to impact Korea’s trade in an unbalanced manner both in the long run and in the short run. Furthermore, Coffman [

18], Bastianin and Manera [

19], and Lee and Huh [

20] all provided evidence that supported the aforementioned findings.

The simultaneous equation model was used by Hsieh [

5] to investigate the impact of oil price shocks and macroeconomic variables on output variations for Korea. He discovered that the elasticity of output with regard to the oil price was assessed to be −0.042, implying that a 1% increase in the oil price would result in a 0.42% decline in real gross domestic product. Using the vector error correction model, Glasure [

21] investigated the link between the price of energy and the level of national income, paying particular attention to the factors that were left out of the analysis. He came to the conclusion that the oil price was a significant factor in both energy consumption and real national income. Previous research failed to account for some factors, which resulted in either a lack of or the presence of a causal relationship between energy consumption and real income. He also discovered that the combination of the two kinds of oil price shocks had a detrimental effect on real national income. Kim [

22] conducted research to examine how fluctuations in the price of oil impacted the production operations of Korean manufacturers. Using a structural vector autoregressive model as the basis for his empirical research, he discovered that an increase in the price of oil led to a decline in both the level of industrial output and the price level of goods. This finding demonstrated how a rise in oil prices had a negative effect on industrial production activities not only by slowing demand in local markets but also by contracting supply in export markets. In addition to this, these results were in line with those found by Lee et al. [

23], Van Wijnbergen [

24], and Cha [

25].

In the previous Korean literature review on this subject, we found that the majority of researchers investigated the economic implications of changes in energy prices by using the simultaneous equation model, structural vector autoregressive model, and vector error correction model, as well as global vector autoregressive model. Therefore, this study employs the stochastic dynamic general equilibrium model to investigate the impact of energy prices on the Korean macroeconomy as a means of contributing more depth to the discussion around this subject. While doing so, it also accounts for the topic’s most microscopic foundational aspects.

3. Model

We design a dynamic stochastic general equilibrium model of the energy price and macroeconomy, which includes the following three sectors: households, firms, and central banks. Energy price is connected with firms to examine the influence it has on the macroeconomy. The following is a specification of the model.

3.1. Households

A separate instantaneous utility function is what we go with in this paper. In the context of the economy, it is assumed that the representative household sector has an infinitely long lifespan. This kind of household receives income by providing labor and obtains utility by engaging in leisure activities. As a result, the purpose of the household is to optimize the allocation of labor and leisure to maximize lifetime utility. Following He [

26], the following expression defines the utility function of the representative household:

where

represents a mathematical expectation operator for all variables’ future values;

represents a discount factor;

presents the sum of the current values of the lifetime utility of the representative household;

represents consumption;

represents the labor supply. Assume that the utility function with constant relative risk aversion is used in this work. It is shown as follows:

where

represents the disutility of labor;

represents the relative risk aversion parameter;

represents the inverse of the elasticity of labor supply;

represents the shock of labor supply. Meanwhile, as with a representative household, it has budget constraints in a rational situation. That is, total expenditures can not exceed total incomes. In Equation (3), total expenditures are on the left side while total incomes are on the right side. The budget constraint is shown as follows:

where

represents price level;

represent bonds;

represents wage;

represents deposit interest rate. By combining Equations (2) and (3), we can determine the first-order conditions of the representative household by constructing a Lagrange function and computing the derivative of labor and consumption. Equation (4) represents the labor supply. Equation (5) represents the Euler equation (decision equation between saving and consumption). The first-order conditions of labor and consumption are shown as follows:

3.2. Firms

Following He and Wang [

27], firms are separated into intermediate goods production firms and final goods production firms. They will be the subject of an in-depth discussion in the sub-sectors that follow.

3.2.1. Intermediate Goods Production Firms

Assume that the intermediate market is perfectly competitive. Following Kim and Loungani [

28], and Backus and Crucini [

29], firms use the capital borrowed from households and energy borrowed from the energy market to produce goods. Its purpose is to minimize its costs:

where

represents the rental price of capital;

represents energy consumption;

represents the price of energy. Meanwhile, the budget constraint is shown as follows:

where

represent intermediate goods;

represents the weight of capital in the capital aggregation function;

represents the elasticity of the demand for energy with respect to its relative price. Then, the capital accumulation equation is shown as follows:

where

represents new investments. By combining Equations (5)–(7), we can determine the first-order conditions of the representative intermediate goods production firm by constructing a Lagrange function and computing the derivative of capital and energy. The first-order conditions of capital and energy are shown as follows:

3.2.2. Final Goods Production Firms

Assume that the final goods market is characterized by monopolistic competition. Final goods production firms use intermediate goods purchased from the intermediate goods market and hire labor to produce differentiated final goods. The nominal price stickiness of the final goods price is determined by Calvo [

30]. Following Finn [

31] and Leduc and Sill [

32]. The purpose of final goods production firms is to minimize their costs:

where

represents intermediate goods price. Meanwhile, the budget constraint is shown as follows:

where

represents final goods;

represents technology shock;

represents the share of intermediate goods. By combining Equations (11) and (12), we can determine the first-order conditions of the representative final goods production firm by constructing a Lagrange function and computing the derivative of labor and intermediate goods price. The expression for marginal costs can be obtained by using the first-order conditions:

where

represents marginal costs. Firms that produce final goods only set prices at random periods of time. In each period, a faction of

of firms sells goods at the previous period’s price, after adjusting it in part to the previous period’s inflation and in part to trend inflation. The other firms can not post the optimal price. As a result, each firm selects the optimal price to maximize the expected discounted dividends paid to households. Following De Fiore et al. (2006) and Natal (2012), the form is shown as follows:

where

represents the degree of staggered pricing.

represents the price of

firm at

period;

represents stochastic discount factor;

represents the output of

firm at

period. Meanwhile, the budget constraint is shown as follows:

where

represents the elasticity of substitution between firms. By combining Equations (14) and (15), we can determine the first-order conditions of the representative firm by constructing a Lagrange function and computing the derivative of relative price and price level.

where

represents the optimal price of homogeneous firms.

3.3. Central Bank

Following Lane [

33] and Walsh [

34], assume that the central bank regulates the money market via the interest rate. A simple Taylor rule is shown as follows:

where

represents interest rate smoothing coefficient;

represents inflation response coefficient;

represents output response coefficient;

represents monetary policy shock.

3.4. Some Identities

Inflation is defined as follows:

The price index of intermediate goods is as follows:

The Phillips curve is as follows:

3.5. Market Clearing Conditions

The following condition keeps clearing in Korea.

4. Results and Discussion

4.1. Parameter Calibration

We employed a parameter calibration method to identify these parameters in this study. In an effort to improve the accuracy and reliability of the estimate findings, we resort to literature that includes Korea as a case study. Following He and Wang [

27], the discount factor (

) is 0.990; the degree of staggered pricing (

) is 0.750; the elasticity of substitution between firms (

) is 6.000; the interest rate smoothing coefficient (

) is 0.750; the inflation response coefficient (

) is 2.514; the output response coefficient (

) is 0.498. Following He [

26], the inverse of the elasticity of labor supply (

) is 1.093. Following Yie and Yoo [

35], the relative risk aversion parameter (

) is 1.773; the depreciation rate (

) is 0.025. Following Kim [

36], the disutility of labor (

) is 1.335. Follwoing An and Kang (2011), the elasticity of the demand for energy with respect to its relative price (

) is 0.045; the weight of capital in the capital aggregation function (

) is 0.570; the share of intermediate goods (

) is 0.360.

4.2. The Effects of Energy Price Shock on Korean Macroeconomy

According to Yoo and Jung [

37], and Kim and Yoo [

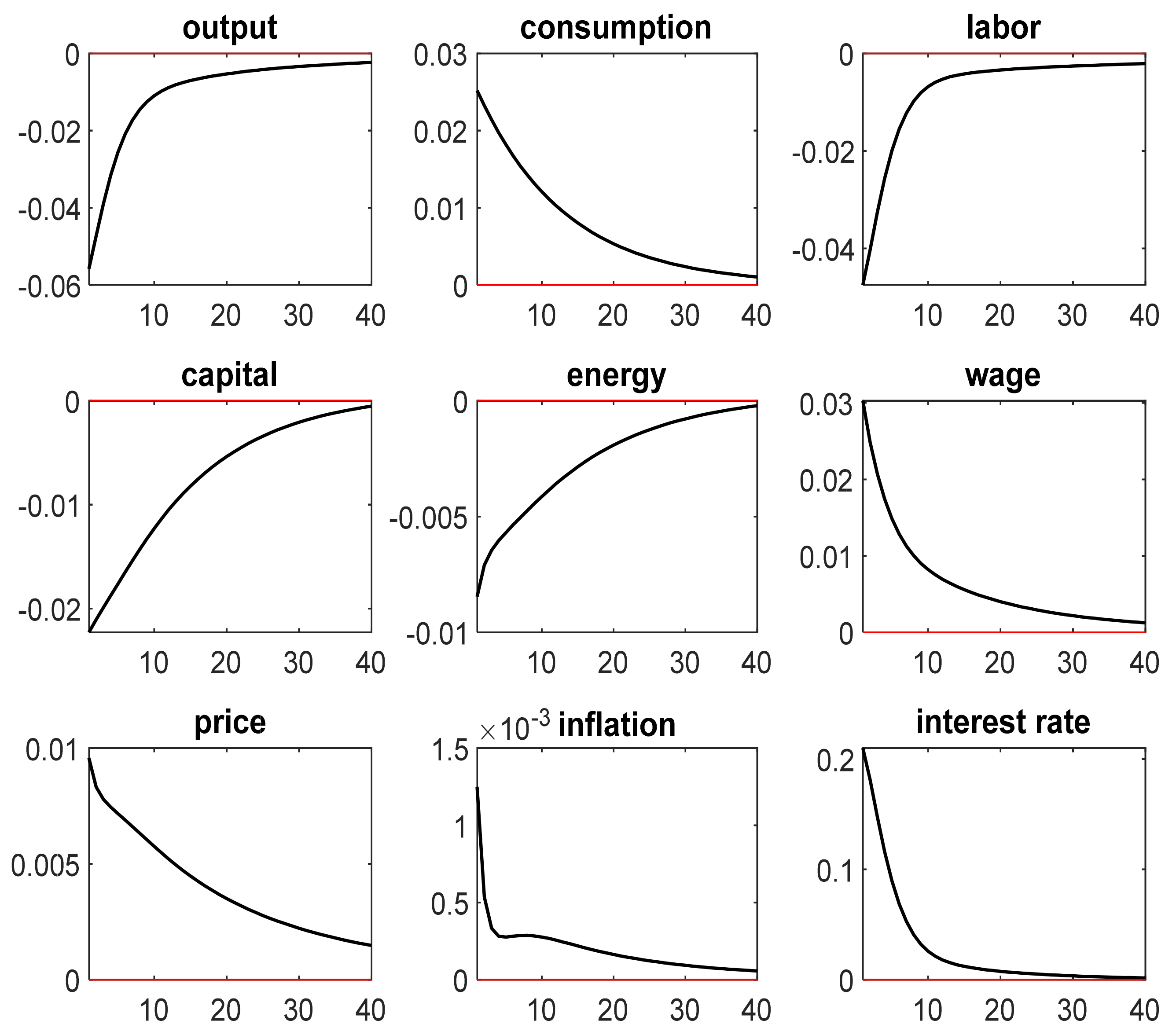

38], the role of energy was becoming an increasingly major component, despite the fact that there were numerous factors impacting the economic fluctuations in Korea. In the meantime, on 21 June 2022, the Chosun Ilbo reported that, in response to Russia’s invasion of Ukraine, the United States had decided to ban the import of Russian crude oil as a penalty, resulting in a dramatic increase in international oil prices. On the global market, the price of oil imported by Korea also increase to USD 120 per barrel. The Chosun Ilbo further said that the Korean economy was greatly reliant on foreign energy and that the increase in international oil prices would be catastrophic for the Korean economy. As energy costs increased, prices would be subject to global upward pressure. As the enterprise’s costs grew, its revenue would similarly decrease. Together, household income, investment, and consumption would decline. Therefore, the aim of this subsection is to examine how energy price shock affects the Korean macroeconomy. The results are presented in

Figure 1.

Figure 1 illustrates how significant shifts occur in key macroeconomic variables in Korea as a result of the energy price shock. A decrease in energy consumption demand is the direct consequence of a rise in energy prices. In the meanwhile, there has been a decline in the total amount of available labor as well as in the stock of capital. Despite this, there has been an uptick in consumption. According to the theory of economic growth, a decrease in output is caused by a combination of factors, including a falling demand for energy, a shrinking capital stock, and a shrinking labor supply. The effects of the energy price shock have led to an increase in general goods prices as well as a rise in relative wage levels. The rise in relative wages and prices subsequently led to an increase in inflation. According to the rules of monetary policy and the Fisher effect, interest rates should react to departures in output and inflation rates from their equilibrium levels. The increase in interest rates is a direct consequence of this. Moreover, these outcomes are consistent with Amiri et al. [

39], Balke and Brown [

40], and Zhang et al. [

41].

4.3. Forecast Error Variance Decomposition

The aim of this subsection is to examine how each structural shock affects the forecast error variance of the endogenous across horizons. Following Smets and Wouters [

42], and Adolfson et al. [

43], the short-run horizon is defined as 1 year; the medium-run horizon is defined as 2.5 years; the long-run horizon is defined as 25 years. The results of forecast error variance decomposition are shown in

Table 1.

Based on the results indicated in

Table 1, let us start by concentrating on the factors that determine output. Once the extremely short-run horizon is taken into account, the primary factors responsible for fluctuations in output are productivity shock and energy price shock. Both shocks are also responsible for explaining a significant portion of the variation in labor supply, energy consumption, price level, inflation, and interest rate. The monetary policy, the labor supply shock, and the government spending shock have a major influence on output in the short run. These effects, however, are expected to last for a considerable amount of time. The influence of productivity and energy price shocks, however, has remained considerable throughout time. The former contributes to around 33.90% and 23.28% percent of the variation in the medium-run output forecast, respectively, while the latter accounts for approximately 31.49% and 23.08%. Meanwhile, it would seem that energy price shock and government spending shock have little effect on the amount of variability in consumption and goods price level.

In the long run, the productivity shock, the monetary shock, the labor supply shock, and the energy price shock are responsible for accounting for 91.36% of the variation in output. These outcomes are consistent with the findings of previous vector autoregressive literature, which shows that such shocks account for the majority of the long-run variance [

44]. However, it should be highlighted that in such literature, it is believed that these shocks affect output in the long run. The limited significance of productivity shock confirms the hypothesis of Gali and Monacelli [

45], Clarida et al. [

46], and Guirado et al. [

47], that the negative correlation between output and employment in response to a productivity shock raises serious doubts regarding the quantitative significance of productivity shocks as a source of aggregate fluctuations in industrialized countries. A possible reason that may explain the substantial positive connection between output, consumption, and employment in the data is the critical impact of labor supply, energy price, and monetary policy shocks in driving output. As the examination of historical decomposition shows, the impact of the monetary policy shock on output disparities is rather steady, owing mostly to South Korea’s sophisticated financial system.

When we look at the drivers of inflation, we find that productivity, monetary policy, and energy price shocks are primarily responsible for changes in inflation across all time periods. In practice, inflation is a process that is subject to a great deal of variation. Meanwhile, it is assumed that inflation will only react extremely slowly to changes in the marginal cost, both those that are already occurring and those that are anticipated. As a result, it should not come as much of a surprise that one needs quantitatively significant “cost-push” shocks in order to account for the behavior of volatile pricing in the short run. Obviously, these shocks have the potential to capture a wide variety of shocks that are not taken into account by the stylized model. Some examples of these types of shocks are changes in changes in tax shocks, terms-of-trade shocks, and others. In the long run, productivity shock, monetary policy shock, labor supply shock, government spending shock, and energy price shock account for 35.98%, 20.76%, 15.77%, 10.72%, and 16.53% of the inflation variation, respectively.

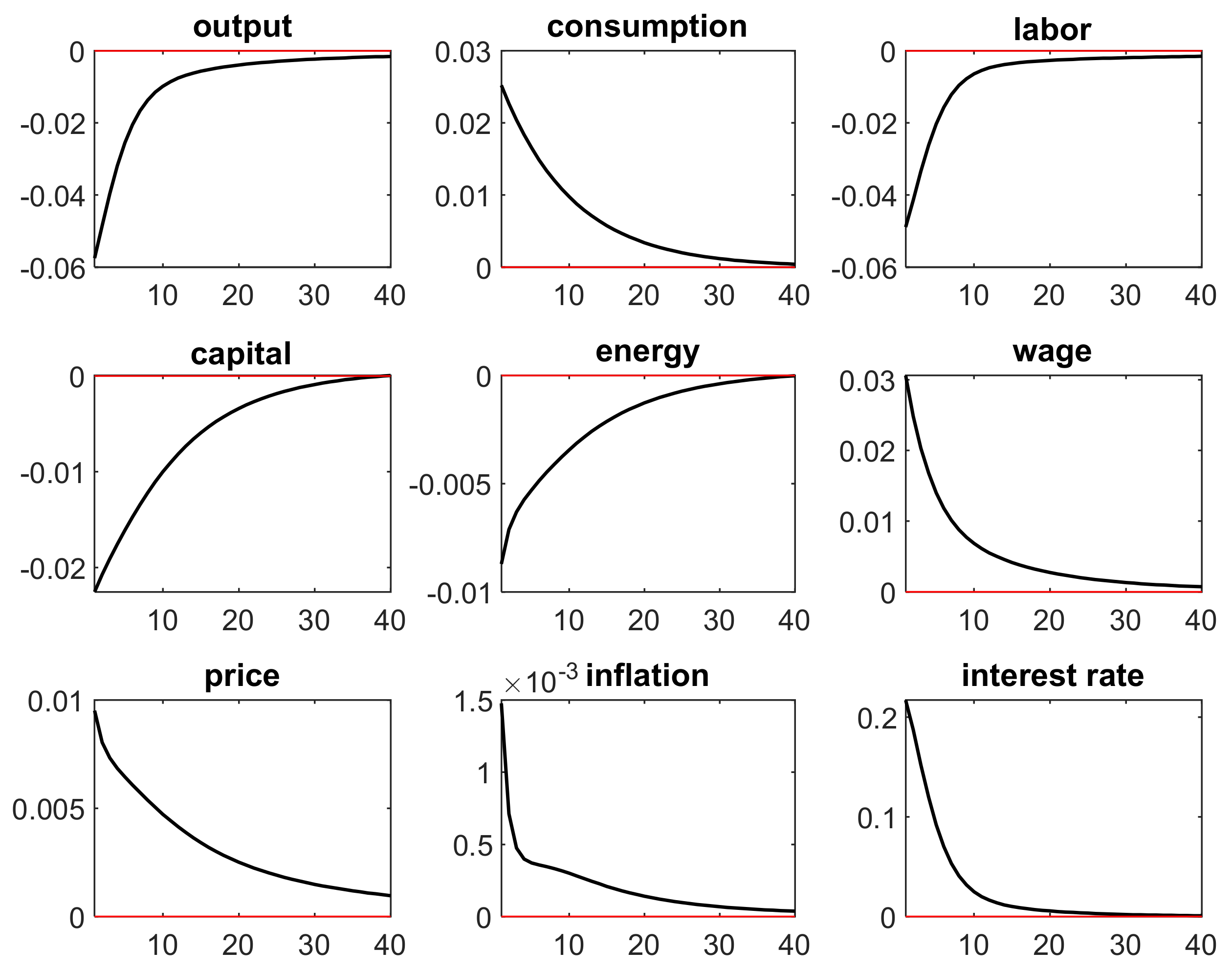

4.4. Robustness Test

Korea is heavily dependent on energy imports. According to the Korean Customs Office on 28 March 2022, as of the 20th of this month, the import size of South Korea’s three primary energy sources (crude oil, natural gas, and coal) has reached USD 38.4966 billion, a rise of 85.4% year on year. The current scenario in Russia and Ukraine, in particular, has caused an increase in global energy prices. Oil, natural gas, and other energy sources are heavily dependent on imports in Korea, with Russia accounting for one-quarter of total crude oil imports. Since increases in oil prices around the world are often mirrored in Korea within two to three weeks, oil prices in Korea are likely to go up in the future. Russia is one of the world’s top natural gas suppliers, and Korea is similarly heavily reliant on natural gas imports. Once the supply and demand for natural gas are uneven, Korea will find it difficult to maintain the 19-month-long freeze in urban natural gas prices and may even cause the country’s electricity prices to increase. Korea’s energy prices will become more international as a result of the intensification of the reform of the process for determining energy prices. As a consequence, in order to ensure that the findings presented in this research are reliable and accurate, we put them through three different types of testing to see how robust they are. First, using international data to simulate the impact of the energy price shock on Koran’s macroeconomic performance may also be seen as a robustness test. Following Balke and Brown [

40], Nakhli et al. [

48], and Argentiero et al. [

49], the autocorrelation coefficient is set to 0.98 and the standard deviation is set to 0.079. The results of the first kind of robustness test are shown in

Figure 2. Second, the inflation response coefficient and the output response coefficient define the strength of interest rate policy. If the coefficient rises, a narrower spread between inflation and output indicates that the interest rate must rise more. Following Ratto et al. [

50] and Soto and Medina [

51], the inflation response coefficient (

) is set to 0.427 and the output response coefficient (

) is set to 2.536. This is the second robustness test. The results are shown in

Figure 3. Third, this study assumes monopolistic competition in the final goods market and nominal price viscosity. That is, only

fraction of all producers in each period is permitted to reset the price. Therefore, it reflects price viscosity. Price stickiness might cause price increases to be delayed. When the macroeconomy is shocked by energy prices, Korean macroeconomic variables will change more violently if price stickiness is reduced. Following Motavaseli et al. [

52], the degree of staggered pricing (

) is set to 0.500. This is the third robustness test. The results are shown in

Figure 4.

The results of the robustness tests are shown in

Figure 2,

Figure 3 and

Figure 4. In

Figure 2, this article swaps out the original model’s data with international data to look at how Korea’s economy has changed as a result of the international energy price shock. Since the link between the model’s endogenous variables has not changed, neither has the way that energy price shocks are passed along. However, the range of change for each variable has expanded differently, as has the time required to return to a state of equilibrium. Except for the goods price level and inflation, the rest of the macroeconomic variables responding to the energy price shock are consistent with the results in

Figure 1. In

Figure 2, even though the inflation response coefficient (

) and the output response coefficient (

) are altered, there is no significant difference between the volatility of each variable and that of each variable in

Figure 1. In

Figure 3, when the degree of staggered pricing (

) is changed to 0.500, each variable in

Figure 4 fluctuates relatively seriously. However, the fluctuating direction of each variable is almost unchanged. As a result, we can conclude that the results in

Figure 1 are reliable and robust.

5. Conclusions

The unpredictability of the global economy brought on by the war between Russia and Ukraine has also prompted fear for the Korean economy. International oil prices continued to climb as a result of the Ukraine–Russia conflict and the COVID-19 pandemic. As a country that imports energy, Korea’s oil prices are likewise increasing significantly. Because of this, the consequences of rising energy prices on the macroeconomy are investigated in this study, using Korea as an example. Using the impulse response function for empirical analysis, the results suggest that an energy price shock leads to an instantaneous drop in energy use. Subsequently, the labor supply, capital stock, and output decline. In contrast, the consumption, wage, goods price level, inflation, and deposit interest rate all rise due to the energy price shock. Moreover, utilizing the variance decomposition for empirical analysis, the energy price shock has a greater impact on forecasting the fluctuating Korean macroeconomy than productivity, monetary policy, labor supply, and government spending shocks. In conclusion, we re-examine this subject matter by using three different kinds of robustness tests. It has been discovered that our findings are robust and reliable.

In contrast to the vast majority of the Korean studies that have been done in the past, this paper provides the following contributions: first, it has been discovered that earlier research conducted in Korea used the vector autoregressive approach, the structural vector autoregressive approach, and the vector error correction approach to investigate this subject. Nevertheless, these approaches are devoid of any economic grounding. For this reason, the dynamic stochastic general equilibrium model was employed in this work to explore the macroeconomic impacts of an energy price shock in Korea. The model included three different sectors: households, firms, and central banks. Second, Korea is an energy importer, and fluctuations in energy prices are quite sensitive to Korea’s macroeconomic variables. Therefore, it is representative to explore this issue using Korea as a case study.

In this article, some policy implications are presented that are based on the findings of the empirical investigation that came before it. First, because of the detrimental effect that the impact of energy prices has had on Korean output, the Korean government needs to expand its energy reserves. It is possible, to some degree, for sufficient energy reserves to mitigate the effect that shifts in energy prices have on the output. Second, it is possible that the results reached in this work may also be applied to other countries, such as Singapore. These countries may prepare for the effect that shifts in energy prices will have on their macroeconomic variables by drawing lessons from South Korea’s experience and learning how to cope with such shifts in advance. Third, because monetary policy and government fiscal policy also have a significant impact on the macroeconomic fluctuations of Korea, the Korean government can also mitigate the impact of energy price shocks on Korean macroeconomic fluctuations by establishing a stable monetary system and introducing appropriate fiscal policies. This is one way in which the Korean government can reduce the impact of energy price shocks on Korean macroeconomic fluctuations.

Finally, this article does have several shortcomings. However, it also offers some recommendations for further research. First, affluent foreign exchange reserves can mitigate the impact of energy price shock on Korea’s macroeconomic fluctuations to a certain degree, so future researchers can add the foreign exchange sector to this article to re-examine this topic, which may produce a more interesting result. Second, Korea is an export-and import-oriented country. To revisit this issue, future researchers might add the import-export sector to this work. This may have various outcomes. Third, future researchers may establish a benchmark analysis in order to undertake a comparative examination. This may provide additional intriguing results.