1. Introduction

For more than two decades after the Cold War, the world economy was increasingly integrated, in terms of both trade—through various free trade agreements—and financial aspects.

Aizenman et al. (

2008) found that the level of financial openness in both developed and emerging countries in Asia and Latin America tended to increase over the period of 1991–2006, along with the lax rules of international exchange flows and international capital flows. The activities of multinational corporations and financial innovations—such as corporate bond issuance and stock listing abroad—also further complicate the inter-state financial linkages in the present (

Azis and Shin 2013). These global monetary and financial conditions are generally summarized under the umbrella term “global liquidity”, which refers to the availability of funding in global financial markets. Even so, in popular discourse, the term global liquidity is often used for more specific matters, such as monetary policy in developed countries or inter-state capital flows, which are more accurately considered to be a subset of the global liquidity issues (

Domanski et al. 2011).

Other aspects of the global economy that often become concerns are global production, global inflation, and global commodity prices. These three variables play a notable role in the economic development of developing countries. For developing countries, economic development is measured by several variables, including GDP, inflation, trade flow, capital inflow, capital account transactions, and foreign exchange, among others (

Aizenman et al. 2008). As identified by

Azis and Shin (

2013), the first surge period (1995Q4–1998Q2) culminated in the Asian financial crisis, while the second surge (2006Q4–2008Q2) was closely related to the credit boom that created preconditions for the global financial crisis. The current global economy may be in a third surge, fueled by a highly accommodative monetary policy in the wake of global recession, along with high commodity prices.

The roles of several variables—such as GDP, inflation, trade flow, capital inflow, capital account transactions, and foreign exchange—affect the influence of global variables on GDP and inflation in developing countries. For most countries, foreign exchange accumulation is a logical response to a possible reversal of capital flows at all times, and to reduce the adverse impacts of economic openness on exchange rate movements (

Aizenman et al. 2008). However, the accumulation of foreign exchange may erode global financial stability by having the bulk of financial instruments invested in developed countries, thereby improving only these countries’ financial conditions (

Domanski et al. 2011;

Landau 2013).

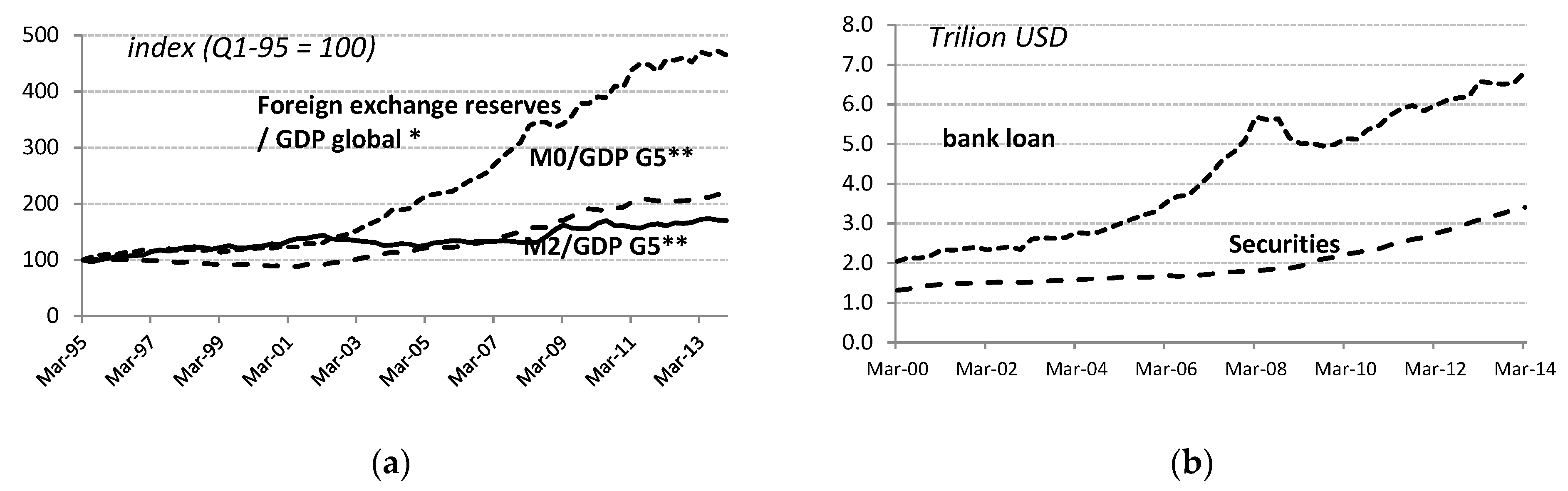

As one of the emerging Asian countries, Indonesia did not escape the phenomenon of this financial integration. Indonesia’s capital inflows have shown an upward trend relative to GDP and inflation since the end of the Asian crisis. The percentage of Indonesian financial assets held by foreigners has also shown an upward trend over the past eight years (

Figure 1a; “*” indicates the total loan from the US, European Union, and Japan, while “**” represents finance from the US, European Union, Japan, UK, and Canada). The fluctuations now tend to be more extreme (

Figure 1b). In line with this, the awareness of economic actors and takeover policies in Indonesia is increasing about the vulnerability of domestic economic conditions to fluctuations in global liquidity.

Empirical studies of the global liquidity spillover on Indonesia’s economy are still relatively limited. Most of the global contagion literature on Indonesia’s economy (

Pratomo 2013) focuses only on the effects of real shock (on output) due to financial shock; in contrast, fluctuations in financial indicators often precede and predict changes in Indonesia’s GDP (

Ng 2011). Several other studies have examined the impact of global liquidity on Indonesia in more specific contexts, such as the work of

Yiu and Sahminan (

2015), who studied the relationship between capital inflow and property prices. Based on these considerations, we believe that global output’s effect on Indonesia’s macroeconomic conditions is a reasonably relevant issue to be studied.

Matsumoto’s study (2011) provides a helpful framework for studying the impacts of worldwide production—particularly in Indonesia, where such research remains restricted. The main aim of this research is to identify the interdependent relationships between world GDP, world commodity prices, world inflation, with regard to Indonesia’s GDP variables and inflation. These relationships can consist of dynamic, direct, and indirect relationships. The appropriate analytical model for analyzing this relationship is vector autoregression (VAR). The VAR method used in this research allows us to detect the heterogeneity of Indonesia’s output, as well as inflation, in response to the shock of certain global variables. This statement is crucial, considering that several other studies (

Sousa and Zaghini 2007) concluded that the impacts of global factors on economic circumstances in different nations might vary significantly. These variations can be linked to variations in each country’s financial systems. The standard VAR model was developed into a threshold VAR model because of the nonlinearity of response variables at various levels.

This paper describes different responses to certain situation variables, whereas other studies assume that the variables respond the same way in all situations. In reality, for different world GDP regimes, the economies of small countries will respond with different magnitudes. This study determines the appropriate threshold values for several global variables that separate the different regimes.

This study’s contribution to the literature is the provision of a research perspective wherein the response or impact of exogenous variables on endogenous variables may vary. This study suggests an idea of the existence of a threshold value as a limit for the occurrence of differences in responses to the global financial liquidity regime.

Afonso et al. (

2018) used a threshold VAR analysis to study the linkages between changes in the debt ratio, economic activity, and financial stress within different financial regimes.

Chowdhury and Ham (

2009) used TVAR because they assumed that low-to-moderate inflation is favorably related to economic growth in some developing countries. After a certain threshold, the level of inflation will undermine growth.

Romyen et al. (

2019) used the threshold gross domestic product (GDP) because, at high GDP, the impact of exports on GDP will be higher than at low GDP.

After this introduction, there will be a discussion of the theoretical background, followed by a review of the relevant literature. There then follows a description of the methodology, and the data and results are analyzed. Finally, there are several conclusions. The Indonesian economy will respond in different ways to the changing world economy. The disclosure of the threshold of world economic variables implies that the world economy being above the threshold will cause the Indonesian economy to be different if it is below its threshold value. A significant threshold value indicates that the nonlinear model is better than the linear model. The nonlinear model is better for identifying Indonesia’s economic response at the level of the world economy, which often fluctuates.

2. Theoretical Background

The main theory of this paper is based on the monetary modeling of

Christiano and Eichenbaum (

1992). Greater liquidity lowers the nominal interest rate in the short term (liquidity impact) and, hence, decreases loan costs and boosts asset prices as the discount rate decreases. Additionally, if prices and wages suffer temporary nominal rigidity, liquidity expansion will also increase inflation expectations, suppressing the expected inflationary interest rate. This expansion of liquidity also encourages risk-taking behavior in the banking sector, and the financial markets in general (

Adrian and Shin 2008).

Mundell and Fleming modeled the balance in the money market (LM), goods market (IS), and foreign exchange market (BOP) in an open economy (

Frenkel and Razin 1987;

Scarth 2014):

where

is GDP,

is the capital net inflow,

is the domestic absorption,

is the net export,

is the foreign exchange reserve,

is the money demand,

is the money supply,

i is the external interest rate,

is world GDP,

is the price level,

is the domestic interest rate, and

is the nominal exchange rate.

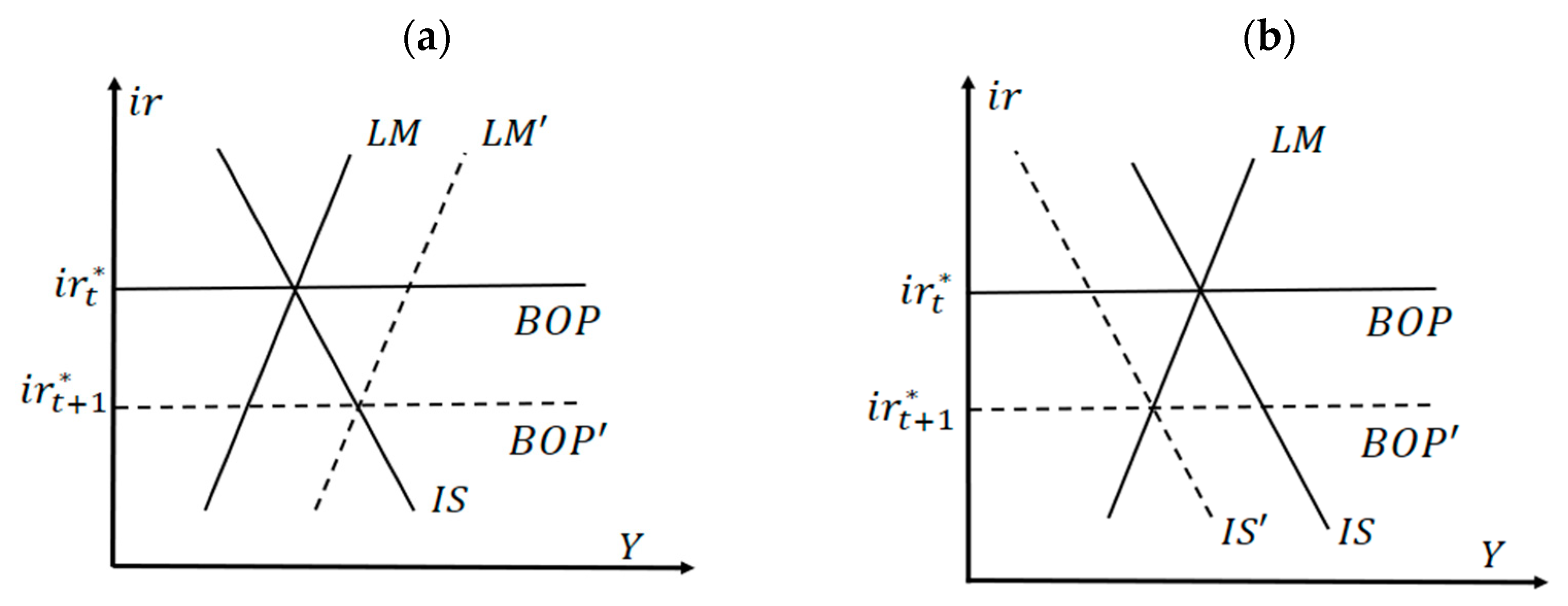

The impacts of capital flow on the significant national factors (output, inflation, and inventory prices) investigated in this research depend on the exchange rate regime. In the fixed exchange rate regime, balance in Equation (3) on the foreign exchange market is accomplished by providing cash to the recipient of the capital flows.

Figure 2a explain the fixed exchange rate regime. If the global interest rate decrease under the domestic rate

, capital inflow occurs to take advantage of this opportunity. This would appreciate home currency. Central Bank sell of its foreign currency reserves to offset this capital inflow. Domestic interest rates have adapted to global interest rates at the new equilibrium point in this system. The decrease of the money supply would shifts the LM curve to the right until the domestic interest rate equal with global interest rate

.

Figure 2b explain the floating exchange rate regime. Conversely, if currency appreciation determines the exchange rate, it has a tendency to decrease the competitiveness of export products. The decrease of the global interest rate

will cause downward pressure on the local interest rate. The pressure will move as the domestic rate closes to the global rate. When negative differential occurs (

), the central bank holds no monetary expansion. When LM Curve holds constant, capital will flow in of the domestic economy. This appreciation the domestic currency will decrease the net export. Decreasing net export shifts the IS to the left until the domestic interest rate equal to the global rate (

).

In this case, liquidity in the global safe asset market is identified by the monetary aggregate

, whereas liquidity in the global risk asset market is projected by the risk premium

. The global economy is modeled according to the following equations:

where

is the global price level,

is the global GDP, and

is the global interest rate. Equation (5) describes equilibrium in the money market (LM), Equation (4) in this case describes equilibrium in the goods market (IS), while Equation (6) is a reflection of the tradeoff between output and inflation (Phillips curve). Exogenous shocks affect liquidity in the global safe asset market, where

increases permanently. The output and rate of domestic inflation for a small open economy are modeled as a function of past values, current values, and expectations of future value of global GDP (

), nominal exchange rate (

ER), real exchange rate (

Q), global inflation (

), and domestic interest rate (

ir), as follows:

The ER is assumed to move in accordance with the uncovered interest rate parity, i.e.,:

The solution to this domestic model is determined by the rate function

. In this case, one assumes that the central bank has a degree of monetary independence

γ. Thus, interest rate movements will partially follow the domestic targets, which follow the Taylor rule:

Equation (10) assumes that domestic monetary policy plays a significant role in determining the spillover effect of global liquidity. 0 < γ < 1 implies that liquidity expansion in the global safe asset market will have a positive effect on inflation, GDP, and domestic asset prices. The appreciation of the exchange rate can offset a rise in inflation, up to a point. The decrease in and expansion of liquidity in the global risk asset market will have a spillover effect in a similar direction.

The theoretical description of the relationship between variables in the TVAR model is explained as follows: Equation (7) explains the impact of global GDP (), real exchange rate (Q), domestic inflation (), global inflation (), and domestic interest rate (ir) on domestic GDP (). Equation (8) explains the impact of nominal exchange rate (ER) and global inflation () on domestic inflation (). Equation (5) explains the role of the global price level in determining the level of global liquidity. Equations (4) and (6) explain the dynamic relationship between global inflation () and global GDP ().

Equation above show that global GDP (, domestic GDP (), global inflation (), and domestic inflation ( dynamically influence one another. The world commodity price P* is included because it plays an important role in determining world exchange rates and inflation. Endogenous and dynamic interrelationships were applied through the VAR model. If the VAR model assumes the impact of the invariant variable, TVAR assumes the impact between the variant variables, depending on the global economic regime.

Literature Review

Brana et al. (

2012) discovered the structural breaks in this excess liquidity growth in 1995, wherein subsequent periods showed a higher and more persistent rate of growth. Monetary aggregate growth has been decoupled from global output growth, leading to what is known as excess liquidity.

Previous studies (

Brana et al. 2012;

Belke et al. 2010a;

Sousa and Zaghini 2007) showed that global liquidity positively influenced short-term output.

Psalida and Sun (

2011) also observed positive effects on the credit gap, indicating the role of credit channels in the transmission of global liquidity impacts. Meanwhile,

Matsumoto (

2011) found that the rising levels of global risk aversion, as measured by the CBOE volatility index (VOX index), have a negative effect on output in various developed and emerging countries. Research conducted by

Sousa and Zaghini (

2007) and

Belke et al. (

2010b) found that global liquidity expansion boosted inflation both at the global level and at the level of individual countries/groups of countries. This is also consistent with the findings of

Ciccarelli and Mojon (

2010) that there is a robust error-correction mechanism between domestic inflation and global inflation.

4. Results and Discussion

The selected domestic variables in this research were real GDP (output), Indonesian inflation, and world inflation.

All of the data incorporated in this research were obtained from The Central Bureau of Statistics (BPS), Bloomberg LP, and International Financial Statistics (IFS) databases (

Table 1), all of which employed logarithms except for interest rate, global GDP, and global GDP deflator. We applied the Census X12 procedure to the leveled information to minimize the seasonal impact of the information, and used a year-on-year differential for the first differential. This study uses quarterly data between 1996:Q1 to 2018:Q4.

Table 2 explains the descriptive statistics covering mean, median, and maximum values, etc. To fundamentally determine the normality, as described by

Brys et al. (

2004), the ranges of skewness and kurtosis of these relevant data were within the range of −2.58 to +2.58, implying that the z-scores performed in a normal manner. The large Jarque–Bera values mean that the null hypothesis of normality was rejected at the 5% significance level, indicating that the

,

,

,

, and

have a non-normal distribution. The

,

,

,

, and

series fluctuate in accordance with the impact of global economic crises.

Table 3 shows that the majority of variables were incorporated in one order in this research (I (1)); some of them are covariance-stationary or trend-stationary at the national level (

Ekananda 2016;

Enders 2009). Especially for GDP and the global GDP deflator, the data obtained from IFS are a percentage of year-on-year growth, so root units at this level cannot be known. The hypothesis of a root unit is denied for global GDP growth, but cannot be denied for global GDP deflator growth.

To test the null hypothesis of linearity against the alternative of nonlinearity (

t = 1, 2), where

t indicates the threshold value, we used a multivariate extension of the linearity test by

Hansen (

1999),

Hansen (

2000), and

Balke (

2000) to test the statistical significance of the variable that is determined as the threshold indicator. The likelihood ratio (LR) test is formulated as follows:

, where

, which is the estimated covariance matrix for the model, is related to the null hypothesis, and

is the estimated covariance matrix for the alternative hypothesis. We apply one threshold compared to applying more than one threshold. The division of two regimes in Indonesia was carried out by

Galih and Safuan (

2018) for Indonesian data.

Table 4 summarizes the LR Test for linearity for 1. The null hypothesis is linearity. The LR test statistic shows that the null hypothesis is rejected for all tests. Therefore,

,

, and

can be used as thresholds for the VAR 1 threshold.

Table 5 and

Table 6 shows the SSR values of the VAR (no threshold) model and the TVAR model, where the TVAR SSR value is lower than that of the VAR model. The TVAR model estimates generate a lower and more efficient SSR. We used RATS programming software to solve TVAR models (

Enders and Doan 2014).

Table 5 shows the lower SSR values using threshold regression compared with linear regression. Threshold regression generates a more robust and effective estimate. This can be demonstrated by assessing the values of the non-threshold and threshold sum of squared residuals (SSR). Based on the Hannan–Quinn (HQIC) and Schwarz Bayesian (SBIC) information criteria, the VAR model with maximum lag of 1 (VAR (1)) is the most appropriate for the complete model without lag restriction, while the same criteria applied for each block separately lead to the VAR (1) or VAR (2) models.

The study chose three threshold variables—namely, world GDP (

), world inflation (

), and the world commodity index. World GDP rate (

) and world inflation rate (

) play important roles in increasing Indonesia’s GDP and inflation. Applying GDP as a threshold was the basis of the research of

Romyen et al. (

2019). In general, if the GDP regime is higher, the behavior of small countries’ economic variables will be different if they are in a lower GDP regime. In conditions of higher world GDP, the response of Indonesian GDP is expected to be higher than in the event of lower world GDP. The use of world inflation and world price commodity index as thresholds is relevant to the research of

Chowdhury and Ham (

2009). In a high-world-GDP regime, the expectation is that Indonesian inflation will be high. In conditions of high world Inflation, the response of Indonesian GDP is expected to be higher than in the case of low world Inflation, due to the reaction of Indonesian production, which requires higher capital inflow and lower inflation. Likewise, Indonesian inflation will be high in the high-world-inflation regime, as a result of the response to capital outflows from Indonesia.

At a high world commodity index, the Indonesian economy will respond quickly by increasing commodity prices. At the low world commodity index, the Indonesian economy was slow to respond by lowering prices. Indonesia still needs imported raw materials for its production. Domestic prices must immediately follow the increase in world commodity indexes.

The second column shows SSR for the TVAR model with threshold GDPW. The model proposes a threshold GDPW value of 0.0320, which separates the VAR in the lower regime and upper regime. Upper and lower specifications are due to high and low statuses, and are more appropriate than crisis or non-crisis status. The crisis status must be relevant to the crisis status that the Indonesian monetary authority has issued.

The second column in

Table 5 shows the SSR value of the TVAR model with inflation as the threshold. The world inflation threshold value is 0.1050. This value divides the inflation level into the upper regime and lower regime.

Column three in

Table 6 shows the SSR value of the TVAR world commodity threshold index price; the threshold value is 0.023. This value divides the world commodity price index level into the upper regime and lower regime.

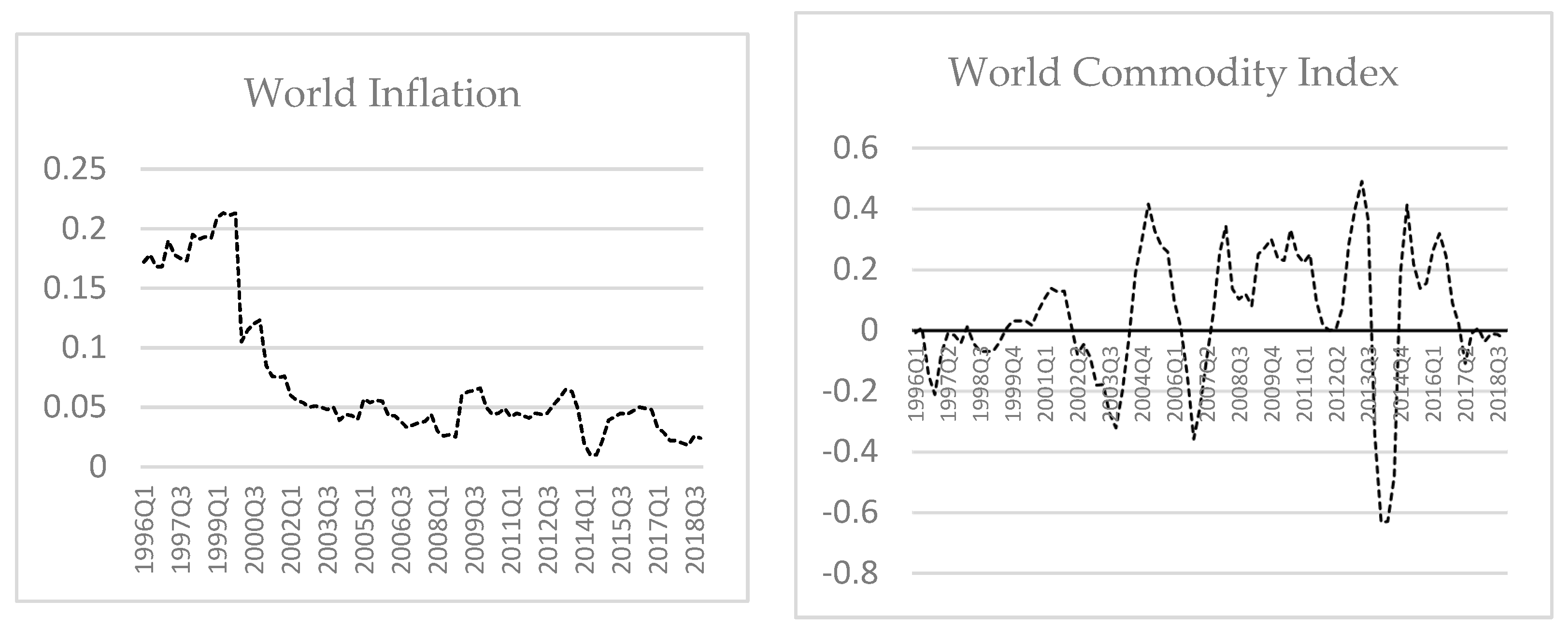

Figure 3 shows the fluctuation data of the world inflation index and world commodity index. The division of inflation at the value of 0.105 is shown by the line that intersects the vertical scale of 0.105. The threshold occurred when the inflation index fell from 2002Q1 to 2018Q1. The inflation threshold divides the regime into two time-groups: before and after 2002Q1.

The division of the commodity index at 0.023 is shown at a value around zero (

Figure 3, right panel). This value equally divides the commodity index into a regime of positive and negative indices. In general, the commodity index in the upper regime is positive.

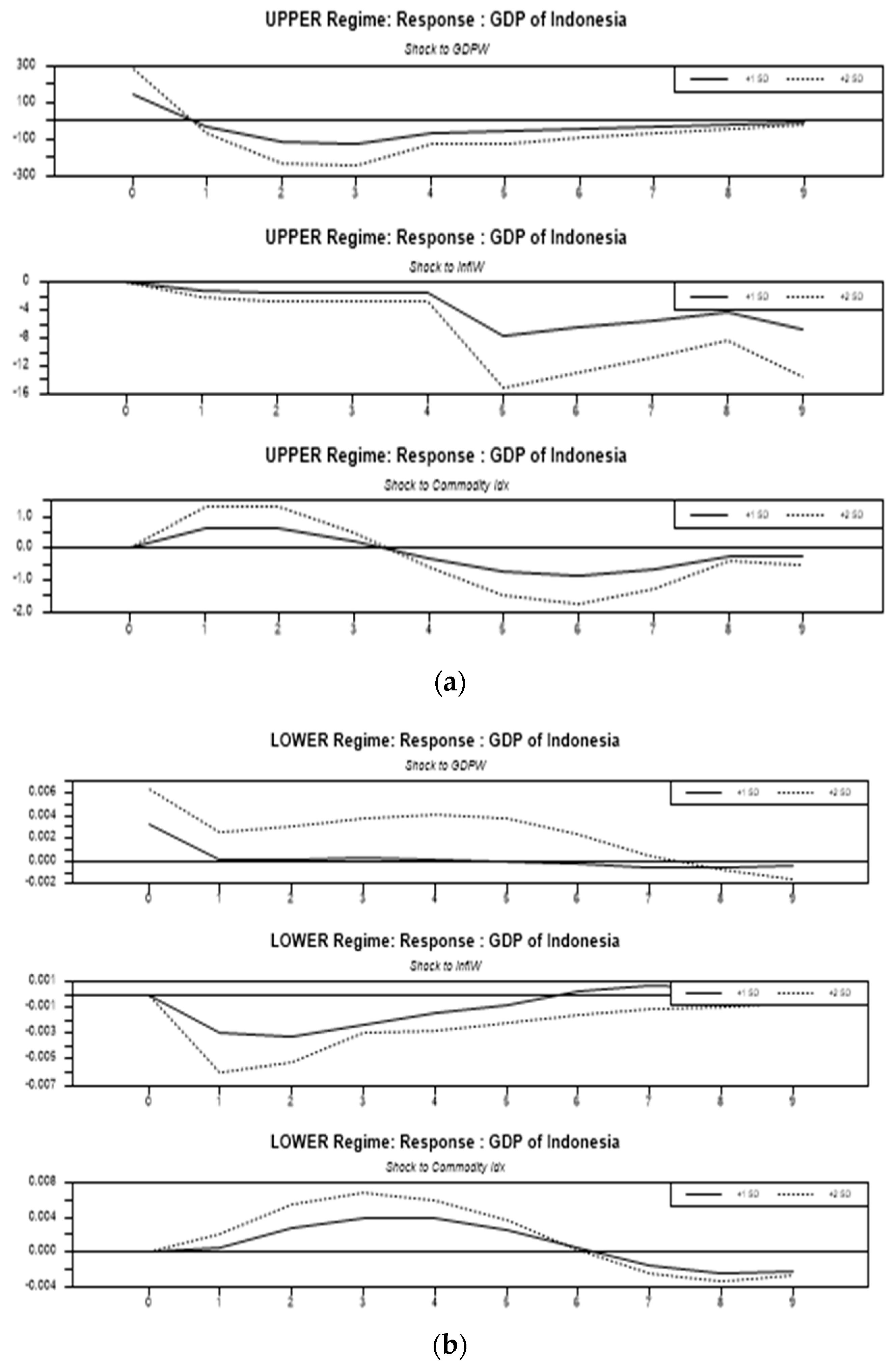

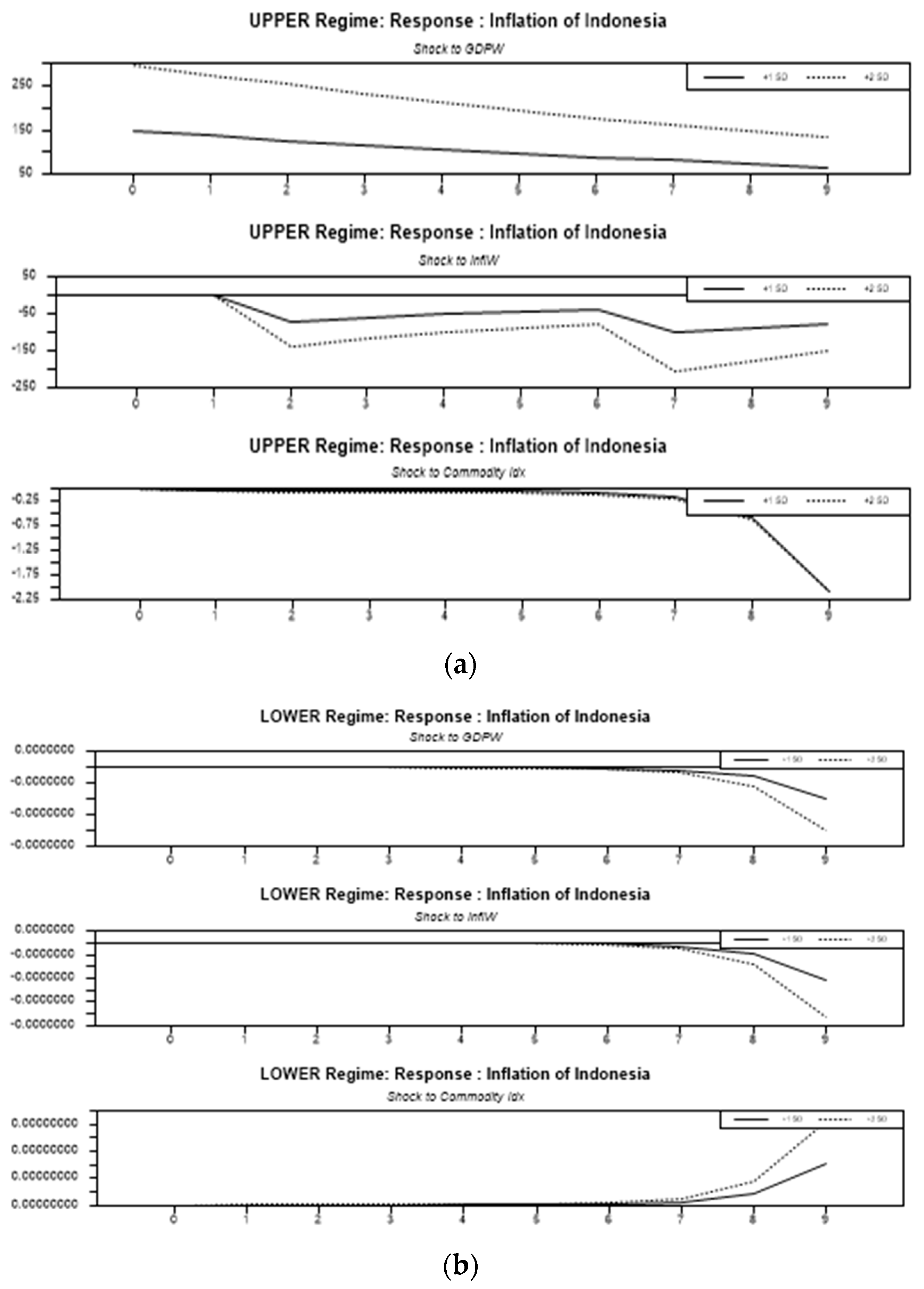

The IRF analysis of the TVAR model shows a different response if the same shock is applied to the variable shock propagator. The GDPW variable is significant as a threshold on the TVAR model’s security system. The GDPW threshold value of 0.023 indicates that the world GDP growth is above 2.3%, causing the difference in the VAR estimation equation. The VAR equations in the two regimes shape the responses of GDP and inflation in Indonesia differently. As usual in VAR analysis, the impulse response function is still a good analytical tool to estimate the response in the future to a sudden change of the variable propagator. The following discussion concerns the response of Indonesian GDP variables () and Indonesian inflation to shock from world GDP propagator variables (), world inflation (), and the world commodity index (. ). Response variables are divided into upper and lower regimes according to the world’s GDP threshold (), world inflation (), and world commodity index (). This study finds that Indonesia’s GDP and inflation responses are higher in a high world GDP situation, as a result of the conducive influence of the world economy that drives the Indonesian economy forward.

Figure 4a shows the response of the Indonesian GDP (

) to the shock of world GDP propagators (

), world inflation (

), and the world commodity index (

), sequentially. In accordance with Cholesky’s orthogonalization, at high levels of world GDP, Indonesia’s GDP responded positively to world GDP shock; positive responses declined for the next 10 quarters. Indonesia’s GDP responded negatively to world inflation shocks; negative response continued until the 10th quarter. In the low regime, Indonesia’s GDP did not respond to the shock of world commodities. Indonesia’s GDP response caused by world GDP and world inflation was consistent with expectations (

Galih and Safuan 2018).

Figure 4b shows Indonesia’s GDP response to the same shock propagators in the low-world-GDP situation, where Indonesia’s GDP does not respond to the shocks of world inflation, world commodities, and world GDP. In the case of shock propagators in all three variables, the low global economic situation cannot promote Indonesia’s GDP.

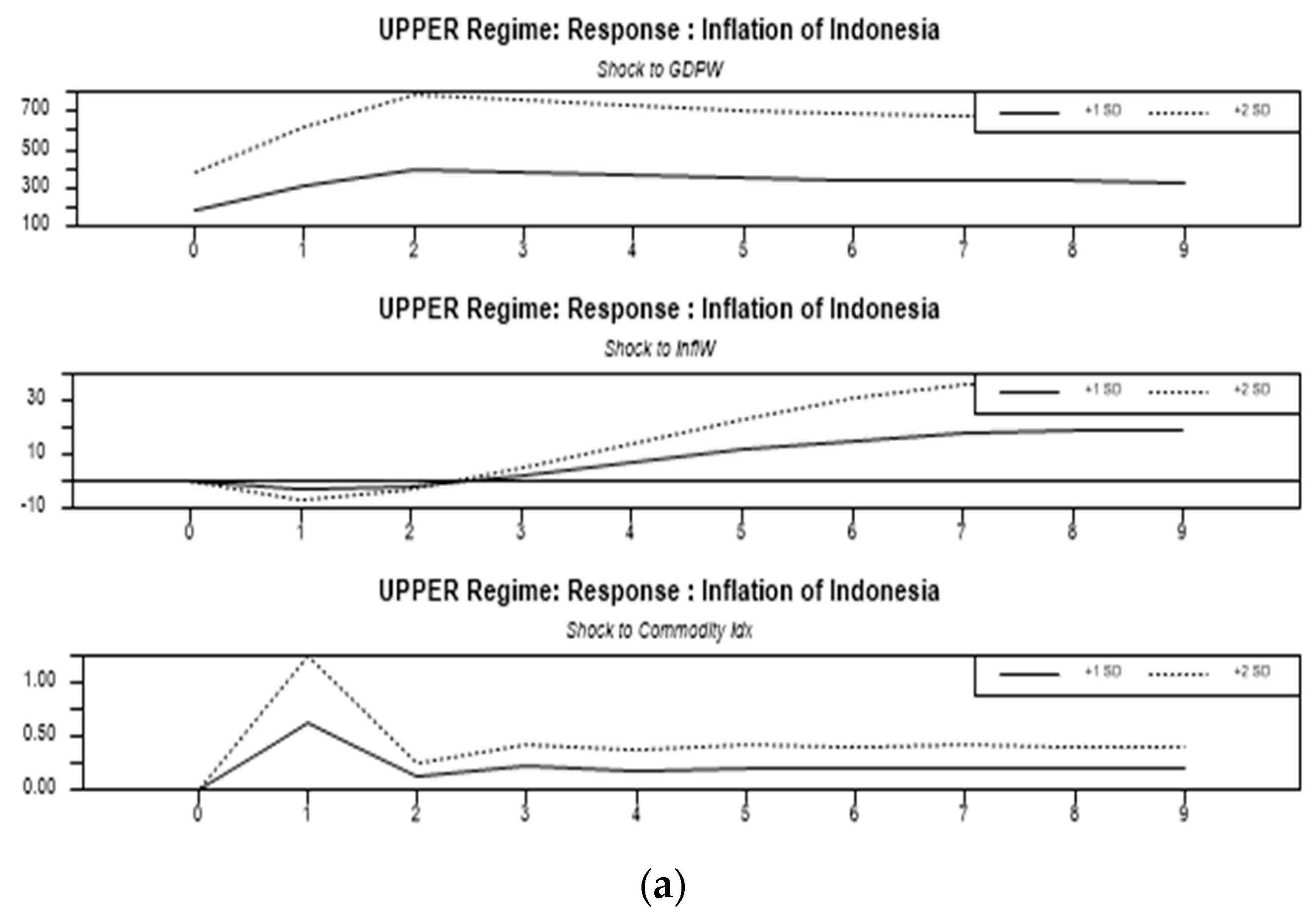

Figure 5a shows the response of Indonesia’s inflation

to the same shock propagator. The study applied the same Cholesky’s orthogonalization structure. The inflation response in the world’s high-GDP regime differs from Indonesia’s inflation response to the world’s low-GDP regime. At high world GDP, Indonesia’s inflation initially responded positively to the shock of world GDP; this response declined to its lowest in the third quarter. Similarly, Indonesia’s inflation responded negatively to the shock of world inflation. In contrast to the shock of world commodities, world inflation responded positively in the 2nd and 3rd quarters. Indonesia’s inflation response was stronger in the world’s low-GDP regime. This fact indicates that at low GDP, Indonesia’s inflation is more responsive than when the GDP regime is high. Some other authors have also explained this phenomenon (

Gromb and Vayanos 2010).

Positive responses declined for the next 10 quarters. Indonesia’s GDP responded to negative shocks in world inflation; the negative response continued until the 10th quarter. In the low regime, Indonesia’s GDP did not respond to the shock of world commodities. Indonesia’s GDP response caused by world GDP and world inflation was consistent with expectations (

Giese and Tuxen 2007).

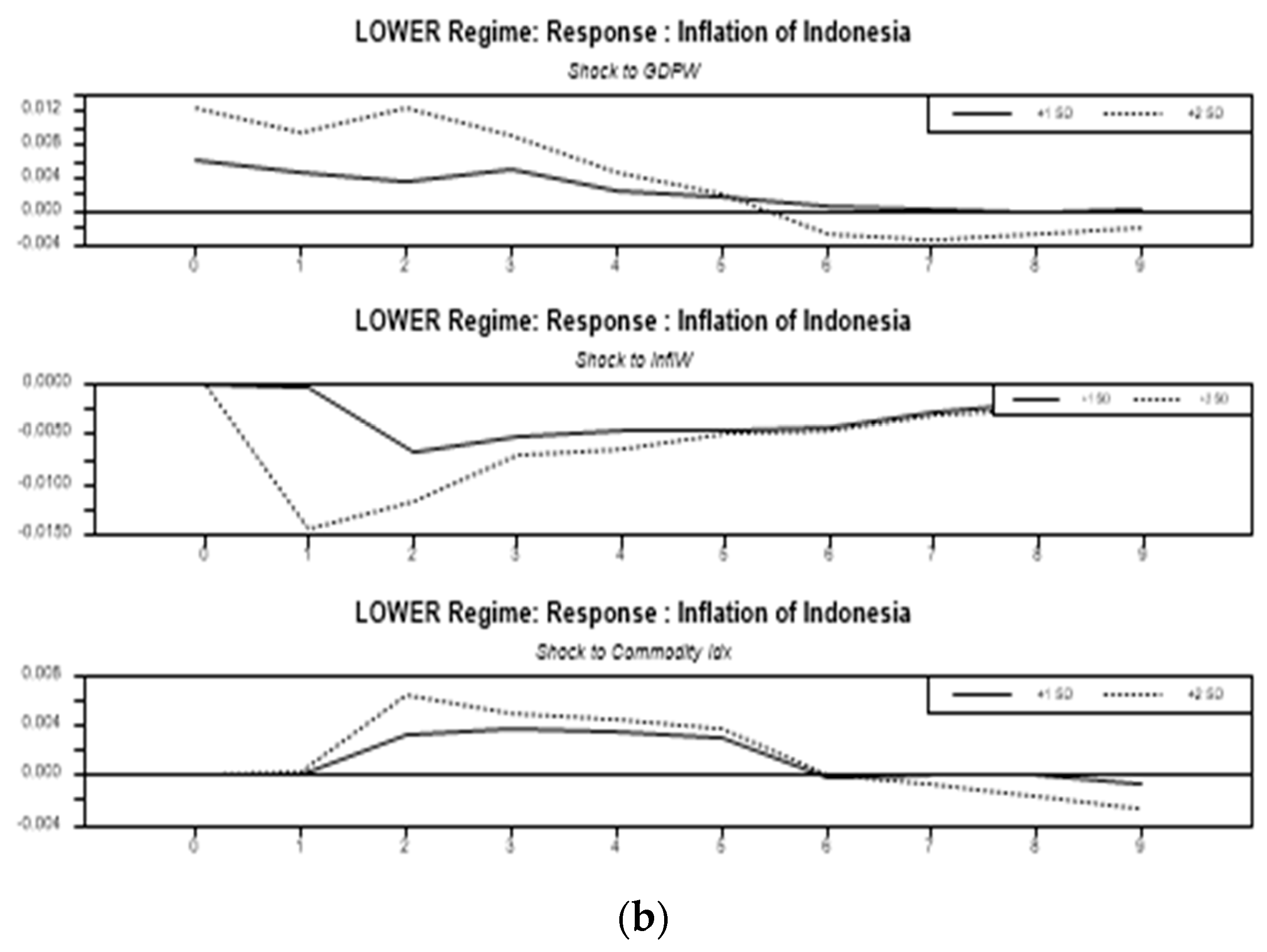

In this study, we analyzed the variable response to the world inflation situation (

) as the threshold. Threshold world inflation is 0.105.

Figure 3 shows inflation in the initial period of high research, and then after 1996Q1 the inflation index is low. The threshold divides the data into two parts according to a clear time period. The analysis in this paper is only aimed at inflation response due to shock propagators. In the upper regime period, during the period of high world inflation.

Figure 6a on the left shows Indonesia’s inflation will respond to the shock of global GDP positively. Inflation in Indonesia does not respond to shocks of world inflation. Indonesia’s inflation did not respond to the shock of world commodities at the beginning of the period, but in Q1, Indonesia’s inflation responded positively, but fell back until there was no response. This is because the inflation target applied in Indonesia is able to reduce the shocks of world inflation and world commodity prices.

Figure 6b shows Indonesia’s inflation response due to the shock propagators in the lower world inflation regime. The same phenomenon was observed as for the high regime, as described earlier. The magnitude of the response in the lower regime was greater. In the lower world inflation regime, inflation targeting policy is looser; thus, responses from various shock variables are more tolerated.

In the previous analysis, the threshold divides the world’s GDP into two regimes, enabling further studying of the world commodity prices (

) as the threshold. The world commodity index reflects changes in the prices of commodities traded in the world. Changes in commodity prices lead to world inflation and changes in the flow of funds between countries. The decline in oil prices was able to undermine the world’s manufacturing industry and energy industry (

Elizabeth et al. 2020). Increased commodity prices have not changed abruptly but, rather, through some adjustment processes following the global supply and demand mechanisms of commodities. Macroeconomic variables can capture the difference in response between the two regimes. The limit of change is reflected by the threshold value to be calculated in this study.

Threshold

is measured at 0.02300.

Figure 3 shows the fluctuation of the world commodity index, which is divided into two equal parts; some are positive, and others are negative.

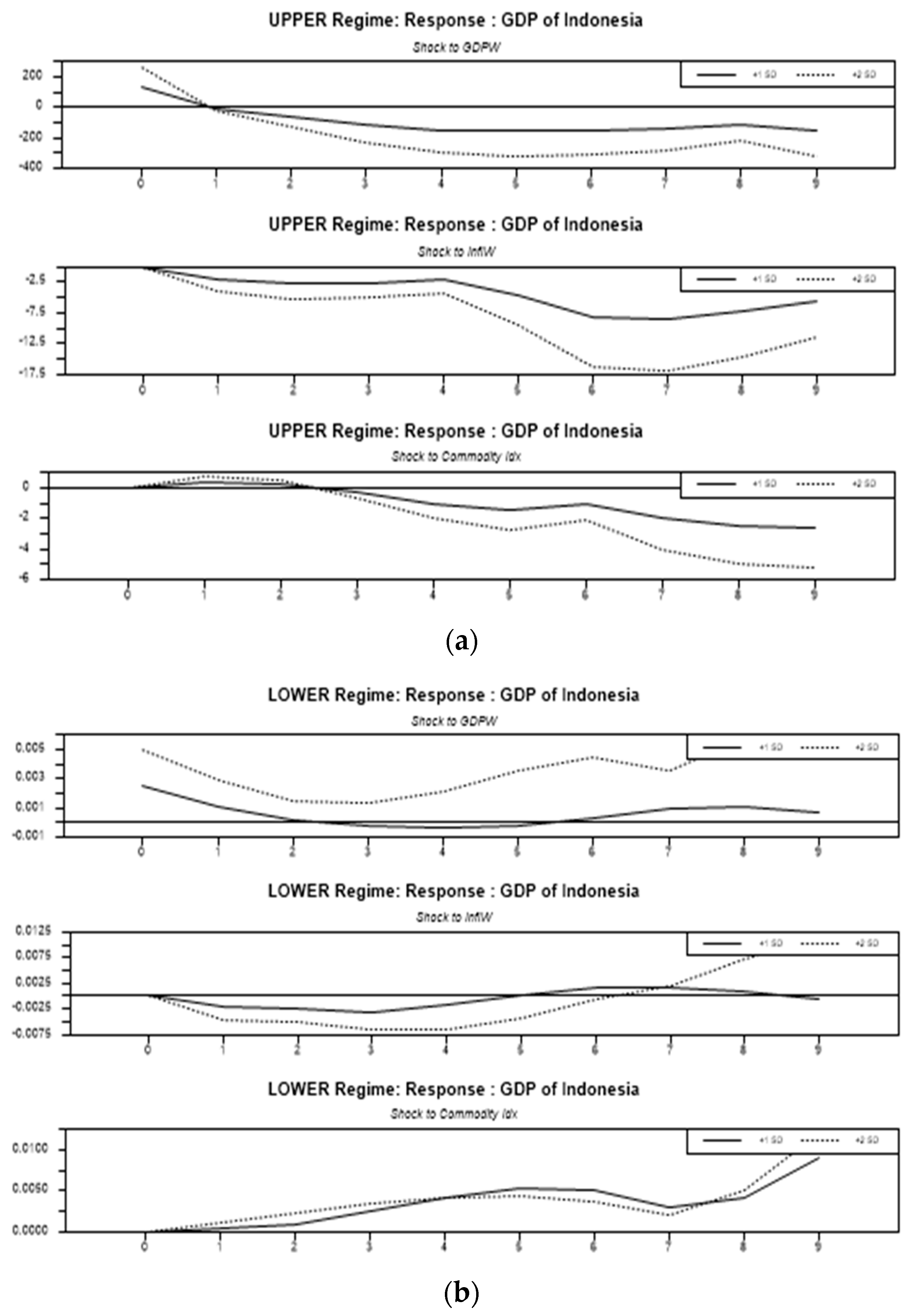

Figure 7a shows the response of Indonesian GDP to shock propagators. We can conclude that the upper regime is indicated by a positive index increase. When there is an increase in the world commodity index, Indonesia’s GDP experiences a bigger boost. This shows that Indonesia can increase its GDP when commodity prices in the world market increase. In the lower regime, the GDP response is weaker than in the upper regime.

The variable response in the lower regime shows different shapes. In general, the response variable in the lower regime is less responsive. The most obvious difference that occurred in Indonesia’s commodity response was due to world commodity shock. Indonesia’s commodity index responds positively to world shock commodities. This is consistent with the hypothesis that high world commodity prices will increase Indonesia’s inflation.

Figure 8 shows Indonesia’s inflation response due to shock propagators. Inflation response in the upper regime is different compared to the lower regime. In the upper regime, Indonesia’s inflation is positive at the beginning of world GDP shock (

). On the other hand, Indonesia’s inflation does not respond to the shock of world inflation and world commodity prices.

Figure 8a shows Indonesia’s inflation responding negatively to the shocks of world GDP and world inflation.

This is consistent with the theory put forward by

Domanski et al. (

2011), who explained that when the world’s commodity index is high, Indonesia’s inflation will be pushed up. Indonesia implements inflation targeting to control domestic inflation so that inflation levels are maintained. The response to low world commodity index also shows low inflation, rising in Q1, but down again in the next quarter.

Table 7 summarizes the response of some variables to impulses under various regimes. The impulse response of TVAR function applies if other variables are not changed and interrupted. It is assumed that the IRF is valid for up to five periods to come before any other variables change. Brackets denote time (

t). Responses recorded are due to the shock of two standard deviations (dashed line).

Description +/−(T1–T2): +/− shows a sign plus(+) or minus (−) of response direction. T1–T2 denote the start and end time, respectively. Sign: +,++,+++: denotes weak, moderate, strong respectively, in the positive direction. Sign: −,−−: denotes weak, moderate respectively, in the negative direction.

Based on the contents of

Table 7, we can draw some conclusions: The impulse of world GDP causes an increase in Indonesia’s GDP. Indonesia’s GDP response is greater in the higher world GDP environment. Indonesia’s inflation is driven to increase in the low- and high-world-GDP regimes. The impulse of Indonesia’s inflation is driven to increase in the situations of both low and high world inflation.

If the world economy is viewed from the level of world commodity prices, Indonesia’s GDP response is higher at low world commodity prices. At the high level of world commodity prices, at the beginning of the period, Indonesia’s inflation did not respond at all. An increase in Indonesia’s inflation occurs in the next 2–5-month period. An inflation increase in Indonesia occurs at both the low and high levels of world commodity prices; this shows that the changes in world commodity prices affect Indonesia’s inflation response after a certain period. This increase occurs at all levels of world commodity prices.

If viewed from the shock of world inflation, Indonesia’s GDP response and inflation are generally very small, even showing no change in response. If viewed from the shock of world commodity prices, Indonesia’s GDP response and inflation Indonesia are also very small at the beginning of the period; however, they will increase after a certain period of time. The phenomenon of response change in the inflation does not show the same pattern due to the shock of world commodity prices; rather, it shows an increase in the next 1–2 periods, then disappears in the next 3–5 periods.

5. Conclusions

Threshold regression calculates a lower SSR value than threshold-free regression. Threshold regression takes into account the non-observed factor of exogenous variables within or beyond the model. The SSR values of the commodity index and global GDP are smaller than those of other regressions, depending on different thresholds.

The impulse simulation of world GDP produces a positive response towards Indonesia’s GDP and Indonesian inflation, in both the upper and lower regimes of , , and . Impulse simulation of world inflation does not show any response in Indonesia’s GDP or inflation in the upper and lower regimes of , , and .

Meanwhile, impulse simulation of world commodity prices

shows no response of Indonesian GDP

in either the upper or lower regimes of

,

, and

. The impulse simulation of the responses of world commodity prices

to Indonesia’s inflation shows diverse patterns; positive responses occur after the next 1–3 periods. This conclusion is consistent with the research of

Galih and Safuan (

2018); in their research, Indonesia’s GDP

did not respond to in either the upper or lower regimes of

,

, and

.

World GDP rate

and world inflation rate

play important roles in increasing Indonesia’s GDP and inflation. The commodity price level of the world

generally affects several periods after the shock occurs, indicating that world commodity prices play an important role in increasing Indonesia’s GDP and inflation in a given period.

Baek (

2021) states that world economic growth and world inflation affect the development of inflation and Indonesia’s GDP.

Khan and Senhadji (

2000) also found threshold effects in the relationship between inflation and growth.

The most significant world GDP threshold is 3.2%; this indicates significantly that at a 3.2% world GDP rate, there are changes in Indonesia’s GDP response behavior and Indonesian inflation. World inflation of 10.5% indicates that a global inflation rate of this magnitude will make Indonesia’s inflation behavior undergo a structural change. World commodity prices of 2.3% indicate that such an increase in world commodity prices will cause changes in the GDP response and inflation of Indonesia. A study that mentions structural changes were carried out by

Chowdhury and Ham (

2009); their study applied inflation and growth, and found that there was a structural shift in both. Different responses occurred in the two regimes.

Global liquidity has no impact on Indonesia’s GDP at various levels of global GDP and global inflation. The effect on Indonesia’s GDP on regional economic factors varies depending on inflation and world GDP. This result is supported by the study of

Djigbenou-Kre and Park (

2016), where the results show that global liquidity has an effect on global imbalances. We can thus conclude that the global economy does not have a balanced and equitable effect on all countries in the world, including Indonesia.

World GDP continues to play a role in ASEAN’s regional change, particularly when it comes to affecting Indonesia’s GDP. The volatility of the world economy does not influence Indonesia’s economic growth. This outcome is demonstrated by the insignificant effect of many independent variables. World inflation continues to be a major changing factor in the ASEAN region, especially in terms of affecting Indonesia’s output. This is consistent with the growth of monetary policy, which aims to preserve the level of inflation in developing nations.

This research faces various limitations. One of the limitations of the VAR model is the use of IRF analysis. The response depicted on the graph can occur, assuming that there is no change in economic conditions over time. In fact, changes in economic variables occur very often, and those variables affect one another. Therefore, the analysis described is focused on the initial response period.