Regime-Switching Determinants of Mutual Fund Performance in South Africa

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Data and Sample Selection

3.2. Markov Switching Model for Determinants of Fund Performance under Bullish and Bearish Market Conditions

3.3. Normality Tests

3.4. Unit Root Tests

4. Estimation Results and Discussion

4.1. Descriptive Statistics of Fund Performance

4.2. Discussion of Markov Regime Switching Regression Results of Fund Performance Determinants

4.3. Cross-Sectional Analysis of the Most Significant Explanatory Variables

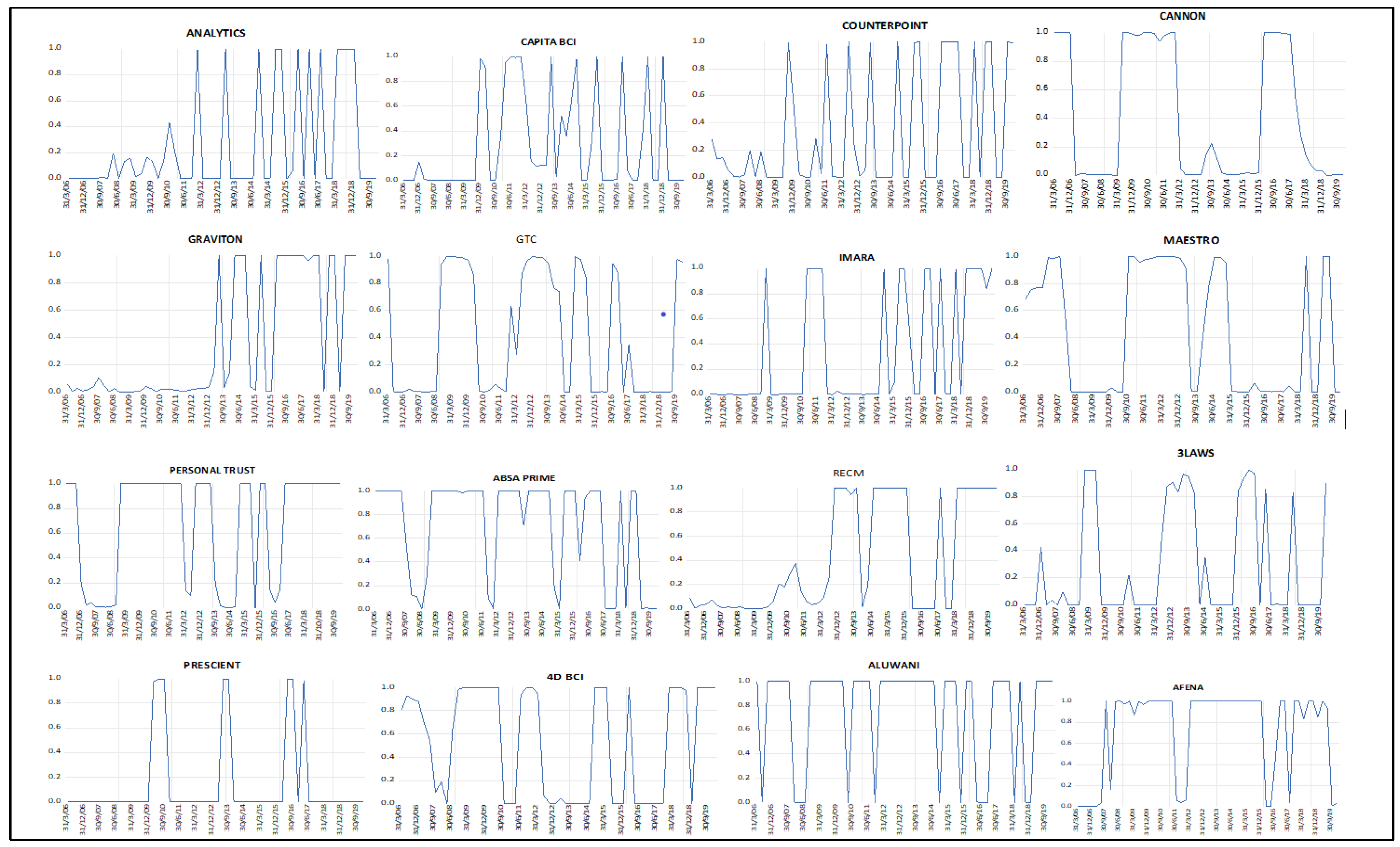

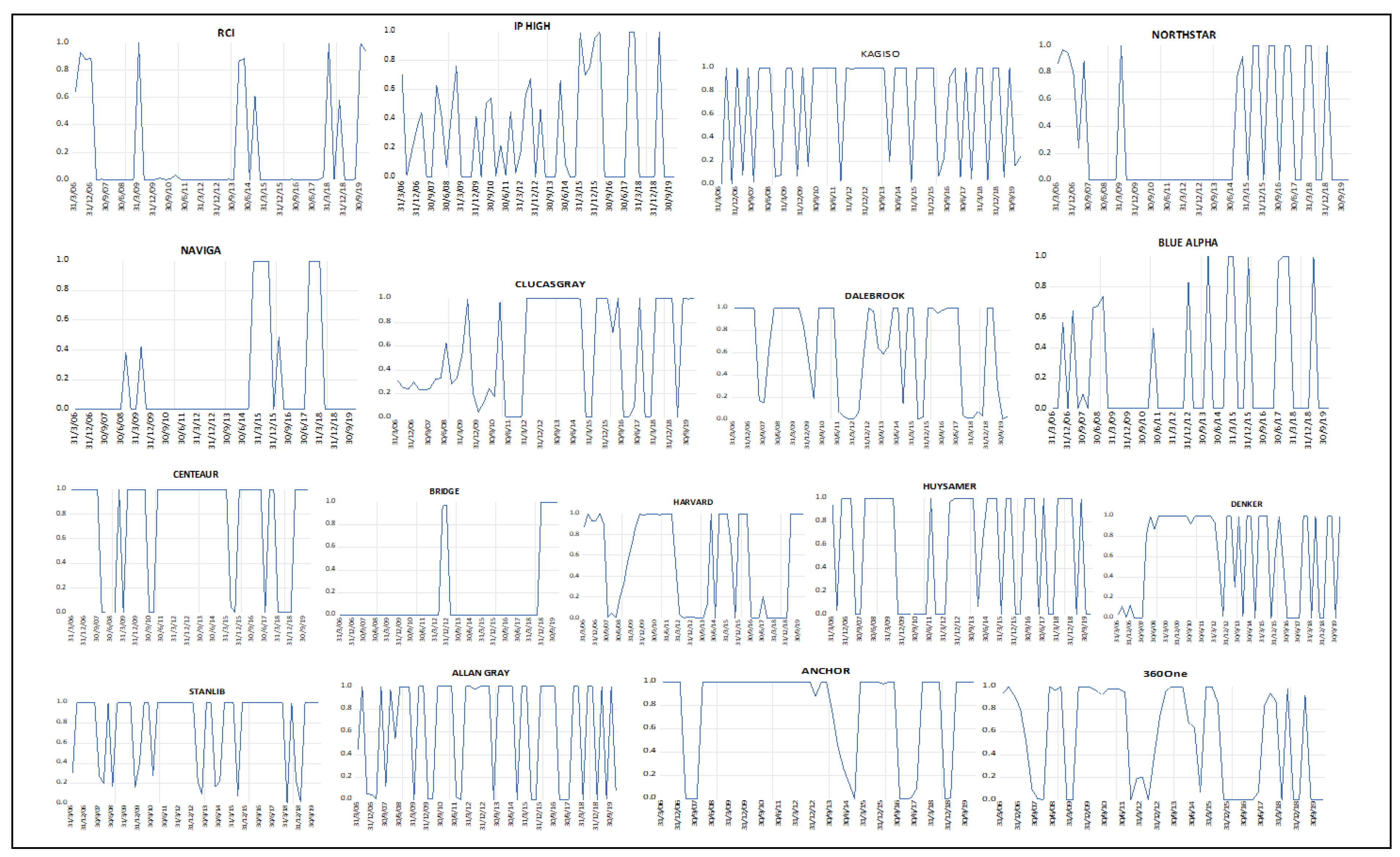

4.4. Smoothed Regime Probabilities

4.5. Regime State Analysis

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Al-Khazali, Osamah, and Ali Mirzaei. 2017. Stock market anomalies, market efficiency and the adaptive market hypothesis: Evidence from Islamic stock indices. Journal of International Financial Markets, Institutions and Money 51: 190–208. [Google Scholar] [CrossRef]

- Anas, Jacques, Monica Billio, Laurent Ferrara, and Marco Lo Duca. 2007. Business cycle analysis with multivariate markov switching models. Growth and Cycle in the Eurozone, 249–60. Available online: https://core.ac.uk/download/pdf/6234154.pdf (accessed on 20 September 2021).

- Apau, Richard, Paul-Francois Muzindutsi, and Peter Moores-Pitt. 2021. Mutual fund flow-performance dynamics under different market conditions in South Africa. Investment Management and Financial Innovations 18: 236–49. [Google Scholar] [CrossRef]

- Areal, Nelson, Maria Céu Cortez, and Florinda Silva. 2013. The conditional performance of US mutual funds over different market regimes: Do different types of ethical screens matter? Financial Markets and Portfolio Management 27: 397–429. [Google Scholar] [CrossRef]

- Arendse, Jennifer, Chris Muller, and Michael Ward. 2018. The winner takes it all: Outperformance drives subsequent flows in South African Unit Trust Funds. Investment Analysts Journal 47: 1–14. [Google Scholar] [CrossRef]

- Asisa. 2020. Collective Investments Schemes and Local Funds Statistics. Available online: https://www.asisa.org.za/statistics/collective-investments-schemes/local-fund-statistics/ (accessed on 11 November 2020).

- Badea, Leonardo, Daniel Ştefan Armeanu, Iulian Panait, and Ştefan Cristian Gherghina. 2019. A Markov Regime Switching Approach towards assessing resilience of Romanian collective investment undertakings. Sustainability 11: 1325. [Google Scholar] [CrossRef]

- Badrinath, Swaminathan G., and Stefano Gubellini. 2012. Does conditional mutual fund outperformance exist? Managerial Finance 38: 1160–83. [Google Scholar] [CrossRef]

- Barber, Brad M, Xing Huang, and Terrance Odean. 2016. Which factors matter to investors? Evidence from mutual fund flows. The Review of Financial Studies 29: 2600–42. [Google Scholar] [CrossRef]

- Ben-David, Itzhak, Francesco Franzoni, and Rabih Moussawi. 2012. Hedge fund stock trading in the financial crisis of 2007–2009. The Review of Financial Studies 25: 1–54. [Google Scholar] [CrossRef]

- Bertolis, Dino Elias, and Mark Hayes. 2014. An investigation into South African general equity unit trust performance during different economic periods. South African Actuarial Journal 14: 73–99. [Google Scholar] [CrossRef]

- Bilgili, Faik, Nadide Sevil Halıcı Tülüce, and İbrahim Doğan. 2012. The determinants of FDI in Turkey: A Markov regime-switching approach. Economic Modelling 29: 1161–69. [Google Scholar] [CrossRef]

- Bojanic, Antonio Nicolás. 2021. A markov-switching model of inflation in Bolivia. Economies 9: 37. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On persistence in mutual fund performance. The Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Chevalier, Judith, and Glenn Ellison. 1997. Risk taking by mutual funds as a response to incentives. Journal of Political Economy 105: 1167–200. [Google Scholar] [CrossRef]

- Chou, Wen-Hsiu, and William George. Hardin. 2014. Performance chasing, fund flows and fund size in real estate mutual funds. The Journal of Real Estate Finance and Economics 49: 379–412. [Google Scholar] [CrossRef]

- Chung, San-Lin, Chi-Hsiou Hung, and Chung-Ying Yeh. 2014. When does investor sentiment predict stock returns? Journal of Empirical Finance 19: 217–40. [Google Scholar] [CrossRef]

- Cremers, Martijn, and Antti Petajisto. 2009. How active is your fund manager? A new measure that predicts performance. The Review of Financial Studies 22: 3329–65. [Google Scholar] [CrossRef]

- Cremers, Martijn, Miguel Almeida Ferreira, Pedro Matos, and Laura Starks. 2016. Indexing and active fund management: International evidence. Journal of Financial Economics 120: 539–60. [Google Scholar] [CrossRef]

- De la Torre-Torres, Oscar Varela, Evaristo Galeana-Figueroa, and José Álvarez-García. 2020. A test of using markov-switching GARCH models in oil and natural gas trading. Energies 13: 129. [Google Scholar] [CrossRef]

- Del Guercio, Diane, and Paula A. Tkac. 2002. The determinants of the flow of funds of managed portfolios: Mutual funds vs. pension funds. Journal of Financial and Quantitative Analysis 37: 523–57. [Google Scholar] [CrossRef]

- Elton, Edwin J., Martin Jay Gruber, and Christopher R. Blake. 1996. The persistence of risk-adjusted mutual fund performance. Journal of Business 69: 133–57. [Google Scholar] [CrossRef]

- Ferreira, Miguel Almeida, Aneel Keswani, Antonio Freitas Miguel, and Sofia B. Ramos. 2012. The flow-performance relationship around the world. Journal of Banking & Finance 36: 1759–80. [Google Scholar]

- Ferreira, Miguel Almeida, Aneel Keswani, António Freitas Miguel, and Sofia B. Ramos. 2013. The determinants of mutual fund performance: A cross-country study. Review of Finance 17: 483–525. [Google Scholar] [CrossRef]

- Franzoni, Francesco, and Martin C. Schmalz. 2017. Fund flows and market states. The Review of Financial Studies 30: 2621–73. [Google Scholar] [CrossRef]

- Fratzscher, Marcel. 2012. Capital flows, push versus pull factors and the global financial crisis. Journal of International Economics 88: 341–56. [Google Scholar] [CrossRef]

- Fuerst, Franz, and George Matysiak. 2013. Analysing the performance of nonlisted real estate funds: A panel data analysis. Applied Economics 45: 1777–88. [Google Scholar] [CrossRef]

- Goetzmann, William N., and Nadav Peles. 1997. Cognitive dissonance and mutual fund investors. Journal of Financial Research 20: 145–58. [Google Scholar] [CrossRef]

- Granger, Clive William John, and Paul Newbold. 1974. Spurious regressions in econometrics. Journal of Econometrics 2: 111–20. [Google Scholar] [CrossRef]

- Gray, Stephen F. 1996. Modeling the conditional distribution of interest rates as a regime-switching process. Journal of Financial Economics 42: 27–62. [Google Scholar] [CrossRef]

- Gueddoudj, Sabbah. 2018. Financial Variables as Predictive Indicators of the Luxembourg GDP Growth. Empirical Economic Review 1: 49–62. [Google Scholar] [CrossRef]

- Guercio, Diane Del, and Jonathan Reuter. 2014. Mutual fund performance and the incentive to generate alpha. The Journal of Finance 69: 1673–704. [Google Scholar] [CrossRef]

- Hamilton, James Douglas. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society 57: 357–84. [Google Scholar] [CrossRef]

- Huang, Feiyu. 2012. An Investigation of the Risk-Adjusted Performance of Canadian REIT Mutual Funds and the Market Timing Skills of fund Managers. Montreal: Concordia University. Available online: https://core.ac.uk/download/pdf/211514431.pdf (accessed on 18 September 2021).

- Huang, Jennifer Chunyan, Kelsey D. Wei, and Hong Yan. 2012. Investor Learning and Mutual Fund Flows. AFA 2012 Chicago Meetings Paper. Available online: https://ssrn.com/abstract=972780 (accessed on 13 December 2020).

- Huij, Joop, and Thierry Post. 2011. On the performance of emerging market equity mutual funds. Emerging Markets Review 12: 238–49. [Google Scholar] [CrossRef]

- Kacperczyk, Marcin, Stijn Van Nieuwerburgh, and Laura Veldkamp. 2016. A rational theory of mutual funds’ attention allocation. Econometrica 84: 571–626. [Google Scholar] [CrossRef]

- Kim, Chang-Jin. 1994. Dynamic linear models with Markov-switching. Journal of Econometrics 60: 1–22. [Google Scholar] [CrossRef]

- Kim, Chang-Jin. 2004. Markov-switching models with endogenous explanatory variables. Journal of Econometrics 122: 127–36. [Google Scholar] [CrossRef]

- Kim, Min Seon. 2019. Changes in Mutual Fund Flows and Managerial Incentives. Available online: https://ssrn.com/abstract=1573051 (accessed on 12 November 2020).

- Kosowski, Robert. 2011. Do mutual funds perform when it matters most to investors? US mutual fund performance and risk in recessions and expansions. The Quarterly Journal of Finance 1: 607–64. [Google Scholar] [CrossRef]

- Koy, Ayben. 2017. Regime dynamics of stock markets in the fragile five. Journal of Economic & Management Perspectives 11: 950–58. [Google Scholar]

- Kunjal, Damien, Faeezah Peerbhai, and Paul-Francois Muzindutsi. 2017. The performance of South African exchange traded funds under changing market conditions. Journal of Asset Management 22: 350–59. [Google Scholar] [CrossRef]

- Li, Mingsheng, Jing Shi, and Jun Xiao. 2013. Mutual Fund Flow-Performance Relationship under Volatile Market Condition. Paper presented at Asian Finance Association (AsFA) 2013 Conference, Sydney, Australia, January 25. [Google Scholar]

- Lo, Andrew Wen-Chuan. 2012. Adaptive markets and the new world order (corrected May 2012). Financial Analysts Journal 68: 18–29. [Google Scholar] [CrossRef]

- Ma, Jason Z., Xiang Deng, Kung-Cheng Ho, and Sang-Bing Tsai. 2018. Regime-switching determinants for spreads of emerging markets sovereign credit default swaps. Sustainability 10: 2730. [Google Scholar] [CrossRef]

- Manconi, Alberto, Massimo Massa, and Ayako Yasuda. 2012. The role of institutional investors in propagating the crisis of 2007–2008. Journal of Financial Economics 104: 491–518. [Google Scholar] [CrossRef]

- Nenninger, Steve, and David Rakowski. 2014. Time-varying flow-performance sensitivity and investor sophistication. Journal of Asset Management 15: 333–45. [Google Scholar] [CrossRef]

- Obalade, Adefemi Alamu, and Muzindutsi Paul-Francois. 2018a. Are there Cycles of Efficiency and Inefficiency? Adaptive Market Hypothesis in Three African Stock Markets. Frontiers in Finance and Economics 15: 185–202. [Google Scholar]

- Obalade, Adefemi Alamu, and Muzindutsi P.F. 2018b. Return predictability and market conditions: Evidence from Nigerian, South African and Mauritian stock markets. African Journal of Business and Economic Research 13: 7–23. [Google Scholar] [CrossRef]

- Papadimitriou, Dimitris, Konstantinos Tokis, and Georgios Vichos. 2020. The Effect of Market Conditions and Career Concerns in the Fund Industry. Available online: https://ssrn.com/abstract=3658288 (accessed on 10 June 2021).

- Pástor, Ľuboš, Robert F. Stambaugh, and Lucian A. Taylor. 2015. Scale and skill in active management. Journal of Financial Economics 116: 23–45. [Google Scholar] [CrossRef]

- Pastpipatkul, Pathairat, Petchaluck Boonyakunakorn, and Kanyaphon Phetsakda. 2020. The impact of Thailand’s openness on bilateral trade between Thailand and Japan: Copula-based markov switching seemingly unrelated regression Model. Economies 8: 9. [Google Scholar] [CrossRef]

- Popescu, Marius, and Zhaojin Xu. 2017. Market states and mutual fund risk shifting. Managerial Finance 43: 828–38. [Google Scholar] [CrossRef]

- Qian, Meifen, Chongbo Xu, and Bin Yu. 2014. Performance manipulation and fund flow: Evidence from China. Emerging Markets Finance and Trade 50: 221–39. [Google Scholar] [CrossRef]

- Rangongo, Timothy. 2018. A fund with inflation-beating growth-fund in focus: Marriott divided growth fund. Finweek 2018: 14. [Google Scholar]

- Rao, Zia-Ur-Rehman, and Muhammad Zubair Tauni. 2016. Fund Performance and fund flow. Case of China. Journal of Academic Research in Economics 8: 146–56. [Google Scholar]

- Rohleder, Martin, Dominik Schulte, and Marco Wilkens. 2017. Management of flow risk in mutual funds. Review of Quantitative Finance and Accounting 48: 31–56. [Google Scholar] [CrossRef]

- Rupande, Lorraine, Hilary Tinotenda Muguto, and Paul-Francois Muzindutsi. 2019. Investor sentiment and stock return volatility: Evidence from the Johannesburg Stock Exchange. Cogent Economics & Finance 7: 1600233. [Google Scholar]

- S&P. 2019. SPIVA South Africa Year End 2018 Score Card. Available online: https://www.spglobal.com/spdji/en/doc-uments/spiva/spiva-south-africa-year-end-2018.pdf (accessed on 12 November 2019).

- Sapp, Travis, and Ashish Tiwari. 2004. Does stock return momentum explain the “smart money” effect? The Journal of Finance 59: 2605–22. [Google Scholar] [CrossRef]

- Schmidt, Amand Floriaan, and Chris Finan. 2018. Linear regression and the normality assumption. Journal of Clinical Epidemiology 98: 146–51. [Google Scholar] [CrossRef] [PubMed]

- Sirri, Erik R., and Peter Tufano. 1998. Costly search and mutual fund flows. The Journal of Finance 53: 1589–622. [Google Scholar] [CrossRef]

- Stafylas, Dimitrios, and Athanasios Andrikopoulous. 2019. Determinants of hedge fund performance during ‘good’and ‘bad’economic periods. Research in International Business and Finance 52: 101130. [Google Scholar] [CrossRef]

- Tan, Ömer Faruk. 2015. Mutual Fund Performance: Evidence from South Africa. EMAJ: Emerging Markets Journal 5: 49–57. [Google Scholar] [CrossRef]

- Tsagris, Michail, and Nikolaos Pandis. 2021. Normality test: Is it really necessary? American Journal of Orthodontics and Dentofacial Orthopedics 159: 548–49. [Google Scholar] [CrossRef] [PubMed]

- Turtle, Harry J., and Chengping Zhang. 2012. Time-varying performance of international mutual funds. Journal of Empirical Finance 19: 334–48. [Google Scholar] [CrossRef][Green Version]

- Urquhart, Andrew, and Frank McGroarty. 2014. Calendar effects, market conditions and the Adaptive Market Hypothesis: Evidence from long-run US data. International Review of Financial Analysis 35: 154–66. [Google Scholar] [CrossRef]

- Urquhart, Andrew, and Frank McGroarty. 2016. Are stock markets really efficient? Evidence of the adaptive market hypothesis. International Review of Financial Analysis 47: 39–49. [Google Scholar] [CrossRef]

- Xiao, Jun, Mingsheng Li, and Jing Shi. 2014. Volatile market condition and investor clientele effects on mutual fund flow performance relationship. Pacific-Basin Finance Journal 29: 310–34. [Google Scholar]

- Yu, Shun-Zheng, and Hisashi Kobayashi. 2006. Practical implementation of an efficient forward-backward algorithm for an explicit-duration hidden Markov model. IEEE Transactions on Signal Processing 54: 1947–51. [Google Scholar]

- Ziphethe-Makola, Sandiswa Masande. 2017. Relationship between AUM and Alpha in SA Mutual Funds. Master’s thesis, University of Cape Town, Cape Town, South Africa. [Google Scholar]

| Fund | Mean | Medium | Maximum | Minimum | Standard Deviation | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| Afena | 1.921 | 2.857 | 8.594 | −8.004 | 3.440 | −0.933 | 3.393 |

| Allan Gray | 2.107 | 1.848 | 16.238 | −14.326 | 5.218 | −0.304 | 4.135 |

| 4D BCI | 2.160 | 1.856 | 11.966 | −4.688 | 3.317 | 0.151 | 3.304 |

| 3LAWS | −0.073 | 1.000 | 5.000 | −7.000 | 3.199 | −0.468 | 2.154 |

| 3600ne | 3.666 | 5.000 | 12.000 | −16.000 | 5.548 | −1.055 | 4.249 |

| Aluwani | 3.549 | 3.022 | 15.664 | −6.487 | 5.780 | 0.108 | 2.240 |

| Analytics | 2.232 | 3.449 | 6.953 | −6.934 | 2.982 | −1.317 | 4.266 |

| Anchor | 2.877 | 4.207 | 12.028 | −6.939 | 3.592 | −0.376 | 3.540 |

| Blue Alpha | 1.864 | 2.423 | 9.873 | −7.095 | 3.813 | −0.055 | 2.582 |

| Bridge | 3.469 | 4.030 | 12.029 | −6.939 | 3.574 | −0.539 | 2.235 |

| Cannon | 1.162 | 1.068 | 16.058 | −9.937 | 5.517 | 0.554 | 3.631 |

| Capita BCI | 1.427 | 1.708 | 3.604 | −3.479 | 1.435 | −1.509 | 6.067 |

| Centeaur | 2.779 | 4.186 | 15.415 | −15.706 | 6.282 | −0.890 | 4.182 |

| Clucasgray | 0.789 | 0.686 | 10.431 | −6.164 | 2.836 | 0.394 | 4.558 |

| Counterpoint | 0.553 | 0.644 | 4.478 | −3.746 | 1.535 | −0.081 | 3.853 |

| Dalebrook | 0.275 | 0.290 | 6.301 | −7.118 | 3.068 | −0.415 | 3.332 |

| Denker | 0.363 | 0.389 | 4.478 | −3.746 | 1.565 | 0.196 | 3.626 |

| Graviton | 1.699 | 2.276 | 3.360 | −3.619 | 1.454 | −1.656 | 5.738 |

| GTC | 0.114 | 0.038 | 6.454 | −6.899 | 2.618 | 0.034 | 4.161 |

| Harvard | 0.006 | 0.103 | 6.241 | −10.738 | 2.605 | −1.347 | 7.701 |

| Huysamer | 0.459 | −0.157 | 8.651 | −11.155 | 3.779 | −0.183 | 3.450 |

| Imara | 2.288 | 2.546 | 9.746 | −8.524 | 3.716 | −0.381 | 3.564 |

| IP HIGH | −0.927 | −1.034 | 8.499 | −7.946 | 2.905 | 0.562 | 4.427 |

| Kagiso | 3.382 | 3.595 | 25.093 | −9.032 | 6.054 | 0.895 | 4.998 |

| Maestro | 0.484 | 0.205 | 7.343 | −10.719 | 3.479 | −0.587 | 3.919 |

| Naviga | −0.092 | −0.141 | 6.285 | −6.419 | 2.259 | −0.007 | 4.959 |

| Northstar | 2.462 | 2.364 | 15.992 | −8.701 | 3.733 | 0.808 | 6.745 |

| Personal Trust | −0.286 | 0.078 | 8.980 | −9.588 | 3.139 | −0.381 | 5.003 |

| RCI | 1.539 | 2.870 | 10.244 | −12.306 | 4.598 | −1.031 | 4.144 |

| RECM | 1.238 | 2.146 | 14.368 | −15.618 | 4.907 | −0.922 | 5.689 |

| Stanlib | 4.012 | 4.045 | 13.084 | −5.799 | 4.374 | −0.093 | 2.529 |

| ABSA Prime | 3.410 | 3.520 | 13.083 | −5.798 | 4.089 | 0.104 | 2.728 |

| Prescient | 3.792 | 6.101 | 9.240 | −6.935 | 4.582 | −0.929 | 2.401 |

| Fund | Intercept | FLOW | LNTNA | LNAGE | STDFND | STDMKT | ECOSIZE |

|---|---|---|---|---|---|---|---|

| Afena | 11.938 *** 5.479 *** | −0.072 0.224 *** | 0.058 −1.232 *** | −2.068 *** −0.818 *** | −643.486 *** −93.279 | −0.706 ** −0.205 | −0.127 ** −0.099 |

| Allan | 2.078 12.712 *** | −0.034 −0.062 ** | 0.709 *** −0.513 *** | −2.204 *** −2.534 *** | 71.376 97.015 | −2.151 *** −2.338 *** | −0.142 ** 0.048 |

| 4D BCI | 8.924 *** 1.086 | 0.106 −0.007 | 0.296 −0.177 | −2.805 *** 0.338 | −35.376 103.763 * | −4.034 *** −0.566 | 0.058 −0.010 |

| 3LAWS | 12.113 15.862 *** | 0.057 −0.001 | −0.706 1.052 *** | −6.016 −10.195 *** | 80.598 −152.805 *** | −5.656 *** −0.935 *** | 0.439 * −0.076 |

| 360One | 23.914 *** 13.486 *** | 0.464 0.091 | 0.124 −1.709 | −9.207 −0.055 | −2167.139 *** −1204.542 *** | 0.331 4.485 ** | −1.099 −0.426 |

| Aluwani | 6.600 *** −3.635 * | 0.009 *** −0.001 | −0.717 * 0.435 | −0.556 ** −0.454 * | 118.190 120.512 *** | −2.124 −2.298 *** | −0.007 0.063 |

| Analytics | 20.298 *** −1.609 | −0039 ** −0.009 *** | −1.267 *** 0.123 | −4.964 *** 0.644 | 55.642 0.685 | −0.418 0.223 | 0.027 0.167 |

| Anchor | 9.284 *** 12.411 *** | −0.017 0.287 *** | −0.547 −1.103 *** | −0.360 0.746 *** | −534.978 *** −601.861 *** | −0.353 −3.639 *** | 0.018 0.139 *** |

| Blue Alpha | 3.816 17.628 *** | 0.019 0.014 ** | 0.042 −3.062 *** | −2.015 * −0.095 | 51.544 *** −204.309 *** | −0.344 8.387 *** | −0.307 −0.015 |

| Bridge | 41.411 *** 51.252 *** | 0.033 −0.244 *** | −4.758 *** −4.366 *** | −1.126 −1.292 *** | −872.245 *** −711.282 *** | 1.017 −12.949 *** | 0.705 −1.321 *** |

| Cannon | 29.533 *** −10.563 *** | 0.275 −0.479 *** | −2.791 3.859 *** | −25.581 *** 2.836 | 1035.957 * −405.872 *** | −23.252 *** −6.390 *** | −0.635 −0.064 |

| Capita BCI | 6.100 *** −0.488 | 0.037 0.013 | −0.852 −0.026 | −0.812 *** 0.048 | −596.041 *** 372.714 *** | −3.136 *** 0.071 | 0.012 0.008 |

| Centeaur | 5.220 *** 7.291 *** | −0.058 −0.216 *** | −0.134 0.379 | −0.681 −2.770 | 119.551 *** −162.205 *** | −1.783 *** −2.238 *** | 0.126 −0.433 *** |

| Clucas. | 3.427 *** 1.814 | −0.227 *** −0.156 *** | −0.143 −0.013 | −1.043 *** 0.375 ** | 13.954 −77.569 | −0.346 −0.216 | −0.168 *** −0.017 |

| Counter. | −0.797 1.314 *** | 0.017 *** 0.008 * | 0.174 −0.125 | −0.664 0.454 *** | 102.463 *** −11.537 | −0.895 −0.349 *** | 0.077 0.029 |

| Dalebrook | −2.834 * 7.903 *** | 0.006 *** −0.014 *** | 0.602 *** −0.661 *** | 0.125 −1.338 *** | −27.726 −390.159 *** | 0.597 −1.407 * | −0.044 0.794 *** |

| Denker | 1.302 −4.237 *** | 0.003 −0.002 | −0.169 −0.241 | 0.406 *** 0.459 | 4.206 635.442 *** | −0.251 −0.425 * | 0.014 0.215 *** |

| Graviton | 4.633 1.365 *** | 0.069 0.008 | −0.017 −0.091 *** | −0.909 0.105 | −209.823 29.489 | −1.718 *** 0.017 | 0.134 ** 0.025 *** |

| GTC | 24.858 21.647 *** | −0.034 −0.030 *** | −2.135 * 1.434 *** | −4.037 −6.902 *** | −632.123 * −223.809 *** | −8.683 *** 1.551 * | −0.251 0.148 |

| Harvard | −1.953 −3.216 ** | −0.127 *** 0.043 | 2.457 *** 1.214 | −0.191 0.826 *** | −466.652 *** −21.239 | 0.682 * 0.336 | 0.256 0.093 |

| Huysamer | −4.197 0.810 | 0.136 *** 0.012 | 2.598 *** −0.995 | 0.038 0.446 | 54.873 * 21.280 | −1.054 0.481 | 0.088 0.350 *** |

| Imara | −5.442 * 1.340 | 0.006 * −0.001 | 2.104 *** 0.911 * | 0.802 −0.154 | −237.013 *** −181.277 *** | 1.003 *** 0.347 | 0.089 −0.001 |

| IP HIGH | 11.217 28.931 *** | 0.007 0.002 | −4.816 −19.534 *** | −1.721 *** 5.988 *** | −370.190 ** −268.682 *** | 0.739 5.809 *** | −0.033 0.850 *** |

| Kagiso | 7.737 *** 7.358 *** | 0.038 −0.037 *** | −0.561 −0.469 *** | −1.207 −1.242 *** | 15.936 137.428 *** | −5.123 *** −3.951 *** | −0.252 ** −0.125 *** |

| Maestro | 4.174 *** 1.042 | −0.325 *** 0.123 *** | 0.921 *** −0.452 *** | −2.969 *** 0.723 | −130.129 −254.010 | −0.124 2.430 * | 0.267 * −0.180 |

| Naviga | 3.042 −6.046 *** | −0.019 * −0.220 *** | −0.226 2.355 *** | −0.886 * −1.827 *** | 100.498 617.188 *** | −0.778 −6.677 *** | −0.486 3.208 *** |

| Northstar | 7.624 *** 7.459 *** | −0.009 0.069 *** | 2.225 ** 4.282 *** | −3.485 *** −5.145 *** | 123.799 −3.175 | −0.355 −0.759 *** | −0.089 * 0.102 *** |

| Personal Trust | −1.082 −4.345 *** | 0.053 *** −0.001 *** | 1.767 * 2.867 *** | −0.487 −0.831 *** | −58.519 28.875 | −0.485 −0.813 *** | −0.238 −0.218 *** |

| RCI | 46.592 * 48.343 *** | 0.007 0.053 *** | −14.441 −18.791 *** | −10.574 * −11.566 *** | −69.376 −791.605 *** | −4.146 *** 1.157 *** | −1.116 2.643 *** |

| RECM | 0.433 −0.535 | −0.072 0.058 * | 0.619 0.129 | −1.366 0.416 *** | −379.661 *** 108.669 *** | 2.130 ** −0.130 | −0.425 * −0.066 |

| Stanlib | 18.676 *** 32.022 *** | −0.039 0.039 | −3.532 * −5.235 *** | 2.503 1.834 *** | −342.103 −704.414 *** | 8.067 3.089 *** | −0.206 0.307 *** |

| ABSA | 14.788 *** 33.219 *** | −0.001 0.024 *** | −1.801 −0.404 | −1.665 −6.777 *** | −369.628 −784.171 *** | 3.493 −1.549 | 0.035 −1.269 *** |

| Prescient | 5.137 9.116 *** | 0.004 −0.028 *** | 9.511 *** 13.604 *** | −6.716 *** −9.491 *** | −433.241 −973.846 *** | 3.344 8.023 *** | 0.144 −0.384 *** |

| Variable | ||||||

|---|---|---|---|---|---|---|

| Regime | LNAGE | No. of Funds | STDFND | No. of Funds | STDMKT | No. of Funds |

| S1 | −4.249 *** | 16 | −358.263 *** | 15 | −2.563 *** | 13 |

| S2 | −2.327 *** | 21 | −286.371 *** | 22 | −0.876 *** | 21 |

| Regime 1 | Regime 2 | |

|---|---|---|

| Regime 1 | 0.659 | 0.340 |

| Regime 2 | 0.314 | 0.669 |

| Probability | Duration | |

|---|---|---|

| Regime 1 | 0.491 | 4.43 |

| Regime 2 | 0.509 | 4.59 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Apau, R.; Moores-Pitt, P.; Muzindutsi, P.-F. Regime-Switching Determinants of Mutual Fund Performance in South Africa. Economies 2021, 9, 161. https://doi.org/10.3390/economies9040161

Apau R, Moores-Pitt P, Muzindutsi P-F. Regime-Switching Determinants of Mutual Fund Performance in South Africa. Economies. 2021; 9(4):161. https://doi.org/10.3390/economies9040161

Chicago/Turabian StyleApau, Richard, Peter Moores-Pitt, and Paul-Francois Muzindutsi. 2021. "Regime-Switching Determinants of Mutual Fund Performance in South Africa" Economies 9, no. 4: 161. https://doi.org/10.3390/economies9040161

APA StyleApau, R., Moores-Pitt, P., & Muzindutsi, P.-F. (2021). Regime-Switching Determinants of Mutual Fund Performance in South Africa. Economies, 9(4), 161. https://doi.org/10.3390/economies9040161