The Role of Tourism in Economic Growth: Empirical Evidence from Saudi Arabia

Abstract

1. Introduction

2. Literature Review

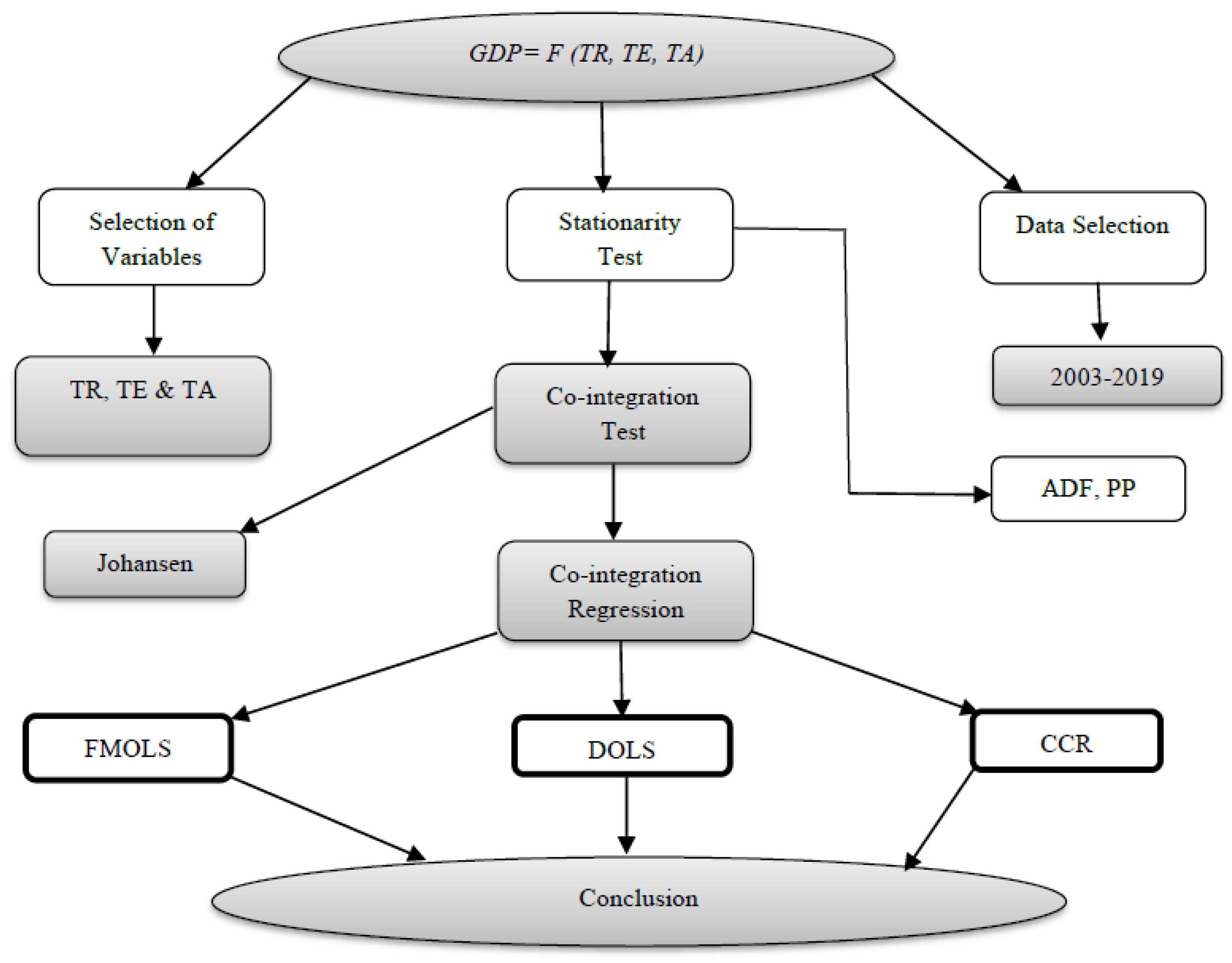

3. Data and Methodology

4. Results

4.1. Descriptive Statistics

4.2. Unit Root Test

4.3. Johansen Co-Integration Test

4.4. Co-Integration Regression

4.5. Granger Causality Test

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adnan, Hye Qazi Muhammad, and Rana Ejaz Ali Khan. 2013. Tourism-led growth hypothesis: A case study of Pakistan. Asia Pacific Journal of Tourism Research 18: 303–13. [Google Scholar] [CrossRef]

- Ahad, Muhammad. 2016. Does Tourism-led Growth Hypothesis exist in Pakistan? A fresh look from Combine Co-integration and Causality Approach with Structural Breaks. International Journal of Economics and Empirical Research 4: 94–111. [Google Scholar]

- Akan, Yusuf, İbrahim Arslan, and Cem Isik. 2008. The Impact of Tourism on Economic Growth: The Case of Turkey. Journal of Tourism 9: 47–69. [Google Scholar]

- Akinboade, Oludele A., and Lydia A. Braimoh. 2010. International tourism and economic development in South Africa: A Granger causality test. International Journal of Tourism Research 12: 149–63. [Google Scholar] [CrossRef]

- Alhowaish, Abdulkarim K. 2016. Is Tourism Development a Sustainable Economic Growth Strategy in the Long Run? Evidence from GCC Countries. Sustainability 8: 605. [Google Scholar] [CrossRef]

- Aslan, Alper. 2014. Tourism development and economic growth in the Mediterranean countries: Evidence from panel Granger causality tests. Current Issues in Tourism 17: 363–72. [Google Scholar] [CrossRef]

- Badulescu, Alina, Daniel Badulescu, Ramona Simut, and Simona Dzitac. 2020. Tourism—Economic growth nexus. The case of Romania. Technological and Economic Development of Economy 26: 867–84. [Google Scholar] [CrossRef]

- Balaguer, Jacint, and Manuel Cantavella-Jorda. 2002. Tourism as a Long-Run Economic Growth Factor The Spanish Case. Applied Economics 34: 877–84. [Google Scholar] [CrossRef]

- Bayramoglu, Turgut, and Yilmaz Onur Ari. 2015. The relationship between tourism and economic growth in Greece economy: A time series analysis. Computational Method in Social Sciences 3: 89–93. [Google Scholar]

- Belloumi, Mounir. 2010. The relationship between tourism receipts, real effective exchange rate and economic growth in Tunisia. International Journal of Tourism Research 12: 550–60. [Google Scholar] [CrossRef]

- Brida, Juan Gabriel, Edgar J. Sanchez Carrera, and W. Adrian Risso. 2008. Tourism’s Impact on long-run Mexican economic growth. Economics Bulletin 3: 1–8. [Google Scholar]

- Chen, Ching-Fu, and Song Zan Chiou-Wei. 2009. Tourism Expansion, Tourism Uncertainty and Economic Growth: New Evidence from Taiwan and Korea. Tourism Management 30: 39–44. [Google Scholar] [CrossRef]

- Chou, Ming Che. 2013. Does Tourism Development Promote Economic Growth in Transition Countries? A Panel Data Analysis. Economic Modelling 33: 226–32. [Google Scholar]

- Costa, Jorge. 2017. How are companies and destinations “surfing the wave” of global tourism? Strategic question overview. Worldwide Hospitality and Tourism Themes 9: 588–91. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49: 1057–71. [Google Scholar] [CrossRef]

- Dritsakis, Nikolaos. 2004. Tourism as a long-run economic growth factor: An empirical investigation for Greece using causality analysis. Tourism Economics 10: 305–16. [Google Scholar] [CrossRef]

- Durbarry, Ramesh. 2004. Tourism and Economic Growth: The Case of Mauritius. Tourism Economics 10: 389–401. [Google Scholar] [CrossRef]

- Ekanayake, Ekanayake M., and Aubrey E. Long. 2012. Tourism Development and Economic Growth in Developing Countries. International Journal of Bussiness and Finance Research 6: 51–63. [Google Scholar]

- Engle, Robert F., and Clive W. J. Granger. 1987. Cointegration and error correction: Representation, estimation and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- FaladeObalade, Timothy A., and Suchi Dubey. 2014. Managing Tourism as a source of Revenue and Foreign direct investment inflow in a developing Country: The Jordanian Experience. International Journal of Academic Research in Economics and Management Sciences 3: 16–42. [Google Scholar] [CrossRef]

- Falk, Martin. 2010. A dynamic panel data analysis of snow depth and winter tourism. Tourism Management 31: 912–24. [Google Scholar] [CrossRef]

- Gunduz, Lokman, and Abdulnasser Hatemi-J. 2005. Is the tourism-led growth hypothesis valid for Turkey? Applied Economics 12: 499–504. [Google Scholar] [CrossRef]

- Holzner, Mario. 2011. Tourism and economic growth: The beach disease? Tourism Management 32: 922–33. [Google Scholar] [CrossRef]

- Jamel, Lamia. 2020. The Relation between Tourism and Economic Growth: A Case of Saudi Arabia as an Emerging Tourism Destination. Virtual Economics 3: 29–47. [Google Scholar] [CrossRef]

- Jeon, Ji-Hong. 2020. Macro and Non-macro Determinants of Korean Tourism Stock Performance: A Quantile Regression Approach. Journal of Asian Finance, Economics and Business 7: 149–56. [Google Scholar] [CrossRef]

- Khalil, Samina, Mehmood Khan Kakar, and Afia Malik. 2007. Role of tourism in Economic Growth: Empirical Evidence from Pakistan Economy. The Pakistan Development Review 46: 985–95. [Google Scholar] [CrossRef]

- Khan, Uzma. 2020. Does Tourism Boost Economic Growth: An Evidence from Italy. International Journal of Economics and Business Administration 8: 214–22. [Google Scholar] [CrossRef]

- Khan, Asif, Sughra Bibi, Ardito Lorenzo, Jiaying Lyu, and Zaheer Udden Babar. 2020. Tourism and Development in Developing Economies: A Policy Implication Perspective. Sustainability 12: 1618. [Google Scholar] [CrossRef]

- Kim, Hyun Jeong, Ming-Hsiang Chen, and SooCheong Shawn Jang. 2006. Tourism expansion and economic development: The case of Taiwan. Tourism Management 27: 925–33. [Google Scholar] [CrossRef] [PubMed]

- Kreishan, Fuad M. 2011. Empirical Study of Tourism and Economic Growth of Bahrain: An ARDL Bounds Testing Approach. International Journal of Economics and Finance 7: 1–9. [Google Scholar] [CrossRef]

- Lee, Jung Wan, and Tantatape Brahmasrene. 2013. Investigating the influence of tourism on economic growth and carbon emissions: Evidence from panel analysis of the European Union. Tourism Management 38: 69–76. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, and Chun-Ping Chang. 2008. Tourism development and economic growth: A closer look at panels. Tourism Management 29: 180–92. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, and Mei-Se Chien. 2008. Structural breaks, tourism development, and economic growth: Evidence from Taiwan. Mathematics and Computers in Simulation 77: 358–68. [Google Scholar] [CrossRef]

- Lee, Jung Wan, and Ahmad Mujafar Syah. 2018. Economic and Environmental Impacts of Mass Tourism on Regional Tourism Destinations in Indonesia. Journal of Asian Finance, Economics and Business 5: 31–41. [Google Scholar] [CrossRef]

- Leitão, Nuno Carlos. 2015. Portuguese Tourism Demand: A Dynamic Panel Data Analysis. International Journal of Economics and Financial Issues 5: 673–77. [Google Scholar]

- Leitão, Nuno Carlos, and Muhammad Shahbaz. 2016. Economic Growth, Tourism Arrivals and Climate Change. Bulletin of Energy Economics (BEE). Economics and Social Development Organization (TESDO) 4: 35–43. [Google Scholar]

- MacKinnon, James G., Alfred A. Haug, and Leo Michelis. 1999. Numerical Distribution Functions of Likelihood Ratio Tests for Cointegration. Journal of Applied Econometrics 14: 563–77. [Google Scholar] [CrossRef]

- Manzoor, Faiza, Longbao Wei, Muhammad Asif, Muhammad Zia ul Haq, and Hafiz ur Rehman. 2019. The Contribution of Sustainable Tourism toEconomic Growth and Employment in Pakistan. International Journal of Environmental Research and Public Health 16: 3785. [Google Scholar] [CrossRef] [PubMed]

- Mason, Peter. 2015. Tourism Impacts, Planning and Management. Arbingdon: Routledge. [Google Scholar]

- Mustafa, Abdul Majeed Mohamed. 2019. Contribution of Tourism and Foreign Direct Investment to Gross Domestic Product: Econometric Analysis in the Case of Sri Lanka. Journal of Asian Finance, Economics and Business 6: 109–14. [Google Scholar] [CrossRef]

- Nissan, Edward, Miguel-Angel Galindo, and María Teresa Méndez. 2011. Relationship between tourism and economic growth. The Service Industries Journal 31: 1567–72. [Google Scholar] [CrossRef]

- Oh, Chi-Ok. 2005. The contribution of tourism development to economic growth in the Korean economy. Tourism Management 26: 39–44. [Google Scholar] [CrossRef]

- Ohlan, Ramphul. 2017. The relationship between tourism, financial development and economic growth in India. Future Business Journal 3: 9–22. [Google Scholar] [CrossRef]

- Ozturk, Ilhan, and Ali Acaravci. 2009. On the causality between tourism growth and economic growth: Empirical evidence from Turkey. Transylvanian Review of Administrative Sciences 25: 73–81. [Google Scholar]

- Park, Joon. 1992. Canonical Cointegrating Regressions. Econometrica 60: 119–43. [Google Scholar] [CrossRef]

- Payne, James E., and Andrea Mervar. 2010. The tourism-growth nexus in Croatia. Tourism Economics 19: 1089–94. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Bruce E. Hansen. 1990. Statistical inference in instrumental variable regression with I (1) processes. Review of Economic Studies 57: 99–125. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Po, Wan-Chen, and Bwo-Nung Huang. 2008. Tourism development and economic growth—A nonlinear approach. Physica A: Statistical Mechanics and its Applications 387: 5535–42. [Google Scholar] [CrossRef]

- Proenca, Sara, and Elias Soukiazis. 2008. Tourism as an economic growth factor: A case study for Southern European Countries. Tourism Economics 14: 791–806. [Google Scholar] [CrossRef]

- Ren, Taizeng, Muhlis Can, Sudharshan R. Paramati, Jianchun Fang, and Wanshan Wu. 2019. The Impact of Tourism Quality on Economic Development and Environment: Evidence from Mediterranean Countries. Sustainability 11: 2296. [Google Scholar] [CrossRef]

- Saikkonen, Pentti. 1992. Estimation and testing of co-integrated systems by an autoregressive approximation. Econometric Theory 8: 1–27. [Google Scholar] [CrossRef]

- Songling, Yang, Muhammad Ishtiaq, and Bui Thi Thanh. 2019. Tourism Industry and Economic Growth Nexus in Beijing, China. Economies 7: 25. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 1993. A simple estimator of co-integrating vectors in higher order integrated systems. Econometrica 61: 783–820. [Google Scholar] [CrossRef]

- Surugiu, Camelia, Nuno Carlos Leitão, and Marius Răzvan Surugiu. 2011. A Panel Data Modelling of International Tourism Demand: Evidences for Romania. Economic Research Ekonomska Istraživanja 24: 134–45. [Google Scholar] [CrossRef]

- Tabash, Mosab I. 2017. The Role of Tourism Sector in Economic Growth: An Empirical Evidence from Palestine. International Journal of Economics and Financial Issues 7: 103–8. [Google Scholar]

- Tang, Chor Foon, and Salah Abosedra. 2012. Small sample evidence on the tourism-led growth hypothesis in Lebanon. Current Issues in Tourism 17: 234–46. [Google Scholar] [CrossRef]

- Tang, Chun-Hung Hugo, and SooCheong Shawn Jang. 2009. The tourism-economy causality in the United States: A sub-industry level examination. Tourism Management 30: 553–58. [Google Scholar] [CrossRef]

- Tang, Chor Foon, and Eu Chye Tan. 2013. How stable is the tourism-led growth hypothesis in Malaysia? Evidence from disaggregated Tourism Markets. Tourism Management 37: 52–47. [Google Scholar] [CrossRef]

- Tang, Chor Foon, and Eu Chye Tan. 2015. Does tourism effectively stimulate Malaysia’s economic growth? Tourism Management 46: 158–63. [Google Scholar] [CrossRef]

- Tavares, Jean Max, and Nuno Carlos Leitao. 2017. The Determinants of International Tourism Demands for Brazil. Tourism Economics 23: 834–45. [Google Scholar] [CrossRef]

- Tugcu, Can Tansel. 2014. Tourism and Economic Growth Nexus Revisited: A Panel Causality Analysis for the case of the Mediterranean Region. Tourism Management 42: 207–12. [Google Scholar] [CrossRef]

- Tuncay, Nesrin, and Ceyhun Can Ozcan. 2020. The effect of Dutch Disease in the tourism sector: The case of Mediterranean Countries. Tourism and Hospitality Management 26: 99–114. [Google Scholar] [CrossRef]

- Turner, Rochelle, and Evelyne Freiermuth. 2016. Travel & Tourism Economic Impact 2016. London: World Travel & Tourism Council. [Google Scholar]

- Wang, Wei, and Haiying Ma. 2015. On Econometric Analysis of the Relationship between GDP and Tourism Income in Guizhou, China. International Journal of Business Administration 6: 41–47. [Google Scholar] [CrossRef][Green Version]

- WTTC. 2019. WTTC Economic Impact Reports. Available online: https://wttc.org/Research/Economic-Impact (accessed on 20 June 2019).

- WTTC. 2021. Global Economic Impact and Trends 2021. Available online: https://wttc.org/Portals/0/Documents/Reports/2021/Global%20Economic%20Impact%20and%20Trends%202021.pdf?ver=2021-07-01-114957-177 (accessed on 21 June 2021).

| Dependent Variable | Mean | Median | Maximum | Minimum | Jarque–Bera | Probability | LNG | LNTR | LNTE | LNTA |

|---|---|---|---|---|---|---|---|---|---|---|

| LNG | 26.99 | 27.192 | 27.399 | 26.098 | 2.185 | 0.335 | 1 | |||

| LNTR | 22.86 | 22.852 | 27.711 | 21.952 | 0.23 | 0.891 | 0.834 | 1 | ||

| LNTE | 23.44 | 23.613 | 23.948 | 22.149 | 9.736 | 0.008 | 0.817 | 0.562 | 1 | |

| LNTA | 16.56 | 16.682 | 16.951 | 15.808 | 1.589 | 0.452 | 0.925 | 0.804 | 0.746 | 1 |

| Dependent | ADF. | Phillips–Perron | |||

|---|---|---|---|---|---|

| Variable | t-Statistic | Prob. | Adj. t-Stat. | Prob. | |

| LNG | Level | −2.637 | 0.106 | −4.705 | 0.002 * |

| 1st difference | −3.428 | 0.027 ** | |||

| LNTR | Level | 0.907 | 0.99 | −0.778 | 0.798 |

| 1st difference | −7.65 | 0.00 * | −9.005 | 0.000 * | |

| LNTE | Level | −3.171 | 0.041 ** | −4.158 | 0.006 * |

| LNTA | Level | −2.615 | 0.11 | −3.15 | 0.042 ** |

| 1st difference | −4.499 | 0.004 * | |||

| Eigenvalue | Trace Statistics | 0.05 Critical Value | Prob. ** | Max–Eigen Statistics | 0.05 Critical Value | Prob. ** | |

|---|---|---|---|---|---|---|---|

| None * | 0.897 | 65.578 | 47.856 | 0.0005 | 34.07 | 27.584 | 0.0064 |

| At most 1 * | 0.813 | 31.507 | 29.797 | 0.0315 | 25.143 | 21.132 | 0.0129 |

| At most 2 | 0.301 | 6.364 | 15.495 | 0.6525 | 5.364 | 14.265 | 0.6953 |

| At most 3 | 0.065 | 0.999 | 3.841 | 0.3174 | 0.999 | 3.842 | 0.3174 |

| LNGDP | LNTR | LNTE | LNTA | ||||

| 1 | −0.994 | (0.44) | −1.41 | (0.191) | −0.265 | (0.793) | |

| Variable | FMOLS | DOLS | CCR | |||

|---|---|---|---|---|---|---|

| LNTR | 0.28 | 0.0209 ** | 0.312 | 0.05 ** | 0.317 | 0.032 ** |

| LNTE | 0.256 | 0.015 ** | 0.287 | 0.23 | 0.235 | 0.0286 ** |

| LNTA | 0.62 | 0.008 * | 0.989 | 0.04 ** | 0.574 | 0.024 ** |

| C | 4.34 | 0.059 | 10.54 | 0.139 | 4.753 | 0.009 * |

| Adj R2 | 0.86 | 0.997 | 0.853 | |||

| Long-run Variance | 0.014 | 6.78 × 10−5 | 0.014 | |||

| Co-integration test | 0.29 | 0.200 | 0.069 | 0.200 | 0.244 | 0.200 |

| Jarque-Bera | 1.346 | 0.51 | 0.467 | 0.792 | 1.301 | 0.522 |

| Null Hypothesis | Obs. | F-Statistics | Probability |

|---|---|---|---|

| LNTA does not Granger cause LNG | 16 | 2.90152 | 0.1123 |

| LNG does not Granger cause LNTA | 9.34552 | 0.0092 | |

| LNTE does not Granger cause LNG | 16 | 0.85377 | 0.3723 |

| LNG does not Granger cause LNTE | 0.13732 | 0.7169 | |

| LNTR does not Granger cause LNG | 16 | 1.92603 | 0.1885 |

| LNG does not Granger cause LNTR | 0.25776 | 0.6202 | |

| LNTE does not Granger cause LNTA | 16 | 1.97735 | 0.1831 |

| LNTA does not Granger cause LNTE | 0.58823 | 0.4568 | |

| LNTR does not Granger cause LNTA | 16 | 0.41381 | 0.5312 |

| LNTA does not Granger cause LNTR | 0.14988 | 0.7049 | |

| LNTR does not Granger cause LNTE | 16 | 0.04247 | 0.8399 |

| LNTE does not Granger cause LNTR | 0.19091 | 0.6693 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naseem, S. The Role of Tourism in Economic Growth: Empirical Evidence from Saudi Arabia. Economies 2021, 9, 117. https://doi.org/10.3390/economies9030117

Naseem S. The Role of Tourism in Economic Growth: Empirical Evidence from Saudi Arabia. Economies. 2021; 9(3):117. https://doi.org/10.3390/economies9030117

Chicago/Turabian StyleNaseem, Sana. 2021. "The Role of Tourism in Economic Growth: Empirical Evidence from Saudi Arabia" Economies 9, no. 3: 117. https://doi.org/10.3390/economies9030117

APA StyleNaseem, S. (2021). The Role of Tourism in Economic Growth: Empirical Evidence from Saudi Arabia. Economies, 9(3), 117. https://doi.org/10.3390/economies9030117