Liquidity Spill-Overs in Sovereign Bond Market: An Intra-Day Study of Trade Shocks in Calm and Stressful Market Conditions

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data

- t—the time in minutes at which the limit order-book is calculated (e.g., before, at, and after the trade is executed);

- P—the price of the limit order book, i.e., the mid-point of ask and bid price;

- Q—the quantity that can be traded at a given quoted price;

- “Ask” and “Bid”—the side of the limit order-book;

- j—number of the priority of the offers in the limit order book (from 1st to 5th best Ask/Bid price and its corresponding quantity).

3.2. Research Methods

- t—minutes after (+)/before (−) a trade is executed,

- M0—the value of bond liquidity indicator at the time of the trade,

- Mt—the value of bond liquidity indicator at time t,

- k—the number of observations at time t.

4. Results of the Event Studies on Spillover Effects of Trades

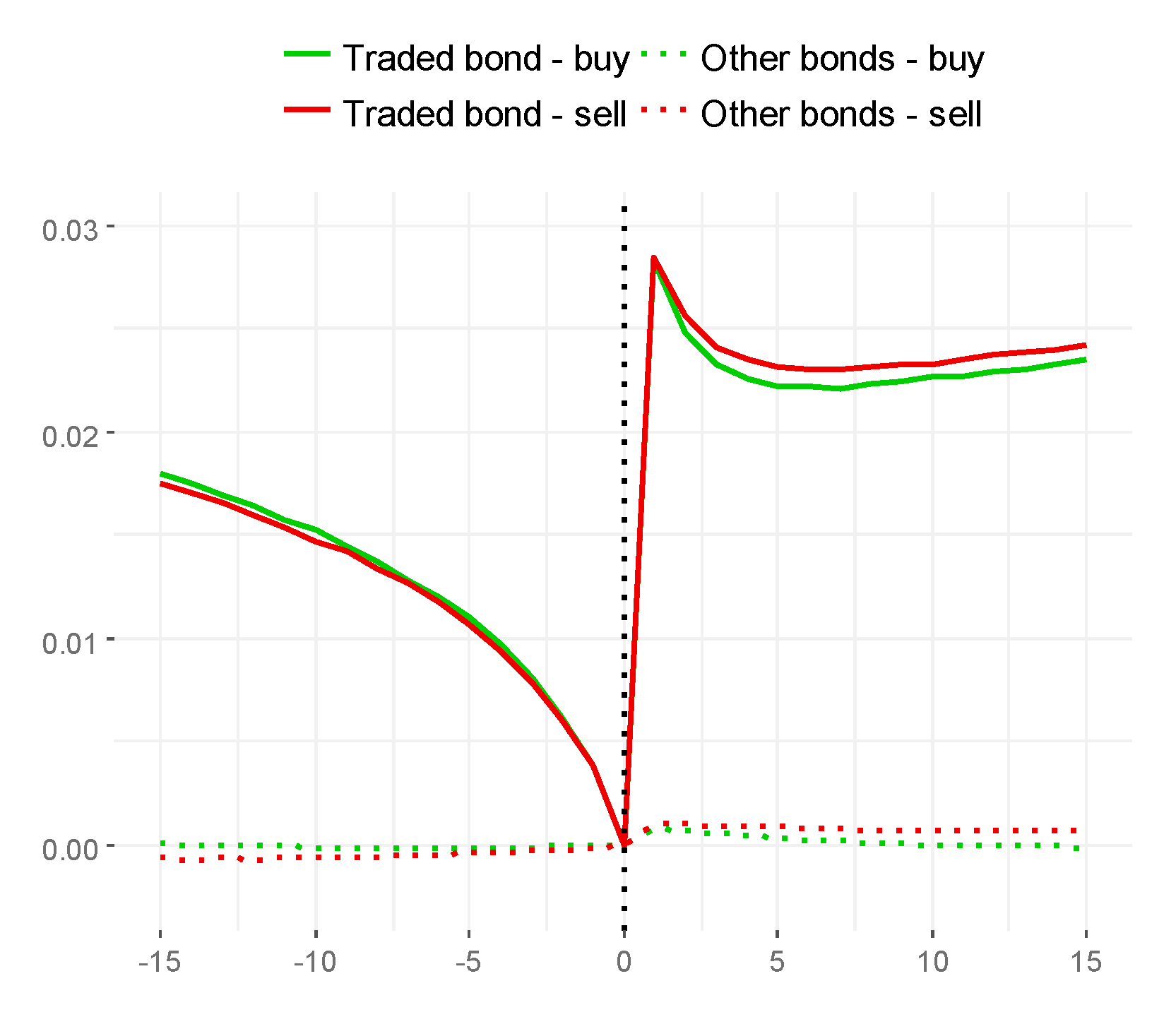

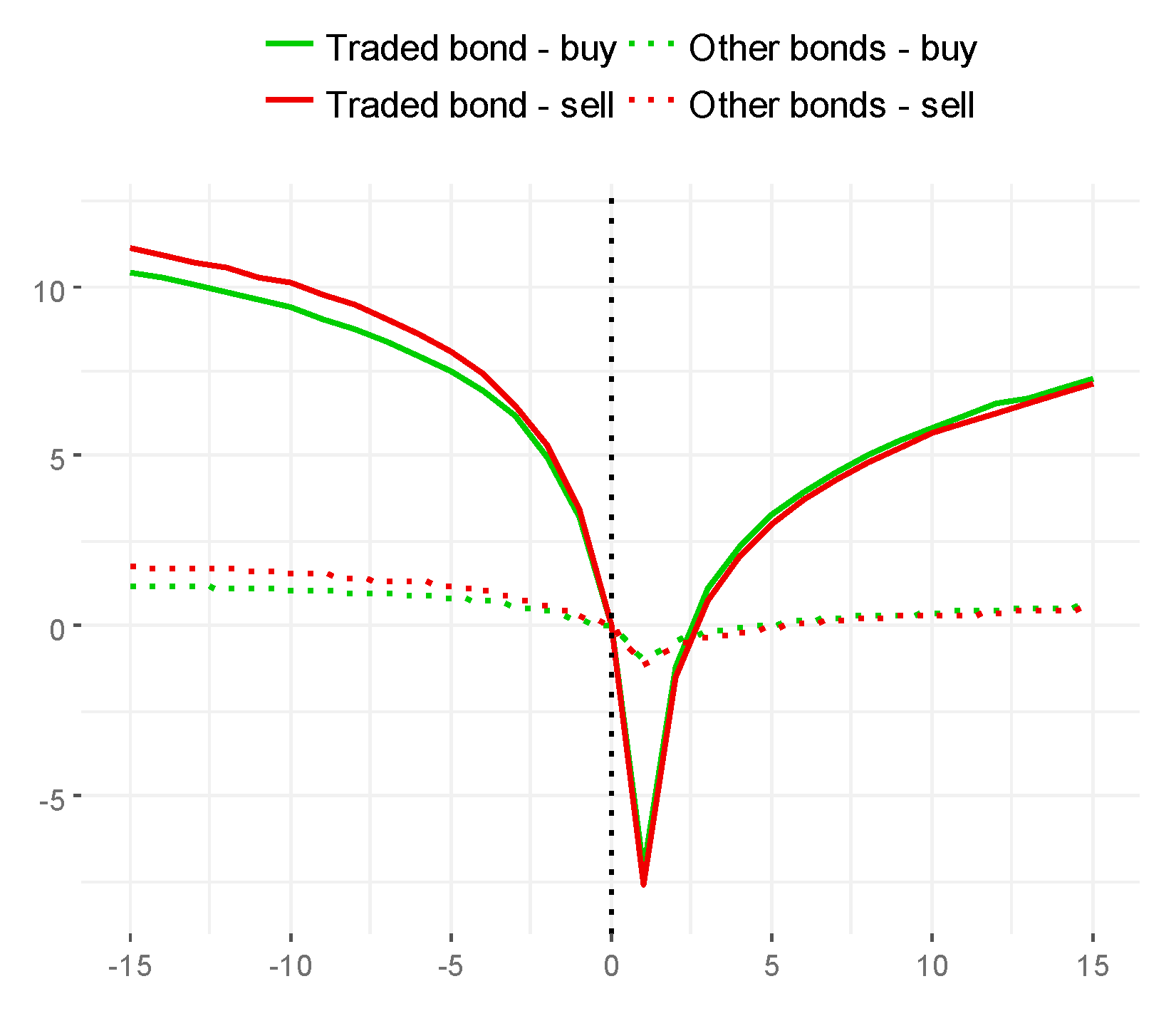

4.1. Direction of Trade

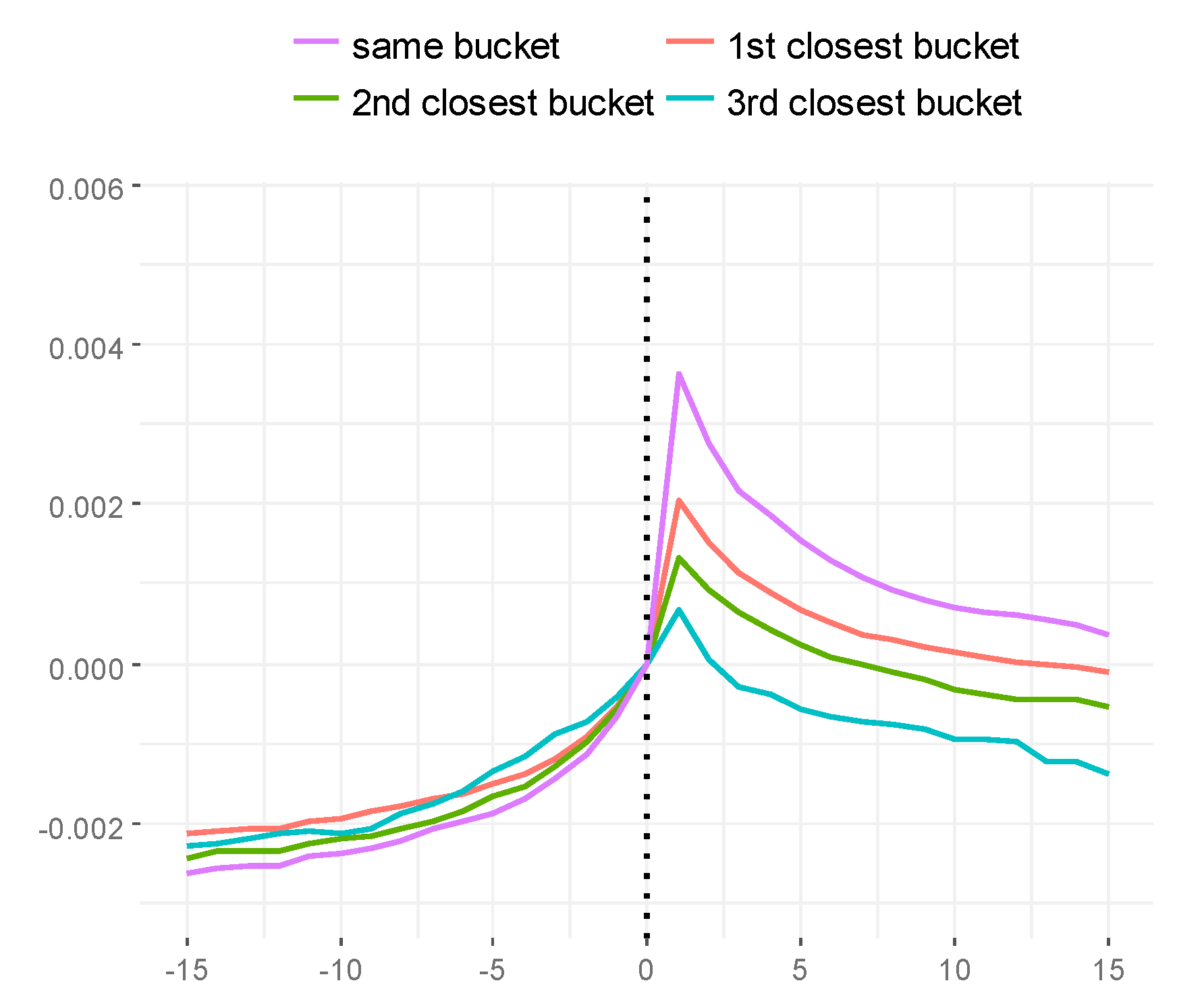

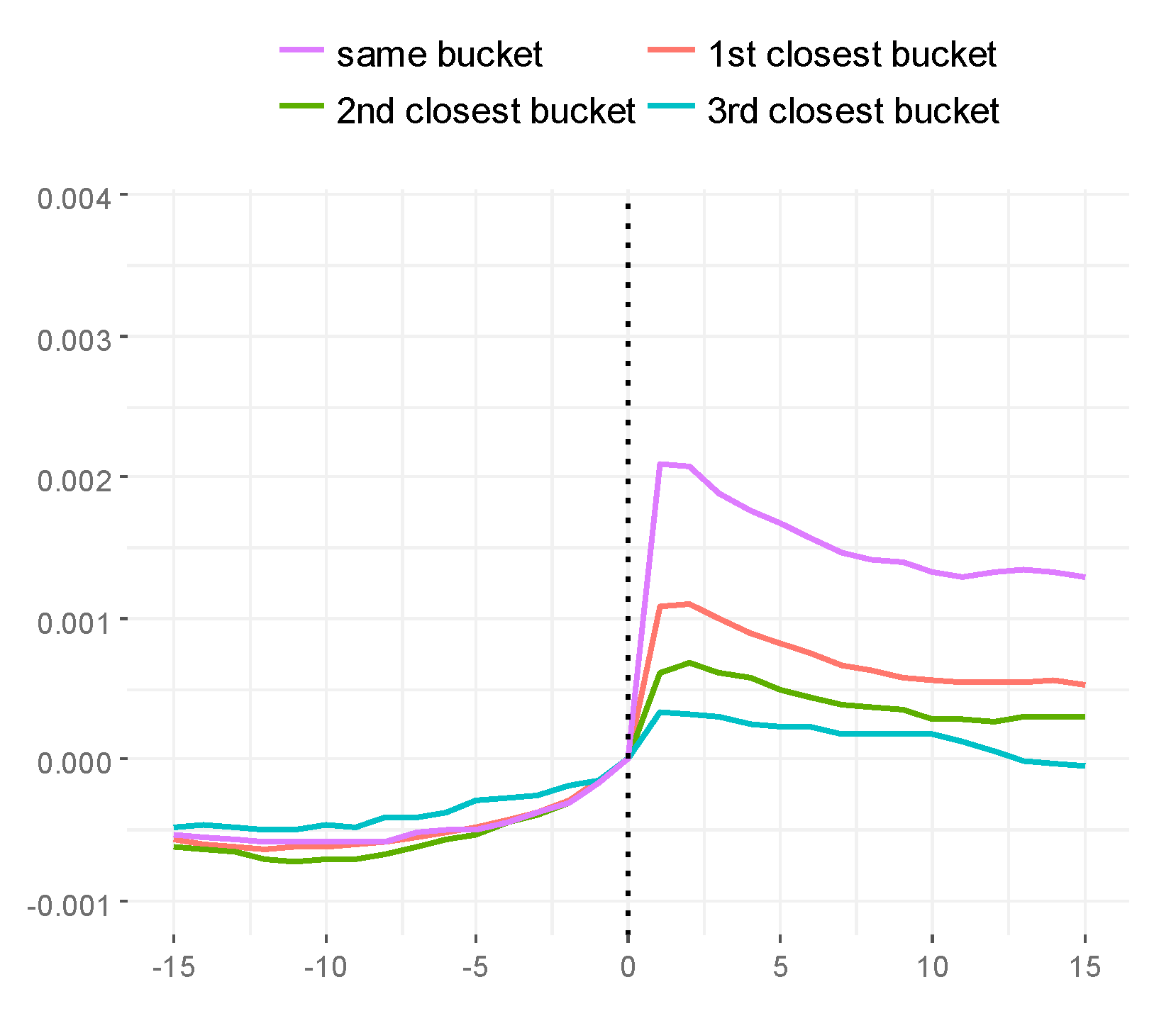

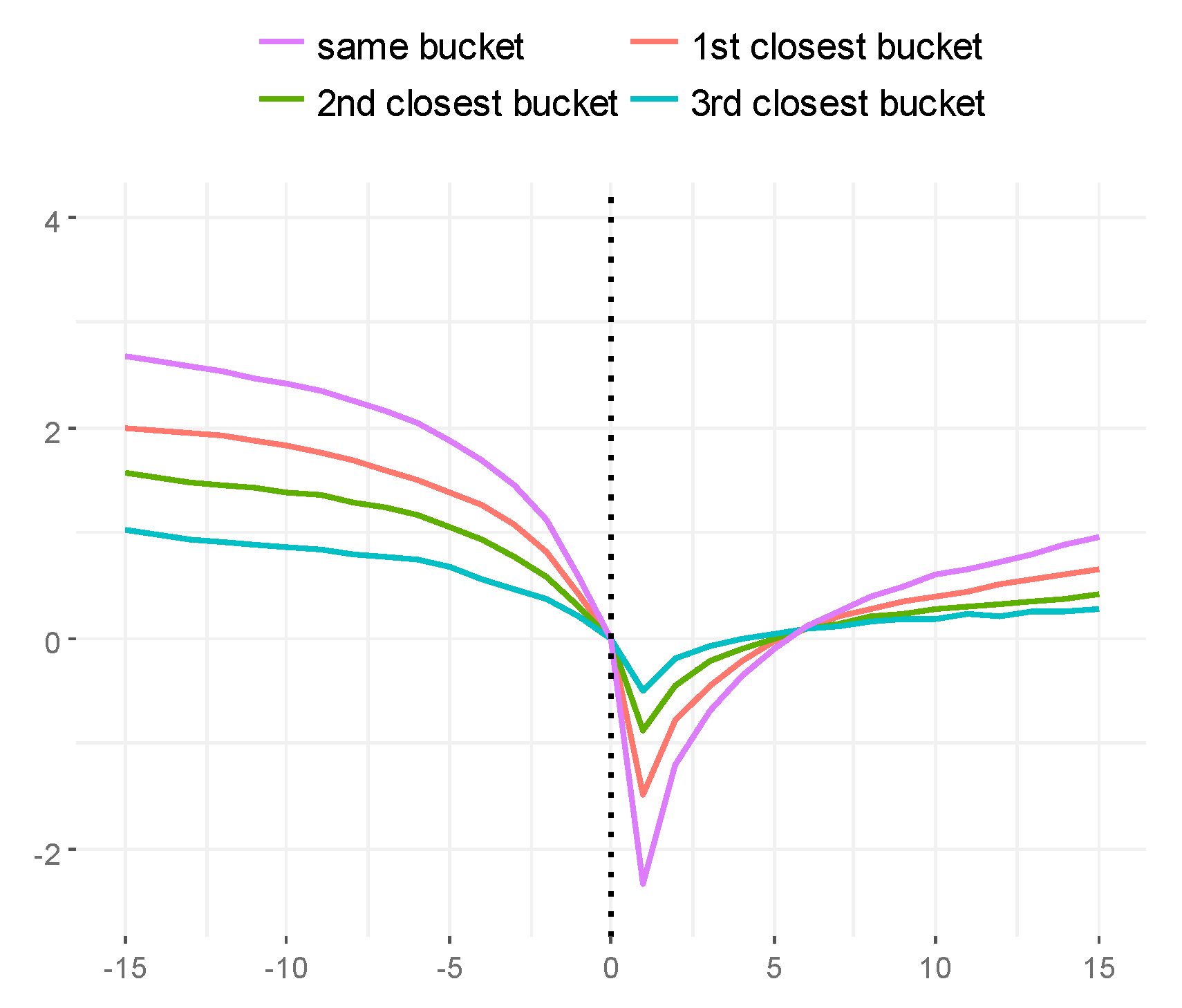

4.2. Maturity Buckets

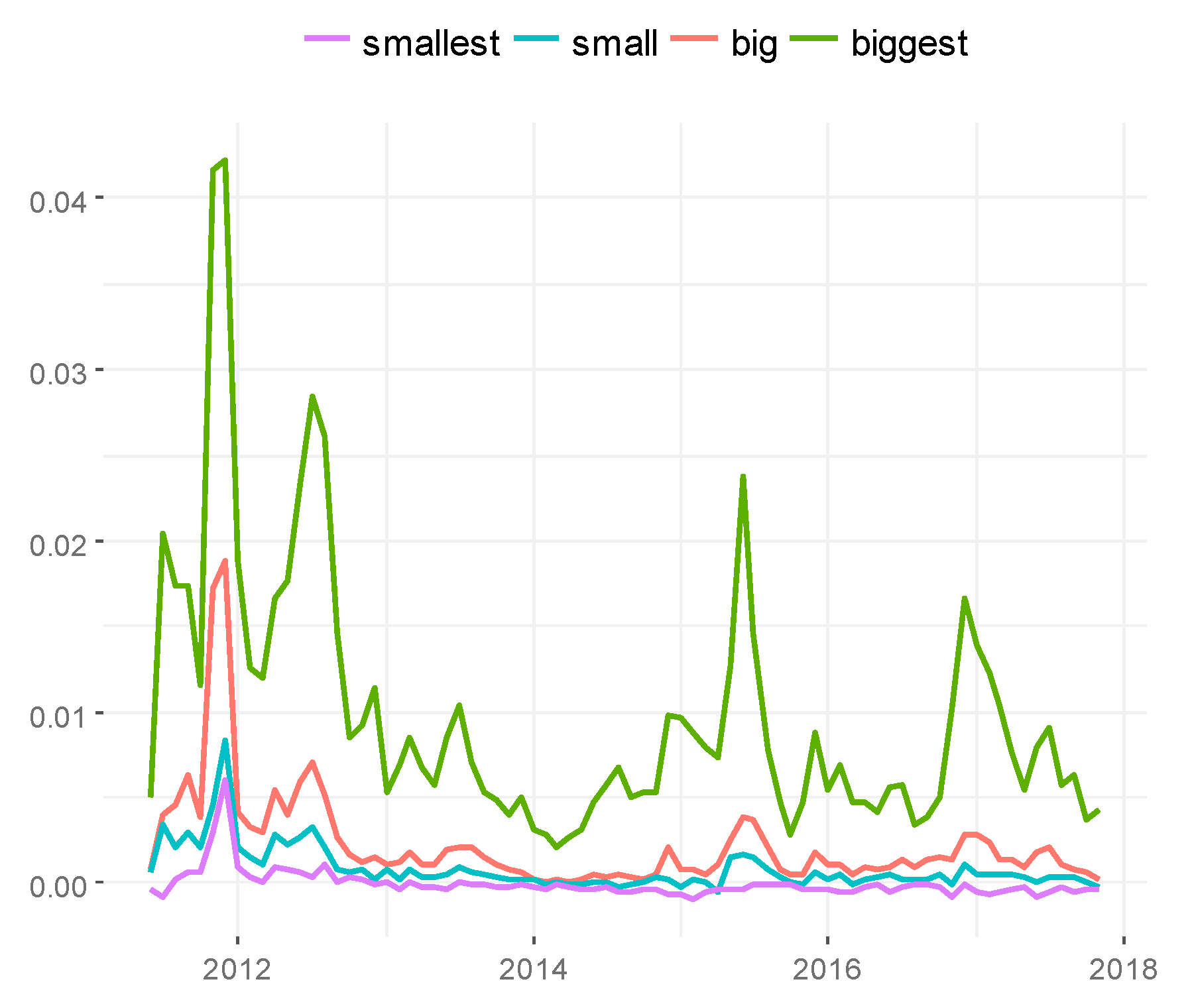

4.3. Size of Transaction

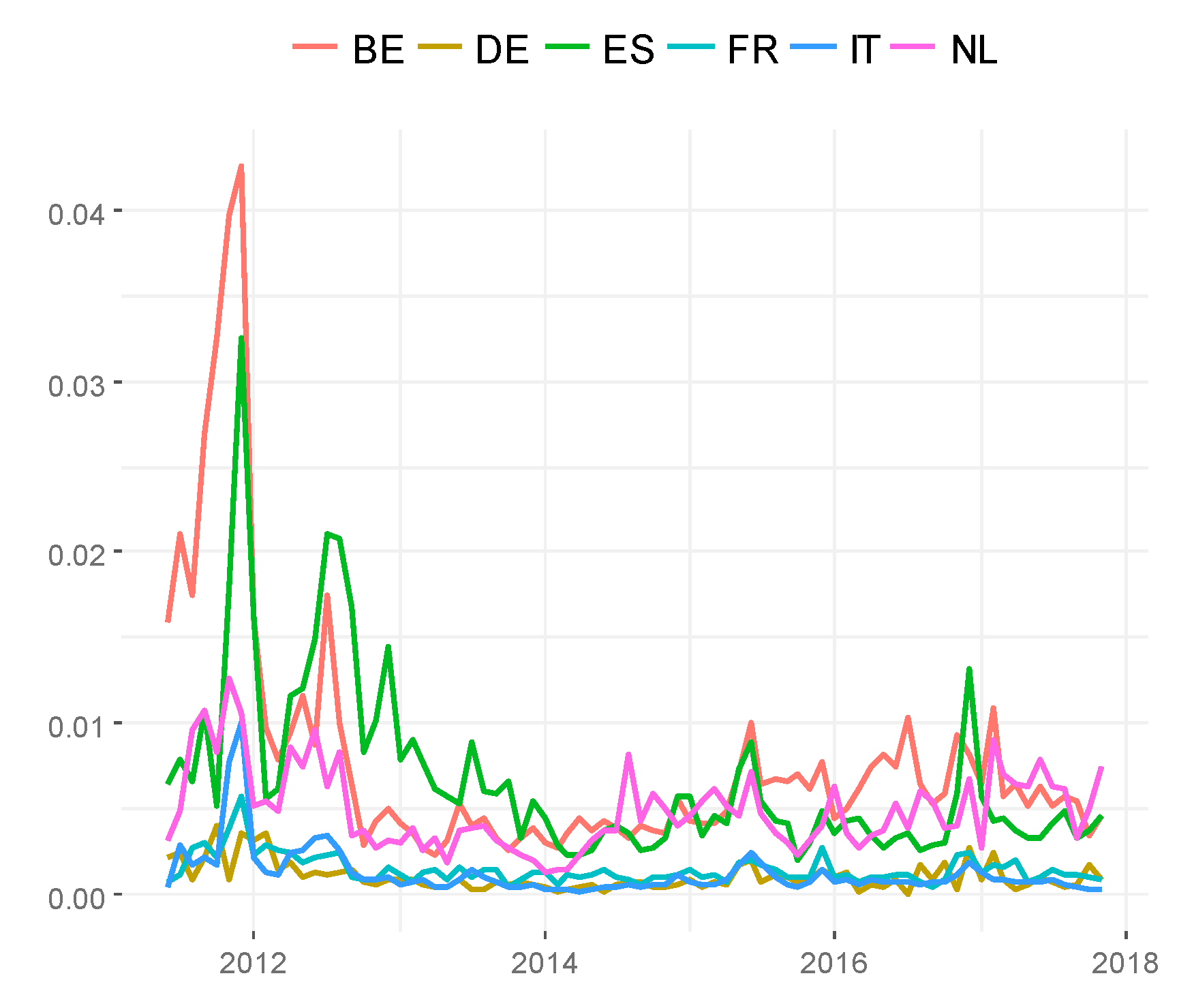

4.4. Issuing Country

5. Results of the Liquidity Spillover Effect from One Market to Another

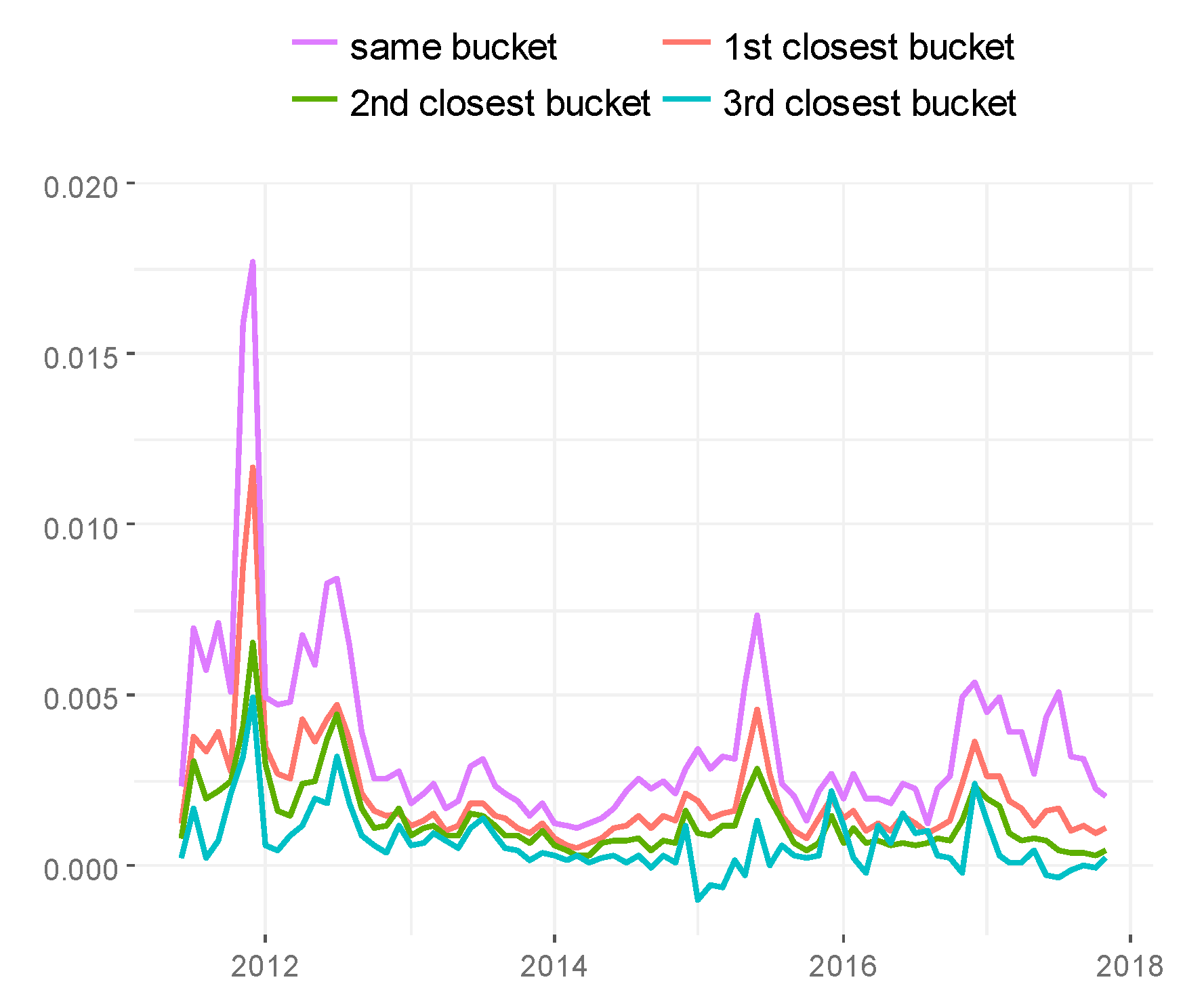

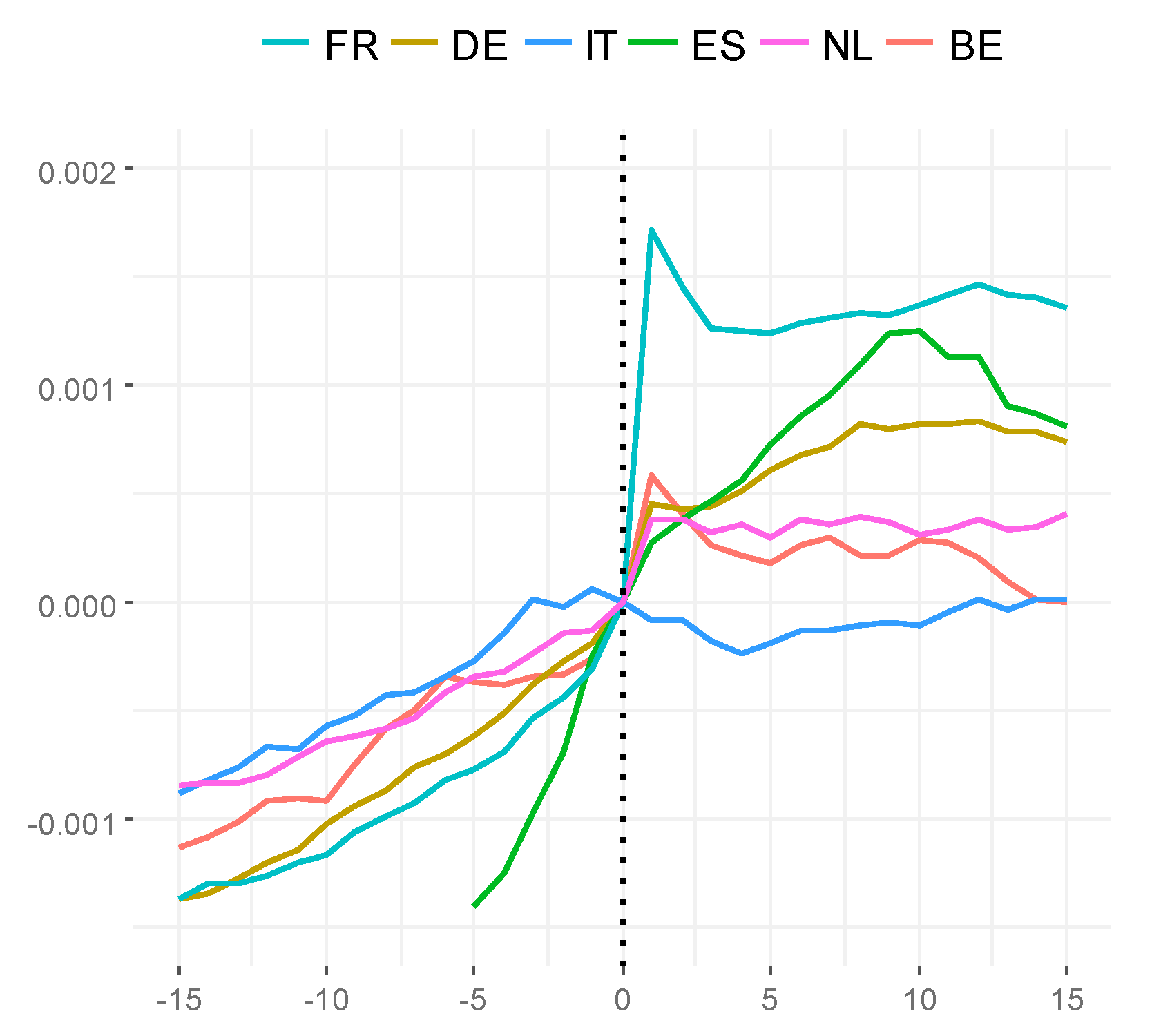

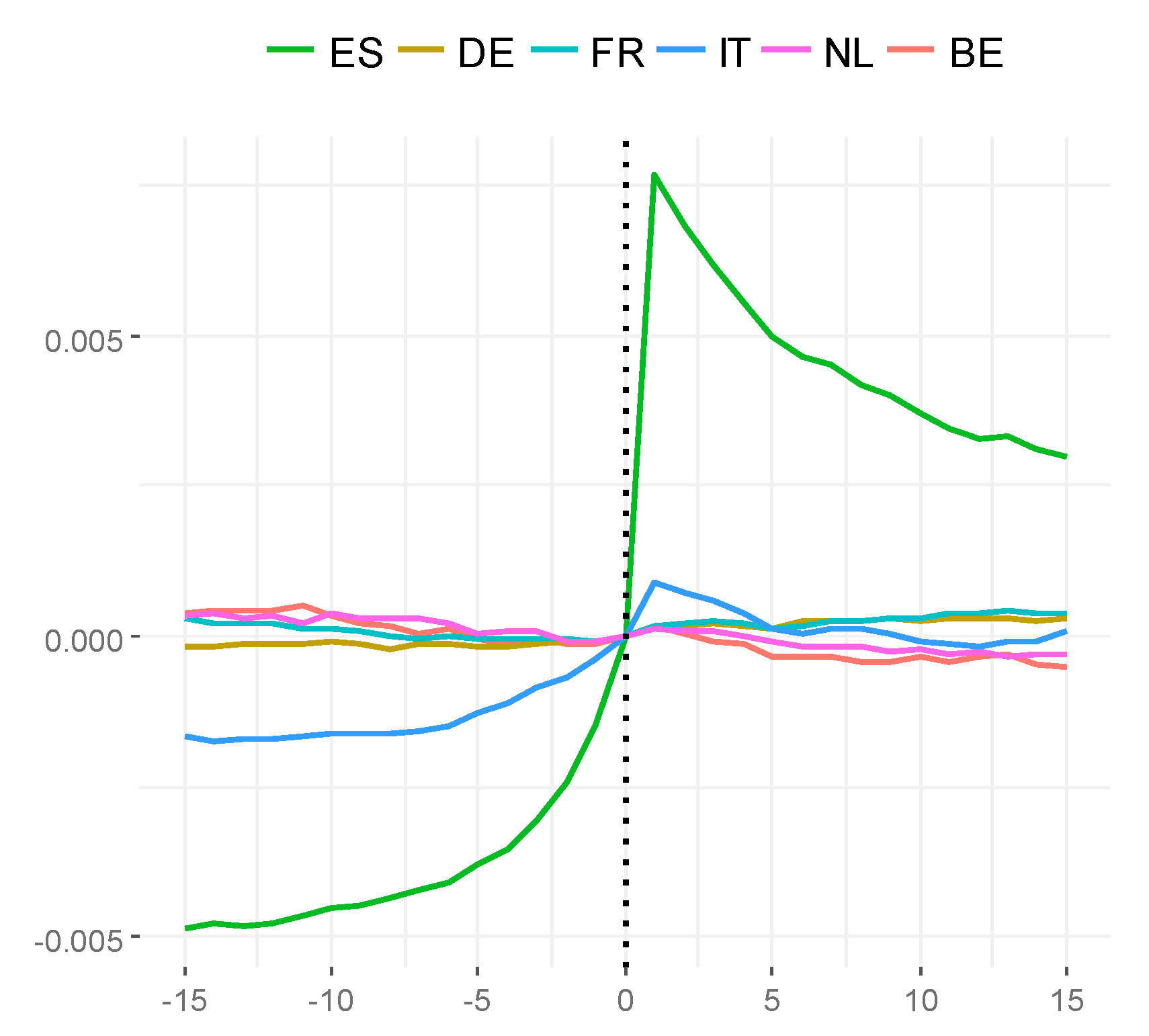

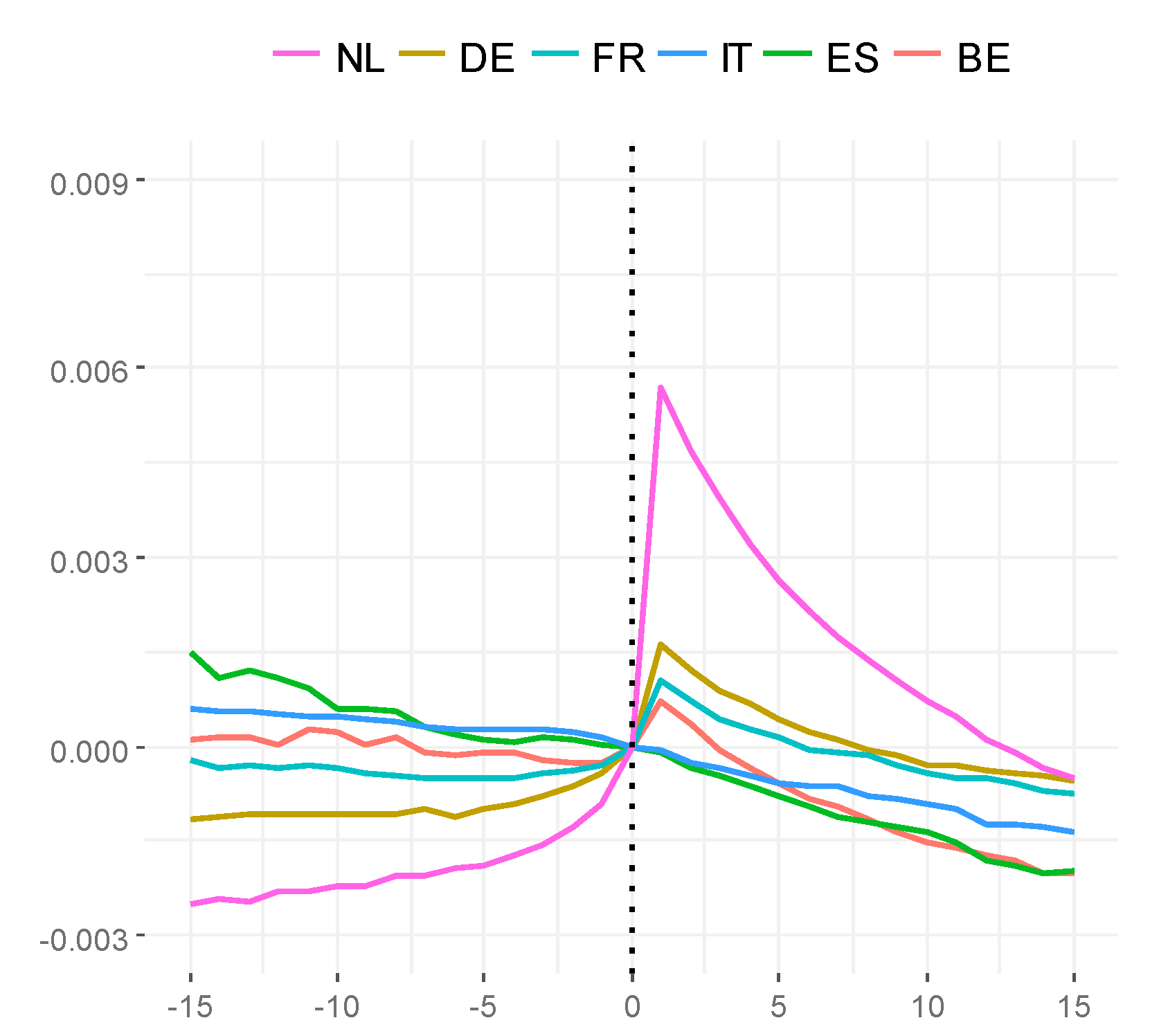

5.1. Event Study of the Liquidity Spillover Effect from One Market to Another

5.2. Panel Regression Model of the Underlying Factors of Liquidity Spillover Effect from One Market to Another

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Albagli, Elias, Luis Ceballos, Sebastian Claro, and Damian Romero. 2015. Channels of US Monetary Policy Spillovers into International Bond Markets. Working Papers Central Bank of Chile 771: 1–29. [Google Scholar] [CrossRef]

- Amihud, Yakov. 2002. Illiquidity and Stock Returns: Cross-section and Time-series Effects. Journal of Financial Markets 5: 31–56. [Google Scholar] [CrossRef]

- Andrulytė, Ieva, and Linas Jurkšas. 2015. The Scale of Insider Trading at the Nasdaq OMX Vilnius Exchange. Monetary Studies 17–19: 5–23. [Google Scholar]

- Bank for International Settlements. 2016a. Electronic Trading in Fixed Income Markets. Report of Bank for International Settlements. Basel: Bank for International Settlements, pp. 1–44. [Google Scholar]

- Bank for International Settlements. 2016b. Fixed Income Market Liquidity. CGFS Papers No. 55. Basel: Bank for International Settlements, pp. 1–35. [Google Scholar]

- Barth, Daniel, and Jay Kahn. 2020. Basis Trades and Treasury Market Illiquidity, Briefs 20-01. Washington: Office of Financial Research, US Department of the Treasury. [Google Scholar]

- Bein, Murad A. 2017. Time-Varying Co-Movement and Volatility Transmission between the Oil Price and Stock Markets in the Baltics and Four European Countries. Inzinerine Ekonomika-Engineering Economics 28: 482–93. [Google Scholar] [CrossRef]

- Blasi, Leonardo. 2016. Liquidity risk and market shock: An event study on emerging market corporate bonds. FMA Conferences Proceedings, 1–44. [Google Scholar]

- Bowman, David, Juan M. Londono, and Horacio Sapriza. 2015. US Unconventional Monetary Policy and Transmission to Emerging Market Economies. Journal of International Money and Finance 55: 27–59. [Google Scholar] [CrossRef]

- Brière, Marie, Ariane Chapelle, and Ariane Szafarz. 2012. No contagion, only globalization and flight to quality. Journal of International Money and Finance 31: 1729–44. [Google Scholar] [CrossRef][Green Version]

- Broto, Carmen, and Matias Lamas. 2020. Is Market Liquidity Less Resilient after the Financial Crisis? Evidence for US Treasuries. Economic Modelling. Amsterdam: Elsevier, vol. 93, pp. 217–29. [Google Scholar]

- Brunnermeier, Markus K., and Lasse Heje Pedersen. 2008. Market Liquidity and Funding Liquidity. The Review of Financial Studies 22: 221–38. [Google Scholar] [CrossRef]

- Calice, Giovanni, Jing Chen, and Julian Williams. 2013. Liquidity Spillovers in Sovereign Bond and CDS Markets: An Analysis of the Eurozone Sovereign Debt Crisis. Journal of Economic Behavior and Organization 85: 122–43. [Google Scholar] [CrossRef]

- Chordia, Tarun, Asani Sarkar, and Avanidhar Subrahmanyam. 2007. Liquidity Spill-overs and Cross-Autocorrelations. Federal Reserve Bank of New York Staff Reports 303: 1–43. [Google Scholar]

- Cifuentes, Rodrigo, Gianluigi Ferrucci, and Hyun Song Shin. 2005. Liquidity Risk and Contagion. Journal of the European Economic Association 3: 556–66. Available online: http://www.jstor.org/stable/40004998 (accessed on 4 March 2021). [CrossRef]

- Claeys, Peter, and Borek Vašíček. 2014. Measuring Bilateral Spillover and Testing Contagion on Sovereign Bond Markets in Europe. Journal of Banking and Finance 46: 151–65. [Google Scholar] [CrossRef]

- Clancy, Daragh, Peter G. Dunne, and Pasquale Filiani. 2019. Liquidity and Tail-Risk Interdependencies in the Euro Area Sovereign Bond Market. Research Technical Papers 11/RT/19. Dublin: Central Bank of Ireland. [Google Scholar]

- Darbha, Madhucchand, and Alfonso Dufour. 2015. Euro Area Government Bond Market Liquidity. SSRN Electronic Journal, 1–45. [Google Scholar] [CrossRef]

- Diaz, Antonio, and Ana Escribano. 2017. Liquidity measures throughout the lifetime of the U.S. Treasury bond. Journal of Financial Markets 33: 42–74. [Google Scholar] [CrossRef]

- Diebold, Francis, and Kamil Yilmaz. 2009. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Dufour, Alfonso, and Minh Nguyen. 2011. Permanent Trading Impacts and Bond Yields. The European Journal of Finance 18: 841–64. [Google Scholar] [CrossRef]

- Dungey, Mardi, Renee Fry, Brenda González-Hermosillo, and Vance Martin. 2006. Contagion in international bond markets during the Russian and the LTCM crises. Journal of Financial Stability 2: 1–27. [Google Scholar] [CrossRef]

- Dunne, Peter, Harald Hau, and Michael Moore. 2015. Dealer Intermediation between Markets. Journal of the European Economic Association 13: 770–804. [Google Scholar] [CrossRef]

- ECB (European Central Bank). 2017. Debt Securities Statistics. Frankfurt am Main: European Central Bank. [Google Scholar]

- European System of Financial Supervision. 2016. Market liquidity and market-making. Report by European System of Financial Supervision 53: 1–25. [Google Scholar] [CrossRef]

- Fassas, Athanasios, and Costas Siriopoulos. 2019. Intraday price discovery and volatility spill-overs in an emerging market. International Review of Economics & Finance 59: 333–46. [Google Scholar]

- Fleming, Michael. 2003. Measuring Treasury Market Liquidity. Economic Policy Review 9: 1–57. [Google Scholar] [CrossRef]

- Galliani, Clara, Giovanni Petrella, and Andrea Resti. 2014. The liquidity of corporate and government bonds: Drivers and sensitivity to different market conditions. Joint Research Centre Technical Reports 1: 38. [Google Scholar] [CrossRef]

- Gkillas, Konstantinos, Rangan Gupta, and Christian Pierdzioch. 2020. Forecasting realized oil-price volatility: The role of financial stress and asymmetric loss. Journal of International Money and Finance 104: 102137. [Google Scholar] [CrossRef]

- Glosten, Lawrence, and Paul Milgrom. 1985. Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics 14: 71–100. [Google Scholar] [CrossRef]

- Goyenko, Ruslan, Y. Craig, W. Holden, and Charles A. Trzcinka. 2009. Do Liquidity Measures Measure Liquidity? Journal of Financial Economics 92: 153–81. [Google Scholar] [CrossRef]

- Gupta, Chandra P., Sanjay Sehgal, and Sahaj Wadhwa. 2018. Agricultural Commodity Trading: Is it Destabilizing Spot Markets? Vikalpa: The Journal for Decision Makers 43: 47–57. [Google Scholar] [CrossRef]

- Han, Jianlei, and Zheyao Pan. 2017. On the relation between liquidity and the futures-cash basis: Evidence from a natural experiment. Journal of Financial Markets 36: 115–31. [Google Scholar] [CrossRef]

- He, Feng, Baiao Liu-Chen, Xiangtong Meng, Xiong Xiong, and Wei Zhang. 2020. Price discovery and spill-over dynamics in the Chinese stock index futures market: A natural experiment on trading volume restriction. Quantitative Finance, Taylor & Francis Journals 20: 2067–83. [Google Scholar]

- Holden, Craig W., Stacey Jacobsen, and Avanidhar Subrahmanyam. 2014. The Empirical Analysis of Liquidity. Foundations and Trends in Finance 8: 263–365. [Google Scholar] [CrossRef]

- Honkanen, Pekka, and Daniel Schmidt. 2017. Price and Liquidity Spill-Overs during Fire Sale Episodes. HEC Research Papers Series 1214; Paris: HEC. [Google Scholar]

- International Monetary Fund. 2015. Market Liquidity—Resilient or Fleeting? Global Financial Stability Report. Washington, DC: International Monetary Fund, vol. 49, p. 82. [Google Scholar]

- Jiang, Ying, Neil Kellard, and Xiaoquan Liu. 2020. Night Trading And Market Quality: Evidence From Chinese And US Precious Metal Futures Markets, Journal of Futures Markets. Hoboken: John Wiley & Sons, Ltd., vol. 40, pp. 1486–507. [Google Scholar]

- Jurkšas, Linas, Daniel Kapp, Ken Nyholm, and Julian Von Landesberger. 2018. Euro area sovereign bond market liquidity since the start of the PSPP. ECB Economic Bulletin. Forthcoming. [Google Scholar] [CrossRef]

- Kandil, Magda. 2018. Growth in Oil- and Non-Oil-Producing Countries. 1 Ivory Square, Plantation Wharf, SW11 3UE. London: World Economics, vol. 19, pp. 75–134. [Google Scholar]

- Kurosaki, Tetsuo, Yusuke Kumano, Kota Okabe, and Teppei Nagano. 2015. Liquidity in JGB Markets: An Evaluation from Transaction Data. Bank of Japan Working Paper Series; Tokyo: Bank of Japan, vol. E2, pp. 1–38. [Google Scholar]

- Kyle, Albert S. 1985. Continuous Auctions and Insider Trading. Econommetrica 53: 1315–36. [Google Scholar] [CrossRef]

- Levisauskaite, Kristina, Vilija Alekneviciene, and Eglė Alekneviciute. 2015. Hierarchical Structures of the Relationships Between Government Bond Markets in the EU Countries. Transformations in Business & Economics 14: 158–72. [Google Scholar]

- Lin, Hai, Junbo Wang, and Chunchi Wu. 2013. Liquidity Risk and Momentum Spill-over from Stocks to Bonds. The Journal of Fixed Income 23: 5–42. [Google Scholar] [CrossRef]

- Macchiati, Valentina, Giuseppe Brandi, Giulio Cimini, Guido Caldarelli, Daniela Paolotti, and Tiziana Di Matteo. 2020. Systemic liquidity contagion in the European interbank market. Journal of Economic Interaction and Coordination. [Google Scholar]

- Mahanti, Sriketan, Amrut Nashikkar, Marti Subrahmanyam, George Chacko, and Gaurav Mallik. 2008. Latent liquidity: A new measure of liquidity, with an application to corporate bonds. Journal of Financial Economics 88: 272–98. [Google Scholar] [CrossRef]

- Moshirian, Fariborz, Xiaolin Qian, Claudia Koon, Ghee Wee, and Bohui Zhang. 2017. The determinants and pricing of liquidity commonality around the world. Journal of Financial Markets 33: 22–41. [Google Scholar] [CrossRef]

- MTS (Mercato dei Titoli di Stato). 2017. MTS Markets Overview. Presentation at World Bank; Available online: http://pubdocs.worldbank.org/en/265741493316237603/Angelo-Proni-WB-Apr-2017.pdf (accessed on 8 March 2021).

- O’Sullivan, Conal, and Vassilios G. Papavassiliou. 2019. Measuring and Analyzing Liquidity and Volatility Dynamics in the Euro-Area Government Bond Market. Open Access publications 10197/9299, Research Repository. Dublin: University College Dublin. [Google Scholar]

- Papadamou, Stephanos, Costas Siriopoulos, and Nikolaos A. Kyriazis. 2020. A Survey of Empirical Findings on Unconventional Central Bank Policies. Journal of Economic Studies. Available online: https://www.researchgate.net/profile/Costas_Siriopoulos2/publication/340512691_A_survey_of_empirical_findings_on_unconventional_central_bank_policies/links/5f1ae98245851515ef44f106/A-survey-of-empirical-findings-on-unconventional-central-bank-policies.pdf (accessed on 8 March 2021).

- Pellizon, Loriana, Marti G. Subrahmanyam, Davide Tomio, and Jun Uno. 2013. The Microstructure of the European Sovereign Bond Market: A Study of the Euro-zone Crisis. SSRN Electronic Journal, 1–51. [Google Scholar] [CrossRef]

- Rappoport, David, and Tugkan Tuzun. 2020. Arbitrage and Liquidity: Evidence from a Panel of Exchange Traded Funds; Finance and Economics Discussion Series 2020-097; Washington, DC: Board of Governors of the Federal Reserve System (U.S.).

- Righi, Marcelo Brutti, and Kelmara Mendes Vieira. 2014. Liquidity Spill-over in International Stock Markets through Distinct Time Scales. PLoS ONE 9: e86134. [Google Scholar] [CrossRef][Green Version]

- Rigobon, Roberto. 2019. Contagion, Spillover, and Interdependence. Economía 19: 69–100. [Google Scholar] [CrossRef]

- Rindi, Barbara, and Ingrid M. Werner. 2017. U.S. Tick Size Pilot. Working Paper Series 2017–18; Columbus: Ohio State University, Charles A. Dice Center for Research in Financial Economics. [Google Scholar]

- Roll, Richard. 1985. A Simple Implicit Measure of the Effective Bid-Ask Spread in an Efficient Market. The Journal of Finance 39: 1127–39. [Google Scholar] [CrossRef]

- Sarr, Abdourahmane, and Tonny Lybek. 2002. Measuring Liquidity in Financial Markets. IMF Working Paper Series; Washington, DC: International Monetary Fund (IMF), vol. 232, pp. 1–64. [Google Scholar]

- Schneider, Michael, Fabrizio Lillo, and Loriana Pellizon. 2016. Modelling illiquidity spill-overs with Hawkes processes: An application to the sovereign bond market. Quantitative Finance, 1–11. [Google Scholar] [CrossRef]

- Shaikh, Imlak. 2018. ‘Investors’ fear and stock returns: Evidence from National Stock Exchange of India. Inzinerine Ekonomika-Engineering Economics 29: 4–12. [Google Scholar] [CrossRef]

- Sheng, Xin, Janusz Brzeszczyński, and Boulis M. Ibrahim. 2017. International Stock Return Co-Movements and Trading Activity, Finance Research Letters. Amsterdam: Elsevier, ssvol. 23, pp. 12–18. [Google Scholar]

- Smimou, Kamal, and Wajih Khallouli. 2017. On the intensity of liquidity spill-overs in the Eurozone. International Review of Financial Analysis 48: 388–405. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 2011. Introduction to Econometrics, 3rd ed. Boston: Pearson Addison-Wesley, chp. 10. [Google Scholar]

- Tang, Dragon Yongjun, and Hong Yan. 2008. Liquidity and Credit Default Swap Spreads. Bank of Canada Working Paper Series; Ottawa: Bank of Canada, pp. 1–42. [Google Scholar] [CrossRef]

- Tsuchida, Naoshi, Toshiaki Watanabe, and Toshinao Yoshiba. 2016. The Intraday Market Liquidity of Japanese Government Bond Futures. Monetary and Economic Studies. Tokyo: Bank of Japan, pp. 67–96. [Google Scholar]

- White, Michael, Paloma Taltavull de La Paz, and Jens Lunde. 2018. The Role of Liquidity in the Transmission of Volatility Across Housing Markets, ERES eres2018_142. Kaiserslautern: European Real Estate Society (ERES). [Google Scholar]

- Zhu, Lili, and Jiawen Yang. 2008. The Role of Psychic Distance in Contagion: A Gravity Model for Contagious Financial Crises. Journal of Behavioral Finance 9: 209–23. [Google Scholar] [CrossRef]

| Variable | Description | Results |

|---|---|---|

| Spill-over FROM | Average monthly spill-over effect from the country of the traded bond (from which spill-over impact is measured) to non-traded bond from another country | Dependent variable |

| distance | The distance between the country of the traded bond and the country of another bond (in 1000 km) | −0.00028 ** (−8.55) |

| num_trades | The number of trades from which the spill-over effect is measured during a month | −0.018 (−1.41) |

| trade_size | The average trade size of bonds from which spill-over effect is measured during a month (in millions) | −0.0000195 (−0.9) |

| illiq_score | The average illiquidity score of bonds from which spill-over effect is measured at the time of the trade | 0.0015 ** (12.02) |

| res_maturity | The average residual maturity of traded bonds at the time of the trade (in years) | −0.000017 (−1.68) |

| Variable | Description | Results |

|---|---|---|

| Spill-over TO | The average monthly spill-over effect to the bonds from the country of the non-traded bond (to which spill-over effect is measured) | Dependent variable |

| distance | The distance between the country of the traded bond and the country of another bond (in 1000 km) | –0.00038 ** (−8.51) |

| num_bonds | The number of bonds with standing limit orders at the time of the trade | −0.000026 ** (−4.35) |

| num_updates | The number of limit order revisions in the central limit order book | 0.0000012 * 1.75 |

| illiq_score | The average illiquidity score of bonds to which spill-over effect is measured at the time of trade | 0.0024 ** (13.79) |

| res_maturity | The average residual maturity of non-traded bonds from another country than the traded-bond (in years) | −0.00003 (−0.77) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jurksas, L.; Teresiene, D.; Kanapickiene, R. Liquidity Spill-Overs in Sovereign Bond Market: An Intra-Day Study of Trade Shocks in Calm and Stressful Market Conditions. Economies 2021, 9, 35. https://doi.org/10.3390/economies9010035

Jurksas L, Teresiene D, Kanapickiene R. Liquidity Spill-Overs in Sovereign Bond Market: An Intra-Day Study of Trade Shocks in Calm and Stressful Market Conditions. Economies. 2021; 9(1):35. https://doi.org/10.3390/economies9010035

Chicago/Turabian StyleJurksas, Linas, Deimante Teresiene, and Rasa Kanapickiene. 2021. "Liquidity Spill-Overs in Sovereign Bond Market: An Intra-Day Study of Trade Shocks in Calm and Stressful Market Conditions" Economies 9, no. 1: 35. https://doi.org/10.3390/economies9010035

APA StyleJurksas, L., Teresiene, D., & Kanapickiene, R. (2021). Liquidity Spill-Overs in Sovereign Bond Market: An Intra-Day Study of Trade Shocks in Calm and Stressful Market Conditions. Economies, 9(1), 35. https://doi.org/10.3390/economies9010035