The Impact of Imitation Strategies, Managerial and Entrepreneurial Skills on Startups’ Entrepreneurial Innovation

Abstract

1. Introduction

2. Theoretical Background

2.1. Entrepreneurial Innovation and Startups

2.2. The Significance of Imitation in Startups

2.3. Managerial and Entrepreneurial Skills in Startups

3. Development of Research Hypotheses

3.1. Outcome-Based Imitation and Entrepreneurial Innovation

3.2. Trait-Based Imitation and Entrepreneurial Innovation

3.3. Frequency-Based Imitation and Entrepreneurial Innovation

3.4. Managerial Skills and Entrepreneurial Innovation

3.5. Entrepreneurial Skills and Entrepreneurial Innovation

4. Methodology

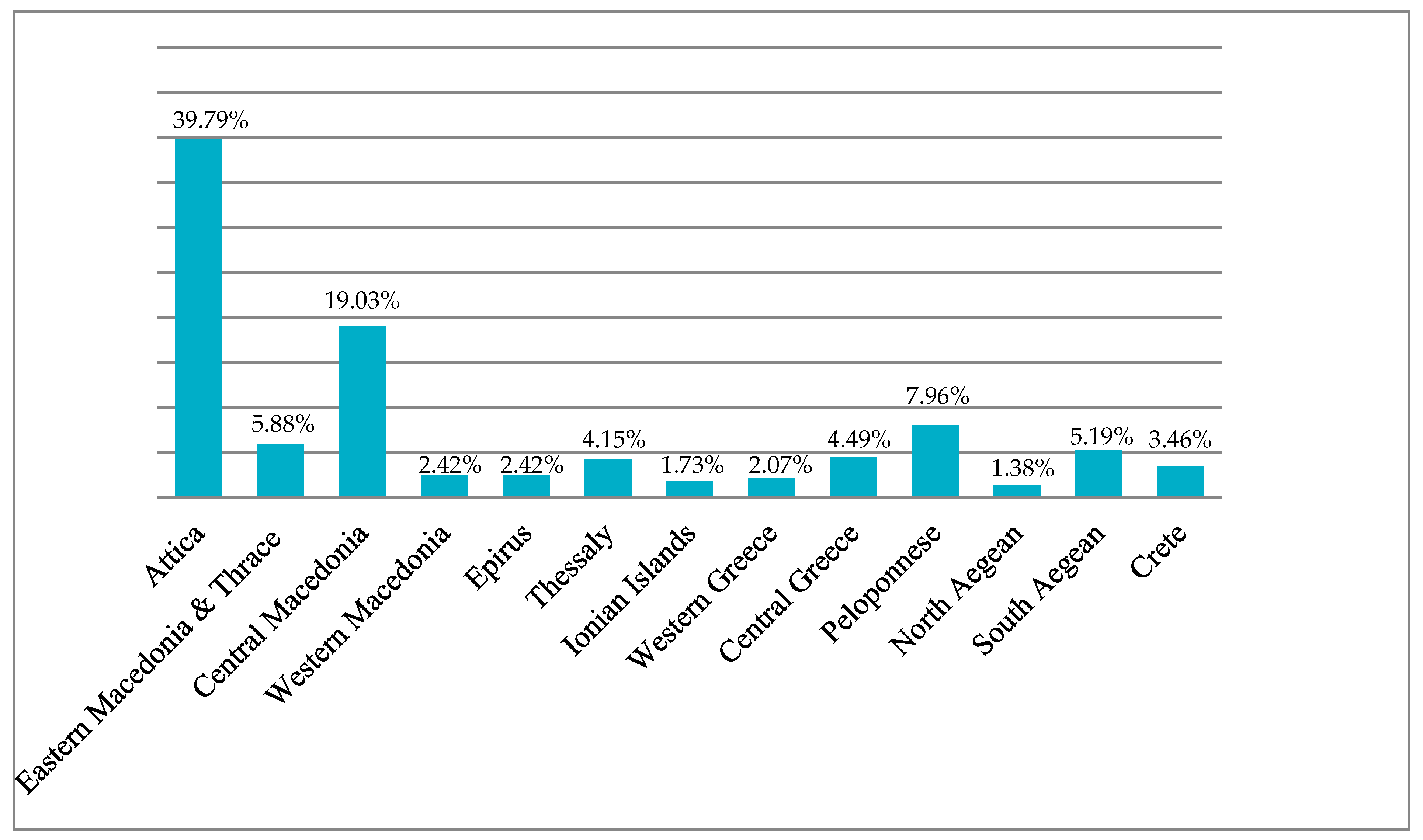

4.1. Data and Sample

4.2. Measures

4.3. Data Analyses

5. Results

6. Discussion and Conclusions

Limitations and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Items | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| EINNOV1 | 0.733 | |||||

| EINNOV2 | 0.762 | |||||

| EINNOV3 | 0.790 | |||||

| EINNOV4 | 0.833 | |||||

| EINNOV5 | 0.821 | |||||

| EINNOV6 | 0.802 | |||||

| EINNOV7 | 0.768 | |||||

| EINNOV8 | 0.809 | |||||

| EINNOV9 | 0.778 | |||||

| OBI1 | 0.824 | |||||

| OBI2 | 0.777 | |||||

| OBI3 | 0.756 | |||||

| OBI4 | 0.771 | |||||

| OBI5 | 0.804 | |||||

| TBI1 | 0.725 | |||||

| TBI2 | 0.801 | |||||

| TBI3 | 0.797 | |||||

| TBI4 | 0.791 | |||||

| TBI5 | 0.756 | |||||

| TBI6 | 0.786 | |||||

| FBI1 | 0.641 | |||||

| FBI2 | 0.619 | |||||

| FBI3 | 0.807 | |||||

| FBI4 | 0.852 | |||||

| FBI5 | 0.812 | |||||

| FBI6 | 0.837 | |||||

| FBI7 | 0.760 | |||||

| FBI8 | 0.767 | |||||

| MS1 | 0.690 | |||||

| MS2 | 0.786 | |||||

| MS3 | 0.828 | |||||

| MS4 | 0.813 | |||||

| MS5 | 0.723 | |||||

| ES1 | 0.780 | |||||

| ES2 | 0.842 | |||||

| ES3 | 0.859 | |||||

| ES4 | 0.785 | |||||

| ES5 | 0.801 |

References

- Aarstad, Jarle, Havard Ness, Sven A. Haugland, and Olav Andreas Kvitastein. 2018. Imitation Strategies and Interfirm Networks in the Tourism Industry: A structure—Agency approach. Journal of Destination Marketing & Management 9: 166–74. [Google Scholar]

- Aarstad, Jarle, Sven A. Haugland, and Arent Greve. 2010. Performance Spillover Effects in Entrepreneurial Networks: Assessing a dyadic theory of social capital. Entrepreneurship Theory and Practice 34: 1003–20. [Google Scholar] [CrossRef]

- Acs, Zoltan J., and David B. Audretsch. 1990. Innovation and Small Firms. Cambridge: MIT Press. [Google Scholar]

- Aernoudt, Rudy. 2004. Incubators: Tool for Entrepreneurship? Small Business Economics 23: 127–35. [Google Scholar] [CrossRef]

- Ahuja, Gautam. 2000. Collaborative networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly 45: 425–55. [Google Scholar] [CrossRef]

- Audretsch, David B., Max Keilbach, and Erik Lehmann. 2006. Entrepreneurship and Economic Growth. Oxford: Oxford University Press. [Google Scholar]

- Baron, Robert, and Michael Ensley. 2006. Opportunity Recognition as the Detection of Meaningful Patterns: Evidence from Comparisons of Novice and Experienced Entrepreneurs. Management Science 52: 1331–44. [Google Scholar] [CrossRef]

- Barringer, Bruce, and R. Duane Ireland. 2006. Entrepreneurship: Successfully Launching New Ventures. Upper Saddle River: Pearson Prentice Hall. [Google Scholar]

- Bates, Timothy. 1990. Entrepreneur human capital inputs and small business longevity. Review of Economics and Statistics 72: 551–59. [Google Scholar] [CrossRef]

- Baum, Joel, Tony Calabrese, and Brian Silverman. 2000. Don’t go it alone: Alliance Network Composition and Startups’ Performance in Canadian Biotechnology. Strategic Management Journal 21: 267–94. [Google Scholar] [CrossRef]

- Blank, Steve, and Bob Dorf. 2012. The Startup Owner’s Manual: The Step-by-Step Guide for Building a Great Company. Hoboken: John Wiley Sons. [Google Scholar]

- Blank, Steve. 2010. Why Startups Are Agile and Opportunistic—Pivoting the Business Model. Available online: www.steveblank.com (accessed on 5 May 2020).

- Bock, Adam, Tore Opsahl, Gerard George, and David Gann. 2012. The effects of culture and structure on strategic flexibility during business model innovation. Journal of Management Studies 49: 279–305. [Google Scholar] [CrossRef]

- Bolton, Michele Kremen. 1993. Imitation versus innovation: Lessons to be learned from the Japanese. Organizational Dynamics 21: 30–45. [Google Scholar] [CrossRef]

- Bygrave, William, and Charles Hofer. 1991. Theorizing about entrepreneurship. Entrepreneurship Theory and Practice 16: 13–22. [Google Scholar] [CrossRef]

- Castanias, Richard, and Constance Helfat. 2001. The managerial rents model: Theory and empirical analysis. Journal of Management 27: 661–78. [Google Scholar] [CrossRef]

- Chandler, Gaylen, and Steven Hanks. 1998. An examination of the substitutability of founders’ human and financial capital in emerging business ventures. Journal of Business Venturing 13: 353–69. [Google Scholar] [CrossRef]

- Cho, Dong Sung, Dong Jae Kim, and Dong Kee Rhee. 1998. Latecomer strategies: Evidence from the semiconductor industry in Japan and Korea. Organization Science 9: 489–505. [Google Scholar] [CrossRef]

- Cohen, Wesley, and Daniel Levinthal. 1989. Innovation and Learning: The two faces of R&D. The Economic Journal 99: 569–96. [Google Scholar]

- Cohen, Wesley, and Daniel Levinthal. 1990. Absorptive Capacity: A New Perspective on Learning and Innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- Colombelli, Alessandra, Jackie Krafft, and Marco Vivarelli. 2016. To be born is not enough: The key role of innovative start-ups. Small Business Economics 47: 277–91. [Google Scholar] [CrossRef]

- Colombo, Massimo, and Evila Piva. 2008. Strengths and weaknesses of academic start-ups: A conceptual model. IEEE Transactions on Engineering Management 55: 37–49. [Google Scholar] [CrossRef]

- Colombo, Massimo, and Luca Grilli. 2005. Founders’ Human Capital and the Growth of New Technology-Based Firms: A Competence-Based View. Research Policy 34: 795–816. [Google Scholar] [CrossRef]

- Cressy, Robert. 1996. Are Business Startups Debt-Rationed? Economic Journal 106: 1253–70. [Google Scholar] [CrossRef]

- Csaszar, Felipe, and Nicolaj Siggelkow. 2010. How much to copy? Determinants of Effective Imitation Breadth. Organization Science 21: 661–76. [Google Scholar] [CrossRef]

- Custódio, Cláudia, Miguel Ferreira, and Pedro Matos. 2019. Do General Managerial Skills Spur Innovation. Management Science 65: 459–76. [Google Scholar]

- Darroch, Jenny, and Rod McNaughton. 2002. Examining the link between knowledge management practices and types of innovation. Journal of Intellectual Capital 3: 210–22. [Google Scholar] [CrossRef]

- Davila, Antonio, George Foster, and Mahendra Gupta. 2003. Venture capital financing and the growth of startup firms. Journal of Business Venturing 18: 689–709. [Google Scholar] [CrossRef]

- Dejardin, Marcus. 2011. Linking net entry to regional economic growth. Small Business Economics 36: 443–60. [Google Scholar] [CrossRef]

- Dimaggio, Paul, and Walter Powell. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef]

- Dobson, Wendy, and A. E. Safarian. 2008. The transition from imitation to innovation: An enquiry into China’s evolving institutions and firm capabilities. Journal of Asian Economics 19: 301–11. [Google Scholar] [CrossRef]

- Dougherty, Deborah. 1992. Interpretive barriers to successful product innovation in large firms. Organization Science 3: 179–203. [Google Scholar] [CrossRef]

- EiT Digital. 2018. Startups in Greece 2018. Athens:FOUND.ATION. Available online: file:///C:/Users/MMNew/Downloads/Startups-in-Greece-2018-by-EIT-Digital-and-Foundation.pdf (accessed on 10 August 2018).

- Ethiraj, Sendil, Daniel Levinthal, and Rishi Roy. 2008. The dual role of modularity: Innovation and imitation. Management Science 54: 939–55. [Google Scholar] [CrossRef]

- EU Commission. 2018. European Startup Initiative, Startup Heatmap Europe. Available online: https://www.startupheatmap.eu (accessed on 4 October 2018).

- Falk, Frank, and Nancy Miller. 1992. A Primer for Soft Modeling. Akron: University of Akron Press. [Google Scholar]

- Faugier, Jean, and Mary Sargeant. 1997. Sampling hard to reach populations. Journal of Advanced Nursing 26: 790–97. [Google Scholar] [CrossRef]

- Fiore, Eleonora, Giuliano Sansone, and Emilio Paolucci. 2019. Entrepreneurship education in a multidisciplinary environment: Evidence from an entrepreneurship programme held in Turin. Administrative Sciences 9: 28. [Google Scholar] [CrossRef]

- Fitjar, Rune Dahl, and Andrés Rodríguez Pose. 2013. Firm collaboration and modes of innovation in Norway. Research Policy 42: 128–38. [Google Scholar] [CrossRef]

- Fombrun, Charles, and Mark Shanley. 1990. What is the name? Reputation building and corporate strategy. Academy of Management Journal 33: 233–58. [Google Scholar]

- Garcia Pont, Carlos, and Nitin Nohria. 2002. Local versus global mimetism: The dynamics of alliance formation in the automobile industry. Strategic Management Journal 23: 307–21. [Google Scholar] [CrossRef]

- Gentry, Richard, Thomas Dalziel, and Mark Jamison. 2013. Who Do Start-Up Firms Imitate? A Study of New Market Entries in the CLEC Industry. Journal of Small Business Management 51: 525–38. [Google Scholar] [CrossRef]

- George, Gerard, and Adam Bock. 2011. The business model in practice and its implications for entrepreneurship research. Entrepreneurship Theory and Practice 35: 83–111. [Google Scholar] [CrossRef]

- Gimeno, Javier, Timothy Folta, Arnold Cooper, and Carolyn Woo. 1997. Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly 42: 750–83. [Google Scholar] [CrossRef]

- Greve, Henrich. 2000. Market Niche Entry Decisions: Competition, Learning and Strategy in Tokyo Banking, 1894–1936. Academy of Management Journal 43: 816–36. [Google Scholar]

- Guo, Hai, Jing Zhao, and Jintong Tang. 2013. The role of top managers’ human and social capital in business model innovation. Chinese Management Studies 7: 447–69. [Google Scholar] [CrossRef]

- Haunschild, Pamela, and Anne Miner. 1997. Modes of Interorganizational Imitation: The Effects of Outcome Salience and Uncertainty. Administrative Science Quarterly 42: 472–500. [Google Scholar] [CrossRef]

- Haunschild, Pamela. 1993. Interorganizational Imitation: The Impact of Interlocks on Corporate Acquisition Activity. Administrative Science Quarterly 38: 564–92. [Google Scholar] [CrossRef]

- Haveman, Heather. 1993. Follow the Leader: Mimetic Isomorphism and Entry into New Markets. Administrative Science Quarterly 38: 593–627. [Google Scholar] [CrossRef]

- Heckathorn, Douglas. 1997. Respondent-driven sampling: A new approach to the study of hiddenpopulations. Social Problems 44: 174–99. [Google Scholar] [CrossRef]

- Helpman, Elhanan. 1993. Innovation, Imitation and Intellectual Property Rights. Econometrica 61: 1247–80. [Google Scholar] [CrossRef]

- Honjo, Yuji. 2004. Growth of New Start-up Firms: Evidence from the Japanese Manufacturing Industry. Applied Economics 36: 343–55. [Google Scholar] [CrossRef]

- Hung, Humphry, and Reuben Mondejar. 2005. Corporate directors and entrepreneurial innovation: An empirical study. The Journal of Entrepreneurship 14: 117–29. [Google Scholar] [CrossRef]

- Johnson, Mark, Clayton Christensen, and Henning Kagermann. 2008. Reinventing your business model. Harvard Business Review 86: 57–68. [Google Scholar]

- Kato, Masatoshi, Hiroyuki Okamuro, and Yuji Honjo. 2015. Does Founders’ Human Capital Matter for Innovation? Evidence from Japanese Start-ups. Journal of Small Business Management 53: 114–28. [Google Scholar] [CrossRef]

- Kim, Linsu. 1997. Imitation to Innovation: The Dynamics of Korea’s Technological Learning. Boston: Harvard Business School Press. [Google Scholar]

- Kim, Woojae, Yongjiang Shi, and Mike Gregory. 2004. Transition from Imitation to Innovation: Lessons from a Korean Multinational Corporation. International Journal of Business 9: 329–46. [Google Scholar]

- Knott, Anne Marie. 2003. The organizational routines factor market paradox. Strategic Management Journal 24: 929–43. [Google Scholar] [CrossRef]

- Koellinger, Philipp, and Roy Thurik. 2012. Entrepreneurship and the business cycle. Review of Economics and Statistics 94: 1143–56. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Udo Zander. 1992. Knowledge of the Firm, Combinative Capabilities and the Replication of Technology. Organization Science 3: 301–441. [Google Scholar] [CrossRef]

- Kohli, Ajay, and Bernard Jaworski. 1990. Market orientation: The construct, research propositions and managerial implications. Journal of Marketing 54: 1–18. [Google Scholar] [CrossRef]

- Kraaijenbrink, Jeroen, J. C. Spender, and Aard Groen. 2010. The resource-based view: A review and assessment of its critiques. Journal of Management 36: 349–72. [Google Scholar] [CrossRef]

- Lackéus, Martin, and Karen Williams Middleton. 2015. Venture creation programs: Bridging entrepreneurship education and technology transfer. Education and Training 57: 48–73. [Google Scholar] [CrossRef]

- Lane, Peter, and Michael Lubatkin. 1998. Relative absorptive capacity and Interorganizational learning. Strategic Management Journal 19: 461–77. [Google Scholar] [CrossRef]

- Lee, Ruby, and Kevin Zheng Zhou. 2012. Is Product Imitation Good for Firm Performance? An Examination of Product Imitation Types and Contingency Factors. Journal of International Marketing 20: 1–16. [Google Scholar] [CrossRef]

- Lévesque, Moren, and Dean Shepherd. 2004. Entrepreneurs’ Choice of Entry Strategy in Emerging and Developed Markets. Journal of Business Venturing 19: 29–54. [Google Scholar] [CrossRef]

- Levitt, Theodore. 1966. Innovative Imitation. Harvard Business Review 44: 63–70. [Google Scholar]

- Lieberman, Marvin, and David Montgomery. 1988. First mover advantages. Strategic Management Journal 9: 41–58. [Google Scholar] [CrossRef]

- Lieberman, Marvin, and Shigeru Asaba. 2006. Why do firms imitate each other? Academy of Management Review 31: 366–85. [Google Scholar] [CrossRef]

- Link, Albert, and John Neufeld. 1986. Innovation versus Imitation: Investigating Alternatives R&D Strategies. Applied Economics 18: 1359–63. [Google Scholar]

- Mansfield, Edwin. 1961. Technical Change and the Rate of Imitation. Econometrica 61: 741–66. [Google Scholar] [CrossRef]

- March, James, and Johan Olsen. 1976. Ambiguity and Choice in Organizations. Bergen: Universitetsforlaget. [Google Scholar]

- Marvel, Matthew, and G. T. Lumpkin. 2007. Technology Entrepreneurs’ Human Capital and its Effects on Innovation Radicalness. Entrepreneurship Theory and Practice 31: 807–28. [Google Scholar] [CrossRef]

- Meyer, John, and Brian Rowan. 1977. Institutionalized Organizations: Formal Structure as Myth and Ceremony. American Journal of Sociology 83: 340–63. [Google Scholar] [CrossRef]

- Mian, Sarfraz, Wadid Lamine, and Alain Fayolle. 2016. Technology Business Incubation: An overview of the state of knowledge. Technovation 50: 1–12. [Google Scholar] [CrossRef]

- Mustar, Philippe, Mike Wright, and Bart Clarysse. 2008. University spin-off firms: Lessons from ten years of experience in Europe. Science and Public Policy 35: 67–80. [Google Scholar] [CrossRef]

- Neyens, Inge, Dries Faems, and Luc Sels. 2010. The impact of continuous and discontinuous alliance strategies on startup innovation performance. International Journal of Technology Management 52: 392–410. [Google Scholar] [CrossRef]

- Niosi, Jorge. 1999. The Diffusion of Organizational Innovations. Towards an Evolutionary Approach. In Institutions and the Evolution of Capitalism: Implications of Evolutionary Economics. Edited by Groenewegen John. Cheltenham: Elgar, pp. 109–21. [Google Scholar]

- Nunnally, Jum, Paul Knott, Albert Duchnowski, and Ronald Parker. 1967. Pupillary response as a general measure of activation. Perception & Psychophysics 2: 149–55. [Google Scholar]

- Ordanini, Andrea, Gaia Rubera, and Robert DeFilippi. 2008. The many moods of organizational imitation: A critical review. International Journal of Management Reviews 10: 375–98. [Google Scholar] [CrossRef]

- Orhan, Muriel, and Don Scott. 2001. Why women enter into entrepreneurship: An explanatory model. Women in Management Review 16: 232–47. [Google Scholar] [CrossRef]

- Papulová, Zuzana, and Matej Mokroš. 2007. Importance of managerial skills and knowledge in management for small entrepreneurs. eLeader, 1–8. [Google Scholar]

- Pretorius, Marius, S. M. Millard, and M. E. Kruger. 2005. Creativity, innovation and implementation: Management experience, venture size, life cycle stage, race and gender as moderators. South African Journal of Business Management 36: 55–68. [Google Scholar] [CrossRef]

- Rhee, Mooweon, Young Choon Kim, and Joon Han. 2006. Confidence in imitation: Niche-width strategy in UK automobile industry. Management Science 52: 501–13. [Google Scholar] [CrossRef]

- Rogers, Everett. 1995. Diffusion of Innovations. New York: Free Press. [Google Scholar]

- Schnaars, Steven. 1994. Managing Imitation Strategies, How Later Entrants Seize Markets from Pioneers. New York: Free Press. [Google Scholar]

- Shane, Scott, and S. Venkataraman. 2000. The promise of entrepreneurship as a field of research. Academy of Management Review 25: 217–26. [Google Scholar] [CrossRef]

- Shane, Scott. 2000. Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science 11: 448–69. [Google Scholar] [CrossRef]

- Shenkar, Oded. 2010. Imitation Is More Valuable Than Innovation. Harvard Business Review 88: 28–29. [Google Scholar]

- Shankar, Venkatesh, Gregory Carpenter, and Lakshman Krishnamurthi. 1998. Late mover advantage: How innovative late entrants outsell pioneers. Journal of Marketing Research 35: 54–70. [Google Scholar] [CrossRef]

- Shepherd, Dean, and Dawn DeTienne. 2005. Prior knowledge, potential financial reward, and opportunity identification. Entrepreneurship Theory and Practice 29: 91–112. [Google Scholar] [CrossRef]

- Short, Jeremy, David Ketchen, Christopher Shook, and Duane Ireland. 2010. The concept of “opportunity” in entrepreneurship research: Past accomplishments and future challenges. Journal of Management 36: 40–65. [Google Scholar] [CrossRef]

- Sinclair, Peter. 1990. The Economics of Imitation. Scottish Journal of Political Economy 17: 113–44. [Google Scholar] [CrossRef]

- Sine, Wesley, Heather Haveman, and Pamela Tolbert. 2005. Risky Business? Entrepreneurship in the New Independent—Power Sector. Administrative Science Quarterly 50: 200–32. [Google Scholar] [CrossRef]

- Sirmon, David G., Michael A. Hitt, R. Duane Ireland, and Brett Anitra Gilbert. 2011. Resource orchestration to create competitive advantage: Breadth, depth, and life cycle effects. Journal of Management 37: 1390–412. [Google Scholar] [CrossRef]

- Smith, Doug, Adam Scaife, and Ben Kirtman. 2012. What is the current state of scientific knowledge with regard to seasonal and decadal forecasting? Environmental Research Letters 7: 1–11. [Google Scholar] [CrossRef]

- Song, Zhi Hong. 2015. Organizational learning, absorptive capacity, imitation and innovation: Empirical analyses of 115 firms across China. Chinese Management Studies 9: 97–113. [Google Scholar] [CrossRef]

- Spender, John Christopher. 2014. Business Strategy: Managing Uncertainty, Opportunity and Enterprise. Oxford: Oxford University Press. [Google Scholar]

- Spender, John Christopher, Vincenzo Corvello, Michele Grimaldi, and Pierluigi Rippa. 2017. Startups and open innovation: A review of the literature. European Journal of Innovation Management 20: 4–30. [Google Scholar] [CrossRef]

- Staniewski, Marcin. 2016. The contribution of business experience and knowledge to successful entrepreneurship. Journal of Business Research 69: 5147–52. [Google Scholar] [CrossRef]

- Strang, David, and Nancy Tuma. 1993. Spatial and temporal heterogeneity in diffusion. American Journal of Sociology 99: 614–39. [Google Scholar] [CrossRef]

- Subramaniam, Mohan, and Mark Youndt. 2005. The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal 48: 450–63. [Google Scholar] [CrossRef]

- Subramaniam, Mohan, and N. Venkatraman. 2001. Determinants of transnational new product development capability: Testing the influence of transferring and deploying tacit overseas knowledge. Strategic Management Journal 22: 359–78. [Google Scholar] [CrossRef]

- Tang, Jintong, K. Michele Kacmar, and Lowell Busenitz. 2012. Entrepreneurial alertness in the pursuit of new opportunities. Journal of Business Venturing 27: 77–94. [Google Scholar] [CrossRef]

- Teece, David, Gary Pisano, and Amy Shuen. 1997. Dynamic Capabilities and Strategic Management. Strategic Management Journal 18: 509–33. [Google Scholar] [CrossRef]

- Thorpe, Richard, Robin Holt, Allan Macpherson, and Luke Pittaway. 2005. Using knowledge within small and medium-sized firms: A systematic review of the evidence. International Journal of Management Reviews 7: 257–81. [Google Scholar] [CrossRef]

- Tsai, Wenpin, and Sumantra Ghoshal. 1998. Social capital and value creation: The role of intrafirm networks. Academy of Management Journal 41: 464–78. [Google Scholar]

- Tsui, Auch, and Lai Si. 2003. Learning Strategies of Small and Medium-sized Chinese Family Firms: A comparative study of two suppliers in Singapore. Management Learning 34: 201–20. [Google Scholar] [CrossRef]

- Valdani, Enrico, and Alessandro Arbore. 2007. Strategies of imitation: An insight. Problems and Perspectives in Management 5: 198–205. [Google Scholar]

- Van de Ven, Andrew H. 1986. Central problems in the management of innovation. Management Science 32: 590–607. [Google Scholar] [CrossRef]

- Watson, Kathryn, Sandra Hogarth Scott, and Nicholas Wilson. 1998. Small business start-ups: Success factors and support implications. International Journal of Entrepreneurial Behaviour & Research 4: 217–38. [Google Scholar]

- Wennekers, Sander, and Roy Thurik. 1999. Linking entrepreneurship and economic growth. Small Business Economics 13: 27–55. [Google Scholar] [CrossRef]

- Weterings, Anet, and Ron Boschma. 2009. Does spatial proximity to customers matter for innovative performance? Evidence from the Dutch software sector. Research Policy 38: 746–55. [Google Scholar] [CrossRef]

- Wu, Jie, Kathryn Rudie Harrigan, Siah Hwee Ang, and Zefu Wu. 2019. The impact of imitation strategy and R&D resources on incremental and radical innovation: Evidence from Chinese manufacturing firms. The Journal of Technology Transfer 44: 210–30. [Google Scholar]

- Wymer, Scott, and Elizabeth Regan. 2005. Factors influencing e-commerce adoption and use by small and medium businesses. Electronic Markets 15: 438–53. [Google Scholar] [CrossRef]

- Zahra, Shaker, R. Duane Ireland, and Michael A. Hitt. 2000. International expansion by new venture firms: International diversity, mode of market entry, technological learning and performance. The Academy of Management Journal 43: 925–50. [Google Scholar]

- Zhang, Shi, and Arthur Markman. 1998. Overcoming the early entrant advantage: The role of alignable and nonalignable differences. Journal of Marketing Research 35: 413–26. [Google Scholar] [CrossRef]

- Zhou, Kevin Zheng, and Fang Wu. 2010. Technological capability, strategic flexibility, and product innovation. Strategic Management Journal 31: 547–61. [Google Scholar] [CrossRef]

- Zhou, Kevin Zheng. 2006. Innovation, imitation, and new product performance: The case of China. Industrial Marketing Management 35: 394–402. [Google Scholar] [CrossRef]

- Zott, Christoph, and Raphael Amit. 2010. Business model design: An activity system perspective. Long Range Planning 43: 216–26. [Google Scholar] [CrossRef]

| Sectors | Frequency | % Relative Frequency |

|---|---|---|

| Advertising | 15 | 5.19 |

| Agriculture/Agri-food | 13 | 4.50 |

| Blockchain/FinTech | 13 | 4.50 |

| Creative Industries/Smart Cities | 16 | 5.54 |

| Entertainment/Lifestyle | 20 | 6.92 |

| Finance | 22 | 7.61 |

| Financial Technology | 11 | 3.81 |

| Food & Beverage | 13 | 4.50 |

| HealthTech | 16 | 5.54 |

| IT/Telecommunications | 23 | 7.96 |

| Logistics | 11 | 3.81 |

| Resource Management | 18 | 6.23 |

| Social Networking | 12 | 4.15 |

| Software | 19 | 6.57 |

| Technology/Artificial Intelligence | 25 | 8.65 |

| Tourism | 20 | 6.92 |

| Transportations | 13 | 4.50 |

| Other | 9 | 3.11 |

| All | 289 | 100.00 |

| Type | Name | Definition |

|---|---|---|

| Dependent | Entrepreneurial Innovation | “The implementation of creative ideas through discovery and exploitation of opportunities in entrepreneurial firms” (Hung and Mondejar 2005, p. 120) |

| Predictors | OBI | “The imitation of practices that appear to have had good outcomes for other firms in the past and avoiding practices with bad outcomes” (Haunschild and Miner 1997, p. 472) |

| TBI | “Copying practices of other organizations with certain features” (Haunschild and Miner 1997, p. 472) | |

| FBI | “The organization’s execution of practices previously used by large numbers of other organizations” (Haunschild and Miner 1997, p. 472) | |

| MS | “The ability to effectively organize, allocate, and configure various firm resources” (Guo et al. 2013, p. 452) | |

| ES | “The ability of top managers to sense and recognize entrepreneurial opportunities” (Guo et al. 2013, p. 452) |

| Variables | Observations | Mean | Median | S.D. | Min | Max |

|---|---|---|---|---|---|---|

| Entrepreneurial Innovation | 289 | 5.08 | 5.33 | 1.24 | 1.11 | 7.00 |

| OBI | 289 | 4.33 | 4.60 | 1.41 | 1.00 | 7.00 |

| TBI | 289 | 4.49 | 4.67 | 1.37 | 1.33 | 7.00 |

| FBI | 289 | 3.94 | 3.88 | 1.44 | 1.00 | 6.88 |

| MS | 289 | 5.02 | 5.20 | 1.19 | 1.00 | 7.00 |

| ES | 289 | 5.20 | 5.40 | 1.18 | 1.00 | 7.00 |

| Number of Employees | 289 | 2.36 | 2.00 | 1.08 | 1.00 | 4.00 |

| Years of Operation | 289 | 1.80 | 2.00 | 0.65 | 1.00 | 3.00 |

| Gender | 289 | 1.49 | 1.00 | 0.50 | 1.00 | 2.00 |

| Age | 289 | 2.47 | 2.00 | 0.92 | 1.00 | 5.00 |

| Owner Educational Background | 289 | 3.35 | 3.00 | 0.75 | 1.00 | 5.00 |

| Owner Work Experience | 289 | 2.46 | 3.00 | 0.67 | 1.00 | 3.00 |

| Variable | Model 1 | Model 2 | ||

|---|---|---|---|---|

| OBI | 0.081 * | (0.066) | ||

| TBI | 0.187 ** | (0.064) | ||

| FBI | −0.179 ** | (0.064) | ||

| MS | 0.268 *** | (0.073) | ||

| ES | 0.152 * | (0.074) | ||

| Number of Employees | −0.094 | (0.082) | −0.107 | (0.074) |

| Years of Operation | −0.049 | (0.140) | −0.110 | (0.128) |

| Gender | −0.167 | (0.148) | −0.072 | (0.134) |

| Age | 0.039 | (0.106) | 0.026 | (0.096) |

| Owner Educational Background | 0.244 * | (0.098) | 0.145 | (0.090) |

| Owner Work Experience | −0.120 | (0.155) | −0.040 | (0.140) |

| Constant | 5.026 | (0.477) | 2.573 | (0.560) |

| Observations | 289 | 289 | ||

| Prob > F | 0.152 | 0.000 | ||

| R—squared | 0.033 | 0.225 | ||

| Adj R—squared | 0.012 | 0.194 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsolakidis, P.; Mylonas, N.; Petridou, E. The Impact of Imitation Strategies, Managerial and Entrepreneurial Skills on Startups’ Entrepreneurial Innovation. Economies 2020, 8, 81. https://doi.org/10.3390/economies8040081

Tsolakidis P, Mylonas N, Petridou E. The Impact of Imitation Strategies, Managerial and Entrepreneurial Skills on Startups’ Entrepreneurial Innovation. Economies. 2020; 8(4):81. https://doi.org/10.3390/economies8040081

Chicago/Turabian StyleTsolakidis, Panagiotis, Naoum Mylonas, and Eugenia Petridou. 2020. "The Impact of Imitation Strategies, Managerial and Entrepreneurial Skills on Startups’ Entrepreneurial Innovation" Economies 8, no. 4: 81. https://doi.org/10.3390/economies8040081

APA StyleTsolakidis, P., Mylonas, N., & Petridou, E. (2020). The Impact of Imitation Strategies, Managerial and Entrepreneurial Skills on Startups’ Entrepreneurial Innovation. Economies, 8(4), 81. https://doi.org/10.3390/economies8040081