Does Financial Integration Enhance Economic Growth in China?

Abstract

1. Introduction

2. Literature Review

3. Methodology

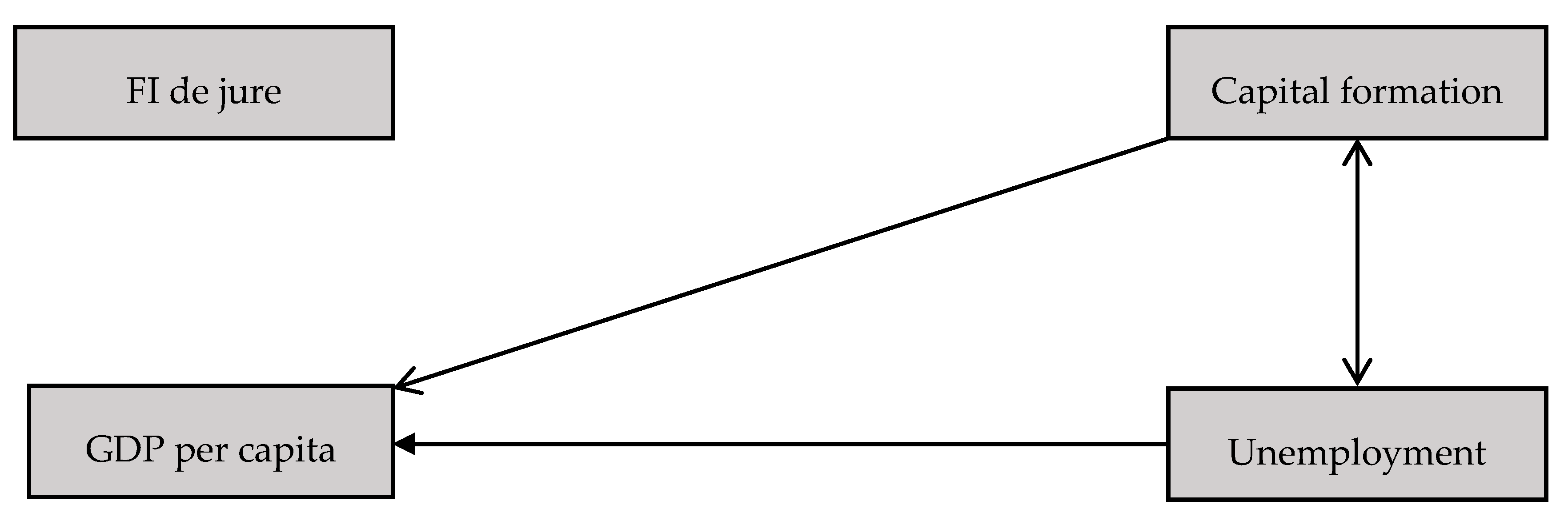

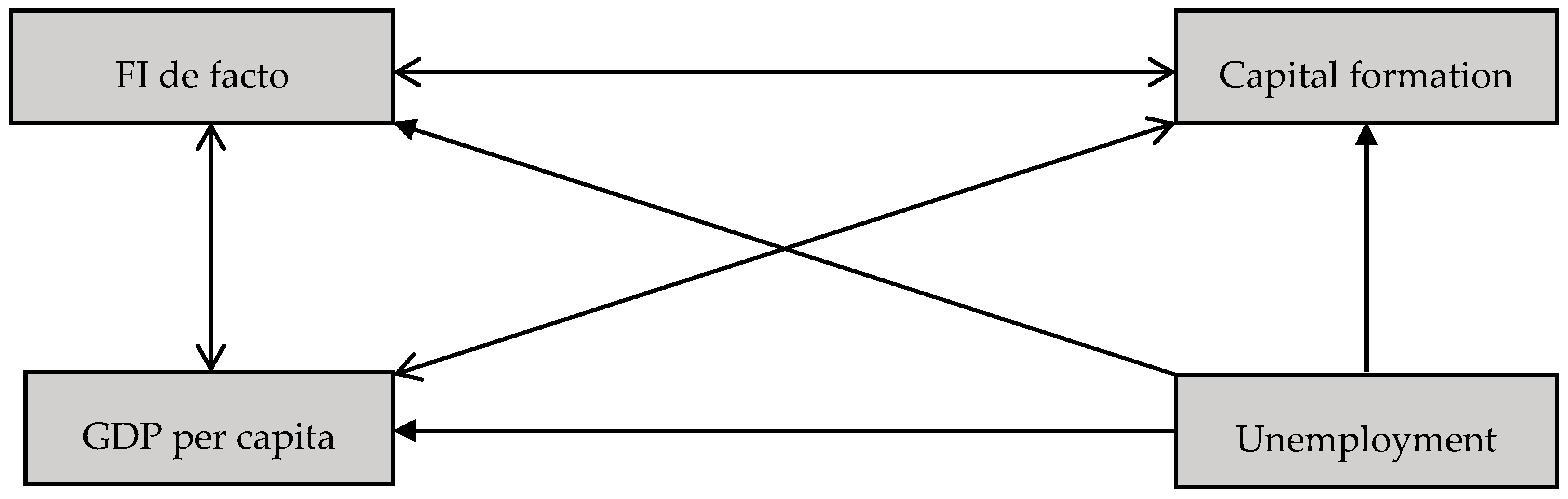

3.1. Model Specification

3.2. Time-Series Analysis

3.3. Variables and Data Sources

4. Research Results

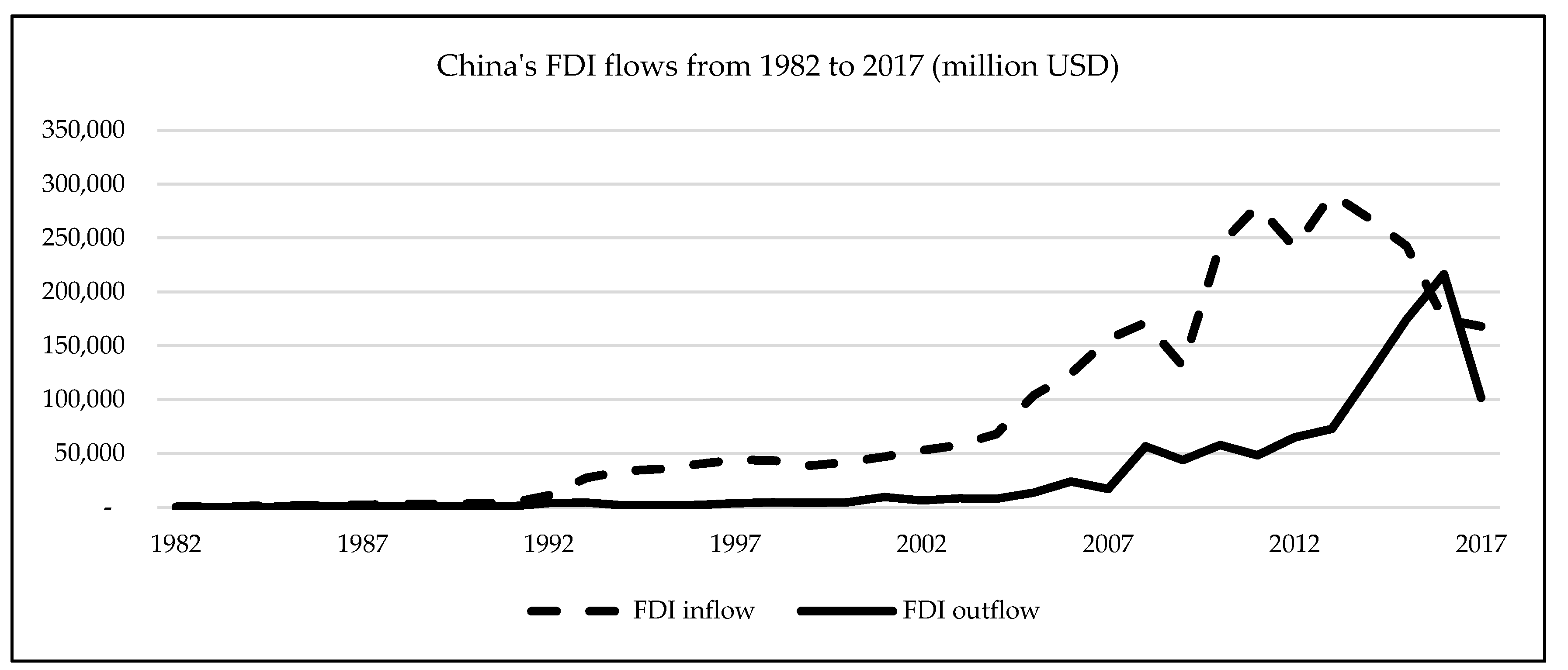

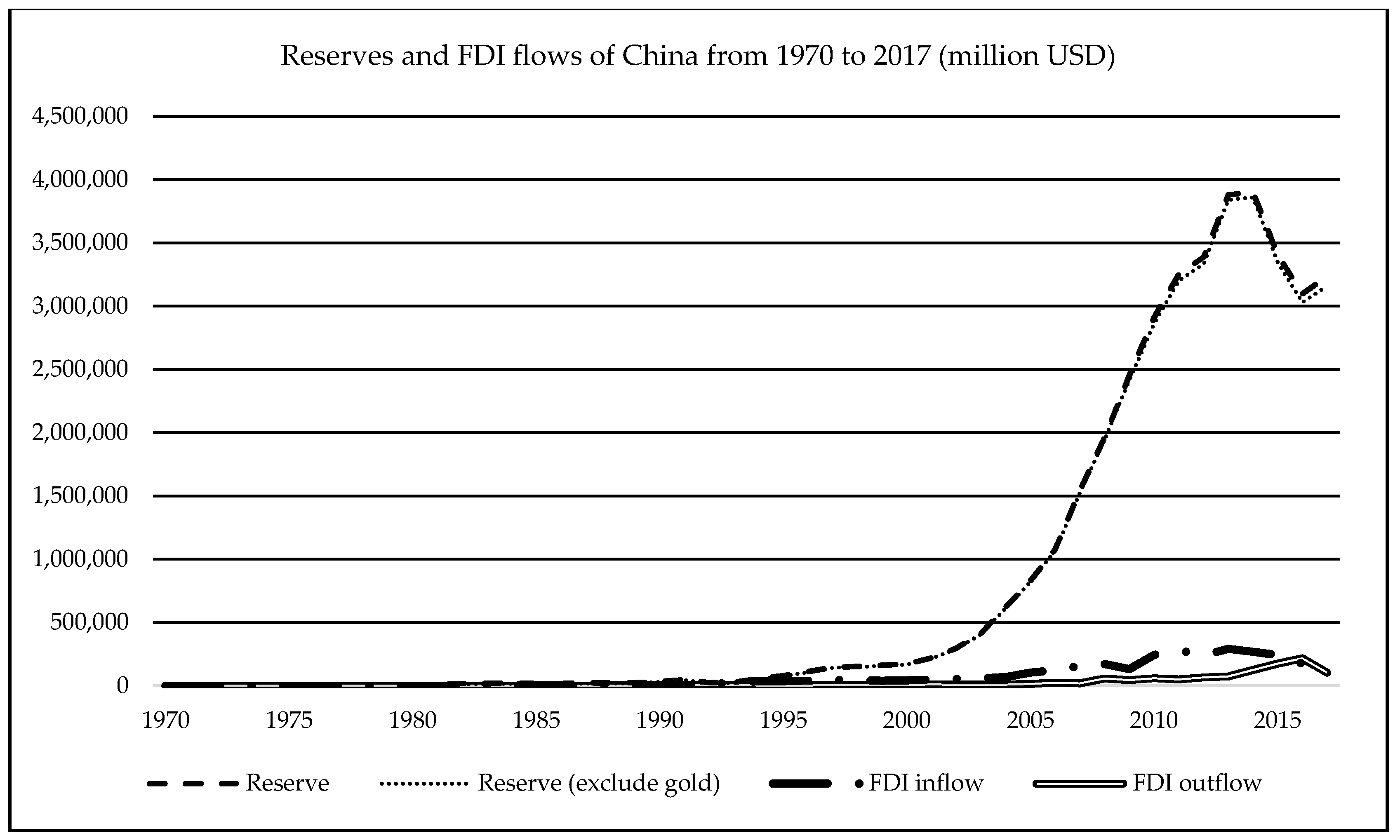

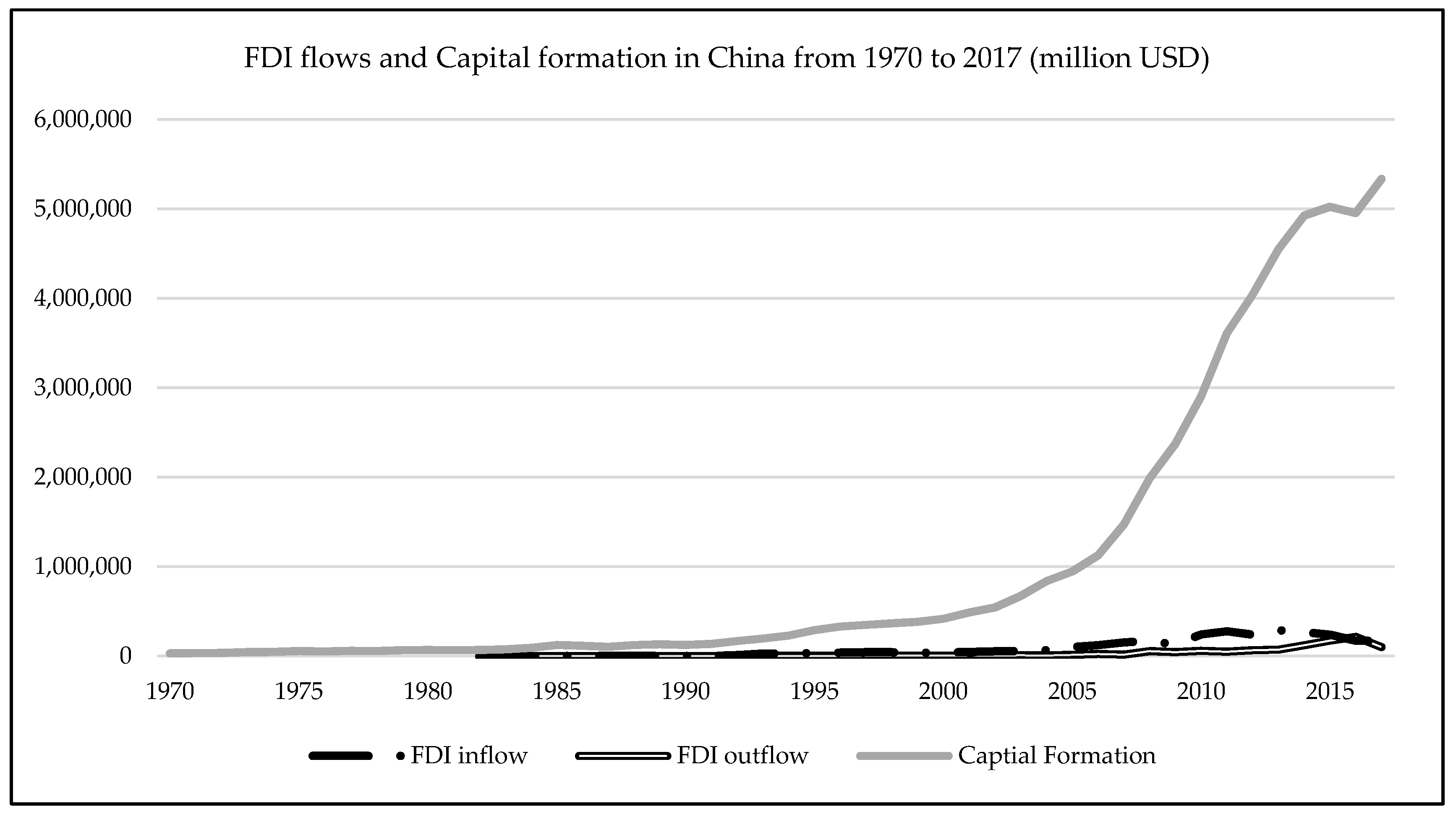

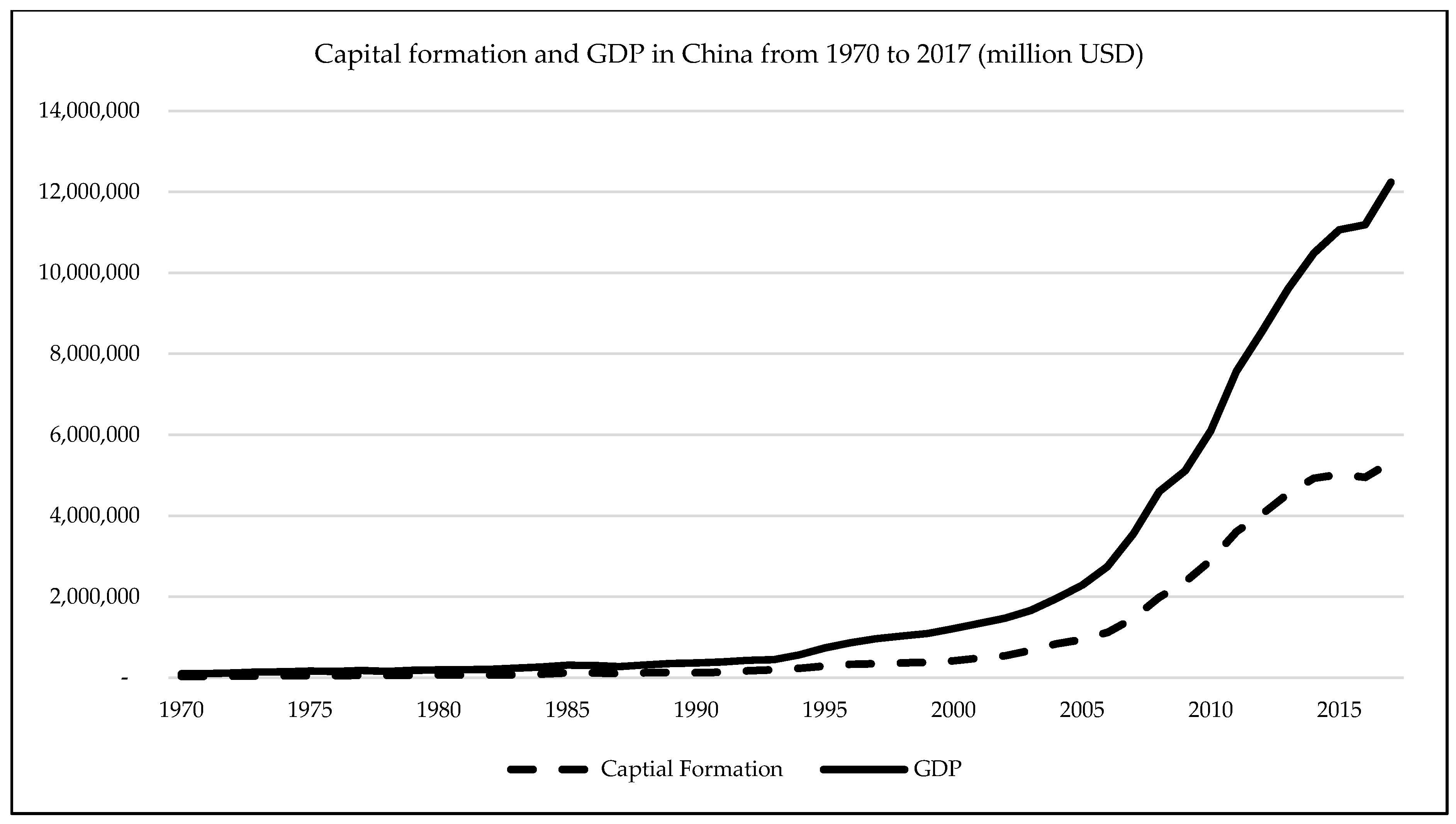

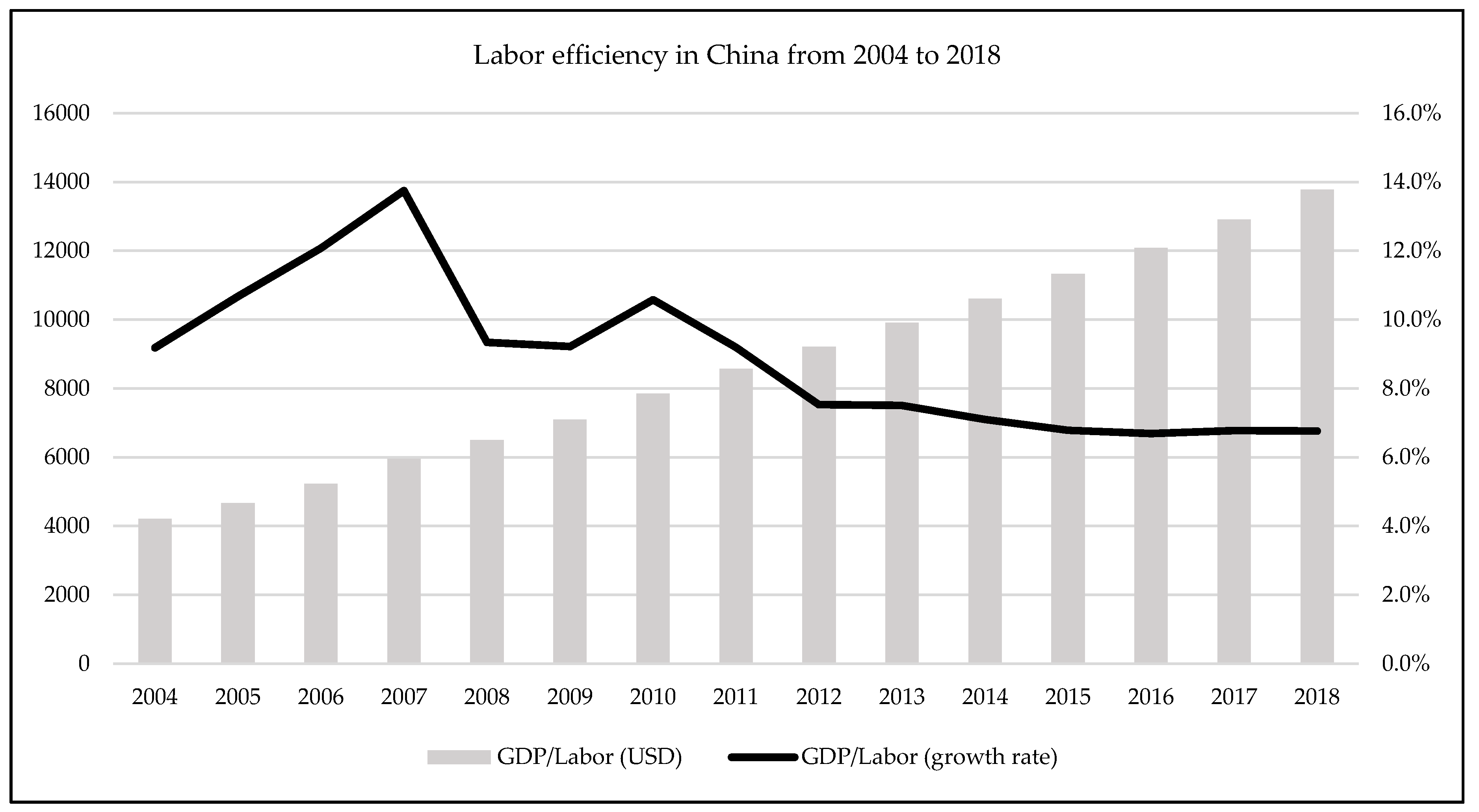

4.1. Descriptive Statistics

4.2. Co-Integration Analysis

5. Discussions

6. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Ang, James B. 2008a. A survey of recent developments in the literature of finance and growth. Journal of Economic Surveys 22: 536–76. [Google Scholar] [CrossRef]

- Ang, James B. 2008b. What are the mechanisms linking financial development and economic growth in Malaysia? Economic Modelling 25: 38–53. [Google Scholar] [CrossRef]

- Ang, James B. 2010. Does foreign aid promote growth? Exploring the role of financial liberalization. Review of Development Economics 14: 197–212. [Google Scholar] [CrossRef]

- Ang, James B., and Warwick J. McKibbin. 2007. Financial liberalization, financial sector development and growth: Evidence from Malaysia. Journal of Development Economics 84: 215–33. [Google Scholar] [CrossRef]

- Anwar, Sajid, and Arusha Cooray. 2012. Financial development, political rights, civil liberties and economic growth: Evidence from South Asia. Economic Modelling 29: 974–81. [Google Scholar] [CrossRef]

- Anwar, Sajid, and Sizhong Sun. 2011. Financial development, foreign investment and economic growth in Malaysia. Journal of Asian Economics 22: 335–42. [Google Scholar] [CrossRef]

- Arestis, Philip, Georgios Chortareas, and Georgios Magkonis. 2014. The financial development and growth nexus: A meta-analysis. Journal of Economic Surveys 29: 549–65. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2005. Does financial liberalization spur growth? Journal of Financial Economics 77: 3–55. [Google Scholar] [CrossRef]

- Bussière, Matthieu, and Marcel Fratzscher. 2008. Financial openness and growth: Short-run gain, long-run pain? Review of International Economics 16: 69–95. [Google Scholar] [CrossRef]

- Cheung, Yin-Wong, Menzie D. Chinn, and Eiji Fujii. 2005. Dimensions of financial integration in greater China: Money markets, banks and policy effects. International Journal of Finance & Economics 10: 117–32. [Google Scholar]

- Dreher, Axel. 2006. Does globalization affect growth? Evidence from a new index of globalization. Applied Economics 38: 1091–110. [Google Scholar] [CrossRef]

- Dreher, Axel, Noel Gaston, and Pim Martens. 2008. Measuring Globalisation: Gauging its Consequences. New York: Springer. [Google Scholar]

- Durusu-Ciftci, Dilek, M. Serdar Ispir, and I. Hakan Yetkiner. 2017. Financial development and economic growth: Some theory and more evidence. Journal of Policy Modeling 39: 290–306. [Google Scholar] [CrossRef]

- Edison, Hali J., Ross Levine, Luca Ricci, and Torsten Sløk. 2002. International financial integration and economic growth. Journal of International Money and Finance 21: 749–76. [Google Scholar] [CrossRef]

- Eichengreen, Barry, Rachita Gullapalli, and Ugo Panizza. 2011. Capital account liberalization, financial development and industry growth: A synthetic view. Journal of International Money and Finance 30: 1090–106. [Google Scholar] [CrossRef]

- Fry, Maxwell J. 1989. Financial development: Theories and recent experience. Oxford Review of Economic Policy 5: 13–28. [Google Scholar] [CrossRef]

- Girardin, Eric, and Zhenya Liu. 2007. The financial integration of China: New evidence on temporally aggregated data for the A-share market. China Economic Review 18: 354–71. [Google Scholar] [CrossRef]

- Goldsmith, Raymond William. 1969. Financial Structure and Development. New Haven: Yale University Press. [Google Scholar]

- Gourinchas, Pierre-Olivier, and Olivier Jeanne. 2006. The elusive gains from international financial integration. The Review of Economic Studies 73: 715–41. [Google Scholar] [CrossRef]

- Greenwood, Jeremy, and Boyan Jovanovic. 1990. Financial development, growth, and the distribution of income. Journal of Political Economy 98: 1076–107. [Google Scholar] [CrossRef]

- Groenewold, Nicolaas, Sam Hak Kan Tang, and Yanrui Wu. 2004. The dynamic interrelationships between the greater China share markets. China Economic Review 15: 45–62. [Google Scholar] [CrossRef]

- Guiso, Luigi, Tullio Jappelli, Mario Padula, and Marco Pagano. 2004. Financial market integration and economic growth in the E.U. Economic Policy 19: 524–77. [Google Scholar] [CrossRef]

- Gurley, John G., and Edward S. Shaw. 1955. Financial aspects of economic development. The American Economic Review 45: 515–38. [Google Scholar]

- Gygli, Savina, Florian Haelg, Niklas Potrafke, and Jan-Egbert Sturm. 2019. The KOF globalization index–revisited. The Review of International Organizations 14: 1–32. [Google Scholar]

- Hatemi-J, Abdulnasser, and Eduardo D. Roca. 2004. Do birds of the same feather flock together?: The case of the Chinese states equity markets. Journal of International Financial Markets, Institutions and Money 14: 281–94. [Google Scholar] [CrossRef]

- Hicks, John Richard. 1969. A Theory of Economic History. Oxford: Oxford University Press. [Google Scholar]

- Huang, Bwo-Nung, Chin-Wei Yang, and John Wei-Shan Hu. 2000. Causality and co-integration of stock markets among the United States, Japan and the South China Growth Triangle. International Review of Financial Analysis 9: 281–97. [Google Scholar] [CrossRef]

- Imbs, Jean. 2006. The real effects of financial integration. Journal of International Economics 68: 296–324. [Google Scholar] [CrossRef]

- King, Robert G., and Ross Levine. 1993. Finance, entrepreneurship and growth. Journal of Monetary Economics 32: 513–42. [Google Scholar] [CrossRef]

- Kose, M. Ayhan, Eswar S. Prasad, and Marco E. 2003. Financial integration and macroeconomic volatility. IMF Staff Papers 50: 119–42. [Google Scholar] [CrossRef]

- Lane, Philip R., and Gian Maria Milesi-Ferretti. 2003. International financial integration. IMF Staff Papers 50: 82–113. [Google Scholar]

- Levine, Ross. 2005. Finance and growth: Theory and evidence. Handbook of Economic Growth 1: 865–934. [Google Scholar]

- Levine, Ross, and Sara Zervos. 1998. Stock markets, banks, and economic growth. American Economic Review 88: 537–58. [Google Scholar]

- Levine, Ross, Norman Loayza, and Thorsten Beck. 2000. Financial intermediation and growth: Causality and causes. Journal of Monetary Economics 46: 31–77. [Google Scholar] [CrossRef]

- Loizos, Konstantinos. 2018. The financial repression-liberalization debate: Taking stock, looking for a synthesis. Journal of Economic Surveys 32: 440–68. [Google Scholar] [CrossRef]

- McKinnon, Ronald I. 1973. Money and Capital in Economic Development. Washington: Brookings Institution Press. [Google Scholar]

- Menyah, Kojo, Saban Nazlioglu, and Yemane Wolde-Rufael. 2014. Financial development, trade openness and economic growth in African countries: New insights from a panel causality approach. Economic Modelling 37: 386–94. [Google Scholar] [CrossRef]

- Nguyen, Ha Minh, Ngoc Hoang Bui, and Duc Hong Vo. 2019a. The Nexus between Economic Integration and Growth: Application to Vietnam. Annals of Financial Economics 14. [Google Scholar] [CrossRef]

- Nguyen, Ha Minh, Ngoc Hoang Bui, Duc Hong Vo, and Michael McAleer. 2019b. Energy consumption and economic growth: Evidence from Vietnam. Journal of Reviews on Global Economics 8: 350–61. [Google Scholar] [CrossRef]

- Okazaki, Kumiko, and Tomoyuki Fukumoto. 2011. Macro-Financial Linkage and Financial Deepening in China after the Global Financial Crisis (No. 11-E-02). Tokyo: Institute for Monetary and Economic Studies, Bank of Japan. [Google Scholar]

- Peia, Oana, and Kasper Roszbach. 2015. Finance and growth: Time series evidence on causality. Journal of Financial Stability 19: 105–18. [Google Scholar] [CrossRef]

- Phuc, Nguyen Van, and Vo Hong Duc. 2019. Macroeconomics Determinants of Exchange Rate Pass-through: New Evidence from the Asia-Pacific Region. Emerging Markets Finance and Trade 24: 1–16. [Google Scholar] [CrossRef]

- Robinson, Joan. 1979. The generalization of the general theory. In The Generalization of the General Theory and Other Essays. London: Palgrave Macmillan, pp. 1–76. [Google Scholar]

- Shaw, Edward Stone. 1973. Financial Deepening in Economic Development. New York: Oxford University Press. [Google Scholar]

- Studart, Rogério. 1993. Financial repression and economic development: Towards a post-Keynesian alternative. Review of Political Economy 5: 277–98. [Google Scholar] [CrossRef]

- Vo, Anh The, Chi Minh Ho, and Duc Hong Vo. 2019a. Understanding the Exchange Rate Pass-through to Consumer Prices in Vietnam using the SVAR Approach. International Journal of Emerging Markets 15: 971–89. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Son Van Huynh, Anh The Vo, and Dao Thi-Thieu Ha. 2019b. The importance of the financial derivatives markets to economic development in the world’s four major economies. Journal of Risk and Financial Management 12: 35. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Phuc Van Nguyen, Ha Minh Nguyen, Anh The Vo, and Thang Cong Nguyen. 2019c. Derivatives Market and Economic Growth Nexus: Policy Implications for Emerging Markets. The North American Journal of Economics and Finance. in press. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Tan Ngoc Vu, Anh The Vo, and Michael McAleer. 2019d. Modeling the Relationship between Crude Oil and Agricultural Commodity Prices. Energies 12. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Anh The Vo, Chi Minh Ho, and Ha Minh Nguyen. 2020. The Role of Renewable Energy, Alternative and Nuclear Energy in Mitigating Carbon Emissions in the CPTPP Countries. Renewable Energy. forthcoming. [Google Scholar] [CrossRef]

- Wang, Zhi, and G. Edward Schuh. 2000. Economic integration among Taiwan, Hong Kong and China: A computable general equilibrium analysis. Pacific Economic Review 5: 229–62. [Google Scholar] [CrossRef]

- Wolde-Rufael, Yemane. 2009. Re-examining the financial development and economic growth nexus in Kenya. Economic Modelling 26: 1140–46. [Google Scholar] [CrossRef]

- Xu, Guangdong, and Binwei Gui. 2019. From financial repression to financial crisis? The case of China. Asian-Pacific Economic Literature 33: 48–63. [Google Scholar] [CrossRef]

- Yang, Jian, Jame W. Kolari, and Insik Min. 2003. Stock market integration and financial crises: The case of Asia. Applied Financial Economics 13: 477–86. [Google Scholar] [CrossRef]

- Yin, Haitao, and Chunbo Ma. 2009. International integration: A hope for a greener China? International Marketing Review 26: 348–67. [Google Scholar] [CrossRef]

| 1 |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Year | 46 | 1993 | 13 | 1970 | 2015 |

| FI de facto | 46 | 26.58 | 15.91 | 6.91 | 49.73 |

| FI de Jure | 46 | 13.56 | 3.16 | 7.13 | 21.21 |

| PI | 46 | 71.03 | 18.73 | 39.19 | 93.60 |

| % of FDI inflow to GDP | 34 | 2.92% | 1.69% | 0.21% | 6.19% |

| % of FDI outflow to GDP | 34 | 0.53% | 0.37% | 0.02% | 1.58% |

| % Money to GDP | 39 | 108.91% | 53.74 | 24.19% | 202.07% |

| FDI inflow (mil $) | 34 | 82,900 | 95,300 | 430 | 291,000 |

| FDI outflow (mil $) | 34 | 22,500 | 39,000 | 44 | 174,000 |

| Capital Formation (mil $) | 46 | 5,780,000 | 8,990,000 | 74,500 | 31,300,000 |

| GDP (mil $) | 46 | 1,960,000 | 3,010,000 | 92,600 | 11,100,000 |

| GDP per capita | 46 | 1497.70 | 2196.54 | 113.16 | 8069.21 |

| GDP growth | 46 | 9.24 | 3.59 | (1.57) | 19.30 |

| Unemployment rate | 37 | 3.39 | 0.98 | 1.80 | 5.40 |

| Log (GDP) | Log (GDP pc) | Log (FI de Facto) | Log (FI de Jure) | Log (Capital) | Unemployment | |

|---|---|---|---|---|---|---|

| Log (GDP) | 1 | |||||

| Log (GDPpc) | 0.9990 | 1 | ||||

| Log (FI de facto) | 0.8996 | 0.8819 | 1 | |||

| Log (FI de jure) | 0.1859 | 0.1988 | 0.0359 | 1 | ||

| Log (Capital) | 0.9822 | 0.9740 | 0.9600 | 0.1374 | 1 | |

| Unemployment | 0.4131 | 0.4269 | 0.0981 | 0.2110 | 0.3412 | 1 |

| Dicky–Fuller | Zivot–Andrews | |||

|---|---|---|---|---|

| Variable | Level | First Difference | Level | First Difference |

| GDP | −0.998 | −3.548 ** | −2.617 | −3.255 ** |

| GDP per capita | −1.135 | −3.545 ** | −2.610 | −3.245 ** |

| FI de facto | −1.189 | −4.193 *** | −3.301 | −3.278 ** |

| FI de jure | −4.392 *** | −6.056 *** | −5.013 ** | −4.942 ** |

| Capital | −2.106 | −4.050 *** | −4.388 | −3.320 ** |

| Unemployment | −1.468 | −4.570 *** | −5.739 *** | −5.362 ** |

| Model | Break Type | Has Co-Integration | Breakpoint |

|---|---|---|---|

| 1 GDPpc (FIdj, Capital, Unemploy) | Level | No | |

| Regime | Yes | 1987 | |

| Trend | No | ||

| Regime and Trend | Yes | 1986 | |

| 2 GDPpc (FIdf, Capital, Unemploy) | Level | No | |

| Regime | No | ||

| Trend | No | ||

| Regime and Trend | No | ||

| 3 GDP (FIdj, Capital, Unemploy) | Level | No | |

| Regime | Yes | 1987 | |

| Trend | No | ||

| Regime and Trend | Yes | 1986 | |

| 4 GDP (FIdf, Capital, Unemploy) | Level | No | |

| Regime | No | ||

| Trend | No | ||

| Regime and Trend | No |

| Mode 1 | Optimal Lags | Breakpoint | F-Statistic |

|---|---|---|---|

| GDPpc (FIdj, Capital, Unemploy) | 3, 2, 4, 4 | 1987 | 4.928 ** |

| GDPpc (FIdf, Capital, Unemploy) | 2, 3, 0, 4 | no | 9.325 *** |

| GDP (FIdj, Capital, Unemploy) | 3, 2, 4, 4 | 1987 | 4.740 ** |

| GDP (FIdf, Capital, Unemploy) | 2, 3, 0, 4 | no | 9.187 *** |

| Variable | Mode 1 (GDP Per Capita) | Mode 2 (GDP Per Capita) | Mode 3 (GDP) | Mode 4 (GDP) |

|---|---|---|---|---|

| Adjustment | −0.242 *** | −0.272 *** | −0.253 *** | −0.269 *** |

| (0.0696) | (0.0537) | (0.0729) | (0.0528) | |

| Long-run effect | ||||

| FI de jure | −0.445 * | −0.427 * | ||

| (0.235) | (0.225) | |||

| FI de facto | −0.844 *** | −0.766 *** | ||

| (0.246) | (0.248) | |||

| Capital formation | 0.878 *** | 1.017 *** | 0.919 *** | 1.040 *** |

| (0.101) | (0.0847) | (0.0962) | (0.0854) | |

| Unemployment | 0.176 | 0.158 * | 0.162 | 0.169 * |

| (0.156) | (0.0877) | (0.149) | (0.0879) | |

| Short-run effect | ||||

| ∆FI de facto (Lag 1) | 0.336 *** | 0.326 *** | ||

| (0.113) | (0.113) | |||

| ∆FI de facto (Lag 2) | 0.273 *** | 0.271 *** | ||

| (0.0925) | (0.0923) | |||

| ∆GDP per capita (Lag 1) | 0.237 | 0.253 * | ||

| (0.179) | (0.123) | |||

| ∆GDP per capita (Lag 2) | −0.405 ** | |||

| (0.168) | ||||

| ∆GDP (Lag 1) | 0.242 | 0.243 * | ||

| (0.177) | (0.122) | |||

| ∆GDP (Lag 2) | −0.398 ** | |||

| (0.167) | ||||

| ∆Capital formation (Lag 3) | 0.486 *** | 0.472 *** | ||

| (0.157) | (0.156) | |||

| ∆Unemployment | −0.0837 | −0.114 ** | −0.0831 | −0.113 ** |

| (0.0598) | (0.0408) | (0.0597) | (0.0406) | |

| ∆Unemployment (Lag 2) | −0.103 * | 0.0559 | −0.100 * | 0.0573 |

| (0.0534) | (0.0399) | (0.0530) | (0.0397) | |

| ∆Unemployment (Lag 3) | −0.0455 | −0.0843 ** | −0.0452 | −0.0829 ** |

| (0.0521) | (0.0332) | (0.0520) | (0.0331) | |

| Constant | −4.191 *** | −5.393 *** | 0.629 | 0.0345 |

| (1.306) | (1.161) | (0.517) | (0.436) | |

| Observations | 33 | 33 | 33 | 33 |

| R-squared | 0.836 | 0.848 | 0.828 | 0.841 |

| Test | Mode 1 (GDP Per Capita) | Mode 2 (GDP Per Capita) | Mode 3 (GDP) | Mode 4 (GDP) |

|---|---|---|---|---|

| Durbin–Watson | 0.2207 | 0.1066 | 0.2389 | 0.1059 |

| LM test with ARCH effect | 0.3185 | 0.7143 | 0.3702 | 0.7884 |

| Breusch–Godfrey test | 0.0837 * | 0.0512 * | 0.0994 * | 0.0508 * |

| White’s test | 0.4180 | 0.4180 | 0.4180 | 0.4180 |

| Heteroskedasticity | 0.4066 | 0.5030 | 0.4641 | 0.4722 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vo, D.H.; Vo, A.T.; Ho, C.M. Does Financial Integration Enhance Economic Growth in China? Economies 2020, 8, 65. https://doi.org/10.3390/economies8030065

Vo DH, Vo AT, Ho CM. Does Financial Integration Enhance Economic Growth in China? Economies. 2020; 8(3):65. https://doi.org/10.3390/economies8030065

Chicago/Turabian StyleVo, Duc Hong, Anh The Vo, and Chi Minh Ho. 2020. "Does Financial Integration Enhance Economic Growth in China?" Economies 8, no. 3: 65. https://doi.org/10.3390/economies8030065

APA StyleVo, D. H., Vo, A. T., & Ho, C. M. (2020). Does Financial Integration Enhance Economic Growth in China? Economies, 8(3), 65. https://doi.org/10.3390/economies8030065