Macroeconomic Growth in Vietnam Transitioned to Market: An Unrestricted VES Framework

Abstract

1. Introduction

2. Conceptual Framework and Empirical Studies

2.1. Conceptual Framework

2.2. Empirics on VES

3. Methodology and Data

3.1. Estimation Method and Model

3.2. Data Description

4. Research Results

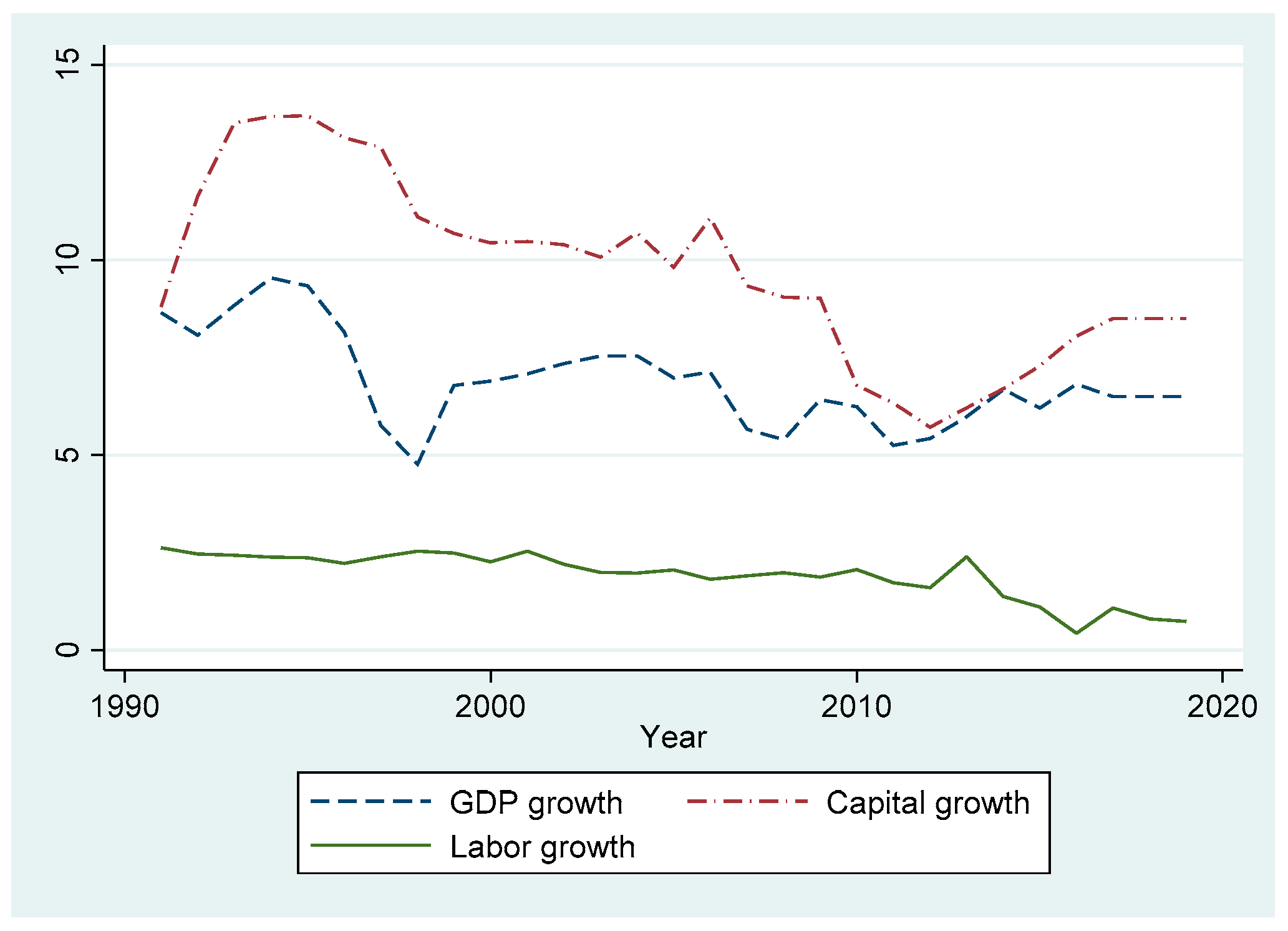

4.1. Descriptive Statistics

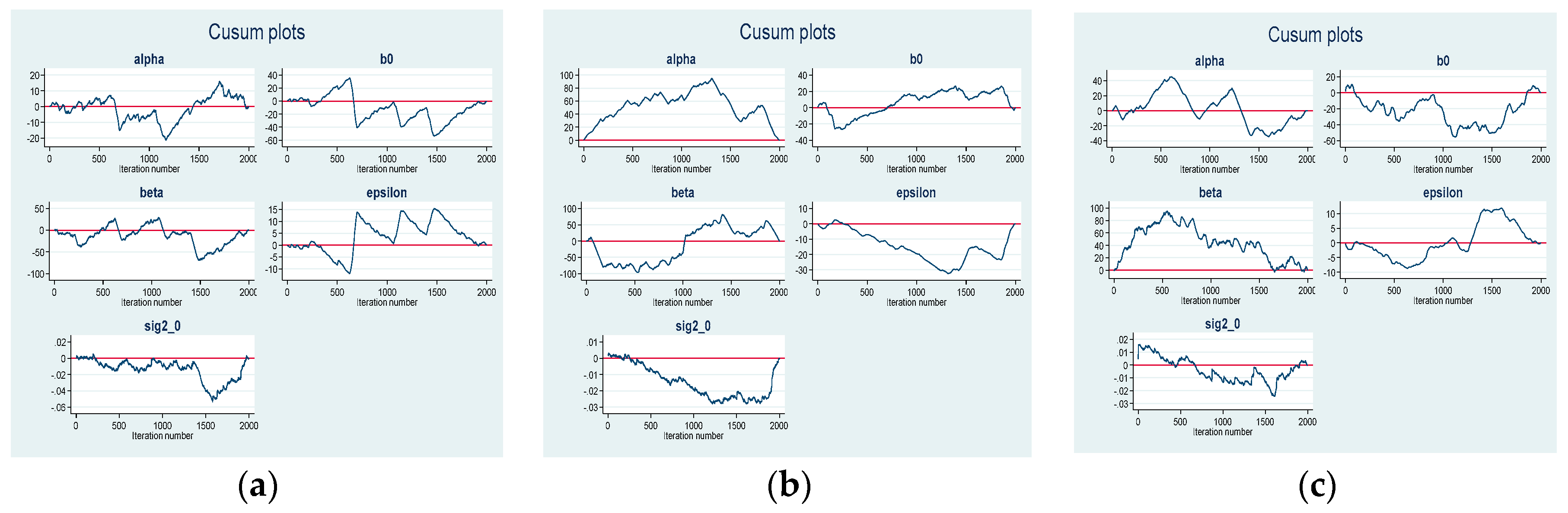

4.2. Bayesian Simulation Results

4.3. Model Comparison

4.4. Discussion

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Anh, Ly H., Vladik Kreinovich, and Nguyen Ngoc Thach, eds. 2018. Econometrics for Financial Applications. Cham: Springer. [Google Scholar]

- Arrow, Kenneth J., Hollis B. Chenery, Bagicha Singh Minhas, and Robert M. Solow. 1961. Capital Labour Substitution and Economic Efficiency. The Review of Economics and Statisticss 63: 225–50. [Google Scholar] [CrossRef]

- Azariadis, Costas. 1993. Intertemporal Macroeconomics. Hoboken: Blackwell Publishers. [Google Scholar]

- Bairam, Erkin. 1989. Learning-by-doing, variable elasticity of substitution and economic growth in Japan, 1878–1939. Journal of Development Studies 25: 344–53. [Google Scholar] [CrossRef]

- Bairam, Erkin. 1990. Capital-labour substitution and slowdown in Soviet economic growth: A re-examination. Bulletin of Economic Research 42: 63–72. [Google Scholar] [CrossRef]

- Barro, Robert J., and Xavier Sala-i-Martin. 1995. Economic Growth. New York: McGraw-Hill. [Google Scholar]

- Brianzoni, Serena, Cristiana Mammana, and Elisabetta Michetti. 2012. Variable elasticity of substituition in a discrete time solow–swan growth model with differential saving. Chaos, Solitons & Fractals 45: 98–108. [Google Scholar]

- Bruton, Henry J. 1956. Innovations and equilibrium growth. Economic Journal 66: 455–66. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1994. The earth is round (p < 0.05). American Psychologist 49: 997–1003. [Google Scholar]

- Davidian, Marie, and David M. Giltinan. 1995. Nonlinear Models for Repeated Measurement Data. Boca Raton: Chapman & Hall/CRC. [Google Scholar]

- De La Grandville, Olivier. 1989. In quest of the slutsky diamond. American Economic Review 79: 468–81. [Google Scholar]

- Diwan, Romesh K. 1970. About the growth path of firms. American Economic Review 60: 30–43. [Google Scholar]

- Duffy, John, and Chris Papageorgiou. 2000. A cross-crountry empirical investigation of the aggregate production function specification. Journal of Economic Growth 5: 87–120. [Google Scholar] [CrossRef]

- Federal Reserve Bank of St. Louis. 2019. Penn World Table. Available online: https://fred.stlouisfed.org (accessed on 18 April 2020).

- Fellner, William. 1954. Full use of underutilization: Appraisal of long-run factors other than defense. American Economic Review 44: 423–26. [Google Scholar]

- Galor, Oded. 1995. Convergence? Inference from theoretical models. Economic Journal 106: 1056–69. [Google Scholar] [CrossRef]

- General Statistics Office of Vietnam. 2008. Statistics Yearbook of Vietnam 2008; Hanoi: Statistical Publishing House.

- General Statistics Office of Vietnam. 2019. Statistical Yearbook of Vietnam 2019; Hanoi: Statistical Publishing House.

- Gordon, David, and Richard Vaughan. 2011. The Historical Role of the Production Function in Economics and Business. American Journal of Business Education 4: 25–30. [Google Scholar] [CrossRef]

- Grassetti, Francesca, and Gevorg Hunanyan. 2018. On the economic growth theory with kadiyala production function. Communications in Nonlinear Science and Numerical Simulation 58: 220–32. [Google Scholar] [CrossRef]

- Grassetti, Francesca, Cristiana Mammana, and Elisabetta Michetti. 2018. Substitutability between production factors and growth. An analysis using VES production functions’. Chaos, Solitons & Fractals 113: 53–62. [Google Scholar]

- Hicks, John. 1932. The Theory of Wages. London: Macmillan and Co., Ltd. [Google Scholar]

- Нгуен, Н. Т. 2003. Вьетнамская экoнoмика: Опыт рефoрмы, прoблемы и перспективы. Прoблемы Сoвременнoй Экoнoмики 2: 95–98. [Google Scholar]

- Huynh, The Nguyen. 2019. Factors affecting technical efficiency in Vietnamese small and medium enterprises. Journal of Asian Business and Economics Studies. Available online: http://jabes.ueh.edu.vn/Home/SearchArticle?article_Id=8fbfecc6-ffc8-4ab8-84b7-5ca9b1ab8c50 (accessed on 11 January 2020).

- Jones, Larry E., and Rodolfo Manuelli. 1990. A convex model of equilibrium growth: Theory and policy implications. Journal of Political Economy 98: 1008–38. [Google Scholar] [CrossRef]

- Jones, Larry E., and Rodolfo E. Manuelli. 1997. Sources of growth. Journal of Economic Dynamics and Control 21: 75–114. [Google Scholar] [CrossRef]

- Karagiannis, Giannis, Theodore Palivos, and Chris Papageorgiou. 2005. Variable Elasticity of Substitution and Economic Growth: Theory and Evidence. In New Trends in Macroeconomics. Edited by Diebolt Claude and C. Kyrtsou Catherine. Berlin/Heidelberg: Springer, pp. 21–37. [Google Scholar]

- Kazi, Umar A. 1980. The variable elasticity of substitution production function: A case study from Indian manufacturing industries. Oxford Economic Papers 32: 163–75. [Google Scholar] [CrossRef]

- Kazuo, Sato. 1963. Growth and the elasticity of factor substitution: A comment–How plausible is imbalanced growth. Economic Record 39: 355–61. [Google Scholar]

- Khan, Anam, Bilal Mehmood, and Ali Sair Shrafat. 2015. The variable elasticity of substitution production function: A case study for Pakistani banking sector. Science International (Lahore) 27: 6349–52. [Google Scholar]

- Khuc, Van Quy, and Tran Quang Bao. 2016. Identifying the determinants of forestry growth during the 2001–2014 period. Journal of Agriculture and Rural Development 12: 2–9. [Google Scholar]

- Klump, Rainer, and Harald Preissler. 2000. CES production functions and economic growth, Scandinavian. Journal of Economics 102: 41–56. [Google Scholar]

- Klump, Rainer, and Olivier de La Grandville. 2000. Economic growth and the elasticity of substitution: Two theorems and some suggestions. The American Economic Review 90: 282–91. [Google Scholar] [CrossRef]

- Kornai, Janos. 2006. The great transformation of Central Eastern Europe: Success and disappointment. Economics of Transition and Institutional Change 14: 207–44. [Google Scholar] [CrossRef]

- Kreinovich, Vladik, Nguyen Ngoc Thach, Nguyen Duc Trung, and Dang Van Thanh, eds. 2019. Beyond Traditional Probabilistic Methods in Economics. Cham: Springer. [Google Scholar]

- Lemoine, Nathan P. 2019. Moving beyond noninformative priors: Why and how to choose weakly informative priors in Bayesian analyses. Oikos 128: 912–28. [Google Scholar] [CrossRef]

- Lovell, CA Knox. 1968. Capacity utilization and production function estimation in postwar American manufacturing. Quarterly Journal of Economics 82: 219–39. [Google Scholar] [CrossRef]

- Lovell, CA Knox. 1973a. CES and VES production functions in a cross-section context. Journal of Political Economy 81: 705–20. [Google Scholar]

- Lovell, CA Knox. 1973b. Estimation and prediction with CES and VES production functions. International Economic Review 14: 676–92. [Google Scholar] [CrossRef]

- Lu, Y., and L. B. Fletcher. 1968. A generalization of the CES production function. Review of Economics and Statistics 50: 449–52. [Google Scholar] [CrossRef]

- McFadden, Daniel. 1978. Estimation Techniques for the Elasticity of Substitution and Other Production Parameters. North Holland. Contributions to Economic Analysis 2: 73–123. [Google Scholar]

- Meyer, Robert A., and K. R. Kadiyala. 1974. Linear and nonlinear estimation of production functions. Southern Economic Journal 40: 463–72. [Google Scholar] [CrossRef]

- Michetti, Elisabetta. 2013. Complex attractors and basins in a growth model with nonconcave production function and logistic population growth rate. Mathematics and Computers in Simulation 108. [Google Scholar] [CrossRef]

- Miller, Eric. 2008. An Assessment of CES and Cobb-Douglas Production Functions, Congressional Budget Office. Available online: https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/94xx/doc9497/2008-05.pdf (accessed on 11 January 2020).

- Mygind, Niels. 2007. Transition from Plan to Market: An Overview. CEES, Copenhagen Business School. Working Paper/Center for East European Studies. Copenhagen Business School, 63. Available online: https://research-api.cbs.dk/ws/portalfiles/portal/59009083/7067.pdf (accessed on 9 July 2020).

- Nerlove, Marc. 1967. Recent Empirical Studies of the CES and Related Production Functions. The Theory and Empirical Analysis of Production 31: 55–136. [Google Scholar]

- Nguyen, Hung T., and Nguyen Ngoc Thach. 2018. A Panorama of Applied Mathematical Problems in Economics. Thai Journal of Mathematics, Special Issue: Annual Meeting in Mathematics 17: 1–20. [Google Scholar]

- Nguyen, Hung T., and Nguyen Ngoc Thach. 2019. A Closer Look at the Modeling of Economics Data. In Beyond Traditional Probabilistic Methods in Economics, ECONVN 2019, Studies in Computational Intelligence. Edited by V. Kreinovich, N. Thach, N. Trung and D. Van Thanh. Cham: Springer, vol. 809. [Google Scholar] [CrossRef]

- Nguyen, Hung T., Nguyen Duc Trung, and Nguyen Ngoc Thach. 2019a. Beyond Traditional Probabilistic Methods in Econometrics. In Beyond Traditional Probabilistic Methods in Economics, ECONVN 2019, Studies in Computational Intelligence. Edited by Vladik Kreinovich, Nguyen Ngoc Thach, Nguyen Duc Trung and Dang Van Thanh. Cham: Springer, vol. 809. [Google Scholar] [CrossRef]

- Nguyen, Hung T., Songsak Sriboonchitta, and Nguyen Ngoc Thach. 2019b. On Quantum Probability Calculus for Modeling Economic Decisions. In Structural Changes and their Econometric Modeling, TES 2019, Studies in Computational Intelligence. Edited by V. Kreinovich and S. Sriboonchitta. Cham: Springer, vol. 808, pp. 18–34. [Google Scholar] [CrossRef]

- Nguyen, Q. H. 2013. Sources of province Hung Yens economic growth. Journal of Economic Development 275: 28–39. [Google Scholar]

- Palivos, Theodore, and Giannis Karagiannis. 2004. The Elasticity of Substitution in Convex Models of Endogenous Growth. Unpublished Manuscript. [Google Scholar]

- Paul, Saumik. 2019. Labour Income Share Dynamics with Variable Elasticity of Substitution. Discussion Paper Series, IZA DP No. 12418. Available online: http://ftp.iza.org/dp12418.pdf (accessed on 11 January 2020).

- Pereira, Claudiney M. 2003. Empirical Essays on the Elasticity of Substitution, Technical Change, and Economic Growth. Ph.D. dissertation, North Carolina State University, Raleigh, NC, USA. [Google Scholar]

- Pham, Le Thong, and Phuong Thuy Ly. 2016. Technical efficiency of Vietnamese manufacturing enterprises. Journal of Economics and Development 229: 43–51. [Google Scholar]

- Pinheiro, José, and Douglas Bates. 2000. Mixed-Effects Models in S and S-PLUS. New York: Springer. [Google Scholar]

- Pitchford, John D. 1960. Growth and the elasticity of substitution. Economic Record 36: 491–503. [Google Scholar] [CrossRef]

- Revankar, Nagesh S. 1971a. A class of variable elasticity of substitution production functions. Econometrica 39: 61–71. [Google Scholar] [CrossRef]

- Revankar, Nagesh S. 1971b. Capital-labour substitution, technological change, and economic growth: The U.S. experience, 1929–1953. Metroeconomica 23: 154–76. [Google Scholar] [CrossRef]

- Roberts, Gareth O., and Jeffrey S. Rosenthal. 2001. Optimal scaling for various Metropolis-Hastings algorithms. Statistical Science 16: 351–67. [Google Scholar] [CrossRef]

- Romer, Paul M. 1986. Increasing Returns and Long-Run Growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Romer, Paul M. 1987. Crazy Explanations for the Productivity Slowdown. In NBER Macroeconomics Annual. Cambridge: MIT Press. [Google Scholar]

- Roskamp, Karl W. 1977. Labour productivity and the elasticity of factor substitution in West Germany industries. Review of Economics and Statistics 59: 366–71. [Google Scholar] [CrossRef]

- Sato, Ryuzo, and Ronald F. Hoffman. 1968. Production functions with variable elasticity of substitution: Some analysis and testing. Review of Economics and Statistics 50: 453–60. [Google Scholar] [CrossRef]

- Sinelnikov-Murylev, Sergey, Sergey Drobyshevsky, Maria Kazakova, and Michael Alexeev. 2015. Decomposition of Russian GDP Growth Rates. Moscow: Gaidar Institute. [Google Scholar]

- Sriboonchitta, Songsak, Hung T. Nguyen, Olga Kosheleva, Vladik Kreinovich, and Thach Ngoc Nguyen. 2019. Quantum Approach Explains the Need for Expert Knowledge: On the Example of Econometrics. In Structural Changes and Their Econometric Modeling, TES 2019, Studies in Computational Intelligence. Edited by Vladik Kreinovich and Songsak Sriboonchitta. Cham: Springer, vol. 808. [Google Scholar] [CrossRef]

- Starbuck, William H. 2006. The Production of Knowledge. The Challenge of Social Science Research. New York: Oxford University Press. [Google Scholar]

- Svítek, Miroslav, Olga Kosheleva, Vladik Kreinovich, and Thach Ngoc Nguyen. 2019. Why Quantum (Wave Probability) Models Are a Good Description of Many Non-quantum Complex Systems, and How to Go Beyond Quantum Models. In Beyond Traditional Probabilistic Methods in Economics, ECONVN 2019, Studies in Computational Intelligence. Edited by V. Kreinovich, N. Thach, N. Trung and D. Van Thanh. Cham: Springer, vol. 809. [Google Scholar] [CrossRef]

- Thach, Nguyen Ngoc, Anh Le Hoang, and An Pham Thi Ha. 2019. The Effects of Public Expenditure on Economic Growth in Asia Countries: A Bayesian Model Averaging Approach. Asian Journal of Economics and Banking 3: 126–49. [Google Scholar]

- Thach, Nguyen Ngoc. 2020a. The Variable Elasticity of Substitution Function and Endogenous Growth: An Empirical Evidence from Vietnam. International Journal of Economics and Business Administration VIII: 263–77. [Google Scholar] [CrossRef]

- Thach, Nguyen Ngoc. 2020b. How to Explain when the ES is Lower than One? A Bayesian Nonlinear Mixed-effects Approach. Journal of Risk and Financial Management 13: 21. [Google Scholar] [CrossRef]

- Thach, Nguyen Ngoc. 2020c. Endogenous Economic Growth: The Arrow-Romer Theory and a Test on Vietnamese Economy. WSEAS Transactions on Business and Economics 17: 374–86. [Google Scholar] [CrossRef]

- Tsang, Herbert H. 1976. A generalized model for the CES-VES family of production function. Metroeconomica 28: 107–18. [Google Scholar] [CrossRef]

- Tu, Thai Giang, and Phuc Tho Nguyen. 2012. Using the Cobb-Douglas to analyze the impact of inputs on coffee productivity in province DakLak. Journal of Economics and Development 8: 90–93. [Google Scholar]

- Tuan, Tran Anh, Vladik Kreinovich, and Thach Ngoc Nguyen. 2019. Decision Making Under Interval Uncertainty: Beyond Hurwicz Pessimism-Optimism Criterion. In Beyond Traditional Probabilistic Methods in Economics, ECONVN 2019, Studies in Computational Intelligence. Edited by Vladik Kreinovich, Nguyen Ngoc Thach, Nguyen Duc Trung and Dang Van Thanh. Cham: Springer, vol. 809. [Google Scholar] [CrossRef]

- Woodruff, Christopher. 2004. Symposium on Transition in Vietnam. Economics of Transition and Institutional Change 12: 193–97. [Google Scholar] [CrossRef]

- Zellner, Arnold, and Hang Ryu. 1998. Alternative functional forms for production, cost and returns to scale functions. Journal of Applied Econometrics 13: 101–27. [Google Scholar] [CrossRef]

| 1990–1999 | 2000–2009 | 2010–2019 | 1990–2019 | |

|---|---|---|---|---|

| Real GDP | 0.0775713 | 0.06785719 | 0.06204859 | 0.0689003 |

| Capital | 0.1211347 | 0.09988975 | 0.07306745 | 0.0970314 |

| Labour | 0.024393 | 0.02039086 | 0.0125189 | 0.0192668 |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Real GDP (gdp) | 30 | 342,900.7 | 185,052.5 | 106,419.8 | 734,854.3 |

| Capital (K) | 30 | 881,396.3 | 615,966.8 | 151,858.5 | 2,227,366 |

| Labour (L) | 30 | 4.58 × 107 | 7,822,043 | 3.29 × 107 | 5.72 × 107 |

| Parameter | Transition Stage | Mean | Std. Dev. | MCSE | Median | Probability of Mean >0 | Equal-Tailed [95% Cred. Interval] |

|---|---|---|---|---|---|---|---|

| alpha | 1990–1999 | 0.7004347 | 0.2064727 | 0.01541 | 0.739583 | 1 * | 0.2774297, 0.987269 |

| b0 | 1.237738 | 0.3356832 | 0.048401 | 1.312661 | 0.99 | 0.3298835, 1.6785 | |

| beta | 0.7798368 | 0.6317611 | 0.049588 | 0.7062168 | 0.91 | −0.085491, 0.149432 | |

| epsilon | 0.7174294 | 0.1035089 | 0.01572 | 0.6879733 | 0.97 ** | 0.6080182, 0.014937 | |

| sig2_0 | 0.0009322 | 0.0006678 | 0.000015 | 0.0007618 | 1 | 0.000317, 0.0026863 | |

| alpha | 2000–2009 | 0.5996914 | 0.2338747 | 0.042459 | 0.583051 | 1 * | 0.2167813, 0.9784832 |

| b0 | 1.115017 | 0.186176 | 0.023994 | 1.137348 | 1 | 0.6282, 1.426625 | |

| beta | 0.7794099 | 0.608169 | 0.068298 | 0.6240513 | 0.98 | 0.00798062, 0.303366 | |

| epsilon | 0.7520055 | 0.0742376 | 0.015827 | 0.7319812 | 0.99 ** | 0.6639818, 0.9548205 | |

| sig2_0 | 0.0004123 | 0.0002971 | 9.0 × 10−6 | 0.0003354 | 1 | 0.0001424, 0.0011015 | |

| alpha | 2010–2019 | 0.6190902 | 0.221302 | 0.041054 | 0.6059595 | 1 * | 0.2574442, 0.9827137 |

| b0 | 0.1127431 | 0.2717961 | 0.029972 | 0.118131 | 0.69 | −0.4590531, 0.633356 | |

| beta | 0.9196118 | 0.5319415 | 0.036116 | 0.8015926 | 0.999 | 0.1480791 2, 0.192505 | |

| epsilon | 0.8833604 | 0.0478443 | 0.00907 | 0.8800785 | 0.98 ** | 0.7983294, 0.9996468 | |

| sig2_0 | 0.0004738 | 0.0004458 | 0.000015 | 0.0003676 | 1 | 0.0001611, 0.0013634 |

| Parameter | Transition Stage | Acceptance Rate | Efficiency | Corr. Time |

|---|---|---|---|---|

| alpha | 1990–1999 | 0.45 | 0.0898 | 11.14 |

| b0 | 0.0241 | 41.58 | ||

| beta | 0.0812 | 12.32 | ||

| epsilon | 0.0217 | 46.13 | ||

| sig2_0 | 1.0000 | 1.00 | ||

| alpha | 2000–2009 | 0.35 | 0.0152 | 65.92 |

| b0 | 0.0301 | 33.22 | ||

| beta | 0.0396 | 25.22 | ||

| epsilon | 0.0110 | 90.90 | ||

| sig2_0 | 0.5398 | 1.85 | ||

| alpha | 2010–2019 | 0.33 | 0.0145 | 68.83 |

| b0 | 0.0411 | 24.32 | ||

| beta | 0.1085 | 9.22 | ||

| epsilon | 0.0139 | 71.87 | ||

| sig2_0 | 0.4719 | 2.12 |

| DIC | log(ML) | log(BF) | |

|---|---|---|---|

| Cobb-Douglas | −107.1396 | 38.21688 | - |

| CES | −105.3526 | 35.84787 | −2.36901 |

| VES | −291.276 | 53.21536 | 14.99848 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ngoc Thach, N. Macroeconomic Growth in Vietnam Transitioned to Market: An Unrestricted VES Framework. Economies 2020, 8, 58. https://doi.org/10.3390/economies8030058

Ngoc Thach N. Macroeconomic Growth in Vietnam Transitioned to Market: An Unrestricted VES Framework. Economies. 2020; 8(3):58. https://doi.org/10.3390/economies8030058

Chicago/Turabian StyleNgoc Thach, Nguyen. 2020. "Macroeconomic Growth in Vietnam Transitioned to Market: An Unrestricted VES Framework" Economies 8, no. 3: 58. https://doi.org/10.3390/economies8030058

APA StyleNgoc Thach, N. (2020). Macroeconomic Growth in Vietnam Transitioned to Market: An Unrestricted VES Framework. Economies, 8(3), 58. https://doi.org/10.3390/economies8030058