The Perceived Impact of Public Sector Corruption on Economic Performance of Micro, Small, and Medium Enterprises in a Developing Country

Abstract

1. Introduction

2. Conceptual Framework

2.1. Corrupt Practices Will Result in a Decrease in Firm Growth

2.2. Corrupt Practices Will Result in an Increase in Firm Growth

3. Material and Methods

3.1. The Data Used in This Study

- SMEs or businesses registered with the Investment Promotion Authority (IPA) and Internal Revenue Commission (IRC)

- SMEs that had loans with Bank South Pacific (BSP), which is the dominant commercial bank in PNG.

- Three to 150 paid employees,

- A maximum borrowing of PGK1.5 million and annual turnover of between PGK100,000 and PGK15 million qualified as SMEs.

3.2. Construction of the Main Variables

- 1.

- Classification of firms by size. We began by classifying the firms into MSMEs based on number of employees. In order to be to be consistent with our measure of firm growth, we used the employment-based definition provided by the Department of Trade, Commerce and Industry (2016) to classify the firms as MSMEs. Sectors such as agriculture, tourism, forestry, fisheries, and services are considered to be more labor intensive. Thus, the number of employees required in these sectors differ from manufacturing, engineering and construction sectors. The MSMEs classification according to size of employees and sector is the following:

- Micro enterprises. Firms that have fewer than five employees.

- Small enterprises. For manufacturing, engineering and construction sectors, number of employees ranges from 5 to 19, whereas for agriculture, tourism, forestry, fisheries and services it is 5 to 39 employees.

- Medium-size enterprises. For the case of manufacturing, engineering and construction sector, the number of employees is 20 to 99, whereas it is 39 to 99 for agriculture, tourism, fisheries, and services.

- In order to identify the sector that the surveyed firms, owners/and or managers of the firms were the product or services their firms provide. If they provide more than one product or service they were asked about the primary product that generated the greatest share of annual revenue. They were also asked about the number of paid employees their PNG offices, including full-time, part-time and casual.

- 2.

- Measures of growth. The survey we used had only one cross-section. However, the respondents answered the following two questions about employment, which allowed us to estimate the expected growth in employment: (1) How many employees are there in all your organization’s PNG offices, including full-time, part-time and casual? (2) Approximately how many new jobs will you provide in the next 12 months?

- 3.

- Corruption obstacle. The survey question asked respondents to judge to what extent government corruption is an obstacle to business expansion or performance. We first coded the possible responses to this question on a 4-point scale as: 0 = Not an obstacle, 1 = Minor (small) obstacle, 2 = Moderate (middle) obstacle, and 3 = Major (big) obstacle. These scores indicate the respondents’ perception of both absolute and relative magnitudes of the severity of government corruption to business performance and expansion. As Levy (1993) has argued, a ranking in the 0–1 range signifies judgement that the absolute severity of government corruption is somewhat negligible; yet, an identical perception of relative severity of the same obstacle may have been ranked by another respondent in the 2–3 range. In such circumstances, nothing useful for policy can be gleaned from differences among entrepreneurs in their perceptions of the absolute magnitude of government corruption as an obstacle (Levy 1993). We therefore constructed the measure of government corruption obstacle, designated Corruption, by collapsing the four responses (“Not an obstacle”, “Minor (small) obstacle”, “Moderate (middle) obstacle”, and “Major (big) obstacle”) into a bivariate variable set equal to 1 if a respondent answered that government corruption was a moderate or major obstacle, and zero otherwise. So, the normalized scores along the scale of 0–1 measures the average difference between respondents who judged the effect of government corruption as least severe and those that judged the effect of government corruption as most severe.

- 4.

- Infrastructure obstacles. The survey contained several other different perceived obstacles to SME performance and expansion, four of which are related to infrastructure variables, namely electricity, water/sewerage, telecommunications and transport. The possible responses to the question of how big each obstacle was on a 4-point scale were: 0 = Not an obstacle, 1 = Minor (small) obstacle, 2 = Moderate (middle) obstacle, and 3 = Major (big) obstacle. The correlation between the electricity obstacle and two of the obstacles was quite high, ρ = 0.68 for water/sewerage and ρ = 0.55 for telecommunications. The correlation between water/sewerage and telecommunication services was also quite high (ρ = 0.53), but the correlation between the transportation obstacle and the other three infrastructure obstacles were somewhat low (ρ = 0.18 for electricity, ρ = 0.22 for water/sewerage, and ρ = 0.13 for telecommunications). Thus, these infrastructure obstacle variables represent distinct but connected measures of the perception about infrastructure as an obstacle to SME operation and expansion. The first principal component (with weights of 0.501, 0.513, 0.483, and 0.191) constructed for the set of 4-point scale responses for each of the four variables explained 56.41 percent of their overall variation. Therefore, we summarized the four sets of responses by averaging the degree of severity of each infrastructure obstacle. The resulting infrastructure obstacle measure for a given firm, designated Infrastructure, is an ordinal estimate of the severity of the infrastructure obstacle and has a maximum value of three and a minimum value of zero. As Table A1 in the Appendix A shows, the dispersion of Infrastructure is nearly similar for all firm sizes in the sample, suggesting homogeneity in firms’ perceptions about infrastructure as an obstacle to MSMEs.

- 5.

- Regulatory policy obstacles. Like infrastructure-related obstacles, this variable was first constructed as the average degree of the severity of regulatory policy obstacles related to government regulations, tax rates and crime/security for the firm. The severity of each of these obstacles was judged on a 4-point scale: 0 = Not an obstacle, 1 = Minor (small) obstacle, 2 = Moderate (middle) obstacle, and 3 = Major (big) obstacle. The correlation between government regulation and tax rates was high (ρ = 0.40), but the correlation between crime/security and the other two variables was low (ρ = 0.22 for government regulation and ρ = 0.16 for tax rates). However, the first principal component (with weights of 0.564, 0.526, and 0.379) constructed for the set of 4-point scale responses for each of the three variables explains 50.9 percent of their overall variation. We therefore summarized the four sets of responses by averaging the degree of severity of each regulatory policy obstacle, with the resulting measure, designated Regulation, being an ordinal estimate of the severity of the regulatory policy obstacle with a maximum value of three and a minimum value of zero. Table A1 in the Appendix A shows a relatively lower dispersion in the perception about regulatory policies as an obstacle to doing business among the medium-size firms, compared to their micro- and small-size counterparts.

3.3. The Empirical Model

4. Results

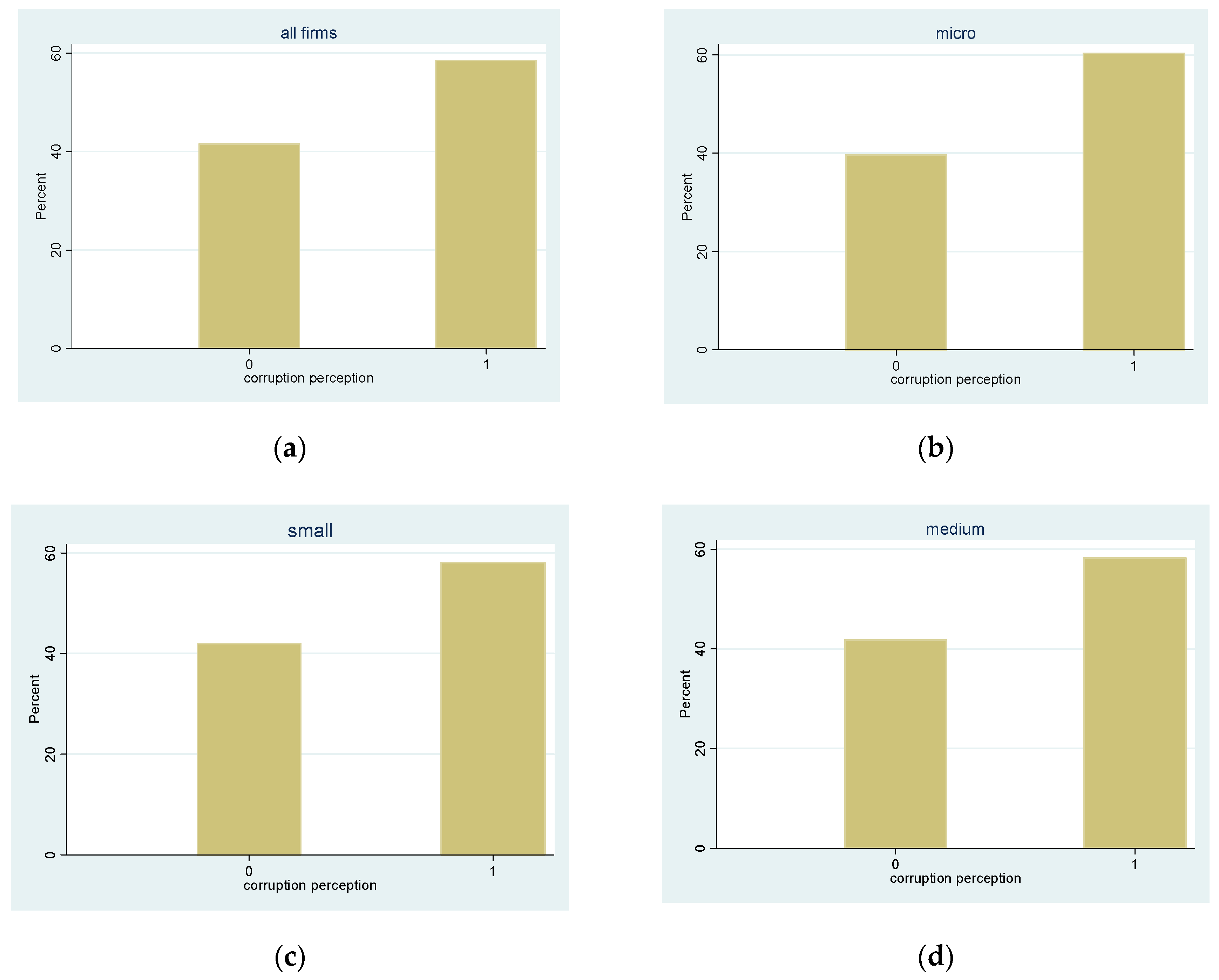

4.1. Data Used for Analysis and Managers/Owners Perception of Corruption

4.2. Econometric Estimates

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Name of Variable | Definition |

|---|---|

| Dependent Variable | |

| Growth | Growth in employment, calculated as the absolute change in the number of people employed between 2012 and 2013 relative to the average size of the firm across the two periods. Employment in 2012 is the number of a firm’s employees in PNG offices. Employment in 2013 is number of employees in 2012 plus estimated number of new jobs a firm will provide in the next 12 months. |

| Endogenous Variables | |

| corruption obstacle | Firm-level corruption obstacle. Binary variable taking the value of 1 if corruption obstacle is moderate or major, 0 otherwise. |

| infrastructure obstacle | Firm-level infrastructure obstacle. Average score of degree of infrastructure obstacle (related to electricity, water and sewerage, telecommunications and transport) for the firm. Severity of each obstacle is judged on a four-point scale: 0 = Not an obstacle, 1 = Minor (small) obstacle, 2 = Moderate (middle) obstacle, 3 = Major (big) obstacle |

| regulatory obstacle | Firm-level regulatory policy obstacles. Average score of degree of regulatory policy obstacle (related to government regulation, tax rates and crime/security) for the firm. Severity of each obstacle is judged on a four-point scale: 0 = Not an obstacle, 1 = Minor (small) obstacle, 2 = Moderate (middle) obstacle, 3 = Major (big) obstacle |

| Instrumental Variables | |

| industry/sector corruption obstacle | Average location-industry/sector corruption obstacle |

| industry/sector infrastructure obstacle | Average location-industry/sector infrastructure obstacle |

| industry/sector regulatory obstacle | Average location-industry/sector regulatory policy obstacle |

| Control Variables/Additional Instruments | |

| Firm size (log employment) | Total employment in 2012, in logarithm |

| Firm age (log age of firm in years) | Number of years the business has been going for, in logarithm. Age of firm is the number of years the business has been going for since the year it was established. |

| Export-import trade | Trivalent variable taking the value of 2 if a firm spent a percentage of annual sales/turnover to both import purchases from overseas and generated a fraction annual sales/turnover from export sales, 1 if a percentage of sales/turnover was spent on either import purchases or generated from export sales, and 0 otherwise |

| % of firm shares owned by foreigners | % of firm owned by private foreign individuals or organizations |

| K/L ratio (log fixed assets per employee) | Total value of fixed assets divided by number of employees, both in 2012, in logarithm. Fixed assets consist of land, buildings and machinery. |

| Dominant business type (Sole trader) | Binary variable taking the value of 1 if firm is sole proprietorship, 0 otherwise |

| Gender of top management | Binary variable taking the value of 1 if the composition a firm’s top managers are men or more than 50% men or all men (i.e., no women), 0 otherwise |

| Dominant sector (Retail) | Binary variable taking the value of 1 if the firm belongs to the dominant sector, which is retail trade with more than 50% of all firms, 0 otherwise |

| Indigenous | Nationality of largest owner. Binary variable taking the value of 1 if indigenous Papua New Guineans are the current largest owners of the firm, 0 otherwise |

| Region dummy | Region dummy variable, taking the value of one (1) if region is Southern, zero (0) otherwise |

| Location dummy | Location dummy variable, taking the value of one (1) if location is Urban, zero (0) otherwise |

| Region fixed effects | Categorical variable: Southern = 1, Momase = 2, Highlands = 3, Islands = 4 |

| Location fixed effects | Categorical variable: Urban = 1, Rural = 2, Remote = 3 |

| Sector fixed effects | Two-digit International Standard Industrial Classification (ISIC) level, Categorical: A = 1, B = 2, …, Q = 17 |

| Size of firm in 2012 | Categorical variable taking the values of 1, 2, 3 and 4 if a firm is, respectively, micro, small, medium and large enterprise based on employment threshold set by the government of PNG. |

| Firm life cycle | Firm growth life cycle fixed effects—partitions the sample of firms into three different age categories from young to old: 0–4 (young), 5–9 (middle-age), 10+ (mature age) years |

References

- Abed, George T., and Sanjeev Gupta. 2002. Governance, Corruption and Economic Performance. Washington: International Monetary Fund. [Google Scholar]

- Acemoglu, Daron, and James Robinson. 2012. Why Nations Fail: The Origins of Power. New York: Crown Publishers. [Google Scholar]

- Allingham, Michael G., and Agnar Sandmo. 1972. Income tax evasion: A theoretical analysis. Journal of Public Economics 1: 323–38. [Google Scholar] [CrossRef]

- Asiedu, Elizabeth, and James Freeman. 2009. The Effect of Corruption on Investment Growth: Evidence from Firms in Latin America, Transition Countries. Lawrence: Department of Economics, University of Kansas. [Google Scholar]

- Athanasouli, Daphne, Antoine Goujard, and Pantelis Sklia. 2012. Corruption and firm performance: Evidence from Greek firms. International Journal of Economic Sciences and Applied Research 5: 43–67. [Google Scholar]

- Ayaydin, Hasan, and Pınar Hayaloglu. 2014. The effect of corruption on firm growth: Evidence from firms in Turkey. Asian Economic and Financial Review 4: 607–24. [Google Scholar]

- Begovic, Boris. 2005. Corruption: Concepts, Types, Causes and Consequences. Buenos Aires: Center for the Opening and Development of Latin America (CADAL). [Google Scholar]

- Blagojevic, Sandra, and Jože P. Damijan. 2012. Impact of Private Incidence of Corruption and Firm Ownership on Performance of Firms in Central and Eastern Europe (LICOS Discussion Paper 310/2012). Leuven: Centre for Institutions and Economic Performance. [Google Scholar]

- Braithwaite, Valerie. 2009. Defiance in Taxation and Governance: Resisting and Dismissing Authority in a Demoncracy. Cheltenham: Edward Elgar. [Google Scholar]

- Daunfeldt, Sven-Olov, Niklas Elert, and Dan Johansson. 2014. The economic contribution of high-growth firms: Do policy implications depend on the choice of growth indicator? Journal of Industry, Competition and Trade 14: 337–65. [Google Scholar] [CrossRef]

- Choi, Jin-Wook. 2009. Institutional structures and effectiveness of anti corruption agencies: A comparative analysis of South Korea and Hong Kong. Asian Journal of Political Science 17: 195–200. [Google Scholar] [CrossRef]

- De Castro, Julio O., Susanna Khavul, and Garry D. Bruton. 2014. Shades of grey: How do informal firms navigate between macro and meso institutional environments? Strategic Entrepreneurship Journal 8: 75–94. [Google Scholar] [CrossRef]

- De Waldemar, Felipe Starosta. 2012. New products and corruption: Evidence from Indian firms. The Developing Economies 50: 268–84. [Google Scholar] [CrossRef]

- Donadelli, Michael, and Lauren Persha. 2014. Understanding emerging market equity risk premia: Industries, governance and microeconomic policy uncertainty. Research in International Business and Finance 30: 284–309. [Google Scholar] [CrossRef]

- Department of Trade, Commerce and Industry. 2016. Papua New Guinea Small and Medium Enterprises Policy 2016. Port Moresby: Government of Papua New Guinea. [Google Scholar]

- Ezebilo, Eugene E. 2011. Local participation in forest and biodiversity conservation in Nigerian rainforest. International Journal of Sustainable Development and World Ecology 18: 42–47. [Google Scholar] [CrossRef]

- Faruq, Hasan, Michael Webb, and David Yi. 2013. Corruption, bureaucracy and firm productivity in Africa. Review of Development Economics 17: 117–29. [Google Scholar] [CrossRef]

- Fishbein, Martin, and Icek Ajzen. 1975. Belief, Attitude, Intention and Behaviour: An Introduction to Theory and Research. Reading: Addison-Wesley. [Google Scholar]

- Fisman, Raymond, and Jakob Svensson. 2007. Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics 83: 63–75. [Google Scholar] [CrossRef]

- Francisco, Manuela, and Nicola Pontara. 2007. Does Corruption Impact on Firms’ Ability to Conduct Business in Mauritania? Evidence from Investment Climate Survey Data. Policy Research Working paper. Washington: The World Bank. [Google Scholar]

- Gaviria, Alejandro. 2002. Assessing the effects of corruption and crime on firm performance: evidence from Latin America. Emerging Markets Review 3: 245–68. [Google Scholar] [CrossRef]

- Gbetnkom, Daniel. 2017. Corruption and small and medium sized enterprise growth in Cameroon. In Inclusive Growth in Africa: Polices, Practice and Lessons Learnt. Edited by Steve Kayizzi-Mugerwa, Abebe Shimeles, Angela Lusigi and Ahmed Moummi. New York: Routledge, pp. 37–58. [Google Scholar]

- Greene, William H. 2003. Econometric Analysis, 5th ed. Prentice Hall: Upper Saddle River. [Google Scholar]

- Hanousek, Jan, Anastasiya Shamshur, and Jiri Tresl. 2017. Firm efficiency, foreign ownership and CEO gender in corrupt environments. Journal of Corporate Finance. [Google Scholar] [CrossRef]

- Hardoon, Deborah, and Finn Heinrich. 2013. Global Corruption Barometer. Berlin: Transparency International. [Google Scholar]

- Helmke, Gretchen, and Steven Levitsky. 2004. Informal institutions and comparative politics: A research agenda. Perspectives on Politics 2: 725–40. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Amos Tversky. 1979. Prospect theory: An analysis of decision under risk. Econometrica 47: 263–92. [Google Scholar] [CrossRef]

- Kenny, Charles. 2007. Corruption, Construction and Developing Countries. World Bank Policy Research Working paper 4271. Washington: World Bank. [Google Scholar]

- Kirchler, Erich, Erik Hoelzl, and Ingrid Wahl. 2008. Enforced versus voluntary tax compliance: The slippery slope framework. Journal of Economic Psychology 29: 210–25. [Google Scholar] [CrossRef]

- Leff, Nathaniel H. 1964. Economic development through bureaucratic corruption. American Behavioural Scientist 8: 8–14. [Google Scholar] [CrossRef]

- Levy, Brian. 1993. Obstacles to developing indigenous small and medium enterprises: An empirical assessment. The World Bank Economic Review 7: 65–83. [Google Scholar] [CrossRef]

- Mendez, Fabio, and Facundo Sepulveda. 2006. Corruption, growth and political regimes: Cross country evidence. European Journal of Political Economy 22: 82–98. [Google Scholar] [CrossRef]

- Meon, Pierre-Guillaume, and Khalid Sekkat. 2005. Does corruption grease or sand the wheels of growth? Public Choice 122: 69–97. [Google Scholar] [CrossRef]

- Payani, Hela Hengene. 2000. Selected problems in the Papua New Guinean Public Service. Asian Journal of Public Administration 22: 135–60. [Google Scholar] [CrossRef]

- Qian, Jun, and Philip E. Strahan. 2007. How laws and institutions shape financial contracts: The case of bank loans. Journal of Finance 62: 2803–34. [Google Scholar] [CrossRef]

- Reyes, José-Daniel. 2018. Effects of FDI on High Growth Firms in Developing Countries. Washington: World Bank. [Google Scholar]

- Sharma, Chandan, and Arup Mitra. 2015. Corruption, governance and firm performance: Evidence from Indian enterprises. Journal of Policy Modeling 37: 835–51. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1993. Corruption. The Quarterly Journal of Economics 108: 599–617. [Google Scholar] [CrossRef]

- Tanzi, Vito, and Hamid R. Davoodi. 2000. Corruption, Growth, and Public Finances. IMF Working paper 182. Washington: International Monetary Fund. [Google Scholar]

- Trading Economics. 2018. Ease of Doing Business in Papua New Guinea. Available online: https://tradingeconomics.com/papua-new-guinea/ease-of-doing-business (accessed on 27 July 2019).

- Tebbutt Research. 2014. Report for SME Baseline Survey for the Small Medium Enterprise Access to Finance Project. Port Moresby: Department of Trade, Commerce and Industry. [Google Scholar]

- van den Berg, Paul, and Niels Noorderhaven. 2016. A users’ perspective on corruption: SMEs in the hospitality sector in Kenya. African Studies 75: 114–32. [Google Scholar] [CrossRef]

- Vial, Virginie, and Julien Hanoteau. 2010. Corruption, manufacturing plant growth and the Asian paradox: Indonesian evidence. World Development 38: 693–705. [Google Scholar] [CrossRef]

- Walton, Grant W. 2009. Rural People’s Perceptions of Corruption in Papua New Guinea. Port Moresby: Transparency International Papua New Guinea. [Google Scholar]

- Walton, Grant W. 2015. Defining corruption where the state is weak: The case of Papua New Guinea. The Journal of Development Studies 51: 15–31. [Google Scholar] [CrossRef]

- Walton, Grant W. 2016. Silent screams and muffled cries: The ineffectiveness of anti-corruption measures in Papua New Guinea. Asian Education and Development Studies 5: 211–26. [Google Scholar] [CrossRef]

- Wang, Yuanyuan, and Jing You. 2012. Corruption and firm growth: Evidence from China. China Economic Review 23: 415–33. [Google Scholar] [CrossRef]

- The World Bank. 2018. Global Investment Competitiveness Report 2017/2018: Foreign Investor Perspectives and Policy Implications. Washington: IBRD/The World Bank. [Google Scholar]

- Williams, Colin C., and Ioana Horodnic. 2015. Explaining the prevalence of the informal economy in the Baltics: An institutional asymmetry perspective. European Spatial Research and Policy 22: 127–44. [Google Scholar] [CrossRef]

- Williams, Colin C., and Alvaro Martinez-Perez. 2016. Evaluating the impacts of corruption on firm performance in developing economies: An institutional perspective. International Journal of Business and Globalisation 16: 401–22. [Google Scholar]

- Williams, Colin C., and Muhammad Shahid. 2016. Informal entrepreneurship and institutional theory: Explaining the varying degrees of (in) formalisation of entrepreneurs in Pakistan. Entrepreneurship and Regional Development 28: 1–25. [Google Scholar] [CrossRef]

- Woolford, Don. 1976. Papua New Guinea: Initiation and Independence. Brisbane: University of Queensland Press. [Google Scholar]

| Variable | OLS Regressions | IV-2SLS Regressions | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Corruption obstacle | 0.040 * (1.69) | 0.042 * (1.75) | 0.070 (1.38) | 0.087 * (1.66) |

| Infrastructure obstacle | 0.008 (0.62) | 0.008 (0.58) | 0.011 (0.48) | 0.014 (0.59) |

| Regulatory obstacle | −0.030 ** (−2.03) | −0.028 * (−1.87) | −0.105 ** (−4.02) | −0.112 *** (−4.02) |

| Firm size (log employment) | −0.137 *** (−3.97) | −0.230 *** (−4.23) | −0.136 *** (−3.85) | −0.239 *** (−4.34) |

| Firm age (log age of firm in years) | 0.050 * (1.66) | 0.065 (1.02) | 0.054 * (1.75) | 0.062 (0.97) |

| Export-import trade | 0.010 (0.48) | 0.024 (1.09) | 0.014 (0.64) | 0.026 (1.17) |

| % of firm shares owned by foreigners | −0.001 (−1.36) | −0.001 (−1.57) | −0.001 (−1.17) | −0.001 (−1.33) |

| K/L ratio (log fixed asset per employee) | 0.070 *** (4.63) | 0.068 *** (4.53) | 0.066 *** (4.25) | 0.063 *** (4.15) |

| Dominant business type (sole trader) | 0.027 (1.01) | 0.008 (0.31) | 0.029 (1.06) | 0.008 (0.30) |

| Gender of top management (dummy) | 0.027 (1.24) | 0.018 (0.84) | 0.033 (1.51) | 0.025 (1.14) |

| Dominant sector (retail) | −0.014 (−0.65) | −0.017 (−0.79) | -0.016 (-0.73) | −0.016 (−0.72) |

| Indigenous | 0.051 (1.12) | 0.035 (0.76) | 0.051 (1.11) | 0.042 (0.91) |

| Constant | 0.055 (0.54) | 0.346 ** (1.99) | 0.154 (1.39) | 0.326 * (1.68) |

| Dummy variables included | No | Yes | No | Yes |

| No. of observations | 981 | 981 | 981 | 981 |

| R2 | 0.108 | 0.146 | 0.082 | 0.116 |

| F test [p value] | 9.81 *** [0.000] | 7.98 *** [0.000] | – | – |

| χ2 test [p value] | – | – | 127.18 *** [0.000] | 173.52 *** [0.000] |

| Variable | OLS Regressions | IV-2SLS Regressions | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Corruption obstacle | 0.127 ** (2.07) | 0.092 (1.51) | 0.202 (1.52) | 0.109 (0.80) |

| Infrastructure obstacle | −0.019 (−0.56) | 0.006 (0.16) | −0.024 (−0.46) | 0.019 (0.33) |

| Regulatory obstacle | −0.065 * (−1.76) | −0.079 * (−2.13) | −0.110 * (−1.88) | −0.108 * (−1.83) |

| Firm size (log employment) | 0.496 (1.10) | 0.298 (0.65) | 0.452 (0.99) | 0.274 (0.61) |

| Firm age (log age of firm in years) | 0.076 (1.10) | 0.114 (0.75) | 0.072 (1.07) | 0.113 (0.77) |

| Export-import trade | 0.052 (0.72) | 0.058 (0.80) | 0.056 (0.79) | 0.058 (0.84) |

| Percentage of firms’ shares owned by foreigners | −0.002 (−0.83) | −0.003 (−1.00) | −0.002 (−0.83) | −0.003 (−0.96) |

| K/L ratio (log fixed asset per employee) | 0.067 * (2.00) | 0.040 (1.15) | 0.061 * (1.83) | 0.036 (1.06) |

| Dominant business type (sole trader) | −0.125 (−1.39) | −0.183 ** (−1.99) | −0.125 (−1.43) | −0.183 ** (−2.09) |

| Gender of top management (dummy) | 0.043 (0.83) | 0.029 (0.58) | 0.048 (0.95) | 0.033 (0.68) |

| Dominant sector (retail) | 0.013 (0.22) | 0.012 (0.21) | 0.022 (0.38) | 0.015 (0.26) |

| Indigenous | 0.190 (0.80) | 0.162 (0.70) | 0.186 (0.80) | 0.169 (0.76) |

| Constant | −0.336 (−0.90) | 0.083 (0.18) | −0.265* (−0.71) | 0.084 (0.18) |

| Dummy variables included | No | Yes | No | Yes |

| No. of observations | 188 | 188 | 188 | 188 |

| R2 | 0.120 | 0.211 | 0.109 | 0.116 |

| F test [p value] | 1.98 ** [0.029] | 2.37 ** [0.002] | – | – |

| Wald χ2 [p value] | – | – | 23.24 ** [0.026] | 47.74 ** [0.000] |

| Variable | OLS Regressions | IV-2SLS Regressions | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Corruption obstacle | 0.034 (1.18) | 0.032 (1.11) | 0.046 (0.77) | 0.050 (0.80) |

| Infrastructure obstacle | 0.019 (1.16) | 0.019 (1.12) | 0.016 (0.56) | 0.022 (0.74) |

| Regulatory obstacle | −0.028 (−(1.63) | −0.025 (−1.37) | −0.116 *** (−3.71) | −0.119 *** (−3.47) |

| Firm size (log employment) | −0.254 *** (−4.28) | −0.250 *** (−4.24) | −0.264 *** (−4.35) | −0.257 *** (−4.27) |

| Firm age (log age of firm in years) | 0.058 (1.50) | 0.040 (0.50) | 0.064 (1.62) | 0.053 (0.65) |

| Export-import trade | 0.005 (0.18) | 0.020 (0.77) | 0.008 (0.29) | 0.020 (0.76) |

| % of firm shares owned by foreigners | −0.001 (−1.15) | −0.001 (−1.38) | −0.001 (−0.92) | −0.001 (−1.14) |

| K/L ratio (log fixed asset per employee) | 0.068 *** (3.52) | 0.068 *** (3.55) | 0.063 *** (3.18) | 0.064 *** (3.32) |

| Dominant business type (sole trader) | 0.061 * (1.95) | 0.047 (1.49) | 0.058 * (1.83) | 0.043 (1.36) |

| Gender of top management (dummy) | 0.008 (0.32) | 0.000 (0.00) | 0.019 (0.70) | 0.013 (0.47) |

| Dominant sector (retail) | −0.027 (−1.04) | −0.030 (−1.14) | −0.027 (−1.03) | −0.026 (−1.00) |

| Indigenous | 0.004 (0.08) | 0.003 (0.06) | 0.006 (0.11) | 0.014 (0.26) |

| Constant | 0.209 (1.60) | 0.286 ** (1.98) | 0.355 *** (2.48) | 0.321 * (1.82) |

| Dummy variables included | No | Yes | No | Yes |

| No. of observations | 690 | 690 | 690 | 690 |

| R2 | 0.108 | 0.137 | 0.066 | 0.094 |

| F test [p value] | 6.81 [0.000] | 5.59 [0.000] | - | - |

| Wald χ2 [p value] | - | - | 90.16 [0.000] | 114.05 [0.000] |

| Variable | OLS Regressions | IV-2SLS Regressions | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Corruption obstacle | 0.010 (0.16) | 0.058 (0.91) | 0.113 (0.90) | 0.415 ** (2.06) |

| Infrastructure obstacle | −0.014 (−0.40) | −0.011 (−0.27) | −0.001 (−0.02) | 0.015 (0.22) |

| Regulatory obstacle | −0.033 (−0.77) | −0.032 (−0.71) | −0.044 (−0.65) | −0.131 (−1.38) |

| Firm size (log employment) | −0.189 (−1.12) | −0.288 * (−1.69) | −0.146 (−0.86) | −0.298 (−1.52) |

| Firm age (log age of firm in years) | 0.057 (0.81) | 0.129 (0.88) | 0.019 (0.26) | −0.078 (−0.40) |

| Export-import trade | 0.035 (0.67) | 0.033 (0.61) | 0.030 (0.57) | 0.050 (0.81) |

| % of firm shares owned by foreigners | 0.000 (−0.56) | 0.000 (−0.42) | 0.000 (−0.24) | 0.000 (0.27) |

| K/L ratio (log fixed asset per employee) | 0.110 *** (2.84) | 0.121 *** (3.10) | 0.118 *** (3.17) | 0.143 *** (3.30) |

| Dominant business type (sole trader) | −0.035 (−0.56) | −0.025 (−0.40) | −0.009 (−0.13) | 0.038 (0.48) |

| Gender of top management (dummy) | 0.132 ** (2.34) | 0.142 ** (2.48) | 0.115 ** (2.04) | 0.110 * (1.70) |

| Dominant sector (retail) | 0.086 (1.20) | 0.143 * 1.92 | 0.095 (1.37) | 0.195 ** (2.24) |

| Indigenous | 0.125 (1.52) | 0.195 ** 2.26 | 0.132 * (1.70) | 0.268 *** 2.62 |

| Constant | −0.139 (−0.36) | 0.039 0.09 | −0.278 (−0.71) | −0.268 (−0.52) |

| Dummy variables included | No | Yes | No | Yes |

| No. of observations | 85 | 85 | 85 | 85 |

| R2 | 0.237 | 0.342 | 0.203 | 0.011 |

| F test [p value] | 1.860 ** [0.054] | 1.78 ** [0.045] | - | - |

| Wald χ2 [p value] | - | - | 24.97 ** [0.015] | 32.90 [0.025] ** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ezebilo, E.E.; Odhuno, F.; Kavan, P. The Perceived Impact of Public Sector Corruption on Economic Performance of Micro, Small, and Medium Enterprises in a Developing Country. Economies 2019, 7, 89. https://doi.org/10.3390/economies7030089

Ezebilo EE, Odhuno F, Kavan P. The Perceived Impact of Public Sector Corruption on Economic Performance of Micro, Small, and Medium Enterprises in a Developing Country. Economies. 2019; 7(3):89. https://doi.org/10.3390/economies7030089

Chicago/Turabian StyleEzebilo, Eugene E., Francis Odhuno, and Philip Kavan. 2019. "The Perceived Impact of Public Sector Corruption on Economic Performance of Micro, Small, and Medium Enterprises in a Developing Country" Economies 7, no. 3: 89. https://doi.org/10.3390/economies7030089

APA StyleEzebilo, E. E., Odhuno, F., & Kavan, P. (2019). The Perceived Impact of Public Sector Corruption on Economic Performance of Micro, Small, and Medium Enterprises in a Developing Country. Economies, 7(3), 89. https://doi.org/10.3390/economies7030089