Bioeconomy: Markets, Implications, and Investment Opportunities

Abstract

1. Introduction

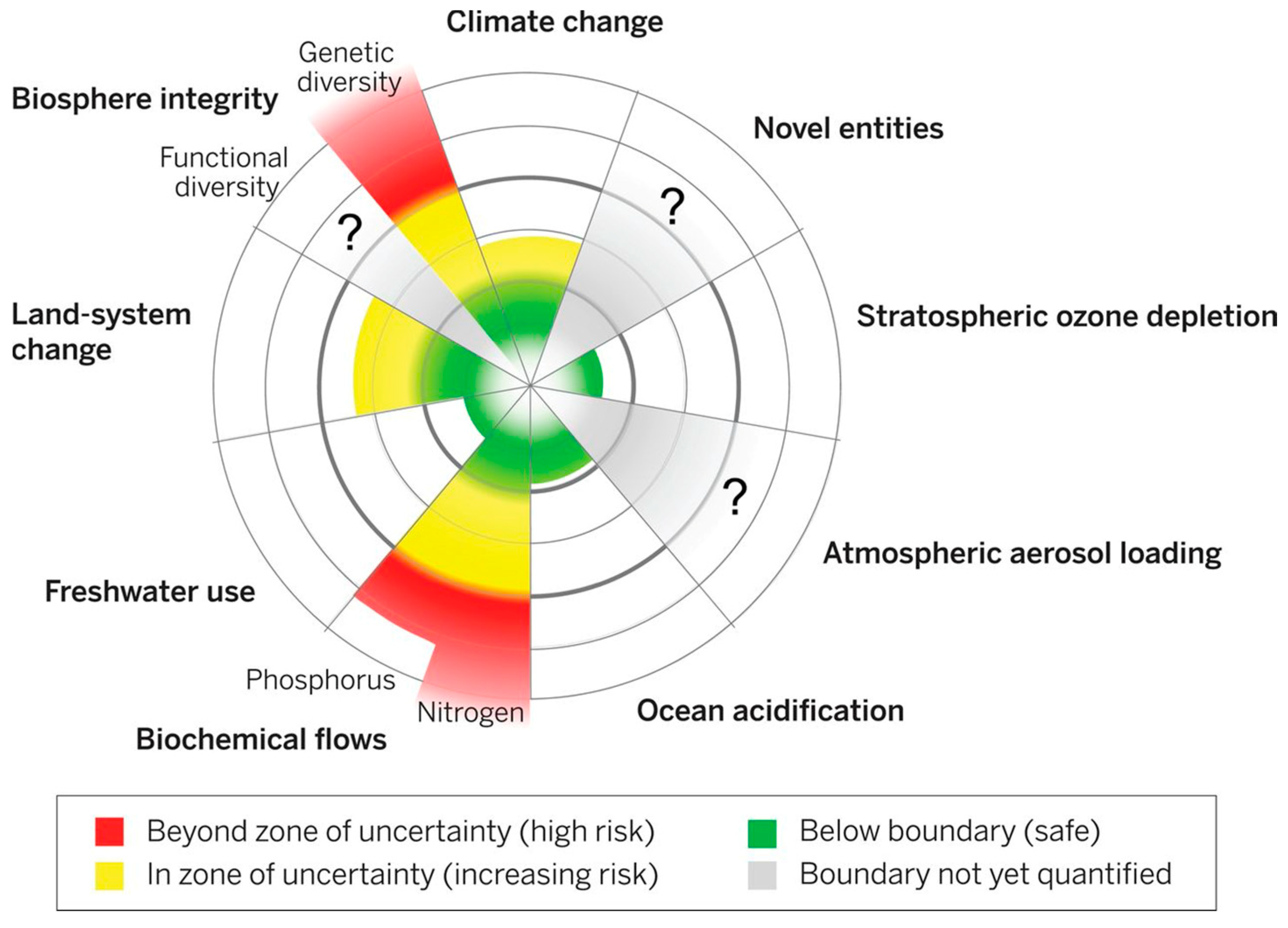

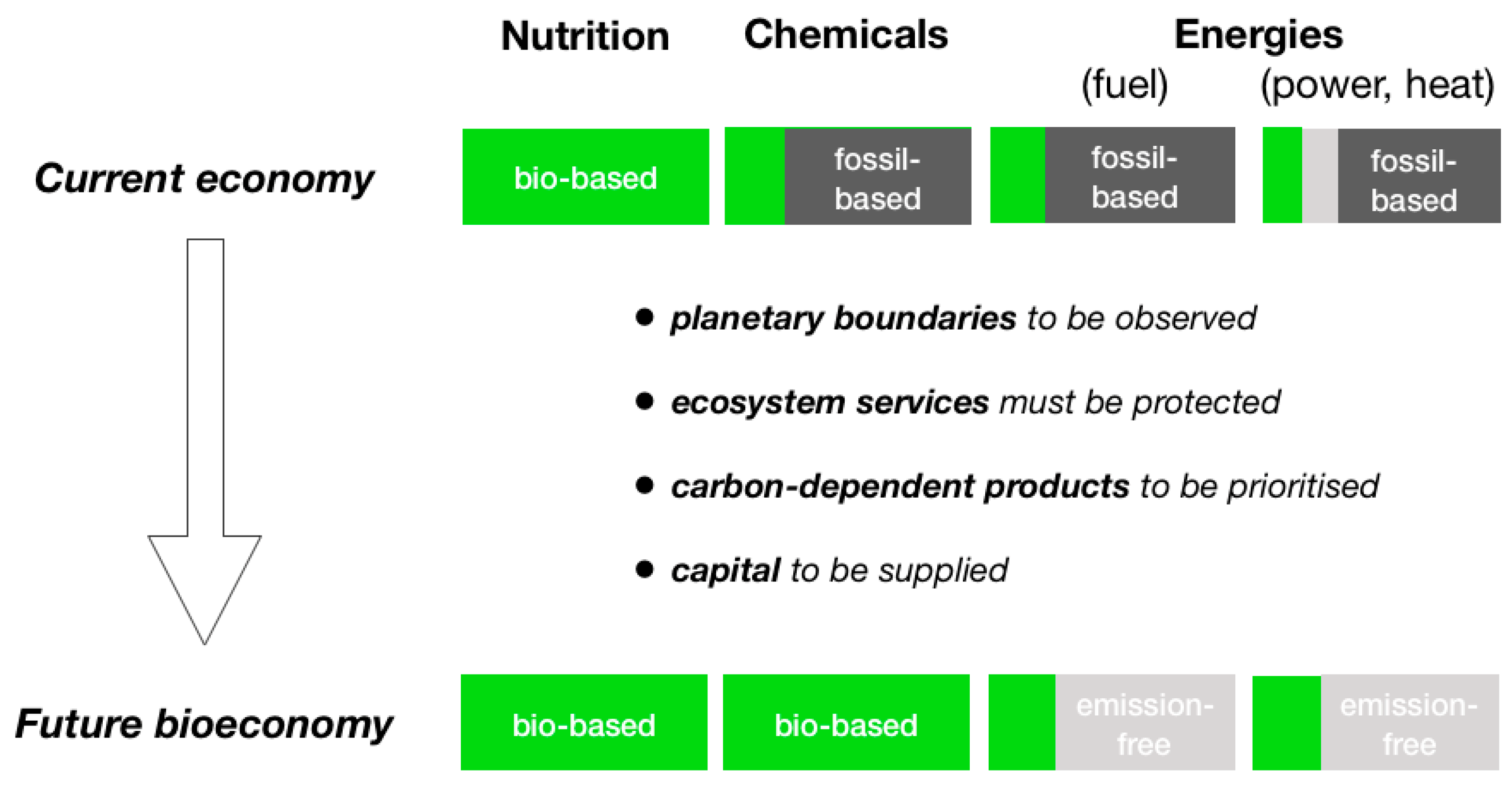

2. Sustainability Guard Rails

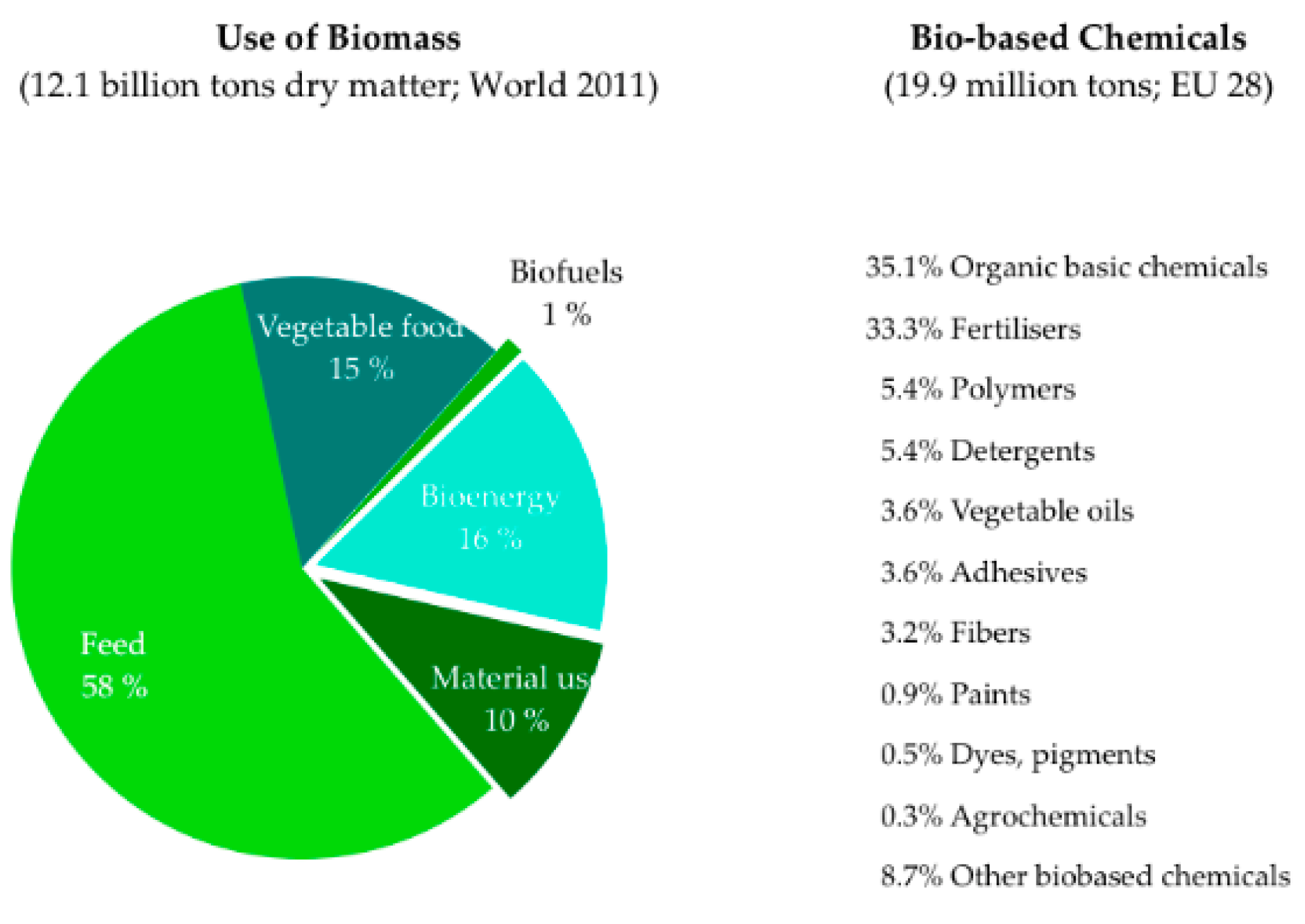

3. The Current Economy

4. The Necessary Change in Raw Materials

4.1. The Future Sources of Carbon

4.2. Supply of Raw Materials

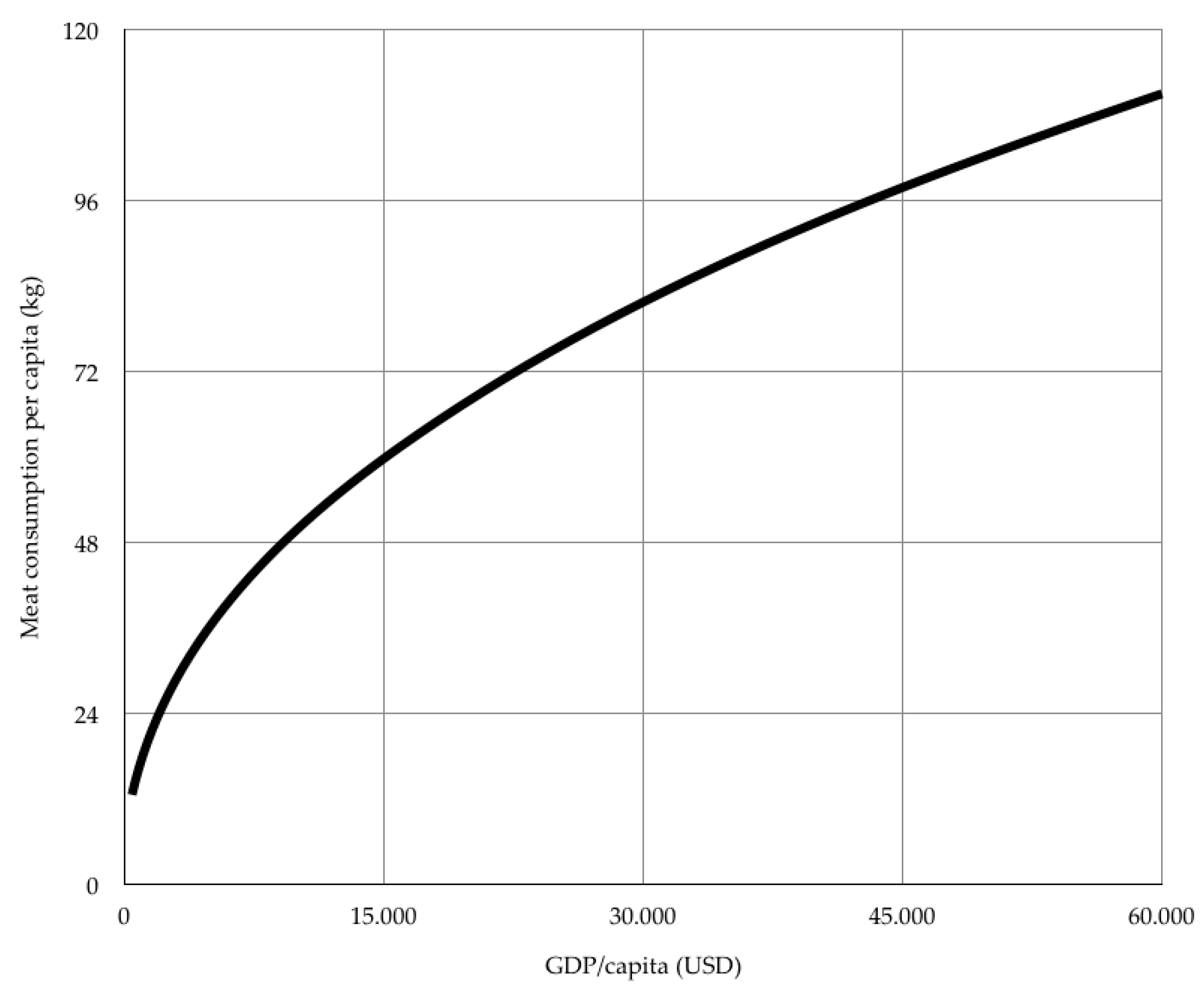

4.2.1. Growing Food Markets

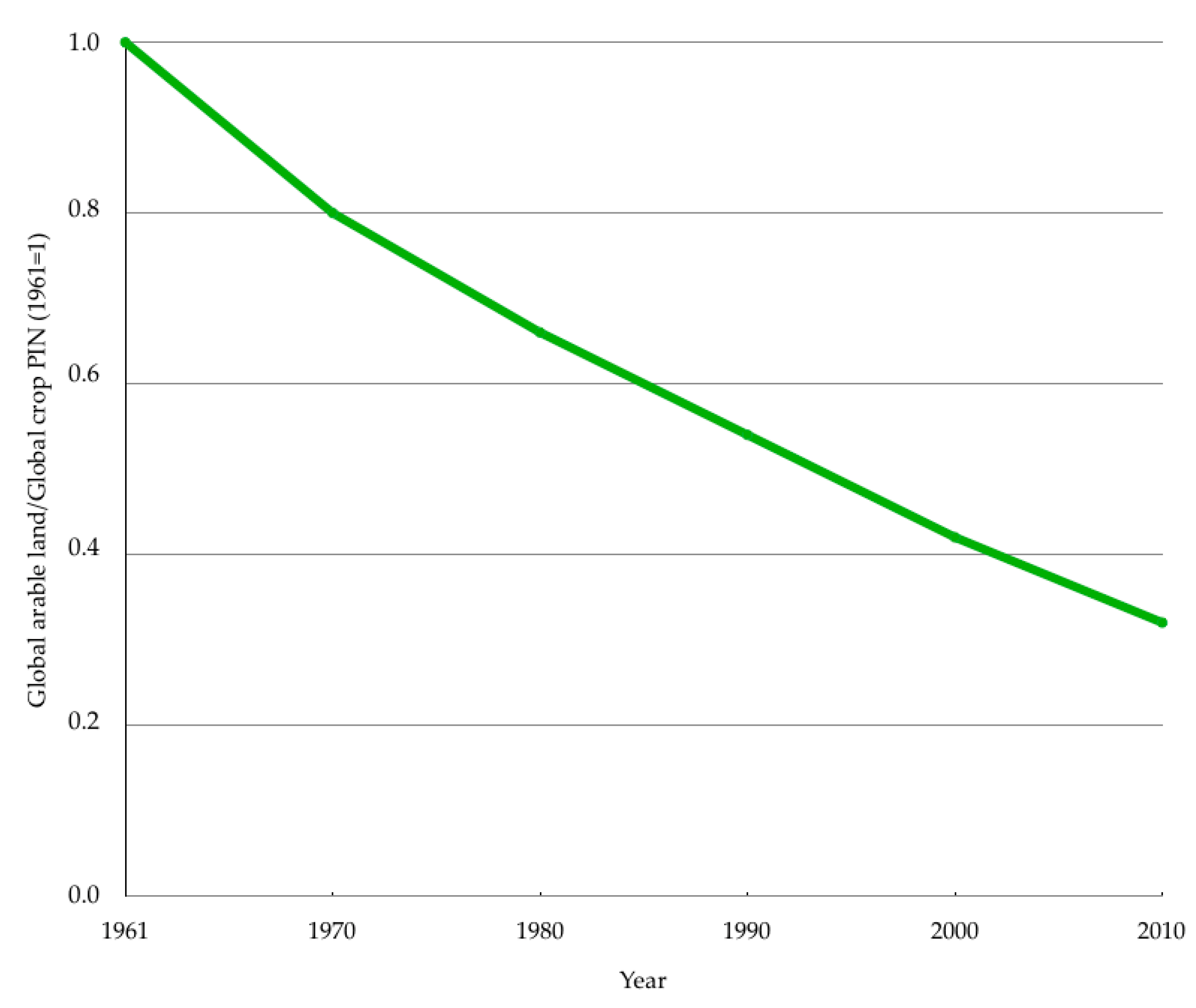

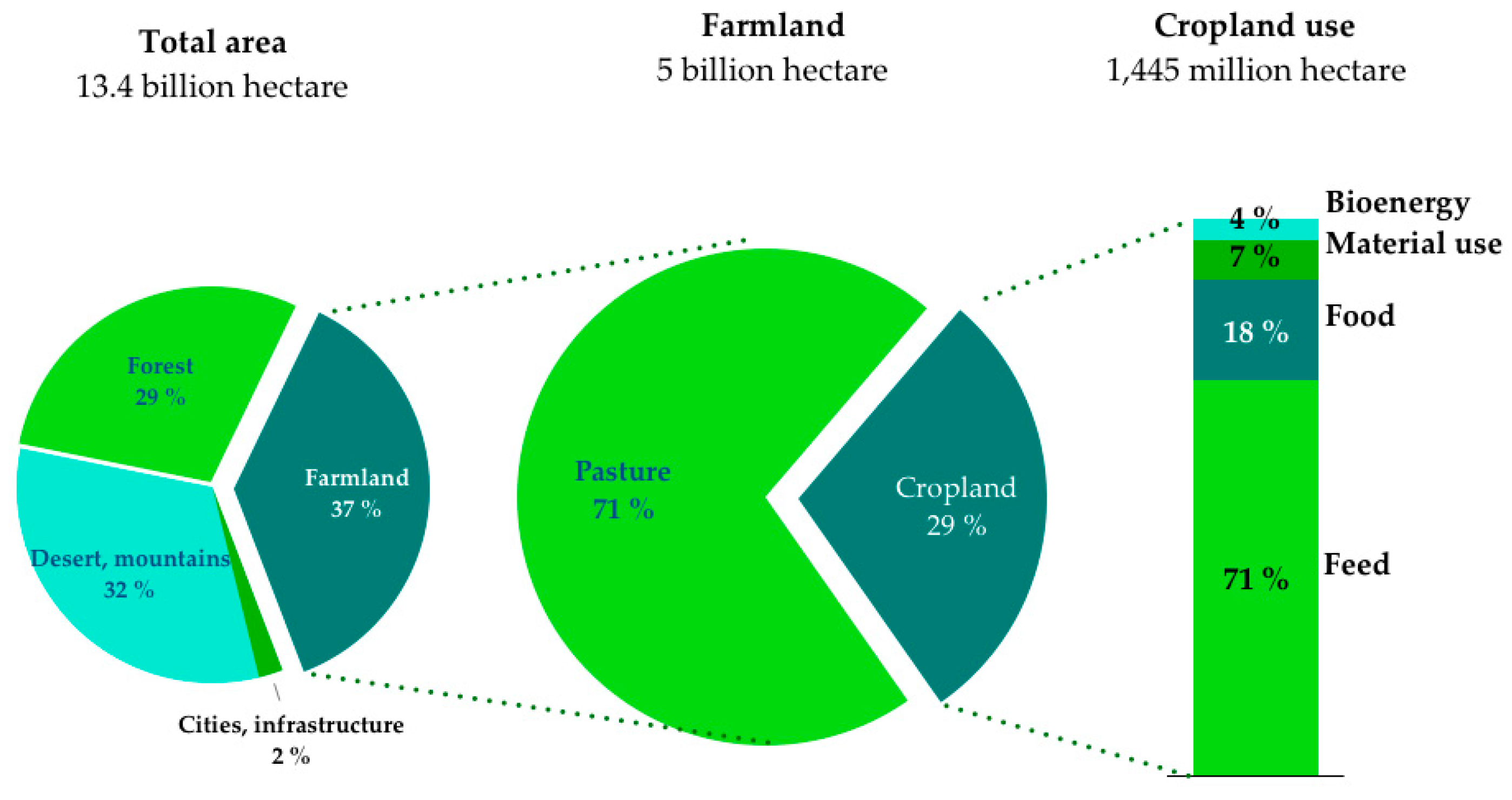

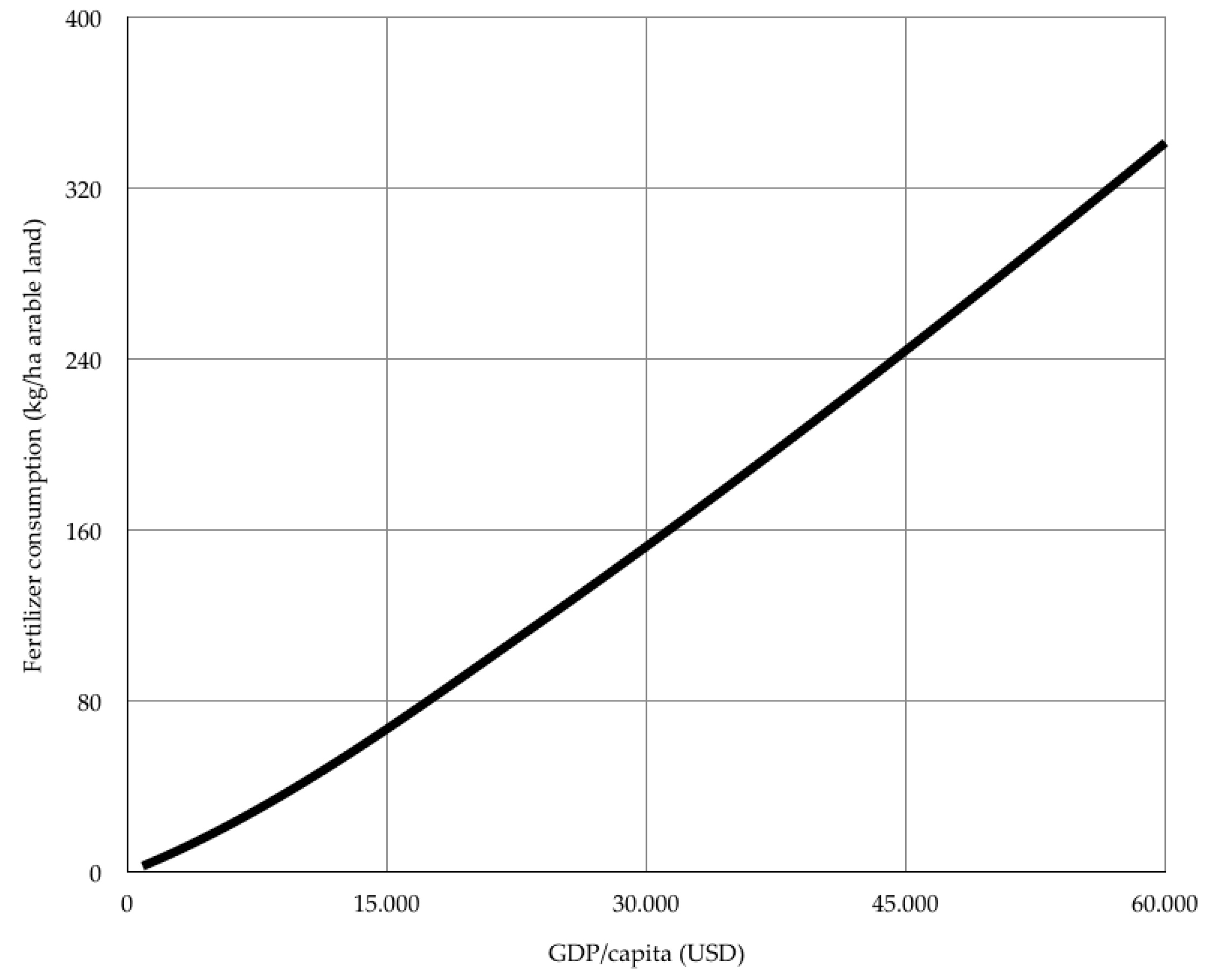

4.2.2. Land and Land Use

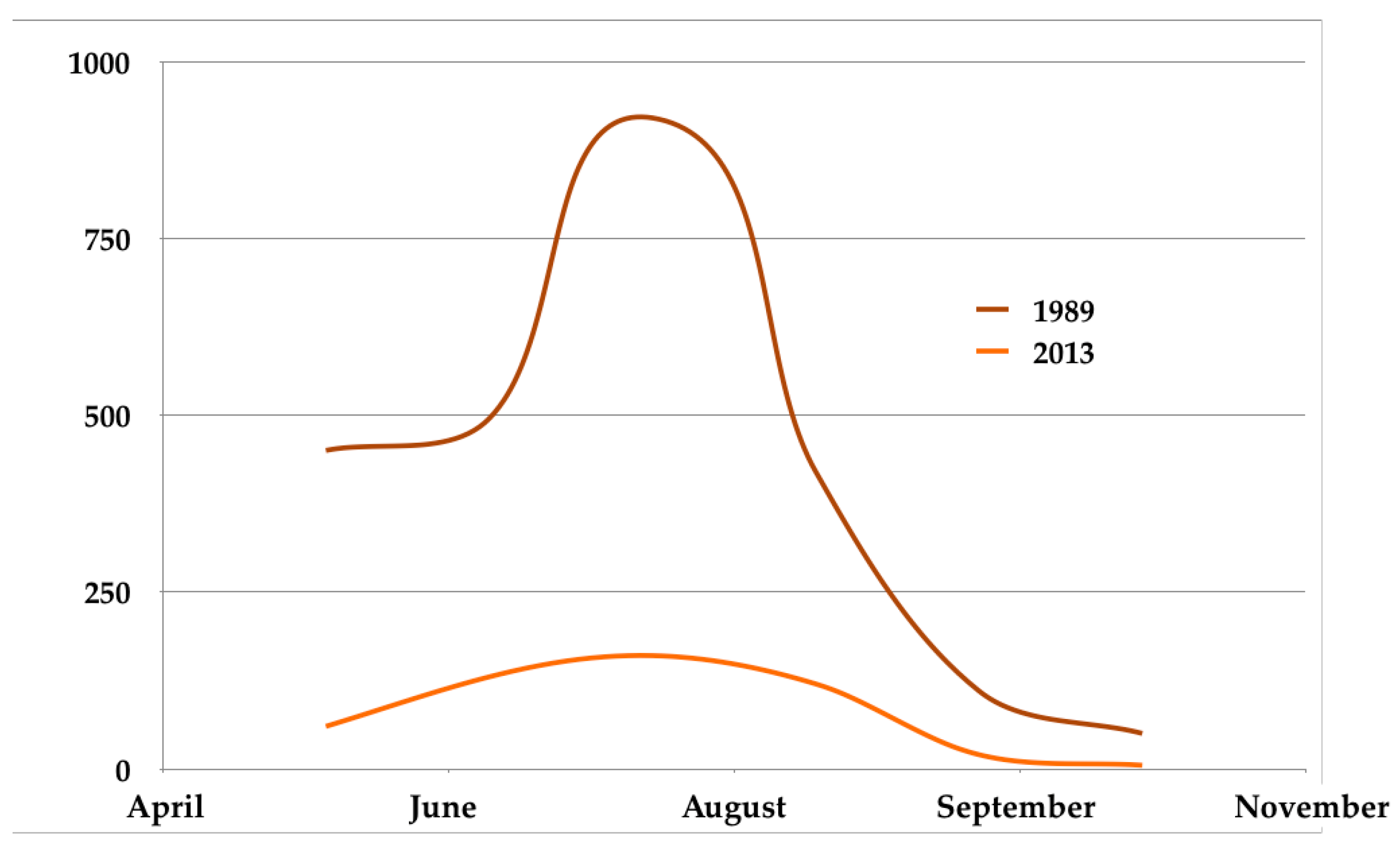

4.2.3. Biodiversity

5. Markets to Be Prioritised

6. Industrial Practice

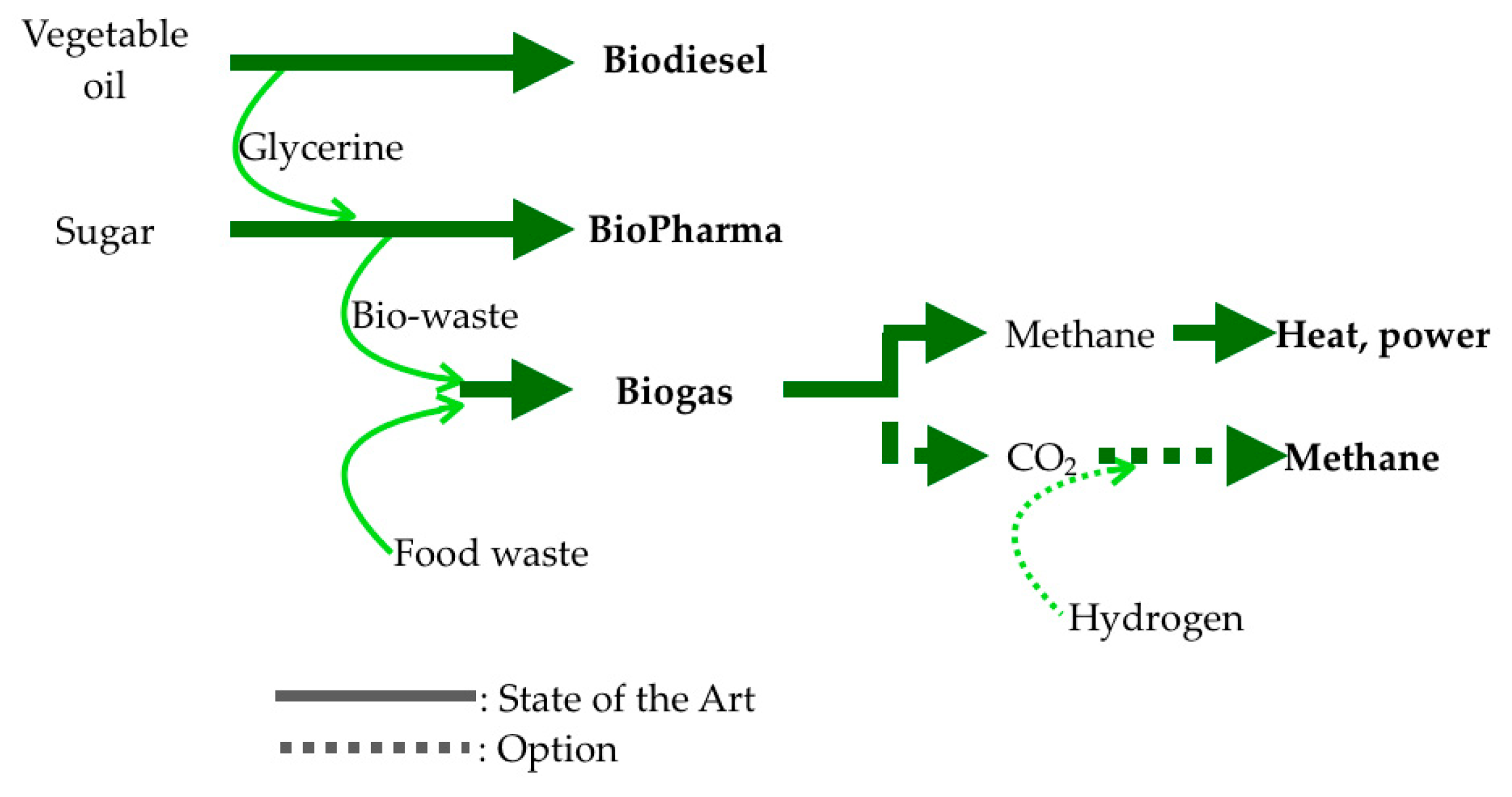

6.1. Biomass Transformation

6.2. Expansion of the Raw Materials Portfolio

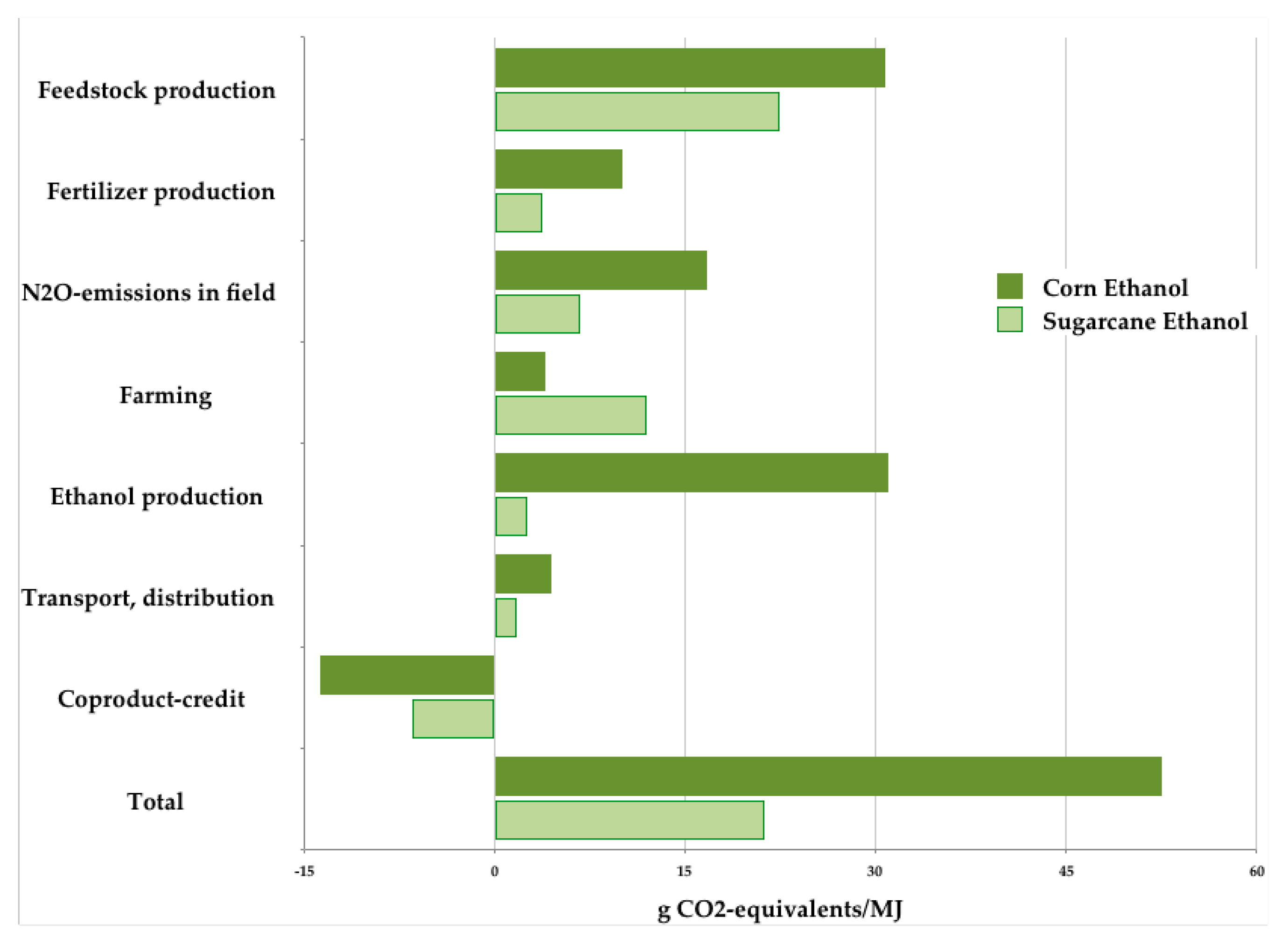

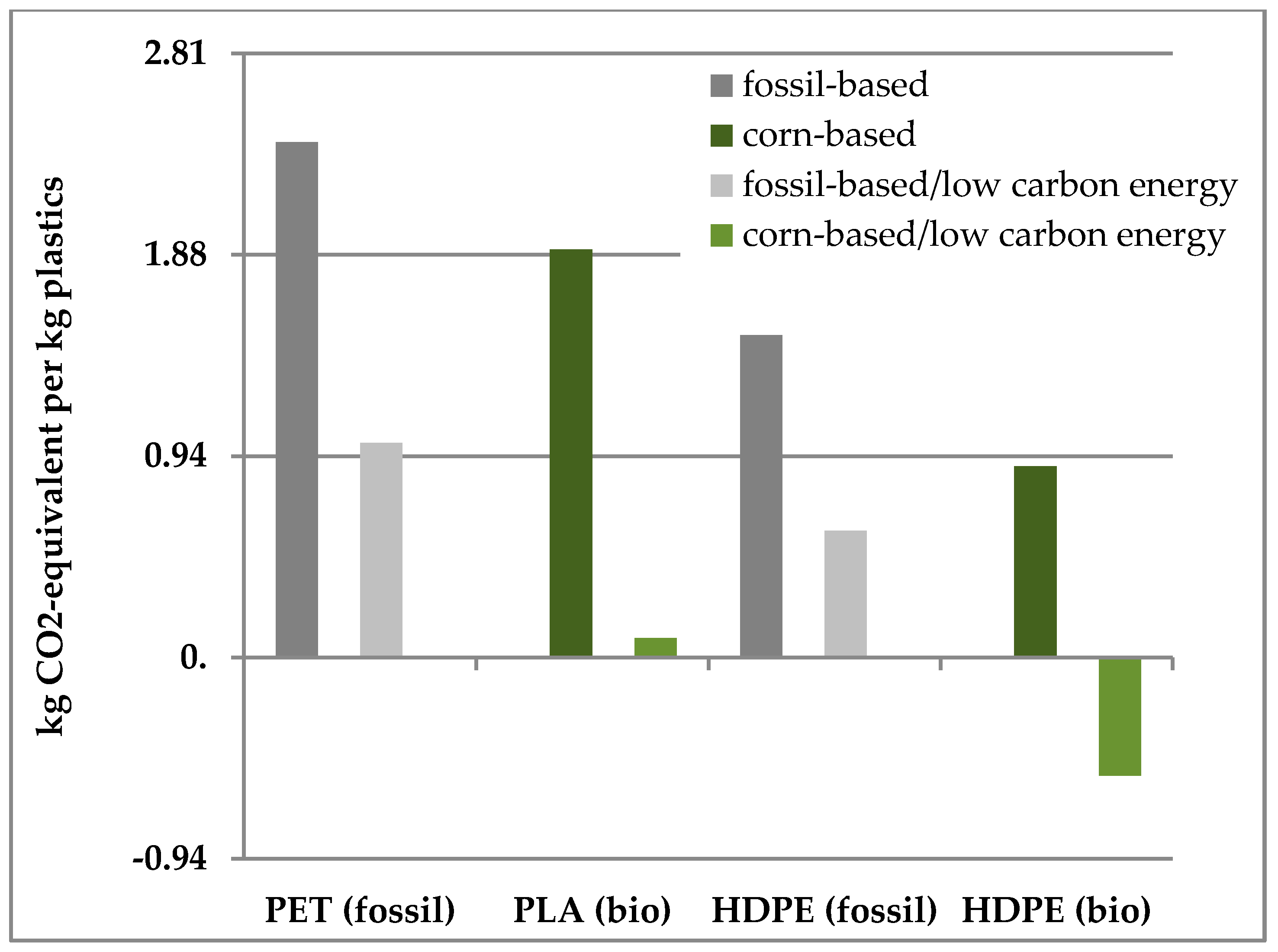

6.3. The Greenhouse Gas Balance

6.4. Value Chains and Infrastructure

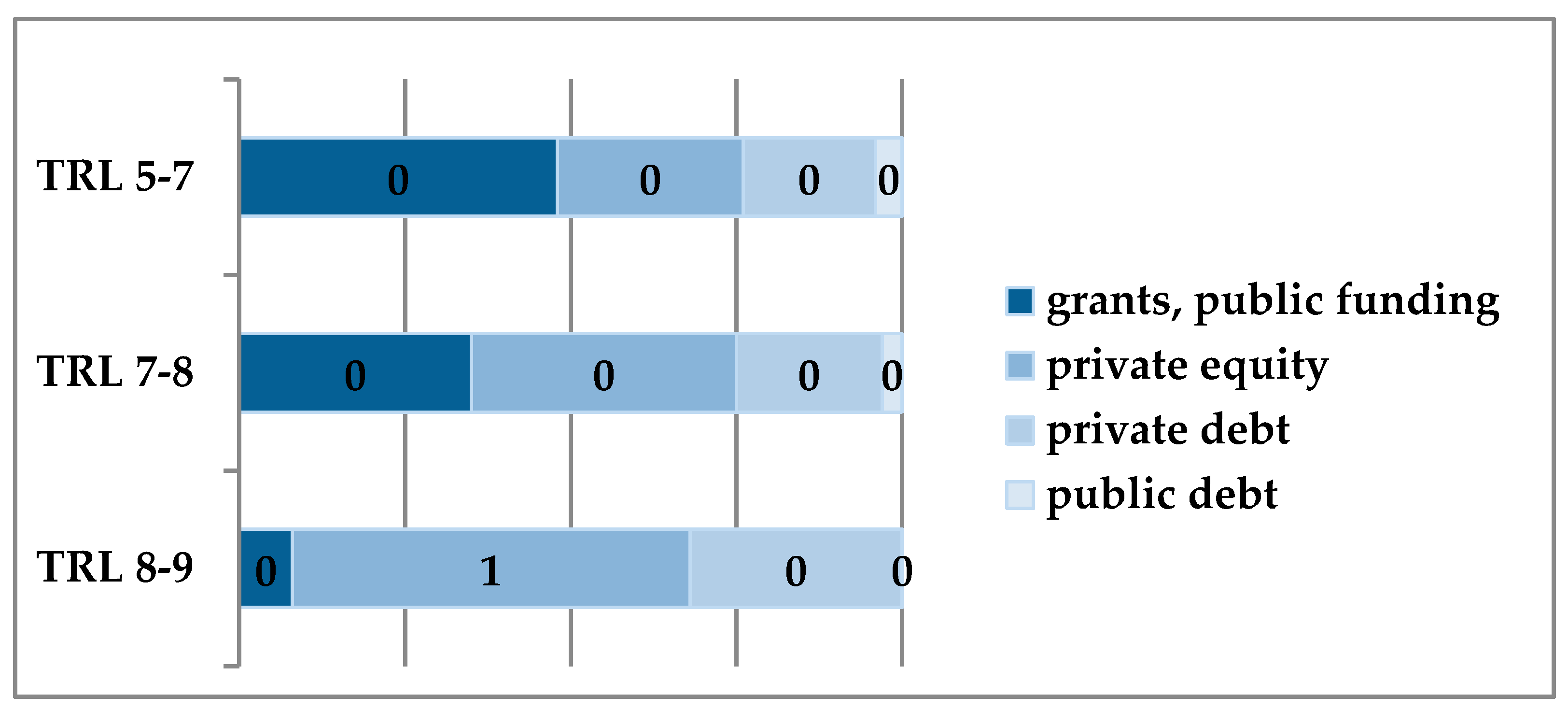

7. Financing

7.1. Capital Requirements

7.2. Supply of Capital

8. Investment Timing

9. Conclusions

Funding

Conflicts of Interest

References

- Acatech, Leopoldina, and Akademienunion. 2017. Sektorkopplung—Optionen für die Nächste Phase der Energiewende (Schriftenreihe zur Wissenschaftsbasierten Politikberatung). Berlin: Königsdruck. ISBN 978-3-8047-3672-6. [Google Scholar]

- Allianz Group. 2018. Allianz Is Driving Change toward a Low-Carbon Economy with an Ambitious Climate Protection Package. Available online: https://www.allianz.com/en/press/news/business/insurance/180504-allianz-announces-climate-protection-package.html (accessed on 12 May 2019).

- ArcelorMittal. 2015. ArcelorMittal, LanzaTech and Primetals Technologies Announce Partnership to Construct Breakthrough €87m Biofuel Production Facility. Available online: http://corporate.arcelormittal.com/news-and-media/news/2015/july/13-07-2015 (accessed on 12 May 2019).

- ASN Bank. 2019. Net Positive Effect on Biodiversity in 2030. Available online: https://www.asnbank.nl/over-asn-bank/duurzaamheid/biodiversiteit/biodiversity-in-2030.html (accessed on 9 July 2019).

- Bank of America. 2019. Coal Policy. Available online: https://about.bankofamerica.com/assets/pdf/COAL_POLICY.pdf (accessed on 12 May 2019).

- Barnosky, Anthony D., Nicholas Matzke, Susumu Tomiya, Guinevere O. Wogan, Brian Swartz, Tiago B. Quental, Charles Marshall, Jenny L. McGuire, Emily L. Lindsey, Kaitlin C. Maguire, and et al. 2011. Has the Earth’s sixth mass extinction already arrived? Nature 471: 51–57. [Google Scholar] [CrossRef] [PubMed]

- BBC. 2019a. UK Parliament Declares Climate Change Emergency. Available online: https://www.bbc.com/news/uk-politics-48126677 (accessed on 21 May 2019).

- BBC. 2019b. Climate Change: Ireland Declares Climate Emergency. Available online: https://www.bbc.com/news/world-europe-48221080 (accessed on 13 May 2019).

- BDB Bundesverband der Deutschen Bioethanolwirtschaft. 2017. Die Deutsche Bioethanolwirtschaft in Zahlen. Available online: https://bdbe.de/daten/marktdaten-deutschland (accessed on 12 May 2019).

- Bender, Michael. 2013a. Global Supply and Demand of Petrochemical Products Relied on LPG as Feedstock. Available online: http://www.lpgc.or.jp/corporate/information/program5_Japan2.pdf (accessed on 21 May 2019).

- Bender, Michael. 2013b. Global Aromatics Supply—Today and Tomorrow. Available online: https://www.dgmk.de/petrochemistry/abstracts_content21/Bender.pdf (accessed on 21 May 2019).

- Berger, Joshua, Mark Jacob Goedkoop, Wijnand Broer, Roel Nozeman, Collette D. Grosscurt, Milena Bertram, and Franck Cachia. 2018. Common Ground in Biodiversity Footprint Methodologies for the Financial Sector. Paris, October 3. Available online: https://www.google.com/search?client=safari&rls=en&q=Berger,+J.;+Goedkoop,+M.J.;+Broer,+W;+Nozeman,+R;+Grosscurt,+C.D.;+Bertram,+M.,+Cachia,+F.;Common+ground+in+biodiversity+footprint+methodologies+for+the+financial+sector,+Paris,+3+October,+2018&ie=UTF-8&oe=UTF-8 (accessed on 22 May 2019).

- Bertau, Martin, Heribert Offermanns, Ludolf Plass, Friedrich Schmidt, and Hans-Jiirgen Wernicke, eds. 2016. Methanol: The Basic Chemical and Energy Feedstock of the Future. Heidelberg, New York, Dordrecht and London: Springer. [Google Scholar]

- BIC. 2016. European Bioeconomy 2013: €2.1 Trillion Turnover and 18.3 Million Employees. Available online: http://biconsortium.eu/sites/biconsortium.eu/files/news-image/BIC_PressRelease_Bioeconomy2013_3March2016.pdf (accessed on 21 May 2019).

- BIO. 2017. The Biobased Economy: Measuring Growth and Impacts. Available online: https://www.bio.org/sites/default/files/Biobased_Economy_Measuring_Impact.pdf (accessed on 21 May 2019).

- Birner, R. 2018. Bioeconomy concepts. In Bioeconomy—Shaping the Transition to a Sustainable, Biobased Economy. Edited by Iris Lewandowski. Cham: Springer Nature, pp. 17–38. [Google Scholar]

- BMWi. 2019. Erneuerbare Energien. Available online: https://www.bmwi.de/Redaktion/DE/Dossier/erneuerbare-energien.html (accessed on 21 May 2019).

- BNP-Paribas. 2015. Financing and Investment Policies: Coal-Fired Power Generation—Sector. Available online: https://group.bnpparibas/uploads/file/csr_sector_policy_cfpg.pdf (accessed on 21 May 2019).

- BNP-Paribas. 2017. BNP Paribas Takes Further Measures to Accelerate Its Support of the Energy Transition. Available online: http://bnpparibas.de/en/2017/10/11/bnp-paribas-takes-further-measures-to-accelerate-its-support-of-the-energy-transition/ (accessed on 21 May 2019).

- Bosch. 2019. Climate Action: Bosch to Be Carbon Neutral Worldwide by 2020. Available online: https://www.bosch-presse.de/pressportal/de/en/climate-action-bosch-to-be-carbon-neutral-world-wide-by-2020-188800.html (accessed on 24 May 2019).

- BPB. 2014. Handelströme Erdöl. Available online: http://bpb.de/nachschlagen/zahlen-und-fakten/globalisierung/52535/handelsstroeme-erdoel (accessed on 21 May 2019).

- Breakthrough Energy. 2019. Manufacturing a Brighter Tomorrow. Available online: http://b-t.energy/landscape/manufacturing/ (accessed on 19 May 2019).

- Bruckner, Martin, Tiina Häyhä, Stefan Giljum, Victor Maus, Günther Fischer, Sylvia Tramberend, and Jan Börner. 2019. Quantifying the global cropland footprint of the European Union’s non-food bioeconomy. Environmental Research Letters 14: 045011. Available online: https://iopscience.iop.org/article/10.1088/1748-9326/ab07f5 (accessed on 12 May 2019). [CrossRef]

- Carbontracker. 2013. Unburnable Carbon Wasted Capital and Stranded Assets. Available online: https://carbontracker.org/reports/unburnable-carbon-wasted-capital-and-stranded-assets/ (accessed on 19 May 2019).

- de Carvalho-Macedo, Isaias, André M. Nassar, Annette L. Cowie, Joaquim E. A. Seabra, Luisa Marelli, Martina Otto, Michael Q. Wang, and Wallace E. Tyner. 2015. Greenhouse Gas Emssions from Bioenergy. In Bioenergy & Sustainability: Bridging the Gaps SCOPE 72. Edited by Glaucia Mendes Souza, Reynaldo L. Victoria, Carlos A. Joly and Luciano M. Verdade. Paris: SCOPE, pp. 582–617. [Google Scholar]

- CEFIC. 2017. World Chemical Sales Geographic Breakdown. Available online: http://fr.zone-secure.net/13451/451623/?startPage=14#page=5 (accessed on 20 May 2019).

- CEFIC. 2018. Bioeconomy. Available online: http://www.cefic.org (accessed on 21 May 2019).

- CEFIC. 2019. Chemical Industry Contributes $5.7 Trillion to Global GDP and Supports 120 Million Jobs, New Report Shows. Available online: https://cefic.org/media-corner/newsroom/chemical-industry-contributes-5-7-trillion-to-global-gdp-and-supports-120-million-jobs-new-report-shows/ (accessed on 11 May 2019).

- Cision. 2018. Food and Beverages Global Market Report 2018. Available online: https://www.prnewswire.com/news-releases/food-and-beverages-global-market-report-2018-300602932.html (accessed on 4 May 2019).

- CheManager. 2013. Rohstoffe in der Chemischen Industrie. Weinheim: CHEManager, pp. 13–14. Available online: https://www.chemanager-online.com/news-opinions/grafiken/rohstoffe-der-chemischen-industrie (accessed on 19 May 2019).

- Cleanleap. 2013. Conventional Bioethanol Production Cost. Available online: http://cleanleap.com/4-bioethanol/42-conventional-bioethanol-production-costs (accessed on 11 May 2019).

- Coady, David, Ian Parry, Louis Sears, and Baoping Shang. 2015. How Large Are Global Energy Subsidies? IMF Working Paper WP/105/105. Available online: http://www.imf.org/en/publications/wp/issues/2016/12/31/how-large-are-global-energy-subsidies-42940 (accessed on 20 May 2019).

- Concawe. 2016. Marine Fuel Facts. Available online: https://www.concawe.eu/wp-content/uploads/2017/01/marine_factsheet_web.pdf (accessed on 9 May 2019).

- Costanza, Robert, Ralph d’Arge, Rudolf de Groot, Stephen Farber, Monica Grasso, Bruce Hannon, Karin Limburg, Shahid Naeem, Robert V. O’Neill, Jose Paruelo, and et al. 1997. The value of the world’s ecosystem services and natural capital. Nature 387: 253–60. [Google Scholar] [CrossRef]

- Costanza, Robert, Rudolf de Groot, Paul Sutton, Sander van der Ploeg, Sharolyn J. Anderson, Ida Kubiszewski, Stephen Farber, and R. Kerry Turner. 2014. Changes in the global value of ecosystem services. Global Environmental 26: 152–58. [Google Scholar] [CrossRef]

- Credit Suisse, and McKinsey. 2016. Conservation Finance—From Niche to Mainstream: The Building of an Institutional Asset Class. Available online: https://assets.rockefellerfoundation.org/app/uploads/20160121144045/conservation-finance-en.pdf (accessed on 22 May 2019).

- DATAUSA. 2019. Petroleum Refining. Available online: https://datausa.io/profile/naics/32411/ (accessed on 3 May 2019).

- DEP. 2017. Entwicklung Pelletproduktion in Deutschland. Available online: http://.depv.de/de/home/marktdaten/entwicklung_pelletproduktion/ (accessed on 21 May 2019).

- Desjardins, Jeff. 2016. The Oil Market Is Bigger Than All Metal Markets Combined. Available online: https://www.visualcapitalist.com/size-oil-market/ (accessed on 4 May 2019).

- Duncan, Tony. 2019. Extracting value from waste biomass by creating renewable chemicals. Industrial Biotechnology 15: 63–64. [Google Scholar] [CrossRef]

- Effenberger, Franz Xaver. 2014. Vison: "Technical Photosynthesis". In Methanol: The Basic Chemical and Energy Feedstock of the Future. Edited by Martin Bertau, Heribert Offermans, Ludolf Plass, Friedrich Schmidt and Hans Jürgen Wernicke. Heidelberg, New York, Dordrecht and London: Springer, pp. 39–50. [Google Scholar]

- EIA. 2018. Short-Term Energy Outlook. Available online: https://www.eia.gov/outlooks/steo/report/global_oil.php (accessed on 20 May 2019).

- EIA. 2019a. Short-Term Energy Outlook. Available online: https://www.eia.gov/outlooks/steo/report/global_oil.php (accessed on 12 May 2019).

- EIA. 2019b. Coal 2018, Analysis and Forecasts to 2023. Available online: https://www.iea.org/coal2018/ (accessed on 12 May 2019).

- EIA. 2019c. Natural Gas. Available online: https://www.eia.gov/outlooks/ieo/pdf/nat_gas.pdf (accessed on 12 May 2019).

- EIA. 2019d. Biofuels for Transport. Available online: https://www.iea.org/tcep/transport/biofuels/ (accessed on 13 May 2019).

- EIB. 2017. Access-to-Finance Conditions for Investments in Bio-Based Industries and the Blue Economy. Available online: http://www.eib.org/attachments/pj/access_to_finance_study_on_bioeconomy_en.pdf (accessed on 20 May 2019).

- El-Chichakli, Beate, Joachim von Braun, Christine Lang, Daniel Barben, and Jim Philp. 2016. Five cornerstones of a global bioeconomy. Nature 535: 221–23. Available online: https://www.nature.com/news/policy-five-cornerstones-of-a-global-bioeconomy-1.20228 (accessed on 11 May 2019). [CrossRef] [PubMed]

- Eramo, Mark. 2018. Global Ethylene Market Outlook: Low Cost Feedstocks Fuel the Next Wave of Investments in North America and China. IHS Chemical. Available online: http://media.corporate-ir.net/media_files/IROL/11/110877/05_Global_Ethylene_Market_Outlook_Eramo.pdf (accessed on 20 May 2019).

- EU-Commission. 2011. A Roadmap for Moving to a Competitive Low Carbon Economy in 2050. Available online: http://.cbss.org/wp-content/uploads/2012/12/EU-Low-Carbon-Road-Map-2050.pdf (accessed on 21 May 2019).

- EU-Commission. 2012. Innovating for Sustainable Growth—A Bioeconomy for Europe. Available online: https://publications.europa.eu/en/publication-detail/-/publication/1f0d8515-8dc0-4435-ba53-9570e47dbd51 (accessed on 21 May 2019).

- EU-Commission. 2014. Food Security, Sustainable Agriculture and Forestry, Marine, Maritime and Inland Water Research and the Bioeconomy. Available online: https://ec.europa.eu/programmes/horizon2020/en/h2020-section/food-security-sustainable-agriculture-and-forestry-marine-maritime-and-inland-water (accessed on 19 May 2019).

- EU-Commission. 2016. Renewable Energy—Recast to 2030 (RED II). Available online: https://ec.europa.eu/jrc/en/jec/renewable-energy-recast-2030-red-ii (accessed on 22 May 2019).

- EU-Commission. 2018. Final Report 2018 by the High-Level Expert Group on Sustainable Finance. Available online: https://ec.europa.eu/info/sites/info/files/180131-sustainable-finance-final-report_en.pdf (accessed on 21 May 2019).

- EU-Commission. 2019. Progress Made in Cutting Emissions. Available online: https://ec.europa.eu/clima/policies/strategies/progress_en (accessed on 4 May 2019).

- EuropaBio. 2019. Jobs and Growth Generated by Industrial Biotechnology in Europe. Available online: https://www.europabio.org/industrial-biotech/publications/jobs-and-growth-generated-industrial-biotechnology-europe (accessed on 22 May 2019).

- FAO. 2018. Global Trends in GDP, Agriculture Value Added, and Food-Processing Value Added (1970–2016). Available online: http://www.fao.org/economic/ess/ess-economic/gdpagriculture/en/ (accessed on 22 May 2019).

- FarmProgress. 2016. The Five Largest Ethanol Producers. Available online: https://www.farmprogress.com/market-reports/afternoon-market-recap-may-10-2019 (accessed on 12 May 2019).

- FAO. 2015. Soils Are Endangered, but the Degradation Can Be Rolled Back. Available online: http://fao.org/news/story/en/item/357059/icode/ (accessed on 20 May 2019).

- FAO. 2016. Food Outlook. Available online: https://weltagrarbericht.de/fileadmin/files/weltagrarbericht/GlobalAgriculture/02Hunger/FoodOutlook10_2016.pdf (accessed on 20 May 2019).

- FNR. 2016. Entwicklung Biodiesel Produktion und Absatz in Deutschland. Available online: https://biokraftstoffe.fnr.de/kraftstoffe/biodiesel/ (accessed on 20 May 2019).

- FOEN. 2016. Proposals for a Roadmap towards a Sustainable Financial System in Switzerland. Available online: http://www.sustainablefinance.ch/upload/cms/user/20160614_Proposals_for_a_Roadmap_FOEN.pdf (accessed on 19 May 2019).

- Gates Foundation. 2017. $306 Million Commitment to Agricultural Development. Available online: https://gatesfoundation.org/Media-Center/Press-Releases/2008/01/%24306-Million-Commitment-to-Agricultural-Development (accessed on 31 January 2019).

- German Bioeconomy Council. 2018. Update Report about National Strategies around the World—Bioeconomy Council (Part III). Berlin: Bioeconomy Council. Available online: https://biooekonomierat.de/fileadmin/Publikationen/berichte/GBS_2018_Bioeconomy-Strategies-around-the_World_Part-III.pdf (accessed on 12 May 2019).

- Goulson, Dave. 2012. Decline of Bees Forces China’s Apple Farmers to Pollinate by Hand. Available online: https://www.chinadialogue.net/article/show/single/en/5193-Decline-of-bees-forces-China-s-apple-farmers-to-pollinate-by-hand (accessed on 20 May 2019).

- Greenpeace. 2019. Eating Less Meat, More Plants Helps the Environment. Available online: https://www.greenpeace.org/usa/sustainable-agriculture/eco-farming/eat-more-plants/ (accessed on 4 May 2019).

- De Groot, Rudolf. 2010. Integrating the ecological and economic dimensions in biodiversity and ecosystem service valuation. In The Economics of Ecosystems and Biodiversity Ecological and Economic Foundations. Edited by Pushpam Kumar. London and Washington: TEEB Earthscan. Available online: http://www.teebweb.org/wp-content/uploads/2013/04/D0-Chapter-1-Integrating-the-ecological-and-economic-dimensions-in-biodiversity-and-ecosystem-service-valuation.pdf (accessed on 20 May 2019).

- Gruß, Andrea. 2019. Klimawandel ist Gefahr und Chance Zugleich. Weinheim: CHEManager, p. 4. [Google Scholar]

- Gruhlke, Martin, and Walter Bürger-Kley. 2015. Chemie oder Teller. CheManager. Available online: http://www.chemanager-online.com/themen/konjunktur/chemie-oder-teller (accessed on 20 May 2019).

- Hallmann, Caspar A., Martin Sorg, Eelke Jongejans, Henk Siepel, Nick Hofland, Heinz Schwan, Werner Stenmans, Andreas Müller, Hubert Sumser, Thomas Hörren, and et al. 2017. More than 75 percent decline over 27 years in total flying insect biomass in protected areas. PLoS ONE 12: e0185809. [Google Scholar] [CrossRef] [PubMed]

- Heede, Richard, and Naomi Oreskes. 2016. Potential Emissions of CO2 and Methane from Proved Reserves of Fossil Fuels: An Alternative Analysis. Global Environmental Change 36: 12–20. [Google Scholar] [CrossRef]

- Herrmann, Michael, and Jürgen Weber. 2011. Öfen und Kamine. Raumheizungen Fachgerecht Planen und Bauen. Berlin: Beute Verlag. [Google Scholar]

- Huber, Betty Moy, Michael Comstock, and Davis Polk. 2017. Reports and Ratings: What They Are, Why They Matter. Harvard Law School Forum on Corporate Governance and Financial Regulation. Davis Polk & Wardwell LLP. July 27. Available online: https://corpgov.law.harvard.edu/2017/07/27/esg-reports-and-ratings-what-they-are-why-they-matter/ (accessed on 20 May 2019).

- IFoA. 2018. Actuaries Seek to Contribute to Sustainable Development Goals. Available online: https://actuaries.org.uk/news-and-insights/media-centre/media-releases-and-statements/actuaries-seek-contribute-sustainable-development-goals (accessed on 20 May 2019).

- Indexmundi. 2018. World GDP—Composition by Sector. Available online: https://www.indexmundi.com/world/gdp_composition_by_sector.html (accessed on 22 May 2019).

- Indexmundi. 2019. World Jet Fuel Consumption by Year. Available online: https://www.indexmundi.com/energy/?product=jet-fuel (accessed on 9 May 2019).

- Investopedia. 2018. What Percentage of the Global Economy Consists of the Oil and Gas Drilling Sector? Available online: https://www.investopedia.com/ask/answers/030915/what-percentage-global-economy-comprised-oil-gas-drilling-sector.asp (accessed on 22 May 2019).

- IPBES. 2019. One million species face extinction. Nature 569: 171. Available online: https://www.nature.com/articles/d41586-019-01448-4 (accessed on 19 May 2019).

- IPCC. 2018. Special Report on Global Warming of 1.5 °C. Available online: https://www.ipcc.ch/report/sr/15/ (accessed on 11 May 2019).

- Issa, Irwa, Sebastian Delbrück, and Ulrich Hamm. 2019. Bioeconomy from Expert’s Perspectives—Results of a Global Expert Survey. Available online: https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0215917#pone.0215917.ref002 (accessed on 11 May 2019).

- Johnson, Christopher N., Andrew Balmford, Barry W. Brook, Jessie C. Buettel, Mauro Galetti, Lei Guanchun, and Janet M. Wilmshurst. 2017. Biodiversity losses and conservation responses in the Anthropocene. Science 356: 270–75. [Google Scholar] [CrossRef] [PubMed]

- Johnson, Francis X., Manoel Regis Lima Verde Leal, and Anne Nyambane. 2018. Sugarcane as a renewable resource for sustainable futures. In Achieving Sustainable Cultivation of Sugarcane. Edited by Philippe Rott and Burleigh Dodds. Cambridge: Science Publishing, pp. 1–23. [Google Scholar]

- Kaye, Leon. 2017. Triple Pundit; Blackrock Investments “Coal Is Dead”. Available online: https://.triplepundit.com/2017/06/blackrock-coal-dead/ (accessed on 20 May 2019).

- Kennedy, Helena Tavares. 2019. Biomethane Business Is Booming—From Waste to Watts and Wonder Chemicals. Available online: http://www.biofuelsdigest.com/bdigest/2019/05/12/biomethane-business-is-booming-from-waste-to-watts-and-wonder-chemicals/ (accessed on 21 May 2019).

- Kircher, Manfred. 2012. The transition to a bioeconomy: Emerging from the oil age. Biofuels, Bioproducts and Biorefining 6: 369–75. [Google Scholar] [CrossRef]

- Kircher, Manfred. 2015. Sustainability of biofuels and renewable chemicals production from biomass. Current Opinion in Chemical Biology 29: 26–32. [Google Scholar] [CrossRef] [PubMed]

- Kircher, Manfred. 2017. Fundamental biochemical and biotechnological principles of biomass growth and use. In Introduction to Renewable Biomaterials. Edited by Ali S. Ayoub and Lucian A. Lucia. Hoboken: Wiley, pp. 1–38. [Google Scholar]

- Kircher, Manfred. 2018. Implementing the bioeconomy in a densely populated and industrialised country. Advances in Industrial Biotechnology 1: 3–11. [Google Scholar] [CrossRef]

- Klankermayer, Jürgen, and Walter Leitner. 2015. Love at second sight for CO2 and H2 in organic synthesis. Science 350: 629–30. [Google Scholar] [CrossRef] [PubMed]

- Laird, Karen. 2016. Corbion Seeks Allies on Alternative Feedstock for PLA Project. Available online: https://plasticstoday.com/materials/corbion-seeks-allies-on-alternative-feedstock-pla-project/90242661225277 (accessed on 20 May 2019).

- Lane, Jim. 2017. Ethanol and Biodiesel: Dropping below the Production Cost of Fossil Fuels? Biofuels Digest. Available online: https://www.biofuelsdigest.com/bdigest/2017/05/18/ethanol-and-biodiesel-dropping-below-the-production-cost-of-fossil-fuels/ (accessed on 19 May 2019).

- Lang, Christine, Hannelore Daniel, Regina Birner, and Martin Reich. 2017. Bioökonomie für eine Nachhaltige Proteinversorgung—Zur Bedeutung Tierischer Produkte und Biobasierter Innovationen. Bioökonomierat. Available online: http://biooekonomierat.de/fileadmin/Publikationen/berichte/Hintergrundpapier_zur_Proteinproblematik_final.pdf (accessed on 23 May 2018).

- Lange, Glenn-Marie, Quentin Wodon, and Kevin Carey. 2018. The Changing Wealth of Nations 2018, Building a Sustainable Future. World Bank Group. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/29001/9781464810466.pdf?sequence=2&isAllowed= (accessed on 6 February 2018).

- Lanzatech. 2017. From Trash to Tank: Upcycling of Landfill to Fuel Demonstrated in Japan. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/29001/9781464810466.pdf?sequence=2&isAllowed= http://www.lanzatech.com/trash-tank-upcycling-landfill-fuel-demonstrated-japan/ (accessed on 16 February 2018).

- Levi, Peter G., and Jonathan M. Cullen. 2018. Mapping Global Flows of Chemicals: From Fossil Fuel Feedstocks to Chemical Products. Environmental Science & Technology 52: 1725–34. [Google Scholar] [CrossRef]

- Lokko, Yvonne, Marc Heijde, Karl Schebesta, Philippe Scholtès, Marc van Montagu, and Mauro Giacca. 2018. Biotechnology and the bioeconomy—Towards inclusive and sustainable industrial development. New Biotechnology 40A: 5–10. [Google Scholar] [CrossRef] [PubMed]

- Manesh, Ali, Kevon Tabrizi, and Teng Yang. 2014. Lignin and Economics of Lignocellulosic Biomass Fractionation. Available online: https://www.bio.org/sites/default/files/lignin-economic-lignocellulosic-fractionation_ali_manesh_0.pdf (accessed on 22 February 2018).

- Maritime Executive. 2019. Transport Uses 25 Percent of World Energy. Available online: https://www.maritime-executive.com/article/transport-uses-25-percent-of-world-energy (accessed on 9 May 2019).

- MarketsandMarkets. 2016. Agrochemicals Market by Type (Fertilizers & Pesticides), Fertilizer Type (Nitrogenous, Potassic, & Phosphatic), Pesticide Type (Organophosphates, Pyrethroids, Neonicotinoids, and Bio-Pesticides), Sub-Types & Crop Type—Global Trends & Forecast to 2020. Available online: https://www.marketsandmarkets.com/Market-Reports/global-agro-chemicals-market-report-132.html?gclid=Cj0KCQiA2Y_UBRCGARIsALglqQ1WLbCJ7PgUD3mQXEj7CwbDJdeYUsC0SQ4zjd0ulKLck4MJT9tnQHsaAhd8EALw_wcB (accessed on 13 February 2018).

- Mason, P. Michael, Katherine Glover, J. Andrew C. Smith, Kathy J. Willis, Jeremy Woods, and Ian P. Thompson. 2015. The potential of CAM crops as a globally significant bioenergy resource: Moving from ‘fuel or food’ to ‘fuel and more food’. Energy & Environmental Science 8: 2320–29. [Google Scholar]

- McGlade, Christophe, and Paul Ekins. 2015. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 517: 187–90. [Google Scholar] [CrossRef]

- Meadows, Donella H., Dennis L. Meadows, Jørgen Randers, and William W. Behrens, III. 1972. The Limits of Growth. New York: Universe Books. [Google Scholar]

- Mercedes. 2019. Ambition2039: Our Path to Sustainable Mobility. Available online: https://blog.daimler.com/en/2019/05/13/mercedes-carbon-neutral-e-mobility/ (accessed on 24 May 2019).

- Mercure, Jean-Francois, Hector Pollitt, Jorge E. Viñuales, Neil R. Edwards, Philip B. Holden, Unnada Chewpreecha, Pablo Salas, Ida Sognnaes, Alice Lam, and Florian Knobloch. 2018. Macroeconomic impact of stranded fossil fuel assets. Nature Climate Change 8: 588–93. Available online: https://www.nature.com/articles/s41558-018-0182-1 (accessed on 22 May 2019). [CrossRef]

- Michelsen, Ejnar Rolf. 1941. Beitrag zur Chemie des Torfes, Dessen Schwelung und Extraktion. Ph.D. thesis, Eidgenössische Technische Hochschule in Zürich, Zürich, Switzerland. [Google Scholar]

- Mordor Intelligence. 2017. Seed Industry—Global Trends, Market Advancements and Forecasts to 2022. Available online: https://www.mordorintelligence.com/industry-reports/seeds-industry (accessed on 23 February 2018).

- MSCI. 2017. ESG Ratings Methodology. Available online: https://msci.com/documents/10199/123a2b2b-1395-4aa2-a121-ea14de6d708a (accessed on 31 January 2018).

- Newbold, T., and L. N. Hudson. 2015. Global effects of land use on local terrestrial biodiversity. Nature 520: 45–50. [Google Scholar] [CrossRef]

- nova-institute. 2017. Bio-Based Polymers Worldwide: Ongoing Growth Despite Difficult Market Environment. Available online: http://news.bio-based.eu/bio-based-polymers-worldwide-ongoing-growth-despite-difficult-market-environment/ (accessed on 13 February 2018).

- nova-institute. 2019. The State of the European Bio-Based Economy Is Very Mixed, the Market Is in a Critical Phase. Available online: http://news.bio-based.eu/michael-carus-ceo-of-nova-institute-in-an-interview-with-bio-based-news-on-the-european-bio-based-economy-and-a-shift-towards-a-renewable-carbon-economy/ (accessed on 9 May 2019).

- OECD. 2017. Economic Outlook June 2017. Available online: http://.oecd.org/eco/outlook/Better-but-not-good-enough-press-handout-summary-of-projections-oecd-economic-outlook-june-2017.pdf (accessed on 9 February 2018).

- Ossewijer, Patricia, Helen K. Watson, Francis X. Johnson, Mateus Batistella, Luis A. B. Cortez, Lee R. Lynd, Stephen R. Kaffka, Stephen P. Long, Hans van Meijl, Andre M. Nassar, and et al. 2015. Bioenergy and food security. In Bioenergy & Sustainablity: Bridging the Gaps. Edited by Glaucia M. Souza, Reynaldo L. Victoria, Carlos A. Joly and Luciano Martins Verdade. Sao Paulo: SCOPE, vol. 72, pp. 90–137. [Google Scholar]

- Philp, Jim. 2018. The bioeconomy, the challenge of the century for policy makers. New Biotechnology 40: 11–19. [Google Scholar] [CrossRef]

- Piotrowski, Stephan, Michael Carus, and Roland Essel. 2015. Global Bioeconomy in the Conflict between Biomass Supply and Demand. Nova Paper #7 on Bio-Based Economy 2015–2010. Available online: http://agricultura.gencat.cat/web/.content/de_departament/de02_estadistiques_observatoris/27_butlletins/02_butlletins_nd/documents_nd/fitxers_estatics_nd/2015/0165_2015_ERenovables_Biomassa_biomassa.pdf (accessed on 20 May 2019).

- Piotrowski, Stephan, and Michael Carus. 2015. A New Study by Nova-Institut: EU-28 Bioeconomy Is Worth 2 Trillion Euro, Providing 19 Million Jobs. Available online: http://news.bio-based.eu/a-new-study-by-nova-institut-eu-28-bioeconomy-is-worth-2-trillion-euro-providing-19-million-jobs/ (accessed on 24 February 2018).

- Piotrowski, Stephan, Michael Carus, and Dirk Carrez. 2016. European Bioeconomy in Figures. Available online: http://biconsortium.eu/sites/biconsortium.eu/files/downloads/20160302_Bioeconomy_in_figures.pdf (accessed on 20 May 2019).

- Piotrowski, Stephan, Michael Carus, and Dirk Carrez. 2018. European Bioeconomy in Figures 2008–2015, Contribution of NACE Classes to the Total Product Volume of Bio-Based Chemicals, EU-28, 2008–2015). Available online: https://biconsortium.eu/sites/biconsortium.eu/files/documents/Bioeconomy_data_2015_20150218.pdf (accessed on 19 May 2019).

- PRP USP. 2017. Projeto de Produção de Energia a Partir de Efluentes Vence Etapa Nacional da G-BIB. Available online: http://prp.usp.br/projeto-de-producao-de-energia-a-partir-de-efluentes-vence-etapa-nacional-da-g-bib/ (accessed on 24 February 2018).

- Raschka, Achim, and Michael Carus. 2012. Stoffliche Nutzung von Biomasse—Basisdaten für Deutschland, Europa und die Welt. Erster Teilbericht zum F+E-Projekt “Ökologischekologische Innovationspolitik—Mehr Ressourceneffizienz und Klimaschutz Durch Nachhaltige Stofffliche Nutzung von Biomasse”, FKZ 3710 93 109. Hürth: nova-Institut GmbH, p. 26. [Google Scholar]

- REN21. 2016. Renewables 2016 Global Status Report. Renewable Energy Policy Network for the 21st Century. Paris: REN21, p. 272. [Google Scholar]

- right.basedonscience. 2019. By How Many °C Would the Earth Warm Up to by 2050 If Every Company Were as Emission-Intensive as. Available online: https://www.xdegreecompatible.de/en (accessed on 24 May 2019).

- Rockström, Johan, Will Steffen, Kevin Noone, Åsa Persson, F. Stuart Chapin, III, Eric Lambin, Timothy M. Lenton, Marten Scheffer, Carl Folke, Hans Joachim Schellnhuber, and et al. 2009a. Planetary boundaries: Exploring the safe operating space for humanity. Ecology and Society 14: 32–43. Available online: http://ecologyandsociety.org/vol14/iss2/art32/ (accessed on 3 February 2018).

- Rockström, Johan, Will Steffen, Kevin Noone, Åsa Persson, F. Stuart Chapin, III, Eric F. Lambin, Timothy M. Lenton, Marten Scheffer, Carl Folke, Hans Joachim Schellnhuber, and et al. 2009b. A safe operating space for humanity. Nature 461: 472–75. [Google Scholar] [CrossRef] [PubMed]

- Reubold, Todd. 2015. These Maps Show Changes in Global Meat Consumption by 2024. Here’s Why That Matters. Available online: https://ensia.com/articles/these-maps-show-changes-in-global-meat-consumption-by-2024-heres-why-that-matters/ (accessed on 6 February 2018).

- Roser, Max, and Hannah Ritchie. 2017. Fertilizer and Pesticides. Available online: https://ourworldindata.org/fertilizer-and-pesticides#yields-tend-to-increase-with-fertilizer-application (accessed on 6 February 2018).

- Roser, Max, and Hannah Ritchie. 2018. Yields and Land Use in Agriculture. Available online: https://ourworldindata.org/yields-and-land-use-in-agriculture (accessed on 6 February 2018).

- Shell. 2019. Shell Pernis. Available online: https://www.shell.nl/over-ons/shell-pernis-refinery.html (accessed on 12 May 2019).

- Sillanpää, Mika, and Chaker Ncibi, eds. 2017a. Legacy of petroleum-based economy. In A Sustainable Bioeconomy—The Green Industrial Revolution. Berlin/Heidelberg: Springer International Publishing AG, pp. 1–28. [Google Scholar]

- Sillanpää, Mika, and Chaker Ncibi, eds. 2017b. Bioeconomy—The path to sustainability. In A Sustainable Bioeconomy—The Green Industrial Revolution. Berlin/Heidelberg: Springer International Publishing AG, pp. 29–54. [Google Scholar]

- Sillanpää, Mika, and Chaker Ncibi, eds. 2017c. Implementing the bioeconomy on the ground: An international overview. In A Sustainable Bioeconomy—The Green Industrial Revolution. Berlin/Heidelberg: Springer International Publishing AG, pp. 271–316. [Google Scholar]

- Sorg, Martin, Heinz Schwan, Werner Stenmans, and Andreas Müller. 2013. Ermittlung der Biomassen flugaktiver Insekten im Naturschutzgebiet Orbroicher Bruch mit Malaise Fallen in den Jahren 1989 und 2013. Mitteilungen aus dem Entomologischen Verein Krefeld 1: 1–5. Available online: https://scholar.google.com/scholar?q=Ermittlung+der+Biomassen+flugaktiver+Insekten+im+Naturschutzgebiet+Orbroicher+Bruch+mit+Malaise+Fallen+in+den+Jahren+1989+und+2013+Sorg+2013 (accessed on 19 May 2019).

- Statista. 2013. Anteil der an Ausländische Investoren Verkauften Ackerflächen in Ausgewählten Entwicklungsländern im Jahr 2012. Available online: https://de.statista.com/statistik/daten/studie/257787/umfrage/land-grabbing-in-der-landwirtschaft-ausgewaehlter-entwicklungslaender/ (accessed on 11 February 2018).

- Statista. 2018a. Global GDP (Gross Domestic Product) at Current Prices from 2010 to 2022 (in Billion U.S. Dollars). Available online: https://statista.com/statistics/268750/global-gross-domestic-product-gdp/ (accessed on 20 May 2019).

- Statista. 2018b. Total Revenue of the Global Chemical Industry from 2002 to 2016 (in Billion U.S. Dollars). Available online: https://statista.com/statistics/302081/revenue-of-global-chemical-industry/ (accessed on 9 February 2018).

- Statista. 2018c. Anzahl der Biogasanlagen in Deutschland. Available online: https://de.statista.com/statistik/daten/studie/167671/umfrage/anzahl-der-biogasanlagen-in-deutschland-seit-1992/ (accessed on 20 May 2019).

- Statista. 2018d. Produktion von Zucker Weltweit in den Jahren 2010/2011 Bis 2016/2017 (in Millionen Tonnen). Available online: https://de.statista.com/statistik/daten/studie/189389/umfrage/zuckererzeugung-weltweit/ (accessed on 31 January 2018).

- Statista. 2018e. Verteilung der Energiebedingten CO2-Emissionen Weltweit Nach Sektor im Jahr 2015. Available online: https://de.statista.com/statistik/daten/studie/167957/umfrage/verteilung-der-co-emissionen-weltweit-nach-bereich/ (accessed on 31 January 2018).

- Statista. 2019a. Share of Economic Sectors in the Global Gross Domestic Product (GDP) from 2006 to 2016. Available online: https://www.statista.com/statistics/256563/share-of-economic-sectors-in-the-global-gross-domestic-product/ (accessed on 22 May 2019).

- Statista. 2019b. Production of Major Vegetable Oils Worldwide from 2012/13 to 2018/2019, by Type (in Million Metric Tons). Available online: https://www.statista.com/statistics/263933/production-of-vegetable-oils-worldwide-since-2000/ (accessed on 4 May 2019).

- Statista. 2019c. Umsatz der Chemisch-Pharmazeutischen Industrie Weltweit und in den EU-28-Staaten in den Jahren 2004 Bis 2017 (in Milliarden Euro). Available online: https://de.statista.com/statistik/daten/studie/5535/umfrage/umsatz-der-chemischen-industrie-weltweit-und-in-der-eu-27/ (accessed on 22 May 2019).

- Steffen, Will, Katherine Richardson, Johan Rockström, Sarah E. Cornell, Ingo Fetzer, Elena M. Bennett, Reinette Biggs, Stephen R. Carpenter, Wim de Vries, Cynthia A. de Wit, and et al. 2015. Planetary boundaries: Guiding human development on a changing planet. Science 347: 1259855. [Google Scholar] [CrossRef] [PubMed]

- The Hindu. 2011. Delhi’s First Bio-Gas Plant to Fuel 120 DTC Buses. Available online: http://www.thehindu.com/todays-paper/tp-national/tp-newdelhi/delhis-first-biogas-plant-to-fuel-120-dtc-buses/article2654959.ece (accessed on 16 February 2018).

- Thwaites, Joe. 2015. What Does the Paris Agreement Do for Finance? Available online: https://en.wikipedia.org/wiki/Paris_Agreement (accessed on 31 January 2018).

- Tsagkari, Mirela, Jean-Luc Couturier, Antonis Kokossis, and Jean-Luc Dubois. 2016. Early-Stage Capital Cost Estimation of Biorefinery Processes: A Comparative Study of Heuristic Techniques. Available online: https://www.ncbi.nlm.nih.gov/pubmed/?term=Couturier%20JL%5BAuthor%5D&cauthor=true&cauthor_uid=27484398 (accessed on 11 May 2019).

- Tzachor, Asaf. 2019. The future of feed: Integrating technologies to decouple feed production from environmental impacts. Industrial Biotechnology 15. Available online: https://www.liebertpub.com/doi/10.1089/ind.2019.29162.atz (accessed on 11 May 2019). [CrossRef]

- UFOP. 2017. UFOP-Bericht zur Globalen Marktversorgung 2017/2018. Available online: https://agrarheute.com/media/2018-01/ufop-bericht_zur_globalen_marktversorgung_2017-2018.pdf (accessed on 11 January 2018).

- UN. 2014. World Urbanization Prospects. Available online: https://esa.un.org/unpd/wup/publications/files/wup2014-highlights.pdf (accessed on 6 February 2018).

- UN. 2015a. Paris Agreement. Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 4 May 2019).

- UN. 2015b. Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/content/documents/21252030%20Agenda%20for%20Sustainable%20Development%20web.pdf (accessed on 22 May 2019).

- UN. 2017. World Population Prospects the 2017 Revision. Available online: https://esa.un.org/unpd/wpp/Publications/Files/WPP2017_KeyFindings.pdf (accessed on 19 May 2019).

- UN. 2018. Global Issues: The Global Energy Mix and Its Role in CO2 Emissions Mitigation. Available online: https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/publication/Monthly_Briefing_121.pdf (accessed on 11 May 2019).

- UNEP. 2015. The Financial System We Need. Aligning the Financial System with Sustainable Development. Available online: http://unepinquiry.org/publication/inquiry-global-report-the-financial-system-we-need/ (accessed on 19 May 2019).

- USEPA. 2014. Global Emissions by Economic Sector. Available online: https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data (accessed on 20 February 2018).

- USDA. 2014. Global Phosphate Rock Reserves and Resources, the Future of Phosphate Fertilizer. Available online: https://www.usda.gov/oce/forum/past_speeches/2014_Speeches/Kauwenbergh.pdf (accessed on 11 February 2018).

- US Grains Council. 2017. Ethanol Market and Pricing Data. September 6. Available online: https://www.grains.org/ethanol-reports/20170906/ethanol-market-and-pricing-data-september-6-2017 (accessed on 20 February 2018).

- VCI. 2017a. Rohstoffbasis der Chemischen Industrie. Available online: https://.vci.de/vci/downloads-vci/top-thema/daten-fakten-rohstoffbasis-der-chemischen-industrie.pdf (accessed on 9 February 2018).

- VCI. 2017b. Rohstoffbasis der Chemischen Industrie. Available online: https://.vci.de/vci/downloads-vci/top-thema/argumente-positionen-rohstoffbasis-der-chemischen-industrie.pdf (accessed on 21 May 2019).

- VCI. 2018. Chemiewirtschaft in Zahlen Online. Table 67b. Available online: https://www.vci.de/die-branche/zahlen-berichte/chemiewirtschaft-in-zahlen-online.jsp (accessed on 25 February 2018).

- Ville de St. Hyacinthe. 2017. Environnement et Matières Résiduelles. Available online: http://.ville.st-hyacinthe.qc.ca/services-aux-citoyens/biomethanisation.php (accessed on 13 February 2018).

- Vogel, Gretchen. 2017. Where Have All the Insects Gone? Science. Available online: http://sciencemag.org/news/2017/05/where-have-all-insects-gone (accessed on 9 February 2018).

- Wackerbauer, Johann, and Jana Lippelt. 2011. Kurz zum Klima: Biokraftstoffe Holen auf. ifo-Schnelldienst. Available online: http://cesifo-group.de/DocDL/ifosd_2011_11_4.pdf (accessed on 11 February 2018).

- Wagemann, Kurt. 2012. Roadmap Bioraffinerien. Berlin: Deutsche Bundesregierung, p. 104. Available online: https://www.bmel.de/SharedDocs/Downloads/Broschueren/RoadmapBioraffinerien.pdf?__blob=publicationFile (accessed on 22 February 2018).

- WEC. 2017. World Energy Resources Bioenergy 2016. Available online: https://worldenergy.org/wp-content/uploads/2017/03/WEResources_Bioenergy_2016.pdf (accessed on 20 May 2019).

- Wagner, Bernd. 2017. Green Economy—Recherche Ist-Stand Nachhaltige Finanzwirtschaft. Available online: http://www.forumng.org/images/stories/Publikationen/FNG_Kurzanalyse_Nachhaltige_Finanzwirtschaft_Januar_2017.pdf (accessed on 18 February 2018).

- Wilson, Edward O. 2016. Half-Earth. Our Planet’s Fight for Life. New York: Liveright Publishing Corp. [Google Scholar]

- Woods, Jeremy, Lee R. Lynd, Mark Laser, Mateus Batistella, Daniel de Castro Victoria, Keith Kline, and André Faaij. 2015. Land and Bioenergy. In Bioenergy & Sustainability: Bridging the Gaps. Edited by Glaucia C. Souza, Reynaldo Victoria, Carlos A. Joly and Luciano Martins Verdade. Sao Paulo: SCOPE, vol. 72, pp. 259–300. [Google Scholar]

- World Resources Institute. 2018. Understanding the IPCC Reports. Available online: http://.wri.org/ipcc-infographics (accessed on 31 January 2018).

- Worldwatch Institute. 2018. Fish Farming Continues to Grow as World Fisheries Stagnate. Available online: http://worldwatch.org/node/5444 (accessed on 12 February 2018).

- Wortmann, Erik. 2015. Global Land Use Change. Available online: https://sites.google.com/a/skagwayschool.org/bird-on-a-string/environmental-science/environmental-science-announcement/ (accessed on 6 February 2018).

- WWF. 2017. Living Planet Report 2016. Available online: http://awsassets.panda.org/downloads/lpr_living_planet_report_2016_summary.pdf (accessed on 22 February 2018).

- WWF, Credit Suisse, and McKinsey. 2014. Conservation Finance—Moving beyond Donor Funding toward an Investor-Driven Approach. Available online: https://www.cbd.int/financial/privatesector/g-private-wwf.pdf (accessed on 22 May 2019).

- Zabel, Florian, Birgitta Putzenlechner, and Wolfram Mauser. 2014. Global agricultural land resources—A high resolution suitability evaluation and its perspectives until 2100 under climate change conditions. PLoS ONE 9: e107522. Available online: http://journals.plos.org/plosone/article?id=10.1371/journal.pone.0107522 (accessed on 22 February 2018). [CrossRef] [PubMed]

- Zeug, Walther, Alberto Besamt, Urs Moesenfechtel, Anne Jäckel, and Daniela Thrän. 2019. Stakeholder’s interests and perceptions of bioeconomy monitoring using a sustainable development goal framework. Sustainability 11: 1511. [Google Scholar] [CrossRef]

- Zinke, Olaf. 2017. Zuckerpreise Erneut Abgestürzt. Agrarheute. Available online: https://www.agrarheute.com/markt/marktfruechte/zuckerpreise-erneut-abgestuerzt-541197 (accessed on 18 February 2018).

| SDG | Goal |

|---|---|

| 1 | No poverty |

| 2 | Zero hunger |

| 3 | Good-health and well-being |

| 4 | Quality education |

| 5 | Gender equality |

| 6 | Clean water and sanitation |

| 7 | Affordable and clean energy |

| 8 | Decent work and economic growth |

| 9 | Industry, innovation and infrastructure |

| 10 | Reduced inequalities |

| 11 | Sustainable cities and communities |

| 12 | Responsible consumption and production |

| 13 | Climate action |

| 14 | Life below water |

| 15 | Life on land |

| 16 | Peace, justice and strong institutions |

| 17 | Partnerships for the goals |

| Fossil Feedstock | Reported Reserves | To Be Produced by 2050 | ||||

|---|---|---|---|---|---|---|

| Volume | Carbon Contained (Gigaton) | CO2-Equivalents (Gigaton) | Share of Total Reserves | CO2-Equivalents (Gigaton) | Share of Reported Reserves | |

| Oil & NGLs | 1688 Gb | 171.2 | 629.9 | 22.9% | 439 | 70% |

| Natural gas | 6558 Tcf | 95.6 | 350.4 | 12.8% | 192 | 55% |

| Coal | 892 Gt | 479.5 | 1756.9 | 64.3% | 368 | 20% |

| Total | - | 746.2 | 2734.2 | 100% | 1000 | 37% |

| Industrial Sectors | |||||

|---|---|---|---|---|---|

| Fossil Feedstock Production | Construction Sector | Chemical Sector | Fuel Sector | Power Sector | Heat Sector |

| Applications | |||||

| Coal mining | Road surfaces | Pharma | Automotive mobility | Electrical devices | Heavy industries |

| Oil, gas production | Roofing | Automotive | Shipping | Lighting | Industrial processing |

| Logistics (pipelines, tankers) | Concrete | Household appliances | Aviation | Air conditioning | Heating homes |

| Oil-refining | Steel, aluminium | Packaging | Machine fuel | Rail services | Heating offices |

| - | Glass | Construction | Cooking (Africa) | Automotive mobility | Heating commercial buildings |

| Carbon Sources | Carbon % | Hydrogen % | Oxygen % | Energy MJ/kg |

|---|---|---|---|---|

| Fossil Carbon Sources | ||||

| Coal | 60–75 | 6 | 17–34 | 25–33 |

| Gas | 75–85 | 9–24 | Traces | 32–45 |

| Oil | 83–87 | 10–14 | 0.1–2 | 43 |

| Biological Carbon Sources | ||||

| Straw 1 | 44 | 6 | 50 | 10–25 |

| Wood | 50 | 6 | 41 | 14–16 |

| Sugar 2 | 40 | 7 | 53 | 16 |

| Safflower oil 3 | 77 | 12 | 11 | 39 |

| Ecosystem | Area (1000 km2) | Share of Untouched Area |

|---|---|---|

| Ocean | 416,546 | 10–15% |

| Mediterranean shrubland | 1741 | 38% |

| Coastal systems | not specified | 40% |

| Temperate mixed forest | 5914 | 49% |

| Grass & rangeland | 19,056 | 50% |

| Warm mixed forest | 5835 | 52% |

| Savanna | 15,604 | 57% |

| Cool coniferous forest | 3130 | 72% |

| Tropical forest | 9149 | 76% |

| Desert | 22,174 | 83% |

| Boreal forests | 17,611 | 85% |

| Wooded tundra | 2596 | 93% |

| Tundra | 6375 | 94% |

| Bulk Products | Production (Mio ton) | Carbon Content (Mio ton) | Market Price (USD/ton) | Theoretical Cost of Carbon (USD/ton) |

|---|---|---|---|---|

| Olefines | ||||

| Ethylene | 150 | 128.6 | 1200–1500 | 1630–1750 |

| Propylene | 120 | 102.8 | 1200–1500 | 1630–1750 |

| Methanol | 130 | 37.2 | 200–280 | 670–980 |

| Total | 400 | 286.6 | - | - |

| Aromatics | ||||

| Benzene | 50 | 46.1 | 1200–1500 | 1300–1625 |

| Toluene | 17 | 15.5 | 1000–1300 | 1100–1423 |

| Xylenes | 45 | 40.8 | 1300–1600 | 1430–1770 |

| Total | 112 | 102.4 | - | - |

| Biologics | ||||

| Sugar | 178 | 71.2 | 360–400 | 900–1000 |

| Lignin | 50 | 36.0 | 500 | 700 |

| Total | 228 | 107.2 | - | - |

| Fuel | Processing Step from Feedstock to Product | Chemicals | ||||

|---|---|---|---|---|---|---|

| Fossil | Biomass | Fossil | Biomass | |||

| Mineral Oil | Sugar | Lignocellulose | Mineral Oil | Sugar | Lignocellulose | |

| Drilling | Farming | Farming | 1 | Drilling | Farming | Farming |

| Logistics | Harvesting | Harvesting | 2 | Logistics | Harvesting | Harvesting |

| Refining | Logistics | Logistics | 3 | Refining | Logistics | Logistics |

| Petrol | Refining | Preprocessing | 4 | Cracking | Refining | Preprocessing |

| - | Sugar-conversion | Saccharification | 5 | Ethylen | Sugar-conversion | Saccharification |

| - | Ethanol | Sugar-conversion | 6 | - | Ethanol-conversion | Sugar-conversion |

| - | - | Ethanol | 7 | - | Ethylen | Ethanol-conversion |

| - | - | - | 8 | - | Ethylen | |

| Producing Biomass (Jobs/1 Million Tons of Biomass) | Processing Biomass (Jobs/1 Million Tons of Biomass) | |

|---|---|---|

| 5400 | Biofuels | 5400 |

| Bio-Chemicals | 12,400 | |

| Feedstock | Carbon Source | Technology | Product | Development Stage |

|---|---|---|---|---|

| Sugar cane Sugar beet Starch-derived Sugar | Sugar | Fermentation | Bioethanol Amino acids Enzymes Biopolymers Pharmaceuticals and more | Commercial |

| Woody materials | Sugar | Fermentation | Bioethanol | Commercial |

| Woody materials | Wood gas | Thermochemical catalysis | Aromatics | Lab-scale |

| Liquid sewage, Solid municipal waste, manure | Complex waste ingredients | Fermentation | Methane | Commercial |

| Municipal solid waste | Synthesis gas (CO) | Gas-fermentation | Chemicals | Commercial |

| Biogas | CO2-emission | Gas-fermentation, Algae cultivation | Methane, Chemicals | Demonstration |

| Steel mill synthesis gas | CO | Gas-fermentation, Fischer-Tropsch | Ethanol, Hydrocarbons | Demonstration |

| Emission | CO2 | Methane | Nitrous Oxide | F-Gases |

|---|---|---|---|---|

| Fossil | 65% | - | - | - |

| Non-fossil | 11% | 16% | 6% | 2% |

| Economic Sector | Emission Sources | Greenhouse Gas |

|---|---|---|

| Energy | Power, heat generation | 25% |

| Agriculture, Forestry | Crop cultivation, cattle breeding | 24% |

| Industry | Production processes | 21% |

| Transport | Automotive, railway, aviation, shipping | 14% |

| Buildings | Air conditioning, power consumption | 6% |

| Other | - | 10% |

| Measure | Planned by Chemical Industries (%) |

|---|---|

| Improving energy efficiency | 86 |

| Optimising running processes | 81 |

| Increasing the share of renewable energies | 60 |

| (Increased) use of renewable raw materials | 56 |

| New business models based on circular economy | 54 |

| New production technologies | 51 |

| Use of CO2 as carbon source | 18 |

| Investment Field | Renewable Energies | Bio-Based Chemicals and Fuels | Ecosystem Services | Total |

|---|---|---|---|---|

| USD (billion per year) | 800–1600 | 50–100 | 200–400 | 1050–2100 |

| Share of global GDP | 1–2% | 0.06–0.12% | 0.26–0.53% | 1.3–2.6% |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kircher, M. Bioeconomy: Markets, Implications, and Investment Opportunities. Economies 2019, 7, 73. https://doi.org/10.3390/economies7030073

Kircher M. Bioeconomy: Markets, Implications, and Investment Opportunities. Economies. 2019; 7(3):73. https://doi.org/10.3390/economies7030073

Chicago/Turabian StyleKircher, Manfred. 2019. "Bioeconomy: Markets, Implications, and Investment Opportunities" Economies 7, no. 3: 73. https://doi.org/10.3390/economies7030073

APA StyleKircher, M. (2019). Bioeconomy: Markets, Implications, and Investment Opportunities. Economies, 7(3), 73. https://doi.org/10.3390/economies7030073