On the Relationship between Economic Integration, Business Environment and Real Convergence: The Experience of the CEE Countries

Abstract

:1. Introduction

- Do the CEE countries develop in accordance with beta convergence hypothesis and is there a sigma convergence between CEE10 and EU15 in years 1995–2016?

- What was the impact of accession to the EU on the economic growth and catching up process of the CEE countries?

- Is there a relationship between economic growth and the business environment in the CEE countries?

- Does the business environment contribute to the economic growth and convergence process of the CEE countries?

2. Literature Review and Hypotheses Development

3. Methodology

- y(t)—GDP per capita at the end of the time period,

- y(0)—GDP per capita at the initial the time period,

- t—the number of years.

- yi(t) = GDP per capita in the i-th country.

- AR(Y)it—rank of GDP per capita level in the i-th country in year t.

- AR(Y)i0—rank of GDP per capita level in the i-th country in year 0 (first period of analysis)

- γ = 0 there is a convergence process between the examined economies.

- γ ≠ 0 there is a divergence process between the studied economies.

- —GDP per capita

- i, l—country or grouping of countries

- t—numbers of years.

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Abramovitz, Moses. 1986. Catching Up, Forging Ahead, and Falling Behind. The Journal of Economic History 46: 385–406. [Google Scholar] [CrossRef]

- Alexe, Ileana. 2012. How Does Economic Crisis Change the Landscape of Real Convergence for Central and Eastern Europe? Romanian Journal of Fiscal Policy (RJFP) 3: 1–8. [Google Scholar]

- Andersson, Sante, Natasha Evers, and Olli Kuivalainer. 2014. International new ventures:rapid internationalization across different industry contexts. European Business Journal 26: 390–405. [Google Scholar]

- Andrade, Eduardo, Márcio Laurini, Regina Madalozo, and Pedro L. Valss Pereira. 2004. Convergence clubs among Brazilian municipalities. Economics Letters 83: 179–84. [Google Scholar] [CrossRef]

- Ani, Teodorica. 2015. Effect of Ease of Doing Business to Economic Growth among Selected Countries in Asia. Asia Pacific Journal of Multidisciplinary Research 3: 139–45. [Google Scholar]

- Artelaris, Panagiotis, Dimitris Kalioras, and George Petrakos. 2010. Regional inequalities and convergence clubs in the European Union new member-states. Eastern Journal of European Studies 1: 113–33. [Google Scholar]

- Ayal, Elizer B., and Georgios Karras. 1998. Components of economic freedom and growth: An empirical study. Journal of Developing Areas 32: 327–28. [Google Scholar]

- Balassa, Béla. 1973. The Theory of Economic Integration. London: George Allen & Unwin, pp. 73–130. [Google Scholar]

- Barro, Robert J., and Xavier Sala-i-Martin. 1992. Convergence. The Journal of Political Economy 100: 223–51. [Google Scholar] [CrossRef]

- Baumol, William J. 1986. Productivity Growth, Convergence, and Welfare: What the Long-Run Data Show. The American Economic Review 76: 1072–85. [Google Scholar]

- Berry, Healther, Mauro F. Guillen, and Arun S. Hendi. 2014. Is there convergence across countries? A spatial approach. Journal of International Business Studies 45: 387–404. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Bobenič-Hintošová, Aneta, Zuzana Kubíková, and Rastislav Ručinský. 2016. Does Quality of Business Environment Influence Foreign Direct Investment Inflows? A Case of Cenral European Countries. European Journal of Management 3: 5–13. [Google Scholar]

- Borsi, Mihály T., and Norbert Metiu. 2015. The evolution of economic convergence in the European Union. Empirical Economy 48: 657–81. [Google Scholar] [CrossRef]

- Boyle, Gerry, and Thomas McCarthy. 1997. A Simple Measure of β-Convergence. Oxford Bulletin of Economics and Statistics 59: 257–64. [Google Scholar] [CrossRef]

- Chambers, Dustin, and Shatakshee Dhongde. 2017. Are countries becoming equally unequal? Empirical Economics 53: 1323–48. [Google Scholar] [CrossRef]

- Cuestas, Juan C., Mercedes Monfort, and Javier Ordonez. 2012. Real Convergence in Europe; A Cluster Analysis. Sheffield Economic Research Paper Series 2012023; Sheffield: University of Sheffield, pp. 1–20. [Google Scholar]

- Dawson, John W. 1998. Institutions. investment and growth: New cross-country and panel data evidence. Economic Inquiry 36: 603–19. [Google Scholar] [CrossRef]

- De Long, James Bradford. 1988. Productivity Growth. Convergence, and Welfare. American Economic Review 78: 1138–54. [Google Scholar]

- Delgado, Mercedes, Michael E. Porter, and Scott Stern. 2010. Clusters and entrepreneurship. Journal of Economic Geography 10: 495–518. [Google Scholar] [CrossRef]

- Djankov, Simeon, Rafael La Porta, Florenciio Lopez-de-Silanes, and Andrei Shleifer. 2002. The Regulation of Entry. The Quarterly Journal of Economics 117: 1–37. [Google Scholar] [CrossRef]

- Dobrinsky, Rumen, and Peter Havlik. 2014. Economic Convergence and Structural Change: The Role of Transition an EU Accession. Research Report 395. Wien: The Vienna Institute for International Economic Studies, pp. 1–28. [Google Scholar]

- Druzhinin, Pavel, and Gor Prokopyev. 2018. An Assessment of the Economic Performance of the EU Baltic Region States. Baltic Region 10: 4–18. [Google Scholar] [CrossRef]

- Easton, Stephen, and Michael Walker. 1997. Income, growth, and economic freedom. American Economic Review 87: 328–32. [Google Scholar]

- Edrees, Abdelbagi. 2015. Foreign Direct Investment. Business Environment and Economic Growth in Sub-Saharan Africa. Pooled Mean Group Technique. Journal of Global Economy 3: 144–49. [Google Scholar] [CrossRef]

- Emvalomatis, Grigorios. 2017. Is productivity deverging in the EU? Evidence from 11 Member States. Empirical Economics 53: 1171–92. [Google Scholar] [CrossRef]

- Friedman, Milton. 1992. Do Old Fallacies Ever Die? Journal of Economic Literature 20: 2129–32. [Google Scholar]

- Ghosh, Sunandan, and Gerrit Faber. 2010. Economic Integration in Europe and Income Divergence over EU Regions (1995–2006). Discussion Paper Series, no. 10–19; Utrecht: Tjalling C. Koopmans Research Institute, Utrecht School of Economics. [Google Scholar]

- Głodowska, Agnieszka. 2015. Beta and Sigme convergence within the European Union countries and regions. Paper presented at 6th GCRM, Maribor, Slovenia, May 18–19; pp. 233–45. [Google Scholar]

- Głodowska, Agnieszka. 2017a. Business Environment and Economic Growth in the European Union Countries: What Can be Explained for the Convergence? Entrepreneurial Business and Economics Review 5: 189–204. [Google Scholar]

- Głodowska, Agnieszka. 2017b. Zmiany otoczenia biznesowego w krajach Unii Europejskiej—Implikacje dla wzrostu konwergentnego. Przedsiębiorczość i Zarządzanie 19: 197–2007. [Google Scholar]

- Gwartney, James D., Robert A. Lawson, and Randall G. Holcombe. 1999. Economic Freedom and the Environment for Economic Growth. Journal of Institutional and Theoretical Economics 155: 643–63. [Google Scholar]

- Haas, Ernst B. 1958. The Uniting of Europe: Political. Social and Economic Forces 1950–1957. Stanford: Stanford University Press, pp. 105–17. [Google Scholar]

- Haider, Jamal Ibrahim. 2012. The impact of business regulatory reforms on economic growth. Journal of The Japanese and International Economies 26: 285–307. [Google Scholar] [CrossRef] [Green Version]

- Halmai, Péter, and Victrória Vásáry. 2010. Real convergence in the new Member States of the European Union (Shorter and longer term prospects). The European Journal of Comparative Economics 7: 229–53. [Google Scholar]

- Hanusch, Marek. 2012. The Doing Business Indicators. Economic Growth and Regulatory Reform. World Bank Policy Research Working Paper 6176. Washington, DC: World Bank, pp. 2–18. [Google Scholar]

- Heckelman, Jac C. 2015. Economic Freedom Convergence Club. In Economic Behavior. Economic Freedom and Entrepreneurship. Edited by Richard J. Cebula, Joshua Hall, Franklin G. Mixon Jr. and James E. Payne. Cheltenham: Edward Elgar Publishing, pp. 102–14. [Google Scholar]

- Helliwell, John F. 1994. Empirical Linkages Between Democracy and Economic Growth. Journal of Political Science 24: 225–48. [Google Scholar]

- Hu, Zhenhui, and Haizheng Li. 2008. Political freedom. economic freedom. and income convergence: Do stages of economic development matter? Public Choice 138: 183–205. [Google Scholar]

- Islam, Nazrul. 2003. What have we learnt from the convergence debate? Journal of Economic Surveys 17: 309–62. [Google Scholar] [CrossRef]

- Knack, Stephen, and Philip Keefer. 1995. Institutions and Economic Performance: Cross—Country Tests Using Alternative Institutional Measures. Economics and Politics 7: 207–27. [Google Scholar] [CrossRef]

- Kormendi, Roger C., and P. G. Meguire. 1985. Macroeconomic Determinants of Growth: Cross-Country evidence. Journal of Monetary Economics 16: 141–63. [Google Scholar] [CrossRef]

- Krill, Christoph. 2006. Cross-National Policy Convergence; Causes. Concepts and Empirical Findings. London: Routledge, pp. 764–74. [Google Scholar]

- Lejko, Ina, and Štefan Bojnec. 2011. Internationalization and Economic Growth: The Comparison of European Economies. Paper presented at 8th International Conference Economic Integration, Competition and Cooperation, Rijeka, Croatia, April 6–9. [Google Scholar]

- Liberda, Zofia Barbara, ed. 2009. Konwergencja Gospodarcza Polski. Warszawa: PTE. [Google Scholar]

- Lindberg, Leon N. 1963. The Political Dynamics of European Economic Integration. Stanford: Stanford University Press, pp. 117–33. [Google Scholar]

- Loray, Romina. 2017. Public Policies in Science. Technology and Innovation: Regional Trends and Areas of Convergence. Revista de Estudios Sociales 62: 68–80. [Google Scholar] [CrossRef]

- Lucas, Robert E., Jr. 1988. On the Mechanics of Economic Development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Machlup, Fritz. 1977. A History of Thought on Economic Integration. London and Basingstoke: Palgrave Macmillian (UK), pp. 39–42. [Google Scholar]

- Maciejewski, Marek. 2017. Determinanty wykorzystania czynników wytwórczych w strukturze eksportu państw Unii Europejskiej. Horyzonty Polityki 8: 131–49. [Google Scholar]

- Mankiw, N. Gregory, David Romer, and David N. Weil. 1992. A Contribution to the Empirics of Economic Growth. Quarterly Journal of Economics 102: 407–37. [Google Scholar] [CrossRef]

- Martin, Ron. 2005. European Integration and Economic Geography: Theory and Empirics in the Regional Convergence Debate. In Multidisciplinary Economics. The Birth of a New Economics Faculty in the Netherlands. Edited by Peter De Gijsel and Hans Schenk. Dordrecht: Springer, pp. 227–57. [Google Scholar]

- Martin, Carmela, and Ismael Sanz. 2003. Real convergence and European Integration: The Experience of the Less developed EU members. Empirica 30: 205–36. [Google Scholar] [CrossRef]

- Martinez-Carrion, Jose M., and Ramón Maria-Dolores. 2017. Regional Inequality and Convergence in Southern Europe. Evedence from Heoght in Italy and Spain. 1850–2000. Revista de Economia Applicada 25: 75–103. [Google Scholar]

- Matkowski, Zbigniew, and Mariusz Próchniak. 2006. Zbieżność rozwoju gospodarczego krajów Europy Środkowowschodniej w stosunku do Unii Europejskiej. In Integracja a konkurencyjność przedsiębiorstw w UE. Edited by Małgorzata Stawicka. Warszawa: Szkoła Wyższa im. B. Jańskiego, pp. 73–88. [Google Scholar]

- Matkowski, Zbigniew, Ryszard Rapacki, and Mariusz Próchniak. 2016. Real income convergence between central eastern and western Europe: Past. present. and prospects. Ekonomista 6: 853–92. [Google Scholar]

- Messaoud, Boudhiaf, and Zribi. El. Ghak Teheni. 2014. Business regulations and economic growth. What can be explained? International Strategic Management Review 2: 69–78. [Google Scholar] [CrossRef]

- Molle, Willem. 2006. The Economicss of European Integration. Theory. Practice. Policy, 5th ed.London: Routladge, Taylor and Frances Group, pp. 24–48. [Google Scholar]

- Monfort, Philippe. 2008. Convergence of EU Regions. Measures and Evolution. Working Papers of European Union Regional Policy 1. Available online: www.ec.europa.eu/regional_policy/sources/docgener/work/200801_convergence.pdf (accessed on 16 June 2017).

- Peev, Evgeni, and Dennis C. Mueller. 2012. Democracy. Economic Freedom and Growth in Transition Economies. Kyklos 65: 371–407. [Google Scholar] [CrossRef]

- Perenyi, Aron, and Mikós Losoncz. 2018. A systematic Review of International Entrepreneurship Special Issue Articles. Sustainability 10: 3476. [Google Scholar] [CrossRef]

- Petrakos, George, Yannis Psycharis, and Dimitris Kallioras. 2005. Regional Inequalities in the EU Accession Countries: Evloution and Challenges. In Integration. Growth, and Cohesion in an Enlarged European Union. Edited by John Bradley, George G. Petrakos and Julia Traistrau. Berlin: Springer, pp. 65–85. [Google Scholar]

- Quah, Danny T. 1993. Galton’s fallacy and Tests of the Convergence Hypotesis. The Scandinavian Journal of Economics 95: 427–43. [Google Scholar] [CrossRef]

- Rapacki, Ryszard, and Mariusz Próchniak. 2014. Wpływ członkostwa w Unii Europejskiej na wzrost gospodarczy i realną konwergencję krajów Europy Środkowo-Wschodniej. Ekonomia 39: 87–122. [Google Scholar]

- Recher, Vedran, and Nataša Kurnoga. 2017. European integration perspectives: From cohesion to divergence? Acta Oeconomica 67: 195–214. [Google Scholar] [CrossRef]

- Romer, Paul M. 1986. Increasing returns and long run growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Romer, Paul. 1990. Endogenous Technological Change. Journal of Political Economy 98: 71–102. [Google Scholar] [CrossRef]

- Sala-i-Martin, Xavier. 1996. The Classical Approach to Convergence Analysis. The Economic Journal 106: 1019–36. [Google Scholar] [CrossRef]

- Salsecci, Gianluca, and Antonio Pesce. 2008. Long-term Growth Perspectives and Economic Convergence of CEE and SEE Countries. World Transition Economy Research 15: 225–39. [Google Scholar] [CrossRef]

- Saygili, Hűlya. 2017. Production fragmentation and factor price convergence. International Review of Economics & Finance 51: 535–44. [Google Scholar]

- Schadler, Susan, Ashoka Mody, Abdul Abiad, and Daniel Leigh. 2006. Growth in the Central and Eastern European Countries of the European Union, IMF. Available online: http://relooney.fatcow. com/00_New_1735.pdf (accessed on 5 May 2019).

- Scully, Gerald W. 1988. The Institutional Framework and Economic Development. Journal of Political Economy 96: 652–62. [Google Scholar] [CrossRef]

- Stanišić, Nenad. 2012. The effects of the economic crisis on income convergence in the European Union. Acta Oeconomica. Periodical of the Hungarian Academy of Sciences 62: 161–82. [Google Scholar] [CrossRef]

- Stanišić, Nenad. 2013. Convergence between the business cycle of Central and Eastern European countries and the Euro area. Baltic Journal of Economic 13: 63–74. [Google Scholar] [CrossRef]

- Terjesen, Siri, Jolanda Hessels, and Dan Li. 2013. Comparative International Entrepreneurship: A Review and Research Agenda. Journal of Management 20: 1–46. [Google Scholar] [CrossRef]

- Tselois, Vassilis. 2009. Growth and convergence in income per capita and income inequality in the regions of the EU. Spatial Economic Analysis 4: 343–70. [Google Scholar] [CrossRef]

- Verblane, Urmas, and Pritt Vahter. 2005. An Analysis of the Economic Convergence Process in the Transition Countries. Tartu: Tartu University Press, pp. 8–42. [Google Scholar]

- Voigt, Sebastian, Enrica De Cian, and Michael Schymura. 2014. Energy intensity developments in 40 major economies: Structural change or technology improvement? Energy Economics 41: 47–62. [Google Scholar] [CrossRef] [Green Version]

- Vojinovic, Borut, and Žan Jan Oplotnik. 2008. Real Convergence in the New EU Member States. Prague Economic Papers 1: 23–39. [Google Scholar] [CrossRef]

- Wach, Krzysztof. 2016. Otoczenie międzynarodowe jako czynnik internacjonalizacji polskich przedsiębiorstw. Prace Komisji Geografii Przemysłu Polskiego Towarzystwa Geograficznego 30: 7–20. [Google Scholar]

- Wilhelmsson, Fredrik. 2009. Effects of the EU Enlargement on Income Convergence in the Easters Border Regions. NUPI Working Paper 758: 5–25. [Google Scholar]

- Żuk, Piotr, Eva Katalin Polgar, Li Savelin, Juan Luis Diaz del Hoyo, and Paul König. 2018. Real convergence in central, eastern and south-eastern Europe. ECB Economic Bulletin 3: 36–65. [Google Scholar]

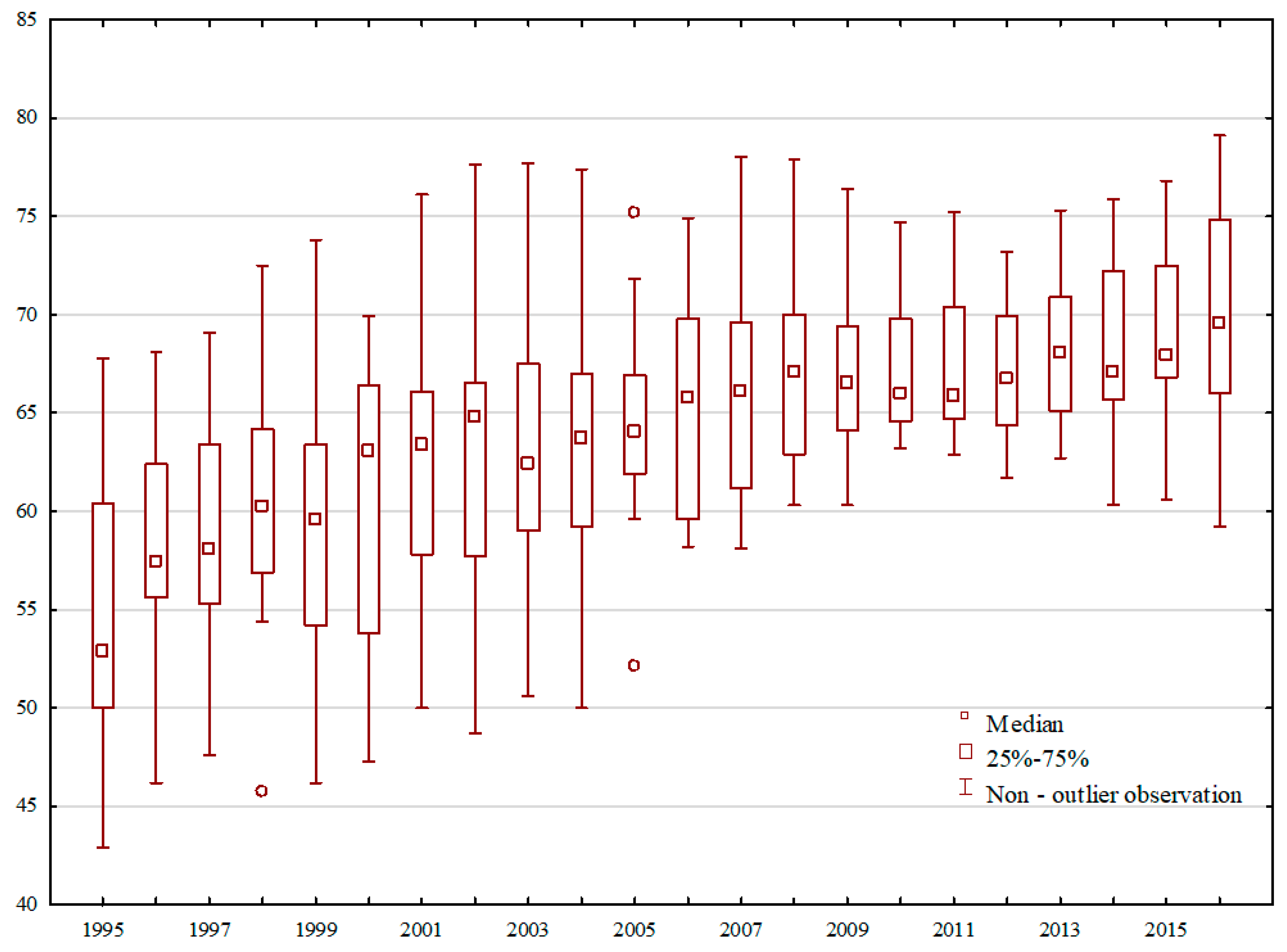

| Measures | 1995 | 1998 | 2001 | 2004 | 2007 | 2010 | 2013 | 2016 |

|---|---|---|---|---|---|---|---|---|

| EU15 | ||||||||

| Mean (average GDP) | 18,220 | 21,547 | 25,567 | 28,020 | 32,700 | 31,207 | 32,507 | 35,607 |

| Maximum GDP | 33,400 | 38,300 | 48,500 | 54,100 | 69,100 | 65,400 | 70,000 | 77,400 |

| Minimum GDP | 12,100 | 14,400 | 17,000 | 18,200 | 21,200 | 20,900 | 19,200 | 19,500 |

| Coefficient of variation | 0.2630 | 0.2413 | 0.2695 | 0.2775 | 0.3235 | 0.3189 | 0.3462 | 0.3726 |

| Skewness index | 1.8109 | 1.8998 | 2.2166 | 2.3189 | 2.5802 | 2.5336 | 2.2338 | 1.9663 |

| CEE10 | ||||||||

| Mean (average GDP) | 6890 | 8330 | 10,000 | 12,360 | 16,130 | 16,330 | 18,360 | 20,500 |

| Maximum GDP | 11,500 | 13,900 | 16,500 | 19,300 | 22,700 | 21,200 | 22,400 | 25,400 |

| Minimum GDP | 4600 | 4800 | 5600 | 7700 | 10,600 | 11,400 | 12,200 | 13,900 |

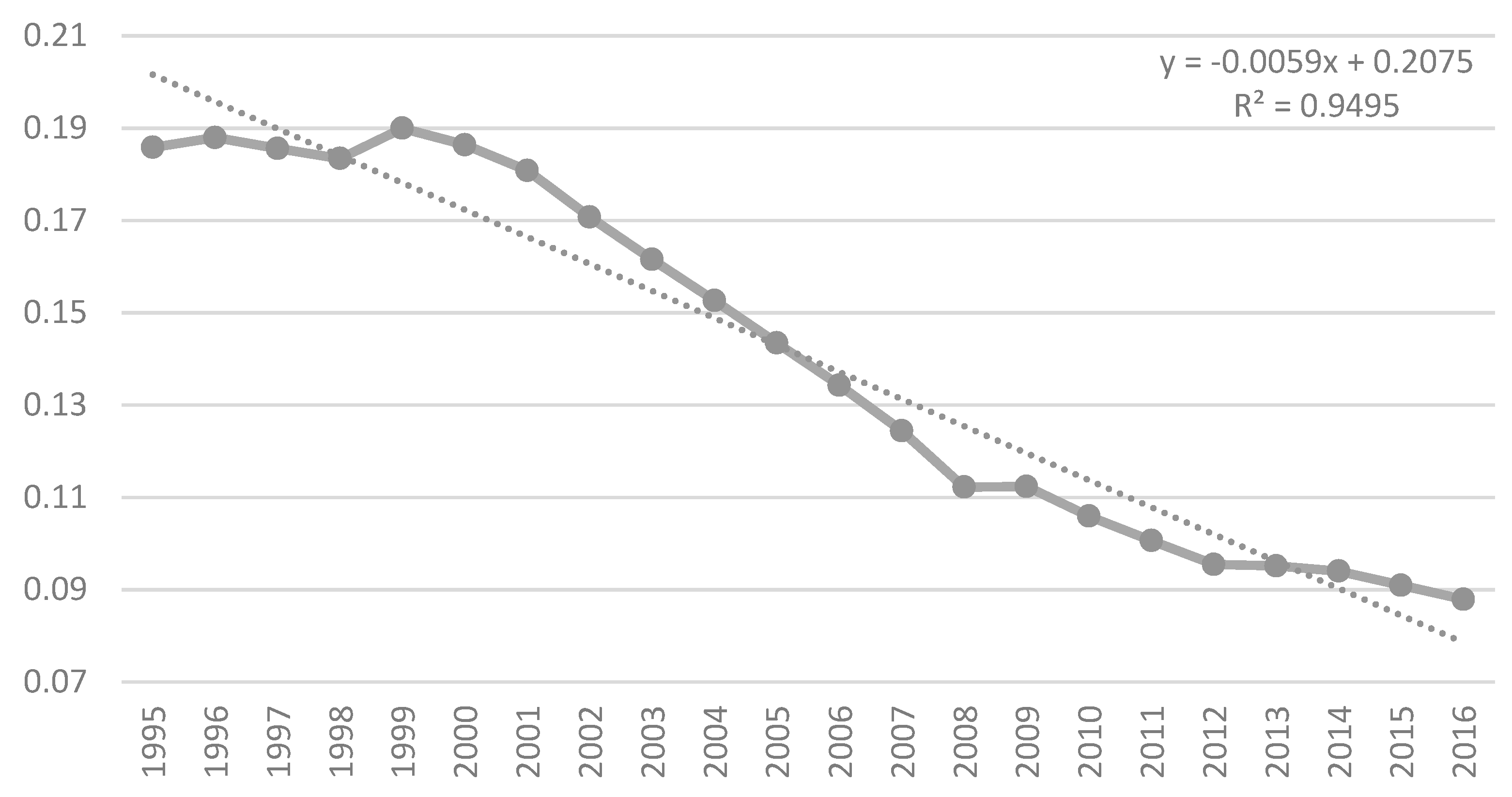

| Coefficient of variation | 0.3635 | 0.3485 | 0.3418 | 0.2898 | 0.2317 | 0.1908 | 0.1651 | 0.1553 |

| Skewness index | 0.9465 | 0.7263 | 0.6307 | 0.5785 | 0.2461 | 0.1879 | −0.6157 | −0.4737 |

| EU25 | ||||||||

| Mean (average GDP | 13,688 | 16,260 | 19,340 | 21,756 | 26,072 | 25,256 | 26,848 | 29,564 |

| Maximum GDP | 33,400 | 38,300 | 48,500 | 54,100 | 69,100 | 65,400 | 70,000 | 77,400 |

| Minimum GDP | 4600 | 4800 | 5600 | 7700 | 10,600 | 11,400 | 12,200 | 13,900 |

| Coefficient of variation | 0.5014 | 0.4824 | 0.4941 | 0.4602 | 0.4516 | 0.4272 | 0.4209 | 0.4337 |

| Skewness index | 0.0693 | 0.1147 | 0.1272 | −0.0015 | −0.2205 | −0.3635 | −0.3911 | −0.3938 |

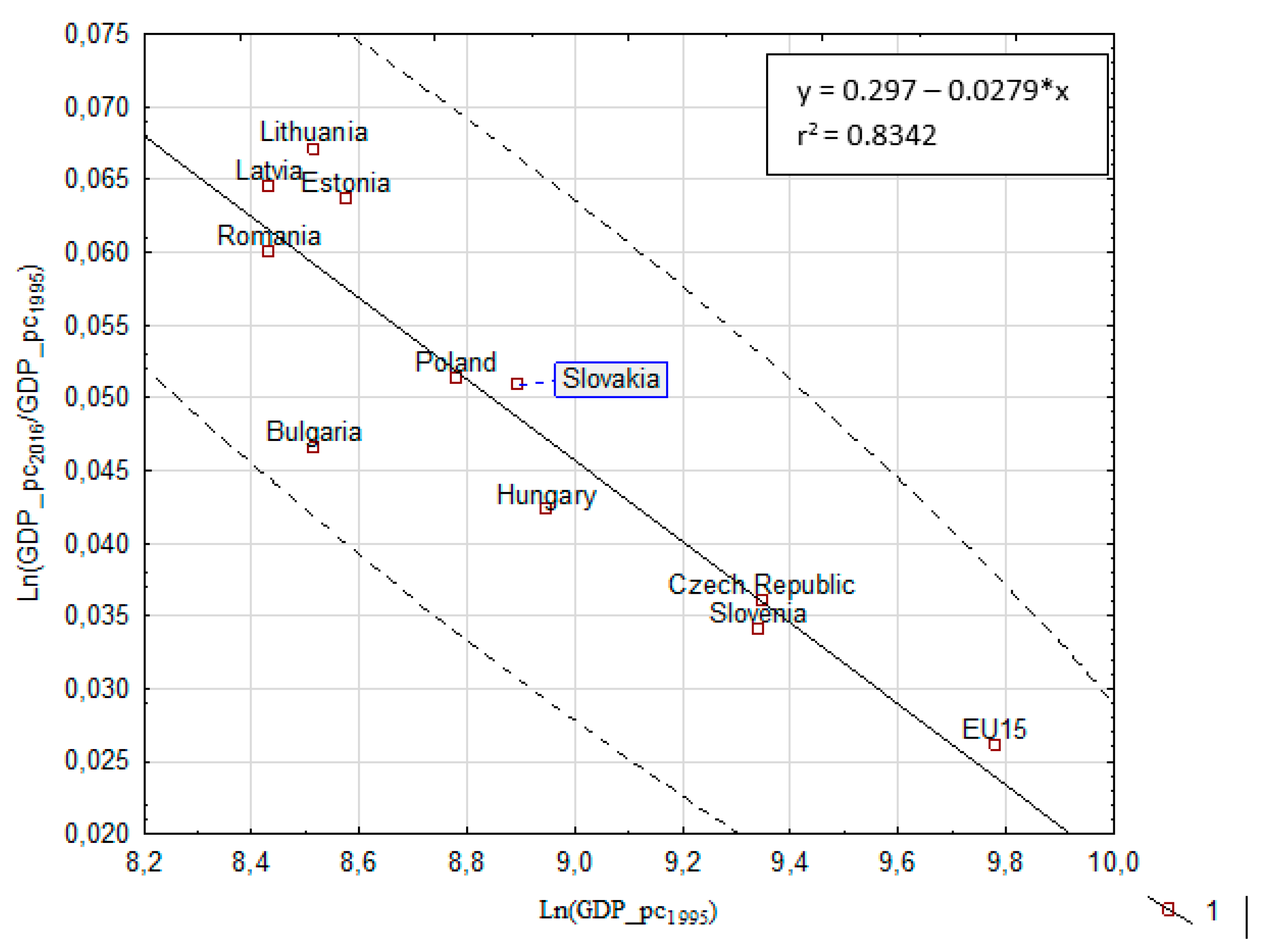

| The results of the regression of beta convergence within EU10 and EU15 countries in years 1995–2016 (N = 242) | |||

| α1 | β | Hl | R² |

| −0.0279 ** | 0.0432 (4.32%) | 24.84 | 0.8342 |

| The results of the regression of beta convergence within EU10 and EU15 countries in years 1995–2004 (N = 121) | |||

| α1 | β | Hl | R² |

| −0.0205 ** | 0.0229 (2.29%) | 33.81 | 0.348 |

| The results of the regression of beta convergence within EU10 and EU15 countries in years 2004–2016 (176) | |||

| α1 | β | Hl | R² |

| −0.0417 ** | 0.0610 (6.01%) | 16.62 | 0.634 |

| Note: *, ** and *** denotes that coefficients are significantly at the 10%, 5% and 1% level. | |||

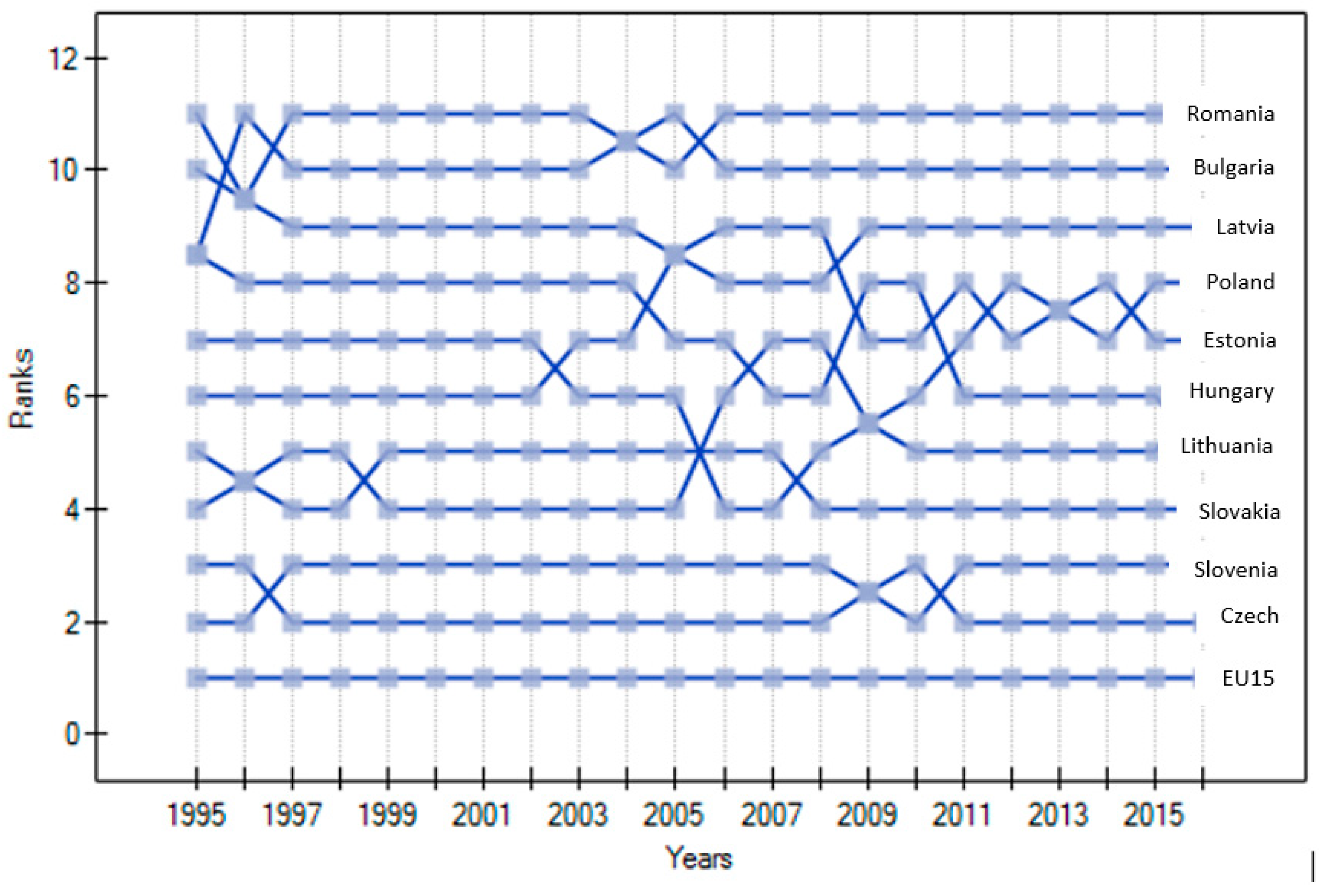

| The Results of the Regression of Gamma Convergence within EU15 and EU10 Countries in Years 1995–2016 (N = 242) | ||

|---|---|---|

| Γ | χ2 | ρ |

| 0.9352 | 205.75 | 93.21 |

| Countries | 1995 | 1998 | 2001 | 2004 | 2007 | 2010 | 2013 | 2016 | 1995–2004 | 2005–2016 | 1995–2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EU15 (benchmark group) | |||||||||||

| Bulgaria | 0.569 | 0.611 | 0.620 | 0.569 | 0.510 | 0.465 | 0.454 | 0.438 | 0.604 | 0.477 | 0.538 |

| Czech Republic | 0.226 | 0.251 | 0.254 | 0.228 | 0.209 | 0.196 | 0.184 | 0.167 | 0.246 | 0.193 | 0.218 |

| Estonia | 0.549 | 0.499 | 0.484 | 0.393 | 0.287 | 0.308 | 0.236 | 0.247 | 0.488 | 0.282 | 0.389 |

| Latvia | 0.597 | 0.559 | 0.533 | 0.462 | 0.374 | 0.399 | 0.321 | 0.304 | 0.544 | 0.362 | 0.454 |

| Lithuania | 0.569 | 0.526 | 0.514 | 0.436 | 0.351 | 0.339 | 0.248 | 0.238 | 0.519 | 0.316 | 0.421 |

| Hungary | 0.406 | 0.411 | 0.379 | 0.343 | 0.354 | 0.311 | 0.290 | 0.292 | 0.390 | 0.313 | 0.350 |

| Poland | 0.474 | 0.444 | 0.454 | 0.425 | 0.406 | 0.325 | 0.290 | 0.278 | 0.450 | 0.342 | 0.394 |

| Romania | 0.597 | 0.636 | 0.641 | 0.569 | 0.493 | 0.409 | 0.380 | 0.349 | 0.619 | 0.429 | 0.524 |

| Slovenia | 0.230 | 0.216 | 0.215 | 0.184 | 0.180 | 0.191 | 0.199 | 0.193 | 0.213 | 0.187 | 0.199 |

| Slovakia | 0.428 | 0.402 | 0.410 | 0.373 | 0.305 | 0.243 | 0.226 | 0.228 | 0.406 | 0.266 | 0.337 |

| Cluster 1: {Luxembourg} | |||||||||||

| Bulgaria | 0.740 | 0.761 | 0.780 | 0.751 | 0.734 | 0.703 | 0.703 | 0.695 | 0.767 | 0.714 | 0.738 |

| Czech Republic | 0.488 | 0.496 | 0.523 | 0.509 | 0.527 | 0.514 | 0.515 | 0.506 | 0.511 | 0.516 | 0.514 |

| Estonia | 0.726 | 0.683 | 0.690 | 0.632 | 0.585 | 0.597 | 0.554 | 0.565 | 0.689 | 0.581 | 0.632 |

| Latvia | 0.758 | 0.725 | 0.723 | 0.681 | 0.645 | 0.660 | 0.615 | 0.606 | 0.727 | 0.638 | 0.680 |

| Lithuania | 0.740 | 0.702 | 0.711 | 0.662 | 0.630 | 0.619 | 0.562 | 0.559 | 0.710 | 0.604 | 0.654 |

| Hungary | 0.625 | 0.619 | 0.617 | 0.596 | 0.632 | 0.599 | 0.593 | 0.597 | 0.620 | 0.605 | 0.612 |

| Poland | 0.674 | 0.644 | 0.669 | 0.654 | 0.667 | 0.609 | 0.593 | 0.588 | 0.663 | 0.622 | 0.641 |

| Romania | 0.758 | 0.777 | 0.793 | 0.751 | 0.723 | 0.666 | 0.655 | 0.636 | 0.776 | 0.681 | 0.726 |

| Slovenia | 0.491 | 0.467 | 0.492 | 0.474 | 0.505 | 0.510 | 0.527 | 0.525 | 0.485 | 0.512 | 0.500 |

| Slovakia | 0.641 | 0.613 | 0.638 | 0.617 | 0.598 | 0.550 | 0.547 | 0.551 | 0.632 | 0.569 | 0.599 |

| Cluster 2: {Finland, the United Kingdom, France, Italy} | |||||||||||

| Bulgaria | 0.555 | 0.597 | 0.600 | 0.538 | 0.465 | 0.417 | 0.402 | 0.370 | 0.584 | 0.427 | 0.505 |

| Czech Republic | 0.202 | 0.230 | 0.225 | 0.186 | 0.152 | 0.138 | 0.122 | 0.087 | 0.217 | 0.133 | 0.176 |

| Estonia | 0.535 | 0.482 | 0.459 | 0.355 | 0.232 | 0.254 | 0.174 | 0.169 | 0.465 | 0.225 | 0.355 |

| Latvia | 0.583 | 0.543 | 0.509 | 0.427 | 0.322 | 0.348 | 0.263 | 0.228 | 0.522 | 0.308 | 0.419 |

| Lithuania | 0.555 | 0.509 | 0.491 | 0.400 | 0.298 | 0.286 | 0.187 | 0.160 | 0.496 | 0.262 | 0.387 |

| Hungary | 0.388 | 0.392 | 0.352 | 0.304 | 0.301 | 0.257 | 0.230 | 0.216 | 0.364 | 0.256 | 0.310 |

| Poland | 0.458 | 0.426 | 0.429 | 0.388 | 0.356 | 0.271 | 0.230 | 0.201 | 0.425 | 0.287 | 0.356 |

| Romania | 0.583 | 0.622 | 0.622 | 0.538 | 0.447 | 0.358 | 0.324 | 0.275 | 0.599 | 0.379 | 0.491 |

| Slovenia | 0.210 | 0.194 | 0.185 | 0.141 | 0.123 | 0.133 | 0.137 | 0.113 | 0.184 | 0.126 | 0.155 |

| Slovakia | 0.411 | 0.383 | 0.383 | 0.334 | 0.251 | 0.187 | 0.165 | 0.149 | 0.381 | 0.209 | 0.299 |

| Cluster 3: {Ireland, The Netherlands, Sweden, Austria, Denmark, Germany, Belgium} | |||||||||||

| Bulgaria | 0.579 | 0.622 | 0.628 | 0.578 | 0.517 | 0.476 | 0.474 | 0.466 | 0.613 | 0.491 | 0.550 |

| Czech Republic | 0.239 | 0.267 | 0.267 | 0.242 | 0.217 | 0.210 | 0.209 | 0.201 | 0.259 | 0.210 | 0.234 |

| Estonia | 0.559 | 0.512 | 0.494 | 0.405 | 0.296 | 0.322 | 0.260 | 0.280 | 0.499 | 0.298 | 0.402 |

| Latvia | 0.606 | 0.570 | 0.542 | 0.473 | 0.382 | 0.415 | 0.344 | 0.336 | 0.554 | 0.378 | 0.466 |

| Lithuania | 0.579 | 0.538 | 0.524 | 0.447 | 0.359 | 0.352 | 0.272 | 0.271 | 0.529 | 0.332 | 0.433 |

| Hungary | 0.418 | 0.425 | 0.391 | 0.356 | 0.362 | 0.324 | 0.313 | 0.324 | 0.402 | 0.330 | 0.365 |

| Poland | 0.485 | 0.457 | 0.465 | 0.437 | 0.414 | 0.338 | 0.313 | 0.311 | 0.461 | 0.357 | 0.408 |

| Romania | 0.606 | 0.646 | 0.649 | 0.578 | 0.500 | 0.421 | 0.402 | 0.379 | 0.628 | 0.444 | 0.535 |

| Slovenia | 0.244 | 0.232 | 0.228 | 0.198 | 0.189 | 0.205 | 0.224 | 0.226 | 0.227 | 0.206 | 0.215 |

| Slovakia | 0.439 | 0.416 | 0.421 | 0.385 | 0.313 | 0.257 | 0.251 | 0.261 | 0.418 | 0.282 | 0.351 |

| Cluster 4: {Spain, Portugal, Greece} | |||||||||||

| Bulgaria | 0.442 | 0.498 | 0.507 | 0.456 | 0.388 | 0.323 | 0.270 | 0.242 | 0.489 | 0.327 | 0.409 |

| Czech Republic | 0.059 | 0.092 | 0.094 | 0.079 | 0.059 | 0.023 | 0.067 | 0.054 | 0.087 | 0.049 | 0.069 |

| Estonia | 0.419 | 0.366 | 0.347 | 0.257 | 0.142 | 0.149 | 0.027 | 0.029 | 0.354 | 0.124 | 0.256 |

| Latvia | 0.475 | 0.435 | 0.404 | 0.334 | 0.235 | 0.249 | 0.120 | 0.091 | 0.419 | 0.204 | 0.320 |

| Lithuania | 0.442 | 0.396 | 0.383 | 0.304 | 0.210 | 0.182 | 0.040 | 0.020 | 0.389 | 0.166 | 0.290 |

| Hungary | 0.254 | 0.265 | 0.230 | 0.202 | 0.213 | 0.152 | 0.085 | 0.078 | 0.242 | 0.149 | 0.197 |

| Poland | 0.331 | 0.302 | 0.313 | 0.292 | 0.271 | 0.169 | 0.085 | 0.063 | 0.309 | 0.188 | 0.250 |

| Romania | 0.475 | 0.527 | 0.533 | 0.456 | 0.369 | 0.259 | 0.185 | 0.140 | 0.507 | 0.280 | 0.399 |

| Slovenia | 0.063 | 0.054 | 0.053 | 0.033 | 0.029 | 0.025 | 0.011 | 0.028 | 0.051 | 0.026 | 0.040 |

| Slovakia | 0.278 | 0.255 | 0.264 | 0.234 | 0.161 | 0.079 | 0.018 | 0.009 | 0.260 | 0.112 | 0.194 |

| Estimation with Fixed Effect (FE) N = 220 | ||

|---|---|---|

| Variables | Model 1 | Model 2 |

| Constant | −9087.96 *** | 0.0221 *** |

| EFI | 224.096 *** | 0.0011 *** |

| BIZ | −107.187 *** | 0.0000 |

| EXP | 163.016 *** | −0.0031 *** |

| LSDV-R2 (%) | 0.550 | 0.170 |

| Within-R2 (%) | 0.560 | 0.199 |

| LSDV F p-value | 0.000 | 0.001 |

| Note: *. ** and *** denotes that coefficients are significantly at the 10%. 5% and 1% level. | ||

| No. | Hypothesis | Results | Methods |

|---|---|---|---|

| H1 | CEE10 and EU15 in the years between 1995 and 2016 have developed in accordance with the convergence hypothesis. Real convergence in the EU was result of a relatively higher GDP per capita growth. observed in countries of Central Eastern Europe (beta convergence). | confirmed for the beta and sigma convergence, rejected for the gamma convergence | The convergence test beta, sigma and gamma, Clark’s coefficient |

| H2 | The economic integration of the Central Eastern European countries to the EU had had a positive and dynamic impact on their catching up process since 2004. | Confirmed | The convergence test beta and sigma |

| H3 | Business environment and economic growth are strongly correlated. The economic growth in the group of the CEE10 is positively affected by their business environment. | Confirmed | Regression model |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Głodowska, A.; Pera, B. On the Relationship between Economic Integration, Business Environment and Real Convergence: The Experience of the CEE Countries. Economies 2019, 7, 54. https://doi.org/10.3390/economies7020054

Głodowska A, Pera B. On the Relationship between Economic Integration, Business Environment and Real Convergence: The Experience of the CEE Countries. Economies. 2019; 7(2):54. https://doi.org/10.3390/economies7020054

Chicago/Turabian StyleGłodowska, Agnieszka, and Bożena Pera. 2019. "On the Relationship between Economic Integration, Business Environment and Real Convergence: The Experience of the CEE Countries" Economies 7, no. 2: 54. https://doi.org/10.3390/economies7020054

APA StyleGłodowska, A., & Pera, B. (2019). On the Relationship between Economic Integration, Business Environment and Real Convergence: The Experience of the CEE Countries. Economies, 7(2), 54. https://doi.org/10.3390/economies7020054