Can Central Banking Policies Make a Difference in Financial Market Performance in Emerging Economies? The Case of India

Abstract

1. Introduction

2. Review of Literature

“…there is a significant difference in the way monetary policy was conducted pre- and post-1979, the year Paul Volcker was appointed Chairman of the Board of Governors of the Federal Reserve System …”

“…The key difference in the estimated policy rules across time involves the response to expected inflation. We find (not surprisingly) that the Federal Reserve was highly “accommodative” in the pre-Volcker years: on average, it let real short-term interest rates decline as anticipated inflation rose. While it raised nominal rates, it typically did so by less than the increase in expected inflation. On the other hand, during the Volcker-Greenspan era the Federal Reserve adopted a proactive stance toward controlling inflation: it systematically raised real as well as nominal short-term interest rates in response to higher expected inflation … Not until Volcker took office did controlling inflation become the organizing focus of monetary policy

3. Materials and Methods

4. Results

4.1. Daily Returns and Risk

4.2. Volatility in Stock Markets and Currency Markets

4.3. Fixed Effect Regression Model

5. Discussion about Central Banking Policy4 in Context of the Results

5.1. Monetary Stability

“The past few years … would have been steadier and more productive of economic well-being if the Federal Reserve had avoided drastic and erratic changes of direction, first expanding the money supply at an unduly rapid pace, then, in early 1966, stepping on the brake too hard, then, at the end of 1966, reversing itself and resuming expansion until at least November, 1967, at a more rapid pace than can long be maintained without appreciable inflation.”

“We will emphasize two other traditions that become important in these times: transparency and predictability… That is not to say we will never surprise markets with actions. A central bank should never say “Never”! But the public should have a clear framework as to where we are going, and understand how our policy actions fit into that framework. Key to all this is communication, and I want to underscore communication with this statement on my first day in office …

Some of the actions I take will not be popular. The Governorship of the Central Bank is not meant to win one votes or Facebook “likes”. But I hope to do the right thing, no matter what the criticism, even while looking to learn from the criticism.”

“The central bank directly controls the policy rate, and thus the short-term nominal rate. The zero lower bound problem stems from its inability to push the short-term nominal policy interest rate below zero. Further reductions in the short-term real rate will come only if it can push up inflationary expectations.”

Stick to the basics;Be monetarily stable and predictable; andTake criticism in your stride and do not bend to pressure—be it political or public.

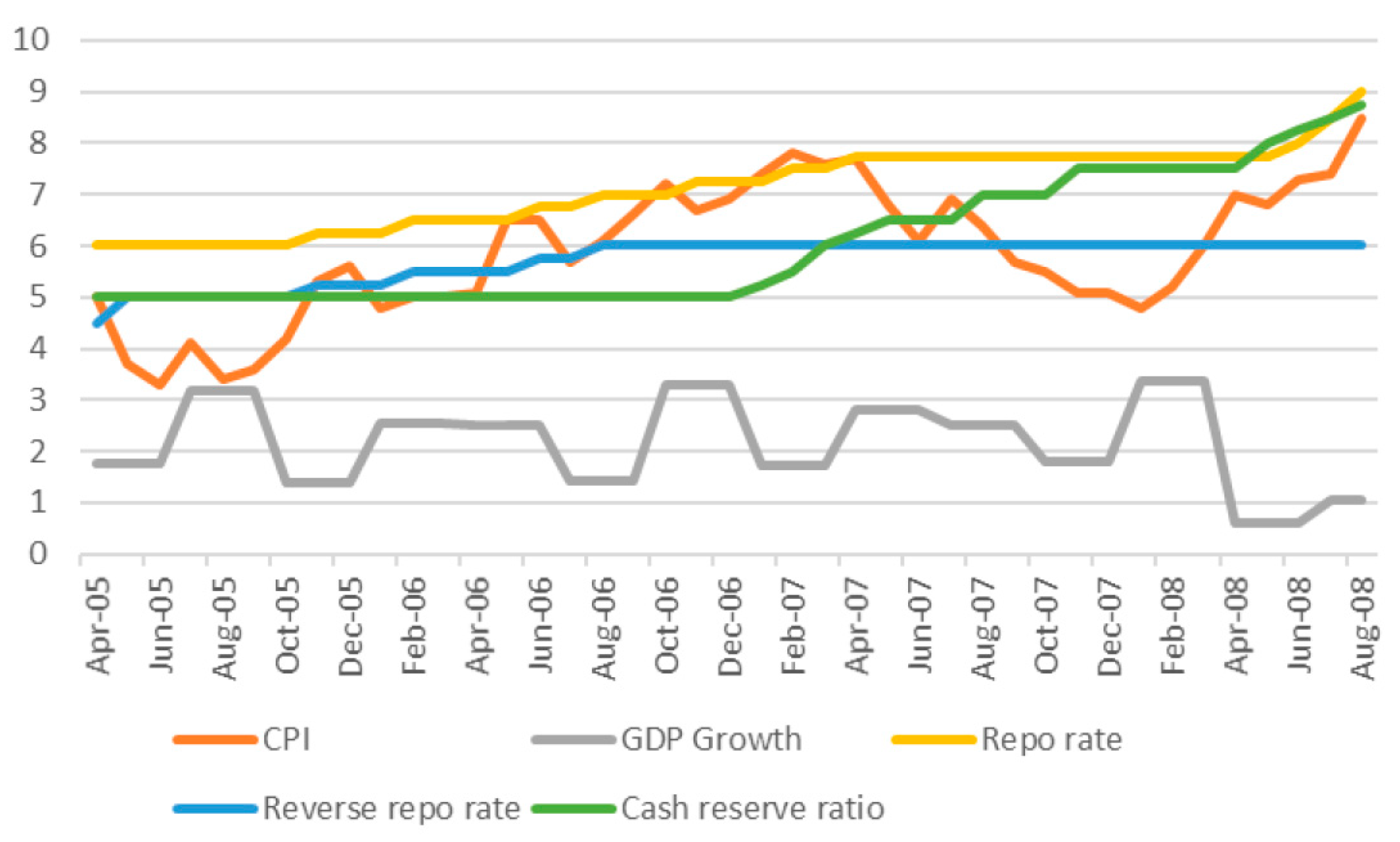

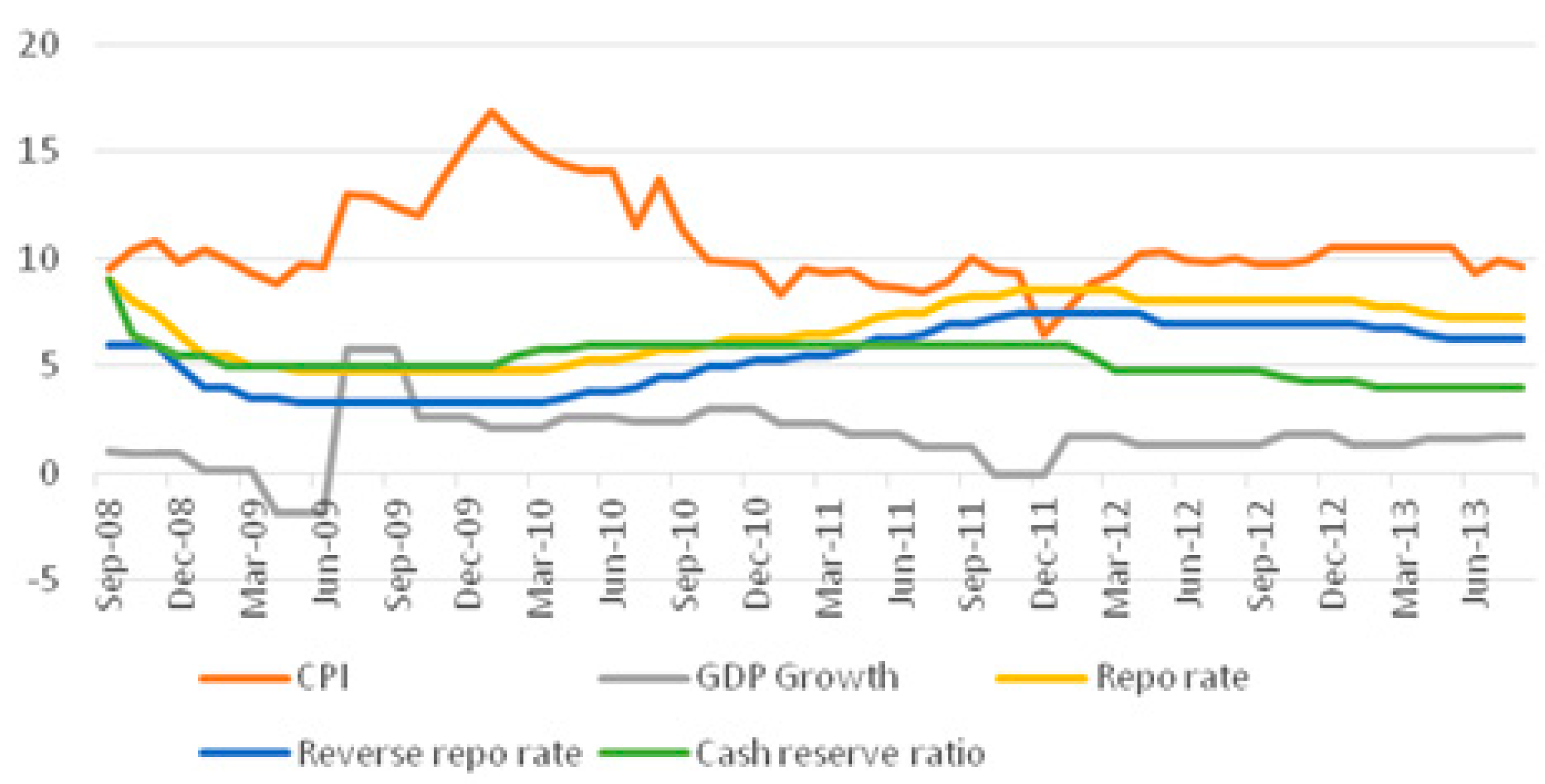

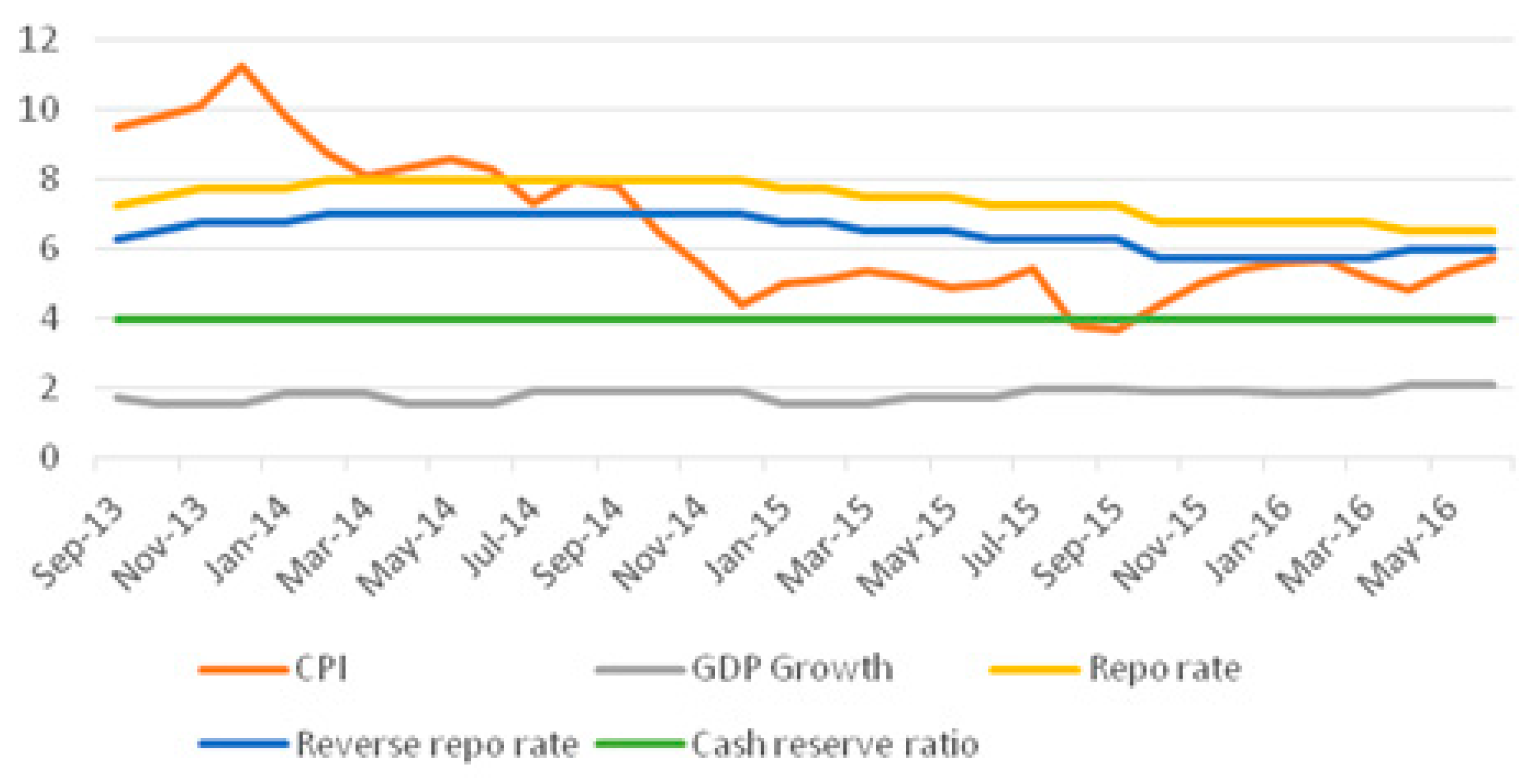

5.2. Inflation and Growth Challenges

“In supporting the economy, we must not allow victory in the battle against inflation to slip beyond our grasp. It is vital that we look beyond the unemployment problem to the need to achieve a reduction in inflation.’

- (a)

- Between 2006 and 2013, the average inflation rate in India was reported to be above 9 per cent. High inflation for such a lengthy period led to public expectations becoming entrenched at high numbers. A rather extended period of low inflation was required to change those expectations;

- (b)

- Since India shifted focus to CPI from WPI only recently, the public perception of inflation is still largely tied to WPI, which puts weight on internationally traded goods like commodities rather than domestic non-traded goods. As a result, with every dip in international inflation, there was a voice for rate cut. This is primarily why the fight was not taken to the domestic sources of inflation, but Rajan appeared committed to doing so;

- (c)

- The usual perception is that whenever inflation is low, the central bank should turn to stimulating growth. This is, however, a gross misconception of the workings of a central banking system. Keeping aside the sentimental reactions8 to those, central banking policies work with a lag of 3 to 4 quarters. Therefore, before taking policy decisions, the central bank needs to anticipate how inflation will behave 3 to 4 quarters later. The current rate of inflation, without doubt, provides insights into how it will behave in the future;

- (d)

- The current inflation, measured on a year on year basis, may be low because there was an unexpected price spurt last year (known as the “base effect”). While evaluating the macro-economic situation through inflation, it is essential to take out the “base effect”, which not everyone may be capable of doing;

- (e)

- Sources of uncertainty, including the strength and distribution of the monsoon, the extent and persistence of low commodity prices, and the effect of external disturbances on the exchange rate, render the assessment of a future economic situation all the more complex (Rajan 2015b).

“We are among the large countries with the highest consumer price inflation in the world, even though growth is weaker than we would like it to be… Our households are turning to gold because they find financial investments unattractive… industrial corporations are complaining about high interest rates…

Ultimately, inflation comes from demand exceeding supply, and it can be curtailed only by bringing both in balance. We need to reduce demand somewhat without having serious adverse effects on investment and supply…

…we do need a more carefully spelled out monetary policy framework than we have currently.”

“While the Brazilian authorities are working hard to rectify the situation, let us not ignore the lessons their experience suggests. Growth has to be obtained in the right way. It is possible to grow too fast with substantial stimulus, as we did in 2010 and 2011, only to pay the price in higher inflation, higher deficits, and lower growth in 2013 and 2014 … And while monetary policy will accommodate to the extent there is room, we will expand sustainable growth potential only by continuing to implement reforms the government and regulators have announced…”

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Allison, Paul D. 2009. Fixed Effects Regression Methods. SAGE Publications. Available online: http://www2.sas.com/proceedings/sugi31/184-31.pdf (accessed on 13 October 2018).

- Andersen, Torben G., Tim Bollerslev, Francis X. Diebold, and Clara Vega. 2007. Real-Time Price Discovery in Global Stock, Bond and Foreign Exchange Markets. Journal of International Economics 73: 251–77. [Google Scholar] [CrossRef]

- Aziza, Francis Oghenerukevwe. 2010. The Effects of Monetary Policy on Stock Market Performance: A Cross-Country Analysis. SSRN Electronic Journal 2010. [Google Scholar] [CrossRef]

- Basistha, Arabinda, and Alexander Kurov. 2008. Macroeconomic Cycles and the Stock Market’s Reaction to Monetary Policy. Journal of Banking and Finance 32: 2606–16. [Google Scholar] [CrossRef]

- Bernanke, Ben S., and Alan S. Blinder. 1992. The Federal Funds Rate and the Channels of Monetary Transmission. American Economic Review 82: 901–21. [Google Scholar] [CrossRef]

- Bernanke, Ben S., and Kenneth N. Kuttner. 2005. What Explains the Stock Market’s Reaction to Federal Reserve Policy? Journal of Finance 60: 1221–57. [Google Scholar] [CrossRef]

- Boivin, Jean, and Marc P. Giannoni. 2006. Has Monetary Policy Become More Effective? The Review of Economics and Statistics 88: 445–62. [Google Scholar] [CrossRef]

- Boivin, Jean. 2006. Has U.S. Monetary Policy Changed? Evidence from Drifting Coefficients and Real-Time Data. Journal of Money, Credit and Banking 38: 1149–73. [Google Scholar] [CrossRef]

- Bomfim, Antulio N. 2003. Pre-Announcement Effects, News Effects, and Volatility: Monetary Policy and the Stock Market. Journal of Banking and Finance 27: 133–51. [Google Scholar] [CrossRef]

- Brash, Donald T. 1999. Inflation Targeting: Is New Zealand’s Experience Relevant to Developing Countries? Presented at the Sixth L.K, Jha Memorial Lecture, Mumbai, India, June 17. [Google Scholar]

- Brooks, Chris. 2008. Introductory Econometrics for Finance. Finance. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Brooks, Ray. 1998. Inflation and Monetary Policy Reform. In Australia: Benefiting from Economic Reform. Edited by Anoop Singh, Joshua Felman, Raymond Brooks, Timothy Callen and Christian Thimann. Washington: International Monetary Fund. [Google Scholar]

- Bryan, Mark L., and Stephen P. Jenkins. 2013. Regression Analysis of Country Effects Using Multilevel Data: A Cautionary Tale. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2322088 (accessed on 12 October 2018).

- Bui, Trung Thanh. 2015. Asymmetric Effect of Monetary Policy on Stock Market Volatility in ASEAN5. Eurasian Journal of Business and Economics 8: 185–97. [Google Scholar] [CrossRef]

- Chen, Shiu Sheng. 2007. Does Monetary Policy Have Asymmetric Effects on Stock Returns? Journal of Money, Credit and Banking 39: 667–88. [Google Scholar] [CrossRef]

- Chuliá, Helena, Martin Martens, and Dick van Dijk. 2010. Asymmetric Effects of Federal Funds Target Rate Changes on S&P100 Stock Returns, Volatilities and Correlations. Journal of Banking and Finance 34: 834–39. [Google Scholar] [CrossRef]

- Clarida, Richard, Jordi Gali, and Mark Gertler. 2000. Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory. Quarterly Journal of Economics 115: 147–80. [Google Scholar] [CrossRef]

- Cogley, Timothy, and Thomas J. Sargent. 2005. Drifts and Volatilities: Monetary Policies and Outcomes in the Post WWII US. Review of Economic Dynamics 8: 262–302. [Google Scholar] [CrossRef]

- Daly, Kevin. 2008. Financial Volatility: Issues and Measuring Techniques. Physica A: Statistical Mechanics and Its Applications 387: 2377–93. [Google Scholar] [CrossRef]

- Ehrmann, Michael, and Marcel Fratzscher. 2004. Taking Stock: Monetary Policy Transmission to Equity Markets. Journal of Money, Credit and Banking 36: 719–37. [Google Scholar] [CrossRef]

- Friedman, Milton. 1968. The Role of Monetary Policy. The American Economic Review 58: 269–95. [Google Scholar] [CrossRef]

- Goodhart, Charles. 2000. Whither Central Banking? Eleventh C. D. Deshmukh Memorial Lecture. Presented at the 11th C. D. Deshmukh Memorial Lecture, Mumbai, India, December 7. [Google Scholar]

- Gospodinov, Nikolay, and Ibrahim Jamali. 2012. The Effects of Federal Funds Rate Surprises on S&P 500 Volatility and Volatility Risk Premium. Journal of Empirical Finance 19: 497–510. [Google Scholar] [CrossRef]

- Guo, Hui. 2004. Stock Prices, Firm Size, and Changes in the Federal Funds Rate Target. Quarterly Review of Economics and Finance 44: 487–507. [Google Scholar] [CrossRef]

- Ioannidis, Christos, and Alexandros Kontonikas. 2008. The Impact of Monetary Policy on Stock Prices. Journal of Policy Modeling 30: 33–53. [Google Scholar] [CrossRef]

- Abel, Istvan, and John Bonin. 1992. The ‘big Bang’ versus ‘Slow but Steady’: A Comparison of the Hugarian and Polish Transformations. CEPR Discussion Paper No 626. London: CEPR. [Google Scholar]

- Jahan, Sarwat, Ahmed Saber Mahmud, and Chris Papageorgiou. 2014. What Is Keynesian Economics? International Monetary Fund 51. [Google Scholar]

- Jensen, Gerald R., Jeffrey M. Mercer, and Robert R. Johnson. 1996. Business Conditions, Monetary Policy, and Expected Security Returns. Journal of Financial Economics 40: 213–37. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 1936. The General Theory of Employment, Interest and Money. London: Palgrave Macmillan UK. [Google Scholar]

- Konrad, Ernst. 2009. The Impact of Monetary Policy Surprises on Asset Return Volatility: The Case of Germany. Financial Markets and Portfolio Management 23: 111–35. [Google Scholar] [CrossRef]

- Kydland, Finn E., and Edward C. Prescott. 1977. Rules Rather than Discretion: The Inconsistency of Optimal Plans. Journal of Political Economy 85: 473–91. [Google Scholar] [CrossRef]

- Lagarde, Christine. 2015. Spillovers from Unconventional Monetary Policy—Lessons for Emerging Markets. Presented at the IMF in Reserve Bank of India, Mumbai, India, March 17. [Google Scholar]

- Lipton, David, and Jeffrey Sachs. 1990. Creating a Market Economy: The Case of Poland. Brookings Papers on Economic Activity 1: 75–147. [Google Scholar] [CrossRef]

- Lobo, Bento J. 2000. Asymmetric Effects of Interest Rate Changes on Stock Prices. Financial Review 35: 125–44. [Google Scholar] [CrossRef]

- Martens, Martin, and Dick van Dijk. 2007. Measuring Volatility with the Realized Range. Journal of Econometrics 138: 181–207. [Google Scholar] [CrossRef]

- Mishra, Prachi, and Raghuram Rajan. 2016. Rules of the Monetary Game. WPS (DEPR). Mumbai: DEPR. [Google Scholar]

- Mummolo, Jonathan, and Erik Peterson. 2018. Improving the Interpretation of Fixed Effects Regression Results. Political Science Research and Methods, 1–7. [Google Scholar] [CrossRef]

- Nelson, Daniel B. 1991. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 59: 347–70. [Google Scholar] [CrossRef]

- New York Times. 2015a. In India, a Banker in Defense Mode. New York Times, January 15. [Google Scholar]

- New York Times. 2015b. As a Boom Fades, Brazilians Wonder How It All Went Wrong. New York Times, September 10. [Google Scholar]

- Patelis, Alex D. 1997. Stock Return Predictability and The Role of Monetary Policy. Journal of Finance 52: 1951–72. [Google Scholar] [CrossRef]

- Poon, Ser-Huang, and Clive W. J. Granger. 2003. Forecasting Volatility in Financial Markets: A Review. Journal of Economic Literature 41: 478–539. [Google Scholar] [CrossRef]

- President of the USA. 1975. Economic Report of the President. Washington: United States Government Printing Office. [Google Scholar]

- Rajan, Raghuram. 2013a. A Step in the Dark: Unconventional Monetary Policy after the Crisis. Presented at the Andrew Crockett Memorial Lecture, Basel, Switzerland, June 23. [Google Scholar]

- Rajan, Raghuram. 2013b. Speech by Governor Raghuram G. Rajan. Presented at the BANCON 2013, Mumbai, India, November 15. [Google Scholar]

- Rajan, Raghuram. 2014. Competitive Monetary Easing: Is It Yesterday Once More. Presented at the Central Bank Speech, Brookings Institution, Washington, DC, USA, April 14. [Google Scholar]

- Rajan, Raghuram. 2015a. Competitive Monetary Easing: Is It Yesterday Once. Macroeconomics and Finance in Emerging Market Economies 8: 2–16. [Google Scholar] [CrossRef]

- Rajan, Raghuram. 2015b. Strong Sustainable Growth for the Indian Economy. Presented at the FIBAC 2015, Mumbai, India, August 24. [Google Scholar]

- Rajan, Raghuram. 2015c. Sustainable Growth in the Financial Sector: 2015 C.K. Prahalad Lecture. Presented at the 4th C. K. Prahalad Memorial Lecture, Mumbai, India, September 18. [Google Scholar]

- Rasche, Robert H, and Marcela M Williams. 2007. The Effectiveness of Monetary Policy. Federal Reserv Bank of St. Louis Review 89: 447–89. [Google Scholar] [CrossRef]

- Rigobon, Roberto, and Brian Sack. 2003. Measuring the Reaction of Monetary Policy to the Stock Market. Quarterly Journal of Economics 118: 639–69. [Google Scholar] [CrossRef]

- Su, Chang. 2010. Application of EGARCH Model to Estimate Financial Volatility of Daily Returns: The Empirical Case of China. Master’s thesis, University of Gothenburg, Gothenburg, Sweden. [Google Scholar]

- Su, Dongwei, and Belton M. Fleisher. 1998. Risk, Return and Regulation in Chinese Stock Markets. Journal of Economics and Business 50: 239–56. [Google Scholar] [CrossRef]

- The Economic Times. 2017. Guess Who Inspired Raghuram Rajan to Become an Economist? The Economic Times, February 14. [Google Scholar]

- The Economist. 2016. Brazil’s Fall. The Economist, January 2. [Google Scholar]

- The Indian Express. 2015. Raghuram Rajan—I Do What I Do. The Indian Express, December 26. [Google Scholar]

- The Mint. 2008. As the Governor’s Term Ends. The Mint, September 4. [Google Scholar]

- The Times of India. 2016. Nobel Laureate Backs Raghuram Rajan. The Times of India, July 26. [Google Scholar]

- The Wire. 2016. Raghuram Rajan’s Legacy at the RBI: Hits, Misses and the Road That Lies Ahead. The Wire, June 19. [Google Scholar]

- Thorbecke, Willem. 1997. On Stock Market Returns and Monetary Policy. Journal of Finance 52: 635–54. [Google Scholar] [CrossRef]

- Ülgen, Faruk. 2009. The Credibility of the Central Bank and the Role of Monetary Authorities in a Market Economy. Économie Appliquée 62: 73–98. [Google Scholar]

- Ülgen, Faruk. 2017. Financial Development, Instability and Some Confused Equations. In Financial Development, Economic Crises and Emerging Market Economies. Edited by Faruk Ülgen. London: Routledge. [Google Scholar]

- Vähämaa, Sami, and Janne Äijö. 2011. The Fed’s Policy Decisions and Implied Volatility. Journal of Futures Markets 31: 995–1010. [Google Scholar] [CrossRef]

- Yellen, Janet. 2014. Monetary Policy and Financial Stability. Michel Camdessus Central Banking Lecture at the International Monetary Fund. Washington: International Monetary Fund. [Google Scholar]

- Zare, Roohollah, M. Azali, and Muzafar Shan Habibullah. 2013. Monetary Policy and Stock Market Volatility in the ASEAN5: Asymmetries Over Bull and Bear Markets. Procedia Economics and Finance 7: 18–27. [Google Scholar] [CrossRef]

| 1 | Brooks (1998) suggests that in the long-run, inflation-targeting countries as a group have improved their rate of economic growth compared to countries which are not inflation-targeters. For a central banker’s opinion about the issue of trade-off between inflation and growth, see Raghuram Rajan’s speech at FIBAC (Rajan 2015b). |

| 2 | Throughout this paper, the term ‘financial markets’ is used in a narrower sense and refers to ‘stock markets’ and ‘currency markets’. |

| 3 | Raghuram Rajan announced his decision not to seek the second term, on Saturday, 18 June 2016. Therefore, the paper considers his period till 17 June 2016 only. For the purpose of the study ‘period 3’ ranges from 5 September 2013 through 17 June 2016. |

| 4 | The Indian Express (“Raghuram Rajan—I Do What I Do”. The Indian Express, 26 December 26 2015) maintains that central banking is much more than monetary policy. Raghuram Rajan, in his speech at BANCON 2013 held at Mumbai on 15 November 2013, outlined five developmental measures of RBI—

For the purpose of this paper, we use the term ‘central banking policy’ in a narrower sense and refer to points ‘a’ and ‘c’ above. |

| 5 | Brooks (1998) suggests that in the long-run, inflation-targeting countries as a group have improved their rate of economic growth compared to countries which are not inflation-targeters. For Raghuram Rajan’s opinion about the issue of trade-off between inflation and growth, see his speech at FIBAC (Rajan 2015b). |

| 6 | ‘Monetarism’ is an economic school of thought that gained popularity in the 1960s and 1970s and presented a theoretical challenge to Keynesian economics. Milton Friedman is regarded as the founding father of ‘monetarism’. |

| 7 | For a more detailed discussion on shock therapy and gradual approach, and the need for distinctive policies in emerging economies, see (Ülgen 2017). |

| 8 | During his speech at FIBAC, Rajan (2015a) interestingly remarked, “the central bank is not a “cheerleader” for the economy. By this I did not mean that the RBI does not want to do its utmost to see the economy do well. Far from it! What I meant is that it is not the role of the central bank to elevate sentiments unduly, to deliver booster shots to the stock market so that it can soar for a while, only to collapse when reality hits.” |

| CODE | Mean | Standard Deviation | ||||

|---|---|---|---|---|---|---|

| Period 1 | Period 2 | Period 3 | Period 1 | Period 2 | Period 3 | |

| BRAZILSI | 0.12102% | 0.01631% | 0.07493% | 0.015509 | 0.016493 | 0.012219 |

| RUSSIASI | 0.11811% | 0.01558% | 0.02985% | 0.016582 | 0.021547 | 0.016682 |

| INDIASI | 0.13424% | 0.01852% | 0.05403% | 0.015195 | 0.013663 | 0.007378 |

| CHINASI | 0.05943% | 0.01840% | 0.07122% | 0.016777 | 0.012531 | 0.014155 |

| SASI | −0.14847% | −0.04284% | −0.01457% | 0.028890 | 0.012672 | 0.008483 |

| USASI | 0.01653% | 0.04816% | 0.05915% | 0.009955 | 0.013873 | 0.007920 |

| ENGLANDSI | 0.02414% | 0.03279% | 0.03585% | 0.008729 | 0.012357 | 0.007694 |

| CODE | Mean | Standard Deviation | ||||

|---|---|---|---|---|---|---|

| Period 1 | Period 2 | Period 3 | Period 1 | Period 2 | Period 3 | |

| BRL | 0.04848% | −0.02478% | −0.02181% | 0.007618 | 0.010428 | 0.009295 |

| RUB | 0.01124% | −0.01383% | −0.07495% | 0.006438 | 0.006418 | 0.013096 |

| INR | −0.00070% | −0.02934% | 0.00089% | 0.007503 | 0.006173 | 0.003901 |

| CNY | 0.01130% | 0.00642% | −0.02274% | 0.006759 | 0.001222 | 0.018214 |

| ZAR | −0.01287% | −0.02046% | −0.04227% | 0.012268 | 0.010192 | 0.007801 |

| USD | 0.01603% | −0.00760% | −0.01690% | 0.007819 | 0.006395 | 0.004695 |

| GBP | 0.00603% | −0.00910% | −0.00990% | 0.006713 | 0.006320 | 0.004069 |

| Coefficient | Brazil | Russia | India | China | South Africa | USA | UK |

|---|---|---|---|---|---|---|---|

| Period 1 | |||||||

| −0.870373 * | −0.971296 * | −0.802541 * | −0.407095 * | −0.344566 * | −0.218331 * | −0.286805 * | |

| 0.911579 * | 0.907331 * | 0.938024 * | 0.969194 * | 0.972015 * | 0.983904 * | 0.982815 * | |

| 0.161086 * | 0.254315 * | 0.343898 * | 0.211069 * | 0.149737 * | 0.087504 * | 0.152899 * | |

| −0.121512 * | −0.117518 * | −0.104141 * | −0.039679 * | −0.026989 * | −0.052589 * | −0.073227 * | |

| Period 2 | |||||||

| −0.214534 * | −0.296477 * | −0.131977 * | −0.157221 * | −0.233755 * | −0.297408 * | −0.262185 * | |

| 0.987107 * | 0.984998 * | 0.995602 * | 0.990827 * | 0.986061 * | 0.981474 * | 0.983323 * | |

| 0.131368 * | 0.22442 * | 0.124109 * | 0.101361 * | 0.157019 * | 0.165667 * | 0.138185 * | |

| −0.050044 * | −0.03448 * | −0.034144 * | −0.015577 * | −0.05525 * | −0.076737 * | −0.06331 * | |

| Period 3 | |||||||

| −2.656791 * | −0.288108 * | −4.555235 * | −0.31507 * | −5.475769 * | −0.831738 * | −0.443394 * | |

| 0.721834 * | 0.979444 * | 0.571035 * | 0.981718 * | 0.415901 * | 0.929482 * | 0.967853 * | |

| 0.252328 * | 0.159692 * | 0.418896 * | 0.210788 * | 0.640924 * | 0.184053 * | 0.163753 * | |

| 0.090004 * | −0.048135 * | −0.08002 * | 0.005254 | 0.002909 | −0.123582 * | −0.113522 * | |

| Coefficient | Brazil | Russia | India | China | South Africa | USA | UK |

|---|---|---|---|---|---|---|---|

| Period 1 | |||||||

| −0.887132 * | −12.96477 * | −18.27678 * | −20.29009 * | −2.981062 * | −0.945516 * | −1.536448 * | |

| 0.930605 * | −0.194295 * | −0.734269 * | −0.817172 * | 0.699804 * | 0.915128 * | 0.87753 * | |

| 0.261607 * | 0.600075 * | 0.373121 * | 0.754948 * | 0.413089 * | 0.148753 * | 0.397939 * | |

| −0.0682 * | −0.320278 * | −0.081446 * | −0.452031 * | −0.08948 * | 0.113646 * | −0.045805 | |

| Period 2 | |||||||

| −0.282274 * | −0.283447 * | −0.316563 * | −0.52637 * | −0.175593 * | −0.175593 * | −0.06194 * | |

| 0.985527 * | 0.982677 * | 0.982647 * | 0.975165 * | 0.987029 * | 0.987029 * | 0.996707 * | |

| 0.193146 * | 0.149606 * | 0.206279 * | 0.334633 * | 0.072835 * | 0.072835 * | 0.036054 * | |

| −0.042263 * | −0.065949 * | −0.017936 * | −0.076479 * | −0.074561 * | −0.074561 * | −0.047901 * | |

| Period 3 | |||||||

| −0.191097 * | −0.178508 * | −0.179176 * | −0.57029 * | −0.048768 * | −12.84762 * | −0.056637 * | |

| 0.98857 * | 0.990255 * | 0.985661 * | 0.934325 * | 0.998621 * | −0.181126 | 0.996849 * | |

| 0.108152 * | 0.130939 * | 0.021268 | −0.533526 * | 0.051142 * | 0.248355 * | 0.033923 * | |

| −0.007767 | −0.060225 * | −0.050644 * | 0.903354 * | −0.054438 * | −0.053304 | −0.040821 * | |

| SI | CUR | |||||

|---|---|---|---|---|---|---|

| Countries/Details | Period 1 | Period 2 | Period 3 | Period 1 | Period 2 | Period 3 |

| Cross-section F | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Cross-section Chi-square | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Dependent Variable | Period | Constant | β (Bank Rate) | p-Value | R-Squared |

|---|---|---|---|---|---|

| SI | 1 | 23,787.45 | −1898.08 | 0.0000 | 0.8521 |

| 2 | 14,408.72 | −340.5505 | 0.0000 | 0.965372 | |

| 3 | 15,624.01 | −313.2186 | 0.0000 | 0.987091 | |

| CUR | 1 | 11.61353 | 0.169952 | 0.0000 | 0.995335 |

| 2 | 13.09690 | 0.259865 | 0.0000 | 0.988658 | |

| 3 | 5.061479 | 2.805512 | 0.0000 | 0.967054 |

| Countries | SI | RSI | ||||

|---|---|---|---|---|---|---|

| Period 1 | Period 2 | Period 3 | Period 1 | Period 2 | Period 3 | |

| Brazil | 49,204.91 | 53,276.61 | 44,088.52 | −13.4704 | −15.5787 | −41.4876 |

| Russia | 457.1368 | −11,818.8 | −12,968.1 | 15.25493 | 17.5434 | 20.85476 |

| India | −135.149 | 5347.073 | 13,503.97 | 35.08641 | 39.29747 | 42.16087 |

| China | −17,229.1 | −12,238 | −13,290.4 | −4.82839 | −8.31949 | −8.70007 |

| South Africa | −5374.4 | −10,492 | −9886.53 | −7.16411 | −7.40686 | −10.6979 |

| USA | −15,335.6 | −13,131.6 | −12,193.6 | −13.077 | −14.172 | −7.32205 |

| UK | −10,410.7 | −9831.36 | −10,087.3 | −13.4336 | −14.2803 | −6.5854 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sharma, G.D.; Mahendru, M.; Srivastava, M. Can Central Banking Policies Make a Difference in Financial Market Performance in Emerging Economies? The Case of India. Economies 2019, 7, 49. https://doi.org/10.3390/economies7020049

Sharma GD, Mahendru M, Srivastava M. Can Central Banking Policies Make a Difference in Financial Market Performance in Emerging Economies? The Case of India. Economies. 2019; 7(2):49. https://doi.org/10.3390/economies7020049

Chicago/Turabian StyleSharma, Gagan Deep, Mandeep Mahendru, and Mrinalini Srivastava. 2019. "Can Central Banking Policies Make a Difference in Financial Market Performance in Emerging Economies? The Case of India" Economies 7, no. 2: 49. https://doi.org/10.3390/economies7020049

APA StyleSharma, G. D., Mahendru, M., & Srivastava, M. (2019). Can Central Banking Policies Make a Difference in Financial Market Performance in Emerging Economies? The Case of India. Economies, 7(2), 49. https://doi.org/10.3390/economies7020049