Determinants of Sino-ASEAN Banking Efficiency: How Do Countries Differ?

Abstract

1. Introduction

2. Methodology

2.1. Data and Variables

2.2. Methods

2.3. Input and Output Selection

2.4. Empirical Model Specification

- = DEA efficiency score of the bank of country in year;

- = The natural logarithm of total assets of the bank of country in year;

- = Return on average assets of the bank of country in year;

- = Capital adequacy ratio of the bank of country in year;

- = Net interest margin of the bank of country in year;

- = Gross domestic product (GDP) growth of the country and in year;

- = Inflation rate of country in year;

- = Real interest rate of country and in year;

- is the country/ASEAN region dummy for indicating the country of origin (including China (CH), Indonesia (ID), Malaysia (MY), the Philippines (PH), Singapore (SG), Thailand (TH), Vietnam (VN) and ASEAN region) of the bank (1 = if based in the country; 0 = otherwise).

- = Error term of the bank of country in year .

3. Results and Discussion

3.1. Descriptive Statistics

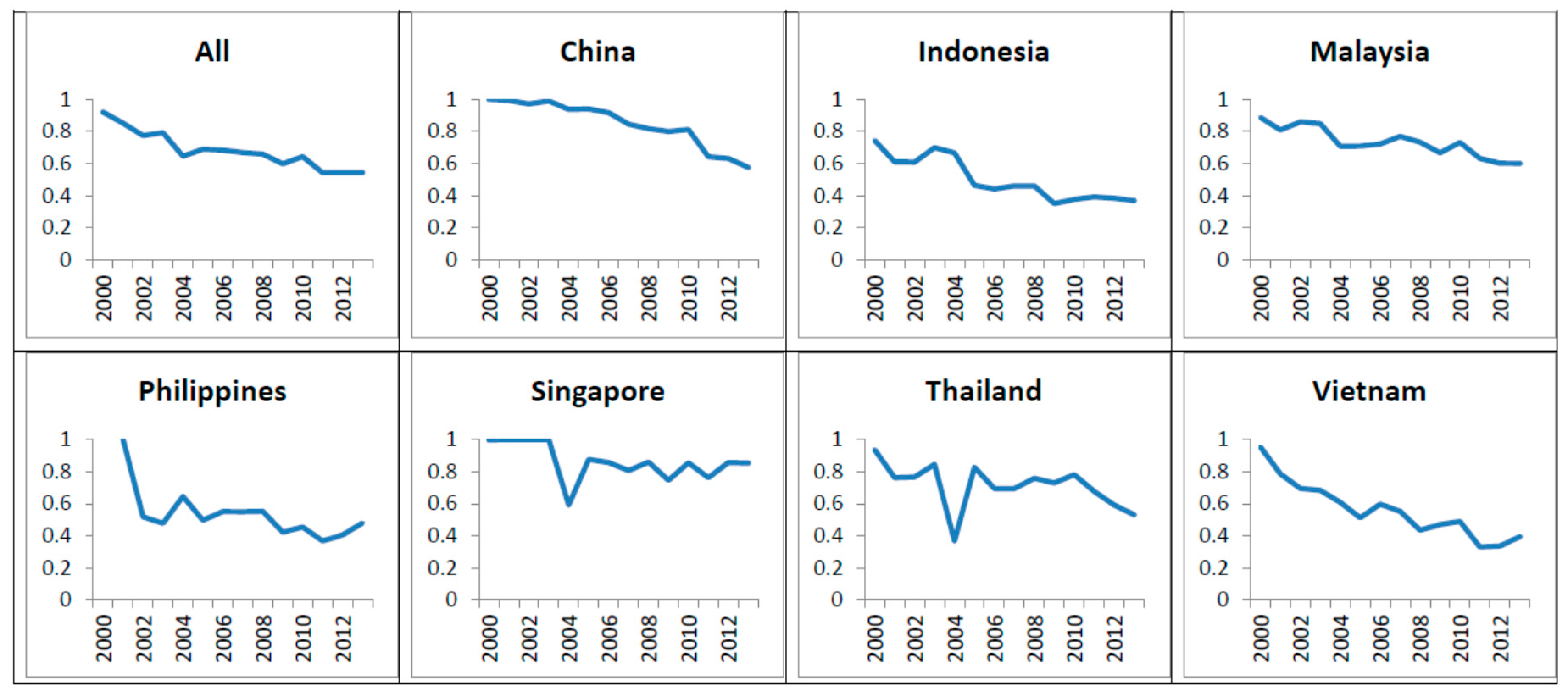

3.2. DEA Efficiency Estimation

3.3. Diagnostic Test

3.4. Regression Results

3.5. Robustness Check

4. Conclusions and Recommendation

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abd Karim, Mohd Zaini. 2001. Comparative bank efficiency across select ASEAN countries. ASEAN Economic Bulletin 18: 289–304. [Google Scholar] [CrossRef]

- ADB, ASEAN. 2013. The Road to ASEAN Financial Integration: A Combined Study on Assessing the Financial Landscape and Formulating Milestones for Monetary and Financial Integration in ASEAN. Manila: Asian Development Bank. [Google Scholar]

- Allen, Linda, and Anoop Rai. 1996. Operational efficiency in banking: An international comparison. Journal of Banking & Finance 20: 655–72. [Google Scholar]

- Altunbas, Y., M. H. Liu, P. Molyneux, and R. Seth. 2000. Efficiency and risk in Japanese banking. Journal of Banking & Finance 24: 1605–28. [Google Scholar]

- Athanasoglou, Panayiotis, Manthos Delis, and Christos Staikouras. 2008. Determinants of Bank Profitability in the South Eastern European Region. Journal of Financial Decision Making 2: 1–17. [Google Scholar]

- Atkinson, Scott E., and Paul W. Wilson. 1995. Comparing mean efficiency and productivity scores from small samples: A bootstrap methodology. Journal of Productivity Analysis 6: 137–52. [Google Scholar] [CrossRef]

- Banna, Hasanul, Rubi Ahmad, and Eric HY Koh. 2017. Determinants of Commercial Banks’ Efficiency in Bangladesh: Does Crisis Matter? The Journal of Asian Finance, Economics and Business 4: 19–26. [Google Scholar] [CrossRef]

- Banna, Hasanul, Rubi Ahmad, and Eric H. Y. Koh. 2018. How does total quality management influence the loan quality of the bank? Total Quality Management & Business Excellence 29: 287–300. [Google Scholar] [CrossRef]

- Barry, Thierno Amadou, Laetitia Lepetita, and Amine Tarazia. 2010. Ownership Structure and Bank Efficiency in Six Asian Countries. Philippine Management Review (Special Issue) 18: 19–35. [Google Scholar]

- Berger, Allen N. 1995. The profit-structure relationship in banking—Tests of market-power and efficient-structure hypotheses. Journal of Money, Credit and Banking 27: 404–31. [Google Scholar] [CrossRef]

- Berger, Allen N., and David B. Humphrey. 1997. Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research 98: 175–212. [Google Scholar] [CrossRef]

- Berger, Allen N., Iftekhar Hasan, and Mingming Zhou. 2009. Bank ownership and efficiency in China: What will happen in the world’s largest nation? Journal of Banking & Finance 33: 113–30. [Google Scholar]

- Carbo, Santiago, Edward P. M. Gardener, and Jonathan Williams. 2003. A note on technical change in banking: The case of European savings banks. Applied Economics 35: 705–19. [Google Scholar] [CrossRef]

- Casu, Barbara, and Philip Molyneux. 2003. A comparative study of efficiency in European banking. Applied Economics 35: 1865–76. [Google Scholar] [CrossRef]

- Chan, Sok-Gee, Eric H. Y. Koh, Fauzi Zainir, and Chen-Chen Yong. 2015. Market structure, institutional framework and bank efficiency in ASEAN 5. Journal of Economics and Business 82: 84–112. [Google Scholar] [CrossRef]

- Coelli, Tim, D. S. Prasada Rao, and George E. Battese. 1998. An Introduction to Efficiency and Productivity. Boston: Analysis, Kluwer Academic Publishers. [Google Scholar]

- Dacanay, Santos José O. 2007. Profit and cost efficiency of Philippine commercial banks under periods of liberalization, crisis and consolidation. The Business Review 7: 315–22. [Google Scholar]

- Daraio, Cinzia, Léopold Simar, and Paul W. Wilson. 2018. Central limit theorems for conditional efficiency measures and tests of the ‘separability’ condition in non-parametric, two-stage models of production. The Econometrics Journal 21: 170–91. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Ash, and Harry Huizinga. 1999. Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review 13: 379–408. [Google Scholar] [CrossRef]

- Dong, Yizhe, Robert Hamilton, and Mark Tippett. 2014. Cost efficiency of the Chinese banking sector: A comparison of stochastic frontier analysis and data envelopment analysis. Economic Modelling 36: 298–308. [Google Scholar] [CrossRef]

- Dougherty, Christopher. 2001. Introduction to Econometrics. Oxford: Oxford University Press. [Google Scholar]

- Efron, Bradley. 1979. Bootstrap methods: Another look at the jackknife. The Annals of Statistics 7: 1–26. [Google Scholar] [CrossRef]

- Ferrier, Gary D., and Vivian Valdmanis. 1996. Rural hospital performance and its correlates. Journal of Productivity Analysis 7: 63–80. [Google Scholar] [CrossRef]

- Fried, Harold O., C. A. Knox Lovell, and Shelton S. Schmidt. 1993. The Measurement of Productive Efficiency: Techniques and Applications. Oxford: Oxford University Press. [Google Scholar]

- Fries, Steven, and Anita Taci. 2005. Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries. Journal of Banking & Finance 29: 55–81. [Google Scholar] [CrossRef]

- Fukuyama, Hirofumi, and Roman Matousek. 2011. Efficiency of Turkish banking: Two-stage network system. Variable returns to scale model. Journal of International Financial Markets, Institutions and Money 21: 75–91. [Google Scholar] [CrossRef]

- Goddard, John, Phil Molyneux, and John O. S. Wilson. 2004. The profitability of European banks: A cross-sectional and dynamic panel analysis. The Manchester School 72: 363–81. [Google Scholar] [CrossRef]

- Grigorian, David A., and Vlad Manole. 2006. Determinants of commercial bank performance in transition: An application of data envelopment analysis. Comparative Economic Studies 48: 497–522. [Google Scholar] [CrossRef]

- Grosskopf, Shawna. 1996. Statistical inference and nonparametric efficiency: A selective survey. Journal of Productivity Analysis 7: 161–76. [Google Scholar] [CrossRef]

- Hadad, Muliaman D., Maximilian J. B. Hall, Karligash A. Kenjegalieva, Wimboh Santoso, and Richard Simper. 2011a. Banking efficiency and stock market performance: An analysis of listed Indonesian banks. Review of Quantitative Finance and Accounting 37: 1–20. [Google Scholar] [CrossRef]

- Hadad, Muliaman D., Maximilian J. B. Hall, Karligash A. Kenjegalieva, Wimboh Santoso, and Richard Simper. 2011b. Productivity changes and risk management in Indonesian banking: A Malmquist analysis. Applied Financial Economics 21: 847–61. [Google Scholar] [CrossRef]

- Hasan, Iftekhar, and Katherin Marton. 2003. Development and efficiency of the banking sector in a transitional economy: Hungarian experience. Journal of Banking & Finance 27: 2249–71. [Google Scholar] [CrossRef]

- Heffernan, Shelagh A., and Xiaoqing Fu. 2010. Determinants of financial performance in Chinese banking. Applied Financial Economics 20: 1585–600. [Google Scholar] [CrossRef]

- Honohan, Patrick, and Daniela Klingebiel. 2003. The fiscal cost implications of an accommodating approach to banking crises. Journal of Banking & Finance 27: 1539–60. [Google Scholar] [CrossRef]

- Jiang, Chunxia, Genfu Feng, and Dirk Willenbockel. 2007. WTO challenges and efficiency of Chinese banks AU—Yao, Shujie. Applied Economics 39: 629–43. [Google Scholar] [CrossRef]

- Kaparakis, Emmanuel I., Stephen M. Miller, and Athanasios G. Noulas. 1994. Short-run cost inefficiency of commercial banks: A flexible stochastic frontier approach. Journal of Money, Credit and Banking 26: 875–93. [Google Scholar] [CrossRef]

- Kwack, Sung Yeung. 2000. An empirical analysis of the factors determining the financial crisis in Asia. Journal of Asian Economics 11: 195–206. [Google Scholar] [CrossRef]

- Lovell, C. A. Knox, Jesús T. Pastor, and Judi A. Turner. 1995. Measuring macroeconomic performance in the OECD: A comparison of European and non-European countries. European Journal of Operational Research 87: 507–18. [Google Scholar] [CrossRef]

- Lozano-Vivas, Ana, Jesus T. Pastor, and José M. Pastor. 2002. An efficiency comparison of European banking systems operating under different environmental conditions. Journal of Productivity Analysis 18: 59–77. [Google Scholar] [CrossRef]

- Maddala, Gangadharrao S., and Shaowen Wu. 1999. A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61: 631–52. [Google Scholar] [CrossRef]

- Manlagñit, Maria Chelo V. 2011. Cost efficiency, determinants, and risk preferences in banking: A case of stochastic frontier analysis in the Philippines. Journal of Asian Economics 22: 23–35. [Google Scholar] [CrossRef]

- Margono, Heru, Subhash C. Sharma, and Paul D. Melvin. 2010. Cost efficiency, economies of scale, technological progress and productivity in Indonesian banks. Journal of Asian Economics 21: 53–65. [Google Scholar] [CrossRef]

- Matthews, Kent, and Mahadzir Ismail. 2006. Efficiency and Productivity Growth of Domestic and Foreign Commercial Banks in Malaysia. Cardiff: Cardiff University. [Google Scholar]

- Mester, Loretta J. 1996. A study of bank efficiency taking into account risk-preferences. Journal of Banking & Finance 20: 1025–45. [Google Scholar]

- Mia, Md Aslam, Lucia Dalla Pellegrina, Patrick Van Damme, and Mahinda Wijesiri. 2018. Financial Inclusion, Deepening and Efficiency in Microfinance Programs: Evidence from Bangladesh. The European Journal of Development Research. [Google Scholar] [CrossRef]

- Molyneux, Philip. 1993. Structure and Performance in European Banking. Bangor: University of Wales. [Google Scholar]

- Molyneux, Philip, Linh H. Nguyen, and Ru Xie. 2013. Foreign bank entry in South East Asia. International Review of Financial Analysis 30: 26–35. [Google Scholar] [CrossRef]

- Noman, Abu Hanifa Md, Chan Sok Gee, and Che Ruhana Isa. 2017. Does competition improve financial stability of the banking sector in ASEAN countries? An empirical analysis. PLoS ONE 12: e0176546. [Google Scholar] [CrossRef] [PubMed]

- Noman, Abu Hanifa Md, Chan Sok Gee, and Che Ruhana Isa. 2018. Does bank regulation matter on the relationship between competition and financial stability? Evidence from Southeast Asian countries. Pacific-Basin Finance Journal 48: 144–61. [Google Scholar] [CrossRef]

- Nurboja, Bashkim, and Marko Košak. 2017. Banking efficiency in South East Europe: Evidence for financial crises and the gap between new EU members and candidate countries. Economic Systems 41: 122–38. [Google Scholar] [CrossRef]

- Parinduri, Rasyad A., and Yohanes E. Riyanto. 2014. Bank Ownership and Efficiency in the Aftermath of Financial Crises: Evidence from Indonesia. Review of Development Economics 18: 93–106. [Google Scholar] [CrossRef]

- Pastor, JoséManuel, Francisco Perez, and Javier Quesada. 1997. Efficiency analysis in banking firms: An international comparison. European Journal of Operational Research 98: 395–407. [Google Scholar] [CrossRef]

- Perry, Philip. 1992. Do banks gain or lose from inflation? Journal of Retail Banking 14: 25–31. [Google Scholar]

- Qin, Xuezhi, and Dickson Pastory. 2012. Commercial Banks Profitability Position: The Case of Tanzania. International Journal of Business & Management 7. [Google Scholar] [CrossRef]

- Schaeck, Klaus, and Martin Cihák. 2014. Competition, efficiency, and stability in banking. Financial Management 43: 215–41. [Google Scholar] [CrossRef]

- Simar, Leopold, and Paul W. Wilson. 1998. Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Management Science 44: 49–61. [Google Scholar] [CrossRef]

- Simar, Leopold, and Paul W. Wilson. 2007. Estimation and inference in two-stage, semi-parametric models of production processes. Journal of econometrics 136: 31–64. [Google Scholar] [CrossRef]

- Simar, Léopold, and Paul W. Wilson. 2011. Two-stage DEA: Caveat emptor. Journal of Productivity Analysis 36: 205. [Google Scholar] [CrossRef]

- Soedarmono, Wahyoe, Fouad Machrouh, and Amine Tarazi. 2013. Bank competition, crisis and risk taking: Evidence from emerging markets in Asia. Journal of International Financial Markets, Institutions and Money 23: 196–221. [Google Scholar] [CrossRef]

- Sufian, Fadzlan. 2009. Determinants of bank efficiency during unstable macroeconomic environment: Empirical evidence from Malaysia. Research in International Business and Finance 23: 54–77. [Google Scholar] [CrossRef]

- Sufian, Fadzlan. 2010. The impact of the Asian financial crisis on bank efficiency: The 1997 experience of Malaysia and Thailand. Journal of International Development 22: 866–89. [Google Scholar] [CrossRef]

- Sufian, Fadzlan, and M. Shah Habibullah. 2009. Do mergers and acquisitions leads to a higher technical and scale efficiency? A counter evidence from Malaysia. African Journal of Business Management 3: 340–49. [Google Scholar]

- Sufian, Fadzlan, and Muzafar Shah Habibullah. 2010. Developments in the efficiency of the Thailand banking sector: A DEA approach. International Journal of Development Issues 9: 226–45. [Google Scholar] [CrossRef]

- Tajgardoon, Gholamreza, Mehdi Behname, and Khosro Noormohamadi. 2012. Is Profitability as a result of Market Power or Efficiency in Islamic Banking Industry. Economics and Finance Review 2: 1–7. [Google Scholar]

- Thoraneenitiyan, Nakhun, and Necmi K. Avkiran. 2009. Measuring the impact of restructuring and country-specific factors on the efficiency of post-crisis East Asian banking systems: Integrating DEA with SFA. Socio-Economic Planning Sciences 43: 240–52. [Google Scholar] [CrossRef]

- Tobin, James. 1958. Estimation of relationships for limited dependent variables. Econometrica 26: 24–36. [Google Scholar] [CrossRef]

- Vu, Ha, and Daehoon Nahm. 2013. The determinants of profit efficiency of banks in Vietnam. Journal of the Asia Pacific Economy 18: 615–31. [Google Scholar] [CrossRef]

- Williams, Jonathan, and Nghia Nguyen. 2005. Financial liberalisation, crisis, and restructuring: A comparative study of bank performance and bank governance in South East Asia. Journal of Banking & Finance 29: 2119–54. [Google Scholar] [CrossRef]

- World Bank. 2014. World Development Indicators 2014. Washington, DC: World Bank Publications. Available online: http://databank.worldbank.org/data/home.aspx (accessed on 10 February 2019).

- Chen, Xiaogang, Michael Skully, and Kym Brown. 2005. Banking efficiency in China: Application of DEA to pre-and post-deregulation eras: 1993–2000. China Economic Review 16: 229–45. [Google Scholar]

- Xue, Mei, and Patrick T. Harker. 1999. Overcoming the Inherent Dependency of DEA Efficiency Scores: A Bootstrap Approach. Philadelphia: Wharton Financial Institutions Center, University of Pennsylvania, Unpublished Working Paper. [Google Scholar]

- Zhang, Tiantian, and Kent Matthews. 2012. Efficiency convergence properties of Indonesian banks 1992–2007. Applied Financial Economics 22: 1465–78. [Google Scholar] [CrossRef]

| 1 | Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. |

| 2 | We estimated numerous variations of Equation (1), including more and less aggregated inputs, combining the output measures and dropping individual inputs. The inferences of the study remain unchanged across the different DEA specifications. |

| 3 | To complete this exercise, the balanced sample on a pooled Sino-ASEAN basis (220 observations) was considered. |

| Variables | Definition | Data Source |

|---|---|---|

| Panel A: Input-Output Variables | ||

| Interest expenses | Bank’s interest expense at the end of the year | Orbis Bank Focus (OBF) |

| Non-interest expenses | Bank’s non-interest expense at the end of the year | OBF |

| Personnel expenses | Bank’s personnel expense at the end of the year | OBF |

| Deposits | Bank’s deposit at the end of the year | OBF |

| Loans | Bank’s loans at the end of the year | OBF |

| Liquid assets | Bank’s liquid assets at the end of the year | OBF |

| Other earning assets | Bank’s other earning assets at the end of the year | OBF |

| Panel B: Variables Used in Regression | ||

| Bank efficiency | Data envelopment analysis (DEA) input-oriented variable return to scale score | DEA estimation |

| Total assets | Bank’s total assets at the end of the year | OBF |

| Bank size | The natural logarithm of bank’s total assets | Own calculation |

| Return on average assets (ROAA) | Bank’s return on average assets at the end of the year in percentage | OBF |

| Capital adequacy ratio (CAR) | Bank’s total equity to total assets at the end of the year in percentage | OBF |

| Net Interest margin (NIM) | Bank’s net interest margin at the end of the year in percentage | OBF |

| GDP growth | Gross domestic product (GDP) growth of the country at the end of the year in percentage | World Bank database |

| Inflation rate | Inflation rate of the country at the end of the year in percentage (Consumer prices) | World Bank database |

| Real interest rate | Real interest rate of the country at the end of the year in percentage | World Bank database |

| Country | Number of Banks | Percentage |

|---|---|---|

| China | 169 | 41.52 |

| Indonesia | 69 | 16.95 |

| Malaysia | 34 | 8.35 |

| Philippines | 44 | 10.81 |

| Singapore | 20 | 4.91 |

| Thailand | 23 | 5.65 |

| Vietnam | 48 | 11.79 |

| Total | 407 | 100 |

| Input-Output Variable’s Descriptive Statistics (Country Wise, Millions USD) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Input | |||||||||

| Country | Obs. | Interest Expenses | Non-Interest Expenses | Personnel Expenses | Deposits | ||||

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | ||

| China | 1040 | 1653.87 | 5501.74 | 877.54 | 3141.93 | 464.54 | 1800.26 | 78,598.17 | 278,448.20 |

| Indonesia | 657 | 170.23 | 327.73 | 133.68 | 284.84 | 63.22 | 138.53 | 3334.25 | 7199.38 |

| Malaysia | 270 | 196.22 | 370.53 | 133.19 | 290.80 | 72.21 | 172.39 | 8552.92 | 17,761.61 |

| Philippines | 214 | 90.35 | 108.45 | 145.69 | 196.00 | 55.63 | 79.93 | 3936.11 | 5611.68 |

| Singapore | 112 | 511.46 | 822.03 | 498.14 | 798.26 | 263.13 | 426.12 | 35,049.76 | 58,726.01 |

| Thailand | 243 | 289.06 | 313.59 | 318.67 | 367.83 | 134.72 | 169.30 | 12,683.09 | 14,689.56 |

| Vietnam | 334 | 192.63 | 346.06 | 58.40 | 115.07 | 26.91 | 66.50 | 2834.28 | 4704.90 |

| All | 2870 | 730.32 | 3396.91 | 425.21 | 1940.69 | 218.56 | 1108.02 | 33,114.47 | 171,732.40 |

| Output | |||||||||

| Country | Obs. | Loans | Liquid Assets | Other Earning Assets | |||||

| Mean | SD | Mean | SD | Mean | SD | ||||

| China | 1040 | 48,029.29 | 167,162.80 | 17,262.27 | 53,159.06 | 33,838.23 | 113,313.30 | ||

| Indonesia | 657 | 2182.01 | 4894.53 | 979.17 | 2068.89 | 1487.23 | 3352.61 | ||

| Malaysia | 270 | 6109.30 | 13,835.53 | 2433.97 | 3800.20 | 2675.53 | 5565.31 | ||

| Philippines | 214 | 2071.67 | 3322.00 | 1170.95 | 1713.31 | 2215.81 | 2958.32 | ||

| Singapore | 112 | 24,059.95 | 42,799.21 | 9504.42 | 14,579.68 | 17,651.27 | 28,454.28 | ||

| Thailand | 243 | 10,405.76 | 11,975.90 | 2158.42 | 2823.07 | 4029.21 | 5179.20 | ||

| Vietnam | 334 | 1855.47 | 3698.95 | 815.33 | 1117.18 | 1095.13 | 1486.64 | ||

| All | 2870 | 20,668.96 | 103,316.80 | 7444.30 | 33,052.04 | 14,176.75 | 70,136.62 | ||

| Variable | Observations | Mean | Std. Dev. | Median | 25% | 75% |

|---|---|---|---|---|---|---|

| Bank efficiency | 2870 | 0.637 | 0.268 | 0.630 | 0.399 | 0.900 |

| Total assets (mill USD) | 39,397.330 | 196,885.100 | 3368.169 | 845.261 | 12,016.380 | |

| Bank size (log total assets) | 8.110 | 2.085 | 8.122 | 6.740 | 9.394 | |

| Return on average assets | 1.130 | 2.999 | 1.117 | 0.622 | 1.564 | |

| Capital adequacy ratio | 12.470 | 11.852 | 9.086 | 6.343 | 14.057 | |

| Net interest margin (%) | 3.751 | 2.981 | 3.265 | 2.414 | 4.421 | |

| GDP growth (%) | 6.956 | 2.902 | 6.486 | 5.318 | 9.112 | |

| Inflation rate (%) | 4.775 | 3.855 | 4.219 | 2.631 | 6.244 | |

| Real interest rate (%) | 2.691 | 3.330 | 3.310 | −0.156 | 4.592 |

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| China | 24 | 60 | 59 | 51 | 50 | 53 | 61 | 75 | 64 | 74 | 62 | 69 | 63 | 60 |

| Indonesia | 24 | 20 | 13 | 15 | 16 | 3 | 0 | 3 | 0 | 0 | 0 | 3 | 5 | 2 |

| Malaysia | 17 | 5 | 16 | 12 | 16 | 8 | 7 | 8 | 12 | 6 | 13 | 13 | 10 | 9 |

| Philippines | 0 | 5 | 0 | 0 | 6 | 3 | 2 | 0 | 2 | 0 | 2 | 0 | 3 | 2 |

| Singapore | 7 | 5 | 3 | 5 | 6 | 18 | 15 | 10 | 12 | 11 | 15 | 8 | 13 | 13 |

| Thailand | 14 | 0 | 6 | 10 | 0 | 13 | 2 | 3 | 7 | 0 | 2 | 3 | 0 | 0 |

| Vietnam | 14 | 5 | 3 | 7 | 6 | 5 | 12 | 3 | 2 | 9 | 6 | 5 | 8 | 13 |

| All | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Year | China | Indonesia | Malaysia | Philippines | Singapore | Thailand | Vietnam | All |

|---|---|---|---|---|---|---|---|---|

| 2000 | 0.24 | 0.24 | 0.17 | 0.00 | 0.07 | 0.14 | 0.14 | 1.00 |

| 2001 | 0.60 | 0.20 | 0.05 | 0.05 | 0.05 | 0.00 | 0.05 | 1.00 |

| 2002 | 0.59 | 0.13 | 0.16 | 0.00 | 0.03 | 0.06 | 0.03 | 1.00 |

| 2003 | 0.51 | 0.15 | 0.12 | 0.00 | 0.05 | 0.10 | 0.07 | 1.00 |

| 2004 | 0.50 | 0.16 | 0.16 | 0.06 | 0.06 | 0.00 | 0.06 | 1.00 |

| 2005 | 0.53 | 0.03 | 0.08 | 0.03 | 0.18 | 0.13 | 0.05 | 1.00 |

| 2006 | 0.61 | 0.00 | 0.07 | 0.02 | 0.15 | 0.02 | 0.12 | 1.00 |

| Pre-crisis overall | 0.51 | 0.13 | 0.12 | 0.02 | 0.08 | 0.06 | 0.07 | 1.00 |

| 2007 | 0.75 | 0.03 | 0.08 | 0.00 | 0.10 | 0.03 | 0.03 | 1.00 |

| 2008 | 0.64 | 0.00 | 0.12 | 0.02 | 0.12 | 0.07 | 0.02 | 1.00 |

| 2009 | 0.74 | 0.00 | 0.06 | 0.00 | 0.11 | 0.00 | 0.09 | 1.00 |

| Crisis overall | 0.71 | 0.01 | 0.09 | 0.01 | 0.11 | 0.03 | 0.05 | 1.00 |

| 2010 | 0.62 | 0.00 | 0.13 | 0.02 | 0.15 | 0.02 | 0.06 | 1.00 |

| 2011 | 0.69 | 0.03 | 0.13 | 0.00 | 0.08 | 0.03 | 0.05 | 1.00 |

| 2012 | 0.63 | 0.05 | 0.10 | 0.03 | 0.13 | 0.00 | 0.08 | 1.00 |

| 2013 | 0.60 | 0.02 | 0.09 | 0.02 | 0.13 | 0.00 | 0.13 | 1.00 |

| Post-crisis overall | 0.64 | 0.03 | 0.11 | 0.02 | 0.12 | 0.01 | 0.08 | 1.00 |

| Period | Obs. | CRS | VRS | ||

| Mean | SD | Mean | SD | ||

| Pre-crisis (2000–2006) | 874 | 0.570 | 0.255 | 0.733 | 0.243 |

| Crisis (2007–2009) | 721 | 0.503 | 0.225 | 0.653 | 0.244 |

| Post-crisis (2010–2013) | 1275 | 0.410 | 0.229 | 0.561 | 0.275 |

| Kruskal–Wallis Test | |||||

| Χ2 (df = 2) | 260.951 | 217.140 | |||

| Sig | *** | *** | |||

| Efficiency | Bank Size | ROAA | CAR | NIM | GDP Growth | Inflation | Real Interest | ||

|---|---|---|---|---|---|---|---|---|---|

| Trend | chi2 | 1294.00 * | 918.86 * | 2001.28 | 1699.02 * | 1351.58 * | 1344.99 * | 1620.44 * | 1554.90 * |

| Drift | chi2 | 1787.84 * | 1253.71 * | 2181.22 * | 1735.76 * | 1821.95 * | 1956.16 * | 2449.30 * | 2359.75 * |

| None | chi2 | 1992.05 * | 1544.02 * | 2911.95 * | 2275.53 * | 1848.21 * | 1944.25 * | 2196.38 * | 2014.99 * |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

|---|---|---|---|---|---|---|---|---|

| Bank efficiency (1) | 1 | |||||||

| Bank size (2) | 0.2514 * | 1 | ||||||

| ROAA (3) | 0.0307 | −0.0177 | 1 | |||||

| CAR (4) | 0.0329 | −0.5071 * | 0.1037 * | 1 | ||||

| NIM (5) | −0.2276 * | −0.2523 * | 0.1448 * | 0.2055 * | 1 | |||

| GDP (6) | 0.2985 * | 0.1945 * | −0.0334 | −0.1349 * | −0.1335 * | 1 | ||

| Inflation (7) | −0.3526 * | −0.2277 * | 0.0361 | 0.0189 | 0.1615 * | −0.1831 * | 1 | |

| Interest (8) | −0.0968 * | −0.0624 * | 0.0147 | 0.0657 * | 0.0583 * | −0.3562 * | −0.3151 * | 1 |

| Exp. Sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Size | +/− | 0.031 *** (0.003) | 0.032 *** (0.003) | 0.034 *** (0.003) | 0.032 *** (0.003) | 0.032 *** (0.003) | 0.033 *** (0.003) | 0.033 *** (0.003) | 0.031 *** (0.003) | 0.021 *** (0.003) |

| ROAA | + | 0.008 *** (0.003) | 0.008 *** (0.003) | 0.007 *** (0.003) | 0.007 *** (0.002) | 0.007 *** (0.003) | 0.008 (0.003) | 0.008 *** (0.003) | 0.008 *** (0.003) | 0.008 *** (0.003) |

| CAR | + | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.007 *** (0.001) | 0.006 *** (0.001) | 0.005 *** (0.001) |

| NIM | +/− | −0.016 *** (0.002) | −0.016 *** (0.002) | −0.016 *** (0.002) | −0.015 *** (0.002) | −0.015 *** (0.002) | −0.016 *** (0.002) | −0.018 *** (0.002) | −0.016 *** (0.002) | −0.012 *** (0.002) |

| GDP | + | 0.016 *** (0.003) | 0.021 *** (0.002) | 0.023 *** (0.002) | 0.019 *** (0.002) | 0.022 *** (0.002) | 0.022 *** (0.002) | 0.021 *** (0.002) | 0.016 *** (0.003) | 0.019 *** (0.003) |

| IF | − | −0.021 *** (0.002) | −0.021 *** (0.002) | −0.021 *** (0.002) | −0.023 *** (0.002) | −0.022 *** (0.002) | −0.022 *** (0.002) | −0.020 *** (0.002) | −0.021 *** (0.002) | −0.011 *** (0.002) |

| RI | − | −0.010 *** (0.002) | −0.009 *** (0.002) | −0.009 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.005 ** (0.002) |

| CN | 0.050 *** (0.017) | |||||||||

| ID | −0.034 ** (0.015) | −0.133 *** (0.022) | ||||||||

| MY | 0.054 *** (0.019) | 0.015 (0.023) | ||||||||

| PH | −0.106 *** (0.020) | −0.170 *** (0.024) | ||||||||

| SG | 0.182 *** (0.029) | 0.144 *** (0.031) | ||||||||

| TH | 0.038 * (0.020) | −0.001 (0.024) | ||||||||

| VN | −0.070 *** (0.018) | −0.161 *** (0.024) | ||||||||

| ASEAN | −0.050 *** (0.017) | |||||||||

| Time trend | −0.042 *** (0.001) | −0.040 *** (0.001) | −0.039 *** (0.001) | −0.039 *** (0.001) | −0.039 *** (0.001) | −0.040 *** (0.001) | −0.039 *** (0.001) | −0.041 *** (0.001) | −0.041 *** (0.001) | |

| Constant | 0.389 *** (0.040) | 0.371 *** (0.039) | 0.324 *** (0.040) | 0.383 *** (0.039) | 0.354 *** (0.039) | 0.348 *** (0.039) | 0.364 *** (0.039) | 0.439 *** (0.048) | 0.452 *** (0.047) | |

| Pseudo R2 | 0.3571 | 0.3558 | 0.3569 | 0.3652 | 0.3698 | 0.3551 | 0.3596 | 0.3571 | 0.4088 | |

| Adjusted R2 (OLS) | 0.2606 | 0.2602 | 0.2608 | 0.2665 | 0.2653 | 0.2610 | 0.2630 | 0.2606 | 0.2956 | |

| LR chi2 | 869.07 | 865.76 | 868.61 | 888.81 | 899.99 | 864.13 | 875.15 | 869.07 | 994.96 | |

| Prob > chi2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Log likelihood | −782.25 | −783.91 | −782.48 | −772.38 | −766.79 | −784.72 | −779.21 | −782.25 | −719.31 | |

| Obs. | 2870 | 2870 | 2870 | 2870 | 2870 | 2870 | 2870 | 2870 | 2870 |

| Exp. Sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Size | +/− | 0.038 *** (0.005) | 0.044 *** (0.005) | 0.038 *** (0.005) | 0.037 *** (0.005) | 0.038 *** (0.005) | 0.046 *** (0.006) | 0.035 *** (0.005) | 0.038 *** (0.005) | 0.046 *** (0.005) |

| ROAA | + | 0.012 *** (0.004) | 0.006 (0.004) | 0.008 * (0.005) | 0.006 (0.003) | 0.009 * (0.005) | 0.007 (0.005) | 0.009 ** (0.005) | 0.012 *** (0.004) | 0.006 (0.004) |

| CAR | + | 0.008 *** (0.001) | 0.008 *** (0.001) | 0.007 *** (0.001) | 0.007 *** (0.001) | 0.007 *** (0.001) | 0.008 *** (0.001) | 0.007 *** (0.001) | 0.008 *** (0.001) | 0.009 *** (0.001) |

| NIM | +/− | −0.019 *** (0.004) | −0.023 *** (0.004) | −0.019 *** (0.004) | −0.017 *** (0.004) | −0.020 *** (0.004) | −0.020 *** (0.004) | −0.020 *** (0.004) | −0.019 *** (0.004) | −0.018 *** (0.004) |

| GDP | + | −0.021 *** (0.006) | 0.031 *** (0.004) | 0.027 *** (0.004) | 0.025 *** (0.004) | 0.028 *** (0.004) | 0.021 *** (0.004) | 0.028 *** (0.004) | −0.021 *** (0.006) | −0.025 *** (0.006) |

| IF | − | −0.023 *** (0.002) | −0.039 *** (0.003) | −0.027 *** (0.003) | −0.028 *** (0.002) | −0.027 *** (0.002) | −0.030 *** (0.003) | −0.027 *** (0.002) | −0.023 *** (0.002) | −0.031 *** (0.003) |

| RI | − | 0.004 * (0.002) | 0.008 *** (0.003) | 0.010 *** (0.003) | 0.010 *** (0.003) | 0.010 *** (0.003) | 0.010 *** (0.003) | 0.009 *** (0.003) | 0.004 * (0.002) | 0.004 * (0.002) |

| CN | 0.394 *** (0.038) | |||||||||

| ID | 0.169 *** (0.028) | −0.311 *** (0.052) | ||||||||

| MY | −0.002 (0.028) | −0.376 *** (0.045) | ||||||||

| PH | −0.181 *** (0.030) | −0.519 *** (0.050) | ||||||||

| SG | −0.036 (0.049) | −0.306 *** (0.051) | ||||||||

| TH | −0.145 *** (0.029) | −0.489 *** (0.047) | ||||||||

| VN | −0.079 (0.029) | −0.350 *** (0.044) | ||||||||

| ASEAN | −0.394 *** (0.038) | |||||||||

| Time trend | −0.038 *** (0.005) | −0.042 *** (0.005) | −0.048 *** (0.005) | −0.042 *** (0.005) | −0.047 *** (0.005) | −0.045 *** (0.005) | −0.047 *** (0.005) | −0.038 *** (0.005) | −0.031 *** (0.005) | |

| Constant | 0.611 *** (0.060) | 0.333 *** (0.059) | 0.390 *** (0.062) | 0.422 *** (0.058) | 0.387 *** (0.060) | 0.408 *** (0.059) | 0.418 *** (0.060) | 1.005 *** (0.081) | 0.988 *** (0.085) | |

| Pseudo R2 | 0.7052 | 0.6194 | 0.5726 | 0.6164 | 0.5733 | 0.6040 | 0.5820 | 0.7052 | 0.7812 | |

| Adjusted R2 | 0.4502 | 0.4253 | 0.4021 | 0.4301 | 0.4032 | 0.4123 | 0.4066 | 0.4502 | 0.4825 | |

| LR chi2 | 556.06 | 488.39 | 451.51 | 486.06 | 452.05 | 476.27 | 458.94 | 556.06 | 615.95 | |

| Prob > chi2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Log likelihood | −116.22 | −150.06 | −168.50 | −151.22 | −168.23 | −156.12 | −164.78 | −116.22 | −86.28 | |

| Obs. | 874 | 874 | 874 | 874 | 874 | 874 | 874 | 874 | 874 |

| Exp. Sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Size | +/− | 0.073 *** (0.005) | 0.070 *** (0.005) | 0.080 *** (0.005) | 0.079 *** (0.005) | 0.078 *** (0.005) | 0.078 *** (0.005) | 0.079 *** (0.005) | 0.073 *** (0.005) | 0.061 *** (0.005) |

| ROAA | + | −0.000 (0.003) | −0.002 (0.002) | −0.001 (0.003) | −0.001 (0.003) | −0.001 (0.003) | −0.000 (0.003) | −0.000 (0.003) | −0.000 (0.003) | −0.001 (0.002) |

| CAR | + | 0.012 *** (0.001) | 0.011 *** (0.001) | 0.012 *** (0.001) | 0.012 *** (0.001) | 0.012 *** (0.001) | 0.012 *** (0.001) | 0.012 *** (0.001) | 0.012 *** (0.001) | 0.010 *** (0.001) |

| NIM | +/− | −0.010 *** (0.003) | −0.004 (0.003) | −0.010 *** (0.003) | −0.011 *** (0.003) | −0.011 *** (0.003) | −0.012 *** (0.003) | −0.012 *** (0.003) | −0.010 *** (0.003) | −0.002 (0.003) |

| GDP | + | 0.003 (0.003) | 0.016 *** (0.002) | 0.021 *** (0.002) | 0.017 *** (0.002) | 0.019 *** (0.002) | 0.019 *** (0.002) | 0.018 *** (0.002) | 0.003 (0.003) | 0.013 *** (0.003) |

| IF | − | −0.016 *** (0.002) | −0.020 *** (0.002) | −0.019 *** (0.002) | −0.021 *** (0.002) | −0.020 *** (0.002) | −0.020 *** (0.002) | −0.020 *** (0.003) | −0.016 *** (0.002) | −0.006 ** (0.003) |

| RI | − | −0.018 *** (0.003) | −0.018 *** (0.003) | −0.017 *** (0.003) | −0.019 *** (0.003) | −0.018 *** (0.003) | −0.018 *** (0.003) | −0.018 *** (0.003) | −0.018 *** (0.003) | −0.009 *** (0.003) |

| CN | 0.165 *** (0.029) | |||||||||

| ID | −0.162 *** (0.019) | −0.259 *** (0.028) | ||||||||

| MY | 0.143 *** (0.029) | 0.031 (0.036) | ||||||||

| PH | −0.017 (0.028) | −0.164 *** (0.035) | ||||||||

| SG | 0.082 ** (0.038) | 0.012 (0.041) | ||||||||

| TH | 0.044 (0.032) | −0.035 (0.039) | ||||||||

| VN | −0.025 (0.029) | −0.207 *** (0.036) | ||||||||

| ASEAN | −0.165 *** (0.029) | |||||||||

| Time trend | −0.091 *** (0.013) | −0.021 *** (0.010) | −0.011 (0.011) | −0.021 * (0.011) | −0.016 (0.011) | −0.016 (0.011) | −0.018 * (0.011) | −0.091 *** (0.013) | −0.055 *** (0.015) | |

| Constant | 0.020 *** (0.062) | 0.053 (0.060) | −0.108 * (0.063) | −0.040 (0.063) | −0.048 (0.063) | −0.051 (0.063) | −0.044 (0.063) | 0.185 ** (0.072) | 0.113 * (0.067) | |

| Pseudo R2 | 1.2049 | 1.2840 | 1.1862 | 1.1359 | 1.1453 | 1.1392 | 1.1367 | 1.2049 | 1.4195 | |

| Adjusted R2 | 0.5216 | 0.5551 | 0.5146 | 0.4976 | 0.5003 | 0.5015 | 0.4978 | 0.5216 | 0.5972 | |

| LR chi2 | 551.76 | 587.97 | 543.15 | 520.12 | 524.43 | 521.65 | 520.51 | 551.76 | 650.01 | |

| Prob > chi2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Log likelihood | 46.92 | 65.03 | 42.62 | 31.11 | 33.26 | 31.87 | 31.30 | 46.92 | 96.05 | |

| Obs. | 721 | 721 | 721 | 721 | 721 | 721 | 721 | 721 | 721 |

| Exp. Sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Size | +/− | 0.064 *** (0.005) | 0.061 *** (0.005) | 0.062 *** (0.005) | 0.059 *** (0.005) | 0.058 *** (0.005) | 0.060 *** (0.005) | 0.062 *** (0.005) | 0.064 *** (0.005) | 0.055 *** (0.005) |

| ROAA | + | 0.021 *** (0.007) | 0.022 *** (0.007) | 0.022 *** (0.007) | 0.026 *** (0.007) | 0.022 *** (0.007) | 0.023 *** (0.007) | 0.022 *** (0.007) | 0.021 *** (0.007) | 0.026 *** (0.007) |

| CAR | + | 0.008 *** (0.001) | 0.008 *** (0.001) | 0.008 *** (0.001) | 0.008 *** (0.001) | 0.007 *** (0.001) | 0.008 *** (0.001) | 0.008 *** (0.001) | 0.008 *** (0.001) | 0.007 *** (0.001) |

| NIM | +/− | −0.009 *** (0.003) | −0.009 *** (0.003) | −0.009 *** (0.003) | −0.008 *** (0.003) | −0.007 *** (0.003) | −0.009 *** (0.003) | −0.009 *** (0.003) | −0.009 *** (0.003) | −0.005 * (0.003) |

| GDP | + | 0.019 *** (0.005) | 0.015 *** (0.004) | 0.015 *** (0.004) | 0.013 *** (0.004) | 0.014 *** (0.004) | 0.017 *** (0.004) | 0.015 *** (0.004) | 0.019 *** (0.005) | 0.019 *** (0.005) |

| IF | − | −0.027 *** (0.003) | −0.025 *** (0.003) | −0.025 *** (0.003) | −0.027 *** (0.003) | −0.026 *** (0.003) | −0.024 *** (0.003) | −0.025 *** (0.004) | −0.027 *** (0.003) | −0.028 *** (0.005) |

| RI | − | −0.027 *** (0.003) | −0.024 *** (0.004) | −0.025 *** (0.003) | −0.027 *** (0.003) | −0.029 *** (0.003) | −0.025 *** (0.003) | −0.025 *** (0.003) | −0.027 *** (0.003) | −0.029 *** (0.005) |

| CN | −0.038 * (0.023) | |||||||||

| ID | −0.017 (0.024) | 0.009 (0.034) | ||||||||

| MY | 0.009 (0.029) | 0.030 (0.031) | ||||||||

| PH | −0.121 *** (0.030) | −0.101 *** (0.033) | ||||||||

| SG | 0.327 *** (0.044) | 0.344 *** (0.046) | ||||||||

| TH | 0.052 * (0.031) | 0.079 ** (0.035) | ||||||||

| VN | −0.001 (0.034) | 0.030 (0.044) | ||||||||

| ASEAN | 0.038 * (0.023) | |||||||||

| Time trend | −0.026 ** (0.010) | −0.037 *** (0.010) | −0.026 *** (0.009) | −0.026 *** (0.009) | −0.018 ** (0.009) | −0.024 *** (0.009) | −0.026 *** (0.009) | −0.026 ** (0.010) | −0.026 ** (0.012) | |

| Constant | 0.019 (0.067) | 0.038 (0.066) | 0.029 (0.071) | 0.090 (0.067) | 0.069 (0.066) | 0.019 (0.067) | 0.037 (0.067) | −0.019 (0.074) | 0.064 (0.077) | |

| Pseudo R2 | 0.4937 | 0.4913 | 0.4909 | 0.5081 | 0.5503 | 0.4937 | 0.4908 | 0.4937 | 0.5735 | |

| Adjusted R2 | 0.3247 | 0.3236 | 0.3233 | 0.3330 | 0.3486 | 0.3267 | 0.3233 | 0.3247 | 0.3602 | |

| LR chi2 | 477.96 | 475.60 | 475.22 | 491.83 | 532.75 | 477.93 | 475.12 | 477.96 | 555.15 | |

| Prob > chi2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Log likelihood | −245.05 | −246.24 | −246.43 | −238.12 | −217.66 | −245.07 | −246.48 | −245.05 | −206.46 | |

| Obs. | 1275 | 1275 | 1275 | 1275 | 1275 | 1275 | 1275 | 1275 | 1275 |

| Exp. Sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Size | +/− | 0.031 *** (0.003) | 0.032 *** (0.003) | 0.034 *** (0.003) | 0.032 *** (0.003) | 0.032 *** (0.003) | 0.033 *** (0.003) | 0.033 *** (0.003) | 0.031 *** (0.003) | 0.021 *** (0.003) |

| ROAA | + | 0.008 * (0.004) | 0.008 * (0.004) | 0.007 * (0.004) | 0.007 * (0.004) | 0.007 * (0.004) | 0.008 * (0.005) | 0.008 * (0.004) | 0.008 * (0.005) | 0.008 * (0.005) |

| CAR | + | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.006 *** (0.001) | 0.007 *** (0.001) | 0.006 *** (0.001) | 0.005 *** (0.001) |

| NIM | +/− | −0.016 *** (0.003) | −0.016 *** (0.003) | −0.016 *** (0.003) | −0.015 *** (0.003) | −0.015 *** (0.003) | −0.016 *** (0.003) | −0.018 *** (0.003) | −0.016 *** (0.003) | −0.012 *** (0.003) |

| GDP | + | 0.016 *** (0.003) | 0.021 *** (0.002) | 0.023 *** (0.002) | 0.019 *** (0.002) | 0.022 *** (0.002) | 0.022 *** (0.002) | 0.021 *** (0.002) | 0.016 *** (0.003) | 0.019 *** (0.003) |

| IF | − | −0.021 *** (0.002) | −0.021 *** (0.002) | −0.021 *** (0.002) | −0.023 *** (0.002) | −0.022 *** (0.002) | −0.022 *** (0.002) | −0.020 *** (0.002) | −0.021 *** (0.002) | −0.011 *** (0.002) |

| RI | − | −0.010 *** (0.002) | −0.009 *** (0.002) | −0.009 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.010 *** (0.002) | −0.005 ** (0.002) |

| CN | 0.050 *** (0.018) | |||||||||

| ID | −0.034 ** (0.015) | −0.133 *** (0.024) | ||||||||

| MY | 0.054 *** (0.019) | 0.015 (0.025) | ||||||||

| PH | −0.106 *** (0.016) | −0.170 *** (0.023) | ||||||||

| SG | 0.182 *** (0.036) | 0.144 *** (0.040) | ||||||||

| TH | 0.038 ** (0.019) | −0.001 (0.025) | ||||||||

| VN | −0.070 *** (0.019) | −0.161 *** (0.027) | ||||||||

| ASEAN | −0.050 *** (0.019) | |||||||||

| Time trend | −0.042 *** (0.001) | −0.040 *** (0.001) | −0.039 *** (0.001) | −0.039 *** (0.001) | −0.039 *** (0.001) | −0.040 *** (0.001) | −0.039 *** (0.001) | −0.041 *** (0.001) | −0.041 *** (0.001) | |

| Constant | 0.389 *** (0.044) | 0.371 *** (0.042) | 0.324 *** (0.043) | 0.383 *** (0.042) | 0.354 *** (0.041) | 0.348 *** (0.041) | 0.364 *** (0.042) | 0.439 *** (0.051) | 0.452 *** (0.050) | |

| Pseudo R2 | 0.3571 | 0.3558 | 0.3569 | 0.3652 | 0.3698 | 0.3551 | 0.3596 | 0.3571 | 0.4088 | |

| LR chi2 | 883.59 | 956.98 | 875.51 | 942.65 | 963.31 | 925.59 | 796.69 | 936.89 | 1163.0 | |

| Prob > chi2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Log likelihood | −782.25 | −783.91 | −782.48 | −772.38 | −766.79 | −784.72 | −779.21 | −782.25 | −719.31 | |

| Obs. | 2860 | 2860 | 2860 | 2860 | 2860 | 2860 | 2860 | 2860 | 2860 |

| Dep. Var: Efficiency Score | Exp. Sign | Model 1 | Model 2 | Model 3 |

|---|---|---|---|---|

| Size | +/− | 0.061 *** (0.004) | 0.061 *** (0.003) | 0.062 *** (0.003) |

| ROAA | + | 0.010 *** (0.003) | 0.010 *** (0.003) | 0.010 *** (0.003) |

| CAR | + | 0.005 *** (0.001) | 0.005 *** (0.001) | 0.005 *** (0.001) |

| NIM | +/− | −0.008 *** (0.002) | −0.008 *** (0.002) | −0.008 *** (0.002) |

| GDP | + | 0.007 *** (0.002) | 0.007 *** (0.002) | 0.008 *** (0.002) |

| IF | − | −0.017 *** (0.001) | −0.017 *** (0.001) | −0.016 *** (0.001) |

| RI | − | −0.007 *** (0.001) | −0.007 *** (0.002) | −0.006 *** (0.002) |

| CN | 0.092 *** (0.015) | |||

| ASEAN | −0.092 *** (0.015) | |||

| Crisis | 0.039 *** (0.010) | |||

| Time trend | −0.042 *** (0.001) | −0.042 *** (0.001) | −0.041 *** (0.002) | |

| Wald chi2 | 1144.54 | 1138.16 | 1174.93 | |

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | |

| Obs. | 2347 | 2347 | 2347 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Banna, H.; Shah, S.K.B.; Noman, A.H.M.; Ahmad, R.; Masud, M.M. Determinants of Sino-ASEAN Banking Efficiency: How Do Countries Differ? Economies 2019, 7, 13. https://doi.org/10.3390/economies7010013

Banna H, Shah SKB, Noman AHM, Ahmad R, Masud MM. Determinants of Sino-ASEAN Banking Efficiency: How Do Countries Differ? Economies. 2019; 7(1):13. https://doi.org/10.3390/economies7010013

Chicago/Turabian StyleBanna, Hasanul, Syed Karim Bux Shah, Abu Hanifa Md Noman, Rubi Ahmad, and Muhammad Mehedi Masud. 2019. "Determinants of Sino-ASEAN Banking Efficiency: How Do Countries Differ?" Economies 7, no. 1: 13. https://doi.org/10.3390/economies7010013

APA StyleBanna, H., Shah, S. K. B., Noman, A. H. M., Ahmad, R., & Masud, M. M. (2019). Determinants of Sino-ASEAN Banking Efficiency: How Do Countries Differ? Economies, 7(1), 13. https://doi.org/10.3390/economies7010013