Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore?

Abstract

1. Introduction

2. Literature Review

2.1. Foreign Direct Investment and Economic Growth

2.2. Foreign Direct Investment and Income Distribution

2.3. Foreign Direct Investment and Environmental Quality

3. Methodology

3.1 Model of Economic Growth

3.2. Model of Income Distribution

3.3. Model of Environmental Quality

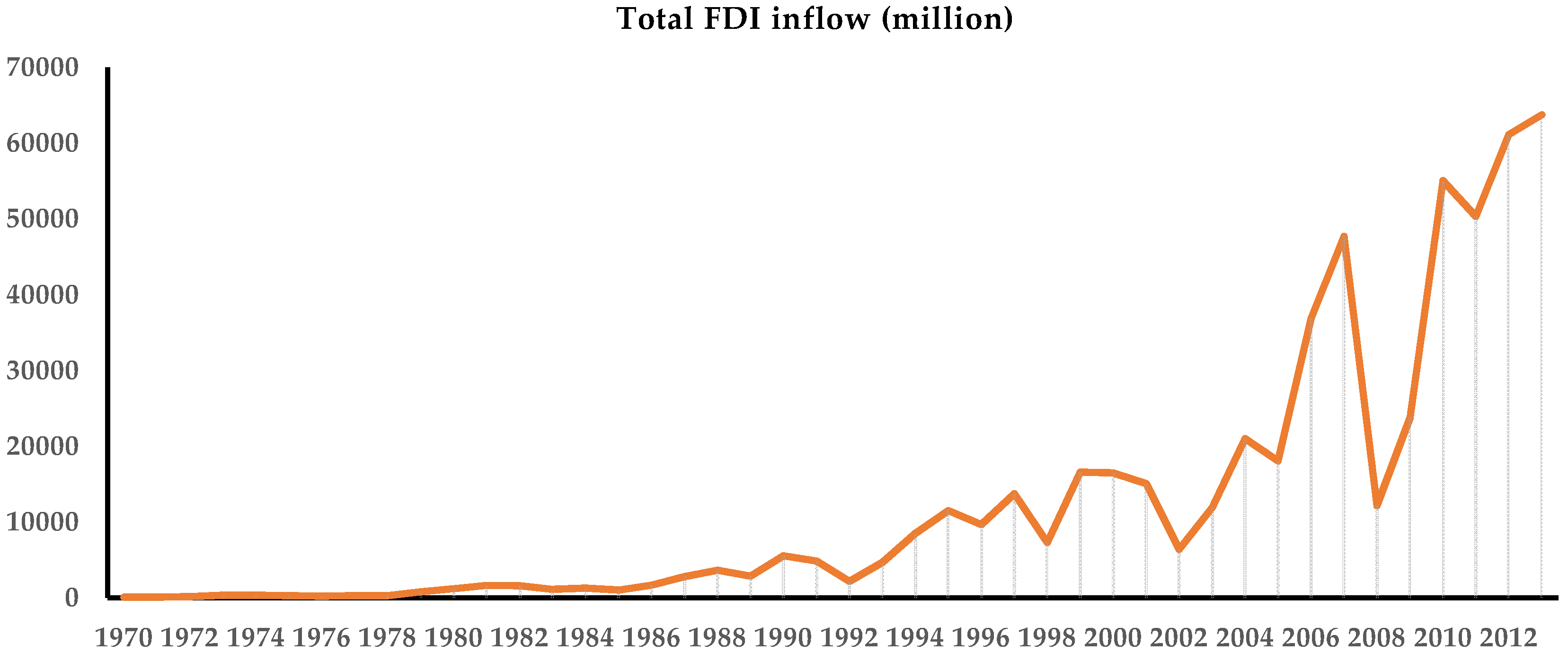

4. Data

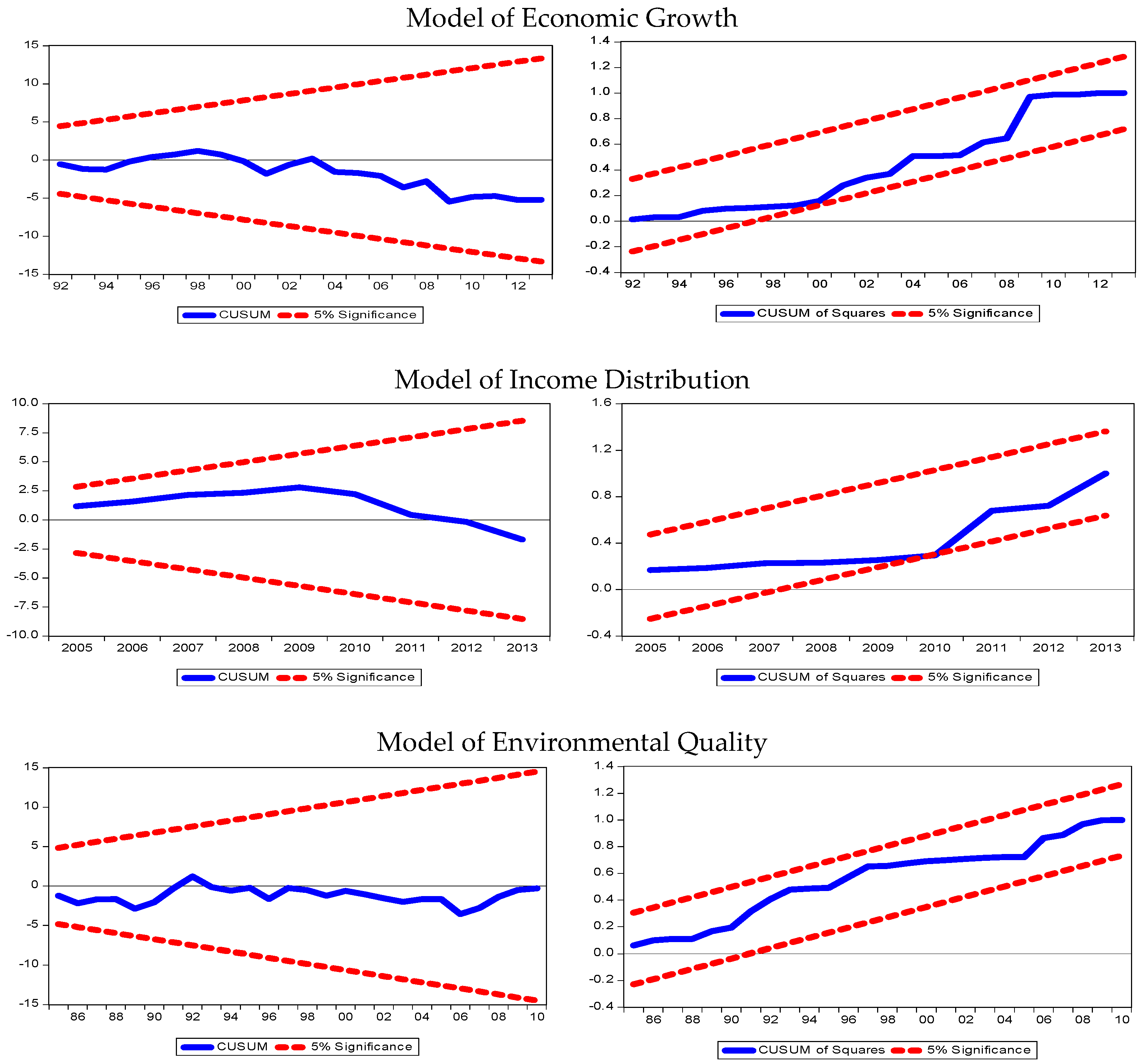

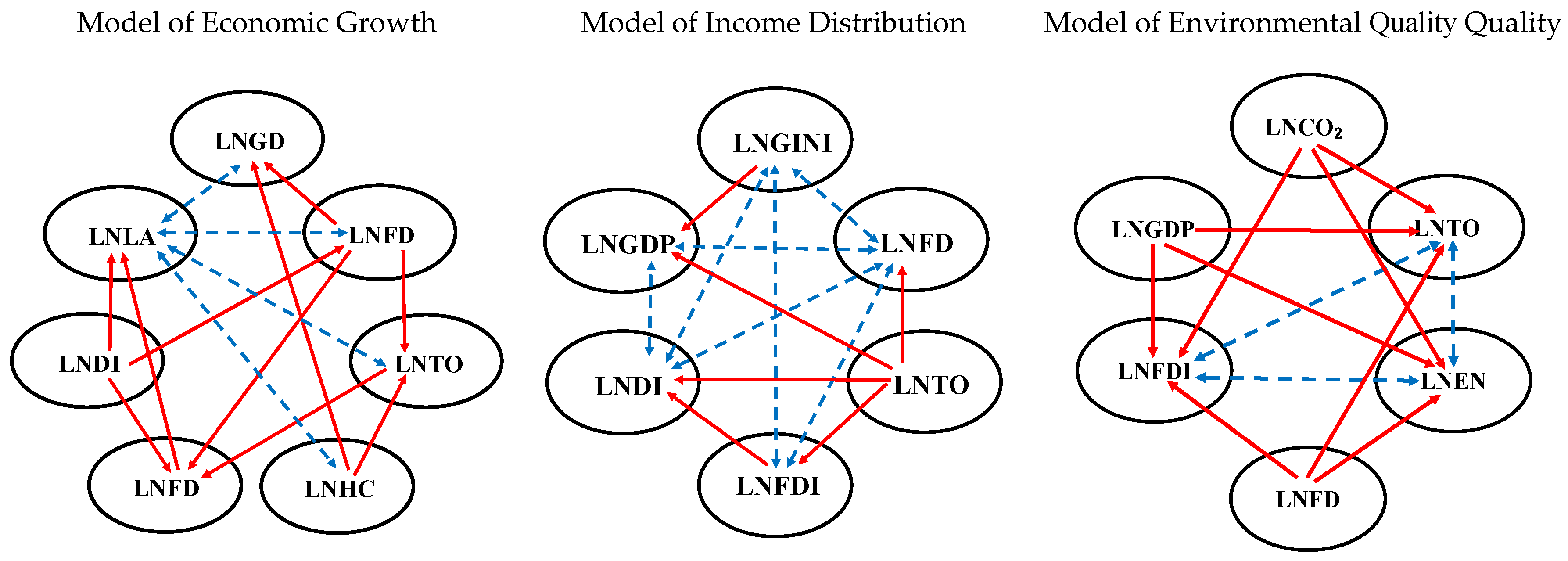

5. Empirical Findings

6. Conclusions

Author Contributions

Conflicts of Interest

References

- Adams, Samuel. 2009. Foreign Direct investment, domestic investment, and economic growth in Sub-Saharan Africa. Journal of Policy Modelling (31): 939–49. [Google Scholar] [CrossRef]

- Alfaro, Laura, Areendam Chanda, Sebnem Kalemli-Ozcan, and Selin Sayek. 2004. FDI and economic growth: The role of local financial markets. Journal of International Economics (64): 89–112. [Google Scholar] [CrossRef]

- Ali, Hamisu Sadi, A. Abdul-Rahim, and Mohammed Bashir Ribadu. 2017. Urbanization and carbon emissions in Singapore: Evidence from the ARDL approach. Environmental Science and Pollution Research (24): 1967–74. [Google Scholar] [CrossRef] [PubMed]

- Anderson, Lill, and Ronald Babula. 2008. The link between openness and long-run economic growth. Journal of International Commerce and Economics (2): 1–20. [Google Scholar]

- Ang, James B. 2007. CO2 emissions, energy consumption, and output in France. Energy Policy (35): 4772–78. [Google Scholar] [CrossRef]

- Ang, James. 2008. Economic development, pollutant emissions, and energy consumption in Malaysia. Journal of Policy Model (30): 271–78. [Google Scholar] [CrossRef]

- Ang, James B. 2010. Determinants of private investment in Malaysia: What causes the post- crisis slumps? Contemporary Economic Policy (28): 378–91. [Google Scholar]

- Antweiler, Werner, Brian R. Copeland, and M. Scott Taylor. 2001. Is free trade good for the environment? America Economic Review (91): 877–908. [Google Scholar] [CrossRef]

- Balasubramanyam, Venkataraman N., Mohammed Salisu, and David Sapsford. 1996. Foreign direct investment and growth in EP and IS countries. The Economic Journal (106): 92–105. [Google Scholar] [CrossRef]

- Barro, Robert J. 1999. Notes on growth accounting. Journal of Economic Growth (4): 119–37. [Google Scholar] [CrossRef]

- Barro, Robert, and Jong Wha Lee. 2011. Educational attainment dataset. Available online: http://www.barrolee.com (accessed on 4 January 2016).

- Barro, Robert J., and X. Sala-I-Martin. 1995. Economic Growth. Cambridge: McGraw Hill. [Google Scholar]

- Basu, Parantap, and Alessandra Guariglia. 2007. Foreign direct investment, inequality, and growth. Journal of Macroeconomics (29): 824–39. [Google Scholar] [CrossRef]

- Behera, Smruti Ranjan, and Devi Prasad Dash. 2017. The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renewable and Sustainable Energy Reviews (70): 96–106. [Google Scholar] [CrossRef]

- Blonigen, Bruce, and Matthew Slaughter. 2001. Foreign affiliate activity and US skill upgrading. Review of Economics and Statistics (83): 362–76. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Economics (87): 115–43. [Google Scholar] [CrossRef]

- Canavire-Bacarreza, Gustavo, and Felix Rioja. 2009. Financial development and the distribution of income in Latin America and the Caribbean. Well-Being and Social Policy (5): 1–18. [Google Scholar]

- Chintrakarn, Pandej, Dierk Herzer, and Peter Nunnenkamp. 2012. FDI and income inequality: Evidence from a panel of U.S. states. Economic Inquiry (50): 788–801. [Google Scholar] [CrossRef]

- Clarke, George, Lixin Xu, and Heng-fu Zou. 2006. Finance and income inequality: What do the data tell us? Southern Economic Journal (72): 578–96. [Google Scholar] [CrossRef]

- Cole, Matthew A. 2004. Trade, the pollution haven hypothesis and the environmental Kuznets curve: Examining the linkages. Ecological Economica (48): 71–81. [Google Scholar] [CrossRef]

- Cole, Matthew A., and Robert J. R. Elliott. 2005. FDI and the capital intensity of “dirty” sectors: A missing piece of the pollution haven puzzle. Review of Development Economics (9): 530–48. [Google Scholar] [CrossRef]

- Cole, Matthew A., Robert J. R. Elliott, and Per G. Fredriksson. 2006. Endogenous pollution havens: Does FDI influence environmental regulations? Scandinavian Journal of Economics (108): 157–78. [Google Scholar] [CrossRef]

- Cole, Matthew A., Robert J. R. Elliott, and Jing Zhang. 2011. Growth, foreign direct investment, and the environment: Evidence from Chinese cities. Journal of Regional Science (51): 121–38. [Google Scholar] [CrossRef]

- Durham, J. Benson. 2004. Absorptive capacity and the effects of foreign direct investment and equity foreign portfolio investment of economic growth. European Economic Review (48): 285–306. [Google Scholar] [CrossRef]

- Duttaray, Mousumi, Amitava K. Dutt, and Kajal Mukhopadhyay. 2008. Foreign direct investment and economic growth in less developed countries: An empirical study of causality and Mechanisms. Applied Economics Letters (40): 1927–39. [Google Scholar] [CrossRef]

- EDGAR. 2015. CO2 Time Series 1990–2014 per Region/Country Dataset. 2015. Emissions Database for Global Atmospheric Research. Available online: http://edgar.jrc.ec.europa.eu/overview.php?v=CO2ts1990-2014 (accessed on 2 January 2016).

- Feenstra, Robert C., and Gordon H. Hanson. 1997. Foreign direct investment and relative wages: Evidence from Mexico’s maquiladoras. Journal of International Economics (42): 371–93. [Google Scholar] [CrossRef]

- Figini, Paolo, and Holger Görg. 2011. Does foreign direct investment affect wage inequality? An empirical investigation. World Economy (34): 1455–75. [Google Scholar] [CrossRef]

- Galor, Oded, and Joseph Zeira. 1993. Income distribution and macroeconomics. The Review of Economic Studies (60): 35–52. [Google Scholar] [CrossRef]

- Global Consumption and Income Project (GCIP). 2015. Income Inequality Dataset. Available online: http://gcip.info/graphs/download (accessed on 12 February 2016).

- Greenwood, Jeremy, and Boyan Jovanvoic. 1990. Financial development, growth, and the distribution of income. Journal of Political Economy (98): 1076–107. [Google Scholar] [CrossRef]

- Grossman, Gene, and Helpman Elhanan. 1991. Innovation and Growth in the Global Economy. Cambridge: MIT Press. [Google Scholar]

- Gui-Diby, Steve Loris. 2014. Impact of foreign direct investments on economic growth in Africa: Evidence from three decades of panel data analyses. Research in Economics (68): 248–56. [Google Scholar] [CrossRef]

- Halicioglu, Ferda. 2009. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy (37): 1156–64. [Google Scholar] [CrossRef]

- He, Jie. 2006. Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecological Economics (60): 228–45. [Google Scholar] [CrossRef]

- Hermes, Niels, and Robert Lensink. 2003. Foreign direct investment, financial development and economic growth. Journal of Development Studies (40): 142–63. [Google Scholar] [CrossRef]

- Hyungsun, Chloe Cho, and Ramirez D. Miguel. 2017. Foreign direct investment and inequality in Southeast Asia: A panel unit root and panel cointegration analysis, 1990–2013. Atlantic Economic Journal (44): 411–24. [Google Scholar]

- International Labor Organization (ILO). 2015. International Labor Dataset. Available online: http://www.ilo.org/global/statistics-and-databases/lang--en/index.htm (accessed on 26 February 2016).

- Jensen, Nathan M., and Rosas Guillermo. 2007. Foreign direct investment and income inequality in Mexico, 1990–2000. International Organization 61: 467–87. [Google Scholar] [CrossRef]

- Kirkulak, Berna, Bin Qiu, and Wei Yin. 2011. The impact of FDI on air quality: Evidence from China. Journal of Chinese Economic and Foreign Trade Studies (4): 81–98. [Google Scholar] [CrossRef]

- Lee, W. Jung. 2013. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy (55): 483–89. [Google Scholar] [CrossRef]

- Lee, Eddy, and Marco Vivarelli. 2006. The social impact of globalization in the developing countries. International Labour Review (145): 167–84. [Google Scholar] [CrossRef]

- Lin, Shu-Chin, Dong-Hyeon Kim, and Yi-Chen Wu. 2013. Foreign direct investment and income inequality: Human capital matters. Journal of Regional Science (53): 874–96. [Google Scholar] [CrossRef]

- List, John, Warren McHone, and Daniel Millimet. 2004. Effects of environmental regulation on foreign and domestic plant births: is there a home field advantage? Journal of Urban Economics (56): 303–26. [Google Scholar] [CrossRef]

- Lucas, Robert E. 1988. On the mechanic of economic growth. Journal of Monetary Economics (22): 3–42. [Google Scholar] [CrossRef]

- Mah, Jai S. 2003. A note on globalization and income distribution—The case of Korea, 1975–1995. Journal of Asian Economics (14): 161–68. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar, and Seema Narayan. 2005. Estimating income and price elasticities of imports for Fiji in a cointegration framework. Economic Modelling (22): 423–38. [Google Scholar] [CrossRef]

- Ozturk, Ilhan, and Ali Acaravci. 2010. CO2 emissions, energy consumption and economic growth in Turkey. Renewable and Sustainable Energy Reviews (14): 3220–25. [Google Scholar] [CrossRef]

- Pegkas, Penagiotis. 2015. The impact of FDI on economic growth in Eurozone countries. The Journal of Economic Asymmetries (12): 124–32. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bound testing approaches to the analysis of level relationship. Journal of Applied Econometrics (16): 289–326. [Google Scholar] [CrossRef]

- Rebelo, Sergio. 1991. Long-run policy analysis and long-run growth. Journal of Political Economy (99): 500–21. [Google Scholar] [CrossRef]

- Romer, Paul M. 1986. Increasing returns and long run growth. Journal of Political Economy (94): 1002–37. [Google Scholar] [CrossRef]

- Sahoo, Dukhabandhu, and Maathai Mathiyazhagan. 2003. Economic growth in India: Does foreign direct investment inflow matter? Singapore Economic Review (48): 151–71. [Google Scholar] [CrossRef]

- Sakyi, Daniel, Villaverde Jose, and Maza Adolfo. 2014. Trade openness, income levels, and economic growth: The case of developing countries, 1970 – 2009. The Journal of International Trade and Economic Growth (23): 1–23. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Sakiru Adebola Solarin, H. Mahmood, and M. Arouri. 2013. Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Economic Modelling (35): 145–52. [Google Scholar] [CrossRef]

- Squalli, Jay, and Kenneth Wilson. 2011. A new measure of trade openness. World Economy (34): 1745–70. [Google Scholar] [CrossRef]

- Sunde, Tafirenyika. 2017. Foreign direct investment and economic growth: ADRL and causality analysis for South Africa. Research in International Business and Finance (41): 434–44. [Google Scholar] [CrossRef]

- Sylwester, Kevin. 2005. Foreign direct investment, growth, and income inequality in less developed countries. International Review of Applied Economics (19): 289–300. [Google Scholar] [CrossRef]

- Toda, Hiro, and Taku Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics (66): 225–50. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development (UNCTAD). 2014. World Investment Report 2014: Investing in the SDGs: An Action Plan. New York and Geneva: United Nations. [Google Scholar]

- United Nations Conference on Trade and Development (UNCTAD). 2015. World Investment Report 2015: Reforming International Investment Governance. New York and Geneva: United Nations. [Google Scholar]

- University of Texas Income Inequality Project (UTIP). 2008. Estimated Household Income Inequality Dataset. Available online: http://utip.gov.utexas.edu/data.html (accessed on 17 May 2015).

- Wacziarg, Romain, and Karen H. Welch. 2008. Trade liberalization and growth: New evidence. The World Bank Economic Review (22): 187–231. [Google Scholar]

- Wang, Miao, and M. C. Sunny Wong. 2009. Foreign direct investment and economic growth: The growth accounting perspective. Economic Inquiry (47): 701–10. [Google Scholar] [CrossRef]

- World Development Indicators (WDI). 2016. World Development Indicators. Washington: The World Bank. [Google Scholar]

- Wei, Kailei, Shujie Yao, and Aying Liu. 2009. Foreign direct investment and regional inequality in China. Review of Development Economics (13): 778–91. [Google Scholar] [CrossRef]

- World Conference on Environment and Development. 1987. Our Common Future. Oxford: Oxford University Press. [Google Scholar]

- Wu, Xuehua, and Nini Li. 2011. Impact analysis of the foreign investment on environmental quality of Shandong. Energy Procedia (5): 1143–47. [Google Scholar]

- Zhang, Xiaobo, and Kevin H. Zhang. 2003. How does globalization affect regional inequality within a developing country? Evidence from China. Journal of Development Studies (39): 47–67. [Google Scholar] [CrossRef]

| LNGDP | LNCO2 | LNGINI | LNLAB | LNDI | LNFDI | LNHC | LNTO | LNEN | LNFD | |

|---|---|---|---|---|---|---|---|---|---|---|

| Malaysia | ||||||||||

| Mean | 8.126 | 1.268 | 8.304 | 7.293 | 3.290 | 1.144 | 9.339 | 4.834 | 7.183 | 4.585 |

| Median | 8.147 | 1.332 | 8.298 | 8.849 | 3.231 | 1.286 | 9.354 | 4.932 | 7.286 | 4.767 |

| Maximum | 8.853 | 2.080 | 8.486 | 9.500 | 3.774 | 2.170 | 10.200 | 5.333 | 7.891 | 4.968 |

| Minimum | 7.232 | 0.291 | 8.098 | 3.608 | 2.900 | −2.870 | 8.243 | 4.231 | 6.261 | 3.609 |

| Std Dev. | 0.482 | 0.598 | 0.070 | 2.512 | 0.229 | 0.794 | 0.491 | 0.388 | 0.545 | 0.379 |

| Skewness | −0.203 | −0.093 | 0.069 | −0.653 | 0.715 | −3.112 | −0.329 | −0.168 | −0.254 | −1.092 |

| Kurtosis | 1.799 | 1.475 | 3.752 | 1.460 | 2.393 | 16.195 | 2.517 | 1.355 | 1.731 | 3.066 |

| Indonesia | ||||||||||

| Mean | 6.718 | −0.080 | 8.299 | 11.221 | 3.167 | 0.610 | 9.091 | 4.084 | 12.088 | 3.380 |

| Median | 6.828 | 0.011 | 8.296 | 11.254 | 3.201 | 0.657 | 9.071 | 4.071 | 12.129 | 3.645 |

| Maximum | 7.501 | 0.667 | 8.592 | 11.720 | 3.486 | 1.613 | 10.350 | 4.318 | 12.920 | 4.092 |

| Minimum | 5.806 | −1.158 | 7.972 | 10.663 | 2.771 | −1.323 | 7.042 | 3.833 | 11.180 | 2.209 |

| Std Dev. | 0.486 | 0.525 | 0.186 | 0.323 | 0.188 | 0.648 | 0.811 | 0.143 | 0.489 | 0.534 |

| Skewness | −0.272 | −0.378 | −0.393 | −0.118 | −0.245 | −1.030 | −0.552 | −0.117 | 0.004 | −0.497 |

| Kurtosis | 1.902 | 2.122 | 1.831 | 1.835 | 2.332 | 4.139 | 3.175 | 1.803 | 1.963 | 1.832 |

| Thailand | ||||||||||

| Mean | 7.321 | 0.515 | 8.408 | 9.685 | 3.320 | 0.346 | 9.310 | 4.534 | 6.668 | 4.282 |

| Median | 7.466 | 0.650 | 8.382 | 10.361 | 3.279 | 0.340 | 9.422 | 4.625 | 6.707 | 4.383 |

| Maximum | 8.142 | 1.520 | 8.544 | 11.000 | 3.728 | 1.877 | 10.160 | 5.097 | 7.500 | 4.901 |

| Minimum | 6.369 | −0.874 | 8.294 | 7.406 | 3.036 | −1.599 | 8.217 | 3.989 | 5.800 | 3.467 |

| Std Dev. | 0.577 | 0.781 | 0.073 | 1.247 | 0.197 | 0.884 | 0.599 | 0.397 | 0.570 | 0.457 |

| Skewness | −0.230 | −0.174 | 0.351 | −1.105 | 0.883 | −0.217 | −0.390 | −0.035 | 0.041 | −0.322 |

| Kurtosis | 1.604 | 1.461 | 1.792 | 2.322 | 2.689 | 2.088 | 1.938 | 1.363 | 1.445 | 1.617 |

| Philippines | ||||||||||

| Mean | 6.972 | −0.253 | 8.413 | 9.325 | 3.059 | 0.637 | 9.039 | 4.174 | 6.116 | 3.644 |

| Median | 6.941 | −0.214 | 8.423 | 10.057 | 3.030 | 0.647 | 9.044 | 4.212 | 6.111 | 3.571 |

| Maximum | 7.366 | −0.022 | 8.486 | 10.615 | 3.396 | 1.427 | 9.810 | 4.690 | 6.241 | 4.244 |

| Minimum | 6.716 | −0.661 | 8.309 | 7.166 | 2.775 | −0.282 | 8.240 | 3.607 | 6.000 | 2.973 |

| Std Dev. | 0.152 | 0.154 | 0.041 | 1.370 | 0.151 | 0.419 | 0.457 | 0.382 | 0.058 | 0.416 |

| Skewness | 0.791 | −0.951 | −0.581 | −0.729 | 0.180 | −0.126 | −0.070 | −0.219 | 0.226 | −0.082 |

| Kurtosis | 3.128 | 3.370 | 2.684 | 1.629 | 2.353 | 2.206 | 1.819 | 1.416 | 2.606 | 1.360 |

| Singapore | ||||||||||

| Mean | 9.683 | 2.267 | 8.309 | 7.301 | 3.488 | 2.301 | 8.960 | 5.493 | 8.152 | 4.440 |

| Median | 9.769 | 2.490 | 8.265 | 7.350 | 3.506 | 2.318 | 9.092 | 5.509 | 8.379 | 4.421 |

| Maximum | 10.515 | 2.950 | 8.480 | 7.990 | 3.533 | 3.277 | 10.000 | 6.108 | 8.909 | 4.890 |

| Minimum | 8.488 | 0.800 | 8.171 | 6.546 | 3.138 | 1.313 | 7.758 | 4.382 | 7.130 | 3.989 |

| Std Dev. | 0.596 | 0.558 | 0.103 | 0.425 | 0.181 | 0.543 | 0.628 | 0.467 | 0.539 | 0.280 |

| Skewness | −0.349 | −1.360 | 0.448 | −0.127 | −0.158 | −0.066 | −0.350 | −0.564 | −0.301 | 0.129 |

| Kurtosis | 1.922 | 3.867 | 1.668 | 1.967 | 2.458 | 2.034 | 2.034 | 2.449 | 1.663 | 1.647 |

| Model | Variable | ADF Test Statistic | PP Test Statistic | |||

|---|---|---|---|---|---|---|

| Intercept | Trend and Intercept | Intercept | Trend and Intercept | |||

| Model of Economic Growth | Level | LNGDP | −2.97 (0) ** | −1.94 (0) | −5.53 (9) *** | −1.86 (4) |

| LNLAB | −0.81 (0) | −2.37 (0) | −0.81 (3) | −2.50 (1) | ||

| LNDI | −1.70 (1) | −2.72 (1) | −1.38 (2) | −2.62 (2) | ||

| LNFDI | −3.10 (0) ** | −5.31 (4) *** | −3.10 (0) ** | −6.76 (14) *** | ||

| LNHC | −1.26 (0) | −1.78 (0) | −1.19 (1) | −1.78 (0) | ||

| LNTO | −3.78 (0) *** | −2.55 (0) | −3.52 (3) ** | −2.58 (3) | ||

| LNFD | −0.30 (0) | −4.02 (0) ** | −0.08 (3) | −3.97 (3) ** | ||

| First difference | LNGDP | −5.64 (1) *** | −6.67 (1) *** | −5.34 (2) *** | −7.91 (10) *** | |

| LNLAB | −5.76 (0) *** | −5.75 (0) *** | −5.75 (2) *** | −5.72 (3) *** | ||

| LNDI | −4.56 (0) *** | −4.49 (0) *** | −4.56 (3) *** | −4.50 (3) *** | ||

| LNFDI | −6.76 (4) *** | −6.66 (4) *** | −26.58 (41) *** | −26.11 (41) *** | ||

| LNHC | −4.89 (0) *** | −4.90 (0) *** | −4.84 (3) *** | −4.83 (4) *** | ||

| LNTO | −4.81 (0) *** | −5.46 (0) *** | −4.78 (3) *** | −5.39 (5) *** | ||

| LNFD | −6.97 (0) *** | −6.90 (0) *** | −8.11 (7) *** | −8.08 (7) *** | ||

| Model of Income Distribution | Level | LNGINI | −0.98 (0) | −1.96 (0) | −1.30 (4) | −1.96 (2) |

| LNGDP | −2.97 (0) ** | −1.94 (0) | −5.53 (9) *** | −1.86 (4) | ||

| LNDI | −1.70 (1) | −2.72 (1) | −1.38 (2) | −2.62 (2) | ||

| LNFDI | −3.10 (0) ** | −5.31 (4) *** | −3.10 (0) ** | −6.76 (14) *** | ||

| LNTO | −3.78 (0) *** | −2.55 (0) | −3.52 (3) ** | −2.58 (3) | ||

| LNFD | −0.30 (0) | −4.02 (0) ** | −0.08 (3) | −3.97 (3) ** | ||

| First difference | LNGINI | −5.60 (0) *** | −6.22 (0) *** | −5.70 (3) *** | −6.26 (2) *** | |

| LNGDP | −5.64 (1) *** | −6.67 (1) *** | −5.34 (2) *** | −7.91 (10) *** | ||

| LNDI | −4.56 (0) *** | −4.49 (0) *** | −4.56 (3) *** | −4.50 (3) *** | ||

| LNFDI | −6.76 (4) *** | −6.66 (4) *** | −26.58 (41) *** | −26.11 (41) *** | ||

| LNTO | −4.81 (0) *** | −5.46 (0) *** | −4.78 (3) *** | −5.39 (5) *** | ||

| LNFD | −6.97 (0) *** | −6.90 (0) *** | −8.11 (7) *** | −8.08 (7) *** | ||

| Model of Environmental Quality | Level | LNCO2 | 2.29 (2) | 1.43 (2) | 1.19 (3) | −0.30 (1) |

| LNGDP | −2.97 (0) ** | −1.94 (0) | −5.53 (9) *** | −1.86 (4) | ||

| LNFDI | −3.10 (0) ** | −5.31 (4) *** | −3.10 (0) ** | −6.76 (14) *** | ||

| LNFD | −0.30 (0) | −4.02 (0)** | −0.08 (3) | −3.97 (3) ** | ||

| LNEN | −1.51(0) | −2.19(0) | −1.52(2) | −2.23(1) | ||

| LNTO | −3.78 (0) *** | −2.55 (0) | −3.52 (3) ** | −2.58 (3) | ||

| First difference | LNCO2 | −0.63 (4) | −8.59 (1) *** | −6.16 (3) *** | −7.95 (3) *** | |

| LNGDP | −5.64 (1) *** | −6.67 (1) *** | −5.34 (2) *** | −7.91 (10) *** | ||

| LNFDI | −6.76 (4) *** | −6.66 (4) *** | −26.58 (41) *** | −26.11 (41) *** | ||

| LNFD | −6.97 (0) *** | −6.90 (0) *** | −8.11 (7) *** | −8.08 (7) *** | ||

| LNEN | −6.55(0) *** | −6.50(0) *** | −6.58(2) *** | −6.54(3) *** | ||

| LNTO | −4.81 (0) *** | −5.46 (0) *** | −4.78 (3) *** | −5.39 (5) *** | ||

| Model | Max. Lag | Lag Order | F Statistic | ||

|---|---|---|---|---|---|

| Model of Economic Growth | 4 | (1,1,1,3,1,2,3) | 5.54 *** | ||

| Model of Income Distribution | 4 | (4,4,4,4,4,4) | 3.25 * | ||

| Model of Environmental Quality | 4 | (3,4,4,4,3,4) | 3.97 ** | ||

| k = 6 | k = 5 | ||||

| Critical Values for F-statistics # | Lower I (0) | Upper I (1) | Lower I (0) | Upper I (1) | |

| 1% | 3.15 | 4.43 | 3.41 | 4.68 | |

| 5% | 2.45 | 3.61 | 2.62 | 3.79 | |

| 10% | 2.12 | 3.23 | 2.26 | 3.35 | |

| Model | A. | B. | C. | D. |

|---|---|---|---|---|

| Serial Correlation [p-Value] | Functional Form [p-Value] | Normality [p-Value] | Heteroscedasticity [p-Value] | |

| Model of Economic Growth | 0.771 [0.475] | 1.944 [0.177] | 0.524 [0.769] | 1.053 [0.448] |

| Model of Income Distribution | 1.17 [0.31] | 0.79 [0.39] | 1.24 [0.53] | 0.71 [0.76] |

| Model of Environmental Quality | 2.77 [0.110] | 1.76 [0.22] | 1.54 [0.46] | 1.71 [0.16] |

| Model of Economic Growth | Model of Income Distribution | Model of Environmental Quality | |||

|---|---|---|---|---|---|

| LNGDP | LNGINI | LNCO2 | |||

| Variables | Coefficient | Variables | Coefficient | Variables | Coefficient |

| LNLAB | −0.781 *** | LNGDP | −0.190 | LNGDP | 1.589 ** |

| LNDI | −0.052 | LNDI | −0.993 *** | LNFDI | −0.221 *** |

| LNFDI | 0.072 * | LNFDI | 0.198 *** | LNFD | 0.860 |

| LNHC | 0.804 *** | LNTO | 0.242 | LNEN | 0.172 *** |

| LNTO | 0.579 *** | LNFD | −0.548 ** | LNTO | −0.314 *** |

| LNFD | 0.634 *** | C | 14.533 *** | C | 6.256 *** |

| C | 2.602*** | ||||

| Model of Economic Growth | Model of Income Distribution | Model of Environmental Quality | |||

|---|---|---|---|---|---|

| Variables | Coefficient | Variables | Coefficient | Variables | Coefficient |

| ΔLNLABt | 0.018 | ΔLNGINIt−1 | 0.198 * | ΔLNCO2t−1 | −0.259 |

| ΔLNDIt | 0.150 * | ΔLNGINIt−2 | 0.310 ** | ΔLNCO2t−2 | −0.573 ** |

| ΔLNFDIt | 0.019 * | ΔLNGINIt−3 | −0.204 * | ΔLNGDPt | −0.239 |

| ΔLNFDIt−1 | 0.003 *** | ΔLNGDPt | −0.202 * | ΔLNGDPt−1 | −0.012 |

| ΔLNHCt | 0.181 * | ΔLNGDPt−1 | 0.189 | ΔLNGDPt−2 | −0.219 |

| ΔLNTOt | 0.139 | ΔLNGDPt−2 | 0.152 | ΔLNGDPt−2 | −0.458 |

| ΔLNTOt−1 | −0.198 ** | ΔLNGDPt−3 | −0.326 ** | ΔLNFDI | −0.274 * |

| ΔLNFDt | −0.119 | ΔLNDIt | −0.167 * | ΔLNFDIt−1 | 0.101 |

| ΔLNFDt−1 | −0.159 ** | ΔLNDIt−1 | −0.197 ** | ΔLNFDIt−2 | −0.077 |

| ΔLNFDt−2 | −0.124 * | ΔLNDIt−2 | 0.038 | ΔLNFDIt−3 | −0.277 * |

| ECTt−1 | −0.674 *** | ΔLNDIt−3 | 0.236 *** | ΔLNFD | −0.053 |

| ΔLNFDIt | 0.022 ** | ΔLNFDt−1 | 0.557 | ||

| ΔLNFDIt−1 | −0.05 ** | ΔLNFDt−2 | −1.850 ** | ||

| ΔLNFDIt−2 | −0.024 ** | ΔLNFDt−3 | 1.561 ** | ||

| ΔLNFDIt−3 | 0.034 ** | ΔLNENYt | −0.028 | ||

| ΔLNTOt | −0.074 | ΔLNENYt−1 | −0.895 ** | ||

| ΔLNTOt−1 | −0.045 | ΔLNENYt−2 | −0.565 | ||

| ΔLNTOt−2 | 0.134 | ΔLNTOt | −0.093 | ||

| ΔLNTOt−3 | −0.130 * | ΔLNTOt−1 | 0.471 | ||

| ΔLNFDt | −0.030 | ΔLNTOt−2 | −0.229 | ||

| ΔLNFDt−1 | −0.121 ** | ΔLNTOt−3 | 2.478 ** | ||

| ΔLNFDt−2 | 0.183 *** | ECTt−1 | −0.394 ** | ||

| ΔLNFDt−3 | −0.130 * | ||||

| ECTt−1 | −0.354 *** | ||||

| R square | 0.99 | R square | 0.99 | R square | 0.98 |

| Ad.R square | 0.99 | Ad.R square | 0.99 | Ad.R square | 0.94 |

| Dependent Variable | Direction of Causality | ||||||

|---|---|---|---|---|---|---|---|

| Model of Economic Growth | |||||||

| Short Run | |||||||

| Singapore | LNGDPt | LNLABt | LNDIt | LNFDIt | LNHCt | LNTOt | LNFDt |

| LNGDPt | - | 19.938 *** [0.005] | 3.881 [0.422] | 1.774 [0.777] | 20.673 *** [0.000] | 19.745 *** [0.000] | 10.500 ** [0.032] |

| LNLABt | 191.75 *** [0.000] | - | 57.922 *** [0.000] | 128.437 *** [0.000] | 24.035 *** [0.000] | 71.408 *** [0.000] | 45.608 *** [0.000] |

| LNDIt | 3.894 [0.420] | 0.402 [0.982] | - | 5.956 [0.202] | 2.112 [0.715] | 3.792 [0.434] | 3.395 [0.494] |

| LNFDIt | 5.622 [0.229] | 7.313 [0.120] | 18.129 *** [0.001] | - | 5.065 [0.280] | 11.991 ** [0.017] | 9.747 ** [0.044] |

| LNHCt | 7.369 [0.117] | 14.154 *** [0.006] | 2.230 [0.693] | 3.078 [0.544] | - | 6.555 [0.161] | 4.284 [0.368] |

| LNTOt | 6.261 [0.184] | 9.401 * [0.051] | 6.619 [0.157] | 5.999 [0.199] | 12.345 ** [0.015] | - | 7.957 * [0.093] |

| LNFDt | 4.133 [0.388] | 7.852 * [0.097] | 8.136 * [0.086] | 0.207 [0.995] | 7.541 [0.109] | 7.255 [0.123] | - |

| Model of Income Distribution | |||||||

| LNGINIt | LNGDPt | LNDIt | LNFDIt | LNTOt | LNFDt | ||

| LNGINIt | - | 6.355 [0.273] | 11.767 ** [0.038] | 10.468 * [0.063] | 5.719 [0.334] | 24.030 *** [0.000] | |

| LNGDPt | 39.788 *** [0.000] | - | 38.305 *** [0.000] | 27.970 *** [0.000] | 27.671 *** [0.000] | 33.739 *** [0.000] | |

| LNDIt | 86.420 *** [0.000] | 31.847 *** [0.000] | - | 86.737 *** [0.000] | 113.112 *** [0.000] | 86.881 *** [0.000] | |

| LNFDIt | 35.622 *** [0.000] | 193.346 *** [0.000] | 6.939 [0.225] | - | 51.928 *** [0.000] | 207.302 *** [0.000] | |

| LNTOt | 0.643 [0.985] | 0.288 [0.997] | 0.728 [0.981] | 0.600 [0.988] | - | 0.650 [0.985] | |

| LNFDt | 56.103 *** [0.000] | 49.001 *** [0.000] | 81.610 *** [0.000] | 48.775 *** [0.000] | 32.253 *** [0.000] | - | |

| Model of Environmental Quality | |||||||

| LNCO2t | LNGDPt | LNFDIt | LNFDt | LNENt | LNTOt | ||

| LNCO2t | - | 4.769 [0.444] | 5.285 [0.382] | 2.868 [0.720] | 2.584 [0.763] | 2.622 [0.758] | |

| LNGDPt | 4.026 [0.545] | - | 3.499 [0.623] | 3.045 [0.692] | 2.766 [0.735] | 2.667 [0.751] | |

| LNFDIt | 53.108 *** [0.000] | 21.864 *** [0.000] | - | 77.163 *** [0.000] | 31.691 *** [0.000] | 26.350 *** [0.000] | |

| LNFDt | 3.326 [0.649] | 4.048 [0.542] | 4.651 [0.459] | - | 3.513 [0.621] | 6.700 [0.243] | |

| LNENt | 30.419 *** [0.000] | 46.416 *** [0.000] | 49.076 *** [0.000] | 29.603 *** [0.000] | - | 47.636 *** [0.000] | |

| LNTOt | 63.906 *** [0.000] | 174.297 *** [0.000] | 108.501 *** [0.000] | 386.316 *** [0.000] | 149.461 *** [0.000] | - | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ridzuan, A.R.; Ismail, N.A.; Che Hamat, A.F. Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies 2017, 5, 29. https://doi.org/10.3390/economies5030029

Ridzuan AR, Ismail NA, Che Hamat AF. Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies. 2017; 5(3):29. https://doi.org/10.3390/economies5030029

Chicago/Turabian StyleRidzuan, Abdul Rahim, Nor Asmat Ismail, and Abdul Fatah Che Hamat. 2017. "Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore?" Economies 5, no. 3: 29. https://doi.org/10.3390/economies5030029

APA StyleRidzuan, A. R., Ismail, N. A., & Che Hamat, A. F. (2017). Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies, 5(3), 29. https://doi.org/10.3390/economies5030029