The Impact of Financial Development on Economic Growth in Nigeria: An ARDL Analysis

Abstract

:1. Introduction

2. Some Stylized Facts

3. Data and Methodology

3.1. Data Description

3.2. Unit Root Test

3.3. Empirical Methodology

4. Empirical Results

4.1. Co-Integration Analysis

4.2. Long-Run and Short-Run Estimates

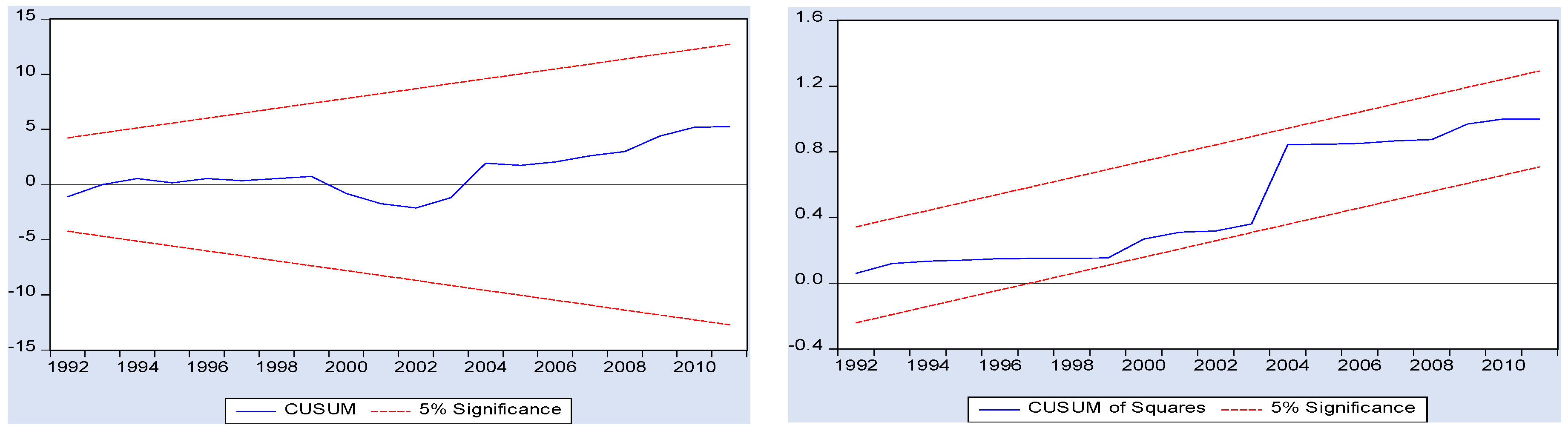

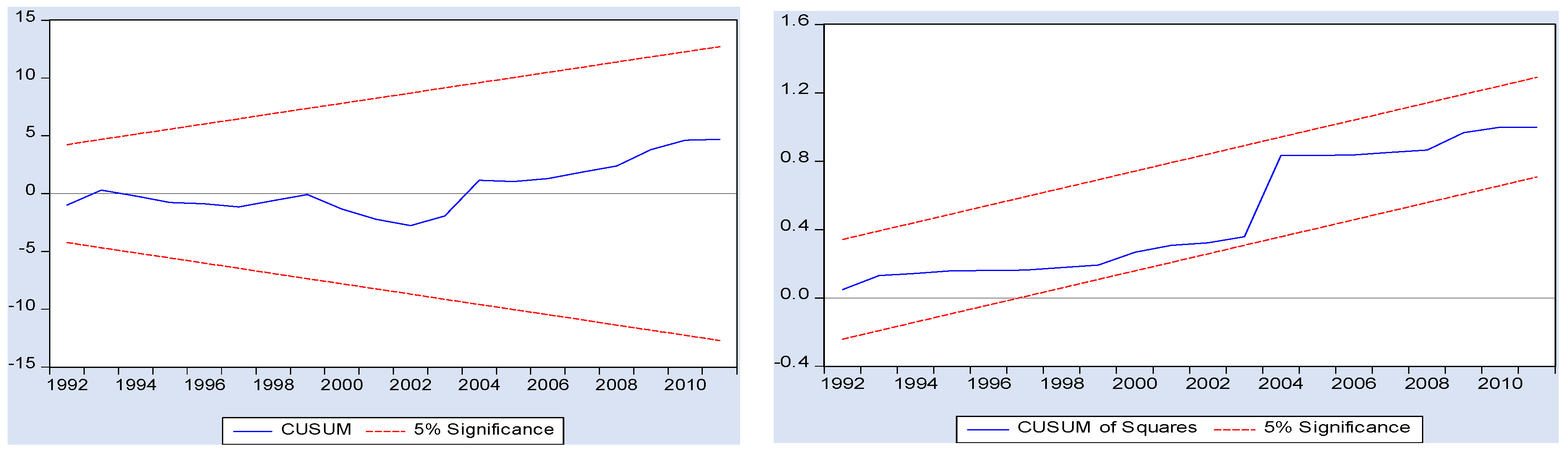

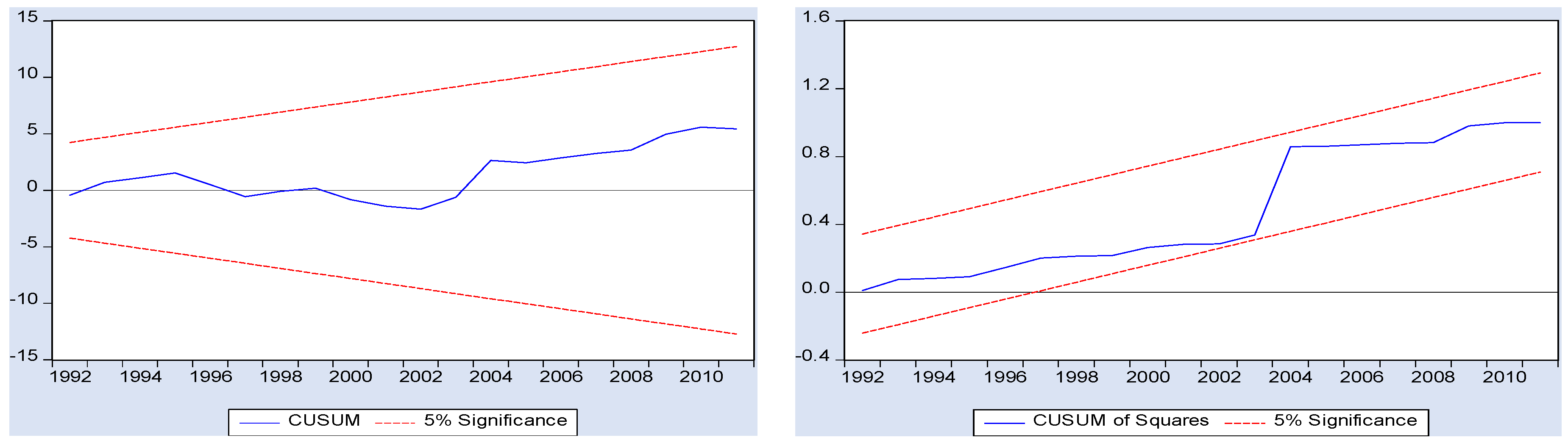

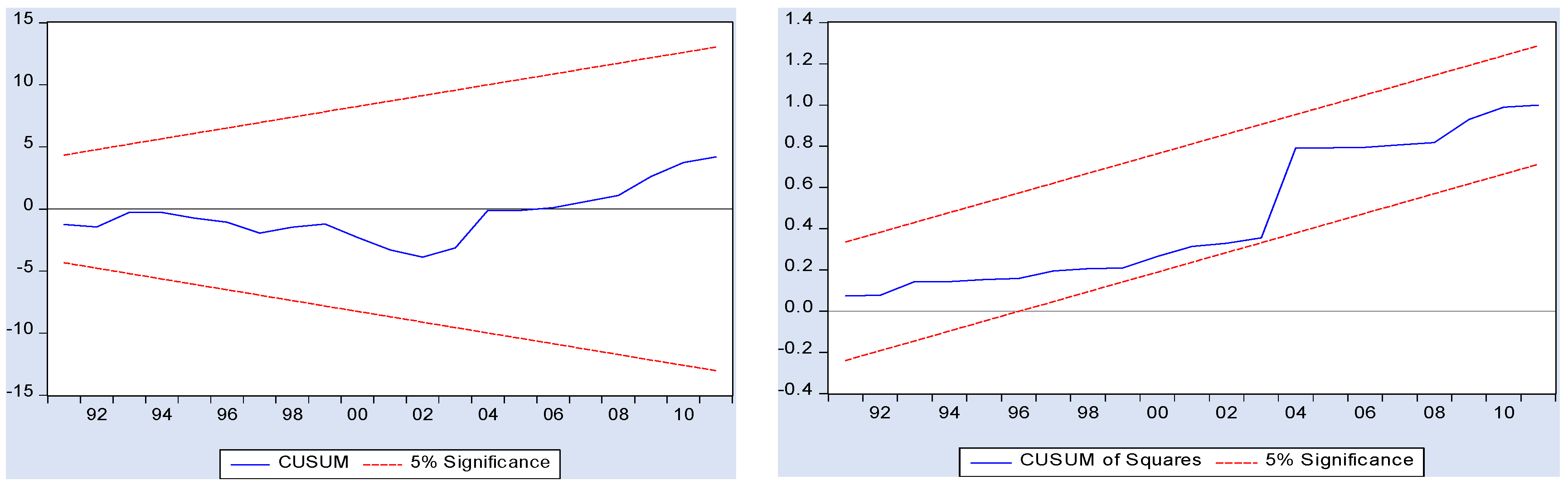

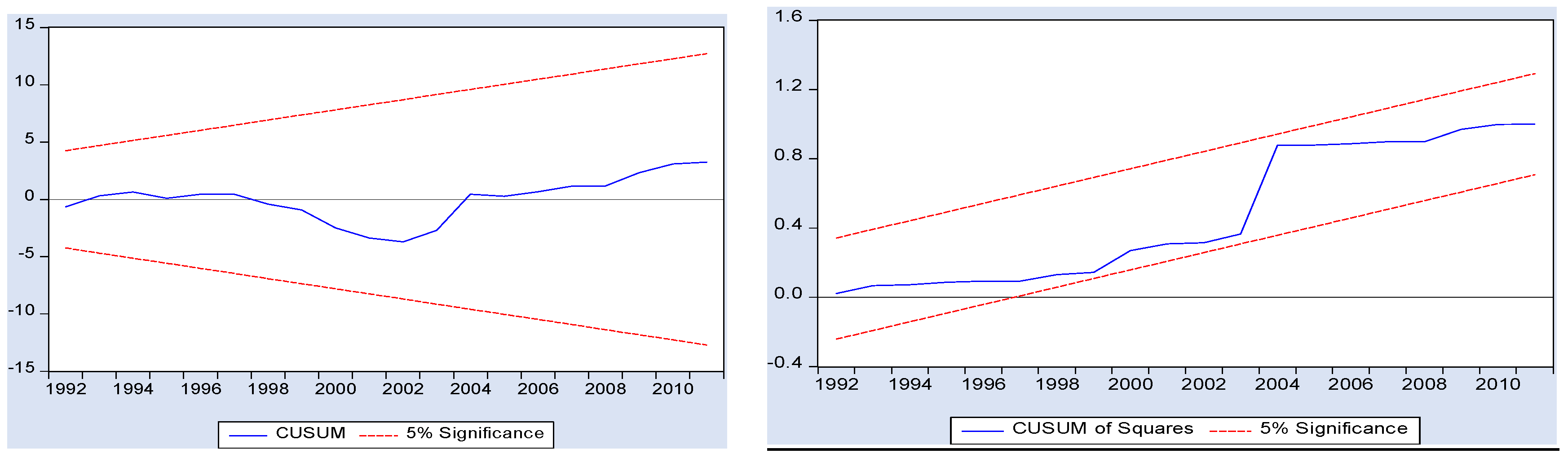

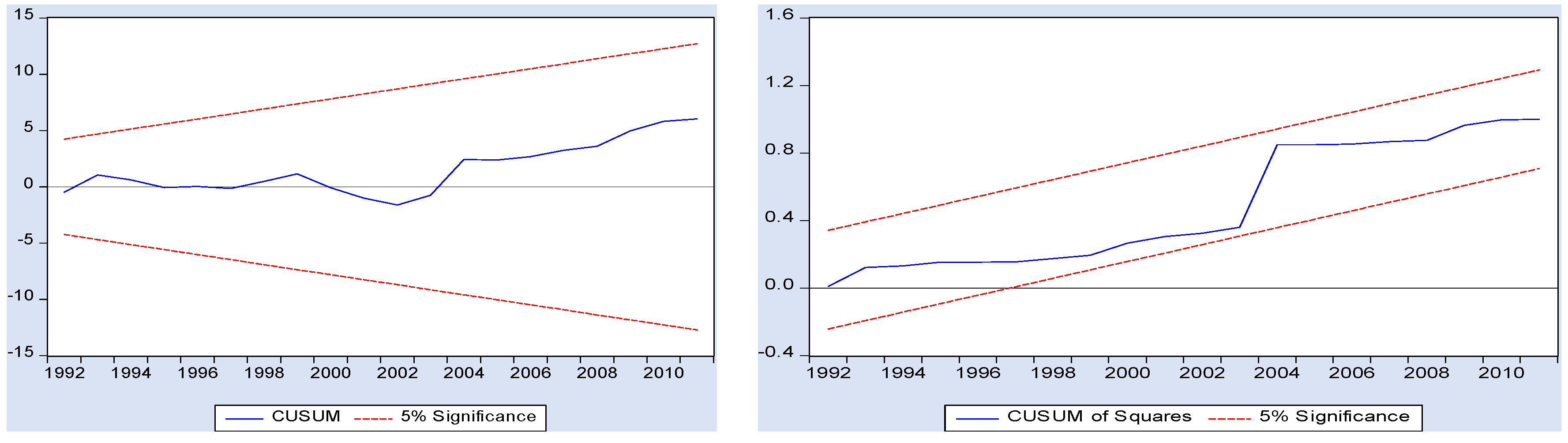

4.3. Diagnostic and Stability Tests

5. Concluding Remarks

Acknowledgments

Conflicts of Interest

Appendix A. List of Selected Non-Oil Dependent Countries

| List of Selected Non-Oil Dependent Countries | ||

| Country Name | Country Name | Country Name |

| Argentina | India | Papua New Guinea |

| Australia | Spain | Paraguay |

| Bahamas, The | Ireland | Peru |

| Botswana | Italy | Portugal |

| Burkina Faso | Jamaica | Senegal |

| Cote d’Ivoire | Japan | Seychelles |

| Cyprus | Kenya | Singapore |

| Dominica | Korea, Rep. | Sri Lanka |

| Dominican Republic | Madagascar | St. Lucia |

| Fiji | Malawi | Swaziland |

| Finland | Malaysia | Thailand |

| Gambia, The | Malta | Turkey |

| Greece | Mauritius | United States |

| Grenada | Nepal | Uruguay |

| Guatemala | Pakistan | Vanuatu |

| Honduras | Panama | |

Appendix B. Data Associated with the Study

| Year | Liquid Liabilities to GDP (%) | Deposit Money Bank Assets to GDP (%) | Private Credit By Deposit Money Banks to GDP (%) | Bank Deposits To GDP (%) | GDP per Capita (Constant 2005 US$) | Gross Fixed Capital Formation (% of GDP) | (% of GDP) | Trade (% of GDP) | Crude Oil Price (Brent UD$ per Barrel) |

| 1981 | 30.92 | 20.05 | 14.27 | 20.30 | 710.6061 | 35.22126 | 14.66089 | 48.29332 | 35.93 |

| 1982 | 31.63 | 22.55 | 16.79 | 20.93 | 685.0285 | 31.95333 | 15.66617 | 37.7485 | 32.97 |

| 1983 | 33.10 | 25.50 | 17.24 | 22.12 | 634.1195 | 23.0065 | 15.33589 | 27.03717 | 29.55 |

| 1984 | 36.17 | 30.15 | 17.11 | 24.19 | 605.7565 | 14.22397 | 13.1504 | 23.60888 | 28.78 |

| 1985 | 33.62 | 30.00 | 15.27 | 22.26 | 639.5429 | 11.96524 | 12.73176 | 25.90006 | 27.56 |

| 1986 | 34.98 | 29.73 | 17.94 | 23.11 | 568.5368 | 15.15382 | 12.58138 | 23.71676 | 14.43 |

| 1987 | 26.13 | 20.60 | 14.15 | 17.68 | 494.239 | 13.60753 | 7.20595 | 41.64666 | 18.44 |

| 1988 | 26.76 | 19.62 | 13.08 | 18.05 | 517.6942 | 11.87108 | 7.645588 | 35.31198 | 14.92 |

| 1989 | 22.29 | 13.87 | 10.29 | 13.89 | 536.9417 | 11.74232 | 5.446973 | 60.39176 | 18.23 |

| 1990 | 20.76 | 11.59 | 8.78 | 12.45 | 590.0519 | 14.25014 | 4.964438 | 53.03022 | 23.73 |

| 1991 | 22.39 | 11.24 | 8.38 | 13.68 | 571.6511 | 13.73268 | 4.833249 | 64.8766 | 20.00 |

| 1992 | 21.06 | 11.12 | 9.49 | 13.01 | 559.8226 | 12.74817 | 5.961901 | 61.03097 | 19.32 |

| 1993 | 25.80 | 16.05 | 12.71 | 16.54 | 557.3815 | 13.55003 | 6.542752 | 58.10985 | 16.97 |

| 1994 | 25.88 | 17.48 | 12.37 | 16.43 | 548.5813 | 11.16543 | 17.94384 | 42.30887 | 15.82 |

| 1995 | 15.98 | 11.41 | 9.16 | 9.81 | 533.4169 | 7.065756 | 12.08512 | 59.76783 | 17.02 |

| 1996 | 12.86 | 9.98 | 8.41 | 8.12 | 546.2431 | 7.289924 | 10.01718 | 57.69099 | 20.67 |

| 1997 | 13.87 | 11.60 | 9.71 | 9.10 | 547.6899 | 8.356764 | 12.99717 | 76.85999 | 19.09 |

| 1998 | 16.71 | 13.71 | 11.84 | 11.12 | 548.6618 | 8.60161 | 13.97338 | 66.17325 | 12.72 |

| 1999 | 18.80 | 16.52 | 12.47 | 13.16 | 537.6261 | 6.994108 | 6.982946 | 55.84639 | 17.97 |

| 2000 | 17.53 | 15.52 | 10.42 | 12.65 | 552.1869 | 7.017881 | 8.34258 | 71.38053 | 28.50 |

| 2001 | 25.08 | 20.73 | 14.82 | 18.16 | 562.2306 | 7.579868 | 8.210655 | 81.81285 | 24.44 |

| 2002 | 20.70 | 17.77 | 12.58 | 15.32 | 568.9709 | 7.009923 | 6.709872 | 63.38364 | 25.02 |

| 2003 | 18.98 | 17.26 | 12.12 | 14.37 | 612.1304 | 9.904054 | 5.152789 | 75.2189 | 28.83 |

| 2004 | 16.39 | 15.83 | 11.51 | 12.72 | 797.8757 | 7.39337 | 6.731593 | 48.44813 | 38.27 |

| 2005 | 16.81 | 17.01 | 12.32 | 13.16 | 804.1524 | 5.458996 | 6.807476 | 50.74836 | 54.52 |

| 2006 | 16.92 | 17.27 | 12.10 | 13.41 | 847.5391 | 8.265865 | 6.859525 | 64.60931 | 65.14 |

| 2007 | 22.54 | 26.61 | 18.16 | 19.06 | 881.5914 | 9.249637 | 10.18013 | 64.46291 | 72.39 |

| 2008 | 30.12 | 36.15 | 27.37 | 26.78 | 911.9575 | 8.323477 | 11.64139 | 64.97297 | 97.26 |

| 2009 | 37.70 | 43.53 | 35.39 | 34.06 | 949.0064 | 12.08816 | 12.95737 | 61.80285 | 61.67 |

| 2010 | 36.49 | 41.55 | 31.29 | 32.95 | 995.6802 | 16.99081 | 8.711384 | 42.65138 | 79.50 |

| 2011 | 32.99 | 36.34 | 22.91 | 29.68 | 1015.815 | 15.97916 | 8.494303 | 52.7941 | 111.26 |

References

- R. Levine. “Finance and growth: Theory and evidence.” NBER Work. Pap., 2004. [Google Scholar] [CrossRef]

- T. Chang, and S.B. Caudill. “Financial development and economic growth: The case of Taiwan.” Appl. Econ. 37 (2005): 1329–1335. [Google Scholar] [CrossRef]

- B. Seetanah. “Financial development and economic growth: An ARDL approach for the case of the small island state of Mauritius.” Appl. Econ. Lett. 15 (2008): 809–813. [Google Scholar] [CrossRef]

- S. Anwar, and L.P. Nguyen. “Financial development and economic growth in Vietnam.” J. Econ. Financ. 35 (2009): 348–360. [Google Scholar] [CrossRef]

- G.S. Uddin, B. Sjö, and M. Shahbaz. “The causal nexus between financial development and economic growth in Kenya.” Econ. Model. 35 (2013): 701–707. [Google Scholar] [CrossRef]

- C. Nwani, and J. Bassey Orie. “Economic growth in oil-exporting countries: Do stock market and banking sector development matter? Evidence from Nigeria’.” Cogent Econ. Financ. 4 (2016): 1153872. [Google Scholar] [CrossRef]

- R. Levine. “Financial development and economic growth: Views and agenda.” J. Econ. Lit. 35 (1997): 688–726. [Google Scholar]

- T. Beck, S.M. Maimbo, I. Faye, and T. Triki. Financing Africa: Through the Crisis and Beyond. Washington, DC, USA: The World Bank, 2011. [Google Scholar]

- T. Beck, A. Demirgüç-Kunt, and V. Maksimovic. “Financial and legal constraints to firm growth: Does firm size matter? ” J. Financ. 60 (2005): 137–177. [Google Scholar] [CrossRef]

- T. Beck, and A. Demirguc-Kunt. “Small and medium-size enterprises: Access to finance as a growth constraint.” J. Bank. Financ. 30 (2006): 2931–2943. [Google Scholar] [CrossRef]

- S. Cevik, and M. Rahmati. “Searching for the Finance-Growth Nexus in Libya.” IMF Working Paper 2013 No. 13/92. Available online: https://www.imf.org/external/pubs/ft/wp/2013/wp1392.pdf (accessed on 1 June 2016).

- Y. Quixina, and A. Almeida. “Financial Development and Economic Growth in a Natural Resource Based Economy: Evidence from Angola.” FEP Working Papers 2014, No: 542. Available online: http://www.fep.up.pt/investigacao/workingpapers/wp542.pdf (accessed on 1 June 2016).

- N. Samargandi, J. Fidrmuc, and S. Ghosh. “Financial development and economic growth in an oil-rich economy: The case of Saudi Arabia.” Econ. Model. 43 (2014): 267–278. [Google Scholar] [CrossRef]

- O. Adeniyi, A. Oyinlola, O. Omisakin, and F.O. Egwaikhide. “Financial development and economic growth in Nigeria: Evidence from threshold modelling.” Econ. Anal. Policy 47 (2015): 11–21. [Google Scholar] [CrossRef]

- M. Nili, and M. Rastad. “Addressing the growth failure of the oil economies: the role of financial development.” Q. J. Econ. Financ. 46 (2007): 726–740. [Google Scholar] [CrossRef]

- T. Beck. “Finance and Oil: Is There a Resource Curse in Financial Development.” CentER Tilburg University Discussion Paper 2011, No. 2011-017. Available online: https://pure.uvt.nl/portal/files/1316213/2011-017.pdf (accessed on 1 June 2016).

- A. Barajas, R. Chami, and S.R. Yousefi. “The Finance and Growth Nexus Re-examined: Do All Countries Benefit Equally? ” IMF Working Paper 2013, No. 13/130. Available online: http://www.imf.org/external/pubs/ft/wp/2013/wp13130.pdf (accessed on 1 June 2016).

- T. Beck, A. Demirgüç-Kunt, and R. Levine. “A new database on financial development and structure.” World Bank Econ. Rev. 14 (2000): 597–605, (An earlier version was issued as World Bank Policy Research Working Paper 2146.). Available online: http://go.worldbank.org/X23UD9QUX0 (accessed on 1 June 2016). [Google Scholar] [CrossRef]

- J.D. Sachs, and A.M. Warner. “Natural resource and economic growth.” NBER Work. Pap., 1995. [Google Scholar] [CrossRef]

- J.D. Sachs, and A.M. Warner. “The curse of natural resources.” Eur. Econ. Rev. 45 (2001): 827–838. [Google Scholar] [CrossRef]

- R.M. Auty. Resource Abundance and Economic Development. Oxford, UK: Oxford University Press, 2001. [Google Scholar]

- C. Nwani, E. Iheanacho, and O. Chijioke. “Oil price and the development of financial intermediation in developing oil-exporting countries: Evidence from Nigeria.” Cogent Econ. Financ. 4 (2016): 1185237. [Google Scholar] [CrossRef]

- M. Pesaran, Y. Shin, and R. Smith. “Bounds testing approaches to the analysis of level relationships.” J. Appl. Econom. 16 (2001): 289–326. [Google Scholar] [CrossRef]

| OPEC Member Country | Some Non-Oil Dependent Countries | ||

|---|---|---|---|

| Nigeria | Algeria | ||

| GDP per capita (constant 2005 US$) | 659.30 | 2731.30 | 8891.97 |

| Credit to private sector (%GDP) | 14.8535 | 27.0366 | 46.4211 |

| Liquid Liabilities (%GDP) | 24.5790 | 56.1961 | 58.0585 |

| Deposit money bank assets (%GDP) | 20.9130 | 45.8504 | 56.8155 |

| Bank deposits (%GDP) | 17.6861 | 37.3495 | 50.3873 |

| FDindex1 | FDindex2 | >FDindex3 | |

| Eigenvalues | 3.6866 | 2.6983 | 2.7366 |

| Proportion | 0.9216 | 0.8994 | 0.9122 |

| Eigenvectors (Loadings) | |||

| CPS | 0.4940 | 0.5799 | 0.5663 |

| LIQ | 0.4750 | 0.5522 | 0.5629 |

| BA | 0.5112 | 0.5990 | |

| BD | 0.5186 | 0.6021 | |

| In Level I(0) | First Difference I(1) | |||

|---|---|---|---|---|

| Variable | ADF | PP | ADF | PP |

| lnRGDPC | 0.3916 | 0.0858 | −4.0543 *** | −4.0409 *** |

| lnFDindex1 | −1.8464 | −1.3791 | −4.1177 *** | −3.9394 *** |

| lnFDindex2 | −1.1789 | −1.4047 | −4.0985 *** | −3.9081 *** |

| lnFDindex3 | −1.2914 | −1.5943 | −4.1943 *** | 4.0331 *** |

| lnCPS | −2.0362 | −1.4202 | −3.9147 *** | −3.6199 ** |

| lnLIQ | −2.0383 | −1.7897 | −4.3686 *** | −4.2594 *** |

| lnBA | −0.9044 | −0.9044 | −3.8804 *** | −3.7139 *** |

| lnBD | −1.0851 | −1.3217 | −4.1300 *** | −3.9828 *** |

| lnOilp | −0.0940 | −0.0011 | −5.5307 *** | −5.5316 *** |

| lnOpen | −2.0651 | −1.9280 | −7.3304 *** | 7.3284 *** |

| lnInvest | −2.7740 * | −2.7659 * | −4.9084 *** | −4.6078 *** |

| lnGCExp | −2.5606 | −2.5476 | −6.0260 *** | −6.0548 *** |

| Models | F-Statistic | Result | ||

|---|---|---|---|---|

| 1 | FRGDPC(RGDPC|FDindex1, Oilp, Open, Invest, GCExp) | ARDL(1, 1, 1, 1, 0, 0) | 4.8722 *** | Cointegration |

| 2 | FRGDPC(RGDPC|FDindex2, Oilp, Open, Invest, GCExp) | ARDL(1, 1, 1, 1, 0, 0) | 4.8089 *** | Cointegration |

| 3 | FRGDPC(RGDPC|FDindex3, Oilp, Open, Invest, GCExp) | ARDL(1, 1, 1, 1, 0, 0) | 4.8305 *** | Cointegration |

| 4 | FRGDPC(RGDPC|CPS, Oilp, Open, Invest, GCExp) | ARDL(1, 1, 1, 1, 0, 0) | 4.5053 *** | Cointegration |

| 5 | FRGDPC(RGDPC|LIQ, Oilp, Open, Invest, GCExp) | ARDL(1, 0, 1, 1, 0, 0) | 4.0349 ** | Cointegration |

| 6 | FRGDPC(RGDPC|BA, Oilp, Open, Invest, GCExp) | ARDL(1, 1, 1, 1, 0, 0) | 4.8738 *** | Cointegration |

| 7 | FRGDPC(RGDPC|BD, Oilp, Open, Invest, GCExp) | ARDL(1, 1, 1, 1, 0, 0) | 5.0236 *** | Cointegration |

| Critical Value Bounds | 1% | 5% | 10% | |

| I0 Bound | 3.06 | 2.39 | 2.08 | |

| I1 Bound | 4.15 | 3.38 | 3.0 | |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| C | 5.4004 *** | 5.3955 *** | 5.4014 *** | 5.2120 *** | 5.7642 *** | 5.3265 *** | 5.3343 *** |

| [11.0828] | [11.1151] | [11.1847] | [12.3461] | [12.1388] | [12.0457] | [12.3868] | |

| lnFintdex | −0.0738 [−0.7921] | ||||||

| lnFintdex2 | −0.0741 [−0.7834] | ||||||

| lnFintdex3 | −0.0794 [−0.8083] | ||||||

| lnCPS | −0.05191 [−0.5554] | ||||||

| lnLIQ | −0.1388 [−0.3635] | ||||||

| lnBA | −0.0565 [−0.7240] | ||||||

| lnBD | −0.0705 [−0.8067] | ||||||

| lnOilp | 0.4447 *** [7.8444] | 0.4439 *** [7.7717] | 0.4433 *** [8.0862] | 0.4398 *** [6.5777] | 0.4292 *** [9.6603] | 0.4426 *** [7.5041] | 0.4457 *** [8.0845] |

| lnOpen | 0.0183 [0.2455] | 0.0179 [0.2376] | 0.0205 [0.2778] | 0.0446 [0.5883] | −0.0311 [−0.4476] | 0.0145 [0.1883] | 0.0195 [0.2657] |

| lnInvest | −0.0402 [−0.7028] | −0.0419 [−0.7312] | −0.0347 [−0.5889] | −0.0552 [−0.8967] | −0.0050 [−0.0839] | −0.0521 [−0.9258] | −0.0355 [−0.6163] |

| lnGCExp | −0.0552 [−0.9708] | −0.0523 [−0.9180] | −0.0602 [−1.0462] | −0.0506 [−0.8251] | −0.0701 [−1.2131] | −0.0431 [−0.7635] | −0.0646 [−1.1287] |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| ECM (−1) | −0.5275 *** [−5.4830] | −0.5263 *** [−5.4450] | −0.5264 *** [−5.4833] | −0.4990 *** [−5.2639] | −0.5490 *** [−5.4517] | −0.5276 *** [−5.4231] | −0.5303 *** [−5.5753] |

| ΔlnFintdex1 | −0.1325 ** [−2.5617] | ||||||

| ΔlnFintdex2 | −0.1315 ** [−2.5102] | ||||||

| ΔlnFintdex3 | −0.1344 ** [−2.5432] | ||||||

| ΔlnCPS | −0.1102 ** [−2.2139] | ||||||

| ΔlnLIQ | −0.1372 ** [−2.5241] | ||||||

| ΔlnBA | −0.1182 ** [−2.5249] | ||||||

| ΔlnBD | −0.1298 ** [−2.6696] | ||||||

| ΔlnOilp | 0.1270 *** [3.9324] | 0.1272 *** [3.9161] | 0.1227 *** [3.7626] | 0.1195 *** [3.5139] | 0.1287 *** [3.9577] | 0.1384 *** [4.3448] | 0.1275 *** [4.0102] |

| ΔlnOpen | −0.1114 *** [−3.2854] | −0.1117 *** [−3.2776] | −0.1083 *** [−3.2150] | −0.0999 *** [−2.9220] | −0.1241 *** [−3.6337] | −0.1178 *** [−3.4000] | −0.1101 *** [−3.2927] |

| ΔlnInvest | 0.0055 [0.1435] | 0.0047 [0.1223] | 0.0078 [0.2035] | −0.0007 [−0.0166] | 0.0255 [0.6782] | 0.0002 [0.0056] | 0.0079 [0.2078] |

| ΔlnGCexp | −0.0012 [−0.0403] | 0.0001 [0.0029] | −0.0041 [−0.1375] | 0.0001 [0.0035] | −0.0099 [−0.3235] | 0.0060 [0.1995] | −0.0057 [−0.1934] |

| Diagnostic tests | |||||||

| Adj. R2 | 0.9542 | 0.9539 | 0.9542 | 0.9523 | 0.9546 | 0.9539 | 0.9550 |

| D-W stat | 1.8343 | 1.8357 | 1.8181 | 1.8135 | 1.7761 | 1.8645 | 1.8259 |

| SC | 0.2413 | 0.2416 | 0.2869 | 0.3399 | 0.4415 | 0.1731 | 0.2528 |

| (0.5396) | (0.5394) | (0.5041) | (0.4677) | (0.4209) | (0.6028) | (0.5303) | |

| Het | 1.0837 | 1.0667 | 1.0877 | 0.6503 | 1.2312 | 0.9728 | 1.1130 |

| (0.2901) | (0.2938) | (0.2893) | (0.4089) | (0.2607) | (0.3153) | (0.2839) | |

© 2016 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iheanacho, E. The Impact of Financial Development on Economic Growth in Nigeria: An ARDL Analysis. Economies 2016, 4, 26. https://doi.org/10.3390/economies4040026

Iheanacho E. The Impact of Financial Development on Economic Growth in Nigeria: An ARDL Analysis. Economies. 2016; 4(4):26. https://doi.org/10.3390/economies4040026

Chicago/Turabian StyleIheanacho, Eugene. 2016. "The Impact of Financial Development on Economic Growth in Nigeria: An ARDL Analysis" Economies 4, no. 4: 26. https://doi.org/10.3390/economies4040026

APA StyleIheanacho, E. (2016). The Impact of Financial Development on Economic Growth in Nigeria: An ARDL Analysis. Economies, 4(4), 26. https://doi.org/10.3390/economies4040026