1. Introduction

The welfare costs of inflation and inflation uncertainty are well documented in the literature. Several studies found that high non-predictable inflation distorts relative prices and the inter- and intra-temporal decisions of economic agents, leading to an inefficient allocation of resources and lower output growth (Friedman, 1977 [

1]; Dotsey and Ireland; 1996 [

2]; Lucas, 2003 [

3]). For example, using a general equilibrium monetary model, Dotsey and Ireland (1996) [

2] found that high inflation distorts a variety of marginal decisions. These include diverting resources from productive to speculative investment, reducing holdings of real cash balances and substituting leisure for work. Similarly, the real effects of inflation uncertainty have been established in the literature since Friedman’s Nobel lecture on inflation and unemployment in 1977 in which he showed that high inflation uncertainty distorts the informational content of prices. This reduces the ability of the price system to allocate resources efficiently. Moreover, high inflation uncertainty distorts individual decisions on consumption, saving and investment. High uncertainty makes it expensive for investors to borrow and to detect profitable investment opportunities. Elder (2004) [

4] found that U.S. output growth decreased by 22 basis points, over a three month period, due to an average shock to inflation uncertainty. In another study, Fountas

et al. (2006) [

5] found, using data on G7 countries, that inflation causes negative welfare effects, both directly and indirectly through the inflation uncertainty channel. They also found that more inflation uncertainty provides an incentive to monetary authorities to surprise the public by raising inflation rates. Inflation uncertainty could also have a negative effect on economic growth by increasing the uncertainty of investments’ profits and hence reducing investments. In a recent study, Chowdhury (2014) [

6] found that inflation uncertainty is detrimental to output growth in India.

Inflation rates in Egypt have increased significantly in recent years, reaching 18% in 2008, after a period of low rates at the beginning of the new millennium at 2% in 2001. This increase in inflation rates was associated with an increase in inflation volatility. Given the substantial economic costs of inflation and inflation uncertainty, understanding the nature of the link between the two variables become an interest to academics and policy makers as this will help guide in designing policies that achieve macroeconomic stability and increase economic welfare.

The objective of this paper is to examine the causal relationship between inflation and inflation uncertainty, using Egyptian data on which limited research has been conducted. A special feature of this paper is that both the two-step approach as well as simultaneous modeling approach is incorporated to check the robustness of results.

The paper is organized as follows:

Section 2 presents a review of the theoretical and empirical literature.

Section 3 presents a brief historical development of inflation rate in Egypt. The data is described in

section 4. The empirical methods of the paper are presented in

Section 5 and the obtained results are discussed in

Section 6.

Section 7 summarizes the findings of the paper and discusses the policy implications.

2. Literature Review

The substantial economic costs of inflation and inflation uncertainty have inspired a growing literature to examine the link between the two. Two main competing theories exist in the literature to explain the relationship between inflation and inflation uncertainty and its causal direction. In his Nobel lecture on inflation and unemployment, Friedman (1977) [

1] considers a positive causation from inflation-level to inflation-uncertainty. Friedman’s hypothesis was further extended by Ball (1992) [

7] within the context of a game with asymmetric information between the public and the monetary authority. In Ball’s (1992) [

7] model, two types of policy makers exist: one is unwilling to disinflate because of the fear of the resulting recessionary effects, and the other is willing to bear the cost of disinflation. In this model, high inflation leads to greater uncertainty because the public is uncertain about the type of future policy maker.

As opposed to the Friedman–Ball hypothesis, Cukierman and Meltzer (1986) [

8] hypothesize that causality runs from inflation-uncertainty to inflation-level. According to this argument, during periods of high inflation uncertainty, the monetary policy is discretionary due to lack of a commitment mechanism. This gives an incentive to the monetary authority to act opportunistically to stimulate output growth by making monetary expansions, which lead to higher inflation.

In contrast to the dominant hypothesis of a positive association between inflation level and inflation uncertainty, other theories postulate a negative relationship (see for example Pourgerami and Maskus, 1987 [

9]; Holland, 1995 [

10]). According to Pourgerami and Maskus (1987) [

9] higher inflation reduces inflation uncertainty as people invest resources to anticipate the future inflation rate better and to shelter themselves from its adverse effects. The same view was further developed by Ungar and Zilberfarb (1993) [

11]. In support of this negative relationship, Holland (1995) [

10] argues that higher inflation uncertainty reduces the inflation rate due to a stabilization motive by the monetary authority, which seeks to reduce the welfare costs of inflation by disinflationary policies when inflation uncertainty is high. This is known in the literature as the “

Stabilizing Fed hypothesis” and postulates a negative effect of inflation uncertainty on inflation level.

A growing body of empirical literature has emerged to examine the causal relationship between inflation and its uncertainty, in a wide range of countries, using different econometric techniques, and covering different time periods, with mixed findings (for a survey of the literature see Davis and Kanago (2000) [

12]). The Friedman–Ball hypothesis is supported, for example, by: Grier and Perry (1998) [

13], Daal

et al. (2005) [

14], Thornton (2008) [

15], Keskek and Orhan (2010) [

16], and Karahan (2012) [

17]. On the other hand, the Cukierman and Meltzer hypothesis is supported by the findings of Conrad and Karanasos (2005) [

18], Wilson (2006) [

19], and Fountas (2010) [

20]. Keskek and Orhan (2010) [

16] found support for the stabilizing Fed hypothesis in the case of Turkey, and Thornton (2007) [

21] found evidence for this hypothesis in Colombia, Mexico and Turkey.

Empirical evidence on the direction of causality between inflation and inflation uncertainty in cross-country studies is inconclusive. For example, in a cross country study of twelve emerging market economies, and using Granger causality test, Thornton (2007) [

21] found strong support for the Friedman–Ball hypothesis in all of the studied countries, while the evidence on the effect of inflation uncertainty on inflation was mixed. The author found that higher inflation uncertainty leads to lower inflation rate in Colombia, Mexico and Turkey, which supports Holland hypothesis, while in Hungary, Indonesia, and Korea, the Cukierman and Meltzer hypothesis holds. In a recent study, Zivkov

et al. (2015) [

22] examined, using GARCH type model along with quantile regression, the link between inflation and inflation uncertainty in eleven Eastern European countries, and found mixed evidence on the direction of causality. Both Friedman’s and Cukierman–Meltzer’s hypotheses have been confirmed mainly for the largest Eastern European countries with flexible exchange rate, while no support for any of these hypotheses was found in smaller, open economies with fixed exchange rate regime. In a panel study of 105 countries over the period 1960–2007, Kim and Lin (2012) [

23] used a system of simultaneous equations and found a two-way interaction between inflation and its variability, which supports both the Friedman–Ball and the Cukierman–Meltzer Hypotheses.

While the extant literature is largely dominated by cross-country studies, several individual country studies have investigated the relationship between inflation and inflation uncertainty. Similar to the cross-country studies, evidence based on country-specific studies on the direction of causality between inflation and inflation uncertainty is equally mixed. For example, using data from U.K. over the period 1972–2002, and using different GARCH-M models of inflation, Kontonikas (2004) [

24] found a positive relationship between past inflation and uncertainty about future inflation, which is consistent with the Friedman–Ball causal link. Kontonikas (2004) [

24] also found that the adoption of inflation target in UK since 1992 has helped eliminate inflation persistence and reduced long-run uncertainty. Using a two-step procedure, Karahan (2012) [

17] examined the relationship between inflation and inflation uncertainty in Turkey from 2002 to 2011 and found evidence in favor of the Friedman–Ball hypothesis that inflationary periods result in high inflation uncertainty in the Turkish case. In another study, Heidari and Bashiri (2010) [

25] used the Full Information Maximum Likelihood method to examine the inflation–inflation uncertainty relationship in Iran and found support for the Friedman–Ball hypothesis.

Using quarterly data from Australia during the period 1949 to 2013, Hossain, (2014) [

26] found a feedback relation between inflation and inflation volatility with an adverse effect of inflation volatility on the rate of unemployment. The author also found that inflation shock has an asymmetric impact on inflation volatility. Payne (2009) [

27] found support for Holland’s stabilization hypothesis in Thailand. Using Granger-causality test, he found that an increase in inflation causes an increase in inflation uncertainty, while an increase in inflation uncertainty causes a decrease in inflation in Thailand. Payne (2009) [

27] also found that inflation targeting reduced inflation uncertainty in response to inflationary shocks.

Several country-specific studies found a two way causal relation between inflation and its uncertainty. For example, using GARCH model and Granger Causality test, Chowdhury (2014) [

6] investigated the relationship between inflation and inflation uncertainty in India and found a positive feedback relationship between the two variables, supporting both the Friedman–Ball and Cukierman–Meltzer hypotheses. The author also found that inflation uncertainty is detrimental to output growth in India. Keskek and Orhan (2010) [

16] examined, using various types of GARCH-M models, the relationship between inflation and inflation uncertainty in Turkey over the period 1984 to 2005. They found that higher inflation rates lead to greater inflation uncertainty, while the effect of inflation uncertainty on inflation is found to be negative due to a stabilization motives’ dominating the opportunistic incentives of monetary authorities.

The mixed findings found in the previous empirical studies on the direction of causality between inflation and inflation uncertainty could be due to differences with respect to the sample of countries that are examined, the used econometric technique, and the covered time periods. There are naturally socio-economic and country-specific factors that differ between countries. Countries may also differ in their macroeconomic policies, the nature of economic problems they face and the dynamics of these problems over time. Accordingly, it is to be expected that, in practice, the inflation–inflation uncertainty relationship is country-specific, and varies depending on the period under investigation.

3. Inflation in Egypt: A Brief Historical Background

Keeping inflation low, stable and predictable has continually remained a key objective of the macroeconomic policies in Egypt. However, data shows that this is merely an objective and has not often been realized. During the study period, the Egyptian economy has witnessed substantial economic and structural changes, as well changes in the economic policies, both fiscal and monetary. These developments have affected the inflation rates in Egypt.

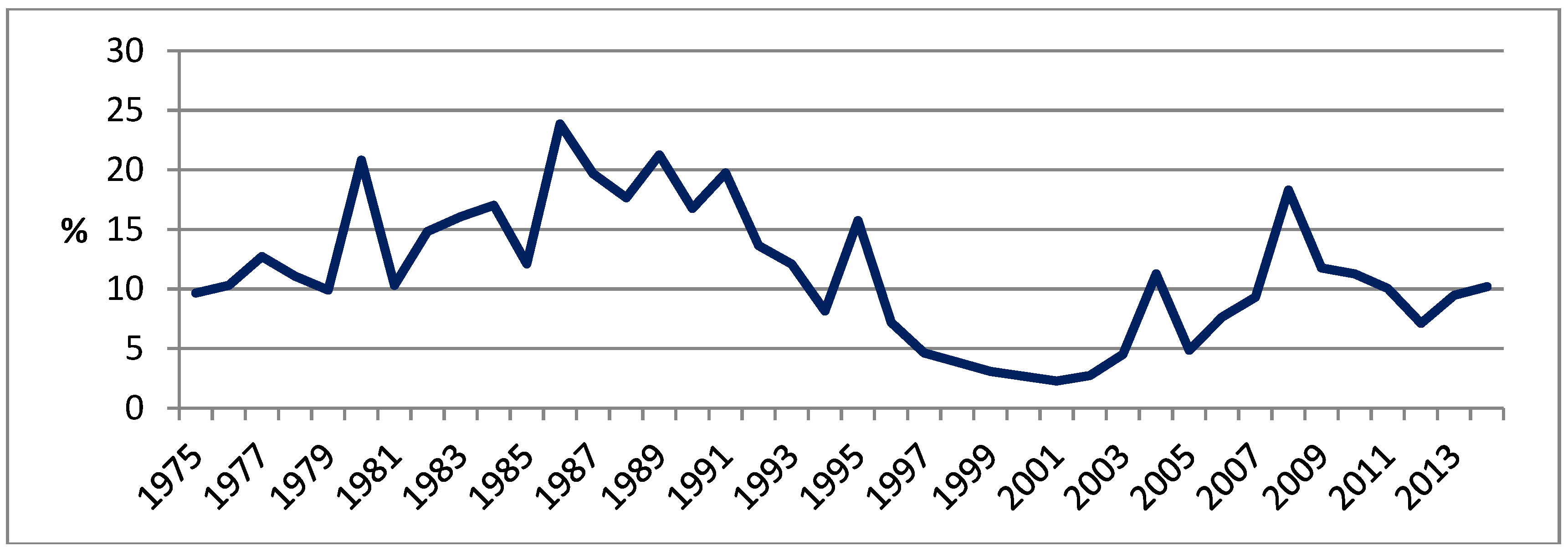

Figure 1 displays the evolution of the annual inflation rate in Egypt during the period from 1975 to 2014. Inflation rates were in general relatively high during the 1980s before dropping substantially in the 1990s after the adoption of the Economic Reform and Structural Adjustment Programme. Afterwards, inflation rates started to increase once again reaching 18% in 2008 compared to 2% in the year 2001.

Figure 1.

Annual Inflation Rate in Egypt (1975–2014). Source: Data is obtained from the International Financial Statistics database.

Figure 1.

Annual Inflation Rate in Egypt (1975–2014). Source: Data is obtained from the International Financial Statistics database.

The adoption of an outdoor economic policy in the second half of the 1970’s has lead to a significant increase in imports and a deterioration of the current account. During that period, government budget deficit increased substantially and was largely financed by money creation and debt financing, all of which exerted upward pressure on inflation rate. The budget deficit deteriorated further as a result of the expansion in government subsidies to mitigate the inflationary pressures resulting from the rising international prices. The growing money supply and domestic liquidity have increased aggregate demand and hence inflation rates. Consequently, inflation rates at the end of the 1970s doubled, within one year, jumping dramatically from 10% in 1979 to 21% in 1980. In 1981, inflation rate dropped back to 10%. During the 1980s, inflation rate averaged 17%, and reached its highest value in 1986 at 24%.

To face the deteriorating economic conditions, including high unemployment and high inflation rates, as well as the substantial deficit in the balance of payment and government budget at the end of the 1980s, in the early 1990s, Egypt adopted a battery of reform policies under the Economic Reform and Structural Adjustment Program (ERSAP) after consultation with the IMF and the World Bank, to restore the internal as well as the external balance. Macroeconomic stabilization, including inflation reduction, was a key objective of this program. One important policy change that had an implication for inflation rate was the switch in financing budget deficits from monetary expansion to non-inflationary finance measures such as Treasury bill auctions. This was also associated with a drop in budget deficit and a significant reduction in external debts and its associated servicing. In 1991, Egypt’s participation in the coalition to free Kuwait in the first Gulf war was generously rewarded by the Paris Club creditors. Egypt was granted a debt relief package of around $20 billion, which enabled Egypt to save an average of over two percentage points of GDP a year in servicing the debts from 1992 to 1997. As a result of this debt relief, along with the ERSAP program and its associated structural adjustment policies, inflation rates decreased substantially from 20% in 1991 to only 3% in 1999 and in 2001, inflation rate reached its lowest level at 2%.

In the new millennium, Egypt continued in adopting economic reform policies in several areas such as foreign exchange rates, taxes, and banking systems. In 2003, a managed floating exchange rate system came into effect to replace the old system that pegs the Egyptian pound against the US dollar. This flexibility in the exchange rate was intended to achieve price stability and reduce the inflationary pressures by correcting for the overvaluation of the Egyptian pound and to face the growing black market for currency, all of which will enhance the competitiveness of the Egyptian exports. Following the new floating system, the Egyptian pound depreciated by around 25%. However, the depreciation of the Egyptian pound seems to have contributed rather than to remedy the increase in the inflation rate given the high dependence on imports to satisfy domestic demand for most of the essential goods. In addition, changes in Egypt’s nominal exchange rate were very limited and have experienced a slow depreciation during 2003–2012, pointing to a de facto crawling peg regime. Despite the undertaken policy reforms, inflation rates increased significantly during this period, reaching 11% in 2004 and 18% in 2008.

7. Conclusions and Policy Implications

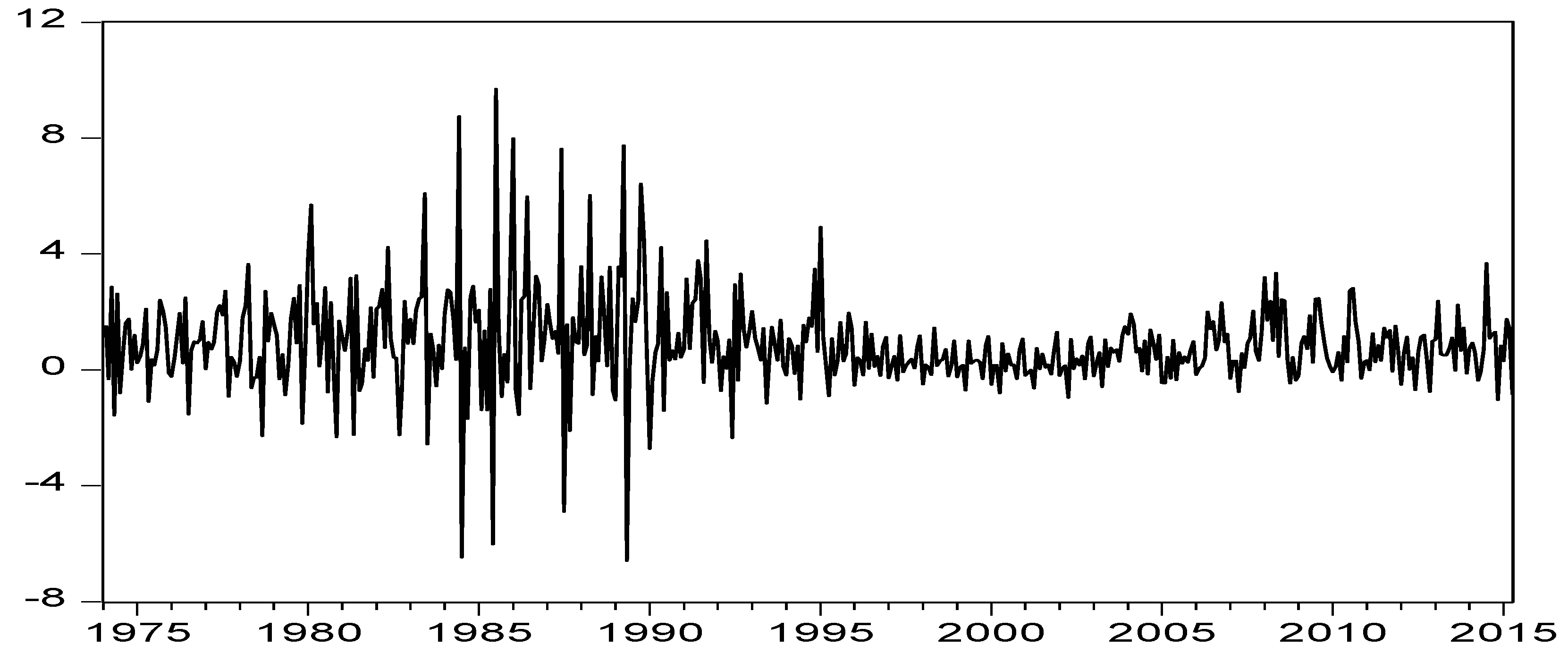

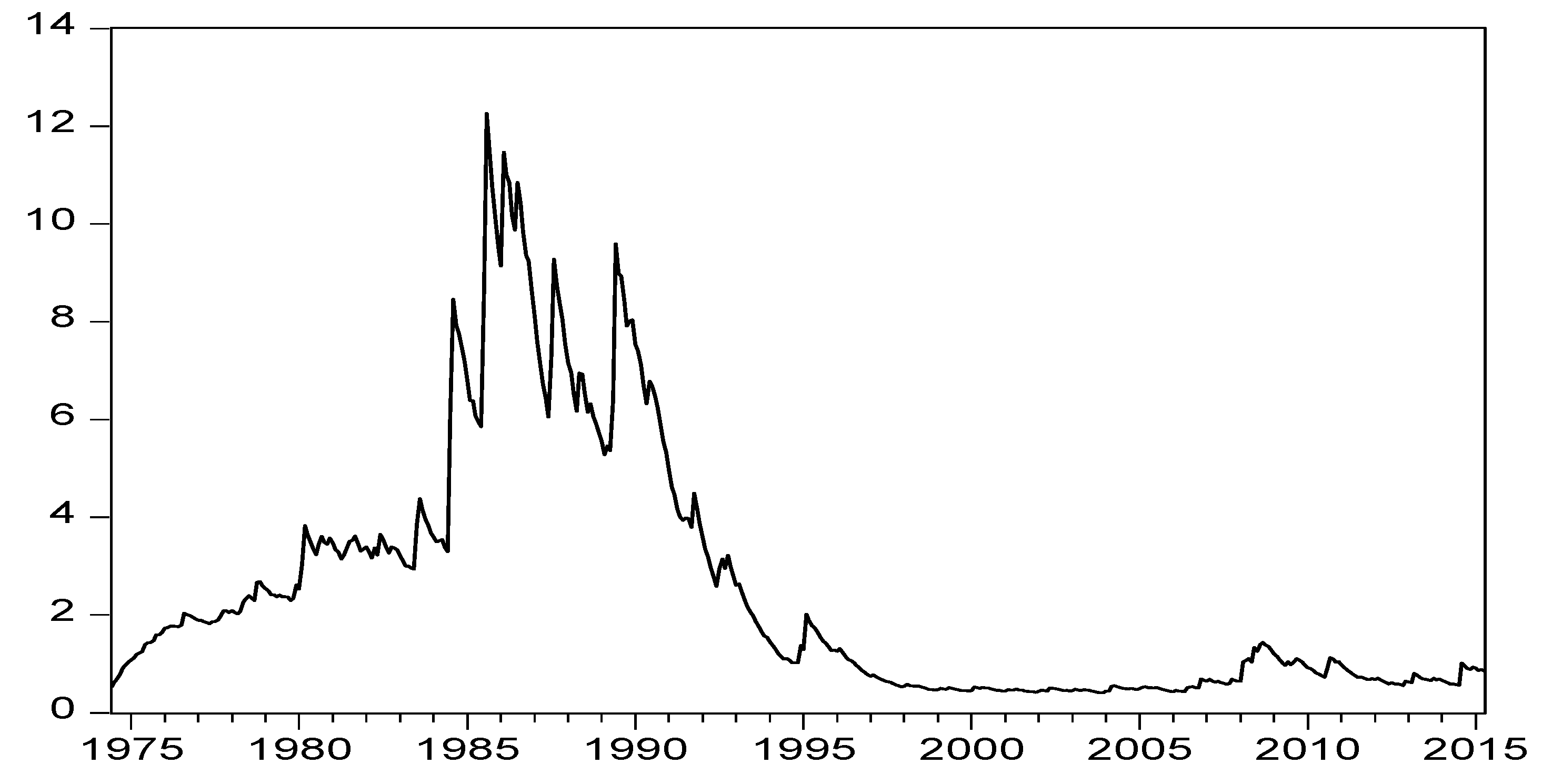

This paper has investigated the linkage between inflation level and inflation uncertainty in Egypt during the period January 1974–April 2015. As a baseline specification, the inflation-uncertainty relation is modeled using the two-step procedure. The estimated conditional variance from an ARMA-GARCH model is used as a measure of inflation uncertainty, and a Granger-causality test is conducted to determine the causal relation between the two variables. To control for any potential feedback effects between inflation and inflation uncertainty, a simultaneous estimation approach is also used as a robustness check for the results. Results show a high degree of volatility persistence in response to inflationary shocks.

Results also showed that the stabilization measures adopted under the ERSAP have helped reduce inflation levels and inflation volatility as the coefficients of the dummy variable that accounts for the effect of the ERSAP were negative.

Granger-causality and asymmetric GARCH-M, EGARCH-M and TGARCH-M models indicate a statistically significant positive, two-way relationship between inflation and inflation uncertainty, supporting both the Friedman–Ball and the Cukierman–Meltzer hypotheses. This has important implications for the relationship between inflation and output given the substantial empirical evidence that greater inflation uncertainty is detrimental to economic growth.

The feedback relationship between inflation and inflation uncertainty that is found in this study has imperative implications for the monetary policy in Egypt. Since the inflationary expectations have significant effect on inflation, monetary authority in Egypt should enhance the credibility of monetary policy and attempt to control inflation uncertainty by restrictive monetary policy measures. One policy measure is establishing a nominal anchor for the monetary policy to stabilize inflation expectation and hence lower inflation rates. In addition, previous studies showed that structural reforms based on improving Egypt’s productive capacity, reducing the budget deficit and national debts, are crucial for controlling inflation (El-Sakka and Ghali, 2005 [

35]). Keskek and Orhan (2010) [

16] found strong evidence, using data from Turkey, that inflation-oriented monetary policy effectively reduces the inflation persistence and eliminates uncertainty.

Given the substantial real costs of inflation and inflation uncertainty, the findings of this paper support the view of adopting inflation control target policy in Egypt. Several studies have found that inflation targeting, once its preconditions are satisfied, contributes to the reduction of inflation and its associated volatility. For example, in a panel study of twenty-five countries, Tas and Ertugrul (2013) [

36] found evidence that the adoption of inflation targeting helped most of the countries to achieve lower inflation uncertainty. In another study, Lin and Ye (2009) [

37] examined the effect of implementing inflation targeting in thirteen developing countries and found that inflation targeting has large and significant effects on lowering both inflation and inflation uncertainty. Similar evidence was found by Payne (2009) [

27] that inflation targeting reduced inflation uncertainty in response to inflationary shocks in Thailand. Kontonikas (2004) [

24] also found that the adoption of inflation target in U.K. since 1992 has helped eliminate inflation persistence and reduced long-run uncertainty. Monetary authorities in Egypt could benefit from the experience of those countries, which succeeded in reducing inflation and its associated uncertainty.