1. Introduction

Empirical research addressing the productivity effects of research and development (R&D) is more than four decades old. Underpinning this strand of literature is the general understanding that R&D is a major driver of productivity growth, which is, in turn, a crucial driver of economic development (

Hall et al., 2010). Despite the plausibility of this proposition, the degree to which R&D results in productivity increases remains contentious among economists. Some have argued that the impact is largely contingent on institutional frameworks, technological intensity, and human capital (

Griffith et al., 2004). In this paper, this study joins this literature by examining the moderating role of human capital in the relationship between R&D and productivity growth in South Africa.

The theoretical foundations of the R&D/productivity nexus may be traced back to endogenous growth models, in which technical development driven by innovation is a significant driver of economic development (

Romer, 1990;

Aghion & Howitt, 1992).

Romer (

1990) argued that contrary to neoclassical models, economic growth is driven by internal forces of capital, human capital, and innovation.

Romer (

1990) and

Lucas (

1988) particularly pioneered the endogenous growth model, which has now become a common framework for examining the effects of innovation on productivity and productivity.

Aghion and Howitt (

1992) and

Grossman and Helpman (

1991) also claimed that the benefits of enhanced human capital and more innovation extended beyond the knowledge sectors to other economic sectors. Similarly,

You (

1979) asserts that the rate of productivity growth that a country’s economy can generate when full employment is in place is contingent upon several factors, including the amount of capital stock, technology, and human capital.

In essence, R&D improves productivity by developing new goods and more efficient manufacturing techniques (

Romer, 1990). This is supported by

Keller (

2009), who emphasizes that technological progress plays a significant role in productivity and that variations in productivity are particularly significant since they account for income disparities across countries. It is against this background that the link between R&D and productivity has been heavily examined, with most empirical evidence supporting a positive but often moderate impact (

Mairesse & Sassenou, 1991;

Hall et al., 2010). R&D increases productivity at the business and industry levels by encouraging innovation, improving manufacturing processes, and promoting technological adoption (

Griffith et al., 2004). However, the degree of this effect varies by sector, with technology-intensive industries often showing higher returns on R&D. Moreover, the evidence from emerging and middle-income economies is more conflicting and often demonstrates less significant impacts (

Crespi & Zuniga, 2012).

The extent to which R&D affects productivity differs across sectors. For example,

Ortega-Argilés et al. (

2015) discovered that R&D investments typically yield more benefits for the manufacturing and services sectors than for primary sectors such as mining. This supports the findings of

Sterlacchini and Venturini (

2014) and

Fernandez (

2022), who observed that technology-intensive industries respond more productively to R&D. In contrast,

Fan et al. (

2017) found no significant relationship between R&D intensity and output per worker in China’s mining industry. These inconclusive findings make it difficult to draw firm conclusions about how R&D affects industries in different sectors.

At a macro level, it has been argued that the productivity gains from R&D are typically less pronounced in emerging and middle-income economies than in advanced ones, in part because of a reduced capability to absorb and effectively utilize outside information (

Cohen & Levinthal, 1990). This approach has been backed by subsequent research, such as

Sterlacchini and Venturini (

2014) and

Elkomy et al. (

2021), which stressed the role of human skills in maximizing R&D benefits. It is against this background that the importance of human capital in moderating the impact of R&D on productivity is becoming more widely acknowledged (

Cammeraat et al., 2021;

Gerybadze, 2010;

Criscuolo et al., 2021). Skilled employees improve absorptive capacity, allowing businesses and industries at large to better use R&D for productivity gains (

Roberts & Wolf, 2018). This view is backed by

Mason et al.’s (

2020) findings, which imply that industries with a higher proportion of skilled people benefit more from R&D. Research conducted in African contexts, including

Adeosun et al. (

2024), emphasizes that the productivity gains of R&D are often hampered by a lack of human capital and insufficient supplementary investments in skills.

Several studies have been conducted in both developed and emerging economies to examine the relationship between R&D and productivity. Prior studies conducted in South Africa have demonstrated the beneficial effects of research and development on productivity and economic growth, especially in the manufacturing sector (

Ledwaba, 2022). Research has particularly demonstrated that while the impacts on capital productivity are often less observed, R&D investments result in innovations that increase labor productivity (

Kahn et al., 2022).

Although the significance of human talents has received little attention, several studies have looked at the relationship between innovation and productivity in South Africa. According to

Cassim et al. (

2020), innovation improves company performance in manufacturing; however, the impacts are somewhat tempered by workforce skill levels. Similarly,

Hanlin et al. (

2022) contend that to provide long-term productivity gains, innovation policy needs to be in line with the growth of human capital.

The effectiveness of South Africa’s innovative ecosystem is called into question due to the country’s slow productivity growth, even with high spending on R&D. Research in developed economies has consistently shown that R&D and productivity are positively correlated (

Hall et al., 2010;

Griffith et al., 2004). However, the evidence from middle-income countries, especially those in Africa, is still inconsistent. The industrial structure of South Africa, which is defined by a diminishing manufacturing base, a growing services sector, and a dominant mining industry, creates a special setting where R&D returns can vary greatly amongst industries. Furthermore, ongoing skill shortages and incompatibility may make it more difficult for industries to convert R&D into productivity increases.

In addition, South African literature on R&D and productivity has mostly concentrated on aggregate impacts, often ignoring sectoral heterogeneities and the moderating influence of human capital (

Adeosun et al., 2024). For example, mining’s capital-intensive nature may limit its responsiveness to new investments, but manufacturing and services, which depend on knowledge-intensive processes, may gain more from R&D. Furthermore, not enough research has been conducted in the South African setting to determine how much skilled labor boosts the productivity effects of R&D.

To this end, this study contributes by determining the extent to which skilled workers moderate the relationship between R&D investment and productivity across South African industries and understanding the sectoral conditions under which this effect is most pronounced. Drawing on the absorptive capacity framework (

Cohen & Levinthal, 1990), the study posits that skilled labor enhances firms’ ability to internalize and apply R&D outputs, thereby amplifying productivity gains. This moderating effect is expected to be stronger in knowledge- and technology-intensive sectors, where innovation processes are more reliant on specialized expertise and learning-by-doing. Conversely, in capital-intensive or low-skill sectors, the productivity effects of R&D may be muted due to limited absorptive capacity. By integrating this theoretical lens with sector-level empirical analysis, the study aims to clarify the mechanisms through which human capital transforms R&D inputs into productivity outcomes, thereby contributing to a more nuanced understanding of South Africa’s innovation productivity dynamics. The findings are intended to inform evidence-based policymaking and guide strategic innovation investments to enhance productivity growth in the South African economy.

The rest of the study is organized as follows.

Section 2 is the literature review section.

Section 3 provides the methodology.

Section 4 presents and interprets empirical findings.

Section 5 discusses empirical findings. Lastly,

Section 6 provides conclusions and policy recommendations.

3. Methodology

Guided by theoretical and empirical literature (

Scherer, 1983;

Zhang et al., 2012;

Ciaffi, 2025), the study considers the following function:

where

is a productivity measure (labor and capital),

captures the stock of R&D proxying innovation (

Kafouros, 2005;

Siliverstovs, 2016;

Peng et al., 2024;

Tetteh, 2024), and

is a vector of controls (export intensity, import penetration, unit labor cost, and capital/labor ratio). The stock of R&D is measured using the perpetual inventory and a deprecation rate of 15% based on the metadata from our data source. Using an industry-level dataset following

Bogliacino and Pianta (

2011), the estimated model then takes the following form:

where subscripts

and

denote industry and year, respectively,

,

and

are as defined before,

is the share of skilled workers,

,

,

and

are unknown parameters to be estimated, and

is the stochastic error term. Parameter

captures the moderating effect of skilled workers. Inclusion of the interactive term is an attempt to capture the potentially important role of skilled workers in ensuring that industries absorb the new knowledge and maximize the benefits of R&D. In this regard,

and

would suggest that the positive effect of R&D on productivity increases with the share of skilled workers.

The study introduces 5 lags to mitigate endogeneity, as productivity levels may influence industrial R&D efforts (

Bravo-Ortega & Marín, 2011). In the empirical literature, the use of lags to mitigate endogeneity is a common practice applied in studies such as

Bogliacino and Pianta (

2011),

Blanco et al. (

2016), and more recently,

Magazzino and Santeramo (

2024). By using 5 lags, this study seeks to establish how a change in the current R&D stock influences productivity over a 5-year period. The logic behind this methodological approach is that it is less likely that industries will make their R&D decisions in year

based on future or expected (i.e., year 5) productivity levels. Apart from partially mitigating endogeneity, the use of lags is additionally intuitive as R&D normally takes time to enhance productivity due to learning and the possible retraining of workers (

Ravenscraft & Scherer, 1982).

In line with both theoretical expectations and empirical findings in the productivity literature, the study includes a set of control variables in the model to account for additional industry-level characteristics that may influence productivity outcomes. In essence, the study includes controls in a bid to isolate the effect of R&D stock on productivity while accounting for other relevant drivers of industry performance.

Export intensity is included to capture the role of international market exposure in enhancing productivity through competition, knowledge spillovers, and scale economies (

Rafique et al., 2025;

Casagrande et al., 2024). Theoretical models, such as

Melitz (

2003), argue that exporting industries are generally more productive due to self-selection and learning-by-exporting mechanisms (

Kamal, 2024;

Bartoloni et al., 2025). Empirical studies have similarly found positive associations between export intensity and productivity (

Nguyen et al., 2024;

Ali & Akhtar, 2024;

Ünsal, 2024;

Van Biesebroeck, 2005;

B. Mazorodze, 2020). Import penetration is also considered as a control to reflect the degree of foreign competition faced by domestic industries (

Friesenbichler et al., 2024;

Unegbu & Ugwunna, 2024). Import competition may compel industries to innovate, reduce inefficiencies, or reallocate resources more effectively, which consequently enhances productivity (

Aghion et al., 2009).

Unit labor cost is introduced to control for variations in industrial competitiveness. High unit labor costs can hamper productivity if wage growth outpaces efficiency gains, while declining unit labor costs may signal improvements in labor productivity or cost efficiency (

Stundziene & Baliute, 2022;

Karlsone & Ozola, 2023).

The capital/labor ratio is used to account for differences in production technology and capital intensity across industries (

Chen, 2020;

Wu & Chen, 2023). A higher capital/labor ratio often reflects capital deepening, which is generally associated with higher productivity (

Chen, 2020;

Astutik & Nugroho, 2024).

3.1. Estimation Strategy

The results from Pesaran’s test for cross-sectional dependence indicated strong evidence of correlation across the cross-sectional units in the panel dataset. The t-statistic was found to be 12.763 with a

p-value of 0.0000, confirming a high prevalence of cross-sectional dependence at all conventional significance levels. The average absolute value of the off-diagonal elements of the correlation matrix was additionally 0.47, suggesting a moderate to high level of average correlation among the industries. This result implied that standard first-generation panel estimators that assume cross-sectional independence, such as fixed effects or random effects models, would produce biased and inconsistent standard errors (

Pesaran, 2021). Compounding the prevalence of cross-sectional dependence was the presence of first-order serial correlation and heteroscedasticity, which, if ignored, distorts statistical inference (

Bai et al., 2021). To account for these violations, the study estimated our baseline model using the feasible generalized least squares method, as recommended by

Greene (

2018). The alternative and commonly applied estimators, such as the system Generalized Method of Moments (GMM), the panel Dynamic Ordinary Least Squares (PDOLS) method, and the Pooled Mean Group (PMG), were inappropriate for this specific analysis. The system GMM is technically designed for small T and large N cases (

Roodman, 2009), which makes it less appropriate given our moderate-to-large T of 31 years. In addition, this estimator, although desirable on account of addressing endogeneity explicitly, is inconsistent and less efficient in the presence of cross-sectional dependence. Monte Carlo results in

Sarafidis and Robertson (

2009) show that the standard moment conditions used by these estimators become invalid in the presence of cross-sectional dependence. In addition, they show that the bias of these estimators can be quite severe to the extent that the traditional within-estimator will not be comparatively inferior anymore (

Sarafidis & Robertson, 2009). The PDOLS method suffers the same weakness of assuming cross-cross-sectional independence, an assumption that was strongly violated in our case. It is against this background that the feasible generalized least squares method was preferred for estimation.

Our estimation strategy first estimates the total sample. To account for potential heterogeneities in the way R&D relates to productivity, the study then estimates sub-variants by sector and technology intensiveness. The former categorization acknowledges the possibility that R&D may affect productivity differently across sectors (mining, manufacturing, and services). The latter categorization allows us to crudely test the hypothesis that R&D largely facilitates productivity growth in technology-intensive sectors. Analysis was performed using the Stata 17 package. The study specifically uses the xtgls command, which fits panel-data linear models by using feasible generalized least squares accounting autoregressive (1) autocorrelation within panels, cross-sectional correlation, and heteroskedasticity across panels.

3.2. Data Description and Sources

The study relies on a panel dataset comprising 66 3-digit industries observed annually stretching from 1993 to 2023. The 66 industries and the sampling period were selected based on data availability. In particular, the study dropped industries that did not entirely have data on key control variables such as export intensity and import penetration. This included industries such as water, site preparation, the building of complete constructions, and the renting of construction equipment, among others. The remaining industries comprise 6 mining industries, 37 manufacturing, and 23 services. The total sample, therefore, consists of 2046 observations (i.e., T = 31 and N = 66,

). The use of 5 lags, however, reduced the sample size from 2046 to 1716 observations. Data on all variables are sourced from Quantec. This is a consultancy firm based in South Africa that commercializes statistical software and micro and macro data. Prominent work that has used this data source includes

Rodrik (

2008) and

Edwards and Jenkins (

2015). The database categorizes workers into three categories, namely skilled, semi-skilled, and low-skilled workers. Skilled workers comprise professional, semi-professional, and technical occupations, managerial, executive, and administrative occupations, and certain transport occupations, e.g., pilot navigator. Semi-skilled workers comprise clerical occupations, sales occupations, transport, delivery and communications occupations, services occupations, farmer, farm manager, artisan, apprentice and related occupations, production foremen, and production supervisors. Low-skilled workers, on the other hand, include all occupations not classified elsewhere. This study takes skilled workers as a ratio of total employment to proxy each industry’s absorptive capacity. The description of variables is given in

Appendix A as

Table A4.

4. Results

Summary statistics and the correlation matrix are contained in

Appendix A,

Table A1 and

Table A2, respectively. The key takeaway points from these tables are that the dataset does not appear to be plagued by outliers and that the correlation coefficients are small to moderate, downplaying concerns of perfect and near multicollinearity among our independent variables. The study then proceeds to present formal results.

Table 1, particularly, presents preliminary diagnostic tests. Evidently, the null hypotheses of cross-sectional independence, no serial correlation, and groupwise homoscedasticity are strongly rejected, indicating that the model suffers from cross-sectional dependence, first-order serial correlation, and groupwise heteroscedasticity. These results provide strong support for the feasible generalized least squares approach, given its ability to correct the standard errors and provide efficient estimates (

Greene, 2018). The time dummies are also jointly significant, necessitating their inclusion to prevent a possible omitted variable bias.

Table 2 presents feasible generalized least squares estimates with time-fixed effects. In all our tables, Log R&D (−5) is the initial stock of R&D in natural logarithm form, Export (−5) is initial export intensity (%), Import (−5) is initial import penetration (%), CLR (−5) represents initial capital/labor ratio, ULC (−5) is the initial labor cost, and SW (−5) is the initial share of skilled workers. Six regression variants were estimated. The study included control variables in a stepwise fashion. The results show a positive, statistically significant but weak association between R&D stock and labor productivity. Raising the R&D stock by 1% at the start of a 5-year window is associated with a 0.01–0.02% increase in labor productivity in the subsequent 5 years, holding constant the initial levels of trade, capital/labor ratio, unit labor cost, and the share of skilled workers. The low elasticity is consistent with the literature as the majority of industry-level studies have found weaker evidence of the R&D/productivity link (

Bogliacino & Pianta, 2011). The elasticity of 0.02% is particularly comparable to the 0.024% reported in

Lehto (

2007).

Table 3 presents regression results in which the dependent variable is now capital productivity. The aim is to determine whether innovation affects labor and capital productivity differently. Interestingly, although the elasticities reported in

Table 2 and

Table 3 are both low, the elasticity of capital productivity to changes in R&D is weaker (about 0.005%), suggesting that R&D enhances the productivity of workers more than the existing capital stock. There are several explanations for this emerging finding. First, R&D investments often lead to new processes and skill-intensive technologies that are complementary to human capital, which ultimately amplifies the marginal productivity of labor more directly. Second, in many contexts, especially in developing and emerging markets such as South Africa, capital stock tends to be less responsive to innovation due to a combination of technological mismatch, outdated machinery, and underutilization, which limits the extent to which R&D can translate into capital productivity gains (

You, 1979). Third, labor may adjust more rapidly to innovation through training and adaptation, while capital adjustments typically involve longer time periods and huge investment costs. Empirically, this result is consistent with

Hecht (

2018), who finds evidence of labor-saving technical changes from R&D. The absence of capital-saving technical changes in

Hecht (

2018) supports our result as it implies rapid growth in labor productivity relative to capital productivity.

In

Table 4, the study presents regression results in which the analysis groups industries into three sectors, namely mining, manufacturing, and services. In the first three regression variants, in which labor productivity is the dependent variable, we observe two main findings. First, it turns out that R&D does not significantly affect labor productivity in the mining sector. Its positive effect is only statistically significant in the manufacturing and service sectors. This result may reflect the capital-intensive nature of mining activities, where productivity gains are often driven more by capital stock and extraction technologies. This is in line with earlier studies such as

Campbell (

1980) and, more recently,

Fan et al. (

2017). The latter, particularly, finds no significant association between R&D intensity and output per worker in China’s mining industry. Second, R&D has a larger effect on labor productivity in the service sector (0.008) compared to manufacturing (0.004) by a factor of 2. This finding underscores the growing prominence of innovation in driving productivity in services. The result is in line with

Ortega-Argilés et al. (

2015), whose analysis found the coefficient of R&D significantly larger in the R&D-user services compared to non-high-tech manufacturing sectors.

Interestingly, in the last three regression variants, R&D turns out to significantly raise capital productivity in the mining sector. The results, therefore, suggest that R&D only enhances capital productivity in the mining sector. This result is plausible given the capital-intensive nature of mining activities, which limits the scope for labor-specific productivity gains through R&D. The result is particularly supportive of

Fernandez’s (

2022) proposition that a crucial channel for innovation in the mining sector lies in the acquisition of technologies integrated into the capital equipment.

In addition, the study observes that while R&D enhances labor productivity in the services sector, its impact on capital productivity is significantly negative. This result is consistent with the labor-intensive nature of most services. Unlike manufacturing, where capital inputs such as machinery and infrastructure play a central role in driving output, the services sector relies heavily on human skills, expertise, and interpersonal engagement. Consequently, R&D in services often prioritizes improvements in service delivery methods, digital tools for client engagement, or employee training, which all enhance the effectiveness of labor inputs more than capital.

Table 5 reports estimates examining the relationship between lagged R&D intensity and productivity outcomes, disaggregated by industry technology intensiveness. Our categorization is based on R&D intensities. Given the arbitrariness involved, the study prefers defining industries as technology-intensive and less-technology-intensive. The list of technology-intensive and less-technology-intensive industries is presented in

Table A3. The results are not presented here for brevity. As

Table 5 shows, the estimates reveal marked differences in how R&D affects labor and capital productivity across technology-intensive and less-technology-intensive industries.

With respect to labor productivity, the results show that R&D has a statistically significant and positive impact in both types of industries, although the magnitude of the effect is notably higher in technology-intensive sectors. Specifically, a 1% increase in R&D at the start of a 5-year period is associated with a 0.0326% increase in labor productivity in technology-intensive industries over a 5-year period, compared to a 0.0105% increase in less-technology-intensive industries. This disparity suggests that technology-intensive industries are better positioned to leverage innovation to enhance human capital productivity. These sectors likely possess stronger absorptive capacities compared to less-technology-intensive industries. This result is in line with previous studies such as

Sterlacchini and Venturini (

2014) and

Elkomy et al. (

2021).

In sharp contrast, the results for capital productivity reveal a small but statistically significant negative effect of R&D on capital productivity (−0.00824). This finding may reflect capital obsolescence induced by innovation as newly developed technologies tend to displace or render existing capital stock less productive. Conversely, in less-technology-intensive industries, the impact of R&D on capital productivity is positive, albeit modest (0.00448), suggesting that R&D can enhance capital productivity in industries where the baseline level of technology is lower.

Table 6 extends the baseline analysis by incorporating an interaction term between R&D stock and the share of skilled workers with the objective of examining the role of human capital as an absorptive capacity for innovation. This approach is grounded in the literature that posits that the productivity effects of R&D are contingent on the presence of complementary skilled labor, which enables industries to internalize new knowledge (

Cohen & Levinthal, 1990).

The results presented in Columns (1) and (2), where the dependent variable is labor productivity, reveal a statistically significant and positive interaction between R&D and the share of skilled workers. Specifically, the coefficient on the interaction term is 0.0459 in Column (1) and 0.0122 in Column (2), indicating that the productivity-enhancing effects of R&D are magnified in industries with a higher proportion of skilled labor. This finding reinforces the notion that human capital acts as a critical enabler of technological assimilation and adaptation, which is crucial for enhancing the marginal returns to R&D. Interestingly, although the direct effect of skilled workers is negative in both specifications, the positive interaction suggests that R&D and human capital are not independent inputs but complement each other in driving labor productivity. The negative linear effect of skilled workers suggests that industries with highly skilled workers may experience productivity declines if the accumulation of skilled workers is not accompanied by significant investment in R&D.

On the contrary, variants (3) and (4), where the dependent variable is capital productivity, confirm a negative and statistically significant interaction between R&D and skilled labor. The coefficients on the interaction term are −0.0489 and −0.0476, respectively. This inverse relationship suggests that in sectors with higher shares of skilled workers, R&D hampers capital productivity. One plausible explanation is that skilled labor-intensive innovation strategies may lead to automation, which increases labor productivity but renders existing capital partially redundant or underutilized, which ultimately lowers capital productivity. It is also possible that these industries allocated R&D toward human capital enhancement rather than capital-deepening technologies, which may have limited direct gains in capital productivity.

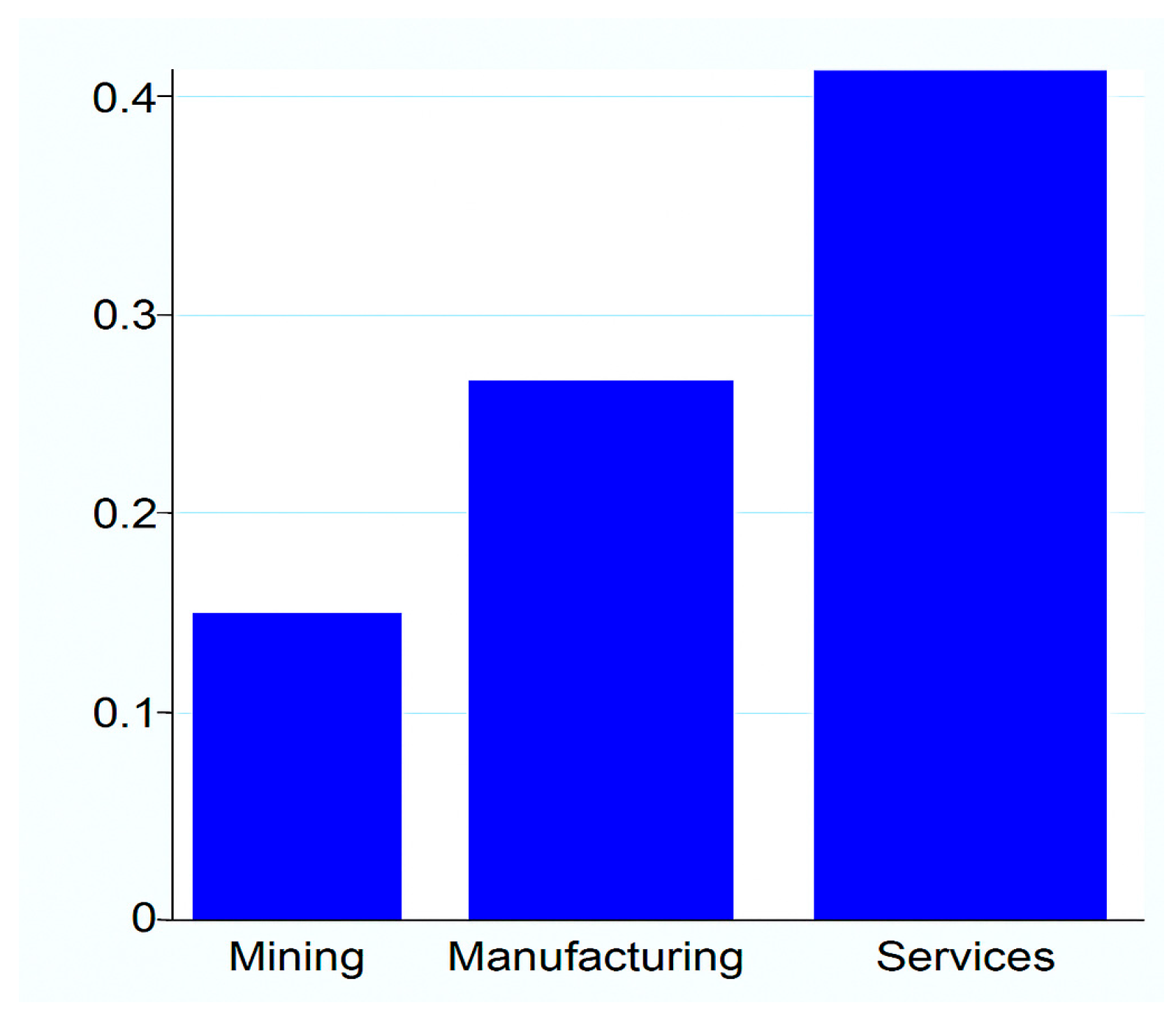

Figure 1 displays the average shares of skilled workers by sector. A quick visual inspection of the graph shows that services (38%) employ most of the skilled workers on average, followed by manufacturing (19%) and mining (9%). Given the important moderating role of skilled workers demonstrated in

Table 6 above,

Figure 1 may suggest the need for training and development workshops in the mining and manufacturing sectors for industries in these sectors to stand a better chance of benefiting from R&D investments.

With respect to our control variables, exports and imports generally display a negative association with labor productivity, possibly reflecting competitive pressures affecting local industries, as similarly observed in

Edwards and Jenkins (

2015), although capital productivity shows mixed responses. For capital productivity in particular, the effect is positive in some sectors and negative in others. The capital/labor ratio is positively associated with both labor and capital productivity, indicating that capital deepening contributes to improved productivity during the sampling period. Unit labor costs have a negative effect on labor productivity, suggesting that rising labor costs can hinder performance. In some cases, however, labor costs positively influence capital productivity, suggesting complementary effects. The share of skilled workers has a heterogeneous effect. It positively affects capital productivity across all models but exhibits a negative or insignificant relationship with labor productivity in some sectors, possibly due to skill mismatches.

5. Discussion

The empirical findings of this study contribute to the growing literature on the productivity effects of R&D in developing economies, with a specific focus on South African industries. The results indicate that R&D expenditure exerts a positive and statistically significant impact on labor productivity, albeit with a relatively low elasticity. This is consistent with previous studies that document modest productivity returns to innovation in contexts characterized by structural constraints, institutional inefficiencies, and limited absorptive capacity (

Hall et al., 2010;

Crespi & Zuniga, 2012).

The effect of R&D on capital productivity is comparatively weaker and less robust across specifications. Sectoral heterogeneity in the productivity effects of R&D is also evident. The lack of significant labor productivity effects in the mining sector is unsurprising given its capital-intensive nature and reliance on physical resource characteristics, which tend to diminish the marginal returns to knowledge-based inputs. In contrast, the positive and statistically significant effects observed in the manufacturing and service sectors are more consistent with international evidence, where such sectors demonstrate higher innovation intensity and stronger integration into global value chains (

Griffith et al., 2004). The pronounced effect in the service sector, in particular, may reflect the increasing importance of intangible assets and human capital, which are key complements to innovation in knowledge-intensive services.

Interestingly, while labor productivity gains are not evident in mining, the positive effect of R&D on capital productivity within this sector suggests that process innovation, automation, and equipment efficiency improvements may be the primary channels through which innovation manifests. This observation underscores the importance of aligning innovation strategies with sector-specific characteristics and production technologies. The findings further reveal that the productivity effects of R&D are more pronounced in technology-intensive industries, particularly in relation to labor productivity. This supports the argument that sectors with higher technological intensity possess stronger absorptive capacities and are better equipped to translate innovation inputs into productive outputs (

Cohen & Levinthal, 1990). However, the negative relationship between R&D and capital productivity in technology-intensive industries may reflect transitional inefficiencies such as the obsolescence of older capital assets or the misalignment between innovation efforts and capital utilization.

The interaction between R&D and human capital provides additional insights to the analysis. The results suggest that the productivity effects of R&D are conditional on the presence of a sufficiently skilled labor force. This finding is consistent with endogenous growth theory, which posits that human capital enhances the productivity of innovation by facilitating learning, adaptation, and diffusion (

Lucas, 1988;

Romer, 1990). In the South African case, where skill mismatches and educational inequalities persist, this result highlights the critical role of coordinated policy interventions that promote both innovation investment and human capital development.

Overall, the findings underscore that R&D can be a meaningful driver of productivity growth in South Africa, but the extent of its impact is mediated by structural conditions, sectoral dynamics, and the quality of the labor force. The evidence supports the view that innovation policy must be sector-specific, complemented by investments in skills, and attentive to the broader institutional and technological ecosystem. Enhancing the productivity returns to R&D will require not only increased expenditure but also improved alignment between innovation, education, and industrial policy.

6. Conclusions

This study concludes that R&D investment positively influences labor productivity in South African industries, particularly within the manufacturing and services sectors and in technology-intensive activities. The effect on capital productivity is marginal and, in some instances, negative. The analysis additionally concludes that skilled workers are critical in ensuring that industries record productivity gains from R&D.

In light of our conclusion, policy recommendations should be carefully tailored and combined with complementary interventions to maximize their impact. Specifically, the following measures are proposed.

6.1. Targeted Skill Development

To enhance labor productivity effectively, it is imperative to implement industry-specific training programs that address the unique skill demands of each industry. In addition, improving the quality and relevance of education and training, particularly in science, technology, engineering, and mathematics (STEM), will impart workers with the skills needed to translate R&D into productivity improvements.

6.2. Technology Adoption Incentives

Fiscal incentives or subsidies should be provided to encourage industries to invest in modern technologies and equipment that boost productivity. To encourage technological upgrading and digital transformation, the government may implement fiscal policy instruments such as targeted tax incentives. Specifically, tax credits could be extended to small- and medium-sized enterprises (SMEs) that invest in approved digital technologies, including automation, data analytics, and cloud-based systems. Such incentives may aim to lower the effective cost of capital for technology adoption, thereby enhancing firms’ innovation capacity and productivity potential. In addition, public procurement policy can be strategically leveraged to stimulate technology diffusion. By introducing preferential procurement criteria that prioritize firms demonstrating the integration of advanced technologies, particularly in sectors such as infrastructure, education, and logistics, the state can create demand-side incentives for digital adoption. This approach not only fosters innovation among suppliers but also aligns public expenditure with broader industrial policy objectives aimed at digital transformation and competitiveness enhancement.

6.3. Access to Finance

Enhancing access to affordable credit and financial services is critical to enhancing investment in R&D, which is often constrained by limited financial resources. SMEs, for instance, typically face higher borrowing costs, stricter collateral requirements, and limited credit history compared to larger firms, which restrict their ability to finance innovation activities. By implementing targeted financial instruments such as low-interest loans, credit guarantees, and innovation grants, policymakers can lower the cost of capital and reduce the financial risks associated with R&D investments. Additionally, establishing specialized venture capital funds and public/private partnerships can provide alternative funding avenues that support early-stage innovation projects.

6.4. Design of Innovation Policy

Second, the design of innovation policy must account for sectoral heterogeneity and the varying degrees of technology intensiveness across industries. Different sectors face distinct innovation challenges and opportunities, which require tailored policy instruments. For example, high-technology sectors such as information and communication technology (ICT) and pharmaceuticals often demand substantial R&D investments, advanced infrastructure, and strong intellectual property protections to foster breakthrough innovations. Conversely, traditional manufacturing and agriculture may benefit more from incremental innovations, process improvements, and technology adoption support, such as extension services and subsidies for equipment modernization. Moreover, policies promoting collaboration between universities, research institutions, and firms should be customized to reflect sector-specific innovation ecosystems, recognizing that the pathways to innovation differ markedly between capital-intensive industries and labor-intensive ones.

In closing, it is important to acknowledge the limitations of our study. First, our study relies on the FGLS estimation approach to correct for the presence of cross-sectional dependence, serial correlation, and groupwise heteroskedasticity. While this technique is robust under the identified violations of classical assumptions, it does not fully address potential endogeneity issues related to the R&D variable. Although lagging the regressors helps in reducing simultaneity bias, the absence of strong external instruments means the causal interpretation of the R&D/productivity relationship should be made cautiously.

Second, the empirical specification controls for key production-side variables (trade intensity, capital/labor ratio, labor costs, and skills). Demand-side dynamics and institutional variables are not adequately incorporated. These omitted factors may interact with R&D in shaping productivity dynamics.

Lastly, the study does not differentiate between public and private R&D or between basic and applied research, which may have distinct impacts on productivity. The heterogeneity in R&D type, funding source, and purpose could moderate its effectiveness but is not explored due to data constraints.

Future research may build on these findings by conducting firm-level analyses that explore heterogeneity in innovation and productivity responses across different types of enterprises. Such studies could reveal how firm size, ownership structure, and export orientation mediate the impact of R&D investments.